Regional Bank Stocks Notch Strongest Day In 4 Years: Why Analysts Expect 'Several Tailwinds' From Trump Policies

Regional bank stocks surged on Wednesday, marking their strongest one-day performance in four years as investors bet on a more favorable banking sector environment when Donald Trump returns to the White House.

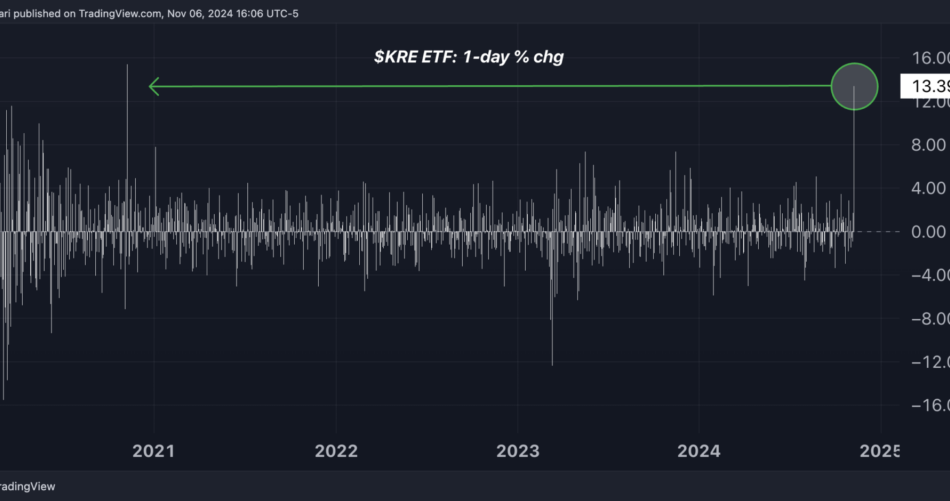

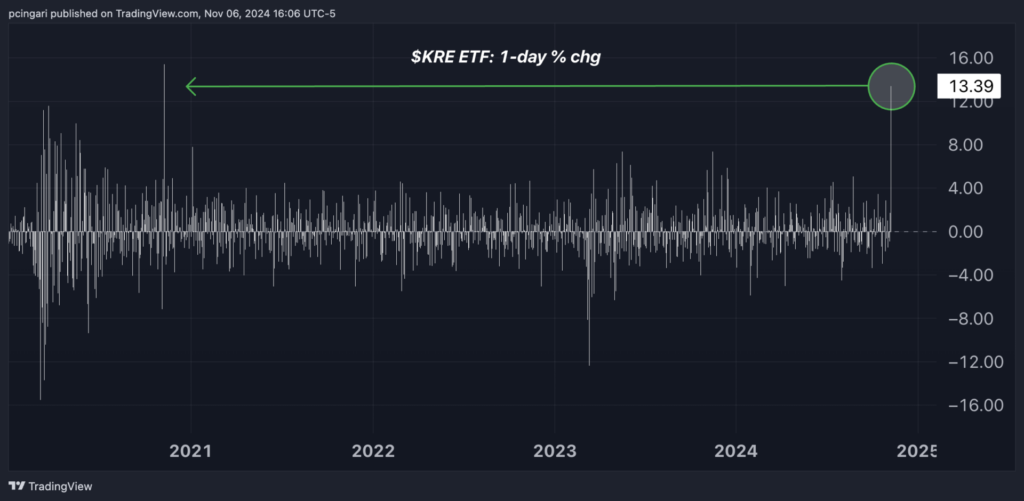

The SPDR S&P Regional Banking ETF KRE — which tracks a basket of 147 small- and mid-cap U.S. banks — jumped 13.4%, posting its largest rally since November 2020. Back then, the announcement of the first COVID-19 vaccine sparked a broad market rebound.

In Wednesday’s trading, regional banks outshined even the biggest U.S. banks. Financials were the top-performing sector in the S&P 500, with the Financials Select Sector SPDR Fund XLF rising 6%.

Yet regional banks saw an even greater lift, driven by expectations that Trump’s policies will uniquely benefit smaller, domestic-focused institutions.

The strength in regional banks also fueled a broader rally in small-cap stocks. The Russell 2000 index, which includes a significant portion of regional banks, surged 6% as investor optimism spread across smaller, U.S.-centric companies.

Regional banks are the most representative sector of the Russell 2000 index, which soared by 6% on Wednesday.

Chart: Regional Banks Mark Best Day Since Covid-19 Vaccine Announcement

JPMorgan’s Elian Identifies 7 Tailwinds For Regional Banks

JPMorgan analyst Anthony Elian sees multiple factors that could fuel a strong performance for regional banks under Trump’s leadership.

“We view these results as being favorable for the regional bank sector tied to several tailwinds,” Elian wrote in a note on Wednesday.

He highlighted seven main drivers:

- Increased lending activity – A pro-business and onshoring agenda is expected to boost lending, potentially driving a revival in loan growth across the industry.

- Lower corporate taxes – Trump’s anticipated tax cuts could enhance profitability for regional banks by reducing their tax burden.

- Eased regulatory environment – According to Elian, “a second Trump administration would include an easier backdrop for regulation for the industry,” which could help banks reduce compliance costs and expand operations.

- Uptick in M&A activity – With a favorable regulatory climate, the sector could see an increase in mergers and acquisitions, a trend that was prevalent during Trump’s first term and could benefit mid-sized banks seeking growth.

- Attractive valuations – Elian noted that regional banks remain undervalued by historical standards, suggesting “there is still material upside on the table.”

- Steep Treasury yield curve, Fed still in easing mode – With the Treasury yield curve in a steep pattern and the Federal Reserve to keep lowering rates, regional banks could benefit from improved net interest margins (NIMs) and net interest income (NII), boosting their earnings and profitability over time.

- Underweight positioning – Elian highlighted that investors are still largely underweight on regional bank stocks, indicating room for increased demand as sentiment shifts.

JPMorgan’s Elian identified a few standout names in the regional banking space. Among his top picks are First Citizens BancShares, Inc. FCNCA and Western Alliance Bancorporation WAL, both of which are well-positioned to take advantage of the expected uptrend in the sector.

Trump’s 2016 Win Offers Historical Context For Sector Rally

The market’s optimism is further bolstered by historical precedent. Regional bank stocks were among the biggest early beneficiaries following Trump’s 2016 election victory.

Between Nov. 9, 2016, and Jan. 10, 2017, the KRE ETF surged nearly 20%, significantly outperforming other sectors during that period.

Chart: Performance Of Regional Bank ETF (Nov. 9, 2016 – Jan. 10, 2017)

Read Next:

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Nvidia Headed to $200 in 2025?

Nvidia (NASDAQ: NVDA) has been one of the best stocks to own over the past two years, returning 239% in 2023, 169% so far in 2024, and over 800% since the start of 2023. That’s quite the run, and many investors might wonder if year three of its run will also be profitable.

While the stock doubling or tripling isn’t likely to occur, a modest gain, like crossing the $200 price per share mark, may be in the cards. So, could Nvidia do this? After all, a $200 stock price at the end of 2025 would represent a 50% rise from today’s price.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Understanding why Nvidia has been a successful stock is critical, as it will clue investors in on whether these trends are sustainable. Artificial intelligence (AI) has been a huge driver across the entire stock market, and few companies (if any) have benefited as much as Nvidia.

Nvidia makes graphics processing units (GPUs), which are used to train and run AI models. Because they can process calculations in parallel, they can process information much faster than a standard CPU on a laptop or phone can. Furthermore, multiple GPUs can be connected in clusters to create unreal processing speeds.

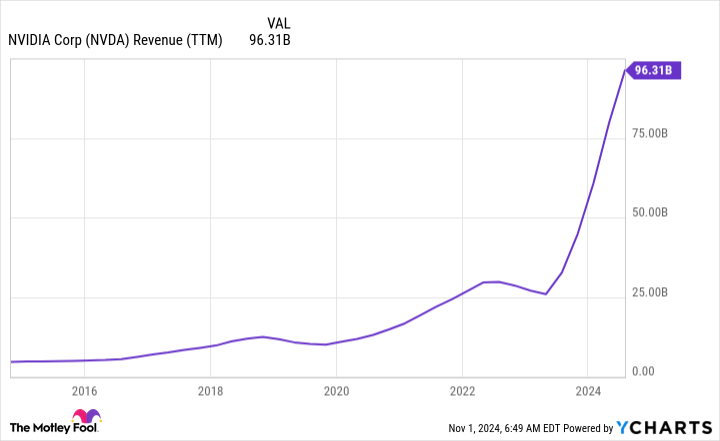

Over the past two years, nearly all of the big tech players have purchased thousands (if not hundreds of thousands) of GPUs from Nvidia, which is why its revenue has skyrocketed.

Nvidia’s margins also expanded during this run, as its profit margin rose from about 30% to more than 55%. These two factors caused Nvidia’s profits to soar, which increased the stock price.

The question is, how long will those catalysts last? After all, no company can sustain its revenue doubling year over year forever.

As Nvidia’s results reach tough year-over-year comparisons, its growth rate will naturally slow down, which is what we’re seeing now. In Q2 FY 2025 (ending July 28), Nvidia’s revenue rose 122% year over year. That’s down from the 262% growth it achieved in Q1. Q3 looks to bring about more of the same, as management expects $32.5 billion in revenue, up 80% from last year.

Make no mistake; these are incredible growth figures, but they are slowing down from the rapid growth investors became accustomed to in 2023 and 2024.

According to Wall Street analysts, 2025 will continue the growth moderation trend. For FY 2026 (ending January 2026), Wall Street analysts expect about 43% growth, which is still quite impressive for Nvidia’s size. They also expect earnings per share growth to match revenue growth, rising 43% next year.

Eli Lilly Posts a Huge Earnings Miss. Should Investors Be Worried?

If you’re investing in a stock with a high valuation, you know that expectations are going to be high when it’s time for the company to report earnings. Any miss compared to analyst estimates or underwhelming guidance can quickly lead to a sell-off, analyst downgrades, and a much different outlook for the stock as a whole.

Healthcare giant Eli Lilly (NYSE: LLY) has been trading at an inflated valuation for some time thanks to excitement around its diabetes and weight loss treatments, Mounjaro and Zepbound. Unfortunately, for shareholders of the company, it failed to meet expectations in its most recent earnings report on Oct. 30. And the numbers weren’t even close.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Is the stock in trouble?

Eli Lilly didn’t have a bad quarter, but when perfection is priced into a stock, anything less than glorious results can end up weighing on its valuation. And while the company’s revenue rose by 20% to $11.4 billion for the third quarter ending Sept. 30, that fell short of analyst expectations of $12.1 billion. On the bottom line, adjusted earnings per share (EPS) of $1.18 were also nowhere near the $1.47 EPS Wall Street was looking for.

The company’s numbers would have been better, but a big problem for the drugmaker these days comes back to inventory levels. Demand is strong, but Eli Lilly says as it was fulfilling back orders to wholesalers for Mounjaro and Zepbound, they didn’t end up ordering more supply and simply used their existing stock. That could create shortages again next quarter if wholesalers have insufficient supply on hand.

Another issue for investors is that Eli Lilly adjusted its guidance for the year, now projecting its adjusted EPS to fall within a range of $13.02 and $13.52 (the previous forecast was $16.10 to $16.60). This change reflects acquisition-related charges the company has incurred recently, but the decrease was disappointing for investors.

Prior to earnings, Eli Lilly stock was trading at around $900. As of Monday, the stock was down to around $800, dropping more than 10% of its value in just a few days after the release of its earnings numbers.

Any kind of hiccup can weigh on the healthcare stock, which was previously trading at more than 100 times its trailing profits. It’s still not even a terribly cheap buy when you look at its forward price-to-earnings multiple of 36, which is based on analyst expectations of next year’s profits. When a stock is trading at such a high premium, expectations are elevated.

Franco-Nevada Reports Q3 2024 Results

Initial Contributions from Tocantinzinho Stream

(in U.S. dollars unless otherwise noted)

TORONTO, Nov. 6, 2024 /PRNewswire/ – “Record gold prices generated higher revenues, Adjusted EBITDA and earnings in Q3 compared to Q2 2024,” stated Paul Brink, CEO. “GEO sales were stable compared to Q2 although lower compared to Q3 2023 without the contribution from Cobre Panama. The quarter benefitted from contributions from the newly commissioned Tocantinzinho mine in Brazil, and increased contributions from royalties from the recently completed Greenstone mine and the newly acquired Yanacocha royalty. Candelaria reported an increase in copper and gold production for the quarter. While Candelaria’s copper output is on track, Lundin Mining has revised its 2024 gold production guidance lower to reflect revised gold grades for the period. In addition, revenue from our Diversified assets translated into lower GEOs reflecting record gold prices. We have adjusted our 2024 guidance as a result. Franco-Nevada continues to benefit from higher gold prices with limited exposure to cost inflation. The company remains debt-free with substantial available capital and has a strong pipeline of potential precious metal streams and royalties.”

Financial Summary

- $275.7 million in revenue, -11% compared to Q3 2023, or +14% when excluding the impact of Cobre Panama remaining on preservation and safe management during the quarter

- 110,110 GEOs sold in the quarter, -32% compared to Q3 2023, which partly reflects:

- 22% due to the impact of Cobre Panama, and

- 3% due to record gold prices, reducing the conversion of non-gold revenue into GEOs

- $213.6 million in operating cash flow, -9% compared to Q3 2023

- $152.7 million in net income or $0.79/share, -13% compared to Q3 2023

- $236.2 million in Adjusted EBITDA or $1.23/share, -7% compared to Q3 2023, or +16% excluding Cobre Panama

- $153.9 million in Adjusted Net Income or $0.80/share, -12% compared to Q3 2023, or +12% excluding Cobre Panama

- Quarterly dividend of $0.36/share effective Q1 2024, an annual increase of 5.88%

- Strong financial position with no debt and $2.3 billion in available capital as at September 30, 2024

Sector-Leading ESG

- Rated #1 precious metals company and #1 gold company by Sustainalytics, AA by MSCI and Prime by ISS ESG

- Committed to the World Gold Council’s Responsible Gold Mining Principles

- Partnering with our operators on community and ESG initiatives

- 40% diverse representation at the Board and top leadership levels as a group

Diverse, Long-Life Portfolio

- Most diverse royalty and streaming portfolio by asset, operator and country

- Attractive mix of long-life streams and high optionality royalties

- Long-life mineral resources and mineral reserves

Growth and Optionality

- Mine expansions and new mines driving 5-year growth profile

- Long-term optionality in gold, copper and nickel and exposure to some of the world’s great mineral endowments

- Strong pipeline of precious metal and diversified opportunities

|

Quarterly revenue and GEOs sold by commodity |

|||||||||||

|

Q3 2024 |

Q3 2023 |

||||||||||

|

GEOs Sold |

Revenue |

GEOs Sold |

Revenue |

||||||||

|

# |

(in millions) |

# |

(in millions) |

||||||||

|

PRECIOUS METALS |

|||||||||||

|

Gold (excluding Cobre Panama) |

71,100 |

$ |

177.6 |

72,939 |

$ |

140.4 |

|||||

|

Silver (excluding Cobre Panama) |

11,111 |

28.5 |

12,261 |

23.4 |

|||||||

|

PGM |

2,166 |

5.6 |

5,170 |

9.7 |

|||||||

|

84,377 |

$ |

211.7 |

90,370 |

$ |

173.5 |

||||||

|

DIVERSIFIED |

|||||||||||

|

Iron ore |

5,528 |

$ |

12.1 |

6,619 |

$ |

12.8 |

|||||

|

Other mining assets |

1,068 |

2.7 |

1,677 |

3.2 |

|||||||

|

Oil |

14,366 |

32.5 |

20,926 |

38.2 |

|||||||

|

Gas |

2,576 |

8.4 |

4,098 |

9.9 |

|||||||

|

NGL |

2,195 |

5.5 |

2,191 |

4.6 |

|||||||

|

25,733 |

$ |

61.2 |

35,511 |

$ |

68.7 |

||||||

|

Royalty, stream and working interests (excluding Cobre |

110,110 |

$ |

272.9 |

125,881 |

$ |

242.2 |

|||||

|

Interest revenue and other interest income |

— |

$ |

2.8 |

— |

$ |

— |

|||||

|

Revenue and GEOs (excluding Cobre Panama) |

110,110 |

$ |

275.7 |

125,881 |

$ |

242.2 |

|||||

|

Cobre Panama |

— |

$ |

— |

34,967 |

$ |

67.3 |

|||||

|

Total revenue and GEOs |

110,110 |

$ |

275.7 |

160,848 |

$ |

309.5 |

|||||

|

Year-to-date revenue and GEOs sold by commodity |

|||||||||||

|

YTD 2024 |

YTD 2023 |

||||||||||

|

GEOs Sold |

Revenue |

GEOs Sold |

Revenue |

||||||||

|

# |

(in millions) |

# |

(in millions) |

||||||||

|

PRECIOUS METALS |

|||||||||||

|

Gold (excluding Cobre Panama) |

215,635 |

$ |

495.3 |

215,146 |

$ |

415.8 |

|||||

|

Silver (excluding Cobre Panama) |

34,796 |

81.5 |

37,231 |

71.9 |

|||||||

|

PGM |

9,284 |

21.8 |

15,951 |

31.0 |

|||||||

|

259,715 |

$ |

598.6 |

268,328 |

$ |

518.7 |

||||||

|

DIVERSIFIED |

|||||||||||

|

Iron ore |

17,984 |

$ |

38.9 |

18,801 |

$ |

36.0 |

|||||

|

Other mining assets |

3,223 |

7.4 |

5,435 |

10.3 |

|||||||

|

Oil |

44,713 |

94.6 |

54,847 |

102.2 |

|||||||

|

Gas |

11,450 |

31.5 |

19,800 |

41.0 |

|||||||

|

NGL |

6,156 |

15.0 |

7,203 |

14.0 |

|||||||

|

83,526 |

$ |

187.4 |

106,086 |

$ |

203.5 |

||||||

|

Royalty, stream and working interests (excluding Cobre Panama) |

343,241 |

$ |

786.0 |

374,414 |

$ |

722.2 |

|||||

|

Interest revenue and other interest income |

— |

$ |

6.5 |

— |

$ |

— |

|||||

|

Revenue and GEOs (excluding Cobre Panama) |

343,241 |

$ |

792.5 |

374,414 |

$ |

722.2 |

|||||

|

Cobre Panama |

30 |

$ |

0.1 |

100,280 |

$ |

193.5 |

|||||

|

Total revenue and GEOs |

343,271 |

$ |

792.6 |

474,694 |

$ |

915.7 |

|||||

In Q3 2024, we recognized $275.7 million in revenue, down 10.9% from Q3 2023 (up 13.8% excluding Cobre Panama). Revenue in the 2023 period included contributions from Cobre Panama, which remained on preservation and safe management during the current period. During the quarter, we benefited from record gold prices, offset by lower contributions from Candelaria and our Energy assets. Precious Metal revenue accounted for 76.8% of our revenue (64.5% gold, 10.3% silver, 2.0% PGM). Revenue was sourced 81.2% from the Americas (38.3% South America, 8.1% Central America & Mexico, 17.0% U.S. and 17.8% Canada).

Guidance

We benefited from record gold prices in the first nine months of 2024, with revenue exceeding our initial expectations. Our full-year revenue for 2024 is expected to be between $1,050 million and $1,150 million. However, lower than expected gold production at Candelaria and slower ramp-ups at our newly contributing mines have resulted in fewer Precious Metal GEOs than originally anticipated. In addition, record gold prices in the current year have impacted the conversion of our non-gold revenue into GEOs. As a result, we are revising our GEO sales guidance as follows:

|

2024 Original Guidance1 |

2024 Revised Guidance2 |

||||||

|

Total GEOs |

480,000 to 540,000 |

445,000 to 465,000 |

|||||

|

Precious Metal GEO sales |

360,000 to 400,000 |

340,000 to 360,000 |

|

Environmental, Social and Governance (“ESG”) Updates

We continue to rank highly with leading ESG rating agencies. During the quarter, we expanded the Franco-Nevada Diversity Scholarship program by awarding four new diversity scholarships to mining engineering students at University of Toronto, Université du Québec, and École Polytechnique. Franco-Nevada is now providing scholarships to 13 students. We also renewed our funding support for the Enseña Perú education initiative in Peru.

Portfolio Additions

- Acquisition of Royalty on Yanacocha Operations: As previously announced, on August 13, 2024, we indirectly acquired from Compañía de Minas Buenaventura (“Buenaventura”) and its subsidiary, an existing 1.8% NSR on all minerals covering Newmont’s Yanacocha mine and adjacent mineral properties, including Conga, located in Peru. Consideration for the Yanacocha royalty consisted of $210 million paid in cash on closing, plus a contingent payment of $15 million payable in Franco-Nevada common shares payable upon the Conga project achieving commercial production. The acquisition of the Yanacocha royalty was effective July 1, 2024.

- Acquisition of Gold Stream on Cascabel Copper-Gold Project: As previously announced, on July 15, 2024, our wholly owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNB”) acquired a gold stream from SolGold with reference to production from the Cascabel project located in Ecuador. FNB partnered with Osisko Gold Royalties’ subsidiary, Osisko Bermuda Limited (“Osisko”), to participate in the financing package on a 70%/30% basis. FNB will provide a total of $525 million and Osisko a total of $225 million for a total combined funding of $750 million, consisting of $100 million in pre-construction funding and $650 million towards construction once the project is fully funded and further derisked. During the quarter, FNB funded $23.4 million upon closing of the agreement.

- Term Loan with EMX Royalty Corporation: As previously announced, on August 9, 2024, we funded a term loan to EMX Royalty Corporation of $35 million. Interest is payable monthly at a rate equal to the 3-Month Term Secured Overnight Financing Rate plus an applicable margin based on EMX’s net debt to adjusted EBITDA ratio.

- G Mining Ventures Private Placement and Warrants: As previously announced, on July 12, 2024, we completed a private placement of $25 million with G Mining Ventures at a price of C$2.279 per share (equivalent to C$9.116 per share following the merger between G Mining Ventures and Reunion Gold on July 15, 2024). La Mancha Investments S.à r.l. completed a concurrent $25 million private placement resulting in total proceeds to G Mining of $50 million. The placement was related to G Mining Ventures’ business combination with Reunion Gold and advancement of the Oko West gold development project in Guyana. Franco-Nevada also holds share purchase warrants which allow the Company to acquire 2,875,000 common shares of G Mining Ventures at a price of C$7.60 for a total cost of C$21.9 million. Franco-Nevada expects to exercise such warrants prior to the accelerated expiry date of December 4, 2024.

- Option to Acquire Royalty with Brazil Potash Corp.: Subsequent to quarter-end, on November 1, 2024, we acquired an option from Brazil Potash for $1.0 million to purchase a 4.0% gross revenue royalty on potash produced from Brazil Potash’s Autazes project in Brazil.

Q3 2024 Portfolio Updates

Precious Metal assets: GEOs sold from our Precious Metal assets were 84,377, down 32.7% from 125,337 GEOs in Q3 2023, or down 6.6% from 90,370 GEOs when excluding Cobre Panama. Lower contributions from Candelaria and Antapaccay were partly offset by higher GEOs from Subika, and contributions from the recently constructed Tocantinzinho and Greenstone mines and the newly acquired Yanacocha royalty.

South America:

- Candelaria (gold and silver stream) – GEOs delivered and sold in Q3 2024 were lower than those sold in Q3 2023. In Q2 2024, mining rates were impacted by the interface of the open pit and historic underground mining stopes, requiring more stockpiled ore to be processed which reduced grades and recoveries. While production in the quarter increased due to access to higher grade ore and improved runtime in the SAG mills, Lundin Mining has revised its 2024 annual gold production guidance for Candelaria down to between 92,000 and 102,000 gold ounces (from 100,000 to 110,000 gold ounces previously) due to revised gold grades and expected recoveries for the period. Lundin Mining expects to achieve its original copper production guidance for Candelaria for 2024.

- Antapaccay (gold and silver stream) – GEOs delivered and sold were lower in Q3 2024 compared to Q3 2023. Mine scheduling was adjusted in part due to a geotechnical event which occurred in Q2 2024 and temporarily limited pit access. Deliveries improved in Q3 2024, and we expect deliveries to be between 50,000 to 60,000 GEOs as originally guided for 2024.

- Antamina (22.5% silver stream) – GEOs delivered and sold were relatively consistent in Q3 2024 compared to Q3 2023. While throughput and copper production increased compared to the prior year period, silver grades were lower, as expected based on the life of mine plan.

- Tocantinzinho (gold stream) – In September 2024, G Mining Ventures announced its Tocantinzinho mine achieved commercial production. The mine is planned to ramp up production through H2 2024, targeting nameplate throughput by Q1 2025. Tocantinzinho is expected to average annual gold production of 174,700 ounces over a 10.5-year mine life and 196,200 ounces for the first five full years. Franco-Nevada received initial deliveries of 1,108 GEOs in Q3 2024.

- Yanacocha (1.8% royalty) – Newmont reported higher leach pad production in Q3 2024 as a result of injection leaching. Newmont’s production guidance for 2024 for the Yanacocha mine was approximately 290,000 ounces and the mine produced 260,000 gold ounces year-to-date as of the end of September 2024. Franco-Nevada recognized 1,156 GEOs in revenue in Q3 2024.

- Cascabel (gold stream and 1% royalty) – SolGold continues to report progress on the development of the project, including the receipt in August 2024 of the underground exploration and geotechnical drilling permits.

- Salares Norte (1–2% royalties) – Gold Fields reported that following the first gold pour at Salares Norte in March 2024, the plant was temporarily shut down and ramp-up suspended due to severe winter weather conditions. Gold Field’s most recent guidance indicated an estimated gold equivalent production for the mine of between 40,000 and 50,000 ounces for 2024 (220,000 and 240,000 ounces initially).

Central America & Mexico:

- Cobre Panama (gold and silver stream) – Production at Cobre Panama has been halted since November 2023 with mining activities currently on preservation and safe management. During the quarter, President Mulino made public statements to the effect that his government intends to address the Cobre Panama mine in early 2025. An integrated audit of Cobre Panama is also expected to be conducted with international experts to establish a factual basis to aid in decision making for the future of the mine. As disclosed in Q2, 2024, Franco-Nevada filed a request for arbitration to the International Centre for Settlement of Investment Disputes on June 27, 2024. While we continue to pursue these legal remedies, we strongly prefer and hope for a resolution with the State of Panama providing the best outcome for the Panamanian people and all parties involved.

- Guadalupe-Palmarejo (50% gold stream) – GEOs sold from Guadalupe-Palmarejo in Q3 2024 decreased relative to Q3 2023 due to lower grades.

U.S.:

- Stillwater (5% royalty) – GEOs from our Stillwater royalty decreased in Q3 2024 compared to Q3 2023. Sibanye-Stillwater announced in September 2024 a further restructuring of its US PGM operations as a result of current PGM prices. Sibanye-Stillwater is now guiding to production of 265,000 PGM ounces starting in 2025. Production guidance for 2024 remains unchanged and is expected to be between 440,000 to 460,000 PGM ounces.

- Goldstrike (2-4% royalties & 2.4-6% NPI) – GEOs from our Goldstrike royalties decreased in Q3 2024 compared to Q3 2023 due to less open pit stockpile tons from royalty ground being processed through the Goldstrike processing facilities, resulting in lower payments for our royalties.

- South Arturo (4-9% royalty) – GEOs from South Arturo increased in Q3 2024 compared to Q3 2023 as royalty payments from the restart of open pit mining are beginning to be received. South Arturo is part of Nevada Gold Mines’ Carlin operations.

Canada:

- Detour Lake (2% royalty) – In June 2024, Agnico Eagle released the results of a technical study reflecting the potential for a concurrent underground operation at Detour Lake that would increase annual production to approximately one million ounces for 14 years starting in 2030. Agnico Eagle expects to commence a two-kilometre exploration ramp in Q1 2025, which will be used collect a bulk sample and to facilitate infill and expansion drilling of the current underground mineral resource.

- Macassa (Kirkland Lake) (1.5-5.5% royalty & 20% NPI) – GEOs from Macassa were higher in Q3 2024 than in Q3 2023, reflecting productivity gains since the completion of #4 Shaft and the new ventilation infrastructure in 2023.Agnico Eagle is continuing to focus on asset optimization and is working on further improving mill throughput.

- Magino (3% royalty) and Island Gold (0.62% royalty) – Alamos completed the acquisition of the Magino mine in July 2024. The transaction is expected to result in substantial synergies through shared infrastructure between the adjacent Magino and Island Gold mines. Alamos has noted potential longer-term upside through a single optimized milling complex at Magino with an expansion to between 15,000 and 20,000 tonnes per day.

- Greenstone (3% royalty) – The mine achieved its inaugural gold pour in May 2024. While the operation has experienced some commissioning issues, it continues to progress toward design capacity, ramping up both mining rates and plant throughput. Equinox Gold has revised its 2024 production estimate to between 110,000 and 130,000 gold ounces (from 175,000 to 205,000 gold ounces previously).

- Canadian Malartic (1.5% royalty) – Agnico Eagle reported that ramp development, shaft sinking activities and surface construction progressed on schedule in Q3 2024. Exploration drilling continued to return positive results in the eastern and upper extensions of the East Gouldie deposit, demonstrating the potential to add significant mineral resources along extensions of the main East Gouldie deposit.

- Valentine Gold (3% royalty) – Calibre Mining reported that construction at the project was 81% complete as of the end of September 2024 and remains on track for completion of construction in Q2 2025. Production is expected to average 195,000 gold ounces per year over an initial mine life of 12 years.

Rest of World:

- MWS (25% stream) – GEOs delivered and sold from our MWS stream were higher than in Q3 2023 reflecting an increase in tonnes processed and higher recoveries. Subsequent to quarter-end, following the delivery of 1,587 gold ounces in Q4 2024, our MWS stream reached its cumulative cap of 312,500 gold ounces.

- Subika (Ahafo) (2% royalty) – GEOs from our Subika (Ahafo) royalty were higher than in Q3 2023. Gold production at the mine increased 60% due to higher mill throughput and higher ore grade milled.

Diversified assets: Our Diversified assets, primarily comprising our Iron Ore and Energy interests, generated $61.2 million in revenue, down 10.9% from $68.7 million in Q3 2023. When converted to GEOs, our Diversified assets contributed 25,733 GEOs, down 27.5% from 35,511 GEOs in Q3 2023, of which 21.9% was due to changes in gold prices used in the conversion of non-gold revenue into GEOs.

Iron Ore:

- Vale Royalty (iron ore royalty) – Revenue from our Vale royalty increased slightly compared to Q3 2023. Production from the Northern System benefited from strong production at S11D, partly offset by lower estimated iron ore prices and higher shipping cost deductions. Higher production from the Southeastern System was driven by enhanced performance at the Itabira plant and higher output at Brucutu. We expect royalty payments from the Southeastern System to commence approximately mid-2025.

- LIORC – LIORC declared a cash dividend of C$0.70 per common share in the current period, compared to C$0.95 in Q3 2023. Production from Iron Ore Company of Canada was 11% lower than Q3 2023 due to an 11-day site-wide shutdown following forest fires in mid-July 2024.

- Caserones (0.517% effective NSR) – GEOs from our interest in Caserones were lower in Q3 2024 than in Q3 2023 in part due to our lower effective NSR interest in the current period. In January 2024, EMX exercised an option to acquire 0.0531% of our NSR, such that we now own a 0.517% effective NSR, compared to 0.5701% in Q3 2023.

Energy:

- U.S. (various royalty rates) – Revenue from our U.S. Energy interests was relatively consistent with Q3 2023. We benefited from an increase in production due to new wells at our Permian interests and new contributions from our new Haynesville interests, which mostly offset the impact of lower realized prices and reduced drilling activity.

- Canada (various royalty rates) – Revenue from our Canadian Energy interests was lower than in Q3 2023. Higher production at Weyburn was more than offset by lower realized prices.

Dividend Declaration

Franco-Nevada is pleased to announce that its Board of Directors has declared a quarterly dividend of US$0.36 per share. The dividend will be paid on December 19, 2024, to shareholders of record on December 5, 2024 (the “Record Date”). The dividend has been declared in U.S. dollars and the Canadian dollar equivalent will be determined based on the daily average rate posted by the Bank of Canada on the Record Date. Under Canadian tax legislation, Canadian resident individuals who receive “eligible dividends” are entitled to an enhanced gross-up and dividend tax credit on such dividends.

The Company has a Dividend Reinvestment Plan (the “DRIP”) which allows shareholders of Franco-Nevada to reinvest dividends to purchase additional common shares at the Average Market Price, as defined in the DRIP, subject to a discount from the Average Market Price in the case of treasury acquisitions. The Company will issue additional common shares through treasury at a 1% discount to the Average Market Price. The Company may, from time to time, in its discretion, change or eliminate the discount applicable to treasury acquisitions or direct that such common shares be purchased in market acquisitions at the prevailing market price, any of which would be publicly announced. Participation in the DRIP is optional. The DRIP and enrollment forms are available on the Company’s website at www.franco-nevada.com. Canadian and U.S. registered shareholders may also enroll in the DRIP online through the plan agent’s self-service web portal at www.investorcentre.com/franco-nevada. Canadian and U.S. beneficial shareholders should contact their financial intermediary to arrange enrollment. Non-Canadian and non-U.S. shareholders may potentially participate in the DRIP, subject to the satisfaction of certain conditions. Non-Canadian and non-U.S. shareholders should contact the Company to determine whether they satisfy the necessary conditions to participate in the DRIP.

This press release is not an offer to sell or a solicitation of an offer for securities. A registration statement relating to the DRIP has been filed with the U.S. Securities and Exchange Commission and may be obtained under the Company’s profile on the U.S. Securities and Exchange Commission’s website at www.sec.gov.

Shareholder Information

The complete unaudited Condensed Consolidated Interim Financial Statements and Management’s Discussion and Analysis can be found on our website at www.franco-nevada.com, on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov.

We will host a conference call to review our Q3 2024 results. Interested investors are invited to participate as follows:

|

Conference Call and Webcast: |

November 7th 8:00 am ET |

|

Dial‑in Numbers: |

Toll‑Free: 1-888-510-2154 International: 437-900-0527 |

|

Conference Call URL (This allows participants to join the |

|

|

Webcast: |

|

|

Replay (available until November 14th): |

Toll‑Free: 1-888-660-6345 International: 289-819-1450 Pass code: 19672# |

Corporate Summary

Franco-Nevada Corporation is the leading gold-focused royalty and streaming company with the most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation. Franco-Nevada is debt-free and uses its free cash flow to expand its portfolio and pay dividends. It trades under the symbol FNV on both the Toronto and New York stock exchanges.

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995, respectively, which may include, but are not limited to, statements with respect to future events or future performance, management’s expectations regarding Franco-Nevada’s growth, results of operations, estimated future revenues, performance guidance, carrying value of assets, future dividends and requirements for additional capital, mineral resources and mineral reserves estimates, production estimates, production costs and revenue, future demand for and prices of commodities, expected mining sequences, business prospects and opportunities, the performance and plans of third party operators, audits being conducted by the Canada Revenue Agency (“CRA”), the expected exposure for current and future tax assessments and available remedies, and statements with respect to the future status and any potential restart of the Cobre Panama mine and related arbitration proceedings. In addition, statements relating to mineral resources and mineral reserves, GEOs or mine lives are forward-looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the estimates and assumptions are accurate and that such mineral resources and mineral reserves, GEOs or mine lives will be realized. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “potential for”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Franco-Nevada to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. A number of factors could cause actual events or results to differ materially from any forward-looking statement, including, without limitation: fluctuations in the prices of the primary commodities that drive royalty and stream revenue (gold, platinum group metals, copper, nickel, uranium, silver, iron-ore and oil and gas); fluctuations in the value of the Canadian and Australian dollar, Mexican peso and any other currency in which revenue is generated, relative to the U.S. dollar; changes in national and local government legislation, including permitting and licensing regimes and taxation policies and the enforcement thereof; the adoption of a global minimum tax on corporations; regulatory, political or economic developments in any of the countries where properties in which Franco-Nevada holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Franco-Nevada holds a royalty, stream or other interest, including changes in the ownership and control of such operators; relinquishment or sale of mineral properties; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Franco-Nevada; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; whether or not the Company is determined to have “passive foreign investment company” (“PFIC”) status as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended; potential changes in Canadian tax treatment of offshore streams; excessive cost escalation as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Franco-Nevada holds a royalty, stream or other interest; access to sufficient pipeline capacity; actual mineral content may differ from the mineral resources and mineral reserves contained in technical reports; rate and timing of production differences from resource estimates, other technical reports and mine plans; risks and hazards associated with the business of development and mining on any of the properties in which Franco-Nevada holds a royalty, stream or other interest, including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, sinkholes, flooding and other natural disasters, terrorism, civil unrest or an outbreak of contagious disease; the impact of future pandemics; and the integration of acquired assets. The forward-looking statements contained herein are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation of the properties in which Franco-Nevada holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; the Company’s ongoing income and assets relating to determination of its PFIC status; no material changes to existing tax treatment; the expected application of tax laws and regulations by taxation authorities; the expected assessment and outcome of any audit by any taxation authority; no adverse development in respect of any significant property in which Franco-Nevada holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. However, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance. In addition, there can be no assurance as to (i) the outcome of the ongoing audit by the CRA or the Company’s exposure as a result thereof, or (ii) the future status and any potential restart of the Cobre Panama mine or the outcome of any related arbitration proceedings. Franco-Nevada cannot assure investors that actual results will be consistent with these forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements due to the inherent uncertainty therein.

For additional information with respect to risks, uncertainties and assumptions, please refer to Franco-Nevada’s most recent Annual Information Form as well as Franco-Nevada’s most recent Management’s Discussion and Analysis filed with the Canadian securities regulatory authorities on www.sedarplus.com and Franco-Nevada’s most recent Annual Report filed on Form 40-F filed with the SEC on www.sec.gov. The forward-looking statements herein are made as of the date hereof only and Franco-Nevada does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law.

ENDNOTES:

- GEOs: Gold equivalent ounces (“GEOs”) include Franco-Nevada’s attributable share of production from our Mining and Energy assets after applicable recovery and payability factors. GEOs are estimated on a gross basis for NSRs and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Silver, platinum, palladium, iron ore, oil, gas and other commodities are converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs varies depending on the royalty or stream agreement of each particular asset, which may make reference to the market price realized by the operator, or the average price for the month, quarter, or year in which the commodity was produced or sold. For Q3 2024, the average commodity prices were as follows: $2,477/oz gold (Q3 2023 – $1,929), $29.42/oz silver (Q3 2023 – $23.57), $963/oz platinum (Q3 2023 – $931) and $970/oz palladium (Q3 2023 – $1,251), $100/t Fe 62% CFR China (Q3 2023 – $113), $75.09/bbl WTI oil (Q3 2023 – $82.26) and $2.24/mcf Henry Hub natural gas (Q3 2023 – $2.66). For YTD 2024 prices, the average commodity prices were as follows: $2,296/oz gold (YTD 2023 – $1,932), $27.21/oz silver (YTD 2023 – $23.44), $951/oz platinum (YTD 2023 – $985) and $973/oz palladium (YTD 2023 – $1,422), $112/t Fe 62% CFR China (YTD 2023 – $116), $77.54/bbl WTI oil (YTD 2023 – $77.39) and $2.22/mcf Henry Hub natural gas (YTD 2023 – $2.58).

- NON-GAAP FINANCIAL MEASURES: Adjusted Net Income and Adjusted Net Income per share, Adjusted Net Income Margin, Adjusted EBITDA and Adjusted EBITDA per share, and Adjusted EBITDA Margin are non-GAAP financial measures with no standardized meaning under International Financial Reporting Standards (“IFRS Accounting Standards”) and might not be comparable to similar financial measures disclosed by other issuers. For a quantitative reconciliation of each non-GAAP financial measure to the most directly comparable financial measure under IFRS Accounting Standards, refer to the following tables. Further information relating to these non-GAAP financial measures is incorporated by reference from the “Non-GAAP Financial Measures” section of Franco-Nevada’s MD&A for the three and nine months ended September 30, 2024 dated November 6, 2024 filed with the Canadian securities regulatory authorities on SEDAR+ available at www.sedarplus.com and with the U.S. Securities and Exchange Commission available on EDGAR at www.sec.gov.

- Adjusted Net Income and Adjusted Net Income per share are non-GAAP financial measures, which exclude the following from net income and earnings per share (“EPS”): impairment losses and reversal related to royalty, stream and working interests and investments; gains/losses on disposals of royalty, stream and working interests and investments; impairment losses and expected credit losses related to investments, loans receivable and other financial instruments, changes in fair value of investments, loans receivable and other financial instruments, foreign exchange gains/losses and other income/expenses; unusual non-recurring items; and the impact of income taxes on these items.

- Adjusted Net Income Margin is a non-GAAP financial measure which is defined by the Company as Adjusted Net Income divided by revenue.

- Adjusted EBITDA and Adjusted EBITDA per share are non-GAAP financial measures, which exclude the following from net income and EPS: income tax expense/recovery; finance expenses and finance income; depletion and depreciation; impairment charges and reversals related to royalty, stream and working interests and investments; gains/losses on disposals of royalty, stream and working interests and investments; impairment losses and expected credit losses related to investments, loans receivable and other financial instruments, changes in fair value of investment, loans receivable and other financial instruments, foreign exchange gains/losses and other income/expenses; and unusual non-recurring items.

- Adjusted EBITDA Margin is a non-GAAP financial measure which is defined by the Company as Adjusted EBITDA divided by revenue.

Reconciliation of Non-GAAP Financial Measures:

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

(expressed in millions, except per share amounts) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net income |

$ |

152.7 |

$ |

175.1 |

$ |

376.7 |

$ |

516.1 |

|

Gain on disposal of royalty interests |

— |

— |

(0.3) |

(3.7) |

||||

|

Foreign exchange loss (gain) and other expenses (income) |

1.3 |

1.8 |

12.7 |

(2.1) |

||||

|

Tax effect of adjustments |

(0.4) |

(1.8) |

(2.4) |

(0.1) |

||||

|

Other tax related adjustments |

||||||||

|

Deferred tax expense related to the remeasurement of deferred tax |

— |

— |

49.1 |

— |

||||

|

Change in unrecognized deductible temporary differences |

0.3 |

— |

(1.1) |

— |

||||

|

Adjusted Net Income |

$ |

153.9 |

$ |

175.1 |

$ |

434.7 |

$ |

510.2 |

|

Basic weighted average shares outstanding |

192.3 |

192.1 |

192.3 |

192.0 |

||||

|

Adjusted Net Income per share |

$ |

0.80 |

$ |

0.91 |

$ |

2.26 |

$ |

2.66 |

|

For the three months ended |

For the nine months ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

(expressed in millions, except Adjusted Net Income Margin) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Adjusted Net Income |

$ |

153.9 |

$ |

175.1 |

$ |

434.7 |

$ |

510.2 |

||||

|

Revenue |

275.7 |

309.5 |

792.6 |

915.7 |

||||||||

|

Adjusted Net Income Margin |

55.8 |

% |

56.6 |

% |

54.8 |

% |

55.7 |

% |

||||

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

(expressed in millions, except per share amounts) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net income |

$ |

152.7 |

$ |

175.1 |

$ |

376.7 |

$ |

516.1 |

|

Income tax expense |

42.2 |

24.9 |

165.0 |

79.5 |

||||

|

Finance expenses |

0.7 |

0.7 |

1.9 |

2.1 |

||||

|

Finance income |

(14.9) |

(15.5) |

(47.1) |

(36.0) |

||||

|

Depletion and depreciation |

54.2 |

68.1 |

165.3 |

204.2 |

||||

|

Gain on disposal of royalty interests |

— |

— |

(0.3) |

(3.7) |

||||

|

Foreign exchange loss (gain) and other expenses (income) |

1.3 |

1.8 |

12.7 |

(2.1) |

||||

|

Adjusted EBITDA |

$ |

236.2 |

$ |

255.1 |

$ |

674.2 |

$ |

760.1 |

|

Basic weighted average shares outstanding |

192.3 |

192.1 |

192.3 |

192.0 |

||||

|

Adjusted EBITDA per share |

$ |

1.23 |

$ |

1.33 |

$ |

3.51 |

$ |

3.96 |

|

For the three months ended |

For the nine months ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

(expressed in millions, except Adjusted EBITDA Margin) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Adjusted EBITDA |

$ |

236.2 |

$ |

255.1 |

$ |

674.2 |

$ |

760.1 |

||||

|

Revenue |

275.7 |

309.5 |

792.6 |

915.7 |

||||||||

|

Adjusted EBITDA Margin |

85.7 |

% |

82.4 |

% |

85.1 |

% |

83.0 |

% |

||||

FRANCO-NEVADA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(in millions of U.S. dollars)

|

At September 30, |

At December 31, |

|||

|

2024 |

2023 |

|||

|

ASSETS |

||||

|

Cash and Cash equivalents |

$ |

1,317.3 |

$ |

1,421.9 |

|

Receivables |

133.9 |

111.0 |

||

|

Gold bullion, prepaid expenses and other current assets |

99.8 |

82.4 |

||

|

Current assets |

$ |

1,551.0 |

$ |

1,615.3 |

|

Royalty, stream and working interests, net |

$ |

4,230.6 |

$ |

4,027.1 |

|

Investments |

323.3 |

254.5 |

||

|

Loans receivable |

110.5 |

24.8 |

||

|

Deferred income tax assets |

30.7 |

37.0 |

||

|

Other assets |

53.5 |

35.4 |

||

|

Total assets |

$ |

6,299.6 |

$ |

5,994.1 |

|

LIABILITIES |

||||

|

Accounts payable and accrued liabilities |

$ |

26.2 |

$ |

30.9 |

|

Current income tax liabilities |

40.1 |

8.3 |

||

|

Current liabilities |

$ |

66.3 |

$ |

39.2 |

|

Deferred income tax liabilities |

$ |

242.0 |

$ |

180.1 |

|

Other liabilities |

4.5 |

5.7 |

||

|

Total liabilities |

$ |

312.8 |

$ |

225.0 |

|

SHAREHOLDERS’ EQUITY |

||||

|

Share capital |

$ |

5,762.1 |

$ |

5,728.2 |

|

Contributed surplus |

21.9 |

20.6 |

||

|

Retained earnings |

380.3 |

212.3 |

||

|

Accumulated other comprehensive loss |

(177.5) |

(192.0) |

||

|

Total shareholders’ equity |

$ |

5,986.8 |

$ |

5,769.1 |

|

Total liabilities and shareholders’ equity |

$ |

6,299.6 |

$ |

5,994.1 |

The unaudited condensed consolidated interim financial statements and accompanying notes can be found in our Q3 2024 Quarterly Report available on our website

FRANCO-NEVADA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(in millions of U.S. dollars and shares, except per share amounts)

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Revenue |

||||||||

|

Revenue from royalty, streams and working interests |

$ |

272.9 |

$ |

309.5 |

$ |

786.1 |

$ |

915.7 |

|

Interest revenue |

2.8 |

— |

5.9 |

— |

||||

|

Other interest income |

— |

— |

0.6 |

— |

||||

|

Total revenue |

$ |

275.7 |

$ |

309.5 |

$ |

792.6 |

$ |

915.7 |

|

Costs of sales |

||||||||

|

Costs of sales |

$ |

31.9 |

$ |

48.9 |

$ |

94.6 |

$ |

134.2 |

|

Depletion and depreciation |

54.2 |

68.1 |

165.3 |

204.2 |

||||

|

Total costs of sales |

$ |

86.1 |

$ |

117.0 |

$ |

259.9 |

$ |

338.4 |

|

Gross profit |

$ |

189.6 |

$ |

192.5 |

$ |

532.7 |

$ |

577.3 |

|

Other operating expenses (income) |

||||||||

|

General and administrative expenses |

$ |

7.8 |

$ |

5.0 |

$ |

21.9 |

$ |

17.4 |

|

Share-based compensation expenses |

2.4 |

0.7 |

7.0 |

6.3 |

||||

|

Gain on disposal of royalty interests |

— |

— |

(0.3) |

(3.7) |

||||

|

Gain on sale of gold bullion |

(2.6) |

(0.2) |

(5.1) |

(2.3) |

||||

|

Total other operating expenses |

$ |

7.6 |

$ |

5.5 |

$ |

23.5 |

$ |

17.7 |

|

Operating income |

$ |

182.0 |

$ |

187.0 |

$ |

509.2 |

$ |

559.6 |

|

Foreign exchange (loss) gain and other (expenses) income |

$ |

(1.3) |

$ |

(1.8) |

$ |

(12.7) |

$ |

2.1 |

|

Income before finance items and income taxes |

$ |

180.7 |

$ |

185.2 |

$ |

496.5 |

$ |

561.7 |

|

Finance items |

||||||||

|

Finance income |

$ |

14.9 |

$ |

15.5 |

$ |

47.1 |

$ |

36.0 |

|

Finance expenses |

(0.7) |

(0.7) |

(1.9) |

(2.1) |

||||

|

Net income before income taxes |

$ |

194.9 |

$ |

200.0 |

$ |

541.7 |

$ |

595.6 |

|

Income tax expense |

42.2 |

24.9 |

165.0 |

79.5 |

||||

|

Net income |

$ |

152.7 |

$ |

175.1 |

$ |

376.7 |

$ |

516.1 |

|

Other comprehensive income (loss), net of taxes |

||||||||

|

Items that may be reclassified subsequently to profit and loss: |

||||||||

|

Currency translation adjustment |

$ |

24.1 |

$ |

(31.7) |

$ |

(27.4) |

$ |

(1.8) |

|

Items that will not be reclassified subsequently to profit and loss: |

||||||||

|

Gain on changes in the fair value of equity investments |

||||||||

|

at fair value through other comprehensive income (“FVTOCI”), |

||||||||

|

net of income tax |

24.3 |

3.5 |

41.5 |

4.5 |

||||

|

Other comprehensive income (loss), net of taxes |

$ |

48.4 |

$ |

(28.2) |

$ |

14.1 |

$ |

2.7 |

|

Comprehensive income |

$ |

201.1 |

$ |

146.9 |

$ |

390.8 |

$ |

518.8 |

|

Earnings per share |

||||||||

|

Basic |

$ |

0.79 |

$ |

0.91 |

$ |

1.96 |

$ |

2.69 |

|

Diluted |

$ |

0.79 |

$ |

0.91 |

$ |

1.96 |

$ |

2.68 |

|

Weighted average number of shares outstanding |

||||||||

|

Basic |

192.3 |

192.1 |

192.3 |

192.0 |

||||

|

Diluted |

192.5 |

192.4 |

192.5 |

192.3 |

||||

The unaudited condensed consolidated interim financial statements and accompanying notes can be found in our Q3 2024 Quarterly Report available on our website

FRANCO-NEVADA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions of U.S. dollars)

|

For the three months ended |

For the nine months ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Cash flows from operating activities |

||||||||

|

Net income |

$ |

152.7 |

$ |

175.1 |

$ |

376.7 |

$ |

516.1 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

|

Depletion and depreciation |

54.2 |

68.1 |

165.3 |

204.2 |

||||

|

Share-based compensation expenses |

1.3 |

1.5 |

4.2 |

4.7 |

||||

|

Gain on disposal of royalty interests |

— |

— |

(0.3) |

(3.7) |

||||

|

Unrealized foreign exchange loss |

0.1 |

1.8 |

7.9 |

(1.7) |

||||

|

Deferred income tax expense |

7.7 |

1.5 |

64.0 |

16.6 |

||||

|

Other non-cash items |

(1.7) |

(0.2) |

(5.7) |

(2.2) |

||||

|

Acquisition of gold bullion |

(20.0) |

(15.9) |

(52.4) |

(41.1) |

||||

|

Proceeds from sale of gold bullion |

12.7 |

1.9 |

29.3 |

20.5 |

||||

|

Changes in other assets |

— |

13.9 |

(17.4) |

13.9 |

||||

|

Operating cash flows before changes in non-cash working capital |

$ |

207.0 |

$ |

247.7 |

$ |

571.6 |

$ |

727.3 |

|

Changes in non-cash working capital: |

||||||||

|

(Increase) decrease in receivables |

$ |

(12.8) |

$ |

9.6 |

$ |

(22.7) |

$ |

0.9 |

|

Decrease (increase) in prepaid expenses and other |

8.2 |

(6.5) |

10.7 |

(10.5) |

||||

|

(Decrease) increase in current liabilities |

11.2 |

(14.8) |

26.9 |

(10.0) |

||||

|

Net cash provided by operating activities |

$ |

213.6 |

$ |

236.0 |

$ |

586.5 |

$ |

707.7 |

|

Cash flows used in investing activities |

||||||||

|

Acquisition of royalty, stream and working interests |

$ |

(238.6) |

$ |

(165.0) |

$ |

(401.7) |

$ |

(435.8) |

|

Advances of loans receivable |

(34.7) |

— |

(118.2) |

— |

||||

|

Acquisition of investments |

(27.9) |

(8.4) |

(38.9) |

(8.9) |

||||

|

Proceeds from repayment of loan receivable |

10.0 |

— |

28.9 |

— |

||||

|

Proceeds from sale of investments |

12.9 |

0.1 |

14.0 |

2.0 |

||||

|

Proceeds from disposal of royalty interests |

— |

— |

11.2 |

7.0 |

||||

|

Acquisition of energy well equipment |

(0.7) |

(0.4) |

(1.4) |

(1.2) |

||||

|

Acquisition of property and equipment |

— |

— |

(0.1) |

— |

||||

|

Net cash used in investing activities |

$ |

(279.0) |

$ |

(173.7) |

$ |

(506.2) |

$ |

(436.9) |

|

Cash flows used in financing activities |

||||||||

|

Payment of dividends |

$ |

(61.1) |

$ |

(56.8) |

$ |

(180.3) |

$ |

(173.2) |

|

Proceeds from exercise of stock options |

— |

— |

2.7 |

2.9 |

||||

|

Revolving credit facility amendment costs |

— |

— |

(0.8) |

— |

||||

|

Net cash used in financing activities |

$ |

(61.1) |

$ |

(56.8) |

$ |

(178.4) |

$ |

(170.3) |

|

Effect of exchange rate changes on cash and cash equivalents |

$ |

4.8 |

$ |

(3.5) |

$ |

(6.5) |

$ |

0.1 |

|

Net change in cash and cash equivalents |

$ |

(121.7) |

$ |

2.0 |

$ |

(104.6) |

$ |

100.6 |

|

Cash and cash equivalents at beginning of period |

$ |

1,439.0 |

$ |

1,295.1 |

$ |

1,421.9 |

$ |

1,196.5 |

|

Cash and cash equivalents at end of period |

$ |

1,317.3 |

$ |

1,297.1 |

$ |

1,317.3 |

$ |

1,297.1 |

|

Supplemental cash flow information: |

||||||||

|

Income taxes paid |

$ |

14.1 |

$ |

16.1 |

$ |

56.6 |

$ |

67.0 |

|

Dividend income received |

$ |

5.1 |

$ |

3.1 |

$ |

9.3 |

$ |

8.7 |

|

Cash paid for interest expense and loan standby fees |

$ |

0.5 |

$ |

0.6 |

$ |

1.5 |

$ |

1.8 |

The unaudited condensed consolidated interim financial statements and accompanying notes can be found in our Q3 2024 Quarterly Report available on our website

![]() View original content:https://www.prnewswire.com/news-releases/franco-nevada-reports-q3-2024-results-302298101.html

View original content:https://www.prnewswire.com/news-releases/franco-nevada-reports-q3-2024-results-302298101.html

SOURCE Franco-Nevada Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Correction: Antelope Enterprise Holdings Limited Receives Deficiency Letter from NASDAQ Regarding Minimum Bid Price Deficiency

NEW YORK, NY, Nov. 06, 2024 (GLOBE NEWSWIRE) — Antelope Enterprise Holdings Limited (NASDAQ Capital Market: AEHL) (“Antelope Enterprise”, “AEHL” or the “Company”), a provider of electricity through natural gas power generation, and the majority interest owner of KylinCloud, a livestreaming e-commerce business in China, announced today a correction as to information contained in the deficiency letter received from Nasdaq regarding the minimum bid price deficiency of its Class A ordinary shares. In accordance with Nasdaq Listing Rule 5810(c)(3)(A) (the “Compliance Period Rule”), the Company has been provided an initial period of 180 calendar days, or until April 30, 2025 (the “Compliance Date”), to regain compliance with the Bid Price Rule. On November 5, 2024, the Company released a press release with information that the Compliance Date was January 22, 2024, which was incorrect.

On November 1, 2024, the Company received a deficiency letter from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market (“Nasdaq”). The deficiency letter advised that for the last 30 consecutive business days the bid price for the Company’s Class A ordinary shares had closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). The deficiency letter does not result in the immediate delisting of the Company’s Class A ordinary shares from the Nasdaq Capital Market.

If, at any time before the Compliance Date, the bid price for the Company’s Class A ordinary shares closes at $1.00 or more for a minimum of 10 consecutive business days as required under the Compliance Period Rule, the Staff will provide written notification to the Company that it complies with the Bid Price Rule, unless the Staff exercises its discretion to extend this 10 day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H). If the Company is not in compliance with the Bid Price Rule by April 30, 2025, the Company may be afforded a second 180 calendar day period to regain compliance. To qualify, the Company would be required to meet the continued listing requirement for the market value of its publicly held shares and all other initial listing standards for The Nasdaq Capital Market, except for the minimum bid price requirement. In addition, the Company would be required to notify Nasdaq of its intent to cure the minimum bid price deficiency, which may include, if necessary, implementing a reverse stock split.

If the Company does not regain compliance with the Bid Price Rule by the Compliance Date and is not eligible for an additional compliance period at that time, the Staff will provide written notification to the Company that its Class A ordinary shares may be delisted. The Company would then be entitled to appeal the Staff’s determination to a NASDAQ Listing Qualifications Panel and request a hearing. There can be no assurance that, if the Company does appeal the delisting determination by the Staff to the NASDAQ Listing Qualifications Panel, that such appeal would be successful.

The Company intends to monitor the closing bid price of its Class A ordinary shares and may, if appropriate, consider available options to regain compliance with the Bid Price Rule, which could include effecting a reverse stock split. However, there can be no assurance that the Company will be able to regain compliance with the Bid Price Rule.

About Antelope Enterprise Holdings Limited

Antelope Enterprise Holdings Limited (“Antelope Enterprise”, “AEHL” or the “Company”) engages in energy infrastructure solutions through natural gas power generation via its wholly owned subsidiary AEHL US LLC and holds a 51% ownership position in Hainan Kylin Cloud Services Technology Co. Ltd (“Kylin Cloud”), which operates a livestreaming e-commerce business in China. Kylin Cloud provides access to over 800,000 hosts and influencers. For more information, please visit our website at https://aehltd.com.

Safe Harbor Statement

Certain of the statements made in this press release are “forward-looking statements” within the meaning and protections of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance, capital, ownership or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this press release include, without limitation, the continued stable macroeconomic environment in the PRC, the PRC technology sectors continuing to exhibit sound long-term fundamentals, and our ability to continue to grow our energy, livestreaming ecommerce, business management and information system consulting businesses. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target” and other similar words and expressions of the future. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the U.S. Securities and Exchange Commission.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 20-F for the year ended December 31, 2023 and otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at http://www.sec.gov. We have no obligation and do not undertake to update, revise or correct any of the forward-looking statements after the date hereof, or after the respective dates on which any such statements otherwise are made.

Contact Information:

Antelope Enterprise Holdings Limited

Edmund Hen, Chief Financial Officer

Email: info@aehltd.com

Precept Investor Relations LLC

David Rudnick, Account Manager

Email: david.rudnick@preceptir.com

Phone: +1 646-694-8538

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Exercise: Yin C Becker At Stryker Realizes $1.34M

On November 5, it was revealed in an SEC filing that Yin C Becker, VP at Stryker SYK executed a significant exercise of company stock options.

What Happened: Becker, VP at Stryker, made a strategic move by exercising stock options for 4,980 shares of SYK as detailed in a Form 4 filing on Tuesday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,340,815.

During Wednesday’s morning session, Stryker shares down by 0.35%, currently priced at $365.88. Considering the current price, Becker’s 4,980 shares have a total value of $1,340,815.

Discovering Stryker: A Closer Look

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, extremities, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and orthopedic robotics. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker’s total revenue currently comes from outside the United States.

Stryker’s Economic Impact: An Analysis

Revenue Growth: Over the 3 months period, Stryker showcased positive performance, achieving a revenue growth rate of 11.92% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Key Profitability Indicators:

-

Gross Margin: The company excels with a remarkable gross margin of 64.02%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Stryker’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 2.18.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.77, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 39.64 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 6.48, Stryker’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 28.01 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Stryker’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wolfspeed Stock Is Falling After The Bell: What's Going On?

Wolfspeed Inc WOLF shares are tumbling in Wednesday’s after-hours session in the wake of the company’s third-quarter financial results. Wolfspeed announced initiatives to streamline its cost structure. Here’s a rundown of the report.

- Q1 Revenue: $194.7 million, versus estimates of $200.39 million

- Q1 Adjusted EPS: Loss of 91 cents, versus estimates for a loss of $1.

“To drive operational improvements, we are taking action to enhance efficiency, align our business with current market conditions and become the first silicon carbide company to transition to pure-play 200-millimeter. The transition to a fully 200-millimeter platform allows us to take further initiatives to streamline our cost structure, including closing our manual Durham 150-millimeter Fab, other manufacturing footprint rationalization, and reducing our workforce,” said Gregg Lowe, CEO of Wolfspeed.

Wolfspeed ended the quarter with approximately $1.7 billion in cash and investments. The company also noted it has access to up to $2.5 billion in incremental funding to support its U.S. capacity expansion plans.

The company said it expects its cost-cutting initiatives to result in approximately $200 million in annual cash savings.