Edge Ai Software Market Size to Surpass USD 13.12 Billion by 2032 | Straits Research

New York, United States, Nov. 06, 2024 (GLOBE NEWSWIRE) — Edge AI software empowers edge devices with the capabilities of artificial intelligence, enabling real-time data processing at the source rather than relying on remote cloud servers. This approach mitigates latency, safeguards data privacy, and optimizes bandwidth consumption, making it well-suited for applications such as smart cities, healthcare, autonomous vehicles, industrial automation, and more. The increasing prevalence of IoT devices, the demand for low-latency and real-time decision-making, the need for privacy in sensitive applications, and the expansion of 5G networks are key drivers for the adoption of Edge AI. By processing data locally, Edge AI facilitates faster responses, energy efficiency, and greater autonomy, making it a crucial component in industries that prioritize speed and operational efficiency.

Download Free Sample Report PDF @https://straitsresearch.com/report/edge-ai-software-market/request-sample

Market Dynamics

Advancements in Energy-Efficient AI Chips and Hardware drive the global Edge AI Software market

The development of specialized AI hardware, such as energy-efficient processors and AI accelerators designed for edge computing, is a major driver of Edge AI adoption. Companies are developing specialized chips optimized for low-power, high-performance AI tasks on edge devices. These chips extend operational lifetimes in IoT devices, drones, and smart sensors, expanding the potential of Edge AI in resource-constrained environments. For instance, on August 6, 2024, Japan’s emerging company EdgeCortix is making energy-efficient AI chips and software for the edge.

Growing Demand for Edge AI in Cybersecurity and Threat Detection creates opportunities for the global edge AI Software market

Edge AI offers a significant opportunity in real-time threat detection and prevention. By processing data locally, it can identify and mitigate security threats faster than cloud-based systems, reducing the risk of data breaches. This approach is particularly valuable in sectors like finance, healthcare, and critical infrastructure, where rapid response and localized security measures are paramount. As businesses prioritize robust, on-device security solutions, this trend is expected to gain traction. For instance, on 12 February 2024, Edge AI hub receives USD 54.01 Bn funding for research into cyber threats.

Regional Analysis

North America is the most significant global Edge AI software market shareholder and is anticipated to exhibit a CAGR of XX% during the forecast period. North America’s Edge AI market is driven by the region’s focus on advanced technologies. The U.S., a key player, is leading the way in AI adoption. Government initiatives and companies like Innodisk, showcasing AI solutions at events like NVIDIA GTC, are contributing to the region’s market growth. The tech advancement and the Tech giants in the US leading the edge AI software demand. Biden-Harris Administration Announces New USD 30 Million in Investment in Innovative IT Technologies.

According to the US Department of State, AI-related federal contracts increased by almost 1,200%, from USD 355 million in the period leading up to August 2022, to USD 4.6 billion in the period leading up to August 2023. In the US automakers will invest nearly USD 50 billion in autonomous vehicle development through 2025. In January 2024, the US Army extended its agreement with the University of Michigan’s Automotive Research Center by five years, with a potential investment of up to USD 100 million to increase work on autonomous vehicle technologies which need the edge AI for direction detection.

Europe is expected to maintain a significant market share due to the increasing popularity of edge AI solutions in manufacturing, automotive, energy & utilities, and other sectors across the U.K., Germany, France, and Italy. Market players are investing heavily in R&D to develop advanced-edge AI solutions. The increasing prevalence of IoT devices, the demand for low-latency and real-time decision-making, and the growing emphasis on data privacy are driving the adoption of edge AI software in Europe.

Between 2018 and 2022, the UK self-driving vehicle sector alone generated USD 593.75 million of direct investment and created 1,500 new jobs that need the edge AI software in cars. France published a national AI strategy with USD 2.63 million to be invested in the creation of AI clusters by 2030. Microsoft To Invest USD 3.52 million in Germany for its AI proliferation. Hence the market for edge AI software is increasing in the European region.

To Gather Additional Insights on the Regional Analysis of the Edge Ai Software Market @ https://straitsresearch.com/report/edge-ai-software-market/request-sample

Key Highlights

- The Global Edge AI Software Market size was valued at USD 19.65 billion in 2023 and is projected to grow from USD 26.5 billion in 2024 to USD 264.59 billion by 2032, exhibiting a CAGR of 32.4% during the forecast period (2024-2032).

- Based on data sources, the global Edge AI software market is segmented into Video and Image Recognition, Speech Recognition, Biometric Data, Sensor Data, and Mobile Data. The video and image recognition segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- Based on Component, the global Edge AI software market is segmented into Solutions, and Services. The Solution segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- Based on End users, the global Edge AI software market is segmented into Automotive, Manufacturing, Healthcare, Energy & Utility, Retail & Consumer Goods, IT & Telecom, and Others. The Automotive segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- North America is the most significant global Edge AI software Market shareholder and is anticipated to exhibit a CAGR of XX% during the forecast period.

Competitive Players

- Alphabet (Google’s parent company)

- IBM

- Microsoft

- Amazon

- Intel

- Synaptics

- ADLINK

- Edge Impulse

- Viso.ai

- Akamai Technologies

Recent Developments

- In March 2024, Neural Magic and Akamai Technologies announced a strategic partnership to improve deep learning capabilities on Akamai’s distributed computing infrastructure. This collaboration aims to drive innovation in edge AI inference across multiple industries.

- On Nov 7, 2023, IBM announced that it is launching a USD500 million venture fund to invest in a range of AI companies.

- Feb. 26, 2024, Lenovo unveiled next-generation Integrated Edge AI Solutions for Telco that help enterprises go beyond the data center to harness vast bodies of data at the far edge for transformative AI applications at scale while reducing energy consumption.

Segmentation

- By Data Source

-

- Video and Image Recognition

- Speech Recognition

- Biometric Data

- Sensor Data

- Mobile Data

- By Component

-

- Solutions

- Services

- By End users

-

- Automotive

- Manufacturing

- Healthcare

- Energy & Utility, Retail & Consumer Goods

- IT & Telecom

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Get Detailed Market Segmentation @ https://straitsresearch.com/report/edge-ai-software-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision-making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A2P Messaging Market Size to Surpass USD 97.84 Billion by 2032 | Straits Research

New York, United States, Nov. 06, 2024 (GLOBE NEWSWIRE) — A2P (Application-to-Person) Messaging refers to automated communications an application sends to an individual. Unlike P2P (Person-to-Person) messaging, which allows for direct contact between individuals, A2P messaging is primarily used for business-to-consumer transactions. It covers a variety of communications such as transactional notifications, promotional messages, and authentication codes.

Download Free Sample Report PDF @https://straitsresearch.com/report/a2p-messaging-market/request-sample

Market Dynamics

Increasing Mobile Device Penetration drives the global A2P messaging market

The increasing integration of mobile devices, particularly smartphones, is a major driver of the A2P (Application-to-Person) messaging market. As mobile devices become more common worldwide, businesses use A2P messaging to reach a larger audience more effectively. This is transforming how businesses communicate with their customers, making A2P messaging an essential tool for reaching and engaging users worldwide. For Instance, on 4 April 2023, WhatsApp expanded its Business API to allow more businesses to send A2P messages directly to customers. Leveraging Emerging Technologies creates opportunities for the global A2P messaging market

Leveraging Emerging Technologies creates opportunities for the global A2P messaging market

Leveraging emerging technologies such as RCS, AI, and chatbots in A2P messaging provides organizations with substantial opportunities to increase communication capabilities and customer experiences, creating a competitive advantage. Businesses that adopt these technologies early can promote innovation, enhance engagement, and adapt their communications strategies to suit their customers’ changing demands.

Regional Analysis

APAC is the dominating region in the global A2P market shareholder and is anticipated to exhibit a CAGR of XX% during the forecast period. APAC (Asia-Pacific) is the dominant market for A2P (Application-to-Person) messaging. This dominance is driven by several factors, such as high mobile penetration, a large population base, rapid digitalization in countries including China, India, and Japan, and significant investments in mobile infrastructure.

The APAC region is a major growth driver in the A2P messaging market due to its huge population, high mobile usage, and increasing digitalization. Key markets such as China, India, and Japan contribute significantly, with A2P messaging being widely used for applications such as advertising, transaction alerts, and customer care. The region’s diversified regulatory structure and varying levels of technology innovation across countries influence market dynamics. The A2P messaging market in APAC is being driven by increased smartphone penetration, expanded mobile network coverage, and a growing need for individualized communication.

North America is the fastest-growing region in the A2P (Application-to-Person) messaging industry, owing to its superior technological infrastructure and high mobile communication service adoption rates. The United States and Canada are major players, accounting for a considerable portion of A2P communications traffic in industries such as banking, healthcare, and retail. The region’s strong regulatory frameworks and emphasis on data security have a significant impact on market dynamics. The proliferation of mobile applications, as well as the increasing requirement for businesses to communicate with customers fastest via SMS and messaging platforms, are important drivers of growth in this region.

To Gather Additional Insights on the Regional Analysis of the A2P Messaging Market @ https://straitsresearch.com/report/a2p-messaging-market/request-sample

Key Highlights

- The global A2P Messaging Market was valued at USD 68.74 billion in 2023 and is expected to increase from USD 71.49 billion in 2024 to USD 97.84 billion in 2032, with a CAGR of 4.2% over the forecast period (2023-2032)

- By components, the global A2P messaging market is bifurcated into solutions and services. The solution segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- By deployment mode, the global A2P messaging market is bifurcated into on-premises and cloud-based. The Cloud-based deployment segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- By SMS Traffic, the global A2P messaging market is bifurcated into transactional SMS and promotional SMS. The transactional SMS segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- By application, the global A2P messaging market is bifurcated into CRM, authentication & security. The notification segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- By vertical, the global A2P messaging market is bifurcated into healthcare, retail & e-commerce, BFSI, travel & hospitality, education, and others. The Retail & E-commerce segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- APAC is the dominating region in the global A2P market shareholder and is anticipated to exhibit a CAGR of XX% during the forecast period.

Competitive Players

- Twilio Inc.

- Infobip

- Nexmo

- Sinch

- SAP SE

- Monty Mobile

- Click tell

- Orange Business Services

- MessageBird

- Mavenir

Recent Developments

- In June 2023, the term “artificially inflated traffic” (AIT) refers to the fraudulent transmission of A2P messages by rogue mobile network operators (MNOs) or other value chain participants, such as SMS aggregators, to profit from higher traffic. Often, the uninformed firm pays the price.

- In March 2022, Infobip Ltd. introduced a new integrated SMS and WhatsApp messaging notification function to increase customer loyalty and improve customer experience.

- In December 2021, Microsoft bought Xandr, an AT&T digital marketing, advertising, and retail media platform. The acquisition will boost Microsoft’s capacity to offer open web solutions for digital marketing, advertising, and retail media.

Segmentation

- By Component

-

- Solution

- Services

- By Deployment Mode

-

- On-premises

- Cloud-based

- By Enterprise Size

-

- Large Enterprises

- Small & Medium Enterprises

- By SMS Traffic

- Transactional SMS

- Promotional SMS

- By Application

-

- CRM

- Authentication & security

- Notification

- Marketing and Promotion

- By Vertical

-

- Healthcare

- Retail & E-commerce

- BFSI

- Travel & Hospitality

- Education

- Others

- By Region

-

- North America

- Europe

- Latin America

- APAC

- Middle East and Africa

Get Detailed Market Segmentation @ https://straitsresearch.com/report/a2p-messaging-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision-making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Flexitanks Market Size Projected to Surpass USD 1.2 Billion by 2031 with Impressive 14.3% CAGR| Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. , Nov. 06, 2024 (GLOBE NEWSWIRE) — The flexitanks industry (industri flexitanks) was valued at US$ 384.4 million in 2022. From 2023 to 2031, the market is predicted to increase at 14.3% CAGR and total US$ 1.2 billion during the forecast period. As flexitank technology advances, including materials, designs, and manufacturing processes, they will become more efficient, safe, and sustainable, making them more appealing to customers.

Flexitanks could be affected by changes in regulations for liquid transportation and environmental concerns. The industry’s future may depend on compliance with evolving standards. The flexitank industry might get eco-friendlier with increased awareness and emphasis on sustainability. The more sustainable practices a company adopts and promotes, the more competitive it will be. Flexitanks may become more appealing in different regions and industries as companies strive to optimize their supply chains and reduce transportation costs.

Request Sample of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2570

Flexitank technology is advancing, such as in materials and design innovations, which might further increase their performance and reliability, thereby expanding their market. With flexitanks, supply chain logistics can be optimized by reducing the need for packaging, storage, and handling, resulting in increased efficiency.

Global Flexitanks Market: Key Players

Recent flexitanks market analysis reveals that leading players are expanding their global footprint and increasing their market share by launching new products and acquisitions. In response to an increasing demand worldwide for liquid cargo flexi-systems, they have increased production and invested in research and development.

- Rishi FIBC Pvt. Ltd.

- Trans Ocean Bulk Logistics Ltd.

- UWL Inc.

- DHL International GmbH

- Bag Supplies (FIBC) Limited

- Trust Flexitanks

- Sai Freight

- Braid Logistics UK

- BLS Ltd.

- Quingdao Global Flexitank Logistics

- Buscherhoff Packaging Solutions GmbH

- LSM S.A. – FLEXPACK

- Sai Flexitanks

- Zijderlaan Bulk Liquids BV

- Andesocean

- HOYER GmbH

- Tiba Group

Key Findings of the Market Report

- Tanks with multiple layers are becoming increasingly popular around the world.

- Pharmaceutical and healthcare industries use liquid detergents heavily to maintain hygienic conditions.

- In 2020, Malaysia produced 25.8% of global palm oil and exported 34.3%.

- A significant portion of the global flexitanks market came from Asia Pacific in 2022.

Global Flexitanks Market: Growth Drivers

- Flexitanks are relatively easier to handle and install than bulk liquid transport containers. The ease of use can result in a reduction in labor and time costs. Flexitanks are often considered an efficient alternative to traditional liquid shipping methods. The cost of transportation can be reduced compared to other methods of transporting bulk liquids. The versatility of these products makes them appealing to a wide range of industries.

- Flexitanks offer greater space efficiency than conventional drums and intermediate bulk containers (IBCs). As a result of this efficiency, a single shipment can transport more liquid. Single-use products reduce cleaning requirements and contamination risks. Increasing global trade will drive the need for cost-effective, efficient shipping methods. Flexitanks are one such solution. Liquids can be transported across borders with flexitanks.

- Flexitanks can provide an alternative solution to the transportation of liquids in compliance with certain regulations. Flexitanks may offer a compliant solution to various industries requiring regulatory compliance.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2570

Global Flexitanks Market: Regional Landscape

- Asia Pacific is expected to lead the market for flexitanks. As the economy and industries in the Asia Pacific grow, flexitanks are in high demand, especially to transport chemicals and industrial liquids. Trade and export-oriented industries are major hubs in the Asia Pacific. With the region’s active involvement in global trade, bulk liquid transportation solutions, such as flexitanks, will likely become more necessary.

- Agriculture and edible oils are major exports from the region. Flexitanks are often used to transport liquid commodities as agricultural exports dominate Asia Pacific countries. Flexitanks can be needed to transport a variety of chemicals and related products to Asia Pacific, including China and India. The Asia Pacific region is developing infrastructure, so flexitanks can help transport adhesives, specialty chemicals, coatings, and other liquids related to construction.

- As the region’s food and beverage industries grow, demand for flexitanks may also increase. The most common use of flexitanks is for transporting liquids suitable for human consumption, such as wines, juices, and edible oils. Regulatory changes, including those related to liquid transportation, can influence flexitank demand. To meet regulatory requirements, flexitanks that comply with these standards may be in greater demand.

Global Flexitanks Market: Segmentation

By Product

- Monolayer

- Bi-layer

- Multilayer

By Type

By Material

By Application

- Food Grade Liquids

- Non-hazardous Chemicals

- Industrial Liquids

- Agricultural Liquids

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report @ https://www.transparencymarketresearch.com/checkout.php?rep_id=2570<ype=S

More Trending Report by Transparency Market Research:

- Chemical Warehousing Market– The global Chemical Warehousing Market (Pasaran Gudang Kimia) stood at US$ 15.3 Bn in 2021 and is projected to reach US$ 22.1 Billion by 2031.

- Hybrid Electrolyte Market– The hybrid electrolyte market (pasaran elektrolit hybrid) was valued at US$ 22.5 Mn in 2021. It is estimated to grow at a CAGR of 11.4 % from 2022 to 2031 and reach US$ 65.5 Million by the end of 2031.

- Light Diffusion Materials Market – The global light diffusion materials market (pasaran bahan resapan cahaya) is estimated to grow at a CAGR of 4.5% from 2024 to 2034 and reach US$ 2.9 Billion by the end of 2034.

- In-mold Labeling Market – The global in-mold labeling market (pasaran pelabelan dalam acuan) is estimated to grow at a CAGR of 4.6% from 2024 to 2034 and reach US$ 3.8 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Cancer Cell Analysis Market Size/Share Worth USD 23.31 Billion by 2033 at a 8% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

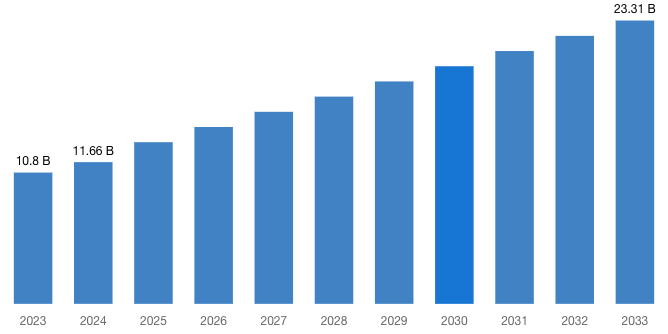

Austin, TX, USA, Nov. 06, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Cancer Cell Analysis Market Size, Trends and Insights By Application (Cancer Research Centers, Cancer Hospital, Surgical Centers, Clinics), By Product (Instruments, Consumables), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

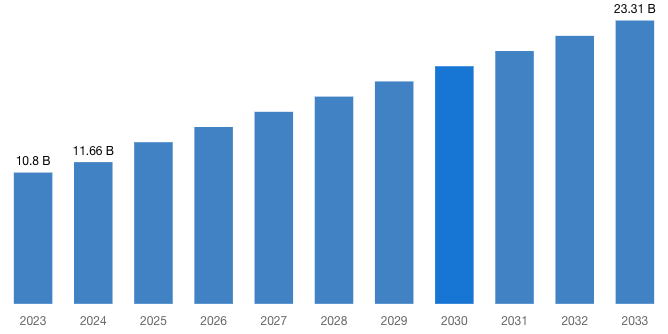

“According to the latest research study, the demand of global Cancer Cell Analysis Market size & share was valued at approximately USD 10.80 Billion in 2023 and is expected to reach USD 11.66 Billion in 2024 and is expected to reach a value of around USD 23.31 Billion by 2033, at a compound annual growth rate (CAGR) of about 8% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Cancer Cell Analysis Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53401

Cancer Cell Analysis Market: Growth Factors and Dynamics

- Increasing Incidence of Cancer: With the rising prevalence of cancer worldwide, there’s a growing demand for advanced diagnostic and treatment methods, including cell analysis techniques.

- Technological Advancements: Advances in cell analysis technologies, such as flow cytometry, next-generation sequencing (NGS), and single-cell analysis techniques, have significantly improved the understanding of cancer biology and personalized treatment options.

- Rising Investments in Research and Development: Governments, academic institutions, and private organizations are investing heavily in cancer research, driving innovation in cell analysis tools and techniques.

- Growing Demand for Personalized Medicine: Personalized medicine approaches require detailed molecular profiling of cancer cells to tailor treatment plans to individual patients. Cell analysis technologies play a crucial role in enabling personalized medicine by providing insights into tumor heterogeneity and drug responses.

- Expanding Applications in Drug Discovery and Development: Cancer cell analysis is increasingly used in drug discovery and development processes to identify new drug targets, evaluate drug efficacy, and predict drug responses. This application drives the demand for advanced cell analysis platforms and services.

- Increasing Adoption of Liquid Biopsy: Liquid biopsy techniques, which involve the analysis of circulating tumor cells (CTCs), cell-free DNA (cfDNA), and other biomarkers in blood or other body fluids, are gaining traction for non-invasive cancer diagnosis, prognosis, and monitoring. This trend fuels the demand for cancer cell analysis technologies.

- Growing Awareness and Screening Programs: Public awareness campaigns and screening programs for early cancer detection contribute to the demand for cell analysis technologies that can detect and characterize cancer cells accurately.

- Emerging Markets and Technological Accessibility: The expanding healthcare infrastructure in emerging markets, coupled with the increasing accessibility of advanced cell analysis technologies, creates new growth opportunities for market players.

- Collaborations and Partnerships: Collaborations between academic institutions, research organizations, and industry players facilitate the development and commercialization of innovative cancer cell analysis solutions, driving market growth.

Request a Customized Copy of the Cancer Cell Analysis Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53401

Cancer Cell Analysis Market: Product development

- In April 2024, QIAGEN N.V. announced new products to enhance cancer research and enable urine collection for liquid biopsy. These innovations and the upcoming IVD version of the QIAcuity digital PCR platform will debut at the AACR annual meeting in San Diego, April 5-10. The event will feature two Exhibitor Spotlight Theater sessions and several poster presentations showcasing QIAGEN’s advancements in cancer research.

- In April 2024, Bio-Rad Laboratories, Inc. unveiled its pioneering ddPLEX ESR1 Mutation Detection Kit, marking its foray into ultrasensitive multiplexed digital PCR assays. Catering to the oncology sector, this innovation enhances the company’s Droplet Digital PCR (ddPCR™) lineup. The kit’s high sensitivity and multiplexed capabilities promise to revolutionize translational research, therapy selection, and disease tracking in oncology. As Bio-Rad continues to innovate in life science and clinical diagnostics, this launch signifies a significant advancement in precision medicine.

- In May 2023, BD (Becton, Dickinson and Company) launched a groundbreaking cell sorting instrument featuring BD CellView™ Image and BD SpectralFX™ Technologies. BD CellView™ allows researchers to see detailed microscopic images and sort cells at high speeds based on visual traits. BD SpectralFX™ enables full-spectrum cell sorting with a simplified workflow. This new BD FACSDiscover™ S8 Cell Sorter enhances research capabilities, promising advancements in drug discovery, immuno-oncology, and genomics.

- In March 2022, Mission Bio, Inc. introduced the Tapestri Solution for Solid Tumor Research. This comprehensive single-cell DNA sequencing workflow on the Tapestri Platform features a nuclei isolation prep protocol, pre-designed research panels for breast cancer and glioblastoma multiforme, and an enhanced single-cell copy number variation (CNV) bioinformatic analysis tool.

- In April 2022, 10x Genomics launched two new products: Fixed RNA Profiling and Nuclei Isolation Kits. These tools enhance sample preparation workflows and expand the use of the Chromium platform for single cell analysis. They facilitate multiomic analysis of fragile human tissues and improve accessibility to frozen sample analysis, which is typically costly and time-consuming. These innovations aim to advance research and human health by simplifying and broadening single cell analysis capabilities.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 11.66 Billion |

| Projected Market Size in 2033 | USD 23.31 Billion |

| Market Size in 2023 | USD 10.80 Billion |

| CAGR Growth Rate | 8% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Application, Product and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Cancer Cell Analysis report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Cancer Cell Analysis report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Cancer Cell Analysis Market Report @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Cancer Cell Analysis Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Cancer Cell Analysis Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in Supply Chain: The pandemic caused significant disruptions in global supply chains, affecting the availability of necessary equipment, reagents, and other supplies crucial for cancer cell analysis.

- Disruption of Clinical Trials: Many clinical trials for cancer treatments were delayed or halted due to the pandemic, affecting the development and validation of new cancer therapies and diagnostic tools.

- Impact on Workforce: Healthcare workers, including those involved in cancer cell analysis, faced burnout and increased workloads, potentially affecting the quality and efficiency of cancer diagnostics and research.

- Accelerated Technological Advancements: The pandemic spurred rapid innovation and adoption of advanced technologies in the healthcare sector. This includes enhanced imaging techniques, artificial intelligence (AI), and machine learning (ML) tools for cancer cell analysis, improving accuracy and efficiency.

- Increased Research Funding: Governments and private organizations increased funding for healthcare research, including cancer research, to better understand the virus’s effects on cancer patients and to develop new diagnostic tools.

- Enhanced Remote Monitoring and Telemedicine: The need for remote healthcare solutions during the pandemic accelerated the development and adoption of telemedicine. This facilitated remote cancer cell analysis and patient monitoring, leading to broader access to healthcare services.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Cancer Cell Analysis Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Cancer Cell Analysis Market Report @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Key questions answered in this report:

- What is the size of the Cancer Cell Analysis market and what is its expected growth rate?

- What are the primary driving factors that push the Cancer Cell Analysis market forward?

- What are the Cancer Cell Analysis Industry’s top companies?

- What are the different categories that the Cancer Cell Analysis Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Cancer Cell Analysis market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Cancer Cell Analysis Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Cancer Cell Analysis Market – Regional Analysis

The Cancer Cell Analysis Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: The growth of the Cancer Cell Analysis Market in North America is driven by key trends including advancements in personalized medicine, the increasing prevalence of cancer, and the integration of AI and machine learning for enhanced diagnostics. Additionally, robust funding for cancer research, a growing focus on early detection and minimally invasive diagnostics, and technological innovations in single-cell analysis contribute significantly. Furthermore, the rising adoption of precision oncology and targeted therapies, along with supportive regulatory frameworks and collaborations between research institutions and biotech companies, bolster market expansion.

- Europe: Key trends driving the growth of the Cancer Cell Analysis Market in Europe include the rising prevalence of cancer, increasing investment in cancer research, and advancements in personalized medicine. Additionally, technological innovations in imaging and analysis techniques, growing adoption of high-throughput screening methods, and increased government funding for oncology research support market expansion. Collaborations between academic institutions and biopharmaceutical companies, along with heightened focus on early diagnosis and targeted therapies, further bolster market growth. Enhanced regulatory frameworks and initiatives to streamline clinical trials also play a crucial role in fostering market development in the region.

- Asia-Pacific: The growth of the Cancer Cell Analysis Market in Asia-Pacific is driven by several key factors: increasing prevalence of cancer, rising healthcare expenditure, and advancements in technology. Additionally, growing awareness about early cancer diagnosis, expanding the biopharmaceutical industry, and supportive government initiatives enhance market expansion. The region’s aging population and lifestyle changes contribute to higher cancer incidence, further boosting demand. Moreover, the presence of major market players and collaborations for research and development fuel market growth. Enhanced laboratory infrastructure and increased adoption of personalized medicine also play significant roles in driving the market forward.

- LAMEA (Latin America, Middle East, and Africa): Key trends driving the growth of the Cancer Cell Analysis Market in LAMEA (Latin America, Middle East, and Africa) include increasing cancer prevalence, advancements in diagnostic technologies, and growing government and private sector investments in healthcare infrastructure. Additionally, rising awareness about early cancer detection and treatment, coupled with an expanding aging population, fuels market demand. Innovations in personalized medicine and targeted therapies also contribute significantly to the market’s expansion in the region.

Request a Customized Copy of the Cancer Cell Analysis Market Report @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Cancer Cell Analysis Market Size, Trends and Insights By Application (Cancer Research Centers, Cancer Hospital, Surgical Centers, Clinics), By Product (Instruments, Consumables), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

List of the prominent players in the Cancer Cell Analysis Market:

- Thermo Fisher Scientific

- Abbott

- Bio-Rad

- GE Healthcare

- Merck Millipore

- Becton Dickinson and Company

- Agilent Technologies

- Olympus Corporation

- Miltenyi Biotec

- Bio-Rad Laboratories

- BioStatus Limited

- Fluidigm Corporation

- NanoCellect Biomedical

- Cell Biolabs

- Creative Bioarray

- Meiji Techno

- Promega Corporation

- PerkinElmer

- Tecan Trading AG

- Others

Click Here to Access a Free Sample Report of the Global Cancer Cell Analysis Market @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Europe Weight Loss Market: Europe Weight Loss Market Size, Trends and Insights By Application (Dietary Supplements, Fitness Equipment, Meal Replacements, Weight Loss Programs), By Product Type (Conventional Weight Loss Products, Organic Weight Loss Products, Meal Plans & Services), By End User (Adults, Teenagers, Elderly), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Pacemaker Manufacturers Market: US Pacemaker Manufacturers Market Size, Trends and Insights By Product (Implantable pacemakers, External pacemakers), By Technology (Single Chamber, Dual Chamber, Biventricular Chamber), By Type (MRI Compatible Pacemakers, Conventional Pacemakers), By Application (Arrhythmias, Atrial Fibrillation, Heart Block, Long QT Syndrome, Congestive Heart Failure, Others), By End User (Hospitals, Cardiac Surgery Centers, Ambulatory Surgical Centers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Intravascular Ultrasound Devices Market: Intravascular Ultrasound Devices Market Size, Trends and Insights By Product Type (IVUS Consoles, IVUS Catheters), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Research Institutes), By Application (Coronary Diagnosis, Coronary Intervention, Coronary Research, Non-coronary/Peripheral Applications), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Ascites Market: Ascites Market Size, Trends and Insights By Types (Transudative, Exudative, Others), By Diagnosis (Ultrasound, CT Scan, MRI, Blood Test, Laparoscopy, Angiography, Others), By Treatment (Medication, Paracentesis, Surgery, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Homecare, Specialty Clinics, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Surgical Site Infection Control Market: Surgical Site Infection Control Market Size, Trends and Insights By Product (Surgical scrubs, Hair clippers, Surgical drapes, Surgical irrigation), By Surgery/Procedure (Cataract surgery, Cesarean section, Dental restoration, Gastric bypass, Others), By Type of Infection (Superficial incisional SSI, Deep incisional SSI, Organ or space SSI), By End-use (Hospitals, Ambulatory surgical centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Clinical Trial Outsourcing Market: Clinical Trial Outsourcing Market Size, Trends and Insights By Services (Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing Services, Clinical Trial Data Management Services, Others), By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional, Observational, Expanded Access), By Applications (Cancer, Cardiovascular Diseases, Nervous System Diseases, Infectious Diseases, Musculoskeletal Disease, Gastroenterology Diseases, Others), By End-User (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Veterinary Orthopedic Implants Market: Veterinary Orthopedic Implants Market Size, Trends and Insights By Product Type (Plates, Screws, Others), By Application (Cruciate Ligament Rupture, Bone Fractures, Elbow Dysplasia, Hip Dysplasia, Others), By End User (Veterinary Hospitals, Veterinary Clinics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Drug Addiction Treatment Market: Global Drug Addiction Treatment Market Size, Trends and Insights By Type (Opioid Addiction, Benzodiazepine Addiction, Barbiturate Addiction, Others), By Treatment (Therapy, Medication, Others), By Route of Administration (Oral, Parenteral, Others), By End Users (Hospitals, Specialty Clinics, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Cancer Cell Analysis Market is segmented as follows:

By Application

- Cancer Research Centers

- Cancer Hospital

- Surgical Centers

- Clinics

By Product

Click Here to Get a Free Sample Report of the Global Cancer Cell Analysis Market @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Cancer Cell Analysis Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Cancer Cell Analysis Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Cancer Cell Analysis Market? What Was the Capacity, Production Value, Cost and PROFIT of the Cancer Cell Analysis Market?

- What Is the Current Market Status of the Cancer Cell Analysis Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Cancer Cell Analysis Market by Considering Applications and Types?

- What Are Projections of the Global Cancer Cell Analysis Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Cancer Cell Analysis Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Cancer Cell Analysis Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Cancer Cell Analysis Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Cancer Cell Analysis Industry?

Click Here to Access a Free Sample Report of the Global Cancer Cell Analysis Market @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

Reasons to Purchase Cancer Cell Analysis Market Report

- Cancer Cell Analysis Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Cancer Cell Analysis Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Cancer Cell Analysis Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Cancer Cell Analysis Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Cancer Cell Analysis market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Cancer Cell Analysis Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Cancer Cell Analysis market analysis.

- The competitive environment of current and potential participants in the Cancer Cell Analysis market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Cancer Cell Analysis market should find this report useful. The research will be useful to all market participants in the Cancer Cell Analysis industry.

- Managers in the Cancer Cell Analysis sector are interested in publishing up-to-date and projected data about the worldwide Cancer Cell Analysis market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Cancer Cell Analysis products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Cancer Cell Analysis Market Report @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Cancer Cell Analysis Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cancer-cell-analysis-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

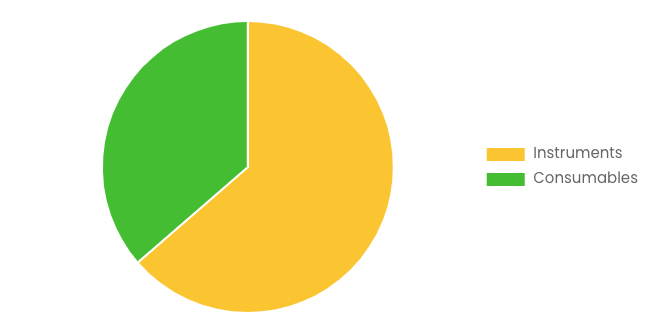

How Did S&P 500 Sectors Perform During Trump's First Term? Could This Time Be Different?

With Donald Trump clinching a second term in the 2024 U.S. presidential election, markets are turning their attention to his potential impact on the economy and markets.

While past performance doesn’t guarantee future results, it can still provide valuable insights for investors looking for clues about what to expect from the new administration.

Here’s a detailed look at how the 11 S&P 500 sectors fared during Trump’s first term.

Although Trump wasn’t sworn in as president until January 2017, financial markets began reacting to his potential policies immediately after his election.

Trump’s first term, which spanned from Nov. 8, 2016 — the day he won against Hillary Clinton — to Nov. 3, 2020 – when he lost versus Joe Biden — brought varied performances across S&P 500 sectors.

Technology and consumer discretionary sectors led the rally, while energy was the clear laggard, with the only negative return among sectors over those four years.

Tech stocks were buoyed by the spectacular rise of Magnificent Seven giants. An equally weighted basket of Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Alphabet Inc. GOOG GOOGL, Amazon.com Inc. AMZN, Meta Platforms Inc. META and Tesla, Inc. TSLA delivered a remarkable 380% return from November 2016 to November 2020. That return is nearly double the performance of the Magnificent Seven during Biden’s term.

Regarding the energy sector’s poor performance, that wasn’t solely a result of the COVID-19 pandemic-driven oil price collapse.

Despite Trump’s pro-fossil-fuel policies, energy stocks faced persistent headwinds throughout his term, even before 2020, with the global shift toward renewables putting continuous pressure on traditional oil and gas investments.

Surprisingly to many, solar stocks — tracked by the Invesco Solar ETF TAN — were among the top-performing industries during Trump’s first presidency, soaring by an impressive 267% between November 2016 and November 2020.

Below is a table and chart showing the performance of S&P 500 sectors under Trump’s first term.

| Sector ETF | Performance Nov. 8, 2016 – Nov. 3, 2020 |

|---|---|

| Technology Select Sector SPDR Fund XLK | +138.56% |

| Consumer Discretionary Select Sector SPDR Fund XLY | +86.70% |

| Health Care Select Sector SPDR Fund XLV | +53.58% |

| Materials Select Sector SPDR Fund XLB | +40.29% |

| Industrial Select Sector SPDR Fund XLI | +37.81% |

| Utilities Select Sector SPDR Fund XLU | +31.52% |

| Financial Select Sector SPDR Fund XLF | +24.31% |

| Consumer Staples Select Sector SPDR Fund XLP | +21.99% |

| Communication Services Select Sector SPDR Fund XLC | +20.20% |

| Real Estate Select Sector SPDR Fund XLRE | +15.84% |

| Energy Select Sector SPDR Fund XLE | -57.40% |

In the first three months following Trump’s 2016 election, financials stocks saw significant gains.

The Financial Select Sector SPDR Fund (XLF) rose by 17.2% between Nov. 8, 2016, and Jan. 10, 2017, outpacing all other sectors. The rally was driven by anticipation of deregulation and tax cuts, which boosted investor confidence in banks and other financial stocks.

Conversely, consumer staples and utilities — traditionally defensive sectors — were the weakest performers in that initial period, with losses of 2.39% and 2.3%, respectively.

| Sector | Return (Nov. 8, 2016 – Jan. 10, 2017) |

|---|---|

| Financials (XLF) | +17.21% |

| Industrials (XLI) | +8.07% |

| Materials (XLB) | +7.15% |

| Energy (XLE) | +6.91% |

| Consumer Discretionary (XLY) | +6.00% |

| Health Care (XLV) | +4.58% |

| Technology (XLK) | +4.20% |

| Real Estate (XLRE) | +0.42% |

| Utilities (XLU) | -2.30% |

| Consumer Staples (XLP) | -2.39% |

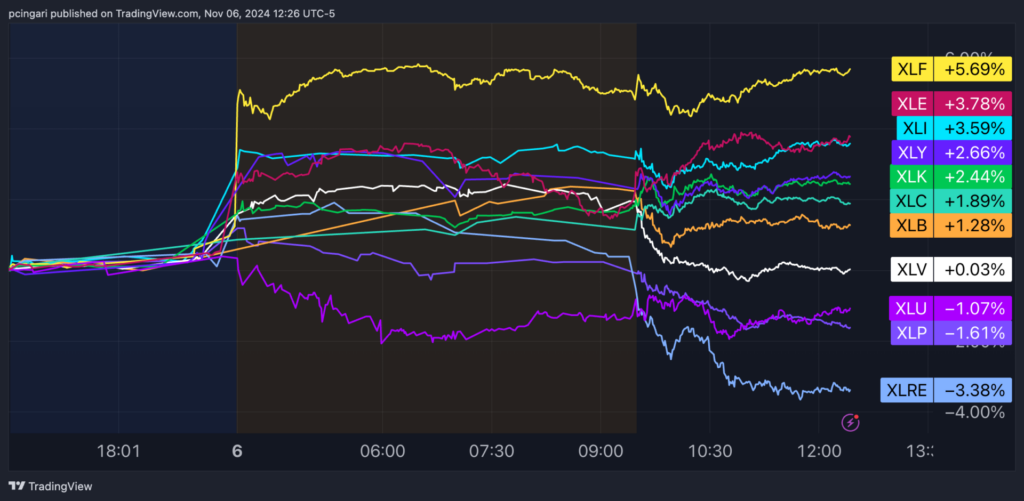

On November 6, 2024, the day after Trump’s re-election was confirmed, market activity showed a familiar pattern with financials and industrials posting the strongest gains.

Financials climbed by 5.6%, followed by energy and industrial, each more than 3.5%, suggesting renewed optimism for deregulation and potential infrastructure investment as investors previously had in the first three months following his election in 2016.

| S&P 500 Sector ETF | % Change (Nov. 6, 2024) |

|---|---|

| Financials (XLF) | +5.7% |

| Energy (XLE) | +3.8% |

| Industrials (XLI) | +3.6% |

| Consumer Discretionary (XLY) | +2.6% |

| Technology (XLK) | +2.4% |

| Communications (XLC) | +1.9% |

| Materials (XLB) | +1.3% |

| Health Care (XLV) | +0.0% |

| Utilities (XLU) | -1.1% |

| Consumer Staples (XLP) | -1.6% |

| Real Estate (XLRE) | -3.4% |

Trump’s return to the White House could bring back some familiar market dynamics, but the economic and geopolitical landscape in 2024 is notably different from 2016.

Investors should be prepared for a mix of potential tailwinds and headwinds that may shape sector performance in unique ways.

Trump’s expected emphasis on tax cuts, deregulation and support for traditional energy sources could once again boost sectors like financials, industrials and consumer discretionary. Financial stocks, in particular, might benefit from any renewed push to ease regulatory restrictions, while industrials could get a lift from a possible infrastructure spending package.

As in his first term, Trump’s focus on “America First” policies could support domestic manufacturing and sectors tied to infrastructure, including industrials and materials.

Trump’s pro-fossil-fuel stance could give the energy sector some breathing room. Traditional energy companies may benefit if there’s a shift in focus back toward oil and gas, though this will depend on global energy market dynamics.

Global trade dynamics have shifted significantly since Trump’s first term, with ongoing tensions between the U.S. and China.

If Trump reintroduces tariffs on Chinese imports, it could impact tech and industrials sectors, which rely on international supply chains and components.

Last but not least, even if Trump policies seem to prioritize fossil fuels, the private sector’s commitment to renewables could still drive growth in solar and clean energy stocks.

Read Now:

Photo: Image created using Shutterstock images

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks, Dollar Rally as Trump Wins US Election: Markets Wrap

(Bloomberg) — Stocks hit all-time highs, bond yields jumped and the dollar was set for its best day since 2020, with investors mapping out Donald Trump’s return to the White House and what his policies will mean for markets.

The S&P 500 climbed 2%, heading toward its 48th record this year, on bets the newly elected president will enact pro-growth policies that will boost Corporate America. A gauge of small caps rallied 4.6% amid speculation they will benefit from Trump’s protectionist stance, while wagers on lower taxes and reduced regulation lifted banks. Insurers focused on the Medicare market jumped on expectations the government will pay higher rates to companies that provide private versions of the US health program for seniors. Trump Media & Technology Group Corp. gained 6%.

Wall Street’s “fear gauge” — the VIX — tumbled the most since August to around 16. Trading on stocks spiked, with the S&P 500 volume 110% above the average of the past month. The Dow Jones Transportation Average jumped to a fresh high after a three-year drought of records, finally confirming the strength of its industrial counterpart. The breakout is a bullish sign to followers of an investing framework known as Dow Theory that says synchronized gains in both gauges portend better times ahead for the broad market.

“For now, investor sentiment is pro-growth, pro-deregulation, and pro-markets,” said David Bahnsen, chief investment officer at The Bahnsen Group. “There is also an assumption that M&A activity will pickup and that more tax cuts are coming or the existing ones will be extended. This creates a strong backdrop for stocks.”

Treasury yields climbed across the curve, with the move led by longer-term bonds as traders slashed wagers on the scope of rate cuts by the Federal Reserve. Investors have doubled down on bets for policies such as tax cuts and tariffs that could trigger price pressures. The moves also signal worries that Trump’s proposals will fuel the budget deficit and spur higher bond supply.

The dollar rallied against most major currencies, with the euro down 1.9%. The Mexican peso pared its loss to 0.7%. Bitcoin, viewed by many as a so-called Trump trade after he embraced digital assets during his campaign, hit a record high. Commodities came under pressure, with gold and copper tumbling. Oil wavered.

“The biggest takeaway from last night is that we received certainty that the market craves,” said Ryan Grabinski at Strategas. “This will allow both business and consumer confidence to improve. Attention now should shift to the Fed meeting tomorrow. The 10-year is approaching the 4.5% level, that’s the level risk assets ran into some trouble in the last 24 months.”

North Dakotans Reject Measure To Legalize Recreational Cannabis, 'Keeping A Shadow Over Their Garden'

North Dakota voters rejected Initiative Measure 5 legalizing recreational cannabis on Tuesday, with those opposed garnering 53.% of the vote, according to AP.

The third time was not the charm for voters in North Dakota to legalize marijuana. Two years ago, a similar measure was also rejected at the ballot box, and another attempt in 2018 also failed. Even though Measure 5 offered a more structured approach to regulation and licensing, it was not enough to gather support. Even a summer poll indicated a tight battle, with most voters not wanting legal weed.

“While we are disappointed that Measure 5 did not pass, Curaleaf remains committed to advocating for responsible cannabis access and education across the country,” Curaleaf’s CURLF chairman and CEO Boris Jordan told Benzinga. “Although this outcome continues to delay the opportunity for legal cannabis in North Dakota, we respect the democratic process and the will of the voters. Curaleaf believes in the potential of cannabis to improve lives and drive economic growth through job creation and tax revenue. As more states across the country embrace reform, we are confident that North Dakota will continue the conversation about cannabis legalization in the future.”

The New Economic Frontier formally launched the campaign in April after filing the initiative with the state. The organization highlighted the financial benefits North Dakota could gain by following neighboring states that have already legalized cannabis.

Measure 5

Under this measure, adults 21 and older would be allowed to use cannabis at home without punishment. The proposal would have allowed possession of one ounce of cannabis, 4 grams of concentrate and 1,500 milligrams of adult-use cannabinoid products.

“Due to the failure to pass Measure 5, individuals in the state can still face criminal penalties for possession—from a criminal infraction of up to a $1,000 fine to a Class A misdemeanor,” Paula Savchenko Esq., founding partner of Cannacore Group and PS Law Group told Benzinga. “Although criminal charges for cannabis-related offenses have declined since the state implemented its medical cannabis program, over 1,800 arrests were related to cannabis in 2023.”

According to her, with medical cannabis sales at $21.6 million for the state in 2023, adult-use sales could reach $70 million within its first year of operations and acquire up to $115 million by its fourth year. She stressed that “the state has forgone the potential tax revenue from the program, which could have supported public services such as health, infrastructure and education.”

Savchenko pointed out that it is unlikely any other legalization effort will make it through the legislature, which means that voters will not be able to legalize adult-use cannabis until the next general election in 2026.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Industry Reactions

Leafwell CEO Emily Fisher told Benzinga, “Leafwell is disappointed that North Dakota did not support Measure 5, which would have expanded responsible access to cannabis for adults. We remain committed to educating and guiding North Dakotans on safe cannabis care and will continue to work toward increased access and regulation in the state.”

Gurpreet (Pete) Sahani CEO of The Blinc Group, commented, “Although this vote did not result in the legalization of recreational cannabis, the push for reform is far from over. Cannabis has already become a part of the national conversation, and North Dakota’s progress toward legalization will continue. Advocates will keep pushing for a legal framework that promotes responsible use, economic growth, and social justice, ensuring this effort returns stronger in the next election cycle.

Louis Samuel, CEO of Golden State Canna, said “For the third time the voters of North Dakota have decided that the nickname they hold on their license plates, ‘The Peace Garden State’ excludes the plant more associated with Peace than any other. Measure 5 provided an opportunity to overcome past failures of initiative and increase liberty in the state, but instead the voters of North Dakota have chosen to place tradition over progress and keep a shadow over their garden.”

Read Next:

Photo: Courtesy of CRYSTALWEED cannabis on Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Standard Chartered and Fosun International Sign a Memorandum of Understanding for Strategic Cooperation

HONG KONG, Nov. 6, 2024 /PRNewswire/ — On November 6, 2024, during the Seventh China International Import Expo (“CIIE”), Standard Chartered Bank (China) Limited Co. (“Standard Chartered China”) and Fosun International Limited (“Fosun International”) signed a memorandum of understanding for strategic cooperation (“MOU”) to further deepen the bank-enterprise cooperation based on the existing cooperation and to expand the depth and breadth of cooperation in the global market, especially in the “Belt and Road” market.

Under the witness of Mary Huen, CEO, Hong Kong and Greater China & North Asia of Standard Chartered, and Wang Qunbin, Co-Chairman of Fosun International, Wesley Yang, Deputy CEO and Head of Financial Markets, Standard Chartered Bank China, and Zhang Houlin, Senior Vice President and Co-Chief Financial Officer of Fosun International, signed the MOU on behalf of both parties.

Under the strategic cooperation agreement, Standard Chartered China will coordinate global resources to actively support Fosun International’s domestic and overseas development needs, and design corresponding comprehensive financial services solutions. At the same time, Standard Chartered will leverage its international network advantage to provide comprehensive cash management, trade financing, and sustainable financial services for Fosun International’s global operations.

“We are very pleased to continue to deepen our cooperation with Fosun International”, said Wesley Yang, Deputy CEO and Head of Financial Markets, Standard Chartered Bank China, “In recent years, Fosun International’s profound global operation capabilities have continued to improve, becoming one of the model companies for Chinese enterprises to operate globally. We look forward to continuing to upgrade our bank-enterprise cooperation with Fosun International, playing a unique role as ‘super connector’ by supporting Fosun International to achieve high-quality global business development.”

Zhang Houlin, Senior Vice President and Co-Chief Financial Officer of Fosun International, said: “We are very pleased to further deepen our long-term strategic partnership with Standard Chartered. The cooperation between Standard Chartered and Fosun began in 2007, and this is the third time that Standard Chartered and Fosun have signed a strategic cooperation memorandum, reflecting Standard Chartered’s long-term support for Fosun. Through this cooperation, Fosun can leverage Standard Chartered’s network and resources to continuously support and help Fosun and its various industry groups in achieving healthy growth globally, deepening our globalization and innovation capabilities.”

This year marks Standard Chartered’s seventh consecutive participation in CIIE. With the new theme of “Connectivity knows no border. Set sail for a new journey”, Standard Chartered demonstrates its positioning as a “super connector” in cross-border finance and its full range of services, bringing a series of innovative solutions to connect global markets, including customised service cases for different trade corridors, cross-border RMB solutions covering 34 global markets, and green and sustainable financial solutions, etc.

This year also marks the seventh consecutive year that Fosun, together with its subsidiary Fosun Pharma, is participating in CIIE under the theme of “Arriving on Schedule, Sharing Global Opportunities”, with a series of innovative products and themed activities being showcased at CIIE. Rooted in China, Fosun International has been developing globally and has long adhered to the two core growth drivers of “Globalization” and “Innovation”, establishing a global business presence in more than 35 countries and regions around the world. Fosun is committed to providing a happiness ecosystem and high quality products and services to one billion global family customers and corporate customers, with extensive cooperation with Standard Chartered in multiple markets around the world.

![]() View original content:https://www.prnewswire.com/news-releases/standard-chartered-and-fosun-international-sign-a-memorandum-of-understanding-for-strategic-cooperation-302297412.html

View original content:https://www.prnewswire.com/news-releases/standard-chartered-and-fosun-international-sign-a-memorandum-of-understanding-for-strategic-cooperation-302297412.html

SOURCE Fosun

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.