From Dollar to Stocks, Trump Trade Erupts Across Markets

(Bloomberg) — Donald Trump quickly put his stamp on financial markets as his victory in the US presidential election propelled “Trump Trade” plays across assets.

Most Read from Bloomberg

US stocks surged, with S&P futures climbing 2.3%; the dollar posted its biggest gain against major currencies since 2020; Treasury bonds tumbled, sending benchmark yields up by almost 20 basis points; and Bitcoin soared to a record.

The swings send a clear signal that investors believe a second Trump administration will look a lot like the first one: a stream of policies (tax cuts, deregulation, tariffs) that will simultaneously stoke economic growth, corporate profits and inflation.

For those on Wall Street who’ve been riding the Trump Trade, and especially those who held their nerve as it wobbled on the eve of polling, it was a moment of vindication.

“If you had the Trump trade on for the last six weeks, it’s been outstanding,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment. “The question is these winning runs don’t last forever and is this a good time to take profits.”

While the message from investors is broadly positive, there is also a stern warning in the market gyrations.

The surge in Treasury yields underscores concerns that Trump’s policies will swell an already bloated budget deficit and reignite an inflation spiral that the Federal Reserve was only just finally quelling in the wake of the pandemic. The 30-year yield climbed as much as 23 basis points to 4.67%, its biggest daily jump since 2020.

The 10-year breakeven rate, a market gauge of where long-term inflation is heading, surged to its highest levels since April. In the parlance of Wall Street, this is the bond vigilantes exerting pressure on leaders in Washington to keep spending in check.

“Vigilantes are in full control. Panic is starting to set in, the coiling we expected is happening,” said NatAlliance Securities’ Andrew Brenner.

In contrast, European bonds rallied as traders rushed to price in faster interest-rate cuts in the region, seeing potential global trade tariffs as a headwind for the region’s fragile economy. That’s a boon for investors including Vanguard which had bet on German bonds outperforming in recent weeks.

A key outstanding question for markets is whether Republicans end up with the “trifecta,” meaning a situation where they gain control of the Senate, the House and the White House. Beyond that, it remains to be seen whether Trump will actually deliver his campaign-trail promises.

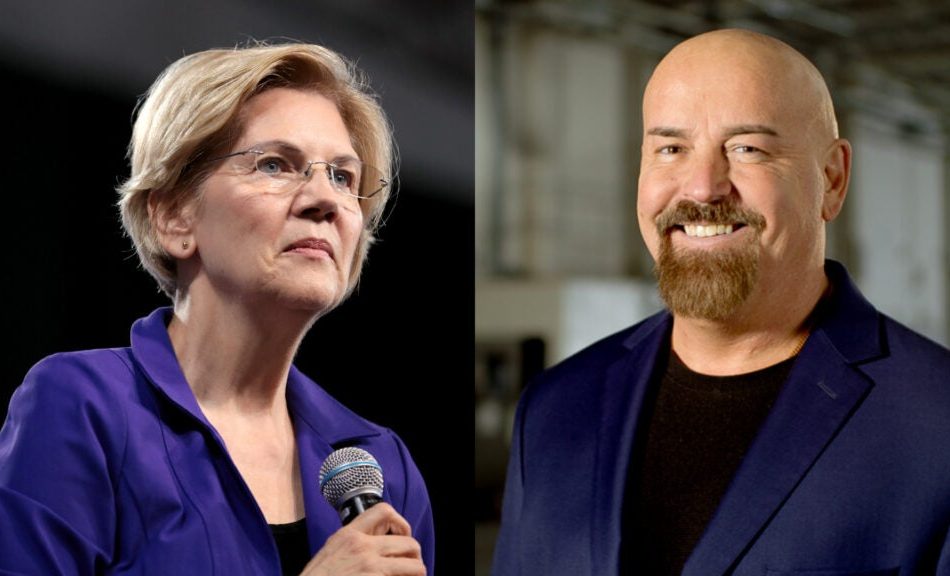

Elizabeth Warren Wins Third Senate Term, Overcomes Challenge From Crypto-Backed GOP Candidate John Deaton

Veteran Democrat Elizabeth Warren has triumphed in securing a third term in the Massachusetts Senate, outpacing her pro-cryptocurrency opponent John Deaton.

What Happened: The Associated Press declared Warren the winner at 8:00 p.m. EST, as results of the high-stakes presidential and congressional races started trickling in.

Warren expressed gratitude to Massachusetts voters after victory and pledged to continue working for their interests in Washington.

“Thank you, Massachusetts! I’m deeply grateful that you’ve decided to send me back to the Senate,” she wrote in an X post.

See Also: What The US Election Means For The Future Of Crypto ETFs

Why It Matters: Warren’s win is particularly significant given the contentious nature of her campaign against Deaton.

The two candidates clashed over the issue of cryptocurrencies, with Warren accusing Deaton of working only for the interests of big cryptocurrency companies, a charge which he vehemently denied.

Warren has been detested by the cryptocurrency community because of her overtly critical stance on the industry. She has argued for more regulations, arguing that it facilitates illegal activities that are largely untraceable.

In her defense, Warren said that she was okay with people buying and trading cryptocurrencies as long as they were subjected to the same laws as the traditional market.

Deaton’s election effort received significant financial support from prominent industry figures, including the Winklevoss twins, who donated $1 million to Bitcoin BTC/USD to the attorney.

Photos courtesy: Gage Skidmore via Flickr and John Deaton Campaign

Check This Out:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ÉCOPARC SAINT-BRUNO BY MONTONI: HOME TO CANADA'S LARGEST PRIVATE GREEN ROOF

SAINT-BRUNO-DE-MONTARVILLE, QC, Nov. 6, 2024 /CNW/ – MONTONI, the Québec leader in sustainable real estate development, is currently completing construction of the largest privately owned green roof in Canada at the Écoparc Saint-Bruno industrial campus. This significant achievement represents an investment of nearly $5 million. The landmark project, developed in partnership with Alberta Investment Management Corporation (AIMCo), has already been hailed for its compliance with the most stringent sustainable real estate development standards, having targeted two major certifications, LEED Gold and Zero-Carbon Building (ZCB). It now includes green roofing with an area of some 246,000 square feet—equivalent to nearly four soccer fields—extending across its two buildings.

Benefits

The green roof surfaces, created by eco-design firm Ohasis Tech and installed by Toiture D. Jean, represent a further step toward reducing the buildings’ carbon footprints and their impacts on local ecosystems. The living roofs will deliver improved water management, counteract the heat island effect, contribute to biodiversity development, capture air pollutants and improve the buildings’ energy efficiency.

“For us, this is one more step in the right direction, creating a sustainable built heritage that future generations will take pride in. Écoparc Saint-Bruno is tangible proof of our commitment to developing spaces that create value—not only for our clients, but also for the communities where we build.”

– Dario Montoni, President, Groupe Montoni

“The largest green roof in Canada is located on public infrastructure, the Vancouver Convention Centre, with an area of some 258,000 square feet. The largest to date in Québec was atop the STM’s Centre de transport Stinson, extending over some 100,000 square feet. It’s extremely inspiring to see private companies like MONTONI that dare to change industry thinking and practices and that truly walk the talk when it comes to the environment. Toiture D. Jean is proud to partner with visionaries like these who are enabling us to fulfil our mission and become an industry leader in green roof installation.”

– David Jean, President, Toiture D. Jean

About Écoparc Saint-Bruno

The $450 million Écoparc Saint-Bruno campus comprises two industrial buildings with 1.6 million square feet of leasable spaces. The use of environmentally friendly construction materials and technologies enabled a reduction of more than 90% in greenhouse gas (GHG) emissions.

With Groupe Colabor and The Master Group as tenants, the campus, which will eventually see nearly 2,000 jobs created, is an active player in the region’s economic vitality. Construction was completed in May 2024 and several more spaces are now ready for leasing.

Occupants enjoy thoughtfully landscaped green spaces and a work environment conducive to wellness and productivity. With its strategic location near the junction of Autoroute 30 and Route 116, two key arteries in the North American logistics chain, the industrial campus is ideally positioned to enable industrial tenants to optimize their commercial operations.

For more information: https://ecoparcsaintbruno.com/

About MONTONI

A pioneer of sustainable building in Canada, MONTONI develops, builds and manages real estate projects at the leading edge of design, performance, urban planning and occupant wellness. Its fundamental purpose is to create value for its clients, the environment and the community.

To date, MONTONI has completed more than 700 projects representing over 30 million square feet of industrial, commercial, institutional and residential construction and 30 corporate campuses, with another 25 million square feet under development—an impressive portfolio of properties across Québec.

Proudly holding the title of one of Canada’s Best-Managed Companies for nearly 25 years, MONTONI has committed to making ESG criteria a permanent strategic reflex. It has completed more than 5.2 million square feet of LEED-certified buildings and, among its construction projects now under way, is targeting LEED certification for another close to 7 million square feet. Additionally, it is in the process of acquiring zero-carbon building (ZCB) certification for nearly 4.5 million square feet. MONTONI’s ambition is to build the real estate heritage of tomorrow that will be a source of pride for future generations. www.groupemontoni.com/en

About Toiture D. Jean

Toiture D. Jean is recognized as one of the national leaders in specialized installation of TPO membranes and is actively working to expand the green roof industry segment. Take action for the environment together with us. Our slogan, “Make an eco-responsible choice,” is more than just a statement; it is our pledge to adhere to sustainable practices and environmentally friendly solutions. Each of our projects adopts an eco-responsible approach, highlighting our commitment to a sustainable future. www.toituredjean.com

About Ohasis Tech

Ohasis Tech is an eco-design firm and manufacturer of green roofing products. The company developed the first living-roof technology designed entirely in Québec. All of its products are made with renewable or recycled materials from local circular economies, thereby minimizing the ecological impact of their manufacturing process. www.ohasistech.ca

SOURCE Groupe Montoni (1995) Division Construction Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/06/c1831.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/06/c1831.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mastech Digital Reports 8% Year-over-Year Revenue Growth and 5% Sequential Revenue Growth for the Third Quarter 2024

Consolidated Gross Margins of 28.5% Set a New Mastech Digital Record for the Quarter

PITTSBURGH, Nov. 6, 2024 /PRNewswire/ — Mastech Digital, Inc. MHH, a leading provider of Digital Transformation IT Services, announced today its financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights:

- Total consolidated revenues increased by $4.1 million on a year-over-year basis and by $2.3 million on a sequential quarterly basis to $51.8 million and represented our third consecutive quarter of revenue growth;

- The Company’s Data and Analytics Services segment reported revenues of $9.4 million, which were 17% higher than revenues in the third quarter of 2023 and 6% higher on a sequential basis from the second quarter of 2024;

- The IT Staffing Services segment delivered revenues of $42.4 million, achieving year-over-year growth of 7% and sequential quarterly growth of 4% when compared to revenues reported in the second quarter of 2024;

- Gross margins achieved during the third quarter of 2024 were a Company performance record 28.5%, surpassing our previous gross margin record from the previous quarter;

- GAAP diluted earnings per share was $0.16 in the third quarter of 2024, versus $0.01 in the third quarter of 2023 and $0.12 in the second quarter of 2024; and

- Non-GAAP diluted earnings per share was $0.23 in the third quarter of 2024, versus $0.11 in the third quarter of 2023 and $0.19 in the second quarter of 2024.

Third Quarter Results:

Revenues for the third quarter of 2024 totaled $51.8 million, compared to $47.8 million during the corresponding quarter of 2023. Gross profits in the third quarter of 2024 were $14.8 million, compared to $12.6 million in the same quarter of 2023. Gross margins improved to a Company performance record 28.5% in the 2024 third quarter, versus 26.3% in the 2023 third quarter. GAAP net income for the third quarter of 2024 totaled $1.9 million or $0.16 per diluted share, compared to $125,000 or $0.01 per diluted share, during the same period of 2023. Non-GAAP net income for the third quarter of 2024 totaled $2.8 million or $0.23 per diluted share compared to $1.3 million, or $0.11 per diluted share, in the third quarter of 2023.

Activity levels at the Company’s Data and Analytics Services segment continued to be solid in the third quarter of 2024. Order bookings totaled $11.1 million during the quarter, as the Company saw numerous existing clients increase spending due to an improved economic outlook. This bookings performance exceeded our 2023 third quarter bookings by $6 million. Our IT Staffing Services clients have also shown a willingness to start new assignments during 2024 compared to the previous year, as we grew our billable consultant base by 13% over the first nine months of 2024.

Vivek Gupta, the Company’s President and Chief Executive Officer, stated: “The third quarter of 2024 was a continuation of the positive momentum that we experienced during the first half of the year. A healthier macro-economic outlook and increased operational efficiencies within both of our business segments have elevated our demand trajectory in 2024. Additionally, our higher gross margin performance has highlighted several upgrades we made to the delivery-side of our organization during the year. In summary, I’m excited about our third quarter 2024 financial performance and the opportunities that we have in front of us.”

Commenting on the Company’s financial position, Jack Cronin, Mastech Digital’s Chief Financial Officer, stated: “On September 30, 2024, we had $23.9 million of cash balances on hand, no bank debt, and borrowing availability of approximately $25 million under our revolving credit facility. Our Days Sales Outstanding (DSO) measurement was a healthy 55 days on September 30, 2024. Our free cash flow for the first nine months of 2024 totaled $2.3 million and included $4.3 million of funding investments in operating working capital levels to support revenue growth.”

About Mastech Digital, Inc.:

Mastech Digital MHH is a leading provider of Digital Transformation IT Services. The Company offers Data Management and Analytics Solutions, Digital Learning, and IT Staffing Services with a Digital First approach. A minority-owned enterprise, Mastech Digital is headquartered in Pittsburgh, PA, with offices across the U.S., Canada, Europe, and India.

Use of Non-GAAP Measures:

This press release contains non-GAAP financial measures to supplement our financial results presented on a GAAP basis. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. Reconciliations of these non-GAAP measures to their comparable GAAP measures are included in the attached financial tables.

We believe that providing non-GAAP net income and non-GAAP diluted earnings per share offers investors useful supplemental information about the financial performance of our business, enables comparison of financial results between periods where certain items may vary independent of business performance, and allows for greater transparency with respect to key metrics used by management in operating our business. Additionally, management uses these non-GAAP financial measures in evaluating the Company’s performance.

Specifically, the non-GAAP financial measures contained herein exclude the following expense items:

Amortization of acquired intangible assets: We amortize intangible assets acquired in connection with our June 2015 acquisition of Hudson IT, our July 2017 acquisition of the services division of InfoTrellis, Inc. and our October 2020 acquisition of AmberLeaf Partners. We exclude these amortization expenses in our non-GAAP financial measures because we believe it allows investors to make more meaningful comparisons between our operating results and those of other companies within our industry and facilitates a helpful comparison of our results with other periods.

Stock-based compensation expenses: We incur material recurring expenses related to non-cash, stock-based compensation. We exclude these expenses in our non-GAAP financial measures because we believe that it provides investors with meaningful supplemental information regarding operational performance. In particular, because of varying available valuation methodologies, subjective assumptions, and the variety of award types that companies can use under ASC 718, we believe that providing non-GAAP financial measures that exclude these expenses allows investors to make more meaningful comparisons between our operating results and those of other companies within our industry and facilitates comparison of our results with other periods.

Settlement reserve on employment-related claim, net of recoveries: In the second quarter of 2023, we recognized a pre-tax reserve of $3.1 million related to an employment claim asserted by a former employee who alleged various employment-related claims against the Company, including a claim of wrongful termination. During the third quarter of 2023, we formally settled this claim in accordance with the economic terms and conditions that were reflected in our second quarter 2023 financial statements. We have excluded this reserve in our non-GAAP financial measures because we believe it is not indicative of our ongoing operating performance and thus its exclusion allows investors to make more meaningful comparison between our operating results and those of other companies within our industry and facilitates a helpful comparison of our results with other periods.

Forward-Looking Statements:

Certain statements contained in this release are forward-looking statements based on management’s expectations, estimates, projections, and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements, which include but are not limited to projections of and statements regarding the Company’s ability to generate revenues, earnings, and cash flow. These statements are based on information currently available to the Company and it assumes no obligation to update the forward-looking statements as circumstances change. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecasted in forward-looking statements due to a variety of factors, including, without limitation, the level of market demand for the Company’s services, the highly competitive market for the types of services offered by the Company, the impact of competitive factors on profit margins, market and general economic conditions that could cause the Company’s customers to reduce their spending for its services, the Company’s ability to create, acquire and build new lines of business, to attract and retain qualified personnel, reduce costs and conserve cash, the extent to which the Company’s business is adversely affected by the impacts of the COVID-19 pandemic or any other pandemics or outbreaks disrupting day-to-day activities and other risks that are described in more detail in the Company’s filings with the Securities and Exchange Commission, including its Form 10-K for the year ended December 31, 2023.

|

MASTECH DIGITAL, INC. |

||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||

|

(Amounts in thousands) |

||||

|

(Unaudited) |

||||

|

September 30, |

December 31, |

|||

|

2024 |

2023 |

|||

|

ASSETS |

||||

|

Current assets: |

||||

|

Cash and cash equivalents |

$ 23,885 |

$ 21,147 |

||

|

Accounts receivable, net |

34,054 |

29,815 |

||

|

Prepaid and other current assets |

7,876 |

5,501 |

||

|

Total current assets |

65,815 |

56,463 |

||

|

Equipment, enterprise software and leasehold improvements, net |

2,083 |

1,913 |

||

|

Operating lease right-of-use assets, net |

4,147 |

5,106 |

||

|

Deferred income taxes |

607 |

793 |

||

|

Deferred financing costs, net |

213 |

284 |

||

|

Non-current deposits |

452 |

457 |

||

|

Goodwill, net of impairment |

27,210 |

27,210 |

||

|

Intangible assets, net of amortization |

10,958 |

13,001 |

||

|

Total assets |

$ 1,11,485 |

$ 1,05,227 |

||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||

|

Current liabilities: |

||||

|

Accounts payable |

$ 4,636 |

$ 4,659 |

||

|

Current portion of operating lease liability |

1,257 |

1,236 |

||

|

Accrued payroll and related costs |

14,717 |

12,354 |

||

|

Other accrued liabilities |

1,491 |

1,622 |

||

|

Total current liabilities |

22,101 |

19,871 |

||

|

Long-term liabilities: |

||||

|

Long-term operating lease liability, less current portion |

2,857 |

3,843 |

||

|

Long-term accrued income taxes |

– |

69 |

||

|

Total liabilities |

24,958 |

23,783 |

||

|

Shareholders’ equity: |

||||

|

Common stock, par value $0.01 per share |

134 |

133 |

||

|

Additional paid-in capital |

37,473 |

35,345 |

||

|

Retained earnings |

55,520 |

52,415 |

||

|

Accumulated other comprehensive income (loss) |

(1,715) |

(1,644) |

||

|

Treasury stock, at cost |

(4,885) |

(4,805) |

||

|

Total shareholders’ equity |

86,527 |

81,444 |

||

|

Total liabilities and shareholders’ equity |

$ 1,11,485 |

$ 1,05,227 |

||

|

MASTECH DIGITAL, INC. |

|||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||

|

(Amounts in thousands, except per share data) |

|||||||

|

(Unaudited) |

|||||||

|

Three Months ended September 30, |

Nine Months ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues |

$ 51,839 |

$ 47,779 |

$ 1,48,196 |

$ 1,55,046 |

|||

|

Cost of revenues |

37,068 |

35,213 |

1,07,314 |

1,15,354 |

|||

|

Gross profit |

14,771 |

12,566 |

40,882 |

39,692 |

|||

|

Selling, general and administrative expenses: |

|||||||

|

Operating expenses |

12,332 |

12,615 |

37,156 |

38,937 |

|||

|

Employment-related claim, net of recoveries |

– |

– |

– |

3,100 |

|||

|

Total selling, general and administrative expenses |

12,332 |

12,615 |

37,156 |

42,037 |

|||

|

Income (loss) from operations |

2,439 |

(49) |

3,726 |

# |

(2,345) |

||

|

Other income/(expense), net |

133 |

203 |

373 |

200 |

|||

|

Income (loss) before income taxes |

2,572 |

154 |

4,099 |

(2,145) |

|||

|

Income tax expense (benefit) |

697 |

29 |

994 |

(358) |

|||

|

Net income (loss) |

$ 1,875 |

$ 125 |

$ 3,105 |

$ (1,787) |

|||

|

Earnings (loss) per share: |

|||||||

|

Basic |

$ 0.16 |

$ 0.01 |

$ 0.27 |

$ (0.15) |

|||

|

Diluted |

$ 0.16 |

$ 0.01 |

$ 0.26 |

$ (0.15) |

|||

|

Weighted average common shares outstanding: |

|||||||

|

Basic |

11,695 |

11,597 |

11,654 |

11,618 |

|||

|

Diluted |

12,011 |

11,968 |

11,949 |

11,618 |

|||

|

MASTECH DIGITAL, INC. |

||||||||||

|

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES |

||||||||||

|

(Amounts in thousands, except per share data) |

||||||||||

|

(Unaudited) |

||||||||||

|

Three Months ended September 30, |

Nine Months ended September 30, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||

|

GAAP Net Income (Loss) |

$ 1,875 |

$ 125 |

$ 3,105 |

# |

$ (1,787) |

|||||

|

Adjustments: |

||||||||||

|

Amortization of acquired intangible assets |

657 |

693 |

2,043 |

2,079 |

||||||

|

Stock-based compensation |

542 |

824 |

1,553 |

2,501 |

||||||

|

Employment-related claim, net of recoveries |

– |

– |

– |

3,100 |

||||||

|

Income tax adjustments |

(305) |

(385) |

(920) |

(1,944) |

||||||

|

Non-GAAP Net Income |

$ 2,769 |

$ 1,257 |

$ 5,781 |

$ 3,949 |

||||||

|

GAAP Diluted Earnings (Loss) Per Share |

$ 0.16 |

$ 0.01 |

$ 0.26 |

$ (0.15) |

||||||

|

Non-GAAP Diluted Earnings Per Share |

$ 0.23 |

$ 0.11 |

$ 0.48 |

$ 0.33 |

||||||

|

Weighted average common shares outstanding: |

||||||||||

|

GAAP Diluted Shares |

12,011 |

11,968 |

11,949 |

11,618 |

||||||

|

Non-GAAP Diluted Shares |

12,011 |

11,968 |

11,949 |

# |

11,998 |

|||||

|

MASTECH DIGITAL, INC. |

|||||||||

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|||||||||

|

(Amounts in thousands) |

|||||||||

|

(Unaudited) |

|||||||||

|

Three Months ended September 30, |

Nine Months ended September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Revenues: |

|||||||||

|

Data and analytics services |

$ 9,398 |

$ 8,038 |

$ 26,341 |

$ 26,206 |

|||||

|

IT staffing services |

42,441 |

39,741 |

1,21,855 |

1,28,840 |

|||||

|

Total revenues |

$ 51,839 |

$ 47,779 |

$ 1,48,196 |

$ 1,55,046 |

|||||

|

Gross Margin %: |

|||||||||

|

Data and analytics services |

50.7 % |

45.8 % |

48.9 % |

43.1 % |

|||||

|

IT staffing services |

23.6 % |

22.4 % |

23.0 % |

22.0 % |

|||||

|

Total gross margin % |

28.5 % |

26.3 % |

27.6 % |

25.6 % |

|||||

|

Segment Operating Income: |

|||||||||

|

Data and analytics services |

$ 1,145 |

$ (832) |

$ 1,435 |

$ (2,393) |

|||||

|

IT staffing services |

1,951 |

1,476 |

4,334 |

5,227 |

|||||

|

Subtotal |

3,096 |

644 |

5,769 |

2,834 |

|||||

|

Amortization of acquired intangible assets |

(657) |

(693) |

(2,043) |

(2,079) |

|||||

|

Employment-related claim, net of recoveries |

– |

– |

– |

(3,100) |

|||||

|

Interest income (expense) and other, net |

133 |

203 |

373 |

200 |

|||||

|

Income before income taxes |

$ 2,572 |

$ 154 |

$ 4,099 |

$ (2,145) |

|||||

Logo: https://stockburger.news/wp-content/uploads/2024/11/Mastech_Digital_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/mastech-digital-reports-8-year-over-year-revenue-growth-and-5-sequential-revenue-growth-for-the-third-quarter-2024-302297473.html

View original content:https://www.prnewswire.com/news-releases/mastech-digital-reports-8-year-over-year-revenue-growth-and-5-sequential-revenue-growth-for-the-third-quarter-2024-302297473.html

SOURCE Mastech Digital, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Treasury Yields Pop On Trump Victory Chances, 10-Year Benchmark Reaches 4-Month High

Yields on U.S. sovereign debt rose during election night as investors digested the preliminary results from the closely contested fight between Donald Trump and Kamala Harris.

What happened: The benchmark 10-year Treasury yield popped 12 basis points to 4.412%, a level not seen since July 2.

Similarly, the yield on 2-year government bonds lifted 6 basis points to 4.262%, the highest since last week of July. The yields on the 30-year Treasury lifted 15 basis points to 4.606% as of this writing.

The uptick comes as the market raised expectations of Trump’s White House comeback after the GOP nominee won battleground states of North Carolina and Georgia.

See Also: Will Donald Trump Prematurely Claim Victory? 5 Polymarket Markets To Watch On Election Night

The market became wary of each candidate’s fiscal policies as both Trump and Harris have proposed expansive tax and spending measures that would deepen the debt — already projected to reach a historic high in the coming years.

According to the CRFB’s central estimate, Trump would increase the national debt by $7.75 trillion between 2026 and 2035, leading the government to issue more bonds to fund the deficit.

Aside from Treasury securities, other market indices rose sharply, including stock futures, the dollar, and gold, while oil fell.

Photo by Steve Heap on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aurora Cannabis Announces Fiscal 2025 Second Quarter Results

NASDAQ | TSX: ACB

- Record Adjusted EBITDA1 of $10.1 Million, a YoY increase of 210%

- Quarterly Net Revenue1 up 29% YoY to $81.1 Million, with 41% growth in Global Medical Cannabis

- Re-Affirms Target of Positive Free Cash Flow1 in the Quarter Ending December 31, 2024

- Maintains Strong Balance Sheet with ~$152 Million of Cash and a Debt-Free Cannabis Business2

EDMONTON, AB, Nov. 6, 2024 /PRNewswire/ – Aurora Cannabis Inc. (the “Company” or “Aurora”) ACB ACB, a leading Canada-based global medical cannabis company, today announced its financial and operational results for the second quarter fiscal 2025.

“Our strong quarterly results demonstrate Aurora’s leadership in global medical cannabis and ability to capitalize on opportunities within rapidly growing markets such as Australia, Germany, Poland, and the UK. International revenue increased 93% to $35 million, exceeding Canadian Medical revenue for the first time, and contributing 57% to total global medical cannabis revenue. The Bevo plant propagation segment also grew a robust 21% during its seasonally lowest quarter, proving the efficacy of our diversified operating model,” said Chairman and Chief Executive Officer Miguel Martin.

“With two quarters remaining in the fiscal year, we are proud to have delivered record adjusted EBITDA1 and believe fiscal 2025 is anchored by our commitment to strategic growth, operational excellence, and the continued strength of our balance sheet,” Mr. Martin concluded.

|

1 This press release includes certain non-GAAP financial measures, which are intended to supplement, not substitute for, comparable GAAP financial measures. See “Non-GAAP Measures” below for reconciliations of non-GAAP financial measures to GAAP financial measures. |

|

2 Aurora’s only remaining debt is non-recourse debt of $57.5 million relating to Bevo Farms Ltd as detailed in the FY2025 Q2 Financial Statements. |

Second Quarter 2025 Highlights

(Unless otherwise stated, comparisons are made between fiscal Q2 2025, Q1 2025, and Q2 2024 results and are in Canadian dollars)

Consolidated Revenue and Adjusted Gross Profit:

Total net revenue1 was $81.1 million, as compared to $63.1 million in the prior year period. The 29% increase from the prior period was mainly due to 41% growth in our global medical cannabis business and 21% growth in our plant propagation business, slightly offset by lower quarterly revenue in our consumer cannabis business.

Consolidated adjusted gross margin before fair value adjustments1 was 54% in Q2 2025 and 51% in the prior year quarter. Adjusted gross profit before FV adjustments1 was $42.6 million in Q2 2025 vs $32.0 million in the prior year quarter, an increase of 33%.

Medical Cannabis:

Medical cannabis net revenue1 was $61.3 million, a 41% increase from the prior year quarter, delivering 76% of Aurora’s Q2 2025 consolidated net revenue1 and 98% of adjusted gross profit before fair value adjustments1.

The increase in net revenue1 of $17.8 million was primarily due to higher sales to Australia, Germany, Poland, and the UK, and stabilized sales in Canada.

Adjusted gross margin before fair value adjustments1 on medical cannabis net revenue reached 68% for the three months ended September 30, 2024, compared to 63% in the prior year quarter. The adjusted gross margins before fair value adjustments improved through sustainable cost reductions, higher selling prices in Australia, and improved efficiency in production operations, including sourcing for Europe from Canada.

Consumer Cannabis:

Aurora’s consumer cannabis net revenue1 was $10.4 million, a 13% decrease compared to $12 million in the prior year quarter. The decrease was due to our decision to prioritize the supply of our GMP manufactured products to our high margin international business rather than the consumer business, which offers lower margins.

Adjusted gross margin before fair value adjustments1 on consumer cannabis net revenue1 was 14%, decreasing from 27% compared to the prior year quarter. The decrease from the prior year comparative quarter is largely due to higher fixed overhead costs allocated to the consumer channel as a result of lower volumes manufactured for products sold by the channel. The Company strategically decided to allocate less internally produced cannabis for the consumer channel in favor of increasing its overall cannabis allocation for both its domestic and international medical channels.

Plant Propagation:

Plant propagation net revenue1 was wholly comprised of the Bevo business, and contributed $8.6 million of net revenue1, a 21% increase compared to $7.2 million in the prior year quarter. The increase was a result of organic growth and increased product offerings, both arising from increased capacity.

Adjusted gross margin before fair value adjustments1 on plant propagation revenue was 19% for Q2 2025 and 22% for the prior year quarter. The fluctuations in the plant propagation adjusted gross margin before fair value adjustments is due to the seasonal timing of lower margin product revenue and ramp up of the orchid business.

Selling, General and Administrative (“SG&A”):

Adjusted SG&A1 was $31.7 million in Q2 2025, which excludes $4.0 million of business transformation costs. The increase compared to the three months ended September 30, 2023 relates to higher freight and logistics costs, notably from sales to Europe with the increase in sourcing from Canada and incremental costs following the acquisition of MedReleaf Australia.

Net Income (Loss):

Net income from continuing operations for the three months ended September 30, 2024 was $1.7 million compared to net income of $0.4 million for the prior year period. The increase in net income of $1.2 million compared to the three months ended September 30, 2023 primarily relates to a decrease in other income of $8.4 million and decrease of operating expenses of $0.7 million, offset by an increase in gross profit of $7.8 million.

Adjusted EBITDA:

Adjusted EBITDA1 increased 210% to $10.1 million for the three months ended September 30, 2024 compared to $3.3 million for the prior year quarter.

Fiscal Q3 2025 Expectations:

In Q3 2025, we expect to see continued strong net revenue1 and adjusted gross margins1 across our global medical cannabis business, supported by net revenue1 growth in Europe and Australia.

For plant propagation, we expect to see seasonally reduced net revenues1 and adjusted gross profit1 that will be in line with historical seasonal trends as 25% – 35% of revenues are normally earned in the second half of a calendar year.

Positive adjusted EBITDA1 is expected to continue, while free cash flow1 is projected to be positive due to strong net revenue1 and continued spend discipline, resulting in strong adjusted gross margins.

Key Quarterly Financial Results

|

($ thousands, except Operational Results) |

Three months ended |

||||||

|

September 30, 2024 |

June 30, 2024 |

$ Change |

% Change |

September 30, 2023(3) |

$ Change |

% Change |

|

|

Financial Results |

|||||||

|

Net revenue (1a) |

$81,122 |

$83,435 |

($2,313) |

(3 %) |

$63,119 |

$18,003 |

29 % |

|

Medical cannabis net revenue (1a) |

$61,316 |

$47,201 |

$14,115 |

30 % |

$43,517 |

$17,799 |

41 % |

|

Consumer cannabis net revenue (1a) |

$10,422 |

$11,533 |

($1,111) |

(10 %) |

$11,959 |

($1,537) |

(13 %) |

|

Plant propagation revenue |

$8,634 |

$23,081 |

($14,447) |

(63 %) |

$7,154 |

$1,480 |

21 % |

|

Adjusted gross margin before FV adjustments on total net revenue (1b) |

54 % |

43 % |

N/A |

11 % |

51 % |

N/A |

3 % |

|

Adjusted gross margin before FV adjustments on cannabis net revenue (1b) |

57 % |

53 % |

N/A |

4 % |

55 % |

N/A |

2 % |

|

Adjusted gross margin before FV adjustments on medical cannabis net revenue (1b) |

68 % |

69 % |

N/A |

(1 %) |

63 % |

N/A |

5 % |

|

Adjusted gross margin before FV adjustments on consumer cannabis net revenue (1b) |

14 % |

24 % |

N/A |

(10 %) |

27 % |

N/A |

(13 %) |

|

Adjusted gross margin before FV adjustments on plant propagation net revenue (1b) |

19 % |

18 % |

N/A |

1 % |

22 % |

N/A |

(3 %) |

|

Adjusted SG&A expense(1d) |

$31,722 |

$31,396 |

$326 |

1 % |

$27,733 |

$3,989 |

14 % |

|

Adjusted EBITDA (1c) |

$10,122 |

$4,887 |

$5,235 |

107 % |

$3,265 |

$6,857 |

210 % |

|

Free cash flow (1e) |

($26,433) |

$6,490 |

($32,923) |

(507 %) |

($29,479) |

$3,046 |

10 % |

|

Balance Sheet |

|||||||

|

Working capital (1f) |

$308,580 |

$322,563 |

($13,983) |

(4 %) |

$200,837 |

$107,743 |

54 % |

|

Cannabis inventory and biological assets (2) |

$177,999 |

$173,197 |

$4,802 |

3 % |

$114,781 |

$63,218 |

55 % |

|

Total assets |

$808,774 |

$838,689 |

($29,915) |

(4 %) |

$818,371 |

($9,597) |

(1) % |

|

1) |

These terms are defined in the “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” section of this MD&A. Refer to the following sections for reconciliation of Non-GAAP Measures to the IFRS equivalent measure: |

|

|

a) |

Refer to the “Revenue” and “Cost of Sales and Gross Margin” section for a reconciliation of cannabis net revenue to the IFRS equivalent. |

|

|

b) |

Refer to the “Adjusted Gross Margin” section for reconciliation to the IFRS equivalent. |

|

|

c) |

Refer to the “Adjusted EBITDA” section for reconciliation to the IFRS equivalent. |

|

|

d) |

Refer to the “Operating Expenses” section for reconciliation to the IFRS equivalent. |

|

|

e) |

Refer to the “Liquidity and Capital Resources” section for a reconciliation to the IFRS equivalent. |

|

|

f) |

“Working capital” is defined as Current Assets less Current Liabilities as reported on the Company’s Consolidated Statements of Financial Position. |

|

|

2) |

Represents total biological assets and inventory, exclusive of merchandise, accessories, supplies, consumables and plant propagation biological assets. |

|

|

3) |

Certain previously reported amounts have been adjusted to exclude the results related to discontinued operations. |

|

Conference Call

Aurora will host a conference call today, Wednesday, November 6, 2024, to discuss these results. Miguel Martin, Chief Executive Officer, and Simona King, Chief Financial Officer, will host the call starting at 8:00 a.m. Eastern time | 6:00 a.m. Mountain Time. A question and answer session will follow management’s presentation.

|

DATE: |

Wednesday, November 6, 2024 |

|

TIME: |

8:00 a.m. Eastern Time | 6:00 a.m. Mountain Time |

|

WEBCAST: |

This weblink has also been posted to the Company’s “Investor Info” link at https://www.auroramj.com/investors/ under “Events”.

About Aurora Cannabis

Aurora is opening the world to cannabis, serving both the medical and consumer markets across Canada, Europe, Australia and South America. Headquartered in Edmonton, Alberta, Aurora is a pioneer in global cannabis, dedicated to helping people improve their lives. The Company’s adult-use brand portfolio includes Drift, San Rafael ’71, Daily Special, Tasty’s, Being and Greybeard. Medical cannabis brands include MedReleaf, CanniMed, Aurora and Whistler Medical Marijuana Co., as well as international brands, Pedanios, Bidiol, IndiMed and CraftPlant. Aurora also has a controlling interest in Bevo Farms Ltd., North America’s leading supplier of propagated agricultural plants. Driven by science and innovation, and with a focus on high-quality cannabis products, Aurora’s brands continue to break through as industry leaders in the medical, wellness and adult recreational markets wherever they are launched. Learn more at www.auroramj.com and follow us on X and LinkedIn.

Aurora’s common shares trade on the NASDAQ and TSX under the symbol “ACB”.

Forward Looking Statements

This news release includes statements containing certain “forward-looking information” within the meaning of applicable securities law (“forward-looking statements”). Forward-looking statements are frequently characterized by words such as “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements made in this news release include, but are not limited to, statements regarding the Company’s Q2 FY2025 results, statements under the heading “Fiscal Q3 2025 Expectations”, including as related to net cannabis revenue growth and adjusted gross margins, revenue and gross profit in the plant propagation segment, and expectations for positive adjusted EBITDA and free cash flow, statements regarding the Company’s continued commitment to operational excellence and strategic growth, and statements regarding the Company’s conference call to discuss results.

These forward-looking statements are only predictions. Forward looking information or statements contained in this news release have been developed based on assumptions management considers to be reasonable. Material factors or assumptions involved in developing forward-looking statements include, without limitation, publicly available information from governmental sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which the Company believes to be reasonable. Forward-looking statements are subject to a variety of risks, uncertainties and other factors that management believes to be relevant and reasonable in the circumstances could cause actual events, results, level of activity, performance, prospects, opportunities or achievements to differ materially from those projected in the forward-looking statements. These risks include, but are not limited to, the ability to retain key personnel, the ability to continue investing in infrastructure to support growth, the ability to obtain financing on acceptable terms, the continued quality of our products, customer experience and retention, the development of third party government and nongovernment consumer sales channels, management’s estimates of consumer demand in Canada and in jurisdictions where the Company exports, expectations of future results and expenses, the risk of successful integration of acquired business and operations, management’s estimation that SG&A will grow only in proportion of revenue growth, the ability to expand and maintain distribution capabilities, the impact of competition, the general impact of financial market conditions, the yield from cannabis growing operations, product demand, changes in prices of required commodities, competition, and the possibility for changes in laws, rules, and regulations in the industry, epidemics, pandemics or other public health crises, and other risks, uncertainties and factors set out under the heading “Risk Factors” in the Company’s annual information form dated June 20, 2024 (the “AIF”) and filed with Canadian securities regulators available on the Company’s issuer profile on SEDAR at www.sedarplus.com and filed with and available on the SEC’s website at www.sec.gov. The Company cautions that the list of risks, uncertainties and other factors described in the AIF is not exhaustive and other factors could also adversely affect its results. Readers are urged to consider the risks, uncertainties and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such information. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

The Company’s AIF, MD&A and annual financial statements, which have been filed on SEDAR+ and with the SEC, are also available on the Company’s website www.auroramj.com and shareholders may receive hard copies free of charge upon request by contacting aurora@icrinc.com.

Non-GAAP Measures

This news release contains reference to certain financial performance measures that are not recognized or defined under IFRS (termed “Non-GAAP Measures”). As a result, this data may not be comparable to data presented by other licensed producers of cannabis and cannabis companies. Non-GAAP Measures should be considered together with other data prepared in accordance with IFRS to enable investors to evaluate the Company’s operating results, underlying performance and prospects in a manner similar to Aurora’s management. Accordingly, these non-GAAP Measures are intended to provide additional information and to assist management and investors in assessing financial performance and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The information included under the heading “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” in the Company’s management’s discussion and analysis for the fiscal period ended September 30, 2024 (the “MD&A”) is incorporated by reference into this news release. The MD&A is available on the Company’s issuer profiles on SEDAR+ at www.sedarplus.com and on the SEC’s EDGAR website at www.sec.gov.

Net Revenue, Adjusted Gross Profit and Margin

Net revenue, adjusted gross profit before FV adjustments, and adjusted gross margin before FV adjustments are Non-GAAP Measures and can be reconciled with revenue, gross profit and gross margin, the most directly comparable GAAP financial measures, respectively, as follows:

|

($ thousands) |

Three months ended |

Six months ended |

|||

|

September 30, |

June 30, |

September 30, |

September 30, |

September 30, |

|

|

Medical cannabis net revenue(1) |

|||||

|

Canadian medical cannabis net revenue |

26,269 |

27,117 |

25,382 |

53,386 |

50,822 |

|

International medical cannabis net revenue |

35,047 |

20,084 |

18,135 |

55,131 |

34,009 |

|

Total medical cannabis net revenue |

61,316 |

47,201 |

43,517 |

108,517 |

84,831 |

|

Consumer cannabis net revenue(1) |

|||||

|

Consumer cannabis net revenue(1) |

10,422 |

11,533 |

11,959 |

22,078 |

25,102 |

|

Wholesale bulk cannabis net revenue(1) |

750 |

1,620 |

489 |

2,370 |

860 |

|

Total cannabis net revenue(1) |

72,488 |

60,354 |

55,965 |

132,842 |

110,793 |

|

— |

|||||

|

Plant propagation revenue |

8,634 |

23,081 |

7,154 |

31,715 |

27,058 |

|

Total net revenue(1) |

81,122 |

83,435 |

63,119 |

164,557 |

137,851 |

|

(1) |

Net revenue is a Non-GAAP Measure and is defined in the “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” section of this MD&A. Refer to the “Cost of Sales and Gross Margin” section of this MD&A for a reconciliation to IFRS equivalent. |

|

(2) |

Certain previously reported amounts have been adjusted to exclude the results related to discontinued operations. |

Adjusted EBITDA

Adjusted EBITDA is a Non-GAAP Measure and can be reconciled with net income (loss), the most directly comparable GAAP financial measure, as follows:

|

($ thousands) |

Three months ended |

Six months ended |

|||

|

September 30, |

June 30, 2024 |

September 30, |

September 30, |

September 30, |

|

|

Net income (loss) from continuing operations |

1,675 |

4,844 |

439 |

6,519 |

(19,758) |

|

Income tax expense (recovery) |

(1,072) |

2,857 |

128 |

1,785 |

224 |

|

Other income (expense) |

(2,995) |

(6,824) |

(11,392) |

(9,819) |

(5,712) |

|

Share-based compensation |

4,468 |

3,019 |

4,568 |

7,487 |

6,849 |

|

Depreciation and amortization |

6,380 |

6,494 |

9,151 |

12,874 |

17,392 |

|

Acquisition costs |

991 |

1,001 |

563 |

1,992 |

789 |

|

Inventory and biological assets fair value and impairment adjustments |

529 |

(12,348) |

(4,705) |

(11,819) |

(8,109) |

|

Business transformation related charges (1) |

3,394 |

4,381 |

6,801 |

7,775 |

12,518 |

|

Out-of-period adjustments (2) |

— |

— |

478 |

— |

808 |

|

Non-recurring items (3) |

(3,248) |

1,463 |

(2,766) |

(1,785) |

883 |

|

Adjusted EBITDA (4) |

10,122 |

4,887 |

3,265 |

15,009 |

5,884 |

|

(1) |

Business transformation related charges includes costs related to closed facilities, certain IT project costs, costs associated with the repurposing of Sky and Sun, severance and retention costs in connection with the business transformation plan, and costs associated with the retention of certain medical aggregators. Some prior period amounts have been adjusted for changes in presentation. |

|

(2) |

Out-of-period adjustments reflect adjustments to net loss for the financial impact of transactions recorded in the current period that relate to prior periods. Some prior period amounts have been adjusted for changes in presentation. |

|

(3) |

Non-recurring items includes one-time excise tax refunds, non-core adjusted wholesale bulk margins, inventory count adjustments resulting from facility shutdowns and inter-site transfers, litigation and non-recurring project costs. |

|

(4) |

Adjusted EBITDA is a Non-GAAP Measure and is not a recognized, defined, or standardized measure under IFRS. Refer to “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” section of the MD&A. Prior period comparatives were adjusted to include the adjustments for markets under development, business transformation costs, and non-recurring charges related to non-core bulk cannabis wholesale to be comparable to the current period presentation. |

Adjusted SG&A

Adjusted SG&A is a Non-GAAP Measure and can be reconciled with sales and marketing and general and administrative expenses, the most directly comparable GAAP financial measure, as follows:

|

Three months ended |

Six months ended |

||||

|

($ thousands) |

September 30, |

June 30, 2024 |

September 30, |

September 30, |

September 30, |

|

General and administration |

22,036 |

22,524 |

22,527 |

44,560 |

43,876 |

|

Sales and marketing |

13,721 |

14,024 |

12,611 |

27,745 |

25,281 |

|

Business transformation costs |

(4,035) |

(4,868) |

(6,515) |

(8,903) |

(10,578) |

|

Out-of-period adjustments |

— |

— |

(478) |

— |

(808) |

|

Non-recurring costs |

— |

(284) |

(412) |

(284) |

(1,005) |

|

Adjusted SG&A (1) |

31,722 |

31,396 |

27,733 |

63,118 |

56,766 |

|

(1) |

Adjusted SG&A is a Non-GAAP Measure and is not a recognized, defined, or standardized measure under IFRS. Refer to the “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” section of this MD&A. |

|

(2) |

Certain previously reported amounts have been adjusted to exclude the results related to discontinued operations. |

Free Cash Flow

The table below outlines free cash flow for the periods ended:

|

Three months ended |

Six months ended |

||||

|

($ thousands) |

September 30, |

June 30, 2024 |

September 30, |

September 30, |

September 30, |

|

Cash provided by (used in) operating |

5,295 |

(1,822) |

(12,883) |

3,473 |

(25,888) |

|

Changes in non-cash working capital |

(29,588) |

10,682 |

(14,781) |

(18,906) |

(10,967) |

|

Net cash provided by (used in) operating activities from continuing operations |

(24,293) |

8,860 |

(27,664) |

(15,433) |

(36,855) |

|

Less: maintenance capital expenditures(1) |

(2,140) |

(2,370) |

(1,815) |

(4,510) |

(4,310) |

|

Free cash flow(2) |

(26,433) |

6,490 |

(29,479) |

(19,943) |

(41,165) |

|

(1) |

Maintenance capital expenditures are comprised of costs to sustain facilities, machinery and equipment in working order to support operations and excludes discretionary investments for revenue growth. |

|

(2) |

Free cash flow is a Non-GAAP Measure and is not a recognized, defined, or a standardized measure under IFRS. Refer to the “Cautionary Statement Regarding Certain Non-GAAP Performance Measures” section of this MD&A. |

Working Capital

Working capital is a Non-GAAP Measure and can be reconciled with total current assets and total current liabilities, the most directly comparable GAAP financial measure, as follows:

|

($ thousands) |

September 30, |

Three months ended June 30, 2024 |

September 30, |

|

Total current assets |

417,675 |

439,366 |

387,981 |

|

Total current liabilities |

(109,095) |

(116,803) |

(152,558) |

|

Working capital(1) |

308,580 |

322,563 |

235,423 |

|

(1) |

Working capital for the three months ended September 30, 2023 has been adjusted. Refer to discussion under “Liquidity and Capital Resources” section of the MD&A. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aurora-cannabis-announces-fiscal-2025-second-quarter-results-302297178.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aurora-cannabis-announces-fiscal-2025-second-quarter-results-302297178.html

SOURCE Aurora Cannabis Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

South Dakota Rejects Measure 29: Cannabis Legalization Fails Again

South Dakota voters rejected Measure 29 on Tuesday, which sought to legalize cannabis for adults. The initiative aimed to allow individuals aged 21 and older to possess limited amounts of cannabis and cultivate plants at home, but it did not receive the necessary support from voters.

The Associated Press reported that with 50% of the votes counted at 2:00 am on Wednesday, the No vote had garnered nearly 60% of the vote.

Measure 29 proposed that adults could possess up to 2 ounces of cannabis flower, 16 grams of cannabis concentrates, and 1,600 milligrams of THC in other products. It also included provisions for growing up to six cannabis plants at home, with a total limit of 12 plants per residence.

See Also: Majority Of South Dakotans Are Against Recreational Cannabis Legalization, New Poll Finds

Industry Leaders React: Economic And Social Impacts Of Measure 29’s Failure

Gurpreet (Pete) Sahani, CEO of The Blinc Group, expressed disappointment: “The failure of this amendment highlights ongoing challenges in legalizing cannabis in South Dakota. However, the need for reform won’t be silenced by this outcome. The push for cannabis legalization will continue.”

John Mueller, CEO and co-founder of Greenlight, calls the outcome “a missed opportunity.”

“South Dakota will continue to miss out on the economic and public safety benefits that come with a regulated adult-use cannabis market,” he said, stressing that legal access to cannabis provides safer options for consumers.

For Ray DeSabato, CEO of Chorus, the result came as no surprise. “Given South Dakota’s traditionally restrictive nature to marijuana, it’s unsurprising that this measure failed.” He also noted that cultivation quality and compliance are ongoing concerns in cannabis, with current prevention solutions having limited impact.

Peter Dikun, owner of Flower Shop Dispensary, sees the vote as a “huge loss” for both the industry and residents.

“If IM29 doesn’t pass, the state misses out on tax revenue and jobs, and we keep wasting taxpayer dollars on prosecutions,” he says. Dikun is also concerned about the growing opposition and spread of misinformation surrounding cannabis.

Todd Smith, CEO of The Hills LLC, predicts: “A lot of cannabis companies will close their doors. There will only be a handful that stay open and hopefully survive till the next opportunity to get on the ballot.”

Previous Attempts At Legalization

This was the third attempt at legalizing cannabis in South Dakota. In 2020, Amendment A was passed by 54% of voters but was later overturned by the state Supreme Court. The 2022 initiative, Measure 27, also failed to pass, indicating the challenges faced by cannabis advocates in the state

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Do These 3 Stocks Signal Cathie Wood's Boldest Move Yet in Artificial Intelligence (AI)?

Cathie Wood mastered an ability to make headline news. Perhaps the biggest reason for this is due to her high-conviction stances in otherwise risky and speculative opportunities.

Wood is the CEO of Ark Invest, an investment management firm offering a series of exchange-traded funds (ETFs) that are mostly comprised of businesses in emerging markets such as biotech and artificial intelligence (AI).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Although Wood does own some blue-chip stocks, the majority of her largest positions are held in smaller companies that she and her team believe have the potential to disrupt legacy incumbents.

Let’s discuss three stocks that Wood holds in her portfolio and detail why these companies could signal a big bet on an under-the-radar opportunity in the AI realm.

Wood has positions in Kratos Defense & Security Solutions (NASDAQ: KTOS), Lockheed Martin (NYSE: LMT), and L3Harris Technologies (NYSE: LHX).

Just to be upfront, none of these stocks is a top-10 position among Ark’s ETFs. Yet despite their relatively small weightings, it’s notable that Wood owns a number of defense contractor stocks. Each is held in either the ARK Space Exploration & Innovation ETF, the ARK Autonomous Technology & Robotics ETF, or The 3D Printing ETF.

Considering Kratos, Lockheed, and L3Harris are all leaders across a variety of areas in government contracting, it makes sense that Wood would own these stocks for specific thematic ETFs that have exposure to the defense industry in particular. With that said, there’s another theory as to why Wood may be investing in these stocks.

Ark’s ETFs hold a number of obvious AI stocks in the “Magnificent Seven” as well as peripheral opportunities in areas such as cybersecurity and data analytics. But the defense sector as a massive opportunity in the AI realm — albeit one that’s mostly overlooked right now.

According to Mordor Intelligence, the total addressable market for AI analytics in the defense arena will reach $16.4 billion by 2029. Furthermore, Mordor estimates that AI robotics in the aerospace industry will become a $46 billion market by the end of the decade.

Perhaps Wood’s most obvious position at the intersection of defense and AI is Palantir (NYSE: PLTR). It’s pretty well-known that Palantir works closely with the U.S. military and other Western government agencies.