Super Micro Slides on Weak Sales Outlook as Delisting Risk Looms

(Bloomberg) — Super Micro Computer Inc. plunged in early trading after issuing a disappointing sales forecast and failing to give a timeline for filing its previous fiscal year’s official financial statements.

Most Read from Bloomberg

Revenue will be $5.5 billion to $6.1 billion in the quarter ending in December, the company said, well below analysts’ projections of $6.79 billion. Its profit outlook, excluding some items, also fell far below estimates.

Super Micro has had a tumultuous year. Shares rose at the start of 2024 as investors bet the AI boom would fuel demand for the company’s high-powered machines, earning the stock inclusion in the S&P 500. But then a former employee alleged earlier this year in federal court that Super Micro had sought to overstate its revenue. Short seller Hindenburg Research referenced those claims in a research report, alleging “glaring accounting red flags.”

The embattled server maker also missed an August deadline to file its annual financial report and last week its auditor Ernst & Young LLP resigned, citing concerns about the company’s governance and transparency. An investigation of the accounting issues by a special board committee found “no evidence of fraud or misconduct on the part of management or the board of directors,” Super Micro said Tuesday in a statement.

Shares of the company have slid 77% since peaking in March, wiping out roughly $50 billion in market value. The stock was down as much as 26% in pre-market trading on Wednesday, heading for the biggest intraday decline in a week.

Sales were hurt in the fiscal first quarter by the availability of semiconductors, Chief Executive Officer Charles Liang said. When asked on a conference call Tuesday whether the company’s accounting issues had affected its relationship with Nvidia Corp., which is the top producer of powerful processors for artificial intelligence, executives said the chip maker hasn’t made any changes to Super Micro’s supply allocations.

“At this moment — according to our relationship, according to our communication — things are very positive,” Liang said of the relationship with Nvidia.

Recently, the failure to file its 10-K financial disclosure and the departure of Ernst & Young has put the San Jose, California-based company at a risk of being delisted by Nasdaq Inc. and booted from the index.

Tuesday’s update was the company’s opportunity to ease investor fears. N Quinn Bolton, an analyst at Needham, suspended his rating of Super Micro after the resignation of Ernst & Young. In a note ahead of the event, he said the update from Super Micro could provide an opportunity to reassess the suspension. Instead, it triggered a sell-off of the company’s stock.

JLL Income Property Trust Appoints Lisa Kaufman to Board of Directors

CHICAGO , Nov. 5, 2024 /PRNewswire/ — JLL Income Property Trust, an institutionally managed daily NAV REIT (NASDAQ:ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX) with approximately $6.6 billion in portfolio equity and debt investments, announced that on November 5, 2024, its Board of Directors voted to appoint Lisa Kaufman as a Director, filling an opening created by the resignation of long-time Director Jacques Gordon, who is taking over as new Director of the Graaskamp Center for Real Estate at the University of Wisconsin–Madison.

Kaufman brings 30 years of wide-ranging real estate experience to the Board and will work with other Directors to oversee the Fund’s strategy. She currently serves as Head of LaSalle Global Solutions for LaSalle Investment Management, the advisor to JLL Income Property Trust. In this capacity, Kaufman is responsible for the firm’s indirect real estate businesses including Securities, Multi-Manager and Structured Investments, and is also a member of LaSalle’s Global Management Committee.

Prior to her current role, Kaufman was Head of LaSalle Securities and a portfolio manager responsible for US accounts and specialty sectors globally. She joined the Securities group in 1998. Throughout her career in real estate securities as both an analyst and portfolio manager, Kaufman covered and analyzed all property types in the global listed universe. She joined LaSalle in 1994 in the private equity acquisitions group where she focused on entity level investments in real estate, recapitalizing existing portfolios, private real estate companies and public REITs.

Kaufman received an M.B.A in finance from Columbia University’s Business School and an A.B. in Urban Studies and Political Science from Brown University. She is a member of the Advisory Board of Governors and the Real Estate Investment Advisory Council (REIAC) Steering Committee at Nareit.

“Lisa is an outstanding addition to our Board, and brings a diverse range of real estate expertise that will add to our already strong roster of Directors,” said JLL Income Property Trust President and CEO Allan Swaringen. “Adding world-class real estate professionals who bring diverse backgrounds and experience to our Board is critical for us to maintain our market leadership position as an institutionally managed daily NAV REIT.”

Kaufman fills the Board position made available by the resignation of Jacques Gordon, who has served as a Director since JLL Income Property Trust’s inception in 2012. Gordon is a distinguished leader in the real estate industry, having served as the Global Head of Research and Strategy for LaSalle Investment Management for almost three decades. At LaSalle, he was responsible for real estate research and strategy that informed investment decisions across the global organization. He also served on the firm’s Management and Investment committees and directed the Investment Strategy Group, which analyzes capital markets, regional economies, and property markets.

After departing LaSalle in 2022 – though he remained an advisor and active Board member for JLL Income Property Trust – Gordon transitioned to academia as Senior Executive in Residence at MIT’s Center for Real Estate. In September 2024, Gordon was appointed as the new Director of the Graaskamp Center for Real Estate at the University of Wisconsin–Madison‘s Wisconsin School of Business – one of the most prestigious university real estate programs in the world, ranked consistently as the #1 Real Estate Program by U.S. News and World Report.

“We thank Jacques for his inspired leadership and guidance over the years,” said Lynn Thurber, Chairman of the Board of JLL Income Property Trust. “Jacques is one of the rare individuals in the industry who can seamlessly blend research and strategy principles into actionable business activities. His leadership helped JLL Income Property Trust to innovate the NAV REIT industry – which brought institutional management of real estate to individual investors. As he transitions to a full time academic role as Director of the Graaskamp Center for Real Estate, we know that his students and faculty will be the beneficiaries of his great wisdom and unparalleled character.”

JLL Income Property Trust is an institutionally managed, daily NAV REIT that brings to investors a growing portfolio of commercial real estate investments selected by an institutional investment management team and sponsored by one of the world’s leading real estate services firms.

For more information on JLL Income Property Trust, please visit our website at www.jllipt.com.

About JLL Income Property Trust, Inc. (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX),

JLL Income Property Trust, Inc. is a daily NAV REIT that owns and manages a diversified portfolio of high quality, income-producing residential, industrial, grocery-anchored retail, healthcare and office properties located in the United States. JLL Income Property Trust expects to further diversify its real estate portfolio over time, including on a global basis. For more information, visit www.jllipt.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Valuations, Forward Looking Statements and Future Results

This press release may contain forward-looking statements with respect to JLL Income Property Trust. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, research, market analysis, plans or predictions of the future. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. Past performance is not indicative of future results and there can be no assurance that future dividends will be paid.

Contacts:

Alissa Schachter

LaSalle Investment Management

Telephone: +1 312 228 2048

Email: alissa.schachter@lasalle.com

Doug Allen

Dukas Linden Public Relations

Telephone: +1 646 722 6530

Email: JLLIPT@DLPR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-appoints-lisa-kaufman-to-board-of-directors-302296875.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-appoints-lisa-kaufman-to-board-of-directors-302296875.html

SOURCE JLL Income Property Trust

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sunoco LP Reports Third Quarter 2024 Financial and Operating Results

DALLAS, Nov. 6, 2024 /PRNewswire/ — Sunoco LP SUN (“SUN” or the “Partnership”) today reported financial and operating results for the quarter ended September 30, 2024.

Financial and Operational Highlights

Net income for the third quarter of 2024 was $2 million compared to net income of $272 million in the third quarter of 2023.

Adjusted EBITDA(1) for the third quarter of 2024 was $456 million compared to $257 million in the third quarter of 2023. Adjusted EBITDA(1) for the third quarter of 2024 includes approximately $14 million of one-time transaction-related expenses(2).

Distributable Cash Flow, as adjusted(1), for the third quarter of 2024 was $349 million compared to $181 million in the third quarter of 2023.

Adjusted EBITDA(1) for the Fuel Distribution segment for the third quarter of 2024 was $253 million compared to $234 million in the third quarter of 2023. The segment sold approximately 2.1 billion gallons of fuel in the third quarter of 2024, an increase of 1% from the third quarter of 2023. Fuel margin for all gallons sold was 12.8 cents per gallon for the third quarter of 2024 compared to 12.5 cents per gallon in the third quarter of 2023.

Adjusted EBITDA(1) for the Pipeline Systems segment for the third quarter of 2024 was $136 million. Adjusted EBITDA(1) for the third quarter of 2024 includes approximately $11 million of one-time transaction-related expenses(2). The segment averaged throughput volumes of approximately 1.2 million barrels per day in the third quarter of 2024.

Adjusted EBITDA(1) for the Terminals segment for the third quarter of 2024 was $67 million. Adjusted EBITDA(1) for the third quarter of 2024 includes approximately $3 million of one-time transaction-related expenses(2). The segment averaged throughput volumes of approximately 690 thousand barrels per day in the third quarter of 2024.

Distribution

On October 28, 2024, the Board of Directors of SUN’s general partner declared a distribution for the third quarter of 2024 of $0.8756 per unit, or $3.5024 per unit on an annualized basis. The distribution will be paid on November 19, 2024, to common unitholders of record on November 8, 2024.

Liquidity, Leverage and Credit

At September 30, 2024, SUN had long-term debt of approximately $7.3 billion and approximately $1.4 billion of liquidity remaining on its $1.5 billion revolving credit facility. SUN’s leverage ratio of net debt to Adjusted EBITDA(1), calculated in accordance with its credit facility, was 4.0 times at the end of the third quarter.

Capital Spending

SUN’s total capital expenditures in the third quarter of 2024 were $93 million, which included $67 million of growth capital and $26 million of maintenance capital.

(1) Adjusted EBITDA and Distributable Cash Flow, as adjusted, are non-GAAP financial measures of performance that have limitations and should not be considered as a substitute for net income. Please refer to the discussion and tables under “Supplemental Information” later in this news release for a discussion of our use of Adjusted EBITDA and Distributable Cash Flow, as adjusted, and a reconciliation to net income.

(2) Transaction-related expenses include certain one-time expenses incurred with acquisitions and divestitures.

Earnings Conference Call

Sunoco LP management will hold a conference call on Wednesday, November 6, 2024, at 9:00 a.m. Central Time (10:00 a.m. Eastern Time) to discuss results and recent developments. To participate, dial 877-407-6184 (toll free) or 201-389-0877 approximately 10 minutes before the scheduled start time and ask for the Sunoco LP conference call. The call will also be accessible live and for later replay via webcast in the Investor Relations section of Sunoco’s website at www.sunocolp.com under Webcasts and Presentations.

About Sunoco LP

Sunoco LP SUN is a leading energy infrastructure and fuel distribution master limited partnership operating in over 40 U.S. states, Puerto Rico, Europe, and Mexico. The Partnership’s midstream operations include an extensive network of approximately 14,000 miles of pipeline and over 100 terminals. This critical infrastructure complements the Partnership’s fuel distribution operations, which serve approximately 7,400 Sunoco and partner branded locations and additional independent dealers and commercial customers. SUN’s general partner is owned by Energy Transfer LP ET.

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.sunocolp.com

Contacts

Investors:

Scott Grischow, Treasurer, Senior Vice President – Finance

(214) 840-5660, scott.grischow@sunoco.com

Media:

Chris Cho, Senior Manager – Communications

(469) 646-1647, chris.cho@sunoco.com

– Financial Schedules Follow –

|

SUNOCO LP |

|||

|

September 30, |

December 31, |

||

|

ASSETS |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

$ 116 |

$ 29 |

|

|

Accounts receivable, net |

902 |

856 |

|

|

Accounts receivable from affiliates |

— |

20 |

|

|

Inventories, net |

890 |

889 |

|

|

Other current assets |

157 |

133 |

|

|

Total current assets |

2,065 |

1,927 |

|

|

Property and equipment |

8,856 |

2,970 |

|

|

Accumulated depreciation |

(1,105) |

(1,134) |

|

|

Property and equipment, net |

7,751 |

1,836 |

|

|

Other assets: |

|||

|

Operating lease right-of-use assets, net |

474 |

506 |

|

|

Goodwill |

1,484 |

1,599 |

|

|

Intangible assets, net |

553 |

544 |

|

|

Other non-current assets |

396 |

290 |

|

|

Investment in unconsolidated affiliates |

1,399 |

124 |

|

|

Total assets |

$ 14,122 |

$ 6,826 |

|

|

LIABILITIES AND EQUITY |

|||

|

Current liabilities: |

|||

|

Accounts payable |

$ 929 |

$ 828 |

|

|

Accounts payable to affiliates |

222 |

170 |

|

|

Accrued expenses and other current liabilities |

515 |

353 |

|

|

Operating lease current liabilities |

32 |

22 |

|

|

Current maturities of long-term debt |

78 |

— |

|

|

Total current liabilities |

1,776 |

1,373 |

|

|

Operating lease non-current liabilities |

482 |

511 |

|

|

Long-term debt, net |

7,259 |

3,580 |

|

|

Advances from affiliates |

86 |

102 |

|

|

Deferred tax liabilities |

166 |

166 |

|

|

Other non-current liabilities |

173 |

116 |

|

|

Total liabilities |

9,942 |

5,848 |

|

|

Commitments and contingencies |

|||

|

Equity: |

|||

|

Limited partners: |

|||

|

Common unitholders |

4,179 |

978 |

|

|

Class C unitholders – held by subsidiaries |

— |

— |

|

|

Accumulated other comprehensive income |

1 |

— |

|

|

Total equity |

4,180 |

978 |

|

|

Total liabilities and equity |

$ 14,122 |

$ 6,826 |

|

|

SUNOCO LP |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues |

$ 5,751 |

$ 6,320 |

$ 17,424 |

$ 17,427 |

|||

|

Cost of Sales and Operating Expenses: |

|||||||

|

Cost of sales |

5,327 |

5,793 |

15,951 |

16,211 |

|||

|

Operating expenses |

151 |

93 |

373 |

262 |

|||

|

General and administrative |

55 |

30 |

225 |

92 |

|||

|

Lease expense |

18 |

18 |

53 |

51 |

|||

|

Loss (gain) on disposal of assets and impairment charges |

(2) |

4 |

52 |

(8) |

|||

|

Depreciation, amortization and accretion |

95 |

44 |

216 |

141 |

|||

|

Total cost of sales and operating expenses |

5,644 |

5,982 |

16,870 |

16,749 |

|||

|

Operating Income |

107 |

338 |

554 |

678 |

|||

|

Other Income (Expense): |

|||||||

|

Interest expense, net |

(116) |

(56) |

(274) |

(162) |

|||

|

Equity in earnings of unconsolidated affiliates |

31 |

1 |

35 |

4 |

|||

|

Gain on West Texas Sale |

— |

— |

598 |

— |

|||

|

Loss on extinguishment of debt |

— |

— |

(2) |

— |

|||

|

Other, net |

(5) |

— |

(7) |

7 |

|||

|

Income Before Income Taxes |

17 |

283 |

904 |

527 |

|||

|

Income tax expense |

15 |

11 |

171 |

27 |

|||

|

Net Income |

$ 2 |

$ 272 |

$ 733 |

$ 500 |

|||

|

Net Income (Loss) per Common Unit: |

|||||||

|

Basic |

$ (0.26) |

$ 2.99 |

$ 5.44 |

$ 5.20 |

|||

|

Diluted |

$ (0.26) |

$ 2.95 |

$ 5.40 |

$ 5.14 |

|||

|

Weighted Average Common Units Outstanding: |

|||||||

|

Basic |

135,998,435 |

84,064,445 |

112,650,388 |

84,061,363 |

|||

|

Diluted |

136,844,312 |

85,132,733 |

113,466,864 |

85,037,289 |

|||

|

Cash Distributions per Unit |

$ 0.8756 |

$ 0.8420 |

$ 2.6268 |

$ 2.5260 |

|||

|

SUNOCO LP |

|||

|

Three Months Ended September 30, |

|||

|

2024 |

2023 |

||

|

Net income |

$ 2 |

$ 272 |

|

|

Depreciation, amortization and accretion |

95 |

44 |

|

|

Interest expense, net |

116 |

56 |

|

|

Non-cash unit-based compensation expense |

4 |

4 |

|

|

Loss (gain) on disposal of assets and impairment charges |

(2) |

4 |

|

|

Unrealized (gains) losses on commodity derivatives |

1 |

(1) |

|

|

Inventory valuation adjustments |

197 |

(141) |

|

|

Equity in earnings of unconsolidated affiliates |

(31) |

(1) |

|

|

Adjusted EBITDA related to unconsolidated affiliates |

47 |

2 |

|

|

Other non-cash adjustments |

12 |

7 |

|

|

Income tax expense |

15 |

11 |

|

|

Adjusted EBITDA (1) |

456 |

257 |

|

|

Transaction-related expenses |

14 |

— |

|

|

Adjusted EBITDA(1), excluding transaction-related expenses |

$ 470 |

$ 257 |

|

|

Adjusted EBITDA (1) |

$ 456 |

$ 257 |

|

|

Adjusted EBITDA related to unconsolidated affiliates |

(47) |

(2) |

|

|

Distributable cash flow from unconsolidated affiliates |

45 |

2 |

|

|

Cash interest expense |

(112) |

(54) |

|

|

Current income tax (expense) benefit |

36 |

(8) |

|

|

Transaction-related income taxes |

(17) |

— |

|

|

Maintenance capital expenditures |

(26) |

(14) |

|

|

Distributable Cash Flow |

335 |

181 |

|

|

Transaction-related expenses |

14 |

— |

|

|

Distributable Cash Flow, as adjusted (1) |

$ 349 |

$ 181 |

|

|

Distributions to Partners: |

|||

|

Limited Partners |

$ 119 |

$ 71 |

|

|

General Partner |

36 |

19 |

|

|

Total distributions to be paid to partners |

$ 155 |

$ 90 |

|

|

Common Units outstanding – end of period |

136.0 |

84.1 |

|

|

(1) |

Adjusted EBITDA is defined as earnings before net interest expense, income taxes, depreciation, amortization and accretion expense, allocated non-cash compensation expense, unrealized gains and losses on commodity derivatives and inventory valuation adjustments, and certain other operating expenses reflected in net income that we do not believe are indicative of ongoing core operations, such as gains or losses on disposal of assets and non-cash impairment charges. We define Distributable Cash Flow as Adjusted EBITDA less cash interest expense, including the accrual of interest expense related to our long-term debt which is paid on a semi-annual basis, current income tax expense, maintenance capital expenditures and other non-cash adjustments. For Distributable Cash Flow, as adjusted, certain transaction-related adjustments and non-recurring expenses are excluded. |

|

|

We believe Adjusted EBITDA and Distributable Cash Flow, as adjusted, are useful to investors in evaluating our operating performance because: |

||

|

• |

Adjusted EBITDA is used as a performance measure under our revolving credit facility; |

|

|

• |

securities analysts and other interested parties use such metrics as measures of financial performance, ability to make distributions to our unitholders and debt service capabilities; |

|

|

• |

our management uses them for internal planning purposes, including aspects of our consolidated operating budget, and capital expenditures; and |

|

|

• |

Distributable Cash Flow, as adjusted, provides useful information to investors as it is a widely accepted financial indicator used by investors to compare partnership performance, and as it provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. |

|

|

Adjusted EBITDA and Distributable Cash Flow, as adjusted, are not recognized terms under GAAP and do not purport to be alternatives to net income as measures of operating performance or to cash flows from operating activities as a measure of liquidity. Adjusted EBITDA and Distributable Cash Flow, as adjusted, have limitations as analytical tools, and one should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations include: |

||

|

• |

they do not reflect our total cash expenditures, or future requirements for capital expenditures or contractual commitments; |

|

|

• |

they do not reflect changes in, or cash requirements for, working capital; |

|

|

• |

they do not reflect interest expense or the cash requirements necessary to service interest or principal payments on our revolving credit facility or senior notes; |

|

|

• |

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect cash requirements for such replacements; and |

|

|

• |

as not all companies use identical calculations, our presentation of Adjusted EBITDA and Distributable Cash Flow, as adjusted, may not be comparable to similarly titled measures of other companies. |

|

|

Adjusted EBITDA reflects amounts for the unconsolidated affiliates based on the same recognition and measurement methods used to record equity in earnings of unconsolidated affiliates. Adjusted EBITDA related to unconsolidated affiliates excludes the same items with respect to the unconsolidated affiliates as those excluded from the calculation of Adjusted EBITDA, such as interest, taxes, depreciation, depletion, amortization and other non-cash items. Although these amounts are excluded from Adjusted EBITDA related to unconsolidated affiliates, such exclusion should not be understood to imply that we have control over the operations and resulting revenues and expenses of such affiliates. We do not control our unconsolidated affiliates; therefore, we do not control the earnings or cash flows of such affiliates. The use of Adjusted EBITDA or Adjusted EBITDA related to unconsolidated affiliates as an analytical tool should be limited accordingly. Inventory valuation adjustments that are excluded from the calculation of Adjusted EBITDA represent changes in lower of cost or market reserves on the Partnership’s inventory. These amounts are unrealized valuation adjustments applied to fuel volumes remaining in inventory at the end of the period. |

||

|

SUNOCO LP |

|||

|

Three Months Ended |

|||

|

2024 |

2023 |

||

|

Segment Adjusted EBITDA: |

|||

|

Fuel Distribution |

$ 253 |

$ 234 |

|

|

Pipeline Systems |

136 |

2 |

|

|

Terminals |

67 |

21 |

|

|

Adjusted EBITDA |

456 |

257 |

|

|

Transaction-related expenses |

14 |

— |

|

|

Adjusted EBITDA, excluding transaction-related expenses |

$ 470 |

$ 257 |

|

The following analysis of segment operating results includes a measure of segment profit. Segment profit is a non-GAAP financial measure and is presented herein to assist in the analysis of segment operating results and particularly to facilitate an understanding of the impacts that changes in sales revenues have on the segment performance measure of Segment Adjusted EBITDA. Segment profit is similar to the GAAP measure of gross profit, except that segment profit excludes charges for depreciation, depletion and amortization. The most directly comparable measure to segment profit is gross profit. The following table presents a reconciliation of segment profit to gross profit.

|

Three Months Ended |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Fuel Distribution segment profit |

$ 164 |

$ 467 |

$ 885 |

$ 1,095 |

|||

|

Pipeline Systems segment profit |

159 |

— |

332 |

2 |

|||

|

Terminals segment profit |

101 |

60 |

256 |

119 |

|||

|

Total segment profit |

424 |

527 |

1,473 |

1,216 |

|||

|

Depreciation, amortization and accretion, excluding corporate and other |

93 |

44 |

213 |

141 |

|||

|

Gross profit |

$ 331 |

$ 483 |

$ 1,260 |

$ 1,075 |

|||

Fuel Distribution

|

Three Months Ended |

|||

|

2024 |

2023 |

||

|

Motor fuel gallons sold |

2,138 |

2,118 |

|

|

Motor fuel profit cents per gallon(1) |

12.8 ¢ |

12.5 ¢ |

|

|

Fuel profit |

$ 96 |

$ 388 |

|

|

Non-fuel profit |

39 |

40 |

|

|

Lease profit |

29 |

39 |

|

|

Fuel Distribution segment profit |

$ 164 |

$ 467 |

|

|

Expenses |

$ 100 |

$ 119 |

|

|

Segment Adjusted EBITDA |

$ 253 |

$ 234 |

|

|

Transaction-related expenses |

— |

— |

|

|

Segment Adjusted EBITDA, excluding transaction-related expenses |

$ 253 |

$ 234 |

|

|

(1) Excludes the impact of inventory valuation adjustments consistent with the definition of Adjusted EBITDA. |

Volumes. For the three months ended September 30, 2024 compared to the same period last year, volumes increased primarily due to growth from investments and profit optimization strategies.

Segment Adjusted EBITDA. For the three months ended September 30, 2024 compared to the same period last year, Segment Adjusted EBITDA related to our Fuel Distribution segment increased due to the net impact of the following:

- an increase of $13 million related to a 1% increase in gallons sold and an increase in profit per gallon; and

- a decrease of $19 million in expenses primarily due to the West Texas Sale in April 2024 and lower allocated overhead; partially offset by

- a decrease of $10 million in lease profit due to the West Texas Sale in April 2024.

Pipeline Systems

|

Three Months Ended |

|||

|

2024 |

2023 |

||

|

Pipelines throughput (barrels per day) |

1,165 |

— |

|

|

Pipeline Systems segment profit |

$ 159 |

$ — |

|

|

Expenses |

$ 72 |

$ — |

|

|

Segment Adjusted EBITDA |

$ 136 |

$ 2 |

|

|

Transaction-related expenses |

11 |

— |

|

|

Segment Adjusted EBITDA, excluding transaction-related expenses |

$ 147 |

$ 2 |

|

Volumes. For the three months ended September 30, 2024 compared to the same period last year, volumes increased due to recently acquired assets.

Segment Adjusted EBITDA. For the three months ended September 30, 2024 compared to the same period last year, Segment Adjusted EBITDA related to our Pipeline Systems segment increased due to the acquisition of NuStar on May 3, 2024 and the formation of the Permian joint venture on July 1, 2024.

Terminals

|

Three Months Ended |

|||

|

2024 |

2023 |

||

|

Throughput (barrels per day) |

694 |

421 |

|

|

Terminal segment profit |

$ 101 |

$ 60 |

|

|

Expenses |

$ 52 |

$ 22 |

|

|

Segment Adjusted EBITDA |

$ 67 |

$ 21 |

|

|

Transaction-related expenses |

3 |

— |

|

|

Segment Adjusted EBITDA, excluding transaction-related expenses |

$ 70 |

$ 21 |

|

Volumes. For the three months ended September 30, 2024 compared to the same period last year, volumes increased due to recently acquired assets.

Segment Adjusted EBITDA. For the three months ended September 30, 2024 compared to the same period last year, Segment Adjusted EBITDA related to our Terminals segment increased primarily due to the recent acquisitions of NuStar, Zenith European terminals and Zenith Energy terminals located across the East Coast and Midwest.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sunoco-lp-reports-third-quarter-2024-financial-and-operating-results-302297450.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sunoco-lp-reports-third-quarter-2024-financial-and-operating-results-302297450.html

SOURCE Sunoco LP

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow, Nasdaq Jump Over 1% Ahead Of Election Results: Investor Sentiment Improves, But Greed Index Remains In 'Fear' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, but the index remained in the “Fear” zone on Tuesday.

U.S. stocks settled higher on Monday, with the Dow Jones index gaining more than 400 points as investors awaited the results of the U.S. presidential election. The Federal Reserve is also scheduled to announce its November rate decision on Thursday.

On the economic data front, the trade deficit in the U.S. increased to $84.4 billion in September, recording the highest level since April 2022, and above market estimates of a $84.1 billion gap, versus a revised $70.8 billion gap in August. The ISM services PMI rose to 56 in October, recording the highest reading since Aug. 2022.

Yum! Brands, Inc. YUM posted downbeat results for its third quarter. Shares of Vimeo Inc. VMEO jumped around 45% on Tuesday after the company reported better-than-expected third-quarter financial results and issued fourth-quarter sales guidance above estimates.

All sectors on the S&P 500 closed on a positive note, with consumer discretionary, industrials, and utilities stocks recording the biggest gains on Tuesday.

The Dow Jones closed higher by around 427 points to 42,221.88 on Tuesday. The S&P 500 gained 1.23% to 5,782.76, while the Nasdaq Composite jumped 1.43% to close at 18,439.17 during Tuesday’s session.

Investors are awaiting earnings results from CVS Health Corporation CVS, Johnson Controls International plc JCI, and Qualcomm Inc. QCOM today.

What is CNN Business Fear & Greed Index?

At a current reading of 43.5, the index remained in the “Fear” zone on Tuesday, versus a prior reading of 41.2.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Green energy stocks sink as Trump wins US election

(Bloomberg) — Shares in renewable energy firms plunged on Wednesday as Donald Trump won a second term as president of the United States on a platform that promised to boost fossil fuels and undo the green agenda of his predecessor.

Most Read from Bloomberg

Shares in US clean energy companies suffered in pre-market trading in New York, especially solar companies. Sunnova Energy International Inc. (NOVA) was down more than 21%, while First Solar Inc. (FSLR) and green hydrogen equipment maker Plug Power Inc. (PLUG) each fell around 14%.

Across the Atlantic, Danish wind firms Orsted A/S and Vestas Wind Systems A/S also slid, as did Germany’s RWE AG and Italy’s Enel SpA.

“The world has changed in the past 24-hours,” Rob West, chief executive officer at research company Thunder Said Energy, wrote in an emailed note. “Momentum behind many energy transition themes has been slowing in 2024. It is now harder to see a re-acceleration.”

Trump has vowed to end the country’s offshore wind efforts as one of his first measures after taking office. During campaigning, he also promised to lift restrictions on domestic energy production.

A second Trump term would be a stark contrast to the presidency of Joe Biden, who set an aggressive target to decarbonize the country’s power grid, vowed to reach 30 gigawatts of offshore wind by 2030 and introduced sweeping climate legislation that favored renewable energy sources.

Offshore Wind Industry Braces for Trump’s Turbulence: QuickTake

Beyond his policies aimed specifically at the energy sector, Trump plans a wide array of tariffs on imported goods. Regardless of those measures’ direct impacts on renewable energy equipment, economists expect the policies to drive up inflation, which could lead the Federal Reserve to raise interest rates. That would make it more expensive to invest in major renewable power plants that require significant upfront costs often funded by debt.

“We expect to see initial sentiment hit across the renewable sector,” Citigroup Inc. analyst Jenny Ping said in a note, adding there will be “some differentiation between renewable technologies, with those exposed to offshore wind potentially more at risk.”

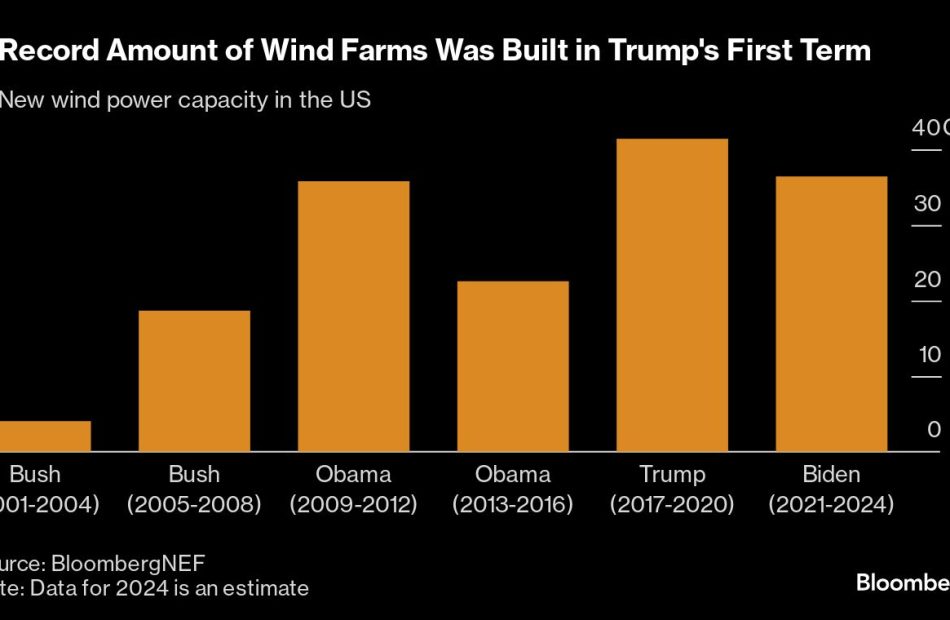

While analysts think it’s unlikely that Republicans will try to repeal Biden’s Inflation Reduction Act, offshore wind farms, which require federal approvals, are particularly vulnerable to executive action. It’s still possible that the renewable power industry could expand significantly under Trump, as it did during his first term in office.

In Trump markets, big question is how much ‘MAGA’ 2.0 will cost

(Bloomberg) — Investors bracing for President Donald Trump 2.0 know two things: The new administration will seek to ram through his “Make America Great Again” agenda, and the ensuing bill could be sky-high.

Most Read from Bloomberg

The Republican victor is poised to unleash a fresh round of policies — tariffs, tax cuts, immigration crackdowns — to both boost economic growth and shield the nation from an influx of low-cost, overseas goods and workers. While Trump’s first term featured similar policies and coincided with a boom in corporate profits, these measures, implemented now, threaten to rekindle an inflation spiral that took years to quell in the aftermath of the pandemic.

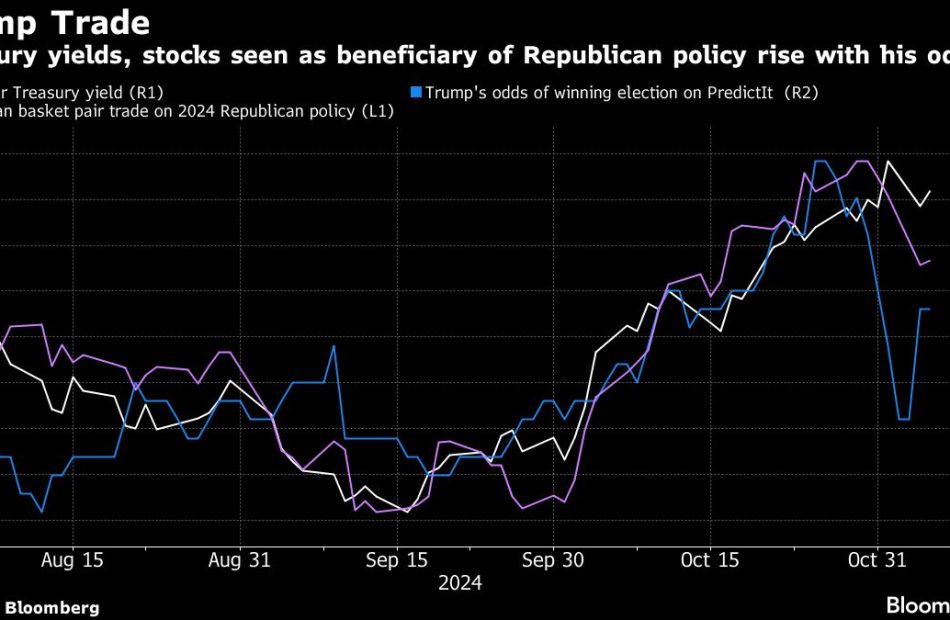

Markets greeted Trump’s win with both optimism and trepidation. Stocks surged in early Wednesday trading with futures on S&P 500 (^GSPC) climbing more than 2% on his business-friendly agenda including deregulation and activist industrial policy. No such cheer was evident in fixed income as 10-year Treasury yields spiked toward 4.5% amid anticipation that a swelling deficit under Trump will force the government to pay up for borrowing.

Higher yields could exert pressure on the risk-taking rally, by hurting interest-rate sensitive stocks and challenging new funding efforts among corporate issuers and consumers. The decade-long gain for stocks is already 35% above the norm, and risk premiums for corporate bonds are at epic lows — making the margin for error on the economy decidedly narrow.

“Stocks have the wind at their back for now, but equities will be keeping a close eye on yields,” said Adam Crisafulli, founder of market intelligence firm Vital Knowledge, who previously spent more than a decade at JPMorgan Chase & Co. “And if the Treasury slump continues, that will short circuit the Trump equity celebration.”

Then there’s a growing risk of protectionism. According to JPMorgan, boosting tariffs on China imports to 60% alone would hurt S&P 500 (^GSPC) profits by as much as $15 a share, an amount that could wipe off almost half of 2025’s income gains. A maximal version of the tariffs plan, with the across-the-board rate at 20%, could lower US GDP by 0.8% and boost price pressures notably in the years ahead if China alone retaliates, Bloomberg Economics projects.

“A material increase in tariffs would represent the most significant departure in policy from the current administration and potentially the largest source of volatility,” JPMorgan strategists including Dubravko Lakos-Bujas wrote in a note before the election result. “The current macro backdrop is much different versus eight years ago, when the business cycle was in mid-cycle, labor market was less tight, inflation was not on the Fed’s radar, and pro-growth 1.0 policies were easier to implement and more impactful to the bottom-line.”

HAMILTON LANE INCORPORATED REPORTS SECOND QUARTER FISCAL 2025 RESULTS, WITH MANAGEMENT & ADVISORY FEES GROWING BY 10% AND ASSETS UNDER MANAGEMENT GROWING BY 10% YEAR-OVER-YEAR

CONSHOHOCKEN, Penn., Nov. 6, 2024 /PRNewswire/ — Leading private markets asset management firm Hamilton Lane Incorporated HLNE today reported its results for the second fiscal quarter ended September 30, 2024.

SECOND QUARTER FISCAL 2025 HIGHLIGHTS

- Assets under management – Total assets under management of $131.4 billion grew $12.2 billion year-over-year. Fee-earning assets under management increased $8.3 billion to $69.7 billion over the same period.

- Revenue – Management and advisory fees of $119.8 million for the quarter represent growth of 10% versus the prior year period.

- Carried Interest – Unrealized carried interest balance of approximately $1.3 billion, up 9% versus the prior year period.

- Earnings per share – GAAP EPS of $1.37 on $55.0 million of GAAP net income for the quarter.

- Dividend – Declared a quarterly dividend of $0.49 per share of Class A common stock to record holders at the close of business on December 16, 2024 that will be paid on January 7, 2025. The target full-year dividend of $1.96 represents a 10% increase from the prior fiscal year dividend.

Hamilton Lane issued a full detailed presentation of its second quarter fiscal 2025 results, which can be accessed on the Company’s Shareholders website at https://shareholders.hamiltonlane.com/

Hamilton Lane Co-CEO Erik Hirsch commented: “Our unwavering commitment to achieving results for our clients and shareholders has led to another successful quarter for the firm. Our core business continues to experience steady growth, and we are consistently innovating to further enhance this progress.”

Conference Call

Hamilton Lane will discuss second quarter fiscal 2025 results in a webcast and conference call today, Wednesday, November 6, 2024, at 11:00 a.m. Eastern Time.

For access to the live event via the webcast, visit Hamilton Lane’s Shareholders website (https://shareholders.hamiltonlane.com/) at least 15 minutes prior to the start of the call. This feature will be in listen-only mode.

A replay of the webcast will be available approximately two hours after the live broadcast for a period of one year and can be accessed in the same manner as the live webcast at the Shareholders page of Hamilton Lane’s website.

About Hamilton Lane

Hamilton Lane HLNE is one of the largest private markets investment firms globally, providing innovative solutions to institutional and private wealth investors around the world. Dedicated exclusively to private markets investing for more than 30 years, the firm currently employs approximately 730 professionals operating in offices throughout North America, Europe, Asia Pacific and the Middle East. Hamilton Lane has $947.4 billion in assets under management and supervision, composed of $131.4 billion in discretionary assets and $816.1 billion in non-discretionary assets, as of September 30, 2024. Hamilton Lane specializes in building flexible investment programs that provide clients access to the full spectrum of private markets strategies, sectors and geographies. For more information, please visit http://www.hamiltonlane.com or follow Hamilton Lane on LinkedIn: https://www.linkedin.com/company/hamilton-lane/.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to: our ability to manage growth, fund performance, competition in our industry, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to fund commitments; our exposure and that of our clients and investors to the credit risks of financial institutions at which we and they hold accounts; our ability to comply with investment guidelines set by our clients; our ability to successfully integrate acquired businesses with ours; our ability to manage risks associated with introducing new types of investment structures, products or services or entering into strategic partnerships; our ability to manage redemption or repurchase rights in certain of our funds; our ability to manage, identify and anticipate risks we face; our ability to manage the effects of events outside of our control; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

SOURCE Hamilton Lane

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Dogecoin Spike After Trump's Speech In Florida, Winning Key Battle States Puts Ex-President On Cusp Of Victory

The cryptocurrency market received an unprecedented boost after Donald Trump, a vocal advocate of the asset class, came to the brink of victory after winning the key battleground states of Pennsylvania, and North Carolina.

What happened: The Associated Press declared Trump the winner at 2:24 a.m. ET, as the highly charged cycle that saw cryptocurrencies become a significant election issue nears its end.

Trump claimed victory at the Palm Beach Convention Center, the home of his official election night party, although AP was yet to project him as the winner.

Bitcoin, the barometer of the market, set a new all-time high earlier, as odds of a Trump victory started increasing on prediction markets like Polymarket and Kalshi.

As of this writing, Bitcoin cooled down to $73,000, as traders took profits on the rally.

| Cryptocurrency | Gains +/- | Price (Recorded at 3 a.m. ET) |

| Bitcoin BTC/USD | +6.24% | $73,004.14 |

| Dogecoin DOGE/USD | +14.22% | $0.1922 |

| Maga (TRUMP) | -5.27% | $3.33 |

Bitcoin’s rise seemed unavoidable, as the former President had passionately advocated for the asset class, going to the extent of promising a national Bitcoin reserve.

Dogecoin was another winner of the day, pumping over 14% in what appeared to be a reaction to the planned Department of Government Efficiency, or ‘DOGE,’ led by Elon Musk under the incoming administration.

Cryptocurrency themed around the man himself Maga, rooted in the “Make America Great Again” movement, dipped somewhat after soaring as high as 18% Tuesday overnight.

Why It Matters: Daniel Cheung, co-founder of cryptocurrency hedge fund Syncracy Capital, expressed optimism for a “biblical” bull market for cryptocurrencies in the coming months.

He said that Trump’s presidency would be a 4-year call option on the market, with expectations of SEC Chair Gary Gensler being removed, the U.S. adopting a sandbox approach to the sector, and a potential Bitcoin strategic reserve.

He also projected that Trump’s triumph would encourage retail participation, resulting in additional flows into the asset class.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.