Dow, Nasdaq Jump Over 1% Ahead Of Election Results: Investor Sentiment Improves, But Greed Index Remains In 'Fear' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, but the index remained in the “Fear” zone on Tuesday.

U.S. stocks settled higher on Monday, with the Dow Jones index gaining more than 400 points as investors awaited the results of the U.S. presidential election. The Federal Reserve is also scheduled to announce its November rate decision on Thursday.

On the economic data front, the trade deficit in the U.S. increased to $84.4 billion in September, recording the highest level since April 2022, and above market estimates of a $84.1 billion gap, versus a revised $70.8 billion gap in August. The ISM services PMI rose to 56 in October, recording the highest reading since Aug. 2022.

Yum! Brands, Inc. YUM posted downbeat results for its third quarter. Shares of Vimeo Inc. VMEO jumped around 45% on Tuesday after the company reported better-than-expected third-quarter financial results and issued fourth-quarter sales guidance above estimates.

All sectors on the S&P 500 closed on a positive note, with consumer discretionary, industrials, and utilities stocks recording the biggest gains on Tuesday.

The Dow Jones closed higher by around 427 points to 42,221.88 on Tuesday. The S&P 500 gained 1.23% to 5,782.76, while the Nasdaq Composite jumped 1.43% to close at 18,439.17 during Tuesday’s session.

Investors are awaiting earnings results from CVS Health Corporation CVS, Johnson Controls International plc JCI, and Qualcomm Inc. QCOM today.

What is CNN Business Fear & Greed Index?

At a current reading of 43.5, the index remained in the “Fear” zone on Tuesday, versus a prior reading of 41.2.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Green energy stocks sink as Trump wins US election

(Bloomberg) — Shares in renewable energy firms plunged on Wednesday as Donald Trump won a second term as president of the United States on a platform that promised to boost fossil fuels and undo the green agenda of his predecessor.

Most Read from Bloomberg

Shares in US clean energy companies suffered in pre-market trading in New York, especially solar companies. Sunnova Energy International Inc. (NOVA) was down more than 21%, while First Solar Inc. (FSLR) and green hydrogen equipment maker Plug Power Inc. (PLUG) each fell around 14%.

Across the Atlantic, Danish wind firms Orsted A/S and Vestas Wind Systems A/S also slid, as did Germany’s RWE AG and Italy’s Enel SpA.

“The world has changed in the past 24-hours,” Rob West, chief executive officer at research company Thunder Said Energy, wrote in an emailed note. “Momentum behind many energy transition themes has been slowing in 2024. It is now harder to see a re-acceleration.”

Trump has vowed to end the country’s offshore wind efforts as one of his first measures after taking office. During campaigning, he also promised to lift restrictions on domestic energy production.

A second Trump term would be a stark contrast to the presidency of Joe Biden, who set an aggressive target to decarbonize the country’s power grid, vowed to reach 30 gigawatts of offshore wind by 2030 and introduced sweeping climate legislation that favored renewable energy sources.

Offshore Wind Industry Braces for Trump’s Turbulence: QuickTake

Beyond his policies aimed specifically at the energy sector, Trump plans a wide array of tariffs on imported goods. Regardless of those measures’ direct impacts on renewable energy equipment, economists expect the policies to drive up inflation, which could lead the Federal Reserve to raise interest rates. That would make it more expensive to invest in major renewable power plants that require significant upfront costs often funded by debt.

“We expect to see initial sentiment hit across the renewable sector,” Citigroup Inc. analyst Jenny Ping said in a note, adding there will be “some differentiation between renewable technologies, with those exposed to offshore wind potentially more at risk.”

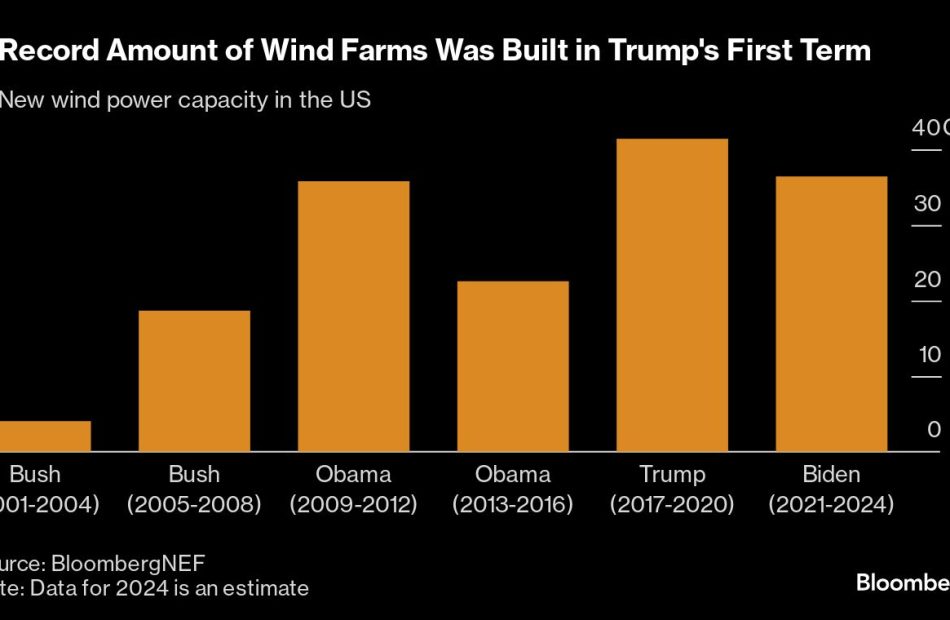

While analysts think it’s unlikely that Republicans will try to repeal Biden’s Inflation Reduction Act, offshore wind farms, which require federal approvals, are particularly vulnerable to executive action. It’s still possible that the renewable power industry could expand significantly under Trump, as it did during his first term in office.

In Trump markets, big question is how much ‘MAGA’ 2.0 will cost

(Bloomberg) — Investors bracing for President Donald Trump 2.0 know two things: The new administration will seek to ram through his “Make America Great Again” agenda, and the ensuing bill could be sky-high.

Most Read from Bloomberg

The Republican victor is poised to unleash a fresh round of policies — tariffs, tax cuts, immigration crackdowns — to both boost economic growth and shield the nation from an influx of low-cost, overseas goods and workers. While Trump’s first term featured similar policies and coincided with a boom in corporate profits, these measures, implemented now, threaten to rekindle an inflation spiral that took years to quell in the aftermath of the pandemic.

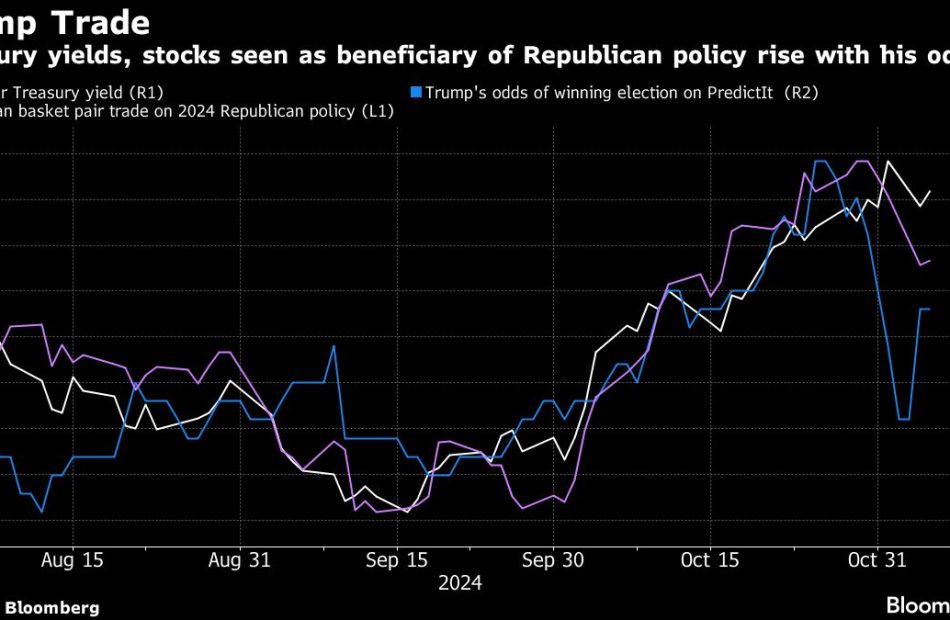

Markets greeted Trump’s win with both optimism and trepidation. Stocks surged in early Wednesday trading with futures on S&P 500 (^GSPC) climbing more than 2% on his business-friendly agenda including deregulation and activist industrial policy. No such cheer was evident in fixed income as 10-year Treasury yields spiked toward 4.5% amid anticipation that a swelling deficit under Trump will force the government to pay up for borrowing.

Higher yields could exert pressure on the risk-taking rally, by hurting interest-rate sensitive stocks and challenging new funding efforts among corporate issuers and consumers. The decade-long gain for stocks is already 35% above the norm, and risk premiums for corporate bonds are at epic lows — making the margin for error on the economy decidedly narrow.

“Stocks have the wind at their back for now, but equities will be keeping a close eye on yields,” said Adam Crisafulli, founder of market intelligence firm Vital Knowledge, who previously spent more than a decade at JPMorgan Chase & Co. “And if the Treasury slump continues, that will short circuit the Trump equity celebration.”

Then there’s a growing risk of protectionism. According to JPMorgan, boosting tariffs on China imports to 60% alone would hurt S&P 500 (^GSPC) profits by as much as $15 a share, an amount that could wipe off almost half of 2025’s income gains. A maximal version of the tariffs plan, with the across-the-board rate at 20%, could lower US GDP by 0.8% and boost price pressures notably in the years ahead if China alone retaliates, Bloomberg Economics projects.

“A material increase in tariffs would represent the most significant departure in policy from the current administration and potentially the largest source of volatility,” JPMorgan strategists including Dubravko Lakos-Bujas wrote in a note before the election result. “The current macro backdrop is much different versus eight years ago, when the business cycle was in mid-cycle, labor market was less tight, inflation was not on the Fed’s radar, and pro-growth 1.0 policies were easier to implement and more impactful to the bottom-line.”

HAMILTON LANE INCORPORATED REPORTS SECOND QUARTER FISCAL 2025 RESULTS, WITH MANAGEMENT & ADVISORY FEES GROWING BY 10% AND ASSETS UNDER MANAGEMENT GROWING BY 10% YEAR-OVER-YEAR

CONSHOHOCKEN, Penn., Nov. 6, 2024 /PRNewswire/ — Leading private markets asset management firm Hamilton Lane Incorporated HLNE today reported its results for the second fiscal quarter ended September 30, 2024.

SECOND QUARTER FISCAL 2025 HIGHLIGHTS

- Assets under management – Total assets under management of $131.4 billion grew $12.2 billion year-over-year. Fee-earning assets under management increased $8.3 billion to $69.7 billion over the same period.

- Revenue – Management and advisory fees of $119.8 million for the quarter represent growth of 10% versus the prior year period.

- Carried Interest – Unrealized carried interest balance of approximately $1.3 billion, up 9% versus the prior year period.

- Earnings per share – GAAP EPS of $1.37 on $55.0 million of GAAP net income for the quarter.

- Dividend – Declared a quarterly dividend of $0.49 per share of Class A common stock to record holders at the close of business on December 16, 2024 that will be paid on January 7, 2025. The target full-year dividend of $1.96 represents a 10% increase from the prior fiscal year dividend.

Hamilton Lane issued a full detailed presentation of its second quarter fiscal 2025 results, which can be accessed on the Company’s Shareholders website at https://shareholders.hamiltonlane.com/

Hamilton Lane Co-CEO Erik Hirsch commented: “Our unwavering commitment to achieving results for our clients and shareholders has led to another successful quarter for the firm. Our core business continues to experience steady growth, and we are consistently innovating to further enhance this progress.”

Conference Call

Hamilton Lane will discuss second quarter fiscal 2025 results in a webcast and conference call today, Wednesday, November 6, 2024, at 11:00 a.m. Eastern Time.

For access to the live event via the webcast, visit Hamilton Lane’s Shareholders website (https://shareholders.hamiltonlane.com/) at least 15 minutes prior to the start of the call. This feature will be in listen-only mode.

A replay of the webcast will be available approximately two hours after the live broadcast for a period of one year and can be accessed in the same manner as the live webcast at the Shareholders page of Hamilton Lane’s website.

About Hamilton Lane

Hamilton Lane HLNE is one of the largest private markets investment firms globally, providing innovative solutions to institutional and private wealth investors around the world. Dedicated exclusively to private markets investing for more than 30 years, the firm currently employs approximately 730 professionals operating in offices throughout North America, Europe, Asia Pacific and the Middle East. Hamilton Lane has $947.4 billion in assets under management and supervision, composed of $131.4 billion in discretionary assets and $816.1 billion in non-discretionary assets, as of September 30, 2024. Hamilton Lane specializes in building flexible investment programs that provide clients access to the full spectrum of private markets strategies, sectors and geographies. For more information, please visit http://www.hamiltonlane.com or follow Hamilton Lane on LinkedIn: https://www.linkedin.com/company/hamilton-lane/.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to: our ability to manage growth, fund performance, competition in our industry, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to fund commitments; our exposure and that of our clients and investors to the credit risks of financial institutions at which we and they hold accounts; our ability to comply with investment guidelines set by our clients; our ability to successfully integrate acquired businesses with ours; our ability to manage risks associated with introducing new types of investment structures, products or services or entering into strategic partnerships; our ability to manage redemption or repurchase rights in certain of our funds; our ability to manage, identify and anticipate risks we face; our ability to manage the effects of events outside of our control; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

SOURCE Hamilton Lane

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Dogecoin Spike After Trump's Speech In Florida, Winning Key Battle States Puts Ex-President On Cusp Of Victory

The cryptocurrency market received an unprecedented boost after Donald Trump, a vocal advocate of the asset class, came to the brink of victory after winning the key battleground states of Pennsylvania, and North Carolina.

What happened: The Associated Press declared Trump the winner at 2:24 a.m. ET, as the highly charged cycle that saw cryptocurrencies become a significant election issue nears its end.

Trump claimed victory at the Palm Beach Convention Center, the home of his official election night party, although AP was yet to project him as the winner.

Bitcoin, the barometer of the market, set a new all-time high earlier, as odds of a Trump victory started increasing on prediction markets like Polymarket and Kalshi.

As of this writing, Bitcoin cooled down to $73,000, as traders took profits on the rally.

| Cryptocurrency | Gains +/- | Price (Recorded at 3 a.m. ET) |

| Bitcoin BTC/USD | +6.24% | $73,004.14 |

| Dogecoin DOGE/USD | +14.22% | $0.1922 |

| Maga (TRUMP) | -5.27% | $3.33 |

Bitcoin’s rise seemed unavoidable, as the former President had passionately advocated for the asset class, going to the extent of promising a national Bitcoin reserve.

Dogecoin was another winner of the day, pumping over 14% in what appeared to be a reaction to the planned Department of Government Efficiency, or ‘DOGE,’ led by Elon Musk under the incoming administration.

Cryptocurrency themed around the man himself Maga, rooted in the “Make America Great Again” movement, dipped somewhat after soaring as high as 18% Tuesday overnight.

Why It Matters: Daniel Cheung, co-founder of cryptocurrency hedge fund Syncracy Capital, expressed optimism for a “biblical” bull market for cryptocurrencies in the coming months.

He said that Trump’s presidency would be a 4-year call option on the market, with expectations of SEC Chair Gary Gensler being removed, the U.S. adopting a sandbox approach to the sector, and a potential Bitcoin strategic reserve.

He also projected that Trump’s triumph would encourage retail participation, resulting in additional flows into the asset class.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Resurgence Sinks Emerging Markets From Mexico to China

(Bloomberg) — Emerging markets were hit hard by the resurgence of the “Trump trade” Wednesday as the dollar and US yields soared following Donald Trump’s election.

Most Read from Bloomberg

Mexico led a currency meltdown, with the peso — often seen as the most vulnerable to Trump’s trade policies — tumbling as much as 3.5%. Currencies in Eastern Europe and South Africa lost at least 1.9%, setting up the emerging-market currency gauge for its worst day since February 2023. China’s stock indexes in Hong Kong slid more than 2.5% as traders priced in punitive tariffs for the world’s second-biggest economy.

Trump’s pledges of stronger restrictions on imports and immigration are fueling bets on higher US borrowing costs and a stronger greenback, dampening the appeal of risk assets. It was Trump’s trade war against China during his first term that halted an EM equity rally and sparked an underperformance versus the US that continues to this day. His signals of an expansive fiscal policy that’s seen as inflationary could undermine the Federal Reserve’s ability to lower borrowing costs — an effect that could ripple out into developing nations.

“A Trump presidency will implement harsher and broader tariffs than during the last Trump administration,” with China targeted more than other countries, said Rajeev De Mello, chief investment officer at Gama Asset Management. “An expansionary fiscal policy will lead to higher bond yields, especially for bonds with longer maturities, resulting in a double whammy for emerging markets through a stronger US dollar and higher US yields.”

The currency selloff was widespread as Trump cruised to victory Wednesday. Eastern European currencies posted some of the biggest losses, helping fuel a drop of 0.9% in the MSCI EM Currency Index. The gauge is less than 0.6% away from erasing its 2024 gains.

Traders had been preparing for a Trump victory in recent weeks, with currency volatility soaring in the lead up to the vote. The Republican’s proposals would hit Mexico — the largest trade partner with the US — particularly hard. On the campaign trail, Trump said automakers building plants in Mexico are a “serious threat” to the US.

“The first moves will be in FX and reflect the stronger US dollar and in short-term euro-sensitive currencies and some Asia FX, and the Mexican peso,” said Cathy Hepworth, managing director and portfolio manager at PGIM Fixed Income. “The EM rates trade will be a bit less clear because there are growth implications for Euro area, central and eastern Europe, and potentially parts of Asia, but FX volatility may cap what central banks can do.”

Wall Street scores political victory with a Trump win: 'This should aid all banks'

US bank stocks rallied following a decisive win by President-elect Donald Trump, in a sign that big Wall Street financial institutions expect to have an easier time in Washington under a new Republican administration.

“This should aid all banks” and especially the biggest, Wells Fargo analyst Mike Mayo said in a Wednesday note.

Trump’s win starts a “new era after 15 years of harsher regulation” that followed the 2008 financial crisis, he added.

Big banks including JPMorgan Chase (JPM), Bank of America (BAC), Goldman Sachs (GS), Wells Fargo (WFC), Citigroup (C) and Morgan Stanley (MS) are all up between 7% and 11% in pre-market trading Wednesday morning.

The country’s largest lenders have had a great year thanks to the economy’s resilience during a period of elevated interest rates and a rebound in their investment banking and trading operations.

An index tracking 24 of the largest domestically chartered US commercial banks (^BKX) is up 27% so far in 2024, outperforming the broader financial sector and major stock indexes.

The hope is next year could be even better, if lending and Wall Street dealmaking churn higher while a new Republican administration loosens some rules for big banks and applies more leniency in approving the sort of corporate mergers that produce big profits for Wall Street giants.

One big lender that may benefit from such leniency is major credit card lender Capital One (COF), which is trying to get regulatory approval to merge with credit card lender and network Discover Financial Services (DFS).

The stock of the McLean, Va.-based Capital One was up 11% Wednesday morning.

Capital One CEO Richard Fairbank told analysts two weeks ago that the tie up was expected to be completed “early in 2025 subject to regulatory and shareholder” approvals.

Keefe Bruyette & Woods predicts that on day one a Trump administration could make as many as eight leadership changes at the federal regulatory agencies that supervise banks or other financial services giants.

That includes the Justice Department and the Federal Trade Commission, which oversee antitrust concerns, as well as the Office of the Comptroller of the Currency (OCC), the Consumer Financial Protection Bureau (CFPB), the Securities and Exchange Commission, and potentially even the Federal Deposit Insurance Corporation.

What banks are hoping is that a new administration would also loosen a new set of controversial capital rules proposed by top bank regulators that would require lenders to set aside greater buffers for future losses.

Sprott Announces Third Quarter 2024 Results

TORONTO, Nov. 06, 2024 (GLOBE NEWSWIRE) — Sprott Inc. (NYSE/TSX:SII) (“Sprott” or the “Company”) today announced its financial results for the three and nine months ended September 30, 2024.

Management commentary

“Sprott’s Assets Under Management (“AUM”) was $33.4 billion as at September 30, 2024, up 8% from June 30, 2024 and up 16% from December 31, 2023,” said Whitney George, CEO of Sprott. “This is our third consecutive quarter of record high AUM, driven by strong gold and silver prices, as well as $589 million in net sales during the period. Given the strength of these results and our confidence in Sprott’s future, our Board has declared a third quarter dividend of $0.30 per share, an increase of 20%. Further, we now expect to repay the balance of our line of credit by the end of this month, resulting in a debt-free balance sheet.”

“With Sprott’s core positioning in precious metals and critical materials, we retain our constructive outlook and believe we are well positioned to navigate volatile market conditions and continue creating value for our clients and shareholders,” continued Mr. George.

Key AUM highlights1

- AUM was $33.4 billion as at September 30, 2024, up 8% from $31.1 billion as at June 30, 2024 and up 16% from $28.7 billion as at December 31, 2023. On a three and nine months ended basis, we primarily benefited from strong market value appreciation in our precious metals physical trusts. We also benefited from net inflows to our exchange listed products and the launch of our Physical Copper Trust in the second quarter.

Key revenue highlights

- Management fees were $38.7 million in the quarter, up 18% from $32.9 million for the quarter ended September 30, 2023 and $113.1 million on a year-to-date basis, up 17% from $97 million for the nine months ended September 30, 2023. Carried interest and performance fees were $4.1 million in the quarter, up from $nil for the quarter ended September 30, 2023 and $4.8 million on a year-to-date basis, up from $0.4 million for the nine months ended September 30, 2023. Net fees were $38.9 million in the quarter, up 31% from $29.7 million for the quarter ended September 30, 2023 and $106.1 million on a year-to-date basis, up 21% from $87.7 million for the nine months ended September 30, 2023. Our revenue performance on both a three and nine months ended basis was primarily due to higher average AUM on strong market value appreciation in our precious metals physical trusts and continuous inflows to the majority of our exchange listed products. We also benefited from carried interest crystallization in a legacy fixed-term exploration LP in our managed equities segment.

- Commission revenues were $0.5 million in the quarter, down 8% from the quarter ended September 30, 2023 and $4.9 million on a year-to-date basis, down 30% from $7 million for the nine months ended September 30, 2023. Net commissions were $0.2 million in the quarter, down 31% from $0.4 million for the quarter ended September 30, 2023 and $2.3 million on a year-to-date basis, down 42% from $3.9 million for the nine months ended September 30, 2023. Commission revenue was lower in the quarter due to modest ATM activity in our critical materials physical trusts. On a year-to-date basis, the decline in commission revenue was due to the sale of our former Canadian broker-dealer in the second quarter of last year.

- Finance income was $1.6 million in the quarter, down 12% from $1.8 million for the quarter ended September 30, 2023 and $7.5 million on a year-to-date basis, up 46% from $5.1 million for the nine months ended September 30, 2023. The decrease in the quarter was due to lower income generation in co-investment positions we hold in our LPs managed in our private strategies segment. The increase on a year-to-date basis was due to higher income earned on streaming syndication activity in the second quarter.

Key expense highlights

- Net compensation expense was $16.9 million in the quarter, up 11% from $15.3 million for the quarter ended September 30, 2023 and $50.3 million on a year-to-date basis, up 9% from $46 million for the nine months ended September 30, 2023. The increase in the quarter and on a year-to-date basis was primarily due to increased AIP accruals on higher net fee generation. Our net compensation ratio was 46% in the quarter (September 30, 2023 – 50%) and 45% on a year-to-date basis (September 30, 2023 – 50%).

- SG&A expense was $4.6 million in the quarter, up 21% from $3.8 million for the quarter ended September 30, 2023 and $13.8 million on a year-to-date basis, up 10% from $12.6 million for the nine months ended September 30, 2023. The increase in the quarter and on a year-to-date basis was due to higher technology and professional services costs.

Earnings summary

- Net income for the quarter was $12.7 million ($0.50 per share), up 87% from $6.8 million ($0.27 per share) for the quarter ended September 30, 2023 and was $37.6 million ($1.48 per share) on a year-to-date basis, up 17% from $32.1 million ($1.27 per share) for the nine months ended September 30, 2023. Our earnings benefited from higher management fees on strong market valuations of our precious metals physical trusts and good inflows to our exchange listed products. We also benefited from carried interest crystallization in our managed equities funds and market value appreciation of our co-investments.

- Adjusted base EBITDA was $20.7 million ($0.81 per share) in the quarter, up 16% from $17.9 million ($0.71 per share) for the quarter ended September 30, 2023 and $62.8 million ($2.47 per share) on a year-to-date basis, up 18% from $53.1 million ($2.10 per share) for the nine months ended September 30, 2023. Adjusted base EBITDA on both a three and nine months ended basis benefited from higher management fees on strong market valuations of our precious metals physical trusts and good inflows to our exchange listed products.

1 See “non-IFRS financial measures” section in this press release and schedule 2 and 3 of “Supplemental financial information”

Subsequent events

- Subsequent to quarter-end, on November 1, 2024, AUM was $34.2 billion, up 2% from $33.4 billion at September 30, 2024.

- On November 5, 2024, the Sprott Board of Directors announced a quarterly dividend of $0.30 per share.

Supplemental financial information

Please refer to the September 30, 2024 quarterly financial statements of the Company and the related management discussion and analysis filed earlier this morning for further details into the Company’s financial position as at September 30, 2024 and the Company’s financial performance for the three and nine months ended September 30, 2024.

Schedule 1 – AUM continuity

| 3 months results | ||||||||||

| (In millions $) | AUM Jun. 30, 2024 |

Net inflows (1) |

Market value changes |

Other net inflows (1) |

AUM Sep. 30, 2024 |

Net management fee rate (2) |

||||

| Exchange listed products | ||||||||||

| – Precious metals physical trusts and ETFs | ||||||||||

| – Physical Gold Trust | 7,283 | 361 | 973 | — | 8,617 | 0.35 | % | |||

| – Physical Silver Trust | 4,994 | 224 | 348 | — | 5,566 | 0.45 | % | |||

| – Physical Gold and Silver Trust | 4,710 | — | 515 | — | 5,225 | 0.40 | % | |||

| – Precious Metals ETFs | 355 | (11 | ) | 60 | — | 404 | 0.33 | % | ||

| – Physical Platinum & Palladium Trust | 143 | 7 | 1 | — | 151 | 0.50 | % | |||

| 17,485 | 581 | 1,897 | — | 19,963 | 0.39 | % | ||||

| – Critical materials physical trusts and ETFs | ||||||||||

| – Physical Uranium Trust | 5,615 | 23 | (230 | ) | — | 5,408 | 0.32 | % | ||

| – Critical Materials ETFs | 2,408 | 56 | (157 | ) | — | 2,307 | 0.55 | % | ||

| – Physical Copper Trust | 98 | 2 | 3 | — | 103 | 0.32 | % | |||

| 8,121 | 81 | (384 | ) | — | 7,818 | 0.38 | % | |||

| Total exchange listed products | 25,606 | 662 | 1,513 | — | 27,781 | 0.39 | % | |||

| Managed equities (3)(4) | 2,962 | (55 | ) | 369 | — | 3,276 | 0.90 | % | ||

| Private strategies (4) | 2,485 | (18 | ) | (85 | ) | — | 2,382 | 0.80 | % | |

| Total AUM (5) | 31,053 | 589 | 1,797 | — | 33,439 | 0.47 | % | |||

| 9 months results | ||||||||||

| (In millions $) | AUM Dec. 31, 2023 |

Net inflows (1) |

Market value changes |

Other net inflows (1) |

AUM Sep. 30, 2024 |

Net management fee rate (2) |

||||

| Exchange listed products | ||||||||||

| – Precious metals physical trusts and ETFs | ||||||||||

| – Physical Gold Trust | 6,532 | 316 | 1,769 | — | 8,617 | 0.35 | % | |||

| – Physical Silver Trust | 4,070 | 256 | 1,240 | — | 5,566 | 0.45 | % | |||

| – Physical Gold and Silver Trust | 4,230 | (161 | ) | 1,156 | — | 5,225 | 0.40 | % | ||

| – Precious Metals ETFs | 339 | (14 | ) | 79 | — | 404 | 0.33 | % | ||

| – Physical Platinum & Palladium Trust | 116 | 42 | (7 | ) | — | 151 | 0.50 | % | ||

| 15,287 | 439 | 4,237 | — | 19,963 | 0.39 | % | ||||

| – Critical materials physical trusts and ETFs | ||||||||||

| – Physical Uranium Trust | 5,773 | 266 | (631 | ) | — | 5,408 | 0.32 | % | ||

| – Critical materials ETFs | 2,143 | 294 | (130 | ) | — | 2,307 | 0.55 | % | ||

| – Physical Copper Trust | — | 2 | (9 | ) | 110 | 103 | 0.32 | % | ||

| 7,916 | 562 | (770 | ) | 110 | 7,818 | 0.38 | % | |||

| Total exchange listed products | 23,203 | 1,001 | 3,467 | 110 | 27,781 | 0.39 | % | |||

| Managed equities (3)(4) | 2,874 | (167 | ) | 569 | — | 3,276 | 0.90 | % | ||

| Private strategies (4) | 2,661 | (172 | ) | (107 | ) | — | 2,382 | 0.80 | % | |

| Total AUM (5) | 28,738 | 662 | 3,929 | 110 | 33,439 | 0.47 | % | |||

| (1) See “Net inflows” and “Other net inflows” in the key performance indicators and non-IFRS and other financial measures section of the MD&A. | ||||||||||

| (2) Management fee rate represents the weighted average fees for all funds in the category, net of fund expenses. | ||||||||||

| (3) Managed equities is made up of primarily precious metal strategies (57%), high net worth managed accounts (35%) and U.S. value strategies (8%). | ||||||||||

| (4) Prior period figures have been reclassified to conform with current presentation. | ||||||||||

| (5) No performance fees are earned on exchange listed products. Performance fees are earned on certain of our managed equities products and are based on returns above relevant benchmarks. Private strategies LPs primarily earn carried interest calculated as a predetermined net profit over a preferred return. |

||||||||||

Schedule 2 – Summary financial information

| (In thousands $) | Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

||||||||

| Summary income statement | ||||||||||||||||

| Management fees (1) | 38,693 | 38,065 | 36,372 | 34,244 | 32,867 | 32,940 | 31,170 | 28,152 | ||||||||

| Fund expenses (2), (3) | (2,385 | ) | (2,657 | ) | (2,234 | ) | (2,200 | ) | (1,740 | ) | (1,871 | ) | (1,795 | ) | (1,470 | ) |

| Direct payouts | (1,483 | ) | (1,408 | ) | (1,461 | ) | (1,283 | ) | (1,472 | ) | (1,342 | ) | (1,187 | ) | (1,114 | ) |

| Carried interest and performance fees | 4,110 | 698 | — | 503 | — | 388 | — | 1,219 | ||||||||

| Carried interest and performance fee payouts – internal | — | (251 | ) | — | (222 | ) | — | (236 | ) | — | (567 | ) | ||||

| Carried interest and performance fee payouts – external (3) | — | — | — | — | — | — | — | (121 | ) | |||||||

| Net fees | 38,935 | 34,447 | 32,677 | 31,042 | 29,655 | 29,879 | 28,188 | 26,099 | ||||||||

| Commissions | 498 | 3,332 | 1,047 | 1,331 | 539 | 1,647 | 4,784 | 5,027 | ||||||||

| Commission expense – internal | (147 | ) | (380 | ) | (217 | ) | (161 | ) | (88 | ) | (494 | ) | (1,727 | ) | (1,579 | ) |

| Commission expense – external (3) | (103 | ) | (1,443 | ) | (312 | ) | (441 | ) | (92 | ) | (27 | ) | (642 | ) | (585 | ) |

| Net commissions | 248 | 1,509 | 518 | 729 | 359 | 1,126 | 2,415 | 2,863 | ||||||||

| Finance income (2) | 1,574 | 4,084 | 1,810 | 1,391 | 1,795 | 1,650 | 1,655 | 1,738 | ||||||||

| Gain (loss) on investments | 937 | 1,133 | 1,809 | 2,808 | (1,441 | ) | (1,950 | ) | 1,958 | (930 | ) | |||||

| Co-investment income (2) | 418 | 416 | 274 | 170 | 462 | 1,327 | 93 | 370 | ||||||||

| Total net revenues (2) | 42,112 | 41,589 | 37,088 | 36,140 | 30,830 | 32,032 | 34,309 | 30,140 | ||||||||

| Compensation (2) | 18,547 | 19,225 | 17,955 | 17,096 | 16,939 | 21,468 | 19,556 | 17,148 | ||||||||

| Direct payouts | (1,483 | ) | (1,408 | ) | (1,461 | ) | (1,283 | ) | (1,472 | ) | (1,342 | ) | (1,187 | ) | (1,114 | ) |

| Carried interest and performance fee payouts – internal | — | (251 | ) | — | (222 | ) | — | (236 | ) | — | (567 | ) | ||||

| Commission expense – internal | (147 | ) | (380 | ) | (217 | ) | (161 | ) | (88 | ) | (494 | ) | (1,727 | ) | (1,579 | ) |

| Severance, new hire accruals and other | (58 | ) | — | — | (179 | ) | (122 | ) | (4,067 | ) | (1,257 | ) | (1,240 | ) | ||

| Net compensation | 16,859 | 17,186 | 16,277 | 15,251 | 15,257 | 15,329 | 15,385 | 12,648 | ||||||||

| Net compensation ratio | 46 | % | 44 | % | 47 | % | 47 | % | 50 | % | 48 | % | 52 | % | 44 | % |

| Severance, new hire accruals and other | 58 | — | — | 179 | 122 | 4,067 | 1,257 | 1,240 | ||||||||

| Selling, general and administrative (“SG&A”) (2) | 4,612 | 5,040 | 4,173 | 3,963 | 3,817 | 4,752 | 4,026 | 3,814 | ||||||||

| SG&A recoveries from funds (1) | (275 | ) | (260 | ) | (231 | ) | (241 | ) | (249 | ) | (282 | ) | (264 | ) | (253 | ) |

| Interest expense | 933 | 715 | 830 | 844 | 882 | 1,087 | 1,247 | 1,076 | ||||||||

| Depreciation and amortization | 502 | 568 | 551 | 658 | 731 | 748 | 706 | 710 | ||||||||

| Foreign exchange (gain) loss (2) | 1,028 | 122 | 168 | 1,295 | 37 | 1,440 | 440 | (484 | ) | |||||||

| Other (income) and expenses (2) | — | (580 | ) | — | 3,368 | 4,809 | (18,890 | ) | 1,249 | 1,686 | ||||||

| Total expenses | 23,717 | 22,791 | 21,768 | 25,317 | 25,406 | 8,251 | 24,046 | 20,437 | ||||||||

| Net income | 12,697 | 13,360 | 11,557 | 9,664 | 6,773 | 17,724 | 7,638 | 7,331 | ||||||||

| Net income per share | 0.50 | 0.53 | 0.45 | 0.38 | 0.27 | 0.70 | 0.30 | 0.29 | ||||||||

| Adjusted base EBITDA | 20,675 | 22,375 | 19,751 | 18,759 | 17,854 | 17,953 | 17,321 | 18,083 | ||||||||

| Adjusted base EBITDA per share | 0.81 | 0.88 | 0.78 | 0.75 | 0.71 | 0.71 | 0.68 | 0.72 | ||||||||

| Summary balance sheet | ||||||||||||||||

| Total assets | 412,477 | 406,265 | 389,784 | 378,835 | 375,948 | 381,519 | 386,765 | 383,748 | ||||||||

| Total liabilities | 82,198 | 90,442 | 82,365 | 73,130 | 79,705 | 83,711 | 108,106 | 106,477 | ||||||||

| Total AUM | 33,439,221 | 31,053,136 | 29,369,191 | 28,737,742 | 25,398,159 | 25,141,561 | 25,377,189 | 23,432,661 | ||||||||

| Average AUM | 31,788,412 | 31,378,343 | 29,035,667 | 27,014,109 | 25,518,250 | 25,679,214 | 23,892,335 | 22,323,075 | ||||||||

(1) Previously, management fees within the above summary financial information table included SG&A recoveries from funds consistent with IFRS 15. For management reporting purposes, these recoveries are now shown next to their associated expense as management believes this will enable readers to transparently identify the net economics of these recoveries. However, SG&A recoveries from funds are still shown within the “Management fees” line on the consolidated statement of operations. Prior year figures have been reclassified to conform with current presentation.

(2) Current and prior period figures on the consolidated statements of operations include the following adjustments: (1) trading costs incurred in managed accounts are now included within “Fund expenses” (previously included within “SG&A”); (2) interest income earned on cash deposits are now included within “Finance income” (previously included within “Other income”); (3) co-investment income and income attributable to non-controlling interest are now included as part of “Co-investment income” (previously included within “Other income”); (4) expenses attributable to non-controlling interest is now included within “Co-investment income” (previously included within “Other expenses”); (5) the mark-to-market expense of DSU issuances are now included within “Compensation” (previously included within “Other expenses”); (6) foreign exchange (gain) loss is now shown separately (previously included within “Other expenses”); and (7) shares received on a previously unrecorded contingent asset in Q2 2023 are now included within “Other (income) and expenses” (previously included within “Other income”). Prior year figures have been reclassified to conform with current presentation.

(3) These amounts are included in the “Fund expenses” line on the consolidated statements of operations.

Schedule 3 – EBITDA reconciliation

| 3 months ended | 9 months ended | |||||||

| (in thousands $) | Sep. 30, 2024 | Sep. 30, 2023 | Sep. 30, 2024 | Sep. 30, 2023 | ||||

| Net income for the period | 12,697 | 6,773 | 37,614 | 32,135 | ||||

| Net income margin (1) | 27 | % | 20 | % | 28 | % | 29 | % |

| Adjustments: | ||||||||

| Interest expense | 933 | 882 | 2,478 | 3,216 | ||||

| Provision for income taxes | 5,698 | (1,349 | ) | 14,899 | 7,333 | |||

| Depreciation and amortization | 502 | 731 | 1,621 | 2,185 | ||||

| EBITDA | 19,830 | 7,037 | 56,612 | 44,869 | ||||

| Adjustments: | ||||||||

| (Gain) loss on investments (2) | (937 | ) | 1,441 | (3,879 | ) | 1,433 | ||

| Stock-based compensation (3) | 4,806 | 4,408 | 13,829 | 12,447 | ||||

| Foreign exchange (gain) loss (4) | 1,028 | 37 | 1,318 | 1,917 | ||||

| Severance, new hire accruals and other (4) | 58 | 122 | 58 | 5,446 | ||||

| Revaluation of contingent consideration (4) | — | — | (580 | ) | (2,254 | ) | ||

| Costs relating to exit of non-core business (4) | — | 3,615 | — | 4,987 | ||||

| Non-recurring regulatory, professional fees and other (4) | — | 1,194 | — | 3,023 | ||||

| Shares received on recognition of contingent asset (4) | — | — | — | (18,588 | ) | |||

| Carried interest and performance fees | (4,110 | ) | — | (4,808 | ) | (388 | ) | |

| Carried interest and performance fee payouts – internal | — | — | 251 | 236 | ||||

| Carried interest and performance fee payouts – external | — | — | — | — | ||||

| Adjusted base EBITDA | 20,675 | 17,854 | 62,801 | 53,128 | ||||

| Adjusted base EBITDA margin (5) | 58 | % | 56 | % | 58 | % | 57 | % |

(1) Calculated as IFRS net income divided by IFRS total revenue.

(2) This adjustment removes the income effects of certain gains or losses on short-term investments, co-investments, and digital gold strategies to ensure the reporting objectives of our EBITDA metric as described below are met.

(3) In prior years, the mark-to-market expense of DSU issuances were included with “other (income) and expenses”. In the current period, these costs are included as part of “stock based compensation”. Prior year figures have been reclassified to conform with current presentation.

(4) Foreign exchange (gain) and loss, severance, new hire accruals and other; revaluation of contingent consideration; costs relating to exit of non-core business; non-recurring regulatory, professional fees and other; and shares received on recognition of contingent asset were previously included with “other (income) and expenses” and are now shown separately in the reconciliation of adjusted base EBITDA above. Prior year figures have been reclassified to conform with current presentation.

(5) Prior year figures have been restated to remove the adjustment of depreciation and amortization.

Conference Call and Webcast

A webcast will be held today, November 6, 2024 at 10:00 am ET to discuss the Company’s financial results.

To listen to the webcast, please register at: https://edge.media-server.com/mmc/p/7nbc4pms

Please note, analysts who cover the Company should register at: https://register.vevent.com/register/BIecf4c3c925374bf19a6ce5051f64dd6d

This press release includes financial terms (including AUM, net commissions, net fees, expenses, adjusted base EBITDA, adjusted base EBITDA margin and net compensation) that the Company utilizes to assess the financial performance of its business that are not measures recognized under International Financial Reporting Standards (“IFRS”). These non-IFRS measures should not be considered alternatives to performance measures determined in accordance with IFRS and may not be comparable to similar measures presented by other issuers. Non-IFRS financial measures do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Our key performance indicators and non-IFRS and other financial measures are discussed below. For quantitative reconciliations of non-IFRS financial measures to their most directly comparable IFRS financial measures please see schedule 2 and schedule 3 of the “Supplemental financial information” section of this press release.

Net fees

Management fees, net of fund expenses and direct payouts, and carried interest and performance fees, net of carried interest and performance fee payouts (internal and external), are key revenue indicators as they represent the net revenue contribution after directly associated costs that we generate from our AUM.

Net commissions

Commissions, net of commission expenses (internal and external), arise primarily from purchases and sales of critical materials in our exchange listed products segment and transaction-based service offerings by our broker dealers.

Net compensation & net compensation ratio

Net compensation excludes commission expenses paid to employees, other direct payouts to employees, carried interest and performance fee payouts to employees, which are all presented net of their related revenues in this MD&A, and severance, new hire accruals and other which are non-recurring. Net compensation ratio is calculated as net compensation divided by net revenues.

EBITDA, adjusted base EBITDA and adjusted base EBITDA margin

EBITDA in its most basic form is defined as earnings before interest expense, income taxes, depreciation and amortization. EBITDA (or adjustments thereto) is a measure commonly used in the investment industry by management, investors and investment analysts in understanding and comparing results by factoring out the impact of different financing methods, capital structures, amortization techniques and income tax rates between companies in the same industry. While other companies, investors or investment analysts may not utilize the same method of calculating EBITDA (or adjustments thereto), the Company believes its adjusted base EBITDA metric results in a better comparison of the Company’s underlying operations against its peers and a better indicator of recurring results from operations as compared to other non-IFRS financial measures. Adjusted base EBITDA margins are a key indicator of a company’s profitability on a per dollar of revenue basis, and as such, is commonly used in the financial services sector by analysts, investors and management.

Forward Looking Statements

Certain statements in this press release contain forward-looking information and forward-looking statements (collectively referred to herein as the “Forward-Looking Statements”) within the meaning of applicable Canadian and U.S. securities laws. The use of any of the words “expect”, “anticipate”, “continue”, “estimate”, “may”, “will”, “project”, “should”, “believe”, “plans”, “intends” and similar expressions are intended to identify Forward-Looking Statements. In particular, but without limiting the forgoing, this press release contains Forward-Looking Statements pertaining to: (i) our constructive outlook in precious metals and critical materials; (ii) our expectation to repay the balance of our line of credit by the end of this month, resulting in a debt-free balance sheet at that time; and (iii) the declaration, payment and designation of dividends and confidence that our business will support the dividend level without impacting our ability to fund future growth initiatives.

Although the Company believes that the Forward-Looking Statements are reasonable, they are not guarantees of future results, performance or achievements. A number of factors or assumptions have been used to develop the Forward-Looking Statements, including: (i) the impact of increasing competition in each business in which the Company operates will not be material; (ii) quality management will be available; (iii) the effects of regulation and tax laws of governmental agencies will be consistent with the current environment; (iv) the impact of public health outbreaks; and (v) those assumptions disclosed under the heading “Critical Accounting Estimates, Judgments and Changes in Accounting Policies” in the Company’s MD&A for the period ended September 30, 2024. Actual results, performance or achievements could vary materially from those expressed or implied by the Forward-Looking Statements should assumptions underlying the Forward-Looking Statements prove incorrect or should one or more risks or other factors materialize, including: (i) difficult market conditions; (ii) poor investment performance; (iii) failure to continue to retain and attract quality staff; (iv) employee errors or misconduct resulting in regulatory sanctions or reputational harm; (v) performance fee fluctuations; (vi) a business segment or another counterparty failing to pay its financial obligation; (vii) failure of the Company to meet its demand for cash or fund obligations as they come due; (viii) changes in the investment management industry; (ix) failure to implement effective information security policies, procedures and capabilities; (x) lack of investment opportunities; (xi) risks related to regulatory compliance; (xii) failure to manage risks appropriately; (xiii) failure to deal appropriately with conflicts of interest; (xiv) competitive pressures; (xv) corporate growth which may be difficult to sustain and may place significant demands on existing administrative, operational and financial resources; (xvi) failure to comply with privacy laws; (xvii) failure to successfully implement succession planning; (xviii) foreign exchange risk relating to the relative value of the U.S. dollar; (xix) litigation risk; (xx) failure to develop effective business resiliency plans; (xxi) failure to obtain or maintain sufficient insurance coverage on favorable economic terms; (xxii) historical financial information being not necessarily indicative of future performance; (xxiii) the market price of common shares of the Company may fluctuate widely and rapidly; (xxiv) risks relating to the Company’s investment products; (xxv) risks relating to the Company’s proprietary investments; (xxvi) risks relating to the Company’s private strategies business; (xxvii) those risks described under the heading “Risk Factors” in the Company’s annual information form dated February 20, 2024; and (xxviii) those risks described under the headings “Managing Financial Risks” and “Managing Non-Financial Risks” in the Company’s MD&A for the period ended September 30, 2024. In addition, the payment of dividends is not guaranteed and the amount and timing of any dividends payable by the Company will be at the discretion of the Board of Directors of the Company and will be established on the basis of the Company’s earnings, the satisfaction of solvency tests imposed by applicable corporate law for the declaration and payment of dividends, and other relevant factors. The Forward-Looking Statements speak only as of the date hereof, unless otherwise specifically noted, and the Company does not assume any obligation to publicly update any Forward-Looking Statements, whether as a result of new information, future events or otherwise, except as may be expressly required by applicable securities laws.

About Sprott

Sprott is a global asset manager focused on precious metals and critical materials investments. We are specialists. We believe our in-depth knowledge, experience and relationships separate us from the generalists. Our investment strategies include Exchange Listed Products, Managed Equities and Private Strategies. Sprott has offices in Toronto, New York, Connecticut and California and the company’s common shares are listed on the New York Stock Exchange and the Toronto Stock Exchange under the symbol (SII). For more information, please visit www.sprott.com.

Investor contact information:

Glen Williams

Managing Partner

Investor and Institutional Client Relations

(416) 943-4394

gwilliams@sprott.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.