Bitget Offers LALIGA EA SPORTS Football Match Day Tickets to Bitget Pay Users

VICTORIA, Seychelles, Nov. 22, 2024 (GLOBE NEWSWIRE) — Bitget, the leading cryptocurrency exchange and Web3 company has announced a campaign offering its users an opportunity to attend LALIGA EA SPORTS match day by leveraging the platform’s ‘Bitget Pay‘ product. Spanning from 21st 18:00 – 22nd 18:00 (UTC+8), the campaign aims to roll out activities planned out under the Bitget x LALIGA partnership to promote the integration of crypto and sports, especially across LATAM, Eastern Europe, CIS, and SEA. Football fans who actively use Bitget Pay during the campaign period will have a unique chance to secure tickets for this much-anticipated match, which features the world’s best teams playing against each other on 7th December.

The promotion involves an exciting campaign wherein participants can purchase a raffle ticket for just 1 USDT, paid through Bitget Pay, to enter a draw for one of the 50 regular match tickets. The purchase window opens on November 21st at 18:00 UTC+8, closing on November 22nd at 18:00 UTC+8. During the campaign period, 50 lucky participants will be chosen to receive match tickets, with winners announced at staggered intervals on Bitget’s X (previously Twitter) handle.

Throughout the campaign, users can experiment with Bitget Pay’s seamless transaction capabilities which attracts football fans interested in exploring crypto for payments. This opportunity for fans to attend a live LALIGA EA SPORTS event through an accessible crypto-driven process highlights the platform’s versatility in bridging the gap between digital finance and everyday experiences.

Bitget Pay remains unavailable in certain regions. However, football enthusiasts across other supported regions can take advantage of this promotion to experience Bitget Pay’s fast and user-friendly features while vying for a chance to be part of the event.

Participants selected in the raffle will be notified via email, and match tickets will be distributed a week prior to match day. For transparency, Bitget will also refund the 1 USDT participation fee to all non-winning users within 10 working days. Bitget has constantly provided its user base with diverse engagement opportunities by adding a range of crypto products to its offerings. Bitget Pay’s promotion is aligned with the mission to connect users with real-life use cases, which can help them discover the ease of financial payments within the crypto ecosystem.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 45 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM market, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/51cfa744-60fa-49cd-8186-c0d081e40008

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASHFORD HOSPITALITY TRUST ANNOUNCES CONVERSION OF LE PAVILLON NEW ORLEANS TO MARRIOTT'S TRIBUTE PORTFOLIO

DALLAS, Nov. 21, 2024 /PRNewswire/ — Ashford Hospitality Trust, Inc. AHT (“Ashford Trust” or the “Company”) announced today the conversion of its 226-room Le Pavillon Hotel in New Orleans, Louisiana to a Tribute Portfolio property. Marriott’s Tribute Portfolio is a growing global family of characterful, independent hotels drawn together by their passion for captivating design and their drive to create vibrant social scenes for guests and locals alike.

The property recently completed a $19 million renovation which included extensive exterior work, upgrading the restaurant, guestrooms, guest bathrooms, corridors as well as a reimagined hotel lobby bar. The new lobby bar, Bar 1803, draws inspiration from the rich history of Le Pavillon and New Orleans, honoring the year Emperor Napoleon signed the Louisiana Purchase. Legend has it Napoleon conceived the idea while soaking in a marble bathtub filled with rose water – one of which (perhaps the very one) resides in one of our suites.

The bar’s design showcases this heritage with a striking image of Napoleon and a lenticular art piece capturing two sides of the French icon: a ‘serious’ Napoleon and a ‘spirited’ one. This playful nod reflects New Orleans’ French roots and vibrant culture. Inspired by the amber hues of iconic NOLA cocktails, Bar 1803 blends history, elegance, and the unmistakable spirit of New Orleans into an unforgettable experience, paying tribute to the city’s enduring legacy and the hotel’s storied past.

Located in the heart of downtown New Orleans on historic Poydras Street, the 226-room Le Pavillon Hotel is known as the “Belle of New Orleans.” It sits adjacent to the historic French Quarter, is located only four blocks from the celebrated music clubs of Bourbon Street and is close to the famous restaurants and antique shops of Royal Street. Originally the site of one of the area’s first great plantation homes, the Le Pavillon Hotel was built in 1907 and is a member of Historic Hotels of America.

“We are thrilled to announce the successful conversion of this iconic property to Marriott’s Tribute Portfolio,” said Stephen Zsigray, President and Chief Executive Officer of Ashford Trust. “With its prime location near key demand drivers in downtown New Orleans, this transformation positions the hotel to stand out as a premier destination in the vibrant New Orleans market. We expect that completing this conversion ahead of Super Bowl LIX and Mardi Gras will position the property for an exceptional start to 2025. This milestone reflects our commitment to maximizing asset value, and we are confident it will drive enhanced financial performance for this property.”

Tribute Portfolio hotels participate in Marriott Bonvoy™, the global travel program from Marriott International. The program offers members an extraordinary portfolio of global brands, exclusive experiences on Marriott Bonvoy Moments and unparalleled benefits including free nights and Elite status recognition. To enroll for free or for more information about the program, visit MarriottBonvoy.marriott.com.

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; and the impact of technology on our operations and business. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

![]() View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-conversion-of-le-pavillon-new-orleans-to-marriotts-tribute-portfolio-302313626.html

View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-conversion-of-le-pavillon-new-orleans-to-marriotts-tribute-portfolio-302313626.html

SOURCE Ashford Hospitality Trust, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

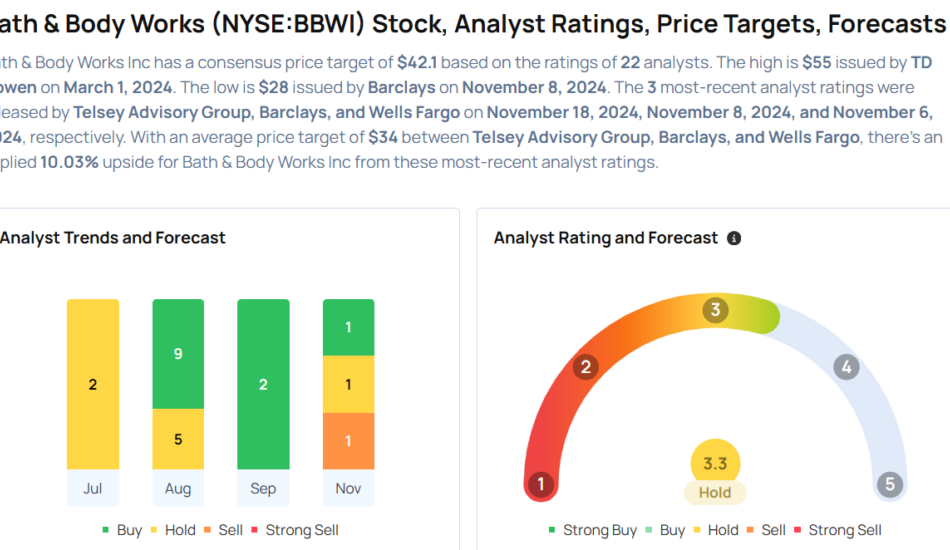

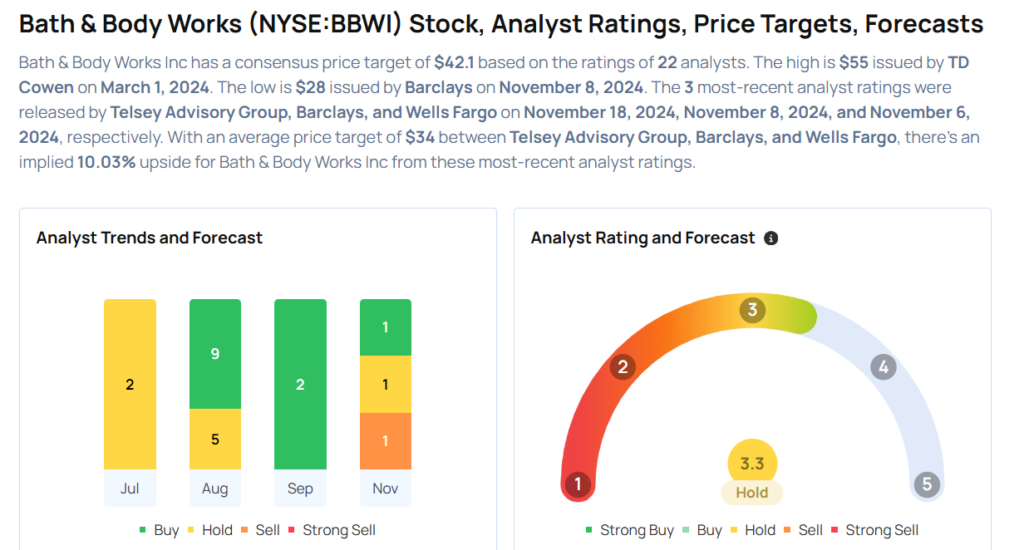

Bath & Body Works Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Bath & Body Works, Inc. BBWI will release earnings results for the third quarter, before the opening bell on Monday, Nov. 25.

Analysts expect Bath & Body Works to report quarterly earnings at 47 cents per share. That’s down from 48 cents per share a year ago. The Columbus, Ohio-based company projects to report quarterly revenue of $1.58 billion, compared to $1.56 billion a year earlier, according to data from Benzinga Pro.

On Nov. 8, Bath & Body Works announced the declaration of its regular quarterly dividend of 20 cents per share payable on Dec. 6, to shareholders of record at the close of business on Nov. 22.

Bath & Body Works shares gained 0.8% to close at $30.75 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Ike Boruchow maintained an Equal-Weight rating and cut the price target from $35 to $32 on Nov. 6. This analyst has an accuracy rate of 66%.

- BMO Capital analyst Simon Siegel reiterated an Outperform rating and lowered the price target from $52 to $50 on Aug. 29. This analyst has an accuracy rate of 75%.

- Goldman Sachs analyst Kate McShane maintained a Buy rating and cut the price target from $60 to $49 on Aug. 29. This analyst has an accuracy rate of 69%.

- JP Morgan analyst Matthew Boss maintained a Neutral rating and slashed the price target from $42 to $39 on Aug. 29. This analyst has an accuracy rate of 67%.

- Raymond James analyst Olivia Tong maintained a Neutral rating and cut the price target from $51 to $42 on Aug. 29. This analyst has an accuracy rate of 66%.

Considering buying BBWI stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Is a Gross Multiplier for Rental Properties?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

The gross multiplier is a key metric in real estate that helps investors compare rental properties based on income potential. By analyzing a property’s gross income or rent, this measure assesses its value relative to earnings. Calculating the gross multiplier can help determine if a property aligns with an investor’s return goals. A financial advisor can help you apply this metric to a larger investment plan.

A gross multiplier is a financial metric used in real estate to evaluate the value of a rental property relative to the income it generates. It helps investors gauge whether a property is priced appropriately based on its income-generating potential.

This multiplier can be applied using either gross income (total income from all sources) or gross rent (specifically rental income), depending on what you want to measure. It is calculated by dividing the property’s purchase price by its gross income.

This provides a snapshot of a property’s earning potential, helping investors compare similar properties more quickly.

For example, a property with a lower gross multiplier may indicate a better value for income, while a higher gross multiplier could suggest a premium price. However, while useful for comparison, the gross multiplier fails to account for expenses or specific market factors, so it is often best used alongside other valuation metrics.

The gross income multiplier (GIM) is used to evaluate a property’s overall income generation by considering all sources of income, including rent, fees and other income streams. This measure is particularly useful for investors looking at properties like multifamily buildings or commercial real estate, where additional income sources may contribute significantly to the property’s revenue.

The gross income multiplier uses a simple formula.

Gross Income Multiplier = Property Purchase Price / Gross Annual Income

For example, if a property’s purchase price is $500,000 and it generates $100,000 in gross annual income, the GIM would be 5. This means the property is priced at five times its gross annual income.

The gross rent multiplier (GRM) is a valuation tool that specifically considers rental income, focusing only on income from tenants rather than all sources. This metric is especially useful for residential rental properties where rental income is the primary or sole source of revenue.

As Trump Backs 'Drill Baby, Drill,' His DOGE Co-Lead Elon Musk Believes 'All Energy Generation Will Be Solar' — Here's What UBS Recommends After Election Dip

Renewable energy stocks present a buying opportunity despite recent electoral headwinds, according to UBS analysts, while Tesla Inc. TSLA CEO Elon Musk continues to advocate solar power’s future dominance.

What Happened: UBS analysts on Thursday elevated U.S. and EU renewables to their top-ranking stock theme, citing an attractive entry point following steep post-election losses, reported Business Insider.

The announcement comes as clean energy shares have tumbled, with companies like Plug Power Inc. PLUG and Enphase Energy Inc. ENPH down over 24% since President-elect Donald Trump‘s victory.

“The environment of an unrelenting power demand shock puts just about every source of power generation in a solid position to capitalize,” UBS analysts wrote, pointing to surging power needs from artificial intelligence data centers and corporate sustainability goals.

The analysts remain optimistic despite Trump’s expected scaling back of President Joe Biden-era clean energy initiatives. They argue that companies could “grandfather” existing subsidies and that state-level emission goals will sustain industry growth.

This view comes as Trump, who has appointed Musk and Vivek Ramaswamy to co-lead his new Department of Government Efficiency named after cryptocurrency Dogecoin, advocates for increased drilling.

Musk, despite his new role in the incoming Trump administration, has historically remained bullish on renewable energy. “Once you understand Kardashev Scale, it becomes utterly obvious that essentially all energy generation will be solar,” he posted on X. He noted that a single square mile receives approximately 2.5 gigawatts of solar energy.

UBS recommends several stocks poised for gains, including NextEra Energy Inc. NEE and Generac Holdings Inc. GNRC in the U.S., along with European players like Iberdrola IBDRY, Siemens Energy SMEGF, and Orsted DOGEF. The analysts cite historical precedent, noting that solar installations grew 50% during Trump’s previous term.

The renewable sector’s growth potential is further supported by expanding applications, including Musk’s recent suggestion that SpaceX’s Starlink satellite network could integrate solar panels and batteries into its hardware offering.

While Trump’s “drill baby, drill” stance has rattled markets, UBS maintains that investor concerns about the sector’s future may be “overdone,” as corporate and state-level commitments to clean energy persist alongside growing power demands from emerging technologies.

Read Next:

Photo via Unsplash

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin's Path To $100K 'Inevitable' But Crypto Community Is 'Leveraged To The Gills,' Warns Galaxy's Mike Novogratz, Predicts Correction To $80K Ahead

Bitcoin‘s BTC/USD surge toward $100,000 could face a significant pullback due to excessive market leverage, Galaxy Digital Holdings Ltd. CEO Mike Novogratz warned in a recent interview, even as the cryptocurrency continues setting new records.

What Happened: The billionaire investor highlighted concerning levels of leverage in the crypto ecosystem. “There’s a ton of leverage in the system right now,” Novogratz said on CNBC. “The crypto community is levered to the gills, and so there will be a correction.”

While Novogratz maintains that Bitcoin reaching $100,000 is “inevitable” – with prices recently touching $99,000 – he projects a potential retreat to $80,000 during a correction phase. This would represent a 20% decline from the six-digit milestone.

The warning comes amid broader market developments, including MicroStrategy Inc. MSTR, completing a $3 billion convertible note offering to acquire additional Bitcoin. The company currently holds 331,200 Bitcoin which it purchased at an average price of $49,874 per coin.

Supporting Novogratz’s cautionary stance, cryptocurrency analyst Michaël van de Poppe forecasts “4-6 flash crashes” before year-end, with Bitcoin potentially dropping 5-10% in single-day moves. Alternative cryptocurrencies could see even steeper declines of 20-30%.

Why It Matters: Despite these concerns, Novogratz expressed optimism about crypto’s regulatory outlook under President-elect Donald Trump‘s administration. “The entire cabinet almost owns bitcoin, and are proponents of digital assets,” he noted, suggesting a “paradigm shift” in cryptocurrency regulation.

The current crypto market surge has pushed total market capitalization to $3.3 trillion, with Ethereum ETH/USD trading at $3,359 and Solana SOL/USD reaching $262. Bitcoin currently trades at $98,563, maintaining its upward trajectory despite warnings of potential corrections.

“Normally you hit 100, you bounce off a bit,” Novogratz concluded while acknowledging the possibility of higher prices due to limited supply and strong demand, particularly from Middle Eastern investors and public equity markets.

Price Action: Bitcoin is currently trading at $99,138, up nearly 2.4% in the last 24 hours, according to Benzinga Pro data.

Read Next:

Image Via Pixabay

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LifeWallet Announces a $2 Million Pharmaceutical Litigation Settlement and Ongoing Settlement Negotiations with Multiple P&C Insurers, Pharmaceutical and Medical Device Manufacturers, While Advancing Efforts to Combat Systemic Medicare Waste, Which Aligns With Initiatives of the Newly-Formed Department of Government Efficiency (DOGE)

MIAMI, Nov. 21, 2024 (GLOBE NEWSWIRE) — MSP Recovery, Inc. d/b/a LifeWallet LIFW (“LifeWallet” or the “Company”) announces it reached a preliminary $2 million settlement as part of its portfolio of pharmaceutical litigation cases, while engaging in ongoing settlement negotiations with other pharmaceutical and medical device manufacturers, as well as property and casualty (“P&C”) insurers. LifeWallet also recently entered into an agreement with one of the Company’s lenders, securing a limited waiver of the Company’s obligation to pay a promissory note, which is expected to provide additional liquidity to the Company.

LifeWallet CEO, John H. Ruiz, is confident in the Company’s continued progress, saying, “Our commitment to discovering waste and recovering improper healthcare payments will continue to have a positive widespread impact.” He continues, “By tackling waste through legal, operational, and technological avenues, LifeWallet is committed to recovering improperly paid funds and promoting accountability within the healthcare system, benefitting all Americans.”

Pharmaceutical Litigation Settlement

On November 21, 2024, LifeWallet reached a preliminary settlement totaling $2 million, subject to finalizing terms in a global settlement agreement, against a defendant for alleged violations of the Racketeer Influenced and Corrupt Organizations Act (“RICO”), and violation of various state consumer protection laws and unjust enrichment laws. The terms of the settlement are a combination of monetary and non-monetary considerations, with the non-monetary considerations involving LifeWallet obtaining prescription drug claims data that will assist in identifying and recovering against other responsible parties, including, but not limited to, at least twelve other pharmaceutical manufacturers, and distributors.

Ongoing Settlement Negotiations

As part of LifeWallet’s owned claims portfolio, the Company is also engaged in ongoing litigation against property and casualty insurers and other pharmaceutical and medical device manufacturers based on claims of anti-competitive pricing, RICO, violation of state consumer protection statutes, and defective medical products or prescription drugs.

On November 11, 2024, the Company announced two comprehensive settlements with P&C insurers, totaling more than $5.2 million, which offer a going-forward process to collaboratively and timely resolve future claims and share important historical data. LifeWallet’s exclusive data matching with primary payers is expected to enhance its claims reconciliation capabilities by identifying claims owned by LifeWallet that it may have a right to recover on, benefiting Medicare plans and downstream entities. These recent P&C insurer settlements follow three other settlements against P&C insurers earlier this year. Some of these settlements require the P&C insurers to provide data to the LifeWallet clearinghouse platform that was designed and created by LifeWallet and Palantir Technologies, Inc.

The LifeWallet/Palantir clearinghouse is a hybrid between a statistical analysis system model and one that identifies improper payments, while also having the capability to provide patients, providers, and attorneys with an individual’s current and past medical conditions as they relate to improper payments or potential claims against the world’s largest pharmaceutical and medical device companies.

LifeWallet notes these settlements are not a guarantee that its portfolio of assigned claims (owed by other Primary Payers) can be settled with the same or similar terms. The settlement values are a combination of monetary and non-monetary considerations, with the non-monetary considerations involving LifeWallet obtaining data on all the claims that were processed and paid by the P&C Insurers, and the P&C Insurers’ assignment of rights to collect against other responsible parties. LifeWallet expects this will enhance its ability to discover liens and recover payments owed more efficiently than through litigation. It also enables LifeWallet to pursue a diversified number of entities that failed to pay liens or collected twice for the same bills, both from the insurer and LifeWallet’s assignor clients.

LifeWallet’s Efforts to Discover and Recover Medicare and Medicaid Waste

The Scope of the Problem

Improper payments by Medicare and Medicaid contribute significantly to government waste, accounting for billions of dollars annually.

- In fiscal year 2022, the United States Government Accountability Office (GAO) reported $247 billion in improper payments across 82 programs, with approximately 52% attributed to Medicare and Medicaid1. This statistic was highlighted by Elon Musk, who is expected to head the newly established Department of Government Efficiency (DOGE) (x.com/doge), which will function as a newly created advisory board to President-elect Donald Trump. Musk commented the above numbers are “just the tip of the iceberg. The actual fraud and waste in government spending is much higher.”

- With Medicare and Medicaid spending surpassing $1 trillion in 2023,2 estimated waste due to accident-related injuries exceeds $100 billion.

LifeWallet’s Initiatives Align with Reducing Government Waste

LifeWallet is dedicated to discovering and recovering substantial improper payments within the Medicare and Medicaid systems, particularly focusing on the Medicare Advantage program. These improper payments often result from systemic communication failures among stakeholders, leading to Medicare erroneously covering accident-related injuries and failing to recuperate those funds.

- Litigation Against Improper Payments: In 2024, LifeWallet has agreed to five settlements against property and casualty insurers, in aggregate totaling more than $10 million dollars to settle historical claims of improper payments, as well as obtain data to pursue claims for additional improper payments and establish a clearinghouse to efficiently settle future claims with certain P&C Insurers.

- Additional Claims Acquisition: In October 2024, LifeWallet paid approximately $2 million dollars to acquire additional Medicare Secondary Payer (MSP) claims with an overall Paid Amount3 exceeding $10.6 billion, encompassing over 450,000 Medicare members. This claims acquisition enhances LifeWallet’s ability to identify and recover improper payments.4

- Technological Enhancements: In 2023, continuing into 2024, LifeWallet has developed the LifeWallet/Palantir clearinghouse that connects P&C Insurers to health plans, allowing for elimination of waste from improper payments made for accident-related injuries.

While these efforts represent steps toward addressing systemic issues in Medicare and Medicaid spending, comprehensive reform requires collaboration among all stakeholders. Individuals expected to be appointed to President-elect Trump’s advisory committee, called the Department of Government Efficiency (DOGE), are emphasizing the importance of addressing Medicare waste, advocating for enhanced oversight and stricter enforcement measures to curb improper payments. Their efforts align with LifeWallet’s continued mission to reduce waste and improve efficiency in healthcare spending.

Nomura Limited Waiver of Company’s Obligation to Pay

On November 18, 2024, Company lender, Nomura Securities International, Inc. (“Nomura”), agreed to a limited waiver of the Company’s obligation to pay promissory note obligations using the proceeds of the Standby Equity Purchase Agreement dated November 14, 2023 by and between the Company and YA II PN, Ltd. until March 31, 2025, and up to an aggregate total of $4 million of such proceeds that would otherwise be paid to Nomura; provided that such proceeds be used to fund the operations of the Company. This waiver is expected to create more liquidity for the Company, to invest in accelerating healthcare reimbursement recoveries.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts, including for example statements regarding potential future settlements. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. As a result, these statements are not guarantees of future performance or results and actual events may differ materially from those expressed in or suggested by the forward-looking statements. Any forward-looking statement made by the Company herein speaks only as of the date made. New risks and uncertainties come up from time to time, and it is impossible for the Company to predict or identify all such events or how they may affect it. the Company has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws. Factors that could cause these differences include, but are not limited to, the Company’s ability to capitalize on its assignment agreements and recover monies that were paid by the assignors; the inherent uncertainty surrounding settlement negotiations and/or litigation, including with respect to both the amount and timing of any such results; the success of the Company’s scheduled settlement mediations; the validity of the assignments of claims to the Company; negative publicity concerning healthcare data analytics and payment accuracy; and those other factors included in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed by it with the SEC. These statements constitute the Company’s cautionary statements under the Private Securities Litigation Reform Act of 1995.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has become a Medicare, Medicaid, commercial, and secondary payer reimbursement recovery leader, disrupting the antiquated healthcare reimbursement system with data-driven solutions to secure recoveries from responsible parties. LifeWallet provides comprehensive solutions for multiple industries including healthcare, legal, and sports NIL. For more information, visit: LIFEWALLET.COM.

CONTACTS:

Media

Media@lifewallet.com

Investors

Investors@LifeWallet.com

1 https://www.gao.gov/products/gao-23-106285

2 https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet#:~:text=Medicare%20spending%20grew%205.9%25%20to,21%20percent%20of%20total%20NHE.

3 “Paid Amount” (a/k/a Medicare Paid Rate or wholesale price) means the amount paid to the provider from the health plan or insurer. This amount varies based on the party making payment. For example, Medicare typically pays a lower fee for service rate than commercial insurers. The Paid Amount is derived from the Claims data we receive from our Assignors. In the limited instances where the data received lacks a paid value, our team calculates the Paid Amount with a formula. The formula used provides rates for outpatient services and is derived from the customary rate at the 95th percentile as it appears from standard industry commercial rates or, where that data is unavailable, the Billed Amount if present in the data. These amounts are then adjusted to account for the customary Medicare adjustment to arrive at the calculated Paid Amount. Management believes that this formula provides a conservative estimate for the Medicare paid amount rate, based on industry studies which show the range of differences between private insurers and Medicare rates for outpatient services. We periodically update this formula to enhance the calculated paid amount where that information is not provided in the data received from our Assignors. Management believes this measure provides a useful baseline for potential recoveries, but it is not a measure of the total amount that may be recovered in respect of potentially recoverable Claims, which in turn may be influenced by any applicable potential statutory recoveries such as double damages or fines. Where we have to extrapolate a Paid Amount to establish damages, the calculated amount may be contested by opposing parties. The figures pertaining to Medicare Member Lives as well as the paid amount were tabulated based on the data provided by health care plans; these figures may be subject to adjustment upon further investigation of the paid amounts reflected by the health plans.

4 https://investor.lifewallet.com/news-releases/news-release-details/lifewallet-acquires-assignment-additional-msp-claims-overall

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HISTORIC AGREEMENT BETWEEN EXPANSION DIEPPE AND MONTONI: 2 MILLION-SQUARE-FOOT SUSTAINABLE INDUSTRIAL PARK

DIEPPE, NB, Nov. 21, 2024 /CNW/ – Expansion Dieppe and MONTONI have signed a 2-million-square-foot development agreement to expand Dieppe Industrial Park in New Brunswick. This interprovincial agreement is a first in the Maritimes for the developer, a Québec pioneer in sustainable real estate. The announcement was made during Expansion Dieppe’s 50th anniversary celebrations.

The development, valued at more than $125 million, will generate nearly 500 jobs locally. It will be designed to attract businesses to Dieppe, a city that is experiencing rapid growth. The municipality’s location in the Atlantic trade corridor makes it an important strategic distribution hub for goods and services.

A strategic location

The City of Dieppe is ideally located, combining a world-class transportation network with a buoyant economic environment. Located near Roméo-LeBlanc International Airport, highways 2, 11 and 15, as well as three deep-water ports, Dieppe Industrial Park offers prime access to local, national and international markets.

This logistics hub, supported by a rail network, facilitates the distribution of goods across Canada and the Northeastern United States, serving more than 70 million consumers with delivery times of under 24 hours. The industrial park is already home to a number of major companies, including J.D. Irving, FedEx, Purolator, UPS, BMM Testlabs, Groupe Touchette and Midland Transport.

“Dieppe Industrial Park plays a strategic role as an economic driver, attracting top-tier companies because of its ideal location and direct access to major North American markets. This partnership with MONTONI testifies to the strong professional relationship we have long enjoyed with the people behind this organization. This agreement is in keeping with our vision of a sustainable expansion that generates local opportunities and strengthens our region’s economic vitality.”

– Louis Godbout, Executive Director, Expansion Dieppe

Dieppe: a fast-growing city with a skilled workforce

Dieppe is known for its thriving economic environment. The city’s population has grown by almost 300% in 30 years, attracting businesses from a wide range of sectors. Dieppe has a bilingual workforce, with more than three-quarters of its residents speaking both official languages, English and French. The population is young, dynamic and skilled. According to the latest estimates, the average age of residents is 40.8, compared with 46.1 for the province of New Brunswick.

Its proximity to educational institutions such as Université de Moncton and Collège communautaire du Nouveau-Brunswick (CCNB) means that the city benefits from a pool of specialized talent that supports business expansion in an environment conducive to innovation.

A shared vision for a sustainable future

Expansion Dieppe and the City of Dieppe have made sustainable development and social responsibility major priorities in their latest strategic plans, incorporating these values into all their practices. The industrial park project in partnership with Montoni Group is fully in keeping with this vision.

Together, Expansion Dieppe and Montoni Group are committed to responsible development, seeking to reduce the ecological footprint of buildings while optimizing the use of space and safeguarding citizens’ quality of life.

“We are very proud to be concluding our very first development agreement in the Maritimes. When we expand into new cities, we always prioritize working with local construction companies and subcontractors. I believe this is the key to success. Expansion Dieppe shares our ambition for building a future that the next generations can be proud of. It is these common values that made Dieppe a natural choice.”

– Dario Montoni, President, Montoni Group

A great place to live

Although Dieppe has a highly developed urban milieu, it also features numerous parks and green spaces, as well as over 75 kilometres of trails and cycle paths. Increasing numbers of young families are settling here because of its stable, safe and lively surroundings. Despite its phenomenal growth, Dieppe has managed to maintain the community spirit that appeals to its residents.

Locals have access to quality healthcare thanks to the many medical clinics as well as Dr. Georges-L.-Dumont University Hospital Centre and Moncton Hospital. The Centre des arts et de la culture is the face of the community’s cultural and artistic dynamism. Sports enthusiasts are well served by the presence of two arenas, including at the UNIplex intergenerational community complex, as well as the Dieppe Aquatic and Sports Centre, various sports fields, parks for practising a variety of outdoor activities year-round, and numerous walking trails and bike paths.

“With our business focus and environmentally friendly economy, Dieppe stands out as an ideal place to do business, raise a family and work! We are delighted with this new partnership, which will enable us to pursue our development according to the principles of smart growth, thereby reducing our environmental impact and improving the quality of life of our residents.”

– Yvon Lapierre, Mayor, Dieppe

About Expansion Dieppe

Since it was founded in 1973 as Dieppe Industrial Park Ltd., Expansion Dieppe has been central to the economic development of the City of Dieppe. With 50 years of experience, the agency is a pivotal player in supporting local businesses and attracting new investment to the region. It leverages its know-how to develop fully serviced land to meet the needs of businesses, while providing no-cost support, access to strategic resources and cutting-edge expertise. The organization helps start-ups get off the ground and growing companies find their ideal location. Expansion Dieppe’s commitment to promoting a dynamic economic environment and forging strong partnerships makes it a leader in southeastern New Brunswick, poised to propel Dieppe into a prosperous future.

About MONTONI

A pioneer of sustainable building in Canada, MONTONI develops, builds and manages real estate projects at the leading edge of design, performance, urban planning and occupant wellness. Its fundamental purpose is to create value for its clients, the environment and the community.

To date, MONTONI has completed more than 700 projects representing over 30 million square feet of industrial, commercial, institutional and residential construction and 30 corporate campuses, with another 25 million square feet under development—an impressive portfolio of properties across Québec.

Proudly holding the title of one of Canada’s Best-Managed Companies for nearly 25 years, MONTONI has committed to making ESG criteria a permanent strategic reflex. It has completed more than 5.2 million square feet of LEED-certified buildings and, among construction projects underway, is targeting LEED certification for nearly 7 million square feet. Construction is also nearing completion on some 4.5 million square feet of Zero-Carbon Building (ZCB) spaces. MONTONI’s ambition is to build a real estate heritage that will be a source of pride for future generations. www.groupemontoni.com

Source: Expansion Dieppe and Montoni Group

SOURCE Groupe Montoni

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/21/c2594.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/21/c2594.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.