Seres Therapeutics to Announce Third Quarter 2024 Financial Results and Business Updates on November 13, 2024

CAMBRIDGE, Mass., Nov. 06, 2024 (GLOBE NEWSWIRE) — Seres Therapeutics, Inc. MCRB, a leading live biotherapeutics company, today announced that management will host a conference call and live audio webcast on November 13, 2024 at 8:30 a.m. ET to discuss third quarter 2024 financial results and provide business updates.

To access the conference call, please dial 800-715-9871 (domestic) or 646-307-1963 (international) and reference the conference ID number 5051385. To join the live webcast, please visit the “Investors and News” section of the Seres website at www.serestherapeutics.com.

A webcast replay will be available on the Seres website beginning approximately two hours after the event and will be archived for approximately 21 days.

About Seres Therapeutics

Seres Therapeutics, Inc. MCRB is a clinical-stage company focused on improving patient outcomes in medically vulnerable populations through novel live biotherapeutics. Seres led the successful development and approval of VOWST™, the first FDA-approved orally administered microbiome therapeutic, which was sold to Nestlé Health Science in September 2024. The Company is developing SER-155, which has demonstrated a significant reduction in bloodstream infections and related complications (as compared to placebo) in a clinical study in patients undergoing allogeneic Hematopoietic Stem Cell Transplantation (allo-HSCT). SER-155 and our other pipeline programs are designed to target multiple disease-relevant pathways and are manufactured from standard clonal cell banks via single-strain cultivation, rather than from the donor-sourced production process used for VOWST. The Company is also advancing additional cultivated oral live biotherapeutics for medically vulnerable populations, including those with chronic liver disease, cancer neutropenia, and solid organ transplants. For more information, please visit www.serestherapeutics.com.

Investor and Media Contact:

IR@serestherapeutics.com

Carlo Tanzi, Ph.D.

Kendall Investor Relations

ctanzi@kendallir.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Stock Surges Over 13% In Premarket: What Is Going On

Tesla Inc. TSLA shares are up by over 13% in pre-market trading on Wednesday over a likely Donald Trump victory in the U.S. Presidential elections.

What Happened: According to The New York Times, Trump currently has over 95% chance of victory given he already has 267 of the 270 electoral votes needed to win.

At the time of writing, the Tesla stock was up 13.3% in premarket trading, at $284.90, according to Benzinga Pro data.

Tesla CEO Elon Musk endorsed Trump in July and has been actively campaigning for the former President both offline and online. Musk even campaigned for Trump in the swing state of Pennsylvania in October.

Trump, meanwhile, has expressed his intent to set up a government efficiency commission led by Musk if elected President. The commission will be tasked with conducting a complete financial and performance audit of the federal government and recommending reforms, Trump said in September.

According to Wedbush analyst Dan Ives, the biggest positive from a Trump win would be for Tesla and Musk.

“We believe a Trump win is a negative for the EV industry as the EV rebates/tax incentives get pulled, however for Tesla a huge positive for scale/price advantage,” Ives said on Wednesday. The analyst added that a Trump win could add $40-$50 to Tesla’s stock.

Tesla’s Frankfurt-listed shares are also up by over 14.5%.

Price Action: Year-to-date, Tesla shares are up 1.2%, after the stock closed up 3.5% at $251.44 on Tuesday, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Trade Sinks Emerging Markets as Trade-War Fears Return

(Bloomberg) — Mexico led a currency meltdown while China spurred an equity selloff as Donald Trump’s election sparked a resurgence of the “Trump Trade” and sent emerging markets sinking.

Most Read from Bloomberg

The peso, often seen as the currency most vulnerable to Trump’s trade policies, tumbled as much as 3.5%, helping to set up the emerging-market currency gauge for its worst day since February 2023. China’s stock indexes in Hong Kong slid more than 2.5% as traders priced in punitive tariffs for the world’s second-biggest economy.

Emerging markets were hit hard early Wednesday by the so-called Trump trade as they stand to lose from his “America first” economic priorities, including restrictions on imports and immigration. It was Trump’s trade war against China in 2018, during his first term, that halted an EM equity rally and sparked an underperformance relative to the US that continues to this day. This time around, Trump has also pointed to an expansive fiscal policy that’s seen as inflationary and could undermine developing nations’ capacity to cut borrowing costs.

“A Trump presidency will implement harsher and broader tariffs than during the last Trump administration,” with China targeted more than other countries, said Rajeev De Mello, chief investment officer at Gama Asset Management. “An expansionary fiscal policy will lead to higher bond yields, especially for bonds with longer maturities, resulting in a double whammy for the emerging markets through a stronger US dollar and higher US yields.”

Traders had been preparing for a Trump victory in recent weeks and volatility in the peso soared. The Republican’s proposals would hit Mexico — the largest trade partner with the US — particularly hard. On the campaign trail, Trump said automakers building plants in Mexico are a “serious threat” to the US.

The currency selloff was widespread as Trump cruised to victory, with the MSCI EM Currency Index dropping as much as 0.8%. It’s less than 1% away from erasing its 2024 gains.

Eastern European currencies posted some of the biggest losses on Wednesday amid concern that Europe’s growth and monetary policy may be constrained, while the continent’s defense expenditure may go up.

Trump’s “trade policies would have particularly negative consequences for Mexico, but also for the euro zone and closely correlated with it the Central and Eastern European region,” said Piotr Matys, a senior FX analyst at In Touch Capital Markets.

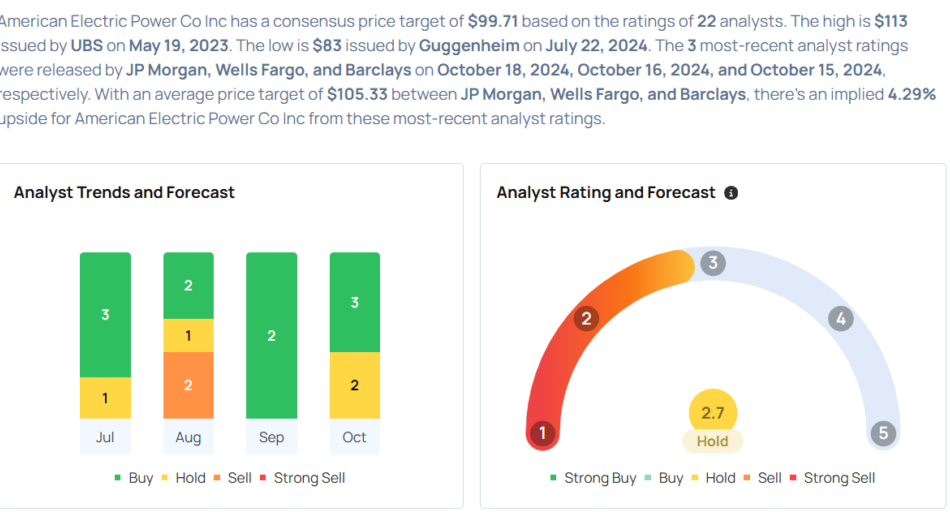

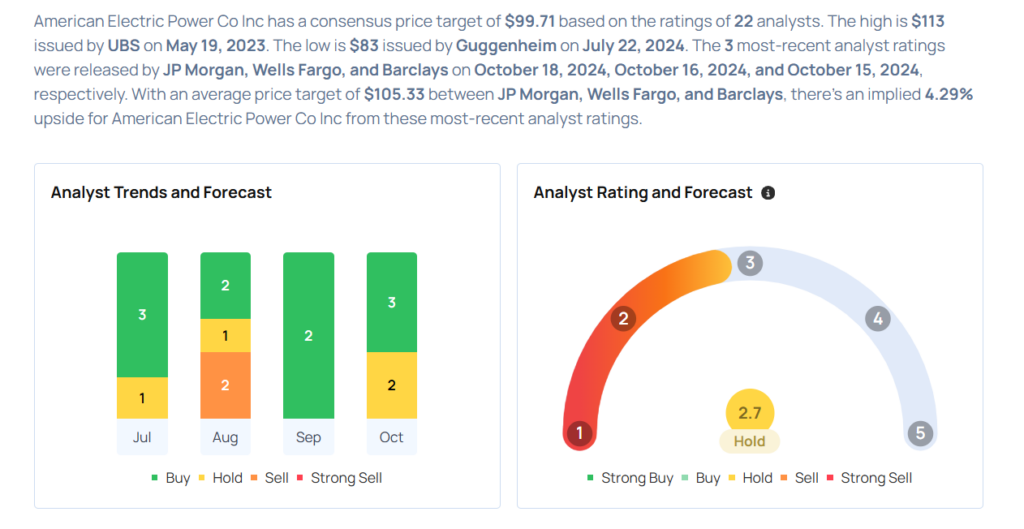

American Electric Power Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

American Electric Power Company, Inc. AEP will release earnings results for its third quarter, before the opening bell on Wednesday, Nov. 6.

Analysts expect the Columbus, Ohio-based company to report quarterly earnings at $1.8 per share, up from $1.77 per share in the year-ago period. American Electric Power projects to report revenue of $5.43 billion for the quarter, compared to $5.37 billion a year earlier, according to data from Benzinga Pro.

On Oct. 24, American Electric Power named Matthew Fransen senior vice president, Finance and Treasurer, effective Dec. 1.

American Electric Power shares gained 2% to close at $100.40 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Jeremy Tonet maintained an Overweight rating and raised the price target from $108 to $112 on Oct. 18. This analyst has an accuracy rate of 62%.

- Wells Fargo analyst Neil Kalton maintained an Equal-Weight rating and increased the price target from $98 to $104 on Oct. 16. This analyst has an accuracy rate of 67%.

- Barclays analyst Nicholas Campanella maintained an Equal-Weight rating and raised the price target from $96 to $100 on Oct. 15. This analyst has an accuracy rate of 65%.

- BMO Capital analyst James Thalacker maintained an Outperform rating and slashed the price target from $114 to $111 on Oct. 4. This analyst has an accuracy rate of 73%.

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Hold rating and a price target of $107 on Sept. 19. This analyst has an accuracy rate of 67%.

Considering buying AEP stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Newmark Advises on Sale of Iconic W Hotel South Beach

Sale Marks Largest Miami Hotel Transaction This Year

NEW YORK, Nov. 5, 2024 /PRNewswire/ — Newmark announces the more than $400 million sale of the 20-story oceanfront W Hotel South Beach in Miami, Florida. Newmark was an advisor to the seller, Tricap1. Reuben Brothers purchased the property.

“I am confident that the Reuben Brothers family will take the W to the next level of greatness, and look forward to the success they will achieve and the impact they will make on the world-class luxury Miami Beach hospitality market,” said David Edelstein, Principal at Tricap. “I thank Related New York for the excellent work it did as builder of the W Hotel and RFR Realty for its partnership. Lastly, it’s been terrific as always working with Newmark.”

The sale is the largest hotel transaction in the Miami market this year, as well as being the newest hotel property to sell since 20212.

“The W Hotel South Beach is a world-class, trophy asset and a once-in-a-lifetime opportunity,” said Doug Harmon, Co-Head of U.S. Capital Markets for Newmark. “We are eager to see this property continue to thrive under new ownership.”

Tricap purchased the 3.85-acre site at 2201 Collins Avenue, formerly home of a Holiday Inn, which was demolished in 2006. The W Hotel, which delivered in 2009, features multiple luxury restaurants, including The Grove, Mr. Chow and WET Bar, as well as a full-service spa, spacious balconies with ocean views and much more. The tower, which also includes more than 200 individually-owned condominiums, sits immediately adjacent to the iconic Miami Beach, with views of Biscayne Bay and the Miami River, ideal access to Interstates 195 and 395, and close proximity to a plethora of luxury retail options along the waterfront.

About Tricap

For over three decades, real estate development and investment firm Tricap has been exceeding projected returns for their co-investment partners across a variety of asset classes, groundbreaking and market-changing projects. With the execution of prudent investment decisions against the backdrop of a creative business plan and capital structure implementation, Tricap seeks to create superior investment returns by identifying early-stage market opportunities and unique transactions. Manhattan-based Tricap has developed and maintained an expansive portfolio of real estate holdings including hotel, office, retail and mixed-use properties in major metropolitan markets including New York City, Miami, Silicon Valley, Seattle and Las Vegas. Tricap’s passionate and devoted team of seasoned experts, led by David Edelstein, applies the core investment principles mirroring that of their founder and continues to differentiate themselves from their competitors while elevating the expectations of their partners and clients.

About Newmark

Newmark Group, Inc. NMRK, together with its subsidiaries (“Newmark”), is a world leader in commercial real estate, seamlessly powering every phase of the property life cycle. Newmark’s comprehensive suite of services and products is uniquely tailored to each client, from owners to occupiers, investors to founders, and startups to blue-chip companies. Combining the platform’s global reach with market intelligence in both established and emerging property markets, Newmark provides superior service to clients across the industry spectrum. For the twelve months ended September 30, 2024, Newmark generated revenues of over $2.6 billion. As of that same date, Newmark’s company-owned offices, together with its business partners, operated from nearly 170 offices with more than 7,800 professionals around the world. To learn more, visit nmrk.com or follow @newmark.

Discussion of Forward-Looking Statements about Newmark

Statements in this document regarding Newmark that are not historical facts are “forward-looking statements” that involve risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements. These include statements about the Company’s business, results, financial position, liquidity, and outlook, which may constitute forward-looking statements and are subject to the risk that the actual impact may differ, possibly materially, from what is currently expected. Except as required by law, Newmark undertakes no obligation to update any forward-looking statements. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see Newmark’s Securities and Exchange Commission filings, including, but not limited to, the risk factors and Special Note on Forward-Looking Information set forth in these filings and any updates to such risk factors and Special Note on Forward-Looking Information contained in subsequent reports on Form 10-K, Form 10-Q or Form 8-K.

1 Eastdil Secured also advised the seller.

2 According to Real Capital Analytics data.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/newmark-advises-on-sale-of-iconic-w-hotel-south-beach-302296891.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/newmark-advises-on-sale-of-iconic-w-hotel-south-beach-302296891.html

SOURCE Newmark

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Astec Reports Third Quarter 2024 Results

Third Quarter 2024 Overview (all comparisons are made to the corresponding prior year third quarter unless otherwise specified):

- Net sales of $291.4 million decreased 3.9%

- Net loss of $6.2 million, which included an $8.4 million charge related to the settlement of a legacy litigation matter: Adjusted net income of $7.0 million

- EBITDA of $0.6 million declined $1.2 million; Adjusted EBITDA was $17.4 million, an increase of $7.4 million

- Diluted EPS of $(0.27) compared to $(0.29); Adjusted EPS of $0.31 compared to $(0.01)

- Operating cash flow of $22.5 million; Free cash flow of $19.9 million

CHATTANOOGA, Tenn., Nov. 06, 2024 (GLOBE NEWSWIRE) — Astec Industries, Inc. ASTE announced today its financial results for the third quarter ended September 30, 2024.

“In the third quarter, we had mixed results. In Infrastructure Solutions, both sales and margins were up for the quarter, while in Materials Solutions, we continued to face difficult market conditions. We made nice progress improving our cash flow in the third quarter, which continues to be a key focal point. We were also able to settle one of our previously disclosed, long-standing, legacy litigation matters related to a product we no longer own, which resulted in an $8.4 million charge in the third quarter,” said Jaco van der Merwe, Chief Executive Officer.

Mr. van der Merwe continued, “With sound fundamentals in place, we continue to focus on commercial and operational excellence. We have a customer-focused approach and product offerings to drive sustainable value creation for our shareholders.”

| GAAP | Adjusted | ||||||||||||||||||

| (in millions, except per share and percentage data) | 3Q 2024 | 3Q 2023 | Change | 3Q 2024 | 3Q 2023 | Change | |||||||||||||

| Net sales | $ | 291.4 | $ | 303.1 | (3.9 | )% | |||||||||||||

| Domestic sales | 211.2 | 229.6 | (8.0 | )% | |||||||||||||||

| International sales | 80.2 | 73.5 | 9.1 | % | |||||||||||||||

| Backlog | 475.8 | 614.7 | (22.6 | )% | |||||||||||||||

| Domestic backlog | 377.6 | 510.6 | (26.0 | )% | |||||||||||||||

| International backlog | 98.2 | 104.1 | (5.7 | )% | |||||||||||||||

| (Loss) income from operations | (7.2 | ) | (5.2 | ) | (38.5 | )% | 9.9 | 3.1 | 219.4 | % | |||||||||

| Operating margin | (2.5 | )% | (1.7 | )% | (80) bps | 3.4 | % | 1.0 | % | 240 bps | |||||||||

| Effective tax rate | 27.1 | % | 8.5 | % | 1,860 bps | 18.6 | % | 108.3 | % | (8,970) bps | |||||||||

| Net (loss) income attributable to controlling interest | (6.2 | ) | (6.6 | ) | 6.1 | % | 7.0 | (0.2 | ) | 3600.0 | % | ||||||||

| Diluted EPS | (0.27 | ) | (0.29 | ) | 6.9 | % | 0.31 | (0.01 | ) | 3200.0 | % | ||||||||

| EBITDA (a non-GAAP measure) | 0.6 | 1.8 | (66.7 | )% | 17.4 | 10.0 | 74.0 | % | |||||||||||

| EBITDA margin (a non-GAAP measure) | 0.2 | % | 0.6 | % | (40) bps | 6.0 | % | 3.3 | % | 270 bps | |||||||||

Segments Results

Our two reportable segments are comprised of sites based upon the nature of the products or services produced, the type of customer for the products, the similarity of economic characteristics, the manner in which management reviews results and the nature of the production process, among other considerations. Based on a review of these factors, our Australia and LatAm sites, which were previously reported in the Infrastructure Solutions segment have moved to the Materials Solutions segment and Astec Digital, which was previously included in the Corporate and Other category has moved to the Infrastructure Solutions segment, each beginning January 1, 2024. Prior periods have been revised to reflect the changes for the segment composition for comparability.

Infrastructure Solutions – Road building equipment, asphalt and concrete plants, thermal storage solutions and related aftermarket parts.

- Net sales of $165.0 million increased slightly as the infrastructure construction market remains strong with healthy demand for asphalt and concrete plant deliveries anticipated through the beginning of 2025.

- Segment Operating Adjusted EBITDA of $15.6 million increased 17.3% and Segment Operating Adjusted EBITDA margin of 9.5% increased 140 basis points.

- Backlog was $351.1 million.

Materials Solutions – Processing equipment to crush, screen and convey aggregates and related aftermarket parts.

- Net sales of $126.4 million decreased by 9.6% primarily due to lower equipment sales attributable to finance capacity constraints with contractors and dealers resulting in fewer product conversions. Dealer quoting remains active.

- Segment Operating Adjusted EBITDA of $14.5 million increased 52.6% and Segment Operating Adjusted EBITDA margin of 11.5% increased 470 basis points, due to a $6.4 million legal charge in the prior year third quarter, continued efforts towards cost reduction and sharing facility capacity with the Infrastructure Solutions segment.

- Backlog was $124.7 million.

Balance Sheet, Cash Flow and Liquidity

- Our total liquidity was $195.1 million, consisting of $52.7 million of cash and cash equivalents available for operating purposes and $142.4 million available for additional borrowings under our revolving credit facility.

- Free Cash Flow in the quarter was $19.9 million after incurring capital expenditures of $2.6 million.

Third Quarter Capital Allocation

- Dividend payment of $0.13 per share.

Investor Conference Call and Webcast

Astec will conduct a conference call and live webcast today, November 6, 2024, at 8:30 A.M. Eastern Time, to review its third quarter financial results as well as current business conditions.

To access the call, dial (888) 440-4118 on Wednesday, November 6, 2024 at least 10 minutes prior to the scheduled time for the call. International callers should dial (646) 960-0833.

You may also access a live webcast of the call at: https://events.q4inc.com/attendee/885477721

You will need to give your name and company affiliation and reference Astec. An archived webcast will be available for ninety days at www.astecindustries.com.

A replay of the call can be accessed until November 20, 2024 by dialing (800) 770-2030, or (609) 800-9909 for international callers, Conference ID# 8741406. A transcript of the conference call will be made available under the Investor Relations section of the Astec Industries, Inc. website within 5 business days after the call.

About Astec

Astec, (www.astecindustries.com), is a manufacturer of specialized equipment for asphalt road building, aggregate processing and concrete production. Astec’s manufacturing operations are divided into two primary business segments: Infrastructure Solutions that includes road building, asphalt and concrete plants, thermal and storage solutions; and Materials Solutions that include our aggregate processing equipment. Astec also operates a line of controls and automation products designed to deliver enhanced productivity through improved equipment performance.

Safe Harbor Statements under the Private Securities Litigation Reform Act of 1995

This News Release contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements relate to, among other things, income, earnings, cash flows, changes in operations, operating improvements, businesses in which we operate and the United States and global economies. Statements in this News Release that are not historical are hereby identified as “forward-looking statements” and may be indicated by words or phrases such as “anticipates,” “supports,” “plans,” “projects,” “expects,” “believes,” “should,” “would,” “could,” “forecast,” “management is of the opinion,” use of the future tense and similar words or phrases. These forward-looking statements are based largely on management’s expectations, which are subject to a number of known and unknown risks, uncertainties and other factors discussed and described in our most recent Annual Report on Form 10-K, including those risks described in Part I, Item 1A. Risk Factors thereof, and in other reports filed subsequently by us with the Securities and Exchange Commission, which may cause actual results, financial or otherwise, to be materially different from those anticipated, expressed or implied by the forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements to reflect future events or circumstances, except as required by law.

Non-GAAP Financial Measures

In an effort to provide investors with additional information regarding the Company’s results, the Company refers to various U.S. GAAP (U.S. generally accepted accounting principles) and non-GAAP financial measures which management believes provides useful information to investors. These non-GAAP financial measures have no standardized meaning prescribed by U.S. GAAP and therefore may not be comparable to the calculation of similar measures for other companies. Management of the Company does not intend these items to be considered in isolation or as a substitute for the related GAAP measures. Nonetheless, this non-GAAP information can be useful in understanding the Company’s operating results and the performance of its core business. Management of the Company uses both GAAP and non-GAAP financial measures to establish internal budgets and targets and to evaluate the Company’s financial performance against such budgets and targets. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measure is included in this News Release.

For Additional Information Contact:

Steve Anderson

Senior Vice President of Administration and Investor Relations

Phone: (423) 899-5898

E-mail: sanderson@astecindustries.com

Certain reclassifications have been made to the prior period financial information included in this News Release to conform to the presentation used in the financial statements for the three months ended September 30, 2024.

| Astec Industries Inc. Condensed Consolidated Statements of Operations (In millions, except shares in thousands and per share amounts; unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net sales | $ | 291.4 | $ | 303.1 | $ | 946.1 | $ | 1,001.0 | |||||||

| Cost of sales | 224.6 | 233.5 | 721.1 | 759.3 | |||||||||||

| Gross profit | 66.8 | 69.6 | 225.0 | 241.7 | |||||||||||

| Operating expenses: | |||||||||||||||

| Selling, general and administrative expenses | 65.6 | 74.3 | 208.1 | 206.7 | |||||||||||

| Goodwill impairment | — | — | 20.2 | — | |||||||||||

| Restructuring, other impairment and asset charges, net | 8.4 | 0.5 | 8.3 | 5.3 | |||||||||||

| Total operating expenses | 74.0 | 74.8 | 236.6 | 212.0 | |||||||||||

| (Loss) income from operations | (7.2 | ) | (5.2 | ) | (11.6 | ) | 29.7 | ||||||||

| Other expenses, net: | |||||||||||||||

| Interest expense | (2.6 | ) | (2.4 | ) | (8.4 | ) | (6.4 | ) | |||||||

| Other income, net | 1.3 | 0.5 | 2.5 | 2.0 | |||||||||||

| (Loss) income before income taxes | (8.5 | ) | (7.1 | ) | (17.5 | ) | 25.3 | ||||||||

| Income tax (benefit) provision | (2.3 | ) | (0.6 | ) | (0.6 | ) | 6.5 | ||||||||

| Net (loss) income | (6.2 | ) | (6.5 | ) | (16.9 | ) | 18.8 | ||||||||

| Net (income) loss attributable to noncontrolling interest | — | (0.1 | ) | 0.1 | (0.2 | ) | |||||||||

| Net (loss) income attributable to controlling interest | $ | (6.2 | ) | $ | (6.6 | ) | $ | (16.8 | ) | $ | 18.6 | ||||

| Earnings per common share | |||||||||||||||

| Basic | $ | (0.27 | ) | $ | (0.29 | ) | $ | (0.74 | ) | $ | 0.82 | ||||

| Diluted | (0.27 | ) | (0.29 | ) | (0.74 | ) | 0.82 | ||||||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 22,816 | 22,747 | 22,792 | 22,709 | |||||||||||

| Diluted | 22,816 | 22,747 | 22,792 | 22,776 | |||||||||||

| Astec Industries Inc. Reportable Segment Net Sales and Operating Adjusted EBITDA (In millions, except percentage data; unaudited) |

Reportable segment net sales exclude intersegment sales.

| Three Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||

| Revenues from external customers | ||||||||||||||

| Infrastructure Solutions | $ | 165.0 | $ | 163.2 | $ | 1.8 | 1.1 | % | ||||||

| Materials Solutions | 126.4 | 139.9 | (13.5 | ) | (9.6 | )% | ||||||||

| Net sales | $ | 291.4 | $ | 303.1 | $ | (11.7 | ) | (3.9 | )% | |||||

| Segment Operating Adjusted EBITDA | ||||||||||||||

| Infrastructure Solutions | $ | 15.6 | $ | 13.3 | $ | 2.3 | 17.3 | % | ||||||

| Materials Solutions | 14.5 | 9.5 | 5.0 | 52.6 | % | |||||||||

| Segment Operating Adjusted EBITDA – Reportable Segments | 30.1 | 22.8 | ||||||||||||

| Reconciliation of Segment Operating Adjusted EBITDA to “(Loss) income before income taxes“ | ||||||||||||||

| Corporate and Other | (12.7 | ) | (12.8 | ) | ||||||||||

| Transformation program | (8.4 | ) | (7.7 | ) | ||||||||||

| Restructuring and other related charges | (8.4 | ) | (0.1 | ) | ||||||||||

| (Loss) gain on sale of property and equipment, net | — | (0.4 | ) | |||||||||||

| Interest expense, net | (2.1 | ) | (1.9 | ) | ||||||||||

| Depreciation and amortization | (7.0 | ) | (7.1 | ) | ||||||||||

| Net income attributable to noncontrolling interest | — | 0.1 | ||||||||||||

| (Loss) income before income taxes | $ | (8.5 | ) | $ | (7.1 | ) | ||||||||

| Segment Operating Adjusted EBITDA Margin | 2024 | 2023 | Change | |||||||||||

| Infrastructure Solutions | 9.5 | % | 8.1 | % | 140 bps | |||||||||

| Materials Solutions | 11.5 | % | 6.8 | % | 470 bps | |||||||||

| (Continued) | ||||||||||||||

| Astec Industries Inc. Reportable Segment Net Sales and Operating Adjusted EBITDA (Continued) (In millions, except percentage data; unaudited) |

|||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | $ Change | % Change | ||||||||||||

| Revenues from external customers | |||||||||||||||

| Infrastructure Solutions | $ | 588.6 | $ | 578.1 | $ | 10.5 | 1.8 | % | |||||||

| Materials Solutions | 357.5 | 422.9 | (65.4 | ) | (15.5 | )% | |||||||||

| Net sales | $ | 946.1 | $ | 1,001.0 | $ | (54.9 | ) | (5.5 | )% | ||||||

| Segment Operating Adjusted EBITDA | |||||||||||||||

| Infrastructure Solutions | $ | 68.4 | $ | 67.5 | $ | 0.9 | 1.3 | % | |||||||

| Materials Solutions | 30.0 | 42.4 | (12.4 | ) | (29.2 | )% | |||||||||

| Segment Operating Adjusted EBITDA – Reportable Segments | 98.4 | 109.9 | |||||||||||||

| Reconciliation of Segment Operating Adjusted EBITDA to “(Loss) income before income taxes“ | |||||||||||||||

| Corporate and Other | (34.5 | ) | (32.5 | ) | |||||||||||

| Transformation program | (25.8 | ) | (22.5 | ) | |||||||||||

| Restructuring and other related charges | (9.4 | ) | (7.6 | ) | |||||||||||

| Goodwill impairment | (20.2 | ) | — | ||||||||||||

| Asset impairment | — | (0.8 | ) | ||||||||||||

| (Loss) gain on sale of property and equipment, net | 1.1 | 3.1 | |||||||||||||

| Interest expense, net | (6.9 | ) | (4.9 | ) | |||||||||||

| Depreciation and amortization | (20.1 | ) | (19.6 | ) | |||||||||||

| Net income (loss) attributable to noncontrolling interest | (0.1 | ) | 0.2 | ||||||||||||

| (Loss) income before income taxes | $ | (17.5 | ) | $ | 25.3 | ||||||||||

| Segment Operating Adjusted EBITDA Margin | 2024 | 2023 | Change | ||||||||||||

| Infrastructure Solutions | 11.6 | % | 11.7 | % | (10) bps | ||||||||||

| Materials Solutions | 8.4 | % | 10.0 | % | (160) bps | ||||||||||

| Astec Industries Inc. Condensed Consolidated Balance Sheets (In millions; unaudited) |

|||||||

| September 30, 2024 | December 31, 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash, cash equivalents and restricted cash | $ | 55.3 | $ | 63.2 | |||

| Investments | 3.6 | 5.7 | |||||

| Trade receivables, contract assets and other receivables, net | 175.2 | 152.7 | |||||

| Inventories, net | 466.4 | 455.6 | |||||

| Other current assets, net | 39.6 | 42.3 | |||||

| Total current assets | 740.1 | 719.5 | |||||

| Property, plant and equipment, net | 185.3 | 187.6 | |||||

| Other long-term assets | 141.7 | 152.2 | |||||

| Total assets | $ | 1,067.1 | $ | 1,059.3 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 87.8 | $ | 116.9 | |||

| Customer deposits | 84.0 | 70.2 | |||||

| Other current liabilities | 127.4 | 111.9 | |||||

| Total current liabilities | 299.2 | 299.0 | |||||

| Long-term debt | 99.0 | 72.0 | |||||

| Other long-term liabilities | 37.5 | 34.6 | |||||

| Total equity | 631.4 | 653.7 | |||||

| Total liabilities and equity | $ | 1,067.1 | $ | 1,059.3 | |||

| Astec Industries Inc. Condensed Consolidated Statements of Cash Flows (In millions; unaudited) |

|||||||

| Nine Months Ended September 30, | |||||||

| 2024 | 2023 | ||||||

| Cash flows from operating activities: | |||||||

| Net (loss) income | $ | (16.9 | ) | $ | 18.8 | ||

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | |||||||

| Depreciation and amortization | 20.1 | 19.6 | |||||

| Provision for credit losses | 1.0 | 0.6 | |||||

| Provision for warranties | 12.8 | 14.4 | |||||

| Deferred compensation (benefit) expense | (0.1 | ) | 0.2 | ||||

| Share-based compensation | 3.7 | 3.5 | |||||

| Deferred tax benefit | (6.7 | ) | (2.1 | ) | |||

| Gain on disposition of property and equipment, net | (1.1 | ) | (3.1 | ) | |||

| Goodwill impairment | 20.2 | — | |||||

| Other impairment charges | — | 0.8 | |||||

| Amortization of debt issuance costs | 0.2 | 0.2 | |||||

| Distributions to deferred compensation programs’ participants | (0.8 | ) | (1.5 | ) | |||

| Change in operating assets and liabilities: | |||||||

| Purchase of trading securities, net | (1.6 | ) | (1.4 | ) | |||

| Receivables and other contract assets | (23.9 | ) | (5.8 | ) | |||

| Inventories | (9.9 | ) | (59.7 | ) | |||

| Prepaid expenses | 2.8 | 8.3 | |||||

| Other assets | (2.1 | ) | (9.6 | ) | |||

| Accounts payable | (28.5 | ) | 7.1 | ||||

| Accrued loss reserves | (0.3 | ) | 1.2 | ||||

| Accrued employee related liabilities | (4.7 | ) | 9.3 | ||||

| Other accrued liabilities | 22.0 | (0.8 | ) | ||||

| Accrued product warranty | (14.1 | ) | (9.6 | ) | |||

| Customer deposits | 13.5 | (8.2 | ) | ||||

| Income taxes payable/prepaid | 0.8 | (1.0 | ) | ||||

| Net cash used in operating activities | (13.6 | ) | (18.8 | ) | |||

| Cash flows from investing activities: | |||||||

| Expenditures for property and equipment | (16.0 | ) | (25.0 | ) | |||

| Proceeds from sale of property and equipment | 2.3 | 20.2 | |||||

| Purchase of investments | (0.9 | ) | (0.8 | ) | |||

| Sale of investments | 0.6 | 1.7 | |||||

| Net cash used in investing activities | (14.0 | ) | (3.9 | ) | |||

| (Continued) | |||||||

| Astec Industries Inc. Condensed Consolidated Statements of Cash Flows (Continued) (In millions; unaudited) |

|||||||

| Nine Months Ended September 30, | |||||||

| 2024 | 2023 | ||||||

| Cash flows from financing activities: | |||||||

| Payment of dividends | (8.9 | ) | (8.9 | ) | |||

| Proceeds from borrowings on credit facilities and bank loans | 140.6 | 221.4 | |||||

| Repayments of borrowings on credit facilities and bank loans | (111.9 | ) | (180.2 | ) | |||

| Sale of Company stock by deferred compensation programs, net | 0.2 | 0.1 | |||||

| Withholding tax paid upon vesting of share-based compensation awards | (0.5 | ) | (1.6 | ) | |||

| Net cash provided by financing activities | 19.5 | 30.8 | |||||

| Effect of exchange rates on cash | 0.2 | (0.3 | ) | ||||

| (Decrease) increase in cash, cash equivalents and restricted cash | (7.9 | ) | 7.8 | ||||

| Cash, cash equivalents and restricted cash, beginning of period | 63.2 | 66.0 | |||||

| Cash, cash equivalents and restricted cash, end of period | $ | 55.3 | $ | 73.8 | |||

We present certain non-GAAP information that can be useful in understanding our operating results and the performance of our core business. We use both GAAP and non-GAAP financial measures to establish internal budgets and targets and to evaluate financial performance against such budgets and targets. We exclude the costs and related tax effects, which are based on the statutory tax rate applicable to each respective item unless otherwise noted below, of the following items as we do not believe they are indicative of our core business operations:

- Transformation program – Incremental costs related to the execution of our ongoing strategic transformation initiatives which may include personnel costs, third-party consultant costs, duplicative systems usage fees, administrative costs, accelerated depreciation and amortization on certain long-lived assets and other similar type charges. Transformation program initiatives include our multi-year phased implementation of a standardized enterprise resource planning system across the global organization and a lean manufacturing initiative at one of our largest manufacturing sites that was largely completed during 2023 with certain capital investments finalized in early 2024. Transformation program costs for the lean manufacturing initiative ceased at the end of 2023. These costs are included in “Cost of sales” and “Selling, general and administrative expenses”, as appropriate, in the Consolidated Statements of Operations.

- Restructuring and other related charges – Charges related to restructuring activities which primarily include personnel termination actions and reorganization efforts to simplify and consolidate our operations. These activities include the workforce reductions effected in the second quarter of 2024, the termination of our previous Chief Executive Officer, the limited overhead restructuring action implemented in February 2023 and ongoing litigation costs for our exited Enid location, including the settlement loss recorded in the third quarter of 2024. These costs are recorded in “Restructuring, impairment and other asset charges, net” in the Consolidated Statements of Operations.

- Goodwill impairment – Goodwill impairment charges, to the extent that they are experienced, are recorded in “Goodwill impairment” in the Consolidated Statements of Operations. These charges are associated with the impairment of the goodwill allocated to the Materials Solutions reporting unit during the second quarter of 2024. The goodwill impairment is largely nondeductible for tax purposes and, as such, the tax impact applied reflects the actual tax impact by jurisdiction.

- Asset impairment – Asset impairment charges, to the extent that they are experienced, are recorded in “Restructuring, impairment and other asset charges, net” in the Consolidated Statements of Operations. These include charges associated with abandoned in-process internally developed software that was determined to be impaired during the second quarter of 2023.

- (Loss) gain on sale of property and equipment, net – Gains or losses recognized on the disposal of property and equipment that are recorded in “Restructuring, impairment and other asset charges, net” in the Consolidated Statements of Operations. We may sell or dispose of assets in the normal course of our business operations as they are no longer needed or used.

| Astec Industries Inc. GAAP vs Non-GAAP Adjusted Income from Operations Reconciliations (In millions, except percentage data; unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net sales | $ | 291.4 | $ | 303.1 | $ | 946.1 | $ | 1,001.0 | |||||||

| (Loss) income from operations | $ | (7.2 | ) | $ | (5.2 | ) | $ | (11.6 | ) | $ | 29.7 | ||||

| Adjustments: | |||||||||||||||

| Transformation program | 8.7 | 7.8 | 26.4 | 22.8 | |||||||||||

| Restructuring and other related charges | 8.4 | 0.1 | 9.4 | 7.6 | |||||||||||

| Goodwill impairment | — | — | 20.2 | — | |||||||||||

| Asset impairment | — | — | — | 0.8 | |||||||||||

| Loss (gain) on sale of property and equipment, net | — | 0.4 | (1.1 | ) | (3.1 | ) | |||||||||

| Adjusted income from operations | $ | 9.9 | $ | 3.1 | $ | 43.3 | $ | 57.8 | |||||||

| Adjusted operating margin | 3.4 | % | 1.0 | % | 4.6 | % | 5.8 | % | |||||||

| Astec Industries Inc. GAAP vs Non-GAAP Adjusted EPS Reconciliations (In millions, except per share amounts; unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net (loss) income attributable to controlling interest | $ | (6.2 | ) | $ | (6.6 | ) | $ | (16.8 | ) | $ | 18.6 | ||||

| Adjustments: | |||||||||||||||

| Transformation program | 8.7 | 7.8 | 26.4 | 22.8 | |||||||||||

| Restructuring and other related charges | 8.4 | 0.1 | 9.4 | 7.6 | |||||||||||

| Goodwill impairment | — | — | 20.2 | — | |||||||||||

| Asset impairment | — | — | — | 0.8 | |||||||||||

| Loss (gain) on sale of property and equipment, net | — | 0.4 | (1.1 | ) | (3.1 | ) | |||||||||

| Income tax impact of adjustments | (3.9 | ) | (1.9 | ) | (9.3 | ) | (6.5 | ) | |||||||

| Adjusted net income (loss) attributable to controlling interest | $ | 7.0 | $ | (0.2 | ) | $ | 28.8 | $ | 40.2 | ||||||

| Diluted EPS | $ | (0.27 | ) | $ | (0.29 | ) | $ | (0.74 | ) | $ | 0.82 | ||||

| Adjustments: | |||||||||||||||

| Transformation program | 0.38 | 0.34 | 1.16 | 1.00 | |||||||||||

| Restructuring and other related charges (a) | 0.37 | — | 0.41 | 0.34 | |||||||||||

| Goodwill impairment | — | — | 0.89 | — | |||||||||||

| Asset impairment | — | — | — | 0.04 | |||||||||||

| Loss (gain) on sale of property and equipment, net | — | 0.02 | (0.05 | ) | (0.14 | ) | |||||||||

| Income tax impact of adjustments | (0.17 | ) | (0.08 | ) | (0.41 | ) | (0.29 | ) | |||||||

| Adjusted EPS | $ | 0.31 | $ | (0.01 | ) | $ | 1.26 | $ | 1.77 | ||||||

| (a) Calculation includes the impact of a rounding adjustment | |||||||||||||||

| Astec Industries Inc. EBITDA and Adjusted EBITDA Reconciliations (In millions, except percentage data; unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net sales | $ | 291.4 | $ | 303.1 | $ | 946.1 | $ | 1,001.0 | |||||||

| Net (loss) income attributable to controlling interest | $ | (6.2 | ) | $ | (6.6 | ) | $ | (16.8 | ) | $ | 18.6 | ||||

| Interest expense, net | 2.1 | 1.9 | 6.9 | 4.9 | |||||||||||

| Depreciation and amortization | 7.0 | 7.1 | 20.1 | 19.6 | |||||||||||

| Income tax (benefit) provision | (2.3 | ) | (0.6 | ) | (0.6 | ) | 6.5 | ||||||||

| EBITDA | 0.6 | 1.8 | 9.6 | 49.6 | |||||||||||

| EBITDA margin | 0.2 | % | 0.6 | % | 1.0 | % | 5.0 | % | |||||||

| Adjustments: | |||||||||||||||

| Transformation program | 8.4 | 7.7 | 25.8 | 22.5 | |||||||||||

| Restructuring and other related charges | 8.4 | 0.1 | 9.4 | 7.6 | |||||||||||

| Goodwill impairment | — | — | 20.2 | — | |||||||||||

| Asset impairment | — | — | — | 0.8 | |||||||||||

| Loss (gain) on sale of property and equipment, net | — | 0.4 | (1.1 | ) | (3.1 | ) | |||||||||

| Adjusted EBITDA | $ | 17.4 | $ | 10.0 | $ | 63.9 | $ | 77.4 | |||||||

| Adjusted EBITDA margin | 6.0 | % | 3.3 | % | 6.8 | % | 7.7 | % | |||||||

| Astec Industries Inc. Free Cash Flow Reconciliation (In millions; unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net cash provided by (used in) operating activities | $ | 22.5 | $ | (16.3 | ) | $ | (13.6 | ) | $ | (18.8 | ) | ||||

| Expenditures for property and equipment | (2.6 | ) | (7.9 | ) | (16.0 | ) | (25.0 | ) | |||||||

| Free cash flow | $ | 19.9 | $ | (24.2 | ) | $ | (29.6 | ) | $ | (43.8 | ) | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Tesla Shares Are Trading Higher By Around 14%; Here Are 20 Stocks Moving Premarket

Shares of Tesla, Inc. TSLA rose sharply in today’s pre-market trading over a likely Donald Trump victory in the U.S. Presidential elections.

According to The New York Times, Trump currently has over 95% chance of victory given he already has 267 of the 270 electoral votes needed to win. Tesla CEO Elon Musk endorsed Trump in July and has been actively campaigning for the former President both offline and online. Musk even campaigned for Trump in the swing state of Pennsylvania in October.

Tesla shares rose 14% to $286.57 in the pre-market trading session.

Here are some other stocks moving in pre-market trading.

Gainers

- FOXO Technologies Inc. FOXO gained 117% to $0.2954 in pre-market trading. FOXO Technologies, last month, said its interim CFO wrote to shareholders expectations to build the business over the next 12-24 months and generate more than $50 million a year in revenue.

- ARB IOT Group Limited ARBB rose 93.1% to $1.09 in pre-market trading after the company signed a MOU to accelerate AI with advanced server solutions.

- The GEO Group, Inc. GEO shares surged 30.7% to $19.78 in pre-market trading after gaining around 7% on Tuesday.

- Trump Media & Technology Group Corp. DJT gained 26.6% to $42.98 in pre-market trading.

- DatChat, Inc. DATS climbed 25.8% to $2.25 in pre-market trading.

- Qualys, Inc. QLYS shares rose 22.4% to $156.96 in pre-market trading after the company reported better-than-expected third-quarter financial results, raised its FY24 guidance, and issued fourth-quarter revenue guidance above estimates.

- Destiny Tech100 Inc. DXYZ gained 22.4% to $14.20 in pre-market trading after gaining 6% on Tuesday.

- CoreCivic, Inc. CXW gained 21.1% to $16.50 in pre-market trading. CoreCivic will release its third quarter financial results after the closing bell on Wednesday, Nov. 6.

- Phunware, Inc. PHUN gained 19.6% to $7.62 in pre-market trading after declining around 8% on Tuesday.

Losers

- Vast Renewables Limited VSTE shares tumbled 55.8% to $2.37 in pre-market trading after dipping more than 20% on Tuesday.

- Zoomcar Holdings, Inc. ZCAR shares fell 42.5% to $7.56 in pre-market trading after the company announced the pricing of $9.15 million private placement.

- Li-Cycle Holdings Corp. LICY dipped 27.6% to $2.75 in pre-market trading. Li-Cycle to host third quarter earnings conference call/webcast on Thursday, Nov. 7.

- Exact Sciences Corporation EXAS shares fell 27% to $52.20 in pre-market trading after the company reported worse-than-expected third-quarter financial results and issued FY24 revenue guidance below estimates.

- Simpple Ltd. SPPL declined 27% to $1.23 in pre-market trading. Simpple shares jumped 43% on Tuesday after the company announced its plan to regain NASDAQ compliance.

- Bluejay Diagnostics, Inc. BJDX shares dipped 25.9% to $0.1015 in pre-market trading after gaining 88% on Tuesday.

- Super Micro Computer, Inc. SMCI fell 24.3% to $20.97 in pre-market trading after the company lowered its financial outlook. The company expects to report first-quarter revenue of $5.9 billion to $6 billion, down from its previous guidance range of $6 billion to $7 billion. The company anticipates adjusted earnings of 75 cents to 76 cents per share, versus its previous guidance of 67 cents to 83 cents per share.

- Bionomics Limited BNOX fell 22.8% to $0.3806 in pre-market trading. Bionomics shares jumped 157% on Tuesday after the company announced it secured an AUS$1 million milestone payment from Carina Biotech for its BNC101 oncology program, with the potential to earn up to AUS$118 million.

- Gevo, Inc. GEVO fell 20.8% to $1.86 in today’s pre-market trading.

- Sunnova Energy International Inc. NOVA fell 20.1% to $5.64 in pre-market trading after gaining 8% on Tuesday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vishay Intertechnology Reports Third Quarter 2024 Results

MALVERN, Pa., Nov. 06, 2024 (GLOBE NEWSWIRE) — Vishay Intertechnology, Inc., VSH, one of the world’s largest manufacturers of discrete semiconductors and passive electronic components, today announced results for the fiscal third quarter ended September 28, 2024.

Highlights

- 3Q 2024 revenues of $735.4 million

- Gross margin was 20.5% and included the negative impact of approximately 150 basis points related to the addition of Newport

- GAAP loss per share of ($0.14); adjusted EPS of $0.08 per share

- 3Q 2024 book-to-bill of 0.88 with book-to-bill of 0.79 for semiconductors and 0.97 for passive components

- Backlog at quarter end was 4.4 months

“For the third consecutive quarter this year, revenue has held fairly constant, reflecting a prolonged period of inventory de-stocking as the pace of consumption by industrial customers remains slow, backlogs are pushed out and macroeconomic conditions in Europe worsen,” said Joel Smejkal, President and CEO. “While the industry remains in a downcycle, we are making the necessary adjustments to manage costs while continuing to execute our five-year strategic plan. We are preparing to participate fully in the next industry up-cycle and we are putting the foundation in place to capitalize on the longer term demand catalysts of e-mobility and sustainability to drive faster revenue growth, and improve profitability and returns on invested capital.”

4Q 2024 Outlook

For the fourth quarter of 2024, management expects revenues in the range of $720 million +/- $20 million, with gross profit margin in the range of 20.0% +/- 50 basis points, including the negative impact of approximately 175 to 200 basis points from the addition of Newport.

A conference call to discuss Vishay’s third quarter financial results is scheduled for Wednesday, November 6, 2024 at 9:00 a.m. ET. To participate in the live conference call, please pre-register at https://register.vevent.com/register/BI24b8e37c574c42d897f4df9a7a5aa306. Upon registering, you will be emailed a dial-in number, and unique PIN.

A live audio webcast of the conference call and a PDF copy of the press release and the quarterly presentation will be accessible directly from the Investor Relations section of the Vishay website at http://ir.vishay.com.

There will be a replay of the conference call available on the Investor Relations website approximately one hour following the call and will remain available for 30 days.

About Vishay

Vishay manufactures one of the world’s largest portfolios of discrete semiconductors and passive electronic components that are essential to innovative designs in the automotive, industrial, computing, consumer, telecommunications, military, aerospace, and medical markets. Serving customers worldwide, Vishay is The DNA of tech®. Vishay Intertechnology, Inc. is a Fortune 1,000 Company listed on the NYSE (VSH). More on Vishay at www.Vishay.com.

This press release includes certain financial measures which are not recognized in accordance with U.S. generally accepted accounting principles (“GAAP”), including free cash; earnings before interest, taxes, depreciation and amortization (“EBITDA”); and EBITDA margin; which are considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. These non-GAAP measures supplement our GAAP measures of performance or liquidity and should not be viewed as an alternative to GAAP measures of performance or liquidity. Non-GAAP measures such as free cash, EBITDA, and EBITDA margin do not have uniform definitions. These measures, as calculated by Vishay, may not be comparable to similarly titled measures used by other companies. Management believes that such measures are meaningful to investors because they provide insight with respect to intrinsic operating results of the Company. Although the terms “free cash” and “EBITDA” are not defined in GAAP, the measures are derived using various line items measured in accordance with GAAP. The calculations of these measures are indicated on the accompanying reconciliation schedules and are more fully described in the Company’s financial statements presented in its annual report on Form 10-K and its quarterly reports presented on Forms 10-Q.

Statements contained herein that relate to the Company’s future performance, including forecasted revenues and margins, capital investment, capacity expansion, returns on invested capital, stockholder returns, and the performance of the economy in general, are forward-looking statements within the safe harbor provisions of Private Securities Litigation Reform Act of 1995. Words and expressions such as “intend,” “suggest,” “guide,” “will,” “expect,” or other similar words or expressions often identify forward-looking statements. Such statements are based on current expectations only, and are subject to certain risks, uncertainties and assumptions, many of which are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance, or achievements may vary materially from those anticipated, estimated or projected. Among the factors that could cause actual results to materially differ include: general business and economic conditions; manufacturing or supply chain interruptions or changes in customer demand (including due to political, economic, and health instability and military conflicts and hostilities); delays or difficulties in implementing our cost reduction strategies; delays or difficulties in expanding our manufacturing capacities; an inability to attract and retain highly qualified personnel; changes in foreign currency exchange rates; uncertainty related to the effects of changes in foreign currency exchange rates; competition and technological changes in our industries; difficulties in new product development; difficulties in identifying suitable acquisition candidates, consummating a transaction on terms which we consider acceptable, and integration and performance of acquired businesses; that the Newport wafer fab will not be integrated successfully into the Company’s overall business; that the expected benefits of the acquisition may not be realized; that the fab’s standards, procedures and controls will not be brought into conformance within the Company’s operation; difficulties in transitioning and retaining fab employees following the acquisition; difficulties in consolidating facilities and transferring processes and know-how; the diversion of our management’s attention from the management of our current business; changes in U.S. and foreign trade regulations and tariffs, and uncertainty regarding the same; changes in applicable domestic and foreign tax regulations, and uncertainty regarding the same; changes in applicable accounting standards and other factors affecting our operations that are set forth in our filings with the Securities and Exchange Commission, including our annual reports on Form 10-K and our quarterly reports on Form 10-Q. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The DNA of tech® is a trademark of Vishay Intertechnology.

Contact:

Vishay Intertechnology, Inc.

Peter Henrici

Executive Vice President – Corporate Development

+1-610-644-1300

| VISHAY INTERTECHNOLOGY, INC. | ||||||||||||

| Summary of Operations | ||||||||||||

| (Unaudited – In thousands, except per share amounts) | ||||||||||||

| Fiscal quarters ended | ||||||||||||

| September 28, 2024 |

June 29, 2024 |

September 30, 2023 |

||||||||||

| Net revenues | $ | 735,353 | $ | 741,239 | $ | 853,653 | ||||||

| Costs of products sold | 584,470 | 578,369 | 616,010 | |||||||||

| Gross profit | 150,883 | 162,870 | 237,643 | |||||||||

| Gross margin | 20.5 | % | 22.0 | % | 27.8 | % | ||||||

| Selling, general, and administrative expenses | 128,545 | 124,953 | 122,513 | |||||||||

| Restructuring and severance costs | 40,614 | – | – | |||||||||

| Operating income (loss) | (18,276 | ) | 37,917 | 115,130 | ||||||||

| Operating margin | -2.5 | % | 5.1 | % | 13.5 | % | ||||||

| Other income (expense): | ||||||||||||

| Interest expense | (6,596 | ) | (6,657 | ) | (7,153 | ) | ||||||

| Loss on early extinguishment of debt | – | – | (18,874 | ) | ||||||||

| Other | 803 | 5,011 | 7,409 | |||||||||

| Total other income (expense) – net | (5,793 | ) | (1,646 | ) | (18,618 | ) | ||||||

| Income (loss) before taxes | (24,069 | ) | 36,271 | 96,512 | ||||||||

| Income tax expense (benefit) | (5,076 | ) | 12,391 | 30,557 | ||||||||

| Net earnings (loss) | (18,993 | ) | 23,880 | 65,955 | ||||||||

| Less: net earnings attributable to noncontrolling interests | 306 | 347 | 426 | |||||||||

| Net earnings (loss) attributable to Vishay stockholders | $ | (19,299 | ) | $ | 23,533 | $ | 65,529 | |||||

| Basic earnings (loss) per share attributable to Vishay stockholders | $ | (0.14 | ) | $ | 0.17 | $ | 0.47 | |||||

| Diluted earnings (loss) per share attributable to Vishay stockholders | $ | (0.14 | ) | $ | 0.17 | $ | 0.47 | |||||

| Weighted average shares outstanding – basic | 136,793 | 137,326 | 139,083 | |||||||||

| Weighted average shares outstanding – diluted | 136,793 | 138,084 | 140,001 | |||||||||

| Cash dividends per share | $ | 0.10 | $ | 0.10 | $ | 0.10 | ||||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||

| Summary of Operations | ||||||||

| (Unaudited – In thousands, except per share amounts) | ||||||||

| Nine fiscal months ended | ||||||||

| September 28, 2024 | September 30, 2023 | |||||||

| Net revenues | $ | 2,222,871 | $ | 2,616,809 | ||||

| Costs of products sold | 1,738,711 | 1,842,980 | ||||||

| Gross profit | 484,160 | 773,829 | ||||||

| Gross margin | 21.8 | % | 29.6 | % | ||||

| Selling, general, and administrative expenses | 381,234 | 365,515 | ||||||

| Restructuring and severance costs | 40,614 | – | ||||||

| Operating income | 62,312 | 408,314 | ||||||

| Operating margin | 2.8 | % | 15.6 | % | ||||

| Other income (expense): | ||||||||

| Interest expense | (19,749 | ) | (18,677 | ) | ||||

| Loss on early extinguishment of debt | – | (18,874 | ) | |||||

| Other | 13,901 | 15,995 | ||||||

| Total other income (expense) – net | (5,848 | ) | (21,556 | ) | ||||

| Income before taxes | 56,464 | 386,758 | ||||||

| Income tax expense | 20,134 | 113,199 | ||||||

| Net earnings | 36,330 | 273,559 | ||||||

| Less: net earnings attributable to noncontrolling interests | 1,172 | 1,211 | ||||||

| Net earnings attributable to Vishay stockholders | $ | 35,158 | $ | 272,348 | ||||

| Basic earnings per share attributable to Vishay stockholders | $ | 0.26 | $ | 1.95 | ||||

| Diluted earnings per share attributable to Vishay stockholders | $ | 0.25 | $ | 1.94 | ||||

| Weighted average shares outstanding – basic | 137,281 | 139,828 | ||||||

| Weighted average shares outstanding – diluted | 138,039 | 140,577 | ||||||

| Cash dividends per share | $ | 0.30 | $ | 0.30 | ||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||

| Consolidated Condensed Balance Sheets | ||||||||

| (Unaudited – In thousands) | ||||||||

| September 28, 2024 | December 31, 2023 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 643,771 | $ | 972,719 | ||||

| Short-term investments | 13,491 | 35,808 | ||||||

| Accounts receivable, net | 428,558 | 426,674 | ||||||

| Inventories: | ||||||||

| Finished goods | 173,353 | 167,083 | ||||||

| Work in process | 290,597 | 267,339 | ||||||

| Raw materials | 223,254 | 213,098 | ||||||

| Total inventories | 687,204 | 647,520 | ||||||

| Prepaid expenses and other current assets | 237,749 | 214,443 | ||||||

| Total current assets | 2,010,773 | 2,297,164 | ||||||

| Property and equipment, at cost: | ||||||||

| Land | 84,851 | 77,006 | ||||||

| Buildings and improvements | 769,865 | 719,387 | ||||||

| Machinery and equipment | 3,291,983 | 3,053,868 | ||||||

| Construction in progress | 295,147 | 290,593 | ||||||

| Allowance for depreciation | (2,963,103 | ) | (2,846,208 | ) | ||||

| 1,478,743 | 1,294,646 | |||||||

| Right of use assets | 125,969 | 126,829 | ||||||

| Deferred income taxes | 160,900 | 137,394 | ||||||

| Goodwill | 255,323 | 201,416 | ||||||

| Other intangible assets, net | 83,427 | 72,333 | ||||||

| Other assets | 105,223 | 110,141 | ||||||

| Total assets | $ | 4,220,358 | $ | 4,239,923 | ||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||

| Consolidated Condensed Balance Sheets (continued) | ||||||||

| (Unaudited – In thousands) | ||||||||

| September 28, 2024 | December 31, 2023 | |||||||

| Liabilities and equity | ||||||||

| Current liabilities: | ||||||||

| Trade accounts payable | $ | 209,864 | $ | 191,002 | ||||

| Payroll and related expenses | 150,726 | 161,940 | ||||||

| Lease liabilities | 27,625 | 26,485 | ||||||

| Other accrued expenses | 275,159 | 239,350 | ||||||

| Income taxes | 51,052 | 73,098 | ||||||

| Total current liabilities | 714,426 | 691,875 | ||||||

| Long-term debt less current portion | 820,799 | 818,188 | ||||||

| U.S. transition tax payable | – | 47,027 | ||||||

| Deferred income taxes | 112,110 | 95,776 | ||||||

| Long-term lease liabilities | 101,012 | 102,830 | ||||||

| Other liabilities | 105,834 | 87,918 | ||||||

| Accrued pension and other postretirement costs | 192,614 | 195,503 | ||||||

| Total liabilities | 2,046,795 | 2,039,117 | ||||||

| Equity: | ||||||||

| Vishay stockholders’ equity | ||||||||

| Common stock | 13,358 | 13,319 | ||||||

| Class B convertible common stock | 1,210 | 1,210 | ||||||

| Capital in excess of par value | 1,302,335 | 1,291,499 | ||||||

| Retained earnings | 1,035,395 | 1,041,372 | ||||||

| Treasury stock (at cost) | (199,440 | ) | (161,656 | ) | ||||

| Accumulated other comprehensive income | 14,808 | 10,337 | ||||||

| Total Vishay stockholders’ equity | 2,167,666 | 2,196,081 | ||||||

| Noncontrolling interests | 5,897 | 4,725 | ||||||

| Total equity | 2,173,563 | 2,200,806 | ||||||

| Total liabilities and equity | $ | 4,220,358 | $ | 4,239,923 | ||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||

| Consolidated Condensed Statements of Cash Flows | ||||||||

| (Unaudited – In thousands) | ||||||||

| Nine fiscal months ended | ||||||||

| September 28, 2024 | September 30, 2023 | |||||||

| Operating activities | ||||||||

| Net earnings | $ | 36,330 | $ | 273,559 | ||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 155,272 | 133,910 | ||||||

| Gain on disposal of property and equipment | (1,168 | ) | (495 | ) | ||||

| Inventory write-offs for obsolescence | 27,163 | 27,469 | ||||||

| Deferred income taxes | (13,667 | ) | 20,654 | |||||

| Stock compensation expense | 14,928 | 11,610 | ||||||

| Loss on early extinguishment of debt | – | 18,874 | ||||||

| Other | 14,506 | 7,574 | ||||||

| Change in U.S. transition tax liability | (37,622 | ) | (27,670 | ) | ||||

| Change in repatriation tax liability | (15,000 | ) | – | |||||

| Changes in operating assets and liabilities, net of effects of businesses acquired | (74,696 | ) | (106,050 | ) | ||||

| Net cash provided by operating activities | 106,046 | 359,435 | ||||||

| Investing activities | ||||||||

| Capital expenditures | (175,175 | ) | (184,079 | ) | ||||

| Proceeds from sale of property and equipment | 1,397 | 1,034 | ||||||

| Purchase of businesses, net of cash acquired | (200,185 | ) | (5,003 | ) | ||||

| Purchase of short-term investments | (101,263 | ) | (82,166 | ) | ||||

| Maturity of short-term investments | 123,561 | 308,021 | ||||||

| Other investing activities | (1,220 | ) | (1,219 | ) | ||||

| Net cash provided by (used in) investing activities | (352,885 | ) | 36,588 | |||||

| Financing activities | ||||||||

| Proceeds from long-term borrowings | – | 750,000 | ||||||

| Repurchase of convertible senior notes due 2025 | – | (386,745 | ) | |||||

| Net payments on revolving credit facility | – | (42,000 | ) | |||||

| Debt issuance and amendment costs | (1,062 | ) | (26,547 | ) | ||||

| Cash paid for capped call | – | (94,200 | ) | |||||

| Dividends paid to common stockholders | (37,467 | ) | (38,207 | ) | ||||

| Dividends paid to Class B common stockholders | (3,629 | ) | (3,629 | ) | ||||

| Repurchase of common stock held in treasury | (37,784 | ) | (57,661 | ) | ||||

| Distributions to noncontrolling interests | – | (867 | ) | |||||

| Cash withholding taxes paid when shares withheld for vested equity awards | (4,092 | ) | (3,994 | ) | ||||

| Net cash provided by (used in) financing activities | (84,034 | ) | 96,150 | |||||

| Effect of exchange rate changes on cash and cash equivalents | 1,925 | (7,879 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | (328,948 | ) | 484,294 | |||||

| Cash and cash equivalents at beginning of period | 972,719 | 610,825 | ||||||

| Cash and cash equivalents at end of period | $ | 643,771 | $ | 1,095,119 | ||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||||||||||||||

| Reconciliation of Adjusted Earnings Per Share | ||||||||||||||||||||

| (Unaudited – In thousands, except per share amounts) | ||||||||||||||||||||

| Fiscal quarters ended | Nine fiscal months ended | |||||||||||||||||||

| September 28, 2024 |

June 29, 2024 |

September 30, 2023 |

September 28, 2024 |

September 30, 2023 |

||||||||||||||||

| GAAP net earnings (loss) attributable to Vishay stockholders | $ | (19,299 | ) | $ | 23,533 | $ | 65,529 | $ | 35,158 | $ | 272,348 | |||||||||

| Reconciling items affecting operating income: | ||||||||||||||||||||

| Restructuring and severance costs | $ | 40,614 | $ | – | $ | – | $ | 40,614 | $ | – | ||||||||||

| Reconciling items affecting other income (expense): | ||||||||||||||||||||

| Loss on early extinguishment of debt | $ | – | $ | – | $ | 18,874 | $ | – | $ | 18,874 | ||||||||||

| Reconciling items affecting tax expense (benefit): | ||||||||||||||||||||

| Tax effects of pre-tax items above | (10,299 | ) | – | (498 | ) | (10,299 | ) | (498 | ) | |||||||||||

| Adjusted net earnings | $ | 11,016 | $ | 23,533 | $ | 83,905 | $ | 65,473 | $ | 290,724 | ||||||||||

| Adjusted weighted average diluted shares outstanding | 137,558 | 138,084 | 140,001 | 138,039 | 140,577 | |||||||||||||||

| Adjusted earnings per diluted share | $ | 0.08 | $ | 0.17 | $ | 0.60 | $ | 0.47 | $ | 2.07 | ||||||||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||||||||||||||

| Reconciliation of Free Cash | ||||||||||||||||||||

| (Unaudited – In thousands) | ||||||||||||||||||||

| Fiscal quarters ended | Nine fiscal months ended | |||||||||||||||||||

| September 28, 2024 |

June 29, 2024 |

September 30, 2023 |

September 28, 2024 |

September 30, 2023 |

||||||||||||||||

| Net cash provided by operating activities | $ | 50,565 | $ | (24,730 | ) | $ | 122,303 | $ | 106,046 | $ | 359,435 | |||||||||

| Proceeds from sale of property and equipment | 132 | 514 | 21 | 1,397 | 1,034 | |||||||||||||||

| Less: Capital expenditures | (59,527 | ) | (62,564 | ) | (66,829 | ) | (175,175 | ) | (184,079 | ) | ||||||||||

| Free cash | $ | (8,830 | ) | $ | (86,780 | ) | $ | 55,495 | $ | (67,732 | ) | $ | 176,390 | |||||||

| VISHAY INTERTECHNOLOGY, INC. | ||||||||||||||||||||

| Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

| (Unaudited – In thousands) | ||||||||||||||||||||

| Fiscal quarters ended | Nine fiscal months ended | |||||||||||||||||||

| September 28, 2024 |

June 29, 2024 |

September 30, 2023 |

September 28, 2024 |

September 30, 2023 |

||||||||||||||||

| GAAP net earnings (loss) attributable to Vishay stockholders | $ | (19,299 | ) | $ | 23,533 | $ | 65,529 | $ | 35,158 | $ | 272,348 | |||||||||

| Net earnings attributable to noncontrolling interests | 306 | 347 | 426 | 1,172 | 1,211 | |||||||||||||||

| Net earnings (loss) | $ | (18,993 | ) | $ | 23,880 | $ | 65,955 | $ | 36,330 | $ | 273,559 | |||||||||

| Interest expense | $ | 6,596 | $ | 6,657 | $ | 7,153 | $ | 19,749 | $ | 18,677 | ||||||||||

| Interest income | (5,230 | ) | (6,663 | ) | (9,183 | ) | (20,946 | ) | (21,419 | ) | ||||||||||

| Income taxes | (5,076 | ) | 12,391 | 30,557 | 20,134 | 113,199 | ||||||||||||||

| Depreciation and amortization | 53,595 | 52,150 | 46,216 | 155,272 | 133,910 | |||||||||||||||

| EBITDA | $ | 30,892 | $ | 88,415 | $ | 140,698 | $ | 210,539 | $ | 517,926 | ||||||||||

| Reconciling items | ||||||||||||||||||||

| Restructuring and severance costs | 40,614 | – | – | 40,614 | – | |||||||||||||||

| Loss on early extinguishment of debt | – | – | 18,874 | – | 18,874 | |||||||||||||||

| Adjusted EBITDA | $ | 71,506 | $ | 88,415 | $ | 159,572 | $ | 251,153 | $ | 536,800 | ||||||||||

| Adjusted EBITDA margin** | 9.7 | % | 11.9 | % | 18.7 | % | 11.3 | % | 20.5 | % | ||||||||||

| ** Adjusted EBITDA as a percentage of net revenues | ||||||||||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.