China Escalates Trade Dispute, Lodges Complaint With WTO Over European EV Tariffs

China escalated its trade dispute with the European Union (EU) on Monday by lodging a formal complaint with the World Trade Organization (WTO) regarding the EU’s recently imposed tariffs on Chinese-made electric vehicles.

The Details: China’s diplomatic mission to the WTO said it “strongly opposes” the EU’s decision to implement tariffs of up to 35% on Chinese EVs. China claimed the tariffs are “protectionist” and “an abuse of trade remedies” in violation of WTO rules.

The European Union raised tariffs on Chinese EV imports last month in response to what it sees as unfair business practices that undercut European industry. The tariffs will be in effect for five years and affect Chinese automakers including Li Auto, Inc. LI and NIO, Inc. – ADR NIO.

Chinese Premier Li Qiang commented on trade policies Tuesday at the opening of the China International Import Expo in Shanghai, one day after lodging the complaint with the WTO. Bloomberg reported Li appeared to take a jab at the U.S. and EU trade policies, mentioning “various acts of dishonesty,” without going into detail.

Malaysian Prime Minister Anwar Ibrahim commended China for its handling of trade in the face of “obscure, condescending and unfair trading practices” at the same event on Tuesday.

Why It Matters: The U.S. and the EU have placed high import duties on China-made EVs as a way to keep the cheaper vehicles from flooding the market and harming the domestic automotive industries. Both countries are opposed to Chinese government subsidies which support China’s EV makers and enable the vehicles to be sold at lower prices than domestically produced EVs.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Election Jitters Meet Interest-Rate Cut Assurance: Why Fed's Powell May Offer Traders A Safe Harbor This Week

Few things seem certain in life ahead of the U.S. presidential election results: death, taxes, and the Federal Reserve cutting interest rates on Thursday.

As the U.S. anxiously awaits results from one of the tightest presidential races in history — potentially too close to call by Thursday — this anticipated rate cut may offer a rare anchor for financial markets, providing traders with a moment of stability during what could be a highly volatile week.

In what’s widely seen as a guaranteed move, the central bank is expected to reduce its benchmark rate by 0.25%, bringing it down to a range of 4.5%-4.75%. This move would set borrowing costs at their lowest levels since February 2023.

See Also: Kamala Harris Gains Support From 866 VCs Representing $276 Billion in Assets

Market-implied probabilities of a 0.25% cut point to a 97.4% chance, as per CME FedWatch, de facto almost fully pricing in the rate cut, which would be the second consecutive reduction from the Fed.

The Fed’s policy statement will be released Thursday at 2:00 p.m. ET, followed by chair Jerome Powell‘s closely watched press conference at 2:30 p.m., where investors will look for clues about the Fed’s outlook on a further rate cut in the last meeting of the year.

Labor Market And Inflation Trends Drive Fed’s Decision

“We expect the Fed to cut by 25bp in November, and Chair Powell’s message is likely to remain optimistic,” said Bank of America rates analyst Mark Cabana.

Cabana explained that October’s softer-than-expected jobs report and downward revisions to payroll data for previous months are key factors that locked the November cut.

Bank of America indicates the recent labor data also significantly increases the odds of an additional rate cut in December.

Goldman Sachs economist David Mericle welcomed latest inflation developments and highlighted that while the October employment report was tepid, other data suggest resilience in the U.S. economy.

“Better inflation news has dampened the concerns about reacceleration or stickiness from the first few months of the year,” he said.

Mericle also highlighted the strong GDP growth in the third quarter, which may assuage fears of an overly softening labor market.

Goldman Sachs is forecasting four additional cuts in the first half of next year, which would bring the terminal rate down to a range of 3.25%-3.5%.

However, Mericle indicated that there’s “more uncertainty about both the speed next year and the final destination,” suggesting that future decisions will depend heavily on incoming economic data.

Potential Skip In December?

JPMorgan aligns with the consensus for a 25-basis-point cut in November, with the possibility of another in December if economic conditions remain stable. The bank, however, warns that labor market data will play an outsized role in shaping the Fed’s future moves.

Analysts at the largest U.S. bank warned that if the unemployment rate falls below 4% in December, the Fed might consider skipping a rate cut in early 2024 — a possibility raised last by Atlanta Fed President Raphael Bostic.

Morgan Stanley expects the FOMC’s statement to reflect an improved outlook on economic growth, while acknowledging progress on inflation. However, they caution that Powell is unlikely to commit to a specific pace for future rate cuts.

In short, the November rate cut is a near certainty during a period of anticipated political volatility, but beyond that, much remains in flux.

How Could Markets React?

The market-implied probability of another 0.25% rate cut at the Dec. 18 meeting currently stands at 77%.

If Fed chair Powell delivers dovish remarks that reinforce expectations for a December rate cut, investors can expect a boost in risk assets. In this scenario, the S&P 500 — represented by the SPDR S&P 500 ETF Trust SPY — is likely to react positively after the Fed meeting, provided that election-related uncertainties don’t overshadow the market.

On the other hand, if Powell signals reluctance to cut rates again in December, it could disappoint investors and add fuel to market volatility, especially amid heightened political risks surrounding the election results.

Read Now:

Image via Federal Reserve

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medical Pendant Market analysis 2025 Satuts and outlook, Strategic Assessment 2031 – Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 05, 2024 (GLOBE NEWSWIRE) — The COVID-19 pandemic significantly impacted the medical pendant market, primarily due to the widespread postponement of elective surgeries and various medical procedures resulting from global lockdown measures. These measures were implemented by governments worldwide to mitigate the spread of the virus among populations. For instance, data published by the World Economic Forum in May 2020 indicated that approximately 28 million elective surgeries were canceled during the initial 12 weeks of the pandemic. This disruption severely affected patient visits to hospitals and ambulatory care centers, ultimately leading to decreased utilization of medical pendants within healthcare settings.

Market Recovery and Demand Surge https://exactitudeconsultancy.com/reports/34461/medical-pendant-market/#request-a-sample

However, the World Health Organization (WHO) provided updated guidance in June 2020, emphasizing the need for countries to strengthen their healthcare systems and enhance health security amid the ongoing pandemic. This guidance prompted numerous healthcare facilities to upgrade their equipment, particularly in critical care areas. As a result, demand for medical pendants in intensive care units (ICUs) and critical care units (CCUs) began to rise. The market is expected to recover and regain its full potential in the next two to three years as healthcare systems adapt to the new normal.

One significant factor contributing to this recovery is the increasing number of patients presenting with severe respiratory illnesses due to COVID-19. Many patients experience reduced oxygen levels, necessitating medical interventions. Medical pendant systems, equipped with medical gas supply capabilities, are critical for administering oxygen to individuals suffering from severe respiratory issues. This surge in the need for critical care and advanced healthcare services during the pandemic is anticipated to drive growth in the medical pendant market.

Despite the positive factors contributing to market growth, the medical pendant industry faces challenges, particularly due to the high costs of devices. This cost barrier may hinder widespread adoption and implementation, especially in developing economies where healthcare budgets may be limited.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/34461/medical-pendant-market/#request-a-sample

Factors Driving Market Growth

Several factors are propelling the demand for medical pendants:

- Chronic Diseases: The rising prevalence of chronic conditions, including neurovascular diseases, cardiovascular disorders, cancer, and other long-term illnesses, has led to increased hospital admission rates. Medical pendants are instrumental in positioning various medical devices and essential equipment during surgical procedures, further driving market demand. The WHO reports that chronic diseases account for 60% of all deaths globally, underscoring the growing need for medical interventions. Cardiovascular diseases alone cause approximately 17.9 million deaths annually, with cancer as the leading cause of mortality worldwide.

- Increased Surgical Procedures: Factors such as the rising number of surgical procedures and the ongoing improvement of healthcare infrastructure are expected to bolster market growth. According to data from OECD published in August 2022, notable surgical volumes were performed in several developed European countries, highlighting the rising demand for medical pendants during surgeries. These devices ensure the availability of light, medical tools, and gas supply to surgeons, which is vital for successful surgical outcomes.

- Aging Population: The increasing geriatric population contributes to heightened demand for specialized healthcare services. As people age, they are more likely to experience chronic health conditions that require surgical intervention. The Journal of Orthopaedic Science has projected substantial increases in knee arthroplasties in Japan by 2030, indicating a growing need for medical pendants to support these surgical procedures.

- Government Initiatives: Governments are actively seeking to enhance healthcare infrastructure and maintain stable supply chains for medical devices. For example, the Spanish government announced new economic measures in September 2022 to support the supply of medical equipment, including a reduction in VAT on medical devices and supplies. Such initiatives are aimed at ensuring hospitals and clinics have access to necessary equipment, including medical pendants.

- Investment in Healthcare: Increasing healthcare expenditure and investments in various countries are driving the development and adoption of advanced medical pendant systems. In India, public healthcare spending rose from 1.8% to 2.1% of GDP between 2020-21 and 2021-22, demonstrating a commitment to improving healthcare quality. Similarly, Germany’s healthcare spending increased from 12.5% to 12.8% of GDP from 2020 to 2021, indicating a broader trend of investment in healthcare infrastructure.

Regional Insights

- United States: The U.S. holds a dominant position in the medical pendant market, accounting for 85.73% of the share in 2022. The prevalence of various chronic diseases, such as cardiac, neurological, and orthopedic disorders, is a significant driver of this market. According to the Centers for Disease Control and Prevention (CDC), chronic diseases are leading causes of death and disability in the U.S., affecting 6 in 10 adults. The CDC also reported that approximately 659,000 people died from cardiovascular diseases in 2020, with projections indicating a 46% increase in heart disease cases by 2030.

- Europe: The European market for medical pendants is growing due to increased healthcare spending and improvements in healthcare infrastructure across various countries. Reports indicate that a substantial number of surgeries are being performed, necessitating the use of medical pendants to facilitate efficient surgical procedures.

- Asia-Pacific: Countries in the Asia-Pacific region are also seeing increased demand for medical pendants, driven by rising healthcare standards and investment in advanced medical technology. The region’s growing population and increasing prevalence of chronic diseases create significant opportunities for market growth.

Medical Pendant Market Trends

Growth of the Fixed Pendant Segment

The fixed pendant segment is projected to hold a significant share of the medical pendant market during the forecast period. This growth can be attributed to various factors, including an increasing number of surgeries, the prevalence of anesthesia and endoscopy procedures, and the overall rise in hospital infrastructure.

Fixed pendant systems are designed with multiple connectors, enabling the attachment of ventilators and gas supply lines. These systems play a vital role in maintaining safety and minimizing contamination risks in hospital environments, particularly in recovery rooms and intensive care units (ICUs). Their affordability, portability, and ease of installation further enhance their appeal, contributing to the growing adoption of fixed medical pendants. As chronic diseases become more prevalent and the number of hospitals utilizing fixed pendant systems rises, the market is set to expand.

A notable driver for this segment is the projected increase in surgical procedures. For instance, an article published in the Annals of the Royal College of Surgeons of England in December 2021 indicated that the demand for hip and knee joint replacement surgeries is expected to increase by nearly 40% by 2060 across England, Wales, Northern Ireland, and the Isle of Man. Older patients are anticipated to account for the most significant relative increase in surgery volumes over time, further propelling the demand for fixed medical pendants. Given these factors, the fixed pendant segment is expected to see robust growth over the forecast period.

North America’s Market Position

The North American market is anticipated to hold a substantial share of the medical pendant market throughout the forecast period. This growth can be attributed to several factors, including a rising number of hospitals and the ongoing improvement of healthcare infrastructure in the region.

Additionally, the increasing prevalence of chronic diseases is expected to drive demand for surgical procedures, further boosting the need for medical pendant systems, especially in endoscopic and laparoscopic applications. For example, according to the American Cancer Society (ACS), an estimated 1.9 million new cancer cases were projected in the United States in 2022, with approximately 15,900 cases in men and 10,480 in women. Similarly, the Canadian Cancer Society (CCS) reported that colorectal cancer is anticipated to be the fourth most commonly diagnosed cancer in Canada, with nearly 24,300 Canadians expected to receive a colorectal cancer diagnosis in 2022, accounting for 10% of all new cancer cases in the country.

The upward trend in investments toward enhancing hospital infrastructure also plays a crucial role in market growth. In May 2022, the Healthcare Information and Management Systems Society (HIMSS) recommended nearly USD 36.7 billion in total investments over ten years to modernize State, Territorial, Local, and Tribal (STLT) public health infrastructures to ensure readiness for ongoing and emerging public health emergencies. Such investment initiatives are likely to significantly boost the medical pendant market.

In addition to this, plans by the Jalisco government in Mexico to invest over USD 301.5 million in healthcare infrastructure over the next three years to establish new hospitals and upgrade existing healthcare centers further underline the commitment to improving healthcare delivery. The Mexican Social Security Institute (IMSS) also announced plans to invest USD 677.2 million to build 111 new hospitals by 2024. These developments are expected to contribute positively to the overall market growth.

Report Link Click Here: https://exactitudeconsultancy.com/reports/34461/medical-pendant-market/

Medical Pendant Industry Key Players

- BeaconMedaes

- Brandon Medical Co. Ltd

- Dragerwerk AG & Co. KGaA

- Novair Medical

- Skytron LLC

- Steris PLC

- Brandon Medical

- Tedisel Medical

- Elektra Hellas SA

- Medimaxkorea Co. Ltd

- Beijing Aeonmed Co. Ltd

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd

Medical Pendant Market News

- Sep 2023: Stryker launched its latest Airo TruCT™ Imaging System, a versatile medical imaging solution that incorporates an innovative pendant design. This new system aims to enhance surgical precision and workflow efficiency by allowing easy access to imaging technology during complex procedures.

- Jun 2023: Philips introduced its Smart Medical Pendant, which features integrated AI capabilities to optimize workflow in operating rooms. This pendant system is designed to improve connectivity and streamline the management of medical devices, enhancing the overall efficiency of surgical teams.

- May 2023: GE Healthcare unveiled its new Versana Active medical pendant, which combines advanced imaging technology with user-friendly design. This system aims to enhance patient safety and comfort while providing healthcare professionals with seamless access to critical tools during procedures.

- Jan 2023: Ziegler announced a partnership with Oberon to co-develop a new line of intelligent medical pendants that incorporate smart sensors for monitoring patient vitals. This initiative is designed to support enhanced patient care in hospitals and surgical centers by providing real-time data to healthcare providers.

- Oct 2022: MedeAnalytics partnered with Siemens Healthineers to integrate advanced analytics into their medical pendant solutions. This collaboration aims to improve the decision-making process for healthcare providers by offering insights on patient management and operational efficiency through integrated pendant systems.

Market Segments :

-

- Double & Multi-arm Movable

-

- Intensive Care Unit (ICU)

-

- Middle East and Africa (MEA)

Get a Sample PDF Brochure:

https://exactitudeconsultancy.com/reports/34461/medical-pendant-market/#request-a-sample

Related Reports:

Aspiration & Biopsy Needles Market

https://exactitudeconsultancy.com/reports/1400/aspiration-biopsy-needles-market/

The Global Aspiration & Biopsy Needles Market is expected to grow at more than 6.9% CAGR from 2019 to 2028. It is expected to reach above USD 1,699 million by 2028 from a little above USD 932 million in 2019.

Anastomosis Device Market

https://exactitudeconsultancy.com/reports/1223/anastomosis-device-market/

The global anastomosis device market is expected to grow at more than 6.9% CAGR from 2019 to 2028. It is expected to reach above USD 3.04 billion by 2028 from a little above USD 1.70 billion in 2019.

Pet Insurance Market

https://exactitudeconsultancy.com/reports/796/pet-insurance-market/

The Global Pet Insurance Market size is expected to grow at more than 16% CAGR from 2019 to 2026. It is expected to reach above USD 17 billion by 2026 from a little above USD 6 billion in 2019.

Ligation Devices Market

https://exactitudeconsultancy.com/reports/1171/ligation-devices-market/

The global ligation devices market was valued at $945.8 million in 2020, and is projected to reach $1,681.2 million by 2028, registering a CAGR of 6.2% from 2021 to 2028.

Medical Device Cleaning Market

https://exactitudeconsultancy.com/reports/1259/medical-device-cleaning-market/

The Global medical device cleaning market is expected to grow at 7.8% CAGR from 2019 to 2028. It is expected to reach above USD 3.2 billion by 2028 from USD 1.6 billion in 2019.

Haemeto Oncology Testing Market

https://exactitudeconsultancy.com/reports/1110/haemeto-oncology-testing-market/

The Global Haemeto Oncology Testing Market is expected to grow at more than 18.6% CAGR from 2019 to 2028. It is expected to reach above USD 8.23 billion by 2028 from a little above USD 1.93 billion in 2019.

Microcatheters Market

https://exactitudeconsultancy.com/reports/1133/microcatheters-market/

The global microcatheters market is projected to reach USD 1200 Million by 2028 from USD 800 Million in 2020, at a CAGR of 5.5% from 2021 to 2028.

Sleep Apnea Devices Market

https://exactitudeconsultancy.com/reports/1333/sleep-apnea-devices-market/

The Global Sleep Apnea Devices Market is expected to grow at a 6.9 % CAGR from 2019 to 2028. It is expected to reach above USD 11.3 billion by 2028 from USD 6.2 billion in 2019.

Spine Surgery Market

https://exactitudeconsultancy.com/reports/687/spine-surgery-market/

The Global Spine Surgery market is expected to grow at 3.8% CAGR from 2019 to 2028. It is expected to reach above USD 52.5 billion by 2028 from USD 38.5 billion in 2019.

Automated External Defibrillator (AED) Market

https://exactitudeconsultancy.com/reports/670/automated-external-defibrillators-aeds-market/

The global Automated External Defibrillators (AEDs) Market is expected to grow at more than 8% CAGR from 2021 to 2026. It is expected to reach above USD 1.4 billion by 2026 from a little above USD 1.1 billion in 2020.

Respiratory Care Devices Market

https://exactitudeconsultancy.com/reports/1315/respiratory-care-devices-market/

The Global Respiratory Care Devices Market Is Expected to Grow At 8.50% CAGR from 2019 To 2028. It Is Expected to Reach Above USD 32.5 Billion By 2028 From USD 15.6 Billion In 2019.

Surface Disinfectant Market

https://exactitudeconsultancy.com/reports/1199/surface-disinfectant-market/

The Global Surface Disinfectant Market is expected to grow at 8.5% CAGR from 2019 to 2028. It is expected to reach above USD 4.72 million by 2028 from USD 2.31 million in 2019.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Robinhood's Election Contracts Hit 200 Million Trades On Election Day

On Tuesday, the recently launched 2024 election contracts on Robinhood Markets Inc (NASDAQ:HOOD) surpassed the 200 million milestone.

On Monday, Robinhood CEO Vlad Tenev shared on X that the company passed 100 million contracts traded in less than a week since launching election contracts.

As per an emailed statement to Benzinga, Robinhood said it reached 200 million contracts.

Robinhood’s election contracts are available to select U.S. users who comply with citizenship requirements.

Robinhood’s 2024 election contracts showed Donald Trump as the frontrunner at 57 cents, with Vice President Kamala Harris trailing at 45 cents. Winning candidate contracts will pay out $1 each.

Robinhood’s election contracts add a new investment avenue for users alongside stocks, options, and cryptocurrency.

Interest in prediction markets for the 2024 election has soared, with Polymarket and Kalshi attracting bets from around the world.

Polymarket is only available to users outside the U.S. Kalshi is regulated by the Commodity Futures Trading Commission in the U.S.

Price Action: HOOD stock is up 2.42% at $24.91 at the last check on Tuesday.

Also Read:

Photo via Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Robinhood’s Election Contracts Hit 200 Million Trades On Election Day originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Tells Tucker Carlson That The Pressure He Faced For Shutting Down X 'Pales In Comparison' With What Trump Went Through

Tesla and SpaceX CEO Elon Musk has dismissed the pressure he faced for shutting down X, formerly Twitter, in comparison to the tribulations faced by Republican presidential nominee Donald Trump.

What Happened: Musk made these remarks during an appearance on Tucker Carlson’s online show, broadcasted from Trump’s Mar-a-Lago estate on Election Day.

In response to questions about the pressure to shut down X, the tech mogul replied with sarcasm.

He noted that, aside from multiple Democrats wanting to jail him, revoke government contracts from his companies, nationalize his businesses, deport him as an illegal immigrant, and arrest him for allegedly being Vladimir Putin’s best friend, there wasn’t much else.

Musk later shared the video on X and added, “Sure, it was a lot of pressure, but it pales by comparison with President Donald Trump, who they tried to kill twice, bankrupt, and imprison for eternity.”

Earlier this year, Republican nominee Donald Trump faced two separate assassination attempts.

If he secures a win, he will be the second president to serve non-consecutive terms. He will also become the oldest person ever elected to the presidency and also the first convicted felon to hold office while under legal indictment.

Why It Matters: Previously, President Joe Biden alleged that Musk violated student visa norms when he first arrived in the U.S. He referred to Musk as a Trump “ally” and an “illegal worker.”

At the time, Musk retorted by saying, “I was in fact allowed to work in the U.S.,” adding that Biden was lying.

A Trump victory in the U.S. Presidential election could be a “potential positive” for Musk’s company Tesla, according to analysts from Wedbush.

While a Trump victory could impact the electric vehicle industry overall, it could benefit Tesla due to its unmatched scale and scope in the EV industry.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CT REIT Reports Third Quarter 2024 Results

TORONTO, Nov. 5, 2024 /CNW/ – CT Real Estate Investment Trust (“CT REIT” or “the REIT”) CRT today reported its consolidated financial results for the third quarter ending September 30, 2024.

“Our growth strategy continues to drive strong and reliable operating results and generate attractive returns for our Unitholders,” said Kevin Salsberg, President and Chief Executive Officer, CT REIT. “Along with our recently closed acquisition in Nanaimo, BC, we are pleased to announce $85 million in new investments this quarter that further serve to add to our strong pipeline of projects and our high-quality portfolio of assets.”

New Investment Activity

CT REIT announced three new investments which will require an estimated $85 million to complete. The investments are, in aggregate, expected to earn a going-in yield of 6.20% and represent approximately 283,000 square feet of incremental gross leasable area (“GLA”).

The table below summarizes the new investments and their anticipated completion dates:

|

Property |

Type |

GLA (sf.) |

Timing |

Activity |

|

Mont Tremblant, |

Vend-in |

128,000 |

Q4 2024 |

Vend-in of a property containing |

|

Winnipeg |

Vend-in |

101,000 |

Q4 2024 |

Vend-in of a Canadian Tire store |

|

Penticton, BC |

Intensification |

54,000 |

Q4 2025 |

Expansion of a Canadian Tire store |

Update on Previously Announced Investment and Disposition Activity

CT REIT invested $47 million in a previously disclosed project that was completed in the third quarter of 2024, adding 141,000 square feet of incremental GLA to the portfolio as detailed in the table below.

|

Property |

Type |

GLA (sf.) |

Timing |

Activity |

|

Nanaimo, BC |

Third party |

141,000 |

Q3 2024 |

Third party acquisition of a property |

Financial and Operational Summary

|

Summary of Selected Information |

||||||||||

|

(in thousands of Canadian dollars, except unit, per unit and |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||

|

2024 |

2023 |

Change 8 |

2024 |

2023 |

Change |

|||||

|

Property revenue |

$ |

144,594 |

$ |

137,479 |

5.2 % |

$ |

433,253 |

$ |

412,804 |

5.0 % |

|

Net operating income 1 |

$ |

113,631 |

$ |

109,930 |

3.4 % |

$ |

342,058 |

$ |

327,444 |

4.5 % |

|

Net income |

$ |

94,457 |

$ |

11,327 |

NM |

$ |

298,887 |

$ |

191,195 |

56.3 % |

|

Net income per unit – basic 2 |

$ |

0.401 |

$ |

0.048 |

NM |

$ |

1.269 |

$ |

0.813 |

56.1 % |

|

Net income per unit – diluted 2,3 |

$ |

0.339 |

$ |

0.048 |

NM |

$ |

1.032 |

$ |

0.711 |

45.1 % |

|

Funds from operations 1 |

$ |

78,111 |

$ |

77,073 |

1.3 % |

$ |

235,739 |

$ |

230,210 |

2.4 % |

|

Funds from operations per unit – diluted 2,4,5 |

$ |

0.331 |

$ |

0.327 |

1.2 % |

$ |

0.999 |

$ |

0.978 |

2.1 % |

|

Adjusted funds from operations 1 |

$ |

72,554 |

$ |

71,026 |

2.2 % |

$ |

219,437 |

$ |

211,915 |

3.5 % |

|

Adjusted funds from operations per unit – diluted 2,4,5 |

$ |

0.308 |

$ |

0.301 |

2.3 % |

$ |

0.930 |

$ |

0.900 |

3.3 % |

|

Distributions per unit – paid 2 |

$ |

0.231 |

$ |

0.225 |

3.0 % |

$ |

0.680 |

$ |

0.659 |

3.3 % |

|

AFFO payout ratio 4 |

75.0 % |

74.8 % |

0.2 % |

$ |

73.1 % |

73.2 % |

(0.1) % |

|||

|

Cash generated from operating activities |

$ |

118,996 |

$ |

98,674 |

20.6 % |

$ |

327,289 |

$ |

306,739 |

6.7 % |

|

Weighted average number of units outstanding 2 |

||||||||||

|

Basic |

235,519,865 |

235,298,281 |

0.1 % |

235,527,287 |

235,085,684 |

0.2 % |

||||

|

Diluted 3 |

327,668,367 |

235,629,173 |

39.1 % |

336,785,263 |

336,351,282 |

0.1 % |

||||

|

Diluted (non-GAAP) 5 |

235,878,938 |

235,629,173 |

0.1 % |

235,898,858 |

235,405,625 |

0.2 % |

||||

|

Indebtedness ratio |

40.7 % |

41.1 % |

(0.4) % |

|||||||

|

Gross leasable area (square feet) 6 |

30,728,768 |

30,383,954 |

1.1 % |

|||||||

|

Occupancy rate 6,7 |

99.4 % |

99.1 % |

0.3 % |

|||||||

|

1 This is a non-GAAP financial measure. See “Specified Financial Measures” below for more information. |

||||||||||

|

2 Total units means Units and Class B LP Units outstanding. |

||||||||||

|

3 Diluted units determined in accordance with IFRS includes restricted and deferred units issued under various plans and the effect of assuming that all of the Class C LP Units will be settled with Class B LP Units. For the three months ended September 30, 2023, the anti-dilutive effect of conversion of Class C LP Units was excluded. Refer to section 7.0 of the MD&A. |

||||||||||

|

4 This is a non-GAAP ratio. See “Specified Financial Measures” below for more information. |

||||||||||

|

5 Diluted units used in calculating non-GAAP measures include restricted and deferred units issued under various plans and exclude the effect of assuming that all of the Class C LP Units will be settled with Class B LP Units. Refer to section 7.0 of the MD&A. |

||||||||||

|

6 Refers to retail, mixed-use commercial and industrial properties and excludes Properties Under Development. |

||||||||||

|

7 Occupancy and other leasing key performance measures have been prepared on a committed basis which includes the impact of existing lease agreements contracted on or before September 30, 2024 and September 30, 2023, and vacancies as at the end of those reporting periods. |

||||||||||

|

8 NM – not meaningful. |

Financial Highlights

Net Income – Net income was $94.5 million for the quarter, an increase of $83.1 million, compared to the same period in the prior year, primarily due to increases in the fair value adjustment on investment properties and higher revenues from the Property portfolio, partially offset by higher interest expense.

Net Operating Income (NOI)* – Total property revenue for the quarter was $144.6 million, which was $7.1 million or 5.2% higher compared to the same period in the prior year. In the third quarter, NOI was $113.6 million, which was $3.7 million or 3.4% higher compared to the same period in the prior year. This was primarily due to the acquisition, intensification and development of income-producing properties completed in 2023 and 2024, which added $2.7 million and rent escalations from Canadian Tire leases, which contributed $1.6 million, partially offset by lower property operating recoveries, which reduced NOI by $0.4 million.

Same store NOI was $110.5 million and same property NOI was $111.3 million for the quarter, which were $1.3 million or 1.2%, and $2.0 million or 1.8%, respectively, higher when compared to the prior year. Same store NOI increased primarily due to the increased revenue derived from contractual rent escalations, partially offset by lower property operating recoveries. Same property NOI increased primarily due to the increase in same store NOI noted, as well as from the intensifications completed in 2023 and 2024.

Funds from Operations (FFO)* – FFO for the quarter was $78.1 million, which was $1.0 million or 1.3% higher than the same period in 2023, primarily due to the impact of NOI variances discussed earlier, partially offset by higher interest expense. FFO per unit – diluted (non-GAAP) for the quarter was $0.331, which was $0.004 or 1.2% higher, compared to the same period in 2023, due to the growth of FFO exceeding the growth in weighted average units outstanding – diluted (non-GAAP).

Adjusted Funds from Operations (AFFO)* – AFFO for the quarter was $72.6 million, which was $1.5 million or 2.2% higher than the same period in 2023, primarily due to the impact of NOI variances discussed earlier, partially offset by higher interest expense. AFFO per unit – diluted (non-GAAP) for the quarter was $0.308, which was $0.007 or 2.3% higher, compared to the same period in 2023, due to the growth of AFFO exceeding the growth in weighted average units outstanding – diluted (non-GAAP).

Distributions – Distributions per Unit paid in the quarter amounted to $0.231, which was 3.0% higher than the same period in 2023 due to an increase in the rate of distributions which became effective with the monthly distributions paid in July 2024.

Normal Course Issuer Bid – During the quarter, CT REIT acquired and cancelled 36,808 Units at a weighted average purchase price of $13.20 per Unit, for a total cost of $0.5 million.

Operating Results

Leasing – CTC is CT REIT’s most significant tenant. As at September 30, 2024, CTC represented 92.7% of total GLA and 91.6% of annualized base minimum rent.

Occupancy – As at September 30, 2024, CT REIT’s portfolio occupancy rate, on a committed basis, was 99.4%.

*NOI, FFO and AFFO are non-GAAP financial measures. See below for additional information.

Specified Financial Measures

CT REIT uses specified financial measures as defined by National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators (“NI 52-112″). CT REIT believes these specified financial measures provide useful information to both management and investors in measuring the financial performance of CT REIT and its ability to meet its principal objective of creating unitholder value over the long term by generating reliable, durable and growing monthly cash distributions on a tax-efficient basis.

These specified financial measures used in this document include non-GAAP financial measures and non-GAAP ratios, within the meaning of NI 52-112. Non-GAAP financial measures and non-GAAP ratios do not have a standardized meaning prescribed by IFRS, also referred to as generally accepted accounting principles (“GAAP”), and therefore they may not be comparable to similarly titled measures and ratios presented by other publicly traded entities and should not be construed as an alternative to other financial measures determined in accordance with GAAP.

See below for further information on specified financial measures used by management in this document and, where applicable, for reconciliations to the nearest GAAP measures.

Net Operating Income

NOI is a non-GAAP financial measure defined as property revenue less property expense, adjusted for straight-line rent. The most directly comparable primary financial statement measure is property revenue. Management believes that NOI is a useful key indicator of performance as it represents a measure of property operations over which management has control. NOI is also a key input in determining the fair value of the Property portfolio. NOI should not be considered as an alternative to property revenue or net income and comprehensive income, both of which are determined in accordance with IFRS.

|

(in thousands of Canadian dollars) |

Three Months Ended |

Nine Months Ended |

||||

|

For the periods ended September 30, |

2024 |

2023 |

Change 1 |

2024 |

2023 |

Change 1 |

|

Property revenue |

$ 144,594 |

$ 137,479 |

5.2 % |

$ 433,253 |

$ 412,804 |

5.0 % |

|

Less: |

||||||

|

Property expense |

(32,045) |

(28,056) |

14.2 % |

(94,824) |

(86,681) |

9.4 % |

|

Property straight-line rent adjustment |

1,082 |

507 |

NM |

3,629 |

1,321 |

NM |

|

Net operating income |

$ 113,631 |

$ 109,930 |

3.4 % |

$ 342,058 |

$ 327,444 |

4.5 % |

|

1 NM – not meaningful. |

||||||

Funds From Operations and Adjusted Funds From Operations

Certain non-GAAP financial measures for the real estate industry have been defined by the Real Property Association of Canada under its publications, “REALPAC Funds From Operations & Adjusted Funds From Operations for IFRS” and “REALPAC Adjusted Cashflow from Operations for IFRS”. CT REIT calculates Fund From Operations, Adjusted Funds From Operations and Adjusted Cashflow from Operations in accordance with these publications.

The following table reconciles GAAP net income and comprehensive income to FFO and further reconciles FFO to AFFO:

|

(in thousands of Canadian dollars) |

Three Months Ended |

Nine Months Ended |

||||

|

For the periods ended September 30, |

2024 |

2023 |

Change 1 |

2024 |

2023 |

Change 1 |

|

Net Income and comprehensive income |

$ 94,457 |

$ 11,327 |

NM |

$ 298,887 |

$ 191,195 |

56.3 % |

|

Fair value adjustment on investment property |

(17,731) |

66,669 |

NM |

(64,296) |

39,302 |

NM |

|

Deferred income tax |

(568) |

(152) |

NM |

220 |

659 |

(66.6) % |

|

Lease principal payments on right-of-use assets |

(212) |

(176) |

20.5 % |

(628) |

(681) |

(7.8) % |

|

Fair value adjustment of unit-based compensation |

1,865 |

(913) |

NM |

688 |

(1,148) |

NM |

|

Internal leasing expense |

300 |

318 |

(5.7) % |

868 |

883 |

(1.7) % |

|

Funds from operations |

$ 78,111 |

$ 77,073 |

1.3 % |

$ 235,739 |

$ 230,210 |

2.4 % |

|

Property straight-line rent adjustment |

1,082 |

507 |

NM |

3,629 |

1,321 |

NM |

|

Direct leasing costs 2 |

(146) |

(346) |

(57.8) % |

(650) |

(900) |

(27.8) % |

|

Capital expenditure reserve |

(6,493) |

(6,208) |

4.6 % |

(19,281) |

(18,716) |

3.0 % |

|

Adjusted funds from operations |

$ 72,554 |

$ 71,026 |

2.2 % |

$ 219,437 |

$ 211,915 |

3.5 % |

|

1 NM – not meaningful. |

||||||

|

2 Excludes internal and external leasing costs related to development projects. |

||||||

Funds From Operations

FFO is a non-GAAP financial measure of operating performance used by the real estate industry, particularly by those publicly traded entities that own and operate income-producing properties. The most directly comparable primary financial statement measure is net income and comprehensive income. FFO should not be considered as an alternative to net income or cash flows provided by operating activities determined in accordance with IFRS. The use of FFO, together with the required IFRS presentations, has been included for the purpose of improving the understanding of the operating results of CT REIT.

Management believes that FFO is a useful measure of operating performance that, when compared period-over-period, reflects the impact on operations of trends in occupancy levels, rental rates, operating costs and property taxes, acquisition activities and interest costs, and provides a perspective of the financial performance that is not immediately apparent from net income determined in accordance with IFRS.

FFO adds back to net income items that do not arise from operating activities, such as fair value adjustments. FFO, however, still includes non-cash revenues related to accounting for straight-line rent and makes no deduction for the recurring capital expenditures necessary to sustain the existing earnings stream.

Adjusted Funds From Operations

AFFO is a non-GAAP financial measure of recurring economic earnings used in the real estate industry to assess an entity’s distribution capacity. The most directly comparable primary financial statement measure is net income and comprehensive income. AFFO should not be considered as an alternative to net income or cash flows provided by operating activities determined in accordance with IFRS.

CT REIT calculates AFFO by adjusting FFO for non-cash income and expense items such as amortization of straight-line rents. AFFO is also adjusted for a reserve for maintaining the productive capacity required for sustaining property infrastructure and revenue from real estate properties and direct leasing costs. As property capital expenditures do not occur evenly during the fiscal year or from year to year, the capital expenditure reserve in the AFFO calculation, which is used as an input in assessing the REIT’s distribution payout ratio, is intended to reflect an average annual spending level. The reserve is primarily based on average expenditures as determined by building condition reports prepared by independent consultants.

Management believes AFFO is a useful measure of operating performance similar to FFO as described above, adjusted for the impact of non-cash income and expense items.

Capital Expenditure Reserve

The following table compares and reconciles recoverable capital expenditures since 2013 to the capital expenditure reserve used in the calculation of AFFO during that period:

|

(in thousands of Canadian dollars) |

Capital |

Recoverable |

Variance |

|

For the periods indicated |

|||

|

October 23, 2013 to December 31, 2022 |

$ 193,885 |

$ 183,586 |

$ 10,299 |

|

Year ended December 31, 2023 |

$ 25,042 |

$ 34,276 |

$ (9,234) |

|

Period ended September 30, 2024 |

$ 19,281 |

$ 25,414 |

$ (6,133) |

|

Total |

$ 238,208 |

$ 243,276 |

$ (5,068) |

The capital expenditure reserve is a non-GAAP financial measure and management believes the reserve is a useful measure to understand the normalized capital expenditures required to maintain property infrastructure. Recoverable capital expenditures are the most directly comparable measure disclosed in the REIT’s primary financial statements. The capital expenditure reserve should not be considered as an alternative to recoverable capital expenditures, which is determined in accordance with IFRS.

The capital expenditure reserve varies from the capital expenditures incurred due to the seasonal nature of the expenditures. As such, CT REIT views the capital expenditure reserve as a meaningful measure.

FFO per unit – Basic, FFO per unit – Diluted (non-GAAP), AFFO per unit – Basic and AFFO per unit – Diluted (non-GAAP)

FFO per unit – basic, FFO per unit – diluted (non-GAAP), AFFO per unit – basic and AFFO per unit – diluted (non-GAAP) are non-GAAP ratios and reflect FFO and AFFO on a weighted average per unit basis. Management believes these non-GAAP ratios are useful measures to investors since the measures indicate the impact of FFO and AFFO, respectively, in relation to an individual per unit investment in the REIT. When calculating diluted per unit amounts, diluted units include restricted and deferred units issued under various plans and exclude the effects of settling the Class C LP Units with Class B LP Units.

Management believes that FFO per unit ratios are useful measures of operating performance that, when compared period-over-period, reflect the impact on operations of trends in occupancy levels, rental rates, operating costs and property taxes, acquisition activities and interest costs, and provides a perspective of the financial performance that is not immediately apparent from net income per unit determined in accordance with IFRS. Management believes that AFFO per unit ratios are useful measures of operating performance similar to FFO as described above, adjusted for the impact of non-cash income and expense items. The FFO per unit and AFFO per unit ratios are not standardized financial measures under IFRS and should not be considered as an alternative to other ratios determined in accordance with IFRS. The component of the FFO per unit ratios, which is a non-GAAP financial measure, is FFO, and the component of AFFO per unit ratios, which is a non-GAAP financial measure, is AFFO.

|

Three Months Ended |

Nine Months Ended |

|||||

|

For the periods ended September 30, |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

Funds from operations/unit – basic |

$ 0.332 |

$ 0.328 |

1.2 % |

$ 1.001 |

$ 0.979 |

2.2 % |

|

Funds from operations/unit – diluted |

$ 0.331 |

$ 0.327 |

1.2 % |

$ 0.999 |

$ 0.978 |

2.1 % |

|

Three Months Ended |

Nine Months Ended |

|||||

|

For the periods ended September 30, |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

Adjusted funds from operations/unit – basic |

$ 0.308 |

$ 0.302 |

2.0 % |

$ 0.932 |

$ 0.901 |

3.4 % |

|

Adjusted funds from operations/unit – diluted |

$ 0.308 |

$ 0.301 |

2.3 % |

$ 0.930 |

$ 0.900 |

3.3 % |

Management calculates the weighted average units outstanding – diluted (non-GAAP) by excluding the full conversion of the Class C LP Units to Class B LP Units, which is not considered a likely scenario. As such, the REIT’s fully diluted per unit FFO and AFFO amounts are calculated, excluding the effects of settling the Class C LP Units with Class B LP Units, which management considers a more meaningful measure.

AFFO Payout Ratio

The AFFO payout ratio is a non-GAAP ratio which measures the sustainability of the REIT’s distribution payout. Management believes this is a useful measure to investors since this metric provides transparency on performance. Management considers the AFFO payout ratio to be the best measure of the REIT’s distribution capacity. The AFFO payout ratio is not a standardized financial measure under IFRS and should not be considered as an alternative to other ratios determined in accordance with IFRS. The component of the AFFO payout ratio, which is a non-GAAP financial measure, is AFFO, and the composition of the AFFO payout ratio is as follows:

|

Three Months Ended |

Nine Months Ended |

|||||

|

For the periods ended September 30, |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

Distribution per unit – paid (A) |

$ 0.231 |

$ 0.225 |

3.0 % |

$ 0.680 |

$ 0.659 |

3.3 % |

|

AFFO per unit – diluted (non-GAAP) 1 (B) |

$ 0.308 |

$ 0.301 |

2.3 % |

$ 0.930 |

$ 0.900 |

3.3 % |

|

AFFO payout ratio (A)/(B) |

75.0 % |

74.8 % |

0.2 % |

73.1 % |

73.2 % |

(0.1) % |

|

1 For the purposes of calculating diluted per unit amounts, diluted units include restricted and deferred units issued under various plans and excludes the effects of settling the Class C LP Units with Class B LP Units. |

Same Store NOI

Same store NOI is a non-GAAP financial measure which reports the period-over-period performance of the same asset base having consistent GLA in both periods. CT REIT management believes same store NOI is a useful measure to gauge the change in asset productivity and asset value. The most directly comparable primary financial statement measure is property revenue. Same store NOI should not be considered as an alternative to property revenue or net income and comprehensive income, both of which are determined in accordance with IFRS.

Same Property NOI

Same property NOI is a non-GAAP financial measure that is consistent with the definition of same store NOI above, except that same property includes the NOI impact of intensifications. Management believes same property NOI is a useful measure to gauge the change in asset productivity and asset value, as well as measure the additional return earned by incremental capital investments in existing assets. The most directly comparable primary financial statement measure is property revenue. Same property NOI should not be considered as an alternative to property revenue or net income and comprehensive income, both of which are determined in accordance with IFRS.

The following table summarizes the same store and same property components of NOI:

|

(in thousands of Canadian dollars) |

Three Months Ended |

Nine Months Ended |

||||

|

For the periods ended September 30, |

2024 |

2023 |

Change 1 |

2024 |

2023 |

Change 1 |

|

Same store |

$ 110,488 |

$ 109,196 |

1.2 % |

$ 328,942 |

$ 323,588 |

1.7 % |

|

Intensifications |

||||||

|

2024 |

130 |

— |

NM |

196 |

— |

NM |

|

2023 |

663 |

127 |

NM |

3,791 |

1,120 |

NM |

|

Same property |

$ 111,281 |

$ 109,323 |

1.8 % |

$ 332,929 |

$ 324,708 |

2.5 % |

|

Acquisitions and developments |

||||||

|

2024 |

1,481 |

590 |

NM |

4,926 |

682 |

NM |

|

2023 |

869 |

17 |

NM |

4,203 |

2,054 |

NM |

|

Net operating income |

$ 113,631 |

$ 109,930 |

3.4 % |

$ 342,058 |

$ 327,444 |

4.5 % |

|

Add: |

||||||

|

Property expense |

32,045 |

28,056 |

14.2 % |

94,824 |

86,681 |

9.4 % |

|

Property straight-line rent adjustment |

(1,082) |

(507) |

NM |

(3,629) |

(1,321) |

NM |

|

Property Revenue |

$ 144,594 |

$ 137,479 |

5.2 % |

$ 433,253 |

$ 412,804 |

5.0 % |

|

1 NM – not meaningful. |

||||||

Management’s Discussion and Analysis (MD&A) and Interim Condensed Consolidated Financial Statements (Unaudited) and Notes

Information in this press release is a select summary of results. This press release should be read in conjunction with CT REIT’s MD&A for the period ended September 30, 2024 (Q3 2024 MD&A) and Interim Condensed Consolidated Financial Statements (Unaudited) and Notes for the period ended September 30, 2024, which are both available on SEDAR+ at sedarplus.ca and at ctreit.com.

Note: Unless otherwise indicated, all figures in this press release are as at September 30, 2024, and are presented in Canadian dollars.

Forward-Looking Statements

This press release contains forward-looking statements and information that reflect management’s current expectations related to matters such as future financial performance and operating results. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our future outlook, anticipated events or results and our operating environment. Readers are cautioned that such information may not be appropriate for other purposes.

Certain statements other than statements of historical facts included in this document may constitute forward-looking information, including, but not limited to, statements concerning future growth, the REIT’s ability to complete the investment under the heading “New Investment Activity”, the timing and terms of any such investment and the benefits expected to result from such investment, statements concerning developments, intensifications, results, performance, achievements, and prospects or opportunities for CT REIT. Forward-looking information is based on reasonable assumptions, estimates, analyses, beliefs, and opinions of management made in light of its experience and perception of prospects and opportunities, current conditions and expected trends, as well as other factors that management believes to be relevant and reasonable at the date such information is provided.

By its very nature, forward-looking information requires the use of estimates and assumptions and is subject to inherent risks and uncertainties. It is possible that the REIT’s assumptions, estimates, analyses, beliefs, and opinions are not correct, and that the REIT’s expectations and plans will not be achieved. Although the forward-looking information contained in this press release is based on information, assumptions and beliefs which are reasonable in the opinion of management and complete, this information is necessarily subject to a number of factors that could cause actual results to differ materially from management’s expectations and plans as set forth in such forward-looking information.

For more information on the risks, uncertainties and assumptions that could cause the REIT’s actual results to differ from current expectations, refer to section 5 “Risk Factors” of CT REIT’s Annual Information Form for fiscal 2023, and to section 12.0 “Enterprise Risk Management” and 14.0 “Forward-looking Information” of CT REIT’s MD&A for fiscal 2023 as well as the REIT’s other public filings available at sedarplus.ca and at ctreit.com.

The forward-looking statements and information contained herein are based on certain factors and assumptions as of the date hereof. CT REIT does not undertake to update any forward-looking information, whether written or oral, that may be made from time to time by it or on its behalf, to reflect new information, future events or otherwise, except as is required by applicable securities laws.

Information contained in or otherwise accessible through the websites referenced in this press release does not form part of this press release and is not incorporated by reference into this press release. All references to such websites are inactive textual references and are for information only.

Additional information about CT REIT has been filed electronically with various securities regulators in Canada through SEDAR+ and is available at sedarplus.ca and at ctreit.com.

Conference Call

CT REIT will conduct a conference call to discuss information included in this news release and related matters at 9:00 a.m. ET on November 6, 2024. The conference call will be available simultaneously and in its entirety to all interested investors and the news media through a webcast by visiting https://edge.media-server.com/mmc/p/pinqofr3/ or by visiting https://www.ctreit.com/English/news-and-events/events-and-webcasts/default.aspx and will be available through replay for 12 months.

About CT Real Estate Investment Trust

CT REIT is an unincorporated, closed-end real estate investment trust formed to own income-producing commercial properties located primarily in Canada. Its portfolio is comprised of over 370 properties totalling more than 30 million square feet of GLA, consisting primarily of net lease single-tenant retail properties located across Canada. Canadian Tire Corporation, Limited, is CT REIT’s most significant tenant. For more information, visit ctreit.com.

For Further Information:

Media: Joscelyn Dosanjh, 416-845-8392, joscelyn.dosanjh@cantire.com

Investors: Lesley Gibson, 416-480-8566, lesley.gibson@ctreit.com

SOURCE CT Real Estate Investment Trust (CT REIT)

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/05/c2908.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/05/c2908.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow, S&P 500, Nasdaq rise as Wall Street braces for election results

US stocks closed Tuesday’s trading session in a sea of green as Americans flocked to the polls on Election Day to decide whether Kamala Harris or Donald Trump will become the next president.

The tech-heavy Nasdaq Composite (^IXIC) led the gains, rising about 1.4% to secure its best day since early October. The benchmark S&P 500 (^GSPC) moved up roughly 1.2%, with the index nabbing its best session since Sept. 19. The Dow Jones Industrial Average (^DJI) jumped 1%, or more than 400 points, as stocks rebounded from a losing day.

Americans are heading to the polls with Harris and Trump running neck-and-neck after an intensely contested presidential race. Investors are buckling in for market volatility, as the outcome may not become clear for days, or even weeks, if the result is disputed.

Read more: The Yahoo Finance guide to the presidential election and what it means for your wallet

Given the huge difference in the candidates’ stances on the economy, a long wait for a declared winner could inject more uncertainty into markets. But historically, while the lack of a clear victory has brought turbulence in the short term, it has rarely halted the long-term trend for gains.

The dollar (DX-Y.NB) retreated further on Tuesday as traders dialed back bets on a Trump win.

Meanwhile, the yield on the benchmark 10-year Treasury (^TNX) dropped 2 basis points to hover around 4.29%. It had moved as high as 4.36% earlier in the session before retreating by late afternoon.

Also dead ahead is the November policy decision from the Federal Reserve, which also has a lot at stake on Election Day. Chair Jerome Powell is overwhelmingly expected to bring in a 25 basis point rate cut at the end of the two-day meeting on Thursday.

In corporates, the bitter seven-week strike at Boeing (BA) has ended after factory workers voted for a new contract offering a 38% pay hike. The plane maker’s shares still nearly 3% after initially opening the day higher.

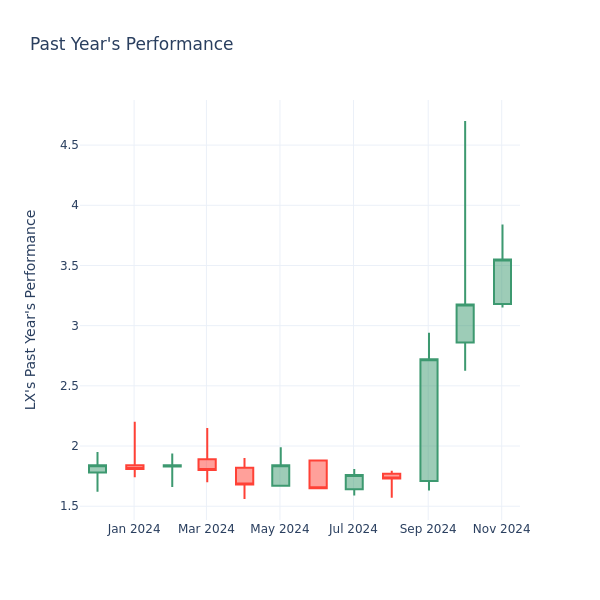

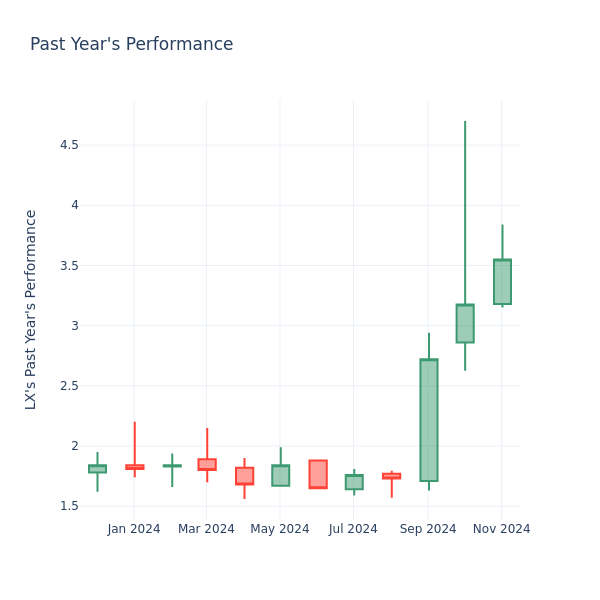

LIVE COVERAGE IS OVER 14 updatesA Look Into LexinFintech Holdings Inc's Price Over Earnings

In the current session, the stock is trading at $3.81, after a 3.81% increase. Over the past month, LexinFintech Holdings Inc. LX stock increased by 14.15%, and in the past year, by 80.20%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

LexinFintech Holdings P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 24.2 in the Consumer Finance industry, LexinFintech Holdings Inc. has a lower P/E ratio of 5.3. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.