Richmond American Announces Grand Opening of New Avondale Community

Amenity-laden Fire Sky at Alamar is set to debut on Saturday, November 9

AVONDALE, Ariz., Nov. 5, 2024 /PRNewswire/ — Richmond American Homes of Arizona, Inc., a subsidiary of M.D.C. Holdings, Inc., is pleased to announce the Grand Opening of Fire Sky at Alamar (RichmondAmerican.com/FireSkyAtAlamar), an exciting addition to the popular Alamar masterplan. This inviting Maricopa County community boasts four exceptional single- and two-story floor plans from the builder’s sought-after Seasons™ Collection (RichmondAmerican.com/Seasons), designed to maximize space and make homeownership more attainable.

Community tours (RichmondAmerican.com/FireSkyGO)

Prospective homebuyers and area agents are encouraged to stop by Fire Sky at Alamar for community and model home tours on Saturday, November 9, from 11 a.m. to 2 p.m. Complimentary refreshments will be provided.

More about Fire Sky at Alamar:

- New single-and two-story homes from the $400s

- Four inspired Seasons™ Collection floor plans

- 3 to 4 bedrooms & approx. 1,730 to 2,380 sq. ft.

- Designer-curated finishes & fixtures

- Community pool, splash pad, dog park, sports courts, picnic areas, playgrounds & more

- Close proximity to the Sierra Estrella Mountains & downtown Phoenix

- Agate and Elderberry models open for tours

Fire Sky at Alamar is located at 12388 W. Trumbull Road in Avondale. For more information, call 623.694.6707 or visit RichmondAmerican.com.

About M.D.C. Holdings, Inc.

M.D.C. Holdings, Inc. was founded in 1972. MDC’s homebuilding subsidiaries, which operate under the name Richmond American Homes, have helped more than 250,000 homebuyers achieve the American Dream since 1977. One of the largest homebuilders in the nation, MDC is committed to quality and value that is reflected in each home its subsidiaries build. The Richmond American companies have operations in Alabama, Arizona, California, Colorado, Florida, Idaho, Maryland, Nevada, New Mexico, Oregon, Tennessee, Texas, Utah, Virginia and Washington. Mortgage lending, insurance and title services are offered by the following MDC subsidiaries, respectively: HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-grand-opening-of-new-avondale-community-302296959.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-grand-opening-of-new-avondale-community-302296959.html

SOURCE M.D.C. Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Sirius XM Holdings

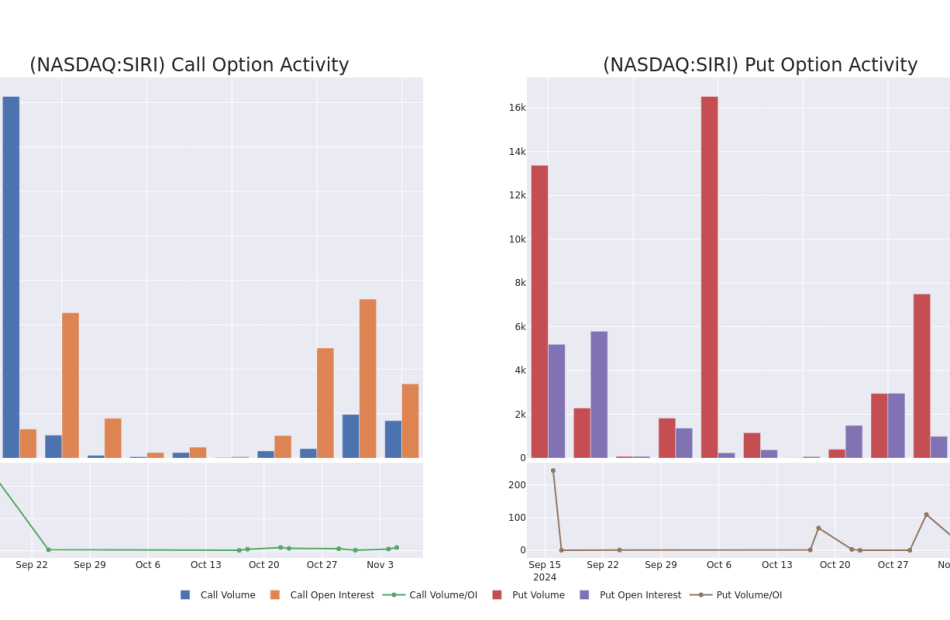

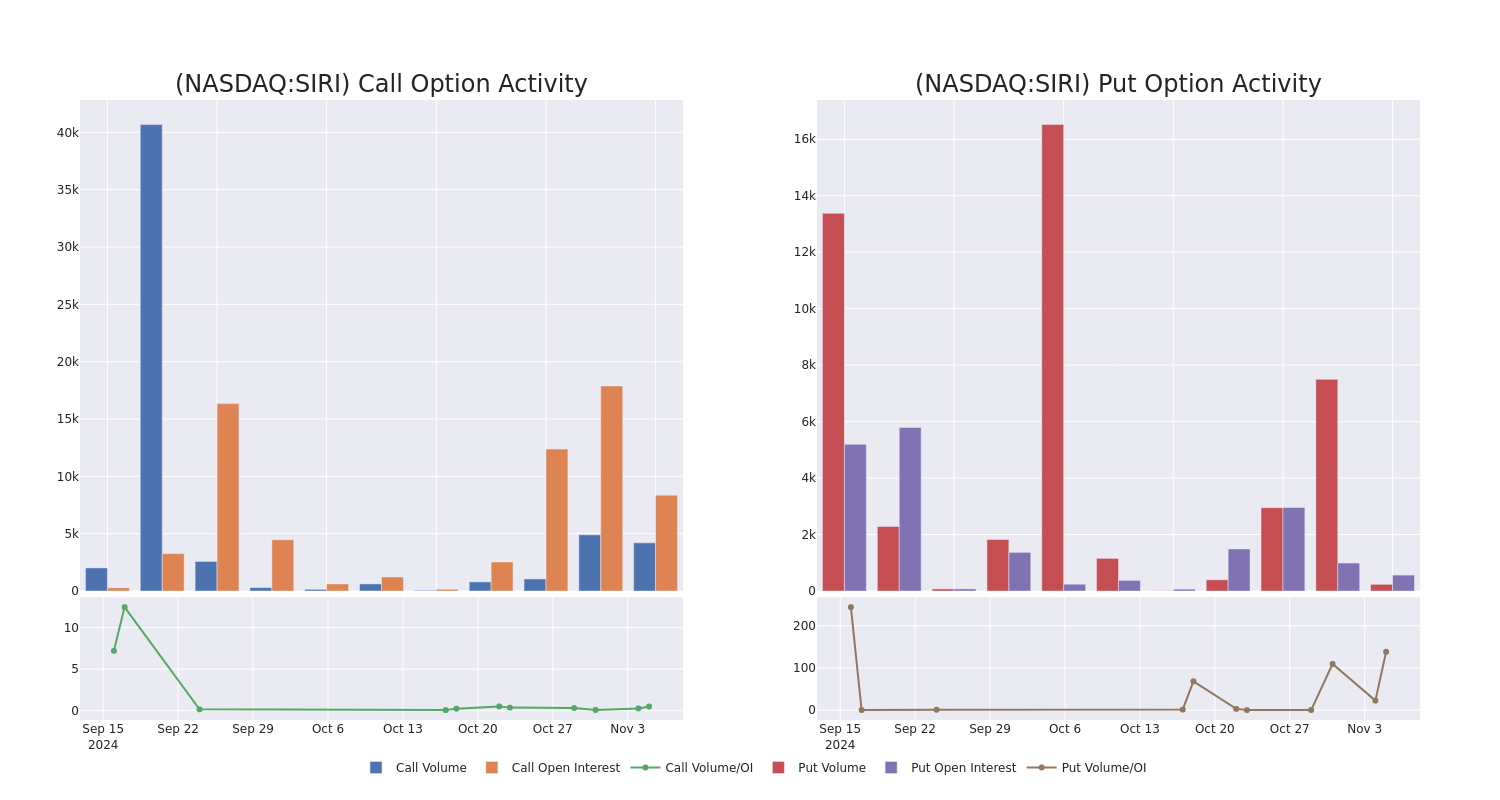

Deep-pocketed investors have adopted a bearish approach towards Sirius XM Holdings SIRI, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SIRI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Sirius XM Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 44% bearish. Among these notable options, 2 are puts, totaling $73,900, and 7 are calls, amounting to $1,172,700.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $23.0 and $28.0 for Sirius XM Holdings, spanning the last three months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sirius XM Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sirius XM Holdings’s significant trades, within a strike price range of $23.0 to $28.0, over the past month.

Sirius XM Holdings Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SIRI | CALL | TRADE | NEUTRAL | 06/20/25 | $4.3 | $3.8 | $4.02 | $25.00 | $1.0M | 71 | 2.5K |

| SIRI | PUT | SWEEP | BEARISH | 06/20/25 | $3.5 | $3.2 | $3.5 | $26.00 | $46.2K | 1 | 138 |

| SIRI | CALL | TRADE | BULLISH | 01/17/25 | $3.9 | $3.9 | $3.9 | $23.00 | $31.2K | 7.8K | 109 |

| SIRI | CALL | TRADE | BULLISH | 01/17/25 | $4.1 | $4.05 | $4.1 | $23.00 | $28.7K | 7.8K | 229 |

| SIRI | PUT | SWEEP | BULLISH | 12/20/24 | $2.84 | $2.77 | $2.77 | $28.00 | $27.7K | 564 | 100 |

About Sirius XM Holdings

Sirius XM operates almost exclusively in the US through its SiriusXM and Pandora audio services. SiriusXM is primarily a satellite radio service, which offers nationwide coverage and mostly ad-free listening, with proprietary channels and exclusive content. It makes agreements with automakers to install its radios in vehicles and give trial services to vehicle buyers, which have traditionally fed its subscriber base. The company operates the service through a handful of geostationary satellites that it owns and operates, but it now offers a streaming SiriusXM option as well. Pandora, which makes up a much smaller portion of revenue and profit, offers a subscription and ad-supported streaming music service that competes with industry giants like Spotify, Apple Music, and YouTube Music.

Where Is Sirius XM Holdings Standing Right Now?

- With a volume of 2,023,037, the price of SIRI is down -2.98% at $26.83.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 86 days.

Expert Opinions on Sirius XM Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $33.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Pivotal Research persists with their Buy rating on Sirius XM Holdings, maintaining a target price of $37.

* An analyst from B of A Securities downgraded its action to Underperform with a price target of $23.

* An analyst from Barrington Research persists with their Outperform rating on Sirius XM Holdings, maintaining a target price of $40.

* An analyst from Benchmark downgraded its action to Buy with a price target of $43.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Sirius XM Holdings with a target price of $23.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Sirius XM Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lithium Argentina Reports Third Quarter 2024 Results

VANCOUVER, British Columbia, Nov. 05, 2024 (GLOBE NEWSWIRE) — Lithium Americas (Argentina) Corp. (“Lithium Argentina,” the “Company,” or “LAAC“) LAAC LAAC, today announced its third quarter results.

“During the quarter, we were pleased to close the Pastos Grandes transaction with our strategic partner, Ganfeng,” commented Sam Pigott, President and CEO. “Proceeds from the transaction, in addition to funds from Ganfeng, resulted in an over $100 million reduction in debt at Caucharí-Olaroz. We are still advancing financing options to replace the remaining short-term debt at the project and provide additional flexibility to support our future growth plans.”

Mr. Pigott continued by saying, “The operations at Caucharí-Olaroz continues to progress well during the third quarter as production volumes reached about 6,800 tonnes, a 21% increase compared to the second quarter of the year. Production is currently operating at approximately 75-80% of design capacity with a focus on sustaining higher production levels. It is expected that these production levels will be maintained through the end of the year and into 2025. Consequently, we still expect production volumes for 2024 to fall within our previous estimate of 20,000 – 25,000 tonnes this year.”

He closed by saying, “Our focus remains on optimizing operations and decreasing our costs. We are committed to delivering value and will continue to monitor market conditions closely as we evaluate our expansion plans and work towards our long-term goals.”

Highlights

Operational Highlights at Caucharí-Olaroz

- During the three months ended September 30, 2024, Caucharí-Olaroz produced approximately 6,800 tonnes of lithium carbonate, up 21% from the second quarter of 2024.

- Caucharí-Olaroz is currently operating at approximately 75 – 80% of the design capacity of 40,000 tonnes per year and is expected to maintain this level of production during the fourth quarter of 2024 and into 2025.

- In October 2024, Caucharí-Olaroz achieved commercial production after reaching elevated production levels for a sustained period of time. As a result, depreciation of certain capital assets will begin in the fourth quarter of 2024.

- Production guidance of 20,000 – 25,000 tonnes of lithium carbonate in 2024 remains unchanged.

- Production continues to be sold primarily to Ganfeng Lithium Co. Ltd. (“Ganfeng“) with realized price of approximately $8,000 per tonne during the three months ended September 30, 2024.

- During the ramp-up, realized pricing is based on China battery-grade price adjusted for Chinese value added taxes (“VAT“) and other deductions related to the removal of trace levels of impurities to achieve battery quality lithium carbonate.

- As a result of lower levels of impurities, beginning in September 2024, this price deduction for additional processing costs, was adjusted from $2,000 to $1,500 per tonne.

- Since the end of the third quarter of 2024, lithium prices have declined further with the most recent realized price for Caucharí-Olaroz at approximately $7,000 per tonne.

Financial and Corporate Highlights

- As of September 30, 2024, Lithium Argentina had $92 million in cash and cash equivalents and maintained its undrawn $75 million credit facility with Ganfeng.

- As of September 30, 2024, Minera Exar S.A. (“Exar“) had, on a 100% basis, approximately $202 million of US dollar and US dollar-linked debt at the official FX rate.

- During the third quarter of 2024, Ganfeng and Lithium Argentina contributed funds to Exar to reduce its leverage by over $110 million.

- Ganfeng and the Company continue to advance financing options to replace short-term debt with longer-term financing for Exar.

- In August 2024, Ganfeng Lithium acquired $70 million in newly issued shares of Proyecto Pastos Grandes S.A. (“PGCo“), the Company’s Argentinian subsidiary holding the Pastos Grandes project (“Pastos Grandes“) in Salta, Argentina, representing a 14.9% interest in Pastos Grandes (the “Pastos Grandes Transaction“).

INVESTOR WEBCAST

______________

AN INVESTOR WEBCAST HAS BEEN SCHEDULED FOR 10:00am ET ON WEDNESDAY, NOVEMBER 6, 2024.

Please use the following link to access:

Third Quarter 2024 Results Webcast

FINANCIAL RESULTS

Selected consolidated financial information is presented as follows:

| (in US$ million except per share information) | Quarter ended September 30, | |

| 2024 | 2023 | |

| $ | $ | |

| Expenses | (8.8) | (9.0) |

| Net (loss)/income | (2.4) | 6.6 |

| (Loss)/income per share – basic | (0.01) | 0.04 |

| (Loss)/income per share – diluted | (0.01) | 0.04 |

| (in US$ million) | As at September 30, 2024 |

As at December 31, 2023 |

| $ | $ | |

| Cash and cash equivalents | 92.3 | 122.3 |

| Total assets | 1,121.8 | 1,055.0 |

| Total liabilities | (228.1) | (226.1) |

In Q3 2024, the Company completed the Pastos Grandes Transaction, resulting in PGCo issuing common shares that represent approximately 14.9% of its equity to Ganfeng for a consideration of $70 million. This transaction allowed the Company to retain control of PGCo and has been accounted for as an equity transaction. Subsequently, PGCo entered into a loan facility agreement with Minera Exar, advancing a $65.0 million loan funded by the proceeds from the Pastos Grandes transaction. These funds supported refinancing of the current debt and working capital and other requirements for the Caucharí-Olaroz project. Total liabilities increased due to accrued interest on convertible senior notes issued by the Company in 2021 and an increase in payables to Minera Exar for lithium carbonate purchases.

In Q3 2024, net loss was $2.4 million compared to a gain of $6.6 million in the comparative period, mainly due to lower gain on change in fair value of the convertible notes derivative liability as a result of insignificant change in the Company’s share price in Q3 2024.

This news release should be read in conjunction with Lithium Argentina’s condensed consolidated interim financial statements and management’s discussion and analysis for the nine months ended September 30, 2024, which are available on SEDAR+. All amounts are in U.S. dollars unless otherwise indicated.

ABOUT LITHIUM ARGENTINA

Lithium Argentina is an emerging producer of lithium carbonate for use primarily in lithium-ion batteries and electric vehicles. The Company, in partnership with Ganfeng Lithium Co, Ltd., is ramping up production of the Caucharí-Olaroz lithium brine operation in Argentina and advancing development of additional lithium resources in the region. Lithium Argentina currently trades on the TSX and on the NYSE, under the ticker symbol “LAAC.”

For further information contact:

Investor Relations

Telephone: +54-11-52630616

Email: Kelly.obrien@lithium-argentina.com

Website: www.lithium-argentina.com

TECHNICAL INFORMATION

The Technical Information in this news release with respect to Caucharí-Olaroz, has been reviewed and approved by Ernest Burga, P.Eng., a Qualified Person as defined by National Instrument 43-101 independent of the Company.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward-looking information”). These statements relate to future events or the Company’s future performance. All statements, other than statements of historical fact, may be forward-looking information. Forward-looking information generally can be identified by the use of words such as “seek,” “anticipate,” “plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,” “predict,” “propose,” “potential,” “targeting,” “intend,” “could,” “might,” “should,” “believe” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information.

In particular, this news release contains forward-looking information, including, without limitation, with respect to the following matters or the Company’s expectations relating to such matters: future financing plans, including the replacement and refinancing of debt at Exar and Caucharí-Olaroz; 2024 and 2025 expected production for the Caucharí-Olaroz project; goals of the Company; development of the Caucharí-Olaroz project, including timing of the ramp up in production capacity and product qualityand use of proceeds from the Pastos Grandes transaction.

Forward-looking information does not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward-looking information contained in this news release is based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, including but not limited to those related to: current technological trends; a cordial business relationship between the Company and third party strategic and contractual partners, including the co-owners of the Caucharí-Olaroz project; ability of the Company to fund, advance, develop and ramp up the Caucharí-Olaroz project, the impacts of the project when full production commences; ability of the Company to advance and develop the Pastos Grandes and Sal de la Puna projects; the Company’s ability to operate in a safe and effective manner; uncertainties relating to receiving and maintaining mining, exploration, environmental and other permits or approvals in Argentina; demand for lithium, including that such demand is supported by growth in the electric vehicle market; the impact of increasing competition in the lithium business, and the Company’s competitive position in the industry; general economic, geopolitical, and political conditions; the stable and supportive legislative, regulatory and community environment in the jurisdictions where the Company operates; regulatory, and political matters that may influence or be influenced by future events or conditions; local and global political and economic conditions; governmental and regulatory requirements and actions by governmental authorities, including changes in government policies; stability and inflation of the Argentine peso, including any foreign exchange or capital controls which may be enacted in respect thereof, and the effect of current or any additional regulations on the Company’s operations; the impact of unknown financial contingencies, including litigation costs, on the Company’s operations; gains or losses, in each case, if any, from short-term investments in Argentine bonds and equities; estimates of and unpredictable changes to the market prices for lithium products; development and ramp up costs for the Caucharí-Olaroz project, and costs for any additional exploration work at the projects; uncertainties inherent to estimates of Mineral Resources and Mineral Reserves, including whether Mineral Resources not included in Mineral Reserves will be further developed into Mineral Reserves; reliability of technical data; anticipated timing and results of exploration, development and construction activities; discretion in the use of proceeds of certain financing activities; the Company’s ability to obtain additional financing on satisfactory terms or at all; the ability to develop and achieve production at any of the Company’s mineral exploration and development properties; the impacts of pandemics and geopolitical issues on the Company’s business; the impact of inflationary and other conditions on the Company’s business and global markets; and accuracy of development budget and construction estimates. Many of these expectations, assumptions, risk and uncertainties are beyond the Company’s control and could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information.

Although the Company believes that the assumptions and expectations reflected in such forward-looking information are reasonable, the Company can give no assurance that these assumptions and expectations will prove to be correct. Since forward-looking information inherently involves risks and uncertainties, undue reliance should not be placed on such information. The Company’s actual results could differ materially from those anticipated in any forward-looking information as a result of the risk factors set out herein and, in the Company’s latest annual information form (“AIF“), management information circular, management discussion & analysis and other publicly filed documents (collectively, the “Company Public Disclosure“) all of which are available on SEDAR+.

All forward-looking information contained in this news release is expressly qualified by the risk factors set out in the latest Company Public Disclosures. Such risks include, but are not limited to the following: lithium prices; inability to obtain required governmental permits and government-imposed limitations on operations; technology risk; political risk associated with foreign operations, including co-ownership arrangements with foreign domiciled partners; risks arising from the outbreak of hostilities in Ukraine, Israel, the Middel East and other parts of the world and the international response, including but not limited to their impact on commodity markets, supply chains, equipment and construction; emerging and developing market risks; risks associated with not having production experience; operational risks; changes in government regulations; changes to environmental requirements; failure to obtain or maintain necessary licenses, permits or approvals; insurance risk; receipt and security of mineral property titles and mineral tenure risk; changes in project parameters as plans continue to be refined; changes in legislation, governmental or community policy; regulatory risks with respect to strategic minerals; mining industry competition; market risk; volatility in global financial conditions; uncertainties associated with estimating Mineral Resources and Mineral Reserves, including uncertainties relating to the assumptions underlying Mineral Resource and Mineral Reserve estimates; risks related to unknown financial contingencies, including litigation costs, on the Company’s operations; unanticipated results of exploration activities; cybersecurity risks and threats; and uncertainties with obtaining required approvals (including regulatory approvals). Such risk factors are not exhaustive. The Company does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking information contained in this news release is expressly qualified in its entirety by this cautionary statement. Additional information about the above-noted assumptions, risks and uncertainties is contained in the Company Public Disclosures, which are available on SEDAR+ at www.sedarplus.ca.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Helen Shan Sees Potential Growth And Acquires In FactSet Research Systems Stock Options

In a recent SEC filing, it was disclosed that Helen Shan, EVP at FactSet Research Systems FDS, made a noteworthy acquisition of company stock options on November 4,.

What Happened: Disclosed in a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, Shan, EVP at FactSet Research Systems, made a strategic derivative acquisition. This involved acquiring stock options for 6,762 shares of FDS, providing the right to buy the company’s stock at an exercise price of $458.8 per share.

FactSet Research Systems shares are trading, exhibiting down of 0.12% and priced at $461.26 during Tuesday’s morning. This values Shan’s 6,762 shares at $16,634.

Discovering FactSet Research Systems: A Closer Look

FactSet provides financial data and portfolio analytics to the global investment community. The company aggregates data from third-party data suppliers, news sources, exchanges, brokerages, and contributors into its workstations. In addition, it provides essential portfolio analytics that companies use to monitor portfolios and address reporting requirements. Buy-side clients (including wealth and corporate clients) account for 82% of FactSet’s annual subscription value. In 2015, the company acquired Portware, a provider of trade execution software. In 2017, it acquired BISAM, a risk management and performance measurement provider. In 2022, it completed its purchase of CUSIP Global Services.

Breaking Down FactSet Research Systems’s Financial Performance

Revenue Growth: FactSet Research Systems displayed positive results in 3 months. As of 31 August, 2024, the company achieved a solid revenue growth rate of approximately 4.93%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 54.07%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): FactSet Research Systems’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 2.35.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.82, caution is advised due to increased financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 33.2 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 8.1 is lower than the industry average, implying a discounted valuation for FactSet Research Systems’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 21.34, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Essential Transaction Codes Unveiled

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of FactSet Research Systems’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

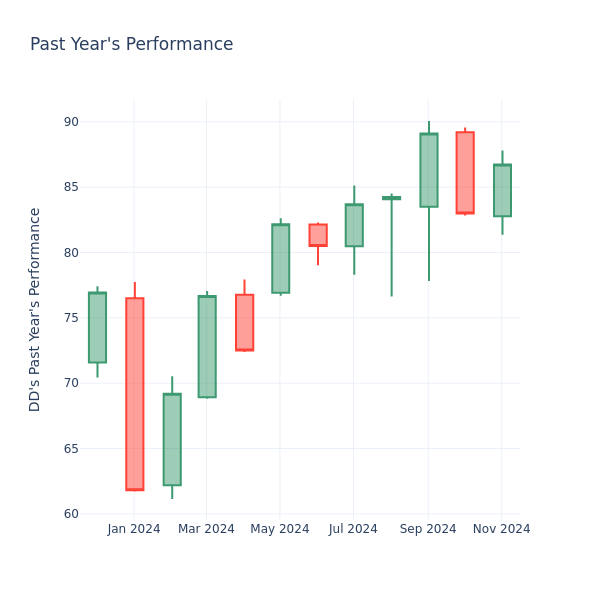

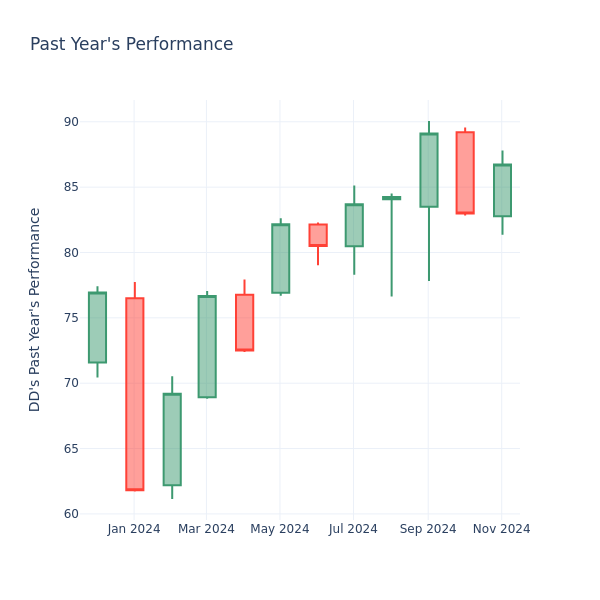

Price Over Earnings Overview: DuPont de Nemours

In the current session, the stock is trading at $86.86, after a 6.12% spike. Over the past month, DuPont de Nemours Inc. DD stock increased by 2.65%, and in the past year, by 26.77%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Comparing DuPont de Nemours P/E Against Its Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

DuPont de Nemours has a better P/E ratio of 104.94 than the aggregate P/E ratio of 47.08 of the Chemicals industry. Ideally, one might believe that DuPont de Nemours Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BOARDWALK REIT REPORTS STRONG RESULTS FOR Q3 2024 – DEMAND FOR AFFORDABLE HOUSING REMAINS HIGH

CALGARY, AB, Nov. 5, 2024 /PRNewswire/ – Boardwalk Real Estate Investment Trust BEI

SUMMARY HIGHLIGHTS FOR THE THREE AND NINE MONTH PERIODS ENDED SEPTEMBER 30, 2024

- STRONG FINANCIAL PERFORMANCE

FOR THE 3 MONTH PERIOD ENDED SEPTEMBER 30, 2024

-

- Funds From Operations (“FFO”) of $1.11 per Unit(1)(2); an increase of 15.6% from Q3 2023

- Profit of $55.4 million

- Net Operating Income (“NOI”) of $100.2 million; an increase of 15.6% from Q3 2023

- Same Property(3) Net Operating Income (“Same Property NOI”) of $99.2 million; an increase of 13.5% from Q3 2023

- Operating Margin of 65.3%; 260 basis point (bps) improvement from Q3 2023

FOR THE 9 MONTH PERIOD ENDED SEPTEMBER 30, 2024

-

- FFO of $3.10 per Unit(1)(2); an increase of 17.4% from the same period a year ago

- Profit of $522.3 million

- NOI of $283.3 million; an increase of 15.6% from the same period a year ago

- Same Property Net Operating Income (“Same Property NOI”) of $282.4 million; an increase of 13.7% from the same period in the prior year

- Operating Margin of 63.3%; 260 basis point (bps) improvement from the same period in the prior year

- SAME PROPERTY RENTAL REVENUE GROWTH IN Q3 2024

- Q3 2024 same property sequential quarterly rental revenue growth of 2.6% from the prior quarter

- Q3 2024 same property rental revenue growth of 9.5% from a year ago

- Occupancy of 98.6% in Q3 2024; an increase of 18 basis points from Q3 2023

- AFFORDABLE HOUSING REMAINS IN HIGH DEMAND

- Rents in Alberta remain some of the most affordable amongst major cities in Canada

- Occupied rent of $1,493 in September of 2024, a $105 improvement from December 2023

- November 2024 preliminary occupancy of 98.0%

- New leasing spreads of 10.4% in Alberta in September 2024

- Renewal leasing spreads of 8.4% in Alberta in September 2024

- STRONG AND FLEXIBLE BALANCE SHEET

- Approximately $413.7 million of total available liquidity at the end of the quarter

- 96% of Boardwalk’s mortgages carry CMHC-insurance

- Unitholders’ Equity of $4.8 billion

- Fair value capitalization rate of 5.09%, an increase of 4 bps from Q4 2023

- Net Asset Value increase to $94.64 per Unit(1)(2), primarily a result of higher market rental rates in the Trust’s non-price controlled markets

- Debt to EBITDA(1) of 10.31x, compared to 11.02x for the year ended December 31, 2023

- Debt to Total Assets(1) of 40.1%, compared to 43.2% for the year-ended December 31, 2023

- UPDATE TO 2024 FINANCIAL GUIDANCE

- Revised FFO range of $4.15 to $4.23 per Unit(1)(2)

- Same Property NOI growth range of +12.5% to +14.5%

- DISTRIBUTION OF $1.44 PER TRUST UNIT ON AN ANNUALIZED BASIS CONFIRMED FOR THE MONTHS OF DECEMBER 2024, JANUARY 2025, AND FEBRUARY 2025

|

(1) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(2) Boardwalk REIT’s units (the “Trust Units”) trade on the Toronto Stock Exchange (“TSX”) under the trading symbol ‘BEI.UN’. Additionally, the Trust has 4,475,000 special voting units issued to holders of “Class B Units” of Boardwalk REIT Limited Partnership (“LP Class B Units” and, together with the Trust Units, the “Units”), each of which also has a special voting unit in the REIT. |

|

(3) Same property figures exclude properties which have been owned for less than 24 months and sold assets. |

Boardwalk Real Estate Investment Trust (“Boardwalk”, the “REIT” or the “Trust”) today announced its financial results for the third quarter of 2024.

Sam Kolias; Chairman and Chief Executive Officer of Boardwalk REIT commented:

“We are pleased to report on another very strong quarter with significant growth in Net Operating Income and Funds From Operations per Unit. Our FFO per Unit of $1.11 during the third quarter represents an improvement of 15.6% from the prior year. We continue to make progress on improving our balance sheet as our cash flows improve and we de-lever organically, providing greater flexibility to compound growth further through the Trust’s value add capital program and accretive external growth opportunities. Occupied rents in the Trust’s largest market of Edmonton remain amongst the most affordable compared to asking rents in major centers in Canada and household incomes.

We remain focused on delivering a sustainable win-win outcome for all members of our Boardwalk Family Forever, which includes our Resident Members, Associates, Investors, external partners and other stakeholders. We are truly better together and we would like to thank all of our stakeholders who are instrumental in creating the best communities where love always lives.

We continue to work collaboratively with our community and policymakers and welcome the opportunity to further advance the best solutions for affordable housing for Canadians. As housing affordability over the last several years has become more challenging, Boardwalk remains committed to the long-term sustainability of our communities through our strategic self-moderation of positive rent adjustments. Recently, the federal government released its 2025-2027 Immigration Levels Plan, aimed to better balance population growth to more sustainable levels when looked at over a longer period of time. Relative to other provinces, Alberta is expected to be less impacted by the new Immigration Levels Plan due to its strong interprovincial migration and lower concentration of non-permanent residents as a percentage of the population.

Across various cycles, we have seen consistent demand for affordable housing. Our repositioning investments in many of our communities, and Resident Member-focused approach and proven platform positions us well to continue as the community provider of choice for Canadians. As we look forward, we remain confident in continuing our track record of delivering strong results for our Boardwalk Family Forever.”

THIRD QUARTER FINANCIAL HIGHLIGHTS

|

$ millions, except per Unit amounts |

||||||

|

Highlights of the Trust’s Third Quarter 2024 Financial Results |

||||||

|

3 Months |

3 Months |

% Change |

9 Months |

9 Months |

% Change |

|

|

Operational Highlights |

||||||

|

Rental Revenue |

$153.4 |

$138.3 |

11.0 % |

$447.7 |

$403.8 |

10.9 % |

|

Same Property Rental Revenue |

$150.1 |

$137.1 |

9.5 % |

$439.4 |

$401.4 |

9.5 % |

|

Net Operating Income (“NOI”) |

$100.2 |

$86.6 |

15.6 % |

$283.3 |

$245.0 |

15.6 % |

|

Same Property NOI |

$99.2 |

$87.5 |

13.5 % |

$282.4 |

$248.4 |

13.7 % |

|

Operating Margin (1) |

65.3 % |

62.7 % |

63.3 % |

60.7 % |

||

|

Same Property Operating Margin |

66.1 % |

63.8 % |

64.3 % |

61.9 % |

||

|

Financial Highlights |

||||||

|

Funds From Operations (“FFO”) (2)(3) |

$60.2 |

$48.3 |

24.7 % |

$167.3 |

$132.5 |

26.3 % |

|

Adjusted Funds From Operations (“AFFO”) (2)(3) |

$51.6 |

$40.4 |

27.7 % |

$141.5 |

$108.9 |

30.0 % |

|

Profit |

$55.4 |

$39.4 |

40.6 % |

$522.3 |

$493.0 |

5.9 % |

|

FFO per Unit (3) |

$1.11 |

$0.96 |

15.6 % |

$3.10 |

$2.64 |

17.4 % |

|

AFFO per Unit (3) |

$0.95 |

$0.80 |

18.8 % |

$2.62 |

$2.17 |

20.7 % |

|

Regular Distributions Declared (Trust Units & LP Class B |

$19.4 |

$14.7 |

32.1 % |

$55.8 |

$43.3 |

28.8 % |

|

Regular Distributions Declared Per Unit (Trust Units & LP |

$0.360 |

$0.293 |

22.9 % |

$1.035 |

$0.863 |

19.9 % |

|

FFO Payout Ratio (3) |

32.2 % |

30.4 % |

33.3 % |

32.7 % |

||

|

Same Property Apartment Suites |

33,722 |

33,264 |

||||

|

Non-Same Property Apartment Suites (4) |

671 |

582 |

||||

|

Total Apartment Suites |

34,393 |

33,846 |

||||

|

(1) Operating margin is calculated by dividing NOI by rental revenue allowing management to assess the percentage of rental revenue which generated profit. |

|

(2) This is a non-GAAP financial measure. |

|

(3) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(4) Includes 183 suites related to the Trust’s joint venture in Brampton, Ontario which is accounted for as an equity accounted investment. |

In Q3 2024, same property operating margin increased compared to the same period in the prior year as the Trust’s same property rental revenue growth remained strong. The Trust anticipates further improvement in its operating margin throughout the remainder of 2024 as a result of continued strong revenue growth and execution of various cost containment initiatives.

|

Continued Highlights of the Trust’s Third Quarter 2024 Financial Results |

||||||

|

Sep. 30, |

Dec. 31, |

|||||

|

Equity |

||||||

|

Unitholders’ equity |

$4,794,944 |

$4,320,072 |

||||

|

Net Asset Value |

||||||

|

Net asset value (1)(2) |

$5,112,367 |

$4,553,515 |

||||

|

Net asset value (“NAV”) per Unit (2) |

$94.64 |

$84.41 |

||||

|

Liquidity, Debt and Distributions |

||||||

|

Cash and cash equivalents |

$107,618 |

|||||

|

Subsequent committed/funded financing |

$60,300 |

|||||

|

Unused credit facilities |

$245,800 |

|||||

|

Total Available Liquidity |

$413,718 |

|||||

|

Total mortgage principal outstanding |

$3,389,969 |

$3,446,801 |

||||

|

Debt to EBITDA(1)(2) |

10.31 |

11.02 |

||||

|

Debt to Total Assets(1)(2) |

40.1 % |

43.2 % |

||||

|

Interest Coverage Ratio (Rolling 4 quarters) |

2.91 |

2.83 |

||||

|

(1) This is a non-GAAP financial measure. |

|

(2) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

The Trust’s fair value of its investment properties as at September 30, 2024 increased from year end, primarily attributable to an increase in market rents driven by strong market conditions. The Trust’s stabilized capitalization rate (“Cap Rate”) of 5.09% for Q3 2024 remained the same as the prior quarter. The Cap Rate ranges utilized continue to be in line with recently published third party quarterly Cap Rate reports.

SOLID OPERATIONAL RESULTS

|

Portfolio Highlights for the Third Quarter of 2024 |

||||||

|

Sep-24 |

Sep-23 |

|||||

|

Average Occupancy (Quarter Average) (1) |

98.63 |

% |

98.45 |

% |

||

|

Average Monthly Rent (Period Ended) |

$ |

1,472 |

$ |

1,340 |

||

|

Average Market Rent (Period Ended) (2) |

$ |

1,644 |

$ |

1,534 |

||

|

Average Occupied Rent (Period Ended) (3) |

$ |

1,493 |

$ |

1,357 |

||

|

Mark-to-Market Revenue Gain (Period Ended) ($ millions) |

$ |

60.2 |

$ |

70.0 |

||

|

Mark-to-Market Revenue Gain Per Unit (Period Ended) |

$ |

1.11 |

$ |

1.39 |

||

|

(1)Average occupancy is adjusted to be on a same property basis. |

|

(2)Market rent is a component of rental revenue and is calculated as of the first day of each month as the average rental revenue amount a willing landlord might reasonably expect to receive, and a willing tenant might reasonably expect to pay, for a tenancy, before adjustments for other rental revenue items such as incentives, vacancy loss, fees, specific recoveries, and revenue from commercial tenants. |

|

(3)Occupied rent is a component of rental revenue and is calculated for occupied suites as of the first day of each month as the average rental revenue, adjusted for other rental revenue items such as fees, specific recoveries, and revenue from commercial tenants. |

|

Oct-23 |

Nov-23 |

Dec-23 |

Jan-24 |

Feb-24 |

Mar-24 |

Apr-24 |

May-24 |

Jun-24 |

Jul-24 |

Aug-24 |

Sep-24 |

Oct-24 |

Nov-24 |

|

|

Same Property |

98.9 % |

98.9 % |

99.0 % |

99.0 % |

98.8 % |

98.8 % |

98.8 % |

98.6 % |

98.6 % |

98.6 % |

98.7 % |

98.4 % |

98.1 % |

98.0 % |

The Trust retained high occupancy during Q3 2024 by focusing on retention and by leveraging its vertically-integrated operating platform to limit time to complete unit turnovers. Positive market rent adjustments were implemented in some communities where rental market fundamentals were strong during the high volume summer leasing season. Average occupied rent increased sequentially, and when compared to the same period a year ago, as the Trust focuses on reducing or eliminating incentives on lease renewals, leasing at market rents for new leases and adjusting market rents in communities where appropriate.

For the third quarter of 2024, same property rental revenue increased 9.5% while same property total rental expense increased by 2.6%, resulting in same property NOI growth of 13.5% in comparison to the same quarter prior year. Same property rental expenses increased primarily due to higher wages and salaries and repairs and maintenance from inflation and higher property taxes.

During the third quarter of 2024, lower incentives along with positive market rent adjustments and lower utilities from water restrictions that were in effect from the City of Calgary, supported Boardwalk’s Calgary portfolio increase in same property NOI of 16.6% in comparison to the same quarter prior year. The positive revenue growth was partially offset by an increase in wages and salaries and repairs and maintenance costs.

In Edmonton, NOI growth was 15.6% for the third quarter of 2024 compared to the same period in the prior year. The overall growth was driven by lower vacancy loss and incentives, and higher market rents. The overall positive increase was partially offset by higher wages and salaries, utilities, building repairs and maintenance costs, and property taxes.

Saskatchewan’s market continues to be strong with the Trust’s portfolio in the region realizing 15.9% same property NOI growth in the third quarter of 2024 versus the same period last year, as a result of strong same property revenue growth due to lower incentives as well as market rent increases, partially offset by higher wages and salaries, building repairs and maintenance, and property taxes.

In Ontario, NOI growth was 7.7% in the third quarter of 2024 compared to the third quarter of 2023. The mark-to-market opportunity on turnover contributed to same property rental revenue growth of 6.4%, which was partially offset by increases in wages and salaries, building repairs and maintenance costs, bad debts expense, and property taxes.

In Quebec, NOI growth was 6.6% compared to the same quarter in the prior year. The overall growth was driven by increases in occupied rents along with higher occupancy rates, as well as lower insurance premiums relative to the previous year.

In British Columbia, higher market rents compared to the prior year, and a same property total rental expense decrease of 5.0%, resulted in same property NOI growth of 7.7% in the third quarter of 2024 compared to the third quarter of 2023.

As shown in our updated guidance further in this release, Boardwalk remains well positioned for continued revenue growth and NOI growth in 2024.

|

Same Property Sep. 30 2024 – 3 M |

# of Suites |

% Rental |

% Total Rental |

% Net Operating |

% of NOI |

||||||||||

|

Edmonton |

12,882 |

10.7 |

% |

3.4 |

% |

15.6 |

% |

35.0 |

% |

||||||

|

Calgary |

6,266 |

10.5 |

% |

(2.8) |

% |

16.6 |

% |

24.6 |

% |

||||||

|

Other Alberta |

1,936 |

11.1 |

% |

7.6 |

% |

13.2 |

% |

4.9 |

% |

||||||

|

Alberta |

21,084 |

10.6 |

% |

1.9 |

% |

15.8 |

% |

64.5 |

% |

||||||

|

Quebec |

6,000 |

5.7 |

% |

4.0 |

% |

6.6 |

% |

16.6 |

% |

||||||

|

Saskatchewan |

3,505 |

11.3 |

% |

3.1 |

% |

15.9 |

% |

10.8 |

% |

||||||

|

Ontario |

3,019 |

6.4 |

% |

4.5 |

% |

7.7 |

% |

7.5 |

% |

||||||

|

British Columbia |

114 |

5.0 |

% |

(5.0) |

% |

7.7 |

% |

0.6 |

% |

||||||

|

33,722 |

9.5 |

% |

2.6 |

% |

13.5 |

% |

100.0 |

% |

|||||||

|

Same Property Sep. 30 2024 – 9 M |

# of Suites |

% Rental |

% Total Rental |

% Net Operating |

% of NOI |

||||||||||

|

Edmonton |

12,882 |

10.7 |

% |

3.3 |

% |

16.2 |

% |

34.7 |

% |

||||||

|

Calgary |

6,266 |

11.1 |

% |

1.9 |

% |

15.7 |

% |

24.4 |

% |

||||||

|

Other Alberta |

1,936 |

10.9 |

% |

0.8 |

% |

18.2 |

% |

4.9 |

% |

||||||

|

Alberta |

21,084 |

10.9 |

% |

2.7 |

% |

16.1 |

% |

64.1 |

% |

||||||

|

Quebec |

6,000 |

5.8 |

% |

2.6 |

% |

7.4 |

% |

16.7 |

% |

||||||

|

Saskatchewan |

3,505 |

10.2 |

% |

0.4 |

% |

16.2 |

% |

10.9 |

% |

||||||

|

Ontario |

3,019 |

5.7 |

% |

5.8 |

% |

5.6 |

% |

7.8 |

% |

||||||

|

British Columbia |

114 |

4.8 |

% |

(6.4) |

% |

7.8 |

% |

0.6 |

% |

||||||

|

33,722 |

9.5 |

% |

2.6 |

% |

13.7 |

% |

100.0 |

% |

|||||||

STRONG LIQUIDITY POSITION

In the third quarter of 2024, Boardwalk renewed $25.6 million of its maturing mortgages at a weighted average interest rate of 4.19% while extending the term of these mortgages by an average of 5.1 years.

For the remainder of 2024, the Trust anticipates $186.6 million of mortgages payable maturing with an average in-place interest rate of 3.14% and will continue to renew these mortgages as they mature. Current market 5 and 10-year CMHC financing rates are estimated to be approximately 3.70% and 4.10%, respectively. To date, the Trust has renewed or forward-locked the interest rate on $352.8 million or 81.4% of its maturing mortgages in 2024 at an average interest rate of 4.29% and an average term of 5.8 years. The Trust remains well positioned with a laddered maturity schedule within its mortgage program, a disciplined capital allocation program and continued use of CMHC funding, which decreases the renewal risk on its existing mortgages.

UPDATE TO 2024 FINANCIAL GUIDANCE

Boardwalk’s current outlook for the remainder of 2024 is for ongoing growth across its portfolio as demand for affordable multi-family housing remains strong. The Trust anticipates outsized revenue and NOI growth in its non-price-controlled markets on a year-over-year basis, as a result of strong performance year-to-date and ongoing positive leasing spreads throughout the remainder of 2024. The Trust’s consistent revenue and disciplined operating cost control performance through the first three quarters of 2024 provides for an increase to the bottom end and tightening of its guidance range for the year as follows:

|

Q3 2024 Revised |

2024 Previous Guidance

|

2023 Actual

|

||

|

Same Property NOI Growth |

12.5% to 14.5% |

12.5% to 14.5% |

13.7 % |

|

|

Profit |

N/A |

N/A |

$666,099 |

|

|

FFO (1)(2) |

N/A |

N/A |

$181,353 |

|

|

AFFO (1)(2)(3) |

N/A |

N/A |

$149,098 |

|

|

FFO Per Unit (2) |

$4.15 to $4.23 |

$4.11 to $4.23 |

$3.60 |

|

|

AFFO Per Unit (2)(3) |

$3.52 to $3.60 |

$3.48 to $3.60 |

$2.96 |

|

|

(1) |

This is a non-GAAP financial measure. |

|

(2) |

Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(3) |

Utilizing a Maintenance CAPEX expenditure of $1,003/suite/year in 2024 and $953/suite/year in 2023. |

The reader is cautioned that this information is forward-looking and actual results may vary from those forecasted. The Trust reviews the assumptions used to derive its forecast quarterly, and based on this review, may adjust its outlook accordingly.

THIRD QUARTER REGULAR MONTHLY DISTRIBUTION ANNOUNCEMENT

The Trust has confirmed its monthly cash distribution for the months of December 2024, January 2025, and February 2025 as follows:

|

Month |

Per Unit |

Annualized |

Record Date |

Distribution Date |

||||

|

December 2024 |

$ |

0.1200 |

$ |

1.44 |

31-Dec-24 |

15-Jan-25 |

||

|

January 2025 |

$ |

0.1200 |

$ |

1.44 |

31-Jan-25 |

17-Feb-25 |

||

|

February 2025 |

$ |

0.1200 |

$ |

1.44 |

28-Feb-25 |

17-Mar-25 |

||

In line with Boardwalk’s distribution policy of maximum re-investment, the Trust’s payout ratio remains conservative at 32.2% of Q3 2024 FFO; and 32.8% of the last 12 months FFO.

Boardwalk’s regular monthly distribution provides a stable and attractive yield for the Trust’s Unitholders.

ESG REPORT

The Trust is committed to environmental, social and governance (“ESG”) objectives and initiatives, including working towards reducing greenhouse gas emissions and electricity and natural gas consumption, water conservation, waste minimization, and a continued focus on governance and oversight. Boardwalk published its fifth annual ESG report in April. The ESG report is available digitally on the Trust’s website.

FINANCIAL INFORMATION

Boardwalk produces quarterly financial statements and management’s discussion and analysis that provides detailed information regarding the Trust’s activities during the quarter. Financial information is available on Boardwalk’s investor website at www.bwalk.com/investors.

TELECONFERENCE ON THIRD QUARTER 2024 FINANCIAL RESULTS

Boardwalk invites you to participate in the teleconference that will be held to discuss these results tomorrow (November 6, 2024) at 1:00 pm Eastern Time (11:00 am Mountain Time). Senior management will speak to the period’s results and provide an update. Presentation materials will be made available on Boardwalk’s investor website at www.bwalk.com/investors prior to the call.

Teleconference: To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3XTW8Vw to receive an instant automated call back.

Alternatively, you can also dial direct to be entered into the call by an operator using the traditional conference call instructions below.

The telephone numbers for the conference are 437-900-0527 (local/international callers) or toll-free 1-888-510-2154 (within North America).

Note: Please provide the operator with the below Conference Call ID or Topic when dialing in to the call.

Conference ID: 84448

Topic: Boardwalk Real Estate Investment Trust, 2024 Third Quarter Results

Webcast: Investors will be able to listen to the call and view Boardwalk’s slide presentation by visiting www.bwalk.com/investors prior to the start of the call.

An information page will be provided for any software needed and system requirements. The webcast and slide presentation will also be available at:

Boardwalk REIT Third Quarter Results Webcast Link

Replay: An audio recording of the teleconference will be available on the Trust’s website:

www.bwalk.com/investors

CORPORATE PROFILE

Boardwalk REIT strives to be Canada’s friendliest community provider and is a leading owner/operator of multi-family rental communities. Providing homes in more than 200 communities, with over 34,000 residential suites totaling over 29 million net rentable square feet, Boardwalk has a proven long-term track record of building better communities, where love always livestm. Our three-tiered and distinct brands: Boardwalk Living, Boardwalk Communities, and Boardwalk Lifestyle, cater to a large diverse demographic and has evolved to capture the life cycle of all Resident Members. Boardwalk’s disciplined approach to capital allocation, acquisition, development, purposeful re-positioning, and management of apartment communities allows the Trust to provide its brand of community across Canada creating exceptional Resident Member experiences. Differentiated by its peak performance culture, Boardwalk is committed to delivering exceptional service, product quality and experience to our Resident Members who reward us with high retention and market leading operating results, which in turn, lead to higher free cash flow and investment returns, stable monthly distributions, and value creation for all our stakeholders.

Boardwalk REIT’s Trust Units are listed on the Toronto Stock Exchange, trading under the symbol BEI.UN. Additional information about Boardwalk REIT can be found on the Trust’s website at www.bwalk.com/investors.

PRESENTATION OF NON-GAAP MEASURES

Non-GAAP Financial Measures

Boardwalk believes non-GAAP financial measures are meaningful and useful measures of real estate organizations operating performance, however, are not measures defined by IFRS. As they do not have standardized meanings prescribed by IFRS, they therefore may not be comparable to similar measurements presented by other entities and should not be construed as an alternative to IFRS defined measures. Below are the non-GAAP financial measures referred to in this news release.

Funds From Operations

The IFRS measurement most comparable to FFO is profit. Boardwalk REIT considers FFO to be an appropriate measurement of the performance of a publicly listed multi-family residential entity as it is the most widely used and reported measure of real estate investment trust performance. Profit includes items such as fair value changes of investment property that are subject to market conditions and capitalization rate fluctuations which are not representative of recurring operating performance. Consistent with REALPAC, we define FFO as adjustments to profit for fair value gains or losses, distributions on the LP Class B Units, gains or losses on the sale of the Trust’s investment properties, depreciation, deferred income tax, and certain other non-cash adjustments, if any, but after deducting the principal repayment on lease liabilities and adding the principal repayment on lease receivable. The reconciliation from profit under IFRS to FFO can be found below. The Trust uses FFO to assess operating performance and its distribution paying capacity, determine the level of Associate incentive-based compensation, and decisions related to investment in capital assets. To facilitate a clear understanding of the combined historical operating results of Boardwalk REIT, management of the Trust believes FFO should be considered in conjunction with profit as presented in the condensed consolidated interim financial statements for the three and nine months ended September 30, 2024 and 2023.

|

FFO Reconciliation |

3 Months |

3 Months |

% Change |

9 Months |

9 Months |

% Change |

||||||||||||

|

Sep. 30, |

Sep. 30, |

Sep. 30, |

Sep. 30, |

|||||||||||||||

|

(In $000’s, except per Unit amounts) |

||||||||||||||||||

|

Profit |

$ |

55,419 |

$ |

39,417 |

$ |

522,294 |

$ |

492,969 |

||||||||||

|

Adjustments |

||||||||||||||||||

|

Other income (1) |

– |

– |

– |

(818) |

||||||||||||||

|

Fair value losses (gains), net |

1,838 |

6,315 |

(363,245) |

(367,028) |

||||||||||||||

|

LP Class B Unit distributions |

1,611 |

1,309 |

4,632 |

3,860 |

||||||||||||||

|

Deferred tax expense |

15 |

27 |

82 |

69 |

||||||||||||||

|

Depreciation |

2,124 |

1,984 |

5,991 |

5,677 |

||||||||||||||

|

Principal repayments on lease liabilities |

(822) |

(786) |

(2,449) |

(2,594) |

||||||||||||||

|

Principal repayments on lease receivable |

– |

– |

– |

321 |

||||||||||||||

|

FFO |

$ |

60,185 |

$ |

48,266 |

24.7 |

% |

$ |

167,305 |

$ |

132,456 |

26.3 |

% |

||||||

|

FFO per Unit |

$ |

1.11 |

$ |

0.96 |

15.6 |

% |

$ |

3.10 |

$ |

2.64 |

17.4 |

% |

||||||

|

(1) |

Other income is comprised of capital gains from investment income. |

Adjusted Funds From Operations

Similar to FFO, the IFRS measurement most comparable to AFFO is profit. Boardwalk REIT considers AFFO to be an appropriate measurement of a publicly listed multi-family residential entity as it measures the economic performance after deducting for maintenance capital expenditures to the existing portfolio of investment properties. AFFO is determined by taking the amounts reported as FFO and deducting what is commonly referred to as “Maintenance Capital Expenditures”. Maintenance Capital Expenditures are referred to as expenditures that, by standard accounting definition, are accounted for as capital in that the expenditure itself has a useful life in excess of the current financial year and maintains the value of the related assets. The reconciliation of AFFO can be found below. The Trust uses AFFO to assess operating performance and its distribution paying capacity, and decisions related to investment in capital assets.

|

(000’s) |

3 Months |

3 Months |

9 Months |

9 Months |

||||||||

|

Sep. 30, 2024 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

|||||||||

|

FFO |

$ |

60,185 |

$ |

48,266 |

$ |

167,305 |

$ |

132,456 |

||||

|

Maintenance Capital Expenditures |

8,624 |

7,878 |

25,843 |

23,604 |

||||||||

|

AFFO |

$ |

51,561 |

$ |

40,388 |

$ |

141,462 |

$ |

108,852 |

||||

Adjusted Real Estate Assets

The IFRS measurement most comparable to Adjusted Real Estate Assets is investment properties. Adjusted Real Estate Assets is comprised of investment properties, equity accounted investment, loan receivable, and cash and cash equivalents. Adjusted Real Estate Assets is useful in summarizing the real estate assets owned by the Trust and it is used in the calculation of NAV, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from Investment Properties under IFRS to Adjusted Real Estate Assets can be found on the following page, under NAV.

Adjusted Real Estate Debt

The IFRS measurement most comparable to Adjusted Real Estate Debt is total mortgage principal outstanding. Adjusted Real Estate Debt is comprised of total mortgage principal outstanding, total lease liabilities attributable to land leases, and construction loan payable. It is useful in summarizing the Trust’s debt which is attributable to its real estate assets and is used in the calculation of NAV, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from total mortgage principal outstanding under IFRS to Adjusted Real Estate Debt can be found below under NAV.

Adjusted Real Estate Debt, net of Cash

Adjusted Real Estate Debt, net of Cash, is most directly comparable to the IFRS measure of total mortgage principal outstanding. Adjusted Real Estate Debt, net of Cash is comprised of the sum of total mortgage principal outstanding, total lease liabilities attributable to land leases, and construction loan payable, then reduced by cash and cash equivalents. It is useful in summarizing the Trust’s debt which is attributable to its real estate assets and is used in the calculation of Debt to EBITDA.

Net Asset Value

The IFRS measurement most comparable to NAV is Unitholders’ Equity. With real estate entities, NAV is the total value of the entity’s investment properties and cash minus the total value of the entity’s debt. The Trust determines NAV by taking Adjusted Real Estate Assets and subtracting Adjusted Real Estate Debt, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from Unitholders’ Equity under IFRS to Net Asset Value is below.

|

Sep. 30, 2024 |

Dec. 31, 2023 |

|||||

|

Investment properties |

$ |

8,371,219 |

$ |

7,702,214 |

||

|

Equity accounted investment |

38,712 |

39,758 |

||||

|

Loan receivable |

57,867 |

– |

||||

|

Cash and cash equivalents |

107,618 |

331,204 |

||||

|

Adjusted Real Estate Assets |

$ |

8,575,416 |

$ |

8,073,176 |

||

|

Total mortgage principal outstanding |

$ |

(3,389,969) |

$ |

(3,446,801) |

||

|

Total lease liabilities attributable to land leases (1) |

(71,602) |

(72,860) |

||||

|

Construction loan payable |

(1,478) |

– |

||||

|

Adjusted Real Estate Debt |

$ |

(3,463,049) |

$ |

(3,519,661) |

||

|

Net Asset Value |

$ |

5,112,367 |

$ |

4,553,515 |

||

|

Net Asset Value per Unit |

$ |

94.64 |

$ |

84.41 |

||

|

Reconciliation of Unitholders’ Equity to Net Asset Value |

Sep. 30, 2024 |

Dec. 31, 2023 |

||||

|

Unitholders’ equity |

$ |

4,794,944 |

$ |

4,320,072 |

||

|

Total Assets |

(8,645,293) |

(8,141,876) |

||||

|

Investment properties |

8,371,219 |

7,702,214 |

||||

|

Equity accounted investment |

38,712 |

39,758 |

||||

|

Loan receivable |

57,867 |

– |

||||

|

Cash and cash equivalents |

107,618 |

331,204 |

||||

|

Total Liabilities |

3,850,349 |

3,821,804 |

||||

|

Total mortgage principal outstanding |

(3,389,969) |

(3,446,801) |

||||

|

Total lease liabilities attributable to land leases (1) |

(71,602) |

(72,860) |

||||

|

Construction loan payable |

(1,478) |

– |

||||

|

Net Asset Value (1) |

$ |

5,112,367 |

$ |

4,553,515 |

||

|

(1) |

Total lease liability attributable to land leases is a component of lease liabilities as calculated in accordance with IFRS. |

Non-GAAP Ratios

The discussion below outlines the non-GAAP ratios used by the Trust. Each non-GAAP ratio has a non-GAAP financial measure as one or more of its components, and, as a result, do not have standardized meanings prescribed by IFRS and therefore may not be comparable to similar financial measurements presented by other entities. Non-GAAP financial measures should not be construed as alternatives to IFRS defined measures.

FFO per Unit, AFFO per Unit, and NAV per Unit

FFO per Unit includes the non-GAAP financial measure FFO as a component in the calculation. The Trust uses FFO per Unit to assess operating performance on a per Unit basis, as well as determining the level of Associate incentive-based compensation.

AFFO per Unit includes the non-GAAP financial measure AFFO as a component in the calculation. The Trust uses AFFO per Unit to assess operating performance on a per Unit basis and its distribution paying capacity.

NAV per Unit includes the non-GAAP financial measure NAV as a component in the calculation. Management of the Trust believes it is a useful measure in estimating the entity’s value on a per Unit basis, which an investor can compare to the entity’s Trust Unit price which is publicly traded to help with investment decisions.

FFO per Unit and AFFO per Unit, are calculated by taking the non-GAAP ratio’s corresponding non-GAAP financial measure and dividing by the weighted average Trust Units outstanding for the period on a fully diluted basis, which assumes conversion of the LP Class B Units and vested deferred units determined in the calculation of diluted per Trust Unit amounts in accordance with IFRS.

NAV per Unit is calculated as NAV divided by the Trust Units outstanding as at the reporting date on a fully diluted basis which assumes conversion of the LP Class B Units and vested deferred units outstanding.

Debt to EBITDA

Debt to EBITDA is calculated by dividing Adjusted Real Estate Debt, net of Cash by consolidated EBITDA. The Trust uses Debt to EBITDA to understand its capacity to pay off its debt.

Debt to Total Assets

Debt to Total Assets is calculated by dividing Adjusted Real Estate Debt by Total Assets. The Trust uses Debt to Total Assets to determine the proportion of assets which are financed by debt.

FFO per Unit Future Financial Guidance

FFO per Unit Future Financial Guidance is calculated as FFO Future Financial Guidance divided by the estimated weighted average Trust Units and LP Class B Units outstanding throughout the year. Boardwalk REIT considers FFO per Unit Future Financial Guidance to be an appropriate measurement of the estimated future financial performance based on information currently available to management of the Trust at the date of this news release.

AFFO per Unit Future Financial Guidance

AFFO per Unit Future Financial Guidance is calculated as AFFO Future Financial Guidance divided by the estimated weighted average Trust Units and LP Class B Units outstanding throughout the year. Boardwalk REIT considers AFFO per Unit Future Financial Guidance to be an appropriate measurement of the estimated future profitability based on information currently available to management of the Trust at the date of this news release.

FFO Payout Ratio

FFO Payout Ratio represents the REIT’s ability to pay distributions. This non-GAAP ratio is computed by dividing regular distributions paid on the Trust Units and LP Class B Units by the non-GAAP financial measure of FFO.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Information in this news release that is not current or historical factual information may constitute forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of securities laws. The use of any of the words “expect”, “anticipate”, “may”, “will”, “should”, “believe”, “intend” and similar expressions are intended to identify forward-looking statements. Forward-looking statements contained in this press release include Boardwalk’s financial guidance for fiscal 2024, Boardwalk’s ability to accelerate organic growth in 2024, expected distributions for December 2024, January 2025, and February 2025, expectations regarding mortgages payable maturing and its intention to renew these mortgages, Boardwalk’s commitment to its capital allocation strategy, accretive capital recycling opportunities, strengthening its long-term development plan in Victoria, BC, and Boardwalk’s commitment to ESG initiatives. Implicit in these forward-looking statements, particularly in respect of Boardwalk’s objectives for its current and future periods, Boardwalk’s strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates, assumptions, intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations are estimates and assumptions subject to risks and uncertainties, including those described in its Management’s Discussion & Analysis of Boardwalk under the heading “Risks and Risk Management”, which could cause Boardwalk’s actual results to differ materially from the forward-looking statements contained in this news release. Specifically, Boardwalk has made assumptions surrounding the impact of economic conditions in Canada and globally, Boardwalk’s future growth potential, prospects and opportunities, interest costs, access to equity and debt capital markets to fund (at acceptable costs), the future growth program to enable the Trust to refinance debts as they mature, the availability of purchase opportunities for growth in Canada, the impact of accounting principles under IFRS, general industry conditions and trends, changes in laws and regulations including, without limitation, changes in tax laws, increased competition, the availability of qualified personnel, fluctuations in foreign exchange or interest rates, and stock market volatility. These assumptions, although considered reasonable by the Trust at the time of preparation, may prove to be incorrect.

This news release also contains future-oriented financial information and financial outlook information (collectively “FOFI”) about Boardwalk’s same property NOI growth, FFO per Unit, and AFFO per Unit guidance for fiscal 2024. Boardwalk has included the FOFI for the purpose of providing further information about the Trust’s anticipated future business operation.

For more exhaustive information on the risks and uncertainties in respect of forward-looking statements and FOFI you should refer to Boardwalk’s Management’s Discussion & Analysis and Annual Information Form for the year ended December 31, 2023 under the headings “Risks and Risk Management” and “Challenges and Risks”, respectively, which are available at www.sedarplus.ca. Forward-looking statements and FOFI contained in this news release are made as of the date of this news release and are based on Boardwalk’s current estimates, expectations and projections, which Boardwalk believes are reasonable as of the current date. You should not place undue importance on forward-looking statements or FOFI and should not rely upon forward-looking statements or FOFI as of any other date. Except as required by applicable law, Boardwalk undertakes no obligation to publicly update or revise any forward-looking statement or FOFI, whether a result of new information, future events, or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-reports-strong-results-for-q3-2024—demand-for-affordable-housing-remains-high-302296985.html

View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-reports-strong-results-for-q3-2024—demand-for-affordable-housing-remains-high-302296985.html

SOURCE Boardwalk Real Estate Investment Trust

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

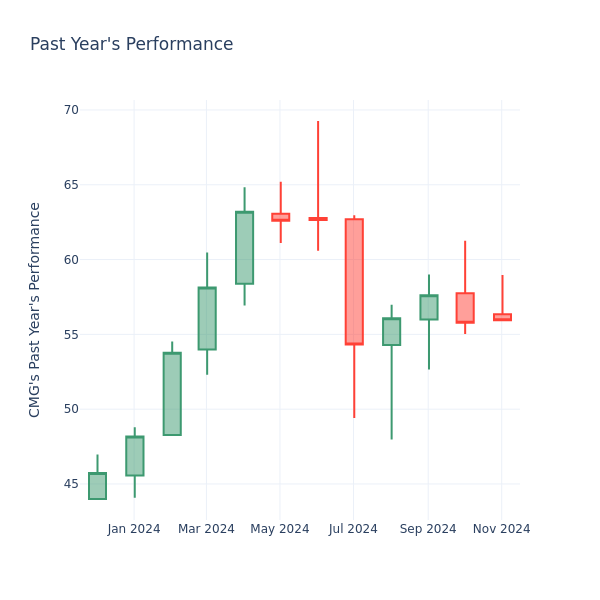

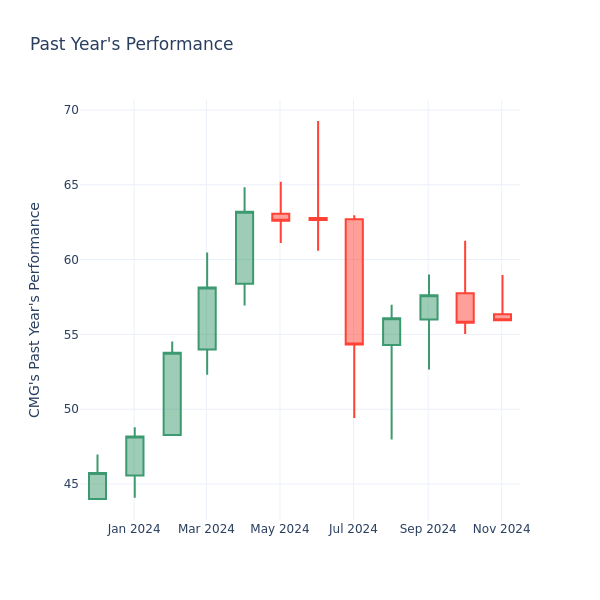

Price Over Earnings Overview: Chipotle Mexican Grill

Looking into the current session, Chipotle Mexican Grill Inc. CMG shares are trading at $55.96, after a 0.74% drop. Over the past month, the stock fell by 3.48%, but over the past year, it actually increased by 34.26%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

Chipotle Mexican Grill P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 114.58 in the Hotels, Restaurants & Leisure industry, Chipotle Mexican Grill Inc. has a lower P/E ratio of 52.36. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What This Donald Trump Stock Market Sentiment Indicator Signals On Election Day

Shares of Truth Social-parent Trump Media & Technology (DJT) surged early Tuesday before reversing lower with the Nasdaq halting trade three times around 3 p.m. EST. The move comes after DJT shares cratered last week, capping off a 120% surge in October with a whimper ahead of Tuesday’s presidential election.

That signals investor sentiment could be hedging in the final countdown to the election as polls show a dead-heat contest between former President Donald Trump and Vice President Kamala Harris.

The Donald Trump-backed DJT stock skyrocketed 119% in October. That included a drop of 10% last week going into Friday’s action.

DJT shares surged more than 14% Tuesday before paring those gains and dropping 1.2% to 33.94 during market action on Tuesday.