BOARDWALK REIT REPORTS STRONG RESULTS FOR Q3 2024 – DEMAND FOR AFFORDABLE HOUSING REMAINS HIGH

CALGARY, AB, Nov. 5, 2024 /PRNewswire/ – Boardwalk Real Estate Investment Trust BEI

SUMMARY HIGHLIGHTS FOR THE THREE AND NINE MONTH PERIODS ENDED SEPTEMBER 30, 2024

- STRONG FINANCIAL PERFORMANCE

FOR THE 3 MONTH PERIOD ENDED SEPTEMBER 30, 2024

-

- Funds From Operations (“FFO”) of $1.11 per Unit(1)(2); an increase of 15.6% from Q3 2023

- Profit of $55.4 million

- Net Operating Income (“NOI”) of $100.2 million; an increase of 15.6% from Q3 2023

- Same Property(3) Net Operating Income (“Same Property NOI”) of $99.2 million; an increase of 13.5% from Q3 2023

- Operating Margin of 65.3%; 260 basis point (bps) improvement from Q3 2023

FOR THE 9 MONTH PERIOD ENDED SEPTEMBER 30, 2024

-

- FFO of $3.10 per Unit(1)(2); an increase of 17.4% from the same period a year ago

- Profit of $522.3 million

- NOI of $283.3 million; an increase of 15.6% from the same period a year ago

- Same Property Net Operating Income (“Same Property NOI”) of $282.4 million; an increase of 13.7% from the same period in the prior year

- Operating Margin of 63.3%; 260 basis point (bps) improvement from the same period in the prior year

- SAME PROPERTY RENTAL REVENUE GROWTH IN Q3 2024

- Q3 2024 same property sequential quarterly rental revenue growth of 2.6% from the prior quarter

- Q3 2024 same property rental revenue growth of 9.5% from a year ago

- Occupancy of 98.6% in Q3 2024; an increase of 18 basis points from Q3 2023

- AFFORDABLE HOUSING REMAINS IN HIGH DEMAND

- Rents in Alberta remain some of the most affordable amongst major cities in Canada

- Occupied rent of $1,493 in September of 2024, a $105 improvement from December 2023

- November 2024 preliminary occupancy of 98.0%

- New leasing spreads of 10.4% in Alberta in September 2024

- Renewal leasing spreads of 8.4% in Alberta in September 2024

- STRONG AND FLEXIBLE BALANCE SHEET

- Approximately $413.7 million of total available liquidity at the end of the quarter

- 96% of Boardwalk’s mortgages carry CMHC-insurance

- Unitholders’ Equity of $4.8 billion

- Fair value capitalization rate of 5.09%, an increase of 4 bps from Q4 2023

- Net Asset Value increase to $94.64 per Unit(1)(2), primarily a result of higher market rental rates in the Trust’s non-price controlled markets

- Debt to EBITDA(1) of 10.31x, compared to 11.02x for the year ended December 31, 2023

- Debt to Total Assets(1) of 40.1%, compared to 43.2% for the year-ended December 31, 2023

- UPDATE TO 2024 FINANCIAL GUIDANCE

- Revised FFO range of $4.15 to $4.23 per Unit(1)(2)

- Same Property NOI growth range of +12.5% to +14.5%

- DISTRIBUTION OF $1.44 PER TRUST UNIT ON AN ANNUALIZED BASIS CONFIRMED FOR THE MONTHS OF DECEMBER 2024, JANUARY 2025, AND FEBRUARY 2025

|

(1) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(2) Boardwalk REIT’s units (the “Trust Units”) trade on the Toronto Stock Exchange (“TSX”) under the trading symbol ‘BEI.UN’. Additionally, the Trust has 4,475,000 special voting units issued to holders of “Class B Units” of Boardwalk REIT Limited Partnership (“LP Class B Units” and, together with the Trust Units, the “Units”), each of which also has a special voting unit in the REIT. |

|

(3) Same property figures exclude properties which have been owned for less than 24 months and sold assets. |

Boardwalk Real Estate Investment Trust (“Boardwalk”, the “REIT” or the “Trust”) today announced its financial results for the third quarter of 2024.

Sam Kolias; Chairman and Chief Executive Officer of Boardwalk REIT commented:

“We are pleased to report on another very strong quarter with significant growth in Net Operating Income and Funds From Operations per Unit. Our FFO per Unit of $1.11 during the third quarter represents an improvement of 15.6% from the prior year. We continue to make progress on improving our balance sheet as our cash flows improve and we de-lever organically, providing greater flexibility to compound growth further through the Trust’s value add capital program and accretive external growth opportunities. Occupied rents in the Trust’s largest market of Edmonton remain amongst the most affordable compared to asking rents in major centers in Canada and household incomes.

We remain focused on delivering a sustainable win-win outcome for all members of our Boardwalk Family Forever, which includes our Resident Members, Associates, Investors, external partners and other stakeholders. We are truly better together and we would like to thank all of our stakeholders who are instrumental in creating the best communities where love always lives.

We continue to work collaboratively with our community and policymakers and welcome the opportunity to further advance the best solutions for affordable housing for Canadians. As housing affordability over the last several years has become more challenging, Boardwalk remains committed to the long-term sustainability of our communities through our strategic self-moderation of positive rent adjustments. Recently, the federal government released its 2025-2027 Immigration Levels Plan, aimed to better balance population growth to more sustainable levels when looked at over a longer period of time. Relative to other provinces, Alberta is expected to be less impacted by the new Immigration Levels Plan due to its strong interprovincial migration and lower concentration of non-permanent residents as a percentage of the population.

Across various cycles, we have seen consistent demand for affordable housing. Our repositioning investments in many of our communities, and Resident Member-focused approach and proven platform positions us well to continue as the community provider of choice for Canadians. As we look forward, we remain confident in continuing our track record of delivering strong results for our Boardwalk Family Forever.”

THIRD QUARTER FINANCIAL HIGHLIGHTS

|

$ millions, except per Unit amounts |

||||||

|

Highlights of the Trust’s Third Quarter 2024 Financial Results |

||||||

|

3 Months |

3 Months |

% Change |

9 Months |

9 Months |

% Change |

|

|

Operational Highlights |

||||||

|

Rental Revenue |

$153.4 |

$138.3 |

11.0 % |

$447.7 |

$403.8 |

10.9 % |

|

Same Property Rental Revenue |

$150.1 |

$137.1 |

9.5 % |

$439.4 |

$401.4 |

9.5 % |

|

Net Operating Income (“NOI”) |

$100.2 |

$86.6 |

15.6 % |

$283.3 |

$245.0 |

15.6 % |

|

Same Property NOI |

$99.2 |

$87.5 |

13.5 % |

$282.4 |

$248.4 |

13.7 % |

|

Operating Margin (1) |

65.3 % |

62.7 % |

63.3 % |

60.7 % |

||

|

Same Property Operating Margin |

66.1 % |

63.8 % |

64.3 % |

61.9 % |

||

|

Financial Highlights |

||||||

|

Funds From Operations (“FFO”) (2)(3) |

$60.2 |

$48.3 |

24.7 % |

$167.3 |

$132.5 |

26.3 % |

|

Adjusted Funds From Operations (“AFFO”) (2)(3) |

$51.6 |

$40.4 |

27.7 % |

$141.5 |

$108.9 |

30.0 % |

|

Profit |

$55.4 |

$39.4 |

40.6 % |

$522.3 |

$493.0 |

5.9 % |

|

FFO per Unit (3) |

$1.11 |

$0.96 |

15.6 % |

$3.10 |

$2.64 |

17.4 % |

|

AFFO per Unit (3) |

$0.95 |

$0.80 |

18.8 % |

$2.62 |

$2.17 |

20.7 % |

|

Regular Distributions Declared (Trust Units & LP Class B |

$19.4 |

$14.7 |

32.1 % |

$55.8 |

$43.3 |

28.8 % |

|

Regular Distributions Declared Per Unit (Trust Units & LP |

$0.360 |

$0.293 |

22.9 % |

$1.035 |

$0.863 |

19.9 % |

|

FFO Payout Ratio (3) |

32.2 % |

30.4 % |

33.3 % |

32.7 % |

||

|

Same Property Apartment Suites |

33,722 |

33,264 |

||||

|

Non-Same Property Apartment Suites (4) |

671 |

582 |

||||

|

Total Apartment Suites |

34,393 |

33,846 |

||||

|

(1) Operating margin is calculated by dividing NOI by rental revenue allowing management to assess the percentage of rental revenue which generated profit. |

|

(2) This is a non-GAAP financial measure. |

|

(3) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(4) Includes 183 suites related to the Trust’s joint venture in Brampton, Ontario which is accounted for as an equity accounted investment. |

In Q3 2024, same property operating margin increased compared to the same period in the prior year as the Trust’s same property rental revenue growth remained strong. The Trust anticipates further improvement in its operating margin throughout the remainder of 2024 as a result of continued strong revenue growth and execution of various cost containment initiatives.

|

Continued Highlights of the Trust’s Third Quarter 2024 Financial Results |

||||||

|

Sep. 30, |

Dec. 31, |

|||||

|

Equity |

||||||

|

Unitholders’ equity |

$4,794,944 |

$4,320,072 |

||||

|

Net Asset Value |

||||||

|

Net asset value (1)(2) |

$5,112,367 |

$4,553,515 |

||||

|

Net asset value (“NAV”) per Unit (2) |

$94.64 |

$84.41 |

||||

|

Liquidity, Debt and Distributions |

||||||

|

Cash and cash equivalents |

$107,618 |

|||||

|

Subsequent committed/funded financing |

$60,300 |

|||||

|

Unused credit facilities |

$245,800 |

|||||

|

Total Available Liquidity |

$413,718 |

|||||

|

Total mortgage principal outstanding |

$3,389,969 |

$3,446,801 |

||||

|

Debt to EBITDA(1)(2) |

10.31 |

11.02 |

||||

|

Debt to Total Assets(1)(2) |

40.1 % |

43.2 % |

||||

|

Interest Coverage Ratio (Rolling 4 quarters) |

2.91 |

2.83 |

||||

|

(1) This is a non-GAAP financial measure. |

|

(2) Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

The Trust’s fair value of its investment properties as at September 30, 2024 increased from year end, primarily attributable to an increase in market rents driven by strong market conditions. The Trust’s stabilized capitalization rate (“Cap Rate”) of 5.09% for Q3 2024 remained the same as the prior quarter. The Cap Rate ranges utilized continue to be in line with recently published third party quarterly Cap Rate reports.

SOLID OPERATIONAL RESULTS

|

Portfolio Highlights for the Third Quarter of 2024 |

||||||

|

Sep-24 |

Sep-23 |

|||||

|

Average Occupancy (Quarter Average) (1) |

98.63 |

% |

98.45 |

% |

||

|

Average Monthly Rent (Period Ended) |

$ |

1,472 |

$ |

1,340 |

||

|

Average Market Rent (Period Ended) (2) |

$ |

1,644 |

$ |

1,534 |

||

|

Average Occupied Rent (Period Ended) (3) |

$ |

1,493 |

$ |

1,357 |

||

|

Mark-to-Market Revenue Gain (Period Ended) ($ millions) |

$ |

60.2 |

$ |

70.0 |

||

|

Mark-to-Market Revenue Gain Per Unit (Period Ended) |

$ |

1.11 |

$ |

1.39 |

||

|

(1)Average occupancy is adjusted to be on a same property basis. |

|

(2)Market rent is a component of rental revenue and is calculated as of the first day of each month as the average rental revenue amount a willing landlord might reasonably expect to receive, and a willing tenant might reasonably expect to pay, for a tenancy, before adjustments for other rental revenue items such as incentives, vacancy loss, fees, specific recoveries, and revenue from commercial tenants. |

|

(3)Occupied rent is a component of rental revenue and is calculated for occupied suites as of the first day of each month as the average rental revenue, adjusted for other rental revenue items such as fees, specific recoveries, and revenue from commercial tenants. |

|

Oct-23 |

Nov-23 |

Dec-23 |

Jan-24 |

Feb-24 |

Mar-24 |

Apr-24 |

May-24 |

Jun-24 |

Jul-24 |

Aug-24 |

Sep-24 |

Oct-24 |

Nov-24 |

|

|

Same Property |

98.9 % |

98.9 % |

99.0 % |

99.0 % |

98.8 % |

98.8 % |

98.8 % |

98.6 % |

98.6 % |

98.6 % |

98.7 % |

98.4 % |

98.1 % |

98.0 % |

The Trust retained high occupancy during Q3 2024 by focusing on retention and by leveraging its vertically-integrated operating platform to limit time to complete unit turnovers. Positive market rent adjustments were implemented in some communities where rental market fundamentals were strong during the high volume summer leasing season. Average occupied rent increased sequentially, and when compared to the same period a year ago, as the Trust focuses on reducing or eliminating incentives on lease renewals, leasing at market rents for new leases and adjusting market rents in communities where appropriate.

For the third quarter of 2024, same property rental revenue increased 9.5% while same property total rental expense increased by 2.6%, resulting in same property NOI growth of 13.5% in comparison to the same quarter prior year. Same property rental expenses increased primarily due to higher wages and salaries and repairs and maintenance from inflation and higher property taxes.

During the third quarter of 2024, lower incentives along with positive market rent adjustments and lower utilities from water restrictions that were in effect from the City of Calgary, supported Boardwalk’s Calgary portfolio increase in same property NOI of 16.6% in comparison to the same quarter prior year. The positive revenue growth was partially offset by an increase in wages and salaries and repairs and maintenance costs.

In Edmonton, NOI growth was 15.6% for the third quarter of 2024 compared to the same period in the prior year. The overall growth was driven by lower vacancy loss and incentives, and higher market rents. The overall positive increase was partially offset by higher wages and salaries, utilities, building repairs and maintenance costs, and property taxes.

Saskatchewan’s market continues to be strong with the Trust’s portfolio in the region realizing 15.9% same property NOI growth in the third quarter of 2024 versus the same period last year, as a result of strong same property revenue growth due to lower incentives as well as market rent increases, partially offset by higher wages and salaries, building repairs and maintenance, and property taxes.

In Ontario, NOI growth was 7.7% in the third quarter of 2024 compared to the third quarter of 2023. The mark-to-market opportunity on turnover contributed to same property rental revenue growth of 6.4%, which was partially offset by increases in wages and salaries, building repairs and maintenance costs, bad debts expense, and property taxes.

In Quebec, NOI growth was 6.6% compared to the same quarter in the prior year. The overall growth was driven by increases in occupied rents along with higher occupancy rates, as well as lower insurance premiums relative to the previous year.

In British Columbia, higher market rents compared to the prior year, and a same property total rental expense decrease of 5.0%, resulted in same property NOI growth of 7.7% in the third quarter of 2024 compared to the third quarter of 2023.

As shown in our updated guidance further in this release, Boardwalk remains well positioned for continued revenue growth and NOI growth in 2024.

|

Same Property Sep. 30 2024 – 3 M |

# of Suites |

% Rental |

% Total Rental |

% Net Operating |

% of NOI |

||||||||||

|

Edmonton |

12,882 |

10.7 |

% |

3.4 |

% |

15.6 |

% |

35.0 |

% |

||||||

|

Calgary |

6,266 |

10.5 |

% |

(2.8) |

% |

16.6 |

% |

24.6 |

% |

||||||

|

Other Alberta |

1,936 |

11.1 |

% |

7.6 |

% |

13.2 |

% |

4.9 |

% |

||||||

|

Alberta |

21,084 |

10.6 |

% |

1.9 |

% |

15.8 |

% |

64.5 |

% |

||||||

|

Quebec |

6,000 |

5.7 |

% |

4.0 |

% |

6.6 |

% |

16.6 |

% |

||||||

|

Saskatchewan |

3,505 |

11.3 |

% |

3.1 |

% |

15.9 |

% |

10.8 |

% |

||||||

|

Ontario |

3,019 |

6.4 |

% |

4.5 |

% |

7.7 |

% |

7.5 |

% |

||||||

|

British Columbia |

114 |

5.0 |

% |

(5.0) |

% |

7.7 |

% |

0.6 |

% |

||||||

|

33,722 |

9.5 |

% |

2.6 |

% |

13.5 |

% |

100.0 |

% |

|||||||

|

Same Property Sep. 30 2024 – 9 M |

# of Suites |

% Rental |

% Total Rental |

% Net Operating |

% of NOI |

||||||||||

|

Edmonton |

12,882 |

10.7 |

% |

3.3 |

% |

16.2 |

% |

34.7 |

% |

||||||

|

Calgary |

6,266 |

11.1 |

% |

1.9 |

% |

15.7 |

% |

24.4 |

% |

||||||

|

Other Alberta |

1,936 |

10.9 |

% |

0.8 |

% |

18.2 |

% |

4.9 |

% |

||||||

|

Alberta |

21,084 |

10.9 |

% |

2.7 |

% |

16.1 |

% |

64.1 |

% |

||||||

|

Quebec |

6,000 |

5.8 |

% |

2.6 |

% |

7.4 |

% |

16.7 |

% |

||||||

|

Saskatchewan |

3,505 |

10.2 |

% |

0.4 |

% |

16.2 |

% |

10.9 |

% |

||||||

|

Ontario |

3,019 |

5.7 |

% |

5.8 |

% |

5.6 |

% |

7.8 |

% |

||||||

|

British Columbia |

114 |

4.8 |

% |

(6.4) |

% |

7.8 |

% |

0.6 |

% |

||||||

|

33,722 |

9.5 |

% |

2.6 |

% |

13.7 |

% |

100.0 |

% |

|||||||

STRONG LIQUIDITY POSITION

In the third quarter of 2024, Boardwalk renewed $25.6 million of its maturing mortgages at a weighted average interest rate of 4.19% while extending the term of these mortgages by an average of 5.1 years.

For the remainder of 2024, the Trust anticipates $186.6 million of mortgages payable maturing with an average in-place interest rate of 3.14% and will continue to renew these mortgages as they mature. Current market 5 and 10-year CMHC financing rates are estimated to be approximately 3.70% and 4.10%, respectively. To date, the Trust has renewed or forward-locked the interest rate on $352.8 million or 81.4% of its maturing mortgages in 2024 at an average interest rate of 4.29% and an average term of 5.8 years. The Trust remains well positioned with a laddered maturity schedule within its mortgage program, a disciplined capital allocation program and continued use of CMHC funding, which decreases the renewal risk on its existing mortgages.

UPDATE TO 2024 FINANCIAL GUIDANCE

Boardwalk’s current outlook for the remainder of 2024 is for ongoing growth across its portfolio as demand for affordable multi-family housing remains strong. The Trust anticipates outsized revenue and NOI growth in its non-price-controlled markets on a year-over-year basis, as a result of strong performance year-to-date and ongoing positive leasing spreads throughout the remainder of 2024. The Trust’s consistent revenue and disciplined operating cost control performance through the first three quarters of 2024 provides for an increase to the bottom end and tightening of its guidance range for the year as follows:

|

Q3 2024 Revised |

2024 Previous Guidance

|

2023 Actual

|

||

|

Same Property NOI Growth |

12.5% to 14.5% |

12.5% to 14.5% |

13.7 % |

|

|

Profit |

N/A |

N/A |

$666,099 |

|

|

FFO (1)(2) |

N/A |

N/A |

$181,353 |

|

|

AFFO (1)(2)(3) |

N/A |

N/A |

$149,098 |

|

|

FFO Per Unit (2) |

$4.15 to $4.23 |

$4.11 to $4.23 |

$3.60 |

|

|

AFFO Per Unit (2)(3) |

$3.52 to $3.60 |

$3.48 to $3.60 |

$2.96 |

|

|

(1) |

This is a non-GAAP financial measure. |

|

(2) |

Please refer to the section titled “Presentation of Non-GAAP Measures” in this news release for more information. |

|

(3) |

Utilizing a Maintenance CAPEX expenditure of $1,003/suite/year in 2024 and $953/suite/year in 2023. |

The reader is cautioned that this information is forward-looking and actual results may vary from those forecasted. The Trust reviews the assumptions used to derive its forecast quarterly, and based on this review, may adjust its outlook accordingly.

THIRD QUARTER REGULAR MONTHLY DISTRIBUTION ANNOUNCEMENT

The Trust has confirmed its monthly cash distribution for the months of December 2024, January 2025, and February 2025 as follows:

|

Month |

Per Unit |

Annualized |

Record Date |

Distribution Date |

||||

|

December 2024 |

$ |

0.1200 |

$ |

1.44 |

31-Dec-24 |

15-Jan-25 |

||

|

January 2025 |

$ |

0.1200 |

$ |

1.44 |

31-Jan-25 |

17-Feb-25 |

||

|

February 2025 |

$ |

0.1200 |

$ |

1.44 |

28-Feb-25 |

17-Mar-25 |

||

In line with Boardwalk’s distribution policy of maximum re-investment, the Trust’s payout ratio remains conservative at 32.2% of Q3 2024 FFO; and 32.8% of the last 12 months FFO.

Boardwalk’s regular monthly distribution provides a stable and attractive yield for the Trust’s Unitholders.

ESG REPORT

The Trust is committed to environmental, social and governance (“ESG”) objectives and initiatives, including working towards reducing greenhouse gas emissions and electricity and natural gas consumption, water conservation, waste minimization, and a continued focus on governance and oversight. Boardwalk published its fifth annual ESG report in April. The ESG report is available digitally on the Trust’s website.

FINANCIAL INFORMATION

Boardwalk produces quarterly financial statements and management’s discussion and analysis that provides detailed information regarding the Trust’s activities during the quarter. Financial information is available on Boardwalk’s investor website at www.bwalk.com/investors.

TELECONFERENCE ON THIRD QUARTER 2024 FINANCIAL RESULTS

Boardwalk invites you to participate in the teleconference that will be held to discuss these results tomorrow (November 6, 2024) at 1:00 pm Eastern Time (11:00 am Mountain Time). Senior management will speak to the period’s results and provide an update. Presentation materials will be made available on Boardwalk’s investor website at www.bwalk.com/investors prior to the call.

Teleconference: To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3XTW8Vw to receive an instant automated call back.

Alternatively, you can also dial direct to be entered into the call by an operator using the traditional conference call instructions below.

The telephone numbers for the conference are 437-900-0527 (local/international callers) or toll-free 1-888-510-2154 (within North America).

Note: Please provide the operator with the below Conference Call ID or Topic when dialing in to the call.

Conference ID: 84448

Topic: Boardwalk Real Estate Investment Trust, 2024 Third Quarter Results

Webcast: Investors will be able to listen to the call and view Boardwalk’s slide presentation by visiting www.bwalk.com/investors prior to the start of the call.

An information page will be provided for any software needed and system requirements. The webcast and slide presentation will also be available at:

Boardwalk REIT Third Quarter Results Webcast Link

Replay: An audio recording of the teleconference will be available on the Trust’s website:

www.bwalk.com/investors

CORPORATE PROFILE

Boardwalk REIT strives to be Canada’s friendliest community provider and is a leading owner/operator of multi-family rental communities. Providing homes in more than 200 communities, with over 34,000 residential suites totaling over 29 million net rentable square feet, Boardwalk has a proven long-term track record of building better communities, where love always livestm. Our three-tiered and distinct brands: Boardwalk Living, Boardwalk Communities, and Boardwalk Lifestyle, cater to a large diverse demographic and has evolved to capture the life cycle of all Resident Members. Boardwalk’s disciplined approach to capital allocation, acquisition, development, purposeful re-positioning, and management of apartment communities allows the Trust to provide its brand of community across Canada creating exceptional Resident Member experiences. Differentiated by its peak performance culture, Boardwalk is committed to delivering exceptional service, product quality and experience to our Resident Members who reward us with high retention and market leading operating results, which in turn, lead to higher free cash flow and investment returns, stable monthly distributions, and value creation for all our stakeholders.

Boardwalk REIT’s Trust Units are listed on the Toronto Stock Exchange, trading under the symbol BEI.UN. Additional information about Boardwalk REIT can be found on the Trust’s website at www.bwalk.com/investors.

PRESENTATION OF NON-GAAP MEASURES

Non-GAAP Financial Measures

Boardwalk believes non-GAAP financial measures are meaningful and useful measures of real estate organizations operating performance, however, are not measures defined by IFRS. As they do not have standardized meanings prescribed by IFRS, they therefore may not be comparable to similar measurements presented by other entities and should not be construed as an alternative to IFRS defined measures. Below are the non-GAAP financial measures referred to in this news release.

Funds From Operations

The IFRS measurement most comparable to FFO is profit. Boardwalk REIT considers FFO to be an appropriate measurement of the performance of a publicly listed multi-family residential entity as it is the most widely used and reported measure of real estate investment trust performance. Profit includes items such as fair value changes of investment property that are subject to market conditions and capitalization rate fluctuations which are not representative of recurring operating performance. Consistent with REALPAC, we define FFO as adjustments to profit for fair value gains or losses, distributions on the LP Class B Units, gains or losses on the sale of the Trust’s investment properties, depreciation, deferred income tax, and certain other non-cash adjustments, if any, but after deducting the principal repayment on lease liabilities and adding the principal repayment on lease receivable. The reconciliation from profit under IFRS to FFO can be found below. The Trust uses FFO to assess operating performance and its distribution paying capacity, determine the level of Associate incentive-based compensation, and decisions related to investment in capital assets. To facilitate a clear understanding of the combined historical operating results of Boardwalk REIT, management of the Trust believes FFO should be considered in conjunction with profit as presented in the condensed consolidated interim financial statements for the three and nine months ended September 30, 2024 and 2023.

|

FFO Reconciliation |

3 Months |

3 Months |

% Change |

9 Months |

9 Months |

% Change |

||||||||||||

|

Sep. 30, |

Sep. 30, |

Sep. 30, |

Sep. 30, |

|||||||||||||||

|

(In $000’s, except per Unit amounts) |

||||||||||||||||||

|

Profit |

$ |

55,419 |

$ |

39,417 |

$ |

522,294 |

$ |

492,969 |

||||||||||

|

Adjustments |

||||||||||||||||||

|

Other income (1) |

– |

– |

– |

(818) |

||||||||||||||

|

Fair value losses (gains), net |

1,838 |

6,315 |

(363,245) |

(367,028) |

||||||||||||||

|

LP Class B Unit distributions |

1,611 |

1,309 |

4,632 |

3,860 |

||||||||||||||

|

Deferred tax expense |

15 |

27 |

82 |

69 |

||||||||||||||

|

Depreciation |

2,124 |

1,984 |

5,991 |

5,677 |

||||||||||||||

|

Principal repayments on lease liabilities |

(822) |

(786) |

(2,449) |

(2,594) |

||||||||||||||

|

Principal repayments on lease receivable |

– |

– |

– |

321 |

||||||||||||||

|

FFO |

$ |

60,185 |

$ |

48,266 |

24.7 |

% |

$ |

167,305 |

$ |

132,456 |

26.3 |

% |

||||||

|

FFO per Unit |

$ |

1.11 |

$ |

0.96 |

15.6 |

% |

$ |

3.10 |

$ |

2.64 |

17.4 |

% |

||||||

|

(1) |

Other income is comprised of capital gains from investment income. |

Adjusted Funds From Operations

Similar to FFO, the IFRS measurement most comparable to AFFO is profit. Boardwalk REIT considers AFFO to be an appropriate measurement of a publicly listed multi-family residential entity as it measures the economic performance after deducting for maintenance capital expenditures to the existing portfolio of investment properties. AFFO is determined by taking the amounts reported as FFO and deducting what is commonly referred to as “Maintenance Capital Expenditures”. Maintenance Capital Expenditures are referred to as expenditures that, by standard accounting definition, are accounted for as capital in that the expenditure itself has a useful life in excess of the current financial year and maintains the value of the related assets. The reconciliation of AFFO can be found below. The Trust uses AFFO to assess operating performance and its distribution paying capacity, and decisions related to investment in capital assets.

|

(000’s) |

3 Months |

3 Months |

9 Months |

9 Months |

||||||||

|

Sep. 30, 2024 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

|||||||||

|

FFO |

$ |

60,185 |

$ |

48,266 |

$ |

167,305 |

$ |

132,456 |

||||

|

Maintenance Capital Expenditures |

8,624 |

7,878 |

25,843 |

23,604 |

||||||||

|

AFFO |

$ |

51,561 |

$ |

40,388 |

$ |

141,462 |

$ |

108,852 |

||||

Adjusted Real Estate Assets

The IFRS measurement most comparable to Adjusted Real Estate Assets is investment properties. Adjusted Real Estate Assets is comprised of investment properties, equity accounted investment, loan receivable, and cash and cash equivalents. Adjusted Real Estate Assets is useful in summarizing the real estate assets owned by the Trust and it is used in the calculation of NAV, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from Investment Properties under IFRS to Adjusted Real Estate Assets can be found on the following page, under NAV.

Adjusted Real Estate Debt

The IFRS measurement most comparable to Adjusted Real Estate Debt is total mortgage principal outstanding. Adjusted Real Estate Debt is comprised of total mortgage principal outstanding, total lease liabilities attributable to land leases, and construction loan payable. It is useful in summarizing the Trust’s debt which is attributable to its real estate assets and is used in the calculation of NAV, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from total mortgage principal outstanding under IFRS to Adjusted Real Estate Debt can be found below under NAV.

Adjusted Real Estate Debt, net of Cash

Adjusted Real Estate Debt, net of Cash, is most directly comparable to the IFRS measure of total mortgage principal outstanding. Adjusted Real Estate Debt, net of Cash is comprised of the sum of total mortgage principal outstanding, total lease liabilities attributable to land leases, and construction loan payable, then reduced by cash and cash equivalents. It is useful in summarizing the Trust’s debt which is attributable to its real estate assets and is used in the calculation of Debt to EBITDA.

Net Asset Value

The IFRS measurement most comparable to NAV is Unitholders’ Equity. With real estate entities, NAV is the total value of the entity’s investment properties and cash minus the total value of the entity’s debt. The Trust determines NAV by taking Adjusted Real Estate Assets and subtracting Adjusted Real Estate Debt, which management of the Trust believes is a useful measure in estimating the entity’s value. The reconciliation from Unitholders’ Equity under IFRS to Net Asset Value is below.

|

Sep. 30, 2024 |

Dec. 31, 2023 |

|||||

|

Investment properties |

$ |

8,371,219 |

$ |

7,702,214 |

||

|

Equity accounted investment |

38,712 |

39,758 |

||||

|

Loan receivable |

57,867 |

– |

||||

|

Cash and cash equivalents |

107,618 |

331,204 |

||||

|

Adjusted Real Estate Assets |

$ |

8,575,416 |

$ |

8,073,176 |

||

|

Total mortgage principal outstanding |

$ |

(3,389,969) |

$ |

(3,446,801) |

||

|

Total lease liabilities attributable to land leases (1) |

(71,602) |

(72,860) |

||||

|

Construction loan payable |

(1,478) |

– |

||||

|

Adjusted Real Estate Debt |

$ |

(3,463,049) |

$ |

(3,519,661) |

||

|

Net Asset Value |

$ |

5,112,367 |

$ |

4,553,515 |

||

|

Net Asset Value per Unit |

$ |

94.64 |

$ |

84.41 |

||

|

Reconciliation of Unitholders’ Equity to Net Asset Value |

Sep. 30, 2024 |

Dec. 31, 2023 |

||||

|

Unitholders’ equity |

$ |

4,794,944 |

$ |

4,320,072 |

||

|

Total Assets |

(8,645,293) |

(8,141,876) |

||||

|

Investment properties |

8,371,219 |

7,702,214 |

||||

|

Equity accounted investment |

38,712 |

39,758 |

||||

|

Loan receivable |

57,867 |

– |

||||

|

Cash and cash equivalents |

107,618 |

331,204 |

||||

|

Total Liabilities |

3,850,349 |

3,821,804 |

||||

|

Total mortgage principal outstanding |

(3,389,969) |

(3,446,801) |

||||

|

Total lease liabilities attributable to land leases (1) |

(71,602) |

(72,860) |

||||

|

Construction loan payable |

(1,478) |

– |

||||

|

Net Asset Value (1) |

$ |

5,112,367 |

$ |

4,553,515 |

||

|

(1) |

Total lease liability attributable to land leases is a component of lease liabilities as calculated in accordance with IFRS. |

Non-GAAP Ratios

The discussion below outlines the non-GAAP ratios used by the Trust. Each non-GAAP ratio has a non-GAAP financial measure as one or more of its components, and, as a result, do not have standardized meanings prescribed by IFRS and therefore may not be comparable to similar financial measurements presented by other entities. Non-GAAP financial measures should not be construed as alternatives to IFRS defined measures.

FFO per Unit, AFFO per Unit, and NAV per Unit

FFO per Unit includes the non-GAAP financial measure FFO as a component in the calculation. The Trust uses FFO per Unit to assess operating performance on a per Unit basis, as well as determining the level of Associate incentive-based compensation.

AFFO per Unit includes the non-GAAP financial measure AFFO as a component in the calculation. The Trust uses AFFO per Unit to assess operating performance on a per Unit basis and its distribution paying capacity.

NAV per Unit includes the non-GAAP financial measure NAV as a component in the calculation. Management of the Trust believes it is a useful measure in estimating the entity’s value on a per Unit basis, which an investor can compare to the entity’s Trust Unit price which is publicly traded to help with investment decisions.

FFO per Unit and AFFO per Unit, are calculated by taking the non-GAAP ratio’s corresponding non-GAAP financial measure and dividing by the weighted average Trust Units outstanding for the period on a fully diluted basis, which assumes conversion of the LP Class B Units and vested deferred units determined in the calculation of diluted per Trust Unit amounts in accordance with IFRS.

NAV per Unit is calculated as NAV divided by the Trust Units outstanding as at the reporting date on a fully diluted basis which assumes conversion of the LP Class B Units and vested deferred units outstanding.

Debt to EBITDA

Debt to EBITDA is calculated by dividing Adjusted Real Estate Debt, net of Cash by consolidated EBITDA. The Trust uses Debt to EBITDA to understand its capacity to pay off its debt.

Debt to Total Assets

Debt to Total Assets is calculated by dividing Adjusted Real Estate Debt by Total Assets. The Trust uses Debt to Total Assets to determine the proportion of assets which are financed by debt.

FFO per Unit Future Financial Guidance

FFO per Unit Future Financial Guidance is calculated as FFO Future Financial Guidance divided by the estimated weighted average Trust Units and LP Class B Units outstanding throughout the year. Boardwalk REIT considers FFO per Unit Future Financial Guidance to be an appropriate measurement of the estimated future financial performance based on information currently available to management of the Trust at the date of this news release.

AFFO per Unit Future Financial Guidance

AFFO per Unit Future Financial Guidance is calculated as AFFO Future Financial Guidance divided by the estimated weighted average Trust Units and LP Class B Units outstanding throughout the year. Boardwalk REIT considers AFFO per Unit Future Financial Guidance to be an appropriate measurement of the estimated future profitability based on information currently available to management of the Trust at the date of this news release.

FFO Payout Ratio

FFO Payout Ratio represents the REIT’s ability to pay distributions. This non-GAAP ratio is computed by dividing regular distributions paid on the Trust Units and LP Class B Units by the non-GAAP financial measure of FFO.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Information in this news release that is not current or historical factual information may constitute forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of securities laws. The use of any of the words “expect”, “anticipate”, “may”, “will”, “should”, “believe”, “intend” and similar expressions are intended to identify forward-looking statements. Forward-looking statements contained in this press release include Boardwalk’s financial guidance for fiscal 2024, Boardwalk’s ability to accelerate organic growth in 2024, expected distributions for December 2024, January 2025, and February 2025, expectations regarding mortgages payable maturing and its intention to renew these mortgages, Boardwalk’s commitment to its capital allocation strategy, accretive capital recycling opportunities, strengthening its long-term development plan in Victoria, BC, and Boardwalk’s commitment to ESG initiatives. Implicit in these forward-looking statements, particularly in respect of Boardwalk’s objectives for its current and future periods, Boardwalk’s strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates, assumptions, intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations are estimates and assumptions subject to risks and uncertainties, including those described in its Management’s Discussion & Analysis of Boardwalk under the heading “Risks and Risk Management”, which could cause Boardwalk’s actual results to differ materially from the forward-looking statements contained in this news release. Specifically, Boardwalk has made assumptions surrounding the impact of economic conditions in Canada and globally, Boardwalk’s future growth potential, prospects and opportunities, interest costs, access to equity and debt capital markets to fund (at acceptable costs), the future growth program to enable the Trust to refinance debts as they mature, the availability of purchase opportunities for growth in Canada, the impact of accounting principles under IFRS, general industry conditions and trends, changes in laws and regulations including, without limitation, changes in tax laws, increased competition, the availability of qualified personnel, fluctuations in foreign exchange or interest rates, and stock market volatility. These assumptions, although considered reasonable by the Trust at the time of preparation, may prove to be incorrect.

This news release also contains future-oriented financial information and financial outlook information (collectively “FOFI”) about Boardwalk’s same property NOI growth, FFO per Unit, and AFFO per Unit guidance for fiscal 2024. Boardwalk has included the FOFI for the purpose of providing further information about the Trust’s anticipated future business operation.

For more exhaustive information on the risks and uncertainties in respect of forward-looking statements and FOFI you should refer to Boardwalk’s Management’s Discussion & Analysis and Annual Information Form for the year ended December 31, 2023 under the headings “Risks and Risk Management” and “Challenges and Risks”, respectively, which are available at www.sedarplus.ca. Forward-looking statements and FOFI contained in this news release are made as of the date of this news release and are based on Boardwalk’s current estimates, expectations and projections, which Boardwalk believes are reasonable as of the current date. You should not place undue importance on forward-looking statements or FOFI and should not rely upon forward-looking statements or FOFI as of any other date. Except as required by applicable law, Boardwalk undertakes no obligation to publicly update or revise any forward-looking statement or FOFI, whether a result of new information, future events, or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-reports-strong-results-for-q3-2024—demand-for-affordable-housing-remains-high-302296985.html

View original content:https://www.prnewswire.com/news-releases/boardwalk-reit-reports-strong-results-for-q3-2024—demand-for-affordable-housing-remains-high-302296985.html

SOURCE Boardwalk Real Estate Investment Trust

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Price Over Earnings Overview: Chipotle Mexican Grill

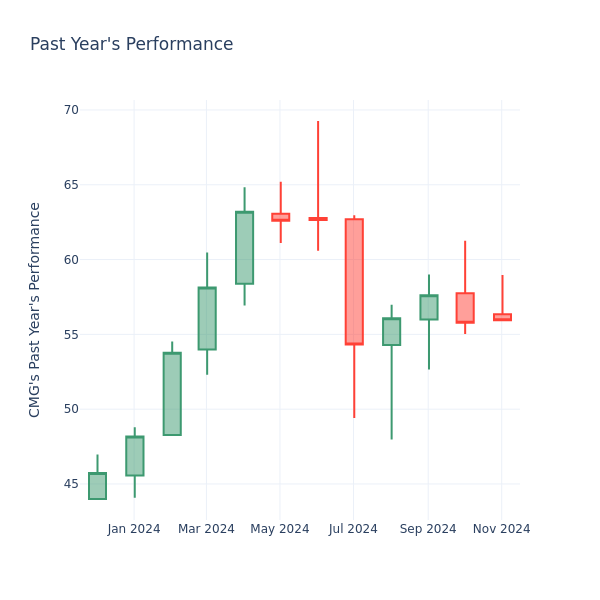

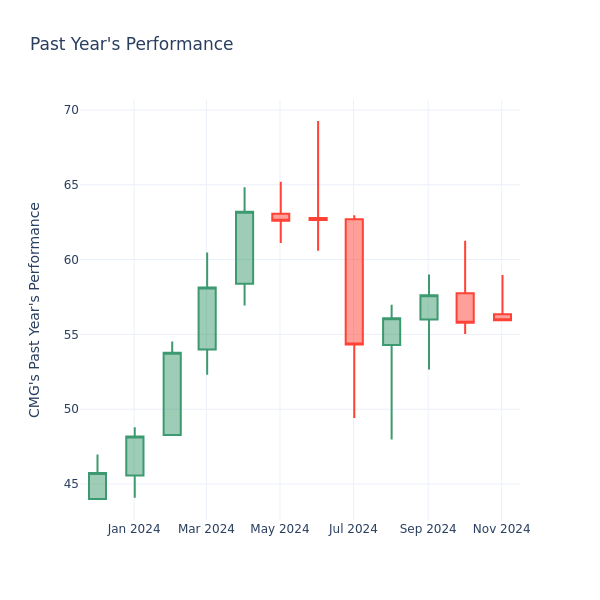

Looking into the current session, Chipotle Mexican Grill Inc. CMG shares are trading at $55.96, after a 0.74% drop. Over the past month, the stock fell by 3.48%, but over the past year, it actually increased by 34.26%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

Chipotle Mexican Grill P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 114.58 in the Hotels, Restaurants & Leisure industry, Chipotle Mexican Grill Inc. has a lower P/E ratio of 52.36. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What This Donald Trump Stock Market Sentiment Indicator Signals On Election Day

Shares of Truth Social-parent Trump Media & Technology (DJT) surged early Tuesday before reversing lower with the Nasdaq halting trade three times around 3 p.m. EST. The move comes after DJT shares cratered last week, capping off a 120% surge in October with a whimper ahead of Tuesday’s presidential election.

That signals investor sentiment could be hedging in the final countdown to the election as polls show a dead-heat contest between former President Donald Trump and Vice President Kamala Harris.

The Donald Trump-backed DJT stock skyrocketed 119% in October. That included a drop of 10% last week going into Friday’s action.

DJT shares surged more than 14% Tuesday before paring those gains and dropping 1.2% to 33.94 during market action on Tuesday.

On Monday, the Trump stock was up and down before rallying 12.4%. In the first trading day of November, DJT shares dropped 13.5% to 30.56 on Friday, after sinking 11.7% to 35.34 Thursday.

↑

X

2024 Election Investing Strategies: How To Prepare Your Portfolio

The Nasdaq also halted trading on the shares more than once early Thursday, as well as earlier in the week. The Trump stock often behaves as a sentiment indicator toward the former president and the strength of his current candidacy. DJT shares hit a short-term high of 46.27 on July 15 following the assassination attempt against the former president. Trump’s lead in the polls peaked soon after, following President Joe Biden’s exit from the 2024 race.

In September, after the presidential debate between Trump and Harris, DJT sank, signaling investor sentiment held that Trump underperformed expectations.

Shares hit a low of 11.75 on Sept. 24 but, going into Friday, DJT had roared back 200% since then. However, now DJT is sinking once more. Trump’s odds of victory on Tuesday appeared to be improving in recent weeks even as national polls show the two candidates in a statistical tie for the White House. However, the latest CNN poll shows Harris with a significant lead over Trump in the key swing states of Michigan and Wisconsin. In Pennsylvania, the biggest swing state, the two are still neck and neck.

What Trump Vs. Harris Outcomes Mean For S&P 500, Fed Rate Cuts

Donald Trump Stock Surges In October

The Donald Trump stock is among those tracked by the subreddit investor group r/WallStreetBets. Website ApeWisdom shows DJT stock was the the top-trending issue on r/WallStreetBets on the weekend and on Monday.

The Donald Trump brand and the value of DJT stock are closely related, as Truth Social launched after X, then called Twitter, shut down Trump’s account following the Jan. 6, 2021, riot at the U.S. Capitol.

Stock Market Election Reaction: Futures, Bitcoin And More

The former president holds a 65% stake in Trump Media, worth several billion dollars based on the current stock price. The company reported in August another quarter of sub-$1 million revenue. Meanwhile, Trump made his return to what was Twitter, now renamed X, on Aug. 12 via a conversation with Elon Musk. The former president had previously sworn he would not return to X and would remain on Truth Social.

The New York Post reported on Friday that “people inside the Trump camp have been speculating for weeks now that Truth Social will at some point, maybe sooner rather than later, get subsumed” by Musk and X.

Trump Media jumped more than 16% on March 26, its first day trading under the DJT ticker, hitting a high of 79.38 intraday. This followed Digital World Acquisition becoming Trump Media & Technology Group after successfully merging with Trump’s tech and social-media platform on March 22. The special purpose acquisition company stock had rallied 35% on the day before the change to “DJT.”

DWAC took Trump Media and Technology Group, or TMTG, public in a reverse merger. After a prolonged battle, DWAC stockholders voted in favor of the special purpose acquisition company’s merger with TMTG. Trump Media is the parent of the conservative social-media platform Truth Social.

DJT shares have advanced more than 96% in 2024, but remain about 31% below their price at the time of conversion.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Election Day: When Polls Close And Votes Are Counted In Key States

2024 Election Spotlight: Massachusetts And Oregon Tackle Psychedelics Reform

As Election Day 2024 unfolds, Massachusetts and Oregon are capturing national attention with pivotal ballot measures on psychedelics. Both states have the potential to reshape U.S. mental health treatment by advancing policies on substances like psilocybin and MDMA, part of the “psychedelic renaissance” in mental health care. These efforts signify growing momentum behind psychedelic-assisted therapy as a solution for PTSD, depression, and addiction, aiming to address urgent mental health needs.

Massachusetts’ Question 4: Legalization And Regulation Of Psychedelics

Massachusetts voters face an important decision with Question 4, which would legalize and decriminalize psychedelics for therapeutic and personal use. If passed, it would allow licensed providers to administer substances like psilocybin and MDMA for therapy and decriminalize personal use and home cultivation of psilocybin.

This initiative marks Massachusetts’ first state-level push for psychedelic reform, potentially setting a precedent for other states. However, the campaign has encountered internal disagreements, particularly around the measure’s dual focus on therapeutic legalization and personal decriminalization, stirring debates on potential risks like unregulated recreational use.

Key Supporters And Opposition In Massachusetts

The campaign for Question 4 is backed by strong support from veterans groups and drug policy advocates. The Heroic Hearts Project, a veterans’ service organization has been especially vocal. The group is promoting the measure as a critical alternative treatment for veterans suffering from PTSD and other mental health conditions. Massachusetts for Mental Health Options, the primary group backing the measure, has received endorsements from numerous veteran advocates, who see psychedelics as a promising path to healing when traditional treatments fail.

Local Support

Eight Massachusetts cities including Salem, Somerville and Cambridge have adopted policies deprioritizing the enforcement of laws against psychedelics. Cambridge and Somerville city councils endorsed the statewide ballot measure, signaling growing momentum for change at the local level.

Despite growing support, the measure has faced opposition. A majority of Massachusetts’ Special Joint Committee on Ballot Initiatives recommended against it in May, citing concerns over its broad scope. Governor Maura Healey introduced a veterans-focused bill to study psilocybin’s therapeutic potential but expressed caution about full-scale legalization. Critics say the measure’s decriminalization and legalization could lead to unintended consequences, like increased recreational use or regulatory challenges. The No campaign, backed by groups like Smart Approaches to Marijuana, has raised public health concerns, urging voters to reject it.

Polls indicate that Massachusetts’ electorate remains divided, with undecided voters likely to influence the final outcome. Voter turnout and public interpretation of the initiative’s complexities could ultimately determine its success.

Oregon’s Evolving Psychedelic Landscape

In Oregon, where voters approved psilocybin therapy with Measure 109 in 2020, the state is once again at the forefront of psychedelic reform. Following its landmark decriminalization of all drug possession under Measure 110, Oregon is considering additional measures in 2024 to further expand access to psychedelic therapies, potentially addressing a wider array of mental health conditions and setting an example for other states.

These measures demonstrate Oregon’s commitment to harm reduction and therapeutic options over punitive drug policies. For advocates nationwide, Oregon’s ongoing initiatives offer a potential model for expanding regulated psychedelic therapy and decriminalization.

Federal Influence And Psychedelic Reform Movement

As state initiatives gain momentum, federal policy on psychedelics remains uncertain. While the FDA has approved limited research, broader legalization and therapeutic use are still unclear. However, bipartisan support for psychedelic research is growing. With votes on Massachusetts’ Question 4 and Oregon’s initiatives, 2024 could be a pivotal year, particularly for MA, which may set a precedent for expanding access to transformative mental health therapies.

Cover image made with AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Genesis Reports 2024 Third Quarter Results and Declares a Special Dividend of $0.10

CALGARY, AB, Nov. 5, 2024 /CNW/ – Genesis Land Development Corp. GDC (the “Corporation” or “Genesis”) reported its financial and operating results for the three months (“Q3”) and nine months ended September 30, 2024 (“YTD”). Genesis is an integrated land developer and residential home builder with a strategy to grow its portfolio of well-located, entitled and unentitled primarily residential lands and serviced lots throughout the Calgary Metropolitan Area (“CMA”).

The following are highlights of Genesis financial results for the third quarter of 2024:

2024 Highlights (Q3 2024 and YTD 2024)

- $256.4 Million of Revenues in YTD 2024: Genesis generated revenues of $256.4 million in YTD 2024 up from $131.7 million achieved in YTD 2023. Q3 2024 revenues of $93.1 million were higher when compared to $41.2 million generated in Q3 2023.

- $27.0 Million of Net Earnings in YTD 2024: Net earnings attributable to equity shareholders in YTD 2024 were $27.0 million ($0.48 net earnings per share – basic and diluted), compared to net earnings attributable to equity shareholders of $6.5 million ($0.11 net earnings per share – basic and diluted) in YTD 2023. Net earnings attributable to equity shareholders in Q3 2024 were $12.0 million ($0.22 net earnings per share – basic and diluted), compared to net earnings attributable to equity shareholders of $2.2 million ($0.04 net earnings per share – basic and diluted) in Q3 2023.

- 569 Lots Sold: In YTD 2024, Genesis sold 569 residential lots, an increase of 171% from 210 lots in YTD 2023. In Q3 2024, Genesis sold 215 residential lots, an increase of 389% from 44 lots in Q3 2023.

- 294 Homes Sold: In YTD 2024, Genesis sold 294 homes, an increase of 47% from 200 homes sold in YTD 2023. In Q3 2024, Genesis sold 102 homes, an increase of 44% from the 71 sold in Q3 2023.

- 312 New Home Orders: New home orders for the nine months ended September 30, 2024 were 312 units compared to 278 units for the same period in 2023. During Q3 2024, Genesis had 77 new home orders compared to 122 for Q3 2023. As of September 30, 2024, Genesis had 265 outstanding new home orders, compared to 283 as at September 30, 2023.

- Land Servicing Activity: In YTD 2024, land servicing activity amounted to $52.5 million compared to $50.1 million in YTD 2023. Genesis is actively servicing five communities.

- Investment in Additional Lands: In Q3 2024, Genesis invested $5.0 million to acquire a 16.7% interest in a limited partnership with 243 acres of land in southeast Calgary. Additionally, in YTD 2024, Genesis closed the acquisition of two parcels of development land located in southeast Calgary totaling 894 acres for $83.4 million.

- Dividend Declared: The Corporation declared an unconditional special cash dividend of $0.10 per common share for a total of $5.7 million on November 5, 2024, payable on November 29, 2024 to shareholders of record on November 18, 2024. Pursuant to subsection 89(14) of the Income Tax Act (Canada) the dividend qualifies as an eligible dividend for Canadian federal income tax purposes.

Genesis maintains financial discipline by prudently managing its balance sheet and opportunistically allocating its cash resources among the following:

- Acquiring and developing land either directly or through land development entities;

- Acquiring builder positions in third party communities; and

- Returning cash to shareholders by paying dividends and/or buying back its common shares.

Selected Financial Results and Operating Data:

|

Three months ended |

Nine months ended |

|||||

|

($000s, except for per share items or unless otherwise noted) |

2024 |

2023 |

2024 |

2023 |

||

|

Key Financial Data |

||||||

|

Total revenues |

93,131 |

41,173 |

256,414 |

131,710 |

||

|

Net earnings attributable to equity shareholders |

12,003 |

2,203 |

26,980 |

6,456 |

||

|

Net earnings per share – basic and diluted |

0.22 |

0.04 |

0.48 |

0.11 |

||

|

Key Operating Data |

||||||

|

Land Development |

||||||

|

Total residential lots sold (units) |

215 |

44 |

569 |

210 |

||

|

Residential lot revenues (1) (2) |

37,090 |

5,838 |

93,704 |

31,188 |

||

|

Development land revenues |

– |

– |

5,466 |

4,242 |

||

|

Home Building |

||||||

|

Homes sold (units) |

102 |

71 |

294 |

200 |

||

|

Revenues (3) |

62,709 |

40,928 |

186,102 |

114,896 |

||

|

Outstanding new home orders at period end (units) |

265 |

283 |

||||

|

(1) |

Includes residential lot sales to third parties, residential lot sales to GBG and other revenues. |

|

(2) |

Includes other revenues and revenues of $Nil in Q3 2024 and $10,796,000 for 60 lots in YTD 2024 purchased by the Home Building division from Lewiston Lands Limited Partnership ($Nil in Q3 2023 and YTD 2023). These amounts are eliminated on consolidation. |

|

(3) |

Includes other revenues and revenues of $6,668,000 for 52 lots in Q3 2024 and $18,062,000 for 133 lots in YTD 2024 purchased by the Home Building division from the Land Development division ($5,593,000 and 43 in Q3 2023; $18,616,000 and 134 in YTD 2023) and sold with the home. These amounts are eliminated from residential lot revenues on consolidation. |

|

($000s, except for per share items or unless otherwise noted) |

As at Sept. 30, 2024 |

As at Dec. 31, 2023 |

||

|

Key Balance Sheet Data |

||||

|

Cash and cash equivalents |

20,773 |

37,546 |

||

|

Total assets |

510,675 |

440,083 |

||

|

Loan and credit facilities |

124,323 |

103,587 |

||

|

Shareholders’ equity |

252,687 |

231,142 |

||

|

Loan and credit facilities to total assets |

24 % |

24 % |

Outlook

Genesis continues to execute on its growth strategy in both its land and housing divisions, sustained by a backlog of new home orders, increasing lot sales volumes, and the continued strength of the CMA market. Despite ongoing economic pressures on consumers, home prices continue to move higher due to the low supply of homes for sale, combined with strong housing demand from increasing population levels.

Genesis is working proactively with key contractor partners and home buyers to address concerns relating to cost increases and a lack of skilled labour and some products and materials in both our land development and home building divisions.

Additional Information

The information contained in this press release should be read in conjunction with the unaudited condensed consolidated interim financial statements for the three and nine months ended September 30, 2024 and 2023 and the related Management’s Discussion and Analysis (“MD&A”) dated November 5, 2024 which have been filed with Canadian securities regulatory authorities. Copies of these documents may be obtained via www.sedarplus.ca or our website at www.genesisland.com.

ADVISORIES

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements which constitute forward-looking statements or information (“forward-looking statements”) within the meaning of applicable securities legislation, including Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations, concerning the business, operations and financial performance and condition of Genesis. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “proposed”, “scheduled”, “future”, “likely”, “seeks”, “estimates”, “plans”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Although Genesis believes that the anticipated future results, performance or achievements expressed or implied by forward-looking statements are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements because they involve assumptions, known and unknown risks, uncertainties and other factors many of which are beyond the Corporation’s control, which may cause the actual results, performance or achievements of Genesis to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements. Accordingly, Genesis cannot give any assurance that anticipated future results, performance or achievements will in fact occur and cautions that actual results may differ materially from those in the forward-looking statements.

Forward-looking statements are based on factors or assumptions made by us with respect to, among other things, opportunities that may or may not be pursued by us; changes in the real estate industry; fluctuations in the Canadian and Alberta economy; changes in the number of lots sold and homes delivered per year; and changes in laws or regulations or the interpretation or application of those laws and regulations. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control.

Forward-looking statements in this news release include, but are not limited to, Genesis’ strategy; the ability to take advantage of growth opportunities; anticipated general economic and business conditions (including prospects for the local economy); and areas of continued operational focus.

Factors that could cause actual results to differ materially from those set forth in the forward-looking statements include, but are not limited to: the impact of contractual arrangements and incurred obligations on future operations and liquidity; local real estate conditions, including the development of properties in close proximity to Genesis’ properties and the strength and growth of the Calgary economy and the CMA market; the uncertainties of real estate development and acquisition activity; fluctuations in interest and inflation rates; ability to access and raise capital on favorable terms; not realizing on the anticipated benefits from transactions or not realizing on such anticipated benefits within the expected time frame; the cyclicality of the oil and gas industry; changes in the Canadian / U.S. dollar exchange rate; labor matters; governmental regulations; general economic and financial conditions; stock market volatility; and other risks and factors described from time to time in the documents filed by Genesis with the securities regulators in Canada available at www.sedarplus.ca, including in the Corporation’s MD&A under the heading “Risks and Uncertainties” and the Corporation’s annual information form under the heading “Risk Factors”.

Furthermore, the forward-looking statements contained in this news release are made as of the date of this news release and, except as required by applicable law, Genesis does not undertake any obligation to publicly update or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Genesis Land Development Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/05/c8770.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/05/c8770.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

John Costigan Takes A Bullish Stance, Acquiring In FactSet Research Systems Stock Options

On November 4, Costigan, Chief Data Officer at FactSet Research Systems FDS, executed a strategic insider move by acquiring stock options for 3,569 shares.

What Happened: Revealed in a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, Costigan, Chief Data Officer at FactSet Research Systems, strategically acquired stock options for 3,569 shares of FDS. These options empower Costigan to buy the company’s stock at a favorable exercise price of $458.8 per share.

FactSet Research Systems shares are trading down 0.12% at $461.26 at the time of this writing on Tuesday morning. Since the current price is $461.26, this makes Costigan’s 3,569 shares worth $8,779.

Get to Know FactSet Research Systems Better

FactSet provides financial data and portfolio analytics to the global investment community. The company aggregates data from third-party data suppliers, news sources, exchanges, brokerages, and contributors into its workstations. In addition, it provides essential portfolio analytics that companies use to monitor portfolios and address reporting requirements. Buy-side clients (including wealth and corporate clients) account for 82% of FactSet’s annual subscription value. In 2015, the company acquired Portware, a provider of trade execution software. In 2017, it acquired BISAM, a risk management and performance measurement provider. In 2022, it completed its purchase of CUSIP Global Services.

Understanding the Numbers: FactSet Research Systems’s Finances

Revenue Growth: Over the 3 months period, FactSet Research Systems showcased positive performance, achieving a revenue growth rate of 4.93% as of 31 August, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 54.07%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): FactSet Research Systems’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 2.35.

Debt Management: FactSet Research Systems’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.82, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 33.2 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 8.1 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 21.34, FactSet Research Systems’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of FactSet Research Systems’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NOBLE CORPORATION PLC ANNOUNCES THIRD QUARTER 2024 RESULTS AND ADDITIONAL SHARE REPURCHASE AUTHORIZATION

- Closed Diamond acquisition on September 4th

- Increased capital return program with additional share repurchase authorization of $400 million

- Repurchased 6.9 million of shares in Q3 2024, $0.50 per share dividend declared for Q4 2024, bringing total FY 2024 cash returns to shareholders to over $525 million, including Q4 dividend

- Q3 Net Income of $61 million, Diluted Earnings Per Share of $0.40, Adjusted EBITDA of $291 million, net cash provided by operating activities of $284 million, and Free Cash Flow of $165 million

- Q4 2024 Guidance provided as follows: Total Revenue $850 to $890 million, Adjusted EBITDA $275 to $305 million, Capital Additions (net of reimbursements) $105 to $135 million

SUGAR LAND, Texas, Nov. 5, 2024 /PRNewswire/ — Noble Corporation plc NENOBLE “, Noble”, or the “, Company”, )) today reported third quarter 2024 results.

|

Three Months Ended |

||||||

|

(in millions, except per share amounts) |

September 30, |

September 30, |

June 30, |

|||

|

Total Revenue |

$ 801 |

$ 697 |

$ 693 |

|||

|

Contract Drilling Services Revenue |

764 |

671 |

661 |

|||

|

Net Income (Loss) |

61 |

158 |

195 |

|||

|

Adjusted EBITDA* |

291 |

283 |

271 |

|||

|

Adjusted Net Income (Loss)* |

89 |

127 |

105 |

|||

|

Basic Earnings (Loss) Per Share |

0.41 |

1.14 |

1.37 |

|||

|

Diluted Earnings (Loss) Per Share |

0.40 |

1.09 |

1.34 |

|||

|

Adjusted Diluted Earnings (Loss) Per Share* |

0.58 |

0.87 |

0.72 |

|||

|

* A Non-GAAP supporting schedule is included with the statements and schedules in this press release. |

||||||

Robert W. Eifler, President and Chief Executive Officer of Noble Corporation plc, stated “We are excited to have closed on the Diamond acquisition during the third quarter, enabling us to start capturing the value from the transaction earlier than expected. Our strategy of pursuing rational and accretive growth in the high-end deepwater segment toward an ultimate objective of maximizing cash returns to shareholders is yielding tangible results, as evidenced by robust third quarter free cash flow and a sector leading dividend and buyback program. Despite a more muted near-term demand environment than we had envisioned coming into this year, Noble is uniquely well positioned to deliver customer and shareholder value through various market conditions.“

Third Quarter Results

Contract drilling services revenue for the third quarter of 2024 totaled $764 million compared to $661 million in the second quarter of 2024, with the sequential increase driven primarily by an approximate four weeks of contribution from the legacy Diamond fleet. Marketed fleet utilization was 82% in the three months ended September 30, 2024, compared to 78% in the previous quarter. Contract drilling services costs for the third quarter of 2024 were $434 million, up from $336 million for the second quarter of 2024, with the sequential increase driven by the legacy Diamond fleet and partially offset by lower contract preparation and mobilization expenses. Net income decreased to $61 million in the third quarter of 2024, down from $195 million in the second quarter of 2024, and Adjusted EBITDA increased to $291 million in the third quarter of 2024, up from $271 million in the second quarter of 2024. Net cash provided by operating activities in the third quarter of 2024 was $284 million, net capital expenditures were $119 million, and free cash flow (non-GAAP) was $165 million.

Balance Sheet, Capital Allocation, and Increased Shareholder Return Authorization

The Company’s balance sheet as of September 30, 2024, reflected total debt principal value of approximately $2.0 billion and cash (and cash equivalents) of $392 million.