Iovance Biotherapeutics Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Iovance Biotherapeutics. Our analysis of options history for Iovance Biotherapeutics IOVA revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $234,150, and 5 were calls, valued at $414,807.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for Iovance Biotherapeutics during the past quarter.

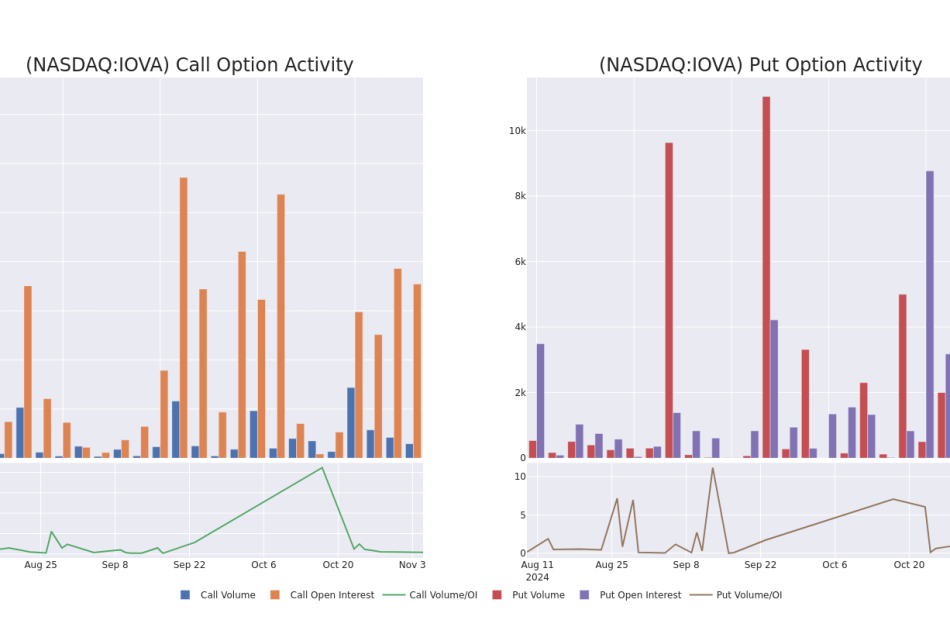

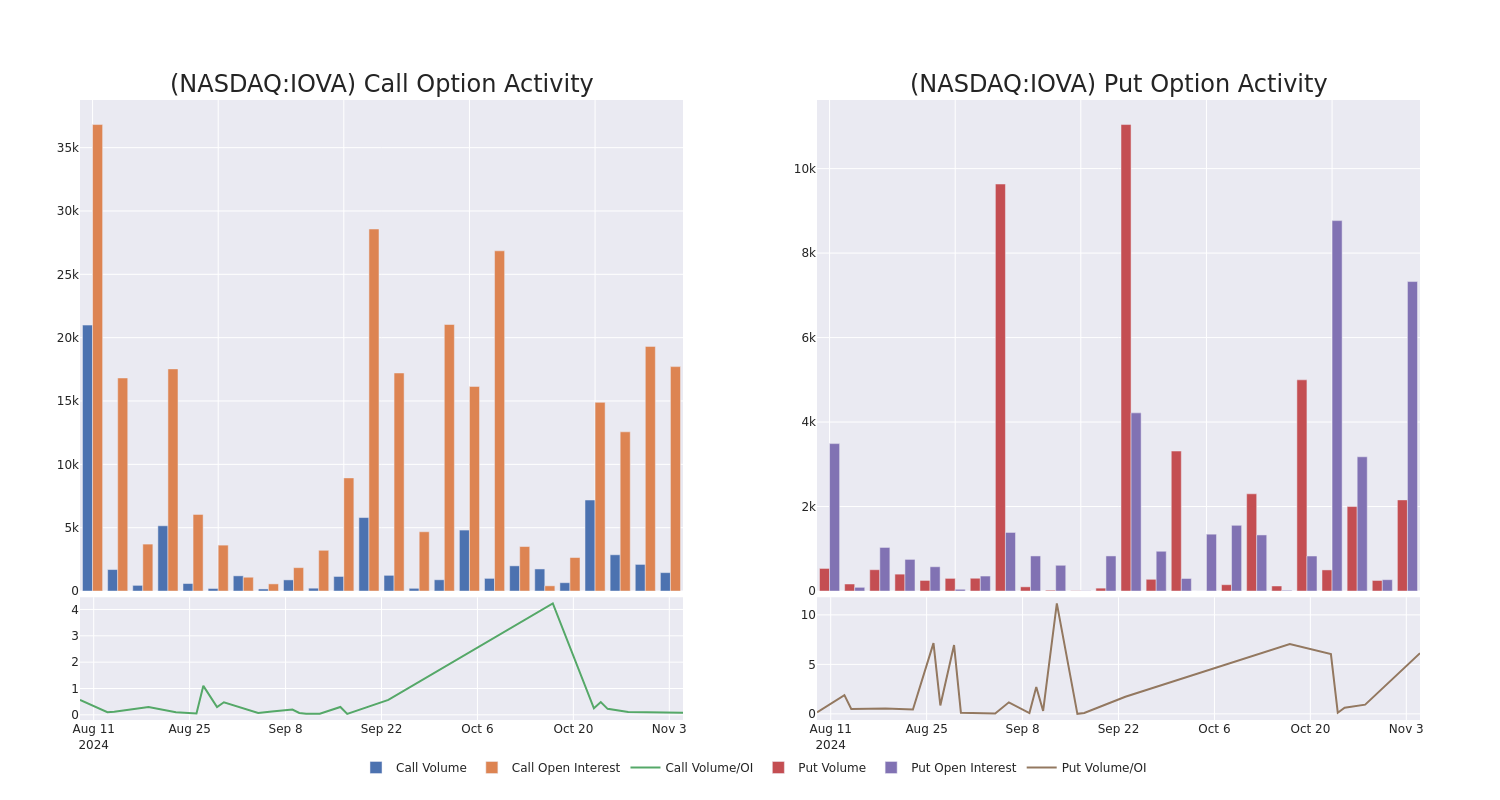

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Iovance Biotherapeutics’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Iovance Biotherapeutics’s whale activity within a strike price range from $7.5 to $15.0 in the last 30 days.

Iovance Biotherapeutics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IOVA | CALL | SWEEP | BULLISH | 03/21/25 | $3.3 | $3.1 | $3.3 | $10.00 | $141.9K | 2.4K | 433 |

| IOVA | CALL | SWEEP | BEARISH | 12/20/24 | $3.2 | $3.0 | $3.0 | $9.00 | $135.0K | 6.1K | 200 |

| IOVA | CALL | SWEEP | BULLISH | 03/21/25 | $1.5 | $1.2 | $1.49 | $15.00 | $64.8K | 891 | 440 |

| IOVA | PUT | TRADE | NEUTRAL | 01/16/26 | $4.0 | $3.8 | $3.9 | $12.00 | $46.8K | 109 | 362 |

| IOVA | PUT | SWEEP | BULLISH | 01/16/26 | $4.0 | $3.8 | $3.8 | $12.00 | $45.6K | 109 | 242 |

About Iovance Biotherapeutics

Iovance Biotherapeutics Inc is a clinical-stage biopharmaceutical company, pioneering a transformational approach to treating cancer by harnessing the human immune system’s ability to recognize and destroy diverse cancer cells using therapies personalized for each patient. The company is preparing for potential U.S. regulatory approvals and commercialization of the first autologous T-cell therapy to address a solid tumor cancer. its objective is to be the leader in innovating, developing, and delivering tumor-infiltrating lymphocyte, or TIL, therapies for patients with solid tumor cancers.

Following our analysis of the options activities associated with Iovance Biotherapeutics, we pivot to a closer look at the company’s own performance.

Iovance Biotherapeutics’s Current Market Status

- With a volume of 1,428,846, the price of IOVA is down -1.97% at $11.21.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

What The Experts Say On Iovance Biotherapeutics

In the last month, 1 experts released ratings on this stock with an average target price of $17.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from UBS lowers its rating to Buy with a new price target of $17.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Iovance Biotherapeutics options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Gives Tepid Sales Forecast, No Filing Schedule

(Bloomberg) — Super Micro Computer Inc. gave a sales forecast that fell short of analysts’ estimates while saying it couldn’t predict when it would file official financial statements for its previous fiscal year. The shares dropped about 14% in extended trading.

Most Read from Bloomberg

The embattled server maker missed an August deadline to file its annual financial report and last week its auditor, Ernst & Young LLP, resigned, citing concerns about the company’s governance and transparency. An investigation of the accounting issues by a special board committee found “no evidence of fraud or misconduct on the part of management or the board of directors,” Super Micro said Tuesday in a statement.

Revenue will be $5.5 billion to $6.1 billion in the quarter ending in December, the company said. Analysts, on average, projected sales of $6.79 billion, according to data compiled by Bloomberg. Profit, excluding some items, is expected to be 56 cents to 65 cents per share, compared with 80 cents anticipated by analysts.

Sales were hurt in the fiscal first quarter by the availability of semiconductors, Chief Executive Officer Charles Liang said. When asked on a conference call whether the company’s accounting issues had affected its relationship with Nvidia Corp., which is the top producer of powerful processors for artificial intelligence, executives said the chipmaker hasn’t made any changes to Super Micro’s supply allocations.

“At this moment — according to our relationship, according to our communication — things are very positive,” Liang said of the relationship with Nvidia.

Super Micro has had a tumultuous year. Shares were rising at the start of 2024, with Wall Street enthusiastic about AI-fueled demand for the company’s high-powered machines, and the company winning inclusion in the S&P 500.

But scrutiny intensified after a former employee alleged earlier this year in federal court that Super Micro had sought to overstate its revenue. Short seller Hindenburg Research referenced those claims in a research report, alleging “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Recently, the failure to file its 10-K financial disclosure and the departure of E&Y has put the San Jose, California-based company at a risk of being delisted by Nasdaq Inc. and booted from the index. The shares have slipped 44% since the auditor’s resignation last week and are down more than 75% from a March peak.

DJT stock jumps in after-hours trading as early election results roll in

Trump Media & Technology Group stock (DJT) surged as much as 25% in after-hours trading on Tuesday as investors brace for more wild swings with early voting results underway. Shares have since retreated, rising a more modest 10%.

Trump has clinched Kentucky, Indiana, and West Virginia, according to the Associated Press, while Harris has claimed Vermont.

The stock had a wild session during market hours after trading was halted several times due to volatility, with shares quickly erasing 15% gains and reversing Monday’s double-digit percentage rise to kick off the week.

Shares were still able to somewhat recover from steeper losses, although the stock still closed down a little over 1%.

Last week, shares suffered their largest percentage decline and closed down around 20% to end the five-day period on Friday, which shaved off around $4 billion from the company’s market cap. The stock has still more than doubled from its September lows.

The latest price action comes as investors await the results of the presidential election between Republican nominee Donald Trump and Democratic candidate Kamala Harris.

Volatility in the stock is expected to continue. One investor has warned that if Trump loses the election, shares of DJT could plunge to $0.

“It’s a binary bet on the election,” Matthew Tuttle, CEO of investment fund Tuttle Capital Management, recently told Yahoo Finance’s Catalysts.

Read more: Trump vs. Harris: 4 ways the next president could impact your bank accounts

Tuttle, who currently owns put options on the stock, said the trajectory of shares hinges on “a buy the rumor, sell the fact” trading strategy.

“I would imagine that the day after him winning, you’d see this come down,” he surmised. “If he loses, I think it goes to zero.”

Interactive Brokers’ chief strategist Steve Sosnick said DJT has taken on a meme-stock “life of its own.”

“It was volatile on the way up, and when a stock is that volatile in one direction, it has a tendency to be that volatile in the other direction,” he said on a call with Yahoo Finance last week.

Prior to the recent volatility, shares in the company — the home of the Republican nominee’s social media platform, Truth Social — had been steadily rising in recent weeks as both domestic and overseas betting markets shifted in favor of a Trump victory.

Prediction sites like Polymarket, PredictIt, and Kalshi all showed Trump’s presidential chances ahead of those of Democratic nominee and current Vice President Kamala Harris. That lead, however, narrowed significantly over the weekend as new polling showed Harris surpassing Trump in Iowa, which has historically voted Republican.

Calibre Reports Q3 and Year-To-Date 2024 Financial Results as the Multi-Million Ounce Valentine Gold Mine Progresses to Construction Completion in Canada

VANCOUVER, British Columbia, Nov. 05, 2024 (GLOBE NEWSWIRE) — Calibre Mining Corp. CXBCXBMF (“Calibre” or the “Company”) announces financial and operating results for the three months (“Q3”) and nine months (“YTD”) ended September 30, 2024. Consolidated Q3 and YTD 2024 filings can be found at www.sedarplus.ca and on the Company’s website at www.calibremining.com. All figures are expressed in U.S. dollars unless otherwise stated.

Darren Hall, President and Chief Executive Officer of Calibre, stated: “As previously reported, the Company delivered 46,076 ounces in the quarter and 166,200 ounces year to date. Consolidated Q4 production is expected to be the strongest of the year, delivering 70,000 – 80,000 ounces, driven by Nicaragua’s Q4 mine plans which are tracking and plan for significantly higher ore tonnes mined. After increasing ore haulage to Libertad by 30% to 3,000 tonnes per day, we forecast a stockpile build of approximately 30,000 ounces which will be processed in 2025.

The Valentine team continues to make significant progress with construction completion at 81% at the end of September and we remain on track to deliver first gold during Q2 2025. I am pleased with the increased focus, and we are confidently heading toward mechanical and electrical completion in early Q1, 2025.

The Valentine Gold Mine and surrounding property offers an impressive 5-million-ounce resource base and numerous discovery opportunities. Previously disclosed results at Valentine indicate robust growth potential below and adjacent to existing Mineral Resources. Our extensive, multi-rig drill program is focused on high priority targets beyond the originally explored 6 km section of defined reserves/resources of the 32 km long Valentine Lake Shear Zone to unlock the significant resource expansion and discovery potential across the property.”

YTD & Q3 2024 Highlights

- Construction of the multi-million-ounce Valentine Gold Mine surpasses 81% construction with a remaining cost to complete on an incurred basis of C$197 million as at September 30, 2024 and remains on track for gold production in Q2 2025;

- Tailings Management Facility is complete and ready to receive water;

- CIL leaching area tanks construction is nearing completion;

- Reclaim tunnel and coarse ore stockpile construction is progressing;

- Primary crusher installation is well advanced and overland conveyor construction has commenced; and

- Pre-commissioning is underway;

- With approximately C$300 million in cash (US$115.8-million and restricted cash US$100-million) at September 30, 2024, Valentine’s initial project capital remains fully financed;

- Bolstered cash position as part of our capital management program with $55 million to be received from an additional gold prepayment arrangement whereby Calibre will physically deliver an additional 20,000 ounces of gold (2,500 ounces of gold per month at $2,816 per ounce) from May 2025 to December 2025;

- Calibre Strengthens its Executive Leadership Team with the Appointment of Chief Operating Officer and Vice President of Technical Services, Nicaragua;

- Expanded the Valentine Gold Mine (“Valentine”) resource expansion and discovery drill program with a 100,000 metre drill program, in addition to the 60,000 metre program already in place at the Leprechaun and Marathon deposits;

- Received the Federal Environmental Assessment approval for the third open pit, the Berry Pit at Valentine scheduled to commence construction activities in Q4 2024;

- Ore control drilling results at the Marathon Pit at Valentine yielded 44% additional gold on 47% higher grades than modelled in the 2022 Mineral Reserve statement, increasing confidence of the deposit as the Company advances toward first gold in Q2 2025;

- New Discovery along the VTEM Gold Corridor and continued step out drilling intercepts high-grade gold mineralization at the Talavera deposit, both located within the Limon mine complex in Nicaragua, reinforcing Limon’s ability to continually deliver compelling results, leading to new discoveries and resource expansion:

- 13.26 g/t gold over 4.9 metres ETW including 33.50 g/t gold over 1.2 metres ETW; and

- 6.38 g/t gold over 10.5 metres ETW;

- Continued to intercept high grade gold mineralization from the resource conversion and expansion program within the Guapinol open pit area at the Eastern Borosi mine in Nicaragua, reinforcing the potential for mine life extension:

- 13.24 g/t gold over 5.8 metres ETW including 18.52 g/t gold over 4.0 metres ETW; and

- 9.24 g/t gold over 6.2 metres ETW including 17.45 g/t gold over 3.1 metres ETW;

- Discovered additional near surface, above reserve grade gold mineralization at the Pan Mine (“Pan”) in Nevada, demonstrating the potential to increase resources, grade and mine life around Pan:

- 0.45 g/t gold over 117.4 meres ETW; and

- 0.56 g/t gold over 59.4 metres including 1.31 g/t gold over 9.1 metres ETW;

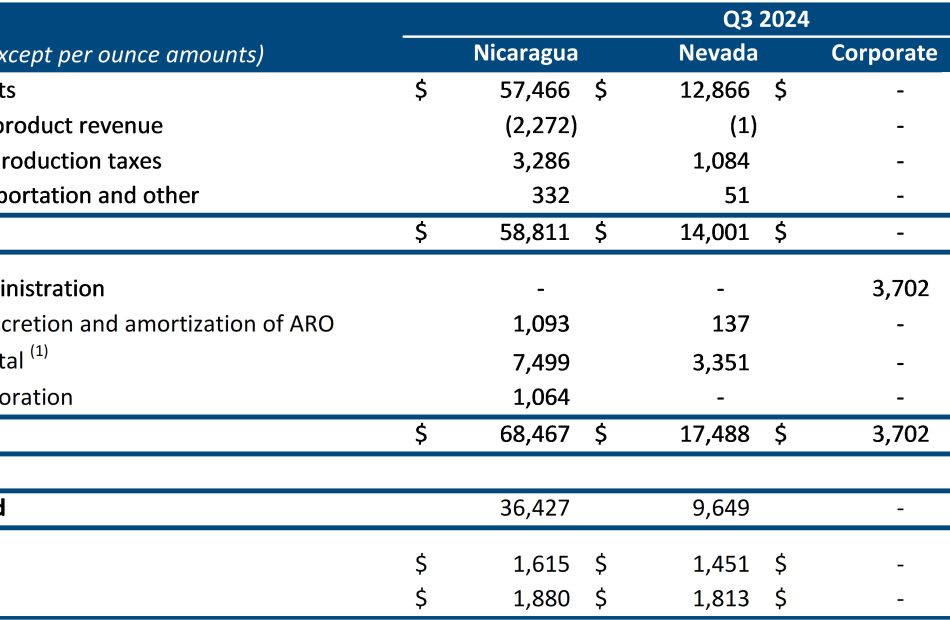

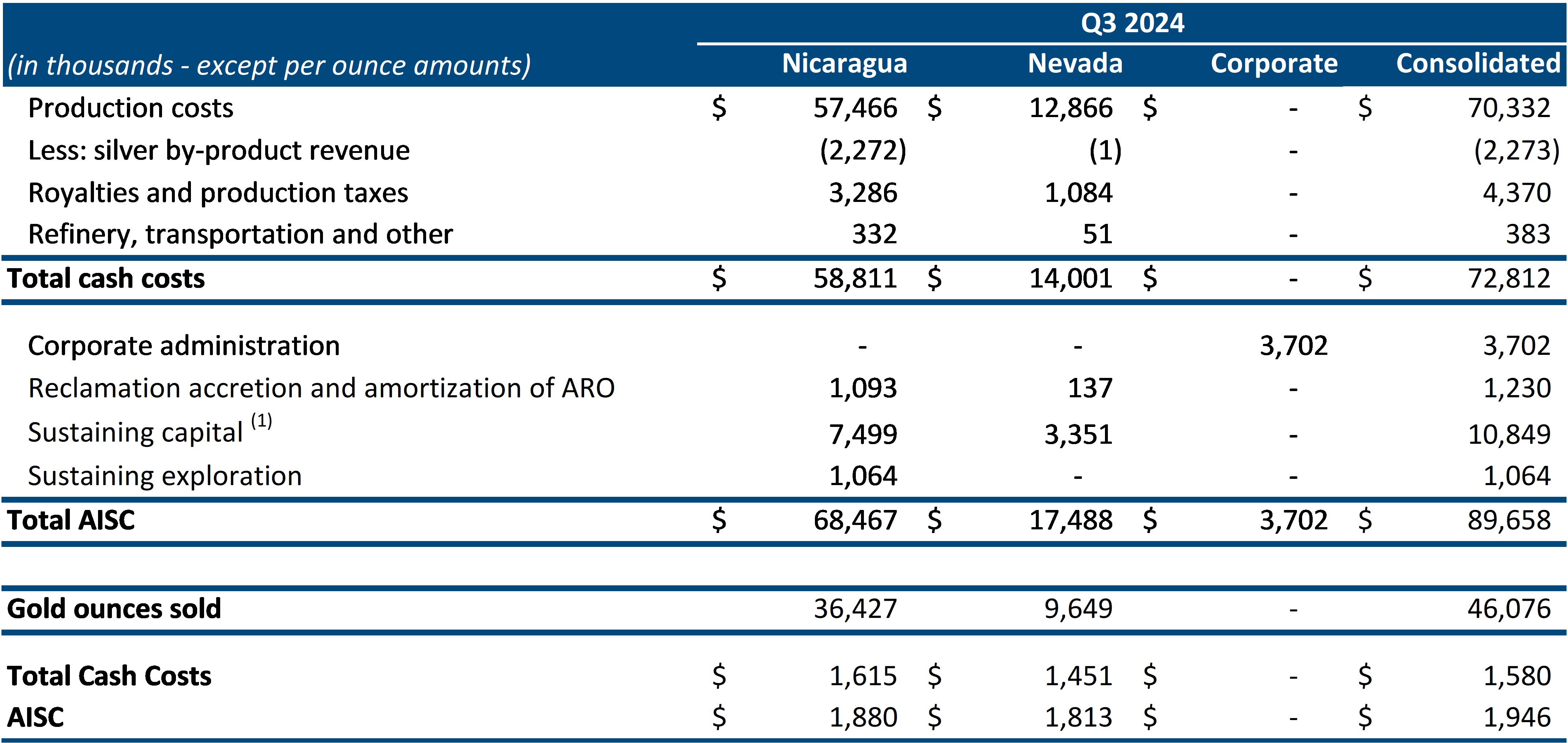

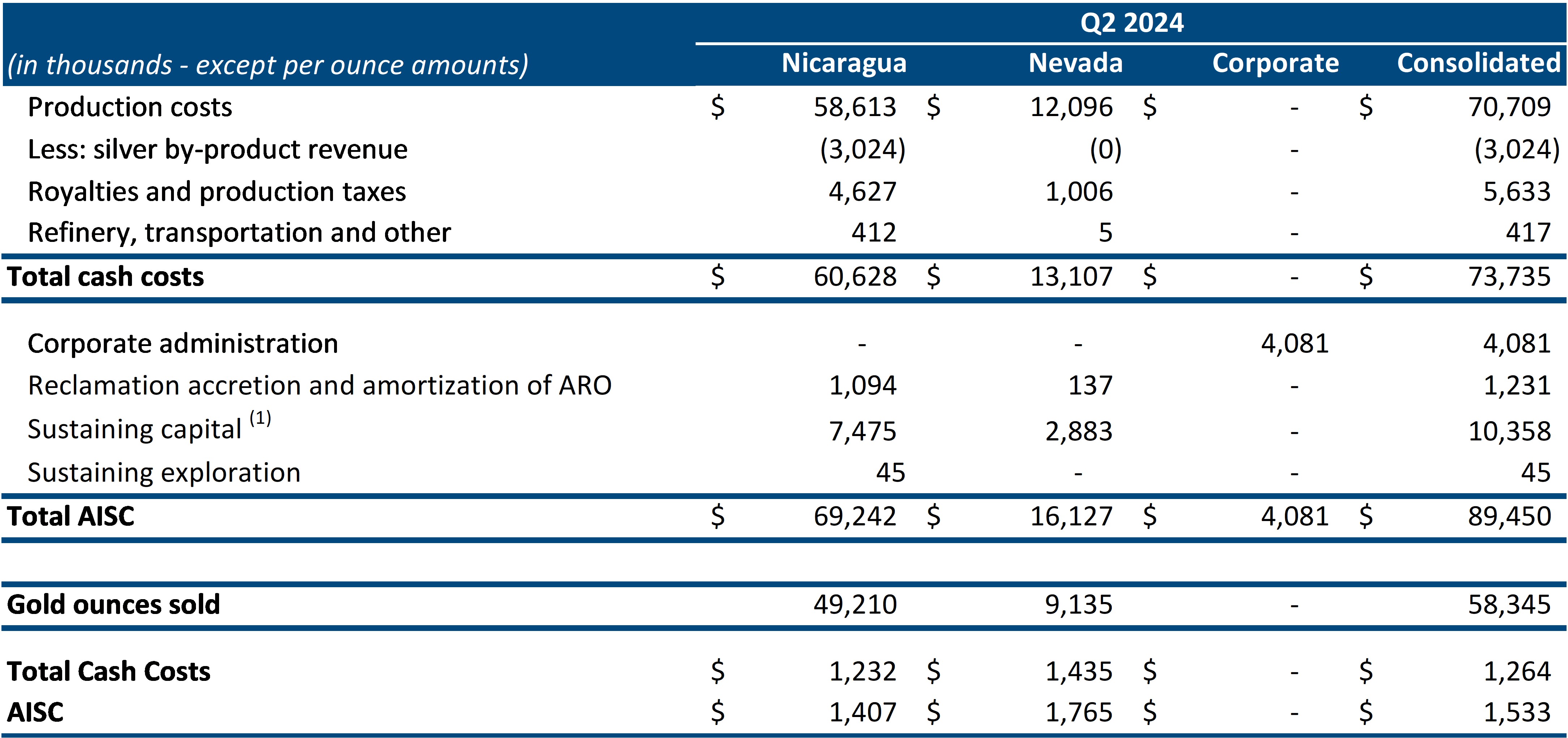

- Consolidated gold sales of 46,076 ounces; Nicaragua 36,427 ounces and Nevada 9,649 ounces;

- Consolidated TCC1 of $1,580/oz; Nicaragua $1,615/oz and Nevada $1,451/oz;

- Consolidated AISC1 of $1,946/oz; Nicaragua $1,880/oz and Nevada $1,813/oz; and

- Cash and restricted cash of $115.8 million and $100.0 million, respectively, as at September 30, 2024.

YTD 2024 Gold Sales and Cost Metrics

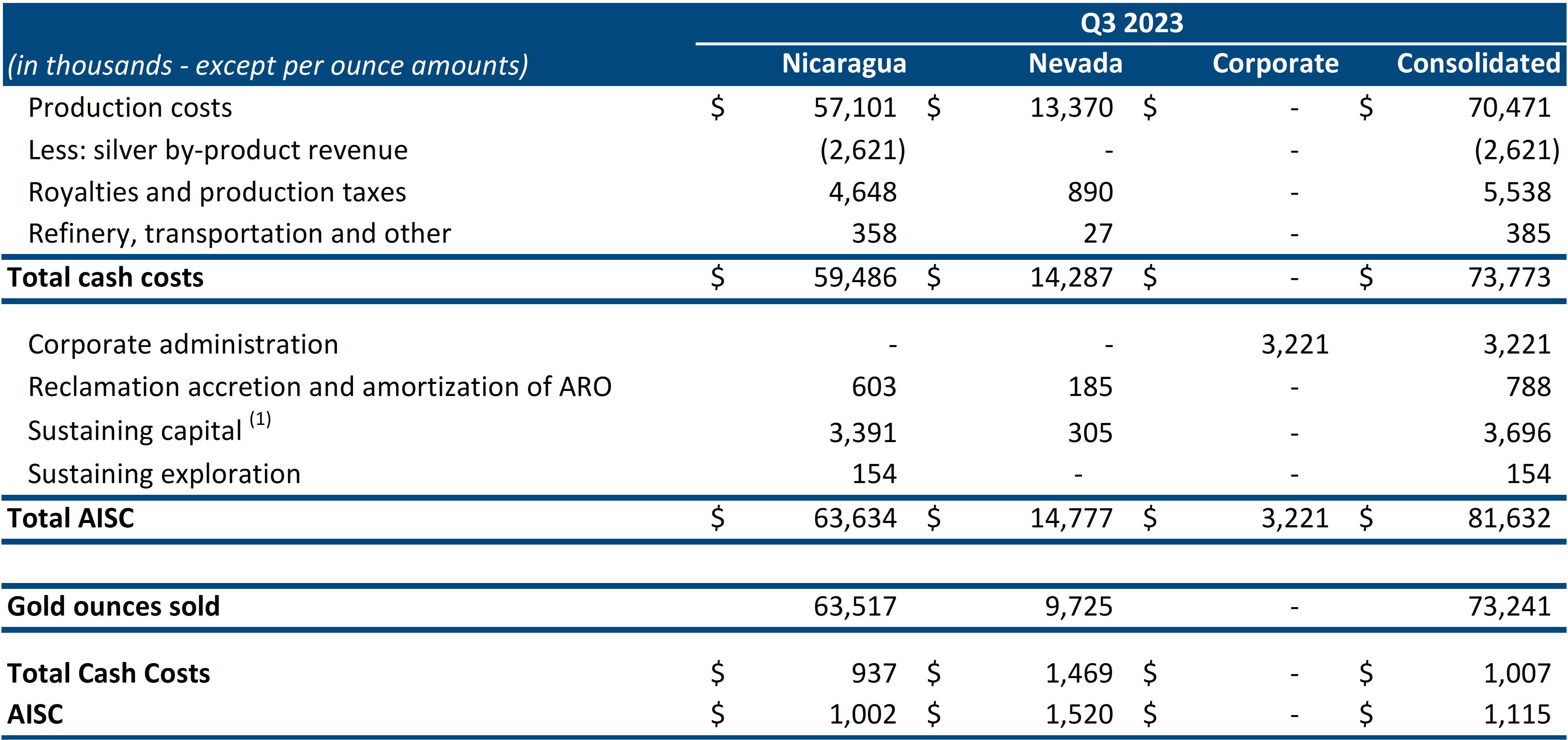

- Consolidated gold sales of 166,200 ounces grossing $374.9 million in revenue, at an average realized gold price1 of $2,256/oz; Nicaragua 140,646 ounces and Nevada 25,554 ounces;

- Consolidated TCC1 of $1,379/oz; Nicaragua $1,364/oz and Nevada $1,463/oz;

- Consolidated AISC1 of $1,656/oz; Nicaragua $1,554/oz and Nevada $1,734/oz; and

- Cash provided by operating activities of $88.8 million.

Click here to learn more about the Valentine Gold Mine – Building Atlantic Canada’s Largest Open Pit Gold Mine

Installation of the Primary Crusher – September 2024

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a6073327-6b82-4aaf-bf52-e1cb2221d7b4

CONSOLIDATED RESULTS: Q3 and Nine Months Ended 2024

Consolidated Results2

| Three Months Ended | Nine Months Ended | ||||||||||||||

| $’000 (except per share and per ounce amounts) | Q3 2024 | Q2 2024 | Q3 2023 | YTD 2024 | YTD 2023 | ||||||||||

| Financial Results | |||||||||||||||

| Revenue | $ | 113,684 | $ | 137,325 | $ | 143,884 | $ | 382,897 | $ | 410,107 | |||||

| Cost of sales, including depreciation and amortization | $ | (97,437 | ) | $ | (94,685 | ) | $ | (101,128 | ) | $ | (294,753 | ) | $ | (281,556 | ) |

| Earnings from mine operations | $ | 16,247 | $ | 42,640 | $ | 42,756 | $ | 88,144 | $ | 128,551 | |||||

| EBITDA (3) | $ | 29,988 | $ | 52,886 | $ | 61,899 | $ | 109,352 | $ | 170,416 | |||||

| Adjusted EBITDA (3) | $ | 28,943 | $ | 54,022 | $ | 62,998 | $ | 122,694 | $ | 172,852 | |||||

| Net earnings | $ | 954 | $ | 20,762 | $ | 23,412 | $ | 18,079 | $ | 73,024 | |||||

| Adjusted net earnings (4) | $ | 2,199 | $ | 19,035 | $ | 24,530 | $ | 26,545 | $ | 74,361 | |||||

| Operating cash flows before working capital (5) | $ | 4,170 | $ | 68,618 | $ | 49,826 | $ | 125,170 | $ | 138,605 | |||||

| Operating cash flow | $ | (17,833 | ) | $ | 60,826 | $ | 54,226 | $ | 88,808 | $ | 140,776 | ||||

| Capital expenditures (sustaining) | $ | 10,849 | $ | 10,358 | $ | 3,696 | $ | 28,916 | $ | 19,545 | |||||

| Capital expenditures (growth) | $ | 136,103 | $ | 97,581 | $ | 29,294 | $ | 301,833 | $ | 70,204 | |||||

| Capital expenditures (exploration) | $ | 12,387 | $ | 8,967 | $ | 7,705 | $ | 28,991 | $ | 21,448 | |||||

| Operating Results | |||||||||||||||

| Gold ounces produced | 45,697 | 58,754 | 73,485 | 166,218 | 208,011 | ||||||||||

| Gold ounces sold | 46,076 | 58,345 | 73,241 | 166,200 | 208,020 | ||||||||||

| Per Ounce Data | |||||||||||||||

| Average realized gold price1 ($/oz) | $ | 2,418 | $ | 2,302 | $ | 1,929 | $ | 2,256 | $ | 1,932 | |||||

| TCC ($/oz)1 | $ | 1,580 | $ | 1,264 | $ | 1,007 | $ | 1,379 | $ | 1,047 | |||||

| AISC ($/oz)1 | $ | 1,946 | $ | 1,533 | $ | 1,115 | $ | 1,656 | $ | 1,195 | |||||

| Per Share Data | |||||||||||||||

| Earnings per share – basic | $ | 0.00 | $ | 0.03 | $ | 0.05 | $ | 0.02 | $ | 0.16 | |||||

| Earnings per share – fully diluted | $ | 0.00 | $ | 0.03 | $ | 0.05 | $ | 0.02 | $ | 0.15 | |||||

| Adjusted net earnings per share – basic (3) | $ | 0.00 | $ | 0.02 | $ | 0.05 | $ | 0.04 | $ | 0.16 | |||||

| Operating cash flows before working capital per share | $ | 0.01 | $ | 0.09 | $ | 0.11 | $ | 0.17 | $ | 0.31 | |||||

| Operating cash flow per share | $ | (0.02 | ) | $ | 0.08 | $ | 0.12 | $ | 0.12 | $ | 0.31 | ||||

| Balance Sheet Data | |||||||||||||||

| Cash | $ | 115,800 | $ | 127,582 | $ | 97,293 | $ | 115,800 | $ | 97,293 | |||||

| Net debt (6) | $ | 178,345 | $ | 164,809 | $ | (77,927 | ) | $ | 178,345 | $ | (77,927 | ) | |||

| Adj. Net debt/Adj. EBITDA (LTM) ratio (7) | $ | 0.91 | $ | 0.72 | $ | (0.37 | ) | $ | 0.91 | $ | (0.37 | ) | |||

Operating Results

| Three Months Ended | Nine Months Ended | ||||

| NICARAGUA | Q3 2024 | Q2 2024 | Q3 2023 | YTD 2024 | YTD 2023 |

| Ore mined (t) | 574,878 | 359,295 | 491,835 | 1,468,960 | 1,588,631 |

| Ore milled (t) | 557,635 | 455,616 | 546,555 | 1,544,261 | 1,545,123 |

| Grade (g/t Au) | 2.30 | 3.48 | 4.35 | 3.00 | 4.03 |

| Recovery (%) | 88.9 | 92.5 | 91.6 | 91.2 | 92.3 |

| Gold produced (ounces) | 36,427 | 49,208 | 63,756 | 140,642 | 177,145 |

| Gold sold (ounces) | 36,427 | 49,210 | 63,517 | 140,646 | 177,100 |

| NEVADA | Three Months Ended | Nine Months Ended | |||

| Q3 2024 | Q2 2024 | Q3 2023 | YTD 2024 20243,256,527 | YTD 2023 | |

| Ore mined (t) | 1,187,591 | 1,080,242 | 1,129,042 | 3,256,527 | 3,513,948 |

| Ore placed on leach pad (t) | 1,158,381 | 1,062,001 | 1,076,876 | 3,195,736 | 3,452,753 |

| Grade (g/t Au) | 0.44 | 0.44 | 0.34 | 0.42 | 0.37 |

| Gold produced (ounces) | 9,270 | 9,546 | 9,729 | 25,576 | 30,866 |

| Gold sold (ounces) | 9,649 | 9,135 | 9,724 | 25,554 | 30,920 |

2024 REVISED GUIDANCE

| CONSOLIDATED | NICARAGUA | NEVADA | |

| Gold Production/Sales (ounces) | 230,000 – 240,000 | 200,000 – 210,000 | 34,000 – 36,000 |

| TCC ($/ounce)1 | $1,300 – $1,350 | $1,300 – $1,350 | $1,450 – $1,500 |

| AISC ($/ounce)1 | $1,550 – $1,600 | $1,450 – $1,500 | $1,650 – $1,750 |

| Growth Capital ($ million)* | $60 – $70 | ||

| Updated Exploration Capital ($ million) | $40 – $45 | ||

*Initial project capital at the Valentine Gold Mine not included

Given Calibre’s proven track record, the Company will continue to reinvest into exploration and growth with over 160,000 metres of drilling and development of new satellite deposits across its asset portfolio.

Consolidated Q4 production is expected to be 70,000 – 80,000 ounces, while TCC and AISC are forecast to be lower. The stronger Q4 outlook is driven by Nicaragua’s mine plans which are tracking and plan for significantly higher ore tonnes mined. After increasing ore haulage to Libertad by 30% to 3,000 tonnes per day we forecast a stockpile build of approximately 30,000 ounces which will be processed in 2025.

Exploration activities include multi-rig diamond, RC and RAB drilling in Newfoundland, Nevada and Nicaragua along with several geo-science initiatives through the exploration pipeline. Growth capital includes new underground development and open pit mine development, leach pad expansion, waste stripping and land acquisition.

Since acquiring the Nicaraguan assets in October 2019, the Nevada assets in 2022, and the Newfoundland & Labrador assets in 2024, Calibre has consistently reinvested in mine development and exploration programs. These investments have led to the discovery of new deposits and growth in both production and Mineral Reserves. This progress positions Calibre well to diversify its portfolio and enhance profitability as it expands its operations into Canada with the Valentine Gold Mine anticipated to deliver first gold during Q2 2025.

The Company’s mineral endowment includes 4.1 million ounces of Reserves, 8.6 million ounces of Measured and Indicated Resources (inclusive of Mineral Reserves), and 3.6 million ounces of Inferred Resources, as detailed in the press release dated March 12, 2024.

Calibre held a Q3 and YTD 2024 Production and Valentine Gold Mine Construction update conference call on October 18, 2024, please visit the Calibre Mining website here, to access the replay of the conference call.

Qualified Person

The scientific and technical information contained in this news release was approved by David Schonfeldt P.GEO, Calibre Mining’s Corporate Chief Geologist and a “Qualified Person” under National Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua. Calibre is focused on delivering sustainable value for shareholders, local communities and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects and district-scale exploration opportunities Calibre will unlock significant value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please contact:

Ryan King

Senior Vice President, Corporate Development & IR

T: 604.628.1010

E: calibre@calibremining.com

W: www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St., Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed nor accepts responsibility for the adequacy or accuracy of this news release.

Notes

(1) NON-IFRS FINANCIAL MEASURES

Calibre has included certain non-IFRS measures as discussed below. The Company believes that these measures, in addition to conventional measures prepared in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. These non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

TCC per Ounce of Gold: TCC include production costs, royalties, production taxes, refinery charges, and transportation charges. Production costs consist of mine site operating costs such as mining, processing, local administrative costs (including stock-based compensation related to mine operations) and current inventory write-downs, if any. Production costs are exclusive of depreciation and depletion, reclamation, capital and exploration costs. TCC are net of by-product silver sales and are divided by gold ounces sold to arrive at a per ounce figure.

AISC per Ounce of Gold: AISC is a performance measure that reflects the total expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, the Company’s definition is derived from the definition as set out by the World Gold Council in its guidance dated June 27, 2013 and November 16, 2018, respectively. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. The Company believes that this measure is useful to external users in assessing operating performance and the ability to generate free cash flow from operations.

Calibre defines AISC as the sum of TCC, corporate general and administrative expenses (excluding one-time charges), reclamation accretion related to current operations and amortization of asset retirement obligations (“ARO”), sustaining capital (capital required to maintain current operations at existing production levels), lease repayments, and exploration expenditures designed to increase resource confidence at producing mines. AISC excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to resource growth, rehabilitation accretion not related to current operations, financing costs, debt repayments, and taxes. Total AISC is divided by gold ounces sold to arrive at a per ounce figure

Average Realized Price per Ounce Sold: Average Realized Gold Price Per Ounce Sold is intended to enable management to understand the average realized price of gold sold in each reporting period after removing the impact of non-gold revenues and by-produce credits, which in the Company’s case are not significant, and to enable investors to understand the Company’s financial performance based on the average realized proceeds of selling gold production in the reporting period. Average Realized Gold Price Per Ounce Sold is a common performance measure that does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is revenue from gold sales.

Adjusted Net Earnings: Adjusted Net Earnings and Adjusted Net Earnings Per Share – Basic exclude a number of temporary or one-time items considered exceptional in nature and not related to the Company’s core operation of mining assets or reflective of recurring operating performance. Management believes Adjusted Net Earnings may assist investors and analysts to better understand the current and future operating performance of the Company’s core mining business. Adjusted Net Earnings and Adjusted Net Earnings Per Share do not have a standard meaning under IFRS. They should not be considered in isolation, or as a substitute for measures of performance prepared in accordance with IFRS and are not necessarily indicative of earnings from mine operations, earnings, or cash flow from operations as determined under IFRS.

Cash From Operating Activities Before Changes in Working Capital: Cash from Operating Activities before Changes in Working Capital is a non-IFRS measure with no standard meaning under IFRS, which is calculated by the Company as net cash from operating activities less working capital items. The Company believes that Net Cash from Operating Activities before Changes in Working Capital, which excludes these non-cash items, provides investors with the ability to better evaluate the operating cash flow performance of the Company.

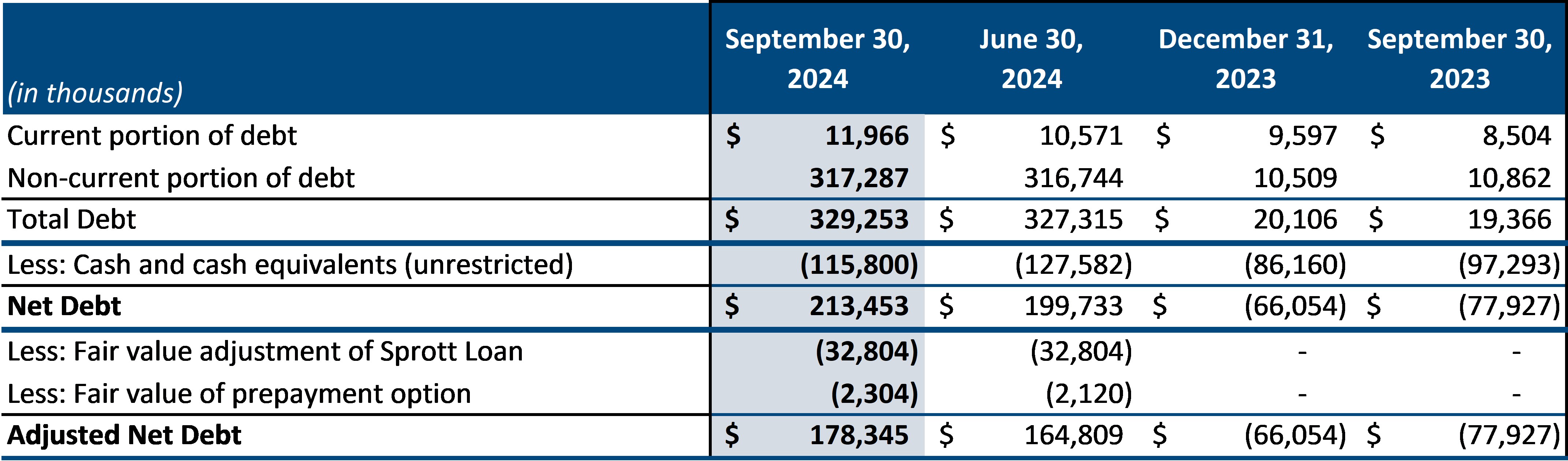

Net Debt and Adjusted Net Debt: The Company believes that in addition to conventional measures prepared in accordance with IFRS, the Company and certain investors and analysts use net debt to evaluate the Company’s performance. Net debt does not have any standardized meaning prescribed under IFRS, and therefore it may not be comparable to similar measures employed by other companies. This measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performances prepared in accordance with IFRS. Net debt is calculated as the sum of the current and non-current portions of loans and borrowings, net of the cash and cash equivalent balance as at the balance sheet date. Adjusted Net Debt is calculated as Net Debt less fair value and other non-cash adjustments that will not result in a cash outflow to the Company. The Company believes that Adjusted Net Debt provides a better understanding of the Company’s liquidity.

EBITDA and Adjusted EBITDA: The Company believes that certain investors use the EBITDA and the adjusted EBITDA (“Adjusted EBITDA”) measures to evaluate the Company’s performance and ability to generate operating cash flows to service debt and fund capital expenditures. EBITDA and Adjusted EBITDA do not have a standardised meaning as prescribed under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The Company calculates EBITDA as earnings or loss before taxes for the period excluding depreciation and depletion and finance costs. EBITDA excludes the impact of cash costs of financing activities and taxes and the effects of changes in working capital balances and therefore is not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Adjusted EBITDA is calculated by excluding one-off costs or credits relating to non-routine transactions from EBITDA that are not indicative of recurring operating performance. Management believes this additional information is useful to investors in understanding the Company’s ability to generate operating cash flow by excluding from the calculation these non-cash and cash amounts that are not indicative of the recurring performance of the underlying operations for the reporting periods.

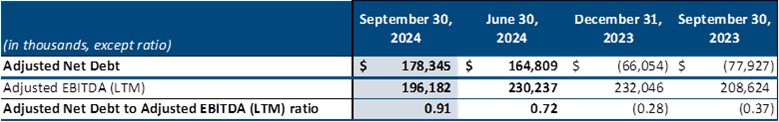

Adjusted Net Debt to Adjusted EBITDA: The Adjusted Net Debt to Adjusted EBITDA measures provide investors and analysts with additional transparency about the Company’s liquidity position, specifically, the Company’s ability to generate sufficient operating cash flows to meet its mandatory interest obligations and pay down its outstanding debt balance in full at maturity. This measure is a Non-IFRS measure and it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The calculation of Adjusted Net Debt is shown above.

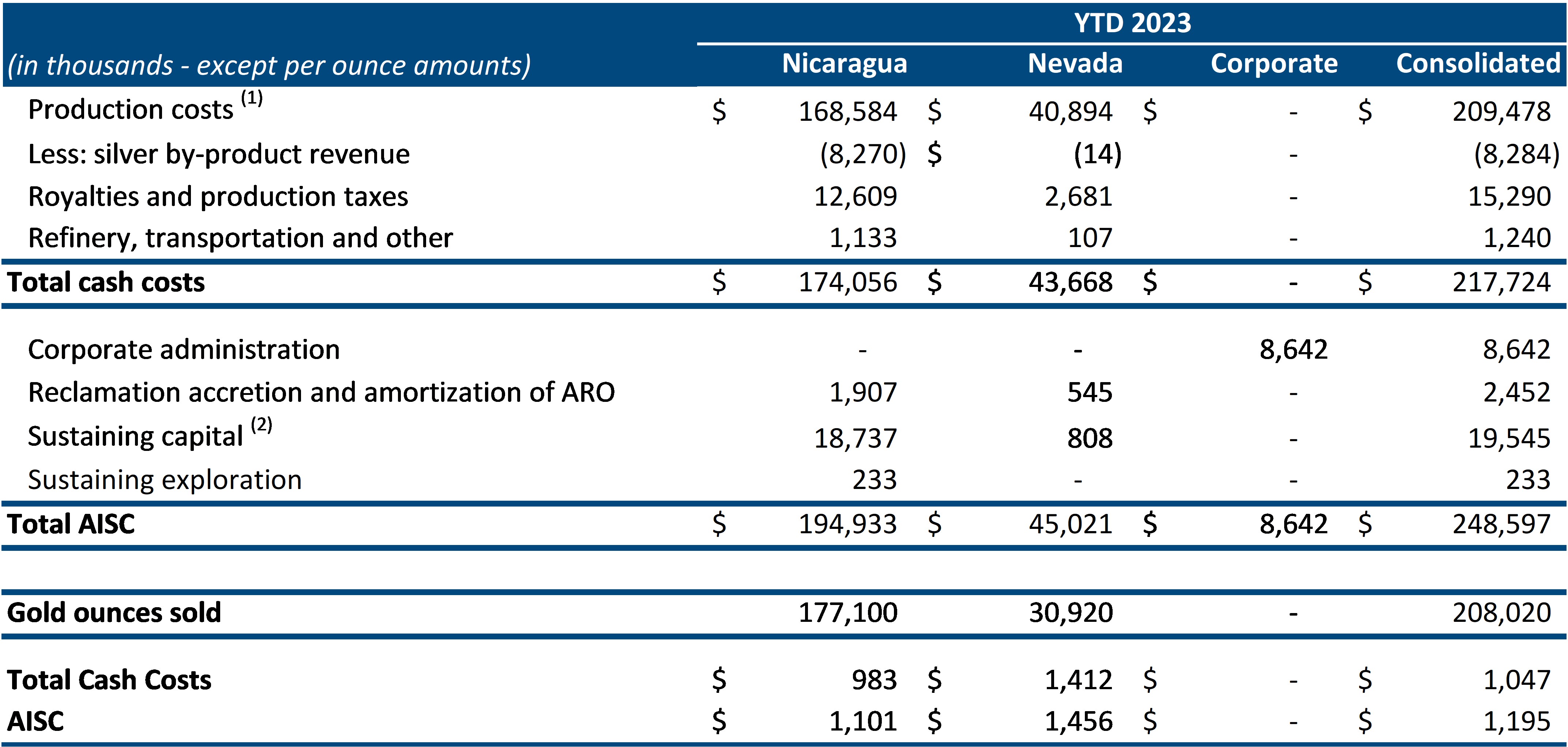

TCC and AISC per Ounce of Gold Sold Reconciliations

The tables below reconcile TCC and AISC for the three months ended September 30, 2024 and 2023.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/12f215d3-2509-46eb-8dbe-d3166260c70f

1. Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q3 2024 MD&A dated September 30, 2024.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d032d456-8d54-4969-91bb-1cedb6c0a415

1. Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q3 2024 MD&A dated September 30, 2024.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6eadfabd-7ebe-4772-a9c0-bb103c6d62a3

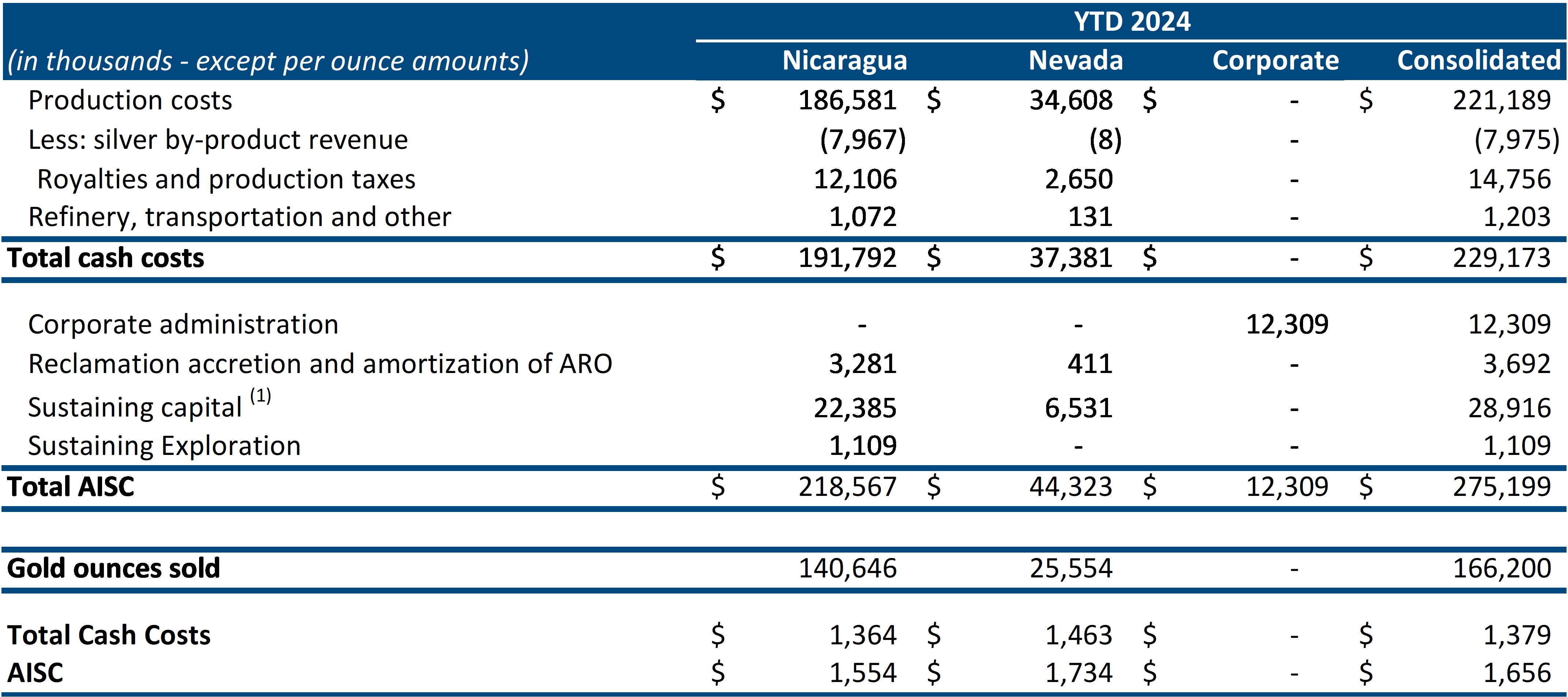

The tables below reconcile TCC and AISC for the nine months ended September 30, 2024 and 2023.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1e42dd70-f465-4c40-8f33-021e71eb9de9

1. Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q3 2024 MD&A dated September 30, 2024.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e3a5e547-636e-41f1-b295-99c31a0076b6

1. Production costs include a $0.7 million net realizable value reversal for the Pan mine.

2. Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q3 2024 MD&A dated September 30, 2024.

(2) CONSOLIDATED FINANCIAL AND OPERATIONAL RESULTS FOR 2024 INCLUDE THE RESULTS FROM MARATHON SINCE ITS ACQUISITION ON JANUARY 25, 2024

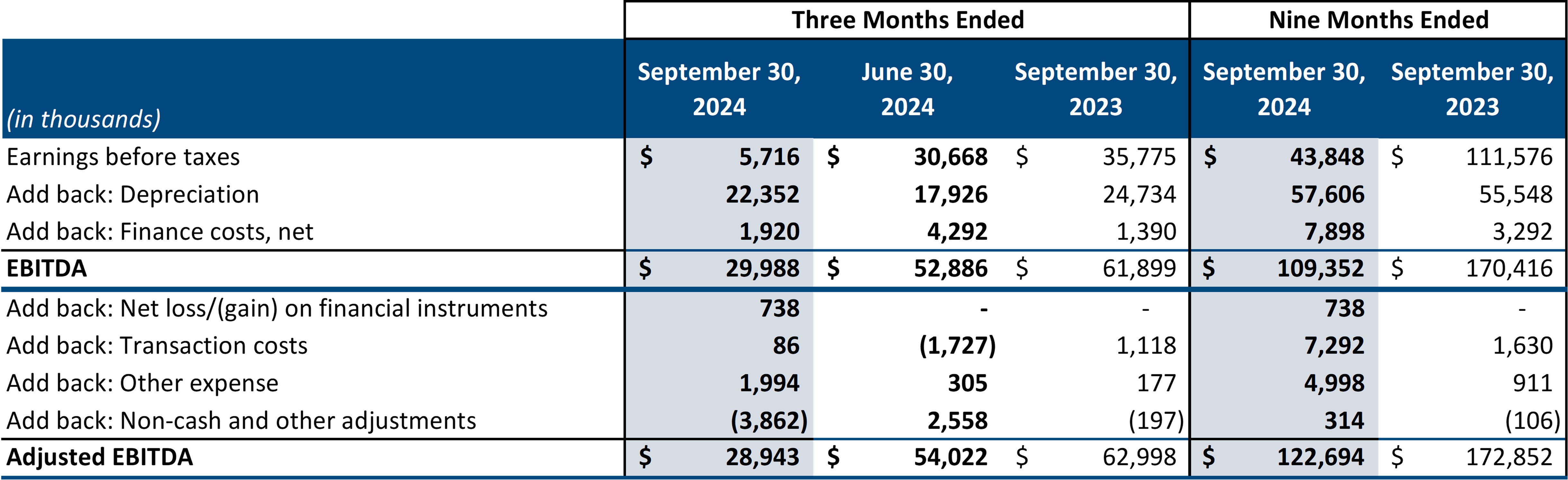

(3) EBITDA and ADJUSTED EBITDA

The following table provides a reconciliation of EBITDA and Adjusted EBITDA to the consolidated statement of operations and comprehensive income for the reporting periods:

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f0b9e7a2-f6ab-48e7-abde-7a8a896fb66d

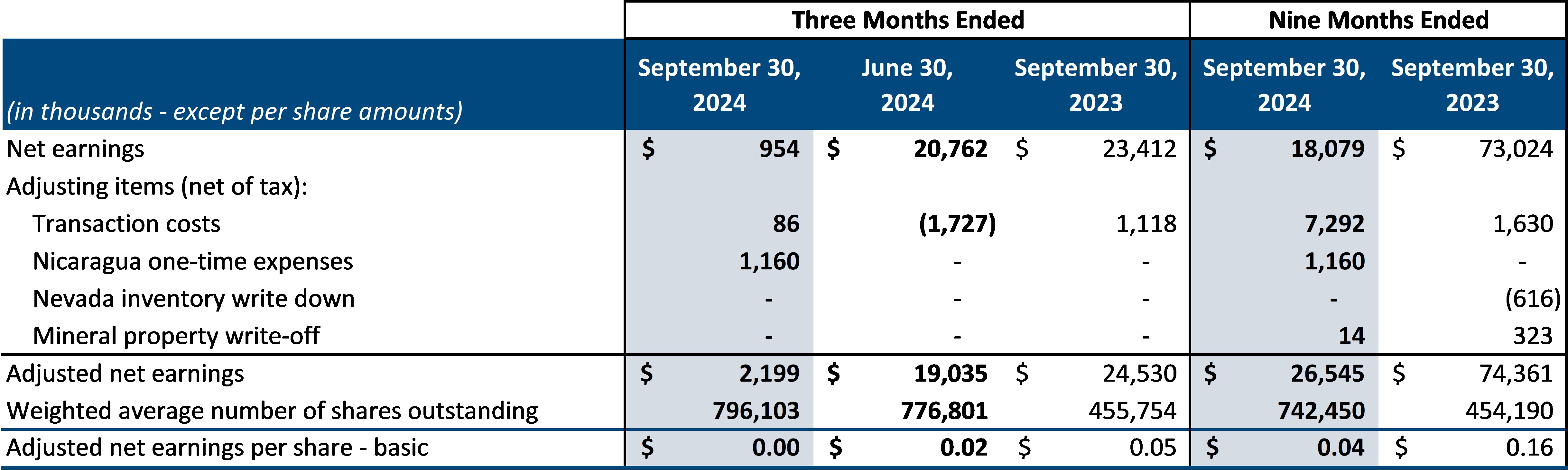

(4) ADJUSTED NET EARNINGS

The following table provides a reconciliation of Adjusted Net Earnings and Adjusted Net Earnings Per Share to the consolidated statement of operations and comprehensive income for the reporting periods:

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/80deddcb-61d2-4a9b-b3b3-1f783bfed7f9

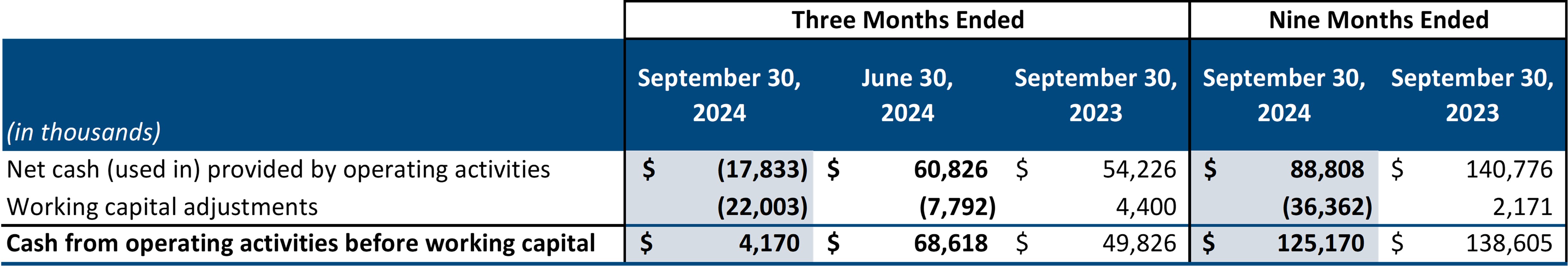

(5) CASH FROM OPERATING ACTIVITIES BEFORE CHANGES IN WORKING CAPITAL

The following table provides a reconciliation of Cash from Operating Activities before Changes in Working Capital to the consolidated statement of cash flows for the reporting periods:

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/28fecac3-ade3-4e70-beed-31a76462e586

(6) NET DEBT and ADJUSTED NET DEBT

The following table provides a reconciliation of Net Debt and Adjusted Net Debt to the consolidated statement of financial position for the reporting periods:

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e1f17bfe-6ac1-4b5f-9f13-2c415f78e8b6

(7) ADJUSTED NET DEBT TO ADJUSTED EBITDA

The following table provides the reconciliation of Adjusted Net Debt to Adjusted EBITDA using the last twelve months of Adjusted EBITDA for the reporting periods:

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d8b7ab19-8c17-4d0c-ada3-3aff5ef03df3

Cautionary Note Regarding Forward Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “assume”, “intend”, “strategy”, “goal”, “objective”, “possible” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. Forward-looking statements in this news release include but are not limited to the Company’s expectations of gold production and production growth; the upside potential of the Valentine Gold Mine; the Valentine Gold Mine achieving first gold production during the second quarter of 2025; the Company’s reinvestment into its existing portfolio of properties for further exploration and growth; statements relating to the Company’s 2024 priority resource expansion opportunities; the Company’s metal price and cut-off grade assumptions. Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Calibre’s control. For a listing of risk factors applicable to the Company, please refer to Calibre’s annual information form (“AIF”) for the year ended December 31, 2023, its management discussion and analysis for the year ended December 31, 2023 and other disclosure documents of the Company filed on the Company’s SEDAR+ profile at www.sedarplus.ca.

Calibre’s forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. Calibre does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, undue reliance should not be placed on forward-looking statements.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market live: Election night updates and impacts

US stock futures moved higher as investors brace for the results of the US presidential election, which have begun rolling in and will continue to over the next several hours.

Near 8 p.m. ET, contracts on the tech-heavy Nasdaq 100 (NQ=F) rose 0.3%, while S&P 500 futures (ES=F) moved roughly 0.5% higher. Dow Jones Industrial Average futures (YM=F) were up about 0.7% on the heels of a winning day for stocks.

Stocks finished Tuesday’s session solidly in the green as Americans flocked to the polls to decide whether Kamala Harris or Donald Trump will become the next president.

Polls in states including Georgia, North Carolina, Pennsylvania, Florida, and Virginia, among others, are now closed. The remaining states will shut down their respective polling stations within the next few hours, with most polling locations set to close by 11 p.m. ET.

So far, Trump has won Kentucky, West Virginia, South Carolina, Alabama, Mississippi, Oklahoma, Florida, Tennessee, and Indiana. Harris has claimed Vermont, Rhode Island, Connecticut, Maryland, and Massachusetts, according to the Associated Press.

As the results start to trickle in, investors will closely scrutinize any movement in stock futures, given the possibility of short-term market volatility. It’s possible the outcome of the election may not become clear for days or even weeks.

Read more: The Yahoo Finance guide to the presidential election and what it means for your wallet

Both Harris and Trump have made their final pitches to voters. Trump pledged last-minute tariffs and less money for chips while Harris promised to “seek common ground” in her final rally in Philadelphia on Monday.

LIVE 12 updates

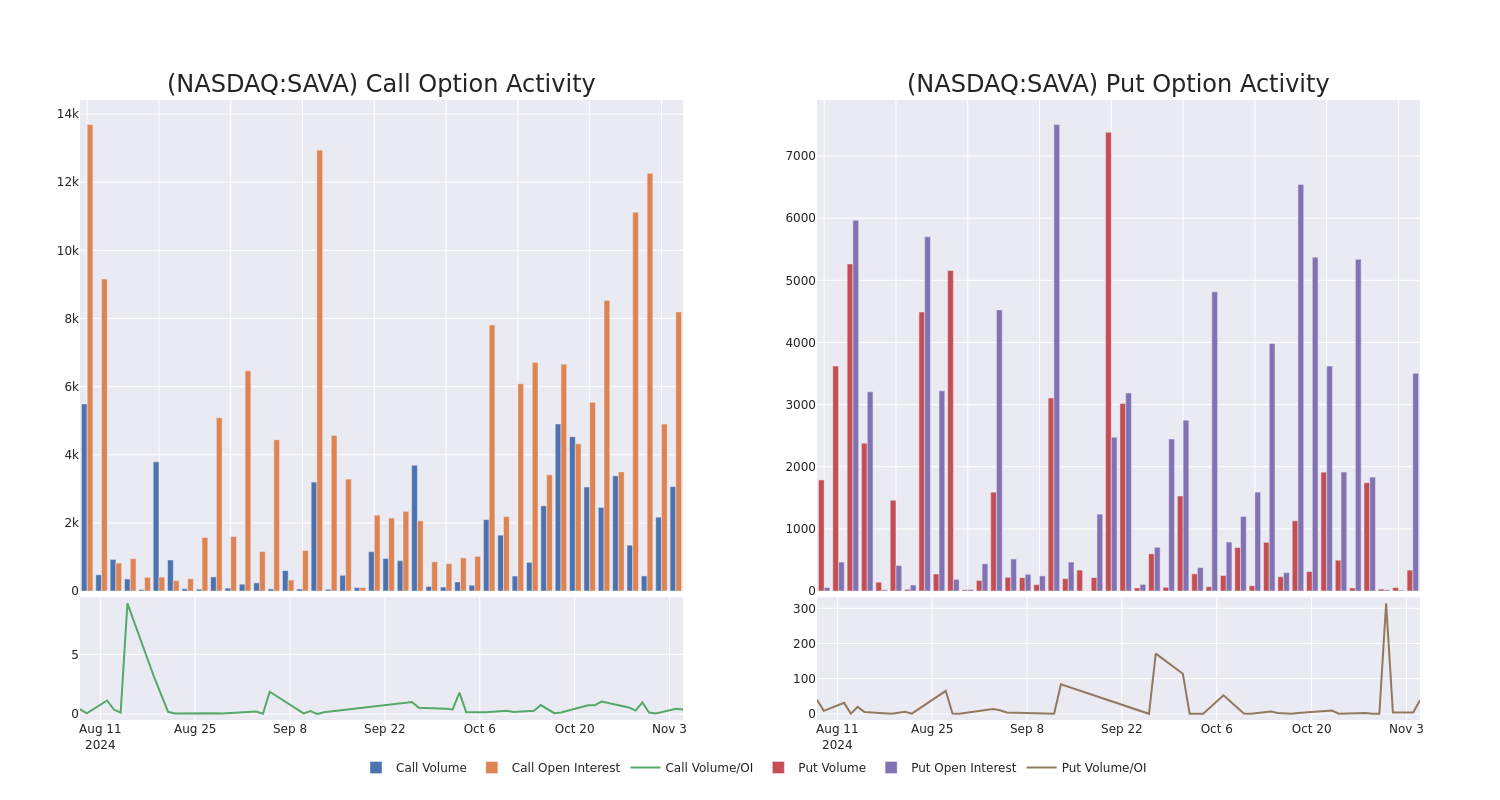

Unpacking the Latest Options Trading Trends in Cassava Sciences

Investors with a lot of money to spend have taken a bearish stance on Cassava Sciences SAVA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SAVA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 11 uncommon options trades for Cassava Sciences.

This isn’t normal.

The overall sentiment of these big-money traders is split between 18% bullish and 54%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $179,025, and 7 are calls, for a total amount of $351,889.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $60.0 for Cassava Sciences over the last 3 months.

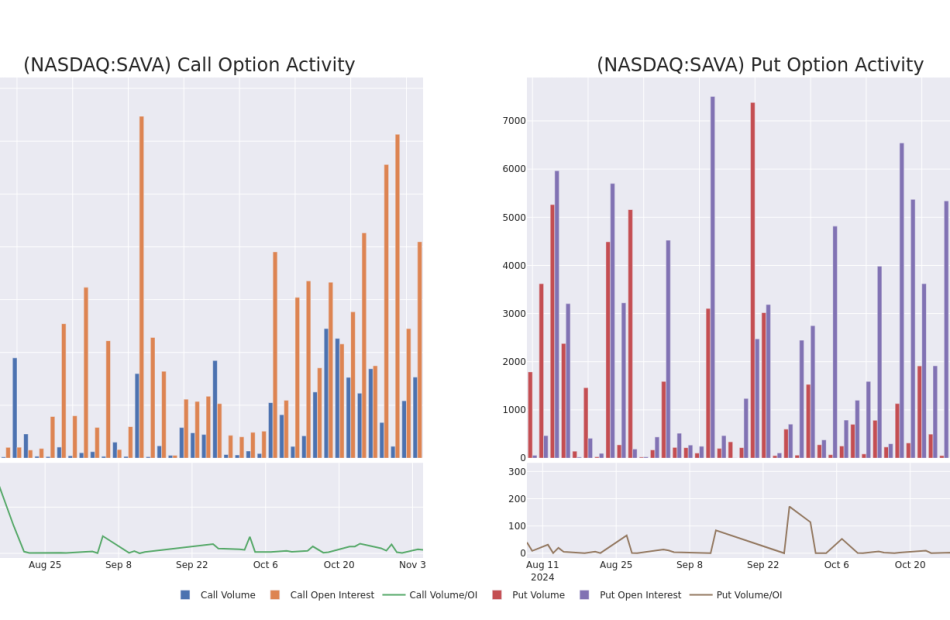

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cassava Sciences’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cassava Sciences’s significant trades, within a strike price range of $15.0 to $60.0, over the past month.

Cassava Sciences Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SAVA | CALL | SWEEP | BEARISH | 12/20/24 | $10.95 | $10.9 | $10.9 | $45.00 | $104.6K | 1.9K | 134 |

| SAVA | PUT | SWEEP | BULLISH | 01/17/25 | $8.45 | $7.75 | $7.76 | $15.00 | $77.5K | 2.3K | 100 |

| SAVA | CALL | SWEEP | BEARISH | 12/20/24 | $10.95 | $10.9 | $10.9 | $45.00 | $71.9K | 1.9K | 200 |

| SAVA | CALL | TRADE | BEARISH | 12/20/24 | $9.0 | $8.7 | $8.7 | $60.00 | $43.4K | 2.2K | 104 |

| SAVA | CALL | TRADE | BEARISH | 12/20/24 | $9.0 | $8.5 | $8.7 | $60.00 | $42.6K | 2.2K | 153 |

About Cassava Sciences

Cassava Sciences Inc is a clinical-stage biotechnology company engaged in developing a scientific approach for the treatment and detection of Alzheimer’s disease. Its therapeutic product candidate is called simufilam, and it is a novel treatment for Alzheimer’s disease; and investigational diagnostic product candidate is called SavaDx, and it is a novel way to detect the presence of Alzheimer’s disease from a small sample of blood, possibly years before the overt appearance of clinical symptoms. It is currently conducting two randomized placebo-controlled Phase 3 clinical trials of oral simufilam in patients with Alzheimer’s disease dementia.

After a thorough review of the options trading surrounding Cassava Sciences, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Cassava Sciences

- With a volume of 1,410,319, the price of SAVA is down -7.39% at $23.93.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 2 days.

What Analysts Are Saying About Cassava Sciences

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $116.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a positive move, an analyst from HC Wainwright & Co. has upgraded their rating to Buy and adjusted the price target to $116.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cassava Sciences, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Move: David J Wilson Invests $1.00M In Columbus McKinnon Stock

It was revealed in a recent SEC filing that David J Wilson, President & CEO at Columbus McKinnon CMCO made a noteworthy insider purchase on November 4,.

What Happened: In a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, it was disclosed that Wilson bought 31,300 shares of Columbus McKinnon, amounting to a total of $1,002,155.

As of Tuesday morning, Columbus McKinnon shares are up by 5.03%, currently priced at $33.0.

Delving into Columbus McKinnon’s Background

Columbus McKinnon Corp is a designer, manufacturer, and marketer of intelligent motion solutions, including motion control products, technologies, automated systems, and services that efficiently and ergonomically move, lift, position, and secure materials. Its key products include hoists, crane components, precision conveyors, actuators, rigging tools, light rail workstations, and digital power and motion control systems. The company’s targeted market verticals include general industries, process industries, industrial automation, and e-commerce/supply chain/warehousing among others. Geographically, the company generates a majority of its revenue from the United States and the rest from Germany, Canada, Asia Pacific, Latin America, Europe, Middle East, and Africa.

Columbus McKinnon: Financial Performance Dissected

Decline in Revenue: Over the 3 months period, Columbus McKinnon faced challenges, resulting in a decline of approximately -6.24% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Navigating Financial Profits:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 30.85%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Columbus McKinnon’s EPS is below the industry average. The company faced challenges with a current EPS of -0.52. This suggests a potential decline in earnings.

Debt Management: Columbus McKinnon’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.56, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 60.47 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.91 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 13.05, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Columbus McKinnon’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GERDAU S.A. – CONSOLIDATED INFORMATION

SÃO PAULO, Nov. 5, 2024 /PRNewswire/ — 3Q24 Highlights

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of R$ 3.0 billion in the third quarter, 14.9% higher compared to 2Q24.

Investments (CAPEX) totaled R$ 1.5 billion in 3Q24, of which R$ 589 million was allocated to Maintenance and R$ 920 million was directed to the Competitiveness of the Business Divisions.

Dividend distribution in the amount of R$ 0.30 per share, equivalent to R$ 619,4 million, to be paid based on 3Q24 results.

Share buyback program of Gerdau S.A., by the end of October 2024, 39.6 million shares were repurchased, equivalent to R$ 729.4 million.

Additional Information

Gerdau S.A. informs that it is filling today its 3Q24 results at the Securities and Exchange Commission (SEC) and at the Comissão de Valores Mobiliários (CVM), which are available at Gerdau’s website. To access this document, please click on https://ri.gerdau.com/en/notices-and-results/results-center/.

The 3Q24 Valuation Guide is also available at Gerdau’s website.

https://ri.gerdau.com/en/financial-information/valuation-guide/

![]() View original content:https://www.prnewswire.com/news-releases/gerdau-sa–consolidated-information-302296997.html

View original content:https://www.prnewswire.com/news-releases/gerdau-sa–consolidated-information-302296997.html

SOURCE Gerdau S.A.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.