ROSEN, A TOP RANKED LAW FIRM, Encourages WM Technology, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – MAPS

NEW YORK, Nov. 04, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of the securities of WM Technology, Inc. MAPS between May 25, 2021, and September 24, 2024, both dates inclusive (the “Class Period”), of the important December 16, 2024 lead plaintiff deadline in the securities class action first filed by the Firm.

SO WHAT: If you purchased WM Technology securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the WM Technology class action, go to https://rosenlegal.com/submit-form/?case_id=29177 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than December 16, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose, among other things, that: (1) WM Technology’s monthly average user metrics (“MAUs”) were severely inflated for years; and (2) as a result, defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the WM Technology class action, go https://rosenlegal.com/submit-form/?case_id=29177 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm or on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ValueScape Unravels Appraisal Bias with AI and Data Science

WASHINGTON, Nov. 4, 2024 /PRNewswire/ — Appraisal bias has come under an increasingly bright spotlight as an issue which can marginalize various people groups in their ability to interact with the housing market fairly and equally. There is a general will to address bias, with some efforts focused on training and some on quality control. However, the risk of potential bias can be difficult to identify quickly and clearly. Through AI-driven data analysis, we believe it is possible to shine light upon whether appraisals are being produced equitably across various market areas and neighborhoods, honing in on any troubling trends.

At ValueScape we have developed our bias application over a lengthy period of time, deliberately taking on as much constructive feedback as possible from investigators, fair housing associations, lenders, lawyers, appraisal management companies and regulators, including HUD, Fannie Mae, VA and the CFPB, and other market participants such as appraisers, realtors and homeowners. This process has led us into developing a multifaceted application based on advanced statistical and AI analysis, to arrive at a more thorough, data-driven model than other solutions. Our application gives clients the ability to construct trending models to analyze their appraisal population with precision for disparate treatment across communities, and alert them to any concerns. The application provides powerful inputs to the ROV process, giving it added value to clients.

This application is active with various clients who are benefiting from its use.

To unlock in-depth analysis and AI-driven trending which can help you in your potential bias assessment, in-line quality control and ROV processes, we invite you to download our white paper Appraisal Bias Indicator™.

About ValueScape

ValueScape is An Award-Winning Artificial Intelligence and Data Science company providing Compliance Management Services to the Housing and Mortgage Industries. ValueScape’s A.I. capabilities include advanced computer vision, machine learning algorithms and large language models. ValueScape’s vast and growing Artificial Intelligence Enhanced property datasets pegged with our super computing resources, allow ValueScape to cover different use cases, including AI Quality Control Review, Appraisal Compliance Reviews, Peer Adjustments Comparison Analysis, Sales Comps and Listing Analysis, AVMs, Property Preservation, etc.

For more information, please visit ValueScape.AI.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/valuescape-unravels-appraisal-bias-with-ai-and-data-science-302295914.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/valuescape-unravels-appraisal-bias-with-ai-and-data-science-302295914.html

SOURCE ValueScape Analytics Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ValueScape Unravels Appraisal Bias with AI and Data Science

WASHINGTON, Nov. 4, 2024 /PRNewswire/ — Appraisal bias has come under an increasingly bright spotlight as an issue which can marginalize various people groups in their ability to interact with the housing market fairly and equally. There is a general will to address bias, with some efforts focused on training and some on quality control. However, the risk of potential bias can be difficult to identify quickly and clearly. Through AI-driven data analysis, we believe it is possible to shine light upon whether appraisals are being produced equitably across various market areas and neighborhoods, honing in on any troubling trends.

At ValueScape we have developed our bias application over a lengthy period of time, deliberately taking on as much constructive feedback as possible from investigators, fair housing associations, lenders, lawyers, appraisal management companies and regulators, including HUD, Fannie Mae, VA and the CFPB, and other market participants such as appraisers, realtors and homeowners. This process has led us into developing a multifaceted application based on advanced statistical and AI analysis, to arrive at a more thorough, data-driven model than other solutions. Our application gives clients the ability to construct trending models to analyze their appraisal population with precision for disparate treatment across communities, and alert them to any concerns. The application provides powerful inputs to the ROV process, giving it added value to clients.

This application is active with various clients who are benefiting from its use.

To unlock in-depth analysis and AI-driven trending which can help you in your potential bias assessment, in-line quality control and ROV processes, we invite you to download our white paper Appraisal Bias Indicator™.

About ValueScape

ValueScape is An Award-Winning Artificial Intelligence and Data Science company providing Compliance Management Services to the Housing and Mortgage Industries. ValueScape’s A.I. capabilities include advanced computer vision, machine learning algorithms and large language models. ValueScape’s vast and growing Artificial Intelligence Enhanced property datasets pegged with our super computing resources, allow ValueScape to cover different use cases, including AI Quality Control Review, Appraisal Compliance Reviews, Peer Adjustments Comparison Analysis, Sales Comps and Listing Analysis, AVMs, Property Preservation, etc.

For more information, please visit ValueScape.AI.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/valuescape-unravels-appraisal-bias-with-ai-and-data-science-302295914.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/valuescape-unravels-appraisal-bias-with-ai-and-data-science-302295914.html

SOURCE ValueScape Analytics Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VPG Reports Fiscal 2024 Third Quarter Results

MALVERN, Pa., Nov. 05, 2024 (GLOBE NEWSWIRE) — Vishay Precision Group, Inc. VPG, a leader in precision measurement and sensing technologies, today announced its results for its fiscal 2024 third quarter ended September 28, 2024.

Third Fiscal Quarter Highlights (comparisons are to the comparable period a year ago):

- Revenues of $75.7 million decreased 11.8%.

- Gross profit margin was 40.0%, as compared to 41.9%.

- Adjusted gross profit margin* was 40.0%, as compared to 42.1%.

- Operating margin was 5.1%, as compared to 9.6%.

- Adjusted operating margin* was 5.2%, as compared to 11.2%.

- Diluted net loss per share of $(0.10) compared to $0.46.

- Adjusted diluted net earnings per share* of $0.19 compared to $0.47.

- EBITDA* was $5.1 million with an EBITDA margin* of 6.7%.

- Adjusted EBITDA* was $8.1 million with an adjusted EBITDA margin* of 10.7%.

Ziv Shoshani, Chief Executive Officer of VPG, commented, “Total revenue in the third quarter was fairly stable sequentially, as trends across our markets remained mixed. Some of our cyclical markets such as steel and consumer were soft, while orders in test and measurement and avionics, military & space were higher. Total orders of $68.6 million declined 6.7% sequentially and resulted in a book-to-bill of 0.91.”

Mr. Shoshani said: “We continue to focus on our long-term strategies for organic growth, as well as to look for additional opportunities to add high-quality businesses to our platform like our recent acquisition of Nokra. As we continue to streamline our operations mainly in the Sensors and Weighing Solutions segments, we believe our operating model and our solid balance sheet positions us to achieve significant operating returns and cash flow as revenues recover.”

Third Fiscal Quarter and Nine Month Financial Trends:

The Company’s third fiscal quarter 2024 net loss attributable to VPG stockholders was $(1.4) million, or $(0.10) per diluted share, compared to $6.3 million, or $0.46 per diluted share, in the third fiscal quarter of 2023. Included in the third quarter 2024 pre-tax earnings was a loss of $2.9 million related to unrealized foreign currency effects.

In the nine fiscal months ended September 28, 2024, net earnings attributable to VPG stockholders were $9.1 million, or $0.68 per diluted share, compared to $21.5 million, or $1.57 per diluted share, in the nine fiscal months ended September 30, 2023.

The third fiscal quarter 2024 adjusted net earnings* were $2.5 million, or $0.19 per adjusted diluted net earnings per share*, compared to $6.4 million, or $0.47 per adjusted diluted net earnings per share* in the third fiscal quarter of 2023.

In the nine fiscal months ended September 28, 2024, adjusted net earnings* were $12.3 million, or $0.92 per adjusted diluted net earnings per share*, compared to $21.4 million, or $1.57 per adjusted diluted net earnings per share* in the nine fiscal months ended September 30, 2023.

Segment Performance:

The Sensors segment revenue of $28.2 million in the third fiscal quarter of 2024 decreased 13.3% from $32.5 million in the third fiscal quarter of 2023. Sequentially, revenue decreased 2.3% compared to $28.9 million in the second fiscal quarter of 2024. The year-over-year decrease in revenues was primarily attributable to lower sales of precision resistors in the Test and Measurement and Avionics, Military and Space (“AMS”) markets. Sequentially, the decrease primarily reflected lower sales of advanced sensors in the Other markets, mainly for consumer applications, which was partially offset by higher sales of precision resistors in the AMS and Test and Measurement end markets.

Gross profit margin for the Sensors segment was 31.0% for the third fiscal quarter of 2024. Gross profit margin decreased compared to 35.9% in the third fiscal quarter of 2023 and 38.3% in the second fiscal quarter of 2024. The year-over-year decrease in gross profit margin was primarily due to lower volume. Sequentially, the lower gross profit margin was primarily due to lower volume and temporary operational and labor inefficiencies.

The Weighing Solutions segment revenue of $25.2 million in the third fiscal quarter of 2024 decreased 13.1% compared to $29.0 million in the third fiscal quarter of 2023 and was 8.3% lower than $27.4 million in the second fiscal quarter of 2024. The year-over-year decrease in revenues was mainly attributable to lower sales in our Transportation and Industrial Weighing markets, as well as in our Other markets primarily for precision agriculture and medical applications. Sequentially, the decrease in revenues was primarily attributable to lower sales in the Industrial Weighing, Transportation, and Other markets.

Gross profit margin for the Weighing Solutions segment was 35.1% for the third fiscal quarter of 2024, which decreased compared to 38.7% in the third fiscal quarter of 2023 and 37.6% in the second fiscal quarter of 2024. The year-over-year and sequential decrease in gross profit margin were primarily due to lower volume and unfavorable product mix.

The Measurement Systems segment revenue of $22.4 million in the third fiscal quarter of 2024 decreased 8.2% year-over-year from $24.4 million in the third fiscal quarter of 2023 and was 6.2% higher than $21.0 million in the second fiscal quarter of 2024. The year-over-year decrease was primarily attributable to decreased revenue in the Steel, Transportation, and in our Other markets. Sequentially, the increase in revenue was primarily due to higher sales of Diversified Technical Systems Inc. (“DTS”) products in the AMS and Transportation markets.

Gross profit margin for the Measurement Systems segment was 56.8%, compared to 53.6% (or 54.5% reflecting an adjustment to exclude $214 thousand of purchase accounting adjustment related to the DTS and Dynamic System Inc. (“DSI”) acquisitions), in the third fiscal quarter of 2023, and 52.4% in the second fiscal quarter of 2024. The year-over-year increase in adjusted gross profit margin* was due to favorable product mix which offset the impact from lower volume. The sequentially higher adjusted gross profit margin* reflected higher volume and favorable product mix.

Near-Term Outlook

“Given our backlog and the current market conditions, we expect net revenues to be in the range of $70 million to $78 million for the fourth fiscal quarter of 2024, at constant third fiscal quarter 2024 foreign currency exchange rates,” concluded Mr. Shoshani.

*Use of Non-GAAP Financial Information:

We define “adjusted gross profit margin” as gross profit margin before purchase accounting adjustments related to the DTS and DSI acquisition. We define “adjusted operating margin” as operating margin before purchase accounting adjustment related to the DTS and DSI acquisitions, and restructuring costs and severance costs. We define “adjusted net earnings” and “adjusted diluted net earnings per share” as net earnings attributable to VPG stockholders before purchase accounting adjustment related to the DTS and DSI acquisitions, restructuring costs and severance costs, foreign currency exchange gains and losses, and associated tax effects. We define “EBITDA” as earnings before interest, taxes, depreciation, and amortization. We define “Adjusted EBITDA” as earnings before interest, taxes, depreciation, and amortization before purchase accounting adjustment related to the DTS and DSI acquisitions, restructuring costs and severance costs, and foreign currency exchange gains and losses.

Management believes that these non-GAAP measures are useful to investors because each presents what management views as our core operating results for the relevant period. The adjustments to the applicable GAAP measures relate to occurrences or events that are outside of our core operations, and management believes that the use of these non-GAAP measures provides a consistent basis to evaluate our operating profitability and performance trends across comparable periods. These reconciling items are indicated on the accompanying reconciliation schedules and are more fully described in VPG’s financial statements presented in our Annual Report on Form 10-K and its Quarterly Reports on Forms 10-Q.

Conference Call and Webcast:

A conference call will be held on Tuesday, November 5, 2024 at 9:00 a.m. ET (8:00 a.m. CT). To access the conference call, interested parties may call 1-833-470-1428 or internationally +1-404-975-4839 and use passcode 148407, or log on to the investor relations page of the VPG website at ir.vpgsensors.com. A replay will be available approximately one hour after the completion of the call by calling toll-free 1-866-813-9403 or internationally 1-929-458-6194 and by using passcode 378501. The replay will also be available on the “Events” page of investor relations section of the VPG website at ir.vpgsensors.com.

About VPG:

Vishay Precision Group, Inc. (VPG) is a leader in precision measurement and sensing technologies. Our sensors, weighing solutions and measurement systems optimize and enhance our customers’ product performance across a broad array of markets to make our world safer, smarter, and more productive. To learn more, visit VPG at www.vpgsensors.com and follow us on LinkedIn.

Forward-Looking Statements:

From time to time, information provided by us, including, but not limited to, statements in this report, or other statements made by or on our behalf, may contain or constitute “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve a number of risks, uncertainties, and contingencies, many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from those anticipated.

Such statements are based on current expectations only, and are subject to certain risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, expected, estimated, or projected. Among the factors that could cause actual results to materially differ include: general business and economic conditions; impact of inflation; potential issues respecting the United States federal government debt ceiling; global labor and supply chain challenges; difficulties or delays in identifying, negotiating and completing acquisitions and integrating acquired companies; the inability to realize anticipated synergies and expansion possibilities; difficulties in new product development; changes in competition and technology in the markets that we serve and the mix of our products required to address these changes; changes in foreign currency exchange rates; political, economic, and health (including pandemics) instabilities; instability caused by military hostilities in the countries in which we operate (including Israel); difficulties in implementing our cost reduction strategies, such as underutilization of production facilities, labor unrest or legal challenges to our lay-off or termination plans, operation of redundant facilities due to difficulties in transferring production to achieve efficiencies; compliance issues under applicable laws, such as export control laws, including the outcome of our voluntary self-disclosure of export control non-compliance; significant developments from the recent and potential changes in tariffs and trade regulation; our efforts and efforts by governmental authorities to mitigate the COVID-19 pandemic, such as travel bans, shelter-in-place orders and business closures and the related impact on resource allocations, manufacturing and supply chains; our status as a “critical”, “essential” or “life-sustaining” business in light of COVID-19 business closure laws, orders and guidance being challenged by a governmental body or other applicable authority; our ability to execute our new corporate strategy and business continuity, operational and budget plans; and other factors affecting our operations, markets, products, services, and prices that are set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this report or as of the dates otherwise indicated in such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

Steve Cantor

Vishay Precision Group, Inc.

781-222-3516

info@vpgsensors.com

| VISHAY PRECISION GROUP, INC. | |||||||

| Consolidated Condensed Statements of Operations | |||||||

| (Unaudited – In thousands, except per share amounts) | |||||||

| Fiscal quarter ended | |||||||

| September 28, 2024 | September 30, 2023 | ||||||

| Net revenues | $ | 75,727 | $ | 85,854 | |||

| Costs of products sold | 45,467 | 49,919 | |||||

| Gross profit | 30,260 | 35,935 | |||||

| Gross profit margin | 40.0 | % | 41.9 | % | |||

| Selling, general and administrative expenses | 26,337 | 26,558 | |||||

| Restructuring costs | 82 | 1,153 | |||||

| Operating income | 3,841 | 8,224 | |||||

| Operating margin | 5.1 | % | 9.6 | % | |||

| Other (expense) income : | |||||||

| Interest expense | (648 | ) | (1,119 | ) | |||

| Other | (2,646 | ) | 1,671 | ||||

| Other (expense) income | (3,294 | ) | 552 | ||||

| Income before taxes | 546 | 8,776 | |||||

| Income tax expense | 1,874 | 2,419 | |||||

| Net (loss) earnings | (1,328 | ) | 6,357 | ||||

| Less: net earnings attributable to noncontrolling interests | 23 | 77 | |||||

| Net (loss) earnings attributable to VPG stockholders | $ | (1,351 | ) | $ | 6,280 | ||

| Basic (loss) earnings per share attributable to VPG stockholders | $ | (0.10 | ) | $ | 0.46 | ||

| Diluted (loss) earnings per share attributable to VPG stockholders | $ | (0.10 | ) | $ | 0.46 | ||

| Weighted average shares outstanding – basic | 13,254 | 13,600 | |||||

| Weighted average shares outstanding – diluted | 13,254 | 13,686 | |||||

| VISHAY PRECISION GROUP, INC. | |||||||

| Consolidated Condensed Statements of Operations | |||||||

| (Unaudited – In thousands, except per share amounts) | |||||||

| Nine fiscal months ended | |||||||

| September 28, 2024 | September 30, 2023 | ||||||

| Net revenues | $ | 233,869 | $ | 265,520 | |||

| Costs of products sold | 136,108 | 153,674 | |||||

| Gross profit | 97,761 | 111,846 | |||||

| Gross profit margin | 41.8 | % | 42.1 | % | |||

| Selling, general and administrative expenses | 80,232 | 80,472 | |||||

| Restructuring costs | 864 | 1,431 | |||||

| Operating income | 16,665 | 29,943 | |||||

| Operating margin | 7.1 | % | 11.3 | % | |||

| Other (expense) income : | |||||||

| Interest expense | (1,925 | ) | (3,195 | ) | |||

| Other | 915 | 2,965 | |||||

| Other (expense) income | (1,010 | ) | (230 | ) | |||

| Income before taxes | 15,654 | 29,713 | |||||

| Income tax expense | 6,508 | 8,023 | |||||

| Net earnings | 9,146 | 21,690 | |||||

| Less: net earnings attributable to noncontrolling interests | 3 | 210 | |||||

| Net earnings attributable to VPG stockholders | $ | 9,143 | $ | 21,480 | |||

| Basic earnings per share attributable to VPG stockholders | $ | 0.68 | $ | 1.58 | |||

| Diluted earnings per share attributable to VPG stockholders | $ | 0.68 | $ | 1.57 | |||

| Weighted average shares outstanding – basic | 13,367 | 13,596 | |||||

| Weighted average shares outstanding – diluted | 13,405 | 13,670 | |||||

| VISHAY PRECISION GROUP, INC. | |||||||

| Consolidated Condensed Balance Sheets | |||||||

| (In thousands) | |||||||

| September 28, 2024 | December 31, 2023 | ||||||

| (Unaudited) | |||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 81,077 | $ | 83,965 | |||

| Accounts receivable, net | 52,821 | 56,438 | |||||

| Inventories: | |||||||

| Raw materials | 34,027 | 33,973 | |||||

| Work in process | 28,275 | 26,594 | |||||

| Finished goods | 26,000 | 27,572 | |||||

| Inventories, net | 88,302 | 88,139 | |||||

| Prepaid expenses and other current assets | 20,137 | 14,520 | |||||

| Total current assets | 242,337 | 243,062 | |||||

| Property and equipment: | |||||||

| Land | 4,186 | 4,154 | |||||

| Buildings and improvements | 73,759 | 72,952 | |||||

| Machinery and equipment | 133,281 | 131,738 | |||||

| Software | 10,198 | 9,619 | |||||

| Construction in progress | 10,761 | 11,379 | |||||

| Accumulated depreciation | (145,391 | ) | (139,206 | ) | |||

| Property and equipment, net | 86,794 | 90,636 | |||||

| Goodwill | 45,610 | 45,734 | |||||

| Intangible assets, net | 41,807 | 44,634 | |||||

| Operating lease right-of-use assets | 25,239 | 26,953 | |||||

| Other assets | 20,739 | 20,547 | |||||

| Total assets | $ | 462,526 | $ | 471,566 | |||

| VISHAY PRECISION GROUP, INC. | |||||||

| Consolidated Condensed Balance Sheets | |||||||

| (In thousands) | |||||||

| September 28, 2024 | December 31, 2023 | ||||||

| (Unaudited) | |||||||

| Liabilities and equity | |||||||

| Current liabilities: | |||||||

| Trade accounts payable | $ | 9,986 | $ | 11,698 | |||

| Payroll and related expenses | 17,819 | 18,971 | |||||

| Other accrued expenses | 21,989 | 22,427 | |||||

| Income taxes | 1,150 | 4,524 | |||||

| Current portion of operating lease liabilities | 4,053 | 4,004 | |||||

| Total current liabilities | 54,997 | 61,624 | |||||

| Long-term debt | 31,383 | 31,856 | |||||

| Deferred income taxes | 3,645 | 3,490 | |||||

| Operating lease liabilities | 20,645 | 22,625 | |||||

| Other liabilities | 14,145 | 14,770 | |||||

| Accrued pension and other postretirement costs | 7,054 | 7,276 | |||||

| Total liabilities | 131,869 | 141,641 | |||||

| Equity: | |||||||

| Common stock | 1,336 | 1,330 | |||||

| Class B convertible common stock | 103 | 103 | |||||

| Treasury stock | (25,335 | ) | (17,460 | ) | |||

| Capital in excess of par value | 202,872 | 202,672 | |||||

| Retained earnings | 191,209 | 182,066 | |||||

| Accumulated other comprehensive loss | (39,564 | ) | (38,869 | ) | |||

| Total Vishay Precision Group, Inc. stockholders’ equity | 330,621 | 329,842 | |||||

| Noncontrolling interests | 36 | 83 | |||||

| Total equity | 330,657 | 329,925 | |||||

| Total liabilities and equity | $ | 462,526 | $ | 471,566 | |||

| VISHAY PRECISION GROUP, INC. | |||||||

| Consolidated Condensed Statements of Cash Flows | |||||||

| (Unaudited – In thousands) | |||||||

| Nine Fiscal Months Ended | |||||||

| September 28, 2024 | September 30, 2023 | ||||||

| Operating activities | |||||||

| Net earnings | $ | 9,146 | $ | 21,690 | |||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

| Depreciation and amortization | 11,771 | 11,559 | |||||

| Loss (gain) on sale of property and equipment | (154 | ) | 38 | ||||

| Share-based compensation expense | 1,060 | 1,885 | |||||

| Inventory write-offs for obsolescence | 1,722 | 1,567 | |||||

| Deferred income taxes | 512 | 691 | |||||

| Foreign currency impacts and other items | (1,213 | ) | (2,755 | ) | |||

| Net changes in operating assets and liabilities: | |||||||

| Accounts receivable | 3,340 | 1,604 | |||||

| Inventories | (1,816 | ) | (7,811 | ) | |||

| Prepaid expenses and other current assets | (5,576 | ) | 1,990 | ||||

| Trade accounts payable | (743 | ) | (1,151 | ) | |||

| Other current liabilities | (3,921 | ) | (1,082 | ) | |||

| Other non current assets and liabilities, net | (767 | ) | (170 | ) | |||

| Accrued pension and other postretirement costs, net | (322 | ) | (945 | ) | |||

| Net cash provided by operating activities | 13,039 | 27,110 | |||||

| Investing activities | |||||||

| Capital expenditures | (6,965 | ) | (9,848 | ) | |||

| Proceeds from sale of property and equipment | 647 | 50 | |||||

| Net cash used in investing activities | (6,318 | ) | (10,798 | ) | |||

| Financing activities | |||||||

| Payments on revolving facility | — | (7,000 | ) | ||||

| Debt issuance costs | (569 | ) | — | ||||

| Purchase of treasury stock | (7,815 | ) | (1,196 | ) | |||

| Distributions to noncontrolling interests | (50 | ) | (138 | ) | |||

| Payments of employee taxes on certain share-based arrangements | (860 | ) | (825 | ) | |||

| Net cash used in financing activities | (9,294 | ) | (9,159 | ) | |||

| Effect of exchange rate changes on cash and cash equivalents | (315 | ) | (1,083 | ) | |||

| (Decrease) Increase in cash and cash equivalents | (2,888 | ) | 6,070 | ||||

| Cash and cash equivalents at beginning of period | 83,965 | 88,562 | |||||

| Cash and cash equivalents at end of period | $ | 81,077 | $ | 94,632 | |||

| Supplemental disclosure of investing transactions: | |||||||

| Capital expenditures accrued but not yet paid | $ | 1,354 | $ | 1,204 | |||

| Supplemental disclosure of financing transactions: | |||||||

| Excise tax on net share repurchases accrued but not yet paid | 60 | — | |||||

| VISHAY PRECISION GROUP, INC. | |||||||||||||||||||||||||||||||

| Reconciliation of Consolidated Adjusted Gross Profit, Operating Income, Net Earnings Attributable to VPG Stockholders and Diluted Earnings Per Share | |||||||||||||||||||||||||||||||

| (Unaudited – In thousands) | |||||||||||||||||||||||||||||||

| Gross Profit | Operating Income | Net (Loss) Earnings Attributable to VPG Stockholders | Diluted Earnings Per share | ||||||||||||||||||||||||||||

| Three months ended | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | |||||||||||||||||||||||

| As reported – GAAP | $ | 30,260 | $ | 35,935 | $ | 3,841 | $ | 8,224 | $ | (1,351 | ) | $ | 6,280 | $ | (0.10 | ) | $ | 0.46 | |||||||||||||

| As reported – GAAP Margins | 40.0 | % | 41.9 | % | 5.1 | % | 9.6 | % | |||||||||||||||||||||||

| Acquisition purchase accounting adjustments | — | 214 | — | 214 | — | 214 | — | 0.02 | |||||||||||||||||||||||

| Restructuring costs | — | — | 82 | 1,153 | 82 | 1,153 | 0.01 | 0.08 | |||||||||||||||||||||||

| Foreign currency exchange gain (loss) | — | — | — | — | 2,912 | (1,283 | ) | 0.22 | (0.09 | ) | |||||||||||||||||||||

| Less: Tax effect of reconciling items and discrete tax items | — | — | — | — | (839 | ) | (77 | ) | (0.06 | ) | — | ||||||||||||||||||||

| As Adjusted – Non GAAP | $ | 30,260 | $ | 36,149 | $ | 3,923 | $ | 9,591 | $ | 2,482 | $ | 6,441 | $ | 0.19 | $ | 0.47 | |||||||||||||||

| As Adjusted – Non GAAP Margins | 40.0 | % | 42.1 | % | 5.2 | % | 11.2 | % | |||||||||||||||||||||||

| VISHAY PRECISION GROUP, INC. | |||||||||||||||||||||||||||||||

| Reconciliation of Consolidated Adjusted Gross Profit, Operating Income, Net Earnings Attributable to VPG Stockholders and Diluted Earnings Per Share | |||||||||||||||||||||||||||||||

| (Unaudited – In thousands) | |||||||||||||||||||||||||||||||

| Gross Profit | Operating Income | Net Earnings Attributable to VPG Stockholders | Diluted Earnings Per share | ||||||||||||||||||||||||||||

| Nine fiscal months ended | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | September 28, 2024 | September 30, 2023 | |||||||||||||||||||||||

| As reported – GAAP | $ | 97,761 | $ | 111,846 | $ | 16,665 | $ | 29,943 | $ | 9,143 | $ | 21,480 | $ | 0.68 | $ | 1.57 | |||||||||||||||

| As reported – GAAP Margins | 41.8 | % | 42.1 | % | 7.1 | % | 11.3 | % | |||||||||||||||||||||||

| Acquisition purchase accounting adjustments | — | 304 | — | 304 | — | 304 | — | 0.02 | |||||||||||||||||||||||

| Restructuring costs | — | — | 864 | 1,431 | 864 | 1,431 | 0.06 | 0.11 | |||||||||||||||||||||||

| Severance cost | — | — | 347 | — | 347 | — | 0.03 | — | |||||||||||||||||||||||

| Foreign currency exchange gain (loss) | — | — | — | — | 34 | (2,139 | ) | — | (0.16 | ) | |||||||||||||||||||||

| Less: Tax effect of reconciling items and discrete tax items | — | — | — | — | (1,913 | ) | (357 | ) | (0.14 | ) | (0.03 | ) | |||||||||||||||||||

| As Adjusted – Non GAAP | $ | 97,761 | $ | 112,150 | $ | 17,876 | $ | 31,678 | $ | 12,301 | $ | 21,433 | $ | 0.92 | $ | 1.57 | |||||||||||||||

| As Adjusted – Non GAAP Margins | 41.8 | % | 42.2 | % | 7.6 | % | 11.9 | % | |||||||||||||||||||||||

| VISHAY PRECISION GROUP, INC. | |||||||||||

| Reconciliation of Adjusted Gross Profit by segment | |||||||||||

| (Unaudited – In thousands) | |||||||||||

| Fiscal quarter ended | |||||||||||

| September 28, 2024 | September 30, 2023 | June 29, 2024 | |||||||||

| Sensors | |||||||||||

| As reported – GAAP | $ | 8,730 | $ | 11,681 | $ | 11,066 | |||||

| As reported – GAAP Margins | 31.0 | % | 35.9 | % | 38.3 | % | |||||

| As Adjusted – Non GAAP | $ | 8,730 | $ | 11,681 | $ | 11,066 | |||||

| As Adjusted – Non GAAP Margins | 31.0 | % | 35.9 | % | 38.3 | % | |||||

| Weighing Solutions | |||||||||||

| As reported – GAAP | $ | 8,840 | $ | 11,207 | $ | 10,310 | |||||

| As reported – GAAP Margins | 35.1 | % | 38.7 | % | 37.6 | % | |||||

| As Adjusted – Non GAAP | $ | 8,840 | $ | 11,207 | $ | 10,310 | |||||

| As Adjusted – Non GAAP Margins | 35.1 | % | 38.7 | % | 37.6 | % | |||||

| Measurement Systems | |||||||||||

| As reported – GAAP | $ | 12,690 | $ | 13,047 | $ | 11,031 | |||||

| As reported – GAAP Margins | 56.8 | % | 53.6 | % | 52.4 | % | |||||

| Acquisition purchase accounting adjustments | — | 214 | — | ||||||||

| As Adjusted – Non GAAP | $ | 12,690 | $ | 13,261 | $ | 11,031 | |||||

| As Adjusted – Non GAAP Margins | 56.8 | % | 54.5 | % | 52.4 | % | |||||

| VISHAY PRECISION GROUP, INC. | |||||||||||

| Reconciliation of Adjusted EBITDA | |||||||||||

| (Unaudited – In thousands) | |||||||||||

| Fiscal quarter ended | |||||||||||

| September 28, 2024 | September 30, 2023 | June 29, 2024 | |||||||||

| Net (loss) earnings attributable to VPG stockholders | $ | (1,351 | ) | $ | 6,280 | $ | 4,603 | ||||

| Interest Expense | 648 | 1,119 | 649 | ||||||||

| Income tax expense | 1,874 | 2,419 | 2,316 | ||||||||

| Depreciation | 2,988 | 2,954 | 2,992 | ||||||||

| Amortization | 925 | 880 | 924 | ||||||||

| EBITDA | 5,084 | $ | 13,652 | $ | 11,484 | ||||||

| EBITDA MARGIN | 6.7 | % | 15.9 | % | 14.8 | % | |||||

| Acquisition purchase accounting adjustments | — | 214 | — | ||||||||

| Restructuring costs | 82 | 1,153 | — | ||||||||

| Foreign currency exchange gain (loss) | 2,912 | (1,283 | ) | (1,289 | ) | ||||||

| ADJUSTED EBITDA | $ | 8,079 | $ | 13,736 | $ | 10,195 | |||||

| ADJUSTED EBITDA MARGIN | 10.7 | % | 16.0 | % | 13.2 | % | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

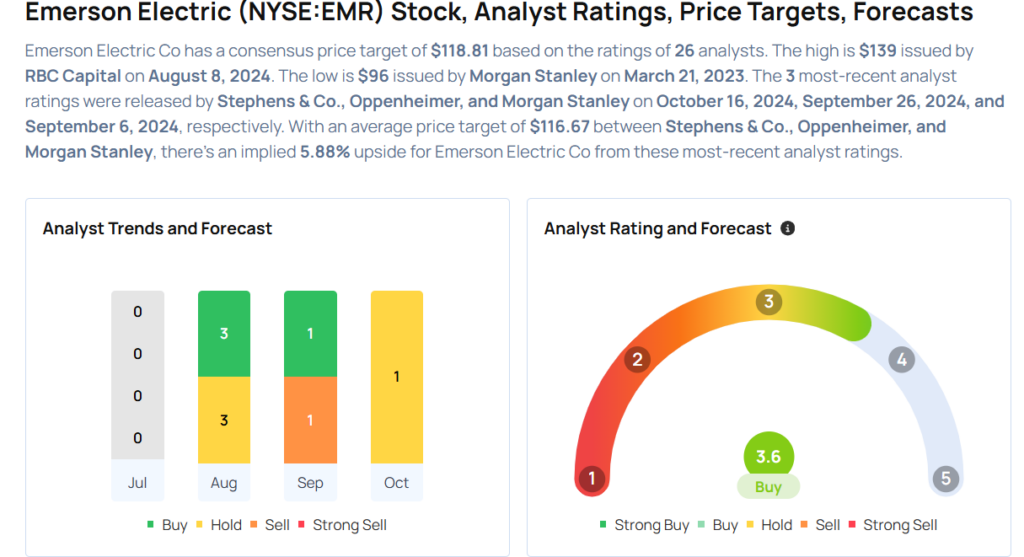

Emerson Electric Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Emerson Electric Co. EMR will release earnings results for its fourth quarter, before the opening bell on Tuesday, Nov. 5.

Analysts expect the Saint Louis, Missouri-based company to report quarterly earnings at $1.47 per share, up from $1.29 per share in the year-ago period. Emerson Electric projects to report revenue of $4.57 billion for the quarter, compared to $4.09 billion a year earlier, according to data from Benzinga Pro.

On Aug. 21, Emerson announced it has made a strategic investment through its corporate venture capital arm Emerson Ventures in Symmera.

Emerson Electric shares gained 1.2% to close at $109.81 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Stephens & Co. analyst Tommy Moll downgraded the stock from Overweight to Equal-Weight and cut the price target from $135 to $120 on Oct. 16. This analyst has an accuracy rate of 80%.

- Oppenheimer analyst Christopher Glynn maintained an Outperform rating and increased the price target from $120 to $125 on Sept. 26. This analyst has an accuracy rate of 83%.

- Morgan Stanley analyst Chris Snyder initiated coverage on the stock with an Underweight rating and a price target of $105 on Sept. 6. This analyst has an accuracy rate of 74%.

- JP Morgan analyst Stephen Tusa downgraded the stock from Overweight to Neutral and slashed the price target from $132 to $115 on Aug. 14. This analyst has an accuracy rate of 69%.

- RBC Capital analyst Deane Dray maintained an Outperform rating and lowered the price target from $140 to $139 on Aug. 8. This analyst has an accuracy rate of 74%.

Considering buying EMR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Southern Company

Summary

Southern Company is an electric and gas utility and wholesaler with nine million customers and 41,000 megawatts of generating capacity. Its gas subsidiary also provides distribution and wholesale gas services. In 2023, retail electricity accounted for about 65% of total revenue, while natural gas sales accounted for just under 20%. Southern’s electrical customer base is evenly balanced, with commercial, industrial, and residential customers each representing about one-third of retail sales. The company is based in Atlanta and provides natural gas to customers in Illinois, Georgia, Virginia, and Tennessee. SO owns regulated electric utilities in Georgia, Alabama, and Mississippi. Its largest utility, Georgia Power, accounted for about 40% of 2023 revenue. The company also offers digital wireless and fiber-optic services.

SO’s 2023 fuel mix is 52% gas, 17% coal, 17% nuclear, and 14% renewables. It is working to achieve net-zero greenhouse-gas emissions by 2050, later than peers without coal generation. The fuel mix will change once the company adds the last of its new nuclear reactors to its three existing nuclear units at the Vogtle Electric Generating Plant in Georgia. The company has faced rising costs and pandemic delays with these reactors – the first U.S. nuclear units built in the last 30 years. Vogtle 3 became o

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Thomson Reuters Reports Third-Quarter 2024 Results

TORONTO, Nov. 5, 2024 /PRNewswire/ — Thomson Reuters (TSX/NYSE:TRI) today reported results for the third quarter ended September 30, 2024:

- Good revenue momentum continued in the third quarter

- Total company revenues up 8%, organic revenues up 7%

- Organic revenues up 9% for the “Big 3” segments (Legal Professionals, Corporates and Tax & Accounting Professionals)

- Total company revenues up 8%, organic revenues up 7%

- Raised total company full-year organic revenue growth outlook to approximately 7%

- Raised organic revenue growth outlook for “Big 3” to approximately 8.5%

- Announced agreement to sell its FindLaw business

“We saw good momentum continue in the third quarter, with revenue and margins moderately ahead of our expectations” said Steve Hasker, President and CEO of Thomson Reuters.

“We remain focused on driving innovation across our portfolio and markets to best serve our customers, demonstrated by our investment in AI now increasing to more than $200 million in 2024. We continue to make progress against our “Build, Partner, Buy” strategy, including launching several new AI product capabilities and making exciting enhancements to CoCounsel, our professional-grade GenAI assistant. In addition, we have closed on the strategic acquisitions of Safe Sign Technologies and Materia, which complement our product roadmap and further accelerate our provision of GenAI tools for professionals.”

Mr. Hasker added, “As we look ahead, we are committed to taking a balanced capital allocation approach, focusing on delivering sustained value creation through a long-term investment strategy.”

Consolidated Financial Highlights – Three Months Ended September 30

|

Three Months Ended September 30, (Millions of U.S. dollars, except for adjusted EBITDA margin and EPS) (unaudited) |

||||

|

IFRS Financial Measures(1) |

2024 |

2023 |

Change |

Change at |

|

Revenues |

$1,724 |

$1,594 |

8 % |

|

|

Operating profit |

$415 |

$441 |

-6 % |

|

|

Diluted earnings per share (EPS) |

$0.67 |

$0.80 |

-16 % |

|

|

Net cash provided by operating activities |

$756 |

$674 |

12 % |

|

|

Non-IFRS Financial Measures(1) |

||||

|

Revenues |

$1,724 |

$1,594 |

8 % |

9 % |

|

Adjusted EBITDA |

$609 |

$632 |

-4 % |

-4 % |

|

Adjusted EBITDA margin |

35.3 % |

39.6 % |

-430bp |

-450bp |

|

Adjusted EPS |

$0.80 |

$0.82 |

-2 % |

-2 % |

|

Free cash flow |

$591 |

$529 |

12 % |

|

|

(1) In addition to results reported in accordance with International Financial Reporting Standards (IFRS), the company uses certain non-IFRS |

||||

Revenues increased 8%, driven by growth in recurring and transactions revenues. Acquisitions had a 1% positive impact and foreign currency had a slightly negative impact on revenue growth.

- Organic revenues increased 7%, driven by 8% growth in recurring revenues (84% of total revenues) and 12% growth in transactions revenues. Global Print revenues decreased 6% organically.

- The company’s “Big 3” segments reported organic revenue growth of 9% and collectively comprised 81% of total revenues.

Operating profit decreased 6% as higher revenues were more than offset by higher costs which included growth investments and the impact of acquisitions.

- Adjusted EBITDA decreased 4% primarily due to the same factors that impacted operating profit. The related margin decreased to 35.3% from 39.6% in the prior-year period. Foreign currency had a 20 basis points positive impact on the year-over-year change in adjusted EBITDA margin.

Diluted EPS decreased to $0.67 compared to $0.80 in the prior-year period primarily reflecting higher tax expense, as the prior-year period included the release of certain tax reserves.

- Adjusted EPS, which excludes the release of certain tax reserves, as well as other adjustments, decreased to $0.80 per share from $0.82 per share in the prior-year period as lower adjusted EBITDA and higher income taxes more than offset lower interest expense.

Net cash provided by operating activities increased by $82 million in the third quarter, primarily due to certain component changes in working capital.

- Free cash flow increased $62 million primarily due to the increase in cash flow from operating activities.

Highlights by Customer Segment – Three Months Ended September 30

|

(Millions of U.S. dollars, except for adjusted EBITDA margins) (unaudited) |

||||||||||||||||||||||

|

Three Months Ended |

||||||||||||||||||||||

|

September 30, |

Change |

|||||||||||||||||||||

|

2024 |

2023 |

Total |

Constant |

Organic(1)(2) |

||||||||||||||||||

|

Revenues |

||||||||||||||||||||||

|

Legal Professionals |

$745 |

$688 |

8 % |

8 % |

7 % |

|||||||||||||||||

|

Corporates |

437 |

391 |

12 % |

12 % |

10 % |

|||||||||||||||||

|

Tax & Accounting Professionals |

221 |

203 |

9 % |

11 % |

10 % |

|||||||||||||||||

|

“Big 3” Segments Combined(1) |

1,403 |

1,282 |

9 % |

10 % |

9 % |

|||||||||||||||||

|

Reuters News |

199 |

180 |

10 % |

10 % |

8 % |

|||||||||||||||||

|

Global Print |

128 |

137 |

-7 % |

-6 % |

-6 % |

|||||||||||||||||

|

Eliminations/Rounding |

(6) |

(5) |

||||||||||||||||||||

|

Revenues |

$1,724 |

$1,594 |

8 % |

9 % |

7 % |

|||||||||||||||||

|

Adjusted EBITDA(1) |

||||||||||||||||||||||

|

Legal Professionals |

$334 |

$338 |

-1 % |

-1 % |

||||||||||||||||||

|

Corporates |

162 |

164 |

-1 % |

-2 % |

||||||||||||||||||

|

Tax & Accounting Professionals |

59 |

64 |

-7 % |

-5 % |

||||||||||||||||||

|

“Big 3” Segments Combined(1) |

555 |

566 |

-2 % |

-2 % |

||||||||||||||||||

|

Reuters News |

40 |

37 |

10 % |

14 % |

||||||||||||||||||

|

Global Print |

43 |

55 |

-22 % |

-21 % |

||||||||||||||||||

|

Corporate costs |

(29) |

(26) |

n/a |

n/a |

||||||||||||||||||

|

Adjusted EBITDA |

$609 |

$632 |

-4 % |

-4 % |

||||||||||||||||||

|

Adjusted EBITDA Margin(1) |

||||||||||||||||||||||

|

Legal Professionals |

44.9 % |

49.1 % |

-420bp |

-430bp |

||||||||||||||||||

|

Corporates |

36.8 % |

41.9 % |

-510bp |

-520bp |

||||||||||||||||||

|

Tax & Accounting Professionals |

26.8 % |

31.2 % |

-440bp |

-430bp |

||||||||||||||||||

|

“Big 3” Segments Combined(1) |

39.5 % |

44.0 % |

-450bp |

-460bp |

||||||||||||||||||

|

Reuters News |

20.4 % |

20.4 % |

0bp |

70bp |

||||||||||||||||||

|

Global Print |

33.1 % |

39.6 % |

-650bp |

-640bp |

||||||||||||||||||

|

Adjusted EBITDA margin |

35.3 % |

39.6 % |

-430bp |

-450bp |

||||||||||||||||||

|

(1) See the “Non-IFRS Financial Measures” section and the tables appended to this news release for additional information on these and (2) Computed for revenue growth only. n/a: not applicable |

||||||||||||||||||||||

Unless otherwise noted, all revenue growth comparisons by customer segment in this news release are at constant currency (or exclude the impact of foreign currency) as Thomson Reuters believes this provides the best basis to measure their performance.

Legal Professionals

Revenues increased 8% to $745 million and included a positive impact from acquisitions. Organic revenue growth was 7%.

- Recurring revenues increased 9% (97% of total, 8% organic). Organic growth was primarily driven by Westlaw, CoCounsel, Practical Law and the segment’s international businesses.

- Transactions revenues decreased 11% (3% of total, all organic).

Adjusted EBITDA decreased 1% to $334 million.

- The margin decreased to 44.9% from 49.1% primarily driven by higher investments.

Corporates

Revenues increased 12% to $437 million, including the acquisition impact of Pagero. Organic revenue growth was 10%.

- Recurring revenues increased 12% (89% of total, 9% organic). Organic growth was primarily driven by Practical Law, Direct and Indirect Tax, Clear and the segment’s international businesses.

- Transactions revenues increased 12% (11% of total, 13% organic) driven primarily by Trust, Direct Tax and segment’s international businesses.

Adjusted EBITDA decreased 1% to $162 million.

- The margin decreased to 36.8% from 41.9%, primarily driven by the Pagero acquisition and higher investments.

Tax & Accounting Professionals

Revenues increased 11% to $221 million. Organic revenue growth was 10%.

- Recurring revenues increased 10% (77% of total, all organic). Organic growth was driven by the segment’s Latin America business and UltraTax products.

- Transactions revenues increased 16% (23% of total, 13% organic) primarily due to UltraTax, Confirmation and the segment’s international businesses.

Adjusted EBITDA decreased 7% to $59 million.

- The margin decreased to 26.8% from 31.2%, primarily driven by higher investments.

The Tax & Accounting Professionals segment is the company’s most seasonal business with approximately 60% of full-year revenues typically generated in the first and fourth quarters. As a result, the margin performance of this segment has been generally higher in the first and fourth quarters as costs are typically incurred in a more linear fashion throughout the year.

Reuters News

Revenues of $199 million increased 10% (8% organic) which included a positive impact from acquisitions. Organic revenue growth was driven primarily by Generative AI related content licensing revenue that was largely transactional in nature and by a contractual price increase from our news agreement with the Data & Analytics business of LSEG.

Adjusted EBITDA increased 10% to $40 million driven by higher revenues.

Global Print

Revenues of $128 million decreased 6%, all organic, driven in part by the migration of customers from a Global Print product to Westlaw.

Adjusted EBITDA decreased 22% to $43 million.

- The margin decreased to 33.1% from 39.6% primarily due to lower revenues.

Corporate Costs

Corporate costs were $29 million compared to $26 million in the prior-year period.

Consolidated Financial Highlights – Nine Months Ended September 30

|

Nine Months Ended September 30, (Millions of U.S. dollars, except for adjusted EBITDA margin and EPS) (unaudited) |

||||

|

IFRS Financial Measures(1) |

2024 |

2023 |

Change |

Change at |

|

Revenues |

$5,349 |

$4,979 |

7 % |

|

|

Operating profit |

$1,387 |

$1,774 |

-22 % |

|

|

Diluted EPS |

$3.59 |

$4.31 |

-17 % |

|

|

Net cash provided by operating activities |

$1,893 |

$1,636 |

16 % |

|

|

Non-IFRS Financial Measures(1) |

||||

|

Revenues |

$5,349 |

$4,979 |

7 % |

8 % |

|

Adjusted EBITDA |

$2,061 |

$1,971 |

5 % |

5 % |

|

Adjusted EBITDA margin |

38.5 % |

39.5 % |

-100bp |

-120bp |

|

Adjusted EPS |

$2.76 |

$2.53 |

9 % |

9 % |

|

Free cash flow |

$1,403 |

$1,258 |

12 % |

|

|

(1) In addition to results reported in accordance with IFRS, the company uses certain non-IFRS financial measures as supplemental |

||||

Revenues increased 7%, driven by growth in recurring and transactions revenues. Foreign currency had a slightly negative impact on revenue growth.

- Organic revenues increased 8%, driven by 8% growth in recurring revenues (80% of total revenues) and 14% growth in transactions revenues. Global Print revenues decreased 8% organically.

- The company’s “Big 3” segments reported organic revenue growth of 9% and collectively comprised 82% of total revenues.

Operating profit decreased 22%, primarily because the 2023 period included a gain on the sale of a majority stake in the company’s Elite business.

- Adjusted EBITDA, which excludes the gain on sale of Elite, as well as other items, increased 5% as higher revenues more than offset growth investments and the impact of acquisitions. The related margin decreased to 38.5% from 39.5% in the prior-year period. Foreign currency had a 20 basis points positive impact on the year-over-year change in adjusted EBITDA margin.

Diluted EPS decreased to $3.59 compared to $4.31 in the prior-year period. The current period reflected lower operating profit and included a $468 million non-cash tax benefit related to tax legislation enacted in Canada. The prior-year period included a significant increase in the value of the company’s investment in LSEG. In 2024, diluted EPS also benefited from a reduction in weighted-average common shares outstanding due to share repurchases and the company’s June 2023 return of capital transaction.

- Adjusted EPS, which excludes the gain on sale of Elite, the changes in value of the company’s LSEG investment, the non-cash tax benefit, as well as other adjustments, increased to $2.76 per share from $2.53 per share in the prior-year period, primarily due to higher adjusted EBITDA. In 2024, adjusted EPS also benefited from a reduction in weighted-average common shares.

Net cash provided by operating activities increased by $257 million due to the cash benefits from higher revenues that more than offset investment spending. The prior-year period also included $80 million of payments associated with the company’s Change Program, which was completed at the end of 2022.

- Free cash flow increased $145 million as higher cash flows from operating activities more than offset higher capital expenditures and lower cash flows from other investing activities.

Highlights by Customer Segment – Nine Months Ended September 30

|

(Millions of U.S. dollars, except for adjusted EBITDA margins) (unaudited) |

||||||||||||||||||||||

|

Nine Months Ended |

||||||||||||||||||||||

|

September 30, |

Change |

|||||||||||||||||||||

|

2024 |

2023 |

Total |

Constant |

Organic(1)(2) |

||||||||||||||||||

|

Revenues |

||||||||||||||||||||||

|

Legal Professionals |

$2,193 |

$2,107 |

4 % |

4 % |

7 % |

|||||||||||||||||

|

Corporates |

1,386 |

1,218 |

14 % |

14 % |

10 % |

|||||||||||||||||

|

Tax & Accounting Professionals |

799 |

714 |

12 % |

14 % |

12 % |

|||||||||||||||||

|

“Big 3” Segments Combined(1) |

4,378 |

4,039 |

8 % |

9 % |

9 % |

|||||||||||||||||

|

Reuters News |

614 |

549 |

12 % |

12 % |

9 % |

|||||||||||||||||

|

Global Print |

375 |

408 |

-8 % |

-8 % |

-8 % |

|||||||||||||||||

|

Eliminations/Rounding |

(18) |

(17) |

||||||||||||||||||||

|

Revenues |

$5,349 |

$4,979 |

7 % |

8 % |

8 % |

|||||||||||||||||

|

Adjusted EBITDA(1) |

||||||||||||||||||||||

|

Legal Professionals |

$1,003 |

$1,001 |

0 % |

0 % |

||||||||||||||||||

|

Corporates |

518 |

481 |

8 % |

7 % |

||||||||||||||||||

|

Tax & Accounting Professionals |

331 |

302 |

10 % |

11 % |

||||||||||||||||||

|

“Big 3” Segments Combined(1) |

1,852 |

1,784 |

4 % |

4 % |

||||||||||||||||||

|

Reuters News |

151 |

111 |

37 % |

39 % |

||||||||||||||||||

|

Global Print |

133 |

158 |

-16 % |

-16 % |

||||||||||||||||||

|

Corporate costs |

(75) |

(82) |

n/a |

n/a |

||||||||||||||||||

|

Adjusted EBITDA |

$2,061 |

$1,971 |

5 % |

5 % |

||||||||||||||||||

|

Adjusted EBITDA Margin(1) |

||||||||||||||||||||||

|

Legal Professionals |

45.7 % |

47.5 % |

-180bp |

-180bp |

||||||||||||||||||

|

Corporates |

37.2 % |

39.4 % |

-220bp |

-230bp |

||||||||||||||||||

|

Tax & Accounting Professionals |

41.5 % |

41.6 % |

-10bp |

-20bp |

||||||||||||||||||

|

“Big 3” Segments Combined(1) |

42.3 % |

44.0 % |

-170bp |

-180bp |

||||||||||||||||||

|

Reuters News |

24.6 % |

20.1 % |

450bp |

460bp |

||||||||||||||||||

|

Global Print |

35.5 % |

38.6 % |

-310bp |

-330bp |

||||||||||||||||||

|

Adjusted EBITDA margin |

38.5 % |

39.5 % |

-100bp |

-120bp |

||||||||||||||||||

|

(1) See the “Non-IFRS Financial Measures” section and the tables appended to this news release for additional information on these and (2) Computed for revenue growth only. n/a: not applicable |

||||||||||||||||||||||

2024 Outlook

The company raised its 2024 outlook for organic revenue growth to reflect strong year-to-date performance. All other measures in the outlook were maintained.

The company’s outlook for 2024 in the table below assumes constant currency rates and excludes the impact of any future acquisitions or dispositions that may occur during the remainder of the year. Thomson Reuters believes that this type of guidance provides useful insight into the anticipated performance of its businesses.

The company expects its fourth-quarter 2024 organic revenue growth to be approximately 5% and its adjusted EBITDA margin to be approximately 37%.

The company continues to operate in an uncertain macroeconomic environment, reflecting ongoing geopolitical risk, uneven economic growth and an evolving interest rate and inflationary backdrop. Any worsening of the global economic or business environment, among other factors, could impact the company’s ability to achieve its outlook.

Reported Full-Year 2023 Results and Full-Year 2024 Outlook

|

Total Thomson Reuters |

FY 2023 Reported |

FY 2024 Outlook 2/8/2024 |

FY 2024 Outlook 5/2/2024 |

FY 2024 Outlook 8/1/2024 |

FY 2024 Outlook 11/5/2024 |

|

Total Revenue Growth |

3 % |

~ 6.5% |

6.5% – 7.0% |

~ 7.0% |

Unchanged |

|

Organic Revenue Growth(1) |

6 % |

~ 6% |

6.0% – 6.5% |

~ 6.5% |

~7.0% |

|

Adjusted EBITDA Margin(1) |

39.3 % |

~ 38% |

Unchanged |

Unchanged |

Unchanged |

|

Corporate Costs |

$115 million |

$120 – $130 million |

Unchanged |

Unchanged |

Unchanged |

|

Free Cash Flow(1) |

$1.9 billion |

~ $1.8 billion |

Unchanged |

Unchanged |

Unchanged |

|

Accrued Capex as % of Revenues(1) |

7.8 % |

~ 8.5% |

Unchanged |

Unchanged |

Unchanged |

|

Depreciation & Amortization of Computer Software Depreciation & Amortization of Internally Developed Software Amortization of Acquired Software |

$628 million

$72 million |

$730 – $750 million

~ $135 million |

Unchanged

Unchanged |

Unchanged

~ $150 million |

Unchanged

Unchanged |

|

Interest Expense (P&L)(2) |

$164 million(2) |

$150 – $170 million |

Unchanged |

$125 – $145 |

Unchanged |

|

Effective Tax Rate on Adjusted Earnings(1) |

16.5 % |

~ 18% |

Unchanged |

Unchanged |

Unchanged |

|

“Big 3” Segments(1) |

FY 2023 Reported |

FY 2024 Outlook 2/8/2024 |

FY 2024 Outlook 5/2/2024 |

FY 2024 Outlook 8/1/2024 |

FY 2024 Outlook 11/5/2024 |

|

Total Revenue Growth |

3 % |

~ 8% |

8.0% – 8.5% |

~ 8.5% |

Unchanged |

|

Organic Revenue Growth |

7 % |

~ 7.5% |

7.5% – 8.0% |

~ 8.0% |

~8.5% |

|

Adjusted EBITDA Margin |

43.8 % |

~ 43% |

Unchanged |

Unchanged |

Unchanged |

|

(1) |

Non-IFRS financial measures. See the “Non-IFRS Financial Measures” section below as well as the tables and footnotes appended to this news release for more information. |

|

(2) |

Full-year 2023 interest expense excludes a $12 million benefit associated with the release of a tax reserve that is removed from adjusted earnings. |

The information in this section is forward-looking. Actual results, which will include the impact of currency and future acquisitions and dispositions completed during 2024 may differ materially from the company’s 2024 outlook. The information in this section should also be read in conjunction with the section below entitled “Special Note Regarding Forward-Looking Statements, Material Risks and Material Assumptions.”

Dividends and common shares outstanding

A quarterly dividend of $0.54 per share is payable on December 10, 2024 to common shareholders of record as of November 21, 2024.

As of October 31, 2024, Thomson Reuters had approximately 449.9 million common shares outstanding.

Acquisitions

In August 2024, the company acquired Safe Sign Technologies, a U.K-based startup that is developing legal-specific large language models (LLMs).

In October 2024, the company acquired Materia, a US-based startup that has developed an agentic AI assistant for the tax, audit and accounting profession.

Sale agreement

In October 2024, the company announced the signing of a definitive agreement to sell its FindLaw business. FindLaw operates an online legal directory and provides website creation and hosting services, law firm marketing solutions, and peer rating services. The sale is expected to close in the fourth quarter of 2024 contingent on receiving regulatory approvals and satisfaction of other customary closing conditions.

Thomson Reuters

Thomson Reuters (NYSE / TSX:TRI) informs the way forward by bringing together the trusted content and technology that people and organizations need to make the right decisions. The company serves professionals across legal, tax, accounting, compliance, government, and media. Its products combine highly specialized software and insights to empower professionals with the data, intelligence, and solutions needed to make informed decisions, and to help institutions in their pursuit of justice, truth and transparency. Reuters, part of Thomson Reuters, is a world leading provider of trusted journalism and news. For more information, visit tr.com.

NON-IFRS FINANCIAL MEASURES

Thomson Reuters prepares its financial statements in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB).

This news release includes certain non-IFRS financial measures, which include ratios that incorporate one or more non-IFRS financial measures, such as adjusted EBITDA (other than at the customer segment level) and the related margin, free cash flow, adjusted earnings and the effective tax rate on adjusted earnings, adjusted EPS, accrued capital expenditures expressed as a percentage of revenues, selected measures excluding the impact of foreign currency, changes in revenues computed on an organic basis as well as all financial measures for the “Big 3” segments.

Thomson Reuters uses these non-IFRS financial measures as supplemental indicators of its operating performance and financial position as well as for internal planning purposes and the company’s business outlook. Additionally, Thomson Reuters uses non-IFRS measures as the basis for management incentive programs. These measures do not have any standardized meanings prescribed by IFRS and therefore are unlikely to be comparable to the calculation of similar measures used by other companies and should not be viewed as alternatives to measures of financial performance calculated in accordance with IFRS. Non-IFRS financial measures are defined and reconciled to the most directly comparable IFRS measures in the appended tables.

The company’s outlook contains various non-IFRS financial measures. The company believes that providing reconciliations of forward-looking non-IFRS financial measures in its outlook would be potentially misleading and not practical due to the difficulty of projecting items that are not reflective of ongoing operations in any future period. The magnitude of these items may be significant. Consequently, for outlook purposes only, the company is unable to reconcile these non-IFRS measures to the most directly comparable IFRS measures because it cannot predict, with reasonable certainty, the impacts of changes in foreign exchange rates which impact (i) the translation of its results reported at average foreign currency rates for the year, and (ii) other finance income or expense related to intercompany financing arrangements. Additionally, the company cannot reasonably predict the occurrence or amount of other operating gains and losses that generally arise from business transactions that the company does not currently anticipate.

ROUNDING

Other than EPS, the company reports its results in millions of U.S. dollars, but computes percentage changes and margins using whole dollars to be more precise. As a result, percentages and margins calculated from reported amounts may differ from those presented, and growth components may not total due to rounding.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS, MATERIAL RISKS AND MATERIAL ASSUMPTIONS

Certain statements in this news release, including, but not limited to, statements in Mr. Hasker’s comments, the “2024 Outlook” section, and statements relating to the sale of the company’s FindLaw business, are forward-looking. The words “will”, “expect”, “believe”, “target”, “estimate”, “could”, “should”, “intend”, “predict”, “project” and similar expressions identify forward-looking statements. While the company believes that it has a reasonable basis for making forward-looking statements in this news release, they are not a guarantee of future performance or outcomes and there is no assurance that any of the other events described in any forward-looking statement will materialize. Forward-looking statements are subject to a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from current expectations. Many of these risks, uncertainties and assumptions are beyond the company’s control and the effects of them can be difficult to predict.

Some of the material risk factors that could cause actual results or events to differ materially from those expressed in or implied by forward-looking statements in this news release include, but are not limited to, those discussed on pages 19-35 in the “Risk Factors” section of the company’s 2023 annual report. These and other risk factors are discussed in materials that Thomson Reuters from time-to-time files with, or furnishes to, the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission (SEC). Thomson Reuters annual and quarterly reports are also available in the “Investor Relations” section of tr.com.

The company’s business outlook is based on information currently available to the company and is based on various external and internal assumptions made by the company in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the company believes are appropriate under the circumstances. Material assumptions and material risks may cause actual performance to differ from the company’s expectations underlying its business outlook. In particular, the global economy has experienced substantial disruption due to concerns regarding economic effects associated with the macroeconomic backdrop and ongoing geopolitical risks. The company’s business outlook assumes that uncertain macroeconomic and geopolitical conditions will continue to disrupt the economy and cause periods of volatility, however, these conditions may last substantially longer than expected and any worsening of the global economic or business environment could impact the company’s ability to achieve its outlook and affect its results and other expectations. For a discussion of material assumptions and material risks related to the company’s 2024 outlook see page 19 of the company’s second-quarter management’s discussion and analysis (MD&A) for the period ended June 30, 2024. The company’s quarterly MD&A and annual report was filed with, or furnished to, the Canadian securities regulatory authorities and the U.S. SEC and are also available in the “Investor Relations” section of tr.com.

The company has provided an outlook for the purpose of presenting information about current expectations for the period presented. This information may not be appropriate for other purposes. You are cautioned not to place undue reliance on forward-looking statements which reflect expectations only as of the date of this news release.

Except as may be required by applicable law, Thomson Reuters disclaims any obligation to update or revise any forward-looking statements.

CONTACTS

Thomson Reuters will webcast a discussion of its third-quarter 2024 results and its 2024 business outlook today beginning at 8:30 a.m. Eastern Standard Time (EST). You can access the webcast by visiting ir.tr.com. An archive of the webcast will be available following the presentation.

|

Thomson Reuters Corporation |

||||||

|

Consolidated Income Statement |

||||||

|

(millions of U.S. dollars, except per share data) |

||||||

|

(unaudited) |

||||||

|

Three Months Ended |

Nine Months Ended |

|||||

|

September 30, |

September 30, |

|||||

|

2024 |

2023 |

2024 |

2023 |

|||

|

CONTINUING OPERATIONS |

||||||

|

Revenues |

$1,724 |

$1,594 |

$5,349 |

$4,979 |

||

|

Operating expenses |

(1,117) |

(958) |

(3,288) |

(3,022) |

||

|

Depreciation |

(30) |

(28) |

(87) |

(87) |

||

|

Amortization of computer software |

(151) |

(132) |

(458) |

(377) |

||

|

Amortization of other identifiable intangible assets |

(21) |

(24) |

(69) |

(72) |

||

|

Other operating gains (losses), net |

10 |

(11) |

(60) |

353 |

||

|

Operating profit |

415 |

441 |

1,387 |

1,774 |

||

|

Finance costs, net: |

||||||

|

Net interest expense |

(21) |

(32) |

(97) |

(121) |

||

|

Other finance (costs) income |

(32) |

117 |

(8) |

(75) |

||

|

Income before tax and equity method investments |

362 |

526 |

1,282 |

1,578 |

||

|

Share of post-tax (losses) earnings in equity method |

(8) |

(174) |

45 |

815 |

||

|

Tax (expense) benefit |

(77) |

18 |

258 |

(397) |

||

|

Earnings from continuing operations |

277 |

370 |

1,585 |

1,996 |

||

|

Earnings (loss) from discontinued operations, net of tax |

24 |

(3) |

35 |

21 |

||

|

Net earnings |

$301 |

$367 |

$1,620 |

$2,017 |

||

|

Earnings (loss) attributable to: |

||||||

|

Common shareholders |

$301 |

$367 |

$1,623 |

$2,017 |

||

|

Non-controlling interests |

– |

– |

(3) |

– |

||

|

Earnings per share: |

||||||

|

Basic earnings (loss) per share: |

||||||

|

From continuing operations |

$0.61 |

$0.81 |

$3.51 |

$4.27 |

||

|

From discontinued operations |

0.06 |

(0.01) |

0.08 |

0.05 |

||

|

Basic earnings per share |

$0.67 |

$0.80 |

$3.59 |

$4.32 |

||

|

Diluted earnings (loss) per share: |

||||||

|

From continuing operations |

$0.61 |

$0.81 |

$3.51 |

$4.27 |

||

|

From discontinued operations |

0.06 |

(0.01) |

0.08 |

0.04 |

||

|

Diluted earnings per share |

$0.67 |

$0.80 |

$3.59 |

$4.31 |

||

|

Basic weighted-average common shares |

449,886,792 |

455,458,515 |

450,788,536 |

466,078,377 |

||

|

Diluted weighted-average common shares |

450,458,885 |

456,062,363 |

451,424,716 |

466,838,142 |

||

|

Thomson Reuters Corporation |

|||

|

Consolidated Statement of Financial Position |

|||

|

(millions of U.S. dollars) |

|||

|

(unaudited) |

|||

|

September 30, |

December 31, |

||

|

2024 |

2023 |

||

|

Assets |

|||

|

Cash and cash equivalents |

$1,731 |

$1,298 |

|

|

Trade and other receivables |

1,011 |

1,122 |

|

|

Other financial assets |

54 |

66 |

|

|

Prepaid expenses and other current assets |

394 |

435 |

|

|

Current assets excluding assets held for sale |

3,190 |

2,921 |

|

|

Assets held for sale |

168 |

– |

|

|

Current assets |

3,358 |

2,921 |

|

|

Property and equipment, net |

430 |

447 |

|

|

Computer software, net |

1,430 |

1,236 |

|

|

Other identifiable intangible assets, net |

3,165 |

3,165 |

|

|

Goodwill |

7,342 |

6,719 |

|

|

Equity method investments |

277 |

2,030 |

|

|

Other financial assets |

380 |

444 |

|

|

Other non-current assets |

623 |

618 |

|

|

Deferred tax |

1,426 |

1,104 |

|

|

Total assets |

$18,431 |

$18,684 |

|

|

Liabilities and equity |

|||

|

Liabilities |

|||

|

Current indebtedness |

$1,036 |

$372 |

|

|

Payables, accruals and provisions |

1,063 |

1,114 |

|

|

Current tax liabilities |

296 |

248 |

|

|