Daily Spotlight: Investors Generally Like November

Summary

The long-term upward trajectory in the U.S. stock market has its foundation in the country’s democratic political system (remember to vote today!) and its market-based, capitalist economic system. In theory, the stock market efficiently allocates the nation’s capital to generate solid investment returns. Theory typically turns into reality in November, which since 1980 has been the best month for equity performance, with an average 2.1% gain, ahead of April (+1.60%), July (+1.4%) December (+1.3%), and October (+1.3%). November’s batting average is high as well: stocks advance during the month 72% of the time. The best Novembers have been 1980 (+10.2%), 2001 (+7.5%), 1996 (+7.3%), 1985 (+6.5%), 1998 (+5.9%), and 2002 (+5.1%). But there have been some clunkers: 2000 (-8%), 2008 (-7.5%) and 1987 (-5.9%). Last year, the S&P 500 rose an impressive 8.9% for the month. What about during presidential-election years? Good question. The track record is even more impressive here. For the 11 election-year Novembers since 1980, stocks have, on average, climbed 2.6%. November

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

SOPHiA GENETICS Reports Third Quarter 2024 Results

Clinical growth reaccelerates with record analysis volume; Cash burn improves 39%

BOSTON and ROLLE, Switzerland, Nov. 5, 2024 /PRNewswire/ — SOPHiA GENETICS SOPH, a cloud-native software company and leader in data-driven medicine, today reported financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Results

- Revenue was $15.9 million, down 2.8% year-over-year

- Gross margins were 67.2% on a reported basis and 73.1% on an adjusted basis, compared to 69.1% and 72.5% in the prior year period, respectively

- Operating loss was $15.4 million on a reported basis and $10.6 million on an adjusted basis, representing year-over-year improvements of 7.1% and 10.4%, respectively

- Cash burn was $9.6 million, representing a year-over-year improvement of 39.1%

- The company reiterates full-year guidance, including revenue between $65 million and $67 million, adjusted gross margin of 72.0% to 72.5%, and adjusted operating loss between $45 million and $50 million

“Record analysis volume drove a reacceleration of Clinical growth across most key geographies in Q3, with volume increasing 16% year-over-year, offset by expected softness in BioPharma,” said Jurgi Camblong, PhD., Chief Executive Officer and Co-founder. “We also delivered another quarter of strong forward-looking indicators with 20 new customer signings, including major wins in the U.S., the U.K., and Brazil. I am proud of our ability to deliver strong new business momentum, while also excelling at cost management. In Q3, we expanded adjusted gross margins to 73.1% and improved cash burn significantly by 39% year-over-year to $9.6 million, while also strengthening commercial teams and customer-facing operations.”

Camblong added, “Looking ahead, I’m excited by major growth catalysts such as our new Liquid Biopsy application MSK ACCESS® powered with SOPHiA DDMTM, which has already attracted an impressive 18 new customers since its launch in Q2. I am also excited by the recent launch of the application’s Solid Tumor testing counterpart, MSK-IMPACT® powered with SOPHiA DDMTM. These applications, which enable any institution across the globe to launch best-in-class Liquid Biopsy and Solid Tumor testing, are also igniting strong interest from BioPharma companies who can leverage the decentralized, global network to improve deployment and development of their therapies.”

Business Highlights

Expanding usage of SOPHiA DDM™ worldwide

- Reached 462 core genomics customers as of September 30, 2024, who used SOPHiA DDM™ over the past 12 months to analyze patients with cancer or rare diseases, up from 431 customers at the end of Q3 2023

- Performed a record 91,000 analyses on SOPHiA DDMTM in Q3 2024, representing 16% year-over-year analysis volume growth or 17% growth when excluding COVID-related analyses

- Continued executing our land and expand strategy, including major successes in the U.S. and Canada with Tennessee Oncology adopting numerous additional applications in Hereditary Cancer and Solid Tumors in addition to MSK-ACCESS® powered with SOPHiA DDMTM and Trillium Health Partners adopting SOPHiA DDMTM for HRD in addition to Hereditary Cancer and HemOnc applications

Accelerating adoption of SOPHiA DDM™ by landing new Clinical customers

- Landed 20 new customers in Q3 2024 who will implement SOPHiA DDMTM and begin generating revenue over the next twelve months, continuing the positive trend of solid bookings momentum year-to-date

- Signed major new customers across all key geographies including GeneView in the U.S. who is adopting SOPHiA DDMTM for Rare and Inherited Disorders, the NHS’s Birmingham Women’s Hospital in the U.K. who is adopting SOPHiA DDMTM for Hereditary Cancer screening, and Hospital Sírio-Libanês, one of the most prestigious hospitals in the world based in Brazil, who is adopting MSK-ACCESS® powered with SOPHiA DDMTM

Building strong new business momentum with new applications

- Signed a total of 18 new customers to MSK-ACCESS® powered with SOPHiA DDMTM since the Liquid Biopsy application’s launch in Q2 2024

- Saw the first cohort of 5 MSK-ACCESS® customers go-live on SOPHiA DDMTM as institutions such as BioReference Health in the U.S., the NHS’s Synnovis Services in the U.K., and the world-renowned University of Heidelberg in Germany recently completed implementation; These institutions will ramp up their usage in Q4 2024 and into 2025

- Launched MSK-IMPACT® powered with SOPHiA DDMTM, the 505-gene Solid Tumor Comprehensive Genomic Profiling counterpart to MSK-ACCESS®, in October 2024

- Continued to drive significant demand for MSK-ACCESS® and MSK-IMPACT® powered with SOPHiA DDMTM as pipeline of ongoing discussions reached more than 50 opportunities

Growing sustainably by maintaining an obsession with operational excellence

- Remained laser-focused on operational excellence and improved cash burn by 39.1% year-over-year to $9.6 million, while also strengthening commercial teams and customer-facing operations

- Expanded adjusted gross margin by 61bps year-over-year to 73.1% as we continue to optimize compute costs and leverage the scale of the cloud-native SOPHiA DDMTM platform

- Improved adjusted operating loss by 10.4% year-over-year in Q3 2024 through continuous improvement initiatives

- Reaffirmed commitment to achieve adjusted operating profitability within the next 2 years; Current cash and existing capital resources are expected to be sufficient to reach adjusted operating profitability

2024 Financial Outlook

Based on information as of today, SOPHiA GENETICS is reaffirming our previously provided guidance of:

- Full-year revenue between $65 million and $67 million, representing growth of 4% to 7% compared to FY 2023

- Adjusted gross margin between 72.0% to 72.5%, compared to 72.2% in FY 2023

- Adjusted operating loss guidance between $45 million and $50 million, compared to $55.9 million in FY 2023

Earnings Call and Webcast Information

SOPHiA GENETICS will host a conference call and live webcast to discuss the third quarter 2024 results on Tuesday, November 5, 2024, at 8:00 a.m. (08:00) Eastern Time / 2:00 p.m. (14:00) Central European Time. The call will be webcast live on the SOPHiA GENETICS Investor Relations website, ir.sophiagenetics.com. Additionally, an audio replay of the conference call will be available on the SOPHiA GENETICS website after its completion.

Non-IFRS Financial Measures

Other than with respect to revenue, the Company only provides guidance on a non-IFRS basis. The Company does not provide a reconciliation of forward-looking adjusted gross margin (non-IFRS measure) to gross margin (the most comparable IFRS financial measure), due to the inherent difficulty in forecasting and quantifying amortization of capitalized research & development expenses that are necessary for such reconciliation. In addition, the Company does not provide a reconciliation of forward-looking adjusted operating loss (non-IFRS measure) to operating loss (the most comparable IFRS financial measure), due to the inherent difficulty in forecasting and quantifying amortization of capitalized research & development expenses and intangible assets, share-based compensation expenses, and non-cash portion of pensions paid in excess of actual contributions, that are necessary for such reconciliation.

To provide investors with additional information regarding the company’s financial results, SOPHiA GENETICS has disclosed here and elsewhere in this earnings release the following non-IFRS measures:

- Adjusted gross profit, which the company calculates as revenue minus cost of revenue adjusted to exclude amortization of capitalized research and development expenses;

- Adjusted gross profit margin, which the company calculates as adjusted gross profit as a percentage of revenue;

- Adjusted operating loss, which the company calculates as operating loss adjusted to exclude amortization of capitalized research and development expenses, amortization of intangible assets, share-based compensation expense, and non-cash portion of pensions expense paid in excess of actual contributions to match the actuarial expense.

These non-IFRS measures are key measures used by SOPHiA GENETICS management and board of directors to evaluate its operating performance and generate future operating plans. The exclusion of certain expenses facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable charges. Accordingly, the company believes that these non-IFRS measures provide useful information to investors and others in understanding and evaluating its operating results in the same manner as its management and board of directors.

These non-IFRS measures have limitations as financial measures, and you should not consider them in isolation or as a substitute for analysis of SOPHiA GENETICS’ results as reported under IFRS. Some of these limitations are:

- These non-IFRS measures exclude the impact of amortization of capitalized research and development expenses and intangible assets. Although amortization is a non-cash charge, the assets being amortized may need to be replaced in the future and these non-IFRS measures do not reflect capital expenditure requirements for such replacements or for new capital expenditures;

- These non-IFRS measures exclude the impact of share-based compensation expenses. Share-based compensation has been, and will continue to be for the foreseeable future, a recurring expense in the company’s business and an important part of its compensation strategy;

- These non-IFRS measures exclude the impact of the non-cash portion of pensions paid in excess of actual contributions to match actuarial expenses. Pension expenses have been, and will continue to be for the foreseeable future, a recurring expense in the business; and

- Other companies, including companies in the company’s industry, may calculate these non-IFRS measures differently, which reduces their usefulness as comparative measures.

Because of these limitations, you should consider these non-IFRS measures alongside other financial performance measures, including various cash flow metrics, net income and other IFRS results.

The tables below provide the reconciliation of the most comparable IFRS measures to the non-IFRS measures for the periods presented.

Presentation of Constant Currency Revenue and Excluding COVID-19-Related Revenue

SOPHiA GENETICS operates internationally, and its revenues are generated primarily in the U.S. dollar, the euro and Swiss franc and, to a lesser extent, British pound, Australian dollar, Brazilian real, Turkish lira and Canadian dollar depending on the company’s customers’ geographic locations. Changes in revenue include the impact of changes in foreign currency exchange rates. We present the non-IFRS financial measure “constant currency revenue” (or similar terms such as constant currency revenue growth) to show changes in revenue without giving effect to period-to-period currency fluctuations. Under IFRS, revenues received in local (non-U.S. dollar) currencies are translated into U.S. dollars at the average monthly exchange rate for the month in which the transaction occurred. When the company uses the term “constant currency”, it means that it has translated local currency revenues for the current reporting period into U.S. dollars using the same average foreign currency exchange rates for the conversion of revenues into U.S. dollars that we used to translate local currency revenues for the comparable reporting period of the prior year. The company then calculates the difference between the IFRS revenue and the constant currency revenue to yield the “constant currency impact” for the current period.

The company’s management and board of directors use constant currency revenue growth to evaluate growth and generate future operating plans. The exclusion of the impact of exchange rate fluctuations provides comparability across reporting periods and reflects the effects of customer acquisition efforts and land-and-expand strategy. Accordingly, it believes that this non-IFRS measure provides useful information to investors and others in understanding and evaluating revenue growth in the same manner as the management and board of directors. However, this non-IFRS measure has limitations, particularly as the exchange rate effects that are eliminated could constitute a significant element of its revenue and could significantly impact performance and prospects. Because of these limitations, you should consider this non-IFRS measure alongside other financial performance measures, including revenue and revenue growth presented in accordance with IFRS and other IFRS results.

In addition to constant currency revenue, the company presents constant currency revenue excluding COVID-19-related revenue to further remove the effects of revenues that are derived from sales of COVID-19-related offerings, including a NGS assay for COVID-19 that leverages the SOPHiA DDMTM Platform and related products and solutions analytical capabilities and COVID-19 bundled access products. SOPHiA GENETICS do not believe that these revenues reflect its core business of commercializing its platform because the company’s COVID-19 solution was offered to address specific market demand by its customers for analytical capabilities to assist with their testing operations. The company does not anticipate additional development of its COVID-19-related solution as the pandemic transitions into a more endemic phase and as customer demand continues to decline. Further, COVID-19-related revenues did not constitute, and the company does not expect COVID-19-related revenues to constitute in the future, a significant part of its revenue. Accordingly, the company believes that this non-IFRS measure provides useful information to investors and others in understanding and evaluating its revenue growth. However, this non-IFRS measure has limitations, including that COVID-19-related revenues contributed to the company’s cash position, and other companies may define COVID-19-related revenues differently. Because of these limitations, you should consider this non-IFRS measure alongside other financial performance measures, including revenue and revenue growth presented in accordance with IFRS and other IFRS results.

The table below provides the reconciliation of the most comparable IFRS growth measures to the non-IFRS growth measures for the current period.

About SOPHiA GENETICS

SOPHiA GENETICS SOPH is a cloud-native healthcare technology company on a mission to expand access to data-driven medicine by using AI to deliver world-class care to patients with cancer and rare disorders across the globe. It is the creator of SOPHiA DDM™, a platform that analyzes complex genomic and multimodal data and generates real-time, actionable insights for a broad global network of hospital, laboratory, and biopharma institutions. For more information, visit SOPHiAGENETICS.COM and connect with us on LinkedIn.

Forward-Looking Statements

This press release contains statements that constitute forward-looking statements. All statements other than statements of historical facts contained in this press release, including statements regarding SOPHiA GENETICS future results of operations and financial position, business strategy, products and technology, partnerships and collaborations, as well as plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements are based on SOPHiA GENETICS’ management’s beliefs and assumptions and on information currently available to the company’s management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including those described in the company’s filings with the U.S. Securities and Exchange Commission. No assurance can be given that such future results will be achieved. Such forward-looking statements contained in this press release speak only as of its date. We expressly disclaim any obligation or undertaking to update these forward-looking statements contained in this press release to reflect any change in the company’s expectations or any change in events, conditions, or circumstances on which such statements are based, unless required to do so by applicable law. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

|

SOPHiA GENETICS SA Interim Condensed Consolidated Statements of Loss (Amounts in USD thousands, except per share data) (Unaudited)

|

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Revenue |

$ 15,853 |

$ 16,303 |

$ 47,440 |

$ 45,323 |

||||

|

Cost of revenue |

(5,199) |

(5,030) |

(15,605) |

(14,309) |

||||

|

Gross profit |

10,654 |

11,273 |

31,835 |

31,014 |

||||

|

Research and development costs |

(7,874) |

(8,984) |

(25,223) |

(27,209) |

||||

|

Selling and marketing costs |

(7,306) |

(6,830) |

(21,515) |

(20,457) |

||||

|

General and administrative costs |

(10,880) |

(12,749) |

(34,288) |

(40,032) |

||||

|

Other operating income, net |

43 |

746 |

67 |

805 |

||||

|

Operating loss |

(15,363) |

(16,544) |

(49,124) |

(55,879) |

||||

|

Interest income, net |

267 |

1,152 |

1,475 |

3,148 |

||||

|

Fair value adjustments on warrant obligations |

182 |

— |

266 |

— |

||||

|

Foreign exchange (losses) gains, net |

(3,394) |

1,867 |

655 |

(1,711) |

||||

|

Loss before income taxes |

(18,308) |

(13,525) |

(46,728) |

(54,442) |

||||

|

Income tax expense |

(130) |

(299) |

(607) |

(478) |

||||

|

Loss for the period |

(18,438) |

(13,824) |

(47,335) |

(54,920) |

||||

|

Attributable to the owners of the parent |

(18,438) |

(13,824) |

(47,335) |

(54,920) |

||||

|

Basic and diluted loss per share |

$ (0.28) |

$ (0.21) |

$ (0.72) |

$ (0.85) |

||||

|

SOPHiA GENETICS SA Interim Condensed Consolidated Statements of Comprehensive Loss (Amounts in USD thousands) (Unaudited)

|

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Loss for the period |

$ (18,438) |

$ (13,824) |

$ (47,335) |

$ (54,920) |

||||

|

Other comprehensive (loss) income: |

||||||||

|

Items that may be reclassified to statement of loss (net of tax) |

||||||||

|

Currency translation adjustments |

6,990 |

(3,382) |

(2,149) |

2,269 |

||||

|

Total items that may be reclassified to statement of loss |

6,990 |

(3,382) |

(2,149) |

2,269 |

||||

|

Items that will not be reclassified to statement of loss (net of tax) |

||||||||

|

Remeasurement of defined benefit plans |

(173) |

13 |

(231) |

(283) |

||||

|

Total items that will not be reclassified to statement of loss |

(173) |

13 |

(231) |

(283) |

||||

|

Other comprehensive (loss) income for the period |

$ 6,817 |

$ (3,369) |

$ (2,380) |

$ 1,986 |

||||

|

Total comprehensive loss for the period |

$ (11,621) |

$ (17,193) |

$ (49,715) |

$ (52,934) |

||||

|

Attributable to owners of the parent |

$ (11,621) |

$ (17,193) |

$ (49,715) |

$ (52,934) |

||||

|

SOPHiA GENETICS SA Interim Condensed Consolidated Balance Sheets (Amounts in USD thousands) (Unaudited)

|

||||

|

September 30, 2024 |

December 31, 2023 |

|||

|

Assets |

||||

|

Current assets |

||||

|

Cash and cash equivalents |

$ 95,787 |

$ 123,251 |

||

|

Accounts receivable |

9,762 |

13,557 |

||

|

Inventory |

6,477 |

6,482 |

||

|

Prepaids and other current assets |

5,178 |

4,757 |

||

|

Total current assets |

117,204 |

148,047 |

||

|

Non-current assets |

||||

|

Property and equipment |

6,018 |

7,469 |

||

|

Intangible assets |

30,354 |

27,185 |

||

|

Right-of-use assets |

15,768 |

15,635 |

||

|

Deferred tax assets |

1,826 |

1,720 |

||

|

Other non-current assets |

6,438 |

6,100 |

||

|

Total non-current assets |

60,404 |

58,109 |

||

|

Total assets |

$ 177,608 |

$ 206,156 |

||

|

Liabilities and equity |

||||

|

Current liabilities |

||||

|

Accounts payable |

$ 5,869 |

$ 5,391 |

||

|

Accrued expenses |

13,818 |

17,808 |

||

|

Deferred contract revenue |

8,150 |

9,494 |

||

|

Lease liabilities, current portion |

2,477 |

2,928 |

||

|

Warrant obligations |

546 |

— |

||

|

Total current liabilities |

30,860 |

35,621 |

||

|

Non-current liabilities |

||||

|

Borrowings |

13,162 |

— |

||

|

Lease liabilities, net of current portion |

16,034 |

15,673 |

||

|

Defined benefit pension liabilities |

3,603 |

3,086 |

||

|

Other non-current liabilities |

442 |

334 |

||

|

Total non-current liabilities |

33,241 |

19,093 |

||

|

Total liabilities |

64,101 |

54,714 |

||

|

Equity |

||||

|

Share capital |

4,188 |

4,048 |

||

|

Share premium |

472,211 |

471,846 |

||

|

Treasury share |

(719) |

(646) |

||

|

Other reserves |

62,946 |

53,978 |

||

|

Accumulated deficit |

(425,119) |

(377,784) |

||

|

Total equity |

113,507 |

151,442 |

||

|

Total liabilities and equity |

$ 177,608 |

$ 206,156 |

||

|

SOPHiA GENETICS SA Interim Condensed Consolidated Statements of Cash Flows (Amounts in USD thousands) (Unaudited)

|

||||

|

Nine months ended September 30, |

||||

|

2024 |

2023 |

|||

|

Operating activities |

||||

|

Loss before tax |

$ (46,728) |

$ (54,442) |

||

|

Adjustments for non-monetary items |

||||

|

Depreciation |

3,439 |

4,339 |

||

|

Amortization |

2,870 |

2,016 |

||

|

Finance (income) expense, net |

(2,333) |

1,641 |

||

|

Fair value adjustments on warrant obligations |

(266) |

— |

||

|

Expected credit loss allowance |

(252) |

54 |

||

|

Share-based compensation |

11,410 |

11,036 |

||

|

Movements in provisions and pensions |

246 |

764 |

||

|

Research tax credit |

(460) |

(785) |

||

|

Loss on disposal of property and equipment |

— |

28 |

||

|

Gain on disposal of lease liability |

— |

(730) |

||

|

Working capital changes |

||||

|

Decrease (Increase) in accounts receivable |

3,813 |

(2,880) |

||

|

Increase in prepaids and other assets |

(420) |

(2,869) |

||

|

Decrease (Increase) in inventory |

48 |

(328) |

||

|

(Decrease) Increase in accounts payables, accrued expenses, deferred contract revenue, and other liabilities |

(4,822) |

2,284 |

||

|

Cash used in operating activities |

(33,455) |

(39,872) |

||

|

Income tax paid |

(374) |

(759) |

||

|

Interest paid |

(1,133) |

(6) |

||

|

Interest received |

2,741 |

3,354 |

||

|

Net cash flows used in operating activities |

(32,221) |

(37,283) |

||

|

Investing activities |

||||

|

Purchase of property and equipment |

(187) |

(1,369) |

||

|

Acquisition of intangible assets |

(195) |

(1,033) |

||

|

Capitalized development costs |

(5,854) |

(4,575) |

||

|

Proceeds upon maturity of term deposits |

— |

17,546 |

||

|

Net cash flow (used in) provided from investing activities |

(6,236) |

10,569 |

||

|

Financing activities |

||||

|

Proceeds from exercise of share options |

370 |

207 |

||

|

Proceeds from borrowings, net of transaction costs |

13,930 |

— |

||

|

Payments of principal portion of lease liabilities |

(2,142) |

(2,518) |

||

|

Net cash flow provided from (used in) financing activities |

12,158 |

(2,311) |

||

|

Decrease in cash and cash equivalents |

(26,299) |

(29,025) |

||

|

Effect of exchange differences on cash balances |

(1,165) |

487 |

||

|

Cash and cash equivalents at beginning of the year |

123,251 |

161,305 |

||

|

Cash and cash equivalents at end of the period |

$ 95,787 |

$ 132,767 |

||

|

SOPHiA GENETICS SA Reconciliation of IFRS Revenue Growth to Constant Currency Revenue Growth and Constant Currency Revenue Growth Excluding COVID-19-Related Revenue (Amounts in USD thousands, except for %) (Unaudited) |

||||||||||||

|

Three months ended |

Nine months ended |

|||||||||||

|

2024 |

2023 |

Growth |

2024 |

2023 |

Growth |

|||||||

|

IFRS revenue |

$ 15,853 |

$ 16,303 |

(3) % |

$ 47,440 |

$ 45,323 |

5 % |

||||||

|

Current period constant currency impact |

(58) |

— |

(63) |

— |

||||||||

|

Constant currency revenue |

$ 15,795 |

$ 16,303 |

(3) % |

$ 47,377 |

$ 45,323 |

5 % |

||||||

|

COVID-19-related revenue |

(4) |

(16) |

(43) |

(213) |

||||||||

|

Constant currency impact on COVID-19-related revenue |

— |

— |

2 |

— |

||||||||

|

Constant currency revenue excluding COVID-19-related revenue |

$ 15,791 |

$ 16,287 |

(3) % |

$ 47,336 |

$ 45,110 |

5 % |

||||||

|

SOPHiA GENETICS SA Reconciliation of IFRS to Adjusted Gross Profit and Gross Profit Margin (Amounts in USD thousands, except percentages) (Unaudited)

|

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Revenue |

$ 15,853 |

$ 16,303 |

$ 47,440 |

$ 45,323 |

||||

|

Cost of revenue |

(5,199) |

(5,030) |

(15,605) |

(14,309) |

||||

|

Gross profit |

$ 10,654 |

$ 11,273 |

$ 31,835 |

$ 31,014 |

||||

|

Amortization of capitalized research and development expenses(1) |

942 |

552 |

2,463 |

1,480 |

||||

|

Adjusted gross profit |

$ 11,596 |

$ 11,825 |

$ 34,298 |

$ 32,494 |

||||

|

Gross profit margin |

67.2 % |

69.1 % |

67.1 % |

68.4 % |

||||

|

Amortization of capitalized research and development expenses(1) |

5.9 % |

3.4 % |

5.2 % |

3.3 % |

||||

|

Adjusted gross profit margin |

73.1 % |

72.5 % |

72.3 % |

71.7 % |

||||

|

SOPHiA GENETICS SA Reconciliation of IFRS to Adjusted Operating Loss for the Period (Amounts in USD thousands) (Unaudited)

|

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Operating loss |

$ (15,363) |

$ (16,544) |

$ (49,124) |

$ (55,879) |

||||

|

Amortization of capitalized research & development expenses(1) |

942 |

552 |

2,463 |

1,480 |

||||

|

Amortization of intangible assets(2) |

119 |

184 |

407 |

536 |

||||

|

Share-based compensation expense(3) |

3,613 |

3,930 |

11,410 |

11,036 |

||||

|

Non-cash pension expense(4) |

106 |

69 |

279 |

231 |

||||

|

Adjusted operating loss |

$ (10,583) |

$ (11,809) |

$ (34,565) |

$ (42,596) |

||||

|

SOPHiA GENETICS SA Reconciliation of IFRS to Adjusted Operating Loss for the fourth quarter and fiscal year 2023 (Amounts in USD thousands) (Unaudited)

|

||

|

Year ended |

||

|

December 31, 2023 |

||

|

Operating loss |

$ (74,826) |

|

|

Amortization of capitalized research & development expenses (1) |

2,099 |

|

|

Amortization of intangible assets(2) |

729 |

|

|

Share-based compensation expense(3) |

15,247 |

|

|

Non-cash pension expense(4) |

(394) |

|

|

Costs associated with restructuring(5) |

1,232 |

|

|

Adjusted operating loss |

$ (55,913) |

|

|

Notes to the Reconciliation of IFRS to Adjusted Financial Measures Tables |

|

|

(1) |

Amortization of capitalized research and development expenses consists of software development costs amortized using the straight-line method over an estimated life of five years. These expenses do not have a cash impact but remain a recurring expense generated over the course of our research and development initiatives. |

|

(2) |

Amortization of intangible assets consists of costs related to intangible assets amortized over the course of their useful lives. These expenses do not have a cash impact, but we could continue to generate such expenses through future capital investments. |

|

(3) |

Share-based compensation expense represents the cost of equity awards issued to our directors, officers, and employees. The fair value of awards is computed at the time the award is granted and is recognized over the vesting period of the award by a charge to the income statement and a corresponding increase in other reserves within equity. These expenses do not have a cash impact but remain a recurring expense for our business and represent an important part of our overall compensation strategy. |

|

(4) |

Non-cash pension expense consists of the amount recognized in excess of actual contributions made to our defined pension plans to match actuarial expenses calculated for IFRS purposes. The difference represents a non-cash expense but remains a recurring expense for our business as we continue to make contributions to our plans for the foreseeable future. |

|

(5) |

Costs associated with restructuring consists of compensation paid to employees during their garden leave period, severance, and any other amounts legally owed to the employees resulting from their termination as part of a planned workforce reduction, which we undertook to optimize our operations. Additionally, it includes any legal fees incurred as part of the restructuring process. While such actions are not planned going forward as part of our regular operations, we expect such expenses could still be incurred from time to time based on corporate needs. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sophia-genetics-reports-third-quarter-2024-results-302295865.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sophia-genetics-reports-third-quarter-2024-results-302295865.html

SOURCE SOPHiA GENETICS

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Workers End Seven-Week Strike By Accepting New Contract With Major Pay Increases

Boeing Co.‘s BA 33,000 International Association of Machinists and Aerospace Workers ratified a groundbreaking four-year contract, achieving a 43.65% compounded wage increase and a $12,000 ratification bonus.

What Happened: This deal, supported by President Joe Biden and Vice President Kamala Harris‘ administration and facilitated by Acting U.S. Secretary of Labor Julie Su, ends a nearly two-month strike across Washington, Oregon, and California.

The contract introduces key benefits, including a 38% wage increase over four years, enhanced retirement contributions, and improved health benefits.

IAM leaders Jon Holden and Brandon Bryant praised the agreement, calling it a major victory for the middle class and a new standard for aerospace industry workers.

Price Action: Boeing’s stock closed at $155.07 on Monday, marking a modest gain of 0.31% during regular trading hours. In after-hours trading, the stock saw an additional rise, climbing 0.63%. Year to date, however, Boeing’s stock has faced a significant decline, down 38.41%, according to data from Benzinga Pro.

Read Next:

Image via Flickr

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Churn as Wall Street Waits on US Election: Markets Wrap

(Bloomberg) — US equity futures fluctuated as voting got underway after one of the most dramatic American presidential campaigns in modern history.

Most Read from Bloomberg

While markets looked relatively subdued in early Tuesday trading, nerves are running high as traders anticipate a long night of ballot counting and the potential for sharp swings no matter the outcome. Overhanging the mood on Wall Street remains the threat of a contested election that has little precedent.

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

That sense of caution showed as stock investors held off on trading and volumes were relatively low in Europe. S&P 500 futures added 0.1%. Ten-year Treasury yields rose two basis points to 4.31%. The dollar weakened. Bitcoin gained 2.7%.

Tech outperformed, with Nasdaq 100 contracts climbing 0.2%. Palantir Technologies Inc. surged 13% in premarket trading on record profit and high demand for its artificial intelligence software. Nvidia Corp. and Tesla Inc. were up slightly.

Wall Street’s Great Election Trades Now Face the Moment of Truth

Across markets, there were clear signs of traders bracing for volatility. Options data suggests a 1.8% move in either direction for the S&P 500 on Wednesday, according to Citigroup’s head of equity trading strategy Stuart Kaiser.

US exchange-traded funds investing in Bitcoin shed $579.5 million on Monday, the highest daily net outflow on record. In Treasuries, the ICE BofA MOVE Index, a measure of implied fluctuations in yields, hit the highest since October 2023.

Currency markets, particularly the dollar and Mexican peso, were also being closely monitored as barometers for Trump versus Harris election strategies. For the Mexican peso, implied volatility for the currency is now near levels seen in sterling right before 2016’s Brexit vote.

“I would be watching for strength in the dollar, particularly versus the euro and emerging market currencies like the Mexican peso as a first reaction, particularly if the results start to indicate that Republicans are likely to take the White House and control of Congress,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle. “The opposite if there is a Democratic sweep.”

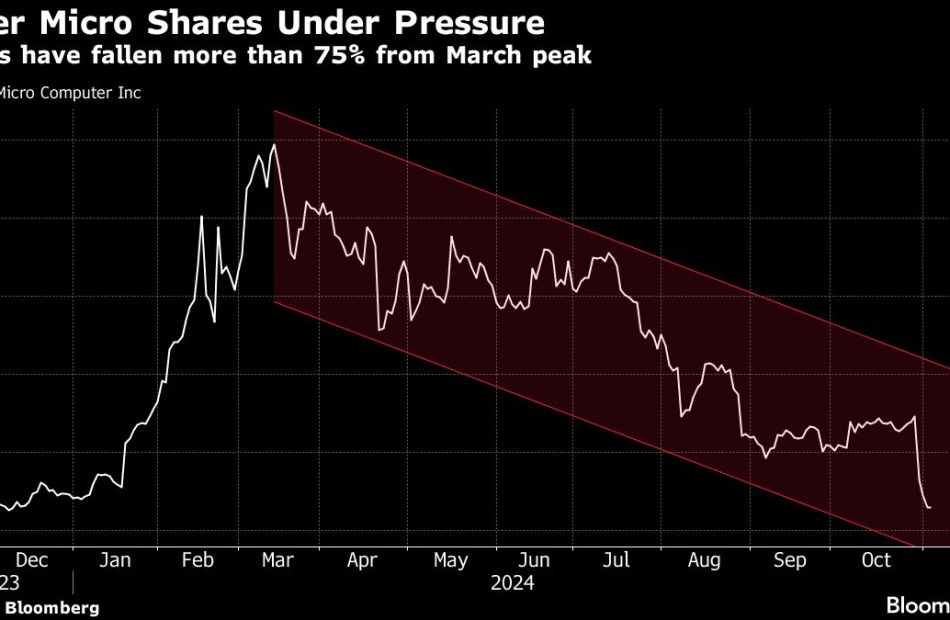

Super Micro Faces Delisting, S&P 500 Removal Amid Auditor Woes

(Bloomberg) — Super Micro Computer Inc. started the year as a hot artificial intelligence trade. But just eight months after shares hit a record high, investors are asking whether the server maker will be delisted by Nasdaq Inc. and booted from the S&P 500.

Most Read from Bloomberg

The troubled firm — which has seen shares plummet more than 75% since March — is due to give a business update on Tuesday after the close. Top of mind is what it says about meeting Nasdaq Inc.’s compliance obligations following the resignation of auditor Ernst & Young LLP last week. The auditor cited concerns about Super Micro’s commitment to integrity and ethics — a blow that follows a US Department of Justice probe and a damaging short-seller report earlier this year.

Super Micro’s listing status was already looking shaky after it failed to file its annual 10-K report by an August deadline. Nasdaq rules give the company until mid-November to submit a plan to restore it to compliance, and if that plan is approved, it could get extra time — pushing the deadline to February 2025. But the resignation of Ernst & Young makes that more challenging.

“I think that they probably end up getting delisted just because of the timelines involved,” Wedbush analyst Matt Bryson said in an interview. “How do they get their 10-K out in just a few months when they don’t have an auditor and their last auditor resigned?”

Representatives for Super Micro, Nasdaq and S&P Global, which owns the S&P 500 Index, declined to comment.

A Nasdaq delisting would be the latest development in a tumultuous year. Super Micro shares were flying high at the start of 2024, with Wall Street enthusiastic about AI-fueled demand for its high-powered data center servers, and the company winning inclusion in the S&P 500. But investors have been bailing as issues pile up, with the 10-K filing delay followed by news that regulators are looking into an ex-employee’s claims that the company sought to overstate its revenue.

At the time of Ernst & Young’s resignation, Super Micro said it doesn’t expect the issue to lead to restatements of previously issued financial reports, and that it has begun the process of identifying another auditor.

But some analysts are more wary. “We now believe there is meaningful risk that prior financial statements may have to be restated once a new public accounting firm is hired,” Needham analysts led by N Quinn Bolton wrote last week, suspending coverage on Super Micro shares.

Pet Valu Reports Third Quarter 2024 Results

Grows Revenue by 5%, Increases Adjusted EBITDA(1) by 13%, and Narrows 2024 Outlook

MARKHAM, ON, Nov. 5, 2024 /CNW/ – Pet Valu Holdings Ltd. (“Pet Valu” or the “Company”) PET, the leading Canadian specialty retailer of pet food and pet-related supplies, today announced its financial results for the third quarter ended September 28, 2024.

Third Quarter Highlights

- System-wide sales(2) were $358.2 million, an increase of 0.3% versus Q3 2023. Same-store sales growth(2) was -2.5%.

- Revenue was $276.0 million, up 5.2% versus Q3 2023.

- Adjusted EBITDA was $64.6 million, up 13.0% versus Q3 2023, representing 23.4% of revenue. Operating income was $40.4 million, up 8.0% versus Q3 2023.

- Net income was $23.2 million, up from $18.0 million in Q3 2023.

- Adjusted Net Income(1) was $29.9 million or $0.41 per diluted share, compared to $28.2 million or $0.39 per diluted share, respectively, in Q3 2023.

- Opened 6 new stores and ended the quarter with 805 stores across the network.

- Officially opened the new Metro Vancouver Region (“MVR”) distribution centre.

- The Board of Directors of the Company declared a dividend of $0.11 per common share.

2024 Outlook

- The Company expects revenue between $1.08 and $1.10 billion, supported by approximately 40 new store openings and flat same-store sales growth, Adjusted EBITDA between $243 and $246 million, and Adjusted Net Income per Diluted Share(3) between $1.50 and $1.53.

“Third quarter performance tells a story of continued resilience and responsible execution as we delivered 5% revenue growth and 13% Adjusted EBITDA growth in a constrained demand environment,” said Richard Maltsbarger, Chief Executive Officer of Pet Valu.”We also reached an important milestone in our supply chain transformation with the successful transition and start-up of our new Surrey DC, unlocking incremental capacity and productivity in Western Canada.

“As we ramp up for the holidays, our merchandising and marketing teams have crafted an exciting slate of events delivering value and expertise to devoted pet lovers when they need it most,” continued Mr. Maltsbarger. “Supported by hundreds of local stores, a sharpened digital platform and an enhanced supply chain network, our curated offering of competitively priced premium products will help inspire magical holiday moments with pets.”

Financial Results for the Third Quarter Fiscal 2024

All comparative figures below are for the 13-week period ended September 28, 2024, compared to the 13-week period ended September 30, 2023.

Revenue was $276.0 million in Q3 2024, an increase of $13.7 million, or 5.2%, compared to $262.3 million in Q3 2023. The increase in revenue was mostly driven by growth in franchise and other revenues and partially offset by a decline in retail sales.

Same-store sales growth was -2.5% in Q3 2024 primarily driven by a 4.1% decrease in same-store transaction growth(2) partially offset by a 1.7% increase in same-store average spend per transaction growth(2). This is compared to same-store sales growth of 4.2% in Q3 2023, which primarily consisted of 4.0% increase in same-store average spend per transaction growth and a 0.2% increase in same-store transaction growth.

Gross profit increased by $2.1 million, or 2.4%, to $89.4 million in Q3 2024, compared to $87.3 million in Q3 2023. Gross profit margin was 32.4% in Q3 2024, compared to 33.3% in Q3 2023. Excluding costs related to the supply chain transformation of 1.1% in Q3 2024 and 1.8% in Q3 2023, the gross profit margin was 33.5% and 35.1% in Q3 2024 and Q3 2023, respectively, and decreased by 1.6%. The decrease was primarily driven by: (i) higher distribution and occupancy costs from the new Greater Toronto Area (“GTA”) and MVR distribution centres; (ii) higher wholesale merchandise sales; and (iii) the unfavourable impact of the weaker Canadian dollar on non-domestic sourced products primarily denominated in U.S. dollars; partially offset by (iv) the allocation of promotional funding.

Selling, general and administrative (“SG&A”) expenses were $49.0 million in Q3 2024, a decrease of $0.9 million, or 1.8%, compared to $49.9 million in Q3 2023. SG&A expenses represented 17.8% and 19.0% of total revenue for Q3 2024 and Q3 2023, respectively. The decrease of $0.9 million in SG&A expenses was primarily due to: (i) higher gain on sale of assets for re-franchised stores; (ii) lower real estate related expenses; and (iii) lower technology expenditures on project-based implementation costs associated with new information technology systems; partially offset by (iv) increased compensation costs as a result of share-based compensation.

Adjusted EBITDA increased by $7.4 million, or 13.0%, to $64.6 million in Q3 2024, compared to $57.2 million in Q3 2023. The increase is explained by higher EBITDA(1) of $8.8 million partially offset by $1.4 million of net lower adjustments from EBITDA for Q3 2024 compared to Q3 2023 including the share of loss from an investment in associate in Q3 2023, lower information technology transformation costs, gain on foreign exchange; and higher business transformation, share-based compensation, and other professional fees. Adjusted EBITDA as a percentage of revenue(3) was 23.4% and 21.8% in Q3 2024 and Q3 2023, respectively.

Net interest expense was $8.3 million in Q3 2024, an increase of $0.2 million, or 2.4%, compared to $8.1 million in Q3 2023. The increase was primarily driven by higher interest expense on lease liabilities resulting primarily from the new MVR distribution centre; partially offset by lower interest expense on the 2021 Term Facility (as herein defined) resulting from lower debt outstanding and lower interest rates compared to Q3 2023.

Income taxes were $9.0 million in Q3 2024 compared to $7.9 million in Q3 2023, an increase of $1.1 million year over year. The increase in income taxes was primarily the result of higher taxable earnings in Q3 2024. The effective income tax rate was 27.9% in Q3 2024 compared to 30.4% in Q3 2023. The Q3 2024 and Q3 2023 effective tax rate was higher than the blended statutory rate of 26.5% due to non-deductible expenses and, in addition for Q3 2023, due to the impairment of an investment in associate.

Net income increased by $5.2 million to $23.2 million in Q3 2024, compared to $18.0 million in Q3 2023. The increase in net income is primarily explained by the higher operating income partially offset by higher income taxes and net interest expense, as described above, and by the impairment related to an investment in associate included in Q3 2023.

Adjusted Net Income increased by $1.7 million to $29.9 million in Q3 2024, compared to $28.2 million in Q3 2023. Adjusted Net Income as a percentage of revenue(3) was 10.8% in Q3 2024 and in Q3 2023, respectively. The year over year change results from the factors described above and the adjustment for the duplicative depreciation expense on property and equipment and right-of-use assets, and interest expense on lease liabilities related to the supply chain transformation initiatives in Q3 2024.

Adjusted Net Income per Diluted Share increased by $0.02 to $0.41 in Q3 2024, compared to $0.39 in Q3 2023. The 5.1% year over year increase results primarily from the changes in Adjusted Net Income and the factors described above.

Cash at the end of the third quarter totaled $35.4 million.

Free Cash Flow(1) amounted to $30.8 million in Q3 2024 compared to $18.1 million in Q3 2023, an increase of $12.7 million primarily driven by an increase in cash from operating activities and a decrease in cash used for investing activities; partially offset by an increase in payments of principal and interest on lease liabilities due to the timing of quarter end in Q3 2023, the new GTA and MVR distribution centres and store network expansion.

Inventory at the end of Q3 2024 was $134.8 million compared to $122.1 million at the end of Q4 2023, an increase of $12.7 million primarily to support the growth of our store network, and due to timing of purchases.

Dividends

On November 4, 2024, the Board of Directors of the Company declared a dividend of $0.11 per common share payable on December 16, 2024 to holders of common shares of record as at the close of business on November 29, 2024.

Outlook

Factoring in YTD 2024 performance, together with market conditions and actions planned in the fourth quarter, the Company expects to achieve the following for full year 2024:

- Revenue between $1.08 and $1.10 billion, supported by approximately 40 new store openings, higher wholesale merchandise sales penetration with Chico franchisees, and approximately flat same-store sales growth;

- Adjusted EBITDA between $243 and $246 million, supported by operating expense leverage, partially offset by pricing investment;

- Adjusted Net Income per Diluted Share between $1.50 and $1.53, which incorporates approximately $20 million pre-tax, or $0.20 per diluted share, of incremental depreciation and lease liability interest expense associated with the new GTA and MVR distribution centres;

- Business transformation costs of approximately $17 million pre-tax, information technology costs of approximately $7 million pre-tax, and share-based compensation of approximately $10 million pre-tax, all of which are excluded from Adjusted EBITDA and Adjusted Net Income per Diluted Share; and

- Net Capital Expenditures(1) of approximately $50 million, roughly half of which is attributable to investments in the Company’s supply chain transformation.

|

(1) This is a non-IFRS financial measure. Non-IFRS financial measures are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS. They are therefore unlikely to be comparable to similar measures presented by other companies. Refer to “Non-IFRS and Other Financial Measures” and “Selected Consolidated Financial Information” below for a reconciliation of the non-IFRS measures (except for Net Capital Expenditures) used in this release to the most comparable IFRS measures. Also refer to the sections entitled “How We Assess the Performance of our Business”, “Non-IFRS and Other Financial Measures” and “Selected Consolidated Financial Information and Industry Metrics” in the MD&A for the third quarter ended September 28, 2024, incorporated by reference herein, for further details concerning EBITDA, Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Net Capital Expenditures including definitions and reconciliations to the relevant reported IFRS measure. |

|

(2) This is a supplementary financial measure. Refer to “Non-IFRS and Other Financial Measures” below and to the section entitled “How We Assess the Performance of our Business” in the MD&A for the third quarter ended September 28, 2024 for the definitions of supplementary financial measures. |

|

(3) This is a non-IFRS ratio. Non-IFRS ratios are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS. They are therefore unlikely to be comparable to similar measures presented by other companies. Refer to “Non-IFRS and Other Financial Measures” below and to the section entitled “How We Assess the Performance of our Business” in the MD&A for the third quarter ended September 28, 2024 for the definitions of non-IFRS ratios and each non-IFRS measure that is used as a component of such non-IFRS ratios. |

Conference Call Details

A conference call to discuss the Company’s third quarter results is scheduled for November 5, 2024, at 8:30 a.m. ET. To access Pet Valu’s conference call, please dial 1-833-950-0062 (ID: 638652). A live webcast of the call will also be available through the Events & Presentations section of the Company’s website at https://investors.petvalu.com/.

For those unable to participate, a playback will be available shortly after the conclusion of the call by dialing 1-866-813-9403 (ID: 921635) and will be accessible until November 12, 2024. The webcast will also be archived and available through the Events & Presentations section of the Company’s website at https://investors.petvalu.com/.

About Pet Valu

Pet Valu is Canada’s leading retailer of pet food and pet-related supplies with over 800 corporate-owned or franchised locations across the country. For more than 45 years, Pet Valu has earned the trust and loyalty of pet parents by offering knowledgeable customer service, a premium product offering and engaging in-store services. Through its neighbourhood stores and digital platform, Pet Valu offers more than 10,000 competitively-priced products, including a broad assortment of premium, super premium, holistic and award-winning proprietary brands. The Company is headquartered in Markham, Ontario and its shares trade on the Toronto Stock Exchange (TSX: PET). To learn more, please visit: www.petvalu.ca.

Non-IFRS and Other Financial Measures

This press release makes reference to certain non-IFRS measures and non-IFRS ratios. These measures and ratios are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS. They are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. Pet Valu uses non-IFRS measures, including “EBITDA”, “Adjusted EBITDA”, “Adjusted Net Income”, “Free Cash Flow” and “Net Capital Expenditures”, and non-IFRS ratios, including “Adjusted EBITDA as a percentage of revenue”, “Adjusted Net Income as a percentage of revenue”, and “Adjusted Net Income per Diluted Share”. This press release also makes reference to certain supplementary financial measures that are commonly used in the retail industry, including “System-wide sales”, “Same-store sales”, “Same-store sales growth”, and “Same-store average spend per transaction growth”. These non-IFRS measures, non-IFRS ratios and supplementary financial measures are used to provide investors with supplemental measures of Pet Valu’s operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. The Company also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures, non-IFRS ratios and these supplementary financial measures in the evaluation of issuers. Management uses non-IFRS measures, non-IFRS ratios and supplementary financial measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and to determine components of management compensation. Refer to the MD&A for the third quarter ended September 28, 2024 for further information on non-IFRS measures, non-IFRS ratios (including each non-IFRS measure that is used as a component of such non-IFRS ratios) and supplementary measures, including for their definition and, for non-IFRS measures, a reconciliation to the most comparable IFRS measure.

Forward-Looking Information

Some of the information contained in this press release is forward-looking information. Forward-looking information is provided as at the date of this press release and is based on management’s opinions, estimates and assumptions in light of its experience and perception of historical trends, current trends, current conditions and expected future developments, as well as other factors that management believes appropriate and reasonable in the circumstances. Such forward-looking information is intended to provide information about management’s current expectations and plans, and may not be appropriate for other purposes. Pet Valu does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable Canadian securities laws. Actual results and the timing of events may differ materially from those anticipated in the forward-looking information as a result of various factors. Particularly, information regarding our expectations of future results, targets, performance achievements, prospects or opportunities, including the information under the headings “2024 Outlook” and “Outlook” in this press release, is “future-oriented financial information” or a “financial outlook” within the meaning of applicable securities legislation, which is based on the factors and assumptions, and subject to the risks, as set out herein and in the Company’s annual information form dated March 4, 2024 (“AIF”). In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “does not anticipate”, “believes”, “continue”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “should”, “might”, “will”, “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information.

Many factors could cause our actual results, level of activity, performance or achievements, future events or developments, or outlook to differ materially from those expressed or implied by the forward-looking information, including, without limitation, the factors discussed in the “Risk Factors” section of the AIF. A copy of the AIF and the Company’s other publicly filed documents can be accessed under the Company’s profile on SEDAR+ at www.sedarplus.ca.

The Company cautions that the list of risk factors and uncertainties described in the AIF is not exhaustive and other factors could also adversely affect its results. Readers are urged to consider the risks, uncertainties and assumptions carefully in evaluating forward-looking information and are cautioned not to place undue reliance on such information.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

|

Condensed Interim Consolidated Statements of Income and Comprehensive Income |

||||

|

Quarters Ended |

Year to Date Ended |

|||

|

September 28, |

September 30, |

September 28, |

September 30, |

|

|

13 weeks |

13 weeks |

39 weeks |

39 weeks |

|

|

Revenue: |

||||

|

Retail sales |

$ 99,962 |

$ 106,708 |

$ 300,428 |

$ 311,739 |

|

Franchise and other revenues |

176,068 |

155,586 |

501,616 |

457,220 |

|

Total revenue |

276,030 |

262,294 |

802,044 |

768,959 |

|

Cost of sales |

186,651 |

174,977 |

537,621 |

502,323 |

|

Gross profit |

89,379 |

87,317 |

264,423 |

266,636 |

|

Selling, general and administrative expenses |

49,023 |

49,947 |

156,972 |

154,175 |

|

Total operating income |

40,356 |

37,370 |

107,451 |

112,461 |

|

Interest expenses, net |

8,326 |

8,128 |

25,551 |

22,190 |

|

(Gain) loss on foreign exchange |

(100) |

246 |

571 |

444 |

|

Other loss |

— |

3,160 |

— |

4,718 |

|

Income before income taxes |

32,130 |

25,836 |

81,329 |

85,109 |

|

Income tax expense |

8,972 |

7,860 |

22,814 |

24,326 |

|

Net income |

23,158 |

17,976 |

58,515 |

60,783 |

|

Other comprehensive income, net of tax: |

||||

|

Currency translation adjustments that may be reclassified to net income, net of tax |

— |

(25) |

— |

18 |

|

Comprehensive income for the period attributable to the shareholders of the Company |

$ 23,158 |

$ 17,951 |

$ 58,515 |

$ 60,801 |

|

Basic net income per share attributable to the common shareholders |

$ 0.32 |

$ 0.25 |

$ 0.82 |

$ 0.85 |

|

Diluted net income per share attributable to the common shareholders |

$ 0.32 |

$ 0.25 |

$ 0.81 |

$ 0.84 |

|

Reconciliation of Net Income to EBITDA and Adjusted EBITDA (Unaudited, in thousands of Canadian dollars unless otherwise noted) |

||||

|

Quarters Ended |

Year to Date Ended |

|||

|

September 28, |

September 30, |

September 28, |

September 30, |

|

|

13 weeks |

13 weeks |

39 weeks |

39 weeks |

|

|

Reconciliation of net income to Adjusted EBITDA: |

||||

|

Net income |

$ 23,158 |

$ 17,976 |

$ 58,515 |

$ 60,783 |

|

Depreciation and amortization |

16,531 |

14,187 |

49,129 |

35,719 |

|

Interest expenses, net |

8,326 |

8,128 |

25,551 |

22,190 |

|

Income tax expense |

8,972 |

7,860 |

22,814 |

24,326 |

|

EBITDA |

56,987 |

48,151 |

156,009 |

143,018 |

|

Adjustments to EBITDA: |

||||

|

Information technology transformation costs(1) |

681 |

1,294 |

5,154 |

2,445 |

|

Business transformation costs(2) |

4,643 |

3,124 |

9,152 |

5,652 |

|

Other professional fees(3) |

239 |

167 |

997 |

516 |

|

Share-based compensation(4) |

2,149 |

1,025 |

7,027 |

2,989 |

|

(Gain) loss on foreign exchange(5) |

(100) |

246 |

571 |

444 |

|

Investment in associate(6) |

— |

3,160 |

— |

4,718 |

|

Adjusted EBITDA |

$ 64,599 |

$ 57,167 |

$ 178,910 |

$ 159,782 |

|

Adjusted EBITDA as a percentage of revenue |

23.4 % |

21.8 % |

22.3 % |

20.8 % |

|

Notes: |

|

|

(1) |

Represents discrete, project-based implementation costs associated with new information technology systems and discrete Software-as-a-Service (“SaaS”) arrangements for transformational initiatives supporting merchandise planning, inventory and order management, e-commerce and omni-channel capabilities, customer relationship management and other key processes. |

|

(2) |

Represents expenses associated with supply chain transformation initiatives such as duplicative warehousing and distribution costs, implementation costs associated with new information technology systems and other transition costs incurred during the transition to a new distribution centre. The expenses included in cost of sales in Q3 2024 and YTD 2024 were $2.3 million and $4.4 million, respectively (Q3 2023 and YTD 2023 – $2.1 million and $2.6 million, respectively). The expenses included in selling, general, and administrative expenses in Q3 2024 and YTD 2024 were $1.2 million and $3.4 million, respectively (Q3 2023 and YTD 2023 – $1.0 million and $3.1 million, respectively). Additionally, business transformation costs include $1.1 million and $1.4 million of expenses predominantly related to a reorganization in the senior leadership team in Q3 2024 and YTD 2024, respectively (Q3 2023 and YTD 2023 – $nil, respectively). |

|

(3) |

Professional fees primarily incurred with respect to: (i) the Canada Revenue Agency’s (“CRA”) examination of the Company’s Canadian tax filings related to the 2016, 2018 and 2019 fiscal years; and (ii) professional fees incurred with respect to the secondary offerings of the Company’s common shares completed on June 1, 2023 (the “2023 Secondary Offering”) and May 15, 2024 (the “2024 Secondary Offering”). |

|

(4) |

Represents share-based compensation in respect of our amended and restated share option plan, long-term incentive plan, and deferred share unit plan. |

|

(5) |

Represents foreign exchange gains and losses. |

|

(6) |

Represents the Company’s share of loss from associate of $3.2 million and $3.4 million for Q3 2023 and YTD 2023, respectively and loss on the fair value of the related call option of $nil and $1.3 million for Q3 2023 and YTD 2023, respectively. |

|

Reconciliation of Net Income to Adjusted Net Income (Unaudited, in thousands of Canadian dollars unless otherwise noted) |

||||

|

Quarters Ended |

Year to Date Ended |

|||

|

September 28, |

September 30, |

September 28, |

September 30, |

|

|

13 weeks |

13 weeks |

39 weeks |

39 weeks |

|

|

Reconciliation of net income to Adjusted Net Income: |

||||

|

Net income |

$ 23,158 |

$ 17,976 |

$ 58,515 |

$ 60,783 |

|

Adjustments to net income: |

||||

|

Information technology transformation costs(1) |

681 |

1,294 |

5,154 |

2,445 |

|

Business transformation costs(2) |

5,677 |

6,704 |

15,474 |

9,232 |

|

Other professional fees(3) |

239 |

167 |

997 |

516 |

|

Share-based compensation(4) |

2,149 |

1,025 |

7,027 |

2,989 |

|

(Gain) loss on foreign exchange(5) |

(100) |

246 |

571 |

444 |

|

Investment in associate(6) |

— |

3,160 |

— |

4,718 |

|

Tax effect of adjustments to net income |

(1,875) |

(2,350) |

(6,594) |

(3,685) |

|

Adjusted Net Income |

$ 29,929 |

$ 28,222 |

$ 81,144 |

$ 77,442 |

|

Adjusted Net Income as a percentage of revenue |

10.8 % |

10.8 % |

10.1 % |

10.1 % |

|

Adjusted Net Income per Diluted Share |

$ 0.41 |

$ 0.39 |

$ 1.12 |

$ 1.07 |

|

Notes: |

|

|

(1) |

Represents discrete, project-based implementation costs associated with new information technology systems and discrete SaaS arrangements for transformational initiatives supporting merchandise planning, inventory and order management, e-commerce and omni-channel capabilities, customer relationship management and other key processes. |

|

(2) |

Represents expenses associated with supply chain transformation initiatives such as duplicative warehousing and distribution costs, implementation costs associated with new information technology systems, and other transition costs incurred during the transition to a new distribution centre. This also includes duplicative depreciation expense on property and equipment and right-of-use assets, and interest expense on lease liabilities. The expenses included in cost of sales in Q3 2024 and YTD 2024 were $3.1 million and $8.4 million, respectively (Q3 2023 and YTD 2023 – $4.6 million and $5.1 million, respectively). The expenses included in selling, general, and administrative expenses in Q3 2024 and YTD 2024 were $1.2 million and $3.4 million, respectively (Q3 2023 and YTD 2023 – $1.0 million and $3.1 million, respectively). The interest expense on the lease liability in Q3 2024 and YTD 2024 was $0.3 million and $2.3 million, respectively (Q3 2023 and YTD 2023 – $1.0 million, respectively). Additionally, business transformation costs include $1.1 million and $1.4 million of expenses predominantly related to a reorganization in the senior leadership team in Q3 2024 and YTD 2024, respectively (Q3 2023 and YTD 2023 – $nil, respectively). |

|

(3) |

Professional fees primarily incurred with respect to: (i) the CRA’s examination of the Company’s Canadian tax filings related to the 2016, 2018, and 2019 fiscal years; and (ii) professional fees incurred with respect to the 2023 Secondary Offering and 2024 Secondary Offering. |

|

(4) |

Represents share-based compensation in respect of our amended and restated share option plan, long-term incentive plan, and deferred share unit plan. |

|

(5) |

Represents foreign exchange gains and losses. |

|

(6) |

Represents the Company’s share of loss from associate of $3.2 million and $3.4 million for Q3 2023 and YTD 2023, respectively and loss on the fair value of the related call option of $nil and $1.3 million for Q3 2023 and YTD 2023, respectively. |

|

Condensed Interim Consolidated Statements of Cash Flows (Unaudited, in thousands of Canadian dollars) |

||||

|

Quarters Ended |

Year to Date Ended |

|||

|

September 28, |

September 30, |

September 28, |

September 30, |

|

|

13 weeks |

13 weeks |

39 weeks |

39 weeks |

|

|

Cash provided by (used in): |

||||

|

Operating activities: |

||||

|

Net income for the period |

$ 23,158 |

$ 17,976 |

$ 58,515 |

$ 60,783 |

|

Adjustments for items not affecting cash: |

||||

|

Depreciation and amortization |

16,531 |

14,187 |

49,129 |

35,719 |

|

Deferred franchise fees |

181 |

74 |

88 |

137 |

|

Gain on disposal of property and equipment |

(1,200) |

(1,017) |

(2,810) |

(1,321) |

|

Loss on sale of right-of-use assets |

(180) |

155 |

(32) |

689 |

|

(Gain) loss on foreign exchange |

(100) |

246 |

571 |

444 |

|

Loss on financial instruments |

— |

— |

— |

1,302 |

|

Share-based compensation expense |

2,149 |

1,025 |

7,027 |

2,989 |

|

Share of loss from associate |

— |

3,160 |

— |

3,416 |

|

Interest expenses, net |

8,326 |

8,128 |

25,551 |

22,190 |

|

Income tax expense |

8,972 |

7,860 |

22,814 |

24,326 |

|

Income taxes paid |

(8,881) |

(9,360) |

(24,881) |

(43,130) |

|

Changes in non-cash operating working capital: |

||||

|

Accounts receivable |

979 |

(601) |

(1,515) |

(1,740) |

|

Inventories |

(1,150) |

(4,261) |

(12,505) |

(16,541) |

|

Prepaid expenses |

10,155 |

(8,151) |

8,023 |

(4,589) |

|

Accounts payable and accrued liabilities |

(3,241) |

5,023 |

2,364 |

(4,544) |

|

Net cash provided by operating activities |

55,699 |

34,444 |

132,339 |

80,130 |

|

Financing activities: |

||||

|

Proceeds from exercise of share options |

3,270 |

5 |

4,089 |

4,349 |

|

Shares repurchased for cancellation |

(2,043) |

— |

(2,043) |

— |

|

Dividends paid on common shares |

(7,907) |

(7,146) |

(23,638) |

(21,390) |

|

Repayment of 2021 Term Facility |

(4,437) |

(4,438) |

(13,312) |

(41,312) |

|

Interest paid on long-term debt |

(8,493) |

(3,797) |

(19,805) |

(7,664) |

|

Repayment of principal on lease liabilities |

(16,541) |

(8,210) |

(48,108) |

(39,068) |

|

Interest paid on lease liabilities |

(5,865) |

(4,554) |

(17,494) |

(11,151) |

|

Standby letter of credit commitment fees |

— |

(209) |

— |

(872) |

|

Net cash used in financing activities |

(42,016) |

(28,349) |

(120,311) |

(117,108) |

|

Investing activities: |

||||

|

Business acquisition, net of cash acquired |

— |

— |

— |

(3,000) |

|

Purchases of property and equipment |

(16,661) |

(14,881) |

(43,139) |

(42,262) |

|

Purchase of intangible assets |

(254) |

(714) |

(1,518) |

(2,689) |

|

Proceeds on disposal of property and equipment |

2,848 |

1,669 |

6,104 |

2,870 |

|

Right-of-use asset initial direct costs |

(474) |

(464) |

(1,418) |

(1,454) |

|

Tenant allowances |

177 |

537 |

1,046 |

1,185 |

|

Notes receivable |

154 |

157 |

505 |

1,050 |

|

Lease receivables |

8,890 |

7,692 |

25,829 |

22,269 |

|

Interest received on lease receivables and other |

2,949 |

2,556 |

8,939 |

8,065 |

|

Repurchase of franchises |

— |

— |

(971) |

(512) |

|

Net cash used in investing activities |

(2,371) |

(3,448) |

(4,623) |

(14,478) |

|

Effect of exchange rate on cash |

31 |

(113) |

(419) |

(237) |

|

Net increase (decrease) in cash |

11,343 |

2,534 |

6,986 |

(51,693) |

|

Cash, beginning of period |

24,087 |

8,807 |

28,444 |

63,034 |

|

Cash, end of period |

$ 35,430 |

$ 11,341 |

$ 35,430 |

$ 11,341 |

|

Free Cash Flows (Unaudited, expressed in thousands of Canadian dollars) |

||||

|

Quarters Ended |

Year to Date Ended |

|||

|

September 28, |

September 30, |

September 28, |

September 30, |

|

|

13 weeks |

13 weeks |

39 weeks |

39 weeks |

|

|

Cash provided by operating activities |

$ 55,699 |

$ 34,444 |

$ 132,339 |

$ 80,130 |

|

Cash used in investing activities |

(2,371) |

(3,448) |

(4,623) |

(14,478) |

|

Repayment of principal on lease liabilities |

(16,541) |

(8,210) |

(48,108) |

(39,068) |

|

Interest paid on lease liabilities |

(5,865) |

(4,554) |

(17,494) |

(11,151) |

|

Notes receivable |

(154) |

(157) |

(505) |

(1,050) |

|

Free Cash Flow |

$ 30,768 |

$ 18,075 |

$ 61,609 |

$ 14,383 |

|

Condensed Interim Consolidated Statements of Financial Position (Unaudited, expressed in thousands of Canadian dollars) |

||

|

As at September 28, |

As at December 30, |

|

|

Assets |

||

|

Current assets: |

||

|

Cash |

$ 35,430 |

$ 28,444 |

|

Accounts and other receivables |

29,327 |

27,875 |

|

Inventories, net |

134,750 |

122,069 |

|

Income taxes recoverable |

8,286 |

6,012 |

|

Prepaid expenses and other assets |

11,380 |

19,403 |

|

Current portion of lease receivables |

38,062 |

34,332 |

|

Total current assets |

257,235 |

238,135 |

|

Non-current assets: |

||

|

Long-term lease receivables |

165,579 |

159,101 |

|

Right-of-use assets, net |

233,843 |

237,941 |

|

Property and equipment, net |

145,324 |

120,493 |

|

Intangible assets, net |

50,751 |

52,205 |

|

Goodwill |

97,969 |

97,562 |

|

Deferred tax assets |

7,230 |

7,230 |

|

Other assets |

3,904 |

4,240 |

|

Total non-current assets |

704,600 |

678,772 |

|

Total assets |

$ 961,835 |

$ 916,907 |

|