Global-E Soars: Q3 Sales Surge 32%, FY24 Outlook Raised Amid GMV Boom

Global-E Online Ltd. GLBE shares are trading higher after the company reported third-quarter results and raised its FY24 outlook.

Sales grew 32% year over year to $176 million, beating the analyst consensus estimate of $169.16 million.

Gross Merchandise Value (GMV) rose 35% Y/Y to $1.13 billion in the quarter. The company reported $82.6 million in service fees and $93.4 million in fulfillment services revenue in the quarter.

Non-GAAP gross profit increased to $82.3 million (+39% Y/Y), and non-GAAP gross margin expanded 240 basis points Y/Y to 46.8%.

Adjusted EBITDA rose to $31.1 million from $22.1 million a year ago. The company’s operating loss narrowed to $21.0 million from $35.6 million.

Loss per share was $0.13, beating the consensus loss of $0.15.

Outlook: For the fourth quarter, Global-e Online projects GMV of $1.615 billion – $1.685 billion and revenue of $243 million and $255 million vs. $246.27 million estimate.

The company raised its FY24 revenue guidance to $732.9 million – $744.9 million (from $710 million – $750 million), vs. the consensus of $730.72 million.

Founder and CEO Amir Schlachet said, “We report today the results of another very strong quarter, with growth of GMV accelerating to 35% year over year and many new merchants going live ahead of the holiday season, including the iconic luxury department store Harrods.”

“Given the successful merchant launches in the recent months, combined with our new bookings for this year which are at an all-time high, we believe that this strong growth momentum will continue.”

Investors can gain exposure to the stock via Amplify ETF Trust Amplify BlueStar Israel Technology ETF ITEQ and The Alger ETF Trust Alger AI Enablers & Adopters ETF ALAI.

Price Action: GLBE shares are up 12.9% at $48.28 at the last check Wednesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With XPeng Stock Today?

XPeng Inc. XPEV shares are trading slightly higher on Wednesday, following mixed third-quarter results from its rival, NIO Inc. NIO.

NIO’s fiscal third quarter revenue totaled 18.67 billion yuan ($2.66 billion), down 2.1% year-over-year but up 7.0% from the previous quarter, missing the consensus estimate of $2.70 billion. The company posted an adjusted loss per share of 2.14 yuan (31 cents), a slight improvement from a 2.28 yuan loss in the same period last year.

China’s $376 billion electric vehicle (EV) market continues to attract new entrants, including companies outside the traditional automotive sector, like makers of vacuum cleaners and hair dryers, according to a report from the South China Morning Post.

Also Read: Sony Eyes Japan’s Kadokawa to Strengthen Gaming and Anime Dominance

Despite optimism, the domestic EV market, the world’s largest, is projected to stagnate over the next two years in terms of revenue growth, the report read.

In contrast, XPeng is projecting robust fourth-quarter vehicle deliveries between 87,000 and 91,000, reflecting year-on-year growth of 44.6% to 51.3%. The company also expects fourth-quarter revenue to range from 15.3 billion to 16.2 billion yuan, a year-on-year increase of 17.2% to 24.1%, surpassing the consensus estimate of 14.77 billion yuan.

XPeng’s flying car subsidiary, Xpeng Aeroht, made significant progress at the 15th China International Aviation and Aerospace Exhibition, securing 2,008 pre-orders for its modular flying car, the Land Aircraft Carrier.

Despite these developments, XPeng’s stock has dropped over 30% in the past year. Investors seeking exposure to XPeng can access the stock through the SPDR S&P Kensho Smart Mobility ETF HAIL.

Price Action: XPEV shares are trading higher by 2.04% to $12.78 at last check Wednesday.

Photo via Shutterstock

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What to Expect from Copart's Earnings

Copart CPRT is preparing to release its quarterly earnings on Thursday, 2024-11-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Copart to report an earnings per share (EPS) of $0.37.

Anticipation surrounds Copart’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

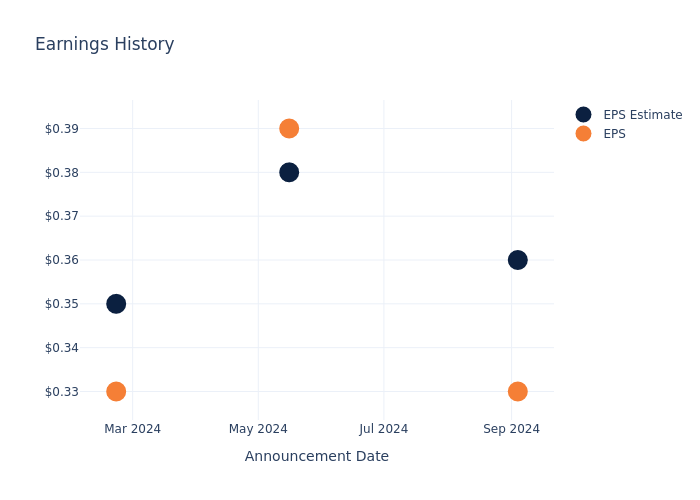

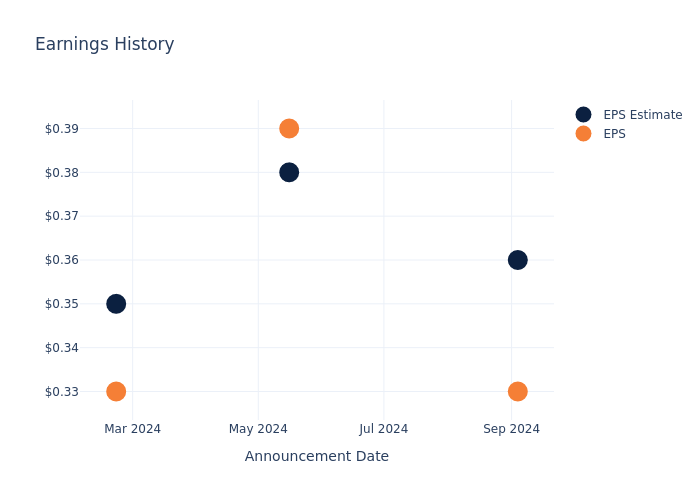

Earnings History Snapshot

Last quarter the company missed EPS by $0.03, which was followed by a 6.67% drop in the share price the next day.

Here’s a look at Copart’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.38 | 0.35 | 0.32 |

| EPS Actual | 0.33 | 0.39 | 0.33 | 0.34 |

| Price Change % | -7.000000000000001% | -0.0% | 4.0% | 2.0% |

Performance of Copart Shares

Shares of Copart were trading at $56.52 as of November 19. Over the last 52-week period, shares are up 11.42%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Copart

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Copart.

The consensus rating for Copart is Neutral, derived from 2 analyst ratings. An average one-year price target of $58.0 implies a potential 2.62% upside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Cintas, RB Global and ACV Auctions, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- As per analysts’ assessments, Cintas is favoring an Neutral trajectory, with an average 1-year price target of $211.45, suggesting a potential 274.12% upside.

- Analysts currently favor an Outperform trajectory for RB Global, with an average 1-year price target of $102.3, suggesting a potential 81.0% upside.

- Analysts currently favor an Outperform trajectory for ACV Auctions, with an average 1-year price target of $22.83, suggesting a potential 59.61% downside.

Snapshot: Peer Analysis

Within the peer analysis summary, vital metrics for Cintas, RB Global and ACV Auctions are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Copart | Neutral | 7.16% | $453.58M | 4.39% |

| Cintas | Neutral | 6.80% | $1.25B | 10.80% |

| RB Global | Outperform | -3.73% | $448.60M | 1.29% |

| ACV Auctions | Outperform | 43.96% | $90.09M | -3.51% |

Key Takeaway:

Copart ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, its return on equity is below average compared to the group.

Unveiling the Story Behind Copart

Based in Dallas, Copart operates an online salvage vehicle auction with operations in 11 countries across North America, Europe, and the Middle East, facilitating over 3.5 million transactions annually. The company utilizes its virtual bidding platform, VB3, to connect vehicle sellers with over 750,000 registered buyers around the world. Buyers primarily consist of vehicle dismantlers, rebuilders, individuals and used vehicle retailers. About 80% of Copart’s vehicle volume is supplied by auto insurance companies holding vehicles deemed a total loss. Copart also offers services such as vehicle transportation, storage, title transfer, and salvage value estimation. The company primarily operates on a consignment basis and collects fees based on the vehicle’s final selling price.

Financial Insights: Copart

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Copart displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 7.16%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Copart’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 30.17% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Copart’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 4.39%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Copart’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.92%, the company showcases efficient use of assets and strong financial health.

Debt Management: Copart’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.02.

To track all earnings releases for Copart visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WillScot Holdings Recent Insider Activity

On November 19, a recent SEC filing unveiled that Sally Shanks, Chief Accounting Officer at WillScot Holdings WSC made an insider sell.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Shanks sold 14,059 shares of WillScot Holdings. The total transaction value is $487,681.

WillScot Holdings‘s shares are actively trading at $37.07, experiencing a up of 5.49% during Wednesday’s morning session.

Discovering WillScot Holdings: A Closer Look

WillScot Holdings Corp designs, delivers, and services onsite, on-demand space solutions for clients. The company offers turnkey solutions in construction, education, manufacturing, retail, healthcare, and entertainment sectors. The products of the company includes modular office complexes, mobile offices, portable storage containers, and others.

Key Indicators: WillScot Holdings’s Financial Health

Revenue Challenges: WillScot Holdings’s revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -0.56%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: With a high gross margin of 53.45%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): WillScot Holdings’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.37.

Debt Management: WillScot Holdings’s debt-to-equity ratio stands notably higher than the industry average, reaching 3.69. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: WillScot Holdings’s current Price to Earnings (P/E) ratio of 292.83 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.78 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 16.0, WillScot Holdings’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of WillScot Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With GlobalFoundries Stock Today?

GlobalFoundries Inc. GFS shares are trading lower on Wednesday despite the announcement of a significant award from the U.S. Department of Commerce.

The company has been granted up to $1.5 billion in direct funding through the CHIPS and Science Act, aimed at strengthening U.S. semiconductor manufacturing. This award builds on a previously signed memorandum of terms from February 2024 and is expected to drive critical expansion in chip production to support key industries such as automotive, smart devices, IoT, data centers, and aerospace and defense.

The funding will support three key projects. First, GlobalFoundries will expand its Malta, New York facility, incorporating advanced technologies already in use at its Singapore and Germany sites to meet the U.S. auto industry’s growing chip demand.

Second, the Essex Junction, Vermont fab will undergo modernization to increase the production of next-generation gallium nitride (GaN) semiconductors for electric vehicles, data centers, and other vital applications.

Also Read: Target Q3 Earnings: Supply Chain Chaos Hits Bottomline, Slashes Annual Profit Outlook, Stock Tanks

Lastly, a new state-of-the-art fab will be constructed on the Malta campus to meet increasing demand for U.S.-made chips in industries like AI, aerospace, and defense.

According to Benzinga Pro, GFS stock has lost over 29% in the past year. Investors can gain exposure to the stock via Renaissance IPO ETF IPO.

Over the next decade, these expansions will result in an investment of over $13 billion and are expected to create nearly 1,000 direct manufacturing jobs, alongside more than 9,000 construction jobs. Additionally, GlobalFoundries will continue workforce development efforts in New York and Vermont, including STEM outreach and new training programs. The company is also committed to sustainability, ensuring that all expansion projects align with its environmental goals.

Price Action: GFS shares are trading lower by 2.01% to $41.53 at last check Wednesday.

Image via Pexels

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

UGI's Earnings: A Preview

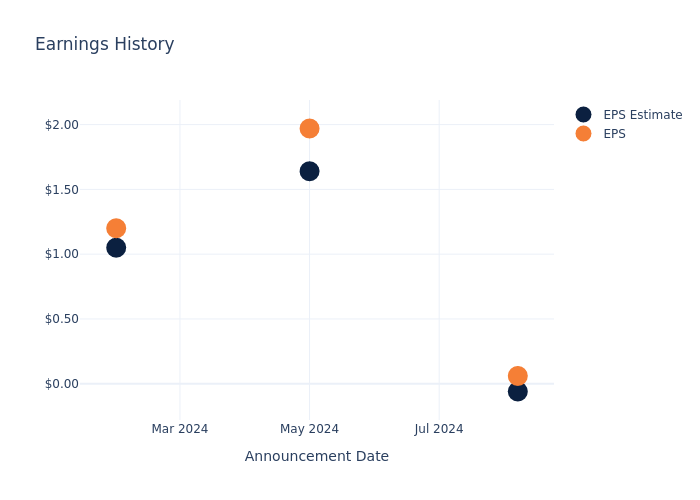

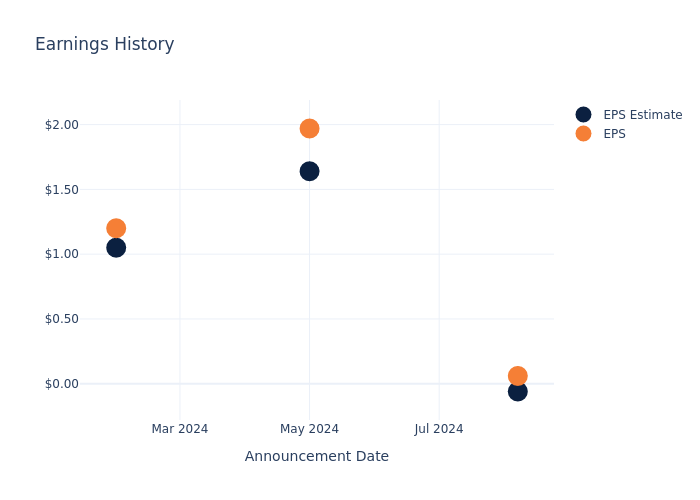

UGI UGI is preparing to release its quarterly earnings on Thursday, 2024-11-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect UGI to report an earnings per share (EPS) of $-0.29.

The announcement from UGI is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.12, leading to a 3.86% drop in the share price on the subsequent day.

Performance of UGI Shares

Shares of UGI were trading at $24.37 as of November 19. Over the last 52-week period, shares are up 11.67%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on UGI

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding UGI.

The consensus rating for UGI is Neutral, based on 1 analyst ratings. With an average one-year price target of $27.0, there’s a potential 10.79% upside.

Comparing Ratings Among Industry Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of New Jersey Resources, National Fuel Gas and Southwest Gas Hldgs, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for New Jersey Resources, with an average 1-year price target of $49.0, suggesting a potential 101.07% upside.

- National Fuel Gas is maintaining an Neutral status according to analysts, with an average 1-year price target of $63.0, indicating a potential 158.51% upside.

- The prevailing sentiment among analysts is an Neutral trajectory for Southwest Gas Hldgs, with an average 1-year price target of $78.0, implying a potential 220.07% upside.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for New Jersey Resources, National Fuel Gas and Southwest Gas Hldgs, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| UGI | Neutral | -16.82% | $741M | -1.03% |

| New Jersey Resources | Neutral | 4.38% | $55.19M | -0.54% |

| National Fuel Gas | Neutral | -10.87% | $170.46M | -5.62% |

| Southwest Gas Hldgs | Neutral | -7.72% | $191.13M | 0.01% |

Key Takeaway:

UGI ranks in the middle among its peers for revenue growth, with a negative growth rate. It ranks at the bottom for gross profit, with the lowest figure. In terms of return on equity, UGI also ranks at the bottom, with a negative percentage. Overall, UGI’s performance is weaker compared to its peers in these key financial metrics.

About UGI

UGI Corp is an American holding company that, through its subsidiaries, is involved in the transport and marketing of energy and related services. Its segments include AmeriGas Propane, UGI International, Midstream & Marketing and UGI Utilities. The AmeriGas Propane segment consists of the propane distribution business. The UGI International segment consists of LPG distribution businesses. The Midstream & Marketing segment consists of energy-related businesses. The UGI Utilities segment consists of the regulated natural gas and electric distribution. The company derives a majority of its revenue from the UGI International segment.

Breaking Down UGI’s Financial Performance

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Negative Revenue Trend: Examining UGI’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -16.82% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Utilities sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: UGI’s net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -3.48%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): UGI’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -1.03%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): UGI’s ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.31%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 1.48, UGI faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for UGI visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Femtocell Market Size to Worth USD 7.49 Billion by 2024 | Straits Research

New York, United States, Nov. 20, 2024 (GLOBE NEWSWIRE) — A femtocell is a wireless device access point that improves internet speed inside the home and office space. Voice calls are converted into voice over IP (VoIP) packets using this device, which takes the role of a wireless Wi-Fi router and connects to mobile devices. The voice packets are subsequently sent to the servers of the mobile number operators over a broadband connection. Mobile phones that use licensed service provider spectra, such as CDMA2000, WiMAX, or UMTS, are compatible with femtocells.

Download Free Sample Report PDF @ https://straitsresearch.com/report/femtocell-market/request-sample

Market Dynamics

Energy Efficient Operation and Cost-Effectivity of Femtocell Drives the Global Market

Energy efficiency is a topic that is being addressed in every aspect of technology. Any technology must be energy efficient, even if maintaining profitability is a top concern. A decrease in the intensity of the elements that together harm the environment is achieved through energy efficiency. This is a significant concern in the rapidly increasing economic and technological sectors. A femtocell employs a small amount of energy instead of massive generators to function. It can be powered by solar cells or tiny batteries. Femtocells can also be used in smart homes, a part of the intelligent communication system that uses communication to regulate energy efficiency. Additionally, as technology has advanced over time, femtocell cost-effectiveness has grown.

Increasing Demand for 5G Network and Low Latency High-Speed Internet Creates Opportunities

The deployment of femtocells is progressing in countries like the United States, China, India, the United Kingdom, France, Germany, Japan, the Republic of Korea, and Singapore. The Chinese government has also dramatically expanded its financial commitment to the 5G network. Additionally, according to China’s Academy of Information and Communication Technologies, the Research Division of the Ministry of Industry and Information Technology, investments in domestic 5G networks are projected to reach Yuan 2.8 trillion (about USD 430 billion) between 2020 and 2030. This causes cellular networks several problems due to user equipment (UE) motions, channel fading, and interference levels. High-speed internet service providers have boosted their investments in femtocell technology, which enables high reliability and low latency bandwidth. It provides high-speed internet at a reasonable price, and it is anticipated that this would give economic possibilities for the market throughout the projected period.

Regional Analysis

North America is the most significant shareholder in the global femtocell market and is expected to grow at a CAGR of 16.9% during the forecast period. North America has created a cutting-edge network infrastructure that instantly meets end-user demand and makes a coherent network by pushing the boundaries of science, technology, and commerce. American telecom operators’ rapid LTE rollout across the nation on the 700 Megahertz (MHz) spectrum has aided the country’s international domination of cellular and internet services. Femtocells controls the market in North America because they offer more sophisticated applications than traditional cellular Wi-Fi.

Europe is expected to grow at a CAGR of 19.8%, generating USD 6,596.5 million during the forecast period. The use of femtocells is anticipated to rise in the following years as a result of the various network infrastructure development initiatives being handled by the European Government. Due to lower consumer spending and the political and economic uncertainties surrounding the outcome of the Brexit negotiations, the economy in countries like the UK and Germany is expected to be modest. Additionally, these countries are putting modern infrastructure and technology into place swiftly. Due to the involvement of industry giants like Verizon, there is severe competition in both the mobile and broadband markets. These countries also have lower smartphone penetration rates than the rest of Europe due to lower consumer prices.

Asia-Pacific enterprises and government organizations are revamping their network infrastructure to offer end users high-quality networking services. Mobile phones have made communication more challenging in nations with dense populations, which is anticipated to drive the rise of the region’s femtocell market. Network transmission failure is one of the biggest problems faced by smartphone users in densely populated countries. Businesses in the Asia-Pacific region are embracing femtocell technology to overcome these problems and provide trustworthy solutions to users. Due to the demand for higher bandwidth applications, the region with the most significant smartphone usage is pressuring wireless network service providers to implement 5G technology into their networks.

To Gather Additional Insights on the Regional Analysis of the Femtocell Market @ https://straitsresearch.com/report/femtocell-market/request-sample

Key Highlights

- The global femtocell market size was valued at USD 6.26 billion in 2023 and is projected to reach from USD 7.49 billion in 2024 to USD 31.81 billion by 2032, growing at a CAGR of 19.8% over the forecast period (2024-32).

- Based on technology, the global femtocell market is bifurcated into IMS/SIP and IU-H. The IU-H segment is the highest contributor to the market and is expected to grow at a CAGR of 19.9% during the forecast period.

- Based on type, the global femtocell market is bifurcated into 2G femtocell, 3G femtocell, 4G femtocell, 5G femtocell. The 4G femtocell segment owns the highest market share and is expected to grow at a CAGR of 19.4% during the forecast period.

- Based on application, the global femtocell market is bifurcated into indoor and outdoor. The indoor segment is the highest contributor to the market and is expected to grow at a CAGR of 18.5% during the forecast period.

- Based on end-users, the global femtocell market is bifurcated into residential, commercial, and public spaces. The commercial segment is the highest contributor to the market and is expected to grow at a CAGR of 18.7% during the forecast period.

- North America is the most significant shareholder in the global femtocell market and is expected to grow at a CAGR of 16.9% during the forecast period.

Competitive Players

- Aricent Inc

- China Mobile Ltd.

- Cisco System Inc.

- Ericsson

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Samsung Electronics Co Ltd

- Vodafone Group Plc

- ZTE Corporation

Recent Developments

- June 2024 – The Telecommunications and Multimedia Applications Institute (iTEAM) at Valencia, Spain’s UPV University, and Spanish carrier Vodafone Spain announced a partnership initiative centered on the research and development of 5G SA networks with Open RAN (O-RAN) hardware.

Segmentation

- By Technology

-

- IMS/SIP

- IU-H

- By Type

-

- 2G Femtocell

- 3G Femtocell

- 4G Femtocell

- 5G Femtocell

- By Applications

-

- Indoor

- Outdoor

- By End-User

- Residential

- Commercial

- Public Space

- By Region

-

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get Detailed Market Segmentation @ https://straitsresearch.com/report/femtocell-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision-making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is It Finally Time to Buy This Beaten-Down Artificial Intelligence (AI) Stock?

ASML Holding (NASDAQ: ASML) is one of the most important companies in the semiconductor industry as its equipment plays a mission-critical role in helping foundries and chipmakers in manufacturing chips, but the stock’s performance so far this year has been underwhelming.

While the PHLX Semiconductor Sector index has recorded solid gains of almost 16% this year (as of this writing), shares of ASML are down 14%. The stock fell big time last month following the release of its third-quarter earnings as management’s 2025 outlook turned out to be lower than what Wall Street was looking for.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, ASML held its Investor Day meeting on Nov. 14, and it looks like management’s comments are having a positive impact on the company’s stock market fortunes. More specifically, ASML stock rose almost 3% following its Investor Day. Let’s see why that was the case.

When ASML released its Q3 results last month, it guided for 2025 revenue of 30 billion euros to 35 billion euros. The company trimmed the higher end of its earlier guidance, which called for 2025 revenue of 30 billion euros to 40 billion euros, driven by slower recovery in certain semiconductor end markets such as smartphones and personal computers (PCs).

The Dutch semiconductor giant also pointed out that limited-capacity additions by memory manufacturers are also going to impact its growth next year. However, ASML did point out that AI will remain a key growth driver despite the headwinds in other markets. According to CEO Christophe Fouquet:

With regard to market conditions, while we continue to view AI as a key driver of the industry recovery with potential upside, we see other segments recovering more slowly than anticipated. The recovery will extend well into 2025, which is leading to customer cautiousness and some pushouts in their investments.

ASML management spoke on the same lines during its investor day meeting, stating that “the emergence of AI creates a significant opportunity for the semiconductor industry,” and the company could “deliver significant revenue and profitability growth” thanks to the proliferation of this technology. As a result, ASML has reiterated its 2030 revenue guidance of 44 billion euros to 60 billion euros, along with a gross margin of 56% to 60%. The company had originally issued this guidance a couple of years ago.

So, ASML’s forecast indicates that the company’s long-term growth forecast is still intact in spite of a short-term hiccup next year. Management points out that the booming demand for AI servers is going to be a key growth driver for the company. More specifically, ASML management estimates that sales of AI servers could increase at an annual rate of 18% from 2025 to 2030, generating $350 billion in revenue at the end of the forecast period.