Market Whales and Their Recent Bets on DVN Options

Deep-pocketed investors have adopted a bearish approach towards Devon Energy DVN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DVN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for Devon Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 47% bearish. Among these notable options, 9 are puts, totaling $1,291,495, and 8 are calls, amounting to $361,816.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $47.5 for Devon Energy over the recent three months.

Insights into Volume & Open Interest

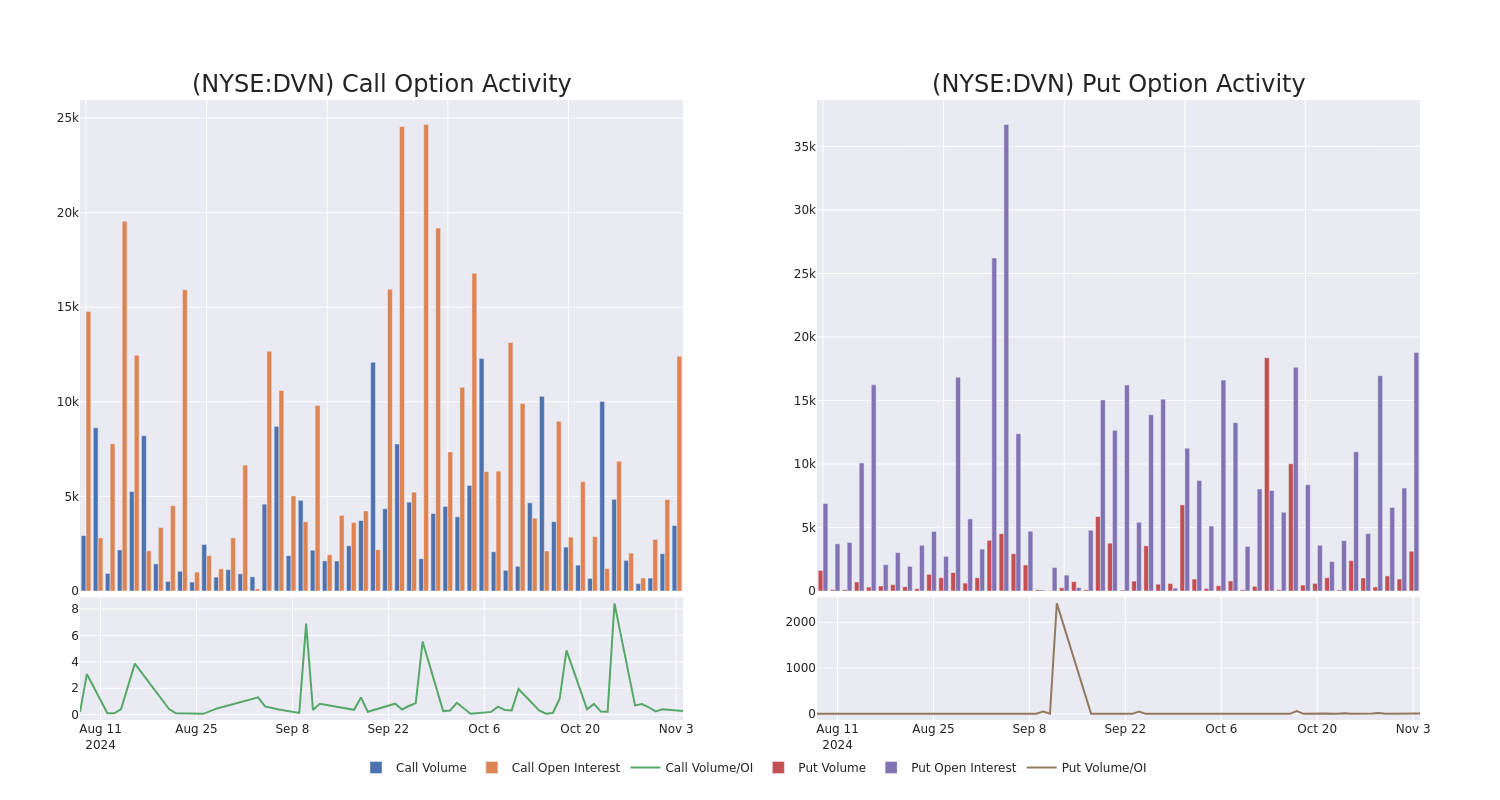

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Devon Energy’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Devon Energy’s whale activity within a strike price range from $30.0 to $47.5 in the last 30 days.

Devon Energy Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | PUT | TRADE | BULLISH | 01/15/27 | $8.4 | $6.35 | $6.5 | $37.50 | $487.5K | 113 | 750 |

| DVN | PUT | SWEEP | BEARISH | 04/17/25 | $7.3 | $7.2 | $7.3 | $45.00 | $218.2K | 791 | 320 |

| DVN | PUT | TRADE | BULLISH | 06/20/25 | $4.85 | $4.6 | $4.7 | $40.00 | $166.8K | 4.3K | 545 |

| DVN | PUT | SWEEP | BEARISH | 06/20/25 | $6.1 | $6.0 | $6.1 | $42.50 | $162.8K | 7.5K | 268 |

| DVN | PUT | TRADE | BULLISH | 06/20/25 | $4.75 | $4.65 | $4.65 | $40.00 | $88.3K | 4.3K | 190 |

About Devon Energy

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2023, Devon reported net proved reserves of 1.8 billion barrels of oil equivalent. Net production averaged roughly 658,000 barrels of oil equivalent per day in 2023 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

After a thorough review of the options trading surrounding Devon Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Devon Energy Standing Right Now?

- Currently trading with a volume of 4,525,218, the DVN’s price is up by 2.39%, now at $39.23.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 1 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Devon Energy, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AI Stock Astera Labs Jumps On Beat-And-Raise Third-Quarter Report

Astera Labs (ALAB) late Monday beat Wall Street’s targets for the third quarter and with the chipmaker’s guidance for the current period. Astera Labs stock rocketed in extended trading.

The Santa Clara, Calif.-based company earned an adjusted 23 cents a share on sales of $113.1 million in the September quarter. Analysts polled by FactSet had expected earnings of 17 cents a share on sales of $97.5 million.

↑

X

The Chip War With China Is Heating Up. Who’s Winning?

Astera Lab’s revenue rose 47% from the June quarter and 206% from the September quarter last year.

“Our business has now entered a new growth phase with multiple product families ramping across AI platforms based upon both third-party GPUs (graphics processing units) and internally developed AI accelerators,” Chief Executive Jitendra Mohan said in a news release.

He added, “With (an) expanding product portfolio including the new Scorpio Fabric Switches, we are cementing our position as a critical part of AI connectivity infrastructure, delivering increased value to our hyperscaler customers, and unlocking additional multiyear growth trajectories for Astera.”

Astera Labs Stock Blasts Off

In after-hours trading on the stock market today, Astera Labs stock rose more than 18% to 82.76. During the regular session Monday, Astera Labs stock fell 4.1% to close at 69.65.

For the current quarter, Astera Labs expects to earn an adjusted 26 cents a share on sales of $128 million. That’s based on the midpoint of its guidance. Wall Street was modeling earnings of 18 cents a share on sales of $107.9 million in the fourth quarter.

Astera Labs makes connectivity chips for cloud and artificial intelligence data centers. Astera’s products are focused on high-speed data transfer and overall system bandwidth expansion in data center computing systems. Its products address critical bottlenecks in AI infrastructure.

Astera’s products span multiple form factors including integrated circuits, boards and modules that are built upon a software architecture called Cosmos. Cosmos is an acronym for its Connectivity System Management and Optimization Software.

Astera Labs started trading on March 20 at an initial public offering price of 36. It notched a record high of 95.21 on March 26 before retreating.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Will Super Micro Stock Get Delisted? Dell Stock Gains Amid Uncertainty.

Is AMD Stock A Buy After Its Q3 Earnings Report?

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens

Polymarket Whale Dumps $3M Bet On Trump After Legendary Trader Advises Caution: 'Recommend Against Leverage And Reckless Gambling'

A Polymarket whale dumped around $3 million in bets on a Donald Trump victory after an influential trader hinted at taking profit on his positions tied to the former President.

What Happened: The whale known as ‘larpas‘ sold $3 million worth of shares in Trump, according to a Monday X post by on-chain tracking firm Arkham Intelligence.

This sale, which occurred within minutes after a post by renowned cryptocurrency trader Gigantic-Cassocked-Rebirth, or GCR, resulted in a 4% drop in Polymarket odds for Trump.

However, the odds recovered by 2% after the sale, returning to 58.6% as of this writing, data from Polymarket showed.

The sell-off followed GCR’s recommendation to traders to avoid leverage and “reckless gambling.” He said that prediction markets have a “right-wing skew” and it made sense to bet on Trump when his odds were less than 10%.

However, with his odds going over 65%, the trader stated that he was comfortable with capturing the meat of the move and thus took profits on his positions and proxy bets.

A well-known entity in cryptocurrency trading circles, GCR garnered fame during the bear market by successfully betting against Terra LUNA/USD ahead of the coin’s dramatic collapse in 2022.

Why It Matters: This sudden sale by ‘larpas’ comes amidst a flurry of activity on Polymarket related to the 2024 presidential election.

A new whale trader, ‘zxgngl,’ has become Trump’s biggest shareholder on the cryptocurrency-based betting platform and stands to gain almost $10 million if the former President wins a second term.

On the other hand, professional politics trader ‘Domer‘ has placed a bet of over $500,000 on Vice President Kamala Harris to win the election. The betting platform gave Harris a 55-60% chance of winning the presidency, despite the betting markets assuming a Trump victory.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toll Brothers New Luxury Home Community Coming Soon to Collegeville, Pennsylvania

COLLEGEVILLE, Pa., Nov. 04, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, announced its newest community, Charterfield Landing, is coming soon to Collegeville, Pennsylvania. This exclusive Toll Brothers neighborhood will feature modern home designs and 55 spacious home sites on approximately 57 acres. This future community will be located at 4037 MacCormack Way in Collegeville, and is anticipated to open for sale in winter 2025.

Charterfield Landing will offer an intimate community setting with home designs ranging in size from 3,520 to 4,658+ square feet. These single-family estate homes by Toll Brothers will feature open-concept floor plans with side-entry garages and basements, as well as the option for first-floor bedroom suites. Homes will be priced from $1.1 million.

Home buyers will experience one-stop shopping at the Toll Brothers Design Studio. The state-of-the-art Design Studio allows home buyers to choose from a wide array of selections to personalize their dream home with the assistance of Toll Brothers professional Design Consultants.

“We are excited to introduce Charterfield Landing, a new community that combines luxury living with a serene environment and convenient access to upscale amenities,” said John Dean, Division President of Toll Brothers in Pennsylvania. “Our thoughtfully designed homes and exceptional personalization options will provide homeowners with the perfect blend of comfort and convenience.”

The community’s proximity to premier shopping, dining, and entertainment options makes it an ideal location for those seeking a vibrant lifestyle. Toll Brothers homeowners will enjoy the peaceful and picturesque surroundings while being located just minutes from premier shopping and dining options at Providence Town Center.

For more information and to join the Toll Brothers interest list for Charterfield Landing, call (855) 872-8205 or visit TollBrothers.com/PA.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/35d90158-388c-417f-8c4d-afa041689542

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9c1acd5-18f0-4253-8a7c-793e4582f844

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PIZZA PIZZA ROYALTY CORP. ANNOUNCES THIRD QUARTER 2024 RESULTS

TORONTO, Nov. 4, 2024 /CNW/ – Pizza Pizza Royalty Corp. (the “Company”) PZA, which indirectly owns the Pizza Pizza and Pizza 73 Rights and Marks, released financial results today for the three months (“Quarter”) and nine months (“Period”) ended September 30, 2024.

Third Quarter highlights:

- Same store sales(2) decreased 5.3%

- Royalty Pool sales decreased 4.6%

- Adjusted earnings per share(5) decreased 6.3%

- Restaurant network increased by six net locations

Year-to-Date Quarter highlights:

- Same store sales(2) decreased 2.7%

- Royalty Pool sales decreased 1.0%

- Adjusted earnings per share(5) decreased 2.3%

- Restaurant network increased by 16 net locations

- Royalty Pool of restaurants for 2024 increased by 31 restaurants on January 1, 2024

“In the third quarter we continued to experience headwinds as we navigate ongoing reduced consumer spending and its impact on foodservice, particularly delivery channels. In this environment, we have seen ongoing shifts to pick up orders across pizza QSR, which is an opportunity for us with our best in class restaurant footprint,” said Paul Goddard, President and CEO of Pizza Pizza Limited. “Our sales recovery strategy continues to leverage our strong everyday value leadership position backed by ongoing enhancements to our menu, restaurants and digital customer experience.”

SALES

Royalty Pool System Sales for the Quarter decreased 4.6% to $155.8 million from $163.2 million in the same quarter last year. By brand, sales from the 672 Pizza Pizza restaurants in the Royalty Pool decreased 5.0% to $134.9 million for the Quarter compared to $142.0 million in the same quarter last year. Sales from the 102 Pizza 73 restaurants decreased 1.8% to $20.8 million for the Quarter compared to $21.2 million in the same quarter last year.

Royalty Pool System Sales for the Period decreased 1.0% to $460.0 million from $464.4 million in the same period last year. By brand, sales from the 672 Pizza Pizza restaurants in the Royalty Pool decreased 1.6% to $397.0 million for the Period compared to $403.3 million in the same period last year. Sales from the 102 Pizza 73 restaurants increased 3.1% to $63.0 million for the Period compared to $61.1 million in the same period last year.

For the Quarter and Period, the change in Royalty Pool System Sales is primarily driven by the offsetting effects of new restaurants added to the Royalty Pool on January 1, 2024 and the same store sales. The Royalty Pool System Sales for the Period also benefitted from the extra day of sales in February 2024 due to the leap year. Additionally, while the number of restaurants in the Pizza 73 Royalty Pool remains less than in 2019 when there were 104 restaurants, the negative impact on Royalty Pool System Sales due to prior year restaurant closures has been mitigated by the Make-Whole Carryover Amount.

SAME STORE SALES GROWTH (“SSSG”)

SSSG, the key driver of yield growth for shareholders of the Company, decreased 5.3% (2023 – increased 7.0%) for the Quarter, and decreased 2.7% for the Period (2023 – increased 9.8%). SSSG is not affected by the additional day during the leap year, as SSSG is calculated using a 13 and 39-week comparative basis.

|

SSSG |

Third Quarter (%) |

Period (%) |

||

|

2024 |

2023 |

2024 |

2023 |

|

|

Pizza Pizza |

-5.9 |

6.4 |

-3.6 |

10.2 |

|

Pizza 73 |

-1.5 |

11.3 |

3.4 |

7.1 |

|

Combined |

-5.3 |

7.0 |

-2.7 |

9.8 |

SSSG is driven by the change in the customer check and customer traffic, both of which are affected by changes in pricing and sales mix. During the Quarter and Period, consistent with the general market trends, at both brands restaurant traffic decreased due to the current economic situation and its impact on consumer discretionary spending. The average customer check was relatively flat as the brands introduced new value-oriented offerings.

MONTHLY DIVIDENDS AND WORKING CAPITAL RESERVE

The Company declared shareholder dividends of $5.7 million for the Quarter, or $0.2325 per share, compared to $5.5 million, or $0.225 per share, for the prior year comparable quarter. The payout ratio is 109% for the Quarter and was 93% in the prior year, comparable quarter.

The Company declared shareholder dividends of $17.1 million for the Period, or $0.6975 per share, compared to $16.2 million, or $0.6575 per share, for the prior year comparable period. The payout ratio is 113% for the Period and was 97% in the prior year, comparable period.

The Company’s policy is to distribute all available cash in order to maximize returns to shareholders over time, after allowing for reasonable reserves. Despite seasonal variations inherent to the restaurant industry, the Company’s policy is to make equal dividend payments to shareholders on a monthly basis in order to smooth out income to shareholders.

The Company’s working capital reserve, excluding the credit facility, is $6.3 million at September 30, 2024, which is a decrease of $1.9 million in the Period due to the decrease in royalty income and the 113% payout ratio. The reserve is available to stabilize dividends and fund other expenditures in the event of short- to medium-term variability in System Sales and, thus, the Company’s royalty income. The Company has historically targeted a payout ratio at or near 100% on an annualized basis.

EARNINGS PER SHARE (“EPS”)

Fully-diluted basic EPS decreased 6.4% to $0.233 for the Quarter compared to the prior year comparable quarter.

As compared to basic EPS, the Company considers adjusted EPS(5) to be a more meaningful indicator of the Company’s operating performance and, therefore, presents fully diluted, adjusted EPS. Adjusted EPS for the Quarter decreased 6.3% to $0.239 when compared to the same period in 2023, and decreased 2.3% to $0.707 for the Period.

RESTAURANT DEVELOPMENT

As announced earlier this year, the number of restaurants in the Company’s Royalty Pool increased by 31 locations to 774 on the January 1, 2024 Adjustment Date, and consists of 672 Pizza Pizza restaurants and 102 Pizza 73 restaurants. The number of restaurants in the Royalty Pool will remain unchanged through 2024.

During the Quarter, PPL opened five traditional and three non-traditional Pizza Pizza restaurants, and closed three non-traditional Pizza Pizza restaurants. PPL also opened one traditional Pizza 73 restaurant.

During the Period, PPL opened 13 traditional and 20 non-traditional Pizza Pizza restaurants, and closed three traditional and 16 non-traditional Pizza Pizza restaurants. PPL also opened one traditional and one non-traditional Pizza 73 restaurant.

PPL management expects to grow its traditional restaurant network by 3-4% and continue its renovation program through 2024.

Readers should note that the number of restaurants added to the Royalty Pool each year may differ from the number of restaurant openings and closings reported by PPL on an annual basis as the periods for which they are reported differ slightly.

CREDIT FACILITY

On June 19, 2024, in response to the cessation of the Canadian Dollar Offered Rate (“CDOR”), the benchmark interest rate on bankers’ acceptances, the credit facility was amended. The amendment transitioned the $47.0 million term loan from bankers’ acceptances to CORRA loans. The remaining terms and conditions are consistent with those of the previous credit facility. The fixed interest rate on the swaps remained unchanged with this amendment, and the effective interest rate remained at 2.685% for the Quarter and Period.

The Company is currently in the process of renegotiating the terms of its credit facility that matures in 2025. The Company expects the new facility to be similar in size, however at higher interest rates as compared to its existing facility.

SELECTED FINANCIAL HIGHLIGHTS

The following tables set out selected financial information and other data of Pizza Pizza Royalty Corp. (“PPRC” or the “Company”) and should be read in conjunction with the September 30, 2024 unaudited interim condensed consolidated financial statements of the Company (“Financial Statements”). Readers should note that the 2024 results are not directly comparable to the 2023 results due to there being 774 restaurants in the 2024 Royalty Pool compared to 743 restaurants in the 2023 Royalty Pool.

|

(in thousands of dollars, except number of restaurants, days in the year, per share amounts, and noted otherwise) |

Three months ended September 30, 2024 |

Three months ended September 30, 2023 |

Nine months ended |

Nine months ended |

||

|

Restaurants in Royalty Pool(1) |

774 |

743 |

774 |

743 |

||

|

Same store sales growth(2) |

-5.3 % |

7.0 % |

-2.7 % |

9.8 % |

||

|

Days in the Period |

92 |

92 |

274 |

273 |

||

|

System Sales reported by Pizza Pizza restaurants in the Royalty Pool(6) |

$ 134,924 |

$ 141,995 |

$ 397,046 |

$ 403,337 |

||

|

System Sales reported by Pizza 73 restaurants in the Royalty Pool(6) |

20,835 |

21,219 |

62,964 |

61,088 |

||

|

Total System Sales |

$ 155,759 |

$ 163,214 |

$ 460,010 |

$ 464,425 |

||

|

Royalty – 6% on Pizza Pizza System Sales |

$ 8,095 |

$ 8,520 |

$ 23,823 |

$ 24,200 |

||

|

Royalty – 9% on Pizza 73 System Sales |

1,876 |

1,910 |

5,667 |

5,498 |

||

|

Royalty income |

$ 9,971 |

$ 10,430 |

$ 29,490 |

$ 29,698 |

||

|

Interest paid on borrowings(3) (5) |

(322) |

(322) |

(961) |

(957) |

||

|

Administrative expenses |

(176) |

(123) |

(496) |

(414) |

||

|

Interest income |

93 |

95 |

317 |

263 |

||

|

Adjusted earnings available for distribution to the Company and Pizza Pizza Limited(5) |

$ 9,566 |

$ 10,080 |

$ 28,350 |

$ 28,590 |

||

|

Distribution on Class B and Class D Exchangeable Shares(4) |

(2,584) |

(2,316) |

(8,040) |

(6,747) |

||

|

Current income tax expense |

(1,714) |

(1,833) |

(5,071) |

(5,168) |

||

|

Adjusted earnings available for shareholder dividends(5) |

$ 5,268 |

$ 5,931 |

$ 15,239 |

$ 16,675 |

||

|

Add back: |

||||||

|

Distribution on Class B and Class D Exchangeable Shares(4) |

2,584 |

2,316 |

8,040 |

6,747 |

||

|

Adjusted earnings from operations(5) |

$ 7,852 |

$ 8,247 |

$ 23,279 |

$ 23,422 |

||

|

Adjusted earnings per share(5) |

$ 0.239 |

$ 0.255 |

$ 0.707 |

$ 0.724 |

||

|

Basic earnings per share |

$ 0.233 |

$ 0.249 |

$ 0.701 |

$ 0.709 |

||

|

Dividends declared by the Company |

$ 5,724 |

$ 5,539 |

$ 17,171 |

$ 16,187 |

||

|

Dividend per share |

$ 0.2325 |

$ 0.2250 |

$ 0.6975 |

$ 0.6575 |

||

|

Payout ratio(5) |

109 % |

93 % |

113 % |

97 % |

||

|

September 30, 2024 |

December 31, 2023 |

|||||

|

Working capital(5) (7) |

$ (40,672) |

$ 8,236 |

||||

|

Total assets |

$ 374,159 |

$ 370,092 |

||||

|

Total liabilities |

$ 75,277 |

$ 76,184 |

||||

|

(1) |

The number of restaurants for which the Pizza Pizza Royalty Limited Partnership (the “Partnership”) earns a royalty (“Royalty Pool”), as defined in the amended and restated Pizza Pizza license and royalty agreement (the “Pizza Pizza License and Royalty Agreement”) and the amended and restated Pizza 73 license and royalty agreement (the “Pizza 73 License and Royalty Agreement”) (together, the “License and Royalty Agreements”). For the 2023 fiscal year, the Royalty Pool includes 644 Pizza Pizza restaurants and 99 Pizza 73 restaurants. The number of restaurants added to the Royalty Pool each year may differ from the number of restaurant openings and closings reported by Pizza Pizza Limited (“PPL”) on an annual basis as the periods for which they are reported differ slightly. |

|

(2) |

Same store sales growth (“SSSG”) is a supplementary financial measure under NI 52-112 and therefore may not be comparable to similar measures presented by other issuers. SSSG means the change in Period’s gross revenue of a particular Pizza Pizza or Pizza 73 restaurant as compared to sales in the previous comparative Period, where the restaurant has been open at least 13 months. Additionally, for a Pizza 73 restaurant whose restaurant territory was adjusted due to an additional restaurant, the sales used to derive the Step-Out Payment (calculated as the difference between the average monthly Pizza 73 Royalty payment attributable to that Adjusted Restaurant in the 12 months immediately preceding the month in which the territory reduction occurs, less the Pizza 73 Royalty payment attributable to the restaurant in the current month) may be added to sales to arrive at SSSG. SSSG does not have any standardized meaning under International Financial Reporting Standards (“IFRS”). See “Exhibit One: Reconciliation of Non-IFRS Measures”. |

|

(3) |

The Company, indirectly through the Partnership, incurs interest expense on the $47 million outstanding bank loan. Interest expense also includes amortization of loan fees. |

|

(4) |

Represents the distribution to PPL from the Partnership on Class B and Class D Units of the Partnership. The Class B and D Units are exchangeable into common shares of the Company (“Shares”) based on the value of the Class B Exchange Multiplier and the Class D Exchange Multiplier at the time of exchange as defined in the License and Royalty Agreements, respectively, and represent 25.2% of the fully diluted Shares at September 30, 2024 (December 31, 2023 – 23.9%). During the quarter ended March 31, 2024, as a result of the final calculation of the equivalent Class B and Class D Share entitlements related to the January 1, 2023 Adjustment to the Royalty Pool, PPL was paid a distribution on additional equivalent Shares as if such Shares were outstanding as of January 1, 2023. Included in the three months ended March 31, 2024, is the payment of $288,000 in distributions to PPL pursuant to the true-up calculation (March 31, 2023 – PPL received $nil). |

|

(5) |

“Adjusted earnings available for distribution to the Company and Pizza Pizza Limited”, “Adjusted earnings from operations”, “Adjusted earnings available for shareholder dividends”, “Adjusted earnings per Share”, “Interest paid on borrowings”, “Payout Ratio”, and “Working Capital” are non-GAAP financial measures under NI 52-112. They do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. See “Exhibit One: Reconciliation of Non-IFRS Measures”. |

|

(6) |

System Sales (as defined in the License and Royalty Agreements) reported by Pizza Pizza and Pizza 73 restaurants include the gross sales of Pizza Pizza company-owned, jointly-controlled and franchised restaurants, and the monthly Make-Whole Payment, excluding sales and goods and service tax or similar amounts levied by any governmental or administrative authority. System Sales do not represent the consolidated operating results of the Company but are used to calculate the royalties payable to the Partnership as presented above. |

|

(7) |

Working capital includes the reclassification of the credit facility to current liabilities, see “Exhibit One: Reconciliation of Non-IFRS Measures – Working Capital”. |

A copy of the Company’s unaudited interim condensed consolidated financial statements and related Management’s Discussion and Analysis (“MD&A”) will be available at www.sedarplus.ca and www.pizzapizza.ca after the market closes on November 4, 2024.

As previously announced, the Company will host a conference call to discuss the results. The details of the conference call are as follows:

|

Date: |

November 4, 2024 |

|

Time: |

5:30 p.m. ET |

|

Call-in number: |

416-945-7677 / 888-699-1199 |

|

Recording call in number: |

289-819-1450 / 888-660-6345 |

|

Available until midnight, November 18, 2024 |

|

|

Conference ID: |

55147# |

A recording of the call will also be available on the Company’s website at www.pizzapizza.ca.

FORWARD-LOOKING STATEMENTS

Certain statements in this report, including information regarding the Company’s dividend policy, its ability to meet covenants and other financial obligations, and the potential business and financial impacts of the COVID-19 pandemic on the Company, PPL and its franchisees and restaurant operators and their ability to achieve their business objectives, constitute “forward-looking” statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. When used in this report, such statements include such words as “may”, “will”, “expect”, “believe”, “plan”, and other similar terminology in conjunction with a discussion of future events or operating or financial performance. These statements reflect management’s current expectations regarding future events and operating and financial performance and speak only as of the date of this MD&A. The Company does not assume any obligation to update any such forward looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. These forward-looking statements involve a number of risks and uncertainties. The following are some factors that could cause actual results to differ materially from those expressed in or underlying such forward-looking statements: changes in national and local business and economic conditions including those resulting from the COVID-19 pandemic (such as customers’ ability and willingness to visit restaurants and their perception of health and food safety issues, discretionary spending patterns and supply chain limitations, and the related financial impact on PPL and its franchisees and restaurant operators), impacts of legislation and governmental regulation, accounting policies and practices, competition, changes in demographic trends and changing consumer preferences, and the results of operations and financial condition of PPL. The foregoing list of factors is not exhaustive and should be read in conjunction with the other information included in the foregoing MD&A, the PPL financial statements for the period ended December 31, 2023 and the related MD&A and the Company’s Annual Information Form.

www.pizzapizza.ca and www.pizza73.com or www.sedarplus.ca.

Exhibit One: Reconciliation of Non-IFRS Measures

The Company’s earnings, as presented under IFRS includes non-cash items, such as deferred tax, that do not affect the Company’s business operations or its ability to pay dividends to shareholders. The Company believes its earnings are not the only, or most meaningful, measurement of the Company’s ability to pay dividends or measure the rate at which the Company is paying out its earnings. Therefore, the Company reports the following non-IFRS measures:

- Adjusted earnings available for distribution to the Company and PPL;

- Adjusted earnings from operations;

- Adjusted earnings available for shareholder dividends;

- Adjusted earnings per share (“EPS”);

- Payout Ratio; and

- Working Capital.

The Company believes that the above noted measures provide investors with more meaningful information regarding the amount of cash that the Company has generated to pay dividends, and, together with Interest Paid on Borrowings and SSSG, help illustrate the Company’s operating performance and highlight trends in the Company’s business. These measures are also frequently used by analysts, investors, and other interested parties in the evaluation of issuers in the Company’s sector, particularly those with a royalty-based model. The adjustments to net earnings as recorded under IFRS relate to non-cash items included in earnings and cash payments accounted for on the statement of financial position. Investors are cautioned, however, that this should not be construed as an alternative to net earnings as a measure of profitability. The method of calculating the Company’s NI 52-112 non-IFRS financial measures: Adjusted earnings available for distribution to the Company and Pizza Pizza Limited, Adjusted earnings from operations, Adjusted earnings available for shareholder dividends, Adjusted EPS, Payout Ratio, Working Capital, Interest Paid on Borrowings and SSSG for the purposes of this MD&A may differ from that used by other issuers and, accordingly, these measures may not be comparable to similar measures used by other issuers.

The table below reconciles the following to “Earnings for the period before income taxes” which is the most directly comparable measure calculated in accordance with IFRS:

- Adjusted earnings available for distribution to the Company and Pizza Pizza Limited;

- Adjusted earnings from operations; and

- Adjusted earnings available for shareholder dividends.

|

(in thousands of dollars, except number of shares) |

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

|

|

Earnings for the period before income taxes |

9,566 |

9,557 |

9,227 |

10,084 |

|

|

Adjusted earnings available for distribution to the Company and Pizza Pizza Limited |

9,566 |

9,557 |

9,227 |

10,084 |

|

|

Current income tax expense |

(1,714) |

(1,712) |

(1,646) |

(1,834) |

|

|

Adjusted earnings from operations |

7,852 |

7,845 |

7,581 |

8,250 |

|

|

Less: Distribution on Class B and Class D Exchangeable Shares |

(2,584) |

(2,584) |

(2,872) |

(2,370) |

|

|

Adjusted earnings available for shareholder dividends |

5,268 |

5,261 |

4,709 |

5,880 |

|

|

Weighted average Shares – diluted |

32,908,631 |

32,908,631 |

32,908,631 |

32,337,580 |

|

|

(in thousands of dollars, except number of shares) |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

|

|

Earnings for the period before income taxes |

10,080 |

9,742 |

8,768 |

9,350 |

|

|

Adjusted earnings available for distribution to the Company and Pizza Pizza Limited |

10,080 |

9,742 |

8,768 |

9,350 |

|

|

Current income tax expense |

(1,833) |

(1,766) |

(1,568) |

(1,679) |

|

|

Adjusted earnings from operations |

8,247 |

7,976 |

7,200 |

7,671 |

|

|

Less: Distribution on Class B and Class D Exchangeable Shares |

(2,316) |

(2,255) |

(2,176) |

(2,059) |

|

|

Adjusted earnings available for shareholder dividends |

5,931 |

5,721 |

5,024 |

5,612 |

|

|

Weighted average Shares – diluted |

32,337,580 |

32,337,580 |

32,337,580 |

32,177,276 |

|

The Basic EPS and the Adjusted EPS calculations are based on fully diluted weighted average shares, and both include PPL’s Class B and Class D Exchangeable Shares since they are exchangeable into and economically equivalent to the Shares. See “Adjusted EPS”.

Adjusted EPS is calculated by dividing Adjusted earnings from operations, as explained above, by the fully diluted weighted average shares.

|

Basic EPS is adjusted as follows: |

Three months ended |

Nine months ended |

||

|

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

|

|

Basic EPS |

$ 0.233 |

$ 0.249 |

$ 0.233 |

$ 0.249 |

|

Adjustments: |

||||

|

Deferred tax expense |

0.006 |

0.006 |

0.006 |

0.006 |

|

Adjusted EPS |

$ 0.239 |

$ 0.255 |

$ 0.239 |

$ 0.255 |

Payout Ratio is a non-IFRS financial measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company presents the Payout Ratio to illustrate the earnings being returned to shareholders. The Company’s Payout Ratio is calculated by dividing the dividends declared to shareholders by the adjusted earnings from operations, after paying the distribution on Class B and Class D Exchangeable Shares, in that same period.

|

Three months ended |

Nine months ended |

|||

|

(in thousands of dollars, except as noted otherwise) |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

|

Dividends declared to shareholders |

5,724 |

5,539 |

5,724 |

5,539 |

|

Adjusted earnings available for shareholder dividends |

5,268 |

5,931 |

5,268 |

5,931 |

|

Payout Ratio |

109 % |

93 % |

109 % |

93 % |

Working Capital is defined as total current assets less total current liabilities. The Company views working capital as a measure for assessing overall liquidity and its ability to stabilize dividends and fund unusual expenditures in the event of short- to medium-term variability in Royalty Pool System Sales. During the Period, the borrowings of $47 million have been reclassified to current liabilities as the facility is scheduled to come due in April 2025. Excluding the impact of the borrowings, the working capital reserve would be $6.3 million as compared to $8.2 million at December 31, 2023. The use of the working capital during the Period relates to the payout ratio of 113%.

|

(in thousands of dollars) |

September 30, 2024 |

December 31, 2023 |

|

|

Total current assets |

9,729 |

12,549 |

|

|

Less: Total current liabilities |

50,401 |

4,313 |

|

|

Working Capital |

(40,672) |

8,236 |

SSSG is a key indicator used by the Company to measure performance against internal targets and prior period results. SSSG is commonly used by financial analysts and investors to compare PPL to other QSR brands. SSSG is defined as the change in period gross revenue of Pizza Pizza and Pizza 73 restaurants as compared to sales in the previous comparative period, where the restaurant has been open at least 13 months. Additionally, for a Pizza 73 restaurant whose restaurant territory was adjusted due to an additional restaurant, the sales used to derive the Step-Out Payment may be added to sales to arrive at SSSG. It is a key performance indicator for the Company as this measure excludes sales fluctuations due to store closings, permanent relocations and chain expansion.

The following table calculates SSSG by reconciling Royalty Pool System Sales, based on calendar periods, to PPL’s 13-week sales reporting period used in calculating same store sales.

|

Three months ended |

Nine months ended |

|||

|

(in thousands of dollars) |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

|

Total Royalty Pool System Sales |

155,759 |

163,214 |

460,010 |

464,425 |

|

Adjustments for stores not in both periods, Make-Whole Carryover Amount, Step-Out payments, and the impact of calendar reporting |

(4,141) |

(3,056) |

(11,440) |

(3,461) |

|

Same Store Sales |

151,618 |

160,158 |

448,570 |

460,964 |

|

SSSG |

-5.3 % |

7.0 % |

-2.7 % |

9.8 % |

SOURCE Pizza Pizza Royalty Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/04/c0938.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/04/c0938.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding KE Holdings's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on KE Holdings BEKE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BEKE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 16 uncommon options trades for KE Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 50% bullish and 37%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $474,893, and 10 are calls, for a total amount of $499,665.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.0 to $40.0 for KE Holdings during the past quarter.

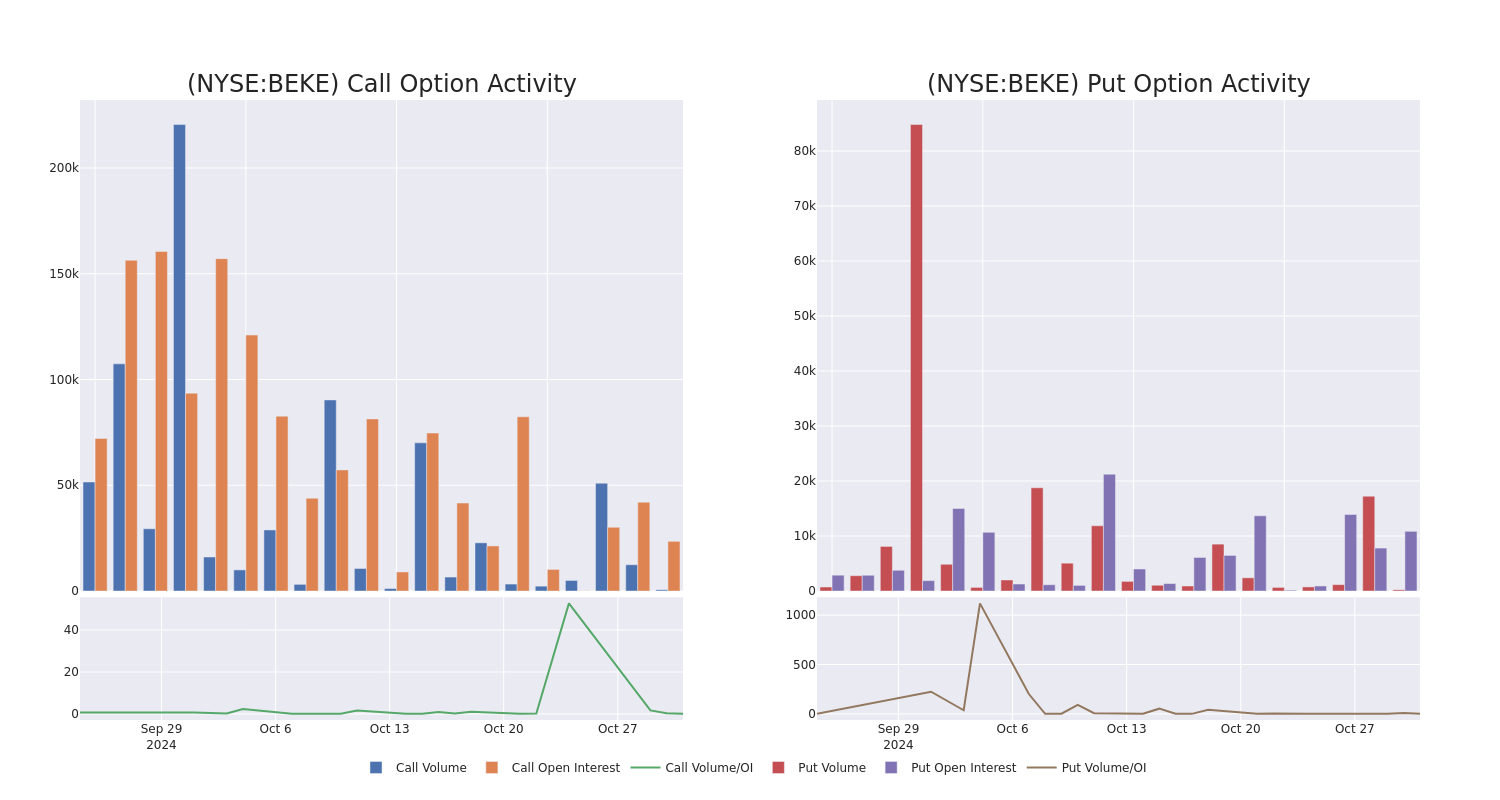

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for KE Holdings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of KE Holdings’s whale trades within a strike price range from $17.0 to $40.0 in the last 30 days.

KE Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BEKE | PUT | SWEEP | BEARISH | 04/17/25 | $2.7 | $2.64 | $2.69 | $21.00 | $178.6K | 575 | 706 |

| BEKE | PUT | SWEEP | BEARISH | 01/17/25 | $1.85 | $1.67 | $1.7 | $21.00 | $85.0K | 3.9K | 500 |

| BEKE | CALL | SWEEP | BULLISH | 01/17/25 | $1.18 | $1.17 | $1.18 | $27.00 | $83.5K | 8.4K | 2.4K |

| BEKE | CALL | SWEEP | BULLISH | 01/16/26 | $1.98 | $1.76 | $1.98 | $40.00 | $66.3K | 367 | 500 |

| BEKE | CALL | SWEEP | BULLISH | 04/17/25 | $6.5 | $6.25 | $6.5 | $17.00 | $65.0K | 1.5K | 30 |

About KE Holdings

KE Holdings, or Beike, is a large residential real estate sales and rental brokerage company in China. Founded in 2001, the company operates through self-owned Lianjia stores in Beijing and Shanghai and connected third-party agencies including franchise brand Deyou in other cities, with commissions charged on existing-home and new-home transactions. Leveraging an online-offline hybrid model, Beike also attract clients through its namesake online marketplace. The company tapped into home renovation services by acquiring Shengdu Home Decoration in 2022. As of the end of 2023, Beike’s cofounders collectively control the company, while Tencent and its affiliates share 8% of voting power.

Following our analysis of the options activities associated with KE Holdings, we pivot to a closer look at the company’s own performance.

Where Is KE Holdings Standing Right Now?

- With a trading volume of 4,609,762, the price of BEKE is up by 0.27%, reaching $22.15.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 11 days from now.

What Analysts Are Saying About KE Holdings

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for KE Holdings, targeting a price of $24.

* An analyst from B of A Securities upgraded its action to Buy with a price target of $28.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest KE Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Super Micro Stock Get Delisted? Dell Stock Gains Amid Uncertainty.

Wall Street analysts are weighing the chances that data center specialist Super Micro Computer (SMCI) could be delisted from the Nasdaq exchange over its accounting issues. The uncertainty has hurt Super Micro stock and boosted shares of rival Dell Technologies (DELL).

Last Wednesday, Super Micro disclosed that Ernst & Young had resigned as its accountant after citing concerns about the company’s financial reporting. That news was on top of a delay in filing its annual 10-K report and a possible investigation by the U.S. Department of Justice.

↑

X

Taking Emotion Out: How This Investment Advisor Applies The IBD Methodology In Trading

“It arguably appears to be an uphill battle for SMCI to remain listed at this point,” Wedbush Securities analyst Matt Bryson said in a client note Monday. Super Micro previously was delisted in 2018 for delays in filing financial reports.

The company has until Nov. 20 to file a plan to return to compliance with Nasdaq requirements.

Bryson reiterated his neutral rating on Super Micro stock but slashed his price target to 32 from 62. Super Micro shares hit a record high of 122.90 on March 8.

On the stock market today, Super Micro stock fell a fraction to close at 26.03. Meanwhile, Dell stock slid 0.8% to 129.85. Last week, Dell stock rose 6.8% while SMCI stock tumbled 44.9%.

“We have had mixed feedback regarding whether concerns around SMCI late filing and/or the reported DOJ investigation might be impacting customer’s decisions,” Bryson said. “But net, given the above, we are more cautious around SMCI’s ability to meet/exceed fiscal Q1 expectations or guide to consensus for fiscal Q2.”

Super Micro Stock: Business Update Coming

San Jose, Calif.-based Super Micro plans to provide a fiscal first-quarter business update after the market close Tuesday.

Meanwhile, Dell is poised to gain market share in data center servers for artificial intelligence applications, Melius Research analyst Ben Reitzes said in a client note Monday.

“Make no mistake, Super Micro isn’t just Dell’s competitor — it’s ‘the’ competitor for AI servers,” Reitzes said. “It’s the one that Elon Musk plays off Dell — and the one we always cared about most in terms of engineering and cooling chops (Dell and Super Micro split share with Elon).”

AI data center customers are starting to become concerned about Super Micro’s operational issues, Reitzes said.

“Many of SMCI’s customers have aspirations of going public (and they) simply can’t afford any nonsense into their make-or-break capital-raising processes for 2025,” he said.

AI chipmaker Nvidia (NVDA) reportedly has moved some of its Super Micro orders to other suppliers, including Taiwan-based Gigabyte and ASRock, DigiTimes said Monday. Nvidia is seeking to maintain supply chain stability for AI servers, the report said.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Vertiv Finds Gold In AI Data Center Plumbing. ‘This Is A Long-Term Trend,’ Says CEO.

Apple Stock Sinks On Disappointing Sales Outlook

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens