Will Super Micro Stock Get Delisted? Dell Stock Gains Amid Uncertainty.

Wall Street analysts are weighing the chances that data center specialist Super Micro Computer (SMCI) could be delisted from the Nasdaq exchange over its accounting issues. The uncertainty has hurt Super Micro stock and boosted shares of rival Dell Technologies (DELL).

Last Wednesday, Super Micro disclosed that Ernst & Young had resigned as its accountant after citing concerns about the company’s financial reporting. That news was on top of a delay in filing its annual 10-K report and a possible investigation by the U.S. Department of Justice.

↑

X

Taking Emotion Out: How This Investment Advisor Applies The IBD Methodology In Trading

“It arguably appears to be an uphill battle for SMCI to remain listed at this point,” Wedbush Securities analyst Matt Bryson said in a client note Monday. Super Micro previously was delisted in 2018 for delays in filing financial reports.

The company has until Nov. 20 to file a plan to return to compliance with Nasdaq requirements.

Bryson reiterated his neutral rating on Super Micro stock but slashed his price target to 32 from 62. Super Micro shares hit a record high of 122.90 on March 8.

On the stock market today, Super Micro stock fell a fraction to close at 26.03. Meanwhile, Dell stock slid 0.8% to 129.85. Last week, Dell stock rose 6.8% while SMCI stock tumbled 44.9%.

“We have had mixed feedback regarding whether concerns around SMCI late filing and/or the reported DOJ investigation might be impacting customer’s decisions,” Bryson said. “But net, given the above, we are more cautious around SMCI’s ability to meet/exceed fiscal Q1 expectations or guide to consensus for fiscal Q2.”

Super Micro Stock: Business Update Coming

San Jose, Calif.-based Super Micro plans to provide a fiscal first-quarter business update after the market close Tuesday.

Meanwhile, Dell is poised to gain market share in data center servers for artificial intelligence applications, Melius Research analyst Ben Reitzes said in a client note Monday.

“Make no mistake, Super Micro isn’t just Dell’s competitor — it’s ‘the’ competitor for AI servers,” Reitzes said. “It’s the one that Elon Musk plays off Dell — and the one we always cared about most in terms of engineering and cooling chops (Dell and Super Micro split share with Elon).”

AI data center customers are starting to become concerned about Super Micro’s operational issues, Reitzes said.

“Many of SMCI’s customers have aspirations of going public (and they) simply can’t afford any nonsense into their make-or-break capital-raising processes for 2025,” he said.

AI chipmaker Nvidia (NVDA) reportedly has moved some of its Super Micro orders to other suppliers, including Taiwan-based Gigabyte and ASRock, DigiTimes said Monday. Nvidia is seeking to maintain supply chain stability for AI servers, the report said.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Vertiv Finds Gold In AI Data Center Plumbing. ‘This Is A Long-Term Trend,’ Says CEO.

Apple Stock Sinks On Disappointing Sales Outlook

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens

Vertex Beats Expectations, But Needs More To Drive 'Another Leg Of Stock Upside'

Vertex Pharmaceuticals (VRTX) beat Wall Street’s third-quarter expectations late Monday, but an analyst says Vertex stock needs more than that “to drive another leg of stock upside.”

↑

X

How To Buy Stocks: Flat Base Chart Pattern

This year, Vertex expects to launch a next-generation treatment for cystic fibrosis and a treatment for moderate-to-severe pain. The Food and Drug Administration will make approval decisions on those two drugs in January.

“We still believe pipeline success would be needed to drive another leg of stock upside and have less confidence in appreciation potential from upcoming readouts, though continued CF performance will likely reaffirm to the market that the high-margin, long-duration, core franchise continues to justify a premium,” RBC Capital Markets analyst Brian Abrahams said in a report.

In after-hours trades, Vertex stock rose nearly 1% to 477.13. Shares are forming a flat base with a buy point at 510.63, according to MarketSurge.

Vertex Stock: Casgevy Contribution

During the September quarter, Vertex earned an adjusted $4.38 per share on $2.77 billion in sales. Earnings climbed more than 7% and beat forecasts for $4.08 a share. Sales rose 12% to $2.77 billion, beating expectations for $2.69 billion, according to FactSet.

The lion’s share of the sales came from Trikafta, Vertex’s latest-generation CF treatment. Sales easily topped expectations at nearly $2.59 billion.

Other products, including Vertex’s Crispr Therapeutics (CRSP)-partnered gene-editing treatment for sickle cell disease and beta thalassemia, brought in $187 million. Analysts expected $184 million from Vertex’s other products.

The sickle cell and beta thalassemia drug, Casgevy, costs about $1.6 million per patient, Piper Sandler analyst Christopher Raymond said in a report. But Vertex doesn’t break out which sales came from Casgevy and which came from other cystic fibrosis drugs like Kalydeco, Orkambi and Symdeko.

For the year, Vertex raised its sales outlook to $10.8 billion to $10.9 billion. Analysts called for earnings of 33 cents a share and $10.76 billion in sales.

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Viking Tops Novo As Obesity Pill Brawl Continues, But Shares Dive

TG Therapeutics Crashes — Reversing A Breakout — After Missing ‘Whisper’ Expectations

Stocks To Buy And Watch: Top IPOs, Big And Small Caps, Growth Stocks

Sun Life Reports Third Quarter 2024 Results

|

Sun Life Financial Inc. (“SLF Inc.”), its subsidiaries and, where applicable, its joint ventures and associates are collectively referred to as “the Company”, “Sun Life”, “we”, “our”, and “us”. We manage our operations and report our financial results in five business segments: Canada, United States (“U.S.”), Asset Management, Asia, and Corporate. The information in this document is based on the unaudited interim financial results of SLF Inc. for the period ended September 30, 2024 and should be read in conjunction with the interim management’s discussion and analysis (“MD&A”) and our unaudited interim consolidated financial statements and accompanying notes (“Interim Consolidated Financial Statements”) for the period ended September 30, 2024, prepared in accordance with International Financial Reporting Standards (“IFRS”). We report certain financial information using non-IFRS financial measures. For more details, refer to the Non-IFRS Financial Measures section in this document. Additional information relating to SLF Inc. is available on www.sunlife.com under Investors – Financial results and reports, on the SEDAR+ website at www.sedarplus.ca, and on the U.S. Securities and Exchange Commission’s website at www.sec.gov. Reported net income (loss) refers to Common shareholders’ net income (loss) determined in accordance with IFRS. Unless otherwise noted, all amounts are in Canadian dollars. Amounts in this document may be impacted by rounding. Certain 2023 results in the Drivers of Earnings and Contractual Service Margin (“CSM”) Movement Analysis were refined to more accurately reflect how the business is managed. |

TORONTO, Nov. 4, 2024 /PRNewswire/ – Sun Life Financial Inc. SLF SLF announced its results for the third quarter ended September 30, 2024.

- Underlying net income(1) of $1,016 million increased $86 million or 9% from Q3’23; underlying return on equity (“ROE”)(1) was 17.9%.

- Wealth & asset management underlying net income(1): $474 million, up $17 million or 4%.

- Group – Health & Protection underlying net income(1): $345 million, up $60 million or 21%.

- Individual – Protection underlying net income(1): $306 million, up $9 million or 3%.

- Corporate expenses & other(1): $(109) million net loss, consistent with the prior year.

- Reported net income of $1,348 million increased $477 million or 55% from Q3’23; reported ROE(1) was 23.8%.

- Assets under management (“AUM”)(1) of $1,515 billion increased $175 billion or 13% from Q3’23.

- Increase to common share dividend from $0.81 to $0.84 per share.

“Sun Life had a strong quarter with more than $1 billion in both underlying and reported net income, showcasing the strength and diversity of our businesses,” said Kevin Strain, President and CEO of Sun Life. “These results reflect our leadership positions in asset management and insurance, driven by strong insurance growth, and a return on equity of close to 18 percent. Our results demonstrate our resolve to deliver on our Purpose to help Clients achieve lifetime financial security and live healthier lives.”

Financial and Operational Highlights

|

Quarterly results |

Year-to-date |

||||

|

Profitability |

Q3’24 |

Q3’23 |

2024 |

2023 |

|

|

Underlying net income ($ millions)(1) |

1,016 |

930 |

2,891 |

2,745 |

|

|

Reported net income – Common shareholders ($ millions) |

1,348 |

871 |

2,812 |

2,337 |

|

|

Underlying EPS ($)(1)(2) |

1.76 |

1.59 |

4.98 |

4.68 |

|

|

Reported EPS ($)(2) |

2.33 |

1.48 |

4.83 |

3.97 |

|

|

Underlying ROE(1) |

17.9 % |

17.7 % |

17.2 % |

17.6 % |

|

|

Reported ROE(1) |

23.8 % |

16.6 % |

16.8 % |

14.9 % |

|

|

Growth |

Q3’24 |

Q3’23 |

2024 |

2023 |

|

|

Wealth sales & asset management gross flows ($ millions)(1) |

41,915 |

39,324 |

135,075 |

128,070 |

|

|

Group – Health & Protection sales ($ millions)(1)(3) |

445 |

374 |

1,467 |

1,483 |

|

|

Individual – Protection sales ($ millions)(1) |

730 |

669 |

2,240 |

1,784 |

|

|

Assets under management (“AUM”) ($ billions)(1) |

1,515 |

1,340 |

1,515 |

1,340 |

|

|

New business Contractual Service Margin (“CSM”) ($ millions)(1) |

383 |

370 |

1,167 |

872 |

|

|

Financial Strength |

Q3’24 |

Q3’23 |

|||

|

LICAT ratios (at period end)(4) |

|||||

|

Sun Life Financial Inc. |

152 % |

147 % |

|||

|

Sun Life Assurance(5) |

147 % |

138 % |

|||

|

Financial leverage ratio (at period end)(1)(6) |

20.4 % |

21.8 % |

|||

|

___________ |

|

|

(1) |

Represents a non-IFRS financial measure. For more details, see the Non-IFRS Financial Measures section in this document and in the Q3’24 MD&A. |

|

(2) |

All earnings per share (“EPS”) measures refer to fully diluted EPS, unless otherwise stated. |

|

(3) |

Prior period amounts related to U.S. Dental sales have been restated to reflect new information. |

|

(4) |

Life Insurance Capital Adequacy Test (“LICAT”) ratio. Our LICAT ratios are calculated in accordance with the OSFI-mandated guideline, Life Insurance Capital Adequacy Test. |

|

(5) |

Sun Life Assurance Company of Canada (“Sun Life Assurance”) is SLF Inc.’s principal operating life insurance subsidiary. |

|

(6) |

The calculation for the financial leverage ratio includes the CSM balance (net of taxes) in the denominator. The CSM (net of taxes) was $9.9 billion as at September 30, 2024 (September 30, 2023 – $9.3 billion). |

Financial and Operational Highlights – Quarterly Comparison (Q3’24 vs. Q3’23)

|

($ millions) |

Q3’24 |

|||||

|

Underlying net income by business type(1)(2): |

Sun Life |

Asset |

Canada |

U.S. |

Asia |

Corporate |

|

Wealth & asset management |

474 |

344 |

101 |

— |

29 |

— |

|

Group – Health & Protection |

345 |

— |

172 |

173 |

— |

— |

|

Individual – Protection |

306 |

— |

102 |

46 |

158 |

— |

|

Corporate expenses & other |

(109) |

— |

— |

— |

(17) |

(92) |

|

Underlying net income(1) |

1,016 |

344 |

375 |

219 |

170 |

(92) |

|

Reported net income – Common shareholders |

1,348 |

644 |

382 |

339 |

32 |

(49) |

|

Change in underlying net income (% year-over-year) |

9 % |

4 % |

11 % |

18 % |

2 % |

nm(3) |

|

Change in reported net income (% year-over-year) |

55 % |

140 % |

5 % |

157 % |

(85) % |

nm(3) |

|

Wealth sales & asset management gross flows(1) |

41,915 |

36,259 |

3,755 |

— |

1,901 |

— |

|

Group – Health & Protection sales(1) |

445 |

— |

124 |

300 |

21 |

— |

|

Individual – Protection sales(1) |

730 |

— |

112 |

— |

618 |

— |

|

Change in wealth sales & asset management gross flows (% year-over-year) |

7 % |

6 % |

11 % |

— |

14 % |

— |

|

Change in group sales (% year-over-year) |

19 % |

— |

4 % |

26 % |

31 % |

— |

|

Change in individual sales (% year-over-year) |

9 % |

— |

(24) % |

— |

19 % |

— |

|

(1) |

Represents a non-IFRS financial measure. For more details, see the Non-IFRS Financial Measures section in this document and in the Q3’24 MD&A. |

|

(2) |

For more information about the business types in Sun Life’s business groups, see section A – How We Report Our Results in the Q3’24 MD&A. |

|

(3) |

Not meaningful. |

Underlying net income(1) of $1,016 million increased $86 million or 9% from prior year, driven by:

- Wealth & asset management(1) up $17 million: Higher fee income in Asset Management, Asia, and Canada, partially offset by unfavourable credit experience in Canada.

- Group – Health & Protection(1)(2) up $60 million: Strong business growth in U.S. Group Benefits and Canada, higher fee-based income in Canada, and improved group life mortality experience in the U.S., partially offset by lower U.S. Dental results.

- Individual – Protection(1)(2) up $9 million: Business growth in Asia and Canada partially offset by unfavourable mortality experience in Asia.

- Corporate expenses & other(1) were in line with prior year.

Reported net income of $1,348 million increased $477 million or 55% from prior year, driven by:

- A decrease in SLC Management’s estimated acquisition-related liabilities(3); and

- The increase in underlying net income.

- Favourable equity market impacts and improved real estate experience(4) were offset by interest rate impacts.

Underlying ROE was 17.9% and reported ROE was 23.8% (Q3’23 – 17.7% and 16.6%, respectively). SLF Inc. ended the quarter with a LICAT ratio of 152%.

|

__________ |

|

|

(1) |

Refer to section C – Profitability in the Q3’24 MD&A for more information on notable items attributable to reported and underlying net income items and the Non-IFRS Financial Measures in this document for a reconciliation between reported net income and underlying net income. For more information about the business types in Sun Life’s operating segments/business groups, see section A – How We Report Our Results in the Q3’24 MD&A. |

|

(2) |

Effective Q1’24, reflects a refinement in the allocation methodology for expenses from Individual – Protection to Group – Health & Protection business types in the U.S. business group. |

|

(3) |

Reflects a decrease of $334 million in estimated future payments for acquisition-related contingent considerations and options to purchase remaining ownership interests of SLC Management affiliates (Q3’23 – an increase of $42 million). For additional information, refer to Note 5 of our Interim Consolidated Financial Statements for the period ended September 30, 2024. |

|

(4) |

Real estate experience reflects the difference between the actual value of real estate investments compared to management’s longer-term expected returns supporting insurance contract liabilities (“real estate experience”). |

Business Group Highlights

Asset Management: A global leader in both public and alternative asset classes through MFS and SLC Management

Asset Management underlying net income of $344 million increased $14 million or 4% from prior year, driven by:

- MFS(1) up $20 million (up US$11 million): Higher fee income from higher average net assets (“ANA”) partially offset by higher expenses. The MFS pre-tax net operating profit margin(2) was 40.5% for Q3’24, compared to 40.8% in the prior year.

- SLC Management down $6 million: Higher fee-related earnings more than offset by a favourable tax rate(3) in the prior year and lower net seed investment income. Fee-related earnings(2) increased 6% driven by higher AUM, reflecting strong capital raising and deployment across the platform, partially offset by higher expenses. Fee-related earnings margin(2) was 24.2% for Q3’24, compared to 23.8% in the prior year.

Reported net income of $644 million increased $376 million or 140% from prior year, driven by a decrease in SLC Management’s estimated acquisition-related liabilities(4), partially offset by fair value changes in management’s ownership of MFS shares.

Foreign exchange translation led to an increase of $5 million in underlying net income and an increase of $11 million in reported net income.

Asset Management ended Q3’24 with $1,103 billion of AUM(2), consisting of $873 billion (US$645 billion) in MFS and $230 billion in SLC Management. Total Asset Management net outflows of $17.4 billion in Q3’24 reflected MFS net outflows of $19.1 billion (US$14.0 billion) partially offset by SLC Management net inflows of $1.7 billion.

Asset Management experienced solid fixed income flows, with MFS generating US$1.1 billion in net inflows for this asset class during the quarter. Further, SLC Management delivered strong capital raising in the quarter, driven by a large strategic multi-platform mandate where they were chosen to manage approximately $3.7 billion of fixed income investments.

On August 22, 2024, we acquired the remaining 20% interest in InfraRed Capital Partners (“lnfraRed”). Since our initial acquisition of the majority stake in InfraRed on July 1, 2020, InfraRed has broadened SLC Management’s suite of alternative investment solutions while also creating the opportunity for InfraRed to access North American investors through our distribution networks, contributing over $17.4 billion in AUM(2). InfraRed continues to invest in early-stage companies with long-term growth potential and build its active pipeline of growth and core yielding opportunities through co-investments. In the third quarter, InfraRed invested, directly and through co-investments, in several opportunities in the energy and fibre communications sectors, with co-investments totalling $340 million over the last 18 months.

Canada: A leader in health, wealth, and insurance

Canada underlying net income of $375 million increased $37 million or 11% from prior year, reflecting:

- Wealth & asset management down $15 million: Unfavourable credit experience partially offset by higher fee income driven by higher AUM.

- Group – Health & Protection up $36 million: Business growth and higher fee-based income.

- Individual – Protection up $16 million: Business growth and higher investment contributions.

Reported net income of $382 million increased $17 million or 5% from prior year, driven by the increase in underlying net income and favourable market-related impacts, partially offset by unfavourable ACMA(5) impacts. The market-related impacts were primarily from favourable equity market impacts and improved real estate experience, partially offset by interest rate impacts.

Canada’s sales(6):

- Wealth sales & asset management gross flows of $4 billion were up 11%, driven by higher mutual fund sales in Individual Wealth, partially offset by lower defined benefit solution sales in Group Retirement Services (“GRS”) and guaranteed product sales in Individual Wealth.

- Group – Health & Protection sales of $124 million were up 4%, driven by higher health sales.

- Individual – Protection sales of $112 million were down 24%, reflecting lower third-party sales.

In the third quarter, we accelerated our wealth strategy of providing innovative product solutions and expanding distribution capabilities with the launch of MyRetirement Income, an innovative first for Canadians that aims to provide retirees with a reliable source of income, while maintaining flexibility and the potential for continued investment growth. This solution leverages automated calculations to help ease the transition from saving to drawing income in retirement so that Clients can focus on living their best retirement. Additionally, we have launched our securities investment dealer platform, Sun Life Canada Securities Inc. (“SLCSI”). Our wealth offerings in SLCSI will broaden our Clients’ access to wealth solutions and help them achieve lifetime financial security.

|

__________ |

|

|

(1) |

MFS Investment Management (“MFS”). |

|

(2) |

Represents a non-IFRS financial measure. For more details, see the Non-IFRS Financial Measures section in this document and in the Q3’24 MD&A. |

|

(3) |

Underlying net income in the prior year included favourable adjustments related to tax filings. |

|

(4) |

Reflects a decrease of $334 million in estimated future payments for acquisition-related contingent considerations and options to purchase remaining ownership interests of SLC Management affiliates (Q3’23 – an increase of $42 million). For additional information, refer to Note 5 of our Interim Consolidated Financial Statements for the period ended September 30, 2024. |

|

(5) |

Assumption changes and management actions (“ACMA”). |

|

(6) |

Compared to the prior year. |

U.S.: A leader in health and benefits

U.S. underlying net income of US$161 million increased US$21 million or 15% ($219 million increased $34 million or 18%) from prior year, driven by:

- Group – Health & Protection(1) up US$15 million: Strong business growth in Group Benefits and improved group life mortality experience partially offset by lower Dental results. Dental results were impacted by a continued acuity shift reflecting higher average utilization in remaining members as a result of Medicaid redeterminations following the end of the Public Health Emergency, partially offset by Medicaid pricing updates and claim and expense management actions.

- Individual – Protection(1) up US$6 million: Higher net investment results, including a partial offset from unfavourable credit experience.

Reported net income of US$250 million increased US$145 million or 138% ($339 million increased $207 million or 157%) from prior year, driven by favourable ACMA impacts, the increase in underlying net income, and lower DentaQuest integration costs, partially offset by market-related impacts primarily from interest rate impacts and unfavourable real estate experience.

Foreign exchange translation led to an increase of $4 million in underlying net income and an increase of $6 million in reported net income.

U.S. group sales of US$219 million were up 22% ($300 million, up 26%), driven by higher Dental and employee benefits sales. Dental sales reflected higher Medicaid and commercial dental sales.

As a leader in health and benefits in the U.S., helping members access the healthcare and coverage they need is at the core of our strategy. We recently reached the milestone of becoming the largest dental benefits provider in the U.S.(2) based on membership with approximately 35 million members. This enables us to reach even more communities throughout the U.S. including underserved areas.

We are also making it faster and easier for members to use their benefits. In the third quarter, we enhanced claims connectivity across our disability, supplemental health, stop-loss, and dental products. When a member has more than one of these products and files a single claim, all other applicable Sun Life benefits will be processed automatically, ensuring members receive all the coverage they elected without having to file additional claims. This creates an advantage for employers who buy multiple Sun Life U.S. products by ensuring members receive all of their benefits quickly and seamlessly when they need it most.

Asia: A regional leader focused on fast-growing markets

Asia underlying net income of $170 million increased $4 million or 2% from prior year, driven by:

- Wealth & asset management up $18 million: Higher fee income primarily driven by higher AUM.

- Individual – Protection down $17 million: Good sales momentum and in-force business growth, and contributions from joint ventures, were more than offset by unfavourable mortality experience, lower earnings on surplus, and higher expenses primarily reflecting continued investments in the business.

- Regional office expenses & other $3 million improved net loss primarily driven by lower incentive compensation.

Reported net income of $32 million decreased $179 million or 85% from prior year, reflecting unfavourable ACMA and market-related impacts. The market-related impacts were primarily from interest rate impacts partially offset by improved real estate experience and favourable equity market impacts.

Foreign exchange translation led to an increase of $2 million in underlying net income and an increase of $4 million in reported net income.

Asia’s sales(3):

- Individual sales of $618 million were up 19%, driven by higher sales in Hong Kong reflecting expanded distribution capabilities, and India reflecting growth mainly in the bancassurance channel, partially offset by lower sales in International due to higher large case sales in the prior year.

- Wealth sales & asset management gross flows of $2 billion were up 14%, driven by higher fixed income fund and mutual fund sales in India, partially offset by lower money market fund sales in the Philippines and lower Mandatory Provident Fund (“MPF”) sales in Hong Kong.

New business CSM of $267 million in Q3’24 was up from $238 million in the prior year, primarily driven by higher sales and stronger profit margins in Hong Kong, partially offset by lower sales in High-Net-Worth.

We are committed to helping our Clients achieve lifetime financial security by offering a broad suite of products that fulfill their needs. During the third quarter, we launched a new product(4) for high-net-worth Clients, which addresses a market need for long-term wealth accumulation potential while offering built-in estate planning.

We continue to expand our capabilities to make it easier for Clients to do business with us. In the Philippines, we implemented a new automated underwriting platform, resulting in a 50% increase in straight-through-processing by Q3, enhancing the Client experience through faster turnaround times while also delivering operating efficiencies.

|

__________ |

|

|

(1) |

Effective Q1’24, reflects a refinement in the allocation methodology for expenses from Individual – Protection to Group – Health & Protection business types in the U.S. business group. |

|

(2) |

Based on membership as of August 2024. Ranking compiled by Sun Life and based on data disclosed by competitors. |

|

(3) |

Compared to prior year. |

|

(4) |

Sun Global Luna. |

Corporate

Underlying net loss was $92 million compared to underlying net loss of $89 million in the prior year, primarily reflecting lower investment income from surplus assets.

Reported net loss was $49 million compared to reported net loss of $105 million in the prior year, driven by market-related impacts.

Earnings Conference Call

The Company’s Q3’24 financial results will be reviewed at a conference call on Tuesday, November 5, 2024, at 10:00 a.m. ET. Visit www.sunlife.com/QuarterlyReports 10 minutes prior to the start of the event to access the call through either the webcast or conference call options. Individuals participating in the call in a listen-only mode are encouraged to connect via our webcast. Following the call, the webcast and presentation will be archived and made available on the Company’s website, www.sunlife.com, until the Q3’25 period end.

|

Media Relations Contact: |

Investor Relations Contact: |

|

Kim Race |

David Garg |

|

Director, Corporate Communications |

Senior Vice-President, Capital Management and Investor Relations |

|

Tel: 416-779-4574 |

Tel: 416-408-8649 |

Non-IFRS Financial Measures

We report certain financial information using non-IFRS financial measures, as we believe that these measures provide information that is useful to investors in understanding our performance and facilitate a comparison of our quarterly and full year results from period to period. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed in isolation from or as alternatives to measures of financial performance determined in accordance with IFRS. Additional information concerning non-IFRS financial measures and, if applicable, reconciliations to the closest IFRS measures are available in the Q3’24 MD&A under the heading N – Non-IFRS Financial Measures and the Supplementary Financial Information packages that are available on www.sunlife.com under Investors – Financial results and reports.

1. Underlying Net Income and Underlying EPS

Underlying net income is a non-IFRS financial measure that assists in understanding Sun Life’s business performance by making certain adjustments to IFRS income. Underlying net income, along with common shareholders’ net income (Reported net income), is used as a basis for management planning, and is also a key measure in our employee incentive compensation programs. This measure reflects management’s view of the underlying business performance of the company and long-term earnings potential. For example, due to the longer term nature of our individual protection businesses, market movements related to interest rates, equity markets and investment properties can have a significant impact on reported net income in the reporting period. However, these impacts are not necessarily realized, and may never be realized, if markets move in the opposite direction in subsequent periods or in the case of interest rates, the fixed income investment is held to maturity.

Underlying net income removes the impact of the following items from reported net income:

- Market-related impacts reflecting the after-tax difference in actual versus expected market movements;

- Assumptions changes and management actions;

- Other adjustments:

i) Management’s ownership of MFS shares;

ii) Acquisition, integration, and restructuring;

iii) Intangible asset amortization;

iv) Other items that are unusual or exceptional in nature.

For additional information about the adjustments removed from reported net income to arrive at underlying net income, refer to section N – Non-IFRS Financial Measures – 2 – Underlying Net Income and Underlying EPS in the Q3’24 MD&A.

The following table sets out the post-tax amounts that were excluded from our underlying net income (loss) and underlying EPS and provides a reconciliation to our reported net income and EPS based on IFRS.

|

Reconciliations of Select Net Income Measures |

Quarterly results |

Year-to-date |

|||

|

($ millions, after-tax) |

Q3’24 |

Q3’23 |

2024 |

2023 |

|

|

Underlying net income |

1,016 |

930 |

2,891 |

2,745 |

|

|

Market-related impacts |

|||||

|

Equity market impacts |

36 |

(21) |

40 |

(21) |

|

|

Interest rate impacts(1) |

38 |

127 |

26 |

39 |

|

|

Impacts of changes in the fair value of investment properties (real estate experience) |

(45) |

(83) |

(260) |

(279) |

|

|

Add: |

Market-related impacts |

29 |

23 |

(194) |

(261) |

|

Add: |

Assumption changes and management actions |

36 |

35 |

45 |

37 |

|

Other adjustments |

|||||

|

Management’s ownership of MFS shares |

(10) |

7 |

(22) |

23 |

|

|

Acquisition, integration and restructuring(2)(3)(4)(5)(6)(7) |

312 |

(89) |

170 |

(113) |

|

|

Intangible asset amortization |

(35) |

(35) |

(109) |

(94) |

|

|

Other(8)(9) |

— |

— |

31 |

— |

|

|

Add: |

Total of other adjustments |

267 |

(117) |

70 |

(184) |

|

Reported net income – Common shareholders |

1,348 |

871 |

2,812 |

2,337 |

|

|

Underlying EPS (diluted) ($) |

1.76 |

1.59 |

4.98 |

4.68 |

|

|

Add: |

Market-related impacts ($) |

0.05 |

0.04 |

(0.34) |

(0.44) |

|

Assumption changes and management actions ($) |

0.06 |

0.06 |

0.08 |

0.06 |

|

|

Management’s ownership of MFS shares ($) |

(0.02) |

0.01 |

(0.04) |

0.04 |

|

|

Acquisition, integration and restructuring ($) |

0.54 |

(0.16) |

0.29 |

(0.20) |

|

|

Intangible asset amortization ($) |

(0.06) |

(0.06) |

(0.19) |

(0.17) |

|

|

Other ($) |

— |

— |

0.05 |

— |

|

|

Reported EPS (diluted) ($) |

2.33 |

1.48 |

4.83 |

3.97 |

|

|

(1) |

Our results are sensitive to long term interest rates given the nature of our business and to non-parallel yield curve movements (for example flattening, inversion, steepening, etc.). |

|

(2) |

Amounts relate to acquisition costs for our SLC Management affiliates, BentallGreenOak, InfraRed Capital Partners, Crescent Capital Group LP and Advisors Asset Management, Inc, which include the unwinding of the discount for Other financial liabilities of $19 million in Q3’24 and $63 million for the first nine months of 2024 (Q3’23 – $21 million; for the first nine months of 2023 – $62 million). |

|

(3) |

Q3’24 reflects a decrease of $334 million in estimated future payments for acquisition-related contingent considerations and options to purchase the remaining ownership interests of SLC Management affiliates (Q3’23 – an increase of $42 million). For additional information, refer to Note 5 of our Interim Consolidated Financial Statements for the period ended September 30, 2024. |

|

(4) |

Includes integration costs associated with DentaQuest, acquired on June 1, 2022. |

|

(5) |

Q2’24 includes a restructuring charge of $108 million in the Corporate business group. |

|

(6) |

To meet regulatory obligations, in Q1’24, we sold 6.3% of our ownership interest in Aditya Birla Sun Life AMC Limited (“partial sale of ABSLAMC”), generating a gain of $84 million. As a result of the transaction, our ownership interest in ABSLAMC was reduced from 36.5% to 30.2% for gross proceeds of $136 million. Subsequently, in Q2’24, we sold an additional 0.2% of our ownership interest. |

|

(7) |

Includes a $65 million gain on the sale of the sponsored markets business in Canada in Q1’23 and a $19 million gain on the sale of Sun Life UK in Q2’23. |

|

(8) |

Includes a Pillar Two global minimum tax adjustment in Q2’24. For additional information, refer to Note 9 of our Interim Consolidated Financial Statements for the period ended September 30, 2024 and section C – Profitability in the Q3’24 MD&A. |

|

(9) |

Includes the early termination of a distribution agreement in Asset Management in Q1’24. |

The following table shows the pre-tax amount of underlying net income adjustments:

|

Quarterly results |

Year-to-date |

||||

|

($ millions) |

Q3’24 |

Q3’23 |

2024 |

2023 |

|

|

Underlying net income (after-tax) |

1,016 |

930 |

2,891 |

2,745 |

|

|

Underlying net income adjustments (pre-tax): |

|||||

|

Add: |

Market-related impacts |

(12) |

107 |

(207) |

(290) |

|

Assumption changes and management actions (“ACMA”)(1) |

63 |

41 |

73 |

47 |

|

|

Other adjustments |

246 |

(156) |

33 |

(255) |

|

|

Total underlying net income adjustments (pre-tax) |

297 |

(8) |

(101) |

(498) |

|

|

Add: |

Taxes related to underlying net income adjustments |

35 |

(51) |

22 |

90 |

|

Reported net income – Common shareholders (after-tax) |

1,348 |

871 |

2,812 |

2,337 |

|

|

(1) |

In this document, the reported net income impact of ACMA excludes amounts attributable to participating policyholders and includes non-liability impacts. In contrast, the net income impacts of method and assumption changes in the Interim Consolidated Financial Statements for the period ended September 30, 2024 includes amounts attributable to participating policyholders and excludes non-liability impacts. |

Taxes related to underlying net income adjustments may vary from the expected effective tax rate range reflecting the mix of business based on the Company’s international operations and other tax-related adjustments.

2. Additional Non-IFRS Financial Measures

Management also uses the following non-IFRS financial measures, and a full listing is available in section N – Non-IFRS Financial Measures in the Q3’24 MD&A.

Assets under management. AUM is a non-IFRS financial measure that indicates the size of our Company’s assets across asset management, wealth, and insurance. There is no standardized financial measure under IFRS. In addition to the most directly comparable IFRS measures, which are the balance of General funds and Segregated funds on our Statements of Financial Position, AUM also includes Third-party AUM and Consolidation adjustments. “Consolidation adjustments” is presented separately as consolidation adjustments apply to all components of total AUM. For additional information about Third-party AUM, refer to sections D – Growth – 2 – Assets Under Management and N – Non-IFRS Financial Measures in the Q3’24 MD&A.

|

Quarterly results |

||

|

($ millions) |

Q3’24 |

Q3’23 |

|

Assets under management |

||

|

General fund assets |

216,180 |

193,858 |

|

Segregated funds |

145,072 |

119,988 |

|

Third-party AUM(1) |

1,196,332 |

1,063,075 |

|

Consolidation adjustments(1) |

(43,014) |

(36,780) |

|

Total assets under management |

1,514,570 |

1,340,141 |

|

(1) |

Represents a non-IFRS financial measure. For more details, see section N – Non-IFRS Financial Measures in the Q3’24 MD&A. |

Cash and other liquid assets. This measure is comprised of cash, cash equivalents, short-term investments, and publicly traded securities, net of loans related to acquisitions and short-term loans that are held at SLF Inc. (the ultimate parent company), and its wholly owned holding companies. This measure is a key consideration of available funds for capital re-deployment to support business growth.

|

($ millions) |

As at September 30, 2024 |

As at December 31, 2023 |

|

Cash and other liquid assets (held at SLF Inc. and its wholly owned holding companies): |

||

|

Cash, cash equivalents & short-term securities |

75 |

712 |

|

Debt securities(1) |

1,032 |

1,228 |

|

Equity securities(2) |

107 |

102 |

|

Sub-total |

1,214 |

2,042 |

|

Less: Loans related to acquisitions and short-term loans(3) (held at SLF Inc. and its wholly owned holding companies) |

— |

(411) |

|

Cash and other liquid assets (held at SLF Inc. and its wholly owned holding companies) |

1,214 |

1,631 |

|

(1) |

Includes publicly traded bonds. |

|

(2) |

Includes ETF Investments. |

|

(3) |

Includes drawdowns from credit facilities to manage timing of cash flows. |

3. Reconciliations of Select Non-IFRS Financial Measures

Underlying Net Income to Reported Net Income Reconciliation – Pre-tax by Business Group

|

Q3’24 |

|||||||

|

($ millions) |

Asset Management |

Canada |

U.S. |

Asia |

Corporate |

Total |

|

|

Underlying net income (loss) |

344 |

375 |

219 |

170 |

(92) |

1,016 |

|

|

Add: |

Market-related impacts (pre-tax) |

(7) |

13 |

14 |

(55) |

23 |

(12) |

|

ACMA (pre-tax) |

— |

(47) |

180 |

(74) |

4 |

63 |

|

|

Other adjustments (pre-tax) |

304 |

(8) |

(43) |

(7) |

— |

246 |

|

|

Tax expense (benefit) |

3 |

49 |

(31) |

(2) |

16 |

35 |

|

|

Reported net income (loss) – Common shareholders |

644 |

382 |

339 |

32 |

(49) |

1,348 |

|

|

Q3’23 |

|||||||

|

Underlying net income (loss) |

330 |

338 |

185 |

166 |

(89) |

930 |

|

|

Add: |

Market-related impacts (pre-tax) |

(3) |

94 |

39 |

(1) |

(22) |

107 |

|

ACMA (pre-tax) |

— |

20 |

(30) |

51 |

— |

41 |

|

|

Other adjustments (pre-tax) |

(81) |

3 |

(71) |

(7) |

— |

(156) |

|

|

Tax expense (benefit) |

22 |

(90) |

9 |

2 |

6 |

(51) |

|

|

Reported net income (loss) – Common shareholders |

268 |

365 |

132 |

211 |

(105) |

871 |

|

Forward-looking Statements

From time to time, the Company makes written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements contained in this document include statements (i) relating to our strategies, plans, targets, goals and priorities; (ii) relating to our growth initiatives and other business objectives; (iii) relating to SLC Management’s estimated acquisition-related liabilities; (iv) that are predictive in nature or that depend upon or refer to future events or conditions; and (v) that include words such as “achieve”, “aim”, “ambition”, “anticipate”, “aspiration”, “assumption”, “believe”, “could”, “estimate”, “expect”, “goal”, “initiatives”, “intend”, “may”, “objective”, “outlook”, “plan”, “project”, “seek”, “should”, “strategy”, “strive”, “target”, “will”, and similar expressions. Forward-looking statements include the information concerning our possible or assumed future results of operations. These statements represent our current expectations, estimates, and projections regarding future events and are not historical facts, and remain subject to change.

Forward-looking statements are not a guarantee of future performance and involve risks and uncertainties that are difficult to predict. Future results and shareholder value may differ materially from those expressed in these forward-looking statements due to, among other factors, the matters set out in the Q3’24 MD&A under the headings C – Profitability – 5 – Income taxes, F – Financial Strength and I – Risk Management and in SLF Inc.’s 2023 AIF under the heading Risk Factors, and the factors detailed in SLF Inc.’s other filings with Canadian and U.S. securities regulators, which are available for review at www.sedarplus.ca and www.sec.gov, respectively.

Important risk factors that could cause our assumptions and estimates, and expectations and projections to be inaccurate and our actual results or events to differ materially from those expressed in or implied by the forward-looking statements contained in this document, are set out below. The realization of our forward-looking statements essentially depends on our business performance which, in turn, is subject to many risks. Factors that could cause actual results to differ materially from expectations include, but are not limited to: market risks – related to the performance of equity markets; changes or volatility in interest rates or credit spreads or swap spreads; real estate investments; fluctuations in foreign currency exchange rates; and inflation; insurance risks – related to mortality experience, morbidity experience and longevity; policyholder behaviour; product design and pricing; the impact of higher-than-expected future expenses; and the availability, cost and effectiveness of reinsurance; credit risks – related to issuers of securities held in our investment portfolio, debtors, structured securities, reinsurers, counterparties, other financial institutions and other entities; business and strategic risks – related to global economic and geopolitical conditions; the design and implementation of business strategies; changes in distribution channels or Client behaviour including risks relating to market conduct by intermediaries and agents; the impact of competition; the performance of our investments and investment portfolios managed for Clients such as segregated and mutual funds; shifts in investing trends and Client preference towards products that differ from our investment products and strategies; changes in the legal or regulatory environment, including capital requirements and tax laws; the environment, environmental laws and regulations; operational risks – related to breaches or failure of information system security and privacy, including cyber-attacks; our ability to attract and retain employees; legal, regulatory compliance and market conduct, including the impact of regulatory inquiries and investigations; the execution and integration of mergers, acquisitions, strategic investments and divestitures; our information technology infrastructure; a failure of information systems and Internet-enabled technology; dependence on third-party relationships, including outsourcing arrangements; business continuity; model errors; information management; liquidity risks – the possibility that we will not be able to fund all cash outflow commitments as they fall due; and other risks – changes to accounting standards in the jurisdictions in which we operate; risks associated with our international operations, including our joint ventures; market conditions that affect our capital position or ability to raise capital; downgrades in financial strength or credit ratings; and tax matters, including estimates and judgements used in calculating taxes.

The Company does not undertake any obligation to update or revise its forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as required by law.

About Sun Life

Sun Life is a leading international financial services organization providing asset management, wealth, insurance and health solutions to individual and institutional Clients. Sun Life has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of September 30, 2024, Sun Life had total assets under management of $1.51 trillion. For more information, please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sun-life-reports-third-quarter-2024-results-302295899.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sun-life-reports-third-quarter-2024-results-302295899.html

SOURCE Sun Life Financial Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Regeneron Pharmaceuticals

Investors with a lot of money to spend have taken a bearish stance on Regeneron Pharmaceuticals REGN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with REGN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for Regeneron Pharmaceuticals.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 60%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $5,066,701, and 4 are calls, for a total amount of $205,030.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $420.0 to $1120.0 for Regeneron Pharmaceuticals over the recent three months.

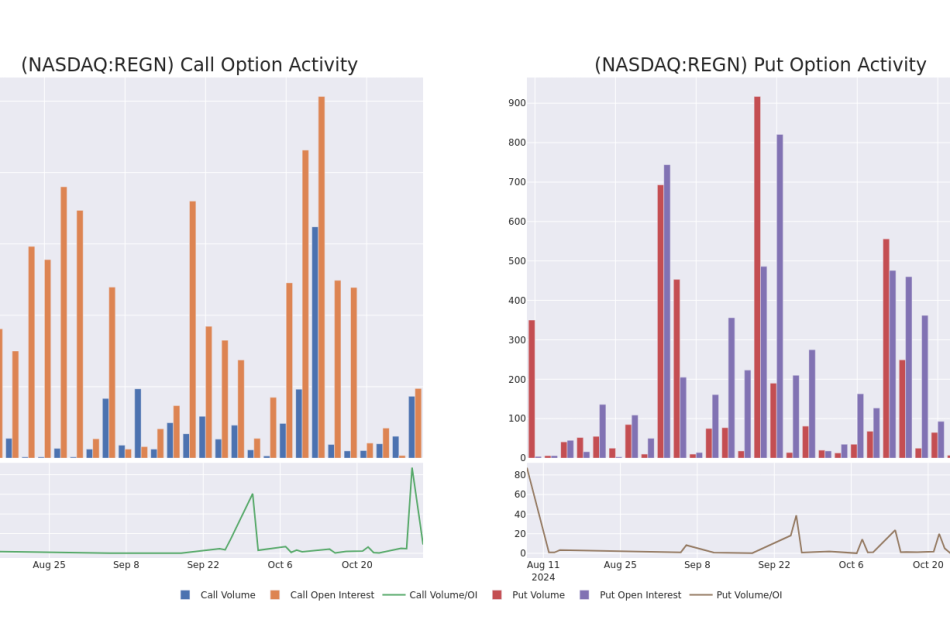

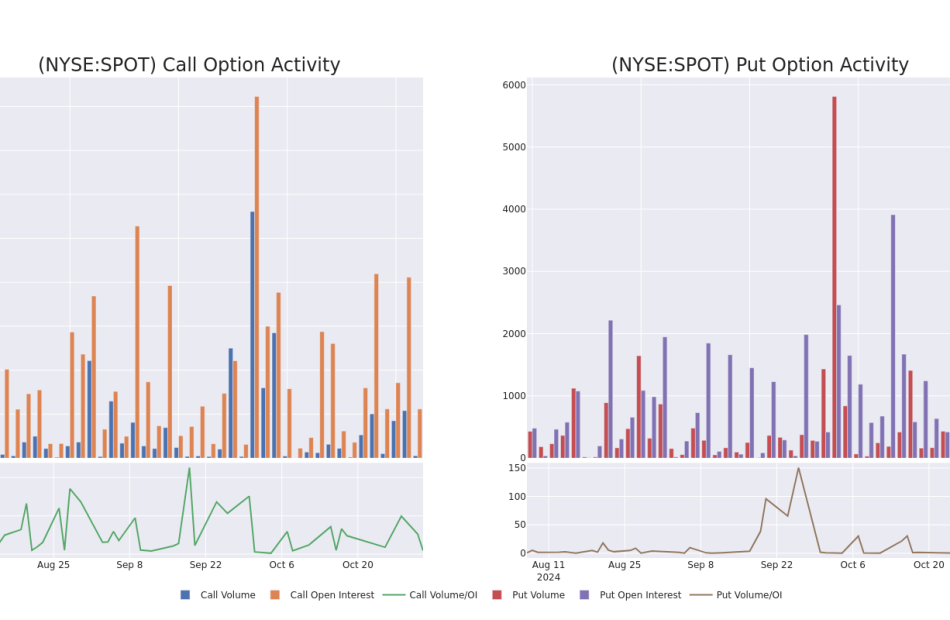

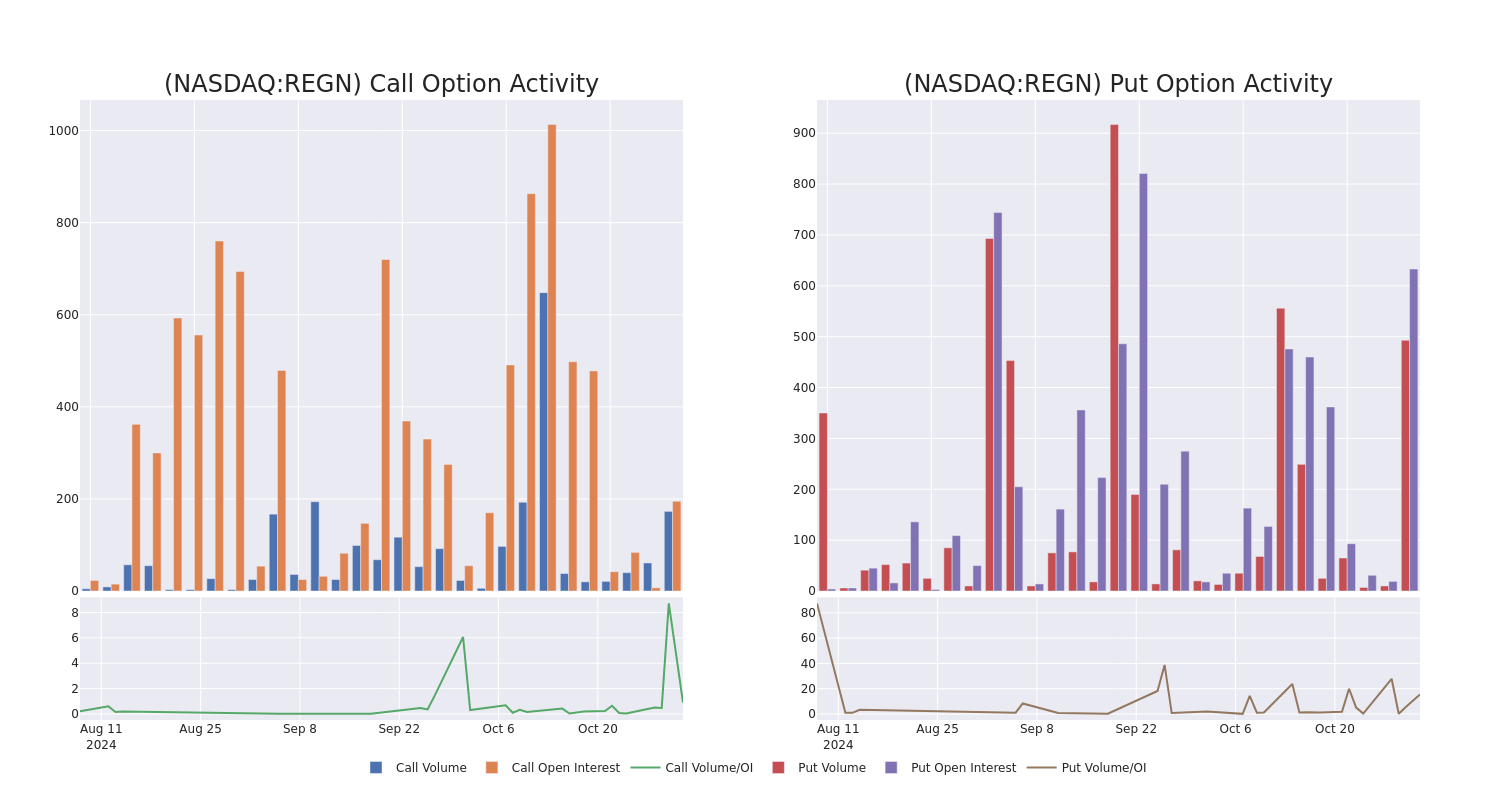

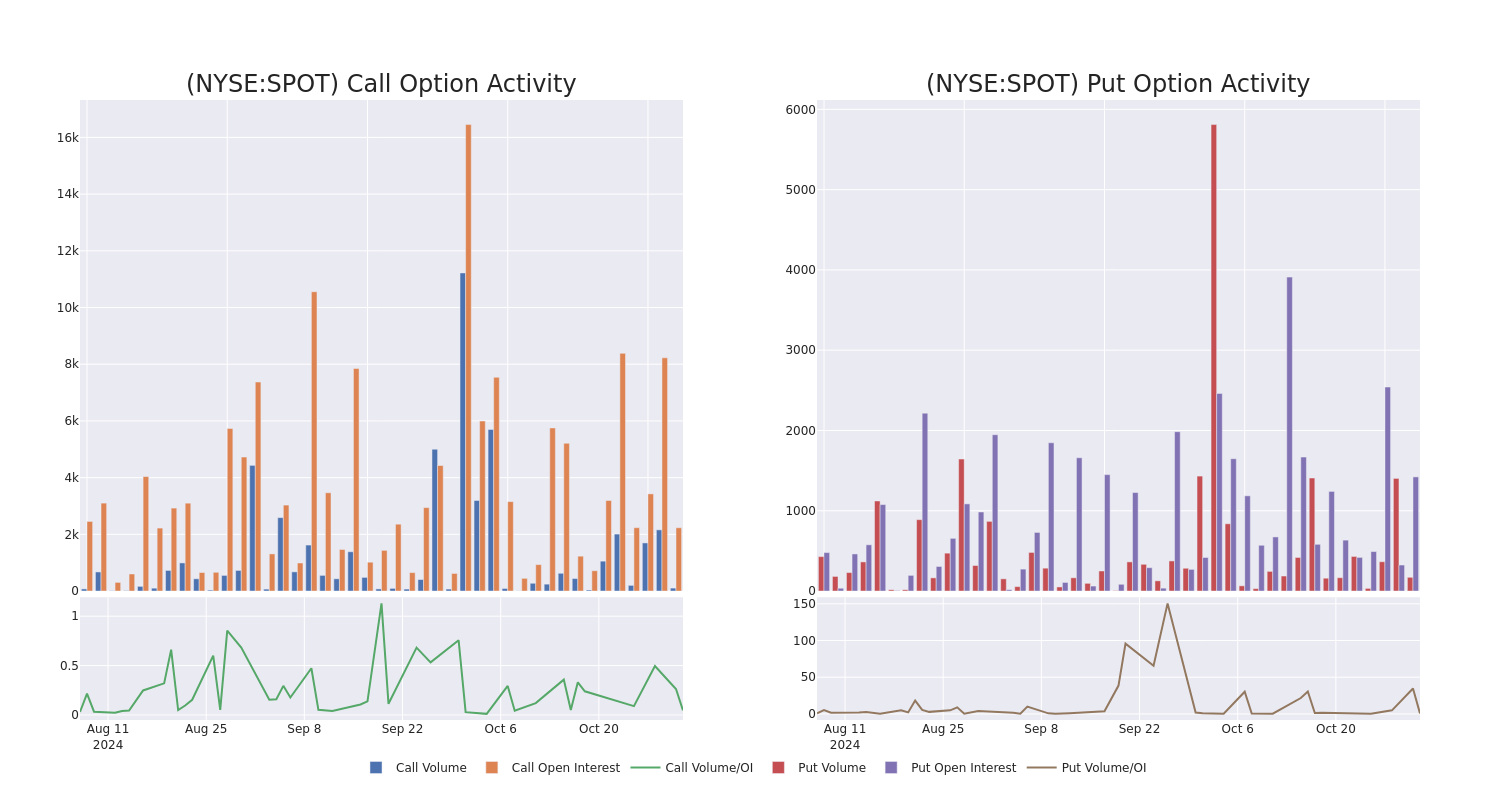

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Regeneron Pharmaceuticals’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Regeneron Pharmaceuticals’s substantial trades, within a strike price spectrum from $420.0 to $1120.0 over the preceding 30 days.

Regeneron Pharmaceuticals Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| REGN | PUT | SWEEP | BEARISH | 09/19/25 | $233.0 | $224.0 | $232.48 | $1060.00 | $2.0M | 95 | 91 |

| REGN | PUT | SWEEP | BEARISH | 06/20/25 | $210.0 | $203.9 | $209.06 | $1040.00 | $837.4K | 98 | 40 |

| REGN | PUT | SWEEP | BEARISH | 11/15/24 | $99.0 | $90.8 | $97.52 | $930.00 | $485.0K | 99 | 50 |

| REGN | PUT | SWEEP | BEARISH | 01/17/25 | $190.0 | $181.4 | $189.9 | $1020.00 | $379.9K | 126 | 20 |

| REGN | PUT | SWEEP | BULLISH | 02/21/25 | $69.7 | $64.0 | $67.8 | $880.00 | $271.2K | 49 | 40 |

About Regeneron Pharmaceuticals

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including low-dose Eylea and Eylea HD, approved for wet age-related macular degeneration and other eye diseases; Dupixent in immunology; Praluent for LDL cholesterol lowering; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and Crispr-based gene editing (Intellia).

Having examined the options trading patterns of Regeneron Pharmaceuticals, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Regeneron Pharmaceuticals’s Current Market Status

- Trading volume stands at 391,366, with REGN’s price down by -1.56%, positioned at $830.46.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 88 days.

What The Experts Say On Regeneron Pharmaceuticals

5 market experts have recently issued ratings for this stock, with a consensus target price of $1138.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Regeneron Pharmaceuticals, targeting a price of $1150.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Regeneron Pharmaceuticals with a target price of $1080.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Regeneron Pharmaceuticals, targeting a price of $1215.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Regeneron Pharmaceuticals with a target price of $1065.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Regeneron Pharmaceuticals, targeting a price of $1184.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Regeneron Pharmaceuticals, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BCE Tumbles to 12-Year Low After $3.6 Billion Ziply Deal

(Bloomberg) — BCE Inc. will pause dividend growth next year as it makes an unexpected push into the US with the purchase of an internet provider in the Pacific Northwest, a move that sent the company’s shares tumbling to a 12-year low.

Most Read from Bloomberg

Canada’s largest telecommunications company will pay C$5 billion ($3.6 billion) for Northwest Fiber LLC, which does business as Ziply Fiber and has 1.3 million locations in Washington, Oregon, Idaho and Montana, with plans to expand to more than 3 million in the next four years, according to a statement Monday.

The announcement comes less than two months after BCE unveiled a deal to sell its stake in Maple Leaf Sports & Entertainment Ltd. to Rogers Communications Inc. for C$4.7 billion. BCE said at the time that transaction would help reduce its debt, an issue credit agencies and analysts had flagged as a problem in recent months.

But BCE now says it will use those proceeds, an expected net amount of C$4.2 billion, to fund most of the Northwest Fiber deal. The company also ruled out increasing its dividend for all of 2025 — after 16 years of boosting its payout annually — and said it will raise fresh equity through a discount on its dividend reinvestment plan, also known as a DRIP.

The plan to halt dividend increases, a key part of the investment thesis for shareholders in Canada’s large telecom companies, sent BCE’s stock plunging the most in more than four years. The shares dropped 9.7% to close at C$40.47 in Toronto, the lowest closing price since May 2012.

Chief Executive Officer Mirko Bibic said the company didn’t decide to acquire Ziply “based on an assessment of one day’s stock market reaction,” and noted that sell-side analysts had been speculating for some time that the company would pause dividend growth and introduce a DRIP discount to shore up its capital position.

“We’re managing this for the long term,” he said in an interview, adding that “pursuing a fiber growth agenda is right on strategy and core to what BCE does really well.”

Talks with the management team at Northwest Fiber, which is owned by Searchlight Capital in partnership with three Canadian pension funds, only began in late September, after the MLSE transaction was announced, Bibic said.

Palantir Climbs On Earnings Beat. Non-U.S. Commercial Sales Growth Misses

Data analytics software maker Palantir Technologies (PLTR) on Monday delivered third-quarter earnings that topped estimates while revenue handily beat Wall Street targets. Palantir stock jumped as December-quarter revenue guidance came in well above expectations.

The company reported earnings after the market close.

↑

X

Palantir Earnings Due As Tech Stocks Stumble

For the quarter ended Sept. 30, Palantir earnings using generally accepted accounting principles, or GAAP, were 10 cents a share, up 43% from a year earlier. Revenue rose 30% to $725.5 million, the software maker said.

Analysts had predicted Palantir earnings of 9 cents a share on revenue of $703.4 million.

In Q3, net income doubled to $144 million from a year earlier.

Palantir Stock: Non-U.S. Commercial Growth Slows

For the current quarter ending in December, Palantir says it expects revenue in a range of $767 million to $771 million. Analysts had predicted sales of $745 million.

On its earnings call with analysts, Palantir said total Q3 government sales rose 33% to $408 million while total commercial sales rose 27% to $317 million. Analysts had estimated total government sales of $378 million and commercial revenue of $328.5 million.

Also, Palantir said U.S. government sales rose 40% to $320 million while U.S. commercial sales rose 54% to $179 million.

On the stock market today, Palantir stock jumped nearly 13% to 46.74 in extended trading.

Heading into the Palantir earnings report, shares were up 142% in 2024.

Further, Palantir stock has outperformed since 2023 amid buzz over generative artificial intelligence technology.

Palantir has already mined the AI opportunity with government customers for intelligence gathering, counterterrorism and military purposes. Now Palantir aims to use generative AI to spur growth in the commercial market. The software maker has expanded into health care, energy and manufacturing.

Palantir Stock: Technical Ratings

Also, Palantir rolled out its “Artificial Intelligence Platform” in early 2023.

Palantir stock holds a perfect Composite Rating of 99, according to IBD Stock Checkup. IBD’s Composite Rating combines five separate proprietary ratings into one easy-to-use rating. The best growth stocks have a Composite Rating of 90 or better.

As of Nov. 4, Palantir stock is extended above an entry point of 29.83, according to MarketSurge chart analysis.

Palantir is among the top AI stocks to watch.

Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing.

YOU MAY ALSO LIKE:

Learn The Best Trading Rules At Investor’s Corner

Want To Trade Options? Try Out These Strategies

Monitor IBD’s “Breaking Out Today” List For Companies Hitting New Buy Points

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

POTOMAC BANCSHARES, INC. REPORTS 2024 THIRD QUARTER RESULTS

CHARLES TOWN, W.Va., Nov. 4, 2024 /PRNewswire/ — Potomac Bancshares, Inc. (the “Company”) PTBS, the one bank holding company for Bank of Charles Town (BCT), also known as The Community’s Bank, for the quarter ended September 30, 2024, earned $1.761 million or $0.42 per share compared to $1.729 million or $0.42 per share for the quarter ended September 30, 2023, and $1.421 million in the second quarter of 2024 or $0.34 per share.

Net income was $4.857 million for the nine months ended September 30, 2024, or $1.17 per share compared to $5.554 million or $1.34 per share for the nine months ended September 30, 2023. Excluding the investment security after-tax loss of $300 thousand taken in the second quarter of 2024, net income for the nine months ended September 30, 2024, would have been $5.157 million, $1.24 per share.

Alice P. Frazier, CEO and President commented, “This quarter’s results reflect a number of successes by the BCT team for which we are proud. We celebrated substantial wins with BCT Wealth accounts that grew assets under management over 20% during the quarter. Momentum continues with new commercial relationships driving loan and related noninterest-bearing deposit growth. Our net interest margin remained stable due to the strategic investment portfolio losses along with our disciplined deposit pricing. Cumulatively, these actions provided solid returns for the quarter.”

Selected Highlights

- Total assets as of Q3 2024 were $871.4 million compared to Q3 2023 total assets of $809.6 million, an increase of $61.8 million or 7.6%.

- Return on Assets (ROA) for the nine months ended September 30, 2024, was 0.78% compared to 0.96% for the same period in 2023.

- Return on Equity (ROE) for the nine months ended September 30, 2024, was 9.69% compared to 12.02% for the same period in 2023.

- Net interest income was $19.9 million for the first nine months of 2024 up from $19.2 million for the same period in 2023.

- Net interest margin for the first nine months of 2024 was 3.20% compared to 3.36% for the same period in 2023.

Linked Quarter Q3 2024 Compared to Q2 2024 Highlights

- Total assets as of Q3 were $871.4 compared to Q2 total assets of $832.5 million, an increase of $38.9 million or 4.7%.

- Loan growth was $22.4 million or 3.4% for Q3 as pipelines continue to build with strategically planned growth in government contracting and SBA lending.

- Net unrealized losses in the AFS portfolio in Q3 decreased $2.6 million, moving to $5.8 million from $8.4 million in Q2.

- Deposits increased $9.7 million during Q3 or 1.3% from Q2.

- Noninterest-bearing deposits increased $3.7 million or 2.2%, and interest-bearing deposits increased $6.0 million or 1.0%.

- Deposits were inflated during Q3 by $40 million, related to a single client who disbursed the funds on September 30, 2024.

- The Tier 1 leverage capital ratio for BCT was 9.67% as of Q3 and 9.99% as of Q2. For the Company, the tangible equity / tangible assets ratio was 8.32% as of Q3 compared to 8.33% as of Q2.

- The net interest margin remained stable at 3.21% for Q3 and Q2 . See Table 4 for additional details.

- The yield on loans increased 15 basis points (bps) to 5.29%.

- The cost of interest-bearing deposits increased 12 bps to 2.41%. The cost of interest-bearing deposits was impacted this quarter by a single large deposit that was disbursed on September 30, 2024.

- The allowance for credit losses was 1.03% and 1.04% of total loans outstanding as of Q3 and Q2, respectively.

- Non-performing assets as a percentage of total assets was 0.30% for Q3 and 0.36% in Q2. The decrease is due to one nonaccrual relationship settled with no loss of income or principal.

- Non-interest income improved in Q3 by $23 thousand or 1.3% from Q2. Wealth and Investments advisory fees grew 18.9% during the quarter primarily due to the growth in new accounts. See Table 3 for additional details.

- The increase in other operating income is due to increases in equity securities market values and fee income from negotiated contracts.

- Non-interest expense was $6.3 million for Q3, an increase of $289 thousand (excluding the loss on sale of securities in Q2 of $386 thousand) or 4.8% from Q2. The increase is primarily in salary and employee benefits and other operating expenses which included multiple one-time expenses as noted below. See Table 3 for additional details.

- Salary and employee benefits were up due to increased incentive-related expenses partially offset by lower payroll tax expenses.

- Computer services and communications decreased as a result of contract negotiations that were completed in June 2024.

- Professional fees included one-time recruiting expenses of approximately $70 thousand.

- Other operating expenses increased primarily due to losses related to fraudulent checks of $174 thousand.

Q3 2024 Compared to Q3 2023 Highlights

- Commercial loan growth of $28.4 million, mortgage loan growth of $3.9 million, and home equity growth of $3.8 million, drove an overall increase in loans outstanding of $36.0 million or 5.5%.

- Non-owner-occupied office property loans were $38.4 million or 5.7% of the total loan portfolio as of Q3 2024. As of Q3 2023, non-owner-occupied office property loans were $45.1 million or 6.9% of the total loan portfolio. Most of the office property loans are for main street small offices.

- The incremental restructurings of the investment portfolio over the past year increased the portfolio yield by 56 bps to 3.11% while duration decreased to 3.60 as of Q3 2024 compared to 4.18 as of Q3 2023.

- Net unrealized losses in the AFS portfolio were $5.8 million as of Q3 2024 and $11.9 million as of Q3 2023.

- Total deposits increased $28.5 million or 4.0%. Noninterest-bearing deposits were up $13.0 million or 8.1%, while interest-bearing deposits were up $15.5 million or 2.8%.

- The Tier 1 leverage capital ratio for BCT was 9.67% as of Q3 2024 compared to 9.93% as of Q3 2023. For the Company, the tangible equity / tangible assets ratio was 8.32% as of Q3 2024 and 7.75% as of Q3 2023.

- Net interest margin remained relatively stable at 3.21% for Q3 2024 compared to 3.23% in Q3 2023. See Table 4 for additional details.

- The earning asset yield increased 45 bps to 5.07% in Q3 2024 compared to 4.62% as of Q3 2023.

- The cost of interest-bearing deposits increased 58 bps in Q3 2024 to 2.41% compared to 1.83% as of Q3 2023. The cost of interest-bearing deposits was impacted this quarter by a single large deposit that was disbursed on September 30, 2024.

- The allowance for credit losses was 1.03% of total loans outstanding as of Q3 2024 and 1.04% as of Q3 2023.

- Non-performing assets as a percentage of total assets was 0.30% as of Q3 2024 and 0.33% as of Q3 2023.

- Non-interest income for Q3 2024 was $1.8 million, an increase of $127 thousand or 7.8%, compared to Q3 2023. As noted above, Wealth and Investments advisory fees increased 13.4% from both assets under management and estate settlements. Other operating income increased by annual true-ups related to VISA marketing agreements which was partially offset by a decrease in secondary market fee income. See Table 3 for additional details.

- Non-interest expense excluding loss on sales of securities was $6.3 million for Q3 2024, an increase of $706 thousand or 12.7% over Q3 2023. Increases are in salaries and employee benefits, computer services and communications, other professional services, and other operating expenses. See Table 3 for additional details.

- Salary and employee benefits were higher as a result of new personnel supporting growth, incentives, and group insurance, partially offset by a reduction in pension and 401(k) expenses. Through contract negotiations, group insurance will be reduced by 20% in future quarters.

- Computer services and communications were higher due to investments in technology in support of growth and business continuity offset by negotiated decreases in core services.

- Other professional services saw increases in audit & compliance, Wealth and Investments outsourcing associated with the growth of assets under management, and recruiting expenses.

- Other operating expenses increased due to check fraud losses, franchise taxes, and net adjustments in the Bank Tech Investment value.

Dividend Announcement

At our October Board meeting, Potomac Bancshares, Inc.’s Board of Directors, declared a quarterly dividend of $0.12 per share. The dividend is for all shareholders of record on November 1, 2024, and will be paid on November 8, 2024.

About the Company

Founded in 1871, BCT – Bank of Charles Town, also known as The Community’s Bank, is a wholly owned subsidiary of Potomac Bancshares, Inc. PTBS. The Company conducts operations through its main office, an additional eight branch offices, and two loan production offices. BCT’s offices are located in Jefferson and Berkeley Counties (WV), Washington County (MD), and Loudoun and Stafford Counties (VA). The Bank provides various banking products and services including free access to over 55,000 ATMs through the Allpoint® network plus another approximately 675 free access ATMs through another partnership. The Bank provides convenient online and mobile banking for individuals, businesses, and local governments. The Bank also offers commercial lines and term loans, residential and commercial construction loans, commercial real estate loans, agricultural loans, and government contractor loans. The Bank is also a Small Business Administration (SBA) Preferred Lender. The Residential Lending division offers secondary market and portfolio mortgage loans, one-time close construction to perm loans, as well as home equity loans and lines of credit. For over 70 years, BCT Wealth Advisors has provided trust services, growing into a premier financial management, investments, and estate services provider. BCT was voted Winner in the LoudounNow 2024 Loudoun’s Favorites readers’ poll in four categories: Bank, Mortgage Company, Banker, and Financial Planner. Additionally, BCT was voted a “Best of the Best” Winner in the 2024 Journal-News Readers’ Choice Awards in three categories: Bank, Financial Planning, and Loan Services. In 2023, American Banker selected BCT as a “Top 200 Community Bank,” an annual listing of the best performing banks in the United States with assets under $2 billion. In five of the last six years, the Bank was named a “Best Bank To Work For” by American Banker.

Forward Looking Statements

Certain statements made in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations, or beliefs about events or results or otherwise are not statements of historical facts, such as statements about the Company’s growth strategy and deployment of capital. Although the Company believes that its expectations with respect to such forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of the Company will not differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ from those discussed in such forward-looking statements include, but are not limited to, the following: (1) general economic conditions, especially in the communities and markets in which the Company conducts its business; (2) credit risk, including risk that negative credit quality trends may lead to a deterioration of asset quality, risk that our allowance for credit losses may not be sufficient to absorb actual losses in the Company’s loan portfolio, and risk from concentrations in the Company’s loan portfolio; (3) changes in the real estate market, including the value of collateral securing portions of the Company’s loan portfolio; (4) changes in the interest rate environment; (5) operational risk, including cybersecurity risk and risk of fraud, data processing system failures, and network breaches; (6) changes in technology and increased competition, including competition from non-bank financial institutions; (7) changes in consumer preferences, spending and borrowing habits, demand for our products and services, and customers’ performance and creditworthiness; (8) difficulty growing loan and deposit balances; (9) the Company’s ability to effectively execute its business plan; (10) changes in regulations, laws, taxes, government policies, monetary policies and accounting policies affecting bank holding companies and their subsidiaries, including changes in deposit insurance premiums; (11) deterioration in the financial condition of the U.S. banking system may impact the valuations of investments the Company has made in the securities of other financial institutions; (12) regulatory enforcement actions and adverse legal actions; (13) difficulty attracting and retaining key employees; and (14) other economic, competitive, technological, operational, governmental, regulatory, and market factors affecting the Company’s operations. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.

|

CONSOLIDATED FINANCIAL HIGHLIGHTS |

|||||||

|

POTOMAC BANCSHARES, INC. |

|||||||

|

Table 1 |

|||||||

|

Nine Months |

|||||||

|

(Unaudited – dollars in thousands, except per share data) |

|||||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Earnings Performance |

|||||||

|

Interest and dividend income |

$30,800 |

$25,756 |

|||||

|

Interest expense |

10,889 |

6,533 |

|||||

|

Net interest income |

19,911 |

19,223 |

|||||

|

Provision for credit losses |

511 |

222 |

|||||

|

Non-interest income |

5,111 |

4,637 |

|||||

|

Non-interest expense |

18,265 |

** |

16,474 |

*** |

|||

|

Income Before Income Tax Expense |

6,246 |

7,164 |

|||||

|

Income tax expense |

1,389 |

1,610 |

|||||

|

Net Income |

$4,857 |

$5,554 |

|||||

|

Return on average equity |

9.69 % |

12.02 % |

|||||

|

Return on average assets |

0.78 % |

0.96 % |

|||||

|

Net interest margin |

3.20 % |

3.36 % |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Balance Sheet Highlights |

|||||||

|

Total assets |

$871,363 |

$809,607 |

|||||

|

Investment securities |

82,369 |

82,575 |

|||||

|

Loans held for sale |

1,219 |

2,159 |

|||||

|

Loans, net of allowance for credit losses of $7,097 in 2024 and $6,768 in 2023 |

679,558 |

643,921 |

|||||

|

Deposits |

749,750 |

721,253 |

|||||

|

Long term FHLB borrowings |

31,000 |

6,000 |

|||||

|

Subordinated debt, net of issuance costs |

9,942 |

9,882 |

|||||

|

Shareholders’ equity |

$72,509 |

$62,770 |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Shareholders’ Value (per share) |

|||||||

|

Earnings per share, basic |

$1.17 |

$1.34 |

|||||

|

Earnings per share, diluted |

$1.17 |

$1.34 |

|||||

|

Cash dividends declared (per share) |

0.34 |

0.28 |

|||||

|

Book value at period end (per share) |

$17.49 |

$15.15 |

|||||

|

End of period number of shares outstanding |

4,144,561 |

4,144,561 |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Safety and Soundness |

|||||||

|

Tier 1 capital ratio (leverage ratio)* |

9.67 % |

9.93 % |

|||||

|

Tangible Equity/Tangible Assets |

8.32 % |

7.75 % |

|||||

|

Non-performing assets as a percentage of |

|||||||

|

total assets including OREO |

0.30 % |

0.33 % |

|||||

|

Allowance for credit losses as a percentage of |

|||||||

|

period end loans |

1.03 % |

1.04 % |

|||||

|

Ratio of net charge offs (recoveries) annualized during the period to |

|||||||

|

average loans outstanding during the period |

0.006 % |

-0.005 % |

|||||

|