POTOMAC BANCSHARES, INC. REPORTS 2024 THIRD QUARTER RESULTS

CHARLES TOWN, W.Va., Nov. 4, 2024 /PRNewswire/ — Potomac Bancshares, Inc. (the “Company”) PTBS, the one bank holding company for Bank of Charles Town (BCT), also known as The Community’s Bank, for the quarter ended September 30, 2024, earned $1.761 million or $0.42 per share compared to $1.729 million or $0.42 per share for the quarter ended September 30, 2023, and $1.421 million in the second quarter of 2024 or $0.34 per share.

Net income was $4.857 million for the nine months ended September 30, 2024, or $1.17 per share compared to $5.554 million or $1.34 per share for the nine months ended September 30, 2023. Excluding the investment security after-tax loss of $300 thousand taken in the second quarter of 2024, net income for the nine months ended September 30, 2024, would have been $5.157 million, $1.24 per share.

Alice P. Frazier, CEO and President commented, “This quarter’s results reflect a number of successes by the BCT team for which we are proud. We celebrated substantial wins with BCT Wealth accounts that grew assets under management over 20% during the quarter. Momentum continues with new commercial relationships driving loan and related noninterest-bearing deposit growth. Our net interest margin remained stable due to the strategic investment portfolio losses along with our disciplined deposit pricing. Cumulatively, these actions provided solid returns for the quarter.”

Selected Highlights

- Total assets as of Q3 2024 were $871.4 million compared to Q3 2023 total assets of $809.6 million, an increase of $61.8 million or 7.6%.

- Return on Assets (ROA) for the nine months ended September 30, 2024, was 0.78% compared to 0.96% for the same period in 2023.

- Return on Equity (ROE) for the nine months ended September 30, 2024, was 9.69% compared to 12.02% for the same period in 2023.

- Net interest income was $19.9 million for the first nine months of 2024 up from $19.2 million for the same period in 2023.

- Net interest margin for the first nine months of 2024 was 3.20% compared to 3.36% for the same period in 2023.

Linked Quarter Q3 2024 Compared to Q2 2024 Highlights

- Total assets as of Q3 were $871.4 compared to Q2 total assets of $832.5 million, an increase of $38.9 million or 4.7%.

- Loan growth was $22.4 million or 3.4% for Q3 as pipelines continue to build with strategically planned growth in government contracting and SBA lending.

- Net unrealized losses in the AFS portfolio in Q3 decreased $2.6 million, moving to $5.8 million from $8.4 million in Q2.

- Deposits increased $9.7 million during Q3 or 1.3% from Q2.

- Noninterest-bearing deposits increased $3.7 million or 2.2%, and interest-bearing deposits increased $6.0 million or 1.0%.

- Deposits were inflated during Q3 by $40 million, related to a single client who disbursed the funds on September 30, 2024.

- The Tier 1 leverage capital ratio for BCT was 9.67% as of Q3 and 9.99% as of Q2. For the Company, the tangible equity / tangible assets ratio was 8.32% as of Q3 compared to 8.33% as of Q2.

- The net interest margin remained stable at 3.21% for Q3 and Q2 . See Table 4 for additional details.

- The yield on loans increased 15 basis points (bps) to 5.29%.

- The cost of interest-bearing deposits increased 12 bps to 2.41%. The cost of interest-bearing deposits was impacted this quarter by a single large deposit that was disbursed on September 30, 2024.

- The allowance for credit losses was 1.03% and 1.04% of total loans outstanding as of Q3 and Q2, respectively.

- Non-performing assets as a percentage of total assets was 0.30% for Q3 and 0.36% in Q2. The decrease is due to one nonaccrual relationship settled with no loss of income or principal.

- Non-interest income improved in Q3 by $23 thousand or 1.3% from Q2. Wealth and Investments advisory fees grew 18.9% during the quarter primarily due to the growth in new accounts. See Table 3 for additional details.

- The increase in other operating income is due to increases in equity securities market values and fee income from negotiated contracts.

- Non-interest expense was $6.3 million for Q3, an increase of $289 thousand (excluding the loss on sale of securities in Q2 of $386 thousand) or 4.8% from Q2. The increase is primarily in salary and employee benefits and other operating expenses which included multiple one-time expenses as noted below. See Table 3 for additional details.

- Salary and employee benefits were up due to increased incentive-related expenses partially offset by lower payroll tax expenses.

- Computer services and communications decreased as a result of contract negotiations that were completed in June 2024.

- Professional fees included one-time recruiting expenses of approximately $70 thousand.

- Other operating expenses increased primarily due to losses related to fraudulent checks of $174 thousand.

Q3 2024 Compared to Q3 2023 Highlights

- Commercial loan growth of $28.4 million, mortgage loan growth of $3.9 million, and home equity growth of $3.8 million, drove an overall increase in loans outstanding of $36.0 million or 5.5%.

- Non-owner-occupied office property loans were $38.4 million or 5.7% of the total loan portfolio as of Q3 2024. As of Q3 2023, non-owner-occupied office property loans were $45.1 million or 6.9% of the total loan portfolio. Most of the office property loans are for main street small offices.

- The incremental restructurings of the investment portfolio over the past year increased the portfolio yield by 56 bps to 3.11% while duration decreased to 3.60 as of Q3 2024 compared to 4.18 as of Q3 2023.

- Net unrealized losses in the AFS portfolio were $5.8 million as of Q3 2024 and $11.9 million as of Q3 2023.

- Total deposits increased $28.5 million or 4.0%. Noninterest-bearing deposits were up $13.0 million or 8.1%, while interest-bearing deposits were up $15.5 million or 2.8%.

- The Tier 1 leverage capital ratio for BCT was 9.67% as of Q3 2024 compared to 9.93% as of Q3 2023. For the Company, the tangible equity / tangible assets ratio was 8.32% as of Q3 2024 and 7.75% as of Q3 2023.

- Net interest margin remained relatively stable at 3.21% for Q3 2024 compared to 3.23% in Q3 2023. See Table 4 for additional details.

- The earning asset yield increased 45 bps to 5.07% in Q3 2024 compared to 4.62% as of Q3 2023.

- The cost of interest-bearing deposits increased 58 bps in Q3 2024 to 2.41% compared to 1.83% as of Q3 2023. The cost of interest-bearing deposits was impacted this quarter by a single large deposit that was disbursed on September 30, 2024.

- The allowance for credit losses was 1.03% of total loans outstanding as of Q3 2024 and 1.04% as of Q3 2023.

- Non-performing assets as a percentage of total assets was 0.30% as of Q3 2024 and 0.33% as of Q3 2023.

- Non-interest income for Q3 2024 was $1.8 million, an increase of $127 thousand or 7.8%, compared to Q3 2023. As noted above, Wealth and Investments advisory fees increased 13.4% from both assets under management and estate settlements. Other operating income increased by annual true-ups related to VISA marketing agreements which was partially offset by a decrease in secondary market fee income. See Table 3 for additional details.

- Non-interest expense excluding loss on sales of securities was $6.3 million for Q3 2024, an increase of $706 thousand or 12.7% over Q3 2023. Increases are in salaries and employee benefits, computer services and communications, other professional services, and other operating expenses. See Table 3 for additional details.

- Salary and employee benefits were higher as a result of new personnel supporting growth, incentives, and group insurance, partially offset by a reduction in pension and 401(k) expenses. Through contract negotiations, group insurance will be reduced by 20% in future quarters.

- Computer services and communications were higher due to investments in technology in support of growth and business continuity offset by negotiated decreases in core services.

- Other professional services saw increases in audit & compliance, Wealth and Investments outsourcing associated with the growth of assets under management, and recruiting expenses.

- Other operating expenses increased due to check fraud losses, franchise taxes, and net adjustments in the Bank Tech Investment value.

Dividend Announcement

At our October Board meeting, Potomac Bancshares, Inc.’s Board of Directors, declared a quarterly dividend of $0.12 per share. The dividend is for all shareholders of record on November 1, 2024, and will be paid on November 8, 2024.

About the Company

Founded in 1871, BCT – Bank of Charles Town, also known as The Community’s Bank, is a wholly owned subsidiary of Potomac Bancshares, Inc. PTBS. The Company conducts operations through its main office, an additional eight branch offices, and two loan production offices. BCT’s offices are located in Jefferson and Berkeley Counties (WV), Washington County (MD), and Loudoun and Stafford Counties (VA). The Bank provides various banking products and services including free access to over 55,000 ATMs through the Allpoint® network plus another approximately 675 free access ATMs through another partnership. The Bank provides convenient online and mobile banking for individuals, businesses, and local governments. The Bank also offers commercial lines and term loans, residential and commercial construction loans, commercial real estate loans, agricultural loans, and government contractor loans. The Bank is also a Small Business Administration (SBA) Preferred Lender. The Residential Lending division offers secondary market and portfolio mortgage loans, one-time close construction to perm loans, as well as home equity loans and lines of credit. For over 70 years, BCT Wealth Advisors has provided trust services, growing into a premier financial management, investments, and estate services provider. BCT was voted Winner in the LoudounNow 2024 Loudoun’s Favorites readers’ poll in four categories: Bank, Mortgage Company, Banker, and Financial Planner. Additionally, BCT was voted a “Best of the Best” Winner in the 2024 Journal-News Readers’ Choice Awards in three categories: Bank, Financial Planning, and Loan Services. In 2023, American Banker selected BCT as a “Top 200 Community Bank,” an annual listing of the best performing banks in the United States with assets under $2 billion. In five of the last six years, the Bank was named a “Best Bank To Work For” by American Banker.

Forward Looking Statements

Certain statements made in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations, or beliefs about events or results or otherwise are not statements of historical facts, such as statements about the Company’s growth strategy and deployment of capital. Although the Company believes that its expectations with respect to such forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of the Company will not differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ from those discussed in such forward-looking statements include, but are not limited to, the following: (1) general economic conditions, especially in the communities and markets in which the Company conducts its business; (2) credit risk, including risk that negative credit quality trends may lead to a deterioration of asset quality, risk that our allowance for credit losses may not be sufficient to absorb actual losses in the Company’s loan portfolio, and risk from concentrations in the Company’s loan portfolio; (3) changes in the real estate market, including the value of collateral securing portions of the Company’s loan portfolio; (4) changes in the interest rate environment; (5) operational risk, including cybersecurity risk and risk of fraud, data processing system failures, and network breaches; (6) changes in technology and increased competition, including competition from non-bank financial institutions; (7) changes in consumer preferences, spending and borrowing habits, demand for our products and services, and customers’ performance and creditworthiness; (8) difficulty growing loan and deposit balances; (9) the Company’s ability to effectively execute its business plan; (10) changes in regulations, laws, taxes, government policies, monetary policies and accounting policies affecting bank holding companies and their subsidiaries, including changes in deposit insurance premiums; (11) deterioration in the financial condition of the U.S. banking system may impact the valuations of investments the Company has made in the securities of other financial institutions; (12) regulatory enforcement actions and adverse legal actions; (13) difficulty attracting and retaining key employees; and (14) other economic, competitive, technological, operational, governmental, regulatory, and market factors affecting the Company’s operations. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.

|

CONSOLIDATED FINANCIAL HIGHLIGHTS |

|||||||

|

POTOMAC BANCSHARES, INC. |

|||||||

|

Table 1 |

|||||||

|

Nine Months |

|||||||

|

(Unaudited – dollars in thousands, except per share data) |

|||||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Earnings Performance |

|||||||

|

Interest and dividend income |

$30,800 |

$25,756 |

|||||

|

Interest expense |

10,889 |

6,533 |

|||||

|

Net interest income |

19,911 |

19,223 |

|||||

|

Provision for credit losses |

511 |

222 |

|||||

|

Non-interest income |

5,111 |

4,637 |

|||||

|

Non-interest expense |

18,265 |

** |

16,474 |

*** |

|||

|

Income Before Income Tax Expense |

6,246 |

7,164 |

|||||

|

Income tax expense |

1,389 |

1,610 |

|||||

|

Net Income |

$4,857 |

$5,554 |

|||||

|

Return on average equity |

9.69 % |

12.02 % |

|||||

|

Return on average assets |

0.78 % |

0.96 % |

|||||

|

Net interest margin |

3.20 % |

3.36 % |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Balance Sheet Highlights |

|||||||

|

Total assets |

$871,363 |

$809,607 |

|||||

|

Investment securities |

82,369 |

82,575 |

|||||

|

Loans held for sale |

1,219 |

2,159 |

|||||

|

Loans, net of allowance for credit losses of $7,097 in 2024 and $6,768 in 2023 |

679,558 |

643,921 |

|||||

|

Deposits |

749,750 |

721,253 |

|||||

|

Long term FHLB borrowings |

31,000 |

6,000 |

|||||

|

Subordinated debt, net of issuance costs |

9,942 |

9,882 |

|||||

|

Shareholders’ equity |

$72,509 |

$62,770 |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Shareholders’ Value (per share) |

|||||||

|

Earnings per share, basic |

$1.17 |

$1.34 |

|||||

|

Earnings per share, diluted |

$1.17 |

$1.34 |

|||||

|

Cash dividends declared (per share) |

0.34 |

0.28 |

|||||

|

Book value at period end (per share) |

$17.49 |

$15.15 |

|||||

|

End of period number of shares outstanding |

4,144,561 |

4,144,561 |

|||||

|

September 30, 2024 |

September 30, 2023 |

||||||

|

Safety and Soundness |

|||||||

|

Tier 1 capital ratio (leverage ratio)* |

9.67 % |

9.93 % |

|||||

|

Tangible Equity/Tangible Assets |

8.32 % |

7.75 % |

|||||

|

Non-performing assets as a percentage of |

|||||||

|

total assets including OREO |

0.30 % |

0.33 % |

|||||

|

Allowance for credit losses as a percentage of |

|||||||

|

period end loans |

1.03 % |

1.04 % |

|||||

|

Ratio of net charge offs (recoveries) annualized during the period to |

|||||||

|

average loans outstanding during the period |

0.006 % |

-0.005 % |

|||||

|

* The capital ratio presented is for Bank of Charles Town. When computing capital ratios, the net of unrealized holding gains (losses) on securities available for sale and the unfunded liability for pension and other post-retirement benefits, all computed net of tax, are added back to these shareholders’ equity figures. |

|

** Non-Interest Expense includes the Loss on Sale of AFS Securities of $386k in April 2024. |

|

*** Non-Interest Expense includes the Loss on Sale of AFS Securities of $274K In September 2023. |

|

CONSOLIDATED FINANCIAL HIGHLIGHTS |

||||||||||||

|

POTOMAC BANCSHARES, INC. |

||||||||||||

|

TABLE 2 |

Quarterly Financial Data |

|||||||||||

|

Three Months Ended |

||||||||||||

|

(Unaudited – dollars in thousands, except per share data) |

||||||||||||

|

9/30/2024 |

6/30/2024 |

3/31/2024 |

12/31/2023 |

9/30/2023 |

||||||||

|

Earnings Performance |

||||||||||||

|

Interest and dividend income |

$10,965 |

$10,088 |

$9,747 |

$9,827 |

$9,176 |

|||||||

|

Interest expense |

4,012 |

3,521 |

3,356 |

3,034 |

2,752 |

|||||||

|

Net interest income |

6,953 |

6,567 |

6,391 |

6,793 |

6,424 |

|||||||

|

Provision for credit losses |

202 |

129 |

180 |

– |

– |

|||||||

|

Non-interest income |

1,760 |

1,737 |

1,614 |

1,662 |

1,633 |

|||||||

|

Non-interest expense |

6,253 |

6,350 |

**** |

5,662 |

6,266 |

** |

5,821 |

*** |

||||

|

Income Before Income Tax Expense |

2,258 |

1,825 |

2,163 |

2,189 |

2,236 |

|||||||

|

Income tax expense |

497 |

404 |

488 |

479 |

507 |

|||||||

|

Net Income |

$1,761 |

$1,421 |

$1,675 |

$1,710 |

$1,729 |

|||||||

|

Return on average equity |

10.75 % |

9.73 % |

10.00 % |

11.21 % |

11.86 % |

|||||||

|

Return on average assets |

0.86 % |

0.79 % |

0.81 % |

0.85 % |

0.93 % |

|||||||

|

Net interest margin |

3.21 % |

3.21 % |

3.16 % |

3.29 % |

3.23 % |

|||||||

|

9/30/2024 |

6/30/2024 |

3/31/2024 |

12/31/2023 |

9/30/2023 |

||||||||

|

Balance Sheet Highlights |

||||||||||||

|

Total assets |

$871,363 |

$832,450 |

$855,330 |

$830,555 |

$809,607 |

|||||||

|

Investment securities |

82,369 |

83,476 |

84,972 |

84,127 |

82,575 |

|||||||

|

Loans held for sale |

1,219 |

1,396 |

2,210 |

678 |

2,159 |

|||||||

|

Loans, net of allowance for credit losses |

679,558 |

657,188 |

648,804 |

644,687 |

643,921 |

|||||||

|

Deposits |

749,750 |

740,096 |

762,927 |

739,680 |

721,253 |

|||||||

|

Long term FHLB borrowings |

31,000 |

6,000 |

6,000 |

6,000 |

6,000 |

|||||||

|

Subordinated debt, net of issuance costs |

9,942 |

9,927 |

9,912 |

9,897 |

9,882 |

|||||||

|

Shareholders’ equity |

$72,509 |

$69,305 |

$67,760 |

$66,874 |

$62,770 |

|||||||

|

9/30/2024 |

6/30/2024 |

3/31/2024 |

12/31/2023 |

9/30/2023 |

||||||||

|

Shareholders’ Value (per share) |

||||||||||||

|

Earnings per share, basic |

$0.42 |

$0.34 |

$0.40 |

$0.41 |

$0.42 |

|||||||

|

Earnings per share, diluted |

$0.42 |

$0.34 |

$0.40 |

$0.41 |

$0.42 |

|||||||

|

Cash dividends declared (per share) |

0.12 |

0.12 |

0.10 |

0.10 |

0.10 |

|||||||

|

Book value at period end (per share) |

$17.49 |

$16.72 |

$16.35 |

$16.14 |

$15.15 |

|||||||

|

End of period number of shares outstanding |

4,144,561 |

4,144,561 |

4,144,561 |

4,144,561 |

4,144,561 |

|||||||

|

9/30/2024 |

6/30/2024 |

3/31/2024 |

12/31/2023 |

9/30/2023 |

||||||||

|

Safety and Soundness |

||||||||||||

|

Tier 1 capital ratio (leverage ratio)* |

9.67 % |

9.99 % |

9.98 % |

9.77 % |

9.93 % |

|||||||

|

Tangible Equity/Tangible Assets |

8.32 % |

8.33 % |

7.92 % |

8.05 % |

7.75 % |

|||||||

|

Non-performing assets as a percentage of |

||||||||||||

|

total assets including OREO |

0.30 % |

0.36 % |

0.32 % |

0.32 % |

0.33 % |

|||||||

|

Allowance for credit losses as a percentage of |

||||||||||||

|

period end loans |

1.03 % |

1.04 % |

1.04 % |

1.02 % |

1.04 % |

|||||||

|

Ratio of net (recoveries) charge offs annualized during the period to |

||||||||||||

|

average loans outstanding during the period |

-0.022 % |

0.029 % |

0.013 % |

0.046 % |

0.004 % |

|||||||

|

* The capital ratio presented is for Bank of Charles Town. When computing capital ratios, the net of unrealized holding gains (losses) on securities available for sale and the unfunded liability for pension and other post-retirement benefits, all computed net of tax, are added back to these shareholders’ equity figures. |

|

** Includes $154 thousand pre tax loss on sale of securities. |

|

*** Includes $274 thousand pre tax loss on sale of securities. |

|

**** Includes $386 thousand pre tax loss on sale of securities. |

|

CONSOLIDATED FINANCIAL HIGHLIGHTS |

|||||||||||

|

POTOMAC BANCSHARES, INC. |

|||||||||||

|

Noninterest Income & Noninterest Expense |

|||||||||||

|

TABLE 3 |

Three Months Ended |

||||||||||

|

(Unaudited – dollars in thousands) |

|||||||||||

|

9/30/2024 |

6/30/2024 |

3/31/2024 |

12/31/2023 |

9/30/2023 |

|||||||

|

Noninterest Income: |

|||||||||||

|

Wealth and Investments |

$514 |

$432 |

$418 |

$471 |

$453 |

||||||

|

Service charges on deposit accounts |

273 |

265 |

246 |

254 |

266 |

||||||

|

Secondary market income |

170 |

274 |

196 |

140 |

223 |

||||||

|

Interchange fees |

522 |

520 |

493 |

506 |

515 |

||||||

|

Other operating income |

281 |

246 |

261 |

291 |

176 |

||||||

|

Total Noninterest Income |

$1,760 |

$1,737 |

$1,614 |

$1,662 |

$1,633 |

||||||

|

Noninterest Expenses: |

|||||||||||

|

Salaries and employee benefits |

$3,302 |

$3,197 |

$2,984 |

$3,348 |

$3,083 |

||||||

|

Net occupancy expense of premises |

278 |

266 |

276 |

256 |

261 |

||||||

|

Furniture and equipment expenses |

353 |

367 |

367 |

341 |

349 |

||||||

|

Advertising and public relations |

103 |

116 |

68 |

92 |

105 |

||||||

|

Computer services and communications |

486 |

535 |

529 |

485 |

486 |

||||||

|

Other professional services |

442 |

429 |

348 |

410 |

329 |

||||||

|

ATM and check card expenses |

248 |

263 |

249 |

258 |

243 |

||||||

|

Loss on sale of AFS securities |

– |

386 |

– |

154 |

274 |

||||||

|

Other operating expenses |

1,041 |

791 |

841 |

922 |

691 |

||||||

|

Total Noninterest Expenses |

$6,253 |

$6,350 |

$5,662 |

$6,266 |

$5,821 |

||||||

|

Total Noninterest Expenses |

|||||||||||

|

Excluding loss on sale of AFS securities |

$6,253 |

$5,964 |

$5,662 |

$6,112 |

$5,547 |

||||||

|

CONSOLIDATED FINANCIAL HIGHLIGHTS |

||||||||||||

|

POTOMAC BANCSHARES, INC. |

||||||||||||

|

AVERAGE BALANCE SHEET, INTEREST AND RATES |

||||||||||||

|

TABLE 4 |

||||||||||||

|

Three Months Ended |

Three Months Ended |

Three Months Ended |

||||||||||

|

(Unaudited – dollars in thousands) |

9/30/2024 |

6/30/2024 |

9/30/2023 |

|||||||||

|

ASSETS: |

Average |

Interest |

Average |

Average |

Interest |

Average |

Average |

Interest |

Average |

|||

|

Interest Earning Assets: |

||||||||||||

|

Loans: |

||||||||||||

|

Loans held for sale |

$ 1,178 |

$ 21 |

7.09 % |

$ 1,775 |

$ 30 |

6.80 % |

$ 1,856 |

$ 30 |

6.41 % |

|||

|

Portfolio loans (1) |

675,868 |

8,985 |

5.29 % |

654,120 |

8,361 |

5.14 % |

648,910 |

8,063 |

4.93 % |

|||

|

Available for sale securities (2) |

89,854 |

707 |

3.13 % |

92,975 |

724 |

3.13 % |

94,677 |

545 |

2.28 % |

|||

|

Federal Reserve |

91,497 |

1,206 |

5.24 % |

70,581 |

926 |

5.28 % |

40,476 |

498 |

4.88 % |

|||

|

Other interest earning assets |

2,708 |

46 |

6.76 % |

2,172 |

47 |

8.70 % |

2,311 |

40 |

6.87 % |

|||

|

Total Interest Earning Assets |

861,105 |

$10,965 |

5.07 % |

821,623 |

$10,088 |

4.94 % |

788,230 |

$9,176 |

4.62 % |

|||

|

Other Assets |

22,984 |

19,997 |

17,485 |

|||||||||

|

Total Assets |

$ 884,089 |

$841,620 |

$805,715 |

|||||||||

|

Liabilities and Stockholders’ Equity |

||||||||||||

|

Interest-bearing liabilities: |

||||||||||||

|

Interest-bearing Deposits |

$ 601,792 |

$ 3,648 |

2.41 % |

$581,787 |

$ 3,307 |

2.29 % |

$550,424 |

$2,535 |

1.83 % |

|||

|

Federal Funds and repurchase agreements |

3,215 |

7 |

0.87 % |

3,706 |

7 |

0.76 % |

5,232 |

10 |

0.76 % |

|||

|

Subordinated debt |

9,933 |

140 |

5.61 % |

9,918 |

140 |

5.68 % |

9,873 |

139 |

5.59 % |

|||

|

FHLB advances |

20,402 |

217 |

4.23 % |

6,000 |

67 |

4.49 % |

6,011 |

68 |

4.49 % |

|||

|

Total Interest-Bearing Liabilities |

635,342 |

$ 4,012 |

2.51 % |

601,411 |

$ 3,521 |

2.35 % |

571,540 |

$2,752 |

1.91 % |

|||

|

Non-interest-bearing deposits and other liabilities |

178,110 |

172,221 |

171,033 |

|||||||||

|

Total Liabilities |

813,452 |

773,632 |

742,573 |

|||||||||

|

Stockholders’ Equity |

70,637 |

67,988 |

63,142 |

|||||||||

|

Total Liabilities and Stockholders’ Equity |

$ 884,089 |

$841,620 |

$805,715 |

|||||||||

|

Interest Rate Spread |

2.56 % |

2.59 % |

2.71 % |

|||||||||

|

Net Interest Income |

$ 6,953 |

$ 6,567 |

$6,424 |

|||||||||

|

Net Interest Margin |

3.21 % |

3.21 % |

3.23 % |

|||||||||

|

(1) Total loan interest income includes amortization of deferred loan fees, net of deferred loan costs. |

|

(2) Average balances exclude unrealized gains/losses. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/potomac-bancshares-inc-reports-2024-third-quarter-results-302295923.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/potomac-bancshares-inc-reports-2024-third-quarter-results-302295923.html

SOURCE Potomac Bancshares, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

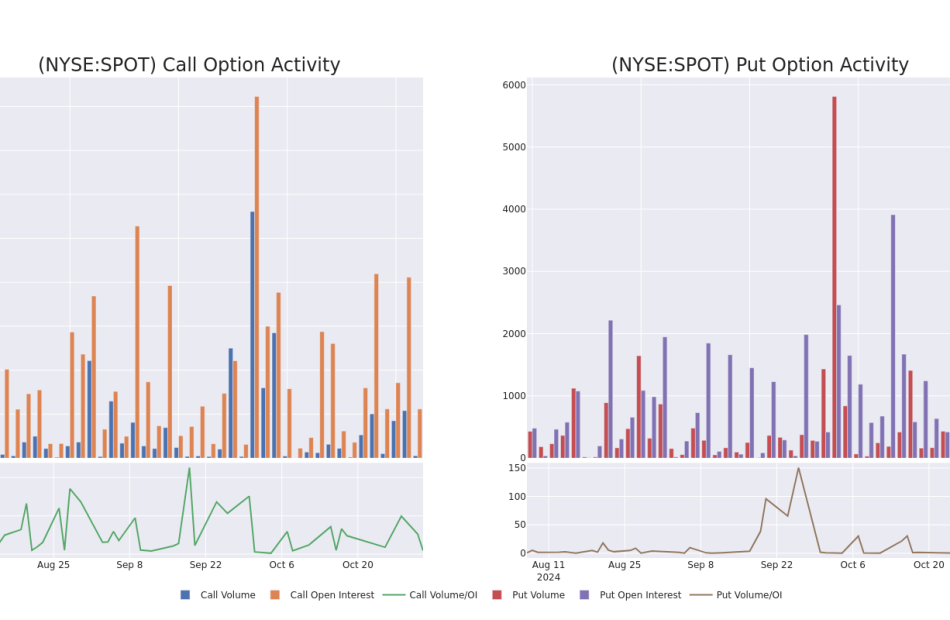

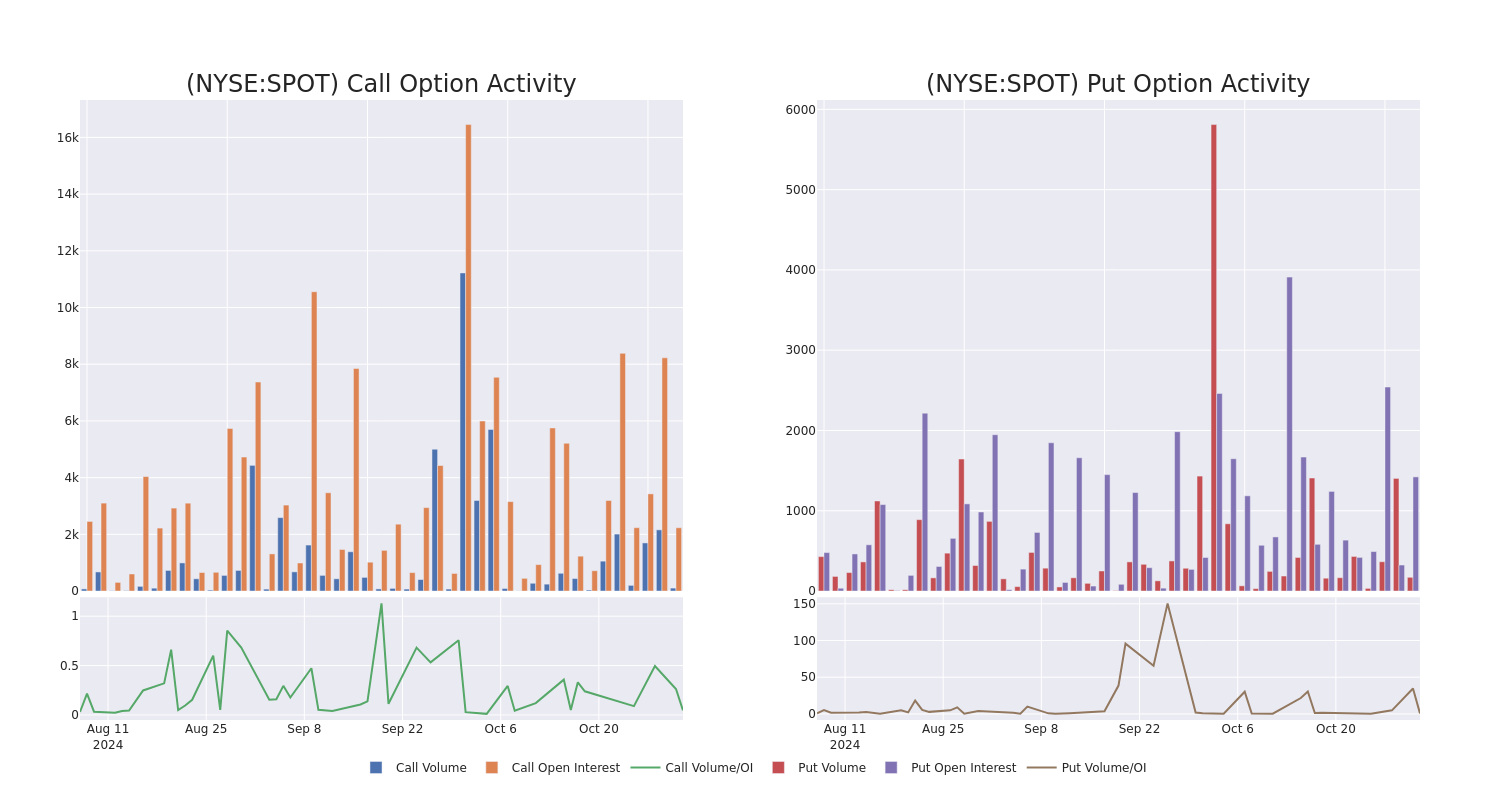

Spotify Technology Unusual Options Activity For November 04

Investors with a lot of money to spend have taken a bearish stance on Spotify Technology SPOT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SPOT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 18 uncommon options trades for Spotify Technology.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 55%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $119,590, and 16 are calls, for a total amount of $965,061.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $260.0 to $460.0 for Spotify Technology during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Spotify Technology options trades today is 223.08 with a total volume of 758.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Spotify Technology’s big money trades within a strike price range of $260.0 to $460.0 over the last 30 days.

Spotify Technology Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | CALL | SWEEP | BEARISH | 03/21/25 | $80.9 | $80.0 | $80.0 | $320.00 | $400.0K | 118 | 50 |

| SPOT | PUT | TRADE | BULLISH | 04/17/25 | $5.3 | $4.55 | $4.75 | $260.00 | $81.7K | 7 | 172 |

| SPOT | CALL | TRADE | BEARISH | 12/20/24 | $27.1 | $27.05 | $27.05 | $380.00 | $75.7K | 216 | 48 |

| SPOT | CALL | TRADE | BEARISH | 01/17/25 | $27.35 | $27.1 | $27.1 | $390.00 | $54.2K | 283 | 20 |

| SPOT | CALL | SWEEP | BULLISH | 12/20/24 | $31.7 | $31.65 | $31.7 | $370.00 | $47.5K | 167 | 16 |

About Spotify Technology

Spotify is the leading global music streaming service provider, with over 600 million monthly active users and 250 million paying subscribers, with the latter comprising the firm’s premium segment. Most of the firm’s revenue and nearly all its gross profit come from the subscribers, who pay a monthly fee to access a very comprehensive music library that consists of most of the most popular songs ever recorded, including all from the major record labels. The firm also sells separate audiobook subscriptions and integrates podcasts within its standard music app. Podcast content is not exclusive and is typically free to access on other platforms. Ad-supported users can access a similar music catalog but cannot customize a similar on-demand experience.

Having examined the options trading patterns of Spotify Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Spotify Technology

- Trading volume stands at 792,241, with SPOT’s price down by -1.19%, positioned at $379.94.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 8 days.

What The Experts Say On Spotify Technology

In the last month, 4 experts released ratings on this stock with an average target price of $457.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Spotify Technology, targeting a price of $490.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Spotify Technology, targeting a price of $438.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Spotify Technology, which currently sits at a price target of $430.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Spotify Technology, which currently sits at a price target of $470.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Spotify Technology, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ken Griffin Just Increased His Position in This Data Center Stock by 704% (Hint: It's Not Nvidia)

Semiconductor stocks have been some of the biggest beneficiaries in the ongoing artificial intelligence (AI) revolution. Chipsets known as graphics processing units (GPUs) are important for developing generative AI, and companies including Nvidia, Advanced Micro Devices, and Taiwan Semiconductor have emerged as early winners in the GPU realm so far.

IT infrastructure is an area tangential to the GPU landscape, and I continue to think it’s going overlooked. GPUs are stored in data centers, so wouldn’t it make sense that as demand for these chips rise, so will the need for data center services?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Well, apparently billionaire investor Ken Griffin of Citadel Advisors might think so. According to Citadel’s most recent 13F filing, the fund increased its position in data center stock Equinix (NASDAQ: EQIX) by 704% during the second quarter — bringing its position to roughly 564,000 shares.

I’ll outline why I see Equinix as an under-the-radar opportunity in the AI space, and will assess if I think the stock is a good buy right now.

One of the most popular applications in AI right now is the large language model (LLM). LLMs such as ChatGPT, Claude, and Gemini have loads of features — from image creation, generating software code, or generic search functionality, these models are changing the way people interact in the workplace and online.

And while LLMs have the ability to generate answers to your queries almost instantly, the underlying build supporting these models is far more complex than you might realize. Generative AI that can process questions and perform tasks quickly takes an incredibly long time to develop. The reason is that these machine learning (ML) applications undergo ongoing training and inferencing testing. Another way of looking at it is that AI models are constantly processing vast amounts of data through complex algorithms — indeed, a big tailwind for the data center market.

During Equinix’s last earnings call, CEO Adaire Fox-Martin made an interesting analogy when comparing the rise of AI to that of cloud computing a decade ago. He stated that “in the near term, AI training workloads are driving significant demand” while inference demand is also “beginning to take shape.”

Today, cloud services have become a multibillion-dollar opportunity for tech stalwarts such as Amazon, Alphabet, Microsoft, and Oracle. One of the reasons for this is that demand for digital infrastructure has risen in parallel with businesses investing more heavily into data to make more informed, efficient decisions.

Etrion Releases Third Quarter 2024 Results

GENEVA, Switzerland, Nov. 04, 2024 (GLOBE NEWSWIRE) — Etrion Corporation (“Etrion” or the “Company”, and, together with its subsidiaries, the “Group”) released today its condensed consolidated interim financial statements and related management’s discussion and analysis (“MD&A”) for the three and nine months ended September 30, 2024.

Q3-24 HIGHLIGHTS

- Etrion closed the third quarter of 2024 with an unrestricted cash balance of US$7.1 million and a positive working capital of US$6.5 million.

- On September 30, 2024, the Group’s Luxembourg subsidiary received an earn-out payment of US$1.2 million. This payment relates to a reimbursement for grid connection costs associated with a former Japanese asset that was sold in 2021.

- In September 2024, the Group’s Japanese subsidiary realized US$0.2 million in proceeds from the sale of specific permits and rights associated with a wind project previously abandoned.

Management Comments:

Marco A. Northland, the Company’s Chief Executive Officer, commented, “The Company going forward will maintain very limited resources and proceed with a windup of the Company as previously disclosed”.

FINANCIAL SUMMARY

| Three months ended | Nine months ended | |||

| US$ thousands (unless otherwise stated) | Q3-24 | Q3-23 | Q3-24 | Q3-23 |

| Financial performance | ||||

| EBITDA | 916 | (806) | 18 | (1,570) |

| Net income (loss) | 338 | (1,262) | (744) | (12,331) |

| Financial position | Sep 2024 |

Dec 2023 | ||

| Unrestricted cash | 7,137 | 9,924 | ||

| Working capital | 6,497 | 7,576 | ||

| Total assets | 7,383 | 10,217 | ||

About Etrion

Etrion’s largest shareholder is the Lundin family, which owns approximately 36% of the Company’s shares directly and through various trusts.

For additional information, please visit the Company’s website at www.etrion.com or contact:

Marco Northland – Chief Executive Officer and Chief Financial Officer

ceo-cfo@etrion.com

The information was submitted for publication at 11:05 p.m. CET on November 4, 2024.

Non-IFRS Measures:

This press release includes non-IFRS measures not defined under IFRS, specifically earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted operating cash flow. Non-IFRS measures have no standardized meaning prescribed under IFRS and therefore such measures may not be comparable with those used by other companies. EBITDA is a useful metric to quantify the Company’s ability to generate cash before extraordinary and non-cash accounting transactions recognized in the financial statements. In addition, EBITDA is useful to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting policy decisions. The most comparable IFRS measure to EBITDA is net income (loss). Refer to Etrion’s MD&A for the three and nine months ended September 30, 2024, for a reconciliation of EBITDA and adjusted operating cash flow reported during the period.

Forward-Looking Information:

This press release contains certain “forward-looking information”. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, other corporate level liabilities and anticipated expenses to cover continuing operations and windup costs, the possibility of acquiring or commencing an alternative business and the possibility that the Company may proceed to wind up its activities and dissolve following the completion of the sale of its solar assets constitute forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company as well as certain assumptions including, without limitation, assumptions as to the amount of funds that will be required to satisfy future obligations and costs associated with the dissolution of the Company. Forward-looking information is subject to a number of significant risks and uncertainties and other factors that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, but are not limited to, the risk that the Company may have insufficient funds to satisfy its future obligations, the risk that the Company may not be successful in identifying and pursuing an alternative business; and uncertainties with respect to the timing of the any alternative business venture or the windup and the dissolution of the Company.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

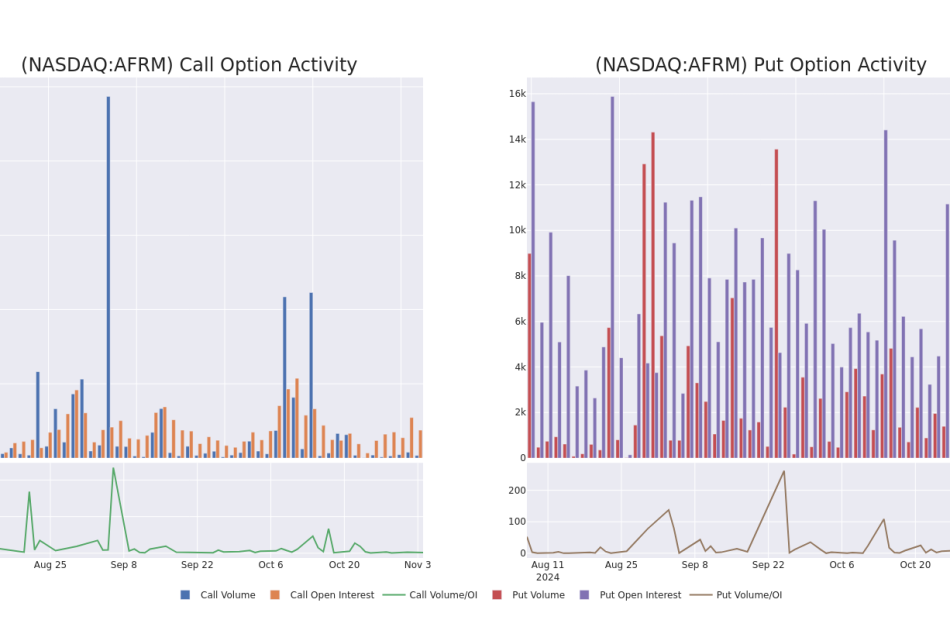

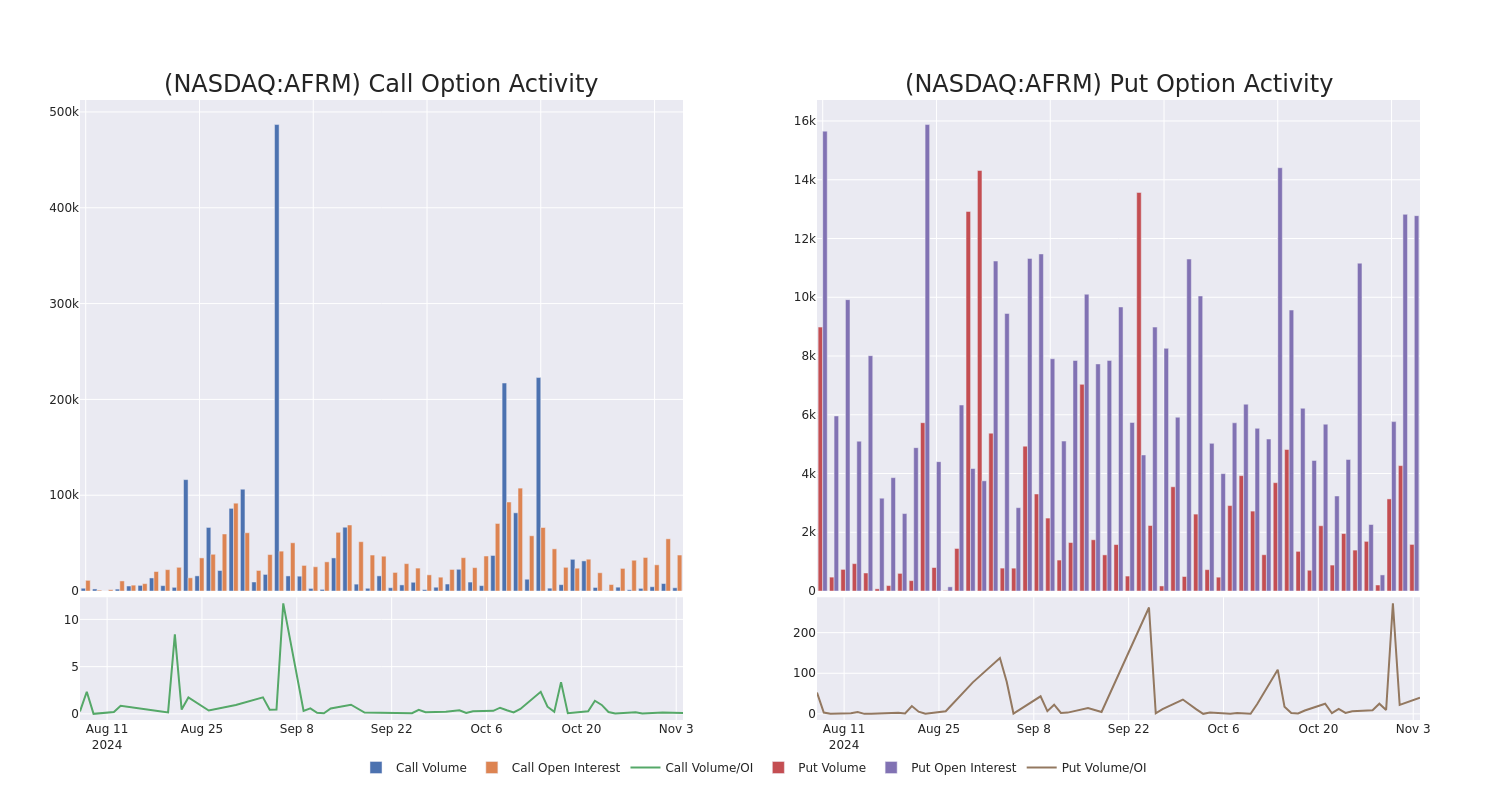

Affirm Holdings's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Affirm Holdings AFRM, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AFRM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 45 extraordinary options activities for Affirm Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 53% leaning bullish and 40% bearish. Among these notable options, 18 are puts, totaling $1,116,305, and 27 are calls, amounting to $1,215,933.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $70.0 for Affirm Holdings over the last 3 months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Affirm Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Affirm Holdings’s substantial trades, within a strike price spectrum from $20.0 to $70.0 over the preceding 30 days.

Affirm Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | PUT | TRADE | NEUTRAL | 12/20/24 | $11.35 | $11.15 | $11.25 | $52.50 | $221.6K | 588 | 201 |

| AFRM | CALL | SWEEP | BEARISH | 11/15/24 | $2.73 | $2.7 | $2.7 | $47.50 | $108.2K | 7.4K | 584 |

| AFRM | PUT | TRADE | BULLISH | 12/20/24 | $26.65 | $26.45 | $26.45 | $70.00 | $105.8K | 8 | 108 |

| AFRM | PUT | TRADE | BEARISH | 11/08/24 | $3.75 | $3.7 | $3.75 | $44.00 | $105.0K | 745 | 312 |

| AFRM | PUT | TRADE | BULLISH | 01/16/26 | $15.05 | $15.0 | $15.0 | $47.50 | $75.0K | 416 | 134 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

In light of the recent options history for Affirm Holdings, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Affirm Holdings’s Current Market Status

- Trading volume stands at 4,599,380, with AFRM’s price up by 0.76%, positioned at $43.55.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 3 days.

What Analysts Are Saying About Affirm Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $51.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has elevated its stance to Overweight, setting a new price target at $52.

* Showing optimism, an analyst from Wedbush upgrades its rating to Neutral with a revised price target of $45.

* An analyst from Goldman Sachs persists with their Buy rating on Affirm Holdings, maintaining a target price of $54.

* An analyst from BTIG has elevated its stance to Buy, setting a new price target at $68.

* Showing optimism, an analyst from Morgan Stanley upgrades its rating to Equal-Weight with a revised price target of $37.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Affirm Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Reports Record Profit, Cites ‘Unwavering’ AI Demand

(Bloomberg) — Palantir Technologies Inc. reported quarterly revenue that beat analysts’ estimates and raised its forecast for operating income in the current period, citing high demand in the US for its artificial intelligence software.

Most Read from Bloomberg

The company’s stock jumped about 13% in after-hours trading following the report.

Third-quarter sales increased 30% to $725.5 million, the Denver-based company said Monday in a statement. Analysts, on average, estimated $703.7 million, according to data compiled by Bloomberg. Palantir also reported net income of $144 million, a record for the company.

“The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand,” from government and commercial customers in the US, Palantir Chief Executive Officer Alex Karp wrote in a letter Monday to shareholders. “The world is in the midst of a US-driven AI revolution that is reshaping industries and economies, and we are at the center of it.”

The company raised its revenue guidance for 2024 to about $2.81 billion. Analysts expected $2.76 billion. The company also reported a substantial increase on a closely watched metric: revenue from its US commercial business, a key driver of sales growth. Palantir expects its US commercial revenue to climb over 50% this year, to more than $687 million.

Palantir’s share price soared after introducing new AI tools last year, becoming a marquee stock of a tech industry frenzy. The share price is up more than 140% so far this year, fueled by demand for its AI software and events such as its recent inclusion in the S&P 500.

Palantir delivered adjusted earnings of 10 cents a share in the period ended Sept. 30, beating analyst estimates of 9 cents. The company projected fourth-quarter adjusted operating income of about $300 million, compared with the average estimate of $261.6 million.

Although Palantir counts global organizations like energy giant BP Plc and the UK’s National Health Service among its customers, demand overseas for its AI software has been weak compared with the US. The company said $499 million of its revenue for the third quarter, about 70%, came from American customers.

“The US is driving the AI revolution we’re seeing,” said Chief Revenue Officer Ryan Taylor during a Monday interview. Taylor said Palantir closed 104 deals over $1 million during the third quarter, thanks largely to its unconventional sales strategy of holding bootcamps to teach customers to use its tools.

Lattice Semiconductor Shares Fall After Q3 EPS Meet Estimate; Revenues Miss: Details

Lattice Semiconductor Corp. LSCC reported its third-quarter results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Lattice Semiconductor reported quarterly earnings of 24 cents per share, which met the analyst consensus estimate. Quarterly revenue came in at $127.091 million, which missed the analyst consensus estimate of $127.092 million and is a decrease from revenue of $192.169 million from the same period last year.

The third-quarter results include a one-time GAAP-only charge of $6.5 million related to actions the company took to drive a comprehensive reduction in spending during the quarter. The actions are expected to result in a 14% workforce reduction and 14% reduction in non-headcount operating expenses. Lattice said it expects the operating expense reduction to help drive annual earnings expansion in the low double-digit range in 2025.

Read Next: Trump Media Stock Volatile On Election Eve As Polls, Betting Markets Predict Tight White House Race

“Through my meetings with employees, customers, and partners, since joining Lattice, I’m even more convinced that we are in an excellent position to expand market share over the long term. Third quarter 2024 results were in line with the Company’s prior expectations, which reflects the disciplined execution of our strategy and a continued focus on operational efficiency,” said Ford Tamer, CEO of Lattice Semiconductor.

“After careful consideration, we proactively took action in the third quarter to better align our resources to the current business level, while maintaining the stability and integrity of our leadership product roadmap, customer support and demand creation infrastructure. Importantly, we do not expect any additional reductions will be needed. While we expect continued near-term industry headwinds, I am excited about the opportunity to build on Lattice’s strong foundation,” Tamer added.

Outlook: Lattice Semiconductor sees fourth-quarter revenue in a range of $112 million to $122 million, versus the $132.03 million estimate.

LSCC Price Action: According to Benzinga Pro, Lattice Semiconductor shares are down 8.94% after-hours at $47.25 at the time of publication Monday.

Read Also:

Photo: Courtesy of Lattice Semiconductor Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.