Palantir Reports Record Profit, Cites ‘Unwavering’ AI Demand

(Bloomberg) — Palantir Technologies Inc. reported quarterly revenue that beat analysts’ estimates and raised its forecast for operating income in the current period, citing high demand in the US for its artificial intelligence software.

Most Read from Bloomberg

The company’s stock jumped about 13% in after-hours trading following the report.

Third-quarter sales increased 30% to $725.5 million, the Denver-based company said Monday in a statement. Analysts, on average, estimated $703.7 million, according to data compiled by Bloomberg. Palantir also reported net income of $144 million, a record for the company.

“The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand,” from government and commercial customers in the US, Palantir Chief Executive Officer Alex Karp wrote in a letter Monday to shareholders. “The world is in the midst of a US-driven AI revolution that is reshaping industries and economies, and we are at the center of it.”

The company raised its revenue guidance for 2024 to about $2.81 billion. Analysts expected $2.76 billion. The company also reported a substantial increase on a closely watched metric: revenue from its US commercial business, a key driver of sales growth. Palantir expects its US commercial revenue to climb over 50% this year, to more than $687 million.

Palantir’s share price soared after introducing new AI tools last year, becoming a marquee stock of a tech industry frenzy. The share price is up more than 140% so far this year, fueled by demand for its AI software and events such as its recent inclusion in the S&P 500.

Palantir delivered adjusted earnings of 10 cents a share in the period ended Sept. 30, beating analyst estimates of 9 cents. The company projected fourth-quarter adjusted operating income of about $300 million, compared with the average estimate of $261.6 million.

Although Palantir counts global organizations like energy giant BP Plc and the UK’s National Health Service among its customers, demand overseas for its AI software has been weak compared with the US. The company said $499 million of its revenue for the third quarter, about 70%, came from American customers.

“The US is driving the AI revolution we’re seeing,” said Chief Revenue Officer Ryan Taylor during a Monday interview. Taylor said Palantir closed 104 deals over $1 million during the third quarter, thanks largely to its unconventional sales strategy of holding bootcamps to teach customers to use its tools.

Lattice Semiconductor Shares Fall After Q3 EPS Meet Estimate; Revenues Miss: Details

Lattice Semiconductor Corp. LSCC reported its third-quarter results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Lattice Semiconductor reported quarterly earnings of 24 cents per share, which met the analyst consensus estimate. Quarterly revenue came in at $127.091 million, which missed the analyst consensus estimate of $127.092 million and is a decrease from revenue of $192.169 million from the same period last year.

The third-quarter results include a one-time GAAP-only charge of $6.5 million related to actions the company took to drive a comprehensive reduction in spending during the quarter. The actions are expected to result in a 14% workforce reduction and 14% reduction in non-headcount operating expenses. Lattice said it expects the operating expense reduction to help drive annual earnings expansion in the low double-digit range in 2025.

Read Next: Trump Media Stock Volatile On Election Eve As Polls, Betting Markets Predict Tight White House Race

“Through my meetings with employees, customers, and partners, since joining Lattice, I’m even more convinced that we are in an excellent position to expand market share over the long term. Third quarter 2024 results were in line with the Company’s prior expectations, which reflects the disciplined execution of our strategy and a continued focus on operational efficiency,” said Ford Tamer, CEO of Lattice Semiconductor.

“After careful consideration, we proactively took action in the third quarter to better align our resources to the current business level, while maintaining the stability and integrity of our leadership product roadmap, customer support and demand creation infrastructure. Importantly, we do not expect any additional reductions will be needed. While we expect continued near-term industry headwinds, I am excited about the opportunity to build on Lattice’s strong foundation,” Tamer added.

Outlook: Lattice Semiconductor sees fourth-quarter revenue in a range of $112 million to $122 million, versus the $132.03 million estimate.

LSCC Price Action: According to Benzinga Pro, Lattice Semiconductor shares are down 8.94% after-hours at $47.25 at the time of publication Monday.

Read Also:

Photo: Courtesy of Lattice Semiconductor Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

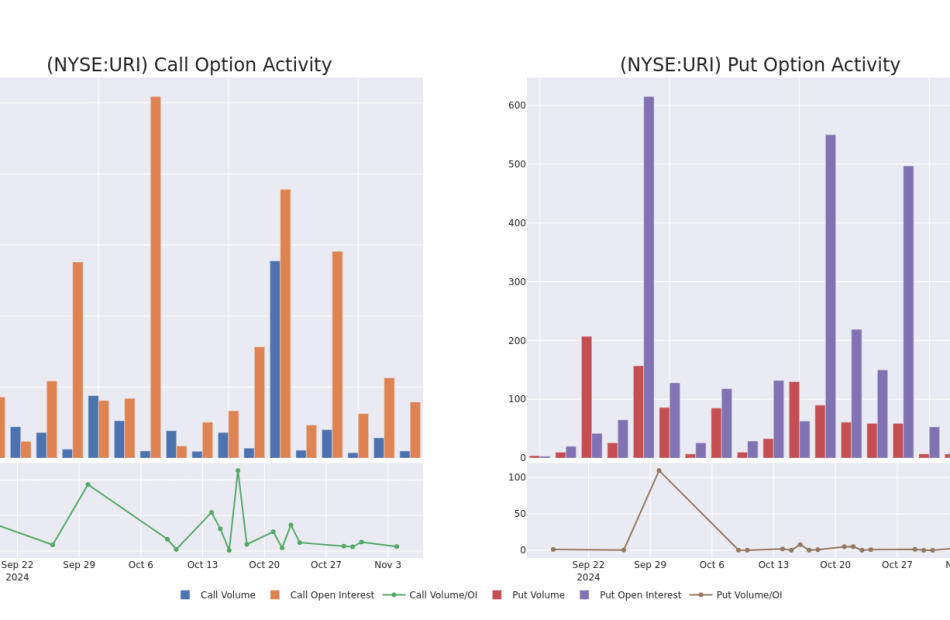

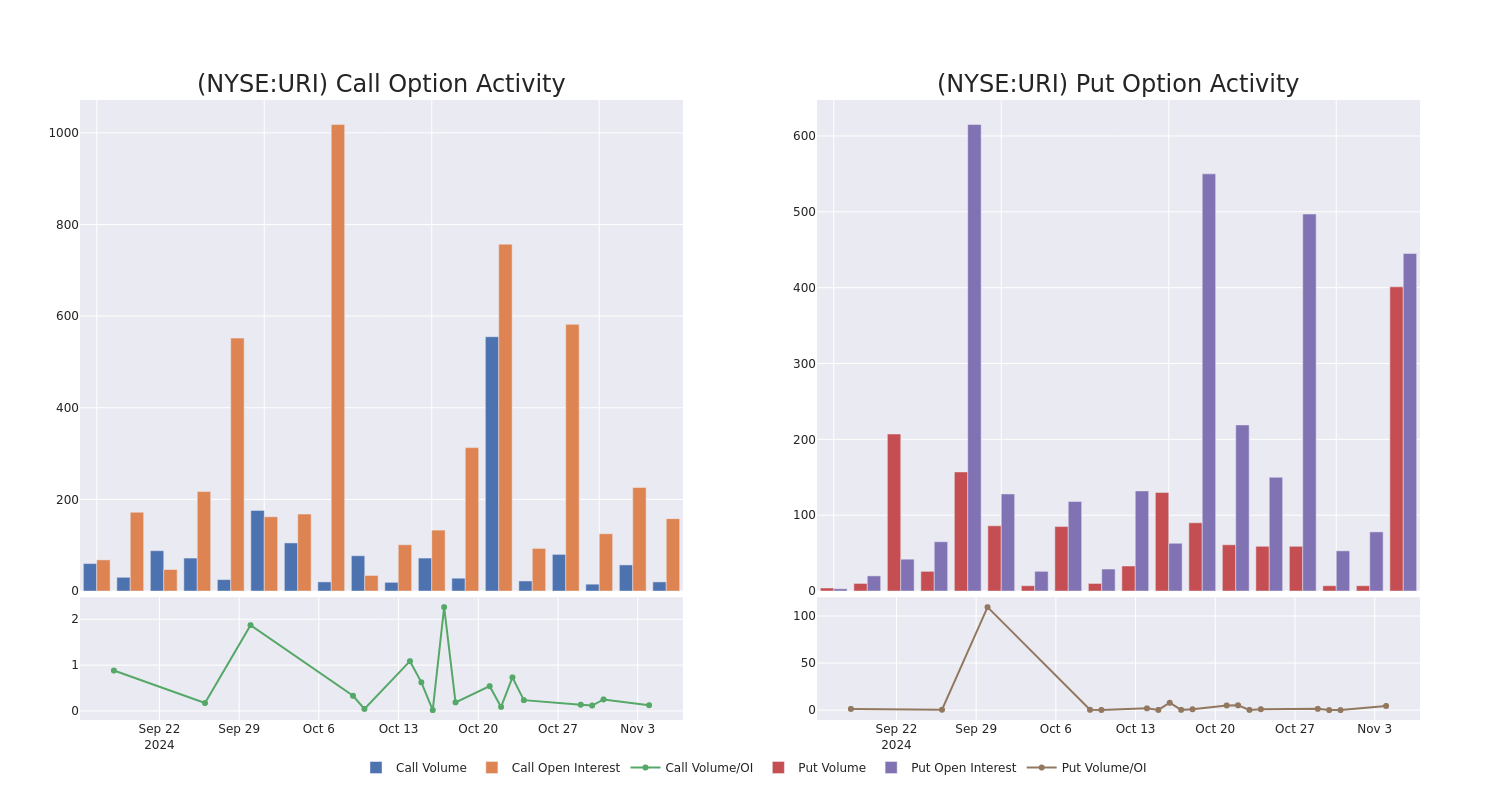

United Rentals Unusual Options Activity For November 04

Investors with a lot of money to spend have taken a bearish stance on United Rentals URI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with URI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for United Rentals.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $555,100, and 3 are calls, for a total amount of $150,585.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $770.0 to $850.0 for United Rentals over the last 3 months.

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for United Rentals’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across United Rentals’s significant trades, within a strike price range of $770.0 to $850.0, over the past month.

United Rentals Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | PUT | SWEEP | BULLISH | 12/20/24 | $31.8 | $29.2 | $29.39 | $770.00 | $138.5K | 440 | 152 |

| URI | PUT | TRADE | BEARISH | 03/21/25 | $64.0 | $63.1 | $64.0 | $790.00 | $115.2K | 5 | 18 |

| URI | PUT | SWEEP | BULLISH | 12/20/24 | $29.7 | $29.3 | $29.37 | $770.00 | $105.6K | 440 | 102 |

| URI | PUT | SWEEP | NEUTRAL | 12/20/24 | $30.0 | $29.3 | $29.57 | $770.00 | $77.1K | 440 | 66 |

| URI | PUT | SWEEP | NEUTRAL | 12/20/24 | $30.1 | $29.0 | $29.6 | $770.00 | $68.1K | 440 | 23 |

About United Rentals

United Rentals is the world’s largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $22 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

Following our analysis of the options activities associated with United Rentals, we pivot to a closer look at the company’s own performance.

Where Is United Rentals Standing Right Now?

- Currently trading with a volume of 403,771, the URI’s price is down by -1.32%, now at $782.96.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 79 days.

Professional Analyst Ratings for United Rentals

5 market experts have recently issued ratings for this stock, with a consensus target price of $862.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on United Rentals with a target price of $930.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for United Rentals, targeting a price of $954.

* An analyst from B of A Securities persists with their Buy rating on United Rentals, maintaining a target price of $910.

* An analyst from Truist Securities has decided to maintain their Buy rating on United Rentals, which currently sits at a price target of $955.

* Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for United Rentals, targeting a price of $565.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Rentals options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Supermicro Shares Plunge Again. Time to Buy the Dip or Stay Away?

The saga around Super Micro Computer (NASDAQ: SMCI) continued with the stock plunging on news that its auditor has resigned. The stock has bounced around like a ping-pong ball this year, with a number of extreme moves to both the upside and downside. Now the stock is down 9% year to date.

Let’s take a closer look at some of recent drama around the stock and see if we can determine whether the stock is a buy or if it best to just stay away.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The latest plunge in Supermicro stock stems from its auditor, Ernst and Young, resigning, with the accounting firm saying it was “unwilling to be associated with the financial statements prepared by management.” It said its resignation stemmed from recent information that has come to its attention, although in July it had raised concerns about Supermicro’s governance, transparency, and internal controls.

For its part, Supermicro said it disagreed with Ernst and Young’s assessment and that it does not expect to have to issue any restatements to its financial reports. It is currently looking for a replacement accounting firm to conduct its audit. This fiscal year was the first year that Ernst and Young was conducting an audit for the company.

Supermicro’s accounting first came into question in the public sphere back in August when short-seller Hindenburg Research accused the company of accounting manipulation, as well as evading sanctions and management self-dealings with related third parties. Its accusations were meant to help drop the stock price to its benefit, which it has succeeded in doing. Short-selling is when an investor borrows a stock from a current shareholder and then immediately sells it with the plan of buying it back later at a lower price.

Supermicro didn’t do itself any favors when shortly after the short report it decided to delay the filing its fiscal 2024 annual report with the Securities and Exchange Commission (SEC) to review the “design and operating effectiveness of its internal controls over financial reporting.” The Wall Street Journal, meanwhile, later reported that the company’s accounting was allegedly being investigated by the Department of Justice (DOJ), which also sent Supermicro’s stock tumbling.

Notably, Ernst and Young’s initial concerns came out before the Hindenburg short report. This also isn’t the first time the company has run into potential accounting issues. Back in 2020, the SEC fined Supermicro for prematurely recognizing revenue and understating expenses, noting that employees were encouraged to ship products to warehouses at quarter-end, upon which it recognized the revenue even though the products had yet to reach customers. CEO Charles Liang was fined $2.1 million, but was not charged with any wrongdoing.

INTERRENT REIT DELIVERS STRONG Q3 RESULTS AND OPERATIONAL EFFICIENCY

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES /

OTTAWA, ON, Nov. 4, 2024 /CNW/ – InterRent Real Estate Investment Trust IIP (“InterRent” or the “REIT“) today reported financial results for the third quarter ended September 30, 2024.

Q3 2024 Highlights:

- Same property and total portfolio occupancy rates of 96.4% in September 2024, a year-over-year (“YoY”) increase of 120 basis points and a sequential increase of 20 basis points from Q2 2024.

- Achieved Average Monthly Rent (“AMR”) of $1,687 for the total portfolio and $1,686 for the same property portfolio in September, representing YoY growth of 7.0% and 5.6% respectively.

- Executed 1,279 new leases during Q3, representing 9.7% of the REIT’s total portfolio, with an average gain-on-lease of 11.4% compared to expiring rents. Suite turnover excluding disposed properties was 23.8% for the trailing 12 months.

- Same property proportionate Net Operating Income (“NOI”) of $41.5 million, an increase of $3.3 million, or 8.7% YoY, with same property NOI margin improving by 40 basis points YoY to reach 68.2%.

- Funds from Operations (“FFO”) reached $23.4 million, an increase of 9.7% YoY. FFO per unit (diluted) of $0.159, an increase of 8.9% from the same period last year.

- Adjusted Funds from Operations (“AFFO”) of $20.9 million, reflecting an improvement of 10.3%. AFFO per unit (diluted) of $0.142, up 9.2% YoY.

- Maintained strong financial position with a debt-to-GBV ratio of 38.5% and variable rate exposure below 1% as of end of Q3.

- Subsequent to the quarter, closed the acquisition of a newly-constructed community in downtown Montréal with 248 residential suites in a 50% joint venture for a total price of $107 million.

- Board of Trustees has approved a 5% increase to the distribution, from $0.3780 per unit to $0.3969 per unit, marking the 13th consecutive year that the REIT has grown its distribution by 5% or more.

- Achieved a 21% improvement in score and ranked first among Canadian public multi-family REITs in the 2024 GRESB Real Estate Assessment.

Brad Cutsey, President & CEO of InterRent, commented on the results:

“We’re pleased with our strong Q3 results following a busy summer leasing season. Although growth in market rent has moderated from last year’s peak, we have seen good leasing activity and increased occupancy across all regions. Our focus remains on enhancing operating efficiency and further growing our industry-leading margins. We’re particularly excited about our recent acquisition in a highly central location in downtown Montréal, strategically positioned near a major hospital and a prominent French university. This addition, secured at a discount to replacement cost, bolsters our already strong and well-located Montréal portfolio. We’re confident that this acquisition, once stabilized, will further supplement our solid organic growth as we continue to leverage our operational strengths and position InterRent for long-term growth.”

Financial Highlights:

|

Selected Consolidated Information |

3 Months Ended September 30, 2024 |

3 Months Ended September 30, 2023 |

Change |

|

Total suites |

12,031(1) |

12,728(1) |

-5.5 % |

|

Average rent per suite (September) |

$ 1,687 |

$ 1,576 |

+7.0 % |

|

Occupancy rate (September) |

96.4 % |

95.2 % |

+120 bps |

|

Proportionate operating revenues |

$ 61,213 |

$ 59,596 |

+2.7 % |

|

Proportionate net operating income (NOI) |

$ 41,730 |

$ 40,291 |

+3.6 % |

|

NOI % |

68.2 % |

67.6 % |

+60 bps |

|

Same Property average rent per suite (September) |

$ 1,686 |

$ 1,596 |

+5.6 % |

|

Same Property occupancy rate (September) |

96.4 % |

95.2 % |

+120 bps |

|

Same Property proportionate operating revenues |

$ 60,836 |

$ 56,380 |

+7.9 % |

|

Same Property proportionate NOI |

$ 41,499 |

$ 38,190 |

+8.7 % |

|

Same Property proportionate NOI % |

68.2 % |

67.8 % |

+40 bps |

|

Net Income (Loss) |

$ (74,153) |

$ (54,560) |

+35.9 % |

|

Funds from Operations (FFO) |

$ 23,410 |

$ 21,335 |

+9.7 % |

|

FFO per weighted average unit – diluted |

$ 0.159 |

$ 0.146 |

+8.9 % |

|

Adjusted Funds from Operations (AFFO) |

$ 20,910 |

$ 18,957 |

+10.3 % |

|

AFFO per weighted average unit – diluted |

$ 0.142 |

$ 0.130 |

+9.2 % |

|

Distributions per unit |

$ 0.0945 |

$ 0.0900 |

+5.0 % |

|

Adjusted Cash Flow from Operations (ACFO) |

$ 22,394 |

$ 17,415 |

+28.6 % |

|

Debt-to-GBV |

38.5 % |

38.6 % |

-10 bps |

|

Interest coverage (rolling 12 months) |

2.46x |

2.30x |

+0.16x |

|

Debt service coverage (rolling 12 months) |

1.63x |

1.52x |

+0.11x |

|

(1) Represents 11,363 (2023 – 12,060) suites fully owned by the REIT, 1,214 (2023 – 1,214) suites owned 50% by the REIT, and 605 (2023 – 605) suites owned 10% by the REIT. |

Strong Operational Results in Q3

As of September 30, 2024, InterRent had proportionate ownership in 12,031 suites, a decrease of 5.5% from September 2023. This change reflects the disposition of 4 communities during the year, which did not contribute to Q3 results and impacted the total portfolio performance comparisons.

During the quarter, the REIT achieved strong operational results by increasing occupancy rates while maintaining steady rent growth. Same property AMR for September reached $1,686, representing an increase of 5.6%. AMR growth was robust across all regional markets, with increases in the 5-7% range for the same property portfolio.

Occupancy rates improved steadily and are within the current target range of 96%-97%. The same property occupancy rate for September was 96.4%, reflecting a year-over-year improvement of 120 basis points and a quarter-over-quarter increase of 20 basis points. The same property occupancy rate in the National Capital Region remained steady at 97.2%, with all other regions showing improvements, including a 300 basis point occupancy increase in the Greater Montreal Area to reach 96.3%.

The REIT executed 1,279 new leases during the quarter and realized an average gain-on-lease of 11.4%. New leases resulted in an annualized incremental revenue gain of approximately $3.0 million. The recently announced immigration levels plan is anticipated to moderate the pace of rental growth in certain markets in the near term. Average market rental gap on the total portfolio has decreased slightly and now stands at approximately 27%. InterRent is closely monitoring market conditions in each region and remains flexible in its strategy. While timing for realizing this gap is affected by the industry-wide trend of reduced turnover, this embedded value continues to support stable, long-term rental income growth.

Focus on Cost Control Drove Up NOI Margin

Driven by strong AMR growth and a 120 basis point reduction in vacancy rates, InterRent achieved a 7.9% increase in same property proportionate operating revenues during the quarter. Same property operating expenses in Q3 increased by 6.3% year-over-year, primarily due to the timing of certain cost allocations. For the first nine months of 2024, operating expenses increased 3.6% compared to the same period last year. The REIT achieved a same property proportionate NOI margin of 68.2% during the quarter, reflecting a 40 basis point improvement year-over-year and 50 basis point increase sequentially.

Proportionate NOI for the same property portfolio increased by 8.7% to reach $41.5 million during the quarter.

Achieved Significant Growth in FFO and AFFO

In Q3 2024, InterRent achieved a 9.7% increase in FFO and an 8.9% increase in FFO per unit, compared to Q3 2023. Year-over-year growth in AFFO was 10.3% and 9.2% on a per unit basis during the quarter. This was driven by increased NOI and a 6.4% year-over-year reduction in financing costs.

During the third quarter, financing costs were $13.9 million on a proportionate basis, or 22.7% of operating revenue, compared to $14.8 million, or 24.8% of operating revenue for the same period last year. The decrease was driven by a reduction in the weighted average interest rate to 3.37% from 3.48% in September 2023, along with a $28.0 million reduction in outstanding mortgage balances. The REIT also benefited from lower debt levels on its credit facilities, reducing credit facility costs by $0.7 million. This improvement was achieved through the strategic use of proceeds from financing activities and capital recycling efforts earlier in the year.

Strong Balance Sheet for Financial Flexibility

Year-over-year, the REIT’s debt-to-GBV ratio decreased 10 basis points to 38.5% at September 30, 2024. InterRent’s current credit facilities totaling $225.0 million remained undrawn as of the end of Q3, with $193.4 million in unencumbered properties and approximately $295 million in available liquidity as of October 31, 2024.

Management remains focused on disciplined capital allocation to maintain the strength of the balance sheet and ensure financial flexibility.

Strategic Acquisition of a Montréal New-Build Community

Subsequent to the quarter, InterRent successfully closed the acquisition of a newly constructed apartment community located in downtown Montréal for $107 million through a 50% joint venture with a trusted partner.

The community is a 20-storey concrete high-rise located at 170 René-Lévesque Boulevard East. The building was newly constructed in 2023, featuring 248 residential suites and approximately 7,000 sq. ft. of commercial space on the ground floor. The commercial space is in the process of being leased to a financial institution and an established national retail brand.

The REIT’s portion of the acquisition will be funded in the near-term through a combination of proceeds from the REIT’s capital recycling program and its operating line of credit. Long-term financing has been submitted in early October through CMHC’s MLI Select Program by meeting energy efficiency and accessibility thresholds.

Sustainability Progress

InterRent remains committed to advancing sustainability initiatives to enhance efficiency, reduce carbon footprints, and build resilience against climate change impacts. In October, InterRent received a 3 Green Star designation for its 2024 GRESB Real Estate Assessment, achieving a score of 81, representing an improvement of 21% from last year and ranking 1st among all public Canadian multi-family REITs that submitted to GRESB this year.

Additionally, the REIT announced in October that its entire Montréal portfolio has achieved certification under the BOMA BEST Sustainable Buildings certification program. This achievement builds on the successful certification of the REIT’s portfolios in Ontario and British Columbia under the Canadian Certified Rental Buildings Program in 2023 and earlier 2024. Under these two programs, 100% of InterRent’s multi-family communities have achieved building certification coverage.

Conference Call & Webcast

Management will host a webcast and conference call to discuss these results and current business initiatives on Tuesday, November 5, 2024, at 10:00 am EST. The webcast will be accessible at: https://www.irent.com/2024-q3-results. A replay will be available for 7 days after the webcast at the same link. The telephone numbers for the conference call are 1-800-717-1738 (toll free) and (+1) 289-514-5100 (international). No access code required.

ABOUT INTERRENT

InterRent REIT is a growth-oriented real estate investment trust engaged in increasing Unitholder value and creating a growing and sustainable distribution through the acquisition and ownership of multi-residential properties.

InterRent’s strategy is to expand its portfolio primarily within markets that have exhibited stable market vacancies, sufficient suites available to attain the critical mass necessary to implement an efficient portfolio management structure, and offer opportunities for accretive acquisitions.

InterRent’s primary objectives are to use the proven industry experience of the Trustees, Management and Operational Team to: (i) to grow both funds from operations per Unit and net asset value per Unit through investments in a diversified portfolio of multi-residential properties; (ii) to provide Unitholders with sustainable and growing cash distributions, payable monthly; and (iii) to maintain a conservative payout ratio and balance sheet.

*Non-GAAP Measures

InterRent prepares and releases unaudited quarterly and audited consolidated annual financial statements prepared in accordance with IFRS (GAAP). In this and other earnings releases, as a complement to results provided in accordance with GAAP, InterRent also discloses and discusses certain non-GAAP financial measures, including Gross Rental Revenue, NOI, Same Property results, Repositioned Property results, FFO, AFFO, ACFO and EBITDA. These non-GAAP measures are further defined and discussed in the MD&A dated November 4, 2024, which should be read in conjunction with this press release. Since Gross Rental Revenue, NOI, Same Property results, Repositioned Property results, FFO, AFFO, ACFO and EBITDA are not determined by GAAP, they may not be comparable to similar measures reported by other issuers. InterRent has presented such non-GAAP measures as Management believes these measures are relevant measures of the ability of InterRent to earn and distribute cash returns to Unitholders and to evaluate InterRent’s performance. These non-GAAP measures should not be construed as alternatives to net income (loss) or cash flow from operating activities determined in accordance with GAAP as an indicator of InterRent’s performance.

Cautionary Statements

The comments and highlights herein should be read in conjunction with the most recently filed annual information form as well as our consolidated financial statements and management’s discussion and analysis for the same period. InterRent’s publicly filed information is located at www.sedarplus.com.

This news release contains “forward-looking statements” within the meaning applicable to Canadian securities legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “anticipated”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. InterRent is subject to significant risks and uncertainties which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward looking statements contained in this release. A full description of these risk factors can be found in InterRent’s most recently publicly filed information located at www.sedar.com. InterRent cannot assure investors that actual results will be consistent with these forward looking statements and InterRent assumes no obligation to update or revise the forward looking statements contained in this release to reflect actual events or new circumstances.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE InterRent Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c1188.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c1188.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

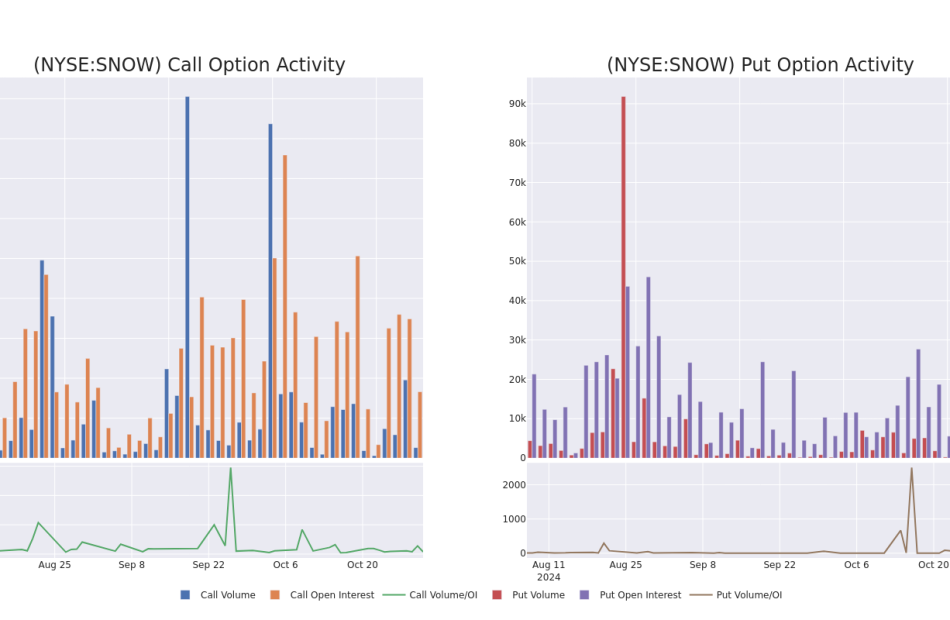

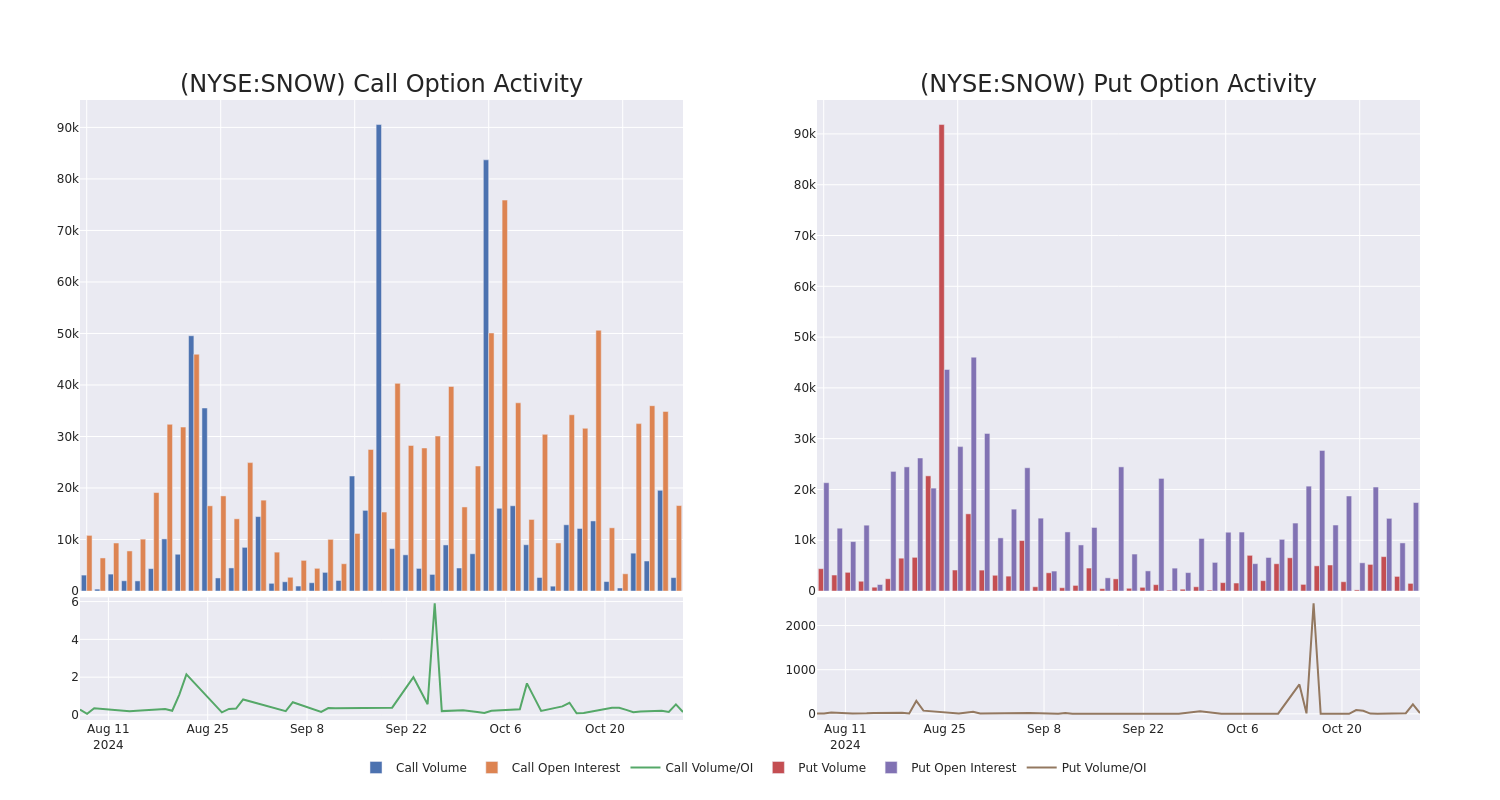

This Is What Whales Are Betting On Snowflake

Financial giants have made a conspicuous bearish move on Snowflake. Our analysis of options history for Snowflake SNOW revealed 55 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 30 were puts, with a value of $2,528,412, and 25 were calls, valued at $1,600,527.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $180.0 for Snowflake over the recent three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Snowflake’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Snowflake’s whale trades within a strike price range from $90.0 to $180.0 in the last 30 days.

Snowflake Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | PUT | TRADE | NEUTRAL | 01/15/27 | $73.65 | $70.8 | $72.0 | $180.00 | $1.2M | 0 | 170 |

| SNOW | CALL | SWEEP | BEARISH | 02/21/25 | $8.15 | $8.0 | $8.0 | $130.00 | $199.2K | 557 | 261 |

| SNOW | CALL | SWEEP | BEARISH | 06/20/25 | $9.4 | $9.05 | $9.05 | $150.00 | $179.1K | 917 | 248 |

| SNOW | CALL | SWEEP | BULLISH | 12/20/24 | $10.3 | $10.15 | $10.22 | $115.00 | $102.8K | 1.0K | 335 |

| SNOW | CALL | TRADE | BEARISH | 01/17/25 | $12.15 | $12.1 | $12.1 | $115.00 | $84.7K | 1.5K | 241 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake’s data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake’s data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Having examined the options trading patterns of Snowflake, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Snowflake

- With a volume of 2,219,035, the price of SNOW is down -1.1% at $114.22.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 16 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snowflake with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Stock Today: This Cash-Secured Put Ahead Of Earnings Produces $185 Immediately

Palantir Technologies (PLTR) is set to report earnings on Monday after the closing bell, and the options market is pricing in a 6.8% move in either direction. So, let’s look at selling a cash-secured put option in Palantir stock.

↑

X

Palantir Earnings Due As Tech Stocks Stumble

Palantir is a leading provider of data analytics software, serving both government and commercial sectors. Analysts anticipate earnings of 9 cents per share, reflecting a 28.6% increase from the same period last year, with projected revenues of $705.1 million, marking year-over-year growth of 26.3%.

Recently, Palantir stock has experienced significant gains, driven by strong demand for its artificial intelligence platforms and strategic partnerships in the defense sector.

Palantir Stock: The Cash-Secured Put

In a cash-secured put, traders take advantage of the high implied volatility around the earnings announcement. A cash-secured put involves selling an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock.

The goal? Either have the put in Palantir stock expire worthless and keep the premium, or take assignment and acquire the stock below the current price.

This trade is very similar to a covered call and quite easy to understand once you know the basics. Anyone selling puts should understand that one might get assigned 100 shares at the strike price.

For Palantir stock, a trader selling the Nov. 8-expiration put with a strike price of 40 will generate around $185 in premium per contract, based on recent trading. The put has a delta of 34, which points to an estimated 66% chance that it will expire worthless.

The put seller would have the obligation to purchase 100 shares of PLTR stock at 40 if called upon to do so by the put buyer.

Calculate the break-even price by taking the strike price less the premium received. So in this case we get a break-even price of 38.15 in Palantir stock, or 9% below Friday’s closing price.

Reward And Risk

If the stock stays above 40 at expiry, the sold put option expires worthless. Traders earn a 4.85% return on capital at risk. That works out to an incredible 354% on an annualized basis.

The main risk with the trade is similar to outright stock ownership. If the stock falls significantly, the trade will suffer a loss, however the loss will be partially offset by the premium received for selling the put.

Cash-secured puts are a fantastic way to generate a return on stocks the trader is happy to own.

With this example, the trader either generates a 4.85% return in a week, or they get to purchase PLTR stock at a reasonable discount on the current price.

If Palantir stock trades below 40 and the put gets assigned, investors can then sell covered calls against the position to generate further income.

According to IBD Stock Checkup, PLTR stock ranks first in its group and has a perfect Composite Rating of 99, an EPS Rating of 97 and a Relative Strength Rating of 98.

Remember that options are risky and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. Follow him on X/Twitter at @OptiontradinIQ.

YOU MIGHT ALSO LIKE:

Morgan Stanley Option Trade Offers 25% Return On Risk, If You’re Winning To Wait

Uber Stock Today: Option Offers Quick 13% Return On Risk If Earnings Go As Expected

Amazon Stock Today: Sell This Put Option, Pocket $290 Instantly

Netflix Stock Today: Getting An $1,800 Profit Potential By Adjusting Risk Profile

JetZero Finalizes Contracts with Major Suppliers for Demonstrator's Flight Control Systems

Contract completion is a major milestone with Tier One suppliers

LONG BEACH, Calif., Nov. 4, 2024 /PRNewswire/ — JetZero has finalized partnership agreements with Tier One suppliers for the key components of the Flight Control System on its full-scale blended wing body (BWB) demonstrator. The execution of contracts marks a critical step in the path toward build and demonstration, with test flights scheduled to begin in 2027.

“Finalizing supplier contracts for the Flight Control Systems is a significant milestone on our journey from design, to test, to demonstration,” said Dan da Silva, chief operating officer for JetZero. “It’s just the latest example of the steady progress JetZero is making toward building this airplane. These suppliers are the best at what they do, and we’re so pleased to see their shared enthusiasm and belief in the blended wing airplane we’re building at JetZero.”

All hardware being integrated onto the airplane already flies on Part 25 commercial air transport airplanes, lowering risk and eliminating barriers to eventual certification. JetZero has intentionally selected partners and components with high technology and integration readiness levels.

Flight Control Systems suppliers include:

BAE Systems: Pilot Controls and Actuation Controllers

Active control sidesticks give immediate and intuitive feedback directly into the pilot’s hands, which enables them to safely make use of the airplane’s full flight envelope. Another significant benefit of this technology is the ability to link the controls electronically from pilot to pilot across the cockpit. This link enables both pilots to feel the forces and see the movement generated by the other. Active control sticks also require less complexity, weight, and volume than mechanically linked control sticks.

Actuator Control Units translate flight control signals, including the pilot inputs from the active control sticks, to commands that control the aircraft’s control surfaces, providing precise coordination and responsiveness. These units work seamlessly with the flight control system, enhancing overall flight performance.

“This order is another significant step for BAE Systems in the aviation market and furthers the company’s pursuit of a greener tomorrow,” said Adam Taylor, business development & capability director at BAE Systems. “As the aerospace industry works diligently to lower emissions, we are proud to be part of JetZero’s project to help further the industry’s sustainability vision.”

Moog: Flight Control Actuation

Moog will provide the complete set of flight control actuators for this industry-leading program. Moog is the foremost leader in the aerospace industry providing flight control equipment and systems to the world’s leading commercial platforms. This includes design, development, test and certification.

“Moog’s extensive experience in actuation technology allows us to provide the right solution optimized for performance, weight and reliability”, said Mark Brooks, Moog senior vice president for commercial aircraft. “Moog is proud and excited to be part of the groundbreaking program that will lead to more efficient and environmentally friendly aircraft.”

Safran: Pilot Controls

Safran Electronics & Defense will develop and manufacture pilot controls and provide engineering services for JetZero’s Blended Wing Body demonstrator aircraft. As part of this collaboration, Safran will supply the Throttle Quadrant, Rudder Brake Pedal, Speedbrake, Flap Control Lever, and additional cockpit components for all development and qualification laboratories, as well as the demonstrator itself.

“This partnership underscores Safran and JetZero’s shared commitment to innovation and environmental sustainability within the aerospace industry, addressing one of the sector’s most significant challenges: the reduction of CO2 emissions” said Bruno Vazzoler, Safran Electronics & Defense Avionics GBU EVP.

Thales: Flight Control Computers

Field-proven for over 40 years and installed on board more than 12,000 aircraft, Thales’s Fly-by-Wire flight control solution is perfectly suited to JetZero’s needs. The Fly-by-Wire flight control systems offer substantial benefits in terms of flight safety, aircraft performance, reliability and availability. Those benefits encompass flight envelope protection, reduced pilot workload, minimized aircraft weight, improved handling qualities and reliability.

“Actively engaged in a low carbon future, Thales is proud to support JetZero in their innovative pursuit of net zero flights,” said Yanik Doyon, VP of Sales & Business Development for Flight Avionics, Thales North America. “Our proven flight controls solution is the perfect fit for a disruptive aircraft paving the way for a sustainable future in aviation.”

Woodward: Trim Control Panel

Woodward’s Trim Control Module contains pilot interfaces intended for yaw trim, pitch trim and reset functions that relieves the pilot from having to maintain constant pressure on the flight controls. The mechanism works with the airplane through two Rotary Variable Differential Transformers (RVDT) essential to the product. The RVDTs are designed and manufactured by Woodward at its Niles, IL facility.

“Woodward is proud to be chosen as a collaborator on the JetZero Blended Wing Body Demonstrator. This pioneering endeavor in sustainable aircraft has potential to revolutionize the aviation industry. Our Trim Control Module is the ideal fit for the demonstrator objectives, and another example of our commitment to working alongside trailblazers in line with our purpose to design and deliver energy control solutions our partners count on to power a clean future,” said Terry Voskuil, President of Aerospace, Woodward.

About JetZero

JetZero, co-founded by aerospace legend Mark Page, is developing the world’s first commercial blended wing body (BWB) airplane. With 50% lower fuel burn and carbon emissions compared to existing commercial airliners, JetZero’s BWB offers the aviation industry a clear path to achieving its 2050 net-zero goals. Working alongside the US Air Force, NASA, and the FAA, and backed by decades of investment and research into blended wing technology, JetZero looks to enter commercial service by 2030.

Media Contact:

Chris Singley

1-214-697-8980

cksingley@jetzero.aero

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jetzero-finalizes-contracts-with-major-suppliers-for-demonstrators-flight-control-systems-302295039.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jetzero-finalizes-contracts-with-major-suppliers-for-demonstrators-flight-control-systems-302295039.html

SOURCE JetZero

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.