ITAÚ UNIBANCO – Projections

SÃO PAULO, Nov. 4, 2024 /PRNewswire/ — Itaú Unibanco Holding S.A. (“Itaú Unibanco” or “Company”), in compliance with the provisions in Article 157, paragraph 4 of Law No. 6,404/76 and in Resolution No. 44/21 of the Brazilian Securities and Exchange Commission (CVM), informs its stockholders and the market in general that it released as of this date its revised projections for the year 2024 in accordance with item 3 (“Projections”) of the Reference Form.

|

2024 Forecast |

Consolidated |

Growth on a comparable basis 4 |

Reviewed |

||

|

Total credit portfolio¹ |

Growth between |

Growth Between |

|||

|

Financial margin with clients |

Growth between |

Growth between |

Maintened |

||

|

Financial margin with the market |

Between |

Maintened |

|||

|

Cost of credit² |

Between |

Maintened |

|||

|

Commissions and fees and results |

Growth between |

Growth between |

Maintened |

||

|

Non interest expenses5 |

Growth between |

Growth between |

Maintened |

||

|

Effective tax rate |

Between |

Maintened |

|||

|

(1) Includes financial guarantees provided and corporate securities; (2) Composed of results from loan losses, impairment and discounts granted; (3) Commissions and fees (+) income from insurance, pension plan and premium bonds operations (-) expenses for claims (-) insurance, pension plan and premium bonds selling expenses; (4) Considers pro forma adjustments in 2023 of the sale of Banco Itaú Argentina; (5) Core expenses below inflation. Calculated based on Brazil core expenses. |

|||||

It is important to mention that since July/24 the company has been considering a cost of capital of around 14.0% p.y. in the management of its businesses.

Information on outlooks for the business, projections and operational and financial goals are solely forecasts, based on management’s current outlook in relation to the future of Itaú Unibanco. These expectations are highly dependent on market conditions, general economic performance of the country, of the sector and the international markets. Therefore, our effective results and performance may differ from those forecasted in this prospective information.

São Paulo – SP, November 04, 2024.

Gustavo Lopes Rodrigues

Investor Relations Officer

CONTACT:

Itaú Unibanco

Comunicação Corporativa

Phone: (11) 5019-8880 / 8881

E-mail: imprensa@itau-unibanco.com.br

![]() View original content:https://www.prnewswire.com/news-releases/itau-unibanco—projections-302295950.html

View original content:https://www.prnewswire.com/news-releases/itau-unibanco—projections-302295950.html

SOURCE Itaú Unibanco Holding S.A.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Hims & Hers Health's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bullish approach towards Hims & Hers Health HIMS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HIMS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 20 extraordinary options activities for Hims & Hers Health. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 65% leaning bullish and 30% bearish. Among these notable options, 6 are puts, totaling $376,235, and 14 are calls, amounting to $1,112,973.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $14.0 to $30.0 for Hims & Hers Health over the recent three months.

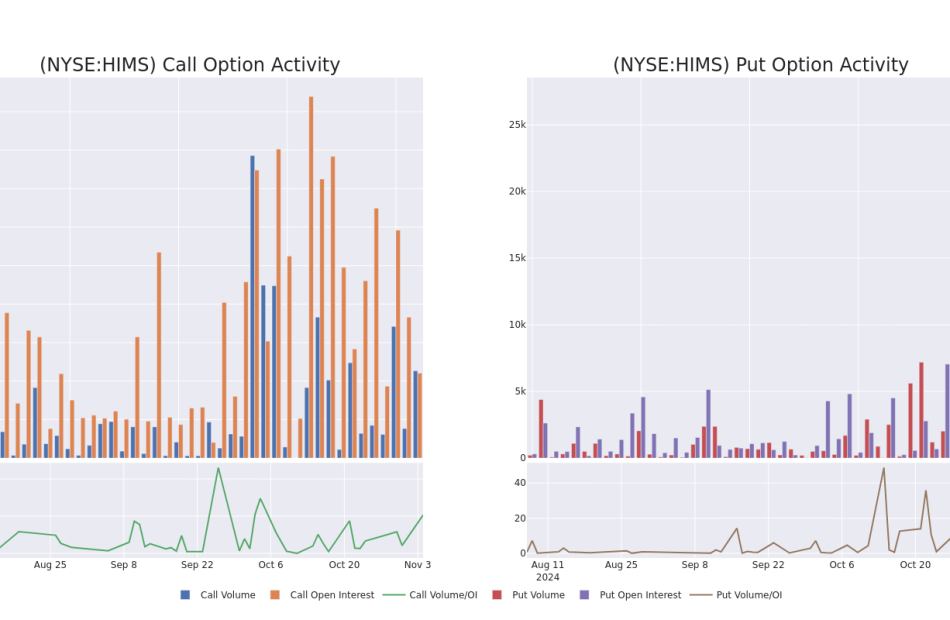

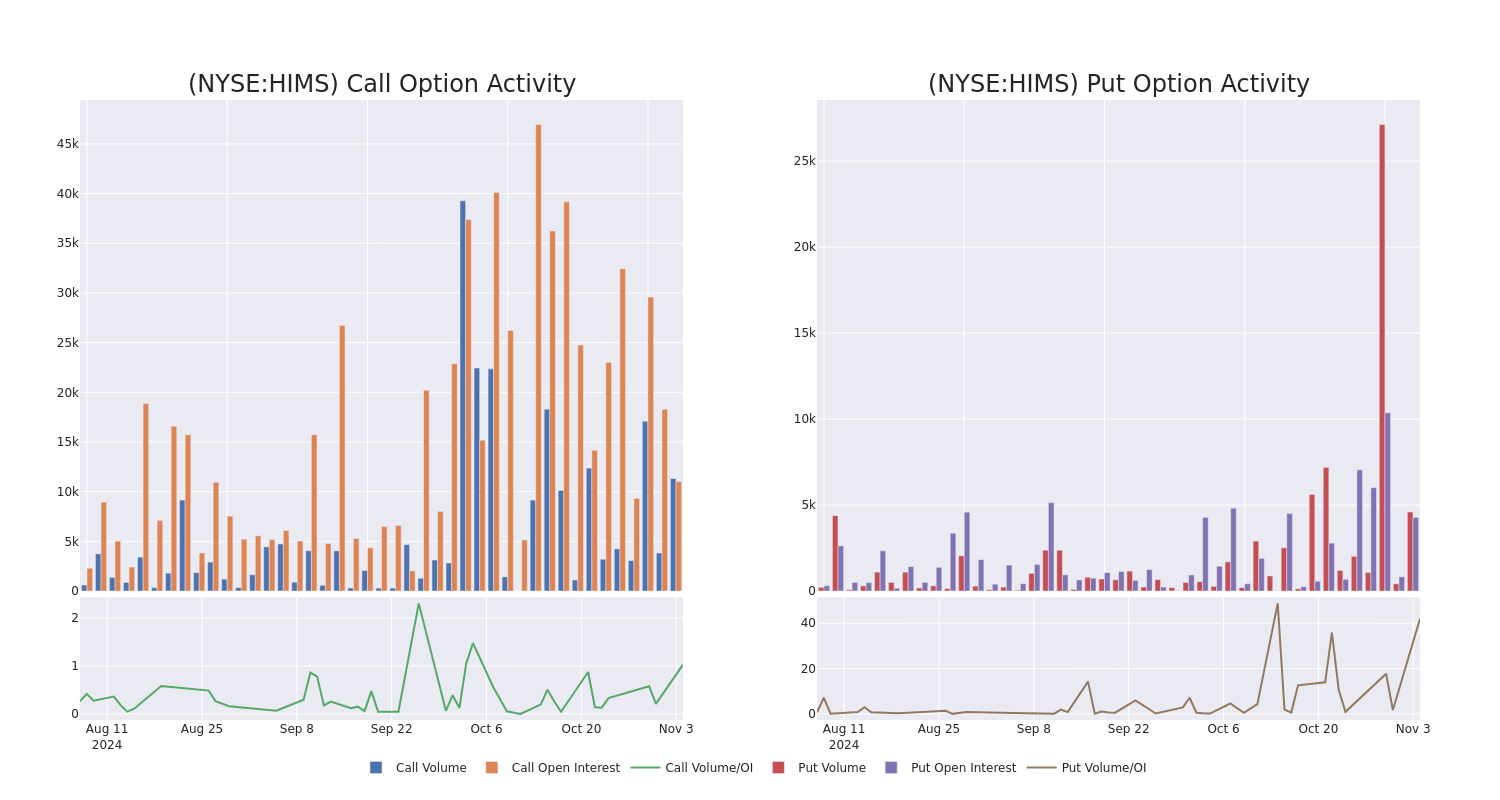

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Hims & Hers Health’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Hims & Hers Health’s whale trades within a strike price range from $14.0 to $30.0 in the last 30 days.

Hims & Hers Health Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HIMS | CALL | SWEEP | BULLISH | 11/08/24 | $1.8 | $1.7 | $1.8 | $20.50 | $307.7K | 401 | 1.8K |

| HIMS | PUT | SWEEP | BULLISH | 01/17/25 | $1.35 | $1.3 | $1.3 | $17.00 | $156.1K | 3.0K | 1.3K |

| HIMS | CALL | SWEEP | BEARISH | 12/20/24 | $1.0 | $0.9 | $0.9 | $27.00 | $153.1K | 87 | 1.6K |

| HIMS | CALL | SWEEP | BULLISH | 01/17/25 | $1.4 | $1.25 | $1.36 | $28.00 | $136.0K | 835 | 1.0K |

| HIMS | CALL | SWEEP | BULLISH | 11/15/24 | $5.4 | $5.3 | $5.4 | $16.00 | $134.9K | 2.0K | 313 |

About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

In light of the recent options history for Hims & Hers Health, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Hims & Hers Health’s Current Market Status

- Currently trading with a volume of 9,976,170, the HIMS’s price is up by 4.05%, now at $21.18.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

Professional Analyst Ratings for Hims & Hers Health

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $24.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on Hims & Hers Health, maintaining a target price of $25.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Hims & Hers Health with a target price of $23.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Hims & Hers Health with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TOROMONT ANNOUNCES RESULTS FOR THE THIRD QUARTER OF 2024 AND QUARTERLY DIVIDEND

TORONTO, Nov. 4, 2024 /CNW/ – Toromont Industries Ltd. TIH today reported its financial results for the third quarter ended September 30, 2024.

|

Three months ended September 30 |

Nine months ended September 30 |

|||||

|

($ millions, except per share amounts) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

Revenue |

$ 1,338.0 |

$ 1,174.0 |

14 % |

$ 3,714.2 |

$ 3,395.4 |

9 % |

|

Operating income |

$ 174.9 |

$ 193.1 |

(9) % |

$ 459.0 |

$ 499.7 |

(8) % |

|

Net earnings |

$ 131.0 |

$ 145.6 |

(10) % |

$ 350.2 |

$ 380.7 |

(8) % |

|

Basic earnings per share (“EPS”) |

$ 1.60 |

$ 1.77 |

(10) % |

$ 4.27 |

$ 4.63 |

(8) % |

|

Continuing operations: |

||||||

|

Net earnings |

$ 131.0 |

$ 145.6 |

(10) % |

$ 350.2 |

$ 375.1 |

(7) % |

|

Basic earnings per share (“EPS”) |

$ 1.60 |

$ 1.77 |

(10) % |

$ 4.27 |

$ 4.56 |

(6) % |

“Results for the third quarter of 2024 reflect good activity levels across most markets as well as continued execution against a strong order backlog. Bottom line results have been dampened as expected against a strong comparator reflective of market dynamics in play last year,” stated Michael S. McMillan, President and Chief Executive Officer of Toromont Industries Ltd. “The Equipment Group executed well with solid new equipment deliveries. Rental markets, specifically light equipment, picked up in the quarter. CIMCO revenue and bottom line improved on good activity and execution. Our financial position remained strong as we continued to invest in the business through working capital and a business acquisition. Although residential related activities are experiencing a slower part of the business cycle, this is partially offset by the completion of deliveries in mining related to mine development and expansion in our territory. As we look out over the next cycle, we anticipate a more balanced revenue mix with a focus on Product Support as recent equipment deliveries are utilized. Our team remains focused on our long‑term investment strategies and our operating disciplines, driving our after-market strategies and delivering customer solutions.”

HIGHLIGHTS:

Consolidated Results

- Revenue increased $163.9 million or 14% in the third quarter compared to the similar period last year, with higher revenue in both groups with Equipment Group up 14% and CIMCO up 17%. Higher revenue in the Equipment Group resulted from solid new equipment deliveries against order backlog. Product support revenue was healthy while rental revenue recovered slightly against easing market conditions, with improved activity for light equipment. CIMCO’s growth reflects good package revenue, dampened slightly by lower product support activity levels in the US.

- Revenue increased $318.8 million (up 9%) to $3.7 billion for the year‑to‑date period. Revenue increased in the Equipment Group 9% and increased at CIMCO 14% compared to the third quarter of 2023.

- Gross profit margins(1) decreased to 24.5% in the quarter and 24.4% for the year-to-date. This represents a 410 bps and 260 bps reduction respectively. Sales mix was unfavourable, with a lower proportion of product support revenue to total, accounting for 140 bps and 90 bps of the reduction respectively. Equipment Group gross profit margin on prime equipment sales and rentals were lower reflecting market dynamics in play.

- Operating income(1) decreased 9% in the quarter, as the higher revenue was more than offset by lower gross margins and higher expenses. Operating income as a percentage of sales decreased to 13.1% from 16.4% in the prior year, reflecting lower gross margins in the current period.

- Operating income decreased 8% in the year‑to‑date period, and was 12.4% of revenue compared to 14.7% in the similar period last year. The decrease in operating income reflects the higher revenue, more than offset by lower gross margins and higher expenses primarily related to growth initiatives.

- Net earnings from continuing operations decreased $14.7 million or 10% in the quarter versus a year ago to $131.0 million. EPS was $1.60 (basic) and $1.59 (fully diluted), lower by 10% compared to the third quarter last year.

- For the year‑to‑date period, net earnings from continuing operations decreased $24.8 million or 7% to $350.2 million compared to the similar period last year. EPS was $4.27 (basic) and $4.23 (fully diluted), lower 6% compared to last year.

- Bookings(1) for the third quarter increased 4% compared to last year with higher bookings in the Equipment Group being offset by lower bookings at CIMCO against a strong comparator. On a year-to-date basis, bookings increased 11% with both groups reporting higher bookings: Equipment Group up 12% and CIMCO up 1%, on a strong comparator.

- Backlog(1) of $1.1 billion as at September 30, 2024, was down slightly from $1.2 billion as at September 30, 2023. Backlog remains healthy, reflecting continued good order intake, offsetting deliveries and progress on construction and delivery schedules.

Equipment Group

- Revenue was up $145.2 million or 14% to $1.2 billion for the quarter. New equipment sales increased 36%, with good activity and deliveries in the mining and construction markets. Rental revenue demonstrated a marginal recovery from earlier this year with improved light equipment activity. Product support activity was good, with a healthy increase in service, reflecting continued growth of our technician workforce, which was slightly offset by a modest decline in parts revenue.

- Revenue was up $278.4 million or 9% to $3.4 billion for the year‑to‑date period. New equipment sales and product support activity were higher across most markets and product groups, partially offset by lower used equipment and rental revenue.

- Operating income decreased $20.9 million or 12% in the third quarter, as the higher revenue was more than offset by lower gross margins and higher expenses, primarily related to growth initiatives. Lower gross margins reflect an unfavourable sales mix as well as market dynamics in play.

- Operating income decreased $48.8 million or 10% to $423.5 million in the year‑to‑date period, due to similar reasons as noted for the quarter. Operating income margin decreased to 12.6% versus 15.3% in the comparable period last year, primarily reflecting lower gross margins.

- Bookings in the third quarter were $367.5 million, a increase of 14%, with strong bookings in construction, power systems and material handling being partially offset with lower mining orders. Year-to-date bookings were $1.5 billion, an increase of 12% from the similar period last year. Construction bookings increased 22%, reflecting good market activity. Mining was also strong with good orders received through the first half of the year. Power systems order activity was lower, in part reflecting a large project received last year. Both mining and power systems orders have more variability over time due to the nature of orders.

- Backlog of $803.7 million at the end of September 2024 was down $167.4 million or 17% from the end of September 2023, reflecting deliveries against opening backlog offset by new bookings.

CIMCO

- Revenue increased $18.7 million or 17% compared to the third quarter last year. Package revenue was higher, up 41%, with good execution on package project construction. Product support revenue was down 2%, reflecting good market activity in Canada supported by the increased technician workforce, offset by lower US activity.

- Revenue increased $40.4 million or 14% to $339.6 million for the year‑to‑date period as package revenue was up 21% on good execution on package project construction, in both the recreational and industrial markets. Product support activity was up 6%, with increases in both Canada and the US.

- Operating income increased $2.7 million or 21% for the quarter, as higher revenue was partly offset by lower gross margins and higher relative expenses in support of the increased activity.

- Operating income was up $8.1 million or 30% to $35.5 million for the year‑to‑date period, reflecting higher revenue and gross margins, partially offset by higher expenses. Operating income margin increased to 10.4% (2023 – 9.1%) reflecting higher gross margins on good execution.

- Bookings decreased 34% in the third quarter, against a strong comparative to $56.8 million, however were 1% higher for the year‑to‑date period at $192.5 million. For the first nine months of the year, higher bookings in the US, up 95%, were largely offset by lower bookings in Canada, down 23%. Recreational bookings were 109% higher while industrial bookings were 42% lower. Booking activity can be variable over time based on customer decision making and construction schedules.

- Backlog of $275.8 million at September 30, 2024 was up $30.5 million or 12% from last year, with an increase in both Canada and the US. Industrial backlog decreased slightly down 2%, with a decrease in Canada, largely offset by an increase in the US. Recreational backlog was up 32%, predominately reflecting a strong increase in Canada and a modest decrease in the US.

Financial Position

- On September 9, 2024, the Company completed the acquisition of the business and net operating assets of Tri-City Equipment Rentals (“Tri-City”) for a total purchase price of $77.5 million. Tri-City is an industry leader in heavy equipment rentals, with operations in Southwestern Ontario. The acquisition expands Toromont Cat’s heavy rents business to better serve our customer base.

- Toromont’s share price of $132.02 at the end of September 2024, translated to both a market capitalization(1) and total enterprise value(1) of $10.8 billion.

- The Company maintained a strong financial position. Leverage as represented by the net debt to total capitalization(1) ratio was -1% at the end of September 2024, compared to -17% at the end of December 2023 and -7% at the end of September 2023. The change in ratio from this time last year reflects cash used in working capital and capital expenditures, including the acquisition of Tri-City, supported by continuing cash inflow from operations.

- The Company purchased and cancelled 673,000 common shares ($82.7 million) under the Normal Course Issuer Bid program in the nine-months ended September 30, 2024. For the similar period last year, the Company purchased and cancelled 238,000 common shares ($25.0 million).

- The Board of Directors approved the regular quarterly dividend of $0.48 cents per share, payable on January 6, 2025 to shareholders on record on December 6, 2024.

- The Company’s return on equity(1) was 19.4% at the end of September 2024, on a trailing twelve‑month basis, compared to 23.1% at the end of December 2023 and 24.7% at the end of September 2023. Trailing twelve‑month pre‑tax return on capital employed(1) was 26.3% at the end of September 2024, compared to 30.4% at the end of December 2023 and 31.6% at the end of September 2023.

“Although rental markets have been challenged this year in some areas, we remain highly committed to this market for the longer term, as evidenced by our acquisition of Tri-City. This acquisition expands our Toromont Cat heavy rents business to better serve existing and new customers and provides a rental hub in the Southwestern Ontario region,” stated John M. Doolittle, Executive Vice President and Chief Financial Officer of Toromont Industries Ltd. “While market dynamics and better equipment availability within the Equipment Group mean returns are lower than last year, new bookings and equipment deliveries have been healthy. We will maintain our focus on operating and financial disciplines to manage our cost structure, while we invest in capacity and capabilities to provide exceptional service to our customers today and in the future. CIMCO is positioned to continue to perform well, with a strong order backlog and improved operating disciplines. This along with our strong financial position and order backlog position us well for the future.”

CORPORATE DEVELOPMENT

The Board of Directors is pleased to announce that it has appointed two new independent directors, effective November 6, 2024.

“We are extremely pleased to have Ave Lethbridge and Paramita Das joining the Board of Directors,” said Richard Roy, Chair, Toromont. “Ave and Paramita bring substantial business acumen and expertise in their respective fields and are important additions that expand the depth and breadth of our team.”

Ms. Lethbridge has more than 30 years’ experience in the energy industry, including over 19 years as a senior executive officer for Toronto Hydro Corporation, most recently as Executive Vice‑President and Chief Human Resources and Safety Officer from 2013 until her retirement in 2021. She currently serves as a corporate director for Kinross Gold Corporation and Algoma Steel Inc. She holds a Master of Science degree in Organizational Development from Pepperdine University, is a graduate of the Institute of Corporate Directors program, ICD.D, and holds a designation in Climate and Biodiversity from Competent Boards.

Ms. Das has more than 20 years’ experience in the resources, mining and materials industry, including almost a decade with Rio Tinto. She served as the Global Head of Marketing, Development and ESG (Chief Marketing Officer) Metals and Minerals at Rio Tinto from 2022 to 2024. Previously, she held progressively senior positions at Rio Tinto in marketing, operations and strategic leadership functions. She currently serves as a corporate director for Coeur Mining Inc. and Genco Shipping & Trading Limited. Ms. Das received a bachelor’s degree in Architectural Engineering, an MBA and additional post-graduate studies in Strategy and Finance. She is certified by the National Association of Corporate Directors.

With these additions, the Company’s Board of Directors will consist of eleven members, of whom ten are independent.

FINANCIAL AND OPERATING RESULTS

All comparative figures in this press release are for the three and nine months ended September 30, 2024 compared to the three and nine months ended September 30, 2023. All financial information presented in this press release has been prepared in accordance with International Financial Reporting Standards (“IFRS”), except as noted below, and are reported in Canadian dollars. This press release contains only selected financial and operational highlights and should be read in conjunction with Toromont’s unaudited interim condensed consolidated financial statements and related notes and Management’s Discussion and Analysis (“MD&A”), as at and for the three and nine months ended September 30, 2024, which are available on SEDAR at www.sedarplus.ca and on the Company’s website at www.toromont.com.

Additional information is contained in the Company’s filings with Canadian securities regulators, including the 2023 Annual Report and 2024 Annual Information Form, which are available on SEDAR and the Company’s website.

QUARTERLY CONFERENCE CALL AND WEBCAST

Interested parties are invited to join the quarterly conference call with investment analysts, in listen-only mode, on Tuesday, November 5, 2024 at 8:00 a.m. (EDT). The call may be accessed by telephone at 1‑888‑669‑1199 (North American toll free) or 416-945-7677 (Toronto area). A replay of the conference call will be available until Tuesday, November 12, 2024 by calling 1‑888‑660‑6345 (North American toll free) or 289-819-1450 (Toronto area) and quoting passcode 11956. The live webcast can also be accessed at www.toromont.com.

Presentation materials to accompany the call will be available on our investor page on our website.

NON-GAAP AND OTHER FINANCIAL MEASURES

Management believes that providing certain non-GAAP measures provides users of the Company’s unaudited interim condensed consolidated financial statements and MD&A with important information regarding the operational performance and related trends of the Company’s business. By considering these measures in combination with the comparable IFRS measures set out below, management believes that users are provided a better overall understanding of the Company’s business and its financial performance during the relevant period than if they simply considered the IFRS measures alone.

The non-GAAP measures used by management do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Accordingly, these measures should not be considered as a substitute or alternative for net income or cash flow, in each case as determined in accordance with IFRS.

Management also uses key performance indicators to enable consistent measurement of performance across the organization. These KPIs are non-GAAP financial measures, do not have a standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers.

Gross Profit / Gross Profit Margin

Gross Profit is defined as total revenue less cost of goods sold.

Gross Profit Margin is defined as gross profit (defined above) divided by total revenue.

Operating Income / Operating Income Margin

Operating income is defined as net income from continuing operations before interest expense, interest and investment income and income taxes and is used by management to assess and evaluate the financial performance of its operating segments. Financing and related interest charges cannot be attributed to business segments on a meaningful basis that is comparable to other companies. Business segments do not correspond to income tax jurisdictions and it is believed that the allocation of income taxes distorts the historical comparability of the performance of the business segments.

Operating income margin is defined as operating income (defined above) divided by total revenue.

|

Three months ended |

Nine months ended |

|||

|

September 30 |

September 30 |

|||

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

|

Net income from continuing operations |

$ 130,951 |

$ 145,619 |

$ 350,220 |

$ 375,055 |

|

plus: Interest expense |

7,202 |

7,053 |

21,240 |

20,976 |

|

less: Interest and investment income |

(11,662) |

(11,747) |

(43,049) |

(32,850) |

|

plus: Income taxes |

48,408 |

52,161 |

130,594 |

136,492 |

|

Operating income |

$ 174,899 |

$ 193,086 |

$ 459,005 |

$ 499,673 |

|

Total revenue |

$ 1,337,992 |

$ 1,174,045 |

$ 3,714,210 |

$ 3,395,364 |

|

Operating income margin |

13.1 % |

16.4 % |

12.4 % |

14.7 % |

Net Debt to Total Capitalization/Equity

Net debt to total capitalization/equity are calculated as net debt divided by total capitalization and shareholders’ equity, respectively, as defined below, and are used by management as measures of the Company’s financial leverage.

Net debt is calculated as long-term debt plus current portion of long-term debt less cash and cash equivalents. Total capitalization is calculated as shareholders’ equity plus net debt.

The calculations are as follows:

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Long-term debt |

$ 498,237 |

$ 647,784 |

$ 647,603 |

|

Current portion of long-term debt |

150,000 |

— |

— |

|

less: Cash and cash equivalents |

670,727 |

1,040,757 |

807,418 |

|

Net debt |

(22,490) |

(392,973) |

(159,815) |

|

Shareholders’ equity |

2,899,540 |

2,683,852 |

2,610,765 |

|

Total capitalization |

$ 2,877,050 |

$ 2,290,879 |

$ 2,450,950 |

|

Net debt to total capitalization |

(1) % |

(17) % |

(7) % |

|

Net debt to equity |

(0.01):1 |

(0.15):1 |

(0.06):1 |

Market Capitalization & Total Enterprise Value

Market capitalization represents the total market value of the Company’s equity. It is calculated by multiplying the closing share price of the Company’s common shares by the total number of common shares outstanding.

Total enterprise value represents the total value of the Company and is often used as a more comprehensive alternative to market capitalization. It is calculated by adding debt/net debt (defined above) to market capitalization.

The calculations are as follows:

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands, except for shares and share price) |

2024 |

2023 |

2023 |

|

Outstanding common shares |

81,937,472 |

82,297,341 |

82,352,479 |

|

times: Ending share price |

$ 132.02 |

$ 116.10 |

$ 110.62 |

|

Market capitalization |

$ 10,817,385 |

$ 9,554,721 |

$ 9,109,831 |

|

Long-term debt |

$ 498,237 |

$ 647,784 |

$ 647,603 |

|

Current portion of long-term debt |

150,000 |

— |

— |

|

less: Cash and cash equivalents |

670,727 |

1,040,757 |

807,418 |

|

Net debt |

$ (22,490) |

$ (392,973) |

$ (159,815) |

|

Total enterprise value |

$ 10,794,895 |

$ 9,161,748 |

$ 8,950,016 |

Order Bookings and Backlog

Order bookings represent the retail value of firm equipment or project orders received during a period. Backlog is defined as the retail value of equipment units ordered by customers with future delivery, and the remaining retail value of package/project orders remaining to be recognized in revenue under the percentage of completion method. Management uses order backlog as a measure of projecting future equipment and project deliveries. There are no directly comparable IFRS measures for order bookings or backlog.

Return on Capital Employed (“ROCE”)

ROCE is utilized to assess both current operating performance and prospective investments. The adjusted earnings numerator used for the calculation is income before income taxes, interest expense and interest income (excluding interest on rental conversions). The denominator in the calculation is the monthly average capital employed, which is defined as net debt plus shareholders’ equity, also referred to as total capitalization, adjusted for discontinued operations.

|

Trailing twelve months ended |

|||

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Net earnings |

$ 504,272 |

$ 534,712 |

$ 540,522 |

|

plus: Interest expense |

28,362 |

28,101 |

27,766 |

|

less: Interest and investment income |

(56,181) |

(46,349) |

(41,857) |

|

plus: Interest income – rental conversions |

3,614 |

3,348 |

3,591 |

|

plus: Income taxes |

187,107 |

194,849 |

192,968 |

|

Adjusted net earnings |

$ 667,174 |

$ 714,661 |

$ 722,990 |

|

Average capital employed |

$ 2,538,075 |

$ 2,347,864 |

$ 2,284,437 |

|

Return on capital employed |

26.3 % |

30.4 % |

31.6 % |

Return on Equity (“ROE”)

ROE is monitored to assess profitability and is calculated by dividing net earnings by opening shareholders’ equity (adjusted for shares issued and shares repurchased and cancelled during the period), both calculated on a trailing twelve month period.

|

Trailing twelve months ended |

|||

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Net earnings |

$ 504,272 |

$ 534,712 |

$ 540,522 |

|

Opening shareholder’s equity (net of adjustments) |

$ 2,596,115 |

$ 2,317,906 |

$ 2,191,616 |

|

Return on equity |

19.4 % |

23.1 % |

24.7 % |

ADVISORY

Information in this press release that is not a historical fact is “forward-looking information”. Words such as “plans”, “intends”, “outlook”, “expects”, “anticipates”, “estimates”, “believes”, “likely”, “should”, “could”, “would”, “will”, “may” and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release reflects current estimates, beliefs, and assumptions, which are based on Toromont’s perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Toromont’s estimates, beliefs and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Toromont can give no assurance that such estimates, beliefs and assumptions will prove to be correct.

Numerous risks and uncertainties could cause the actual results to differ materially from the estimates, beliefs and assumptions expressed or implied in the forward-looking statements, including, but not limited to: business cycles, including general economic conditions in the countries in which Toromont operates; commodity price changes, including changes in the price of precious and base metals; inflationary pressures; potential risks and uncertainties relating to COVID-19 or a potential new world health issue; increased regulation of or restrictions placed on our businesses; changes in foreign exchange rates, including the Cdn$/US$ exchange rate; the termination of distribution or original equipment manufacturer agreements; equipment product acceptance and availability of supply, including reduction or disruption in supply or demand for our products stemming from external factors; increased competition; credit of third parties; additional costs associated with warranties and maintenance contracts; changes in interest rates; the availability and cost of financing; level and volatility of price and liquidity of Toromont’s common shares; potential environmental liabilities and changes to environmental regulation; information technology failures, including data or cybersecurity breaches; failure to attract and retain key employees as well as the general workforce; damage to the reputation of Caterpillar, product quality and product safety risks which could expose Toromont to product liability claims and negative publicity; new, or changes to current, federal and provincial laws, rules and regulations including changes in infrastructure spending; any requirement to make contributions or other payments in respect of registered defined benefit pension plans or postemployment benefit plans in excess of those currently contemplated; increased insurance premiums; and risk related to integration of acquired operations including cost of integration and ability to achieve the expected benefits. Readers are cautioned that the foregoing list of factors is not exhaustive.

Any of the above mentioned risks and uncertainties could cause or contribute to actual results that are materially different from those expressed or implied in the forward-looking information and statements included herein. For a further description of certain risks and uncertainties and other factors that could cause or contribute to actual results that are materially different, see the risks and uncertainties set out under the heading “Risks and Risk Management” and “Outlook” sections of Toromont’s most recent annual Management Discussion and Analysis, as filed with Canadian securities regulators at www.sedarplus.ca or at our website www.toromont.com. Other factors, risks and uncertainties not presently known to Toromont or that Toromont currently believes are not material could also cause actual results or events to differ materially from those expressed or implied by statements containing forward-looking information.

Readers are cautioned not to place undue reliance on statements containing forward-looking information, which reflect Toromont’s expectations only as of the date of this press release, and not to use such information for anything other than their intended purpose. Toromont disclaims any obligation to update or revise any forward‑looking information, whether as a result of new information, future events or otherwise, except as required by law.

ABOUT TOROMONT

Toromont Industries Ltd. operates through two business segments: the Equipment Group and CIMCO. The Equipment Group includes one of the larger Caterpillar dealerships by revenue and geographic territory, spanning the Canadian provinces of Newfoundland and Labrador, Nova Scotia, New Brunswick, Prince Edward Island, Québec, Ontario and Manitoba, in addition to most of the territory of Nunavut. The Equipment Group includes industry-leading rental operations and a complementary material handling business. CIMCO is one of North America’s leading suppliers of thermal management solutions that enable customers to reduce energy consumption and emissions, use natural refrigerants and monitor and control their operating environments autonomously. Both segments offer comprehensive product support capabilities. This press release and more information about Toromont Industries Ltd. can be found at www.toromont.com.

For more information contact:

John M. Doolittle

Executive Vice President and

Chief Financial Officer

Toromont Industries Ltd.

Tel: 416-514-4790

FOOTNOTE

|

(1) |

These financial metrics do not have a standardized meaning under International Financial Reporting Standards (IFRS), which are also referred to herein as Generally Accepted Accounting Principles (GAAP), and may not be comparable to similar measures used by other issuers. These measurements are presented for information purposes only. The Company’s Management’s Discussion and Analysis (MD&A) includes additional information regarding these financial metrics, including definitions and a reconciliation to the most directly comparable GAAP measures, under the headings “Additional GAAP Measures”, “Non-GAAP Measures” and “Key Performance Indicators.” |

TOROMONT INDUSTRIES LTD.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

Three months ended |

Nine months ended |

|||

|

September 30 |

September 30 |

|||

|

($ thousands, except share amount) |

2024 |

2023 |

2024 |

2023 |

|

Revenue |

$ 1,337,992 |

$ 1,174,045 |

$ 3,714,210 |

$ 3,395,364 |

|

Cost of goods sold |

1,010,202 |

838,545 |

2,807,347 |

2,479,418 |

|

Gross profit |

327,790 |

335,500 |

906,863 |

915,946 |

|

Selling and administrative expenses |

152,891 |

142,414 |

447,858 |

416,273 |

|

Operating income |

174,899 |

193,086 |

459,005 |

499,673 |

|

Interest expense |

7,202 |

7,053 |

21,240 |

20,976 |

|

Interest and investment income |

(11,662) |

(11,747) |

(43,049) |

(32,850) |

|

Income before income taxes |

179,359 |

197,780 |

480,814 |

511,547 |

|

Income taxes |

48,408 |

52,161 |

130,594 |

136,492 |

|

Income from continuing operations |

130,951 |

145,619 |

350,220 |

375,055 |

|

Income from discontinued operations |

— |

— |

— |

5,605 |

|

Net earnings |

$ 130,951 |

$ 145,619 |

$ 350,220 |

$ 380,660 |

|

Basic earnings per share |

||||

|

Continuing operations |

$ 1.60 |

$ 1.77 |

$ 4.27 |

$ 4.56 |

|

Discontinued operations |

$ — |

$ — |

$ — |

$ 0.07 |

|

$ 1.60 |

$ 1.77 |

$ 4.27 |

$ 4.63 |

|

|

Diluted earnings per share |

||||

|

Continuing operations |

$ 1.59 |

$ 1.76 |

$ 4.23 |

$ 4.52 |

|

Discontinued operations |

$ — |

$ — |

$ — |

$ 0.07 |

|

$ 1.59 |

$ 1.76 |

$ 4.23 |

$ 4.59 |

|

|

Weighted average number of shares outstanding |

||||

|

Basic |

81,930,534 |

82,281,891 |

82,109,395 |

82,302,881 |

|

Diluted |

82,545,416 |

82,923,627 |

82,703,042 |

82,909,989 |

SOURCE Toromont Industries Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c3407.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c3407.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TOROMONT ANNOUNCES RESULTS FOR THE THIRD QUARTER OF 2024 AND QUARTERLY DIVIDEND

TORONTO, Nov. 4, 2024 /CNW/ – Toromont Industries Ltd. TIH today reported its financial results for the third quarter ended September 30, 2024.

|

Three months ended September 30 |

Nine months ended September 30 |

|||||

|

($ millions, except per share amounts) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

Revenue |

$ 1,338.0 |

$ 1,174.0 |

14 % |

$ 3,714.2 |

$ 3,395.4 |

9 % |

|

Operating income |

$ 174.9 |

$ 193.1 |

(9) % |

$ 459.0 |

$ 499.7 |

(8) % |

|

Net earnings |

$ 131.0 |

$ 145.6 |

(10) % |

$ 350.2 |

$ 380.7 |

(8) % |

|

Basic earnings per share (“EPS”) |

$ 1.60 |

$ 1.77 |

(10) % |

$ 4.27 |

$ 4.63 |

(8) % |

|

Continuing operations: |

||||||

|

Net earnings |

$ 131.0 |

$ 145.6 |

(10) % |

$ 350.2 |

$ 375.1 |

(7) % |

|

Basic earnings per share (“EPS”) |

$ 1.60 |

$ 1.77 |

(10) % |

$ 4.27 |

$ 4.56 |

(6) % |

“Results for the third quarter of 2024 reflect good activity levels across most markets as well as continued execution against a strong order backlog. Bottom line results have been dampened as expected against a strong comparator reflective of market dynamics in play last year,” stated Michael S. McMillan, President and Chief Executive Officer of Toromont Industries Ltd. “The Equipment Group executed well with solid new equipment deliveries. Rental markets, specifically light equipment, picked up in the quarter. CIMCO revenue and bottom line improved on good activity and execution. Our financial position remained strong as we continued to invest in the business through working capital and a business acquisition. Although residential related activities are experiencing a slower part of the business cycle, this is partially offset by the completion of deliveries in mining related to mine development and expansion in our territory. As we look out over the next cycle, we anticipate a more balanced revenue mix with a focus on Product Support as recent equipment deliveries are utilized. Our team remains focused on our long‑term investment strategies and our operating disciplines, driving our after-market strategies and delivering customer solutions.”

HIGHLIGHTS:

Consolidated Results

- Revenue increased $163.9 million or 14% in the third quarter compared to the similar period last year, with higher revenue in both groups with Equipment Group up 14% and CIMCO up 17%. Higher revenue in the Equipment Group resulted from solid new equipment deliveries against order backlog. Product support revenue was healthy while rental revenue recovered slightly against easing market conditions, with improved activity for light equipment. CIMCO’s growth reflects good package revenue, dampened slightly by lower product support activity levels in the US.

- Revenue increased $318.8 million (up 9%) to $3.7 billion for the year‑to‑date period. Revenue increased in the Equipment Group 9% and increased at CIMCO 14% compared to the third quarter of 2023.

- Gross profit margins(1) decreased to 24.5% in the quarter and 24.4% for the year-to-date. This represents a 410 bps and 260 bps reduction respectively. Sales mix was unfavourable, with a lower proportion of product support revenue to total, accounting for 140 bps and 90 bps of the reduction respectively. Equipment Group gross profit margin on prime equipment sales and rentals were lower reflecting market dynamics in play.

- Operating income(1) decreased 9% in the quarter, as the higher revenue was more than offset by lower gross margins and higher expenses. Operating income as a percentage of sales decreased to 13.1% from 16.4% in the prior year, reflecting lower gross margins in the current period.

- Operating income decreased 8% in the year‑to‑date period, and was 12.4% of revenue compared to 14.7% in the similar period last year. The decrease in operating income reflects the higher revenue, more than offset by lower gross margins and higher expenses primarily related to growth initiatives.

- Net earnings from continuing operations decreased $14.7 million or 10% in the quarter versus a year ago to $131.0 million. EPS was $1.60 (basic) and $1.59 (fully diluted), lower by 10% compared to the third quarter last year.

- For the year‑to‑date period, net earnings from continuing operations decreased $24.8 million or 7% to $350.2 million compared to the similar period last year. EPS was $4.27 (basic) and $4.23 (fully diluted), lower 6% compared to last year.

- Bookings(1) for the third quarter increased 4% compared to last year with higher bookings in the Equipment Group being offset by lower bookings at CIMCO against a strong comparator. On a year-to-date basis, bookings increased 11% with both groups reporting higher bookings: Equipment Group up 12% and CIMCO up 1%, on a strong comparator.

- Backlog(1) of $1.1 billion as at September 30, 2024, was down slightly from $1.2 billion as at September 30, 2023. Backlog remains healthy, reflecting continued good order intake, offsetting deliveries and progress on construction and delivery schedules.

Equipment Group

- Revenue was up $145.2 million or 14% to $1.2 billion for the quarter. New equipment sales increased 36%, with good activity and deliveries in the mining and construction markets. Rental revenue demonstrated a marginal recovery from earlier this year with improved light equipment activity. Product support activity was good, with a healthy increase in service, reflecting continued growth of our technician workforce, which was slightly offset by a modest decline in parts revenue.

- Revenue was up $278.4 million or 9% to $3.4 billion for the year‑to‑date period. New equipment sales and product support activity were higher across most markets and product groups, partially offset by lower used equipment and rental revenue.

- Operating income decreased $20.9 million or 12% in the third quarter, as the higher revenue was more than offset by lower gross margins and higher expenses, primarily related to growth initiatives. Lower gross margins reflect an unfavourable sales mix as well as market dynamics in play.

- Operating income decreased $48.8 million or 10% to $423.5 million in the year‑to‑date period, due to similar reasons as noted for the quarter. Operating income margin decreased to 12.6% versus 15.3% in the comparable period last year, primarily reflecting lower gross margins.

- Bookings in the third quarter were $367.5 million, a increase of 14%, with strong bookings in construction, power systems and material handling being partially offset with lower mining orders. Year-to-date bookings were $1.5 billion, an increase of 12% from the similar period last year. Construction bookings increased 22%, reflecting good market activity. Mining was also strong with good orders received through the first half of the year. Power systems order activity was lower, in part reflecting a large project received last year. Both mining and power systems orders have more variability over time due to the nature of orders.

- Backlog of $803.7 million at the end of September 2024 was down $167.4 million or 17% from the end of September 2023, reflecting deliveries against opening backlog offset by new bookings.

CIMCO

- Revenue increased $18.7 million or 17% compared to the third quarter last year. Package revenue was higher, up 41%, with good execution on package project construction. Product support revenue was down 2%, reflecting good market activity in Canada supported by the increased technician workforce, offset by lower US activity.

- Revenue increased $40.4 million or 14% to $339.6 million for the year‑to‑date period as package revenue was up 21% on good execution on package project construction, in both the recreational and industrial markets. Product support activity was up 6%, with increases in both Canada and the US.

- Operating income increased $2.7 million or 21% for the quarter, as higher revenue was partly offset by lower gross margins and higher relative expenses in support of the increased activity.

- Operating income was up $8.1 million or 30% to $35.5 million for the year‑to‑date period, reflecting higher revenue and gross margins, partially offset by higher expenses. Operating income margin increased to 10.4% (2023 – 9.1%) reflecting higher gross margins on good execution.

- Bookings decreased 34% in the third quarter, against a strong comparative to $56.8 million, however were 1% higher for the year‑to‑date period at $192.5 million. For the first nine months of the year, higher bookings in the US, up 95%, were largely offset by lower bookings in Canada, down 23%. Recreational bookings were 109% higher while industrial bookings were 42% lower. Booking activity can be variable over time based on customer decision making and construction schedules.

- Backlog of $275.8 million at September 30, 2024 was up $30.5 million or 12% from last year, with an increase in both Canada and the US. Industrial backlog decreased slightly down 2%, with a decrease in Canada, largely offset by an increase in the US. Recreational backlog was up 32%, predominately reflecting a strong increase in Canada and a modest decrease in the US.

Financial Position

- On September 9, 2024, the Company completed the acquisition of the business and net operating assets of Tri-City Equipment Rentals (“Tri-City”) for a total purchase price of $77.5 million. Tri-City is an industry leader in heavy equipment rentals, with operations in Southwestern Ontario. The acquisition expands Toromont Cat’s heavy rents business to better serve our customer base.

- Toromont’s share price of $132.02 at the end of September 2024, translated to both a market capitalization(1) and total enterprise value(1) of $10.8 billion.

- The Company maintained a strong financial position. Leverage as represented by the net debt to total capitalization(1) ratio was -1% at the end of September 2024, compared to -17% at the end of December 2023 and -7% at the end of September 2023. The change in ratio from this time last year reflects cash used in working capital and capital expenditures, including the acquisition of Tri-City, supported by continuing cash inflow from operations.

- The Company purchased and cancelled 673,000 common shares ($82.7 million) under the Normal Course Issuer Bid program in the nine-months ended September 30, 2024. For the similar period last year, the Company purchased and cancelled 238,000 common shares ($25.0 million).

- The Board of Directors approved the regular quarterly dividend of $0.48 cents per share, payable on January 6, 2025 to shareholders on record on December 6, 2024.

- The Company’s return on equity(1) was 19.4% at the end of September 2024, on a trailing twelve‑month basis, compared to 23.1% at the end of December 2023 and 24.7% at the end of September 2023. Trailing twelve‑month pre‑tax return on capital employed(1) was 26.3% at the end of September 2024, compared to 30.4% at the end of December 2023 and 31.6% at the end of September 2023.

“Although rental markets have been challenged this year in some areas, we remain highly committed to this market for the longer term, as evidenced by our acquisition of Tri-City. This acquisition expands our Toromont Cat heavy rents business to better serve existing and new customers and provides a rental hub in the Southwestern Ontario region,” stated John M. Doolittle, Executive Vice President and Chief Financial Officer of Toromont Industries Ltd. “While market dynamics and better equipment availability within the Equipment Group mean returns are lower than last year, new bookings and equipment deliveries have been healthy. We will maintain our focus on operating and financial disciplines to manage our cost structure, while we invest in capacity and capabilities to provide exceptional service to our customers today and in the future. CIMCO is positioned to continue to perform well, with a strong order backlog and improved operating disciplines. This along with our strong financial position and order backlog position us well for the future.”

CORPORATE DEVELOPMENT

The Board of Directors is pleased to announce that it has appointed two new independent directors, effective November 6, 2024.

“We are extremely pleased to have Ave Lethbridge and Paramita Das joining the Board of Directors,” said Richard Roy, Chair, Toromont. “Ave and Paramita bring substantial business acumen and expertise in their respective fields and are important additions that expand the depth and breadth of our team.”

Ms. Lethbridge has more than 30 years’ experience in the energy industry, including over 19 years as a senior executive officer for Toronto Hydro Corporation, most recently as Executive Vice‑President and Chief Human Resources and Safety Officer from 2013 until her retirement in 2021. She currently serves as a corporate director for Kinross Gold Corporation and Algoma Steel Inc. She holds a Master of Science degree in Organizational Development from Pepperdine University, is a graduate of the Institute of Corporate Directors program, ICD.D, and holds a designation in Climate and Biodiversity from Competent Boards.

Ms. Das has more than 20 years’ experience in the resources, mining and materials industry, including almost a decade with Rio Tinto. She served as the Global Head of Marketing, Development and ESG (Chief Marketing Officer) Metals and Minerals at Rio Tinto from 2022 to 2024. Previously, she held progressively senior positions at Rio Tinto in marketing, operations and strategic leadership functions. She currently serves as a corporate director for Coeur Mining Inc. and Genco Shipping & Trading Limited. Ms. Das received a bachelor’s degree in Architectural Engineering, an MBA and additional post-graduate studies in Strategy and Finance. She is certified by the National Association of Corporate Directors.

With these additions, the Company’s Board of Directors will consist of eleven members, of whom ten are independent.

FINANCIAL AND OPERATING RESULTS

All comparative figures in this press release are for the three and nine months ended September 30, 2024 compared to the three and nine months ended September 30, 2023. All financial information presented in this press release has been prepared in accordance with International Financial Reporting Standards (“IFRS”), except as noted below, and are reported in Canadian dollars. This press release contains only selected financial and operational highlights and should be read in conjunction with Toromont’s unaudited interim condensed consolidated financial statements and related notes and Management’s Discussion and Analysis (“MD&A”), as at and for the three and nine months ended September 30, 2024, which are available on SEDAR at www.sedarplus.ca and on the Company’s website at www.toromont.com.

Additional information is contained in the Company’s filings with Canadian securities regulators, including the 2023 Annual Report and 2024 Annual Information Form, which are available on SEDAR and the Company’s website.

QUARTERLY CONFERENCE CALL AND WEBCAST

Interested parties are invited to join the quarterly conference call with investment analysts, in listen-only mode, on Tuesday, November 5, 2024 at 8:00 a.m. (EDT). The call may be accessed by telephone at 1‑888‑669‑1199 (North American toll free) or 416-945-7677 (Toronto area). A replay of the conference call will be available until Tuesday, November 12, 2024 by calling 1‑888‑660‑6345 (North American toll free) or 289-819-1450 (Toronto area) and quoting passcode 11956. The live webcast can also be accessed at www.toromont.com.

Presentation materials to accompany the call will be available on our investor page on our website.

NON-GAAP AND OTHER FINANCIAL MEASURES

Management believes that providing certain non-GAAP measures provides users of the Company’s unaudited interim condensed consolidated financial statements and MD&A with important information regarding the operational performance and related trends of the Company’s business. By considering these measures in combination with the comparable IFRS measures set out below, management believes that users are provided a better overall understanding of the Company’s business and its financial performance during the relevant period than if they simply considered the IFRS measures alone.

The non-GAAP measures used by management do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Accordingly, these measures should not be considered as a substitute or alternative for net income or cash flow, in each case as determined in accordance with IFRS.

Management also uses key performance indicators to enable consistent measurement of performance across the organization. These KPIs are non-GAAP financial measures, do not have a standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers.

Gross Profit / Gross Profit Margin

Gross Profit is defined as total revenue less cost of goods sold.

Gross Profit Margin is defined as gross profit (defined above) divided by total revenue.

Operating Income / Operating Income Margin

Operating income is defined as net income from continuing operations before interest expense, interest and investment income and income taxes and is used by management to assess and evaluate the financial performance of its operating segments. Financing and related interest charges cannot be attributed to business segments on a meaningful basis that is comparable to other companies. Business segments do not correspond to income tax jurisdictions and it is believed that the allocation of income taxes distorts the historical comparability of the performance of the business segments.

Operating income margin is defined as operating income (defined above) divided by total revenue.

|

Three months ended |

Nine months ended |

|||

|

September 30 |

September 30 |

|||

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

|

Net income from continuing operations |

$ 130,951 |

$ 145,619 |

$ 350,220 |

$ 375,055 |

|

plus: Interest expense |

7,202 |

7,053 |

21,240 |

20,976 |

|

less: Interest and investment income |

(11,662) |

(11,747) |

(43,049) |

(32,850) |

|

plus: Income taxes |

48,408 |

52,161 |

130,594 |

136,492 |

|

Operating income |

$ 174,899 |

$ 193,086 |

$ 459,005 |

$ 499,673 |

|

Total revenue |

$ 1,337,992 |

$ 1,174,045 |

$ 3,714,210 |

$ 3,395,364 |

|

Operating income margin |

13.1 % |

16.4 % |

12.4 % |

14.7 % |

Net Debt to Total Capitalization/Equity

Net debt to total capitalization/equity are calculated as net debt divided by total capitalization and shareholders’ equity, respectively, as defined below, and are used by management as measures of the Company’s financial leverage.

Net debt is calculated as long-term debt plus current portion of long-term debt less cash and cash equivalents. Total capitalization is calculated as shareholders’ equity plus net debt.

The calculations are as follows:

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Long-term debt |

$ 498,237 |

$ 647,784 |

$ 647,603 |

|

Current portion of long-term debt |

150,000 |

— |

— |

|

less: Cash and cash equivalents |

670,727 |

1,040,757 |

807,418 |

|

Net debt |

(22,490) |

(392,973) |

(159,815) |

|

Shareholders’ equity |

2,899,540 |

2,683,852 |

2,610,765 |

|

Total capitalization |

$ 2,877,050 |

$ 2,290,879 |

$ 2,450,950 |

|

Net debt to total capitalization |

(1) % |

(17) % |

(7) % |

|

Net debt to equity |

(0.01):1 |

(0.15):1 |

(0.06):1 |

Market Capitalization & Total Enterprise Value

Market capitalization represents the total market value of the Company’s equity. It is calculated by multiplying the closing share price of the Company’s common shares by the total number of common shares outstanding.

Total enterprise value represents the total value of the Company and is often used as a more comprehensive alternative to market capitalization. It is calculated by adding debt/net debt (defined above) to market capitalization.

The calculations are as follows:

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands, except for shares and share price) |

2024 |

2023 |

2023 |

|

Outstanding common shares |

81,937,472 |

82,297,341 |

82,352,479 |

|

times: Ending share price |

$ 132.02 |

$ 116.10 |

$ 110.62 |

|

Market capitalization |

$ 10,817,385 |

$ 9,554,721 |

$ 9,109,831 |

|

Long-term debt |

$ 498,237 |

$ 647,784 |

$ 647,603 |

|

Current portion of long-term debt |

150,000 |

— |

— |

|

less: Cash and cash equivalents |

670,727 |

1,040,757 |

807,418 |

|

Net debt |

$ (22,490) |

$ (392,973) |

$ (159,815) |

|

Total enterprise value |

$ 10,794,895 |

$ 9,161,748 |

$ 8,950,016 |

Order Bookings and Backlog

Order bookings represent the retail value of firm equipment or project orders received during a period. Backlog is defined as the retail value of equipment units ordered by customers with future delivery, and the remaining retail value of package/project orders remaining to be recognized in revenue under the percentage of completion method. Management uses order backlog as a measure of projecting future equipment and project deliveries. There are no directly comparable IFRS measures for order bookings or backlog.

Return on Capital Employed (“ROCE”)

ROCE is utilized to assess both current operating performance and prospective investments. The adjusted earnings numerator used for the calculation is income before income taxes, interest expense and interest income (excluding interest on rental conversions). The denominator in the calculation is the monthly average capital employed, which is defined as net debt plus shareholders’ equity, also referred to as total capitalization, adjusted for discontinued operations.

|

Trailing twelve months ended |

|||

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Net earnings |

$ 504,272 |

$ 534,712 |

$ 540,522 |

|

plus: Interest expense |

28,362 |

28,101 |

27,766 |

|

less: Interest and investment income |

(56,181) |

(46,349) |

(41,857) |

|

plus: Interest income – rental conversions |

3,614 |

3,348 |

3,591 |

|

plus: Income taxes |

187,107 |

194,849 |

192,968 |

|

Adjusted net earnings |

$ 667,174 |

$ 714,661 |

$ 722,990 |

|

Average capital employed |

$ 2,538,075 |

$ 2,347,864 |

$ 2,284,437 |

|

Return on capital employed |

26.3 % |

30.4 % |

31.6 % |

Return on Equity (“ROE”)

ROE is monitored to assess profitability and is calculated by dividing net earnings by opening shareholders’ equity (adjusted for shares issued and shares repurchased and cancelled during the period), both calculated on a trailing twelve month period.

|

Trailing twelve months ended |

|||

|

September 30 |

December 31 |

September 30 |

|

|

($ thousands) |

2024 |

2023 |

2023 |

|

Net earnings |

$ 504,272 |

$ 534,712 |

$ 540,522 |

|

Opening shareholder’s equity (net of adjustments) |

$ 2,596,115 |

$ 2,317,906 |

$ 2,191,616 |

|

Return on equity |

19.4 % |

23.1 % |

24.7 % |

ADVISORY

Information in this press release that is not a historical fact is “forward-looking information”. Words such as “plans”, “intends”, “outlook”, “expects”, “anticipates”, “estimates”, “believes”, “likely”, “should”, “could”, “would”, “will”, “may” and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release reflects current estimates, beliefs, and assumptions, which are based on Toromont’s perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Toromont’s estimates, beliefs and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Toromont can give no assurance that such estimates, beliefs and assumptions will prove to be correct.

Numerous risks and uncertainties could cause the actual results to differ materially from the estimates, beliefs and assumptions expressed or implied in the forward-looking statements, including, but not limited to: business cycles, including general economic conditions in the countries in which Toromont operates; commodity price changes, including changes in the price of precious and base metals; inflationary pressures; potential risks and uncertainties relating to COVID-19 or a potential new world health issue; increased regulation of or restrictions placed on our businesses; changes in foreign exchange rates, including the Cdn$/US$ exchange rate; the termination of distribution or original equipment manufacturer agreements; equipment product acceptance and availability of supply, including reduction or disruption in supply or demand for our products stemming from external factors; increased competition; credit of third parties; additional costs associated with warranties and maintenance contracts; changes in interest rates; the availability and cost of financing; level and volatility of price and liquidity of Toromont’s common shares; potential environmental liabilities and changes to environmental regulation; information technology failures, including data or cybersecurity breaches; failure to attract and retain key employees as well as the general workforce; damage to the reputation of Caterpillar, product quality and product safety risks which could expose Toromont to product liability claims and negative publicity; new, or changes to current, federal and provincial laws, rules and regulations including changes in infrastructure spending; any requirement to make contributions or other payments in respect of registered defined benefit pension plans or postemployment benefit plans in excess of those currently contemplated; increased insurance premiums; and risk related to integration of acquired operations including cost of integration and ability to achieve the expected benefits. Readers are cautioned that the foregoing list of factors is not exhaustive.

Any of the above mentioned risks and uncertainties could cause or contribute to actual results that are materially different from those expressed or implied in the forward-looking information and statements included herein. For a further description of certain risks and uncertainties and other factors that could cause or contribute to actual results that are materially different, see the risks and uncertainties set out under the heading “Risks and Risk Management” and “Outlook” sections of Toromont’s most recent annual Management Discussion and Analysis, as filed with Canadian securities regulators at www.sedarplus.ca or at our website www.toromont.com. Other factors, risks and uncertainties not presently known to Toromont or that Toromont currently believes are not material could also cause actual results or events to differ materially from those expressed or implied by statements containing forward-looking information.

Readers are cautioned not to place undue reliance on statements containing forward-looking information, which reflect Toromont’s expectations only as of the date of this press release, and not to use such information for anything other than their intended purpose. Toromont disclaims any obligation to update or revise any forward‑looking information, whether as a result of new information, future events or otherwise, except as required by law.

ABOUT TOROMONT

Toromont Industries Ltd. operates through two business segments: the Equipment Group and CIMCO. The Equipment Group includes one of the larger Caterpillar dealerships by revenue and geographic territory, spanning the Canadian provinces of Newfoundland and Labrador, Nova Scotia, New Brunswick, Prince Edward Island, Québec, Ontario and Manitoba, in addition to most of the territory of Nunavut. The Equipment Group includes industry-leading rental operations and a complementary material handling business. CIMCO is one of North America’s leading suppliers of thermal management solutions that enable customers to reduce energy consumption and emissions, use natural refrigerants and monitor and control their operating environments autonomously. Both segments offer comprehensive product support capabilities. This press release and more information about Toromont Industries Ltd. can be found at www.toromont.com.

For more information contact:

John M. Doolittle

Executive Vice President and

Chief Financial Officer

Toromont Industries Ltd.

Tel: 416-514-4790

FOOTNOTE

|

(1) |

These financial metrics do not have a standardized meaning under International Financial Reporting Standards (IFRS), which are also referred to herein as Generally Accepted Accounting Principles (GAAP), and may not be comparable to similar measures used by other issuers. These measurements are presented for information purposes only. The Company’s Management’s Discussion and Analysis (MD&A) includes additional information regarding these financial metrics, including definitions and a reconciliation to the most directly comparable GAAP measures, under the headings “Additional GAAP Measures”, “Non-GAAP Measures” and “Key Performance Indicators.” |

TOROMONT INDUSTRIES LTD.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

Three months ended |

Nine months ended |

|||

|

September 30 |

September 30 |

|||

|

($ thousands, except share amount) |

2024 |

2023 |

2024 |

2023 |

|

Revenue |

$ 1,337,992 |

$ 1,174,045 |

$ 3,714,210 |

$ 3,395,364 |

|

Cost of goods sold |

1,010,202 |

838,545 |

2,807,347 |

2,479,418 |

|

Gross profit |

327,790 |

335,500 |

906,863 |

915,946 |

|

Selling and administrative expenses |

152,891 |

142,414 |

447,858 |

416,273 |

|

Operating income |

174,899 |

193,086 |

459,005 |

499,673 |

|

Interest expense |

7,202 |

7,053 |

21,240 |

20,976 |

|

Interest and investment income |

(11,662) |

(11,747) |

(43,049) |

(32,850) |

|

Income before income taxes |

179,359 |

197,780 |

480,814 |

511,547 |

|

Income taxes |

48,408 |

52,161 |

130,594 |

136,492 |

|

Income from continuing operations |

130,951 |

145,619 |

350,220 |

375,055 |

|

Income from discontinued operations |

— |

— |

— |

5,605 |

|

Net earnings |

$ 130,951 |

$ 145,619 |

$ 350,220 |

$ 380,660 |

|

Basic earnings per share |

||||

|

Continuing operations |

$ 1.60 |

$ 1.77 |

$ 4.27 |

$ 4.56 |

|

Discontinued operations |

$ — |

$ — |

$ — |

$ 0.07 |

|

$ 1.60 |

$ 1.77 |

$ 4.27 |

$ 4.63 |

|

|

Diluted earnings per share |

||||

|

Continuing operations |

$ 1.59 |

$ 1.76 |

$ 4.23 |

$ 4.52 |

|

Discontinued operations |

$ — |

$ — |

$ — |

$ 0.07 |

|

$ 1.59 |

$ 1.76 |

$ 4.23 |

$ 4.59 |

|

|

Weighted average number of shares outstanding |

||||

|

Basic |

81,930,534 |

82,281,891 |

82,109,395 |

82,302,881 |

|

Diluted |

82,545,416 |

82,923,627 |

82,703,042 |

82,909,989 |

SOURCE Toromont Industries Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c3407.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c3407.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Barrick Gold Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Barrick Gold.

Looking at options history for Barrick Gold GOLD we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $60,075 and 7, calls, for a total amount of $401,005.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $20.0 for Barrick Gold during the past quarter.

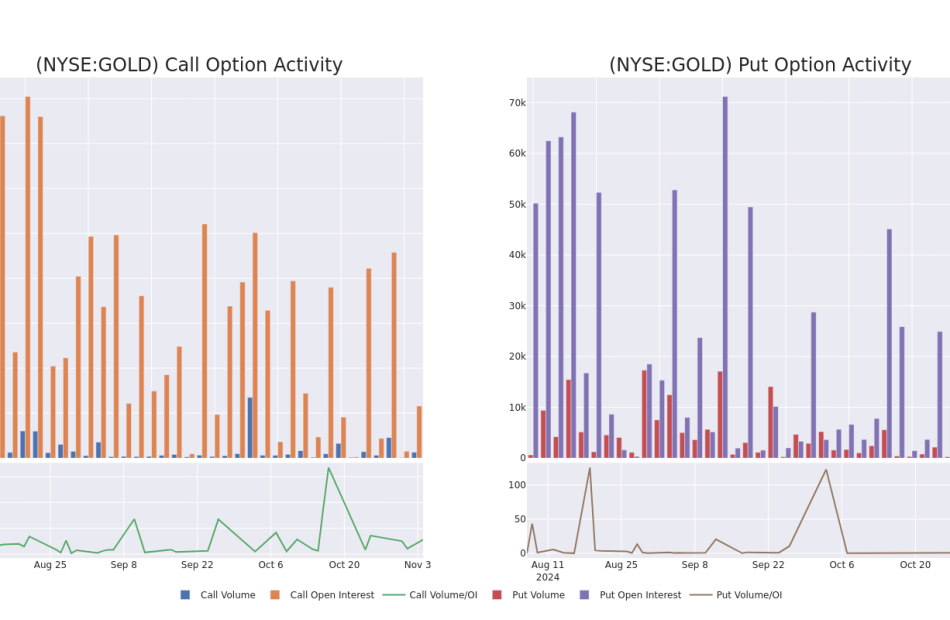

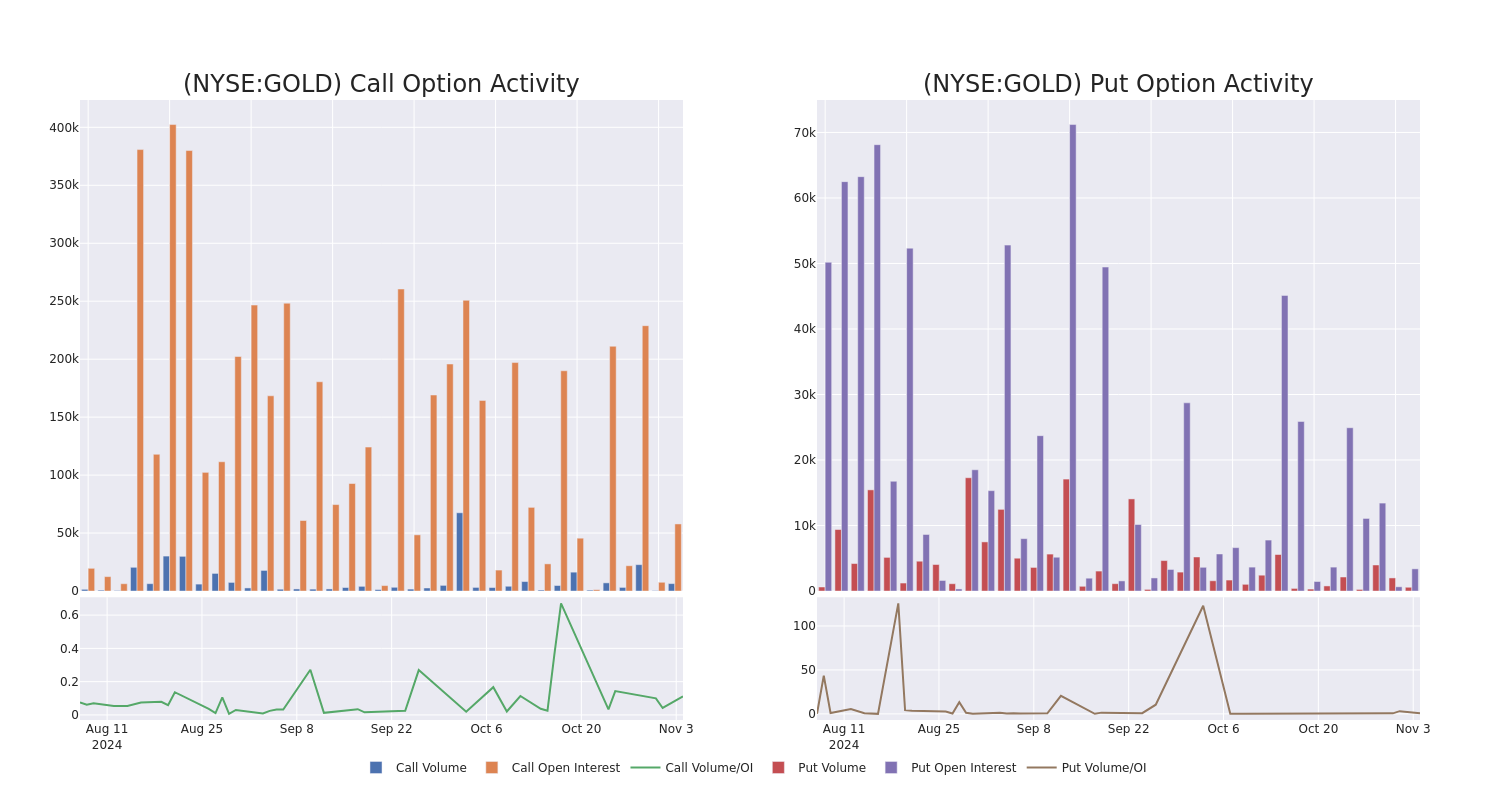

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Barrick Gold options trades today is 10210.17 with a total volume of 6,992.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Barrick Gold’s big money trades within a strike price range of $15.0 to $20.0 over the last 30 days.

Barrick Gold Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BULLISH | 12/20/24 | $0.58 | $0.56 | $0.58 | $20.00 | $115.4K | 11.5K | 2.2K |

| GOLD | CALL | SWEEP | BEARISH | 01/16/26 | $5.15 | $5.05 | $5.05 | $15.00 | $63.1K | 14.2K | 184 |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $4.05 | $3.95 | $4.05 | $17.00 | $58.7K | 7.5K | 271 |

| GOLD | CALL | TRADE | BULLISH | 11/15/24 | $0.22 | $0.21 | $0.22 | $20.00 | $54.9K | 24.5K | 3.0K |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $4.05 | $3.95 | $4.05 | $17.00 | $44.9K | 7.5K | 112 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world’s largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

In light of the recent options history for Barrick Gold, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Barrick Gold Standing Right Now?

- Trading volume stands at 12,506,357, with GOLD’s price down by -1.08%, positioned at $18.84.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 3 days.

What Analysts Are Saying About Barrick Gold

In the last month, 2 experts released ratings on this stock with an average target price of $22.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $22.