Cool Roof Coating Market is Projected to Reach a US$ 9.51 Billion with 6.8% CAGR by 2034 | Fact.MR Report

Rockville, MD , Nov. 04, 2024 (GLOBE NEWSWIRE) — With energy prices rising, the need reduce usage has never been greater before. Worldwide Demand for Cool Roof Coatings Market is poised to reach a market value of US$ 4.92 billion in 2024, as mentioned in the revised market research analysis published by Fact.MR, a market research and competitive intelligence provider. The market for cool roof coatings is projected to expand at 6.8% CAGR from 2024 to 2034.

In recent years, there has been an increase in the demand for energy-saving building materials. They are used for new homes and the renovation of commercial and residential buildings. Cool roof coatings offer improved and secure structures, which are estimated to promote economic and environmental stability. Further, cool roof coatings also assist in minimizing energy costs as they transfer comparatively less heat to buildings and therefore remain cooler. This ultimately leads to the use of less energy in air conditioning systems.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=2364

Key Takeaway from Market Study:

Key Takeaway from Market Study:

- Sales of cool roof coatings are estimated to reach US$ 4.92 billion in 2024.

- The global cool roof coating market is projected to reach a value of US$ 9.51 billion by the end of 2034.

- The market has been projected to expand at a CAGR of 6.8% from 2024 to 2034.

- Demand for cool roof coatings in South Korea is projected to rise at 8.1% CAGR through 2034.

- The healthcare sector is set to account for 52% share of the global market by 2034-end.

- East Asia is approximated to contribute 24.6% share of global market revenue by the end of 2034.

“Increasing consumer inclination toward energy saving solutions, implementation of green building codes, and rising global warming are contributing to growing use of cool roof coatings,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Cool Roof Coating Market:

Leading manufacturers of cool roof coatings are Sherwin Williams, Kansai Paints Co. Ltd., Valspar Corporation, National Coatings Corporation, BASF SE, Nippon Paints, Monarch Industries, Sika AG, GAF Materials, Akzo Nobel, PPG Industries Inc., DowDupont, Excel Coatings, and Nutech Paints.

Expansion of Construction Sector Means High Cool Roof Coating Use in China:

Demand for cool roof coatings in China is projected to increase at a CAGR of 6.4% and reach a market valuation of US$ 1.34 billion by 2034-end. The rising demand for cool roof coatings in the country is attributed to the growing count of infrastructure activities. In addition, the increasing population is generating demand for living space, which contributes to the expansion of the construction sector, subsequently, an increase in the demand for cool roof coatings is experienced.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the cool roof coating market, presenting historical demand data (2018 to 2023) and forecast statistics for the period (2024 to 2034).

The study divulges essential insights into the market based on roof type (low-slope, steep-slope), material (elastomeric plastic, silicon, tiles, metal), technology (water-based, solvent-based), and application (residential, commercial, hospitality, healthcare), across six major regions of the world (North America, Europe, East Asia, Latin America, South Asia & Oceania, and MEA).

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=2364

Country-wise Insights:

The demand outlook for cool roof coatings in the United States is strong, with the market value expected to reach US$ 759.3 million in 2024, growing at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2034. By 2034, the market is projected to be worth US$ 1.22 billion.

The U.S. is anticipated to hold 73.5% of the North American market by the end of 2034. With buildings and homes accounting for a significant share of total energy use, increasing consumer awareness about energy consumption, alongside the implementation of LEED (Leadership in Energy and Environmental Design) initiatives for green building certification, is set to positively influence the market trends for cool roof coatings in the United States.

Segmentation of Cool Roof Coating Market Research:

- By Roof Type :

- By Material Type :

- Elastomeric Plastic

- Silicon

- Tiles

- Metal

- By Technology :

- By Region :

- Residential

- Commercial

- Hospitality

- Healthcare

Checkout More Related Studies Published by Fact.MR Research:

Roofing Market: Global demand for roofing materials is expected to increase at a CAGR of 5.5% from 2023 to 2033. The global roofing market is valued at US$ 82.2 billion in 2023 and is this expected to reach US$ 140.4 billion by the end of 2033.

Waterproofing Membranes Market: The waterproofing membrane market is estimated to be valued at US$ 31.5 billion in 2023. Waterproofing material is a thin impermeable membrane that functions along with asphalt to provide protection to the underlying structure of the buildings.

Roofing Adhesives Market: The global roofing adhesives market has reached a valuation of US$ 6.6 billion in 2023 and is projected to climb to US$ 16 billion by 2033-end, expanding at a noteworthy CAGR of 9.2% over the next 10 years (2023 to 2033, according to a detailed industry analysis by Fact. MR.

Steep Slope Roofing Material Market: The global steep slope roofing material market size is set to reach a valuation of US$ 15.12 billion in 2024. As per this latest industry analysis by Fact.MR, the market has been projected to expand at a CAGR of 3.3% to end up at US$ 20.92 billion by 2034.

Waterproofing Chemical Market: The global waterproofing chemical market size is expected to reach a valuation of US$ 4.43 billion in 2024 and climb to a size of US$ 6.49 billion by the end of 2034. The market is forecasted to expand at 3.9% CAGR from 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Likely To Open In Green Amid Hints Of Tentativeness On Election Eve: Expert Says Brace For Volatility Ahead Of Fed's Rate Decision

U.S. stocks could get off to a positive start on Monday after the averages registered a mixed October. While the S&P 500 and Dow Jones snapped their five-month winning streak, the Nasdaq Composite closed in the green buoyed by Big Tech earnings.

America goes to polls on Tuesday to elect its 47th president, and data so far suggests that it will be a neck-to-neck race between Democratic candidate Kamala Harris and Republican nominee Donald Trump.

The Federal Open Market Committee, or FOMC, is also widely expected to deliver another rate cut this week, with CME Group’s FedWatch tool suggesting there is a 96% chance that this will happen.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.15% |

| S&P 500 | 0.19% |

| Dow Jones | 0.08% |

| R2K | -0.01% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY gained 0.20% to $572.21 and the Invesco QQQ ETF QQQ rose 0.22% to $488.50, according to Benzinga Pro data.

Cues From Last Week:

Oil prices continued to rebound after tanking the week before, amid delays in production output increase by the Organization of the Petroleum Exporting Countries, or OPEC.

Most sectors on the S&P 500 closed on a negative note, with utilities, energy, and real estate stocks recording the biggest losses on Friday.

However, consumer discretionary and information technology stocks bucked the overall market trend, closing the session higher.

| Index | Last Week’s Performance (+/-) | Value |

| Nasdaq Composite | -1.5% | 18,518.61 |

| S&P 500 | -1.4% | 5,728.80 |

| Dow Jones | -0.15% | 42,052.19 |

| Russell 2000 | 0.1% | 2,210.13 |

Insights From Analysts:

A Harris win could see the U.S. dollar weakening, according to ING analyst Francesco Pesole.

“Despite some unwinding of Trump trades, asset markets are still broadly pricing in a Trump win. As things stand now, we expect the dollar to sell off if Harris wins, while the impact of a Trump win may depend more on the Congress composition.”

On the other hand, rate cut expectations seem to be unanimous among analysts, even though the Presidential race is neck-to-neck.

“On Thursday, when we may or may not know who the next President is going to be, we should almost certainly see a 25 basis points cut from the Fed and a reiteration from [Fed Chair] Powell that the Fed’s subsequent meetings will be data dependent,” Deutsche Bank analyst Jim Reid in a research note.

Fed chair Jerome Powell’s commentary would also be on the Street’s radar as it looks for guidance on the central bank’s rate action going forward.

“We look for Fed Chair Powell to once again be the voice of reason corralling the FOMC to prudently ease monetary policy,” said EY Chief Economist Gregory Daco.

Nathan Peterson, Director of Derivatives Analysis at the Schwab Center for Financial Research, laid out the thesis for market movements for the next week.

“My overall forecast for next week is “volatile and bearish.” What could challenge my outlook? If Election Results are not drawn out (meaning we have clarity on the winner following Election Day), or the Fed doesn’t provide a hawkish tone next Thursday, like I suspect they will, then stocks will likely rally.”

See Also: How To Trade Futures

Upcoming Economic Data

Monday’s economic calendar is light, but crucial economic data is scheduled for the rest of the week.

- On Monday, factory order data will be released at 10 a.m. ET.

- On Tuesday, U.S. trade deficit data will be released at 8:30 a.m. ET.

- ISM services data will be released at 10 a.m. ET.

- On Wednesday, S&P will release the final U.S. services purchasing manager’s index (PMI) at 9:45 a.m. ET.

- On Thursday, initial jobless claims data and preliminary productivity numbers will be released at 8:30 a.m. ET.

- Wholesale inventories data will be released at 10 a.m. ET.

- FOMC will announce its rate decision at 2 p.m. ET.

- Fed Chair Powell will address a press conference at 2:30 p.m. ET.

- On Friday, preliminary consumer sentiment data will be released at 10 a.m. ET.

- Fed Governor Michelle Bowman will speak about banking regulations at 11 a.m. ET.

Stocks In Focus:

- Trump Media & Technology Group Corp. DJT will be in focus on election eve. The stock experienced increased volatility last week and fell over 27%.

- Tesla Inc. TSLA shares will be in focus on Monday after the Elon Musk-led EV giant saw its China sales decline in October.

- Nvidia Corp. NVDA will join the Dow Jones Industrial Average this week, replacing Intel Corp. INTC and ending its 25-year run.

- Apple Inc.’s AAPL largest shareholder, the Warren Buffett-led Berkshire Hathaway, pared its stake in the iPhone maker by 25% in the July-September quarter.

- Boeing Co. BA machinists are set to vote on the new proposed deal that could bring an end to a seven-week-long strike.

- Investors are awaiting earnings results from Constellation Energy Corporation CEG, Marriott International, Inc. MAR, and Wynn Resorts, Limited WYNN today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures surged in the early New York session, rising by over 3% after OPEC announced a delay in increasing production.

The 10-year Treasury note yield eased marginally to 4.285%.

Major Asian markets ended in the green on Monday, and European stocks showed strength as well in early trading.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DJT stock braces for another volatile trading week ahead of Trump, Harris election

Trump Media & Technology Group stock (DJT) reversed earlier losses to jump by more than 7% in afternoon trading on Monday as shares brace for another volatile week on Wall Street just one day ahead of the presidential election.

The stock suffered its largest percentage decline last week and closed down around 20% to end the five-day period on Friday.

And since Tuesday, more than $4 billion has been shaved from the company’s market cap, although the stock still has more than doubled from its September lows.

The oscillating of shares will likely continue as the election nears. One investor has warned that if Trump loses the election on Tuesday, shares of DJT could plunge to $0.

“It’s a binary bet on the election,” Matthew Tuttle, CEO of investment fund Tuttle Capital Management, recently told Yahoo Finance’s Catalysts.

Tuttle, who currently owns put options on the stock, said the trajectory of shares hinges on “a buy the rumor, sell the fact” trading strategy.

“I would imagine that the day after him winning, you’d see this come down,” he surmised. “If he loses, I think it goes to zero.”

Interactive Brokers’ chief strategist Steve Sosnick said DJT has taken on a meme-stock “life of its own.”

“It was volatile on the way up and when a stock is that volatile in one direction, it has a tendency to be that volatile in the other direction,” he said in a call with Yahoo Finance last week.

Prior to the recent sell-off, shares in the company, the home of the Republican nominee’s social media platform Truth Social, had risen in recent weeks as both domestic and overseas betting markets shifted in favor of a Trump victory.

Prediction sites like Polymarket, PredictIt, and Kalshi all showed Trump’s presidential chances ahead of those of Democratic nominee and current Vice President Kamala Harris. That lead, however, narrowed significantly over the weekend as new polling showed Harris surpassing Trump in Iowa, which has historically voted Republican.

And as betting markets tighten, national polls show both candidates in a virtually deadlocked race. Polls in key battleground states like Pennsylvania, Michigan, and Wisconsin, which are likely to decide the fate of the election, also show razor-thin margins.

In September, the stock traded at its lowest level since the company’s debut following the expiration of its highly publicized lockup period. Shares had also been under pressure as previous polling in September saw Harris with a bigger lead on the former president.

Understanding Adobe's Position In Software Industry Compared To Competitors

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Adobe ADBE alongside its primary competitors in the Software industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company’s performance within the industry.

Adobe Background

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Adobe Inc | 40.88 | 14.61 | 10.46 | 11.46% | $2.31 | $4.85 | 10.59% |

| Salesforce Inc | 51.34 | 4.89 | 7.92 | 2.44% | $2.79 | $7.17 | 8.39% |

| SAP SE | 92.53 | 6.08 | 7.56 | 3.53% | $2.71 | $6.21 | 9.38% |

| Intuit Inc | 59.61 | 9.45 | 10.84 | -0.11% | $0.13 | $2.4 | 17.4% |

| Palantir Technologies Inc | 246.59 | 23.18 | 40.17 | 3.43% | $0.11 | $0.55 | 27.15% |

| Synopsys Inc | 53.45 | 10.33 | 12.45 | 5.49% | $0.46 | $1.24 | 12.65% |

| Cadence Design Systems Inc | 74.23 | 16.95 | 17.71 | 5.4% | $0.41 | $1.05 | 18.81% |

| Workday Inc | 41.23 | 7.59 | 8.16 | 1.6% | $0.28 | $1.57 | 16.68% |

| Autodesk Inc | 58.72 | 24.96 | 10.69 | 12.17% | $0.39 | $1.36 | 11.9% |

| Roper Technologies Inc | 39.86 | 3.13 | 8.62 | 2.01% | $0.69 | $1.19 | 2.78% |

| AppLovin Corp | 69.88 | 67.08 | 14.48 | 39.35% | $0.51 | $0.8 | 43.98% |

| Datadog Inc | 262.26 | 17.26 | 18.96 | 1.9% | $0.06 | $0.52 | 26.66% |

| Ansys Inc | 57.20 | 5.06 | 12.20 | 2.37% | $0.2 | $0.52 | 19.64% |

| Tyler Technologies Inc | 110.19 | 7.88 | 12.56 | 2.37% | $0.12 | $0.24 | 9.84% |

| Zoom Video Communications Inc | 27 | 2.73 | 5.16 | 2.6% | $0.23 | $0.88 | 2.09% |

| PTC Inc | 75.52 | 7.37 | 10.05 | 2.32% | $0.13 | $0.41 | -4.37% |

| Manhattan Associates Inc | 75.31 | 58.09 | 16.09 | 24.6% | $0.08 | $0.15 | 11.84% |

| Dynatrace Inc | 103.98 | 7.79 | 10.85 | 1.89% | $0.06 | $0.32 | 19.93% |

| Average | 88.17 | 16.46 | 13.2 | 6.67% | $0.55 | $1.56 | 14.99% |

After thoroughly examining Adobe, the following trends can be inferred:

-

The Price to Earnings ratio of 40.88 is 0.46x lower than the industry average, indicating potential undervaluation for the stock.

-

With a Price to Book ratio of 14.61, significantly falling below the industry average by 0.89x, it suggests undervaluation and the possibility of untapped growth prospects.

-

The Price to Sales ratio is 10.46, which is 0.79x the industry average. This suggests a possible undervaluation based on sales performance.

-

The Return on Equity (ROE) of 11.46% is 4.79% above the industry average, highlighting efficient use of equity to generate profits.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $2.31 Billion is 4.2x above the industry average, highlighting stronger profitability and robust cash flow generation.

-

The gross profit of $4.85 Billion is 3.11x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 10.59% is significantly lower compared to the industry average of 14.99%. This indicates a potential fall in the company’s sales performance.

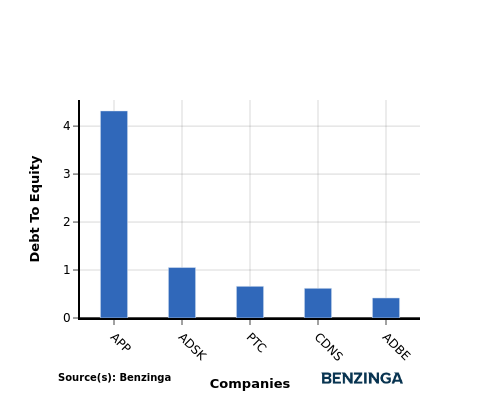

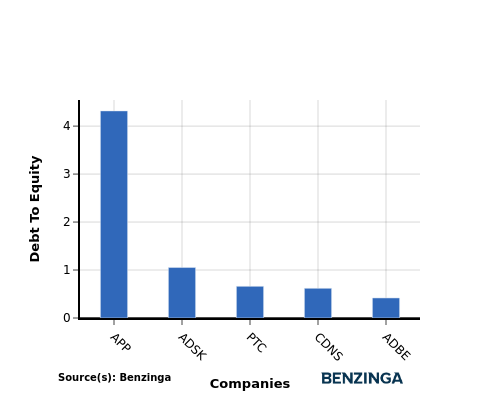

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Adobe stands in comparison with its top 4 peers, leading to the following comparisons:

-

Adobe has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.42.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

For Adobe in the Software industry, the PE, PB, and PS ratios are all low compared to peers, indicating potential undervaluation. On the other hand, Adobe’s high ROE, EBITDA, and gross profit suggest strong profitability and operational efficiency. However, the low revenue growth rate may raise concerns about future performance compared to industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Reynolds Consumer Prods Director Trades Company's Stock

A significant insider buy by Rolf Stangl, Director at Reynolds Consumer Prods REYN, was executed on November 4, and reported in the recent SEC filing.

What Happened: In a significant move reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, Stangl purchased 7,207 shares of Reynolds Consumer Prods, demonstrating confidence in the company’s growth potential. The total value of the transaction stands at $196,378.

Tracking the Monday’s morning session, Reynolds Consumer Prods shares are trading at $29.0, showing a down of 1.76%.

Unveiling the Story Behind Reynolds Consumer Prods

Reynolds Consumer Products Inc is a provider of household products. The firm is engaged in the production and sales of cooking products, waste and storage products, and tableware. It operates through four reportable segments namely, Reynolds Cooking and Baking, Hefty Waste and Storage, Hefty Tableware, and Presto Products. Reynolds Cooking and Baking segment produce branded and store brand aluminum foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, butcher paper, plastic wrap, baking cups, oven bags and slow cooker liners.

Financial Milestones: Reynolds Consumer Prods’s Journey

Revenue Growth: Reynolds Consumer Prods’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -2.67%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 26.26%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Reynolds Consumer Prods’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.41.

Debt Management: Reynolds Consumer Prods’s debt-to-equity ratio is below the industry average at 0.88, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The P/E ratio of 15.55 is lower than the industry average, implying a discounted valuation for Reynolds Consumer Prods’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.55 is lower than the industry average, implying a discounted valuation for Reynolds Consumer Prods’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 10.22, Reynolds Consumer Prods presents an attractive value opportunity.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Deep Dive into Insider Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Reynolds Consumer Prods’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Vibration Control System Market is Projected to Grow at a 3.6% CAGR, Reaching US$ 271.59 Billion by 2034 | Fact.MR Report

Rockville, MD, Nov. 04, 2024 (GLOBE NEWSWIRE) — According to the latest report published by Fact.MR, a market research and competitive intelligence provider, the global automotive vibration control system market is expected to reach a valuation of US$ 271.59 Bn by the end of 2034 while expanding at a CAGR of 3.6% over the same period.

Convergence in the automobile industry promises a positive stance and dynamic changes in demand. Additionally, the momentum of core factors are driving the shift of consumer preference, including economical, demographical and social disruption, with the aid of technological advancements. Dynamically shifting consumer preference towards elite and luxurious vehicles owing to surge in disposable income and global per capita GDP plays a vital role in the industry.

Luxurious vehicle demand has witnessed a swift and steady recovery from the COVID-19 pandemic and has reached the pre-COVID trajectory. Luxury automobiles account for roughly 13% of total global car sales, and are expected to hold a market share of around 16-18% over the decade. As such, growing demand for luxury vehicles will subsequently drive the sales of vibration control systems.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7212

Key Takeaways from Market Study

- The global automotive vibration control system market is poised to expand at a CAGR of 3.6% through 2034.

- On the basis of type, the market is projected to be dominated by body & chassis with 70% market share by 2034

- North America is likely to an attractive region from the demand side. The region is projected to utilize more than 2,154.6 Mn units of automotive vibration control systems by the end of 2034.

- By vehicle category, commercial vehicles are likely to account for 3% of revenue share in the global market and create an absolute $ opportunity of US$ 40.4 Bn over the assessment period.

- The OEM sales channel is projected to grow 1.5X by value, while the aftermarket segment is set to grow by 1.3X during the forecast period.

- The European region is expected to register a CAGR of 3% over the forecast period and be valued at US$ 60.7 Bn by 2034-end.

“Passenger vehicles are likely to be the most attractive segment in this market and attract manufacturers for investments during the assessment period” says a Fact.MR analyst

Leading Players Driving Innovation in the Automotive Vibration Control System Market:

Key players in the automotive vibration control system market are Continental AG, Parker Hannifin Corp., Bridgestone Corporation, ZF Friedrichshafen, Trelleborg AB, HUTCHINSON, DynaTronic Corporation Ltd., Cooper Standard, GERB, Technical Manufacturing Corporation, LORD Corporation, Trelleborg AB, Farat Ltd., Bridgestone Corporation, Fukoku Co., Ltd., VICODA GmbH, MUPRO Services GmbH, Kinetics Noise Control, Inc.

Winning Strategy:

East Asia is likely to be the most prominent region from the demand side. Capital expansion and strong supply chain network in East Asia will open new doors for manufacturers during the assessment period.

In addition to this, market players have several opportunities to follow inorganic growth strategies such as mergers, partnerships, and collaborations to expand in the East Asia region.

Adoption of inorganic growth strategies will lead to a strong consumer base, which is poised to help cash flow generation in the near future.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=7212

Automotive Vibration Control System Industry News:

- As part of a joint venture to execute predictive maintenance across its tanker fleet, Norwegian ship owner Solvang deployed SKF’s Enlight ProCollect, a new manual vibration monitoring system, in January 2021.

More Valuable Insights Available

Fact.MR, in its new offering, presents an unbiased analysis of the global automotive vibration control system market, presenting historical demand data (2017-2021) and forecast statistics for the period of 2024-2034.

The study divulges essential insights on the market on the basis of type (engines & powertrains (damper pulleys, engine mounts, center bearing support and differential mounts), body & chassis (suspension bushing, air springs, strut mounts, dynamic dampers, cab mounts and frame & sub frame mounts), exhaust mounts, radiator mounts, and interiors (mounts and air springs), vehicle category (industrial vehicles (construction equipment, mining equipment, material handling equipment, agriculture & forestry equipment, industrial trucks, commercial vehicles (LCVs, HCVs, and buses & coaches), rolling stocks (locomotive, passenger, and freight) and passenger vehicles), and sales channel (OEM, aftermarket (online sales (company-owned websites, e-Commerce websites), offline (auto-parts stores and authorized dealers), and others), across six major regions (North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa).

Check out More Related Studies Published by Fact.MR:

Airline Market: Size has been forecasted to expand at a noteworthy CAGR of 8.8% to reach a valuation of US$ 1723.91 billion by the end of 2034.

Motorcycle Filter Market: Size is forecasted to expand at a CAGR of 5.1% to reach a valuation of US$ 6.36 billion by the end of 2034.

Tire Pressure Sensor and Airbag Sensor Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.7%, from a valuation of US$ 5.56 billion in 2024 to US$ 10.63 billion by 2034.

Automotive Battery Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.1%, from US$ 52.71 billion in 2024 to US$ 95.29 billion by 2034.

Vibration Motors Market: Size is estimated at USD 6.5 Billion in 2022 and is forecast to reach USD 24.1 Billion by 2032, growing at a CAGR of 14.1% during 2022-2032.

Automotive Suspension Bush Market: Size is expected to grow at a compound annual growth rate (CAGR) of 4.1%, from a valuation of US$ 2.85 billion in 2024 to US$ 4.26 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LiDAR Drone Market Expected to Reach USD 994.5 Million by 2033, Driven by Increased Adoption and Regulatory Support -Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 04, 2024 (GLOBE NEWSWIRE) — LiDAR drone market is projected to grow from USD 167 million in 2023 to USD 994.5 million by 2033; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.53% from 2023 to 2033.

The growth of the LiDAR drone market is being driven by several factors, including the increasing adoption of LiDAR-equipped drones in industries like mining, corridor mapping, and precision agriculture, as well as the relaxation of regulations surrounding commercial drone use. Additionally, government initiatives supporting the use of LiDAR drones for large-scale surveys and the development of 4D LiDAR sensors are expected to create significant growth opportunities during the forecast period.

However, the high purchasing and operational costs of LiDAR drones, along with safety concerns, present challenges to the overall growth of the LiDAR drone industry.

| Country Specific Insights CAGR (2023-2033) | |

| United States | 18.23% |

| United Kingdom | 19.70% |

| China | 21.45% |

| Japan | 19.34% |

| South Korea | 20.40% |

https://exactitudeconsultancy.com/reports/30810/lidar-drone-market/

Regulatory Barriers and Drone Usage Restrictions Across Various Countries

The adoption of LiDAR drones is growing globally, thanks to their ability to capture precise data for a wide range of applications. However, many countries impose strict regulations on drone usage, which can slow market expansion. While some regions have relaxed drone laws, others maintain strict policies requiring operators to obtain multiple government approvals before flight. Additionally, drone operators often face high registration costs and must seek specific permissions for each mission. Countries like Algeria, Barbados, Cuba, Iran, Kenya, Saudi Arabia, and Sri Lanka have imposed significant restrictions or outright bans on drone operations, which limits the growth of the LiDAR drone market.

COVID-19 Pandemic: A Temporary Setback for LiDAR Drone Adoption

The COVID-19 pandemic created significant disruptions across industries worldwide, affecting supply chains and delaying production schedules. LiDAR drone manufacturers and users were not immune to these impacts. With global lockdowns, many government projects involving drones such as corridor mapping, surveillance, and precision agriculture were put on hold or delayed, leading to a reduction in market activity during 2020 and 2021. As a result, scheduled drone operations were halted, and procurement and service contracts were postponed or cancelled, leading to temporary negative growth in the market.

Advancements in Next-Generation UAV LiDAR Sensors to Drive Market Growth

In recent years, the growing adoption of drones across various applications has led to a surge in demand for LiDAR technology. By integrating advanced mapping technologies, along with navigation and positioning systems, UAV-based LiDAR products offer several operational benefits. The development of dynamic sensor technologies, including collision avoidance and warning systems, enhances the versatility and appeal of these products. UAV LiDAR systems now feature optical altimeter technology that allows precise measurement and computation, tailored to different investigative needs. Lightweight components and sophisticated photogrammetric software enable efficient image processing, delivering better data for government and corporate decisions. These drones can generate high-resolution 3D images and process objects with exceptional accuracy, particularly in applications where overhead imaging is required. With laser scanners based on micro-electromechanical mirrors producing dense point clouds, the increasing demand for such capabilities is expected to drive significant market growth in the coming years.

https://exactitudeconsultancy.com/reports/30810/lidar-drone-market/

Emergence of 4D LiDAR Sensors

4D LiDAR sensors are an advancement over 3D systems, incorporating cameras to expand their applications. These sensors can be used in various scenarios, including damage assessments, mission planning, and environmental management. By integrating video feeds with LiDAR technology, these systems can capture multi-megapixel images at 30 frames per second, providing accurate depth and spatial data for each pixel. This enables real-time data processing with enhanced precision, delivering highly accurate information on object locations and movements in relation to their surroundings. The rise of 4D LiDAR sensors is expected to open new opportunities for the LiDAR drone market.

High Costs Limiting Widespread Adoption of LiDAR Drones

Despite the advancements in LiDAR technology, the high purchase and operational costs of LiDAR drones pose a challenge to their broader adoption. These systems rely on multiple high-powered components, including LiDAR sensors, UAV cameras, GPS, GNSS, IMUs, and large batteries, which can drive the total cost of these drones to between USD 50,000 and USD 300,000. The heavy payloads necessary to support these components also increase the overall operational expenses, limiting their accessibility to industries with larger budgets.

LiDAR Lasers to Lead the Market by Component

LiDAR lasers are critical components in UAV-based LiDAR systems, playing a key role in environmental scanning and data acquisition. These lasers measure the time taken for reflected signals to return to the detectors, enabling the calculation of distances ranging from meters to kilometres. By gathering information through time-of-flight (ToF) reflection, LiDAR laser systems produce detailed 3D images of surrounding environments, making them indispensable for various surveying applications.

Bathymetric LiDAR to Experience Significant Growth

Bathymetric LiDAR is projected to grow at the highest compound annual growth rate (CAGR) due to its superior accuracy in underwater surveying applications. Unlike sonar, bathymetric LiDAR systems use two lasers one for measuring water depth (via green light) and another for determining the altitude above water (via red light). This dual-laser approach enables precise calculations of water depths, making it an optimal solution for oceanographic studies, coastal mapping, and underwater terrain analysis.

Short-Range LiDAR Drones to Capture the Largest Market Share

The demand for short-range LiDAR drones is increasing globally due to their lightweight design, detailed data acquisition capabilities, and ease of use. These drones, operating within a range of less than 200 meters, are particularly popular for small-scale surveys as they don’t require extensive permissions for operation. Their lightweight design enhances manoeuvrability and extends battery life, making them highly suitable for precision tasks that require high accuracy over shorter distances.

APAC LiDAR Drone Market Set for Significant Growth

The LiDAR drone market in the Asia Pacific (APAC) region is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period. This rapid growth is driven by the increasing demand for LiDAR drones in various sectors, including surveying, mapping, and infrastructural development projects. LiDAR drones are also being adopted for forest management and mining activities across the region.

Several factors contribute to this growth, including favourable government policies, which provide moderate regulations on LiDAR drone usage, making it easier for industries to adopt this technology. Additionally, the availability of low-cost LiDAR drones and the presence of local manufacturers and players in the region further support the market’s expansion. The combination of these factors positions APAC as a significant player in the global LiDAR drone market throughout the forecast period.

https://exactitudeconsultancy.com/reports/30810/lidar-drone-market/#request-a-sample

Market Segments:

LiDAR Drone Market, LiDAR Type:

LiDAR Drone Market, by Drone Type:

- Rotary-wing LiDAR Drones

- Fixed-wing LiDAR Drones

LiDAR Drone Market, by Component:

- LiDAR Lasers

- Navigation and positioning systems

- UAV cameras

- Others

LiDAR Drone Market, by Drone Range:

- Short-range LiDAR Drones

- Medium-range LiDAR Drones

- Long-range LiDAR Drones

LiDAR Drone Market, by Application:

- Corridor mapping

- Archaeology

- Construction

- Environment

- Entertainment

- Precision Agriculture

- Others

Segmental Share in CAGR (%) for the year 2023:

| Segments (2023) | CAGR (in %) |

| Facial Recognition | 27.4 |

| Service | 41.23 |

| Cloud | 73.7 |

| Retail & E-commerce | 23.5 |

| Marketing & Advertisement | 34.9 |

| North America | 37.3 |

LiDAR Drone Market, by region:

- North America

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- RoW

- Middle East & Africa

- South America

Recent Developments in the LiDAR Drones Market

- February 2021: Phoenix LiDAR Systems partnered with NORDIC UNMANNED (Norway), Europe’s only listed drone operator, to offer industry-leading LiDAR, UAVs, UAS, photogrammetry, and 3D measurement products.

- June 2021: Velodyne introduced the Velabit LiDAR sensor for safety-critical applications, including infrastructure, automotive, industrial settings, UAV mapping, and sidewalks.

- May 2022: YellowScan expanded its footprint in the Asia Pacific region by adding Dat Hop Co. Ltd., a Vietnam-based supplier of geospatial and hydrographic survey solutions, to its YellowScan Global Partners Network.

- June 2022: Phoenix LiDAR Systems unveiled the HydroRANGER, a dual-purpose LiDAR system that provides both topographic and bathymetric measurements for comprehensive shoreline system mapping.

Finally, the LIDAR Drone Market report is the believable source for gaining the market research that will exponentially accelerate your business. The report gives the principal locale, economic situations with the item value, benefit, limit, generation, supply, request, and market development rate and figure, and so on. LIDAR Drone Market industry report additionally Presents a new task SWOT examination, speculation attainability investigation, and venture return investigation.

We offer customization on LIDAR Drone Market report based on specific client requirement:

1: Market Report in PDF and Excel format.

2: Access to +20% free customization.

3: Access to our analyst’s facts for the following 1 year.

More Reports –

Facial Recognition Market – https://exactitudeconsultancy.com/reports/1391/facial-recognition-market/

The Global Facial Recognition Market was valued at USD 3 billion in 2019, and it is expected to reach a value of USD 13 billion by 2028, registering a CAGR of 17% over the forecast period, 2020 – 2028.

Mobility as a Service Market – https://exactitudeconsultancy.com/reports/1903/mobility-as-a-service-market/

The global mobility as a service market is expected to grow at 18.00% CAGR from 2019 to 2028. It is expected to reach above USD 10.851 billion by 2028 from USD 2.37 billion in 2019.

Indoor Location Market – https://exactitudeconsultancy.com/reports/2715/indoor-location-market/

The global Indoor Location Market size is expected to grow at more than 22% CAGR from 2020 to 2029. It is expected to reach above USD 20.35 billion by 2029 from USD 6.25 billion in 2020.

Edge Analytics Market – https://exactitudeconsultancy.com/reports/1219/edge-analytics-market/

The Edge Analytics Market size is estimated to grow from USD 3.35 billion in 2019 to USD 14.87 billion by 2028, at an estimated CAGR of 18% from 2019 to 2028.

Dual In-line Memory Module (DIMM) Market –

https://exactitudeconsultancy.com/reports/773/dual-in-line-memory-module-dimm-market/

The Global DIMM (Dual In-line Memory Module) Market size is expected to grow at more than 22% CAGR from 2021 to 2026. It is expected to reach above USD 10 billion by 2026 from a little above USD 3 billion in 2021.

Private Wireless Networks Market- https://exactitudeconsultancy.com/reports/2585/private-wireless-networks-market/

The global Private Wireless Networks Market is expected to grow at 18% CAGR from 2020 to 2029. It is expected to reach above USD 80 billion by 2029 from USD 18 billion in 2020.

Spectrum Analyzers Market – https://exactitudeconsultancy.com/reports/2920/spectrum-analyzers-market/

The global spectrum analyzers market size is estimated to be valued at USD 1,704.98 million in 2020 and is projected to reach USD 3214.53 million by 2029, recording a CAGR of 7.3%.

Smart Grid Market – https://exactitudeconsultancy.com/reports/1855/smart-grid-market/

The global smart grid market is expected to grow at 19.1% CAGR from 2019 to 2028. It is expected to reach above USD 145.65 billion by 2028 from USD 30.43 billion in 2019.

Color Detection Sensors Market – https://exactitudeconsultancy.com/reports/2916/color-detection-sensors/

The global color detection sensors market is expected to grow at 8% CAGR from 2020 to 2029. It is expected to reach above USD 3.54 billion by 2029 from USD 1.77 billion in 2020.

Enterprise Architecture Tools Market – https://exactitudeconsultancy.com/reports/2224/enterprise-architecture-tools-market/

The global Enterprise Architecture Tools Market is expected to grow at 4.5% CAGR from 2019 to 2028. It is expected to reach above USD 1427 million by 2028 from USD 960 million in 2019.

Data Visualization Tools Market – https://exactitudeconsultancy.com/reports/2452/data-visualization-tools-market-growth/

The global data visualization tools market size is estimated to be valued at USD 6.8 billion in 2021 and is projected to reach USD 13 billion by 2028, recording a CAGR of 9.7%.

Smart Electricity Meters Market – https://exactitudeconsultancy.com/reports/1818/smart-electricity-meters-market/

The global smart electricity meters market is expected to grow at more than 6.2% CAGR from 2019 to 2028. It is expected to reach above USD 13.49 billion by 2028 from a little above USD 9.94 billion in 2019.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Post-Herpetic Neuralgia Treatment Market Projected to Reach $1.38 Billion by 2034, Growing at a CAGR of 5.3% | Fact.MR Report

Rockville, MD, Nov. 04, 2024 (GLOBE NEWSWIRE) — The global post herpetic neuralgia treatment market is calculated to reach a size of US$ 822.4 million in 2024 and climb to US$ 1.38 billion by the end of 2034. The market is forecasted to expand at 5.3% CAGR through 2034. Increasing rates of post herpetic neuralgia treatments is being driven by more number of favorable reimbursement policies worldwide.

Adoption of post-herpetic neuralgia treatment is increasing because of its efficacy as patients seek therapy that enhances their quality of life. Accessibility is pivotal, necessitating readily available options through healthcare providers and pharmacies. There’s a significant market for new drug development in post-herpetic neuralgia therapy. Since the competition is minimal, the introduction of any effective treatment is expected to gain rapid acceptance, requiring fewer resources. Global healthcare spending is on the rise, driving the market further.

Other factors that are projected to drive post-herpetic neuralgia treatment market growth include governmental support to enhance treatment access and efficacy. Increasing aging population and growing public awareness of post-herpetic neuralgia treatment are creating more opportunities for market players. This is also leading to early detection of the conditions and improved patient outcomes due to timely intervention.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10057

Key Takeaways from the Market Study:

- The global post herpetic neuralgia treatment market is set to reach US$ 822.4 million in 2024.

- The market is forecasted to touch US$ 1.38 billion by the end of 2034, expanding at a CAGR of 3%.

- Revenue from post-herpetic neuralgia treatments in the United States is estimated to reach US$ 248 million in 2024.

- China occupies 50% share of the East Asia market in 2024.

- The market in Japan is forecasted to reach US$ 43 million in 2024.

- The North American market is projected to expand at a CAGR of 3% from 2024 to 2034.

“Increasing prevalence of shingles among the aging population worldwide is a primary driver for the adoption of post-herpetic neuralgia treatments. Other factors include government support to enhance access to therapy and rising healthcare spending,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Post Herpetic Neuralgia Treatment Market:

Key industry participants like Pfizer, Arbor Pharma, Assertio Therapeutics, Endo Pharma, Teikoku Pharma, Teva, Mylan, Hengrui Medicine, Acorda Therapeutics, Purdue Pharma L.P., Teikoku Pharma USA, Inc., and Janssen Pharmaceuticals, Inc., etc. are driving the post herpetic neuralgia treatment industry.

Side Effects and Ineffectiveness Associated with Certain Medications:

Biotechnology advancements are enabling more precise treatment planning tailored to a patient’s genetic composition or unique characteristics, significantly contributing to the development of precision or personalized medicine. However, the use of certain drugs is constrained by side effects such as orthostatic hypotension, sedation, dry mouth, constipation, and urinary retention.

Patients with cardiac conditions are advised against their use. Nortriptyline and amitriptyline are the most commonly prescribed TCAs for post-herpetic neuralgia treatment. In later stages of treatment, corticosteroids are administered, but their limited effectiveness and adverse effects have restricted their usage.

Post Herpetic Neuralgia Treatment Industry News:

- In July 2022, Acasti Pharma announced the initiation of a pharmacokinetic study for GTX-101, its drug candidate targeting post-herpetic neuralgia treatment. GTX-101 is a novel formulation of bupivacaine hydrochloride (HCl) intended for topical application through a bio-adhesive, film-forming polymer. This formulation aims to relieve pain associated with post-herpetic neuralgia, a neuropathic condition that arises from nerve damage due to the varicella-zoster virus (shingles). By utilizing this innovative formulation, the application of bupivacaine hydrochloride (HCl) is designed to provide targeted relief when administered topically through the bioadhesive film-forming polymer.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10057

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the post herpetic neuralgia market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the post-herpetic neuralgia market based on treatment type (drugs, patches, steroid injectables) and distribution channel (institutional sales, retail sales), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR Research:

CBD patches market is expected to reach US$ 124.6 million in 2023 and surge ahead at a CAGR of 18.7% to end up at a market size of US$ 691.9 million by 2033.

Skincare devices market analysis is expected to be valued at US$ 43.48 Billion by 2032, growing at a12% CAGR.

Traditional Chinese medicine for skincare market is growing steadily due to the rising demand for various Chinese herbal medicines, acupuncture, and diet therapy, around the world.

Nerve monitoring devices market is expected to rise at a 5.0% value CAGR and reach US$ 2.2 Billion by 2032 from US$ 1.3 Billion in 2021.

Surgical drapes and gowns market currently accounts for a valuation of US$ 3.8 billion and is projected to reach US$ 4.7 billion by the end of 2026.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.