Robert Kennedy Jr. Says He Will Advise All US Water Systems To Remove Fluoride On Day 1 Of Trump Administration — Ex-President: 'Sounds OK To Me'

In a recent interview with NBC News, former President Donald Trump has shown tentative support for Robert Kennedy Jr.’s plan to remove fluoride from water.

What Happened: When asked about Kennedy’s proposal, Trump responded, “Well, I haven’t talked to him about it yet, but it sounds OK to me.” Kennedy, a former independent presidential candidate who endorsed Trump, has been known to propagate health-related conspiracies, reported The Hill.

Kennedy stated on Saturday, on X, that if Trump wins the upcoming election, his administration would encourage all U.S. water systems to eliminate fluoride from public water on its first day in office. He associated fluoride, an industrial waste, with various health issues including arthritis, bone fractures, and neurodevelopmental disorders.

However, the Centers for Disease Control and Prevention (CDC) argues that fluoride strengthens teeth and reduces cavities. It has been added to drinking water at low levels and is considered a significant public health achievement in the past century.

While Trump has not confirmed whether Kennedy would be part of his Cabinet if he wins the 2024 election, Kennedy stated that Trump promised him a role in the White House and control of public health agencies.

Why It Matters: The relationship between Trump and Kennedy has evolved over recent months. In August, after securing Kennedy’s endorsement, Trump welcomed him at an Arizona campaign rally, commending Kennedy’s “extraordinary” presidential campaign and emphasizing their shared values.

In September, Kennedy revealed that Trump might appoint him to select leaders for key public health agencies if he wins a second term.

In October, Trump pledged to give Kennedy full authority over health, food, and medicine issues if he secures a second term.

Image Courtesy: Flickr.

Did You Know?

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peanut The Squirrel-Themed Meme Coins Surge Amid Social Media Outrage Over Celebrity Animal's Death: Trump will Save The Squirrels, Says Elon Musk

Memecoins cashing on the popularity of pet squirrel and social media star ‘Peanut’ have become the new money-minting opportunities for cryptocurrency degens.

What happened: A token named PEANUT on the popular decentralized exchange (DEX) Uniswap UNI/USD jumped over 58% in the last 24 hours, with its market capitalization now around $2.2 million, as per CoinMarketCap.

A coin with a similar name was launched on Solana SOL/USD-based DEX Raydium, which was up a whopping 336% in the last 24 hours, though having a far lower market capitalization of $33,790.

It is worth noting that the liquidity of these tokens is very low because they are not traded on major cryptocurrency exchanges and are only available on DEXs as of this writing, making them vulnerable to extreme price swings.

Why It Matters: The death of the adorable creature has become the latest flashpoint ahead of the presidential elections.

New York state officials confiscated and euthanized Peanut, along with a raccoon named Fred, triggering a wave of outrage from social media and influential figures.

Tech mogul and Republican supporter Elon Musk wrote, “President Donald Trump will save the squirrels,” along with a condolence message for the animal.

According to the statement from authorities first reported by CBS News, the officials took the action citing potential human exposure to rabies from the animals.

Additionally, a person involved with the investigation was bitten by the squirrel, prompting the officials to put the animals down to test for rabies.

Peanut’s Instagram account is followed by 666,000 followers, with his videos of donning little hats and munching on waffles bringing delight to many.

Image via Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

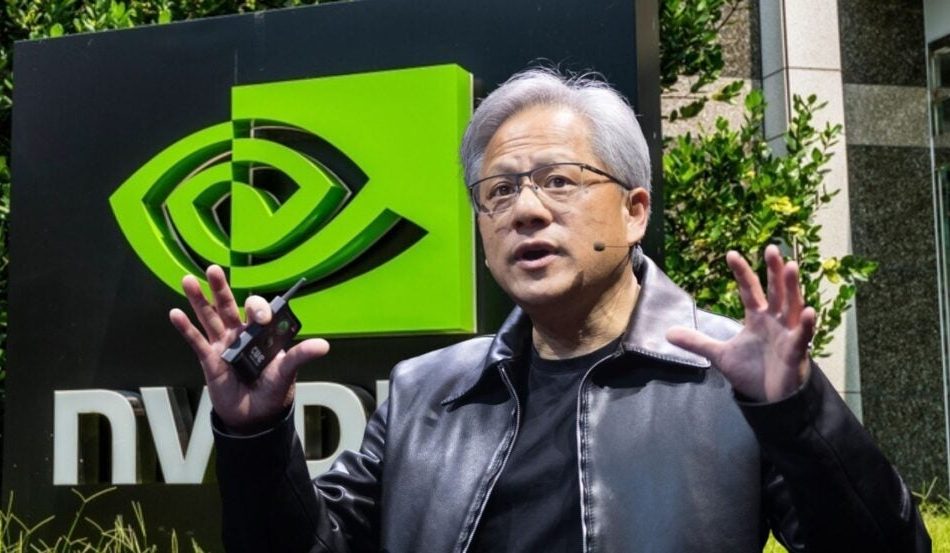

Nvidia's Need For Speed: Jensen Huang Pushes SK Hynix For Earlier Memory Chip Delivery

Nvidia Corp NVDA CEO Jensen Huang has requested SK Hynix Inc. HXSCF to expedite the supply of its next-generation high-bandwidth memory chips by six months.

What Happened: The request was made during a meeting between Huang and SK Group Chairman Chey Tae-won, reported Reuters on Monday. SK Hynix had previously announced its plan to provide the chips to clients in the second half of 2025, a timeline that was already ahead of the initial target.

The demand for high-capacity, energy-efficient chips for Nvidia’s graphic processing units, used in AI technology development, has been on the rise. Nvidia currently holds over 80% of the global AI chip market.

SK Hynix, a leading player in the global race to meet the surging demand for HBM chips, is facing intensified competition from companies like Samsung Electronics SSNLF and Micron Technology MU.

The company is also planning to supply the latest 12-layer HBM3E to an undisclosed customer this year and intends to ship samples of the more advanced 18-layer HBM3E early next year.

Why It Matters: The demand for AI technology has been a significant driver of growth for SK Hynix. The company reported a record-breaking quarterly profit in October, with a 7% revenue surge, largely attributed to the rising demand for AI technology.

Despite Samsung’s soaring profits, its delays in Nvidia’s certification for AI memory chips have allowed competitors like SK Hynix and Micron Technology to take the lead in high-bandwidth memory.

SK Hynix’s commencement of mass production of their latest high-bandwidth memory chips in September positioned the company ahead in the competitive race to meet the growing demand driven by artificial intelligence advancements.

SK Hynix plans to invest $6.8 billion in a new production facility in South Korea, as part of a larger commitment to invest 120 trillion won in the construction of four fabs in the Yongin cluster.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Supplier Foxconn Plans $80M Vietnam Chip Plant

Taiwanese contract manufacturer Hon Hai Precision Industry Co. Ltd. HNHPF, widely known as Foxconn and a major Apple Inc. supplier, is set to expand its presence in Vietnam with an $80 million investment through its subsidiary, Shunsin.

What Happened: According to a document from Vietnam’s environment ministry, Shunsin aims to build a plant in Bac Giang province focused on producing integrated circuits, reported Reuters.

The facility is expected to begin full-scale operations by December 2026, targeting an annual output of 4.5 million units.

Foxconn did not immediately respond to Benzinga‘s request for comment.

The products from this plant will be exported primarily to the United States, the European Union, and Japan. This new investment follows Foxconn’s July approval to invest $383 million in another facility in Vietnam for printed circuit boards.

Since entering Vietnam in the early 2000s, Foxconn has invested over $3.2 billion, with most of its facilities located in northern provinces like Bac Ninh and Bac Giang. Shunsin has not yet commented on the development.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ethereum Could Hit $6K, Predicts Top Analyst — But Here's Why Its Long-Term Future Remains Under A Dark Cloud

Popular cryptocurrency analyst Ali Martinez expressed bullish sentiments on Ethereum ETH/USD, citing an attractive risk-to-reward ratio.

What Happened: In an X post on Monday, Martinez stated his optimism toward the second-largest cryptocurrency, highlighting its potential for a long position. He revealed his strategy, setting his stop-loss below $1,880 and targeting a take-profit price of $6,000.

The risk-reward ratio is a way to evaluate the potential gains of a trade against the potential loss. In a highly volatile cryptocurrency market, this ratio helps traders decide whether a trade is worth pursuing.

As of this writing, the entry price of Ether was $2,460.54, meaning an initial risk of around $600. With Martinez hoping to take a profit at $6,000, the reward would be $3,540. The risk-reward ratio was thus roughly 1:6.

Why It Matters: Martinez’s optimism was not supported by moving average (MA) indicators, with nearly all of them flashing a “Sell” signal for Ethereum, according to TradingView.

Furthermore, momentum indicators like the Awesome Oscillator and the Moving Average Convergence/Divergence also painted a bearish chart for Ethereum.

Cryptocurrency analytics firm 10x Research underlined in a recent video the factors that were putting pressure on Ethereum. The foremost was its declining staking yields, which stood at just over 3.1% as of this writing, as per Staking Rewards.

In contrast, rewards on risk-free U.S. Treasurys were much higher, with the 2-year yield at 4.21% and the benchmark 10-year yield at 4.31%.

Moreover, the rising dominance of Solana SOL/USD, powered by the meme coin frenzy, was taking attention and investments away from Ethereum, which used to be the preferred platform for such projects.

In a nutshell, analysts at 10x Research were skeptical about Ethereum’s long-term prospects unless there’s some “significant innovation.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marriott, Constellation Energy And 3 Stocks To Watch Heading Into Monday

With U.S. stock futures trading mixed this morning on Monday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Constellation Energy Corporation CEG to report quarterly earnings at $2.64 per share on revenue of $5.71 billion before the opening bell, according to data from Benzinga Pro. Constellation Energy shares fell 5.5% to $243.99 in after-hours trading.

- Analysts expect Marriott International, Inc. MAR to post quarterly earnings at $2.31 per share on revenue of $6.27 billion. The company will release earnings before the markets open. Marriott shares gained 0.5% to $261.75 in after-hours trading.

- Chewy Inc. CHWY will replace Stericycle Inc. SRCL in the S&P MidCap 400 before the opening bell on Wednesday, Nov. 6. Waste Management Inc. WM is acquiring Stericycle in a transaction expected to be completed soon. Chewy shares surged 5.1% to $28.51 in the after-hours trading session.

Check out our premarket coverage here

- After the markets close, Wynn Resorts, Limited WYNN is projected to report quarterly earnings at $1.01 per share on revenue of $1.73 billion. Wynn Resorts shares gained 0.2% to $95.87 in the after-hours trading session.

- Analysts expect Celanese Corporation CE to report quarterly earnings at $2.85 per share on revenue of $2.7 billion after the closing bell. Celanese shares gained 1.5% to $126.70 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Supplier TSMC To Double Advanced Chip Packaging Capacity As AI Demand From Microsoft, Amazon Soars

Taiwan Semiconductor Mfg. Co. Ltd. TSM is set to double its production capacity for advanced packaging, a move driven by the increasing demand for artificial intelligence chips from major players like Nvidia Corp. NVDA, Microsoft Corp MSFT, Amazon.com Inc. AMZN, and Alphabet Inc GOOGL GOOG.

What Happened: TSMC’s CoWoS (Chip-on-Wafer-on-Substrate) advanced packaging is experiencing a surge in demand, particularly from AI chip manufacturers and cloud service providers, reported CNA.

TSMC is expected to double its production capacity in 2025, with Nvidia projected to occupy over 50% of the capacity.

Despite TSMC’s efforts to ramp up production, the demand for advanced packaging continues to outstrip supply. The company plans to double its CoWoS production capacity by 2025, according to the report.

Notably, TSMC’s Arizona plant in the U.S. will collaborate with major packaging and testing company Amkor to expand the production of advanced packaging, in response to the increasing demand from AI and AI chip manufacturers.

See Also: Jim Cramer Warns Apple Stock Should Have ‘Never Been Up That Much’ After Q3 Earnings

Why It Matters: The decision by TSMC to double its CoWoS production capacity comes at a time when Nvidia is making significant strides in the AI sector, recently replacing Intel on the Dow Jones Industrial Average.

This shift underscores Nvidia’s growing influence and the increasing demand for AI technology.

Meanwhile, TSMC has faced challenges, such as disruptions caused by Typhoon Kong-rey, impacting its operations in Taiwan.

Additionally, TSMC’s advancements in 3-nanometer technology have been pivotal, as evidenced by Apple’s recent launch of the M4 Pro and M4 Max chips, further emphasizing the importance of TSMC’s role in the semiconductor industry.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

United Imaging Healthcare Announces Q3 2024 Results with Revenue of January to September of 6.95 Billion CNY

SHANGHAI, Nov. 4, 2024 /PRNewswire/ — United Imaging Healthcare (SSE: 688271), a global leader in manufacturing advanced medical imaging and radiotherapy equipment, announced its financial results for the third quarter of 2024. Reflecting its development strategy and strategic R&D investments, the company reported that revenue of January to September is 6.95 billion CNY, with net income attributable to shareholders reaching 0.67 billion CNY.

In 2024, United Imaging Healthcare has significantly increased its R&D efforts to pioneer high-end medical technologies and support the digital transformation of healthcare institutions. To date, over ten innovative United Imaging Healthcare products have received market approval,* including:

- uLinac HalosTx, an integrated CT circular linear accelerator

- uMI Panvivo, a robust new PET/CT platform

- uMI Panorama GS, a next-generation, 148cm whole-body PET/CT system

- uOmnispace, a hospital-grade intelligent post-processing software suite

These innovations, with the uMI Panorama molecular imaging solution as a key highlight, have gained international recognition. uMI Panorama has been installed at premier institutions in the United States. And, at the EANM 2024 the European Association of Nuclear Medicine (EANM) annual congress, United Imaging Healthcare launched its next-generation PET/CT system, the uMI Panvivo, which will be unveiled for U.S. audiences at the Radiologic Society of North America annual meeting in Chicago, as part of an innovation launch featuring multiple new products in several modalities.

Committed to advancing medical innovation through exceptional R&D capabilities and industry leadership, United Imaging Healthcare was recently honored on the Fortune China Tech 50 for 2024. This prestigious recognition underscores United Imaging Healthcare’s role in pioneering healthcare technology and elevating standards in medical imaging and patient care globally.

*not all products noted are clinically or commercially available in the U.S.

About United Imaging Healthcare

At United Imaging Healthcare, we develop and produce advanced medical products, digital healthcare solutions, and intelligent solutions that cover the entire process of imaging diagnosis and treatment. Founded in 2011, our company has subsidiaries and R&D centers across China, the United States, Poland, Dubai, and other parts of the world. With a cutting-edge digital portfolio and a mission of Equal Healthcare for All™, we help drive industry progress and bold change. To learn more, visit https://www.united-imaging.com

![]() View original content:https://www.prnewswire.com/news-releases/united-imaging-healthcare-announces-q3-2024-results-with-revenue-of-january-to-september-of-6-95-billion-cny-302295094.html

View original content:https://www.prnewswire.com/news-releases/united-imaging-healthcare-announces-q3-2024-results-with-revenue-of-january-to-september-of-6-95-billion-cny-302295094.html

SOURCE United Imaging Healthcare Co., Ltd.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.