Trump's Historical Hiccup: A Tale Of MyPillow Guy Mike Lindell, Al Capone, And Confusion

In a recent rally held in Kinston, North Carolina, former President Donald Trump delivered a perplexing speech, featuring a tale about “MyPillow” CEO Mike Lindell and notorious gangster Al Capone.

What Happened: The rally, which began two hours behind schedule, saw Trump in a less irate yet equally unfocused demeanor compared to his previous speeches in Pennsylvania. He seemed disoriented about his whereabouts, incorrectly implying that Pennsylvania Senate candidate David McCormick was in attendance at the North Carolina event, reported Politico.

The most peculiar part of Trump’s speech was a fabricated story about Lindell and the late Al Capone dining together. According to Trump, if Capone didn’t sleep well due to disliking Lindell’s pillows, Lindell would have been in grave danger.

“If he didn’t sleep well because he didn’t like Mike’s pillows, Mike had almost no chance of living,” said Trump. “He would dispose of Mike somewhere in a foundation of a building or something. You would never see Mike again. Mike does not want to have dinner with Scarface.” The report noted that Capone died in 1947, while Lindell was born in 1961.

The crowd in Kinston seemed puzzled by Trump’s comments, showing more enthusiasm when he returned to his prepared speech.

Despite the confusion, Trump encouraged his supporters to vote, stating, “It’s now or never. This moment will never come again.” He also criticized the current administration’s handling of Hurricane Helene and former President Barack Obama, all while his voice appeared to be weakening, possibly due to his rigorous campaign schedule.

Why It Matters: This rally comes amidst a tight pre-election showdown between Trump and Vice President Harris. Recent polls suggest a close race, with some even indicating a slight lead for Trump.

Trump’s lead in the crucial swing state of Pennsylvania, as per a recent Benzinga report, adds to the election’s uncertainty. Meanwhile, Lindell, a staunch Trump supporter, continues to claim that the 2020 election was rigged.

Over the weekend, Lindell shared a “critical” message with his followers on X, urging them to vote for Trump. He urged them to “pray, pray, pray” and get “every single person to get out and vote.”

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Technologies Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Top Analysts

Palantir Technologies Inc. PLTR will release earnings results for its third quarter, after the closing bell on Monday, Nov. 4.

Analysts expect the Denver, Colorado-based company to report quarterly earnings at 9 cents per share, up from 7 cents per share in the year-ago period. Palantir Technologies projects to report revenue of $701.13 million for the quarter, according to data from Benzinga Pro.

The company recently announced a strategic partnership with L3Harris Technologies Inc. LHX to combine Palantir’s Artificial Intelligence Platform with L3Harris’ sensor and software-defined systems. The collaboration aims to support U.S. Army programs and expand capabilities in AI-driven defense technology, enhancing situational awareness and target identification.

Palantir Technologies shares gained 0.9% to close at $41.92 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

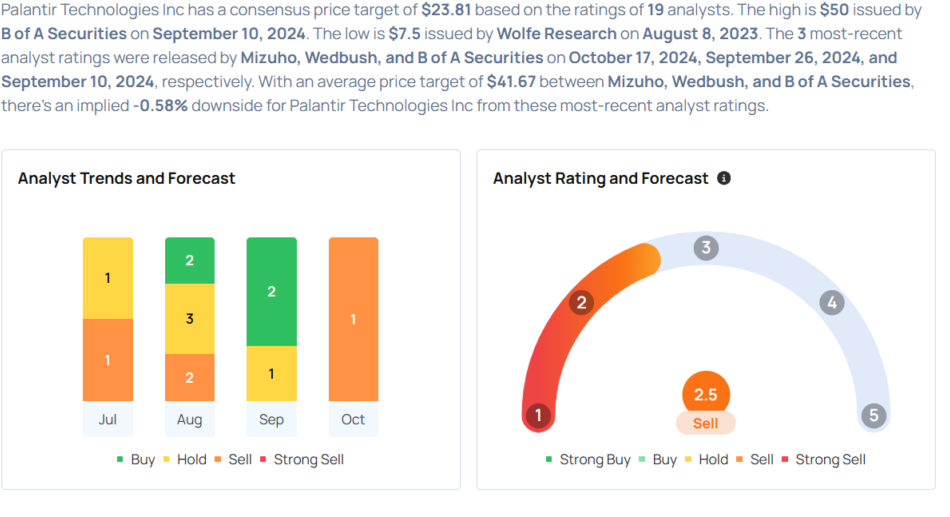

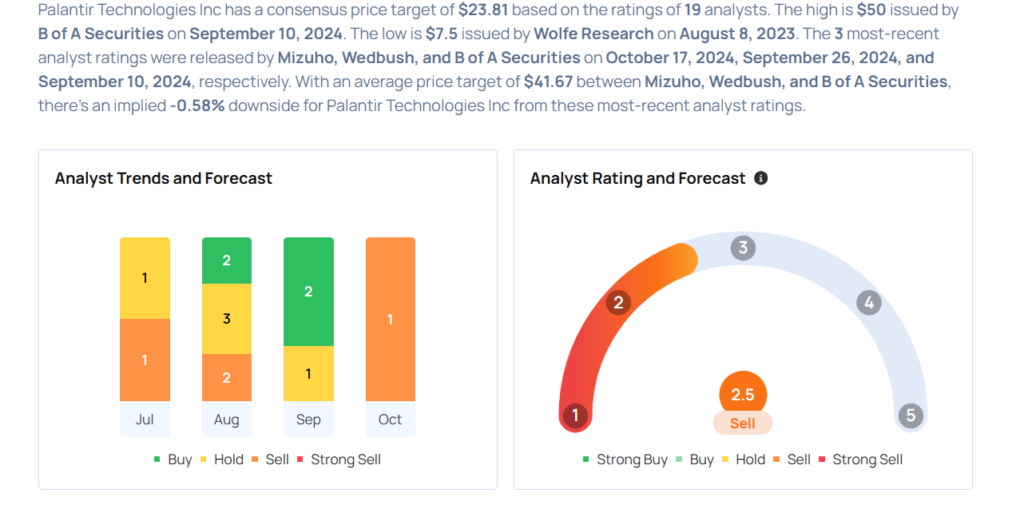

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Mizuho analyst Matthew Broome maintained an Underperform rating and raised the price target from $24 to $30 on Oct. 17.

- Wedbush analyst Daniel Ives maintained an Outperform rating and increased the price target from $38 to $45 on Sept. 26.

- Raymond James analyst Brian Gesuale downgraded the stock from Outperform to Market Perform on Sept. 23.

- B of A Securities analyst Mariana Perez maintained a Buy rating and raised the price target from $30 to $50 on Sept. 10.

- Northland Capital Markets analyst Michael Latimore initiated coverage on the stock with a Market Perform rating and a price target of $35 on Aug. 22.

Considering buying PLTR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nio Shares Are Up Nearly 2% In Pre Market: What's Going On?

Shares of Tesla Inc. rival Nio Inc. NIO surged nearly 2% in premarket trading on Monday amid reports of the Chinese automaker working on a hybrid electric car under the Firefly brand.

As per Benzinga Pro data, Nio shares were trading at $5.17 during premarket hours on Monday after closing at $5.10 on Friday.

The hybrid model will be sold in overseas markets including the Middle East, North Africa, and Europe but not within China, according to a Reuters report. Currently, Nio manufactures only battery electric vehicles.

Nio investor Abu Dhabi investment vehicle CYVN Holdings suggested the hybrid model to boost sales in the Middle Eastern markets where there is not sufficient charging infrastructure for mass adoption of BEVs.

While the vehicle is slated for launch in late 2026, deliveries are expected to commence in 2027.

Nio did not immediately respond to Benzinga’s request for comment.

Deliveries Gather Steam: Nio also registered a growth of 30.5% year-on-year in its deliveries in October, surging to 20,976 vehicles during the month.

This includes 16,657 NIO brand vehicles and 4,319 ONVO brand vehicles.

Deliveries of the first ONVO vehicle – the ONVO L60 – commenced in late September, making October the first whole month of sales for the family-oriented EV brand.

Why It Matters: Nio has yet to launch any vehicles under the Firefly brand. The brand is aimed at the budget segment and its first model is set to be unveiled in December.

The report of Nio considering a hybrid model comes on the heels of the European Union hiking tariffs on EVs made in China and imported to the country. Hybrids are exempted from these increased tariffs.

EV adoption has also been slowing in certain foreign markets.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Verona Pharma Reports Third Quarter 2024 Financial Results and Provides Corporate Update

Ohtuvayre™ (ensifentrine) launch recorded Q3 net sales of $5.6 million and October net sales exceeded Q3

Through October more than 2,200 unique prescribers and more than 5,000 prescriptions filled across a broad COPD population

Pipeline expansion continues: Phase 2 programs enrolling

Conference call today at 9:00 a.m. ET / 2:00 p.m. GMT

LONDON and RALEIGH, N.C., Nov. 04, 2024 (GLOBE NEWSWIRE) — Verona Pharma plc VRNA (“Verona Pharma” or the “Company”), a biopharmaceutical company focused on respiratory diseases, announces its financial results for the third quarter ended September 30, 2024, and provides a corporate update.

“We are pleased to report an exceptionally strong start to the US launch of Ohtuvayre (ensifentrine) with healthcare professionals (HCPs) prescribing treatment across a broad range of chronic obstructive pulmonary disease (“COPD”) patients including background single, dual and nearly 50% on triple therapy,” said David Zaccardelli, Pharm. D., President and Chief Executive Officer. “While it is still very early in the launch, we are extremely encouraged from the initial patient and HCP reports about Ohtuvayre’s potential to improve COPD symptoms regardless of COPD severity. This broad utilization across all patient types is consistent with market research and supports our belief that Ohtuvayre’s bronchodilator and non-steroidal anti-inflammatory activity is a significant advancement for COPD patients and can re-define the treatment paradigm.

“In the third quarter, through the first seven weeks of launch, we recorded $5.6 million of net sales. We are excited by the continued acceleration as net sales for October exceeded the third quarter. More than 5,000 Ohtuvayre prescriptions were filled and more than 2,200 unique HCPs prescribed Ohtuvayre in just 12 weeks.

“Alongside our successful Ohtuvayre launch, in the third quarter we initiated two Phase 2 clinical trials: a dose-ranging trial with glycopyrrolate, a long-acting muscarinic antagonist (“LAMA”), supporting a nebulized fixed-dose combination program with ensifentrine for the maintenance treatment of COPD, and a trial assessing the efficacy and safety of nebulized ensifentrine in patients with non-cystic fibrosis bronchiectasis (“NCFBE”).”

Third Quarter and Recent Highlights

- In August 2024, the Company launched Ohtuvayre for the maintenance treatment of COPD in the US.

- During the third quarter of 2024, the Company began enrollment in two new clinical programs:

- Phase 2 dose-ranging trial with glycopyrrolate, a LAMA, supporting a fixed-dose combination program for the maintenance treatment of COPD via a nebulizer.

- Phase 2 trial to assess the efficacy and safety of nebulized ensifentrine in patients with NCFBE.

- Following the end of the third quarter, the Company received notification from the Centers for Medicare & Medicaid Services that its permanent, product-specific J-code for Ohtuvayre, J7601, has been accepted and will be effective January 1, 2025.

- The Company recently presented additional analyses of data from the Phase 3 ENHANCE trials with ensifentrine for the maintenance treatment of COPD at the European Respiratory Society International Congress 2024 and at CHEST Annual Meeting 2024 (“CHEST”). Approximately 1,500 HCPs visited Verona Pharma’s medical and commercial booths for Ohtuvayre at CHEST.

- In September 2024, the Company’s development partner in Greater China, Nuance Pharma, completed enrollment in its pivotal Phase 3 clinical trial evaluating ensifentrine for the maintenance treatment of COPD in China. Results from the trial are expected in 2025.

Third Quarter 2024 Financial Results

- Cash position: Cash and cash equivalents at September 30, 2024 were $336.0 million (December 31, 2023: $271.8 million). The Company believes cash and cash equivalents at September 30, 2024, along with product sales and funding expected to become available under the $650 million strategic financings completed in May 2024, will enable Verona Pharma to fund planned operating expenses and capital expenditure requirements through at least the end of 2026.

- Product sales: Net sales were $5.6 million for the third quarter ended September 30, 2024 (Q3 2023: $0 million) related to product sales of Ohtuvayre. The Company received FDA approval on June 26, 2024 and the product was commercially available beginning in August 2024.

- Cost of sales: Cost of sales was $0.5 million for the third quarter ended September 30, 2024 (Q3 2023: $0 million), which included Ohtuvayre manufacturing costs incurred after US approval, inventory overhead costs and sales-based royalties due to Ligand.

- R&D Expenses: Research and development (“R&D”) expenses were $10.6 million for the third quarter ended September 30, 2024 (Q3 2023: $3.0 million). This increase of $7.6 million was primarily due to an $7.8 million increase in clinical trial and other development costs as we initiated two Phase 2 trials in the quarter.

- SG&A Expenses: Selling general and administrative expenses (“SG&A”) were $35.2 million for the third quarter ended September 30, 2024 (Q3 2023: $13.4 million). This increase of $21.8 million was driven primarily by a $9.7 million increase in people-related costs and $2.8 million in share-based compensation primarily related to our field sales team, which was hired in the lead up to the launch of Ohtuvayre. Additionally, marketing and other commercial related activities, including travel, increased by $7.5 million due to the launch. We also had an increase of $1.6 million related to professional and consulting fees, information technology costs and other support costs due to the continued build-out of our commercial organization.

- Net loss: Net loss was $43.0 million for the third quarter ended September 30, 2024 (Q3 2023: $14.7 million).

Conference Call and Webcast Information

Verona Pharma will host an investment community webcast and conference call at 9:00 a.m. ET / 2:00 p.m. GMT on Monday, November 4, 2024, to discuss the third quarter 2024 financial results and provide a corporate update.

To participate, please dial one of the following numbers and ask to join the Verona Pharma call:

- +1-833-816-1396 for callers in the United States

- +1-412-317-0489 for international callers

A live webcast will be available on the Events and Presentations link on the Investors page of the Company’s website, www.veronapharma.com, and the audio replay will be available for 90 days. An electronic copy of the third quarter 2024 results press release will also be made available today on the Company’s website.

For further information please contact:

About Verona Pharma

Verona Pharma is a biopharmaceutical company focused on developing and commercializing innovative therapies for the treatment of chronic respiratory diseases with significant unmet medical needs. Ohtuvayre™ (ensifentrine) is the Company’s first commercial product and the first inhaled therapy for the maintenance treatment of COPD that combines bronchodilator and non-steroidal anti-inflammatory activities in one molecule. Ensifentrine has potential applications in non-cystic fibrosis bronchiectasis, cystic fibrosis, asthma and other respiratory diseases. For more information, please visit www.veronapharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this press release other than statements of historical fact should be considered forward-looking statements. Words such as “anticipate,” “believe,” “plan,” “expect,” “intend,” “may,” “potential,” “prepare,” “possible” and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the potential benefits and efficacy of our drug Ohtuvayre to treat adult patients in the US with COPD, as well as the continued growth of sales and adoption by HCPs of Ohtuvayre, and statements regarding our two recently initiated Phase 2 clinical trials.

These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from our expectations expressed or implied by the forward-looking statements, including, but not limited to, the efficacy of Ohtuvayre compared to competing drugs and the other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the period ended September 30, 2024 filed with the Securities and Exchange Commission (“SEC”) on November 4, 2024, as such factors may be updated from time to time in our other filings with the SEC. We disclaim any obligation to update or revise any forward-looking statement contained in this press release, even if subsequent events cause our views to change, except as required under applicable law.

Verona Pharma plc

Consolidated Financial Summary

(unaudited)

(in thousands, except share and per share amounts)

| Three months ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| Revenue | $ | 5,624 | $ | – | ||||

| Operating expenses | ||||||||

| Cost of sales | 543 | – | ||||||

| Research and development | 10,552 | 2,958 | ||||||

| Selling, general and administrative | 35,196 | 13,353 | ||||||

| Total operating expenses | 46,291 | 16,311 | ||||||

| Operating loss | (40,667 | ) | (16,311 | ) | ||||

| Other income/(expense) | ||||||||

| Research and development tax credit | 1,612 | (309 | ) | |||||

| Interest income | 4,750 | 3,390 | ||||||

| Interest expense | (9,882 | ) | (401 | ) | ||||

| Foreign exchange gain/(loss) | 1,475 | (1,012 | ) | |||||

| Total other (expense)/income, net | (2,045 | ) | 1,668 | |||||

| Loss before income taxes | (42,712 | ) | (14,643 | ) | ||||

| Income tax expense | (250 | ) | (44 | ) | ||||

| Net loss | $ | (42,962 | ) | $ | (14,687 | ) | ||

| Weighted-average shares outstanding – basic and diluted | 651,944 | 638,239 | ||||||

| Loss per ordinary share – basic and diluted | $ | (0.07 | ) | $ | (0.02 | ) | ||

| Sep-30 | Jun-30 | |||||||

| 2024 | 2024 | |||||||

| Cash and cash equivalents | $ | 336,040 | $ | 404,599 | ||||

| Total assets | $ | 381,818 | $ | 434,123 | ||||

| Shareholders’ equity | $ | 130,491 | $ | 168,274 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Woman Loses Thousands In Bitcoin After Fake Sheriffs Dupe Her Into Clearing Fraud Arrest Warrant

In another case of a shocking cryptocurrency scam, a Colorado resident was tricked into sending $6,000 worth of Bitcoin BTC/USD to bogus law enforcement officials.

What Happened: As per documents first accessed by Decrypt, the scammers threatened the victim with arrest for supposedly missing jury duty. The victim, under the impression that she had missed a jury summons, followed the scammer’s instructions to settle a fake warrant via a Bitcoin ATM.

An additional transfer of $4,000 was in progress, but deputies managed to prevent it from being completed.

The Summit County Sheriff’s Office confirmed the incident and warned that similar cases of scammers masquerading as law enforcers were on the rise across the state.

“A deputy will never call anyone to notify them of a warrant for their arrest and then offer to clear it in exchange for gift cards, wire transfers or Bitcoin,” the statement from the office read.

See Also: Peanut The Squirrel-Themed Meme Coins Surge Amid Social Media Outrage Over Celebrity Animal’s Death

Why It Matters: The rising cases of impersonations intended to swindle cryptocurrency holders have become a cause for concern for the entire country.

Earlier in August, the Federal Bureau of Investigation (FBI) sounded the alarm on incidents of scammers impersonating cryptocurrency exchange employees to defraud people.

Price Action: At the time of writing, Bitcoin was exchanging hands at $68,784.68, up 0.56% in the last 24 hours, according to data from Benzinga Pro.

What’s Next: Investors and enthusiasts alike can stay informed on these issues at events like Benzinga’s upcoming Future of Digital Assets conference on Nov. 19, where industry experts and law enforcement officials are expected to discuss the latest trends in cryptocurrency security and fraud prevention.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Settle Higher Following Jobs Data, Amazon Surges Post Results: Fear Index In 'Neutral' Zone

The CNN Money Fear and Greed index showed an improvement in the overall market sentiment, while the index remained in the “Neutral” zone on Friday.

U.S. stocks settled higher on Friday, as investors digested the recent jobs data.

The U.S. economy added 12,000 jobs in October compared to a revised 223,000 gain in September and versus market estimates of 113,000. Average hourly earnings increased by 0.4% over a month to $35.46 in October, while the unemployment rate remained at 4.1% in October.

Shares of Amazon.com Inc. AMZN surged over 6% on Friday after the company posted stronger-than-expected results for the third quarter. Apple Inc. AAPL shares slipped over 1% following fourth-quarter results.

Most sectors on the S&P 500 closed on a negative note, with utilities, energy, and real estate stocks recording the biggest losses on Friday. However, consumer discretionary and information technology stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed higher by around 289 points to 42,052.19 on Friday. The S&P 500 rose 0.41% to 5,728.80, while the Nasdaq Composite rose 0.80% at 18,239.92 during Friday’s session.

U.S. stocks recorded losses in October, with the Dow falling 1.3% and the broad market index declining 1% during the month.

Investors are awaiting earnings results from Constellation Energy Corporation CEG, Marriott International, Inc. MAR, and Wynn Resorts, Limited WYNN today.

What is CNN Business Fear & Greed Index?

At a current reading of 48.8, the index remained in the “Neutral” zone on Friday, versus a prior reading of 46.5.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investment Firm Raises Price Target For Warren Buffett's Berkshire Hathaway To $750,000 Despite Q3 Earnings Miss

Investment banking firm Keefe Bruyette has raised its price target for Berkshire Hathaway BRK BRK to $750,000, even though the company fell short of third-quarter earnings expectations. The firm continues to hold a Market Perform rating on the stock.

What Happened: Berkshire Hathaway’s third quarter operating earnings per share came in at $7,023, missing the Street’s forecast of $7,335. The shortfall was primarily due to weaker-than-expected results in property and casualty underwriting, as well as in the Manufacturing, Service, and Retailing sectors. Additionally, the company faced higher “other” losses than anticipated.

Despite these setbacks, the Warren Buffett-led company saw stronger-than-expected income from its Railroads, Utilities, and Energy sectors, along with robust insurance investment income. Keefe Bruyette noted that the earnings miss and the lack of share repurchases might put pressure on Berkshire’s shares as the week progresses.

Why It Matters: Berkshire Hathaway highlighted that the decline in third-quarter operating earnings was driven by weaknesses in its insurance underwriting segment. The Omaha-based conglomerate’s quarterly operating earnings of $10.09 billion marked a decline of over 6% compared to the previous year.

Furthermore, as of the end of September, approximately 70% of Berkshire’s aggregate fair value was concentrated in five companies, underscoring its investment strategy.

Read Next:

Image via Flickr

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dollar Slips as Polls Show US Race on Knife’s Edge: Markets Wrap

(Bloomberg) — The dollar fell as investors walked back bets on Donald Trump winning the US presidential election after weekend polls indicated Kamala Harris was gaining ground. Oil rose after OPEC+ delayed an output hike.

Most Read from Bloomberg

An index of the greenback dropped the most in more than a month, while the Mexican peso — which tumbled in the aftermath of Trump’s 2016 victory — was the top performer among 16 major currencies tracked by Bloomberg. Treasury futures rose while European stocks were little changed.

The moves came after a poll by the Des Moines Register showed Harris with a lead in Iowa — a state Trump has won in each of his prior election contests. One element of the so-called Trump trade favors higher Treasury yields and a stronger dollar. Still, other surveys show the two candidates poised for a photo finish, with voters narrowly split both nationally and across the pivotal swing states.

The dollar gauge and 10-year Treasury yields both had reached their highest since July in recent weeks, after investors ramped up wagers on a second term for Trump. There’s concern that his support for looser fiscal policy and steep tariffs will deepen the federal deficit and fuel inflation, undermining Treasuries.

“It’s impossible to call at this point,” Bill Maldonado, chief executive officer at Eastspring Investments, told Bloomberg TV. “We’ve heard Trump talking about tariffs and other measures, but do we really know what’s going to get implemented in what manner? It’s almost impossible to position for it.”

US futures edged higher after Wall Street’s gains Friday following robust earnings from the likes of Amazon.com and Intel Corp. Asian shares rose, with Japanese markets being closed for a holiday.

In addition to the US election, trading across financial markets this week also will be shaped by central bank decisions for the US, UK and Australia, among others.

The Federal Reserve is expected to cut rates by 25 basis points Thursday, after the latest jobs data showed US hiring advanced at the slowest pace since 2020 while the unemployment rate remained low. Even so, the numbers were distorted by severe hurricanes and a major strike.

Economists also expect the Bank of England to lower its benchmark rate by a quarter point to 4.75%.