Mar-a-Lago's Original Owner Lived In A Lavish 36-Room Estate In D.C. — Here's What It's Like Inside

Before Mar-a-Lago became Donald Trump’s Florida retreat, it was a winter escape for Marjorie Merriweather Post, the powerhouse heiress behind the General Foods empire. In the spring and fall, however, her home base was Hillwood Estate, a sprawling 26,000-square-foot mansion in Washington, D.C. that served as more than a personal retreat — it was a meticulously curated museum of 18th-century French and Russian art.

Don’t Miss:

Post bought Hillwood in 1955 and gave it a full makeover, transforming it into a 36-room showplace of her collections. Business Insider recently visited the home. The estate’s interiors reflected her distinct eye for beauty and history, with rooms like the French Drawing Room, where gilded panels from Louis XVI’s time and original fireplaces were on display. The Icon Room housed treasures of Russian Orthodox art, including Fabergé eggs once gifted by Russian Tsars to family members. An avid collector, Post installed custom display cases throughout the house, filling them with porcelain, paintings and exquisite artifacts — rarely found outside museums.

But Hillwood wasn’t just an indoor paradise. Its grounds spanned 25 acres of manicured lawns and themed gardens. Among these were the Japanese Garden, designed by Shogo Myaida in the 1950s, and a formal French parterre with English ivy walls, lending the garden an outdoor “room” feel. Post’s dedication to elegance extended even to the Lunar Lawn, where she hosted parties with a view of the Washington Monument peeking through the trees.

Trending: ‘Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.38% average annual returns for investors – here’s how to join with just $100

Visitors could also see Hillwood’s unique kitchen, which, though lavish for its time, required all dishes to be hand-washed because Post’s fine china and porcelain couldn’t go in a dishwasher. The butler’s pantry was fully stocked with General Foods products. They indicated her ties to the food empire she helped build.

Post was known for her hospitality, often inviting school groups and art lovers to view her private collection. She envisioned Hillwood as a public museum, which it became after her death. Every detail — down to the lilac sofas in the Pavilion with trays for snacks during movie screenings — shows her legacy of sharing beauty and art with others.

Today, Hillwood remains a grand time capsule and one of D.C.’s hidden gems. The public can now experience the opulent life of one of America’s most remarkable businesswomen.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Haley Tells Pennsylvania Voters To Put Emotion Aside And Rally Behind Trump

Former GOP presidential candidate Nikki Haley urged Pennsylvania voters to strip the emotion from their voting decisions.

While in Pennsylvania to support Republican Senate candidate Dave McCormick, Haley emphasized that voters must avoid emotional decisions, stating that it’s crucial to achieve more than just electing McCormick, reported The Hill.

Haley and former President Donald Trump faced off in this year’s GOP presidential primary, frequently targeting each other in their bid for the nomination. Despite their clashes, she later expressed her intention to vote for him.

By backing Trump, she reinforces her belief in his ability to shape a future that aligns with her vision for America, particularly in contrast to the current administration.

On Wednesday, she stated that it’s essential to elect Trump, explaining that if Trump wins Pennsylvania, then McCormick will also win there.

Haley emphasized the importance of removing emotion from the election, urging voters to focus on policy and its implications for their children and future generations.

In May, Haley stated that as a voter, she prioritizes a president who supports allies, holds enemies accountable, secures the border without excuses, and champions capitalism and freedom while reducing debt.

Haley acknowledged that Trump hasn’t been perfect on these issues but emphasized that President Biden has been a disaster, leading her to decide to vote for Trump.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Says This Crypto Could Explode By Up To 3.765%, And It Is Not Bitcoin Or Solana

Michaël van de Poppe, a well-known cryptocurrency analyst, has forecasted a massive upswing in the value of Sei, a competitor to Solana, with a potential increase of up to 3,765%.

What Happened: Van de Poppe conveyed his bullish perspective on Sei SEI/USD in an YouTube post. He expressed confidence in the substantial growth potential of the native token of the layer-one blockchain.

Van de Poppe’s estimates indicate that Sei’s value could rise anywhere from 1,188% to 3,765% from its present level.

He said, “If we have an estimate of anything between $50 to $100 billion [in Sei’s fully diluted valuation]… it seems likely that anything between $5 to $15 is going to be the peak for Sei… which at current valuations is between 10x to 40x as a potential sort of number that we’re going to get to.”

Also Read: Michaël Van De Poppe Predicts Massive Bitcoin Surge, Says Price May Soar By 890%

However, for this growth to occur, Sei must first surpass a significant resistance zone by climbing nearly 30% from its current position. Van de Poppe further noted, “Now if we look at the technical analysis, then it’s just consolidating in a very narrow range. And what we want to see is that it breaks back above $0.50 because then it’s going to take all the liquidity above the recent highs. And if it does that, it’s going to exceed its run just like Sui did and have a new all-time high.”

At the time this article was written, Sei was trading at $0.388.

Why It Matters: This prediction by Van de Poppe underscores the growing interest and potential in layer-one blockchains like Sei. As these platforms continue to evolve and gain traction, they present significant investment opportunities.

However, investors should be aware of the volatility inherent in the crypto market and make informed decisions.

The predicted surge in Sei’s value, if realized, could mark a significant milestone for the cryptocurrency, further solidifying its position in the competitive crypto landscape.

Read Next

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘I know it’s awkward to give advice to wealthy people’: My wife, 50, has terminal cancer. Our estate is worth $18 million. How do we prepare?

Thank you for all your money advice. I’m not going to ask you if I can afford to retire or when. I know that we’re blessed financially and I know it’s awkward to give advice to wealthy people. What level of estate planning does one need at different levels of wealth, from say a $1 million to a $10 million to a $100 million estate?

I’m 51 and my wife is 50. We have two children,19 and 21, with one starting law school and the younger planning on medical school. Our estate is worth $18 million. Our assets include a primary residence of $2.5 million, $5.4 million in almost all non-Roth IRA/401(k), $4.5 million in brokerage and savings accounts, and $6 million in income-generating real estate.

The rest of the estate is split between automobiles, furniture and jewelry, etc. I am not counting on any value of the business, and I am unsure if we will ever be able to sell it. I also am not counting on our expected inheritance of $2 million to $3 million sometime over the next decade, but if this materializes it will have to be considered for estate-tax purposes.

Unfortunately, my wife was diagnosed with terminal cancer seven years ago and, upon her passing, this will complicate my tax situation. I expect to live to around 85-90 by health and family history. Our careers peaked two years ago at about $1.2 million, and have since cut back due to exhaustion with a current household income of about $750,000 a year. We have no debt.

We’re hoping to pay all higher-education costs for the children over the next seven years. We wish to continue tithing 10%, and give gifts to the children every year up to the annual limits. Other than that, I’m a simple guy, and don’t care for the complexity of spending on clutter and the hassles of maintenance or excessive travel, but enjoy travel in moderation with family.

Sanders Slams Trump's Tax Plan, John Paulson Plans To Join Elon Musk's DOGE, GOP Megadonor Predicts Trump's Victory And More: This Week In Politics

The past week was a whirlwind of political news, with the 2024 presidential election taking center stage. From Senator Bernie Sanders criticizing Donald Trump‘s tax plan to a leading economist making his election prediction, the political landscape was buzzing with activity. Here’s a quick recap of the top stories.

Sanders Criticizes Trump’s Tax Plan

Senator Bernie Sanders has voiced strong opposition to Donald Trump‘s proposal to eliminate all income taxes. Sanders described the plan as ‘insane economics’ that would disproportionately benefit the wealthy while harming the poorest members of society. He also suggested that the plan’s popularity among billionaires was due to their potential financial gain.

Market Expert Makes 2024 Election Prediction

With just a week left in the head-to-head matchup between Donald Trump and Vice President Kamala Harris, leading market economist Christophe Barraud made his prediction on who will win the 2024 presidential election. Barraud has earned the title of “the world’s most accurate economist” over the years thanks to his accurate predictions on the U.S. economy.

See Also: Why Trump’s Polymarket, Kalshi Election Odds Might Be Wrong

Kamala Harris Receives Endorsement From Puerto Rico’s Largest Newspaper

El Nuevo Día, Puerto Rico’s largest newspaper, endorsed Kamala Harris for the presidency. This endorsement comes amidst a recent controversy involving derogatory remarks about Puerto Rico made at a Donald Trump rally.

Trump’s Billionaire Ally Plans To Join Elon Musk’s DOGE

John Paulson, a billionaire investor and a close ally of former President Donald Trump, has revealed his plans to work with Elon Musk on substantial federal spending cuts if he were to be appointed Treasury secretary in a second Trump administration.

GOP Megadonor Predicts Trump’s Victory

Citadel LLC CEO Ken Griffin, a significant Republican donor, predicted that Donald Trump would reclaim the U.S. presidency during the Future Investment Initiative summit in Saudi Arabia.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Someone Has To Bring Order' – MBA Calls For A National Housing Director, Regardless Of Who Wins The Presidency

The Mortgage Bankers Association called on Monday for the creation of a National Housing Director position, citing the need to streamline housing policy amid growing regulatory hurdles and political uncertainty.

Speaking at the MBA’s Annual Convention in Denver, CEO Bob Broeksmit pushed for centralized oversight of the nation’s housing policies. “Someone has to bring order to this mess,” Broeksmit said. “Under our proposal, a Housing Director would focus solely on housing and oversee every housing policy, no matter which agency it comes from and spot contradictory rules from a mile away.”

Don’t Miss:

According to HousingWire, the proposal comes as the mortgage industry braces for potential “gridlock” following the upcoming presidential election. Broeksmit predicted a divided government, with at least one chamber of Congress likely controlled by the opposition party.

The political landscape could shift more power to regulatory agencies like the Federal Housing Finance Agency and Consumer Financial Protection Bureau as legislative solutions become harder to achieve. “While the stream of regulation will continue, the kind of regulation depends on who wins,” Broeksmit said.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

According to the HousingWire report, the MBA has recently notched several policy victories, including stopping the FHFA’s proposed Suspended Counterparty Program and helping reshape the Basel III Endgame Rules, which Broeksmit called “a disaster in the making” for low-to-moderate income lending.

Despite the sharp differences between the presidential candidates, Broeksmit sees housing remaining a priority. “For all their differences, both Donald Trump and Kamala Harris will focus on housing,” he said. “Both of them have said we need to get prices under control. They’re also clearly aware that we need more affordable units for purchase and rent.”

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for just $1,000

Harris proposals: According to previous Benzinga reporting, Harris plans to expand access to affordable housing through a $25,000 down payment assistance program for first-time buyers and tax incentives to encourage housing development. Her campaign promises to add 3 million housing units by accelerating federal funds for cities that streamline zoning and construction.

Trump proposals: Trump’s proposals focus on creating tax incentives for homebuyers and reducing housing costs by cutting regulations. He also advocates using federal land for residential construction and claims that controlling inflation will help make homeownership more affordable.

See Also: Mark Cuban believes “the next wave of revenue generation is around real estate and entertainment” — this new real estate fund allows you to get started with just $100.

The MBA expects mortgage rates to remain between 6% and 6.5% through year-end before settling in the high 5% range by late 2025.

The organization also plans to advocate for extending key provisions of the 2017 Tax Cuts and Jobs Act, which expire in 2025.

“If we truly want to help more Americans find affordable housing, the last thing we should do is raise their taxes,” Broeksmit said.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Election Anxiety Grips Emerging Markets as Investors Slash Risk

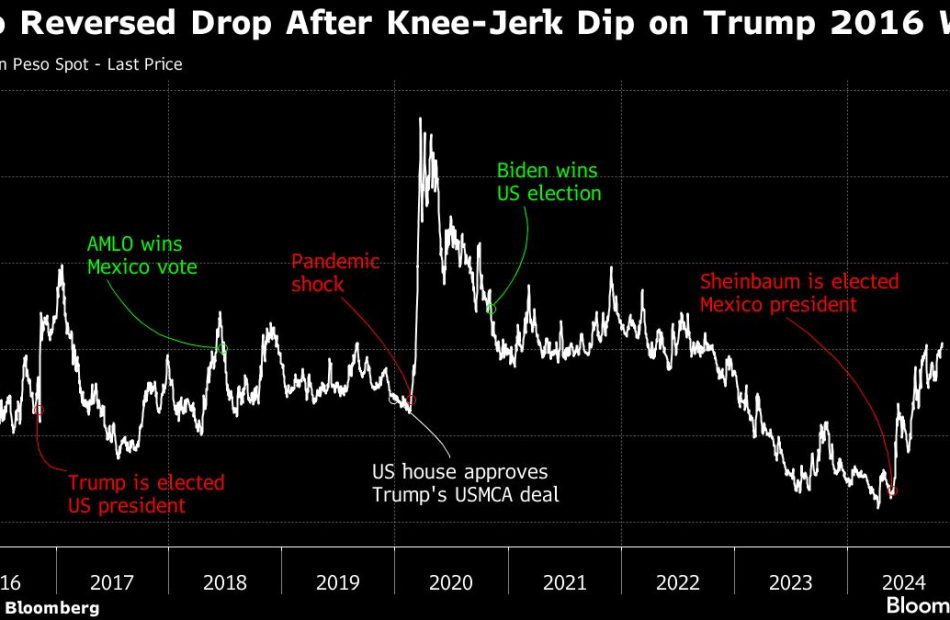

(Bloomberg) — From Mexico City to Shanghai, traders whipsawed by a volatile year are preparing for a fresh political jolt: A US presidential election that’s threatening to upend global trade and potentially roil the economic outlook across the developing world.

Most Read from Bloomberg

As the race remains neck-and-neck in the runup to Tuesday’s vote, investors have been positioning for the fallout of a victory by Donald Trump, whose tariff and tax plans would likely curb imports and put upward pressure on US interest rates.

As a result, hedge funds have been stepping up bets against the Mexican peso, sending it sliding to the lowest this year. The Chinese yuan has slipped, too, as the dollar staged its biggest advance in over two years. Investors have yanked money out of funds focused on developing countries’ bonds and around the world, emerging-market stocks just had their worst monthly loss since January.

The price movements show the high stakes across emerging markets, which is leaving them primed for another round of selling or a rapid rebound if Vice President Kamala Harris is handed a victory at the polls.

In “an election that is a complete toss up, it is very difficult to take active currency bets,” said Arif Joshi, co-head of emerging-market debt at Lazard Asset Management, who said markets are pricing in some of the risks of voters returning Trump to the White House. That suggests a Harris win would be “a structural bullish move for emerging markets.”

In the US, Trump would likely alter the status quo far more significantly than Harris, a former US Senator who has served as President Joe Biden’s vice president for the past four years. In emerging markets, the main risk stems from Trump’s plan to enact tariffs, which would weaken their exports and demand for their currencies.

Trump has also cast doubt on the US’s commitment to alliances like the North Atlantic Treaty Organization and to Ukraine’s efforts to defeat Russia’s invasion. That has weighed on local bonds of some eastern European countries and pushed up Ukraine’s dollar debt on wagers that Trump’s election may push it to cut a ceasefire deal with Russia.

“I wouldn’t be surprised to see a knee-jerk negative reaction if Trump is elected, with everybody kind of freaking out, and then starting to see if the approach is more pragmatic,” said Robert Koenigsberger, founder and chief investment officer of Gramercy Funds Management.

The Smile Code Podcast Explores "Choosing the Common Good: The Power of Selflessness"

Seattle, WA November 03, 2024 –(PR.com)– A Message of Unity for Challenging Times

“In today’s world, it’s easy to feel that we’re all on different sides,” says Dr. Esi Quaidoo, host of The Smile Code. “But this episode is a reminder that when we choose compassion over division, we create lasting change and inspire others to do the same. By celebrating these real-life stories of selflessness, we’re encouraging listeners to see beyond their differences and focus on what brings us together.”

Key Themes in the Episode

The episode centers around several themes designed to resonate with listeners and promote personal reflection:

Unity and Shared Humanity – The episode highlights powerful examples of individuals reaching across divides to support and uplift others, emphasizing the importance of shared humanity.

Compassion as a Choice – Listeners are invited to consider how acts of kindness and empathy can have a ripple effect, inspiring others to act with compassion.

Voting for the Common Good – With an election on the horizon, the episode encourages audiences to think about the greater impact of their vote, advocating for choices that serve all people, especially the most vulnerable.

How to Listen

The episode, “Choosing the Common Good: The Power of Selflessness,” is available now on all major podcast platforms, including Apple Podcasts, Spotify, YouTube and Google Podcasts. To tune in, search for The Smile Code Podcast or visit TheSmileCodePodcast.com.

Engage with Us

Listeners are encouraged to join the conversation on social media using hashtags like #ChoosingTheCommonGood, #PowerOfSelflessness, and #SharedHumanity. For more information, episode highlights, or to contact Dr. Quaidoo for interviews, please visit DrQ@SmileMattersinc.com or DM or follow @SmilemattersInc.com on Instagram.

About The Smile Code Podcast

The Smile Code is a podcast dedicated to exploring the pursuit of happiness through the power of empathy, kindness, authenticity, and a healthy attractive Smile. Each episode features inspiring stories, actionable insights, and thought-provoking discussions to help listeners build meaningful connections and find fulfillment. Hosted by Dr. Esi Quaidoo, The Smile Code invites everyone to discover the impact of a healthy attractive smile – both on themselves and the world around them

Contact Information:

Smile Matters, Inc. -The Smile Code Podcast

Dr. Esi Quaidoo

206-466-1796

Contact via Email

https://TheSmileCodePodcast.com

Read the full story here: https://www.pr.com/press-release/924500

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.