Musk Loses Bid to Dismiss Ex-Twitter CEO’s Severance Claim

(Bloomberg) — Elon Musk was dealt a significant setback in a court fight over compensation sought by the top Twitter Inc. executives he fired when he took over the company in 2022.

Most Read from Bloomberg

A judge ruled late Friday that former chief executive officer Parag Agrawal and other high-ranking officers can proceed with claims that Musk terminated them right as he was closing the deal to cheat them out of severance pay before they could submit resignation letters.

In the complaint the ex-executives filed in March, they cited a passage in Walter Isaacson’s biography of Musk in which the billionaire is quoted telling the author as he rushed to complete the acquisition there was a “200-million differential in the cookie jar between closing tonight and doing it tomorrow morning.”

Musk has been fighting legal claims for back pay by thousands of Twitter staff he laid off when he acquired the social media company for $44 billion two years ago and rebranded it as X Corp.

At least one former employee was awarded unpaid severance in September in a closed-door arbitration that could set a precedent for other similar cases, the worker’s lawyer told Bloomberg News.

In July, Musk and X Corp. defeated a lawsuit alleging that at least $500 million in severance pay was owed to about 6,000 laid-off employees under provisions of the federal Employee Retirement Income Security Act.

US District Judge Maxine Chesney on Friday rejected arguments by Musk’s lawyers that Agrawal’s claims should be dismissed. Agrawal was joined in the lawsuit by Vijaya Gadde, who was Twitter’s top legal and policy official; Ned Segal, the chief financial officer; and Sean Edgett, the company’s general counsel.

They allege they’re owed severance benefits equal to one year’s salary plus unvested stock awards valued at the acquisition price.

Chesney is overseeing two other suits brought by Twitter executives, including one by Nicholas Caldwell, who was general manager for “core tech” and is seeking $20 million as compensation for lost severance. The judge on Friday denied Musk’s request to dismiss a claim by Caldwell that mirrors Agrawal’s allegations.

Representatives of X didn’t respond outside regular business hours to a request for comment.

The case is Agrawal v. Musk, 24-cv-01304, US District Court, Northern District of California (San Francisco).

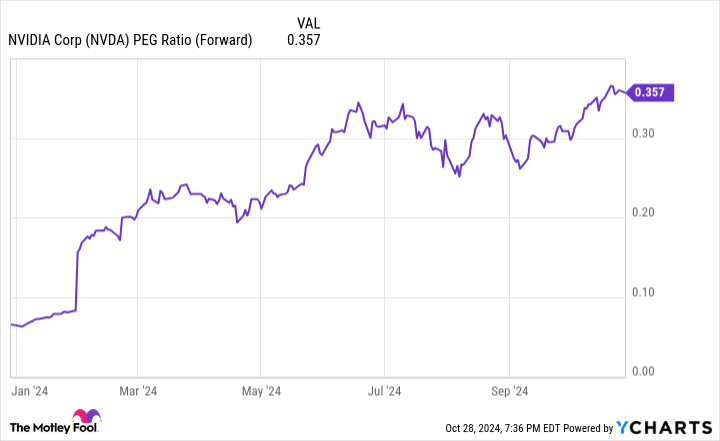

Think Nvidia Stock Is Expensive? This Chart Might Change Your Mind

Nvidia (NASDAQ: NVDA) has been this year’s most influential stock, and it has posted huge gains in the process. The artificial intelligence (AI) leader’s sales and earnings have continued to expand at an impressive pace, and the company’s share price is up roughly 180% so far this year.

That is just the latest leg of an incredible run that has seen the company’s share price soar almost 860% since the beginning of 2023, and more than 2,650% over the last five years. Thanks to these explosive gains, the company’s price-to-earnings multiple has ballooned to 66 as of this writing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Such a valuation comes with heavy expectations for growth, and it’s not unreasonable to have concerns the chip company’s stock price has climbed too far, too quickly. But there’s another valuation metric that suggests the red-hot AI stock still has upside potential.

The stock’s gains don’t look excessive in light of Nvidia’s recent business results. For example, revenue rose 205% year over year through the first half of fiscal 2025 (the six months ended July 28, 2024) — and earnings per share were up 285% over the same period.

With expectations for its impressive growth to continue, Nvidia is trading at a forward price/earnings-to-growth (PEG) ratio of roughly 0.36. A PEG ratio of less than 1.0 is often viewed as a signal the stock is undervalued because its anticipated earnings growth is high relative to its earnings-based valuation.

While there’s no doubt Nvidia’s sales and earnings growth will have to decelerate eventually, the company’s leadership position, momentum, and PEG ratio suggest the stock still has room to run. With the launch of its next-generation Blackwell processors set for later this year, the company could have another major sales and earnings catalyst on the near horizon.

Spending on GPUs to power AI applications will undoubtedly go through some cyclical shifts, but the rise of artificial intelligence is still in its early innings — and Nvidia remains essential to that rise.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

AGNC Sports a Gigantic 15% Yield. Are Investors Paying Too Much for It?

AGNC Investment (NASDAQ: AGNC) is a very complex business, but its 15% dividend yield is like a siren’s song to dividend investors traveling along Wall Street. There are a lot of good reasons why income-focused investors should avoid AGNC, and the mortgage real estate investment trust (REIT) added a new one when it reported third-quarter earnings. Here’s what you need to know before buying AGNC.

A property-owning REIT buys a building, like an apartment or warehouse, and leases it out to generate rental income. That’s fairly easy to understand because it’s exactly what you would do if you had a rental property. The only difference is the scale of the asset, with REITs owning institutional-level properties.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The whole point of a REIT is that it gives smaller investors access to such cash-producing assets, which would normally be outside of their investment capacity.

AGNC isn’t a property-owning REIT; it is a mortgage REIT. It buys mortgages that have been pooled into bond-like securities. In some ways, it is more like a mortgage-focused mutual fund that just happens to trade as a company. Mortgage bonds can be very hard to track for small investors.

Factors that affect the price of such securities include interest rates, housing market dynamics, mortgage repayment rates, and even the year of creation of the mortgage bond (sometimes called the vintage). As a shareholder, it is highly unlikely that you will be able to keep tabs on AGNC’s portfolio.

There’s another wrinkle here. AGNC Investment isn’t really an income stock; it is a total return investment. Just look at the chart below — the dividend has not only been volatile over time but it has been trending lower for years. The stock price has followed the dividend lower. And yet, if you reinvested the dividend, your total return would have been strongly positive. The big takeaway here is that if you spend AGNC’s dividend on living expenses, like most dividend investors are probably looking to do, you will end up with less income and less capital.

AGNC data by YCharts.

AGNC Investment proudly noted that it sold stock to raise capital when it reported third-quarter 2024 results. That’s not unusual at all; REITs issue stock to fund investments all the time. But here’s the oddity: The CFO noted, “During the third quarter, we issued $781 million in common stock through our ATM program at a considerable premium to our tangible net book value.” To simplify that just a little, the company sold stock for more than the company’s shares were really worth.

Gold is hovering near all-time highs. Here's how investors can play the craze.

Gold (GC=F) was hovering at a record high around $2,700 per ounce on Wednesday and silver was trading near 12-year highs, with the US presidential election between Kamala Harris and Donald Trump just days away and most investors expecting another rate cut at the Federal Reserve’s next meeting on Nov. 7.

This week, Goldman Sachs analysts predicted gold will rise about 10% to $3,000 by December 2025 due to physical gold demand from central banks, investors pouring into exchange-traded funds (ETFs) backed by physical gold, and speculative positioning.

“History suggests that gold positioning tends to rise with uncertainty and when investors seek safe havens,” wrote Goldman Sachs’ Lina Thomas and Daan Struyven.

Retail investors wanting to get in on the precious metals action have several options, from owning physical gold to investing in mining companies. Here are some:

“For gold, as well as silver, buying the physical asset is the safest and most reliable way,” said Alex Ebkarian, co-founder and COO of Allegiance Gold.

Ebkarian said investors should have a mid- to long-term outlook for their return on investment, as well as understand there are storage and transportation fees if the gold is stored outside the home such as at a secure depository. There is also an upfront premium cost paid during acquisition.

“When it comes to investing in bars, I suggest starting at the 1 oz with well-known brands such as PAMP Suisse, Valcambi,” he said.

Physical purchases can be made from local dealers, online platforms, and even big box retailer Costco (COST), though the latter doesn’t purchase any back from customers.

Buying coins also carries a premium — from the most common ones to the rarest collectibles.

“When it comes to coins, it is best to focus on products from the world’s top four sovereign mints: US Mint, the Royal Canadian Mint, the Perth Mint, and the Royal Mint. They produce investment-grade coins that are highly sought after and extremely liquid. Diversifying your holdings provides you more flexibility and options in the future,” said Ebkarian.

The most popular for both gold and silver is the 1 oz. American Eagle.

“American Eagle 1 oz. coins are the most liquid, traded, and recognized bullion coins in the world. Those are in great demand,” said Scott Travers, executive editor of COINage Magazine and author of the Coin Collector’s Survival Manual.

Travers said consumers should make sure coins are verified through one of the industry’s main three grading agencies or buy a tester to verify them.

The stock market gives this candidate a 70% chance to be the next U.S. president

Vice President Kamala Harris’s chance of winning the U.S. presidential election is lower than it was two weeks ago, according to a model that uses the stock market’s year-to-date performance to predict the incumbent political party’s likelihood of victory.

Nevertheless, that model still predicts that Harris, the Democratic presidential candidate, is likely to win the presidency on Tuesday — giving her a 70% probability of victory. The reason Harris’s likelihood of winning was lower on Nov. 1 than the 72% where it stood on Oct. 17, when I last wrote about this model, is that the Dow Jones Industrial Average DJIA has declined in the interim.

Need to Know: The U.S. election need not be scary. History shows this is the way to trade it, says Citi.

This stock-market prediction model is not complicated. It exploits the historical tendency for the incumbent political party’s chance of electoral victory to reflect the Dow’s year-to-date performance. The model’s track record is statistically highly significant — at the 99% level.

Take a look at the chart above. It plots the trendline that best fits the historical data back to 1900. Is the model foolproof? Of course not. And bear in mind that a 70% probability is not 100%. Furthermore, even if the model had a perfect track record, there’s no guarantee that the future will be like the past.

That said, my simple model does have a better track record than the majority of models Wall Street uses, many if not most of which have no statistical validity. The model makes theoretical sense: The stock market is forward-looking, so a rising market means that most investors are upbeat about the economy’s prospects in coming months. Numerous studies have found that people tend to vote their pocketbooks.

I got a lot of angry emails in response to my mid-October column, with many of you arguing that a Harris presidency would be disastrous for the economy. I myself have no idea. But I do know that, if those dire forecasts were correct, we would expect the stock market to plunge whenever Harris’s chances of winning go up. That hasn’t been the case, as I pointed out in a column earlier this week. The stock market on average has risen in the weeks since July in which the Harris contract at PredictIt.org rose.

This ‘Do Nothing Portfolio' Can Beat the S&P 500

A hypothetical stock portfolio has taken hands-off investing to a whole new level.

Jeffrey Ptak, a chartered financial analyst (CFA) for Morningstar, recently devised a passive investment portfolio that’s based on the composition of the S&P 500. But instead of replacing stocks with new companies as they’re delisted from the index, Ptak’s strategy takes an alternative approach: it does nothing.

A financial advisor can help you select investments aligned with your financial goals. Find a fiduciary advisor today.

This laissez-faire approach to investing produced some compelling hypothetical returns: the portfolio would have beaten the S&P 500 by 5.6% during the 30-year period of March 1993 to March 2023. Here’s how it works, as well as some important lessons you can take from it.

About the Do Nothing Portfolio

Appropriately, Ptak has dubbed this super-passive approach the “Do Nothing Portfolio.” The strategy started with a simple hypothetical: “Imagine you bought a basket of stocks 10 years ago and then you didn’t trade them, not even to rebalance,” he wrote on Morningstar.com. “You just let ’em sit. How would you have done?”

To find out, Ptak compiled the S&P 500’s holdings as of March 31, 2013, and then calculated each stock’s monthly returns going back 10 years. Over 100 of those holdings were no longer in the index 10 years later, many of which were acquired by other companies, according to Ptak. What was left at the end of the 10 years was a portfolio of surviving stocks and cash that had built up over the years following company acquisitions.

The Do Nothing Portfolio would have generated a 12.2% annual return during those 10 years – practically identical to the S&P 500’s return during that time. That caught Ptak’s attention, considering 5.5% of the Do Nothing Portfolio’s assets were cash. By comparison, the S&P 500 was fully invested. The Do Nothing Portfolio was also less volatile during that period and produced better risk-adjusted returns than the index, Ptak wrote.

Ptak took his experiment several steps further and tested the Do Nothing Portfolio in two other non-overlapping 10-year periods – March 31, 1993 to March 31, 2003, and March 31, 2003 to March 31, 2013. The portfolio beat the index by nearly one percentage point during the first 10-year stretch and nearly matched it in the second, all while offering better risk-adjusted returns.

In total, the Do Nothing Portfolio would have outperformed the index over the full 30-year period and been less volatile. For example, Ptak found that $10,000 invested in the Do Nothing Portfolio at the end of March 1993 would have grown to $172,278 within 30 years, while the same investment in the S&P 500 would have been worth $163,186.

TGI Fridays files for bankruptcy protection as sit-down restaurant struggles continue

Restaurant chain TGI Fridays filed for bankruptcy protection Saturday, saying it is looking for ways to “ensure the long-term viability” of the casual dining brand after closing many of its branches this year.

The Dallas-based company’s Chapter 11 filing in a Texas federal court accelerates a gradual decline for an iconic chain that was once near the center of American pop culture but has seen its customer base dwindle as tastes changed.

The company has boasted that its bartenders trained Tom Cruise for his role in the 1988 film “Cocktail.” Its serving staff’s button-filled uniforms, meant to evoke a fun atmosphere, were later parodied in the 1999 satire “Office Space,” starring Jennifer Aniston.

Rohit Manocha, executive chairman of TGI Fridays, said in a statement that the “primary driver of our financial challenges resulted from COVID-19 and our capital structure.”

Sit-down chain restaurants more broadly have faced challenges in recent years as diners choose to get food delivered or visit upscale fast-food chains like Chipotle and Shake Shack.

In September a U.S. bankruptcy judge approved a reorganization plan for the seafood chain Red Lobster after years of mounting losses. Italian American food chain Buca di Beppo filed for bankruptcy protection in August.

Founded in 1965 as a bar on Manhattan’s Upper East Side, TGI Fridays expanded over the following decades to become a ubiquitous suburban gathering spot known for its ribs, potato skins topped with cheese and bacon, and a decor bedecked with red stripes and Tiffany-style lamps.

Its empire peaked in 2008 with 601 restaurants in the U.S. and a $2 billion business, according to Kevin Schimpf, director of industry research at Technomic. Its sales in the U.S. were $728 million in 2023, down 15% from the prior year, according to Technomic.

It now counts 163 restaurants in the U.S., down from 269 last year. It closed 36 in January and dozens more in the past week.

TGI Fridays Inc. said it only owns and operates 39 restaurants in the U.S., which is just a fraction of the 461 TGI Fridays-branded restaurants around the world. A separate entity, TGI Fridays Franchisor, owns the intellectual property and has franchised the brand to 56 independent owners in 41 countries. Those remain open.

A United Kingdom-based franchisee, Hostmore, also sought debt protection in September and abruptly closed locations throughout that country after a failed takeover deal to acquire TGI Fridays.

During the pandemic TGI Fridays made an effort to expand into the delivery market by making itself a hub for so-called ghost kitchens, which have no storefront and only prepare food for delivery. Among the major creditors owed money by TGI Fridays is the delivery service DoorDash, according to Saturday’s bankruptcy court filings.

Another iconic U.S. sit-down restaurant, Denny’s, announced in October that it is closing 150 of its lowest-performing restaurants in an effort to turn around the brand’s flagging sales.

V INVESTOR NEWS: Visa Inc. Investors that Suffered Losses are Encouraged to Contact Rosen Law about Ongoing Investigation into the Company – V

NEW YORK, Nov. 02, 2024 (GLOBE NEWSWIRE) — Rosen Law Firm, a global investor rights law firm, continues to investigate Visa Inc. V for potential violations of the federal securities laws.

If you invested in Visa, you are encouraged to obtain additional information by visiting https://rosenlegal.com/case/visa-inc/.

Why did Visa’s Stock Drop?

On September 24, 2024, during market hours, the United States Department of Justice issued a release entitled “Justice Department Sues Visa for Monopolizing Debit Markets.” In this release, the DOJ announced that it had “filed a civil antitrust lawsuit today against Visa for monopolization and other unlawful conduct in debit network markets[.]” The release further stated the “complaint alleges that Visa illegally maintains a monopoly over debit network markets by using its dominance to thwart the growth of its existing competitors and prevent others from developing new and innovative alternatives.”

The release quoted Attorney General Merrick Garland as stating “[w]e allege that Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market[.] Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service. As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.”

On this news, Visa’s stock fell 5.4% on September 24, 2024.

Click here for more information: https://rosenlegal.com/case/visa-inc/.

What Can You Do?

If you invested in Visa you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://rosenlegal.com/submit-form/?case_id=29131 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

Why Rosen Law Firm?

We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

For more information about RLF and its attorneys, please visit https://rosenlegal.com/.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.