A Republican Sweep Might Be The Most Inflationary Election Outcome, Economists Warn

As the U.S. heads into the elections on Nov. 5, economists warn that a Republican victory across the White House and Congress could significantly increase inflationary pressures.

The impact, they say, would stem primarily from higher tariffs, a swelling budget deficit and restricted immigration policies, setting the stage for a more hawkish Federal Reserve stance.

Goldman Sachs economists Alec Phillips and David Mericle highlighted tariffs as the largest inflationary risk if Republicans take control.

In a report released in September, they projected that under a Republican sweep, tariffs on Chinese imports and autos would likely be reinstated swiftly, driving up the effective tariff rate by 3-4 percentage points (pp).

Such an increase could push core personal consumption expenditures (PCE) inflation up by 0.3-0.4 percentage points at its peak.

“Tariffs would have the largest impact on inflation,” said Phillips and Mericle, noting that every 1pp increase in effective tariff rate could elevate core PCE prices by 0.1pp.

If implemented more broadly, a universal 10% tariff on all U.S. imports could have an even larger effect, potentially driving core PCE inflation to 2.75%-3%, depending on the speed of enactment.

In addition to tariffs, the budget deficit is another critical pressure point.

Under former President Donald Trump‘s fiscal plans, the Committee for a Responsible Federal Budget (CRFB) projects that the U.S. deficit would increase by $7.75 trillion between 2026 and 2035 in a baseline scenario.

In the high-deficit scenario, Trump’s economic plans would add as much as $15.55 trillion to the national debt.

By contrast, the fiscal approach from a hypothetical Kamala Harris administration would increase the debt by $3.95 trillion over the same period, in the baseline scenario. In the high-deficit scenario, Harris’ plans would add $8.3 trillion to the debt burden.

The rising impact on inflation will be produced mainly by three channels: higher tariffs, a wider budget deficit and a lower migration.

“The Bond Vigilantes may also be voting against Washington,” veteran Wall Street investor Ed Yardeni recently said, noting that regardless of the election outcome, bond investors are wary of swelling federal deficits and inflation risks.

“The next administration will face net interest outlays of over $1 trillion on the ballooning federal debt.”

Read Also: Trump Vs. Harris: How Their Fiscal Plans Could Add Trillions To The US National Debt

Concerns over a widening fiscal deficit are pushing up U.S. Treasury yields, which influence borrowing costs across the economy.

Adam Turnquist, chief technical strategist at LPL Financial, observed betting market odds favoring a Trump win have moved in tandem with rising 10-year Treasury yields. This trend suggests markets anticipate more debt issuance and inflationary pressures under a potential Republican administration.

“Growing concerns over rising U.S. deficits and who will win the White House next month may also be behind the advance in yields,” Turnquist said.

Higher Treasury yields tend to increase interest rates across the economy, impacting everything from corporate loans to mortgage rates. For instance, homebuyers could face higher mortgage costs as 10-year Treasury yields rise, potentially dampening demand in the housing market.

Another inflationary factor under a potential Republican administration is reduced immigration.

Goldman Sachs estimates that net immigration would fall to around 750,000 annually under a Republican-controlled government, compared to 1.25 million under a divided government and 1.5 million under a Harris-led administration.

A tighter immigration policy could strain the labor market by limiting the available workforce, pushing employers to raise wages to attract domestic workers.

This wage growth can, in turn, fuel inflation as businesses pass higher labor costs onto consumers. With fewer workers to fill positions, the competition for labor in certain sectors would intensify, potentially leading to elevated salary pressures across the economy.

Goldman Sachs chief economist Jan Hatzius indicated the Federal Reserve would likely adopt a more aggressive stance in response to inflationary pressures from tariffs.

“The monetary policy effects of tariffs is hawkish,” Hatzius said, as higher inflation could force the Fed to hike interest rates to contain price growth.

However, raising rates in a high-debt environment is fraught with challenges. With the national debt already surpassing $33 trillion, higher interest rates would sharply increase the government’s debt-servicing costs, putting additional strain on an already precarious fiscal position.

On the other hand, if the Fed chooses to accommodate government spending by holding off on rate hikes and maintaining a loose monetary policy, it risks stoking even higher inflation. Such complacency could allow price pressures to spiral, creating a dangerous feedback loop of rising inflation and mounting debt.

This delicate balancing act between controlling inflation and managing debt expenses could severely limit the Fed’s flexibility, making its policy decisions increasingly challenging in an environment of persistent inflationary pressures.

Read Now:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Stock Is Joining the Dow Jones Industrial Average Stock Index and Intel Is Being Booted

Nvidia (NASDAQ: NVDA) stock investors got some good news to kick off their weekends. On Friday after the market close, S&P Dow Jones Indices announced that the artificial intelligence (AI) chip giant will replace fellow chipmaker Intel (NASDAQ: INTC) in the Dow Jones Industrial Average (DJINDICES: ^DJI), the oldest U.S. stock index.

Not surprisingly, Nvidia stock was up and Intel stock was down in Friday’s after-hours trading session. Nvidia stock gained 2.9% while Intel stock lost 1.9%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia is replacing Intel in the Dow Jones Industrial Average (commonly called “the Dow”) before the market open on Friday, Nov. 8.

Intel has been a member of the Dow since 1999, as it was added in its glory days in the dot-com era.

Nvidia is replacing Intel in the Dow index to “ensure a more representative exposure to the semiconductors industry,” the S&P Dow Jones Indices said in its press release.

This makes good sense as Nvidia’s whopping $3.39 trillion market cap makes it the second largest stock trading on a U.S. exchange, trailing leader Apple by a slim margin. Meanwhile, Intel’s market cap is $99 billion — just 1/34th the size of Nvidia’s. More to the point, Nvidia is much more representative than Intel of the current U.S. tech environment because it is the biggest player in supplying chips and related technology to enable AI capabilities.

As background, the Dow Jones Industrial Average is a 30-large stock index that aims to be representative of the U.S. stock market, which in turn is generally a reflection of the U.S. economy. So, in the early decades of its history — it was launched in 1896 — it was primarily composed of heavy industrial and energy stocks. In recent decades, technology stocks have been being added to the Dow, as they have become increasingly dominant in the U.S. stock market.

Three of the so-called “Big Techs” — the largest technology companies trading on U.S. stock exchanges — Amazon, Apple, and Microsoft — are current components of the Dow.

The Dow stock index is price-weighted, which means that each of its 30 components receives a weighting based on its price. So, stock components that are trading at higher prices affect the Dow’s performance more than those that are trading at lower prices.

ALX Oncology Announces Results from Phase 1b/2 Trial of Evorpacept in Combination with Zanidatamab will be Presented at the San Antonio Breast Cancer Symposium (SABCS) 2024

SOUTH SAN FRANCISCO, Calif., Nov. 01, 2024 (GLOBE NEWSWIRE) — ALX Oncology Holdings Inc., (“ALX Oncology” or “the Company”) ALXO, a clinical-stage biotechnology company advancing therapies that boost the immune system to treat cancer in new ways and extend patients’ lives, today announced that results from a Phase 1b/2 combination trial evaluating ALX Oncology’s evorpacept in combination with Jazz Pharmaceuticals’ zanidatamab in HER2-positive and HER2-low metastatic breast cancer have been accepted for a poster spotlight presentation at the San Antonio Breast Cancer Symposium (SABCS), which will be held in San Antonio, Texas, from December 10-13, 2024.

The Phase 1b/2 clinical trial is a two-part, open-label, multicenter study (NCT05027139) that evaluated the potential of evorpacept in combination with zanidatamab as a novel treatment for patients with HER2-expressing breast cancer and other cancers. Data from this study will be summarized in the following poster spotlight presentation:

Title: Zanidatamab in combination with evorpacept in HER2-positive and HER2-low metastatic breast cancer: Results from a phase 1b/2 study

Abstract Number: SESS-2007

Presenter: Alberto J. Montero, M.D., MBA, Clinical Director, Breast Cancer Medical Oncology Program, Diana Hyland Endowed Chair for Breast Cancer, and Professor of Medicine at University Hospitals Seidman Cancer Center, Case Western Reserve University

Presentation Date and Time: Thursday, Dec. 12, 7:00 a.m. – 8:30 a.m. CST

Presentation ID: PS8-09

Location: Henry B. Gonzalez Convention Center, San Antonio, Texas

About ALX Oncology

ALX Oncology ALXO is a clinical-stage biotechnology company advancing therapies that boost the immune system to treat cancer in new ways and extend patients’ lives. ALX Oncology’s lead therapeutic candidate, evorpacept, has demonstrated potential to serve as a cornerstone therapy upon which the future of immuno-oncology can be built. Evorpacept is currently being evaluated across multiple ongoing clinical trials in a wide range of cancer indications. More information is available at www.alxoncology.com and on LinkedIn @ALX Oncology.

Company Contact: Caitlyn Doherty, Manager, Corporate Communications, ALX Oncology cdoherty@alxoncology.com (650) 466-7125 Investor Contact: Malini Chatterjee, Ph.D., Blueprint Life Science Group mchatterjee@bplifescience.com (917) 330-4269 Media Contact: Audra Friis, Sam Brown, Inc. audrafriis@sambrown.com (917) 519-9577

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Realtor.com Trends Reveal Millennials Are Making Gains In Surprising States As First-Time Homebuyers Surge

First-time homebuyers are gaining ground in unexpected territory, with Rhode Island leading a wave of Northeastern and Midwestern states where new buyers are claiming a growing share of home sales.

According to data issued by Freddie Mac initially cited by Realtor.com, Rhode Island topped the nation with a 14.3% increase in first-time buyer market share from 2019 through 2024, despite the state’s median listing price of $569,950 sitting well above the national average of $425,000.

Don’t Miss:

The trend extends throughout the region, with Iowa, Nebraska, Wisconsin, and Connecticut all seeing first-time buyer shares climb by more than 10% over the same period.

The shift comes as first-time buyers now account for more than half of conventional conforming mortgages nationwide, up from 20% in 2004, according to Freddie Mac’s latest market outlook report.

The surge in new buyers appears strongest in areas with moderate or slower overall sales activity.

Meanwhile, popular retirement destinations like Arizona and Florida saw smaller gains in first-time buyer share, likely due to competition from older Americans moving to these regions.

Only two states bucked the trend entirely, with Louisiana and North Dakota seeing slight declines in first-time buyer share over the past five years.

See Also: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

The broader picture remains challenging for new buyers. When including cash sales and unconventional loans, first-time buyers made up just 26% of all existing home sales last month, according to the National Association of Realtors — matching historic lows seen in recent months.

New buyers are facing significant headwinds. Entry-level home prices have grown 63% more than high-end home prices since 2000, according to Freddie Mac’s analysis. The supply crunch is equally severe, with approximately 30 renter households competing for each available home for sale, up from fewer than 10 in 2006.

“Less affordable housing is acutely felt by those seeking to buy their first homes, especially those without substantial wealth at their disposal,” Freddie Mac’s report says.

Trending: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

Behind the regional shift lies a demographic wave, with Millennials and the oldest members of Generation Z becoming a force in the housing market. Data from Freddie Mac shows that young adult renters are earning more than in previous years, with three million renter households between ages 25 and 44 now earning at least $75,000 annually in inflation-adjusted terms.

However, economic headwinds are mounting for those potential buyers. The unemployment rate for renters has climbed from 5% to over 6% since 2023 while remaining stable for homeowners.

It’s a disparity that could impact future first-time buyer activity, as most future buyers are currently renting.

Freddie Mac is responding to the challenges. In the second quarter of this year alone, the organization financed roughly 200,000 primary home purchases, with first-time buyers accounting for 53% of the transactions. The agency has also launched a new platform to help potential buyers connect with down payment assistance programs through their lenders.

The findings come as the housing market grapples with high mortgage rates and tight inventory, creating some of the toughest conditions on record for aspiring homeowners.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia To Join Dow Jones Industrial Average, Replacing Intel

Nvidia (NVDA) will replace rival chipmaker Intel (INTC) in the Dow Jones Industrial Average, S&P Dow Jones Indices announced late Friday. Sherwin-Williams (SHW) will step in for Dow Inc. (DOW). The changes will take place before the open on Friday, Nov. 8.

Nvidia stock rose 2.9% Friday night, while Sherwin-Williams gained 3.4%. Intel stock fell 1.85% and Dow Inc. dipped 0.9%.

↑

X

Nasdaq Hits New High Again; Reddit, Alphabet, Eateries In Focus

Separately, Vistra Corp. (VST) will replace AES Corp. (AES) in the Dow Jones Utility Average on Nov. 8. Vistra, the S&P 500’s top performer in 2024, reports earnings next week. VST stock initially edged higher but fell 3.9% amid after-hours losses in nuclear-related plays.

Meanwhile, Chewy (CHWY) will replace Stericycle (SRCL) in the S&P MidCap 400 before the open on Wednesday, Nov. 6. Waste Management (WM) is about to close its Stericycle takeover.

Chewy stock jumped 5.1% Friday night.

Nvidia’s Dow Entrance Long-Speculated

Nvidia joining the Dow Jones has been speculated for several months, as the AI chip leader skyrocketed. In June, Nvidia stock split 10-for-1, heightening Dow Jones buzz. The price-weighted Dow doesn’t want high-priced stocks that swing the indexes with modest percentage moves.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Catch The Next Big Winning Stock With MarketSurge

Best Growth Stocks To Buy And Watch

How To Invest: Rules For When To Buy And Sell Stocks In Bull And Bear Markets

Election 2024: What Trump Vs. Harris Outcomes Mean For Stocks, Federal Reserve

Pardee Resources Company: Third Quarter Report Posted

PHILADELPHIA, Nov. 1, 2024 /PRNewswire/ — Pardee Resources Company PDER (the “Company”) announced today that it has posted its third quarter report on the OTC Markets website https://www.otcmarkets.com/stock/PDER/disclosure where it is available for review. The Company will also distribute its third quarter report to its shareholders electronically and via U.S. Mail in the next several days.

In addition to historical statements, this press release contains statements relating to future events and our future results. These statements are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our judgments and future expectations concerning our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to, difficult economic conditions and other risks and uncertainties. As a result, these forward-looking statements may turn out to be incorrect. We are under no obligation to (and expressly disclaim any obligation to) update or alter these forward-looking statements whether as a result of new information, future events or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/pardee-resources-company-third-quarter-report-posted-302294259.html

View original content:https://www.prnewswire.com/news-releases/pardee-resources-company-third-quarter-report-posted-302294259.html

SOURCE Pardee Resources Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

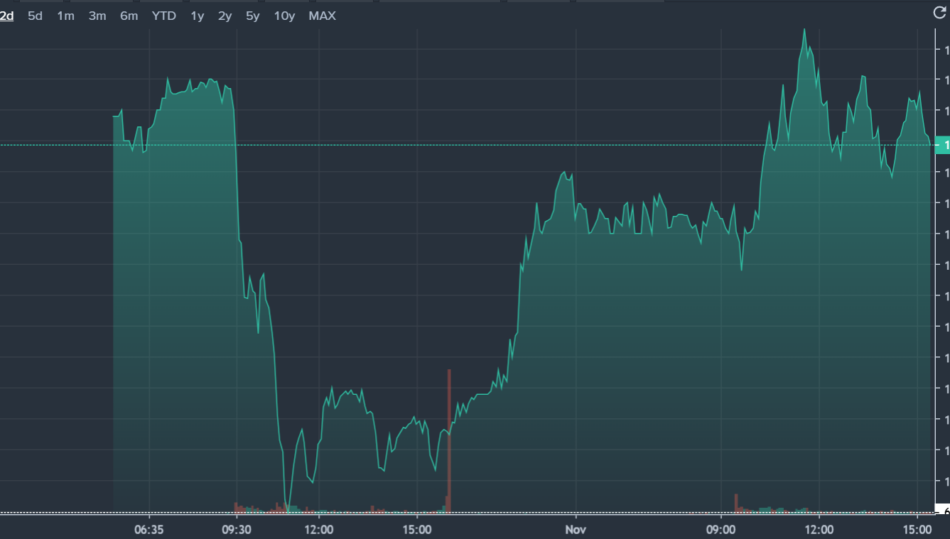

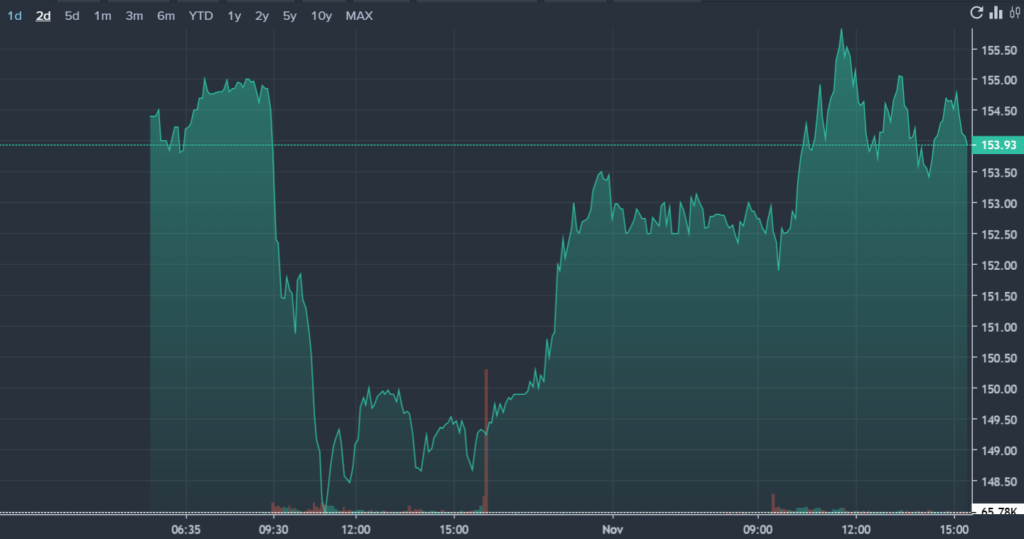

Why Boeing Shares Traded Higher On Friday

Boeing Co. BA shares traded higher Friday as striking employees are expected to vote on a new contract proposal on Monday, Nov. 4. Here’s what you need to know.

What To Know: According to Aviation Daily, the company announced a tentative deal with the International Association of Machinists (IAM), potentially ending a 49-day strike. This union-recommended agreement proposes a 38% wage increase over four years—13% in the first year, followed by 9% in each of the next two years and 7% in the final year.

Additionally, workers would receive a $12,000 ratification bonus and improved 401(k) contributions. Boeing also committed to locating any new aircraft production in the Puget Sound region of Washington, a key concession for the union.

This deal comes after union members previously rejected two offers, including a 35% wage increase in October. The initial union request included a 40% wage increase and pension restorations, but the new deal focuses on wage hikes and bonuses, while pensions remain unchanged. If approved, Boeing expects production facilities to gradually reopen as early as Nov. 6, with full staffing anticipated over the following weeks.

The strike and production delays have impacted Boeing’s suppliers, with some, like Spirit AeroSystems, already implementing employee furloughs. Boeing CEO Kelly Ortberg emphasized the importance of a careful restart process, citing ongoing issues with production stability and meeting FAA safety standards.

What Else: Boeing’s rating also remains on S&P’s CreditWatch following a larger-than-anticipated equity issuance, which helps offset projected cash flow deficits through 2025. However, S&P noted Boeing’s limited flexibility for further cash flow pressures and cited ongoing strike-related and post-strike operational risks as areas of concern.

BA Price Action: Boeing shares were up 3.5% at $154.59 on Friday, according to Benzinga Pro.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 In 13 Homeowners Are Risking It All — Here's Why Experts Call It A 'Huge Mistake'

A growing number of American homeowners are gambling with their largest investment by dropping their home insurance coverage, a trend that industry experts warn could have serious financial consequences.

Data from the Consumer Federation of America cited by CNBC Make It reveals that one in 13 homeowners now lacks insurance coverage, up from 5% to 7.4% since 2019. The shift comes as average annual premiums for a $300,000 home jumped 23% last year to $2,230.

Don’t Miss:

Not having homeowners insurance is “definitely a huge mistake,” Alaina Hixson, director of sales and operations at The Churchill Agency, said to CNBC. “While home insurance is often not cheap, the investment can save thousands and even hundreds of thousands in some cases.”

The risks of going uninsured are becoming increasingly apparent in states like Florida, where recent data from the state’s Office of Insurance Regulation shows tens of thousands of homeowners faced claim denials after Hurricanes Helene and Milton.

Out of 57,415 residential claims from Hurricane Helene, 19,068 were closed without payment. Hurricane Milton saw even higher numbers, with 27,834 denied claims out of 202,989 total residential claims.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

California homeowners face similar challenges as insurers retreat from high-risk areas. According to the San Francisco Chronicle, 13% of realtors had sales fall through this year due to unavailable or unaffordable insurance — double the rate from last year.

The frequency of costly natural disasters has more than quadrupled since the 1980s, according to the National Oceanic and Atmospheric Administration. Despite the increasing risk, many homeowners remain unprotected against specific threats like flooding.

A Trusted Choice survey found that 50% of homeowners don’t realize flood coverage requires a separate policy.

Trending: Unlock the hidden potential of commercial real estate — This platform allows individuals to invest in commercial real estate offering a 12% target yield with a bonus 1% return boost today!

Cathleen Tobin, a New York-based certified financial planner, framed the decision. “The question isn’t, ‘Can I afford homeowners insurance?’ But rather, ‘Can I afford not to have it?’”

While mortgage lenders require insurance coverage, homeowners who’ve paid off their properties or purchased with cash might choose to forgo coverage, which leaves them fully exposed to repair costs if disaster strikes.

Industry experts recommend maintaining coverage sufficient to rebuild at current construction costs, rather than market value.

For those struggling with premiums, they suggest considering higher deductibles while maintaining adequate savings to cover them if needed.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.