Nasdaq Surges Over 200 Points; Amazon Shares Jump After Strong Results

U.S. stocks traded higher midway through trading, with the Nasdaq Composite gaining more than 200 points on Friday.

The Dow traded up 1.18% to 42,254.81 while the NASDAQ surged 1.31% to 18,332.35. The S&P 500 also rose, gaining, 0.95% to 5,759.63.

Check This Out: Top 2 Real Estate Stocks You May Want To Dump This Quarter

Leading and Lagging Sectors

Consumer discretionary shares rose by 2.9% on Friday.

In trading on Friday, utilities shares fell by 1.1%.

Top Headline

Amazon.com Inc. AMZN shares surged 7% on Friday after the copany posted stronger-than-expected results for the third quarter.

Amazon reported third-quarter net sales of $158.9 billion, up 11% year-over-year. The total beat a Street consensus estimate of $157.2 billion, according to data from Benzinga Pro. The company said it sees fourth-quarter net sales to come in a range of $181.5 billion to $188.5 billion, up 7% to 11% year-over-year.

Equities Trading UP

- ChromaDex Corporation CDXC shares shot up 55% to $5.41 after the company reported a year-over-year increase in third-quarter EPS results and raised its FY24 revenue guidance.

- Shares of Proto Labs, Inc. PRLB got a boost, surging 31% to $36.54 after the company reported better-than-expected third-quarter financial results and issued fourth-quarter adjusted EPS guidance with its midpoint above estimates.

- Interface, Inc. TILE shares were also up, gaining 33% to $23.15 after the company reported better-than-expected third-quarter financial results and raised its FY24 net sales guidance above estimates.

Equities Trading DOWN

- ESSA Pharma Inc. EPIX shares dropped 70% to $1.58 after the company announced it terminated its Phase 2 study evaluating masofaniten combined with enzalutamide in patients with mCRPC.

- Shares of Myriad Genetics, Inc. MYGN were down 21% to $17.24. Myriad Genetics will hold its third quarter earnings conference call on Thursday, Nov. 7.

- Lexicon Pharmaceuticals, Inc. LXRX was down, falling 36% to $1.2550. Lexicon Pharmaceuticals announced the outcome of the FDA’s Endocrinologic and Metabolic Drugs Advisory Committee Meeting to review the company’s New Drug Application (NDA) for Zynquista (sotagliflozin). The company is seeking approval for the oral SGLT1/SGLT2 inhibitor as an adjunct to insulin therapy for glycemic control in adults with type 1 diabetes (T1D) and chronic kidney disease (CKD).

Commodities

In commodity news, oil traded up 1.1% to $70.04 while gold traded up 0.2% at $2,753.70.

Silver traded down 0.1% to $32.755 on Friday, while copper rose 0.5% to $4.3635.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.25%, Germany’s DAX gained 1.10% and France’s CAC 40 gained 1.05%. Spain’s IBEX 35 Index surged 1.42%, while London’s FTSE 100 rose 1.06%.

Asia Pacific Markets

Asian markets closed mostly lower on Friday, with Japan’s Nikkei 225 falling 2.63%, Hong Kong’s Hang Seng Index gaining 0.93%, China’s Shanghai Composite Index declining 0.24% and India’s BSE Sensex falling 0.27%.

Economics

- The U.S. economy added 12,000 jobs in October compared to a revised 223,000 gain in September and versus market estimates of 113,000.

- Average hourly earnings increased by 0.4% over a month to $35.46 in October, while unemployment rate came in unchanged at 4.1% in October.

- U.S. construction spending increased by 0.1% month-over-month to an annual rate of $2,148.8 billion in September.

- The S&P Global Flash manufacturing PMI was revised upward to 48.5 in October versus a preliminary reading of 47.8.

- The ISM manufacturing PMI declined to 46.5 in October versus 47.2 in the previous month and down from estimates of 47.6.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Friday's Top 5 Trending Stocks: What's The Scoop On Amazon, Trump Media, Intel?

Amazon.com, Inc. AMZN, Trump Media & Technology Group Corp. DJT, Intel Corp. INTC, Apple, Inc. and Super Micro Computer, Inc. SMCI are the top five trending tickers on Stocktwits Friday. Here’s a look at what grabbed retail investors’ attention.

AMZN Delivers: Amazon shares are surging Friday following a strong earnings release after Thursday’s closing bell. The e-commerce giant saw North American sales grow 9% over last year, and International sales were up 12%. Amazon Web Services (AWS) reported $27.5 billion in sales, a 19% rise from the previous year.

DJT Stumbles: Trump Media & Technology stock took a breather this week after rallying more than 100% over the past month. The stock is highly responsive to news related to Donald Trump and has been volatile as the presidential candidates stay neck-and-neck in the final days of campaigning leading up to next week’s election.

Read Next: Shock October Jobs Report Leaves Fed In ‘Tight Spot:’ Experts Say Interest Rate Cuts Ahead

INTC Bounces: Intel shares are making a comeback after the company reported better-than-expected revenue in the third quarter. CEO Pat Gelsinger highlighted Intel’s progress in cost reduction and efficiency improvements, though the stock remains down more than 50% year-to-date.

AAPL Bites: Apple shares are down Friday following the company’s third-quarter earnings release which included weak December sales guidance and confirmed a downturn in sales in China. Apple’s stock has shed nearly 4% this week.

SMCI Drops: Super Micro stock is not-so-super following the resignation of its accounting firm, Ernst & Young, earlier this week. The firm said it was “unwilling to be associated” with SMCI’s financial statements, which have been under scrutiny following a DOJ probe into the company and a short report from Hindenburg Research which alleged “accounting manipulations.” SMCI shares are down more than 40% since Ernst & Young resigned on Wednesday.

AMZN, DJT, INTC, AAPL, SMCI Price Action: According to Benzinga Pro, Amazon shares are up 6.99% at $199.43, Trump Media & Technology shares are down 8.91% at $32.19, Intel shares are up 7.53% at $23.16, Apple shares are down 1.73% at $222.00 and Super Micro shares are down 5.26% at $27.58 at the time of publication Friday.

Read Also:

Image: Gerd Altmann from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shell Reports Strong Q3: Analysts Highlight Robust Buybacks Amid Market Challenges

Shell PLC SHEL shares are trading relatively flat on Friday.

Yesterday, the company reported revenue of $71.09 billion, beating the consensus of $61.34 billion. Total production at Integrated Gas fell 4% quarter over quarter (Q/Q) to 941 kboe/d, and Upstream rose 2% Q/Q at 1,811 kboe/d.

RBC Capital Markets analyst Biraj Borkhataria reiterated the Outperform rating on Shell, with a price forecast of 3,500 pence.

The analyst highlighted that the earnings beat was notable for being broad-based rather than reliant on a single division.

Borkhataria projects management to look through softer quarters and maintain buybacks at $3.5 billion per quarter through next year.

According to the analyst, strong performance in the LNG division and resilient upstream earnings contributed to the positive results. Additionally, net debt (excluding leases) has fallen to just under $9 billion, the lowest level in over a decade.

Also Read: Shell’s Solid Q3 Performance: Strong Revenue, $3.5 Billion Buyback, And Refined Capex Guidance

They also mentioned that positive commentary on shareholder returns supports the stock, and Shell’s strong balance sheet offers flexibility in a potential downturn.

This positions the company to maintain share buybacks even in a weaker macro environment, and the analyst anticipates that the contrast with its peers will become more apparent by 2025.

Scotiabank Global Equity Research analyst Paul Y. Cheng reiterated the Outperform rating on Shell, with a price forecast of $80.

The earnings beat was broad-based, with Shell exceeding consensus estimates in all key segments, including Upstream, Integrated Gas, Marketing, and Chemicals & Products.

The only exception was the smaller Renewables and Energy Solutions division, which slightly fell short of the market’s expectations.

The analyst noted that Shell repurchased $3.5 billion in shares during the third quarter, meeting expectations.

Cheng also indicated that the company is likely to maintain its current buyback pace despite a less favorable outlook for commodity prices.

Price Action: SHEL shares are trading lower by 0.06% to $67.51 at last check Friday.

Image by siam.pukkato via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kansas City Life Announces Third Quarter 2024 Results

KANSAS CITY, Mo., Nov. 1, 2024 /PRNewswire/ — Kansas City Life Insurance Company recorded net income of $1.3 million or $0.14 per share in the third quarter of 2024, down from net income of $4.6 million or $0.47 per share in the third quarter of 2023. Net income totaled $7.6 million or $0.79 per share in the first nine months of 2024, up from $5.8 million or $0.60 per share in the first nine months of 2023.

The results for the third quarter of 2024 reflected lower insurance revenues and higher policyholder benefits, specifically from death benefits, and interest credited to policyholder account balances versus the prior year. Improvements for the quarter included increases in net investment income and net investment gains.

The improvement in the first nine months of 2024 compared to the prior year largely resulted from increases in net investment income and net investment gains and a decrease in policyholder benefits. Partially offsetting these were a decrease in insurance revenues and increases in operating expenses and interest credited to policyholder account balances.

Kansas City Life Insurance Company KCLI was established in 1895 and is based in Kansas City, Missouri. The Company’s primary business is providing financial protection through the sale of life insurance and annuities. The Company operates in 49 states and the District of Columbia. For more information, please visit www.kclife.com.

|

Kansas City Life Insurance Company Condensed Consolidated Income Statement (amounts in thousands, except share data) |

|||||||||||

|

Quarter Ended |

Nine Months Ended |

||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||

|

Revenues |

$ |

125,147 |

$ |

122,626 |

$ |

374,967 |

$ |

372,547 |

|||

|

Net income |

$ |

1,321 |

$ |

4,599 |

$ |

7,610 |

$ |

5,821 |

|||

|

Net income per share, basic and diluted |

$ |

0.14 |

$ |

0.47 |

$ |

0.79 |

$ |

0.60 |

|||

|

Dividends paid |

$ |

0.14 |

$ |

0.14 |

$ |

0.42 |

$ |

0.42 |

|||

|

Average number of shares outstanding |

9,683,414 |

9,683,414 |

9,683,414 |

9,683,414 |

|||||||

![]() View original content:https://www.prnewswire.com/news-releases/kansas-city-life-announces-third-quarter-2024-results-302294335.html

View original content:https://www.prnewswire.com/news-releases/kansas-city-life-announces-third-quarter-2024-results-302294335.html

SOURCE Kansas City Life Insurance Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cardano's Price Increased More Than 3% Within 24 hours

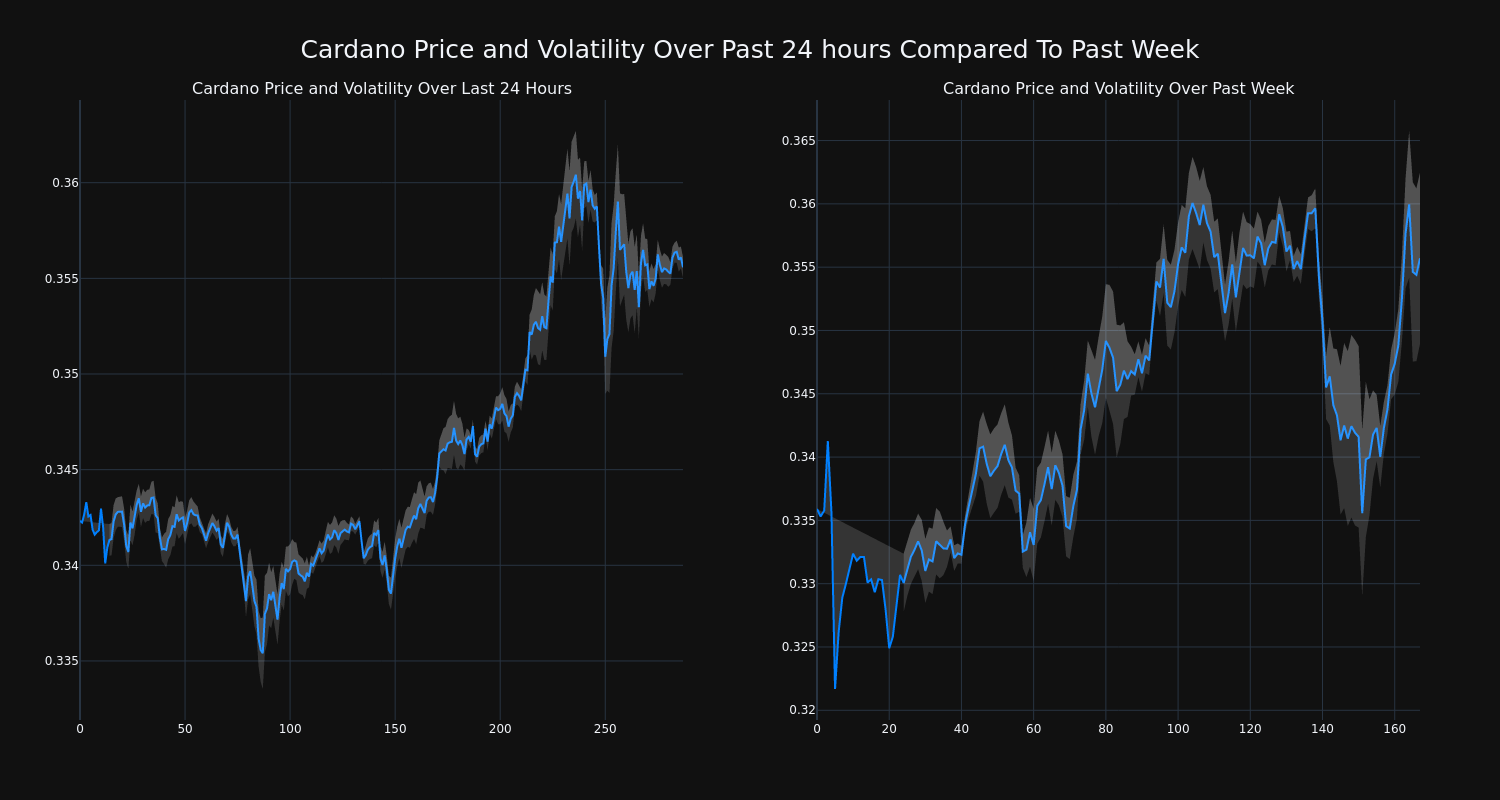

Cardano’s ADA/USD price has increased 3.88% over the past 24 hours to $0.36. Over the past week, ADA has experienced an uptick of over 6.0%, moving from $0.34 to its current price. As it stands right now, the coin’s all-time high is $3.09.

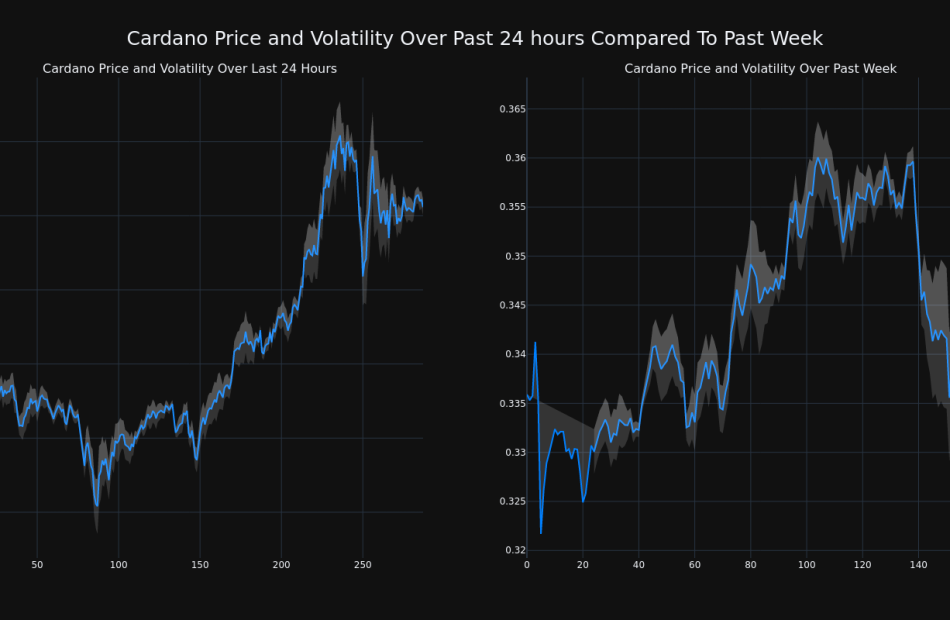

The chart below compares the price movement and volatility for Cardano over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

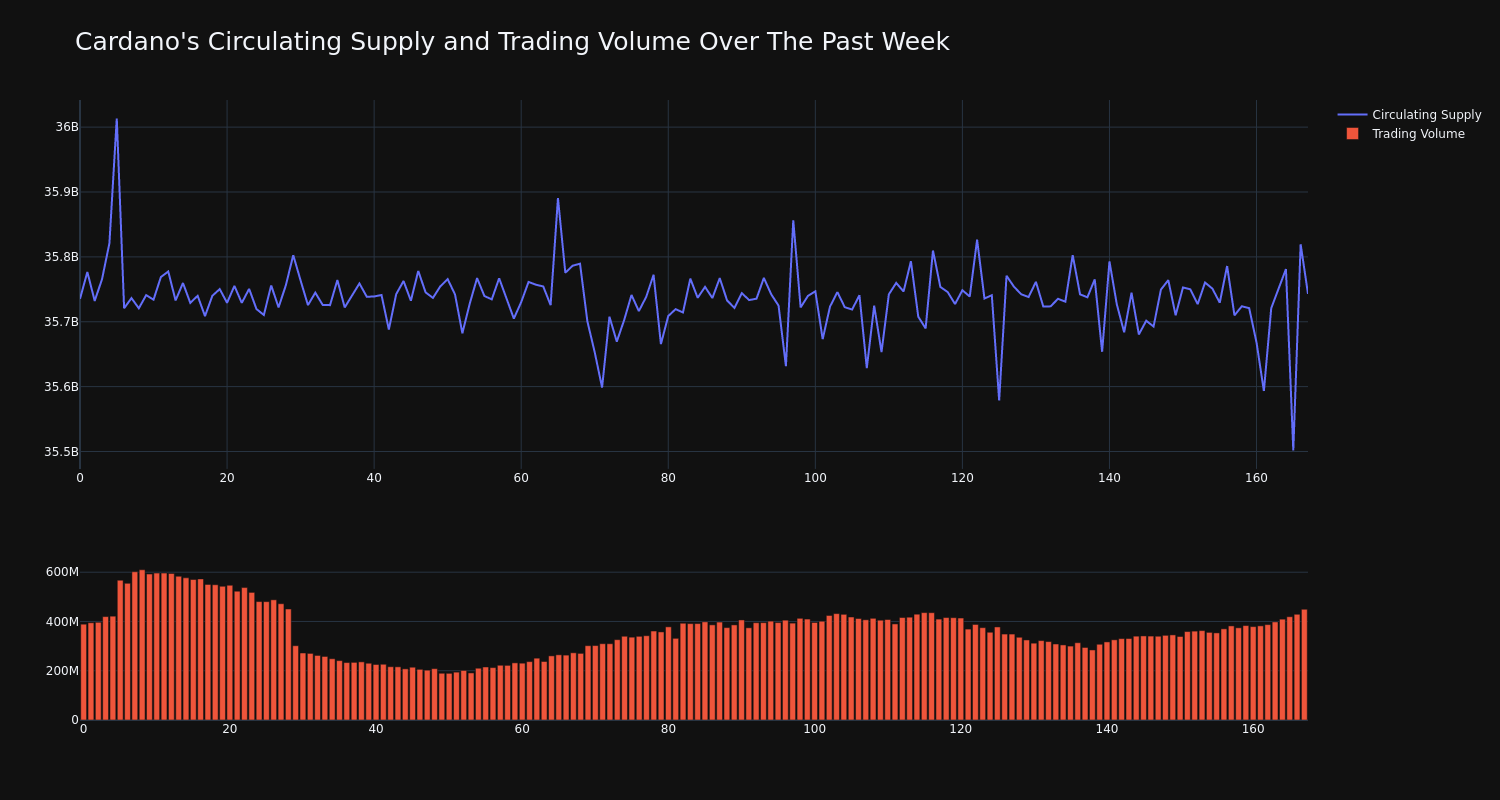

Cardano’s trading volume has climbed 16.0% over the past week along with the circulating supply of the coin, which has increased 0.02%. This brings the circulating supply to 35.75 billion, which makes up an estimated 79.44% of its max supply of 45.00 billion. According to our data, the current market cap ranking for ADA is #11 at $12.71 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CENTENE SUBSIDIARY BUCKEYE HEALTH PLAN AWARDED CONTRACT TO SERVE DUAL ELIGIBILE MEDICARE AND MEDICAID MEMBERS IN OHIO

ST. LOUIS, Nov. 1, 2024 /PRNewswire/ — Centene Corporation CNC, a leading healthcare enterprise committed to helping people live healthier lives, announced today that its subsidiary, Buckeye Health Plan (Buckeye), has been selected by the Ohio Department of Medicaid (ODM) to continue providing Medicare and Medicaid services for dually eligible individuals through a Fully Integrated Dual Eligible Special Needs Plan (FIDE SNP). FIDE SNPs fully integrate care for dually eligible beneficiaries under a single managed care organization, allowing enrollees to receive all of their medical, behavioral and long-term services and supports through one plan.

MyCare Ohio members will not have any change at this time. Current MyCare Ohio providers will continue to serve MyCare Ohio members as they do today until the transition to the Next Generation MyCare plans in January 2026. At that time, the selected plans will be responsible for supporting Ohioans who are eligible for both Medicare and Medicaid healthcare coverage in the 29 counties where MyCare Ohio is currently available. Statewide expansion of the program will follow as quickly as possible.

“We are proud to be working with ODM to connect Ohio communities with the personal, specialized care they need and deserve,” said Centene Chief Executive Officer, Sarah M. London. “With our FIDE SNP program, we will continue to make sure our members get everything they need – under one plan – so they can focus on their health.”

Buckeye is among four health plans selected by ODM to deliver high-quality healthcare to Medicare-Medicaid eligible members through the state’s new FIDE SNP product. Buckeye’s current MMP program serves more than 9,000 members across 12 counties. With the FIDE SNP product offered through the Next Generation MyCare Ohio Program, Buckeye has the potential to expand its reach statewide when the program expands in 2027. Under the new contract, Buckeye will deploy innovative initiatives to meet members’ unique needs, addressing barriers to healthcare and critical social drivers of health, and improving care to promote independence.

“As your guide to better health, Buckeye is honored to continue to serve dually eligible Ohioans,” said Buckeye Health Plan President and CEO, Steve Province. “After serving this dual-eligible population for over a decade, Buckeye understands the importance of providing innovative solutions to meet the needs of Ohioans with complex healthcare challenges and advocating for support to help them thrive. We look forward to continuing our partnerships with members, providers, caregivers and the State of Ohio under the new contract.”

For more information about Buckeye’s current MyCare Ohio product, visit mmp.buckeyehealthplan.com.

Meridian Health Plan of Michigan, Inc., a Centene Corporation company, was also recently selected by the Michigan Department of Health and Human Services to provide highly integrated Medicare and Medicaid services for dually eligible Michiganders through a Highly Integrated Dual Eligible Special Needs Plan.

About Centene Corporation

Centene Corporation, a Fortune 500 company, is a leading healthcare enterprise that is committed to helping people live healthier lives. The Company takes a local approach – with local brands and local teams – to provide fully integrated, high-quality and cost-effective services to government-sponsored and commercial healthcare programs, focusing on under-insured and uninsured individuals. Centene offers affordable and high-quality products to more than 1 in 15 individuals across the nation, including Medicaid and Medicare members (including Medicare Prescription Drug Plans) as well as individuals and families served by the Health Insurance Marketplace and the TRICARE program.

Centene uses its investor relations website to publish important information about the Company, including information that may be deemed material to investors. Financial and other information about Centene is routinely posted and is accessible on Centene’s investor relations website, http://investors.centene.com/.

About Buckeye Health Plan

Buckeye Health Plan offers managed healthcare for Ohioans on Medicaid, Medicare, integrated Medicaid-Medicare (called MyCare Ohio) and the Health Insurance Exchange. Since 2004, Buckeye has been dedicated to improving the health of Ohioans, many with low incomes, by providing coordinated healthcare and other essential support that individuals and families need to grow and thrive. Buckeye Health Plan is a Centene Corporation company. Follow Buckeye on Twitter @Buckeye_Health and on Facebook at http://www.facebook.com/BuckeyeHealthPlan.

Forward-Looking Statements

All statements, other than statements of current or historical fact, contained in this press release are forward-looking statements. Without limiting the foregoing, forward-looking statements often use words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “seek,” “target,” “goal,” “may,” “will,” “would,” “could,” “should,” “can,” “continue” and other similar words or expressions (and the negative thereof). Centene Corporation and its subsidiaries (Centene, the Company, our or we) intends such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with these safe-harbor provisions. In particular, these statements include, without limitation, statements about our expected contract start dates and terms, our future operating or financial performance, market opportunity, competition, expected activities in connection with completed and future acquisitions and dispositions, our investments and the adequacy of our available cash resources. These forward-looking statements reflect our current views with respect to future events and are based on numerous assumptions “ and assessments made by us in light of our experience and perception of historical trends, current conditions, business strategies, operating environments, future developments and other factors we believe appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties and are subject to change because they relate to events and depend on circumstances that will occur in the future, including economic, regulatory, competitive and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. All forward-looking statements included in this press release are based on information available to us on the date hereof. Except as may be otherwise required by law, we undertake no obligation to update or revise the forward-looking statements included in this press release, whether as a result of new information, future events, or otherwise, after the date hereof. You should not place undue reliance on any forward-looking statements, as actual results may differ materially from projections, estimates, or other forward-looking statements due to a variety of important factors, variables and events including, but not limited to: our ability to design and price products that are competitive and/or actuarially sound including but not limited to any impacts resulting from Medicaid redeterminations; our ability to maintain or achieve improvement in the Centers for Medicare and Medicaid Services (CMS) Star ratings and maintain or achieve improvement in other quality scores in each case that can impact revenue and future growth; our ability to accurately predict and effectively manage health benefits and other operating expenses and reserves, including fluctuations in medical utilization rates; competition, including for providers, broker distribution networks, contract reprocurements and organic growth; our ability to adequately anticipate demand and provide for operational resources to maintain service level requirements; our ability to manage our information systems effectively; disruption, unexpected costs, or similar risks from business transactions, including acquisitions, divestitures, and changes in our relationships with third parties; impairments to real estate, investments, goodwill, and intangible assets; changes in senior management, loss of one or more key personnel or an inability to attract, hire, integrate and retain skilled personnel; membership and revenue declines or unexpected trends; rate cuts or other payment reductions or delays by governmental payors and other risks and uncertainties affecting our government businesses; changes in healthcare practices, new technologies, and advances in medicine; our ability to effectively and ethically use artificial intelligence and machine learning in compliance with applicable laws; increased healthcare costs; inflation and interest rates; the effect of social, economic, and political conditions and geopolitical events, including as a result of changes in U.S. presidential administrations or Congress; changes in market conditions; changes in federal or state laws or regulations, including changes with respect to income tax reform or government healthcare programs as well as changes with respect to the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act (collectively referred to as the ACA) and any regulations enacted thereunder; uncertainty concerning government shutdowns, debt ceilings or funding; tax matters; disasters, climate-related incidents, acts of war or aggression or major epidemics; changes in expected contract start dates and terms; changes in provider, broker, vendor, state, federal, and other contracts and delays in the timing of regulatory approval of contracts, including due to protests; the expiration, suspension, or termination of our contracts with federal or state governments (including, but not limited to, Medicaid, Medicare or other customers); the difficulty of predicting the timing or outcome of legal or regulatory audits, investigations, proceedings or matters, including, but not limited to, our ability to resolve claims and/or allegations made by states with regard to past practices on acceptable terms, or at all, or whether additional claims, reviews or investigations will be brought by states, the federal government or shareholder litigants, or government investigations; challenges to our contract awards; cyber-attacks or other data security incidents or our failure to comply with applicable privacy, data or security laws and regulations; the exertion of management’s time and our resources, and other expenses incurred and business changes required in connection with complying with the terms of our contracts and the undertakings in connection with any regulatory, governmental, or third party consents or approvals for acquisitions or dispositions; any changes in expected closing dates, estimated purchase price, or accretion for acquisitions or dispositions; losses in our investment portfolio; restrictions and limitations in connection with our indebtedness; a downgrade of our corporate family rating, issuer rating or credit rating of our indebtedness; the availability of debt and equity financing on terms that are favorable to us and risks and uncertainties discussed in the reports that Centene has filed with the Securities and Exchange Commission (SEC). This list of important factors is not intended to be exhaustive. We discuss certain of these matters more fully, as well as certain other factors that may affect our business operations, financial condition, and results of operations, in our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Due to these important factors and risks, we cannot give assurances with respect to our future performance, including without limitation our ability to maintain adequate premium levels or our ability to control our future medical and selling, general and administrative costs.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/centene-subsidiary-buckeye-health-plan-awarded-contract-to-serve-dual-eligibile-medicare-and-medicaid-members-in-ohio-302294532.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/centene-subsidiary-buckeye-health-plan-awarded-contract-to-serve-dual-eligibile-medicare-and-medicaid-members-in-ohio-302294532.html

SOURCE CENTENE CORPORATION

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pinnacle Partners and Trilogy Investment Co. Launch Build-to-Rent OZ Fund

New BTR OZ Fund Fosters Development in Underserved Markets

ATLANTA, Nov. 1, 2024 /PRNewswire/ — Pinnacle Partners and Trilogy Investment Company launched a new Build-to-Rent (BTR) Opportunity Zone Fund to capitalize three shovel ready BTR communities in Decatur, GA, Augusta, GA and Huntsville, AL. With nearly 500 homes planned across these projects in Qualified Opportunity Zones, the Fund aims to revitalize these communities with new housing, while also intending to offer substantial tax incentives to investors.

“This tax-advantaged real estate fund is targeting strong risk-adjusted returns, fueled by long-term positive trends in these markets with an exciting in-demand asset class,” said Jeff Feinstein, Managing Partner, Pinnacle Partners. “In fact, the Fund’s launch is timely for investors looking for more tax-efficient strategies as they complete their year-end tax planning. We believe this is a great opportunity for investors who can manage the risk and liquidity.”

“The Pinnacle/Trilogy BTR OZ Fund is a groundbreaking initiative that will channel significant investments into underserved areas, foster community development and seek to offer attractive returns to investors,” comments Jason Joseph, CEO of Trilogy Investment Company.

The Pinnacle/Trilogy BTR OZ Fund launch follows Pinnacle Partners’ successful closing of two BTR projects with Trilogy Investment Company through Pinnacle Partners OZ Fund VIII. This closing includes a townhome development in the NoDa submarket of Charlotte, NC, and Avondale Station, a single-family home development in Avondale, AZ.

“This growing relationship with Trilogy has allowed us to be their co-GP investment partner for their upcoming pipeline of BTR projects,” states Feinstein. “We collectively have such conviction of the BTR asset class, moving forward with three curated projects in a new Opportunity Zone fund is the perfect next step.”

The Pinnacle/Trilogy BTR OZ Fund is now open to accredited investors seeking to take advantage of tax benefits of investing in Qualified Opportunity Zones while diversifying their investment portfolio.

For more information, visit Build-to-Rent OZ Fund.

About Trilogy Investment Company

Led by a team of investment, development, and construction professionals, Trilogy Investment Company provides Build-To-Rent communities for residents seeking the stability and social benefits of home ownership but rent by choice or have been priced out of the competitive housing market. Located in desirable neighborhoods near good schools and major economic drivers, these communities offer luxurious finishes and coveted amenities for like-minded families and young professionals desiring rental opportunities beyond traditional apartments. Created with targeted demographics in mind, these communities provide the flexibility of rentals with the stability, privacy, and social benefits of homeownership. Trilogy Investment Company was named the 37th fastest-growing private company in Atlanta for 2023 by the Atlanta Business Chronicle. To learn more about Trilogy Investment Company, visit www.trilogyic.com and follow the company on LinkedIn.

About Pinnacle Partners

Pinnacle Partners is an early mover and leader in Opportunity Zone (OZ) real estate investing. The firm and its subsidiaries have invested over $270 million of equity across 13 projects, consisting of approximately 2,400 multifamily units and two historic adaptive reuse office buildings. Pinnacle seeks best-in-class development partners in target markets across the U.S. with track records of delivering and operating successful projects. For more information, visit www.pinnacleoz.com.

Past performance of Pinnacle Partners OZ Funds is not indicative of future results. There can be no assurance that the fund’s objectives will be achieved or that cash distributions will, in fact, be made or, if made, whether those distributions will be made when or in the amount anticipated or that certain tax benefits will be available to investors. An investment in the fund is illiquid, speculative, and will involve significant risks. Full details about the fund and its associated risks can be found in the fund offering documents.

MEDIA CONTACT:

Denim Marketing

Carol Morgan

404-626-1978

Carol@DenimMarketing.com

www.DenimMarketing.com

![]() View original content:https://www.prnewswire.com/news-releases/pinnacle-partners-and-trilogy-investment-co-launch-build-to-rent-oz-fund-302294133.html

View original content:https://www.prnewswire.com/news-releases/pinnacle-partners-and-trilogy-investment-co-launch-build-to-rent-oz-fund-302294133.html

SOURCE Trilogy Investment Co

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Helport AI Reports Fiscal Full Year 2024 Financial Results

FY 2024 Revenue up 132% to $29.6 Million Year over Year

Net Income up 53% to $7.4 Million Year over Year

Completed Merger and Began Trading as a Public Company on Nasdaq Under Ticker Symbol “HPAI” on August 5, 2024

Management to Host Business Update Conference Call on Wednesday, November 6, 2024 at 5:30 pm ET

SINGAPORE and SAN DIEGO, Nov. 01, 2024 (GLOBE NEWSWIRE) — Helport AI Limited HPAI (“Helport AI” or the “Company”), an AI technology company serving enterprise clients with intelligent software, services and solutions, today announced financial results for its fiscal full year ended June 30, 2024.

Helport AI Highlights:

- A pioneering AI technology company dedicated to empowering enterprises with intelligent software, services and solutions, aimed at accelerating sales growth, driving operational excellence and reducing cost in customer engagement.

- Established global presence, with offices in the United States, Singapore, and the Philippines. supporting 30,000+ active users around the world.

- Helport AI’s products and services have been applied across various industries, including banking, insurance, mortgage sales, wealth management, government services, and real estate.

- Helport AI Assist – a SaaS software launched in 2022, which has become a key business focus, and provides AI-powered real-time speech guidance for customer communications, dedicated to enhancing sales performance and driving operational excellence, with functions including Agent Assistant, Quality Assurance Assistant, Supervisor Assistant, and Knowledge Base Assistant.

- Our AI+BPO service provides worldwide 24/7 customer engagement with AI-driven monitoring, compliance, and knowledge tools. Through global BPO partners, clients could access flexible, multilingual support, boosting performance and reducing costs.

- HDE (Helport AI Developer Ecosystem) – An in-development ecosystem-based developer platform that packages Helport AI’s core underlying technologies and algorithms for different industries through open APIs, allowing for the rapid creation of industry-specific applications.

Fiscal 2024 Year & Subsequent Operational Highlights:

- Helport AI Assist Software is officially approved and available on Google Cloud Marketplace.

- On August 2, 2024, the Company closed its business combination with Tristar Acquisition I Corp. (“Tristar”) TRIS

- Upon closing, an aggregate of $10.4 million in gross proceeds was raised to support its operations, including $5.5 million private placement financing (“PIPE Investment”) and the rest in the form of convertible notes.

- Revenue for the fiscal year ended June 30, 2024 was $29.6 million, an increase of 132% from $12.7 million in the prior year.

- Gross profit for fiscal year 2024 was $18.6 million, an increase of 137% from $7.8 million in fiscal year 2023.

- Net income was $7.4 million in fiscal year 2024 compared to $4.8 million in fiscal year 2023, an increase of 53%.

- Net cash provided by operating activities was $5.0 million for the fiscal year ended June 30, 2024.

- Cash was $2.6 million as of June 30, 2024. Subsequently consummated the PIPE Investment referenced above.

- As of August 8, 2024, there were 37,132,968 ordinary shares and 18,844,987 warrants issued and outstanding.

Management Commentary

“Fiscal 2024 was highlighted by laying the foundation for a global expansion, our Nasdaq listing in August, and rising demand for our AI software and services for enterprise clients,” said Guanghai Li, Chief Executive Officer of Helport AI. “The transition from a private to public company was an incredibly proud moment and milestone for our company, our employees and our shareholders, one that we expect will catalyze our product development and service improvements, enhance our brand awareness in the U.S., and provide opportunities for growth outside of our traditional organically funded operations.

“Helport AI aspires to be a global leader in AI-enhanced customer contact software and services, dedicated to empowering businesses with scalable and intelligent customer engagement. Our mission is to empower everyone to work as an expert through AI solutions. We believe that we are at the forefront of transforming how businesses engage with their customers, enhancing sales, optimizing operations and driving success across industries.

“Our proprietary software, Helport AI Assist, provides AI-powered real time speech guidance for customer contact. Our self-developed AI technologies include real-time communication assistance, real-time sales guidance, real-time quality assurance, efficient knowledge base construction, voice cloning, and more. Our fully independent architecture, where the AI engine is separated from the knowledge base, allows for seamless flexibility, while keeping knowledge bases straightforward. This simplicity allows for faster deployment and adoption, and we intend that it would enable our customers to exceed their goals, particularly in the areas of sales, quality control, and compliance.

“Looking ahead, we will continue to strengthen our capabilities in more industries, including insurance, mortgage, wealth management, banking, government services, telecommunications, real estate, e-commerce, and more. We believe that we have made great strides in the financial services sector, securing partnerships in mortgage, insurance, and wealth management. These partnerships underscore our adaptability in catering to complex industries, where accurate interpretation and communication are critical.

“Our San Diego office will serve as our growth engine for the U.S. market and innovation, while our Singapore office will continue to be the center for global operations. This is expected to strengthen our presence in North America, especially as we see major breakthroughs with developing partnerships such as Google and eWorld Enterprise Solutions in supporting U.S. government sectors.

“We are pleased to announce Helport AI’s official listing on Google Cloud Marketplace, a milestone that we believe will enhance our global reach and strengthen our technology and data security credibility. We trust that this presence will enable us to deliver scalable, high-performance AI solutions across industries, advancing operational efficiency and customer engagement. Looking forward, we will focus on expanding U.S. partnerships and strengthening our ecosystem to drive the next wave of intelligent customer interactions.

“In the mid-term we plan to launch our Helport AI Developer Ecosystem (HDE). Inspired by NVIDIA’s CUDA platform, we are developing an open API interface that aims to enable thirty-party developers to create their own applications using our AI engine. This will allow any developers to innovate within our ecosystem, making it increasingly easy for anyone to innovate on our platform. By fostering this ecosystem, we aim to solidify our position as the go-to platform for AI-driven solutions across industries.

“Taken together, we expect our revenue growth will sustain in 2025, driven by the full impact of our new partnerships and expanded U.S. presence. In addition, we will continue to prioritize R&D investments, particularly in the development of HDE, to support long-term innovation and expansion. We look forward to providing updates in the months to come, including those attending our Business Update Conference Call next Wednesday, November 6th,” concluded Li.

2024 Fiscal Year Financial Results

Revenue for the fiscal year ended June 30, 2024 increased by 132% to $29.6 million compared to $12.7 million in the fiscal year ended June 30, 2023. The increase was primarily attributable to an average monthly subscribed seats increase from 2,192 for the fiscal year ended June 30, 2023 to 5,475 for the fiscal year ended June 30, 2024, which was driven by (i) efforts in continuous optimization and development in service offerings and platform, (ii) capabilities to increase overall cost performance for customers in their business management process, and (iii) the growing demands in professional technology services market.

Gross Profit for the fiscal year ended June 30, 2024 increased to $18.6 million compared to a gross profit of $7.8 million in the fiscal year ended June 30, 2023. Gross margin was 62.8% in the fiscal year ended June 30, 2024 as compared to 61.6% in the fiscal year ended June 30, 2023. The increases indicate that as sales increased, the Company was also able to optimize cost structure and achieve economic scale effect in the improvement of gross profit margin performance.

General and administrative expenses increased to $5.0 million in the fiscal year ended June 30, 2024 from $1.6 million in the fiscal year ended June 30, 2023, primarily attributable to an increase in withholding tax incurred from AI service provided to customers in the PRC subject to a 10% withholding tax rate.

Research and development expenses increased to $4.3 million in the fiscal year ended June 30, 2024, compared to $0.4 million in the fiscal year ended June 30, 2023, primarily due to the addition of AI training service fees and product development fees incurred during the year in order to enhance core competence to differentiate and diversify in products and service offerings with competitive technology, especially related to the development of AI technology application scenarios.

Net income for the fiscal year ended June 30, 2024 was $7.4 million as compared with $4.8 million in the fiscal year ended June 30, 2023, an increase of 53%.

Cash was $2.6 million as of June 30, 2024, as compared to $0.1 million on June 30, 2023.

Net cash provided by operating activities was $5.0 million in fiscal year ended June 30, 2024 compared to net cash used of $0.5 million in fiscal year 2023.

Business Update Conference Call

Guanghai Li, Chief Executive Officer, and Tao Ke, Chief Financial Officer, will host the conference call, followed by a question-and-answer session. The conference call will be accompanied by a presentation, which can be viewed during the webcast or accessed via the investor relations section of the Company’s website here.

To access the call, please use the following information:

| Date: | Wednesday, November 6, 2024 |

| Time: | 5:30 p.m. Eastern Time, 2:30 p.m. Pacific Time |

| Toll-free dial-in number: | 1-800-445-7795 |

| International dial-in number: | 1-203-518-9848 |

| Conference ID (Required for Entry): | HELPORT |

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact MZ Group at 1-949-491-8235.

The conference call will be broadcast live and available for replay at https://viavid.webcasts.com/starthere.jsp?ei=1695608&tp_key=0c8510f685 and via the investor relations section of the Company’s website here.

A replay of the webcast will be available after 9:30 p.m. Eastern Time through February 6, 2025.

| Toll-free replay number: | 1-844-512-2921 |

| International replay number: | 1-412-317-6671 |

| Replay ID: | 11157509 |

About Helport AI

Helport AI HPAI is a provider of AI-driven solutions, specializing in providing products and services aimed at enhancing professional capabilities across industries. Focused on delivering measurable outcomes, Helport AI is set to transform the way businesses operate by ensuring that professionals have the tools they need to succeed. The company serves enterprise-level customer contact services through intelligent products, solutions, and a digital platform, and is dedicated to helping businesses optimize their operations and improve customer engagement. Our mission is to empower everyone to work as an expert. For more information, please visit Helport AI’s website: https://ir.helport.ai/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements, including, but not limited to, Helport AI’s business plan and outlook. These forward-looking statements involve known and unknown risks and uncertainties and are based on Helport AI’s current expectations and projections about future events that Helport AI believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions. Helport AI undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although Helport AI believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and Helport AI cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in Helport AI’s registration statement and other filings with the U.S. Securities and Exchange Commission.

Investor Relations Contact:

Chris Tyson

Executive Vice President

MZ North America

Direct: 949-491-8235

HPAI@mzgroup.us

www.mzgroup.us

| HELPORT AI LIMITED COMBINED BALANCE SHEETS (Amounts in and U.S. dollars (“US$”), except share data) |

|||||||

| As of June 30, | |||||||

| 2024 | 2023 | ||||||

| Cash | $ | 2,581,086 | $ | 142,401 | |||

| Accounts receivable | 21,313,735 | 14,545,921 | |||||

| Deferred offering costs | 817,871 | – | |||||

| Prepaid expenses and other receivables | 41,966 | – | |||||

| Total current assets | 24,754,658 | 14,688,322 | |||||

| Intangible assets, net | 2,425,694 | 4,083,333 | |||||

| Total non-current asset | 2,425,694 | 4,083,333 | |||||

| Total assets | $ | 27,180,352 | $ | 18,771,655 | |||

| Accounts payable | $ | 284,067 | $ | 10,158,729 | |||

| Income tax payable | 2,724,998 | 1,123,065 | |||||

| Amount due to related parties | 965,776 | 592,797 | |||||

| Convertible promissory notes | 4,889,074 | – | |||||

| Accrued expenses and other liabilities | 5,263,239 | 1,212,985 | |||||

| Total current liabilities | 14,127,154 | 13,087,576 | |||||

| Total liabilities | 14,127,154 | 13,087,576 | |||||

| Commitments and contingencies | |||||||

| Ordinary shares (US$1 par value per share; 50,000 authorized as of June 30, 2024, and 2023; 156 issued and outstanding as of June 30, 2024 and 2023, respectively)* | 156 | 156 | |||||

| Additional paid-in capital | 7,556 | 7,556 | |||||

| Subscription receivables | (156 | ) | (156 | ) | |||

| Retained earnings | 13,045,642 | 5,676,523 | |||||

| Shareholders’ equity | 13,053,198 | 5,684,079 | |||||

| Total liabilities and shareholders’ equity | $ | 27,180,352 | $ | 18,771,655 | |||

| * | The shares and per share information are presented on a retroactive basis to reflect the shares reorganization (Note 10). |

| HELPORT AI LIMITED COMBINED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Amounts in and U.S. dollars (“US$”), except share data) |

|||||||||||

| For the years ended June 30, | |||||||||||

| 2024 | 2023 | 2022 | |||||||||

| Revenues | $ | 29,575,625 | $ | 12,728,313 | $ | 2,667,914 | |||||

| Cost of revenues | (10,998,011 | ) | (4,882,792 | ) | (1,246,701 | ) | |||||

| Gross profit | 18,577,614 | 7,845,521 | 1,421,213 | ||||||||

| Selling expenses | (97,984 | ) | (50,830 | ) | (99,817 | ) | |||||

| General and administrative expenses | (4,979,382 | ) | (1,625,887 | ) | (340,625 | ) | |||||

| Research and development expenses | (4,303,490 | ) | (375,410 | ) | – | ||||||

| Total operating expenses | (9,380,856 | ) | (2,052,127 | ) | (440,442 | ) | |||||

| Income from operation | 9,196,758 | 5,793,394 | 980,771 | ||||||||

| Financial expenses, net | (226,713 | ) | (7,936 | ) | (5,894 | ) | |||||

| Other income, net | 1,007 | – | – | ||||||||

| Income before income tax expense | 8,971,052 | 5,785,458 | 974,877 | ||||||||

| Income tax expense | (1,601,933 | ) | (970,755 | ) | (152,917 | ) | |||||

| Net income | $ | 7,369,119 | $ | 4,814,703 | $ | 821,960 | |||||

| Total comprehensive income | $ | 7,369,119 | $ | 4,814,703 | $ | 821,960 | |||||

| Earnings per ordinary share | |||||||||||

| Basic | 47,238 | 30,863 | 5,269 | ||||||||

| Diluted | 47,238 | 30,863 | 5,269 | ||||||||

| Weighted average number of ordinary shares outstanding* | |||||||||||

| Basic | 156 | 156 | 156 | ||||||||

| Diluted | 156 | 156 | 156 | ||||||||

| * | The shares and per share information are presented on a retroactive basis to reflect the shares reorganization (Note 10). |

| HELPORT AI LIMITED COMBINED STATEMENTS OF CASH FLOWS (Amounts in and U.S. dollars (“US$”), except share data) |

|||||||||||

| For the years ended June 30, | |||||||||||

| 2024 | 2023 | 2022 | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Net income | $ | 7,369,119 | $ | 4,814,703 | $ | 821,960 | |||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Amortization of intangible assets | 2,352,639 | 2,333,334 | 583,333 | ||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | (6,813,674 | ) | (12,079,780 | ) | (2,463,761 | ) | |||||

| Prepaid expenses and other receivables | (41,966 | ) | – | – | |||||||

| Accounts payable | (3,158,729 | ) | 2,547,916 | 610,813 | |||||||

| Amount due to related parties | 21,640 | 7,626 | 16,450 | ||||||||

| Accrued expenses and other liabilities | 3,702,668 | 951,932 | 194,508 | ||||||||

| Income tax payable | 1,601,933 | 970,148 | 152,917 | ||||||||

| Net cash provided by/(used in) operating activities | 5,033,630 | (454,121 | ) | (83,780 | ) | ||||||

| CASH FLOWS FORM INVESTING ACTIVITY | |||||||||||

| Purchase of intangible assets | (7,410,933 | ) | – | – | |||||||

| Net cash used in investing activity | (7,410,933 | ) | – | – | |||||||

| CASH FLOWS FORM FINANCING ACTIVITIES | |||||||||||

| Payment for listing costs | (817,871 | ) | – | – | |||||||

| Proceeds from convertible promissory notes | 4,889,074 | – | – | ||||||||

| Loan from a third party | 977,156 | 66,545 | – | ||||||||

| Repayment of loan from a third party | (629,570 | ) | – | – | |||||||

| Loan from related parties | 354,977 | 569,059 | 196,388 | ||||||||

| Repayment of loan from related parties | (3,638 | ) | (45,102 | ) | (114,465 | ) | |||||

| Net cash provided by financing activities | 4,770,128 | 590,502 | 81,923 | ||||||||

| Effect of exchange rate changes | 45,860 | (2,380 | ) | – | |||||||

| Net change in cash | 2,438,685 | 134,001 | (1,857 | ) | |||||||

| Cash at the beginning of the year | 142,401 | 8,400 | 10,257 | ||||||||

| Cash at the end of the year | $ | 2,581,086 | $ | 142,401 | $ | 8,400 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.