CCR – Results for the 3rd quarter of 2024

SÃO PAULO, Oct. 31, 2024 /PRNewswire/ —

Highlights

- The Company announced the extension of Renovias’ term until April 13, 2026. Further details can be found in the regulatory matters section.

- Record traffic in all platforms, with growths of 4.4% in toll roads, 5.1% in urban mobility, and 8.8% in airports.

- CCR announced that will start the payment of dividends, totaling R$ 304 million, on November 29, 2024.

- CCR won the auction for the Sorocabana Route. The fixed grant amount offered was R$1.6 billion.

Consolidated Operational and Financial Highlights

|

OPERATIONAL AND FINANCIAL HIGHLIGHTS (R$ MM) |

3Q23 |

3Q24 |

Var.% |

9M23 |

9M24 |

Var.% |

|

Consolidated Adjusted Net Revenue¹ |

3,416 |

3,782 |

10.7 % |

9,745 |

10,748 |

10.3 % |

|

Consolidated Adjusted EBITDA¹ |

2,122 |

2,190 |

3.2 % |

5,853 |

6,265 |

7.0 % |

|

Adjusted EBITDA – Toll Roads |

1,549 |

1,621 |

4.6 % |

4,375 |

4,653 |

6.4 % |

|

Adjusted EBITDA – Mobility |

552 |

571 |

3.5 % |

1,422 |

1,561 |

9.8 % |

|

Adjusted EBITDA – Airports |

235 |

274 |

16.5 % |

632 |

793 |

25.4 % |

|

Adjusted EBITDA – Others |

(214) |

(276) |

28.8 % |

(575) |

(742) |

29.0 % |

|

Consolidated Adjusted EBITDA Margin² |

62.1 % |

57.9 % |

-4.2 p.p. |

60.1 % |

58.3 % |

-1.8 p.p. |

|

Adjusted Net Income¹ |

502 |

560 |

11.7 % |

1,022 |

1,420 |

38.9 % |

|

Net Debt/LTM Adjusted EBITDA (x) |

2.9 |

3.1 |

0.2 p.p. |

2.9 |

3.1 |

0.2 p.p. |

|

Toll Roads – Equivalent Vehicles (million) |

300.9 |

314.0 |

4.4 % |

869.3 |

909.6 |

4.6 % |

|

Mobility – Transported Passengers (million) |

184.3 |

193.6 |

5.1 % |

529.2 |

560.6 |

5.9 % |

|

Airports – Boarded Passengers (million) |

4.8 |

5.2 |

8.8 % |

13.5 |

14.6 |

8.4 % |

|

CAPEX³ |

1,331 |

2,101 |

57.9 % |

4,190 |

4,982 |

18.9 % |

- Excludes construction revenue and expenses. Adjustments are described in the “non-recurring effects” section in Exhibit I.

- The Adjusted EBITDA Margin was calculated by dividing Adjusted EBITDA by Adjusted Net Revenue.

- Includes improvement works that do not generate future economic benefits for ViaOeste.

Videoconference

Conference call in Portuguese with simultaneous translation into English:

November 1st, 2024

10:00 a.m. São Paulo / 09:00 a.m. New York

Videoconference link:

https://grupoccr-br.zoom.us/webinar/register/WN_BwhScwe7RiiCHKDSZ1znTg

IR Contacts

Flávia Godoy: (+55 11) 3048-5900 – flavia.godoy@grupoccr.com.br

Douglas Ribeiro: (+55 11) 3048-5900 – douglas.ribeiro@grupoccr.com.br

Cauê Cunha: (+55 11) 3048-5900 – caue.cunha@grupoccr.com.br

Igor Yamamoto: (+55 11) 3048-5900 – igor.yamamoto@grupoccr.com.br

Caique Moraes: (+55 11) 3048-5900 – caique.moraes@grupoccr.com.br

![]() View original content:https://www.prnewswire.com/news-releases/ccr—results-for-the-3rd-quarter-of-2024-302293552.html

View original content:https://www.prnewswire.com/news-releases/ccr—results-for-the-3rd-quarter-of-2024-302293552.html

SOURCE CCR S.A.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aker Horizons ASA: Third-quarter results 2024

FORNEBU, Norway, Nov. 1, 2024 /PRNewswire/ — Aker Horizons ASA AKH, a developer of green energy and industry, today announced results for the third quarter 2024. Aker Horizons’ net capital employed stood at NOK 6.1 billion, a decrease of NOK 1.0 billion from the second quarter, mainly driven by impairments in Mainstream. The company reported a cash position of NOK 3.0 billion and an undrawn credit facility of EUR 500 million, giving available liquidity of NOK 8.8 billion.

Third quarter main developments:

The JV between Aker Carbon Capture (ACC) and SLB was renamed SLB Capturi and announced its first US-based project:

- SLB Capturi was awarded a FEED contract by CO280 Solutions for a large-scale carbon capture plant at a pulp and paper mill on the US Gulf Coast.

- The Board of Directors of ACC continues the process of determining the future strategy and structure of ACC and will communicate conclusions within Q1 2025.

Mainstream Renewable Power (Mainstream) is delivering on its pipeline in South Africa and focuses on business optimization:

- The 50 MW solar project Ilikwa in South Africa reached financial close.

- The commercial margin of the Andes platform in Chile improved in Q3.

- Mainstream is streamlining its business to focus on growth in core markets South Africa, Australia and the Philippines, with continued investment in key offshore projects.

Aker Horizons Asset Development (AAD) completed a concept optimization for Narvik Green Ammonia; strong data center interest for sites in Northern Norway:

- A concept optimization for the Narvik Green Ammonia project has been concluded with a decision to move the project to Lallasletta.

- An MoU was signed with Masdar to explore collaboration and investment opportunities in green hydrogen.

- Data center players are showing significant interest in Kvandal and other industrial sites in the Powered Land site portfolio.

SuperNode secured funding to advance superconducting transmission technology development:

- Significant grants were secured from Irish and UK institutions to fund research & development.

- SuperNode opened a new Cable Technology Centre in Blyth, UK, enabling first production of superconducting cables for bulk electricity transmission

Lars P. Sørvaag Sperre, CEO of Aker Horizons, commented:

“We are pleased to see ACC and SLB Capturi reaching material milestones this quarter to enter the important US carbon capture market. Mainstream will now embark on a business plan that focuses on growth in selected core markets. This will enable Mainstream to speed up the development of projects. Furthermore, we have continued to develop and explore options for Aker Horizon’s green hydrogen projects and the Powered Land sites. It is really encouraging to see the strong interest from the data center industry around our activities in the Narvik area”.

Aker Horizons reports net capital employed to reflect a portfolio composed mainly of unlisted assets. Net capital employed includes Aker Horizons’ initial investment in the portfolio company, adjusted for any profit or loss and any additional investments, adjusted for foreign exchange fluctuations. As of the third quarter, Aker Horizons had NOK 2.4 billion net capital employed in ACC, NOK 2.8 billion in Mainstream, NOK 543 million in AAD, NOK 197 million in SuperNode and NOK 242 million in other assets.

The Q3 2024 presentation is attached.

Aker Horizons’ CEO Lars P. Sørvaag Sperre and CFO Kristoffer Dahlberg, and Mainstream’s CEO Mary Quaney will present the main developments in the third quarter 2024 today at 08:30 CEST, followed by a Q&A session. The presentation, which is open to all, will be held in English and will be webcast on Aker Horizons’ website:

https://akerhorizons.com/investors

For further information, please contact:

Stian Andreassen, Investor Relations, tel: +47 41 64 31 07, email: stian.andreassen@akerhorizons.com

Mats Ektvedt, Media, tel: +47 41 42 33 28, email: mats.ektvedt@corporatecommunications.no

About Aker Horizons

Aker Horizons develops green energy and green industry to accelerate the transition to Net Zero. The company is active in renewable energy, carbon capture and hydrogen and develops industrial-scale decarbonization projects. As part of the Aker group, Aker Horizons applies industrial, technological and capital markets expertise with a planet-positive purpose to drive decarbonization globally. Aker Horizons is listed on the Oslo Stock Exchange and headquartered in Fornebu, Norway. Across its portfolio, the company is present on five continents. www.akerhorizons.com

This information is considered to be inside information pursuant to the EU Market Abuse Regulation and is subject to the disclosure requirements in Regulation EU 596/2014 and the Norwegian Securities Trading Act § 5-12. This stock exchange announcement was published by Mats Ektvedt, Partner in Corporate Communications, on 1 November 2024 at 07:00 CET.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/aker-horizons/r/aker-horizons-asa–third-quarter-results-2024,c4059993

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/aker-horizons-asa-third-quarter-results-2024-302293848.html

View original content:https://www.prnewswire.com/news-releases/aker-horizons-asa-third-quarter-results-2024-302293848.html

SOURCE Aker Horizons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple, Amazon, Intel, Peloton, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

U.S. stocks turned downward on Thursday, with the Nasdaq Composite dipping around 500 points. The Dow traded down 0.9% to 41,763.46 while the NASDAQ fell 2.76% to 18,095.15. The S&P 500 also fell, dropping, 1.9% to 5,705.45.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Apple Inc. AAPL

Apple shares closed down 1.82% at $225.91, with an intraday high of $229.83 and a low of $225.37. The 52-week range is $164.08 to $237.49. The iPhone maker reported a fiscal fourth-quarter revenue of $94.9 billion, beating analyst estimates.

Amazon.com Inc. AMZN

Amazon shares ended the day down 3.39% at $186.19, with an intraday high of $190.6 and a low of $185.23. The 52-week range is $133.85 to $201.2. The online retail giant posted third-quarter net sales of $158.9 billion, up 11% year-over-year.

Intel Corp. INTC

Intel shares closed down 3.50% at $21.52, with an intraday high of $22.25 and a low of $21.47. The 52-week range is $18.51 to $51.28. The chipmaker reported an EPS loss of 46 cents against an estimate of a loss of two cents.

Peloton Interactive Inc. PTON

Peloton shares soared 27.82% to close at $8.5, with an intraday high of $8.92 and a low of $7.67. The 52-week range is $2.7 to $8.92. The fitness company smashed first-quarter sales estimates and reported a GAAP net loss of $1 million.

Tesla Inc. TSLA

Tesla shares ended the day down 2.99% at $249.85, with an intraday high of $259.75 and a low of $249.25. The 52-week range is $138.8 to $273.54. The EV maker remains California’s top EV choice even as registrations drop.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: Ishant Mishra On Unsplash

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ensign Energy Services Inc. Reports 2024 Third Quarter Results

CALGARY, AB, Nov. 1, 2024 /CNW/ –

FINANCIAL HIGHLIGHTS

(Unaudited, in thousands of Canadian dollars, except per common share data)

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

||||||

|

Revenue |

$ 434,617 |

$ 444,405 |

(2) |

$ 1,257,716 |

$ 1,361,227 |

(8) |

|||||

|

Adjusted EBITDA 1 |

119,049 |

117,295 |

1 |

336,727 |

361,235 |

(7) |

|||||

|

Adjusted EBITDA per common share 1 |

|||||||||||

|

Basic |

$0.65 |

$0.63 |

3 |

$1.83 |

$1.96 |

(7) |

|||||

|

Diluted |

$0.64 |

$0.63 |

2 |

$1.82 |

$1.95 |

(7) |

|||||

|

Net income (loss) attributable to common shareholders |

5,268 |

(5,229) |

nm |

(538) |

9,314 |

nm |

|||||

|

Net income (loss) attributable to common |

|||||||||||

|

Basic |

$0.03 |

$(0.03) |

nm |

$0.00 |

$0.05 |

(99) |

|||||

|

Diluted |

$0.03 |

$(0.03) |

nm |

$0.00 |

$0.05 |

(99) |

|||||

|

Cash provided by operating activities |

103,201 |

105,566 |

(2) |

323,481 |

376,911 |

(14) |

|||||

|

Funds flow from operations |

116,914 |

119,596 |

(2) |

323,602 |

354,651 |

(9) |

|||||

|

Funds flow from operations per common share |

|||||||||||

|

Basic |

$0.64 |

$0.65 |

(2) |

$1.76 |

$1.93 |

(9) |

|||||

|

Diluted |

$0.63 |

$0.65 |

(3) |

$1.75 |

$1.92 |

(9) |

|||||

|

Total debt, net of cash |

1,066,356 |

1,246,041 |

(14) |

1,066,356 |

1,246,041 |

(14) |

|||||

|

Weighted average common shares – basic (000s) |

183,781 |

183,786 |

— |

183,969 |

183,917 |

— |

|||||

|

Weighted average common shares – diluted (000s) |

184,467 |

184,614 |

— |

184,642 |

185,148 |

— |

|||||

|

nm – calculation not meaningful |

|

1 Please refer to Adjusted EBITDA calculation in Non-GAAP Measures. |

- Revenue for the third quarter of 2024 was $434.6 million, a two percent decrease from the third quarter of 2023 revenue of $444.4 million.

- Revenue by geographic area:

- Canada – $131.0 million, 30 percent of total;

- United States – $216.2 million, 50 percent of total; and

- International – $87.4 million, 20 percent of total.

- Adjusted EBITDA for the third quarter of 2024 was $119.0 million, a one percent increase from Adjusted EBITDA of $117.3 million for the third quarter of 2023.

- Funds flow from operations for the third quarter of 2024 decreased two percent to $116.9 million from $119.6 million in the third quarter of the prior year.

- Net income attributable to common shareholders for the third quarter of 2024 was $5.3 million, up from net loss attributed to common shareholders of $5.2 million for the third quarter of 2023.

- During the third quarter of 2024, $44.7 million of debt was repaid and a total of $135.0 million was repaid during the first nine months of 2024. The Company is on track to achieve its’ stated debt targets as from January 1, 2023 to September 30, 2024, a total of $352.6 million of debt has been repaid leaving $247.4 million of the $600.0 million debt reduction target expected to be achieved by the end of 2025.

- Interest expense decreased by 24 percent to $23.8 million from $31.3 million. The decrease is the result of lower debt levels and reduced effective interest rates.

OPERATING HIGHLIGHTS

(Unaudited)

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

||||||

|

Drilling |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Number of marketed rigs |

|||||||||||

|

Canada 1 |

94 |

115 |

(18) |

94 |

115 |

(18) |

|||||

|

United States |

77 |

85 |

(9) |

77 |

85 |

(9) |

|||||

|

International 2 |

31 |

32 |

(3) |

31 |

32 |

(3) |

|||||

|

Total |

202 |

232 |

(13) |

202 |

232 |

(13) |

|||||

|

Operating days 3 |

|||||||||||

|

Canada 1 |

3,861 |

3,262 |

18 |

10,064 |

9,193 |

9 |

|||||

|

United States |

3,065 |

3,581 |

(14) |

9,111 |

12,500 |

(27) |

|||||

|

International 2 |

1,269 |

1,265 |

— |

3,843 |

3,616 |

6 |

|||||

|

Total |

8,195 |

8,108 |

1 |

23,018 |

25,309 |

(9) |

|||||

|

Well Servicing |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Number of rigs |

|||||||||||

|

Canada |

46 |

47 |

(2) |

46 |

47 |

(2) |

|||||

|

United States |

47 |

47 |

— |

47 |

47 |

— |

|||||

|

Total |

93 |

94 |

(1) |

93 |

94 |

(1) |

|||||

|

Operating hours |

|||||||||||

|

Canada |

12,161 |

10,624 |

14 |

36,114 |

36,204 |

— |

|||||

|

United States |

35,518 |

32,397 |

10 |

97,081 |

90,961 |

7 |

|||||

|

Total |

47,679 |

43,021 |

11 |

133,195 |

127,165 |

5 |

|||||

|

1 |

Excludes coring rigs. |

|

2 |

Includes workover rigs. |

|

3 |

Defined as contract drilling days, between spud to rig release. |

- Canadian drilling recorded 3,861 operating days in the third quarter of 2024, an 18 percent increase from 3,262 operating days in the third quarter of 2023. Canadian well servicing recorded 12,161 operating hours in the third quarter of 2024, a 14 percent increase from 10,624 operating hours in the third quarter of 2023.

- United States drilling recorded 3,065 operating days in the third quarter of 2024, a 14 percent decrease from 3,581 operating days in the third quarter of 2023. United States well servicing recorded 35,518 operating hours in the third quarter of 2024, a 10 percent increase from 32,397 operating hours in the third quarter of 2023.

- International drilling recorded 1,269 operating days in the third quarter of 2024, generally consistent with 1,265 operating days recorded in the third quarter of 2023.

FINANCIAL POSITION HIGHLIGHTS

|

As at ($ thousands) |

September 30 2024 |

December 31 2023 |

September 30 2023 |

||

|

Working capital (deficit) 1, 2 |

(8,128) |

15,780 |

(1,165,149) |

||

|

Cash |

24,517 |

20,501 |

47,077 |

||

|

Total debt, net of cash |

1,066,356 |

1,189,848 |

1,246,041 |

||

|

Total assets |

2,883,811 |

2,947,986 |

3,073,053 |

||

|

Total debt to total debt plus equity ratio |

0.45 |

0.48 |

0.50 |

|

1 |

See non-GAAP Measures section. |

|

2 |

Change in working capital (deficit) from September 30, 2024, to September 30, 2023 was largely due to the Company’s revolving credit facility and unsecured Senior notes being classified as current. |

- Total debt, net of cash, was reduced by $123.5 million since December 31, 2023.

- Our debt reduction for 2024 is targeted to be approximately $200.0 million. Our target debt reduction for the period beginning 2023 to the end of 2025 is approximately $600.0 million. If industry conditions change, this target could be increased or decreased.

CAPITAL EXPENDITURE HIGHLIGHTS

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||||||||

|

Capital expenditures |

|||||||||||||||||

|

Upgrade/growth |

5,033 |

1,939 |

nm |

9,171 |

13,967 |

(34) |

|||||||||||

|

Maintenance |

32,345 |

36,020 |

(10) |

131,402 |

130,316 |

1 |

|||||||||||

|

Proceeds from disposals of property and equipment |

(3,844) |

(8,891) |

(57) |

(15,231) |

(12,345) |

23 |

|||||||||||

|

Net capital expenditures |

33,534 |

29,068 |

15 |

125,342 |

131,938 |

(5) |

|||||||||||

|

nm – calculation not meaningful |

- Net purchases of property and equipment for the third quarter of 2024 totaled $33.5 million, consisting of $5.0 million in upgrade capital and $32.3 million in maintenance capital, offset by disposition proceeds of $3.8 million. Gross capital expenditures for 2024 are targeted to be approximately $167.0 million, primarily related to maintenance expenditures, opportunistic tubular purchases, and selective growth projects that have been funded by customers. In addition, the Company may consider other upgrade or growth projects in response to customer demand and appropriate contract terms.

This news release contains “forward-looking information and statements” within the meaning of applicable securities legislation. For a full disclosure of the forward-looking information and statements and the risks to which they are subject, see the “Advisory Regarding Forward-Looking Statements” later in this news release. This news release contains references to Adjusted EBITDA, Adjusted EBITDA per common share and working capital. These measures do not have any standardized meaning prescribed by IFRS Accounting Standards (“IFRS”) and accordingly, may not be comparable to similar measures used by other companies. The non-GAAP measures included in this news release should not be considered as an alternative to, or more meaningful than, the IFRS measures from which they are derived or to which they are compared. See “Non-GAAP Measures” later in this news release.

OVERVIEW

Revenue for the third quarter of 2024 was $434.6 million, a two percent decrease from $444.4 million in revenue for the third quarter of 2023. Revenue for the nine months ended September 30, 2024, was $1,257.7 million, a decrease of eight percent from revenue for the nine months ended September 30, 2023, of $1,361.2 million.

Adjusted EBITDA totaled $119.0 million ($0.65 per common share) in the third quarter of 2024, one percent higher than Adjusted EBITDA of $117.3 million ($0.63 per common share) in the third quarter of 2023. For the nine months ended September 30, 2024, Adjusted EBITDA totaled $336.7 million ($1.83 per common share), seven percent lower than Adjusted EBITDA of $361.2 million ($1.96 per common share) in the nine months ended September 30, 2023.

Net income attributable to common shareholders for the third quarter of 2024 was $5.3 million ($0.03 per common share) compared to a net loss attributable to common shareholders of $5.2 million ($0.03 per common share) for the third quarter of 2023. Net loss attributable to common shareholders for the nine months ended September 30, 2024, was $0.5 million ($0.00 per common share), compared to a net income attributable to common shareholders of $9.3 million ($0.05 per common share) for the nine months ended September 30, 2023.

Funds flow from operations decreased two percent to $116.9 million ($0.64 per common share) in the third quarter of 2024 compared to $119.6 million ($0.65 per common share) in the third quarter of the prior year. Funds flow from operations decreased nine percent to $323.6 million ($1.76 per common share) for the nine months ended September 30, 2024, compared to $354.7 million ($1.93 per common share) for the nine months ended September 30, 2023.

The outlook for oilfield services continues to be generally constructive despite the year-over-year decline in oilfield services activity in certain operating regions. The recent completion of the Trans Mountain Pipeline expansion has resulted in increased Canadian industry activity, while the US rig count continues to be depressed in part because of relatively low natural gas commodity prices. Furthermore, there have been several recent oil and natural gas customer mergers and acquisitions (“M&A“) in both the Canadian and the US markets that have impacted drilling programs over the short-term, with customers exercising discipline with their capital programs. However, despite these short-term headwinds, demand for crude oil continues to increase year-over-year. Moreover, OPEC+ nations continue to exercise production and supply discipline in response to market conditions.

Over the near term, geopolitical tensions, hostilities in areas of the Middle East, and the ongoing Russia–Ukraine conflict continue to impact global commodity prices and add uncertainty to the outlook for crude oil supply and commodity prices over the short-term.

The Company’s operating days were consistent for the three months ended September 30, 2024 and declined for the nine months ended September 30, 2024, when compared with the same periods in 2023. Operating activity was negatively impacted in the first nine months of 2024 due to customer capital discipline, the above-mentioned customer M&A activity between oil and natural gas producers in the United States markets and depressed natural gas commodity prices. Offsetting the activity decrease in the United States is an activity increase in Canada, largely as a result of the completion of the Trans Mountain Pipeline expansion.

The average United States dollar exchange rate was $1.36 for the first nine months of 2024 (2023 – $1.35), slightly higher than the prior period.

The Company’s working capital as at September 30, 2024, was a deficit of $8.1 million, compared to a surplus of $15.8 million as at December 31, 2023. The decrease in working capital is the result of lower net income, despite higher operating activity when compared to the fourth quarter of 2023.

The Company’s available liquidity, consisting of cash and available borrowings under its $850.0 million Credit Facility, was $66.3 million as at September 30, 2024.

REVENUE AND OILFIELD SERVICES EXPENSE

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Revenue |

|||||||||||

|

Canada |

131,007 |

108,259 |

21 |

362,860 |

328,993 |

10 |

|||||

|

United States |

216,172 |

257,747 |

(16) |

633,185 |

809,081 |

(22) |

|||||

|

International |

87,438 |

78,399 |

12 |

261,671 |

223,153 |

17 |

|||||

|

Total revenue |

434,617 |

444,405 |

(2) |

1,257,716 |

1,361,227 |

(8) |

|||||

|

Oilfield services expense |

301,763 |

313,227 |

(4) |

876,628 |

956,929 |

(8) |

|||||

Revenue for the three months ended September 30, 2024, totaled $434.6 million, a decrease of two percent from the third quarter 2023 of $444.4 million. Revenue for the nine months ended September 30, 2024, totaled $1,257.7 million, an eight percent decrease from the nine months ended September 30, 2023 of $1,361.2 million.

The decrease in total revenue during the first nine months of 2024 was primarily due to recent M&A activity in the oil and natural gas sector in the United States market, impacting drilling activity, along with reinforced customer discipline with regards to their capital programs. Moreover, depressed natural gas commodity prices also contributed to reduced drilling activity. Offsetting the decrease in the United States was improved activity in the Company’s Canada and international markets.

CANADIAN OILFIELD SERVICES

Revenue increased 21 percent to $131.0 million for the three months ended September 30, 2024, from $108.3 million for the three months ended September 30, 2023. The Company recorded revenue of $362.9 million in Canada for the nine months ended September 30, 2024, an increase of 10 percent from $329.0 million recorded for the nine months ended September 30, 2023.

Canadian revenue accounted for 30 percent of the Company’s total revenue in the third quarter of 2024 (2023 – 24 percent) and 29 percent (2023 – 24 percent) for the first nine months of 2024.

The Company’s Canadian drilling operations recorded 3,861 operating days in the third quarter of 2024, compared to 3,262 operating days for the third quarter of 2023, an increase of 18 percent. For the nine months ended September 30, 2024, the Company recorded 10,064 operating days compared to 9,193 days for the nine months ended September 30, 2023, an increase of nine percent. Canadian well servicing hours increased by 14 percent to 12,161 operating hours in the third quarter of 2024 compared to 10,624 operating hours in the corresponding period of 2023. For the nine months ended September 30, 2024, Canadian well servicing hours remained consistent year over year.

The financial results for the Company’s Canadian operations for the third quarter of 2024 improved along with operating activity, largely as a result of the recent completion of the Trans Mountain Pipeline expansion.

During the first nine months of 2024, the Company transferred 23 under-utilized Canadian drilling rigs into its operations reserve fleet.

UNITED STATES OILFIELD SERVICES

The Company’s United States operations recorded revenue of $216.2 million in the third quarter of 2024, a decrease of 16 percent from the $257.7 million recorded in the corresponding period of the prior year. During the nine months ended September 30, 2024, revenue of $633.2 million was recorded, a decrease of 22 percent from the $809.1 million recorded in the corresponding period of the prior year.

The Company’s United States operations accounted for 50 percent of the Company’s revenue in the third quarter of 2024 (2023 – 58 percent) and 50 percent of the Company’s revenue in the first nine months of 2024 (2023 – 60 percent).

Drilling rig operating days decreased by 14 percent to 3,065 operating days in the third quarter of 2024 from 3,581 operating days in the third quarter of 2023 and decreased by 27 percent to 9,111 operating days in the first nine months of 2024 from 12,500 operating days in the first nine months of 2023. United States well servicing recorded 35,518 operating hours in the third quarter of 2024 which was a 10 percent increase from 32,397 operating hours recorded in the third quarter of 2023. For the first nine months of 2024, well servicing activity increased by seven percent to 97,081 operating hours from 90,961 operating hours in the first nine months of 2023.

Operating and financial results for the Company’s United States operations in the first nine months of 2024 were adversely impacted by the recent customer M&A activity, customer capital discipline and depressed natural gas commodity prices.

During the first nine months of 2024, the Company transferred six under-utilized United States drilling rigs into its reserve fleet.

INTERNATIONAL OILFIELD SERVICES

The Company’s international operations recorded revenue of $87.4 million in the third quarter of 2024, a 12 percent increase from the $78.4 million recorded in the corresponding period of the prior year. International revenues for the nine months ended September 30, 2024, increased 17 percent to $261.7 million from $223.2 million recorded for the nine months ended September 30, 2023.

The Company’s international operations contributed 20 percent of the total revenue in the third quarter of 2024 (2023 – 18 percent) and 21 percent of the Company’s revenue in the first nine months of 2024 (2023 – 16 percent).

International operating days for the three months ended September 30, 2024, totaled 1,269 operating days, fairly consistent with 1,265 operating days in the same period of 2023. For the nine months ended September 30, 2024, international operating days totaled 3,843 operating days compared to 3,616 operating days for the nine months ended September 30, 2023, an increase of six percent.

Operating and financial results from international operations reflect positive industry conditions that supported increased drilling activity and rig revenue rates.

During the first nine months of 2024, the Company transferred one under-utilized international drilling rig into its reserve fleet.

DEPRECIATION

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Depreciation |

91,028 |

76,957 |

18 |

261,793 |

229,647 |

14 |

|||||

Depreciation expense totaled $91.0 million for the third quarter of 2024 compared with $77.0 million for the third quarter of 2023, an increase of 18 percent. Depreciation expense for the first nine months of 2024 increased by 14 percent, to $261.8 million compared with $229.6 million for the same period of 2023. The increase in depreciation primarily is the result of drilling rigs moving into the reserve fleet since the beginning of the year, which are depreciated on an accelerated basis.

GENERAL AND ADMINISTRATIVE

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

General and administrative |

13,805 |

13,883 |

(1) |

44,361 |

43,063 |

3 |

|||||

|

% of revenue |

3.2 |

3.1 |

3.5 |

3.2 |

|||||||

General and administrative expense decreased one percent to $13.8 million (3.2 percent of revenue) for the third quarter of 2024 compared to $13.9 million (3.1 percent of revenue) for the third quarter of 2023. For the nine months ended September 30, 2024, general and administrative expense totaled $44.4 million (3.5 percent of revenue) compared to $43.1 million (3.2 percent of revenue) for the nine months ended September 30, 2023. General and administrative expense increased primarily due to annual wage increases.

FOREIGN EXCHANGE AND OTHER (GAIN) LOSS

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Foreign exchange and other (gain) loss |

(7,973) |

4,005 |

nm |

(3,309) |

9,778 |

nm |

|||||

|

nm – calculation not meaningful |

Included in this amount is the impact of foreign currency fluctuations in the Company’s subsidiaries that have functional currencies other than the Canadian dollar.

INTEREST EXPENSE

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Interest expense |

23,772 |

31,265 |

(24) |

75,790 |

97,223 |

(22) |

|||||

Interest expense was incurred on the Company’s Credit and Term Facilities, capital lease and other obligations.

Interest expense decreased by 22 percent for the first nine months of 2024 compared to the same period of 2023, as a result of lower debt levels and reduced effective interest rates. The Company remains committed to disciplined capital allocation and debt repayment.

INCOME TAXES (RECOVERY)

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Current income taxes |

655 |

789 |

(17) |

2,137 |

1,957 |

9 |

|||||

|

Deferred taxes income (recovery) |

2,142 |

(858) |

nm |

(1,971) |

4,998 |

nm |

|||||

|

Total income taxes (recovery) |

2,797 |

(69) |

nm |

166 |

6,955 |

(98) |

|||||

|

nm – calculation not meaningful |

FUNDS FLOW FROM OPERATIONS AND WORKING CAPITAL

|

($ thousands, except per common share data) |

Three months ended September 30 |

Nine months ended September 30 |

|||||||||

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

||||||

|

Cash provided by operating activities |

103,201 |

105,566 |

(2) |

323,481 |

376,911 |

(14) |

|||||

|

Funds flow from operations |

116,914 |

119,596 |

(2) |

323,602 |

354,651 |

(9) |

|||||

|

Funds flow from operations per common share |

$0.64 |

$0.65 |

(2) |

$1.76 |

$1.93 |

(9) |

|||||

|

Working capital (deficit) 1 |

(8,128) |

15,780 |

nm |

(8,128) |

15,780 |

nm |

|||||

|

nm – calculation not meaningful |

|

1 Comparative figure as at December 31, 2023 |

During the three months ended September 30, 2024, the Company generated funds flow from operations of $116.9 million ($0.64 per common share) compared to funds flow from operations of $119.6 million ($0.65 per common share) for the three months ended September 30, 2023, a decrease of two percent. For the nine months ended September 30, 2024, the Company generated funds flow from operations of $323.6 million ($1.76 per common share), a decrease of nine percent from $354.7 million ($1.93 per common share) for the nine months ended September 30, 2023. The decrease in funds flow from operations for the nine months ended September 30, 2024, compared to the same period of 2023, is largely due to the decrease in net income and operating activity year over year.

At September 30, 2024, the Company’s working capital deficit was $8.1 million, compared to a working capital surplus of $15.8 million at December 31, 2023. The decrease in working capital is the result of lower net income, despite higher operating activity compared to the fourth quarter of 2023.

The Company’s existing bank facility provides for total borrowings of $850.0 million, of which $41.8 million was undrawn and available as at September 30, 2024.

INVESTING ACTIVITIES

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Purchase of property and equipment |

(37,378) |

(37,959) |

(2) |

(140,573) |

(144,283) |

(3) |

|||||

|

Proceeds from disposals of property and equipment |

3,844 |

8,891 |

(57) |

15,231 |

12,345 |

23 |

|||||

|

Distribution to non-controlling interest |

(500) |

— |

nm |

(500) |

— |

nm |

|||||

|

Net change in non-cash working capital |

4,300 |

(2,052) |

nm |

28,625 |

1,717 |

nm |

|||||

|

Cash used in investing activities |

(29,734) |

(31,120) |

(4) |

(97,217) |

(130,221) |

(25) |

|||||

|

nm – calculation not meaningful |

Net purchases of property and equipment for the third quarter of 2024 totaled $33.5 million (2023 – $29.1 million). Net purchases of property and equipment during the first nine months of 2024 totaled $125.3 million (2023 – $131.9 million). The purchase of property and equipment for the first nine months of 2024 consists of $9.2 million in upgrade and growth capital and $131.4 million in maintenance capital.

FINANCING ACTIVITIES

|

Three months ended September 30 |

Nine months ended September 30 |

||||||||||

|

($ thousands) |

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|||||

|

Proceeds from long-term debt |

9,415 |

5,273 |

79 |

66,129 |

41,820 |

58 |

|||||

|

Repayments of long-term debt |

(54,126) |

(59,307) |

(9) |

(201,150) |

(197,036) |

2 |

|||||

|

Lease obligation principal repayments |

(5,459) |

(1,912) |

nm |

(10,251) |

(12,299) |

(17) |

|||||

|

Interest paid |

(23,429) |

(17,000) |

38 |

(75,987) |

(81,422) |

(7) |

|||||

|

Issuance of common shares under share option plan |

30 |

— |

nm |

226 |

— |

nm |

|||||

|

Purchase of common shares held in trust |

(544) |

(496) |

10 |

(1,576) |

(1,443) |

9 |

|||||

|

Cash used in financing activities |

(74,113) |

(73,442) |

1 |

(222,609) |

(250,380) |

(11) |

|||||

|

nm – calculation not meaningful |

On October 13, 2023, the Company amended and restated its existing credit agreement with its syndicate of lenders, which provides a revolving Credit Facility and a three-year $369.0 million Term Facility. The amendments include an extension to the maturity date of the now $850.0 million Credit Facility to the earlier of (i) the date that is six months prior to the earliest maturity of any future Senior Notes, and (ii) October 13, 2026. The Credit Facility includes a reduction of the facility by $75.0 million at the end of the fourth quarter of 2024 and a further reduction of $75.0 million by the end of the second quarter of 2025. The final size of the Credit Facility will then be $700.0 million.

The Term Facility requires repayments of at least $27.7 million each quarter beginning in the first quarter of 2024 to the fourth quarter 2025; and then repayments of at least $36.9 million each quarter from the first quarter 2026 to the fourth quarter 2026.

The amended and restated Credit Facility provides the Company with continued access to revolver capacity in a dynamic industry environment.

On June 26, 2024, the Company amended and restated its existing credit agreement with its syndicate of lenders to include a US $50.0 million secured Letter of Credit Facility and various updates regarding the replacement of the Canadian Dollar Offered Rate (“CDOR”) with the Canadian Overnight Repo Rate Average (“CORRA”). Furthermore, the Company finalized a US $25.0 million unsecured Letter of Credit Facility in the third quarter of 2024.

As at September 30, 2024, the amount of available borrowings under the Credit Facility was $41.8 million As at September 30, 2024, the amount available was US $28.5 million on the Letter of Credit Facility.

The current capital structure of the Company consisting of the Credit Facility and the Term Facility, allows the Company to utilize funds flow generated to reduce debt in the near term with greater flexibility than a more non-callable weighted capital structure.

Covenants

The following is a list of the Company’s currently applicable covenants pursuant to the Credit Facility and the associated calculations as at September 30, 2024:

|

Covenant |

September 30, 2024 |

|||

|

The Credit Facility |

||||

|

Consolidated Net Debt to Consolidated EBITDA 1 |

≤ 4.00 |

2.34 |

||

|

Consolidated EBITDA to Consolidated Interest Expense1,2 |

≥ 2.50 |

4.52 |

||

|

Consolidated Net Senior Debt to Consolidated EBITDA1,3 |

≤ 2.50 |

2.30 |

|

1 |

Consolidated Net Debt is defined as consolidated total debt, less cash and cash equivalent. Consolidated EBITDA, as defined in the Company’s Credit Facility agreement, is used in determining the Company’s compliance with its covenants. The Consolidated EBITDA is substantially similar to Adjusted EBITDA. |

|

2 |

Consolidated Interest Expense is defined as all interest expense calculated on twelve month rolling consolidated basis. |

|

3 |

Consolidated Net Senior Debt is defined as Consolidated Total Debt minus subordinated debt, cash and cash equivalent. |

As at September 30, 2024, the Company was in compliance with all covenants related to the Credit Facility.

The Credit Facility

The amended and restated credit agreement, a copy of which is available on SEDAR+, provides the Company with its Credit Facility and includes requirements that the Company comply with certain covenants including a Consolidated Net Debt to Consolidated EBITDA ratio, a Consolidated EBITDA to Consolidated Interest Expense ratio and a Consolidated Net Senior Debt to Consolidated EBITDA ratio.

OUTLOOK

Industry Overview

The global outlook for oilfield services continues to be constructive and supports steady demand for services. Crude oil supply and demand fundamentals remain tight but balanced, with moderated supply from OPEC+ nations. However, economic conditions, geopolitical tensions, renewed hostilities in areas of the Middle East, and the ongoing Russia–Ukraine conflict continue to impact global commodity prices and add uncertainty to the global crude demand outlook over the short-term. As a result, global crude prices declined in the third quarter of 2024 and have since been volatile into the fourth quarter with the benchmark price of West Texas Intermediate (“WTI“) averaging US $82/bbl in July, $77/bbl in August, $70/bbl in September and $72/bbl in October.

Over the short-term, depressed natural gas prices and recent customer M&A activity in the Company’s United States operating region have adversely impacted drilling programs. Over the long-term, the Company expects customer consolidation will be positive for oilfield services activity and facilitate relatively consistent drilling programs. Moreover, the results of the upcoming Presidential and Congressional elections in the United States may impact future oilfield activity in the region. Offsetting the prevailing short-term softness in the United States market, Canadian activity has improved year-over-year as result of the completion of the Trans Mountain Pipeline expansion project. Furthermore, the pending activation of the Coastal GasLink Pipeline and several liquefied natural gas (“LNG“) projects, including LNG Canada, are expected to support increased activity in Canada over the medium-to-long term.

The Company remains committed to disciplined capital allocation and debt repayment. The Company has targeted approximately $200.0 million in debt reduction for the 2024 year. In addition, from the period beginning 2023 to the end of 2025, the Company reaffirms its previously announced targeted debt reduction of approximately $600.0 million. If industry conditions change, these targets may be increased or decreased.

Canadian Activity

Canadian activity, representing 30 percent of total revenue in the first nine months of 2024, increased in the third quarter as operations exited seasonal spring break-up. Activity in Canada is expected to remain steady in the fourth quarter of 2024 and increase in the first quarter of 2025 as operations enter the winter drilling season. In the Canadian market, additional pipeline and transportation capacity and positive market conditions are expected to support strong and steady activity in 2025.

As of October 31, 2024, of our 94 marketed Canadian drilling rigs, approximately 57 percent were engaged under term contracts of various durations. Approximately 43 percent of our contracted rigs have a remaining term of six months or longer, although they may be subject to early termination.

United States Activity

United States activity, representing 50 percent of total revenue in the first nine months of 2024, improved in the third quarter of 2024 in comparison to the second quarter of 2024. The quarter-over-quarter increase was primarily due to rig activations in the Company’s California and Rockies operating regions. Activity in the United States is expected to remain steady in the fourth quarter of 2024 and into 2025.

As of October 31, 2024, of our 77 marketed United States drilling rigs, approximately 55 percent were engaged under term contracts of various durations. Approximately 10 percent of our contracted rigs have a remaining term of six months or longer, although they may be subject to early termination.

International Activity

International activity, representing 20 percent of total revenue in the first nine months of 2024, was steady in the third quarter as one rig in Oman went on standby and Australia activity decreased by one rig. Offsetting the declines was a one rig addition in Argentina in the third quarter of 2024. International activity is expected to modestly decline in the fourth quarter of 2024 as an additional rig in Oman is expected to go on standby, offset by an anticipated one rig addition in Venezuela.

Activity in the Company’s Middle East segment declined by one rig going on standby in Oman in the third quarter. Activity is expected to decline by a second rig going on standby in Oman in the fourth quarter of 2024. Currently, the Company has one active and two standby rigs in Oman, two rigs active in Bahrain, and two rigs active in Kuwait. Activity is expected to increase in 2025, inasmuch as the two rigs on standby in Oman are expected to commence active operations.

Activity in Australia declined by one rig in the third quarter of 2024 and is expected to remain steady at seven rigs in the fourth quarter.

Operations in Argentina improved by one rig in the third quarter of 2024 and are expected to remain steady at two rigs active in the fourth quarter. Operations in Venezuela, which were dormant for several years, remained steady at one rig active in the third quarter and are expected to improve by one rig to a total of two rigs active in the fourth quarter of 2024.

As of October 31, 2024, of our 31 marketed international drilling rigs, approximately 58 percent were engaged under term contracts of various durations. Approximately 61 percent of our contracted rigs have a remaining term of six months or longer, although they may be subject to early termination.

RISK AND UNCERTAINTIES

The Company is subject to numerous risks and uncertainties. A summary discussion of certain risks faced by the Company may be found hereinbelow and a fulsome discussion is included under the “Risk Factors” section of the Company’s Annual Information Form (“AIF“) and the “Risks and Uncertainties” section of the Company’s Management’s Discussion & Analysis (“MD&A“) for the year ended December 31, 2023, which are available under the Company’s SEDAR+ profile at www.sedarplus.com.

Other than as described within this document, the Company’s risk factors and management of those risks have not changed substantially from those as disclosed in the AIF. Additional risks and uncertainties not presently known by the Company, or that the Company does not currently anticipate or deem material, may also impair the Company’s future business operations or financial condition. If any such potential events, whether described in the risk factors in this document or the Company’s AIF or otherwise actually occur, or described events intensify, overall business, operating results and the financial condition of the Company could be materially adversely affected.

CONFERENCE CALL

A conference call will be held to discuss the Company’s third quarter 2024 results at 10:00 a.m. MDT (12:00 p.m. EDT) on Friday, November 1, 2024. The conference call number is 1-888-510-2154 and the conference call ID is: 11652. A taped recording of the conference call will be available until November 8, 2024, by dialing 1-888-660-6345 and entering the reservation number 11652#. A live broadcast may be accessed through the Company’s website at www.ensignenergy.com/presentations.

Ensign Energy Services Inc. is an international oilfield services contractor and is listed on the Toronto Stock Exchange under the trading symbol ESI.

Ensign Energy Services Inc.

Consolidated Statements of Financial Position

|

As at |

September 30 |

December 31 |

||

|

(Unaudited – in thousands of Canadian dollars) |

||||

|

Assets |

||||

|

Current Assets |

||||

|

Cash |

$ 24,517 |

$ 20,501 |

||

|

Accounts receivable |

313,030 |

304,544 |

||

|

Inventories, prepaid, investments and other |

54,697 |

56,809 |

||

|

Total current assets |

392,244 |

381,854 |

||

|

Property and equipment |

2,280,580 |

2,356,487 |

||

|

Deferred income taxes |

210,987 |

209,645 |

||

|

Total assets |

$ 2,883,811 |

$ 2,947,986 |

||

|

Liabilities |

||||

|

Current Liabilities |

||||

|

Accounts payable and accruals |

$ 265,178 |

$ 231,838 |

||

|

Share-based compensation |

8,042 |

11,014 |

||

|

Income taxes payable |

3,798 |

4,176 |

||

|

Current portion of lease obligation |

12,654 |

8,346 |

||

|

Current portion of long-term debt |

110,700 |

110,700 |

||

|

Total current liabilities |

400,372 |

366,074 |

||

|

Share-based compensation |

6,098 |

6,606 |

||

|

Long-term debt |

980,173 |

1,099,649 |

||

|

Lease obligations |

12,825 |

11,589 |

||

|

Income tax payable |

7,550 |

8,809 |

||

|

Deferred income taxes |

148,179 |

146,497 |

||

|

Total liabilities |

1,555,197 |

1,639,224 |

||

|

Shareholders’ Equity |

||||

|

Shareholders’ capital |

268,299 |

267,482 |

||

|

Contributed surplus |

22,902 |

23,750 |

||

|

Accumulated other comprehensive income |

275,186 |

254,765 |

||

|

Retained earnings |

762,227 |

762,765 |

||

|

Total shareholders’ equity |

1,328,614 |

1,308,762 |

||

|

Total liabilities and shareholders’ equity |

$ 2,883,811 |

$ 2,947,986 |

Ensign Energy Services Inc.

Consolidated Statements of (Loss) Income

|

Three months ended |

Nine months ended |

|||||||

|

September 30 |

September 30 |

September 30 |

September 30 |

|||||

|

(Unaudited – in thousands of Canadian dollars, except |

||||||||

|

Revenue |

$ 434,617 |

$ 444,405 |

$ 1,257,716 |

$ 1,361,227 |

||||

|

Expenses |

||||||||

|

Oilfield services |

301,763 |

313,227 |

876,628 |

956,929 |

||||

|

Depreciation |

91,028 |

76,957 |

261,793 |

229,647 |

||||

|

General and administrative |

13,805 |

13,883 |

44,361 |

43,063 |

||||

|

Share-based compensation |

3,475 |

12,256 |

7,541 |

7,835 |

||||

|

Foreign exchange and other (gain) loss |

(7,973) |

4,005 |

(3,309) |

9,778 |

||||

|

Total expenses |

402,098 |

420,328 |

1,187,014 |

1,247,252 |

||||

|

Income before interest expense, accretion of deferred financing charges and other gains and |

32,519 |

24,077 |

70,702 |

113,975 |

||||

|

Loss (gain) on asset sale |

177 |

(4,316) |

(6,231) |

(6,584) |

||||

|

Interest expense |

23,772 |

31,265 |

75,790 |

97,223 |

||||

|

Accretion of deferred financing charges |

417 |

2,200 |

1,251 |

6,599 |

||||

|

Income (loss) before income taxes |

8,153 |

(5,072) |

(108) |

16,737 |

||||

|

Income taxes (recovery) |

||||||||

|

Current income taxes |

655 |

789 |

2,137 |

1,957 |

||||

|

Deferred income taxes (recovery) |

2,142 |

(858) |

(1,971) |

4,998 |

||||

|

Total income taxes (recovery) |

2,797 |

(69) |

166 |

6,955 |

||||

|

Net income (loss) |

$ 5,356 |

$ (5,003) |

$ (274) |

$ 9,782 |

||||

|

Net income (loss) attributable to: |

||||||||

|

Common shareholders |

5,268 |

(5,229) |

(538) |

9,314 |

||||

|

Non-controlling interests |

88 |

226 |

264 |

468 |

||||

|

5,356 |

(5,003) |

(274) |

9,782 |

|||||

|

Net income (loss) attributable to common |

||||||||

|

Basic |

$ 0.03 |

$ (0.03) |

$ 0.00 |

$ 0.05 |

||||

|

Diluted |

$ 0.03 |

$ (0.03) |

$ 0.00 |

$ 0.05 |

||||

Ensign Energy Services Inc.

Consolidated Statements of Cash Flows

|

Three months ended |

Nine months ended |

|||||||

|

September 30 2024 |

September 30 2023 |

September 30 2024 |

September 30 2023 |

|||||

|

(Unaudited – in thousands of Canadian dollars) |

||||||||

|

Cash provided by (used in) |

||||||||

|

Operating activities |

||||||||

|

Net income (loss) |

$ 5,356 |

$ (5,003) |

$ (274) |

$ 9,782 |

||||

|

Items not affecting cash |

||||||||

|

Depreciation |

91,028 |

76,957 |

261,793 |

229,647 |

||||

|

Loss (gain) on asset sale |

177 |

(4,316) |

(6,231) |

(6,584) |

||||

|

Share-based compensation, net cash settlements |

3,834 |

5,935 |

(1,439) |

43 |

||||

|

Unrealized foreign exchange and other |

(9,812) |

13,416 |

(5,317) |

12,943 |

||||

|

Accretion of deferred financing charges |

417 |

2,200 |

1,251 |

6,599 |

||||

|

Interest expense |

23,772 |

31,265 |

75,790 |

97,223 |

||||

|

Deferred income taxes (recovery) |

2,142 |

(858) |

(1,971) |

4,998 |

||||

|

Funds flow from operations |

116,914 |

119,596 |

323,602 |

354,651 |

||||

|

Net change in non-cash working capital |

(13,713) |

(14,030) |

(121) |

22,260 |

||||

|

Cash provided by operating activities |

103,201 |

105,566 |

323,481 |

376,911 |

||||

|

Investing activities |

||||||||

|

Purchase of property and equipment |

(37,378) |

(37,959) |

(140,573) |

(144,283) |

||||

|

Proceeds from disposals of property and equipment |

3,844 |

8,891 |

15,231 |

12,345 |

||||

|

Distribution to non-controlling interest |

(500) |

— |

(500) |

— |

||||

|

Net change in non-cash working capital |

4,300 |

(2,052) |

28,625 |

1,717 |

||||

|

Cash used in investing activities |

(29,734) |

(31,120) |

(97,217) |

(130,221) |

||||

|

Financing activities |

||||||||

|

Proceeds from long-term debt |

9,415 |

5,273 |

66,129 |

41,820 |

||||

|

Repayments of long-term debt |

(54,126) |

(59,307) |

(201,150) |

(197,036) |

||||

|

Lease obligation principal repayments |

(5,459) |

(1,912) |

(10,251) |

(12,299) |

||||

|

Interest paid |

(23,429) |

(17,000) |

(75,987) |

(81,422) |

||||

|

Issuance of common shares under share option plan |

30 |

— |

226 |

— |

||||

|

Purchase of common shares held in trust |

(544) |

(496) |

(1,576) |

(1,443) |

||||

|

Cash used in financing activities |

(74,113) |

(73,442) |

(222,609) |

(250,380) |

||||

|

Net (decrease) increase in cash |

(646) |

1,004 |

3,655 |

(3,690) |

||||

|

Effects of foreign exchange on cash |

(63) |

2,002 |

361 |

887 |

||||

|

Cash – beginning of period |

25,226 |

44,071 |

20,501 |

49,880 |

||||

|

Cash – end of period |

$ 24,517 |

$ 47,077 |

$ 24,517 |

$ 47,077 |

||||

Ensign Energy Services Inc.

Non-GAAP Measures

Adjusted EBITDA, Adjusted EBITDA per common share, working capital and Consolidated EBITDA. These non-GAAP measures do not have any standardized meaning prescribed by IFRS and accordingly, may not be comparable to similar measures used by other companies. The non-GAAP measures included in this news release should not be considered as an alternative to, or more meaningful than, the IFRS measure from which they are derived or to which they are compared.

Adjusted EBITDA is used by management and investors to analyze the Company’s profitability based on the Company’s principal business activities prior to how these activities are financed, how assets are depreciated, amortized and how the results are taxed in various jurisdictions. Additionally, in order to focus on the core business alone, amounts are removed related to foreign exchange, share-based compensation expense, the sale of assets and fair value adjustments on financial assets and liabilities, as the Company does not deem these to relate to its core drilling and well services business. Adjusted EBITDA is not intended to represent income (loss) as calculated in accordance with IFRS.

|

ADJUSTED EBITDA |

Three months ended |

Nine months ended |

||||||||

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

||||||

|

Income (loss) before income taxes |

8,153 |

(5,072) |

(108) |

16,737 |

||||||

|

Add-back/(deduct): |

||||||||||

|

Interest expense |

23,772 |

31,265 |

75,790 |

97,223 |

||||||

|

Accretion of deferred financing charges |

417 |

2,200 |

1,251 |

6,599 |

||||||

|

Depreciation |

91,028 |

76,957 |

261,793 |

229,647 |

||||||

|

Share-based compensation |

3,475 |

12,256 |

7,541 |

7,835 |

||||||

|

Gain on asset sale |

177 |

(4,316) |

(6,231) |

(6,584) |

||||||

|

Foreign exchange and other (gain) loss |

(7,973) |

4,005 |

(3,309) |

9,778 |

||||||

|

Adjusted EBITDA |

119,049 |

117,295 |

336,727 |

361,235 |

||||||

Consolidated EBITDA

Consolidated EBITDA, as defined in the Company’s Credit Facility agreement, is used in determining the Company’s compliance with its covenants. The Consolidated EBITDA is substantially similar to Adjusted EBITDA. Consolidated EBITDA is calculated on a rolling twelve-month basis.

Working Capital

Working capital is defined as current assets less current liabilities as reported on the consolidated statements of financial position.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS

Certain statements herein constitute forward-looking statements or information (collectively referred to herein as “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements generally can be identified by the words “believe”, “anticipate”, “expect”, “plan”, “estimate”, “target”, “continue”, “could”, “intend”, “may”, “potential”, “predict”, “should”, “will”, “objective”, “project”, “forecast”, “goal”, “guidance”, “outlook”, “effort”, “seeks”, “schedule”, “contemplates” or other expressions of a similar nature suggesting future outcome or statements regarding an outlook.

Disclosure related to expected future commodity pricing or trends, revenue rates, equipment utilization or operating activity levels, operating costs, capital expenditures and other prospective guidance provided herein including, but not limited to, information provided in the “Funds Flow from Operations and Working Capital” section regarding the Company’s expectation that funds generated by operations combined with current and future credit facilities will support current operating and capital requirements, information provided in the “Financial Instruments” section regarding Venezuela and information provided in the “Outlook” section regarding the general outlook for 2024 and beyond, are examples of forward-looking statements.

Forward-looking statements are not representations or guarantees of future performance and are subject to certain risks and unforeseen results. The reader should not place undue reliance on forward-looking statements as there can be no assurance that the plans, initiatives, projections, anticipations or expectations upon which they are based will occur. The forward-looking statements are based on current assumptions, expectations, estimates and projections about the Company and the industries and environments in which the Company operates, which speak only as of the date such statements were made or as of the date of the report or document in which they are contained. These assumptions include, among other things: the fluctuation in commodity prices which may influence customers to modify their capital programs; the status of current negotiations with the Company’s customers and vendors; customer focus on safety performance; royalty regimes and effects of regulation by government agencies; existing term contracts that may not be renewed or are terminated prematurely; the Company’s ability to provide services on a timely basis and successfully bid on new contracts; successful integration of acquisitions; future operating costs; the general stability of the economic and political environments in the jurisdictions where we operate; inflation, interest rate and exchange rate expectations; pandemics; and impacts of geopolitical events such as the hostilities in the Middle East and between Ukraine and the Russian Federation, and the global community responses thereto; that the Company will have sufficient cash flow, debt or equity sources or other financial resources required to fund its capital and operating expenditures and requirements as needed; that the Company’s conduct and results of operations will be consistent with its expectations; and other matters.

The forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risk factors include, among others: general economic and business conditions which will, among other things, impact demand for and market prices of the Company’s services and the ability of the Company’s customers to pay accounts receivable balances; volatility of and assumptions regarding commodity prices; foreign exchange exposure; fluctuations in currency and interest rates; inflation; economic conditions in the countries and regions in which the Company conducts business; political uncertainty and civil unrest; the Company’s ability to implement its business strategy; impact of competition and industry conditions; risks associated with long-term contracts; force majeure events; artificial intelligence development and implementation; cyber-attacks; determinations by the Organization of Petroleum Exporting Countries (“OPEC“) and other countries (OPEC and various other countries are referred to as “OPEC+”) regarding production levels; loss of key customers; litigation risks, including the Company’s defence of lawsuits; risks associated with contingent liabilities and potential unknown liabilities; availability and cost of labour and other equipment, supplies and services; business interruption and casualty losses; the Company’s ability to complete its capital programs; operating hazards and other difficulties inherent in the operation of the Company’s oilfield services equipment; availability and cost of financing and insurance; access to credit facilities and debt capital markets; availability of sufficient cash flow to service and repay its debts; impairment of capital assets; the Company’s ability to amend or comply with covenants under the credit facility and other debt instruments; actions by governmental authorities; impact of and changes to laws and regulations impacting the Company and the Company’s customers, and the expenditures required to comply with them (including safety and environmental laws and regulations and the impact of climate change initiatives on capital and operating costs); safety performance; environmental contamination; shifting interest to alternative energy sources; environmental activism; the adequacy of the Company’s provision for taxes; tax challenges; the impact of, and the Company’s response to future pandemics; workforce and reliance on key management; technology; cybersecurity risks; seasonality and weather risks; risks associated with acquisitions and ability to successfully integrate acquisitions; risks associated with internal controls over financial reporting; the impact of the ongoing hostilities in the Middle East and between Ukraine and the Russian Federation and the global community responses thereto; the results of the upcoming United States Presidential and Congressional elections and other risks and uncertainties that may affect the Company’s business, assets, personnel, operations, revenues or expenses.

In addition, the Company’s operations and levels of demand for its services have been, and at times in the future may be, affected by political risks and developments, such as expropriation, nationalization, or regime change, and by national, regional and local laws and regulations such as changes in taxes, royalties and other amounts payable to governments or governmental agencies, environmental protection regulations, pandemics, pandemic mitigation strategies and the impact thereof upon the Company, its customers and its business, ongoing hostilities in the Middle East and between Ukraine and the Russian Federation, related potential future impact on the supply of oil and natural gas to Europe by Russia and the impact of global community responses to the ongoing conflicts, including the impact of shipping through the Red Sea and governmental energy policies, laws, rules or regulations that limit, restrict or impede exploration, development, production, transportation or consumption of hydrocarbons and/or incentivize development, production, transportation or consumption of alternative fuel or energy sources.

Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results from operations may vary in material respects from those expressed or implied by the forward-looking statements. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are interdependent upon other factors, and the Company’s course of action would depend upon its assessment of the future considering all information then available. Unpredictable or unknown factors not discussed herein could also have material adverse effects on forward-looking statements.

Readers are cautioned that the lists of important factors contained herein are not exhaustive. For additional information on these and other factors that could affect the Company’s business, operations or financial condition, refer to the “Risk Factors” section of the Company’s Annual Information Form for the year ended December 31, 2023 available on SEDAR+ at www.sedarplus.ca.

The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements contained herein are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE Ensign Energy Services Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/01/c1099.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/01/c1099.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

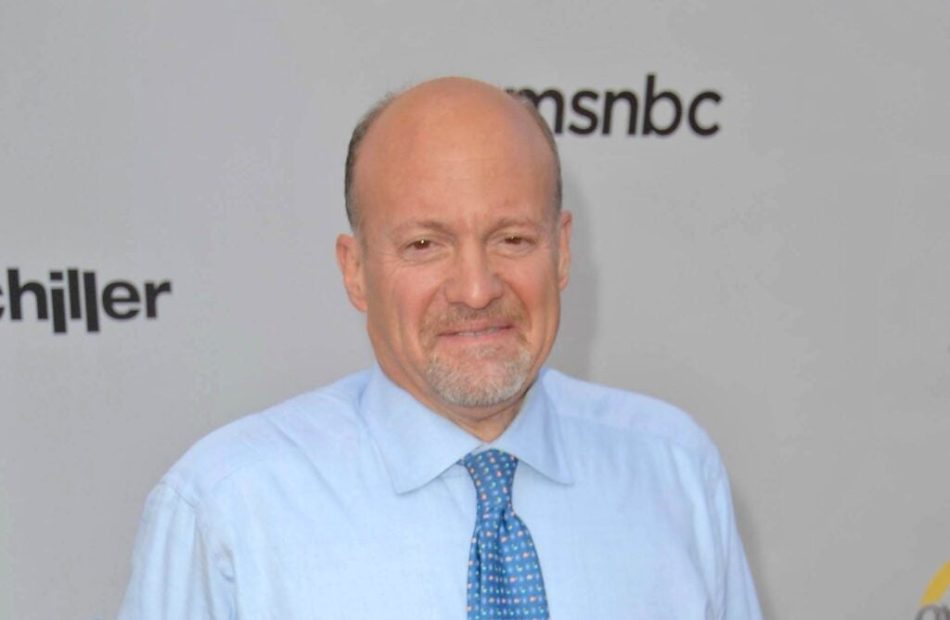

Jim Cramer Says Mark Zuckerberg Has 'Your Brain' As Meta Pours Billions Into Global Domination Strategy

While discussing Meta Platforms Inc.’s META third-quarter earnings report, financial analyst Jim Cramer made a striking statement about CEO Mark Zuckerberg‘s marketing prowess.

What Happened: On Thursday, during a conversation on CNBC’s Squawk on the Street, Cramer and Scott Wapner discussed Meta’s potential for long-term growth.

During this time, Cramer suggested that tech leaders like Zuckerberg operate on a different level, stating, “These guys think different from you and me.”

“They have a view which just says we want to dominate in this area. So we are going to spend a little more than others and we will dominate,” he added.

Cramer then used Procter & Gamble as an example, stating that if the company wanted to make Tide a global brand, it would need to pay Zuckerberg a significant amount.

In return, Zuckerberg could target 1.6 billion potential customers currently deciding between Tide and other brands.

“He can target them,” Cramer said, referring to Zuckerberg’s ability to identify potential customers. “He knows who is trying to decide. I’ve never seen anything like it. He has your brain.”

Why It Matters: Meta reported third-quarter revenue of $40.59 billion, surpassing analyst expectations of $40.29 billion. Adjusted earnings for the quarter came in at $6.03 per share, exceeding the forecasted $5.25 per share.

Meta projects fourth-quarter revenue between $45 billion and $48 billion, compared to an estimated $46.31 billion. For the full year 2024, expected total expenses are revised to $96 billion to $98 billion, down from previous guidance of $96 billion to $99 billion.

Despite the positive earnings report, Meta witnessed a drop in stocks during the after-hours trading. However, in his earlier post, Cramer dismissed concerns about worsening AI losses, underscoring that the tech giant is thriving with AI advancements.

Price Action: At the time of writing, Meta shares rose 0.14% to $568.40 in after-hours trading, following a 4.09% drop to $567.58 during the regular session, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prospera Energy Commences Restructure Initiatives at the Board Level to Attain PEI Potential

CALGARY, Alberta, Nov. 01, 2024 (GLOBE NEWSWIRE) — Prospera Energy Inc. TSX (“Prospera” or the “Corporation“)

Prospera announces the opportunistic appointment of Mr. Shubham Garg as Chairman of the Board of Directors. Previous Chairman, Mr. Mel Clifford has stepped down from the Board of Directors for personal reasons, effective October 31, 2024. The Board and Prospera express their sincere gratitude to Mr. Clifford for his dedication and contributions to PEI’s restructuring efforts out of bankruptcy.