VIX Index Notches Third-Strongest October Spike In An Election Year, S&P 500 Snaps 5-Month Winning Streak: Why Volatility 'Is Unlikely To Pull Back,' Analyst Says

The CBOE Volatility Index (VIX), often referred to as the market’s “fear gauge,” saw a sharp 34% increase in October, signaling intensified investor concern as the U.S. presidential election looms.

This spike marks the third-strongest October VIX increase for an election year, with only 2008 and 2020 witnessing larger jumps.

Excluding the extraordinary 52% spike in October 2008, driven by the financial crisis, and the 44% rise in October 2020 amid the COVID-19 pandemic, October 2024’s surge marks the highest volatility for an election-year October since the VIX’s index inception in 1990.

| Election Year | CBOE VIX (% change) | VIX Level (Close on 31/10) |

|---|---|---|

| October 1992 | 13.1 | 16.15 |

| October 1996 | 6.8 | 18.11 |

| October 2000 | 14.9 | 23.63 |

| October 2004 | 22.0 | 16.27 |

| October 2008 | 52.0 | 59.89 |

| October 2012 | 18.2 | 18.6 |

| October 2016 | 28.4 | 17.6 |

| October 2020 | 44.2 | 38.02 |

| October 2024 | 34.1 | 22.43 |

Political uncertainty is a significant driver of this volatility, with Vice President Kamala Harris and former President Donald Trump neck-and-neck in polling data, though Trump holds a substantial lead in betting markets.

Market-implied odds from CFTC-regulated platform Kalshi currently give Trump a 57% chance of re-election.

Concerns over the candidates’ fiscal policies and the country’s ballooning national debt levels are adding to market tension, as neither candidate has outlined a plan to tackle the fiscal risk.

S&P 500 Ends Five-Month Rally

Alongside political anxiety, disappointing earnings from major tech companies fueled a late-month selloff.

The S&P 500, as measured by the SPDR S&P 500 ETF Trust SPY, fell in October, snapping a five-month winning streak. Microsoft Corp. MSFT led the decline, dropping 6% on Thursday — its worst single-day performance in over two years — as guidance over 2025 revenue disappointed earnings.

Quincy Krosby, chief global strategist at LPL Financial, highlighted that mega-cap tech’s forward guidance disappointed markets, particularly around AI spending and the slower-than-expected integration of AI into Microsoft’s cloud services. “The market overall has been disappointed with mega tech guidance,” she said, highlighting the potential impact on market sentiment as the election draws near.

Analysts Warn of Further Volatility

Many analysts see no immediate end to the current bout of market anxiety.

Michael Gayed, CFA, commented, “I think the markets could be a little more prepared for a Trump win this time around, but I wouldn’t be surprised to see the VIX start to pick up again.”

David Morrison, senior market analyst at Trade Nation, echoed this sentiment, warning that “volatility remains elevated and is unlikely to pull back until there’s certainty over the result of next week’s Presidential Election.”

Morrison added that a decisive election outcome could alleviate some market fears, but with polling data as tight as it is, uncertainty is likely to persist.

Now Read:

Image:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Progress Completes Acquisition of ShareFile

ShareFile’s AI-powered, document-centric collaboration platform expands Progress’ industry-leading product portfolio and marks a major milestone in the company’s Total Growth Strategy

BURLINGTON, Mass., Oct. 31, 2024 (GLOBE NEWSWIRE) — Progress PRGS, the trusted provider of AI-powered infrastructure software, today announced the completion of the acquisition of ShareFile, a business unit of Cloud Software Group, Inc., providing a SaaS-native, AI-powered, document-centric collaboration platform, focusing on industry segments including business and professional services, financial services, industrial and healthcare.

“This acquisition marks the latest major milestone in Progress’ Total Growth Strategy, which is built on three pillars: Invest and Innovate, Acquire and Integrate and Drive Customer Success. The addition of ShareFile significantly enhances our product capabilities, benefiting our customers and meaningfully expanding the customer base we serve,” said Yogesh Gupta, CEO of Progress. “We are thrilled to welcome ShareFile customers and employees to the Progress community and look forward to a bright future with ShareFile now part of Progress.”

Progress products help organizations to develop, deploy and manage responsible AI-powered applications and experiences. ShareFile fits strategically with Progress’ Digital Experience portfolio to enable customers to deliver more efficient and effective client and team collaboration, while simplifying the sharing of documents and prioritizing security.

As previously announced, Progress acquired ShareFile for a purchase price of $875 million, funded with a combination of cash and Progress’ existing revolving credit facility. ShareFile is expected to add more than $240M in annual revenue and more than 86,000 customers to Progress.

About Progress

Progress PRGS empowers organizations to achieve transformational success in the face of disruptive change. Our software enables our customers to develop, deploy and manage responsible AI-powered applications and experiences with agility and ease. Customers get a trusted provider in Progress, with the products, expertise and vision they need to succeed. Over 4 million developers and technologists at hundreds of thousands of enterprises depend on Progress. Learn more at www.progress.com.

Note Regarding Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Progress has identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “should,” “expect,” “intend,” “plan,” “target,” “anticipate” and “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Risks, uncertainties and other important factors that could cause actual results to differ from those expressed or implied in the forward-looking statements include: uncertainties as to the effects of disruption from the acquisition of ShareFile (i.e., making it more difficult to maintain relationships with employees, licensees, other business partners or governmental entities); other business effects, including the effects of industry, economic or political conditions outside of Progress’ or ShareFile’s control; transaction costs; actual or contingent liabilities; uncertainties as to whether anticipated synergies will be realized; and uncertainties as to whether ShareFile’s business will be successfully integrated with Progress’ business. For further information regarding risks and uncertainties associated with Progress’ business, please refer to Progress’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended November 30, 2023. Progress undertakes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

| Press Inquiries: Erica McShane VP, Corporate Communications Progress Software +1 781-280-4000 pr@progress.com |

Investor Relations: Mike Micciche SVP, Investor Relations Progress Software +1 781-280-4000 Investor-relations@progress.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IPX1031 Spins Its Frightfully Fun 10-31 Day Video On 10/31

Get Ready to Crawl with Excitement!

CHICAGO, Oct. 31, 2024 /PRNewswire/ — National 1031 Qualified Intermediary leader, Investment Property Exchange Services, Inc. (IPX1031) celebrates October 31st with its Day of the 10-31 video. Halloween is here, and there is no more fitting day in the 1031 industry for a fun video showcasing what IPX1031 does best – helping you navigate the web of tax deferral. Whether you’re a real estate investor or a Halloween lover, IPX1031’s Itsy Bitsy Spider video will be a treat for you.

The video features the classic nursery rhyme character of “The Itsy Bitsy Spider,” but with a twist – the spider climbs up the tax deferral process. You’ll laugh, you’ll learn, and you might even scream – as this video alludes to the enticing benefits of tax deferral through a 1031 Exchange.

“Through a fun and lively video, we wanted to show real estate owners and investors how strategic tax planning can be advantageous by utilizing 1031 Exchanges,” said John Wunderlich, IPX1031 President.

Halloween can be frightening, but 1031 Exchanges don’t have to be. IPX1031 works with your advisors to make the 1031 Exchange process simple and stress-free. Don’t be afraid to check out IPX1031’s website or social media channels for even more 10-31 Day info on 1031 Exchanges. www.ipx1031.com

Because who doesn’t love a little extra deferral?

About IPX1031

Investment Property Exchange Services, Inc. (IPX1031) is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial FNF, a Fortune 500 company, IPX1031 provides industry leading security for exchange funds as well as expertise and experience in facilitating all types of 1031 Exchanges. IPX1031’s nationwide staff, which includes industry experts, veteran attorneys and accountants, are available to provide answers and guidance to clients and their legal and tax advisors. For more information about IPX1031 visit www.ipx1031.com.

For more information, contact:

Cindi Marinez, VP, National Marketing Director

cindi.marinez@ipx1031.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ipx1031-spins-its-frightfully-fun-10-31-day-video-on-1031-302293483.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ipx1031-spins-its-frightfully-fun-10-31-day-video-on-1031-302293483.html

SOURCE IPX1031

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Mixed as Apple Down, Amazon Up on Earnings: Markets Wrap

(Bloomberg) — Wall Street traders hoping for a clear direction on stocks after Thursday’s selloff didn’t get that in late hours amid a mixed bag of earnings from a pair of tech heavyweights.

Most Read from Bloomberg

A roughly $300 billion exchange-traded fund tracking the Nasdaq 100 (QQQ) struggled for direction after the close of regular trading. Apple Inc., the world’s most valuable company, fell 2% after reporting weaker-than-anticipated sales in China. Amazon.com Inc. climbed 4% on a bullish forecast. Intel Corp. jumped 9% as its outlook sparked optimism over a turnaround effort.

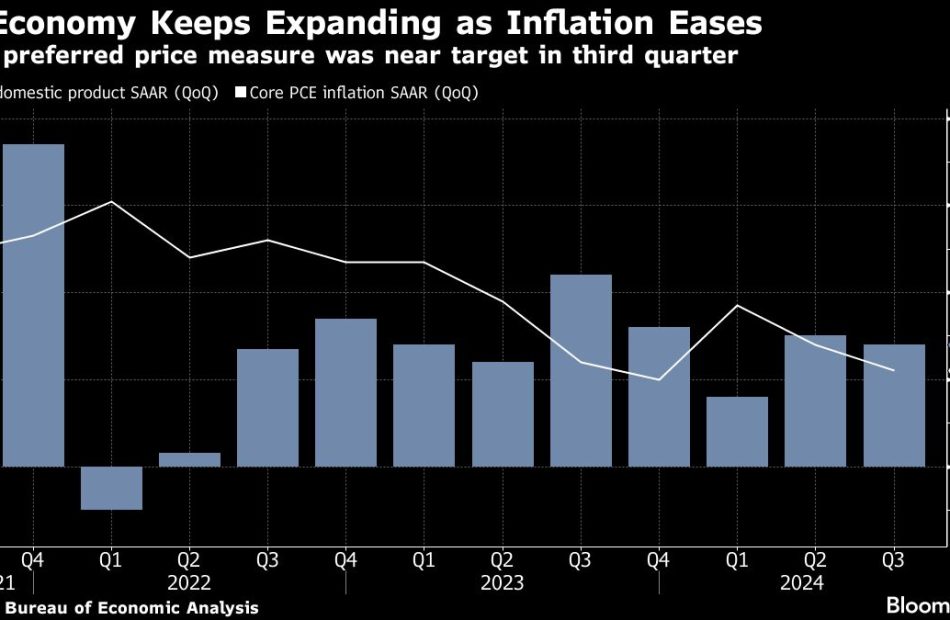

In regular hours, a 1.9% slide in the S&P 500 wiped out the gauge’s advance for October, halting a streak of monthly gains that would have been the longest since 2021. The Nasdaq 100 dropped 2.4%. Disappointing outlooks from Microsoft Corp. and Meta Platforms Inc. fueled concern that a nearly 45% surge in the megacaps that have powered the bull market might have gone too far.

“Halloween is bringing tricks, not treats to many investors,” said Steve Sosnick at Interactive Brokers. “The market’s mindset seems to be switching from one where anything AI-related was a reason for enthusiasm towards one where investors are looking for some returns on their massive spending.”

Those worries hit a market showing signs of exhaustion near record highs ahead of next week’s US election and the Federal Reserve decision. Moreover, there’s a nearly palpable narrative taking hold that the election – rather than offering a sense of certainty – will cause volatility to spike, noted Quincy Krosby at LPL Financial. That’s not to mention the jobs report on Friday.

Treasuries saw their biggest monthly loss in two years on bets the Fed won’t be too aggressive with rate cuts amid a strong economy. The dollar notched its best month since 2022.

The yen jumped as much as 1%, extending gains seen after Bank of Japan Governor Kazuo Ueda said that currency markets have had a major impact on the economy, pointing to another potential rate hike in coming months. Chancellor of the Exchequer Rachel Reeves sought to reassure the financial markets after her budget on Wednesday triggered a selloff in UK bonds.

Oil surged on a report Iran is planning a fresh attack on Israel. Gold retreated as some investors booked profit after the metal’s rally to a fresh record.

Why Altria Stock Was Surging Today

On Thursday, good news from one of the market’s favorite “sin stocks” drove its share price up by almost 8%. This lucky company was Altria (NYSE: MO); the cigarette maker’s latest quarterly earnings report was received most favorably by market players. The stock’s pop on the day was in market contrast to the 1.9% slump of the benchmark S&P 500 index.

That morning, Altria released its third-quarter figures, which were slightly higher than the consensus analyst estimates. The tobacco giant also reaffirmed its existing full-year guidance.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The quarter saw the company book $5.34 billion in net revenue, which was up by 1% from the same period of 2023. Meanwhile, non-GAAP (adjusted) net income improved over that time span, rising by nearly 4% to a shade under $2.36 billion ($1.38 per share).

Both headline numbers topped pundit projections, although not spectacularly. The consensus analyst expectation for revenue was $5.32 billion, and that for adjusted profitability was $1.35 per share.

For years, Altria has been contending with precipitous declines in the traditional cigarette market due to a general consumer move to more healthy lifestyle choices (in addition to concentrated anti-smoking efforts by authorities). However, vaping products and other consumption alternatives have found quite a niche in the market.

The company did well with next-generation products during the quarter. Its shipment volume for NJOY electric cigarette and vaping products more than doubled on a year-over-year basis, and that for its on! nicotine pouches saw a 46% increase.

Altria also maintained its adjusted net income guidance for the entirety of 2024; since this means growth over the 2023 numbers if fulfilled, the market found this encouraging. Management is expecting $5.07 to $5.15 per share for the line item, which would shake out to annual growth of at least 2.5%.

The company continues to do a decent job coping with the end of the Cigarette Era, although it remains to be seen whether next-generation products can ultimately offset the severe shrinking of the traditional segment.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Light & Wonder (LNW) Faces Scrutiny Over Gaming Revenue Claims- Hagens Berman

SAN FRANCISCO , Oct. 31, 2024 (GLOBE NEWSWIRE) — Shares in Light & Wonder, a leading gaming technology company, are under pressure following a recent court ruling that questioned the legality of its popular Dragon Train® slot machines. The ruling has raised questions about the propriety of Light & Wonder’s disclosures regarding the success of Dragon Train® and its prospects for continued revenue growth.

Hagens Berman encourages Light & Wonder, Inc. LNW investors who suffered substantial losses to submit your losses now. The firm also encourages persons with knowledge who may assist the investigation to contact its attorneys.

Visit: www.hbsslaw.com/investor-fraud/lnw

Contact the Firm Now: LNW@hbsslaw.com

844-916-0895

Investigation Into Light & Wonder, Inc. (LNW):

Aristocrat Technologies, a competitor, recently secured a preliminary injunction against Light & Wonder, alleging that the latter had misappropriated trade secrets in the development of Dragon Train®. The court found that Aristocrat was likely to succeed in demonstrating Light & Wonder’s wrongdoing and that the company had gained an unfair advantage.

The financial press has reported that Aristocrat’s allegations also involve two former Aristocrat designers who worked on a similar product, Dragon Link. The designers’ involvement in both products has raised questions about the originality of Dragon Train®.

Following the court ruling, Light & Wonder’s share price plummeted by 19% on September 24, 2024, wiping out approximately $1.9 billion in shareholder value.

Law firm Hagens Berman has announced an investigation into whether Light & Wonder may have misled investors about the legality and propriety of its reported gaming revenue growth. The firm is examining the company’s disclosures and the circumstances surrounding the development of Dragon Train®.

If you invested in Light & Wonder and have substantial losses, or have knowledge that may assist the firm’s investigation, submit your losses now »

If you’d like more information and answers to frequently asked questions about the Light & Wonder investigation, read more »

Whistleblowers: Persons with non-public information regarding Light & Wonder should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email LNW@hbsslaw.com.

About Hagens Berman

Hagens Berman is a global plaintiffs’ rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman’s team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hostaway Announces Strategic Integration with Lake.com to Enhance Vacation Rental Management

TORONTO, Oct. 31, 2024 /PRNewswire/ – Hostaway, the premier all-in-one vacation rental software and Airbnb management system, is pleased to announce its strategic integration with Lake.com, a leading online vacation rental platform. This collaboration is set to elevate the vacation rental management experience by merging Hostaway’s robust tools with Lake.com’s innovative solutions.

Highlights:

- Seamless Connectivity: Integrate Hostaway’s comprehensive management system with Lake.com’s platform for enhanced synchronization and efficiency.

- Enhanced Automation: Increase efficiency of daily work processes and introduce such features as auto-messaging and auto-invoicing.

- Broadened Market Reach: Increase demand and acquire more reservations with the help of Lake.com’s extensive network.

- Unified Management: Manage reservations, availability, and communications from a single, unified dashboard.

David Ciccarelli, CEO of Lake Inc., shared, “We’re excited to partner with Hostaway, a leader in vacation rental management. This collaboration will help us provide property owners with cutting-edge tools to manage their listings effortlessly, while also enhancing the experience for our guests. It’s a big step in our mission to make lakeside getaways seamless and memorable for everyone.”

Marcus Rader, CEO and Co-Founder of Hostaway, added,”Lake is a great tribute to how segmentation within the travel industry works. You have to find your niche, and stick to it. Lakes are some of the best ways of extending the seasonality too – shallow lakes get warm quickly in spring, while bigger lakes bring in warm air the entire fall. Having lived by the Great Lakes for a decade, I’m proud to see Lake.com as a Hostaway partner!”

Hostaway’s flexible and customizable platform will now be integrated with Lake.com, allowing property managers to automate and simplify their marketing, sales, communication, and operations processes. By leveraging Hostaway’s robust software, Lake.com aims to enhance the efficiency of property management, making it easier for property owners to manage their listings and bookings while delivering an exceptional experience to travelers.

To learn more, visit:

https://www.lake.com/integrations/hostaway/

About Lake.com

Lake.com specializes in vacation rentals within a 15-minute drive of lakes, bays, rivers and canals. Focusing on family, friendship, and caring for the natural world, Lake.com blends tradition with technology, offering a return to the simple pleasures of life for families vacationing in the great outdoors. For more information, visit https://www.lake.com.

About Hostaway

Hostaway provides a single package for end-to-end vacation rental software and Airbnb management from listing to bookings and everything in between. It begins with channel management and communication up to analytics and reporting, Hostaway helps property managers to grow their business. For more information, visit https://www.hostaway.com/.

![]() View original content:https://www.prnewswire.com/news-releases/hostaway-announces-strategic-integration-with-lakecom-to-enhance-vacation-rental-management-302292963.html

View original content:https://www.prnewswire.com/news-releases/hostaway-announces-strategic-integration-with-lakecom-to-enhance-vacation-rental-management-302292963.html

SOURCE Lake.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

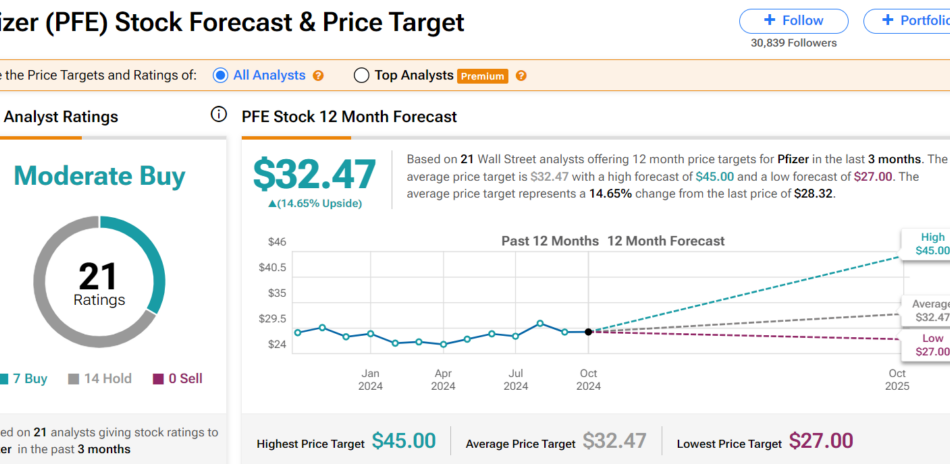

Is Pfizer (NYSE:PFE) a High-Yielding Dividend Stock Worth Buying?

In life, there’s a common expression that also carries over into the dividend investing world: If it seems too good to be true, it usually is too good to be true. Oftentimes, dividend stocks with 6% or higher yields are yield traps. This means that the dividend income they provide to shareholders seems great, but it isn’t sustainable. Now and then, though, I stumble across high-yielding dividend stocks that aren’t yield traps. I believe that one such example is Pfizer (PFE).

Interestingly, Pfizer’s 5.9% dividend yield is more than quadruple the 1.3% yield of the S&P 500 index (SPX). Despite the high yield, here is why I think the well-known healthcare stock is an income stock that warrants a Buy rating after its third-quarter earnings results.

On October 29th, Pfizer released its third-quarter financial results. The firm’s total revenue jumped 31.2% over the year-ago period to $17.7 billion, which topped the analyst consensus by $2.8 billion. Rising COVID-19 infections in the summer and early fall led to an uptick in demand for antiviral COVID-19 treatment, Paxlovid, according to CEO Albert Bourla. That mainly was what drove the 43.6% year-over-year spike in Primary Care segment revenue to nearly $9.1 billion in the third quarter.

In addition, Pfizer’s Oncology segment posted $4 billion in revenue, which was up 29.8% over the year-ago period. This was due to ongoing momentum from advanced prostate cancer treatment Xtandi and the recent launches of advanced bladder cancer therapy Padcev and lymphoma therapy Adcetris. The company’s Specialty Care segment reported $4.3 billion in revenue during the quarter, which was equivalent to a 14% year-over-year growth rate. That was made possible by the expansion of the healthcare provider base for the Vyndaqel rare heart disease medication family.

Pfizer also posted $1.06 in adjusted diluted EPS for the third quarter, which was comfortably ahead of the analyst consensus of $0.61. These results were fueled by topline performance as well as by improvements in operating structure and favorable tax rates. On the first point, ongoing cost reductions have improved the company’s profitability. That’s how adjusted diluted EPS growth significantly outpaced revenue growth in the quarter.

After coming down from its COVID-19 pandemic high, Pfizer looks like it is firmly on the road to recovery, which adds to my bullish outlook. The company expects to realize $4 billion of its $5.5 billion-plus in annual targeted savings in 2024. That’s thanks to its cost realignment program launched last October. The other $1.5 billion-plus in anticipated annual savings are expected to materialize by the end of 2027 from the first phase of the manufacturing optimization program.