Oak Ridge Financial Services, Inc. Announces Third Quarter 2024 Results and Quarterly Cash Dividend of $0.12 Per Share

OAK RIDGE, N.C., Oct. 31, 2024 (GLOBE NEWSWIRE) — Oak Ridge Financial Services, Inc. (“Oak Ridge”; or the “Company”) BKOR, the parent company of Bank of Oak Ridge (the “Bank”), announced unaudited financial results for the third quarter of 2024.

Third Quarter 2024 Highlights

- Earnings per share of $0.54, compared to $0.46 for the prior quarter and $0.55 for the third quarter of 2023.

- Return on equity of 9.56%, compared to 8.57% for the prior quarter and 10.63% for the third quarter of 2023.

- Dividends declared per common share of $0.12, unchanged from the prior quarter and up 20% from the third quarter of 2023.

- Tangible book value per common share of $22.78 as of quarter end, compared to $21.95 at the end of the prior quarter, and $20.26 at the end of the comparable period in 2023.

- Net interest margin of 3.81%, unchanged from the prior quarter and 3.83% for the third quarter of 2023.

- Efficiency ratio of 67.9%, compared to 70.0% for the prior quarter and 68.7% for the comparable period in 2023.

- Loans receivable of $505.5 million at quarter end, up 11.1% (annualized) from $466.8 million as of the prior year end, and up 11.2% from $454.5 million at the comparable quarter end in 2023.

- Nonperforming assets to total assets of 0.45% at quarter end, compared to 0.08% as of the prior quarter end and 0.08% at the comparable quarter end in 2023.

- Nonperforming assets were $2.9 million at quarter end, compared to $542,000 as of the prior quarter end and $412,000 at the comparable quarter end in 2023. $2.2 million of the total $2.4 million increase in nonperforming assets from the prior quarter end to the current quarter end were due to the guaranteed and nonguaranteed balances of four Small Business Administration (“SBA”) 7(a) loans moving to nonaccrual status during the third quarter of 2024. The balance of nonperforming loans guaranteed by the SBA was $1.8 million at quarter end, with no balances as of the prior quarter end and the comparable quarter end in 2023.

- Securities available-for-sale and held-to maturity of $102.4 million at quarter end, down 9.8% (annualized) from $110.6 million as of the prior year end, and down 5.9% from $108.9 million at the comparable quarter end in 2023.

- Total deposits of $510.5 million at quarter end, up 4.7% (annualized) from $493.1 million as of the prior year end, and up 6.5% from $477.9 million at the comparable quarter end in 2023.

- Total short and long-term borrowings, junior subordinated notes, and subordinated debentures of $70.2 million at quarter end, up 27.6% (annualized) from $58.2 million as of the prior year end, and up 3.0% from $68.2 million at the comparable quarter end in 2023.

- Total stockholders’ equity of $62.9 million at quarter end, up 7.3% (annualized) from $58.3 million as of the prior quarter end, and up 6.9% from $55.3 million at the comparable quarter end in 2023. At September 30, 2024, the Bank’s Community Bank Leverage Ratio (CBLR) was 11.1%, down slightly from 11.2% at December 31, 2023. A bank or savings institution electing to use the CBLR will generally be considered well-capitalized and to have met the risk-based and leverage capital requirements of the capital regulations if it has a leverage ratio greater than 9.0%.

Tom Wayne, Chief Executive Officer, announced, “While our earnings per share in the third quarter of 2024 decreased compared to the comparable 2023 period, they increased from the previous quarter. We had double-digit annualized loan growth from the 2023-year end and the comparable quarter end in 2023, funded by a mix of deposits and borrowings. Despite a rise in nonperforming assets of $2.4 million from the previous quarter, $2.3 million and $1.8 million of this increase pertains to the total and guaranteed balances, respectively, of four SBA loans which are also secured by real estate and personal guarantees. Our net interest margin remained stable and strong in the current quarter, with our capital and liquidity positions remaining solid at quarter end. Oak Ridge is dedicated to fostering and expanding comprehensive client relationships, offering long-term core deposit and lending solutions, alongside various products and services tailored to our clients’ financial goals. We are immensely proud of our team and grateful for their dedication to serving our clients and ensuring the Bank’s safe and sound management.”

The Company adopted and implemented a share repurchase program in the third quarter of 2024. There were no shares repurchased during the third quarter of 2024. Between September 30, 2024, and October 30, 2024, the Company repurchased a total of 16,700 shares for $321,000.

A quarterly cash dividend of $0.12 per share of common stock is payable on December 3, 2024, to stockholders of record as of the close of business on November 15, 2024, which represents the 24th consecutive quarterly dividend paid by the Company. “We are pleased to pay another quarterly cash dividend to our stockholders,” said Mr. Wayne. “Paying stockholders a portion of our earnings reflects our continuing commitment to enhance stockholder value.”

For the three months ended September 30, 2024, and 2023, net interest income was $6.0 million and $5.6 million, respectively. For the three months ended September 30, 2024, the annualized net interest margin was 3.81% compared to 3.83% for the third quarter of 2023, a decrease of two basis points. For the nine months ended September 30, 2024, and 2023, net interest income was $17.5 million and $16.4 million, respectively. For the nine months ended September 30, 2024, the annualized net interest margin was 3.80% compared to 3.88% in the same period in 2023, a decrease of eight basis points.

For the three months ended September 30, 2024, the Company recorded a provision for credit losses of $261,000, compared to a provision for credit losses of $137,000 in the third quarter of 2023. For the nine months ended September 30, 2024, the Company recorded a provision for credit losses of $848,000, compared to a provision for credit losses of $295,000 for the same period in 2023. The allowance for credit losses as a percentage of total loans was 1.06% at September 30, 2024, compared to 1.05% at December 31, 2023. Nonperforming assets represented 0.45% of total assets on September 30, 2024, compared to 0.07% on December 31, 2023. The recorded balances of nonperforming loans were $2.9 million on September 30, 2024, compared to $418,000 on December 31, 2023. The increase in nonperforming loans from December 31, 2023, was primarily attributable to four SBA 7(a) loans totaling $2.3 million moving to nonaccrual status during the third quarter of 2024, of which $1.8 million is guaranteed by the SBA.

Noninterest income totaled $924,000 for the three months ended September 30, 2024, compared to $1.1 million for the third quarter of 2023. There were increases and decreases in components of noninterest income from the third quarter of 2023 to the comparable quarter of 2024, with the following category significantly contributing to the overall net decrease: there were no gains on sale(s) of SBA loans during the third quarter of 2024, compared to gains of $147,000 in the third quarter of 2023. The Company retained all its third quarter 2024 originations of SBA loans for balance sheet management purposes, while selling the guaranteed portion for most SBA loans originated in the third quarter of 2023.

Noninterest income totaled $2.5 million for the nine months ended September 30, 2024, compared to $3.0 million for the comparable period in 2023. There were increases and decreases in components of noninterest income from the first nine months of 2023 to the comparable period 2024, with the following category significantly contributing to the overall net decrease: There were no gains on sale(s) of SBA loans during the first nine months of 2024, compared to gains of $475,000 in the comparable period in 2023. The Company retained all its 2024 originations of SBA loans for balance sheet management purposes, while selling the guaranteed portion for most SBA loans originated in the first nine months of 2023.

Noninterest expense totaled $4.7 million for the three months ended September 30, 2024, compared to $4.6 million for the comparable period in 2023. There were increases and decreases in components of noninterest expense from 2023 to 2024, with the following category significantly contributing to the overall net increase: Salaries were $2.3 million for the three months ended September 30, 2024, compared to $2.2 million for the comparable period in 2023. The increase in salaries is mostly due to annual merit increases to employees effective April 1, 2024. Occupancy expenses were $658,000 for the three months ended September 30, 2024, compared to $250,000 in the comparable period in 2023. The increase in occupancy expense is mostly due to higher property maintenance expenses in 2024 compared to 2023. Equipment expense was $143,000 for the three months ended September 30, 2024, compared to $208,000 in the comparable period in 2023. The decrease in equipment expense is mostly due to lower equipment depreciation expense in 2024 compared to 2023. Professional and advertising expenses were $332,000 for the three months ended September 30, 2024, compared to $379,000 in the comparable period in 2023. The decrease in professional and advertising expenses is mostly due to decreases in information technology contracted services in 2024 compared to 2023. Telecommunications expense was $71,000 for the three months ended September 30, 2024, compared to $135,000 in the comparable period in 2023. The decrease in telecommunications expense is mostly due to the reduction in unnecessary or redundant telecommunications expenses.

Noninterest expense totaled $13.7 million and $13.6 million for the nine months ended September 30, 2024, and 2023, respectively. There were increases and decreases in components of noninterest expense from 2023 to 2024, with the following categories significantly contributing to the overall net increase of $31,000: Equipment expense was $461,000 for the nine months ended September 30, 2024, compared to $658,000 in the comparable period in 2023. The decrease in equipment expense is mostly due to lower equipment depreciation expense in 2024 compared to 2023. Occupancy expenses were $1.0 million for the nine months ended September 30, 2024, compared to $819,000 in the comparable period in 2023. The increase in occupancy expense is mostly due to higher property maintenance expenses in 2024 compared to 2023. Data and items processing expense was $1.7 million for the nine months ended September 30, 2024, compared to $1.5 million in the comparable period in 2023. The increase in data and items processing expense is mostly due to higher software licensing fees from our core processing vendor. Professional and advertising expenses were $951,000 for the nine months ended September 30, 2024, compared to $1.1 million in the comparable period in 2023. The decrease in professional and advertising expenses is mostly due to decreases in information technology contracted services in 2024 compared to 2023. Telecommunications expense was $213,000 for the nine months ended September 30, 2024, compared to $390,000 in the comparable period in 2023. The decrease in telecommunications expense is mostly due to the reduction in unnecessary or redundant telecommunications expenses.

Many communities in western North Carolina suffered significant damage from Hurricane Helene. Currently, it appears that our customers, who are predominantly located in the Piedmont Triad area of North Carolina, have been largely unaffected. The Bank made monetary donations to two organizations and our employees have donated critical supplies to support hurricane Helene relief efforts in western North Carolina.

About Oak Ridge Financial Services, Inc., and Bank of Oak Ridge

At Bank of Oak Ridge, we pride ourselves on knowing your name when you walk through our door. Whether in-person or through our digital offerings, managing your financial well-being is easy, safe, and convenient. We are the longest-running employee-owned community bank in the Triad and have served community members, local businesses, and non-profit organizations since 2000. Learn more about what makes Bank of Oak Ridge the Triad’s community bank by visiting one of our convenient locations in Greensboro, High Point, Summerfield, and Oak Ridge.

Oak Ridge Financial Services, Inc. BKOR is the holding company for Bank of Oak Ridge. Bank of Oak Ridge is a member of the FDIC and an Equal Housing Lender.

Awards & Recognitions | Best Bank in the Triad | Triad’s Top Workplace Finalist | 2016 Better Business Bureau Torch Award for Business Ethics | Triad’s Healthiest Employer Winner

Banking for Business & Personal | Mobile & Online Banking | Worldwide ATM | Debit, Credit + Rewards | Checking, Savings & Money Market | Loans + SBA | Mortgage | Insurance | Wealth Management

Let’s Talk | 336.644.9944 | www.BankofOakRidge.com | Extended Interactive Teller Machine Hours at all Triad Locations

Forward-looking Information This earnings release contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Company. These forward-looking statements involve risks and uncertainties and are based on the beliefs and assumptions of the management of the Company and on the information available to management at the time that these disclosures were prepared. These statements can be identified by the use of the words “expect,” “anticipate,” “estimate” and “believe,” variations of these words and other similar expressions. Readers should not place undue reliance on forward-looking statements as a number of important factors could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, (1) competition in the Company’s markets, (2) changes in the interest rate environment, (3) general national, regional or local economic conditions may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and the possible impairment of collectability of loans, (4) legislative or regulatory changes, including changes in accounting standards, (5) significant changes in the federal and state legal and regulatory environment and tax laws, and (6) the impact of changes in monetary and fiscal policies, laws, rules and regulations. The Company undertakes no obligation to update any forward-looking statements.

| OAK RIDGE FINANCIAL SERVICES, INC. | ||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||||||

| (Dollars in thousands, except share data) | ||||||||||||||||

| September 30, | December 31, | September 30, |

||||||||||||||

| 2024 | 2023 | 2023 | ||||||||||||||

| ASSETS | (unaudited) | (audited) | (unaudited) | |||||||||||||

| Cash and due from banks | $ | 10,522 | $ | 7,792 | $ | 9,182 | ||||||||||

| Interest-bearing deposits with banks | 11,308 | 12,633 | 15,294 | |||||||||||||

| Total cash and cash equivalents | 21,830 | 20,425 | 24,476 | |||||||||||||

| Securities available-for-sale | 83,769 | 91,849 | 90,148 | |||||||||||||

| Securities held-to-maturity, net of allowance for credit losses | 18,668 | 18,706 | 18,720 | |||||||||||||

| Restricted stock, at cost | 4,006 | 2,404 | 2,828 | |||||||||||||

| Loans receivable | 505,521 | 466,796 | 454,521 | |||||||||||||

| Allowance for credit losses | (5,354 | ) | (4,920 | ) | (4,808 | ) | ||||||||||

| Net loans receivable | 500,167 | 461,876 | 449,713 | |||||||||||||

| Property and equipment, net | 8,827 | 8,366 | 8,523 | |||||||||||||

| Accrued interest receivable | 3,098 | 2,580 | 2,427 | |||||||||||||

| Bank owned life insurance | 6,244 | 6,178 | 6,155 | |||||||||||||

| Right-of-use assets – operating leases | 2,242 | 2,466 | 2,537 | |||||||||||||

| Other assets | 4,614 | 4,544 | 5,735 | |||||||||||||

| Total assets | $ | 653,465 | $ | 619,394 | $ | 611,262 | ||||||||||

| LIABILITIES | ||||||||||||||||

| Noninterest-bearing deposits | $ | 114,152 | $ | 99,702 | $ | 106,981 | ||||||||||

| Interest-bearing deposits | 396,346 | 393,442 | 370,881 | |||||||||||||

| Total deposits | 510,498 | 493,144 | 477,862 | |||||||||||||

| Short-term borrowings | 52,000 | 40,000 | 50,000 | |||||||||||||

| Long-term borrowings | – | – | – | |||||||||||||

| Junior subordinated notes – trust preferred securities | 8,248 | 8,248 | 8,248 | |||||||||||||

| Subordinated debentures, net of discount | 9,973 | 9,943 | 9,933 | |||||||||||||

| Lease liabilities – operating leases | 2,242 | 2,466 | 2,537 | |||||||||||||

| Accrued interest payable | 1,021 | 1,154 | 1,094 | |||||||||||||

| Other liabilities | 6,580 | 6,092 | 6,235 | |||||||||||||

| Total liabilities | 590,562 | 561,047 | 555,909 | |||||||||||||

| STOCKHOLDERS’ EQUITY | ||||||||||||||||

| Common stock | 27,100 | 26,736 | 26,603 | |||||||||||||

| Retained earnings | 36,575 | 33,364 | 32,161 | |||||||||||||

| Net unrealized loss on debt securities, net of tax | (412 | ) | (1,580 | ) | (3,827 | ) | ||||||||||

| Net unrealized gain (loss) on hedging derivative instruments, net of tax | (360 | ) | (173 | ) | 416 | |||||||||||

| Total accumulated other comprehensive loss | (772 | ) | (1,753 | ) | (3,411 | ) | ||||||||||

| Total stockholders’ equity | 62,903 | 58,347 | 55,353 | |||||||||||||

| Total liabilities and stockholders’ equity | $ | 653,465 | $ | 619,394 | $ | 611,262 | ||||||||||

| Common shares outstanding | 2,761,870 | 2,732,720 | 2,732,020 | |||||||||||||

| Common shares authorized | 50,000,000 | 50,000,000 | 50,000,000 | |||||||||||||

| OAK RIDGE FINANCIAL SERVICES, INC. | ||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | ||||||||||||||||

| (Dollars in thousands, except share data) | ||||||||||||||||

| Three Months Ended | Nine months ended | |||||||||||||||

| September 30, | June 30, | September 30, | September 30, | September 30, | ||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Interest and dividend income: | ||||||||||||||||

| Loans and fees on loans | $ | 7,971 | $ | 7,663 | $ | 6,455 | $ | 22,865 | $ | 18,151 | ||||||

| Interest on deposits in banks | 275 | 244 | 207 | 670 | 663 | |||||||||||

| Restricted stock dividends | 67 | 64 | 42 | 177 | 141 | |||||||||||

| Interest on investment securities | 1,402 | 1,453 | 1,515 | 4,299 | 3,722 | |||||||||||

| Total interest and dividend income | 9,715 | 9,424 | 8,219 | 28,011 | 22,677 | |||||||||||

| Interest expense | ||||||||||||||||

| Deposits | 2,758 | 2,460 | 1,678 | 7,568 | 4,074 | |||||||||||

| Short-term and long-term debt | 961 | 1,130 | 915 | 2,991 | 2,230 | |||||||||||

| Total interest expense | 3,719 | 3,590 | 2,593 | 10,559 | 6,304 | |||||||||||

| Net interest income | 5,996 | 5,834 | 5,626 | 17,452 | 16,373 | |||||||||||

| Provision for (recovery of) credit losses | 261 | 322 | 137 | 848 | 295 | |||||||||||

| Net interest income after provision for credit losses | 5,735 | 5,512 | 5,489 | 16,604 | 16,078 | |||||||||||

| Noninterest income: | ||||||||||||||||

| Service charges on deposit accounts | 231 | 198 | 162 | 602 | 459 | |||||||||||

| Gain (loss) on sale of securities | – | – | – | – | 77 | |||||||||||

| Brokerage commissions on mortgage loans | – | – | 9 | – | 43 | |||||||||||

| Insurance commissions | 169 | 125 | 135 | 428 | 341 | |||||||||||

| Gain on sale of Small Business Administration loans | – | – | 147 | – | 475 | |||||||||||

| Debit and credit card interchange income | 292 | 309 | 333 | 889 | 924 | |||||||||||

| Income from Small Business Investment Company | 111 | 22 | 135 | 211 | 186 | |||||||||||

| Income earned on bank owned life insurance | 23 | 22 | 21 | 67 | 60 | |||||||||||

| Other Service Charges and Fees | 98 | 87 | 108 | 283 | 428 | |||||||||||

| Total noninterest income | 924 | 763 | 1,050 | 2,480 | 2,993 | |||||||||||

| Noninterest expenses: | ||||||||||||||||

| Salaries | 2,287 | 2,311 | 2,174 | 6,764 | 6,666 | |||||||||||

| Employee Benefits | 310 | 302 | 335 | 924 | 908 | |||||||||||

| Occupancy | 358 | 351 | 250 | 1,004 | 819 | |||||||||||

| Equipment | 143 | 155 | 208 | 461 | 658 | |||||||||||

| Data and Item Processing | 607 | 526 | 527 | 1,653 | 1,465 | |||||||||||

| Professional & Advertising | 332 | 305 | 379 | 951 | 1,082 | |||||||||||

| Stationary and Supplies | 32 | 45 | 26 | 109 | 94 | |||||||||||

| Telecommunications | 71 | 63 | 135 | 213 | 390 | |||||||||||

| FDIC Assessment | 118 | 111 | 102 | 343 | 308 | |||||||||||

| Other expense | 438 | 448 | 452 | 1,271 | 1,162 | |||||||||||

| Total noninterest expenses | 4,696 | 4,617 | 4,588 | 13,693 | 13,552 | |||||||||||

| Income before income taxes | 1,963 | 1,658 | 1,951 | 5,391 | 5,519 | |||||||||||

| Income tax expense | 460 | 382 | 456 | 1,245 | 1,255 | |||||||||||

| Net income and income available to common shareholders | $ | 1,503 | $ | 1,276 | $ | 1,495 | $ | 4,146 | $ | 4,264 | ||||||

| Basic income per common share | $ | 0.54 | $ | 0.46 | $ | 0.55 | $ | 1.50 | $ | 1.56 | ||||||

| Diluted income per common share | $ | 0.54 | $ | 0.46 | $ | 0.55 | $ | 1.50 | $ | 1.56 | ||||||

| Basic weighted average shares outstanding | 2,761,870 | 2,761,870 | 2,732,720 | 2,755,806 | 2,726,535 | |||||||||||

| Diluted weighted average shares outstanding | 2,761,870 | 2,761,870 | 2,732,720 | 2,755,806 | 2,726,535 | |||||||||||

| OAK RIDGE FINANCIAL SERVICES, INC. | ||||||||||||||||

| Selected Financial Data | ||||||||||||||||

| As of or For The Three Months Ended, | ||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||

| 2024 | 2024 | 2024 | 2023 | 2023 | ||||||||||||

| Return on average common stockholders’ equity1 | 9.56 | % | 8.57 | % | 9.31 | % | 10.44 | % | 10.63 | % | ||||||

| Tangible book value per share | $ | 22.78 | $ | 21.95 | $ | 21.56 | $ | 21.35 | $ | 20.26 | ||||||

| Return on average assets1 | 0.91 | % | 0.80 | % | 0.88 | % | 0.95 | % | 0.98 | % | ||||||

| Net interest margin1 | 3.81 | % | 3.81 | % | 3.79 | % | 3.79 | % | 3.83 | % | ||||||

| Efficiency ratio | 67.9 | % | 70.0 | % | 68.3 | % | 65.2 | % | 68.7 | % | ||||||

| Nonperforming assets to total assets | 0.45 | % | 0.08 | % | 0.06 | % | 0.07 | % | 0.07 | % | ||||||

| Allowance for credit losses to total loans | 1.06 | % | 1.06 | % | 1.03 | % | 1.05 | % | 1.06 | % | ||||||

| 1Annualized | ||||||||||||||||

Contact: Skylar Mearing, Marketing Director

Phone: 336.662.4840

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

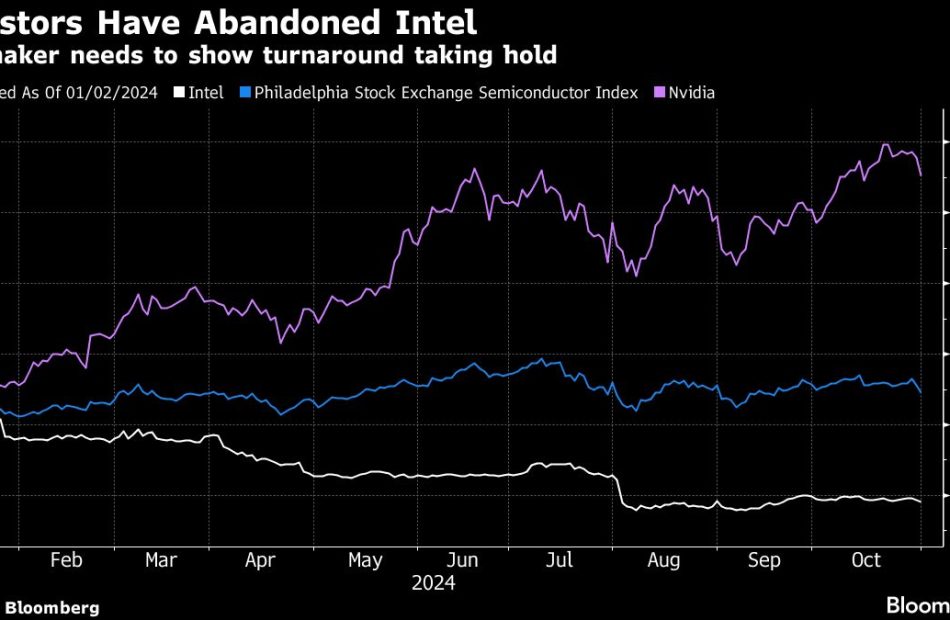

Intel Surges After Results Spark Optimism Over Turnaround

(Bloomberg) — Intel Corp. gave a fourth-quarter revenue forecast slightly above estimates, sparking optimism that it’s capable of reclaiming some lost market share.

Most Read from Bloomberg

Fourth-quarter revenue will be $13.3 billion to $14.3 billion, the Santa Clara, California-based company said in a statement. That compares with the $13.6 billion analysts estimated on average. The company is projecting a profit of 12 cents a share compared with the 6 cents Wall Street projected.

The company gained 9.2% to $23.51 in extended trading, after closing at $21.52 in New York. The shares were down 57% so far this year.

Intel, once the industry leader in computer processors, is now working to preserve cash to fund a turnaround plan — one Chief Executive Officer Pat Gelsinger called the “most audacious rebuilding plan” in corporate history, in an interview with Bloomberg.

In the prior quarter, Intel cut jobs, slashed its spending and suspended investor payouts. The total headcount reduction will be 16,500. Now, Gelsinger needs to show that he can counterbalance the cash drain by generating new orders from customers.

“This was a critical period of time for the company,” Gelsinger said in the interview. “We got a lot done.”

The fall from investor favor for what was once the world’s largest chipmaker underlines a major shift in semiconductor industry in favor of artificial intelligence hardware. Companies are spending on computers built around accelerator chips for AI, an area where Intel’s offerings have barely made a dent. Instead, customers are fleeing for Nvidia Corp, fueling its massive rise.

Orders for Intel’s AI accelerator chip, Gaudi, have been weaker than projected and it won’t now reach the company’s $500 million revenue target this year, Gelsinger said on the post-earnings call with investors. Rival Advanced Micro Devices Inc. earlier this week increased its forecast for a similar product to more than $5 billion. Nvidia is on course to have revenue of more than $100 billion from its AI chip unit this year, according to analysts.

Intel’s decline in value has made it attractive to potential acquirers in various break-up scenarios, according to reporting by Bloomberg and other news organizations. Gelsinger has said some of the business units he thinks are undervalued will seek outside investors or look to sell shares to the public.

Energy Fuels Announces Q3-2024 Results, Including Active Uranium Mining and Processing, Successful Rare Earth Production, and Continuing to Build a World-Scale Rare Earth Supply Chain Centered in the U.S.

DENVER, Oct. 31, 2024 /PRNewswire/ – Energy Fuels Inc. UUUU EFR (“Energy Fuels” or the “Company”), an industry leader in uranium and rare earth elements (“REE“) production, today reported its financial results for the quarter ended September 30, 2024. The Company previously announced details for its upcoming November 1, 2024, earnings call, which are also included in this news release.

“Uranium drives our current financial outlook, while rare earth elements and heavy mineral sand products are significantly adding to our long-term value and growth strategy,” said Mark Chalmers, Energy Fuels’ President and Chief Executive Officer. “This quarter, we maintained our clean balance sheet while adding a new long-term U.S. utility customer, completing another spot sale of U3O8, and commencing processing of the large inventory stockpile of uranium feedstock at the White Mesa Mill, which is expected to continue well into 2025 and beyond. Uranium production is, and will remain, the core of the Energy Fuels’ business, as we leverage our unique permits, facilities and expertise to process uranium-bearing materials to produce a variety of critical materials that advance the global energy transition through an American-based supply chain. We have long been a leading U.S. uranium producer, and we have now proven our ability to produce important rare earth materials at commercial scale with the completion and successful commissioning of our REE separation circuit this quarter. We are also aggressively moving forward with our plans to secure rare earth feedstocks globally and expand our processing capacity domestically in order to capture market share and achieve profitability. Our acquisition of Base Resources Limited and its world-class Toliara heavy mineral sands/monazite project in Madagascar on October 2, 2024 is an exciting step in achieving these objectives.

“We invite all stakeholders to join us in our upcoming November 1, 2024, earnings call, details of which are below, to learn more about these exciting achievements.”

Q3-2024 Highlights

Unless noted otherwise, all dollar amounts are in U.S. dollars.

- Robust Balance Sheet with Over $180 million of Liquidity and No Debt: As of September 30, 2024, the Company had $183.16 million of working capital including $47.46 million of cash and cash equivalents, $101.15 million of marketable securities (interest-bearing securities and uranium stocks), $35.91 million of inventory, and no debt.

- Over $10 Million of Additional Liquidity from Market Value of Inventory: At October 28, 2024 commodity prices, the Company’s product inventory has a market value of approximately $23.79 million, while the balance sheet reflects product inventory carried at cost of $13.38 million.

- Incurred Net Loss of $12 Million: During the three months ended September 30, 2024, the Company incurred a net loss of $12.08 million, or $0.07 per common share, primarily due to transaction and integrations costs related to the Donald Project joint venture (described below), the acquisition of Base Resources (described below) and recurring operating expenses, partially offset by sales of natural uranium concentrates (“U3O8“).

- Uranium Continues to Drive Revenue: The Company sold 50,000 pounds of U3O8 on the spot market at a realized sales price of $80.00 per pound of U3O8 for total proceeds of $4.00 million, which resulted in a gross profit of $2.15 million and a gross margin of 54%.

- New Long-Term Uranium Sales Contract with U.S. Utility: The Company added a fourth long-term uranium sales contract to its existing portfolio. Under the contract, the Company expects to deliver a total of 270,000 to 330,000 pounds of uranium between 2026 and 2027, and potentially an additional 180,000 to 220,000 pounds until 2029, under a “hybrid” pricing formula, subject to floor and ceiling prices, that maintains exposure to further uranium market upside and protection from inflation.

- “Phase 1” REE Separation Circuit Successfully Commissioned: Final commissioning of the Phase 1 REE separation circuit at the Company’s White Mesa Mill (the “Mill“) was successfully completed during the quarter resulting in the production of approximately 38 tonnes of ‘on-spec’ separated NdPr.

- Samples of NdPr Actively Being Qualified by Potential Customers: NdPr produced at the Mill is currently being qualified with permanent magnet manufacturers and other potential customers to set the stage for potential offtake in the future.

- Well-Stocked to Capture Market Opportunities: As of September 30, 2024, the Company held 235,000 pounds of finished U3O8 and 805,000 pounds of U3O8 in ore and raw materials and work-in-progress inventory for a total of 1,040,000 pounds of U3O8 in inventory. This inventory increased from last quarter due to Pinyon Plain, La Sal and Pandora mine ore production and additional alternate feed materials received, partially offset by our spot sale during Q3-2024. The Company expects these uranium inventories to continue increasing as we continue to mine additional ore. The Company also held 905,000 pounds of finished vanadium (“V2O5“), 38 tonnes of finished separated neodymium praseodymium (“NdPr“) and 9 tonnes of finished high purity, partially separated mixed rare earth carbonate (“RE Carbonate“) in inventory.

Capitalizing on Strong Uranium Pricing:

- Due to uranium market tailwinds and upcoming commitments in long-term contracts with U.S. nuclear utilities, the Company is currently mining and stockpiling uranium ore from its Pinyon Plain, La Sal and Pandora mines and plans to ramp up to a production run-rate of approximately 1.1 to 1.4 million pounds of U3O8 per year by late-2024.

- The Company expects to produce a total of 150,000 to 200,000 pounds of finished U3O8 during 2024 from stockpiled alternate feed materials and newly mined ore, which is at the lower end of our previous guidance of 150,000 to 500,000 pounds of finished U3O8 during 2024, due to delays in transporting ore from the Pinyon Plain mine to the White Mesa Mill, which is expected to be resolved in Q4-2024. Mining continues at the Pinyon Plain mine, with mined ore being stockpiled at the mine site, containing approximately 180,000 pounds of U3O8 at September 30, 2024, which is expected to be processed at the Mill later in 2024 or in early 2025.

- During Q3-2024, the Company received positive results from drill holes during ongoing preparations at its Nichols Ranch in situ recovery (“ISR“) Project in Wyoming. Both the Nichols Ranch Project and Whirlwind Mine in Colorado are being prepared for production and are within one year of a “go” decision, as market conditions warrant. Production from these mines, when combined with alternate feed materials, uranium from monazite, and 3rd party uranium ore purchases, would be expected to increase the Company’s production run-rate to roughly two million pounds per year by as early as 2026.

- The Company continued advancing permitting and other pre-development activities on its large-scale Roca Honda, and Bullfrog uranium projects in Q3-2024, which together with its Sheep Mountain Project, have the potential to expand the Company’s uranium production to a run-rate of up to five million pounds of U3O8 per year in the coming years.

- As of October 28, 2024, the spot price of U3O8 was $81.00 per pound and the long-term price of U3O8 was $82.00 per pound, according to data from TradeTech.

Rare Earth Element Production Milestones:

- The Company produced about 38 tonnes of separated NdPr from its newly commissioned Phase 1 REE separation circuit at the Mill in Q2- and Q3-2024.

- Samples of the Company’s NdPr product have been sent to permanent magnet and other companies around the world for product qualification, and initial testing responses have been positive.

- The Company is currently in the process of updating the White Mesa Mill’s AACE International (“AACE“) Class 4 Pre-Feasibility Study (not a Pre-Feasibility Study subject to or intended to be compliant with NI 43-101 or S-K 1300), originally released in Q2-2024 to increase throughput to a total of 60,000 tpa of monazite, producing roughly 6,000 tpa of NdPr, 150 to 225 tpa of Dy, and 50 to 75 tpa of Tb, of which the existing commissioned Phase 1 circuit will constitute about 17% of this amount (10,000 tpa of monazite). The Mill PFS referenced above can be viewed on the Company’s website, www.energyfuels.com.

Heavy Mineral Sands:

- On October 2, 2024, the Company announced it completed its previously announced acquisition of all the issued and outstanding shares of Base Resources Ltd. (“Base Resources“), which is expected to transform the Company into a global leader in critical minerals production, including HMS (titanium and zirconium), REEs and uranium. The acquisition of Base includes the advanced, world-class Toliara HMS project in Madagascar. In addition to its stand-alone, ilmenite, rutile (titanium) and zircon (zirconium) production capability, the Toliara Project also contains a long-life, high-value and low-cost monazite (REEs) stream, produced as a byproduct of primary titanium and zirconium production. Toliara’s monazite is expected to be processed at the Mill into separated REE products, along with uranium, at globally competitive capital and operating costs. The Toliara Project is subject to negotiation of fiscal terms with the Madagascar government and the receipt of certain Madagascar government approvals and actions before a current suspension on activities at the Toliara Project will be lifted and development may occur. The transaction also includes Base’s management, mine development and operations teams, who have a successful track-record of designing, constructing, and profitably operating a world-class HMS operation in Kenya.

- The Company continued to advance the Donald Project (the “Donald Project“), a large monazite-rich HMS project in Australia, pursuant to its joint venture with Astron Corporation limited, announced in Q2-2024. The Company expects that a final investment decision (“FID“) will be made on the Donald Project as early as 2025.

- During Q3-2024, the Company also continued to advance its wholly owned Bahia HMS project in Brazil (the “Bahia Project“) with its Phase 2 drilling campaign, which is expected to continue through the rest of the year. Additionally, the Company completed bulk test work on a 2.5 tonne sample in March 2024, and recently shipped a larger 15 tonne sample to the U.S. for additional process test work. The Company expects to complete a U.S. Subpart 1300 of Regulation S-K (“S-K 1300“) and Canadian National Instrument 43-101 (“NI 43-101“) compliant mineral resource estimate on the Bahia Project during 2024.

Vanadium Highlights:

- The Company chose not to execute any vanadium sales during Q3-2024 and holds about 905,000 pounds of V2O5 in inventory.

- As of October 28, 2024, the spot price of V2O5 was $5.25 per pound, according to data from Fastmarkets.

Medical Isotope Highlights:

- On August 19, 2024, the Company announced it acquired RadTran LLC (“RadTran“), a private company specializing in the separation of critical radioisotopes, to further the Company’s plans for development and production of medical isotopes used in cancer treatments. RadTran’s expertise includes separation of radium-226 (“Ra-226“) and radium-228 (“Ra-228“) from uranium and thorium process streams. This acquisition is expected to significantly enhance Energy Fuels’ planned capabilities to address the global shortage of these essential isotopes used in emerging targeted alpha therapies (“TAT“) for cancer treatment.

- The Company continues to utilize its research and development (“R&D“) license for the recovery of R&D quantities of Ra-226 at the Mill. Activities to set up the pilot facility at the Mill continued in Q3-2024 and are expected to progress through the end of the year, with the goal of producing R&D quantities of Ra-226 for testing by end-users of the product in late 2024 or early 2025.

Mr. Chalmers continued:

“During the quarter, we achieved numerous additional milestones to bring the Energy Fuels’ vision to fruition for our innovative, low-cost, U.S.-centered critical mineral supply chain. As previously announced, shortly after the close of the quarter, we successfully completed our acquisition of Base Resources. This is a major piece of our strategic puzzle, bringing to the Company the Base Resources management and operations team and the world-class Toliara Project in Madagascar, which is considered by industry experts to be one of the best HMS projects in the world. With the Toliara Project, our joint venture on the Donald Project in Australia, and our 100% ownership of the Bahia Project, we have secured a leading position in the titanium and zirconium mineral industry, in addition to a low-cost source of REE feedstock that will be processed in the United States.

“These developments have the potential to transform Energy Fuels into a world leader in titanium, zirconium, and rare earth elements production, while maintaining our position as a U.S. leader in uranium and vanadium production. All these materials are critical to the global energy transition and to our vision of creating a leading diversified critical minerals company.”

Conference Call and Webcast at 10:00 AM MT (12:00 pm ET) on November 1, 2024:

Conference call access with the ability to ask questions:

To instantly join the conference call by phone, please use the following link to easily register your name and phone number. After registering, you will receive a call immediately and be placed into the conference call

or

Alternatively, you may dial in to the conference call where you will be connected to the call by an Operator.

- North American Toll Free: 1-800-510-2154

To view the webcast online:

Audience URL: https://app.webinar.net/5kM3dkJ6D4A

Conference Replay

- Conference Replay Toronto: 1-289-819-1450

- Conference Replay North American Toll Free: 1-888-660-6345

- Conference Replay Entry Code: 53463 #

- Conference Replay Expiration Date: 11/15/2024

The Company’s Quarterly Report on Form 10-Q has been filed with the U.S. Securities and Exchange Commission (“SEC“) and may be viewed on the Electronic Document Gathering and Retrieval System (“EDGAR“) at www.sec.gov/edgar, on the System for Electronic Data Analysis and Retrieval + (“SEDAR+“) at www.sedarplus.ca, and on the Company’s website at www.energyfuels.com. Unless noted otherwise, all dollar amounts are in U.S. dollars.

Selected Summary Financial Information:

|

Three Months Ended September 30, |

|||

|

(In thousands, except per share data) |

2024 |

2023 |

|

|

Results of Operations: |

|||

|

Uranium concentrates revenues |

$ 4,000 |

$ 10,473 |

|

|

RE Carbonate revenues |

— |

288 |

|

|

Total revenues |

4,047 |

10,987 |

|

|

Gross profit |

2,200 |

5,439 |

|

|

Operating loss |

(11,913) |

(6,944) |

|

|

Net income (loss) attributable to the company |

(12,060) |

10,563 |

|

|

Basic net income (loss) per common share |

(0.07) |

0.07 |

|

|

Diluted net income (loss) per common share |

(0.07) |

0.07 |

|

|

(In thousands) |

September 30, 2024 |

December 31, 2023 |

Percent Change |

||

|

Financial Position: |

|||||

|

Working capital |

$ 183,155 |

$ 222,335 |

(18) % |

||

|

Current assets |

193,923 |

232,695 |

(17) % |

||

|

Mineral properties, net |

124,856 |

119,581 |

4 % |

||

|

Property, plant and equipment, net |

43,548 |

26,123 |

67 % |

||

|

Total assets |

400,404 |

401,939 |

— % |

||

|

Current liabilities |

10,768 |

10,360 |

4 % |

||

|

Total liabilities |

23,717 |

22,734 |

4 % |

ABOUT ENERGY FUELS

Energy Fuels is a leading US-based critical minerals company, focused on uranium, REEs, HMS, vanadium and medical isotopes. The Company has been the leading U.S. producer of natural uranium concentrate for the past several years, which is sold to nuclear utilities that process it further for the production of carbon-free nuclear energy and owns and operates several conventional and in situ recovery uranium projects in the western United States. The Company also owns the White Mesa Mill in Utah, which is the only fully licensed and operating conventional uranium processing facility in the United States. At the Mill, the Company also produces advanced REE products, vanadium oxide (when market conditions warrant), and is preparing to begin pilot-scale recovery of certain medical isotopes from existing uranium process streams needed for emerging cancer treatments. The Company also owns the operating Kwale HMS project in Kenya which is nearing the end of its life and is developing three (3) additional HMS projects, including the Toliara Project in Madagascar, the Bahia Project in Brazil, and the Donald Project in Australia in which the Company has the right to earn up to a 49% interest in a joint venture with Astron Corporation Limited. The Company is based in Lakewood, Colorado, near Denver, with its heavy mineral sands operations managed from Perth, Australia. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” For more information on all we do, please visit http://www.energyfuels.com

Cautionary Note Regarding Forward-Looking Statements: This news release contains certain “Forward Looking Information” and “Forward Looking Statements” within the meaning of applicable United States and Canadian securities legislation, which may include, but are not limited to, statements with respect to: any expectation that the Company will maintain its position as a leading U.S.-based critical minerals company or as the leading producer of uranium in the U.S.; any expectation with respect to timelines to production; any expectation as to rates or quantities of production; any expectation as to costs of production or gross profits or gross margins; any expectation as to future sales or sales prices; any expectation that the Company will be profitable; any expectation that the Company’s permitting efforts will be successful and as to any potential future production from any properties that are in the permitting or development stage; any expectation with respect to the Company’s planned exploration programs; any expectation that the Company will achieve its business objective of becoming a long-term, profitable U.S. critical minerals company; any expectation that Energy Fuels will be successful in expanding its U.S. separation, or other value-added U.S. REE production capabilities at the Mill, or otherwise, including the timing of any facilities or other initiatives and the expected production capacity associated with any such production capabilities; any expectation that the Mill’s REE products will meet commercial expectations or result in commercial offtake agreements; any expectation that the Company will update the Mill PFS to increase throughput of the planned Phase 2 separation circuit; any expectation that the Company’s planned Phase 2 separation facility will complete engineering design and will receive all required permits and licenses on a timely basis or at all; any expectation that the Company is well-stocked to capture market opportunities; any expectation that the Bahia Project, Donald Project and/or Toliara Project will be low-cost sources of monazite feed for the Mill and/or also potentially produce significant standalone cashflow from the sale of ilmenite, rutile, zircon and other minerals; any expectation as to the exploration program to be conducted at the Bahia Project during 2024; any expectation that the Company will complete an S-K 1300 and NI 43-101 compliant mineral resource estimate for the Bahia Project during 2024, or otherwise; any expectation that a FID will be made on the Donald Project or that the Company will earn its full 49% interest in the Donald JV; any expectation that any production at the Bahia Project, Donald Project and/or Toliara Project or Mill will be world or globally competitive; any expectation that the Base Resources team will continue to have a successful track-record of designing, constructing, and profitably operating any of the Company’s HMS projects; any expectation that Energy Fuels will be successful in agreeing on fiscal terms with the Government of Madagascar or in achieving sufficient fiscal and legal stability for the Toliara Project; any expectation that the current suspension relating to the Toliara Project will be lifted in the near future or at all; any expectation that the additional permits for the recovery of Monazite at the Toliara Project will be acquired on a timely basis or at all; any expectation that the Toliara Project will become a world-class HMS project; any expectation about the long-term opportunity in REEs; any expectation that the Company will be globally competitive in its markets; any expectation that the Company will complete engineering on its R&D pilot facility for the production of Ra-226 at the Mill, will set up the first stage of the pilot facility, and produce R&D quantities of Ra-226 at the Mill for testing by end-users of the product or at all; any expectation that the Company’s evaluation of radioisotope recovery at the Mill will be successful; any expectation that any radioisotopes that can be recovered at the Mill will be sold on a commercial basis; any expectation as to the quantities to be delivered under existing uranium sales contracts; any expectation that the Company will be successful in completing any additional contracts for the sale of uranium to U.S. utilities on commercially reasonable terms or at all; and any expectation as to future uranium, vanadium, HMS or REE prices or market conditions. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans,” “expects,” “does not expect,” “is expected,” “is likely,” “budgets,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” “does not anticipate,” or “believes,” or variations of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “occur,” “be achieved” or “have the potential to.” All statements, other than statements of historical fact, herein are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: commodity prices and price fluctuations; engineering, construction, processing and mining difficulties, upsets and delays; permitting and licensing requirements and delays; changes to regulatory requirements; legal challenges; the availability of feed sources for the Mill; competition from other producers; public opinion; government and political actions; the failure of the Government of Madagascar to agree on fiscal terms for the Toliara Project or provide the approvals necessary to achieve sufficient fiscal and legal stability on acceptable terms and conditions or at all; the failure of the current suspension affecting the Toliara Project to be lifted on a timely basis or at all; the failure of the Company to obtain the required permits for the recovery of Monazite from the Toliara Project; the failure of the Company to provide or obtain the necessary financing required to develop the Toliara Project, the Donald Project, the Bahia Project and/or its expanded REE separations capacity; available supplies of monazite; the ability of the Mill to produce RE Carbonate, REE oxides or other REE products to meet commercial specifications on a commercial scale at acceptable costs or at all; market factors, including future demand for REEs; actual results differing from estimates and projections; the ability of the Mill to recover radium or other radioisotopes at reasonable costs or at all; market prices and demand for medical isotopes; and the other factors described under the caption “Risk Factors” in the Company’s most recently filed Annual Report on Form 10-K, which is available for review on EDGAR at www.sec.gov/edgar, on SEDAR+ at www.sedarplus.ca, and on the Company’s website at www.energyfuels.com. Forward-looking statements contained herein are made as of the date of this news release, and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company assumes no obligation to update the information in this communication, except as otherwise required by law.

1 The information relating to the Donald Project’s estimated monazite production is based on the Donald DFS prepared on June 27, 2023. This study constituted a “Feasibility Study” for the purposes of JORC, and the Ore Reserves underpinning this study were estimated in accordance with JORC. The results from this study may not be comparable to (as the case may be) data or estimates under either NI 43-101 or S-K 1300– see disclosure under “Technical Information.”

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/energy-fuels-announces-q3-2024-results-including-active-uranium-mining-and-processing-successful-rare-earth-production-and-continuing-to-build-a-world-scale-rare-earth-supply-chain-centered-in-the-us-302293432.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/energy-fuels-announces-q3-2024-results-including-active-uranium-mining-and-processing-successful-rare-earth-production-and-continuing-to-build-a-world-scale-rare-earth-supply-chain-centered-in-the-us-302293432.html

SOURCE Energy Fuels Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Down 500 Points; Uber Shares Dip After Q3 Results

U.S. stocks traded lower toward the end of trading, with the Nasdaq Composite dipping around 500 points on Thursday.

The Dow traded down 0.62% to 41,880.03 while the NASDAQ fell 2.69% to 18,107.65. The S&P 500 also fell, dropping, 1.64% to 5,718.50.

Check This Out: Top 2 Real Estate Stocks You May Want To Dump This Quarter

Leading and Lagging Sectors

Utilities shares rose by 1.6% on Thursday.

In trading on Thursday, information technology shares fell by 3.4%.

Top Headline

Shares of Uber Technologies, Inc UBER dipped more than 10% on Thursday after the company reported quarterly results.

The company posted fiscal third-quarter 2024 revenue growth of 20% year-on-year to $11.188 billion, beating the analyst consensus of $10.97 billion. Uber reported GAAP EPS of 46 cents and adjusted EPS of 46 cents, which beat the analyst consensus of 41 cents.

Trips grew 17% year-over-year to 2.9 billion, or 31 million per day. Uber’s Monthly Active Platform Consumers reached 161 million, up 13% year-over-year.

Equities Trading UP

- Root, Inc. ROOT shares shot up 77% to $72.03 after the company reported better-than-expected third-quarter financial results.

- Shares of Alphatec Holdings, Inc. ATEC got a boost, surging 39% to $7.82 after the company reported better-than-expected third-quarter revenue results and raised its FY24 revenue guidance.

- Lemonade, Inc. LMND shares were also up, gaining 27% to $23.89 after the company reported third-quarter earnings and sales above estimates and raised its FY24 guidance.

Equities Trading DOWN

- Matinas BioPharma Holdings, Inc. MTNB shares dropped 65% to $0.6700 after the company announced the termination of negotiations under the previously disclosed non-binding term sheet regarding global rights to MAT2203. Matinas has implemented an 80% reduction in its workforce.

- Shares of Aurora Innovation, Inc. AUR were down 24% to $5.01 after reporting a wider-than-expected quarterly loss.

- COMPASS Pathways plc CMPS was down, falling 23% to $4.7750 after the company announced it pushed its topline data readout from its COMP005 Phase 3 trial to Q2 2025 and its COMP006 data will be announced after the 26-week time point.

Commodities

In commodity news, oil traded up 1% to $69.30 while gold traded down 1.8% at $2,751.50.

Silver traded down 3.7% to $32.820 on Thursday, while copper fell 0.1% to $4.3475.

Euro zone

European shares were lower today. The eurozone’s STOXX 600 dipped 1.20%, Germany’s DAX fell 0.93% and France’s CAC 40 slipped 1.05%. Spain’s IBEX 35 Index fell 0.36%, while London’s FTSE 100 fell 0.61%.

Asia Pacific Markets

Asian markets closed mostly lower on Thursday, with Japan’s Nikkei 225 falling 0.50%, Hong Kong’s Hang Seng Index falling 0.31%, China’s Shanghai Composite Index gaining 0.42% and India’s BSE Sensex falling 0.69%.

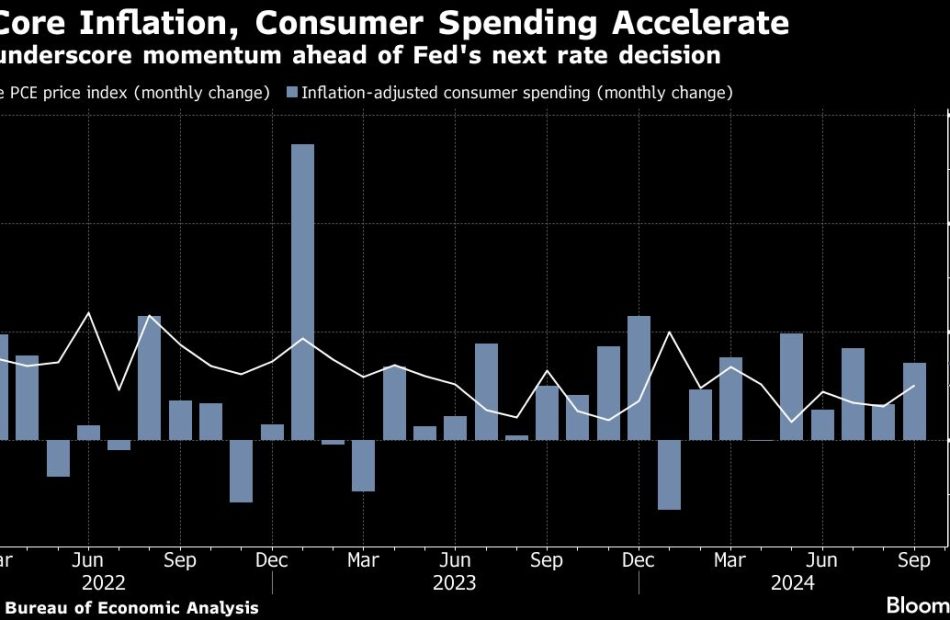

Economics

- U.S. initial jobless claims declined by 12,000 from the previous week to 216,000 in the week ending Oct. 26.

- U.S. personal income increased by 0.3% from the prior month to $24.948 trillion in September, while personal spending increased by 0.5% to an annualized rate of $20.024 trillion.

- The personal consumption expenditure price index rose 0.2% month-over-month in September following a 0.1% increase in August.

- U.S. natural-gas supplies rose 78 billion cubic feet to 8.863 trillion cubic feet in the week ended Oct. 25.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft Stock Slides 5.6% In October Despite Another Quarter Of Double-Digit Growth; Why It's Not A Buy Now

Enterprise software juggernaut Microsoft (MSFT), like most tech stocks, had started September on the wrong foot. But Microsoft stock reversed bullishly, gaining more than 3% for the month. And in recent weeks, the megacap tech slowly regained more of its long-running mojo ahead of its fiscal first-quarter results.

↑

X

Want To Snag A 10-Bagger Stock Like Nvidia? Here’s How One Trader Did It.

However, investors got a Halloween scare.

After hours Wednesday, Microsoft stock rose to as high as 444.95. But shares later sank as much as 5% below the regular-session close of 432.53 on fiscal first-quarter results. On Thursday, shares tanked 6% lower and dipped to as low as 406.30. Volume soared to 53.9 million shares, the second busiest day for Microsoft this year so far. MSFT is now down 5% for the week, all but guaranteed to snap a three-week win streak.

MSFT also dropped 5.6% for the month of October, gutting September’s gain and then some.

The Nasdaq 100, meanwhile, has fallen 2.3% for the week and is challenging the rising 10-week moving average. The index, which tracks the Nasdaq’s 100 largest nonfinancial components, had been aiming at an eighth straight gain.

Microsoft Stock Sours On Q1 Numbers

After the close on Wednesday, the member of the Magnificent Seven megacap growth stocks reported earnings in the September-ended quarter of $3.30 a share, up 10% vs. a year earlier and 20 cents above the FactSet consensus view. Sales hit $65.6 billion, rising 16% and surpassing every analyst’s forecast tracked by Yahoo Finance.

Revenue in its server products and cloud computing services businesses jumped 23% vs. a year ago. That’s definitely healthy. Meanwhile, revenue in its intelligent cloud unit rose 20% to $24.1 billion. The Microsoft 365 commercial products unit saw 13% revenue growth; sales in the 365 consumer products area increased 5%.

Please read this tech story for more details on the quarterly report.

Before the earnings shock, the stock had quietly treaded water amid a general decline in daily turnover. The dull action came despite news that the Redmond, Wash., tech giant plans to launch autonomous AI (artificial intelligence) agents that could help workers perform and support tasks in the fields of sales, finance, supply chain management and other areas of business operations.

In fact, the last time shares in Microsoft stock vigorously exchanged hands came on Sept. 20, or the triple-witching session in which weekly and monthly stock and index options expired.

A New Rebound In Store?

However, on Oct. 22, MSFT rallied 2.1% to 427.51 and notched a session high of 429.42. Volume ran up to 25 million shares, a 41% faster pace than usual. In contrast, the Nasdaq composite struggled to stay above water, while the S&P 500 fell 0.3%.

That healthy gain in big turnover suggested strong institutional investor demand. Also, Jefferies analyst Brent Thill told CNBC during an afternoon show that he sees Microsoft, as a cloud computing titan, as among the best plays currently in the theme of artificial intelligence investing.

On Tuesday this week, shares again outperformed the stock market today, rising 1.3% vs. a nearly 0.3% gain by the S&P 500 in afternoon movement. The Economist reported that Microsoft accused Google operator Alphabet of running “shadow campaigns” against the company’s European cloud computing business. In September, Google filed an antitrust complaint against Microsoft to the European Commission. Microsoft stock rose more than 0.6% in Wednesday afternoon trading ahead of quarterly results due after the regular session close.

Microsoft stock began to decline on Sept. 18, following the Federal Reserve’s key decision to cut interest rates by half a point. Shares also experienced heavier selling pressure after an Oppenheimer research analyst reduced his forecast for Microsoft’s Azure cloud computing revenue for the fiscal year ending in June 2025.

Microsoft Stock Today

Microsoft stock had risen nicely above a key technical level, the 50-day moving average. Plus, the 50-day line is starting to rise again, a promising sign. But that bullish chart action got obliterated on Thursday.

Indeed, shares are not yet ready for a new breakout and a big run to all-time highs, which would make every investor owning Microsoft stock happy. But clearly a new set-up has emerged. Currently trading near 434, the Redmond, Wash., firm now trades 7% off its peak of 468.35.

The Big Picture: Time To Short This Fallen Angel In AI Sector?

So, is Microsoft stock, affectionately nicknamed by some investors as Mr. Softy, a buy now? Or, is it a sell?

This story examines the fundamental, technical and institutional sponsorship metrics of the Redmond, Wash., firm and whether it makes sense right now for individual investors to deploy their capital.

Long-Term Leader

The member of IBD’s Long-Term Leaders resides inside the pantheon of the greatest stock market winners in U.S. history. Not long after its IPO in March 1986, MSFT demonstrated true leadership on an initial breakout from a four-month base. Microsoft stock has shown leadership — and enriched investors by rising to new highs — in multiple bull markets since then.

Without question, the company has done a spectacular job of not only maintaining a high level of reliability and trust in its brand. Management has found new markets and industries in which to grow at a rapid clip. Company financials back up the story.

Microsoft stock has rallied as much as 24.5% since Jan. 1. It began the year at 376.04. However, Microsoft’s relative strength line has continued to fall, meaning it’s underperformed the S&P 500.

You’d prefer to see a stock’s RS line to rise, not fall. The very best stocks are able to rise more quickly during a confirmed market uptrend.

Tech News: Why DA Davidson Downgraded Microsoft Stock

June Fiscal Q4 Results

On July 30, the company reported earnings in the June-ended fiscal fourth quarter of $2.95 a share, up 10% vs. a year ago and a penny above the FactSet forecast. Revenue grew 15% to $64.7 billion, $300 million above views.

The company’s Azure and related cloud services sales jumped a healthy 29% to $28.5 billion. However, that missed the Visible Alpha consensus estimate of $28.7 billion. Devices revenue dropped 11%. LinkedIn revenue grew 10% while Xbox content and services rose 61%. Productivity and business process revenue came in at $20.3 billion. Microsoft chalked up $13.22 billion in product revenue and $15.9 billion in the area of personal computing.

Please read this IBD tech story for more color on analysts’ reactions.

Following a global data fiasco rendered by a Windows-related software update failure at CrowdStrike (CRWD), Microsoft stock slumped to the 200-day line, a key long-term technical level of support and resistance.

Nonetheless, Microsoft serves as a principal investment choice in the themes of artificial intelligence, enterprise software, digital hardware and cloud computing. It has gained 860% since the end of July 2014. The S&P 500 has rallied 189%.

Stock Market Forecast For The Next 6 Months: Eye These Factors, Risks

Big Earnings Boost Microsoft Stock

In fiscal 2018, Microsoft scored a profit of $3.88 a share. Six years later, profit totaled $11.80 a share, up 204% over that time frame. Over the past four quarters, Microsoft’s earnings per share on average rose 23.5% vs. year-ago levels. Simply incredible for a company with trailing 12-month sales topping $245 billion.

Sales have moved at a slower clip than earnings. But growth has remained steady, up 8%, 13%, 18% and 17% in the past four quarters ahead of Wednesday’s news. Gross margin edged back above 70% in the March-ended fiscal third quarter.

No wonder IBD Stock Checkup recently gave MSFT an Earnings Per Share Rating of 93. After Wednesday’s report, the EPS score dipped to 90.

In fiscal 2023, the company posted an impressive 37% return on equity (ROE), a measure of profit-generating efficiency. Its long-term debt to shareholders equity was reasonably low at 20%. Big stock market winners, such as Microsoft stock, tend to post high ROEs before they stage big price runs. Hence, MSFT also gets a top-drawer A grade for IBD’s SMR Rating (Sales + Margins + ROE).

Please see this Investor’s Corner for more on the SMR Rating.

Microsoft’s IBD Composite Rating fell hard on Thursday to a subpar 70. In general, the biggest stock market winners tend to show a Composite of 95 or higher at the start of their mighty runs.

The Relative Strength Rating for Microsoft stock also nose-dived on Thursday. At 45, it plunged 17 points and needs to improve. Back in August, the RS Rating stood at 83. A solid weekly gain could boost Microsoft’s RS score again.

A 45 RS Rating means Microsoft stock has outperformed 45% of all companies over the past 12 months. Highly unacceptable. In fact, the average Relative Strength Rating among the biggest stock market winners in recent decades when they began their gigantic price runs is 87, according to IBD research.

This means numerous big winner break out to new highs and produce big profits for investors willing to make a timely buy when their Relative Strength Rating is already strong, say at 95 or higher.

The 3-month RS Rating has ramped up to a 69 vs. 58 in recent days.

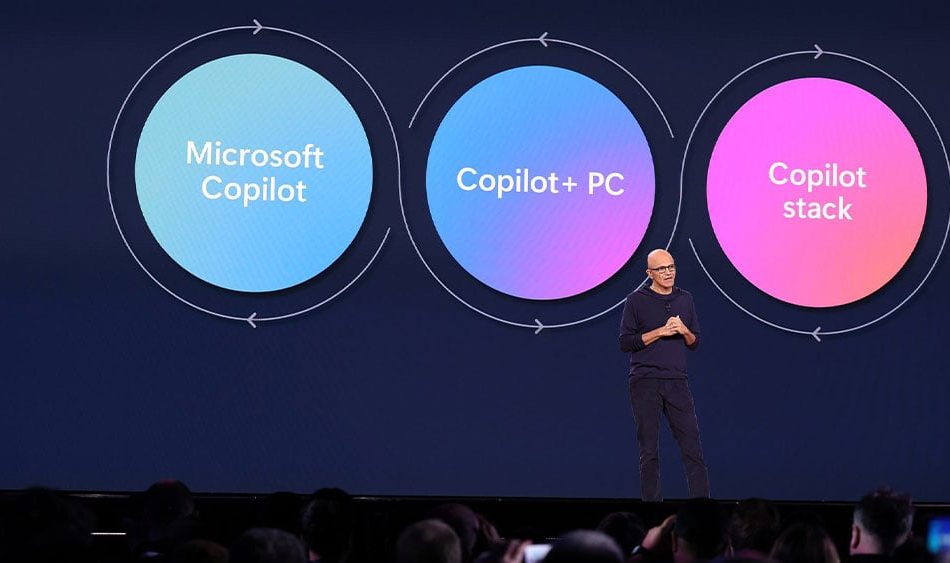

MSFT Stock: Nadella’s Take

The company has invested billions of dollars in OpenAI for its ChatGPT AI platform. “This next generation of AI will reshape every software category and every business, including our own,” CEO Satya Nadella stated in the company’s 2023 annual report. “Forty-eight years after its founding, Microsoft remains a consequential company because time and time again — from PC/Server, to Web/Internet, to Cloud/Mobile — we have adapted to technological paradigm shifts.”

Amid a new funding round for OpenAI, according to news reports, the company is now valued at $157 billion. On Thursday, OpenAI reportedly a launched a new web browser to compete in the internet search market.

On Sept. 17, shares rallied as much as 3% and hit a two-month high of 441.85 on news that the company is boosting its share buyback plan by up to $60 billion. That’s roughly 1.8% of the company’s stock market value of $3.23 trillion. A day later on Sept. 18, Microsoft announced it is teaming up with money management titan BlackRock (BLK) and MGX, a venture fund based in Abu Dhabi, UAE, to invest up to $30 billion in AI infrastructure, including datacenters and energy generation.

Which Stocks Are On IBD Long-Term Leaders? Check The List Here

Microsoft Stock And Institutional Activity

Microsoft stock has 7.433 billion shares outstanding. One of the few companies in the trillion-dollar club, its total market value recently exceeded $3.4 trillion.

Mutual funds, hedge funds, insurers, pension plans, sovereign wealth funds and the like dominate the long-term movement of share prices. MSFT stock is no exception. In the third quarter of 2023, as many as 10,119 mutual funds held MSFT stock, based on MarketSurge data. That number has since grown to as high as 10,509 funds as the end of the June quarter. In Q3, the figure eased to 10,362.

To determine the right time to buy MSFT stock, always consult a stock chart. The monthly chart offers an excellent view of a stock’s long-term trend. The weekly chart helps a savvy investor identify time-tested chart patterns that have repeatedly emerged among big stock market winners. Finally, the daily chart helps pinpoint an exact buy point.

During the 2022 bear market, Microsoft struggled like other growth companies. But in early November 2022, the stock bottomed out at 213.43 and began to grind higher. Three months later in February 2023, Microsoft stock attempted to break a 14-month downtrend. While it gained some ground, the attempt failed. But in March, Microsoft busted out of that downtrend in bullish form. Mr. Softy rallied 15.6% that month. Turnover climbed.

The monthly action highlighted a bullish character change in Microsoft stock.

Find Large Cap Stock Champions Here In This Unbiased Stock List

MSFT Stock: Weekly Chart Action

On a weekly chart, MSFT delivered a buy opportunity when it cleared 276.76, the high in the week ended Feb. 10, 2023, in enormous weekly turnover of 237 million shares. This strong move signaled unusually strong demand. Over 18 weeks, Microsoft rallied more than 32%, then dipped back into base-building phase.

A base allows a great stock to take a break as investors lock in gains. The price action becomes dull; general interest wanes. However, when institutions start getting greedy again, the stock begins to rally off lows and set up a potential breakout.

In the week ended Nov. 10, 2023, shares cleared a shallow saucer pattern with a 366.78 buy point. Shares went on to form a base-on-base pattern.

Not all breakouts succeed.

In the week ended May 24 this year, Microsoft stock poked above a 430.82 entry. Gains were minimal. On May 31, it fell 7% below the buy point, triggering the golden rule of investing: cut losses short. Two months later in July, Microsoft dove below its 10-week moving average.

Cheap Growth Stocks To Buy And Watch: Mining Plays Lead Market

Microsoft Stock: Daily Chart Action

On Sept. 18 and 19, IBD boosted its suggested investment exposure level twice. This has implications for new positions.

In recent weeks, Microsoft offered an aggressive entry near its 200-day moving average — drawn in black on a daily chart at Investors.com and in MarketSurge — for investors who already hold a big gain and would like to add to their positions. The 200-day moving average is rising steadily and has now surpassed 420.

This column noted in recent weeks that shares are trying to rally above the 200-day line. It makes sense to wait and see if the stock not only stabilizes but also rallies in robust fashion back above the 200-day line before possibly going long.

Given the whipsawing action, Microsoft stock needs to prove it can solidly regain support at the 200-day moving average before it is a new buy. So investors should wait and watch at this point.

Always stay wary of buying too far above the 200-day line on a price percentage basis. IBD suggests this rule: Buy within 5% of the buy point or moving average. At this point, with the right side of the base taking more shape, a potential trendline entry near 430 is also emerging. Also watch for a potential handle, or final shakeout of disgruntled shareholders before a potential big run, to complete.

Meanwhile, the stock continues to build a base; that’s another big reason to keep monitoring its chart action.

For long-term holders, MSFT is not a sell. But watch to see how it handles a potential test of its recent lows: 388.03 back in April and 385.59 set on Aug. 5.

Finally, if the nascent rebound withers and MSFT falls hard, traders need to cut losses on newly bought shares. Keeping losses at no larger than 7% remains the golden rule of investing.

Please follow Chung on X/Twitter: @saitochung and @IBD_DChung

YOU MIGHT ALSO LIKE:

Find Big Winners Like Microsoft Stock: Go Inside IBD Big Cap 20

Find The Best Growth Stocks Via This Highly Stringent Screen

Ready Capital Corporation Announces Third Quarter 2024 Results and Webcast Call

NEW YORK, Oct. 31, 2024 (GLOBE NEWSWIRE) — Ready Capital Corporation RC (the “Company”) today announced that the Company will release its third quarter 2024 financial results after the New York Stock Exchange closes on Thursday, November 7, 2024. Management will host a webcast and conference call on Friday, November 8, 2024 at 8:30 a.m. Eastern Time to provide a general business update and discuss the financial results for the quarter ended September 30, 2024.

Webcast:

The Company encourages use of the webcast due to potential extended wait times to access the conference call via dial-in. The webcast of the conference call will be available in the Investor Relations section of the Company’s website at www.readycapital.com. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

Dial-in:

The conference call can be accessed by dialing 877-407-0792 (domestic) or 201-689-8263 (international).

Replay:

A replay of the call will also be available on the Company’s website approximately two hours after the live call through November 22, 2024. To access the replay, dial 844-512-2921 (domestic) or 412-317-6671 (international). The replay pin number is 13748606.

About Ready Capital Corporation

Ready Capital Corporation RC is a multi-strategy real estate finance company that originates, acquires, finances and services lower-to-middle-market investor and owner occupied commercial real estate loans. The Company specializes in loans backed by commercial real estate, including agency multifamily, investor, construction, and bridge as well as U.S. Small Business Administration loans under its Section 7(a) program. Headquartered in New York, New York, the Company employs approximately 350 professionals nationwide.

Contact

Investor Relations

Ready Capital Corporation

212-257-4666

InvestorRelations@readycapital.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Milestone Reached: Foundation Poured for SPC Zach Parker's Accessible Home at Republic Grand Ranch

HOUSTON, Oct. 31, 2024 /PRNewswire/ — A significant milestone has been reached in the construction of the home for triple amputee and retired Army Specialist Zach Parker. On a beautiful morning at Republic Grand Ranch, the foundation was poured for the Parker family’s future home, marking an exciting step in this project. The home is being custom-built by Design Tech Homes, with support from the Helping A Hero initiative and generous donations from key partners in the construction industry.

The foundation pour was made possible through the contributions of Keystone, Heidelberg, and Builders Post Tension, whose generosity and commitment have helped make this home a reality for a well-deserving hero. The home is part of the Bass Pro Shops 100 Homes Challenge, which provides custom-built, fully accessible homes to wounded veterans like SPC Zach Parker.

“We spent the day touring the property with Zac and his family, determined to find the perfect homesite. It was a special moment to see this family’s vision coming to life at the foundation pour,” said Gary Sumner, managing partner of Patten Properties.

The home is situated on a beautiful two-acre lot within Republic Grand Ranch, intentionally selected to offer the Parker family privacy and access to nature. The custom home, crafted by Design Tech Homes, will be fully wheelchair accessible, allowing Zach to navigate his daily activities with ease and comfort.

As the project progresses, the Parker family and the entire community look forward to many more milestones, from framing to interior design, and ultimately, move-in day.

“We are truly honored to partner with Republic Grand Ranch, Patten Companies, Helping A Hero, and all the generous donors who helped make this home a reality. It’s incredible to see what a community can achieve when we come together for such a meaningful cause!” – Design Tech Homes

Stay tuned for more updates as we continue building this home for a true American hero. Follow here: IG, FB, LinkedIn & Republic Grand Ranch

About Patten Properties

Patten Properties and its partners are recognized as being among the industry’s foremost authorities on real estate investment and development across the nation. Our culture is founded on integrity and professionalism, which we proudly combine with a commitment to creating value and opportunity in today’s exciting real estate environment.

CONTACT:

Heather Robison

heather@pattenco.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/milestone-reached-foundation-poured-for-spc-zach-parkers-accessible-home-at-republic-grand-ranch-302293050.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/milestone-reached-foundation-poured-for-spc-zach-parkers-accessible-home-at-republic-grand-ranch-302293050.html

SOURCE Patten Properties

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Fall on Tech Results Ahead of US Jobs Data: Markets Wrap

(Bloomberg) — Asian equities fell after US stocks dropped on lackluster tech results. A rally in Treasuries favored the long end of the curve ahead of US jobs data due later Friday.

Most Read from Bloomberg

Shares in Japan, South Korea and Australia declined, while a gauge of US-listed Chinese companies dropped for a third straight day on Thursday. The S&P 500 lost 1.9% and the Nasdaq 100 dropped 2.4% Thursday, their worst sessions since early September. Elsewhere, oil extended gains on a report Iran may be planning fresh attacks on Israel.

Declines for US equities reflected investor unease over tech giants, including Microsoft Corp and Meta Platforms Inc. Apple Inc. shares were slightly softer in post-market trading after reporting weaker-than-anticipated sales in China. Amazon.com Inc. and Intel Corp. bucked the trend, rising in after-hours trade on optimistic outlooks, supporting a small advance for US stock futures early Friday.

“It makes some sense to trim some from those names that have worked so well over the past 12-18 months and look for AI laggards as well as other tech themes like cybersecurity, robotics and automation,” said Michael Landsberg, chief investment officer, Landsberg Bennett Private Wealth Management.