GOP Megadonor Ken Griffin Says 'Expectation Today Is That Donald Trump Will Win The White House'

Citadel LLC CEO Ken Griffin predicted that Donald Trump would reclaim the U.S. presidency during the Future Investment Initiative summit in Saudi Arabia.

What Happened: Griffin, a significant Republican donor, expressed confidence in Trump’s victory, Fortune reported on Wednesday. Despite his previous instances of financial support for the GOP, Griffin has not directly funded Trump’s campaign, instead focusing on primary candidates, particularly in open primaries

“The expectation today is that Donald Trump will win the White House in just a few days; we will know shortly,” Griffin said.

Griffin also commented on market volatility, suggesting that the election’s conclusion would reduce uncertainty, benefiting asset prices.

“We’re at that moment of peak uncertainty. It is a race that Trump is favored to win, but it is almost a coin toss,” he added.

Why It Matters: The 2024 presidential election is shaping up to be a closely contested race between Trump and Vice President Kamala Harris. Recent betting odds indicate a tight competition, with prediction markets favoring Trump.

This follows a tumultuous period, including a tragic incident at a Trump rally in Butler, Pennsylvania in July, where a shooting resulted in casualties. Billionaires like Griffin and Elon Musk donated $100,000 to the victims.

Did You Know?

Photo by Dan G via Flickr

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers and DLC Acquire Open-Air Shopping Center in Fairfax County, VA

NEW YORK, Oct. 30, 2024 /PRNewswire/ — Cohen & Steers CNS announced today that funds managed by the Private Real Estate Group of Cohen & Steers and DLC, an owner and operator of open-air shopping centers in the U.S., have jointly acquired Springfield Commons, an open-air community shopping center in Springfield, Virginia.

Springfield Commons is a 119,085 square foot shopping center located approximately 15 miles west of Washington, D.C. The center sits across from Springfield Town Center, a vibrant shopping destination that offers a mix of retail, entertainment, and dining options. This hub enhances the area’s appeal as a strong retail node, attracting new housing and a hotel currently in development, which will further enhance the community. The property is shadow anchored by the most visited Home Depot in Virginia and is 78% occupied by tenants including Pure Gym, Old Navy, Pure Hockey, Staples and more. The property is expected to be 98% leased in the short-term.

As a suburb of Washington D.C., Springfield provides access to a major transit hub and strong employment prospects for its affluent population, as well as access to other notable suburbs including Alexandria and Arlington. The retail submarket is 96.9% occupied and has achieved 3.3% year-over-year rent growth, outperforming the national levels of 95.7% and 2.9% respectively1.

James S. Corl, Head of the Private Real Estate Group at Cohen & Steers, said:

“We believe that valuations in the open-air shopping center sector are attractive, and the market is revealing compelling investment opportunities. We’re excited to expand our partnership with DLC and leverage their operating experience to drive long-term value in Springfield Commons.”

Open-air shopping centers are at their highest occupancy level of the past 16 years at 95.7% nationally and are the most highly occupied of any major commercial property type in the U.S. according to CoStar Group. Open-air shopping centers were also the best performing private core real estate sector in 2023 according to NCREIF. To learn more about Cohen & Steers’ open-air shopping center investment thesis, please read our whitepaper: The Retail Renaissance has arrived in private real estate investing.

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo and Singapore.

About DLC. DLC is one of the nation’s preeminent private retail real estate companies, with expertise in acquisitions, development, architecture, leasing, and management. Headquartered in Metro New York, DLC has regional operations in Atlanta, Buffalo, Chicago, Dallas, and Washington, DC. For additional information about DLC and its portfolio, please visit www.dlcmgmt.com.

Website: https://www.cohenandsteers.com

Symbol: NYSE: CNS

1 Source: CoStar 2Q24 Data as of 7/30/24

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-and-dlc-acquire-open-air-shopping-center-in-fairfax-county-va-302291691.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-and-dlc-acquire-open-air-shopping-center-in-fairfax-county-va-302291691.html

SOURCE Cohen & Steers, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stellantis Reports Lower Q3 2024 Net Revenues Amid Transitional Period of Product Upgrades and Inventory Reduction; Confirms Full-Year Guidance

Stellantis Reports Lower Q3 2024 Net Revenues Amid Transitional Period

of Product Upgrades and Inventory Reduction; Confirms Full-Year Guidance

- Net revenues of €33.0 billion, down 27% compared to Q3 2023, primarily due to lower shipments and unfavorable mix as well as pricing and foreign exchange impacts

- Consolidated shipments(1) of 1,148 thousand units, were down 279 thousand, or 20% year-over-year. Q3 2024 included production gaps in several models as a global product transition begins, planned North American inventory reductions, and headwinds from a challenging European market environment

- Product blitz remains on track to deliver approximately 20 new models in 2024. Temporary gaps in our line-up are due in part to the transformational upgrade of the product portfolio, which expands market coverage, consolidates platforms, and delivers unique multi-energy flexibility

- Total inventory of 1,330 thousand units at September 30, 2024 was down 129 thousand units year-to-date. The U.S. dealer inventory level, a focus priority, was reduced by over 80 thousand units at October 30, 2024 from June 30, 2024, and is on track to reach our previously communicated 100 thousand unit reduction target in November 30, 2024

- Reception for new products is strong, including orders for more than 50 thousand units for the all-new Citroën C3, approximately 75 thousand units for the all-new Peugeot 3008, and over 200 dealers in place for the European Leapmotor launch

- The Company’s €3 billion buyback program was completed in October (Including €0.9B in Q3), returning a total of €7.7 billion to shareholders in 2024. Consistent capital policy will support early 2025 dividend calibration and buybacks

- The Company reiterates its 2024 financial guidance, which was updated on September 30, 2024

| “While Q3 2024 performance is below our potential, I’m pleased with our progress addressing operational issues, in particular U.S. inventories, which have been reduced meaningfully and are on track for year-end targets, as well as stabilization of U.S. market share. In Europe, stringent quality requirements delayed the start of certain high-volume products, but with progress resolving challenges we will soon benefit from the significantly expanded reach our generational new product wave brings to 2025 and beyond.” Doug Ostermann, CFO |

|

| Citroën C5 Aircross Concept |

| |

Q3 2024 |

Q3 2023 |

Change |

FY 2024 GUIDANCE AOI margin(2): 5.5% – 7% Industrial free cash flows(3): €(5) billion – €(10) billion |

|||||

| Combined shipments (000 units) | 1,174 | 1,478 | (21)% | ||||||

| Consolidated shipments (000 units) | 1,148 | 1,427 | (20)% | ||||||

| Net revenues (€ billion) | 33.0 | 45.1 | (27)% | ||||||

| YTD 2024 | YTD 2023 | Change | |||||||

| Combined shipments (000 units) | 4,105 | 4,805 | (15)% | ||||||

| Consolidated shipments (000 units) | 4,020 | 4,629 | (13)% | ||||||

| Net revenues (€ billion) | 118.0 | 143.5 | (18)% | ||||||

____________________________________________________________________________________________________________________________________

All reported data is unaudited. Reference should be made to the section “Safe Harbor Statement” included elsewhere within this document.

AMSTERDAM, October 31, 2024 – Stellantis reports lower Q3 2024 Net revenues amid transitional period of product upgrades and inventory reduction actions. The Company reiterates its 2024 financial guidance, which was updated on September 30, 2024. Net revenues declined 27% year-over-year, primarily due to lower shipments and unfavorable mix, as well as pricing and foreign exchange impacts. Consolidated shipments(1) for the three months ending September 30, 2024, were 1,148 thousand units, representing a 20% decline year-over-year.

Product Blitz

The Company plans approximately 20 new product launches in 2024. This next-generation product blitz features the initial offerings from the STLA platform family imbued with superior multi-energy flexibility (hybrid, all-electric, and gasoline powertrains). Three products launched in the third quarter:

- Alfa Romeo Junior – The new compact car brings Alfa Romeo sportiness and best-in-class driving dynamics back into the hotly contested B-segment in the European market and is offered with the widest powertrain line-up to meet all customer requirements. Junior already has more than 10,000 orders.

- Citroën C3 – The all-electric ë-C3 leads the fourth-generation line-up of Citroën’s most popular B-segment car and has more than 25,000 orders since opening. The ë-C3 is priced at €23,300 for the 320km electric range version and €19,900 for the 200km range option coming soon, making electric mobility more accessible. The iconic, all-new C3 with a new Hybrid version has more than 50,000 orders.

- Citroën Basalt – Already launched in India, the Basalt arrived in South America (Brazil) starting at R$89,990, combining interior space and Coupe style as the most affordable SUV on the market.

The upcoming wave of American product launches kicks off soon with the all-electric Dodge Charger Daytona, the all-electric Jeep® Wagoneer S, the all-new, all-electric Ram 1500 REV; and the Ram 1500 Ramcharger range-extended EV pickup.

In Europe, Leapmotor International, a joint venture led by Stellantis in collaboration with Chinese automaker Leapmotor, distributed the first vehicles supported by over 200 dealers. This includes the C10, a D-segment SUV with a 420 km range (WLTP) and the T03, a 5-door A-segment BEV compact car with a 265 km range and priced below €20,000. The partnership offers European buyers access to advanced, high-value BEV technology, bolstered by Stellantis’ organizational and retail expertise, distinguishing Leapmotor International from its competitors.

Stellantis charged into the Paris Motor Show in October with new and upgraded electrified vehicles in the lineup to give customers a wide range of options for clean, safe and affordable mobility:

- The Peugeot E-408 was unveiled, expanding the brand’s lineup of BEVs to 12 vehicles, the most comprehensive of any European mainstream manufacturer. Launched in the first half, the all-new Peugeot 3008 has approximately 75,000 orders, with a 25% BEV mix.

- The debut of the refreshed Citroën C4 and C4 X vehicles – both available in all-electric – along with the all-new C5 Aircross concept, based on STLA Medium, mark the next step in the makeover of the brand’s vehicle lineup. The brand also celebrates four years of the Ami micromobility vehicle, and showed the next generation Ami, which will go on sale in 2025.

- Alfa Romeo staged the world debut of Junior IBRIDA, the compact car with 136-hp, 48-volt Hybrid Variable Geometry Turbo, which complements the ELETTRICA’s 54-kWh battery, available in two power variants, the 156hp and the top-of-the-range, VELOCE, at 240hp with 410km of range. The brand also previewed the Tonale MY2025 with new features and a revamped interior.

- Leapmotor made an impressive entrance at the Paris Motor Show with the global debut of the highly anticipated B10 C-SUV, the first model in its B-series built on the advanced LEAP 3.5 architecture.

Technology Push

Stellantis will offer 40 BEV models in Europe this year, the vast majority built on its innovative, flexible multi-energy platforms. These platforms enable Stellantis to meet evolving customer demands, adapting to local and regional needs. The Peugeot E-3008 and E-5008, based on the STLA Medium platform, offer up to 700km of range in the WLTP combined cycle, making them the best-in-class in their segment. In the U.S., Stellantis announced an investment of over $406 million in three Michigan facilities to support multi-energy technology and manufacturing flexibility, allowing for adaptation to various electrification scenarios.

Stellantis has partnered with the French Alternative Energies and Atomic Energy Commission (CEA) to develop next-generation battery cells. This collaboration aims to create high-performance, longer-lasting cells with a lower carbon footprint, driving future affordability & sustainability in battery electric vehicles. Stellantis also plans to incorporate Factorial’s solid-state batteries into a demonstration fleet of all-new Dodge Charger Daytona vehicles based on the STLA Large platform by 2026, a key step in bringing solid-state battery technology to mass production.

Value Creation

Stellantis Pro One inaugurated its new global commercial vehicles hub at the Mirafiori Automotive Park 2030 in Turin, Italy, enhancing efficiency and decision-making speed. The commercial vehicles business accounts for one-third of Stellantis’ Net revenues. Stellantis Pro One closed the third quarter ranked #1 in the EU30 commercial vehicles market with over 29% market share year-to-date September and a 1% year-over-year volume increase, and maintains segment leadership in BEVs at 32.8%.

On October 31, 2024 at 1:00 p.m. CET / 8:00 a.m. EDT, a live webcast and conference call will be held to present Stellantis’ Third Quarter 2024 Shipments and Revenues, with the presentation expected to be posted at approximately 8:00 a.m. CET / 3:00 a.m. EDT. The webcast and recorded replay will be accessible under the Investors section of the Stellantis corporate website (www.stellantis.com).

SEGMENT PERFORMANCE

| NORTH AMERICA | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Shipments (000s) | 299 | 470 | (171) | 1,137 | 1,493 | |||||||

| Net revenues (€ million) | 12,425 | 21,523 | (9,098) | 50,778 | 67,439 | |||||||

| ENLARGED EUROPE | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Shipments (000s) | 496 | 599 | (103) | 1,883 | 2,077 | |||||||

| Net revenues (€ million) | 12,482 | 14,124 | (1,642) | 42,451 | 48,985 | |||||||

| MIDDLE EAST & AFRICA | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Combined shipments (000s)(1) | 104 | 139 | (35) | 377 | 440 | |||||||

| Consolidated shipments (000s)(1) | 78 | 105 | (27) | 292 | 313 | |||||||

| Net revenues (€ million) | 1,892 | 3,021 | (1,129) | 6,897 | 7,719 | |||||||

| SOUTH AMERICA | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Shipments (000s) | 259 | 227 | +32 | 653 | 647 | |||||||

| Net revenues (€ million) | 4,215 | 4,285 | (70) | 11,582 | 11,848 | |||||||

| CHINA AND INDIA & ASIA PACIFIC | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Combined shipments (000s)(1) | 14 | 37 | (23) | 46 | 127 | |||||||

| Consolidated shipments (000s)(1) | 14 | 20 | (6) | 46 | 78 | |||||||

| Net revenues (€ million) | 426 | 705 | (279) | 1,498 | 2,691 | |||||||

| MASERATI | ||||||||||||

| Q3 2024 | Q3 2023 | Change |

|

YTD 2024 | YTD 2023 | |||||||

| Shipments (000s) | 2.1 | 5.3 | (3.2) | 8.6 | 20.6 | |||||||

| Net revenues (€ million) | 195 | 496 | (301) | 826 | 1,805 | |||||||

Reconciliations

Net revenues from external customers to Net revenues

| Q3 2024 | (€ million) | NORTH AMERICA | ENLARGED EUROPE | MIDDLE EAST & AFRICA | SOUTH AMERICA | CHINA AND INDIA & ASIA PACIFIC | MASERATI | OTHER(*) | STELLANTIS | ||||||||

| Net revenues from external customers | 12,424 | 12,458 | 1,892 | 4,216 | 426 | 193 | 1,351 | 32,960 | |||||||||

| Net revenues from transactions with other segments | 1 | 24 | — | (1) | — | 2 | (26) | — | |||||||||

| Net revenues | 12,425 | 12,482 | 1,892 | 4,215 | 426 | 195 | 1,325 | 32,960 | |||||||||

_____________________________________________________________________________________________________

(*) Other activities, unallocated items and eliminations

| Q3 2023 | (€ million) | NORTH AMERICA | ENLARGED EUROPE | MIDDLE EAST & AFRICA | SOUTH AMERICA | CHINA AND INDIA & ASIA PACIFIC | MASERATI | OTHER(*) | STELLANTIS | ||||||||

| Net revenues from external customers | 21,522 | 14,077 | 3,022 | 4,320 | 705 | 495 | 995 | 45,136 | |||||||||

| Net revenues from transactions with other segments | 1 | 47 | (1) | (35) | — | 1 | (13) | — | |||||||||

| Net revenues | 21,523 | 14,124 | 3,021 | 4,285 | 705 | 496 | 982 | 45,136 | |||||||||

_____________________________________________________________________________________________________

(*) Other activities, unallocated items and eliminations

| YTD 2024 | (€ million) | NORTH AMERICA | ENLARGED EUROPE | MIDDLE EAST & AFRICA | SOUTH AMERICA | CHINA AND INDIA & ASIA PACIFIC | MASERATI | OTHER(*) | STELLANTIS | ||||||||

| Net revenues from external customers | 50,775 | 42,306 | 6,897 | 11,589 | 1,497 | 824 | 4,089 | 117,977 | |||||||||

| Net revenues from transactions with other segments | 3 | 145 | — | (7) | 1 | 2 | (144) | — | |||||||||

| Net revenues | 50,778 | 42,451 | 6,897 | 11,582 | 1,498 | 826 | 3,945 | 117,977 | |||||||||

_____________________________________________________________________________________________________

(*) Other activities, unallocated items and eliminations

| YTD 2023 | (€ million) | NORTH AMERICA | ENLARGED EUROPE | MIDDLE EAST & AFRICA | SOUTH AMERICA | CHINA AND INDIA & ASIA PACIFIC | MASERATI | OTHER(*) | STELLANTIS | ||||||||

| Net revenues from external customers | 67,438 | 48,888 | 7,720 | 11,929 | 2,690 | 1,805 | 3,034 | 143,504 | |||||||||

| Net revenues from transactions with other segments | 1 | 97 | (1) | (81) | 1 | — | (17) | — | |||||||||

| Net revenues | 67,439 | 48,985 | 7,719 | 11,848 | 2,691 | 1,805 | 3,017 | 143,504 | |||||||||

_____________________________________________________________________________________________________

(*) Other activities, unallocated items and eliminations

NOTES

(1) Combined shipments include shipments by Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by Company’s consolidated subsidiaries. This includes the vehicles produced by our joint ventures and associates (including Leapmotor) which are distributed by our consolidated subsidiaries. In addition to the volumes included in consolidated shipments, combined shipments also includes the vehicles distributed by our joint ventures (such as Tofas). Figures by segments may not add up due to rounding. China shipments from DPCA are no longer included in Combined shipments as of November 2023; prior periods have not been restated.

(2) Adjusted operating income/(loss) margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

(3) Industrial free cash flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities; (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the substantive timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control.

Rankings, market share and other industry information are derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (ANTS), Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA), Ministry of Infrastructure and Sustainable Mobility (MIMS), S&P Global, Ward’s Automotive) and internal information unless otherwise stated.

For purposes of this document, and unless otherwise stated industry and market share information are for passenger cars (PC) plus light commercial vehicles (LCV), except as noted below:

- Enlarged Europe excludes Russia and Belarus; Q3 2023 and year to date 2023 figures have been restated;

- Middle East & Africa exclude Iran, Sudan and Syria;

- South America excludes Cuba;

- India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups), Australia, New Zealand and South East Asia);

- China represents PC only and includes licensed sales from DPCA; and

- Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from S&P Global data, Maserati competitive segment and internal information.

Prior period figures have been updated to reflect current information provided by third-party industry sources.

EU30 = EU 27 (excluding Malta), Iceland, Norway, Switzerland and UK.

Low emission vehicles (LEV) = battery electric (BEV), plug-in hybrid (PHEV), range-extender electric vehicle (REEV) and fuel cell electric (FCEV) vehicles.

All Stellantis reported BEV and LEV sales include Citroën Ami, Opel Rocks-e and Fiat Topolino; in countries where these vehicles are classified as quadricycles, they are excluded from Stellantis reported combined sales, industry sales and market share figures.

About Stellantis

Stellantis N.V. STLASTLAP is one of the world’s leading automakers aiming to provide clean, safe and affordable freedom of mobility to all. It’s best known for its unique portfolio of iconic and innovative brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, FIAT, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Stellantis is executing its Dare Forward 2030, a bold strategic plan that paves the way to achieve the ambitious target of becoming a carbon net zero mobility tech company by 2038, with single-digit percentage compensation of the remaining emissions, while creating added value for all stakeholders. For more information, visit www.stellantis.com. Contacts: communications@stellantis.com or investor.relations@stellantis.com

SAFE HARBOR STATEMENT

This document, in particular references to “FY 2024 Guidance”, contains forward looking statements. Statements regarding future financial performance and the Company’s expectations as to the achievement of certain targeted metrics, including revenues, industrial free cash flows, vehicle shipments, capital investments, research and development costs and other expenses at any future date or for any future period are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Company’s current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them.

Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the Company’s ability to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; the Company’s ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; the Company’s ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; the Company’s ability to produce or procure electric batteries with competitive performance, cost and at required volumes; the Company’s ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in the Company’s vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in the Company’s vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; the Company’s ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of the Company’s defined benefit pension plans; the Company’s ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; the Company’s ability to access funding to execute its business plan; the Company’s ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with the Company’s relationships with employees, dealers and suppliers; the Company’s ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; and other risks and uncertainties.

Any forward-looking statements contained in this document speak only as of the date of this document and the Company disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning the Company and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission and AFM.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Euroclear achieves robust third quarter results

BRUSSELS, Oct. 31, 2024 /PRNewswire/ — Results for the first nine months of 2024

Highlights

Euroclear’s business income and interest earnings reached record levels

- Underlying operating income increased by 6% to reach €2.18 billion. Net profit increased by 8% to €890 million.

- Underlying business income is up by 5% to €1,302 million, driven by record levels in settlement and safe keeping activities, with assets under custody crossing the €40 trillion mark for the first time ever. In Q3 2024, business income increased by 8% compared to Q3 2023, driven by strong performance especially in the Eurobonds & European assets and funds business.

- Underlying interest income continues to increase, up 9% to €882 million in the context of sustained high interest rates environment and gradual policy rate cuts.

Pace of cost growth continues to slow

- After a step-up in investment in digital capabilities, workforce and IT infrastructure in 2023, the growth of underlying operating expenses slowed to 3% for the first nine months of 2024.

- In Q3 2024, underlying costs decreased by 1.5% compared to Q3 2023, reflecting Euroclear’s continued focus on cost mitigation and non-recurrence of specific items.

- As a result, the business income operating margin improved to 24.7% for the first nine months of 2024.

Strong shareholder return and capital position

- Underlying earnings per share increased by 8% to €283 in line with continued increase in net profit.

- Euroclear group retains a very strong capital position, comfortably above regulatory requirements with an underlying Common Equity Tier 1 capital ratio slightly below 60%[1].

Russian sanctioned assets

- Following the implementation of the EU windfall contribution regulation, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024, of which a first tranche of €1.55 billion for H1 2024 was paid to the European Fund for Ukraine in July 2024.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 with the outlook for future interest earnings dependent on policymaking decisions.

- The impacts of the Russian sanctions are detailed in the last section of this press release.

|

Euroclear Holding |

||||||||

|

(€ m) |

YTD Q3 23 |

Russian sanctions impacts |

YTD Q3 23 underlying |

YTD Q3 24 |

Russian sanctions impacts after Windfall Contribution |

YTD Q3 24 underlying |

Underlying |

|

|

Operating income |

5,052 |

2,996 |

2,056 |

4,424 |

2,240 |

2,184 |

128 |

6 % |

|

Business income |

1,226 |

-18 |

1,243 |

1,282 |

-20 |

1,302 |

59 |

5 % |

|

Interest, banking & other income |

3,826 |

3,013 |

813 |

6,030 |

5,148 |

882 |

69 |

9 % |

|

Windfall contribution |

-2,888 |

-2,888 |

0 |

0 |

||||

|

Operating expenses |

-991 |

-34 |

-956 |

-1,049 |

-68 |

-981 |

-24 |

-3 % |

|

Operating profit before Impairment |

4,061 |

2,961 |

1,100 |

3,375 |

2,172 |

1,203 |

103 |

9 % |

|

Impairment |

0 |

0 |

0 |

-5 |

0 |

-5 |

-5 |

|

|

Pre tax profit |

4,061 |

2,961 |

1,100 |

3,370 |

2,172 |

1,198 |

98 |

9 % |

|

Tax |

-1,018 |

-740 |

-278 |

-1,573 |

-1,265 |

-308 |

-30 |

-11 % |

|

Net profit |

3,043 |

2,221 |

822 |

1,797 |

907 |

890 |

68 |

8 % |

|

EPS |

966.8 |

261.2 |

570.9 |

282.9 |

||||

|

Business income operating margin |

19.2 % |

23.1 % |

24.7 % |

|||||

|

EBITDA margin (EBITDA/oper.income) |

82.0 % |

57.5 % |

59.1 % |

|||||

Valerie Urbain, Chief Executive Officer of Euroclear, commented:

“We are maintaining our trajectory of strong financial results and excellent performance, with our settlement and safe keeping activities reaching once again record levels. We remain focused on the execution of our strategy and delivering outstanding service to our customers, while continuing to invest to support our long-term growth.

We believe digital assets offer significant benefits and our teams have continued to innovate to advance their adoption across geographies and asset classes. After two successful issuances, Euroclear now welcomed the first issuance in USD by an Asia-based issuer on its Digital Securities Issuance (D-SI) platform. Euroclear took part in a groundbreaking pilot project to tokenise gold, Gilts and Eurobonds for collateral management and completed the dress rehearsal of its trial for Eurosystem wholesale Central Bank Digital Currency (CBDC) exploratory work. Finally, Euroclear joined forces with Singapore-based Marketnode to help establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using Distributed Ledger Technology (DLT).

As a group with European roots, Euroclear reiterated its commitment to supporting the European Capital Markets Union. With Europe entering a new political cycle, Euroclear presented a detailed memorandum on the competitiveness in Europe’s markets and engaged with key stakeholders to chart the course for enhanced market development and integration in Europe. I firmly believe that by attracting more issuers and investors, by removing barriers to efficiency, competition and integration and by supporting innovation, European capital markets can become more liquid, resilient and competitive.”

Business performance

The key operating metrics (end of period unless stated otherwise) demonstrate an excellent business performance during the period.

|

Q3 2023 |

Q3 2024 |

YoY evolution |

3-year CAGR |

|

|

Assets under custody |

€37 trillion |

€40 trillion |

+9 % |

+3 % |

|

Number of transactions |

224 million |

243 million |

+9 % |

+4 % |

|

Turnover |

€813 trillion |

€850 trillion |

+5 % |

+5 % |

|

Fund assets under custody |

€3 trillion |

€3.4 trillion |

+14 % |

+6 % |

|

Collateral Highway |

€1.67 trillion |

€1.9 trillion |

+14 % |

+2 % |

|

Underlying cash deposits (average) |

€24.3 trillion |

€22.4 trillion |

-8 % |

+3 % |

Euroclear’s assets under custody reached a record €40 trillion, growing for the eighth quarter in a row, thanks to solid stock exchange performances coupled with robust results in fixed income.

Despite the usual summer slowdown, settlement volumes hit a new high due to sustained activity since the beginning of the year.

Funds depot is boosted by the success of ETFs, combined with the positive evolution of the stock valuations, and breaks its all-time record level close to €3.4 trillion.

The Collateral Highway’s outstanding continues to increase and is now very close to the early 2022 peak.

Business milestones

Reshaping traditional financial services

Euroclear made significant progress in its journey to become a digital, data-enabled Financial Market Infrastructure by welcoming the first Digital Native Note (DNN) issued by the Asian Infrastructure Investment Bank on its Digital Securities Issuance (D-SI) platform. This marks the first digital issuance in USD for Euroclear and the first such issuance by an Asia-based issuer on its platform. Euroclear’s DSI service enables the issuance, distribution and settlement of fully digital international securities on Distributed Ledger Technology (DLT).

In the related digital securities space, Euroclear, alongside Digital Asset and The World Gold Council, has successfully completed a groundbreaking pilot to tokenise gold, Gilts and Eurobonds for collateral management. This initiative showcases how DLT can revolutionise collateral mobility, enhance liquidity and boost transactional efficiency.

Furthermore, with the support of Paris Europlace, Euroclear has brought together a group of French banks around its D-SI platform and Banque de France’s DL3S platform for Central Bank Digital Currency (CBDC). As a result, these financial institutions will issue the first Digital Native Note (DNN) under French Law and settle it in CBDC.

Advancing the funds business

In October 2024, Euroclear acquired a strategic stake in Marketnode, a Singapore-based digital market infrastructure operator. By joining forces with Marketnode and its existing shareholders – the Singapore Exchange (SGX Group), Temasek and HSBC – Euroclear will contribute to establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using new technology. This first strategic investment in Asia reinforces the region’s importance to Euroclear’s positioning and business growth.

In line with its commitment to make private markets more accessible to a wider range, Euroclear announced a pioneer collaboration with BlackRock. Both companies join forces to expand the distribution of BlackRock’s private market funds via Euroclear’s FundsPlace. With a global reach serving over 2,500 clients across the globe, FundsPlace is well-equipped to extend BlackRock’s diverse range of private market funds to an even broader array of investors.

Simplification of Euroclear’s group structure

On 1 October 2024, Euroclear completed the previously announced simplification of its group structure. Two out of the four financial holding companies of the Euroclear group, Euroclear AG and Euroclear Investments SA/NV, were successively merged into Euroclear Holding SA/NV, the ultimate parent entity of the Euroclear group.

This simplification of the corporate structure results in a significant reduction of complexity both in terms of governance and financial administration, while keeping direct participations in regulated entities at the level of Euroclear SA/NV. This merger also streamlines and accelerates the dividend upstreaming process.

A call for unlocking scale and competitiveness in Europe’s markets

As a trusted market infrastructure having contributed to the integration of European and global markets over decades, Euroclear is committed to advance the European Capital Markets Union. To instigate a meaningful dialogue with all involved stakeholders, Euroclear published a thought leadership paper on the European capital markets highlighting, key challenges, real opportunities and the critical need to improve integration and competitiveness, specifically in the post-trade sector.

To read the full paper, go to https://www.euroclear.com/content/dam/euroclear/news%20&%20insights/Format/Whitepapers-Reports/Whitepaper-Unlocking-Europe-capital-markets.pdf

Supporting academic research on sustainable finance

In line with its ambition to advancing the understanding of sustainable finance, Euroclear announced its sponsorship of a new Chair in Sustainable Finance at the Solvay Brussels School of Economics and Management of the Université Libre de Bruxelles (ULB). Professor Dr Guntram Wolff will be the first holder of this newly created Chair, which will contribute to the creation of knowledge on sustainable finance, executive training as well as teaching.

Russian sanctions impacts

Financial impacts of the Russian assets

- The Russian sanctions continue to have a significant impact on Euroclear’s earnings.

- Interest earnings related to Russian assets, which are subject to Belgian corporate tax, generated €1.27 billion tax revenue.

- Following the implementation of the EU windfall contribution regulation applicable to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024 onwards, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024.

- Euroclear made a first payment for H1 2024 of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

- The sanctions and Russian countermeasures resulted in direct costs of €68 million and a loss of business income of €20 million.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 (see quarterly evolution in the table below) with the outlook for future interest earnings dependent on policymaking decisions. As a reference, an interest rate cut of 0.25% in Euro would have a potential impact of €51 million on the windfall contribution on quarterly basis.

|

Russian sanctions |

o/w CBR as of 15 Feb. |

CBR Q1 2024 as of 15 Feb. |

CBR Q2 2024 |

CBR Q3 2024 |

o/w Other Russia |

||||

|

Operating income |

2,240 |

1,000 |

191 |

407 |

402 |

1,240 |

|||

|

Business income |

-20 |

0 |

0 |

0 |

0 |

-20 |

|||

|

Interest, banking & other income |

5,148 |

3,888 |

746 |

1,577 |

1,565 |

1,260 |

|||

|

Windfall contribution provision |

-2,888 |

-2,888 |

-554 |

-1,170 |

-1,163 |

||||

|

Operating expenses |

-68 |

-16 |

-3 |

-7 |

-6 |

-52 |

|||

|

Operating profit before Impairment |

2,172 |

984 |

188 |

400 |

396 |

1,188 |

|||

|

Tax |

-1,265 |

-968 |

-185 |

-393 |

-390 |

-297 |

|||

|

Net profit |

907 |

16 |

3 |

7 |

6 |

891 |

|||

Update on Russian sanctions and countermeasures

Russia’s invasion of Ukraine in February 2022 resulted in market-wide application of international sanctions. Euroclear considers the application of international sanctions as a key obligation. Therefore, well established processes are in place which have allowed the group to implement the sanctions while maintaining our normal course of business.

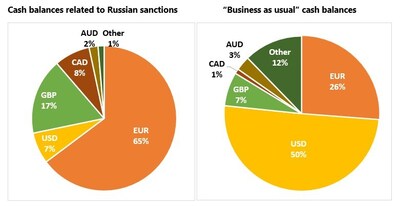

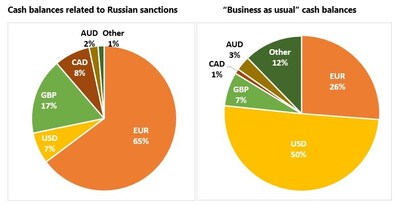

As a result of the sanctions, blocked coupon payments and redemptions owed to sanctioned entities continue to accumulate on Euroclear Bank’s balance sheet. At the end of September 2024, Euroclear Bank’s balance sheet totalled €216 billion, of which €176 billion relate to sanctioned Russian assets.

In line with Euroclear’s risk appetite and policies and as expected by the EU Capital Requirements Regulation, Euroclear’s cash balances are re-invested to minimise risk and capital requirements. In the first nine months of 2024, interest arising on cash balances from Russian-sanctioned assets was approximately €5.15 billion. Such interest earnings are driven by the prevailing interest rates and the amount of cash balances that Euroclear is required to invest. Subject to Belgian corporate tax, these earnings generated €1.27 billion tax revenue for the Belgian State. As such, future earnings will be influenced by the evolving interest rate environment.

Effective 15 February 2024, the EU Council adopted a Regulation requiring Central Securities Depositories (CSDs) holding reserves and assets of the Central Bank of Russia with a total value of more than €1 million to apply specific rules in relation to the cash balances accumulating due to restrictive measures. These CSDs, such as Euroclear Bank, should account for and manage such extraordinary cash balances separately from their other activities, should keep separate the net profit generated and should not dispose of these ensuing net profits (e.g. in the form of dividends to shareholders).

In May 2024, the European Commission has adopted a new regulation about a windfall contribution applicable to CSDs holding Russian Central Bank assets with a total value of more than €1 million. The profits generated by the reinvestment of these sanctioned amounts dating from 15 February 2024 onwards are required to be contributed to the European Fund for Ukraine. Consequently, Euroclear made a first payment of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

Euroclear continues to act prudently and to strengthen its capital by retaining the remainder of the Russian sanction related profits as a buffer against current and future risks. Euroclear is focused on minimising potential legal, financial, and operational risks that may arise for itself and its clients, while complying with its obligations.

As a direct consequence of the sanctions and countermeasures, Euroclear faces multiple proceedings in Russian courts. Since Russia considers international sanctions against public order, Russian claimants initiated legal proceedings aiming mainly to access assets blocked in Euroclear Bank’s books, by claiming an equivalent amount in Russian Ruble and enforcing their claim in Russia. Despite all legal actions taken by Euroclear and the considerable resources mobilised, the probability of unfavourable rulings in Russian courts is high since Russia does not recognise the international sanctions.

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q3 2024 for both entities are shown below.

|

Figures in Million of EUR |

|||||||

|

Euroclear Bank Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

||||

|

Net interest income |

3,130.5 |

3,803.8 |

-673.2 |

||||

|

Net fee and commission income |

841.5 |

815.7 |

25.8 |

||||

|

Other income |

-4.6 |

20.9 |

-25.5 |

||||

|

Total operating income |

3,967.5 |

4,640.3 |

-672.9 |

||||

|

Administrative expenses |

-710.2 |

-612.5 |

-97.7 |

||||

|

Operating profit before impairment and taxation |

3,257.3 |

4,027.9 |

-770.6 |

||||

|

Result for the period |

1,709.5 |

3,013.6 |

-1,304.0 |

||||

|

Euroclear Bank Statement of Financial Position |

|||||||

|

Shareholders’ equity |

7,745.3 |

5,615.7 |

2,129.7 |

||||

|

Debt securities issued and funds borrowed (incl.subordinated debt) |

3,876.2 |

4,846.0 |

-969.8 |

||||

|

Total assets |

215,916.9 |

164,481.0 |

51,435.9 |

||||

The drop in Q3 2024 figures compared to Q3 2023 reflects the booking of the windfall contribution related to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024.

|

Euroclear Investments Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

|||||||

|

Dividend |

706.7 |

395.5 |

311.3 |

|||||||

|

Net gains/(losses) on financial assets & liabilities |

18.8 |

10.5 |

8.3 |

|||||||

|

Other income |

-0.1 |

-0.2 |

0.1 |

|||||||

|

Total operating income |

725.4 |

405.8 |

319.6 |

|||||||

|

Administrative expenses |

-1.6 |

-0.8 |

-0.8 |

|||||||

|

Operating profit before impairment and taxation |

723.8 |

405.0 |

318.8 |

|||||||

|

Result for the period |

719.3 |

402.4 |

316.9 |

|||||||

|

Euroclear Investments Statement of Financial Position |

||||||||||

|

Shareholders’ equity |

443.8 |

696.7 |

-253.0 |

|||||||

|

Debt securities issued and funds borrowed |

1,656.9 |

1,656.2 |

0.7 |

|||||||

|

Total assets |

2,100.8 |

2,354.5 |

-253.7 |

|||||||

The evolution of Q3 2024 figures compared to Q3 2023 reflects the increase in intragroup dividend.

About Euroclear

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency, and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International and Irish CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & International.

1 Post deduction of dividend relating to 2023 earnings, including Sept. 2024 YTD profit and based on estimated underlying RWA of around EUR 7.4bn. Assuming a 60% dividend pay-out on the Sept. 2024 profit, the CET1 ratio would be 52%.

Pascal Brabant / pascal.brabant@euroclear.com / +32 475 78 36 62

Photo – https://stockburger.news/wp-content/uploads/2024/10/Annexes.jpg

Logo – https://stockburger.news/wp-content/uploads/2024/10/Euroclear_logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/euroclear-achieves-robust-third-quarter-results-302292235.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/euroclear-achieves-robust-third-quarter-results-302292235.html

SOURCE Euroclear

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft's AI Business Set To Hit $10B Revenue Milestone In Q2: Satya Nadella Says It Is The 'Fastest Business In Our History'

Microsoft Corp MSFT announced during its first-quarter earnings call that its artificial intelligence business is on track to surpass $10 billion in annual revenue run rate next quarter, marking the fastest-growing business segment in the company’s history.

What Happened: CEO Satya Nadella highlighted the rapid adoption of AI across the company’s product portfolio, emphasizing strong customer demand and widespread enterprise implementation.

“AI-driven transformation is changing work, work artifacts and workflow across every role, function, and business process, helping customers drive new growth and operating leverage,” Nadella said during the earnings call.

“Our AI business is on track to surpass an annual revenue run rate of $10 billion next quarter, which will make it the fastest business in our history to reach this milestone,” Nadella said.

Key developments driving AI growth include:

- Nearly 70% of Fortune 500 companies now use Microsoft 365 Copilot

- Azure OpenAI Service usage more than doubled over the past six months

- GitHub Copilot enterprise customers increased 55% quarter-over-quarter

CFO Amy Hood emphasized the strategic importance of AI investments, noting that “only 2.5 years in, our AI business is on track to surpass $10 billion of annual revenue run rate in Q2. This will be the fastest business in our history to reach this milestone.”

See Also: Cathie Wood Shuffles Her Tech Deck: Continues Dumping Tesla And Palantir, Stocks Up On AMD And Meta

Why It Matters: The company’s Azure cloud service saw 33% growth, with AI services contributing approximately 12 points to that growth. However, Microsoft acknowledged that demand continues to exceed available capacity, prompting increased infrastructure investments.

The rapid growth in AI revenue comes as Microsoft reported overall revenue of $65.6 billion for the first quarter, up 16% year-over-year, with Microsoft Cloud revenue reaching $38.9 billion, representing 22% growth.

Price Action: Microsoft Corp’s stock closed at $432.53 on Wednesday, up 0.13% for the day. In after-hours trading, the stock declined by 3.71%. Year-to-date, Microsoft shares have seen a notable gain of 16.63%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Li Auto Inc. Announces Unaudited Third Quarter 2024 Financial Results

Quarterly total revenues reached RMB42.9 billion (US$6.1 billion)1

Quarterly deliveries reached 152,831 vehicles

BEIJING, China, Oct. 31, 2024 (GLOBE NEWSWIRE) — Li Auto Inc. (“Li Auto” or the “Company”) LI HKEX: 2015)), a leader in China’s new energy vehicle market, today announced its unaudited financial results for the quarter ended September 30, 2024.

Operating Highlights for the Third Quarter of 2024

- Total deliveries for the third quarter of 2024 were 152,831 vehicles, representing a 45.4% year-over-year increase.

| 2024 Q3 | 2024 Q2 | 2024 Q1 | 2023 Q4 | |||||||

| Deliveries | 152,831 | 108,581 | 80,400 | 131,805 | ||||||

| 2023 Q3 | 2023 Q2 | 2023 Q1 | 2022 Q4 | |||||||

| Deliveries | 105,108 | 86,533 | 52,584 | 46,319 | ||||||

- As of September 30, 2024, in China, the Company had 479 retail stores in 145 cities, 436 servicing centers and Li Auto-authorized body and paint shops operating in 221 cities, and 894 super charging stations in operation equipped with 4,286 charging stalls.

Financial Highlights for the Third Quarter of 2024

- Vehicle sales were RMB41.3 billion (US$5.9 billion) in the third quarter of 2024, representing an increase of 22.9% from RMB33.6 billion in the third quarter of 2023 and an increase of 36.3% from RMB30.3 billion in the second quarter of 2024.

- Vehicle margin2 was 20.9% in the third quarter of 2024, compared with 21.2% in the third quarter of 2023 and 18.7% in the second quarter of 2024.

- Total revenues were RMB42.9 billion (US$6.1 billion) in the third quarter of 2024, representing an increase of 23.6% from RMB34.7 billion in the third quarter of 2023 and an increase of 35.3% from RMB31.7 billion in the second quarter of 2024.

- Gross profit was RMB9.2 billion (US$1.3 billion) in the third quarter of 2024, representing an increase of 20.7% from RMB7.6 billion in the third quarter of 2023 and an increase of 49.3% from RMB6.2 billion in the second quarter of 2024.

- Gross margin was 21.5% in the third quarter of 2024, compared with 22.0% in the third quarter of 2023 and 19.5% in the second quarter of 2024.

- Operating expenses were RMB5.8 billion (US$825.4 million) in the third quarter of 2024, representing an increase of 9.2% from RMB5.3 billion in the third quarter of 2023 and an increase of 1.5% from RMB5.7 billion in the second quarter of 2024.

- Income from operations was RMB3.4 billion (US$489.2 million) in the third quarter of 2024, representing an increase of 46.7% from RMB2.3 billion in the third quarter of 2023 and an increase of 633.4% from RMB468.0 million in the second quarter of 2024.

- Operating margin was 8.0% in the third quarter of 2024, compared with 6.7% in the third quarter of 2023 and 1.5% in the second quarter of 2024.

- Net income was RMB2.8 billion (US$401.9 million) in the third quarter of 2024, representing an increase of 0.3% from RMB2.8 billion in the third quarter of 2023 and an increase of 156.2% from RMB1.1 billion in the second quarter of 2024. Non-GAAP net income3 was RMB3.9 billion (US$548.8 million) in the third quarter of 2024, representing an increase of 11.1% from RMB3.5 billion in the third quarter of 2023 and an increase of 156.2% from RMB1.5 billion in the second quarter of 2024.

- Diluted net earnings per ADS4 attributable to ordinary shareholders was RMB2.66 (US$0.38) in the third quarter of 2024, compared with RMB2.67 in the third quarter of 2023 and RMB1.05 in the second quarter of 2024. Non-GAAP diluted net earnings per ADS attributable to ordinary shareholders was RMB3.63 (US$0.52) in the third quarter of 2024, compared with RMB3.29 in the third quarter of 2023 and RMB1.42 in the second quarter of 2024.

- Net cash provided by operating activities was RMB11.0 billion (US$1.6 billion) in the third quarter of 2024, compared with RMB14.5 billion net cash provided by operating activities in the third quarter of 2023 and RMB429.4 million net cash used in operating activities in the second quarter of 2024.

- Free cash flow5 was RMB9.1 billion (US$1.3 billion) in the third quarter of 2024, compared with RMB13.2 billion in the third quarter of 2023 and negative RMB1.9 billion in the second quarter of 2024.

Key Financial Results

(in millions, except for percentages and per ADS data)

| For the Three Months Ended | % Change6 | ||||||||||

| September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

YoY | QoQ | |||||||

| RMB | RMB | RMB | |||||||||

| Vehicle sales | 33,616.1 | 30,319.7 | 41,323.8 | 22.9% | 36.3% | ||||||

| Vehicle margin | 21.2% | 18.7% | 20.9% | (0.3)pts | 2.2pts | ||||||

| Total revenues | 34,679.5 | 31,678.4 | 42,874.2 | 23.6% | 35.3% | ||||||

| Gross profit | 7,644.5 | 6,176.9 | 9,224.7 | 20.7% | 49.3% | ||||||

| Gross margin | 22.0% | 19.5% | 21.5% | (0.5)pts | 2.0pts | ||||||

| Operating expenses | (5,305.1) | (5,708.9) | (5,792.0) | 9.2% | 1.5% | ||||||

| Income from operations | 2,339.4 | 468.0 | 3,432.7 | 46.7% | 633.4% | ||||||

| Operating margin | 6.7% | 1.5% | 8.0% | 1.3pts | 6.5pts | ||||||

| Net income | 2,812.9 | 1,100.9 | 2,820.5 | 0.3% | 156.2% | ||||||

| Non-GAAP net income | 3,467.3 | 1,503.1 | 3,851.0 | 11.1% | 156.2% | ||||||

| Diluted net earnings per ADS attributable to ordinary shareholders | 2.67 | 1.05 | 2.66 | (0.4)% | 153.3% | ||||||

| Non-GAAP diluted net earnings per ADS attributable to ordinary shareholders | 3.29 | 1.42 | 3.63 | 10.3% | 155.6% | ||||||

| Net cash provided by/(used in) operating activities | 14,506.5 | (429.4) | 11,024.6 | (24.0)% | N/A | ||||||

| Free cash flow (non-GAAP) | 13,224.8 | (1,852.7) | 9,051.8 | (31.6)% | N/A | ||||||

Recent Developments

One Million Deliveries Milestone

- On October 18, 2024, the Company hit the one million cumulative vehicle deliveries milestone, becoming the first emerging new energy automotive brand in China to reach this benchmark. Notably, the Company hit this milestone just 58 months after delivering its first vehicle in December 2019.

OTA 6.4 Update

- In October 2024, the Company released the OTA update version 6.4 for Li MEGA and the Li L series, significantly enhancing the user experience with a range of new and upgraded autonomous driving, smart space, and smart electric features. With this update, the Company also rolled out its latest autonomous driving solution, which integrates an end-to-end (E2E) model and a vision-language model (VLM), on a full scale to over 320,000 Li AD Max users. Additionally, “Li Xiang Tong Xue” has evolved further with an upgraded voice model and a newly added eye tracking function, along with several other features, enabling more natural and human-like interaction with users.

Safety and Health Assessment Results

- In September 2024, Li MEGA and Li L6 successfully passed the China Insurance Automotive Safety Index (C-IASI) crash tests, adhering to the latest assessment protocols. Both models received a “G+” rating – the highest safety rating – across occupant safety, pedestrian safety, and assistance safety categories and an “A” rating in the crashworthiness and repair economy category. Notably, Li MEGA became the first MPV to receive a “G” rating in crash tests of 25% frontal offset impact on both the driver and the passenger sides under C-IASI’s latest assessment protocols.

- In September 2024, Li L6 received a record-setting overall score under the latest assessment protocols of the China Automobile Health Index (C-AHI) assessment conducted by the China Automotive Engineering Research Institute Co., Ltd. Li L6 received the highest ratings across all three categories assessed: the Clean Air Index, the Health Protection Index, and the Energy Efficiency and Emission Index.

Environmental, Social, and Governance (ESG) Performance

- In September 2024, the Company was awarded the highest “AAA” rating by MSCI ESG Research for the second consecutive year, recognizing its excellence in key areas such as corporate governance, product quality and safety, clean technologies, and its commitment to sustainable development and social responsibility.

CEO and CFO Comments

Mr. Xiang Li, chairman and chief executive officer of Li Auto, commented, “We achieved record-breaking deliveries in the third quarter, further cementing our leadership among Chinese automotive brands in the RMB200,000 and above NEV market. In October, we celebrated a major milestone: one million cumulative deliveries, a first for emerging new energy automotive brands in China. These remarkable results highlighted our rapidly growing brand influence and users’ strong recognition of our advancements in intelligentization. As our vehicle deliveries continue to grow, we are creating a virtuous cycle of innovation and advancement, driving the intelligentization of Li Auto vehicles to new heights. Notably, our latest autonomous driving solution, which integrates an end-to-end (E2E) model and a vision-language model (VLM), received overwhelmingly positive feedback from test users. In October, we rolled out this new solution on a full scale to over 320,000 Li AD Max users. Looking ahead, we remain committed to harnessing the power of technology to drive innovation, reinforcing our position as an industry leader as we continue to grow alongside our over one million user families.”

Mr. Tie Li, chief financial officer of Li Auto, added, “In the third quarter, we maintained our robust business performance. Our record vehicle deliveries boosted revenues to a historic high of RMB42.9 billion, representing an increase of 23.6% year-over-year. With sales across our model lineup steadily growing, our economies of scale continued to expand which, combined with Li AD Max vehicles accounting for a larger proportion of our sales mix driven by breakthroughs in intelligentization, allowed us to meaningfully expand our gross margin to 21.5%. Additionally, our net income reached RMB2.8 billion and operating cash flow reached RMB11.0 billion in the third quarter. Building on our solid execution across the organization and strong profitability, we are poised to maintain a relentless pursuit of business growth and technological innovation, which will propel us forward on our journey to achieving our long-term vision.”

Financial Results for the Third Quarter of 2024

Revenues

- Total revenues were RMB42.9 billion (US$6.1 billion) in the third quarter of 2024, representing an increase of 23.6% from RMB34.7 billion in the third quarter of 2023 and an increase of 35.3% from RMB31.7 billion in the second quarter of 2024.

- Vehicle sales were RMB41.3 billion (US$5.9 billion) in the third quarter of 2024, representing an increase of 22.9% from RMB33.6 billion in the third quarter of 2023 and an increase of 36.3% from RMB30.3 billion in the second quarter of 2024. The increase in revenue from vehicle sales over the third quarter of 2023 and second quarter of 2024 was primarily attributable to the increase in vehicle deliveries, partially offset by the lower average selling price mainly due to different product mix.

- Other sales and services were RMB1.6 billion (US$220.9 million) in the third quarter of 2024, representing an increase of 45.8% from RMB1.1 billion in the third quarter of 2023 and an increase of 14.1% from RMB1.4 billion in the second quarter of 2024. The increase in revenue from other sales and services over the third quarter of 2023 and second quarter of 2024 was mainly attributable to the increased provision of services and sales of accessories, which is in line with higher accumulated vehicle sales, and increased sales of embedded products and services offered together with vehicle sales, which is in line with higher vehicle deliveries.

Cost of Sales and Gross Margin

- Cost of sales was RMB33.6 billion (US$4.8 billion) in the third quarter of 2024, representing an increase of 24.5% from RMB27.0 billion in the third quarter of 2023 and an increase of 32.0% from RMB25.5 billion in the second quarter of 2024. The increase in cost of sales over the third quarter of 2023 and second quarter of 2024 was mainly attributable to increase in vehicle deliveries, partially offset by the lower average cost of sales due to different product mix and cost reduction.

- Gross profit was RMB9.2 billion (US$1.3 billion) in the third quarter of 2024, representing an increase of 20.7% from RMB7.6 billion in the third quarter of 2023 and an increase of 49.3% from RMB6.2 billion in the second quarter of 2024.

- Vehicle margin was 20.9% in the third quarter of 2024, compared with 21.2% in the third quarter of 2023 and 18.7% in the second quarter of 2024. The vehicle margin remained relatively stable over the third quarter of 2023. The increase in vehicle margin over the second quarter of 2024 was mainly due to cost reduction, partially offset by lower average selling price mainly due to different product mix.

- Gross margin was 21.5% in the third quarter of 2024, compared with 22.0% in the third quarter of 2023 and 19.5% in the second quarter of 2024. The gross margin remained relatively stable over the third quarter of 2023. The increase in gross margin over the second quarter of 2024 was mainly due to the increase in vehicle margin.

Operating Expenses

- Operating expenses were RMB5.8 billion (US$825.4 million) in the third quarter of 2024, representing an increase of 9.2% from RMB5.3 billion in the third quarter of 2023 and an increase of 1.5% from RMB5.7 billion in the second quarter of 2024.

- Research and development expenses were RMB2.6 billion (US$368.6 million) in the third quarter of 2024, representing a decrease of 8.2% from RMB2.8 billion in the third quarter of 2023 and a decrease of 14.6% from RMB3.0 billion in the second quarter of 2024. The decrease in research and development expenses over the third quarter of 2023 and second quarter of 2024 was mainly attributable to decreased design and development costs for new products and technologies, and decreased employee compensation.

- Selling, general and administrative expenses were RMB3.4 billion (US$478.7 million) in the third quarter of 2024, representing an increase of 32.1% from RMB2.5 billion in the third quarter of 2023 and an increase of 19.3% from RMB2.8 billion in the second quarter of 2024. The increase in selling, general and administrative expenses over the third quarter of 2023 and second quarter of 2024 was primarily due to increased employee compensation associated with the recognition of share-based compensation expenses regarding the chief executive officer’s performance-based awards in the third quarter of 2024 as the achievement of the related performance condition was deemed probable as well as the growth in the number of staff.

Income from Operations

- Income from operations was RMB3.4 billion (US$489.2 million) in the third quarter of 2024, representing an increase of 46.7% from RMB2.3 billion in the third quarter of 2023 and an increase of 633.4% from RMB468.0 million in the second quarter of 2024. Operating margin was 8.0% in the third quarter of 2024, compared with 6.7% in the third quarter of 2023 and 1.5% in the second quarter of 2024. Non-GAAP income from operations was RMB4.5 billion (US$636.0 million) in the third quarter of 2024, representing an increase of 49.1% from RMB3.0 billion in the third quarter of 2023 and an increase of 412.9% from RMB870.1 million in the second quarter of 2024.

Net Income and Net Earnings Per Share

- Net income was RMB2.8 billion (US$401.9 million) in the third quarter of 2024, representing an increase of 0.3% from RMB2.8 billion in the third quarter of 2023 and an increase of 156.2% from RMB1.1 billion in the second quarter of 2024. Non-GAAP net income was RMB3.9 billion (US$548.8 million) in the third quarter of 2024, representing an increase of 11.1% from RMB3.5 billion in the third quarter of 2023 and an increase of 156.2% from RMB1.5 billion in the second quarter of 2024.

- Basic and diluted net earnings per ADS attributable to ordinary shareholders were RMB2.82 (US$0.40) and RMB2.66 (US$0.38) in the third quarter of 2024, respectively, compared with RMB2.86 and RMB2.67 in the third quarter of 2023, respectively, and RMB1.11 and RMB1.05 in the second quarter of 2024, respectively. Non-GAAP basic and diluted net earnings per ADS attributable to ordinary shareholders were RMB3.85 (US$0.55) and RMB3.63 (US$0.52) in the third quarter of 2024, respectively, compared with RMB3.53 and RMB3.29 in the third quarter of 2023, respectively, and RMB1.51 and RMB1.42 in the second quarter of 2024, respectively.

Cash Position, Operating Cash Flow and Free Cash Flow

- Cash position7 was RMB106.5 billion (US$15.2 billion) as of September 30, 2024.

- Net cash provided by operating activities was RMB11.0 billion (US$1.6 billion) in the third quarter of 2024, compared with RMB14.5 billion net cash provided by operating activities in the third quarter of 2023 and RMB429.4 million net cash used in operating activities in the second quarter of 2024. The change in net cash provided by operating activities over the third quarter of 2023 was mainly due to increased payment related to inventory purchase, partially offset by the increase in cash received from customers. The change in net cash provided by operating activities over the second quarter of 2024 was mainly due to the increase in cash received from customers as a result of the increase in vehicle deliveries.

- Free cash flow was RMB9.1 billion (US$1.3 billion) in the third quarter of 2024, compared with RMB13.2 billion in the third quarter of 2023 and negative RMB1.9 billion in the second quarter of 2024.

Business Outlook

For the fourth quarter of 2024, the Company expects:

- Deliveries of vehicles to be between 160,000 and 170,000 vehicles, representing a year-over-year increase of 21.4% to 29.0%.

- Total revenues to be between RMB43.2 billion (US$6.2 billion) and RMB45.9 billion (US$6.5 billion), representing a year-over-year increase of 3.5% to 10.0%.

This business outlook reflects the Company’s current and preliminary views on its business situation and market conditions, which are subject to change.

Conference Call

Management will hold a conference call at 8:00 a.m. U.S. Eastern Time on Thursday, October 31, 2024 (8:00 p.m. Beijing/Hong Kong Time on October 31, 2024) to discuss financial results and answer questions from investors and analysts.

For participants who wish to join the call, please complete online registration using the link provided below prior to the scheduled call start time. Upon registration, participants will receive the conference call access information, including dial-in numbers, passcode, and a unique access PIN. To join the conference, please dial the number provided, enter the passcode followed by your PIN, and you will join the conference instantly.

Participant Online Registration: https://s1.c-conf.com/diamondpass/10042773-bt4saz.html

A replay of the conference call will be accessible through November 7, 2024, by dialing the following numbers:

| United States: | +1-855-883-1031 |

| Mainland China: | +86-400-1209-216 |

| Hong Kong, China: | +852-800-930-639 |

| International: | +61-7-3107-6325 |

| Replay PIN: | 10042773 |

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.lixiang.com.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures, such as non-GAAP cost of sales, non-GAAP research and development expenses, non-GAAP selling, general and administrative expenses, non-GAAP income from operations, non-GAAP net income, non-GAAP net income attributable to ordinary shareholders, non-GAAP basic and diluted net earnings per ADS attributable to ordinary shareholders, non-GAAP basic and diluted net earnings per share attributable to ordinary shareholders and free cash flow, in evaluating its operating results and for financial and operational decision-making purposes. By excluding the impact of share-based compensation expenses and release of valuation allowance on deferred tax assets, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not presented in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should not consider them in isolation, or as a substitute for financial information prepared in accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliation of U.S. GAAP and Non-GAAP Results” set forth at the end of this press release.

Exchange Rate Information

This press release contains translations of certain Renminbi amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi are made at a rate of RMB7.0176 to US$1.00, the exchange rate on September 30, 2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the Renminbi or U.S. dollars amounts referred could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

About Li Auto Inc.

Li Auto Inc. is a leader in China’s new energy vehicle market. The Company designs, develops, manufactures, and sells premium smart electric vehicles. Its mission is: Create a Mobile Home, Create Happiness (创造移动的家, 创造幸福的家). Through innovations in product, technology, and business model, the Company provides families with safe, convenient, and comfortable products and services. Li Auto is a pioneer in successfully commercializing extended-range electric vehicles in China. While firmly advancing along this technological route, it builds platforms for battery electric vehicles in parallel. The Company leverages technology to create value for users. It concentrates its in-house development efforts on proprietary range extension systems, innovative electric vehicle technologies, and smart vehicle solutions. The Company started volume production in November 2019. Its current model lineup includes Li MEGA, a high-tech flagship family MPV, Li L9, a six-seat flagship family SUV, Li L8, a six-seat premium family SUV, Li L7, a five-seat flagship family SUV, and Li L6, a five-seat premium family SUV. The Company will continue to expand its product lineup to target a broader user base.

For more information, please visit: https://ir.lixiang.com.

Safe Harbor Statement