Veris Residential, Inc. Reports Third Quarter 2024 Results

Raises Full-Year 2024 Guidance

JERSEY CITY, N.J., Oct. 30, 2024 /PRNewswire/ — Veris Residential, Inc. VRE (the “Company”), a forward-thinking, environmentally and socially conscious multifamily REIT, today reported results for the third quarter 2024.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Net Income (Loss) per Diluted Share |

$(0.10) |

$(0.60) |

$(0.12) |

$(1.16) |

|

Core FFO per Diluted Share |

$0.17 |

$0.12 |

$0.49 |

$0.42 |

|

Core AFFO per Diluted Share |

$0.19 |

$0.15 |

$0.58 |

$0.48 |

|

Dividend per Diluted Share |

$0.07 |

$0.05 |

$0.18 |

$0.05 |

YEAR-TO-DATE HIGHLIGHTS

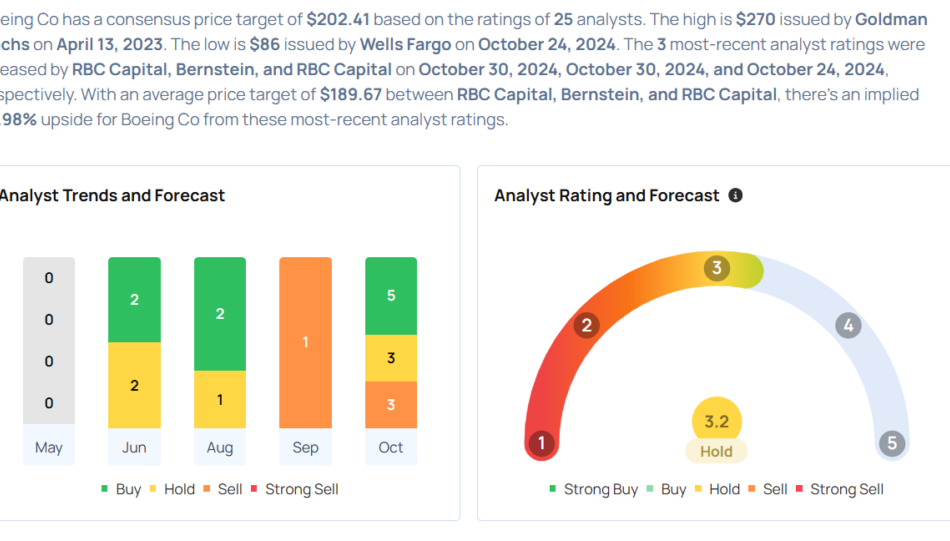

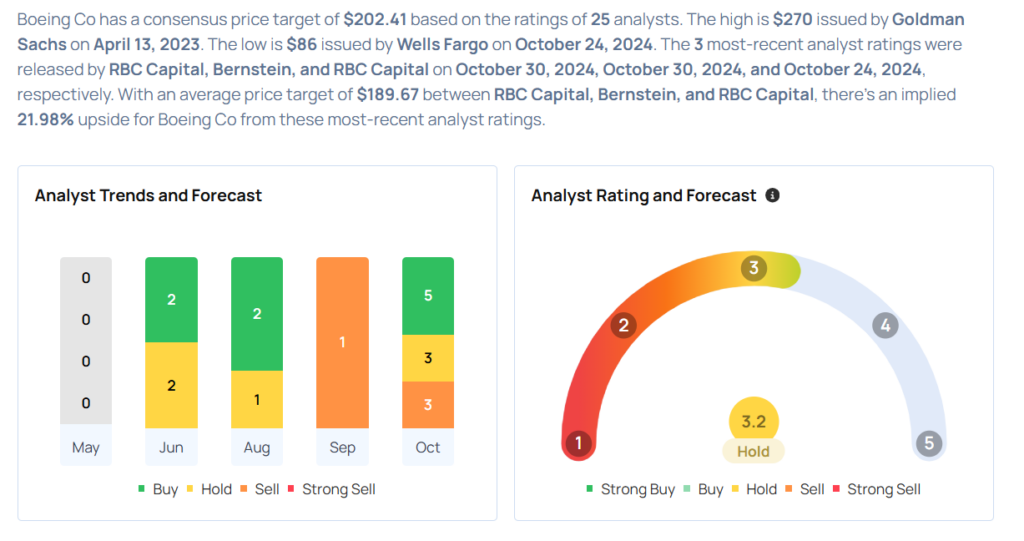

- Same Store multifamily Blended Net Rental growth rate of 4.6% for the quarter and 4.8% year to date.

- Year-over-year Normalized Same Store NOI growth of 8.4% for the third quarter and 8.0% year to date.

- Year-to-date Normalized Same Store NOI margin of 66.8%, a 130 basis point improvement from the same period last year.

- Reduced net debt by approximately $227 million since September 30, 2023, and refinanced $531 million of mortgage debt, leaving no remaining consolidated debt maturities until 2026.

- Raised guidance as a result of the favorable resolutions of certain non-controllable expenses and better-than-expected revenue growth.

- Core FFO guidance raised by over 13% at the low end and 7% at the high end, resulting in a revised range of $0.59 – $0.60.

- Same Store NOI guidance raised by 240 basis points at the low end and 120 basis points at the high end, resulting in a revised range of 5.4% – 6.2%.

- Named 2024 Regional Listed Sector Leader by GRESB for distinguished ESG leadership and performance, with the highest listed residential score in the U.S. and the third-best listed residential score worldwide.

|

September 30, 2024 |

June 30, 2024 |

Change |

|

|

Same Store Units |

7,621 |

7,621 |

— % |

|

Same Store Occupancy |

95.1 % |

95.1 % |

— % |

|

Same Store Blended Rental Growth Rate (Quarter) |

4.6 % |

5.4 % |

(0.8) % |

|

Average Rent per Home |

$3,980 |

$3,923 |

1.5 % |

Mahbod Nia, Chief Executive Officer, commented, “Our portfolio continues to exhibit strong revenue growth, underpinned by robust demand for our premium properties and limited new supply in our key markets. I am extremely proud of the work our teams have done to mitigate controllable expense growth during a period of elevated inflation. These efforts, combined with a better than expected resolution of our non-controllable expenses last quarter, drove a substantial 17% year-over-year increase in Core FFO per share during the first nine months of the year, further improving our operating margin to 66.8% and allowing us to once again raise guidance.”

SAME STORE PORTFOLIO PERFORMANCE

The following table shows Same Store performance:

|

($ in 000s) |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

2024 |

2023 |

% |

2024 |

2023 |

% |

|

|

Total Property Revenue |

$75,843 |

$72,948 |

4.0 % |

$224,680 |

$212,227 |

5.9 % |

|

Controllable Expenses |

13,452 |

13,543 |

(0.7) % |

39,499 |

38,421 |

2.8 % |

|

Non-Controllable Expenses |

10,572 |

11,596 |

(8.8) % |

35,023 |

33,130 |

5.7 % |

|

Total Property Expenses |

24,024 |

25,139 |

(4.4) % |

74,522 |

71,551 |

4.2 % |

|

Same Store NOI |

$51,819 |

$47,809 |

8.4 % |

$150,158 |

$140,676 |

6.7 % |

|

Less: Real Estate Tax Adjustments |

— |

20 |

— |

1,689 |

||

|

Normalized Same Store NOI |

$51,819 |

$47,789 |

8.4 % |

$150,158 |

$138,987 |

8.0 % |

In the third quarter, the Company renewed its property insurance program and finalized property taxes for its Jersey City assets, reducing Same Store non-controllable expenses by 8.8% for the quarter.

FINANCE AND LIQUIDITY

Approximately all of the Company’s debt is hedged or fixed. The Company’s total debt portfolio has a weighted average effective interest rate of 4.96% and weighted average maturity of 3.3 years.

|

Balance Sheet Metric ($ in 000s) |

September 30, 2024 |

June 30, 2024 |

|

Weighted Average Interest Rate |

4.96 % |

4.51 % |

|

Weighted Average Years to Maturity |

3.3 |

3.1 |

|

Interest Coverage Ratio |

1.7x |

1.7x |

|

Net Debt |

$1,645,447 |

$1,646,023 |

|

TTM EBITDA |

$140,682 |

$139,654 |

|

TTM Net Debt to EBITDA |

11.7x |

11.8x |

During the third quarter, the Company repaid the $43 million mortgage on Signature Place and the $265 million mortgage on Liberty Towers using a combination of cash on hand, $145 million of additional draws on the Term Loan and a $157 million draw on the Secured Revolving Credit Facility. At quarter end, the Company had liquidity of approximately $170 million.

The $200 million Term Loan balance and $150 million of the Revolver were hedged with interest rate caps at a strike rate of 3.5%. The nine-month interest rate cap on the Revolver has not been designated as an effective accounting hedge to allow for flexibility should the Company repay a portion of the Revolver balance before the interest rate cap expires.

At the beginning of the third quarter, the Company successfully met Sustainable KPI provisions that resulted in a 5-basis-point spread reduction for all borrowings on the Term Loan and Revolver.

ESG

The Company has again been recognized by global and national real estate organizations for its accomplishments in ESG and DEI. Most significantly, GRESB designated the Company as a Regional Listed Sector Leader in the Residential category, a recognition highlighting the top GRESB assessment performers in the Americas. The Company achieved the highest listed residential score in the U.S. and third-best listed residential score worldwide, earning its third-consecutive 5 Star rating.

The Company was also recognized by Nareit with the Mid Cap Diversity Impact Award for its social responsibility policies.

DIVIDEND

The Company paid a dividend of $0.07 per share on October 16, 2024, for shareholders of record as of September 30, 2024.

GUIDANCE

The Company has raised its 2024 guidance ranges to reflect the favorable outcome of certain non-controllable expenses that were finalized in the third quarter and continued multifamily outperformance.

|

Revised Guidance |

Previous Guidance (July) |

|||||

|

2024 Guidance Ranges |

Low |

High |

Low |

High |

||

|

Same Store Revenue Growth |

4.6 % |

— |

5.0 % |

4.0 % |

— |

5.0 % |

|

Same Store Expense Growth |

2.5 % |

— |

3.0 % |

4.5 % |

— |

5.5 % |

|

Same Store NOI Growth |

5.4 % |

— |

6.2 % |

3.0 % |

— |

5.0 % |

|

Core FFO per Share Guidance |

Low |

High |

|

|

Net Loss per Share |

$(0.15) |

— |

$(0.14) |

|

Other FFO adjustments per share |

$(0.16) |

— |

$(0.16) |

|

Depreciation per Share |

$0.90 |

— |

$0.90 |

|

Core FFO per Share |

$0.59 |

— |

$0.60 |

CONFERENCE CALL/SUPPLEMENTAL INFORMATION

An earnings conference call with management is scheduled for Thursday, October 31, 2024, at 8:30 a.m. Eastern Time and will be broadcast live via the Internet at: http://investors.verisresidential.com.

The live conference call is also accessible by dialing (877) 451-6152 (domestic) or (201) 389-0879 (international) and requesting the Veris Residential third quarter 2024 earnings conference call.

The conference call will be rebroadcast on Veris Residential, Inc.’s website at:

http://investors.verisresidential.com beginning at 8:30 a.m. Eastern Time on Thursday, October 31, 2024.

A replay of the call will also be accessible Thursday, October 31, 2024, through Sunday, December 1, 2024, by calling (844) 512-2921 (domestic) or +1(412) 317-6671 (international) and using the passcode, 13747452.

Copies of Veris Residential, Inc.’s third quarter 2024 Form 10-Q and third quarter 2024 Supplemental Operating and Financial Data are available on Veris Residential, Inc.’s website under Financial Results.

In addition, once filed, these items will be available upon request from:

Veris Residential, Inc. Investor Relations Department

Harborside 3, 210 Hudson St., Ste. 400, Jersey City, New Jersey 07311

ABOUT THE COMPANY

Veris Residential, Inc. is a forward-thinking, environmentally and socially conscious real estate investment trust (REIT) that primarily owns, operates, acquires and develops holistically inspired, Class A multifamily properties that meet the sustainability-conscious lifestyle needs of today’s residents while seeking to positively impact the communities it serves and the planet at large. The Company is guided by an experienced management team and Board of Directors, underpinned by leading corporate governance principles; a best-in-class, sustainable approach to operations; and an inclusive culture based on equality and meritocratic empowerment.

For additional information on Veris Residential, Inc. and our properties available for lease, please visit http:// www.verisresidential.com/.

The information in this press release must be read in conjunction with, and is modified in its entirety by, the Quarterly Report on Form 10-Q (the “10-Q”) filed by the Company for the same period with the Securities and Exchange Commission (the “SEC”) and all of the Company’s other public filings with the SEC (the “Public Filings”). In particular, the financial information contained herein is subject to and qualified by reference to the financial statements contained in the 10-Q, the footnotes thereto and the limitations set forth therein. Investors may not rely on the press release without reference to the 10-Q and the Public Filings, available at https://investors.verisresidential.com/financial-information.

We consider portions of this information, including the documents incorporated by reference, to be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of such act. Such forward-looking statements relate to, without limitation, our future economic performance, plans and objectives for future operations, and projections of revenue and other financial items. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target,” “continue” or comparable terminology. Forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which we cannot predict with accuracy and some of which we may not anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Disclosure Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K, as may be supplemented or amended by the Company’s Quarterly Reports on Form 10-Q, which are incorporated herein by reference. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise, except as required under applicable law.

|

Investors |

Media |

|

|

Anna Malhari |

Amanda Shpiner/Grace Cartwright |

|

|

Chief Operating Officer |

Gasthalter & Co. |

|

|

investors@verisresidential.com |

veris-residential@gasthalter.com |

Additional details in Company Information.

|

Consolidated Balance Sheet (in thousands) (unaudited)

|

||

|

September 30, 2024 |

December 31, 2023 |

|

|

ASSETS |

||

|

Rental property |

||

|

Land and leasehold interests |

$462,531 |

$474,499 |

|

Buildings and improvements |

2,635,580 |

2,782,468 |

|

Tenant improvements |

12,946 |

30,908 |

|

Furniture, fixtures and equipment |

106,901 |

103,613 |

|

3,217,958 |

3,391,488 |

|

|

Less – accumulated depreciation and amortization |

(411,537) |

(443,781) |

|

2,806,421 |

2,947,707 |

|

|

Real estate held for sale, net |

— |

58,608 |

|

Net investment in rental property |

2,806,421 |

3,006,315 |

|

Cash and cash equivalents |

12,782 |

28,007 |

|

Restricted cash |

19,687 |

26,572 |

|

Investments in unconsolidated joint ventures |

113,595 |

117,954 |

|

Unbilled rents receivable, net |

2,204 |

5,500 |

|

Deferred charges and other assets, net |

49,110 |

53,956 |

|

Accounts receivable |

2,041 |

2,742 |

|

Total Assets |

$3,005,840 |

$3,241,046 |

|

LIABILITIES & EQUITY |

||

|

Revolving credit facility and term loans |

353,580 |

— |

|

Mortgages, loans payable and other obligations, net |

1,324,336 |

1,853,897 |

|

Dividends and distributions payable |

7,467 |

5,540 |

|

Accounts payable, accrued expenses and other liabilities |

45,509 |

55,492 |

|

Rents received in advance and security deposits |

10,993 |

14,985 |

|

Accrued interest payable |

4,816 |

6,580 |

|

Total Liabilities |

1,746,701 |

1,936,494 |

|

Redeemable noncontrolling interests |

9,294 |

24,999 |

|

Total Stockholders’ Equity |

1,116,337 |

1,137,478 |

|

Noncontrolling interests in subsidiaries: |

||

|

Operating Partnership |

104,092 |

107,206 |

|

Consolidated joint ventures |

31,811 |

34,869 |

|

Total Noncontrolling Interests in Subsidiaries |

$135,903 |

$142,075 |

|

Total Equity |

$1,249,845 |

$1,279,553 |

|

Total Liabilities and Equity |

$3,005,840 |

$3,241,046 |

|

Consolidated Statement of Operations (In thousands, except per share amounts) (unaudited) 1 |

|||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

REVENUES |

2024 |

2023 |

2024 |

2023 |

|

|

Revenue from leases |

$62,227 |

$59,935 |

$183,786 |

$174,223 |

|

|

Management fees |

794 |

1,230 |

2,587 |

2,785 |

|

|

Parking income |

3,903 |

3,947 |

11,570 |

11,673 |

|

|

Other income |

1,251 |

1,361 |

5,048 |

4,596 |

|

|

Total revenues |

68,175 |

66,473 |

202,991 |

193,277 |

|

|

EXPENSES |

|||||

|

Real estate taxes |

8,572 |

9,301 |

27,251 |

25,158 |

|

|

Utilities |

2,129 |

2,039 |

6,196 |

5,863 |

|

|

Operating services |

10,156 |

13,583 |

35,354 |

37,195 |

|

|

Property management |

3,762 |

3,533 |

13,370 |

9,864 |

|

|

General and administrative |

8,956 |

14,604 |

29,019 |

34,460 |

|

|

Transaction related costs |

— |

2,704 |

1,406 |

7,051 |

|

|

Depreciation and amortization |

21,159 |

21,390 |

61,592 |

65,008 |

|

|

Land and other impairments, net |

2,619 |

— |

2,619 |

3,396 |

|

|

Total expenses |

57,353 |

67,154 |

176,807 |

187,995 |

|

|

OTHER (EXPENSE) INCOME |

|||||

|

Interest expense |

(21,507) |

(23,715) |

(64,683) |

(67,422) |

|

|

Interest cost of mandatorily redeemable noncontrolling interests |

— |

(36,392) |

— |

(49,782) |

|

|

Interest and other investment income |

181 |

1,240 |

2,255 |

5,283 |

|

|

Equity in earnings (loss) of unconsolidated joint ventures |

(268) |

210 |

2,919 |

2,843 |

|

|

Gain (loss) on disposition of developable land |

— |

— |

11,515 |

(23) |

|

|

Gain on sale of unconsolidated joint venture interests |

— |

— |

7,100 |

— |

|

|

Gain (loss) from extinguishment of debt, net |

8 |

(1,046) |

(777) |

(3,702) |

|

|

Other income (expense), net |

(310) |

(57) |

(305) |

2,794 |

|

|

Total other (expense) income, net |

(21,896) |

(59,760) |

(41,976) |

(110,009) |

|

|

Loss from continuing operations before income tax expense |

(11,074) |

(60,441) |

(15,792) |

(104,727) |

|

|

Provision for income taxes |

(39) |

(293) |

(274) |

(293) |

|

|

Loss from continuing operations after income tax expense |

(11,113) |

(60,734) |

(16,066) |

(105,020) |

|

|

Income from discontinued operations |

206 |

61 |

1,877 |

691 |

|

|

Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net |

— |

423 |

1,548 |

(2,286) |

|

|

Total discontinued operations, net |

206 |

484 |

3,425 |

(1,595) |

|

|

Net loss |

(10,907) |

(60,250) |

(12,641) |

(106,615) |

|

|

Noncontrolling interest in consolidated joint ventures |

391 |

592 |

1,429 |

1,815 |

|

|

Noncontrolling interests in Operating Partnership of income from continuing operations |

923 |

5,243 |

1,293 |

9,785 |

|

|

Noncontrolling interests in Operating Partnership in discontinued operations |

(18) |

(42) |

(295) |

134 |

|

|

Redeemable noncontrolling interests |

(81) |

(350) |

(459) |

(7,333) |

|

|

Net loss available to common shareholders |

$(9,692) |

$(54,807) |

$(10,673) |

$(102,214) |

|

|

Basic earnings per common share: |

|||||

|

Net loss available to common shareholders |

$(0.10) |

$(0.60) |

$(0.12) |

$(1.16) |

|

|

Diluted earnings per common share: |

|||||

|

Net loss available to common shareholders |

$(0.10) |

$(0.60) |

$(0.12) |

$(1.16) |

|

|

Basic weighted average shares outstanding |

92,903 |

92,177 |

92,615 |

91,762 |

|

|

Diluted weighted average shares outstanding(6) |

101,587 |

100,925 |

101,304 |

100,770 |

|

|

1 For more details see Reconciliation to Net Income (Loss) to NOI. |

|

FFO, Core FFO and Core AFFO (in thousands, except per share/unit amounts) |

|||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Net loss available to common shareholders |

$ (9,692) |

$ (54,807) |

$ (10,673) |

$ (102,214) |

|

|

Add (deduct): Noncontrolling interests in Operating Partnership |

(923) |

(5,243) |

(1,293) |

(9,785) |

|

|

Noncontrolling interests in discontinued operations |

18 |

42 |

295 |

(134) |

|

|

Real estate-related depreciation and amortization on continuing operations(1) |

23,401 |

23,746 |

68,547 |

72,087 |

|

|

Real estate-related depreciation and amortization on discontinued operations |

— |

1,926 |

668 |

10,870 |

|

|

Continuing operations: Gain on sale from unconsolidated joint ventures |

— |

— |

(7,100) |

— |

|

|

Discontinued operations: Realized (gains) losses and unrealized (gains) losses on disposition of rental property, net |

— |

(423) |

(1,548) |

2,286 |

|

|

FFO(2) |

$ 12,804 |

$ (34,759) |

$ 48,896 |

$ (26,890) |

|

|

Add/(Deduct): |

|||||

|

Gain (Loss) from extinguishment of debt, net |

(8) |

1,046 |

777 |

3,714 |

|

|

Land and other impairments |

2,619 |

— |

2,619 |

3,396 |

|

|

(Gain) Loss on disposition of developable land |

— |

— |

(11,515) |

23 |

|

|

Rebranding and Severance/Compensation related costs (G&A) |

206 |

5,904 |

2,079 |

7,869 |

|

|

Rebranding and Severance/Compensation related costs (Property Management) |

26 |

288 |

2,390 |

288 |

|

|

Severance/Compensation related costs (Operating Expenses) |

— |

649 |

— |

649 |

|

|

Rockpoint buyout premium |

— |

34,775 |

— |

34,775 |

|

|

Redemption value adjustments to mandatorily redeemable noncontrolling interests |

— |

— |

— |

7,641 |

|

|

Amortization of derivative premium(7) |

1,303 |

999 |

3,093 |

3,751 |

|

|

Derivative mark to market adjustment |

16 |

— |

16 |

— |

|

|

Transaction related costs |

— |

2,704 |

1,406 |

7,051 |

|

|

Core FFO |

$ 16,966 |

$ 11,606 |

$ 49,761 |

$ 42,267 |

|

|

Add (Deduct) Non-Cash Items: |

|||||

|

Straight-line rent adjustments(3) |

(341) |

781 |

(683) |

421 |

|

|

Amortization of market lease intangibles, net |

(9) |

— |

(25) |

(79) |

|

|

Amortization of lease inducements |

— |

37 |

7 |

52 |

|

|

Amortization of stock compensation |

3,005 |

3,234 |

9,979 |

9,725 |

|

|

Non-real estate depreciation and amortization |

165 |

228 |

594 |

813 |

|

|

Amortization of deferred financing costs |

1,675 |

1,353 |

4,486 |

3,185 |

|

|

Deduct: |

|||||

|

Non-incremental revenue generating capital expenditures: |

|||||

|

Building improvements |

(2,288) |

(2,247) |

(4,890) |

(6,678) |

|

|

Tenant improvements and leasing commissions(4) |

(55) |

(125) |

(142) |

(1,106) |

|

|

Core AFFO(2) |

$ 19,118 |

$ 14,867 |

$ 59,087 |

$ 48,600 |

|

|

Funds from Operations per share/unit-diluted |

$0.13 |

$(0.35) |

$0.48 |

$(0.27) |

|

|

Core Funds from Operations per share/unit-diluted |

$0.17 |

$0.12 |

$0.49 |

$0.42 |

|

|

Core Adjusted Funds from Operations per share/unit-diluted |

$0.19 |

$0.15 |

$0.58 |

$0.48 |

|

|

Dividends declared per common share |

$0.07 |

$0.05 |

$0.1825 |

$0.05 |

|

|

See Non-GAAP Financial Definitions. |

|

See Consolidated Statements of Operations. |

|

Adjusted EBITDA ($ in thousands) (unaudited) |

|||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Core FFO (calculated on a previous page) |

$ 16,966 |

$ 11,606 |

$ 49,761 |

$ 42,267 |

|

|

Deduct: |

|||||

|

Equity in (earnings) loss of unconsolidated joint ventures |

268 |

(210) |

(3,181) |

(2,843) |

|

|

Equity in earnings share of depreciation and amortization |

(2,407) |

(2,584) |

(7,549) |

(7,740) |

|

|

Add-back: |

|||||

|

Interest expense |

21,507 |

23,715 |

64,683 |

68,244 |

|

|

Amortization of derivative premium |

(1,303) |

(999) |

(3,093) |

(3,751) |

|

|

Derivative mark to market adjustment |

(16) |

— |

(16) |

— |

|

|

Recurring joint venture distributions |

2,374 |

2,896 |

8,252 |

8,982 |

|

|

Noncontrolling interests in consolidated joint ventures |

(391) |

(592) |

(1,429) |

(1,815) |

|

|

Interest cost for mandatorily redeemable noncontrolling interests |

— |

1,617 |

— |

7,366 |

|

|

Redeemable noncontrolling interests |

81 |

350 |

459 |

7,333 |

|

|

Income tax expense |

39 |

293 |

297 |

293 |

|

|

Adjusted EBITDA |

$ 37,118 |

$ 36,092 |

$ 108,184 |

$ 118,336 |

|

|

See Consolidated Statements of Operations and Non-GAAP Financial Footnotes. |

|

See Non-GAAP Financial Definitions. |

|

Components of Net Asset Value ($ in thousands)

|

|||||

|

Real Estate Portfolio |

Other Assets |

||||

|

Operating Multifamily NOI1 |

Total |

At Share |

Cash and Cash Equivalents |

$12,782 |

|

|

New Jersey Waterfront |

$173,720 |

$147,629 |

Restricted Cash |

19,687 |

|

|

Massachusetts |

26,032 |

26,032 |

Other Assets |

53,355 |

|

|

Other |

30,712 |

22,651 |

Subtotal Other Assets |

$85,824 |

|

|

Total Multifamily NOI |

$230,464 |

$196,312 |

|||

|

Commercial NOI2 |

3,524 |

2,851 |

Liabilities and Other |

||

|

Total NOI |

$233,988 |

$199,163 |

|||

|

Operating – Consolidated Debt at Share |

$1,262,734 |

||||

|

Non-Strategic Assets |

Operating – Unconsolidated Debt at Share |

295,863 |

|||

|

Other Liabilities |

68,785 |

||||

|

Estimated Land Value3 |

$187,311 |

Revolving Credit Facility4 |

157,000 |

||

|

Total Non-Strategic Assets |

$187,311 |

Term Loan4 |

200,000 |

||

|

Preferred Units |

9,294 |

||||

|

Subtotal Liabilities and Other Considerations |

$1,993,676 |

||||

|

Outstanding Shares5 |

|||||

|

Diluted Weighted Average Shares |

102,312 |

||||

|

1 See Multifamily Operating Portfolio for more details. The Real Estate Portfolio table is reflective of the quarterly NOI annualized. |

|

2 See Commercial Assets and Developable Land for more details. |

|

3 Based off 4,139 potential units, see Commercial Assets and Developable Land for more details. |

|

4 On April 22, 2024, the Company secured a $500 million facility comprised of a $300 million revolver and $200 million delayed-draw term loan. The facility has a three-year term with a one-year extension option and a $200 million accordion feature. As of September 30, 2024. the Term Loan was fully drawn and hedged at a strike rate of 3.5%, expiring in July 2026. The Revolver was $157 million drawn, $150 million of the Revolver is hedged at a strike rate of 3.5%, expiring in June 2025. |

|

5 Outstanding shares for the quarter ended September 30, 2024 is comprised of the following (in 000s): 92,903 weighted average common shares outstanding, 8,684 weighted average Operating Partnership common and vested LTIP units outstanding, and 725 shares representing the dilutive effect of stock-based compensation awards. |

|

See Non-GAAP Financial Definitions. |

|

Multifamily Operating Portfolio (in thousands, except Revenue per home) |

|||||||||

|

Operating Highlights |

|||||||||

|

Percentage Occupied |

Average Revenue per Home |

NOI |

Debt Balance |

||||||

|

Ownership |

Apartments |

3Q 2024 |

2Q 2024 |

3Q 2024 |

2Q 2024 |

3Q 2024 |

2Q 2024 |

||

|

NJ Waterfront |

|||||||||

|

Haus25 |

100.0 % |

750 |

95.8 % |

95.3 % |

$4,950 |

$4,842 |

$7,931 |

$7,337 |

$343,061 |

|

Liberty Towers* |

100.0 % |

648 |

91.7 % |

94.9 % |

4,237 |

4,206 |

5,506 |

4,833 |

— |

|

BLVD 401 |

74.3 % |

311 |

94.7 % |

95.4 % |

4,304 |

4,186 |

2,592 |

2,236 |

116,016 |

|

BLVD 425 |

74.3 % |

412 |

95.2 % |

94.6 % |

4,147 |

4,052 |

3,413 |

3,161 |

131,000 |

|

BLVD 475 |

100.0 % |

523 |

96.8 % |

95.5 % |

4,241 |

4,122 |

4,319 |

4,474 |

165,000 |

|

Soho Lofts* |

100.0 % |

377 |

95.6 % |

96.6 % |

4,832 |

4,731 |

3,375 |

3,067 |

— |

|

Urby Harborside |

85.0 % |

762 |

96.5 % |

96.7 % |

4,094 |

4,051 |

5,866 |

5,291 |

183,362 |

|

RiverHouse 9 |

100.0 % |

313 |

96.2 % |

96.6 % |

4,392 |

4,275 |

2,661 |

2,565 |

110,000 |

|

RiverHouse 11 |

100.0 % |

295 |

96.3 % |

96.7 % |

4,363 |

4,319 |

2,500 |

2,328 |

100,000 |

|

RiverTrace |

22.5 % |

316 |

95.3 % |

94.7 % |

3,829 |

3,764 |

2,113 |

2,176 |

82,000 |

|

Capstone |

40.0 % |

360 |

94.4 % |

95.9 % |

4,471 |

4,405 |

3,154 |

3,137 |

135,000 |

|

NJ Waterfront Subtotal |

85.0 % |

5,067 |

95.3 % |

95.7 % |

$4,371 |

$4,291 |

$43,430 |

$40,605 |

$1,365,439 |

|

Massachusetts |

|||||||||

|

Portside at East Pier |

100.0 % |

180 |

95.9 % |

95.5 % |

$3,269 |

$3,208 |

$1,245 |

$1,198 |

$56,500 |

|

Portside 2 at East Pier |

100.0 % |

296 |

94.8 % |

96.7 % |

3,446 |

3,395 |

2,108 |

2,117 |

95,827 |

|

145 Front at City Square* |

100.0 % |

365 |

95.1 % |

93.0 % |

2,475 |

2,535 |

1,467 |

1,540 |

— |

|

The Emery |

100.0 % |

326 |

94.0 % |

94.2 % |

2,840 |

2,801 |

1,688 |

1,530 |

71,024 |

|

Massachusetts Subtotal |

100.0 % |

1,167 |

94.8 % |

94.7 % |

$2,946 |

$2,931 |

$6,508 |

$6,385 |

$223,351 |

|

Other |

|||||||||

|

The Upton |

100.0 % |

193 |

88.8 % |

87.7 % |

$4,525 |

$4,637 |

$1,392 |

$1,320 |

$75,000 |

|

The James* |

100.0 % |

240 |

93.8 % |

94.5 % |

3,148 |

3,113 |

1,535 |

1,365 |

— |

|

Signature Place* |

100.0 % |

197 |

96.1 % |

93.7 % |

3,201 |

3,210 |

1,022 |

978 |

— |

|

Quarry Place at Tuckahoe |

100.0 % |

108 |

98.1 % |

97.1 % |

4,293 |

4,436 |

723 |

815 |

41,000 |

|

Riverpark at Harrison |

45.0 % |

141 |

97.2 % |

93.6 % |

2,823 |

2,923 |

570 |

526 |

30,192 |

|

Metropolitan at 40 Park1 |

25.0 % |

130 |

95.6 % |

92.8 % |

3,722 |

3,750 |

731 |

735 |

34,100 |

|

Station House |

50.0 % |

378 |

94.7 % |

93.4 % |

3,017 |

2,851 |

1,705 |

1,627 |

87,883 |

|

Other Subtotal |

73.8 % |

1,387 |

94.5 % |

93.1 % |

$3,421 |

$3,411 |

$7,678 |

$7,366 |

$268,175 |

|

Operating Portfolio23 |

85.2 % |

7,621 |

95.1 % |

95.1 % |

$3,980 |

$3,923 |

$57,616 |

$54,356 |

$1,856,965 |

|

1 As of September 30, 2024, Priority Capital included Metropolitan at $23.3 million (Prudential). |

|

2 Rental revenue associated with retail leases is included in the NOI disclosure above. Total sf outlined on Annex 6: Multifamily Operating Portfolio excludes approximately 189,367 sqft of ground floor retail, of which 142,739 sf was leased as of September 30, 2024. |

|

3 See Unconsolidated Joint Ventures and Annex 6: Multifamily Operating Portfolio for more details. |

|

*Properties that are currently in the collateral pool for the Term Loan and Revolving Credit Facility. |

|

See Non-GAAP Financial Definitions. |

|

Commercial Assets and Developable Land ($ in thousands)

|

||||||||

|

Commercial |

Location |

Ownership |

Rentable SF |

Percentage Leased 3Q 2024 |

Percentage Leased 2Q 2024 |

NOI 3Q 2024 |

NOI 2Q 2024 |

Debt Balance |

|

Port Imperial Garage South |

Weehawken, NJ |

70.0 % |

320,426 |

N/A |

N/A |

$590 |

$591 |

$31,237 |

|

Port Imperial Garage North |

Weehawken, NJ |

100.0 % |

304,617 |

N/A |

N/A |

12 |

(1) |

— |

|

Port Imperial Retail South |

Weehawken, NJ |

70.0 % |

18,064 |

92.0 % |

92.0 % |

115 |

77 |

— |

|

Port Imperial Retail North |

Weehawken, NJ |

100.0 % |

8,400 |

100.0 % |

100.0 % |

46 |

127 |

— |

|

Riverwalk at Port Imperial |

West New York, NJ |

100.0 % |

29,923 |

80.0 % |

80.0 % |

164 |

111 |

— |

|

Shops at 40 Park1 |

Morristown, NJ |

25.0 % |

50,973 |

69.0 % |

69.0 % |

(46) |

656 |

6,010 |

|

Commercial Total |

80.9 % |

732,403 |

78.4 % |

78.4 % |

$881 |

$1,561 |

$37,247 |

|

|

Developable Land Parcel Units2 |

|

|

NJ Waterfront |

2,351 |

|

Massachusetts |

849 |

|

Other |

939 |

|

Developable Land Parcel Units Total |

4,139 |

|

1 The Company sold this joint venture on October 22, 2024. |

|

2 The Company has an additional 13,775 SF of developable retail space within land developments that is not represented in this table. |

|

See Non-GAAP Financial Definitions. |

|

Same Store Market Information1 |

||||||||||

|

Sequential Quarter Comparison (NOI in thousands) |

||||||||||

|

NOI at Share |

Occupancy |

Blended Lease Rate2 |

||||||||

|

Apartments |

3Q 2024 |

2Q 2024 |

Change |

3Q 2024 |

2Q 2024 |

Change |

3Q 2024 |

2Q 2024 |

Change |

|

|

New Jersey Waterfront |

5,067 |

$38,836 |

$36,180 |

7.3 % |

95.3 % |

95.7 % |

(0.4) % |

6.6 % |

6.0 % |

0.6 % |

|

Massachusetts |

1,167 |

6,765 |

6,636 |

1.9 % |

94.8 % |

94.7 % |

0.1 % |

0.7 % |

5.0 % |

(4.3) % |

|

Other3 |

1,387 |

6,218 |

6,135 |

1.4 % |

94.5 % |

93.1 % |

1.4 % |

0.5 % |

3.0 % |

(2.5) % |

|

Total |

7,621 |

$51,819 |

$48,951 |

5.9 % |

95.1 % |

95.1 % |

— % |

4.6 % |

5.4 % |

(0.8) % |

|

Year-over-Year Third Quarter Comparison (NOI in thousands) |

||||||||||

|

NOI at Share |

Occupancy |

Blended Lease Rate2 |

||||||||

|

Apartments |

3Q 2024 |

3Q 2023 |

Change |

3Q 2024 |

3Q 2023 |

Change |

3Q 2024 |

3Q 2023 |

Change |

|

|

New Jersey Waterfront |

5,067 |

$38,836 |

$34,591 |

12.3 % |

95.3 % |

95.9 % |

(0.6) % |

6.6 % |

10.3 % |

(3.7) % |

|

Massachusetts |

1,167 |

6,765 |

6,822 |

(0.8) % |

94.8 % |

94.1 % |

0.7 % |

0.7 % |

7.3 % |

(6.6) % |

|

Other3 |

1,387 |

6,218 |

6,376 |

(2.5) % |

94.5 % |

94.2 % |

0.3 % |

0.5 % |

8.3 % |

(7.8) % |

|

Total |

7,621 |

$51,819 |

$47,789 |

8.4 % |

95.1 % |

95.3 % |

(0.2) % |

4.6 % |

9.6 % |

(5.0) % |

|

Average Revenue per Home (based on 7,621 units) |

|||||||

|

Apartments |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

2Q 2023 |

|

|

New Jersey Waterfront |

5,067 |

$4,371 |

$4,291 |

$4,274 |

$4,219 |

$4,084 |

$4,048 |

|

Massachusetts |

1,167 |

2,946 |

2,931 |

2,893 |

2,925 |

2,918 |

2,836 |

|

Other3 |

1,387 |

3,421 |

3,411 |

3,374 |

3,307 |

3,350 |

3,356 |

|

Total |

7,621 |

$3,980 |

$3,923 |

$3,899 |

$3,855 |

$3,772 |

$3,736 |

|

1 All statistics are based off the current 7,621 Same Store pool. |

|

2 Blended lease rates exclude properties not managed by Veris. |

|

3 “Other” includes properties in Suburban NJ, New York, and Washington, DC. See Multifamily Operating Portfolio for breakout. |

|

See Non-GAAP Financial Definitions. |

|

Same Store Performance ($ in thousands)

|

||||||||||||||

|

Multifamily Same Store1 |

||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

Sequential |

||||||||||||

|

2024 |

2023 |

Change |

% |

2024 |

2023 |

Change |

% |

3Q24 |

2Q24 |

Change |

% |

|||

|

Apartment Rental Income |

$68,830 |

$66,061 |

$2,769 |

4.2 % |

$203,111 |

$192,212 |

$10,899 |

5.7 % |

$68,830 |

$67,584 |

$1,246 |

1.8 % |

||

|

Parking/Other Income |

7,013 |

6,887 |

126 |

1.8 % |

21,569 |

20,015 |

1,554 |

7.8 % |

7,013 |

7,161 |

(148) |

(2.1) % |

||

|

Total Property Revenues2 |

$75,843 |

$72,948 |

$2,895 |

4.0 % |

$224,680 |

$212,227 |

$12,453 |

5.9 % |

$75,843 |

$74,745 |

$1,098 |

1.5 % |

||

|

Marketing & Administration |

2,447 |

2,520 |

(73) |

(2.9) % |

7,120 |

7,188 |

(68) |

(0.9) % |

2,447 |

2,535 |

(88) |

(3.5) % |

||

|

Utilities |

2,503 |

2,415 |

88 |

3.6 % |

7,265 |

6,894 |

371 |

5.4 % |

2,503 |

2,188 |

315 |

14.4 % |

||

|

Payroll |

4,399 |

4,666 |

(267) |

(5.7) % |

13,012 |

13,297 |

(285) |

(2.1) % |

4,399 |

4,315 |

84 |

1.9 % |

||

|

Repairs & Maintenance |

4,103 |

3,942 |

161 |

4.1 % |

12,102 |

11,042 |

1,060 |

9.6 % |

4,103 |

4,386 |

(283) |

(6.5) % |

||

|

Controllable Expenses |

$13,452 |

$13,543 |

$(91) |

(0.7) % |

$39,499 |

$38,421 |

$1,078 |

2.8 % |

$13,452 |

$13,424 |

$28 |

0.2 % |

||

|

Other Fixed Fees |

755 |

763 |

(8) |

(1.0) % |

2,188 |

2,216 |

(28) |

(1.3) % |

755 |

712 |

43 |

6.0 % |

||

|

Insurance |

703 |

1,163 |

(460) |

(39.6) % |

4,264 |

4,724 |

(460) |

(9.7) % |

703 |

1,781 |

(1,078) |

(60.5) % |

||

|

Real Estate Taxes |

9,114 |

9,670 |

(556) |

(5.7) % |

28,571 |

26,190 |

2,381 |

9.1 % |

9,114 |

9,877 |

(763) |

(7.7) % |

||

|

Non-Controllable Expenses |

$10,572 |

$11,596 |

$(1,024) |

(8.8) % |

$35,023 |

$33,130 |

$1,893 |

5.7 % |

$10,572 |

$12,370 |

$(1,798) |

(14.5) % |

||

|

Total Property Expenses |

$24,024 |

$25,139 |

$(1,115) |

(4.4) % |

$74,522 |

$71,551 |

$2,971 |

4.2 % |

$24,024 |

$25,794 |

$(1,770) |

(6.9) % |

||

|

Same Store GAAP NOI |

$51,819 |

$47,809 |

$4,010 |

8.4 % |

$150,158 |

$140,676 |

$9,482 |

6.7 % |

$51,819 |

$48,951 |

$2,868 |

5.9 % |

||

|

Real Estate Tax Adjustments3 |

— |

20 |

(20) |

— |

1,689 |

(1,689) |

— |

— |

— |

|||||

|

Normalized Same Store NOI |

$51,819 |

$47,789 |

$4,030 |

8.4 % |

$150,158 |

$138,987 |

$11,171 |

8.0 % |

$51,819 |

$48,951 |

$2,868 |

5.9 % |

||

|

Normalized SS NOI Margin |

68.3 % |

65.5 % |

2.8 % |

66.8 % |

65.5 % |

1.3 % |

68.3 % |

65.5 % |

2.8 % |

|||||

|

Total Units |

7,621 |

7,621 |

7,621 |

7,621 |

7,621 |

7,621 |

||||||||

|

% Ownership |

85.2 % |

85.2 % |

85.2 % |

85.2 % |

85.2 % |

85.2 % |

||||||||

|

% Occupied – Quarter End |

95.1 % |

95.3 % |

(0.2) % |

95.1 % |

95.3 % |

(0.2) % |

95.1 % |

95.1 % |

— % |

|||||

|

1 Values represent the Company’s pro rata ownership of the operating portfolio. The James and Haus25 were added to the Same Store pool in 1Q 2024. |

|

2 Revenues reported based on Generally Accepted Accounting Principals or “GAAP”. |

|

3 Represents tax settlements and final tax rate adjustments recognized that are applicable to prior periods. |

|

Debt Profile ($ in thousands) |

|||||

|

Lender |

Effective Interest Rate(1) |

September 30, 2024 |

December 31, 2023 |

Date of Maturity |

|

|

Repaid Permanent Loans in 2024 |

|||||

|

Soho Lofts(2) |

Flagstar Bank |

3.77 % |

— |

158,777 |

07/01/29 |

|

145 Front at City Square(3) |

US Bank |

SOFR+1.84% |

— |

63,000 |

12/10/26 |

|

Signature Place(4) |

Nationwide Life Insurance Company |

3.74 % |

— |

43,000 |

08/01/24 |

|

Liberty Towers(5) |

American General Life Insurance Company |

3.37 % |

— |

265,000 |

10/01/24 |

|

Repaid Permanent Loans in 2024 |

$— |

$529,777 |

|||

|

Secured Permanent Loans |

|||||

|

Portside 2 at East Pier |

New York Life Insurance Co. |

4.56 % |

95,827 |

97,000 |

03/10/26 |

|

BLVD 425 |

New York Life Insurance Co. |

4.17 % |

131,000 |

131,000 |

08/10/26 |

|

BLVD 401 |

New York Life Insurance Co. |

4.29 % |

116,016 |

117,000 |

08/10/26 |

|

Portside at East Pier(6) |

KKR |

SOFR + 2.75% |

56,500 |

56,500 |

09/07/26 |

|

The Upton(7) |

Bank of New York Mellon |

SOFR + 1.58% |

75,000 |

75,000 |

10/27/26 |

|

RiverHouse 9(8) |

JP Morgan |

SOFR + 1.41% |

110,000 |

110,000 |

06/21/27 |

|

Quarry Place at Tuckahoe |

Natixis Real Estate Capital, LLC |

4.48 % |

41,000 |

41,000 |

08/05/27 |

|

BLVD 475 |

The Northwestern Mutual Life Insurance Co. |

2.91 % |

165,000 |

165,000 |

11/10/27 |

|

Haus25 |

Freddie Mac |

6.04 % |

343,061 |

343,061 |

09/01/28 |

|

RiverHouse 11 |

The Northwestern Mutual Life Insurance Co. |

4.52 % |

100,000 |

100,000 |

01/10/29 |

|

Port Imperial Garage South |

American General Life & A/G PC |

4.85 % |

31,237 |

31,645 |

12/01/29 |

|

The Emery |

Flagstar Bank |

3.21 % |

71,024 |

72,000 |

01/01/31 |

|

Secured Permanent Loans Outstanding |

$1,335,665 |

$1,339,206 |

|||

|

Secured and/or Repaid Permanent Loans |

$1,335,665 |

$1,868,983 |

|||

|

Unamortized Deferred Financing Costs |

(11,329) |

(15,086) |

|||

|

Secured Permanent Loans |

$1,324,336 |

$1,853,897 |

|||

|

Secured RCF & Term Loans: |

|||||

|

Revolving Credit Facility(9) |

Various Lenders |

SOFR + 2.71% |

$157,000 |

$— |

04/22/27 |

|

Term Loan(9) |

Various Lenders |

SOFR + 2.71% |

200,000 |

— |

04/22/27 |

|

RCF & Term Loan Balances |

$357,000 |

$— |

|||

|

Unamortized Deferred Financing Costs |

(3,420) |

— |

|||

|

Total RCF & Term Loan Debt |

$353,580 |

$— |

|||

|

Total Debt |

$1,677,916 |

$1,853,897 |

|||

|

See Debt Profile Footnotes. |

|

Debt Summary and Maturity Schedule ($ in thousands) |

||||

|

As of September 30, 99.6% of the Company’s total pro forma debt portfolio (consolidated and unconsolidated) is hedged or fixed. The Company’s total debt portfolio has a weighted average interest rate of 4.96% and a weighted average maturity of 3.3 years. |

||||

|

Balance |

% of Total |

Weighted Average Interest Rate |

Weighted Average Maturity in Years |

|

|

Fixed Rate & Hedged Debt |

||||

|

Fixed Rate & Hedged Secured Debt |

$1,685,665 |

99.6 % |

4.93 % |

3.0 |

|

Variable Rate Debt |

||||

|

Variable Rate Debt1 |

7,000 |

0.4 % |

7.65 % |

2.6 |

|

Totals / Weighted Average |

$1,692,665 |

100.0 % |

4.94 % |

3.0 |

|

Unamortized Deferred Financing Costs |

(14,749) |

|||

|

Total Consolidated Debt, net |

$1,677,916 |

|||

|

Partners’ Share |

(72,941) |

|||

|

VRE Share of Total Consolidated Debt, net2 |

$1,604,975 |

|||

|

Unconsolidated Secured Debt |

||||

|

VRE Share |

$295,863 |

53.0 % |

4.88 % |

4.5 |

|

Partners’ Share |

262,684 |

47.0 % |

4.88 % |

4.5 |

|

Total Unconsolidated Secured Debt |

$558,547 |

100.0 % |

4.88 % |

4.5 |

|

Pro Rata Debt Portfolio |

||||

|

Fixed Rate & Hedged Secured Debt |

$1,907,280 |

99.6 % |

4.95 % |

3.3 |

|

Variable Rate Secured Debt |

8,503 |

0.4 % |

7.59 % |

2.2 |

|

Total Pro Rata Debt Portfolio |

$1,915,783 |

100.0 % |

4.96 % |

3.3 |

|

Debt Maturity Schedule as of September 3034 |

||||||||

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

|

|

Secured Debt |

$474 |

$316 |

$343 |

$131 |

$71 |

|||

|

Term Loan Draw |

$200 |

|||||||

|

Revolver |

$157 |

|||||||

|

Unused Revolver Capacity |

$143 |

|||||||

|

1 Variable rate debt includes the unhedged balance on the Revolver. |

|

2 Minority interest share of consolidated debt is comprised of $33.7 million at BLVD 425, $29.9 million at BLVD 401 and $9.4 million at Port Imperial South Garage. |

|

3 The Term Loan, Revolver and Unused Revolver Capacity are are shown with the one-year extension option utilized on the new facilities. At quarter end, the Term Loan was fully drawn and hedged at a strike of 3.5%, expiring July 2026. The Revolver is partially capped with $150 million notional capped at a strike rate of 3.5%, expiring in June 2025. |

|

4 The graphic reflects consolidated debt balances only. |

|

Annex 1: Transaction Activity |

|||||

|

2024 Dispositions to Date |

|||||

|

($ in thousands except per SF) |

|||||

|

Location |

Transaction Date |

Number of |

SF |

Gross Asset Value |

|

|

Land |

|||||

|

2 Campus Drive |

Parsippany-Troy Hills, NJ |

1/3/2024 |

N/A |

N/A |

$9,700 |

|

107 Morgan |

Jersey City, NJ |

4/16/2024 |

N/A |

N/A |

54,000 |

|

6 Becker/85 Livingston |

Roseland, NJ |

4/30/2024 |

N/A |

N/A |

27,900 |

|

Subtotal Land |

$91,600 |

||||

|

Multifamily |

|||||

|

Metropolitan Lofts1 |

Morristown, NJ |

1/12/2024 |

1 |

54,683 |

$30,300 |

|

Subtotal Multifamily |

1 |

54,683 |

$30,300 |

||

|

Office |

|||||

|

Harborside 5 |

Jersey City, NJ |

3/20/2024 |

1 |

977,225 |

$85,000 |

|

Subtotal Office |

1 |

977,225 |

$85,000 |

||

|

Retail |

|||||

|

Shops at 40 Park2 |

Morristown, NJ |

10/22/2024 |

1 |

50,973 |

$15,700 |

|

Subtotal Retail |

1 |

50,973 |

$15,700 |

||

|

2024 Dispositions to Date |

$222,600 |

||||

|

1 The joint venture sold the property; releasing approximately $6 million of net proceeds to the Company. |

|

2 The joint venture sold the property for $15.7 million, of which the Company did not receive any net proceeds after repayment of property-level debt,, selling expenses, and preferred return to our joint venture partner. |

|

Annex 2: Reconciliation of Net Income (Loss) to NOI (three months ended) |

|||

|

3Q 2024 |

2Q 2024 |

||

|

Total |

Total |

||

|

Net Income (Loss) |

$ (10,907) |

$ 2,735 |

|

|

Deduct: |

|||

|

Income from discontinued operations |

(206) |

(1,419) |

|

|

Management Fees |

(794) |

(871) |

|

|

Interest and other investment income |

(181) |

(1,536) |

|

|

Equity in (earnings) loss of unconsolidated joint ventures |

268 |

(2,933) |

|

|

(Gain) loss on disposition of developable land |

— |

(10,731) |

|

|

(Gain) loss from extinguishment of debt, net |

(8) |

785 |

|

|

Other income, net |

310 |

250 |

|

|

Add: |

|||

|

Property management |

3,762 |

4,366 |

|

|

General and administrative |

8,956 |

8,975 |

|

|

Transaction related costs |

— |

890 |

|

|

Depreciation and amortization |

21,159 |

20,316 |

|

|

Interest expense |

21,507 |

21,676 |

|

|

Provision for income taxes |

39 |

176 |

|

|

Net Operating Income (NOI) |

$ 41,286 |

$ 42,679 |

|

|

Summary of Consolidated Multifamily NOI by Type (unaudited): |

3Q 2024 |

2Q 2024 |

|

|

Total Consolidated Multifamily – Operating Portfolio |

$ 43,477 |

$ 40,864 |

|

|

Total Consolidated Commercial |

927 |

905 |

|

|

Total NOI from Consolidated Properties (excl. unconsolidated JVs/subordinated interests) |

$ 44,404 |

$ 41,769 |

|

|

NOI (loss) from services, land/development/repurposing & other assets |

427 |

1,166 |

|

|

Total Consolidated Multifamily NOI |

$ 44,831 |

$ 42,935 |

|

|

See Consolidated Statement of Operations. |

|

See Non-GAAP Financial Definitions. |

|

Annex 3: Consolidated Statement of Operations and Non-GAAP Financial Footnotes |

|

|

FFO, Core FFO, AFFO, NOI, & Adjusted EBITDA |

|

|

1. |

Includes the Company’s share from unconsolidated joint ventures, and adjustments for noncontrolling interest of $2.4 million and $2.6 million for the three months ended September 30, 2024 and 2023, respectively, and $7.5 million and $7.7 million for the nine months ended September 30, 2024 and 2023, respectively. Excludes non-real estate-related depreciation and amortization of $0.2 million and $0.2 million for the three months ended September 30, 2024 and 2023, respectively, and $0.6 million and $0.8 million for the nine months ended September 30, 2024 and 2023, respectively. |

|

2. |

Funds from operations is calculated in accordance with the definition of FFO of the National Association of Real Estate Investment Trusts (Nareit). See Non-GAAP Financial Definitions for information About FFO, Core FFO, AFFO, NOI, & Adjusted EBITDA. |

|

3. |

Includes the Company’s share from unconsolidated joint ventures of $58 thousand and $40 thousand for the three months ended September 30, 2024 and 2023, respectively, and ($35) thousand and $26 thousand for the nine months ended September 30, 2024 and 2023, respectively. |

|

4. |

Excludes expenditures for tenant spaces in properties that have not been owned by the Company for at least a year. |

|

5. |

Net Debt calculated by taking the sum of secured revolving credit facility, secured term loan, and mortgages, loans payable and other obligations, and deducting cash and cash equivalents and restricted cash, all at period end. |

|

6. |

Calculated based on weighted average common shares outstanding, assuming redemption of Operating Partnership common units into common shares 8,684 and 8,748 shares for the three months ended September 30, 2024 and 2023, respectively, and 8,689 and 9,007 for the nine months ended September 30, 2024 and 2023, respectively, plus dilutive Common Stock Equivalents (i.e. stock options). |

|

7. |

Includes the Company’s share from unconsolidated joint ventures of $72 thousand for the three months and nine months ended September 30, 2024. |

|

See Consolidated Statement of Operations. |

|

|

See FFO, Core FFO and Core AFFO. |

|

|

See Adjusted EBITDA. |

|

|

Annex 4: Unconsolidated Joint Ventures ($ in thousands)

|

|||||||

|

Property |

Units |

Physical Occupancy |

VRE’s Nominal Ownership1 |

3Q 2024 NOI2 |

Total Debt |

VRE Share of 3Q NOI |

VRE Share of Debt |

|

Multifamily |

|||||||

|

Urby Harborside |

762 |

96.5 % |

85.0 % |

$5,866 |

$183,362 |

$4,986 |

$155,858 |

|

RiverTrace at Port Imperial |

316 |

95.3 % |

22.5 % |

2,113 |

82,000 |

475 |

18,450 |

|

Capstone at Port Imperial |

360 |

94.4 % |

40.0 % |

3,154 |

135,000 |

1,262 |

54,000 |

|

Riverpark at Harrison |

141 |

97.2 % |

45.0 % |

570 |

30,192 |

257 |

13,586 |

|

Metropolitan at 40 Park |

130 |

95.6 % |

25.0 % |

731 |

34,100 |

183 |

8,525 |

|

Station House |

378 |

94.7 % |

50.0 % |

1,705 |

87,883 |

853 |

43,942 |

|

Total Multifamily |

2,087 |

95.6 % |

55.0 % |

$14,139 |

$552,537 |

$8,015 |

$294,361 |

|

Retail |

|||||||

|

Shops at 40 Park3 |

N/A |

69.0 % |

25.0 % |

(46) |

6,010 |

(12) |

1,503 |

|

Total Retail |

N/A |

69.0 % |

25.0 % |

$(46) |

$6,010 |

$(12) |

$1,503 |

|

Total UJV |

2,087 |

55.0 % |

$14,093 |

$558,547 |

$8,003 |

$295,863 |

|

|

1 Amounts represent the Company’s share based on ownership percentage. |

|

2 The sum of property level revenue, straight line and ASC 805 adjustments; less: operating expenses, real estate taxes and utilities. |

|

3 The Company sold this joint venture on October 22, 2024. |

|

Annex 5: Debt Profile Footnotes |

|

|

1. |

Effective rate of debt, including deferred financing costs, comprised of the cost of terminated treasury lock agreements (if any), debt initiation costs, mark-to-market adjustment of acquired debt and other transaction costs, as applicable. |

|

2. |

The loan on Soho Lofts was repaid in full on June 28, 2024, through a $55 million Term Loan draw. |

|

3. |

The loan on 145 Front Street was repaid in full on May 22, 2024 using cash on hand. |

|

4. |

The loan on Signature Place was repaid in full at maturity on August 1, 2024, through a $43 million Term Loan draw. |

|

5. |

The loan on Liberty Towers was repaid in full at maturity on September 30, 2024, through a combination of a $102 million Term Loan draw, $157 million Revolver draw and cash on hand. |

|

6. |

The loan on Portside at East Pier is capped at a strike rate of 3.5%, expiring in September 2026. |

|

7. |

The loan on Upton is capped at a strike rate of 1.0%, expiring in October 2024. The Company intends to place a new cap on this loan at expiration. |

|

8. |

The loan on RiverHouse 9 is capped at a strike rate of 3.5%, expiring in July 2026. |

|

9. |

The Company’s facilities consist of a $300 million Revolver and $200 million delayed-draw Term Loan and are supported by a group of eight lenders. The eight lenders consists of JP Morgan Chase and Bank of New York Mellon as Joint Bookrunners; Bank of America Securities, Capital One, Goldman Sachs Bank USA, and RBC Capital Markets as Joint Lead Arrangers; and Associated Bank and Eastern Bank as participants. The facilities have a three-year term ending April 2027, with a one-year extension option. The Term Loan was accessed three times ($55 million in June, $43 million in August and $102 million in September) and was fully drawn as of September 30, 2024. The three Term Loan tranches are capped at a strike rate of 3.5%, expiring in July 2026. As of September 30, 2024, the Revolver was $157 million drawn, of which $150 million was capped at a strike rate of 3.5%, expiring in June 2025. |

|

Balance as of |

Initial |

Deferred |

5 bps |

Updated |

SOFR or |

All In |

|

|

Secured Revolving Credit Facility (Unhedged) |

$7,000,000 |

2.10 % |

0.66 % |

(0.05) % |

2.71 % |

4.94 % |

7.65 % |

|

Secured Revolving Credit Facility |

$150,000,000 |

2.10 % |

0.66 % |

(0.05) % |

2.71 % |

3.50 % |

6.21 % |

|

Secured Term Loan |

$200,000,000 |

2.10 % |

0.66 % |

(0.05) % |

2.71 % |

3.50 % |

6.21 % |

|

Annex 6: Multifamily Property Information |

||||||

|

Location |

Ownership |

Apartments |

Rentable SF |

Average Size |

Year Complete |

|

|

NJ Waterfront |

||||||

|

Haus25 |

Jersey City, NJ |

100.0 % |

750 |

617,787 |

824 |

2022 |

|

Liberty Towers |

Jersey City, NJ |

100.0 % |

648 |

602,210 |

929 |

2003 |

|

BLVD 401 |

Jersey City, NJ |

74.3 % |

412 |

369,515 |

897 |

2003 |

|

BLVD 425 |

Jersey City, NJ |

100.0 % |

523 |

475,459 |

909 |

2011 |

|

BLVD 475 |

Jersey City, NJ |

74.3 % |

311 |

273,132 |

878 |

2016 |

|

Soho Lofts |

Jersey City, NJ |

100.0 % |

377 |

449,067 |

1,191 |

2017 |

|

Urby Harborside |

Jersey City, NJ |

85.0 % |

762 |

474,476 |

623 |

2017 |

|

RiverHouse 9 |

Weehawken, NJ |

100.0 % |

313 |

245,127 |

783 |

2021 |

|

RiverHouse 11 |

Weehawken, NJ |

100.0 % |

295 |

250,591 |

849 |

2018 |

|

RiverTrace |

West New York, NJ |

22.5 % |

316 |

295,767 |

936 |

2014 |

|

Capstone |

West New York, NJ |

40.0 % |

360 |

337,991 |

939 |

2021 |

|

NJ Waterfront Subtotal |

85.0 % |

5,067 |

4,391,122 |

867 |

||

|

Massachusetts |

||||||

|

Portside at East Pier |

East Boston, MA |

100.0 % |

180 |

154,859 |

862 |

2015 |

|

Portside 2 at East Pier |

East Boston, MA |

100.0 % |

296 |

230,614 |

779 |

2018 |

|

145 Front at City Square |

Worcester, MA |

100.0 % |

365 |

304,936 |

835 |

2018 |

|

The Emery |

Revere, MA |

100.0 % |

326 |

273,140 |

838 |

2020 |

|

Massachusetts Subtotal |

100.0 % |

1,167 |

963,549 |

826 |

||

|

Other |

||||||

|

The Upton |

Short Hills, NJ |

100.0 % |

193 |

217,030 |

1,125 |

2021 |

|

The James |

Park Ridge, NJ |

100.0 % |

240 |

215,283 |

897 |

2021 |

|

Signature Place |

Morris Plains, NJ |

100.0 % |

197 |

203,716 |

1,034 |

2018 |

|

Quarry Place at Tuckahoe |

Eastchester, NY |

100.0 % |

108 |

105,551 |

977 |

2016 |

|

Riverpark at Harrison |

Harrison, NJ |

45.0 % |

141 |

124,774 |

885 |

2014 |

|

Metropolitan at 40 Park |

Morristown, NJ |

25.0 % |

130 |

124,237 |

956 |

2010 |

|

Station House |

Washington, DC |

50.0 % |

378 |

290,348 |

768 |

2015 |

|

Other Subtotal |

73.8 % |

1,387 |

1,280,939 |

924 |

||

|

Operating Portfolio1 |

85.2 % |

7,621 |

6,635,610 |

871 |

||

|

See Multifamily Operating Portfolio. |

|

|

1 Total sf outlined excludes approximately 189,367 sqft of ground floor retail, of which 142,739 sf was leased as of September 30, 2024. |

|

Annex 7: Noncontrolling Interests in Consolidated Joint Ventures |

|||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

BLVD 425 |

$ 155 |

$ 59 |

$ 327 |

$ 130 |

|

|

BLVD 401 |

(528) |

(672) |

(1,687) |

(1,919) |

|

|

Port Imperial Garage South |

12 |

21 |

(3) |

(40) |

|

|

Port Imperial Retail South |

5 |

21 |

34 |

84 |

|

|

Other consolidated joint ventures |

(35) |

(21) |

(100) |

(70) |

|

|

Net losses in noncontrolling interests |

$ (391) |

$ (592) |

$ (1,429) |

$ (1,815) |

|

|

Depreciation in noncontrolling interests |

721 |

715 |

2,179 |

2,141 |

|

|

Funds from operations – noncontrolling interest in consolidated joint ventures |

$ 330 |

$ 123 |

$ 750 |

$ 326 |

|

|

Interest expense in noncontrolling interest in consolidated joint ventures |

787 |

790 |

2,359 |

2,374 |

|

|

Net operating income before debt service in consolidated joint ventures |

$ 1,117 |

$ 913 |

$ 3,109 |

$ 2,700 |

|

Non-GAAP Financial Definitions

NON-GAAP FINANCIAL MEASURES

Included in this financial package are Funds from Operations, or FFO, Core Funds from Operations, or Core FFO, net operating income, or NOI and Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization, or Adjusted EBITDA, each a “non-GAAP financial measure,” measuring Veris Residential, Inc.’s historical or future financial performance that is different from measures calculated and presented in accordance with generally accepted accounting principles (“U.S. GAAP”), within the meaning of the applicable Securities and Exchange Commission rules. Veris Residential, Inc. believes these metrics can be a useful measure of its performance which is further defined.

Adjusted Earnings Before Interest, Tax, Depreciation and Amortization (Adjusted “EBITDA”)

The Company defines Adjusted EBITDA as Core FFO, plus interest expense, plus income tax expense, plus income (loss) in noncontrolling interest in consolidated joint ventures, and plus adjustments to reflect the entity’s share of Adjusted EBITDA of unconsolidated joint ventures. The Company presents Adjusted EBITDA because the Company believes that Adjusted EBITDA, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. Adjusted EBITDA should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity.

Blended Net Rental Growth Rate or Blended Lease Rate

Weighted average of the net effective change in rent (inclusive of concessions) for a lease with a new resident or for a renewed lease compared to the rent for the prior lease of the identical apartment unit.

Core FFO and Adjusted FFO (“AFFO”)

Core FFO is defined as FFO, as adjusted for certain items to facilitate comparative measurement of the Company’s performance over time. Adjusted FFO (“AFFO”) is defined as Core FFO less (i) recurring tenant improvements, leasing commissions, and capital expenditures, (ii) straight-line rents and amortization of acquired above/below market leases, net, and (iii) other non-cash income, plus (iv) other non-cash charges. Core FFO and Adjusted AFFO are presented solely as supplemental disclosure that the Company’s management believes provides useful information to investors and analysts of its results, after adjusting for certain items to facilitate comparability of its performance from period to period. Core FFO and Adjusted FFO are non-GAAP financial measures that are not intended to represent cash flow and are not indicative of cash flows provided by operating activities as determined in accordance with GAAP. As there is not a generally accepted definition established for Core FFO and Adjusted FFO, the Company’s measures of Core FFO may not be comparable to the Core FFO and Adjusted FFO reported by other REITs. A reconciliation of net income per share to Core FFO and Adjusted FFO in dollars and per share are included in the financial tables accompanying this press release.

Funds From Operations (“FFO”)

FFO is defined as net income (loss) before noncontrolling interests in Operating Partnership, computed in accordance with U.S. GAAP, excluding gains or losses from depreciable rental property transactions (including both acquisitions and dispositions), and impairments related to depreciable rental property, plus real estate-related depreciation and amortization. The Company believes that FFO per share is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that as FFO per share excludes the effect of depreciation, gains (or losses) from property transactions and impairments related to depreciable rental property (all of which are based on historical costs which may be of limited relevance in evaluating current performance), FFO per share can facilitate comparison of operating performance between equity REITs.

FFO per share should not be considered as an alternative to net income available to common shareholders per share as an indication of the Company’s performance or to cash flows as a measure of liquidity. FFO per share presented herein is not necessarily comparable to FFO per share presented by other real estate companies due to the fact that not all real estate companies use the same definition. However, the Company’s FFO per share is comparable to the FFO per share of real estate companies that use the current definition of the National Association of Real Estate Investment Trusts (“Nareit”). A reconciliation of net income per share to FFO per share is included in the financial tables accompanying this press release.

NOI and Same Store NOI

NOI represents total revenues less total operating expenses, as reconciled to net income above. The Company considers NOI to be a meaningful non-GAAP financial measure for making decisions and assessing unlevered performance of its property types and markets, as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not affect the overall performance of the individual assets being measured and assessed.

Same Store NOI is presented for the same store portfolio, which comprises all properties that were owned by the Company throughout both of the reporting periods.

|

Company Information |

||

|

Company Information |

||

|

Corporate Headquarters |

Stock Exchange Listing |

Contact Information |

|

Veris Residential, Inc. |

New York Stock Exchange |

Veris Residential, Inc. |

|

210 Hudson St., Suite 400 |

Investor Relations Department |

|

|

Jersey City, New Jersey 07311 |

Trading Symbol |

210 Hudson St., Suite 400 |

|

(732) 590-1010 |

Common Shares: VRE |

Jersey City, New Jersey 07311 |

|

Anna Malhari |

||

|

Chief Operating Officer |

||

|

E-Mail: amalhari@verisresidential.com |

||

|

Web: www.verisresidential.com |

||

|

Executive Officers |

||

|

Mahbod Nia |

Amanda Lombard |

Taryn Fielder |

|

Chief Executive Officer |

Chief Financial Officer |

General Counsel and Secretary |

|

Anna Malhari |

Jeff Turkanis |

|

|

Chief Operating Officer |

EVP & Chief Investment Officer |

|

|

Equity Research Coverage |

||

|

Bank of America Merrill Lynch |

BTIG, LLC |

Citigroup |

|

Josh Dennerlein |

Thomas Catherwood |

Nicholas Joseph |

|

Evercore ISI |

Green Street Advisors |

JP Morgan |

|

Steve Sakwa |

John Pawlowski |

Anthony Paolone |

|

Truist |

||

|

Michael R. Lewis |

||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/veris-residential-inc-reports-third-quarter-2024-results-302292067.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/veris-residential-inc-reports-third-quarter-2024-results-302292067.html

SOURCE Veris Residential, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.