Looking At Oklo's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Oklo OKLO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with OKLO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 18 uncommon options trades for Oklo.

This isn’t normal.

The overall sentiment of these big-money traders is split between 27% bullish and 55%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $179,530, and 15 are calls, for a total amount of $757,027.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $18.0 to $26.0 for Oklo over the last 3 months.

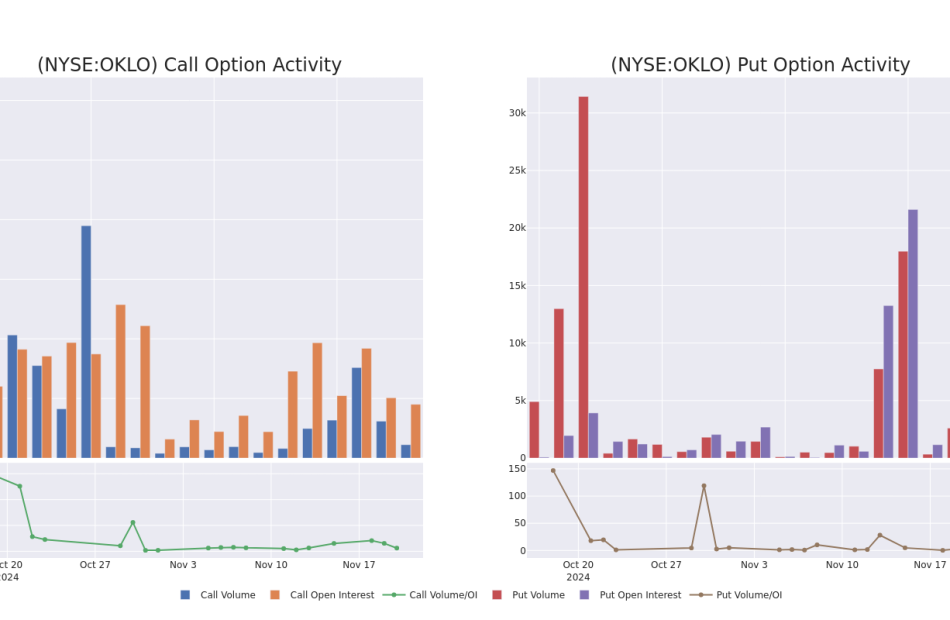

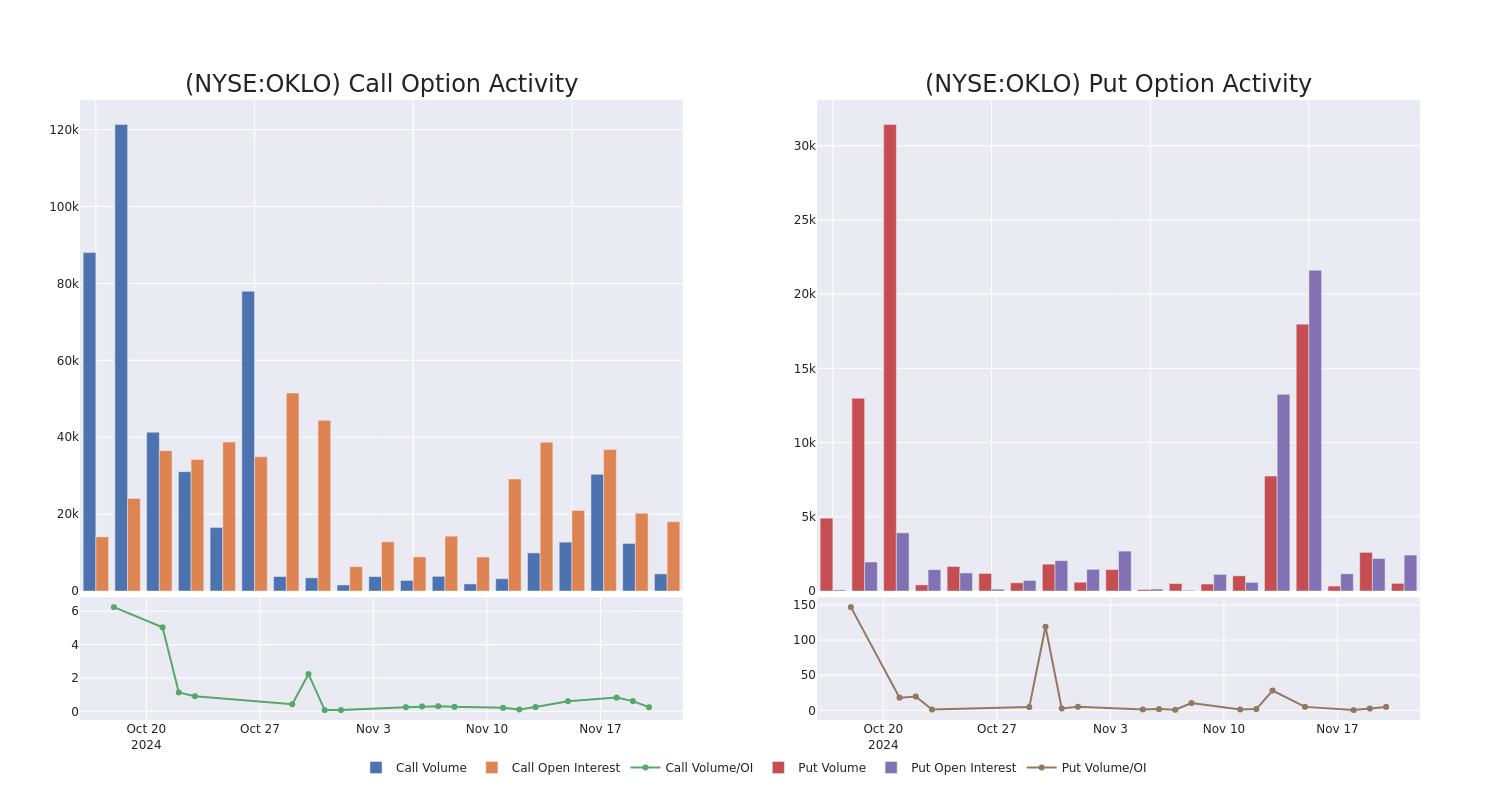

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Oklo’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oklo’s whale activity within a strike price range from $18.0 to $26.0 in the last 30 days.

Oklo Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKLO | CALL | SWEEP | BEARISH | 03/21/25 | $5.0 | $4.7 | $4.7 | $21.00 | $141.0K | 1.4K | 552 |

| OKLO | CALL | SWEEP | BEARISH | 01/17/25 | $2.4 | $2.2 | $2.35 | $25.00 | $117.5K | 3.0K | 534 |

| OKLO | PUT | SWEEP | BULLISH | 11/22/24 | $0.6 | $0.5 | $0.55 | $18.50 | $75.5K | 2.3K | 10 |

| OKLO | CALL | SWEEP | BULLISH | 12/20/24 | $3.6 | $3.6 | $3.6 | $20.00 | $68.7K | 3.7K | 702 |

| OKLO | PUT | SWEEP | BEARISH | 12/13/24 | $2.3 | $2.3 | $2.3 | $19.00 | $64.1K | 105 | 4 |

About Oklo

Oklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

After a thorough review of the options trading surrounding Oklo, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Oklo

- Currently trading with a volume of 6,318,619, the OKLO’s price is down by -4.27%, now at $20.87.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 85 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oklo options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hosted Pbx Market Size to Worth USD 47.76 Billion by 2032 | Straits Research

New York, United States, Nov. 20, 2024 (GLOBE NEWSWIRE) — In the Hosted PBX Market, the primary drivers are the increasing adoption of cloud-based communication solutions, which offer cost-effectiveness, scalability, and flexibility, making them attractive to businesses of all sizes. The rise of remote work and hybrid work models has significantly fuelled demand, as organizations seek reliable, cloud-based systems that can support geographically dispersed teams. Additionally, the growing need for unified communications and collaboration tools integrating voice, video, and messaging on a single platform is boosting the adoption of Hosted PBX systems. Small and medium-sized enterprises (SMEs) are also turning to Hosted PBX solutions for their affordability, minimal hardware requirements, and ease of implementation.

Download Free Sample Report PDF @https://straitsresearch.com/report/hosted-pbx-market/request-sample

Market Dynamics

Rising Demand for Enterprise Mobility in Hosted PBX Market Drives the Global Market

The demand for enterprise mobility has been growing at a high rate; this acts as one of the major growth drivers for the Hosted PBX market. With remote working and flexible working times becoming one of the major modern trends in business today, this has translated into higher demand for access to seamless communication across different devices, such as smartphones, tablets, and laptops. The hosted PBX systems supporting enterprise mobility require employees to log in to the communication tools from every location, thus ensuring connectivity and productivity from wherever they go.

SME Adoption in the Hosted PBX Market brings up the opportunity for the Global Market

SME adoption of Hosted PBX systems is driven by their cost-effectiveness and flexibility compared to traditional on-premises solutions. One of the major driving factors for SMEs is to find inexpensive, scalable communication solutions that avoid the huge upfront costs and maintenance associated with traditional PBX systems. With hosted PBX, SMEs are able to pay only for what’s in use, while other value-added features such as call forwarding, voicemail, and conferencing capabilities are all bundled together in subscription plans. This flexibility is therefore highly desirable for growing businesses that want to scale their communications infrastructure without heavy investments. Hosted PBX systems also allow remote work, fitting in with the more recent trend of remote and hybrid work environments. With Hosted PBX, SMEs achieve more complex features with enhanced scalability and lesser administrative burden, all while conserving a lower cost structure.

Regional Analysis

In North America, the Hosted PBX market is robust and continues to experience substantial growth, driven primarily by the high adoption rates of cloud-based solutions among businesses of all sizes. Among these, the leading contributors include the United States and Canada, wherein the countries have a mature technology infrastructure and the key market players have a strong presence. Hosted PBX systems are mostly taken as cost-effective, scalable, feature rich with advanced unified communications, AI integrations, remote work support, and more, making North American enterprises move toward these systems more and more. In this region, the competition between vendors becomes very important, with numerous vendors for different business requirements.

In Europe, the Hosted PBX market is characterized by a mature and competitive landscape, driven by several key factors. There is high adoption of advanced communication technologies and countrywide digital transformation initiatives that help boost the regional marketplace. Hosted PBX systems easily provide these because of the growing demand by European businesses for flexible, scalable, and cost-effective solutions for communication. This is driving the market with well-established technology providers to provide unified communications and collaboration tools. Across most European markets, the demand for Hosted PBX solutions that are secure and stable has also been favored by regulatory frameworks and compliance requirements. Also, with the pandemic-induced transition to remote and hybrid working environments, the pace of cloud-based communications more broadly has increased.

In the Asia-Pacific region, the Hosted PBX market is experiencing robust growth, driven by rapid digital transformation, increasing cloud adoption, and a growing SME sector. The frontline countries pushing toward modern communication solutions include China, India, and Japan. This demand is further fuelled by cost-effective and scalable communication solutions for business growth. In Latin America, the market is growing due to increased investment in telecommunication infrastructure and the growth of SMEs demanding flexible solutions for communication. Another potential market is the Middle East and Africa, where development is driven by infrastructure and a shift in demand to the cloud. Hosted PBX firms in these regions are leveraging to better operational efficiency and reduce costs. With these regions developing still, it is only expected that the Hosted PBX market shall also grow with the increasing needs for communication technologies and supportive government policies.

To Gather Additional Insights on the Regional Analysis of the Hosted Pbx Market @https://straitsresearch.com/report/hosted-pbx-market/request-sample

Key Highlights

- The global Hosted PBX Market size was valued at USD 11.5 billion in 2023 and is projected to grow from USD 13.47 billion in 2024 to USD 47.61 billion by 2031, exhibiting a CAGR of 17.1% during the forecast period (2024-2032).

- Based on Component, the Hosted PBX Market is segmented into Solution and Services. The Solution segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- Based on Application, the Hosted PBX Market is segmented into Unified communication and collaboration, Mobility, Call center and others. The Unified communication and collaboration segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- Based on End-user, the Hosted PBX Market is segmented as Healthcare & Life Sciences, BFSI, Retail & eCommerce, Government, Manufacturing. The BFSI segment owns the highest market share and is estimated to exhibit a CAGR of XX% during the forecast period.

- North America is the most significant global Hosted PBX Market shareholder and is anticipated to exhibit a CAGR of XX% during the forecast period.

Competitive Players

- Cisco Systems

- AT&T

- Avaya

- XO Communications

- Ozonetel

- Nexge Technologies

- BullsEye Telecom

- TPx Communications

- Telesystem

- OneConnect

- InterGlobe Communications

- 3CX

- BT Group

- Mitel Networks

- 8×8

- Polyco

- Comcast Business

- MegaPath

- CenturyLink

- RingCentral (US)

- Star2Star Communications

- Nextiva

- NovoLink Communications

Recent Developments

- June 07, 2023, Cisco and AT&T have collaborated to support businesses in expanding connectivity for an increasingly mobile-centric workforce They have introduced innovative solutions to improve connectivity and revolutionize communication for hybrid work environments.

- On November 9, 2020, BT and RingCentral Extend Partnership to Accelerate Adoption of Cloud-Based

Segmentation

- By Component

-

- Solution

- Services

- By Application

-

- Unified communication and collaboration

- Mobility

- Call centre

- Others

- By End-user

-

- Healthcare & Life Sciences

- BFSI

- Retail & eCommerce

- Government

- Manufacturing

Region Covered

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Get Detailed Market Segmentation @https://straitsresearch.com/report/hosted-pbx-market/segmentation

About Straits Research Pvt. Ltd.

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision-making and ROI.

Whether you are looking at business sectors in the next town or crosswise over continents, we understand the significance of being acquainted with the client’s purchase. We overcome our clients’ issues by recognizing and deciphering the target group and generating leads with utmost precision. We seek to collaborate with our clients to deliver a broad spectrum of results through a blend of market and business research approaches.

Phone: +1 646 905 0080 (U.S.)

+44 203 695 0070 (U.K.)

Email: sales@straitsresearch.com

Follow Us: LinkedIn | Facebook | Instagram | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If I Convert $235k to a Roth IRA, Will It Affect My Medicare Premiums?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Because Medicare premiums are tied to income, converting a $235,000 retirement account to a Roth IRA has the potential to cause Medicare Part B premiums to increase. For many taxpayers, in fact, a single-year conversion of that magnitude could more than triple the amount of the monthly premium most Medicare enrollees pay for Part B coverage. However, that’s not certain. Much depends on the enrollee’s income level before the conversion and other details. And it’s possible to use some strategies that could reduce or even eliminate the premium increase while still taking advantage of the benefits of a Roth conversion.

If you’re contemplating converting retirement funds to a Roth account, consider talking over the implications with a financial advisor.

Most people pay the same monthly premium to Medicare for Part B coverage. For 2024, this premium is $174.70 per month. It adjusts annually to reflect inflation and usage patterns that affect Medicare’s cost of doing business. Beginning in 2025, the standard premium is $185, an increase of $10.30, or $123.60 annually.

For higher-income enrollees, Medicare applies a surcharge to Part B and Part D premiums. This is called the Income-Related Monthly Adjustment Amount (IRMAA). The size of the surcharge varies according to income, using a specific income measure called Modified Adjusted Gross Income (MAGI), so that higher earners pay more. The surcharge also varies by filing status.

Brackets set up by filing status and income are used to determine IRMAA premiums. These brackets change annually, as does the Part B premium amount. For 2025, the Part B premium is $185. Here is a table showing IRMAA brackets for 2025:

At the higher income levels, clearly, IRMAA packs a sizable financial punch. A single filer earning more than $500,000 will pay $628.90 per month or $7,546.80 per year, compared to the $185 monthly or $2,220 per year paid by someone earning $106,000.

An important wrinkle to the IRMAA regulations is that the adjustment is applied to the current year’s premiums using the enrollee’s MAGI from two years earlier. So an increase in income this year won’t result in higher Medicare premiums this year.

Also note that IRMAA also applies to Part D premiums. However, since these premiums are much smaller than Medicare Part B premiums, the financial impact of an IRMAA-hiked Part D premium is relatively minor.

BMO Announces Cash Distributions for Certain BMO ETFs and ETF Series of BMO Mutual Funds for November 2024

TORONTO, Nov. 20, 2024 /CNW/ – BMO Asset Management Inc., as manager of the BMO ETFs, and BMO Investments Inc., as manager of the BMO Mutual Funds, today announced the November 2024 cash distributions for unitholders of BMO ETFs and unitholders of ETF Series units of the BMO Mutual Funds (ETF Series) that distribute monthly, as set out in the table below. Unitholders of record of the BMO ETFs and ETF Series at the close of business on November 27, 2024 will receive cash distributions payable on December 3, 2024.

The ex-dividend date and record date for all BMO ETFs and ETF Series of BMO Mutual Funds is November 27, 2024.

Details of the per unit cash distribution amount are as follows:

|

FUND NAME |

FUND TICKER |

CASH DISTRIBUTION |

|

BMO Aggregate Bond Index ETF |

ZAG |

0.040 |

|

BMO Canadian MBS Index ETF |

ZMBS |

0.040 |

|

BMO Discount Bond Index ETF |

ZDB |

0.030 |

|

BMO Emerging Markets Bond Hedged to CAD Index ETF |

ZEF |

0.045 |

|

BMO Equal Weight Banks Index ETF |

ZEB |

0.140 |

|

BMO Equal Weight REITs Index ETF |

ZRE |

0.090 |

|

BMO Equal Weight Utilities Index ETF |

ZUT |

0.075 |

|

BMO ESG High Yield US Corporate Bond Index ETF |

ESGH |

0.100 |

|

BMO ESG High Yield US Corporate Bond Index ETF (Hedged Units) |

ESGH.F |

0.095 |

|

BMO High Yield US Corporate Bond Hedged to CAD Index ETF |

ZHY |

0.056 |

|

BMO High Yield US Corporate Bond Index ETF |

ZJK |

0.090 |

|

BMO High Yield US Corporate Bond Index ETF (USD Units)* |

ZJK.U |

0.085 |

|

BMO Laddered Preferred Share Index ETF |

ZPR |

0.045 |

|

BMO Laddered Preferred Share Index ETF (USD Units)* |

ZPR.U |

0.068 |

|

BMO Long Corporate Bond Index ETF |

ZLC |

0.060 |

|

BMO Long Federal Bond Index ETF |

ZFL |

0.033 |

|

BMO Long Provincial Bond Index ETF |

ZPL |

0.040 |

|

BMO Mid Corporate Bond Index ETF |

ZCM |

0.050 |

|

BMO Mid Federal Bond Index ETF |

ZFM |

0.028 |

|

BMO Mid Provincial Bond Index ETF |

ZMP |

0.034 |

|

BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF |

ZMU |

0.042 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC |

0.059 |

|

BMO Mid-Term US IG Corporate Bond Index ETF (USD Units)* |

ZIC.U |

0.042 |

|

BMO Real Return Bond Index ETF |

ZRR |

0.057 |

|

BMO Short Corporate Bond Index ETF |

ZCS |

0.038 |

|

BMO Short Federal Bond Index ETF |

ZFS |

0.025 |

|

BMO Short Provincial Bond Index ETF |

ZPS |

0.030 |

|

BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF |

ZSU |

0.038 |

|

BMO US Aggregate Bond Index ETF |

ZUAG |

0.060 |

|

BMO US Aggregate Bond Index ETF (Hedged Units) |

ZUAG.F |

0.060 |

|

BMO US Aggregate Bond Index ETF (USD Units)* |

ZUAG.U |

0.060 |

|

BMO US Preferred Share Hedged to CAD Index ETF |

ZHP |

0.090 |

|

BMO US Preferred Share Index ETF |

ZUP |

0.100 |

|

BMO US Preferred Share Index ETF (USD Units)* |

ZUP.U |

0.098 |

|

BMO Balanced ETF (Fixed Percentage Distribution Units) |

ZBAL.T |

0.141 |

|

BMO Canadian Banks Accelerator ETF |

ZEBA |

0.115 |

|

BMO Canadian Dividend ETF |

ZDV |

0.070 |

|

BMO Canadian High Dividend Covered Call ETF |

ZWC |

0.100 |

|

BMO Covered Call Canadian Banks ETF |

ZWB |

0.110 |

|

BMO Covered Call Canadian Banks ETF (USD Units)* |

ZWB.U |

0.140 |

|

BMO Covered Call Dow Jones Industrial Average Hedged to CAD ETF |

ZWA |

0.130 |

|

BMO Covered Call Energy ETF |

ZWEN |

0.220 |

|

BMO Covered Call Health Care ETF |

ZWHC |

0.160 |

|

BMO Covered Call Technology ETF |

ZWT |

0.150 |

|

BMO Covered Call US Banks ETF |

ZWK |

0.145 |

|

BMO Covered Call Utilities ETF |

ZWU |

0.070 |

|

BMO Europe High Dividend Covered Call ETF |

ZWP |

0.105 |

|

BMO Europe High Dividend Covered Call Hedged to CAD ETF |

ZWE |

0.120 |

|

BMO Floating Rate High Yield ETF |

ZFH |

0.080 |

|

BMO Global High Dividend Covered Call ETF |

ZWG |

0.175 |

|

BMO Growth ETF (Fixed Percentage Distribution Units) |

ZGRO.T |

0.160 |

|

BMO International Dividend ETF |

ZDI |

0.080 |

|

BMO International Dividend Hedged to CAD ETF |

ZDH |

0.090 |

|

BMO Monthly Income ETF |

ZMI |

0.070 |

|

BMO Monthly Income ETF (USD Units)* |

ZMI.U |

0.120 |

|

BMO Premium Yield ETF |

ZPAY |

0.160 |

|

BMO Premium Yield ETF (Hedged Units) |

ZPAY.F |

0.155 |

|

BMO Premium Yield ETF (USD Units)* |

ZPAY.U |

0.160 |

|

BMO Ultra Short-Term Bond ETF |

ZST |

0.155 |

|

BMO Ultra Short-Term US Bond ETF (USD Units)* |

ZUS.U |

0.185 |

|

BMO USD Cash Management ETF |

ZUCM |

0.110 |

|

BMO USD Cash Management ETF (USD Units)* |

ZUCM.U |

0.105 |

|

BMO US Dividend ETF |

ZDY |

0.080 |

|

BMO US Dividend ETF (USD Units)* |

ZDY.U |

0.060 |

|

BMO US Dividend Hedged to CAD ETF |

ZUD |

0.055 |

|

BMO US High Dividend Covered Call ETF |

ZWH |

0.100 |

|

BMO US High Dividend Covered Call ETF (USD Units)* |

ZWH.U |

0.105 |

|

BMO US High Dividend Covered Call Hedged to CAD ETF |

ZWS |

0.090 |

|

BMO US Put Write ETF |

ZPW |

0.125 |

|

BMO US Put Write ETF (USD Units)* |

ZPW.U |

0.125 |

|

BMO US Put Write Hedged to CAD ETF |

ZPH |

0.120 |

|

BMO Global Enhanced Income Fund (ETF Series) |

ZWQT |

0.085 |

|

BMO Global Dividend Opportunities Fund (Active ETF Series) |

BGDV |

0.034 |

|

BMO Global REIT Fund (Active ETF Series) |

BGRT |

0.055 |

|

BMO Money Market Fund (ETF Series) |

ZMMK |

0.170 |

|

BMO Global Infrastructure Fund (Active ETF Series) |

BGIF |

0.050 |

*Cash distribution per unit ($) amounts are USD for ZJK.U, ZPR.U, ZIC.U, ZUAG.U, ZUP.U, ZWB.U, ZMI.U, ZPAY.U, ZUS.U, ZUCM.U, ZDY.U, ZWH.U, and ZPW.U.

Further information about BMO ETFs and ETF Series of the BMO Mutual Funds can be found at www.bmoetfs.com.

Commissions, management fees and expenses all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the applicable ETF Facts document or prospectus before investing. BMO ETFs and ETF Series of the BMO Mutual Funds are not guaranteed, their values change frequently, and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. Units of the BMO ETFs and ETF Series securities of the BMO Mutual Funds may be bought and sold at market price on a stock exchange and brokerage commissions will reduce returns. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

About BMO Global Asset Management

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors.

About BMO Financial Group

BMO Financial Group is the eighth largest bank in North America by assets, with total assets of $1.4 trillion as of July 31, 2024. Serving customers for 200 years and counting, BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services to 13 million customers across Canada, the United States, and in select markets globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

SOURCE BMO Financial Group

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c2222.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c2222.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US finalizes $1.5 billion chips award for GlobalFoundries to expand production

By David Shepardson

WASHINGTON (Reuters) – The U.S. Commerce Department said Wednesday it has finalized a $1.5 billion government subsidy for GlobalFoundries to expand semiconductor production in Malta, New York and Vermont.

The binding contract for New York-based GlobalFoundries, he world’s third-largest contract chipmaker, finalizes a preliminary award announced in February after the company said it was investing $13 billion over the next 10 plus years in its U.S. manufacturing sites that serve automotive, smart mobile devices, Internet of Things, data centers, and aerospace and defense.

Commerce Secretary Gina Raimondo told Reuters last week the department is racing to complete as many final agreements with recipients under the $52.7 billion “Chips and Science” program created in 2022 as possible before the Biden administration ends on Jan. 20. “We’re working as hard as we can,” Raimondo said.

The Commerce award will support expansion of GlobalFoundries Malta, New York fab by adding technologies already in use at GF’s Singapore and Germany facilities to provide chips for the U.S. auto industry. New York state has also committed to providing another $550 million in support, GF said.

GF also plans to build a new fab in Malta, New York “in alignment with market conditions and customer demand” to produce chips for automotive, AI, aerospace and defense.

“GF’s essential chips are at the core of U.S. economic, supply chain and national security,” said GF CEO Thomas Caulfield, calling the state and federal funding key “to ensure our customers have the American-made chips they need to succeed and win.”

Commerce last week finalized its first major award — a $6.6 billion government subsidy for Taiwan Semiconductor Manufacturing Co’s U.S. unit. The first final awards come just weeks before President-elect Donald Trump, who criticized the program, takes office.

Commerce has allocated $36 billion for chips projects including $6.4 billion for Samsung in Texas, $8.5 billion for Intel and $6.1 billion for Micron Technology.

On Nov. 1, Commerce imposed a $500,000 penalty on GlobalFoundries for shipping chips without authorization to an affiliate of blacklisted Chinese chipmaker SMIC. GF said it regretted the inadvertent action.

(Reporting by David Shepardson; Editing by Chizu Nomiyama)

One Economist Thinks Elon Musk Holds The Key To Affordable Mortgages – Here's Why

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The housing market is grappling with a significant decline in sales due to high home prices and elevated mortgage rates, which hover around 7%.

The challenging environment has forced many potential buyers out of the market, particularly first-time homebuyers whose share has hit a 43-year low.

Don’t Miss:

According to National Association of Realtors Chief Economist Lawrence Yun, one potential factor that could influence mortgage rates is billionaire Elon Musk’s actions.

Yun suggests that Musk’s recent moves, particularly those related to Tesla and X (formerly Twitter), could impact market sentiment and interest rates.

While the exact mechanisms are complex, Musk’s influence extends beyond the tech industry. His actions can have broader economic implications and his decisions could shape future mortgage rates and the overall housing market.

Trending: Over the last five years, the price of gold has increased by approximately 83% — Investors like Bill O’Reilly and Rudy Giuliani are using this platform to create customized gold IRAs to help shield their savings from inflation and economic turbulence.

“The overall inflation rate is normalizing and the Federal Reserve can move away from its current restrictive monetary policy, which means further cuts to the short-term interest rate in upcoming months,” Yun told MarketWatch.

That could force mortgage rates down.

The October consumer price index (CPI) report showed a 2.6% year-over-year increase, with housing costs driving a significant portion of the rise. While this marks a decline from the peak inflation rate of nearly 9% in June 2022, the Fed’s suggested target of 2% inflation remains elusive.

The Fed’s aggressive rate-hiking campaign in 2022 aimed to curb inflation, but it’s important to note that mortgage rates aren’t directly tied to the federal funds rate. Instead, they track the 10-year Treasury yield, often influenced by market expectations of future Fed actions.

Trending: Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

As market participants weigh the potential impact of various economic factors, including ongoing geopolitical tensions and fiscal policies, the trajectory of interest rates remains uncertain. This uncertainty could lead to further fluctuations in mortgage rates, making it challenging for homebuyers and refinancers to accurately predict future costs.

Silexion Therapeutics to Present at the Noble Capital Markets 20th Annual Emerging Growth Equity Conference

GRAND CAYMAN, CAYMAN ISLANDS, Silexion Therapeutics Corp. SLXN (“Silexion” or the “Company”), a clinical-stage biotech developing RNA interference (RNAi) therapies for KRAS-driven cancers, today announced that the Company’s management will be attending and presenting at the Noble Capital Markets 20th Annual Emerging Growth Equity Conference taking place December 3-4, 2024, in Boca Raton, Florida.

Ilan Hadar, Chief Executive Officer will deliver a company presentation titled “Transforming Cancer Care: Silexion Therapeutics’ Innovative Approach to Pancreatic Cancer” on December 4, 2024 at 11:30 am. A replay of the presentation will be posted, when available, to Silexion’s website on the Presentation & Events page of the investors section.

The Company’s management team will be available for one-on-one meetings throughout the summit. Interested investors are encouraged to contact the Noble investor outreach team to schedule a meeting.

About Silexion Therapuetics

Silexion Therapeutics SLXN is a pioneering clinical-stage, oncology-focused biotechnology company developing innovative RNA interference (RNAi) therapies to treat solid tumors driven by KRAS mutations, the most common oncogenic driver in human cancers. The company’s first-generation product, LODER™, has shown promising results in a Phase 2 trial for non-resectable pancreatic cancer. Silexion is also advancing its next-generation siRNA candidate, SIL-204, designed to target a broader range of KRAS mutations and showing significant potential in preclinical studies. The company remains committed to pushing the boundaries of therapeutic innovation in oncology, with a focus on improving outcomes for patients with difficult-to-treat cancers. For more information please visit: https://silexion.com

Company Contact

Silexion Therapeutics Corp

Ms. Mirit Horenshtein Hadar, CFO

mirit@silexion.com

Investor Contact

ARX | Capital Markets Advisors

North American Equities Desk

silexion@arxadvisory.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uncovering Potential: Ituran Location & Control's Earnings Preview

Ituran Location & Control ITRN is gearing up to announce its quarterly earnings on Thursday, 2024-11-21. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Ituran Location & Control will report an earnings per share (EPS) of $0.66.

The announcement from Ituran Location & Control is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

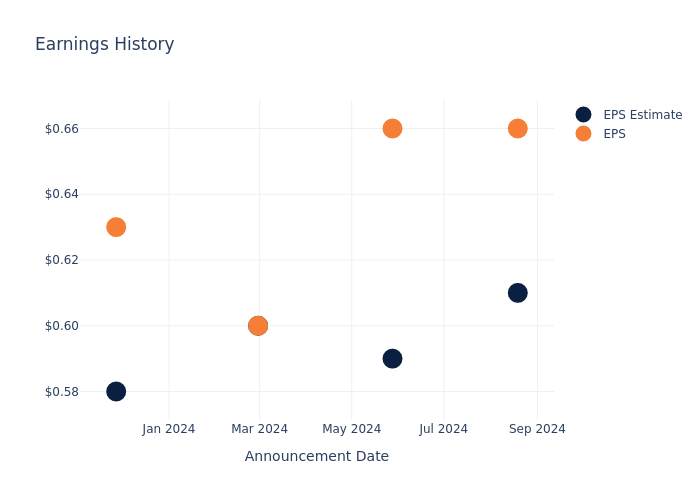

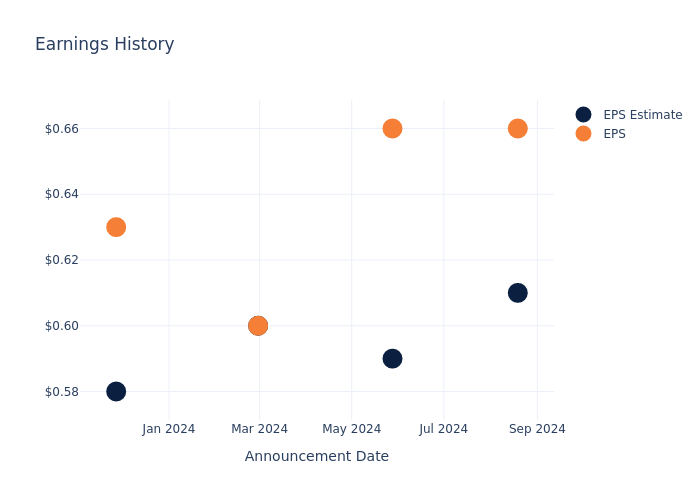

Overview of Past Earnings

The company’s EPS beat by $0.05 in the last quarter, leading to a 2.62% increase in the share price on the following day.

Here’s a look at Ituran Location & Control’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.61 | 0.59 | 0.6 | 0.58 |

| EPS Actual | 0.66 | 0.66 | 0.6 | 0.63 |

| Price Change % | 3.0% | -0.0% | 1.0% | 1.0% |

Market Performance of Ituran Location & Control’s Stock

Shares of Ituran Location & Control were trading at $27.18 as of November 18. Over the last 52-week period, shares are up 9.29%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.