SR BANCORP, INC. ANNOUNCES QUARTERLY FINANCIAL RESULTS

BOUND BROOK, N.J., Oct. 30, 2024 /PRNewswire/ — SR Bancorp, Inc. (the “Company”) SRBK, the holding company for Somerset Regal Bank (the “Bank”), announced net income of $1.4 million for the three months ended September 30, 2024 (unaudited), or $0.16 per basic and diluted share, compared to a net loss of $10.5 million for the three months ended September 30, 2023 (unaudited). Excluding $1.0 million of net accretion income related to fair value adjustments, net income would have been $627,000 for the three months ended September 30, 2024. Excluding $3.9 million of merger costs and a $4.2 million provision for credit losses related to the acquisition of Regal Bancorp and its wholly-owned subsidiary Regal Bank, which is described in greater detail below, and a $5.4 million charitable contribution, offset by $161,000 of net accretion income related to fair value adjustments, net income would have been $586,000 for the three months ended September 30, 2023.

Total assets were $1.05 billion, an increase of $32.1 million, or 3.1%, from $1.02 billion at June 30, 2024. Net loans were $767.7 million, an increase of $35.9 million, or 4.9%, from $731.9 million at June 30, 2024. Total deposits were $819.4 million, an increase of $12.3 million, or 1.5%, from $807.1 million at June 30, 2024. The increase in loans was funded primarily through a $20.0 million short-term borrowing and increased deposits.

Completed Stock Offering and Merger

The conversion of Somerset Savings Bank, SLA from the mutual to stock form of organization and related stock offering by the Company was completed on September 19, 2023. In connection therewith, the Company sold 9,055,172 shares of common stock at a price of $10.00 per share and contributed 452,758 shares and $905,517 in cash to the Somerset Regal Charitable Foundation, Inc., a charitable foundation formed in connection with the conversion.

Promptly following the completion of the conversion and related stock offering, Regal Bancorp merged with and into the Company, with the Company as the surviving entity (the “Merger”). Immediately following the Merger, Regal Bank, a New Jersey chartered commercial bank headquartered in Livingston, New Jersey and the wholly-owned subsidiary of Regal Bancorp, merged with and into Somerset Bank, which converted to a commercial bank charter, and was renamed Somerset Regal Bank. The Merger was completed on September 19, 2023.

Branch Closure

On September 25, 2024, the Company closed one of its retail branch locations in Livingston, New Jersey acquired in the Merger due to its close proximity to another Bank branch.

Comparison of Operating Results for the Three Months Ended September 30, 2024 and September 30, 2023

General. Net income increased $11.9 million, or 113.0%, to net income of $1.4 million for the three months ended September 30, 2024 from a net loss of $10.5 million for the three months ended September 30, 2023. Net income for the three months ended September 30, 2024 included $1.0 million of net accretion income related to fair value adjustments resulting from the Merger. The net loss for the three months ended September 30, 2023 included $3.9 million of merger-related costs, a $4.2 million provision for credit losses related to the Merger and a $5.4 million charitable contribution, offset by $161,000 of net accretion income related to the fair value adjustments.

Interest Income. Interest income increased $5.9 million, or 106.9%, to $11.5 million for the three months ended September 30, 2024 from $5.5 million for the three months ended September 30, 2023 primarily due to a 163 basis point increase in the yield on interest-earning assets and a $258.2 million increase in the average balance of interest-earning assets. The increase resulted from a $6.5 million, or 173.9%, increase in interest income on loans due to the increased size of the loan portfolio as a result of the Merger as well as a higher average yield on the loan portfolio due to higher market rates and increased proportion of higher-yielding commercial real estate loans, offset by a $197,000 decrease in interest income on securities, and a $410,000 decrease in interest income from other interest-earnings assets. The decrease in interest income on securities was due to a $48.8 million decrease in the average balance of securities resulting primarily from the sale of $35.4 million of lower-yielding securities in the fourth quarter of fiscal year 2024 as part of a balance sheet repositioning. The decrease in interest income from other interest-earning assets was due to a decrease in the average balance of those assets of $36.9 million, or 44.1%, which were used primarily to originate new loans.

Interest Expense. Interest expense increased $2.5 million, or 177.0%, to $3.9 million for the three months ended September 30, 2024 from $1.4 million for the three months ended September 30, 2023 due to a $2.6 million increase in interest expense on deposits, offset by a $77,000 decrease in interest expense on borrowings. The decrease in interest expense on borrowings was due to the borrowing being outstanding for a partial period during the three months ended September 30, 2024 as compared to a full period for the three months ended September 30, 2023, despite the higher average rate. Interest expense on interest-bearing demand deposits increased $879,000 due to an increase of $132.9 million in the average balance and an increase of 123 basis points in the cost of interest-bearing deposits to 1.36% for the three months ended September 30, 2024 from 0.13% for the three months ended September 30, 2023. Interest expense on certificates of deposit increased $1.7 million as the average rate on certificates of deposit increased 152 basis points to 3.99% for the three months ended September 30, 2024 from 2.47% for the three months ended September 30, 2023 due to the highly competitive interest rate environment in our market area. The average balance of certificates of deposit also increased $100.9 million, or 57.3%, to $276.9 million for the three months ended September 30, 2024 from $176.1 million for the three months ended September 30, 2023.

Net Interest Income. Net interest income increased $3.4 million, or 83.2%, to $7.6 million for the three months ended September 30, 2024 from $4.1 million for the three months ended September 30, 2023. Net interest rate spread increased 58 basis points to 2.70% for the three months ended September 30, 2024 from 2.12% for the three months ended September 30, 2023. Net interest margin increased 80 basis points to 3.21% for the three months ended September 30, 2024 from 2.41% for the three months ended September 30, 2023. Net interest-earning assets increased $41.8 million, or 23.0%, to $223.5 million for the three months ended September 30, 2024 from $181.7 million for the three months ended September 30, 2023. The increases in the Bank’s net interest rate spread and net interest margin were primarily a result of the cost of interest-bearing liabilities increasing at a slower rate than the yield on interest-earning assets.

Provision for Credit Losses. The Bank establishes provisions for credit losses, which are charged to operations to maintain the allowance for credit losses at a level it considers necessary to absorb probable credit losses attributable to loans that are reasonably estimable at the balance sheet date. In determining the level of the allowance for credit losses, the Bank considers, among other things, past and current loss experience, evaluations of real estate collateral, economic conditions, the amount and type of lending, adverse situations that may affect a borrower’s ability to repay a loan and the levels of delinquent, classified and criticized loans. The amount of the allowance is based on estimates and the ultimate losses may vary from such estimates as more information becomes available or conditions change. The Bank assesses the allowance for credit losses and records provisions for credit losses on a quarterly basis.

The Bank recorded a recovery for credit losses of $154,000 for the three months ended September 30, 2024 as compared to a provision for credit losses of $4.2 million for the three months ended September 30, 2023. The recovery reflects updates made to model assumptions in the calculation of the Bank’s allowance for credit losses to reflect the change in the loan composition following the Merger. The Bank had no charge-offs for the three months ended September 30, 2024 and $9,000 of non-performing loans at September 30, 2024 compared to no charge-offs for the three months ended September 30, 2023 and $144,000 of non-performing loans at September 30, 2023. The Bank’s allowance for credit losses as a percentage of total loans was 0.66% at September 30, 2024 compared to 0.77% at September 30, 2023.

Noninterest Income. Noninterest income increased $288,000, or 56.1%, to $801,000 for the three months ended September 30, 2024 from $513,000 for the three months ended September 30, 2023, primarily as a result of an increase of $125,000 in service charges and fees, due to the increase in volume as a result of the Merger, as well as an increase of $85,000 in the cash surrender value of bank owned life insurance, resulting from an increase in the average balance of the related assets, for the three months ended September 30, 2024 compared to the three months ended September 30, 2023.

Noninterest Expense. Noninterest expense decreased $6.1 million, or 47.3%, to $6.8 million for the three months ended September 30, 2024 from $12.9 million for the three months ended September 30, 2023, primarily as a result of a $5.4 million charitable contribution during the three months ended September 30, 2023, as well as a $1.3 million, or 28.7%, decrease in salaries and employee benefits resulting from one-time change in control payments incurred during the three months ended September 30, 2023.

Income Tax Expense. The provision for income taxes was $363,000 for the three months ended September 30, 2024, compared to a benefit of $1.9 million for the three months ended September 30, 2023. The Bank’s effective tax rate was 21.0% for the three months ended September 30, 2024 compared to 15.6% for the three months ended September 30, 2023.

Comparison of Financial Condition at September 30, 2024 and June 30, 2024

Assets. Assets increased $32.1 million, or 3.1%, to $1.05 billion at September 30, 2024 from $1.02 billion at June 30, 2024. The increase was primarily driven by new loan originations, resulting in a net increase of $35.9 million in loans receivable.

Cash and Cash Equivalents. Cash and cash equivalents increased $1.4 million, or 3.0%, to $47.3 million at September 30, 2024 from $45.9 million at June 30, 2024.

Securities. Securities held-to-maturity decreased $3.6 million, or 2.3%, to $154.7 million at September 30, 2024 from $158.3 million at June 30, 2024. The decrease was primarily due to principal repayments and maturities.

Loans. Loans receivable, net, increased $35.9 million, or 4.9%, to $767.7 million at September 30, 2024 from $731.9 million at June 30, 2024, driven by an increase in multi-family loans of $25.6 million, or 14.2%, and an increase in residential mortgage loans of $11.5 million, or 2.9%.

Goodwill and Intangible Assets. Goodwill and the core deposit intangible asset recognized from the Merger totaled $27.8 million at September 30, 2024 compared to $28.1 million at September 30, 2023. The decrease was due to the amortization of the core deposit intangible.

Deposits. Deposits increased $12.3 million, or 1.5%, to $819.4 million at September 30, 2024 from $807.1 million at June 30, 2024. Increases in interest-bearing checking accounts offset decreases in non-maturity savings accounts due in part to the Bank having raised rates on certain interest-bearing deposit products in an effort to remain competitive in the market area. At September 30, 2024, $114.3 million, or 13.9%, of total deposits consisted of noninterest-bearing deposits. At September 30, 2024, $137.6 million, or 16.8%, of total deposits were uninsured.

Borrowings. During the three months ended September 30, 2024, the Bank borrowed $20.0 million from the Federal Home Loan Bank of New York to provide for additional liquidity in order to fund new loans. Such borrowing remained outstanding at September 30, 2024. At June 30, 2024, there were no outstanding borrowings.

Equity. Equity increased $1.1 million, or 0.5%, to $200.5 million at September 30, 2024 from $199.5 million at June 30, 2024. The increase was primarily due to net earnings of $1.4 million, a decrease in accumulated other comprehensive loss related to the funded status of the Company’s pension plan of $337,000, or 27.7%, offset by a decrease of $737,000 due to the repurchase of 66,288 shares of common stock.

About Somerset Regal Bank

Somerset Regal Bank is a full-service New Jersey commercial bank headquartered in Bound Brook, New Jersey that operates 14 branches in Essex, Hunterdon, Middlesex, Morris, Somerset and Union Counties, New Jersey. At September 30, 2024, Somerset Regal Bank had $1.05 billion in total assets, $767.7 million in net loans, $819.4 million in deposits and total equity of $200.5 million. Additional information about Somerset Regal Bank is available on its website, www.somersetregalbank.com.

Forward-Looking Statements

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements, which are based on certain current assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. Forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, inflation, general economic conditions or conditions within the securities markets, our ability to successfully integrate acquired operations and realize the expected level of synergies and cost savings, real estate market values in the Bank’s lending area changes in the quality of our loan and security portfolios, increases in non-performing and classified loans, economic assumptions or changes in our methodology that may impact our allowance for credit losses calculation, changes in liquidity, including the size and composition of our deposit portfolio and the percentage of uninsured deposits in the portfolio, the availability of low-cost funding, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyber attacks, the failure to maintain current technologies, failure to retain or attract employees and legislative, accounting and regulatory changes that could adversely affect the business in which the Company and the Bank are engaged. Our actual future results may be materially different from the results indicated by these forward-looking statements. Except as required by applicable law or regulation, we do not undertake, and we specifically disclaim any obligation, to release publicly the results of any revisions that may be made to any forward-looking statement.

|

SR Bancorp, Inc. and Subsidiaries |

||||||||

|

Consolidated Statements of Financial Condition |

||||||||

|

September 30, 2024 (Unaudited) and June 30, 2024 |

||||||||

|

(Dollars in thousands) |

||||||||

|

September 30, 2024 |

June 30, 2024 |

|||||||

|

(Unaudited) |

||||||||

|

Assets |

||||||||

|

Cash and due from banks |

$ |

4,222 |

$ |

8,622 |

||||

|

Interest-bearing deposits at other banks |

43,076 |

37,287 |

||||||

|

Total cash and cash equivalents |

47,298 |

45,909 |

||||||

|

Securities held-to-maturity, at amortized cost |

154,724 |

158,325 |

||||||

|

Equity securities, at fair value |

27 |

25 |

||||||

|

Loans receivable, net of allowance for credit losses of $5,075 and |

767,717 |

731,859 |

||||||

|

Premises and equipment, net |

5,204 |

5,419 |

||||||

|

Right-of-use asset |

2,308 |

2,311 |

||||||

|

Restricted equity securities, at cost |

2,131 |

1,231 |

||||||

|

Accrued interest receivable |

2,800 |

2,695 |

||||||

|

Bank owned life insurance |

37,353 |

37,093 |

||||||

|

Goodwill and intangible assets |

27,755 |

28,141 |

||||||

|

Other assets |

5,643 |

7,836 |

||||||

|

Total assets |

$ |

1,052,960 |

$ |

1,020,844 |

||||

|

Liabilities and Equity |

||||||||

|

Liabilities |

||||||||

|

Deposits: |

||||||||

|

Noninterest-bearing |

$ |

114,296 |

$ |

108,026 |

||||

|

Interest-bearing |

705,088 |

699,074 |

||||||

|

Total deposits |

819,384 |

807,100 |

||||||

|

Borrowings |

20,000 |

— |

||||||

|

Advance payments by borrowers for taxes and insurance |

7,890 |

8,073 |

||||||

|

Accrued interest payable |

292 |

149 |

||||||

|

Lease liability |

2,405 |

2,403 |

||||||

|

Other liabilities |

2,445 |

3,636 |

||||||

|

Total liabilities |

852,416 |

821,361 |

||||||

|

Equity |

||||||||

|

Common stock, $0.01 par value, 55,000,000 authorized; |

87 |

95 |

||||||

|

Additional paid-in capital |

90,706 |

91,436 |

||||||

|

Retained earnings |

117,572 |

116,205 |

||||||

|

Unearned compensation ESOP |

(6,941) |

(7,036) |

||||||

|

Accumulated other comprehensive loss |

(880) |

(1,217) |

||||||

|

Total stockholders’ equity |

200,544 |

199,483 |

||||||

|

Total liabilities and stockholders’ equity |

$ |

1,052,960 |

$ |

1,020,844 |

||||

|

SR Bancorp, Inc. and Subsidiaries |

||||||||

|

Consolidated Statements of Income |

||||||||

|

For the three months ended September 30, 2024 (Unaudited) and September 30, 2023 (Unaudited) |

||||||||

|

(Dollars in thousands) |

||||||||

|

Three Months Ended |

||||||||

|

September 30, 2024 |

September 30, 2023 |

|||||||

|

(Unaudited) |

||||||||

|

Interest Income |

||||||||

|

Loans, including fees |

$ |

10,286 |

$ |

3,755 |

||||

|

Securities: |

||||||||

|

Taxable |

661 |

858 |

||||||

|

Federal funds sold |

— |

10 |

||||||

|

Interest bearing deposits at other banks |

520 |

920 |

||||||

|

Total interest income |

11,467 |

5,543 |

||||||

|

Interest Expense |

||||||||

|

Deposits: |

||||||||

|

Demand |

926 |

47 |

||||||

|

Savings and time |

2,784 |

1,111 |

||||||

|

Borrowings |

163 |

240 |

||||||

|

Total interest expense |

3,873 |

1,398 |

||||||

|

Net Interest Income |

7,594 |

4,145 |

||||||

|

(Credit) Provision for Credit Losses |

(154) |

4,162 |

||||||

|

Net Interest Income After (Credit) Provision for Credit Losses |

7,748 |

(17) |

||||||

|

Noninterest Income |

||||||||

|

Service charges and fees |

296 |

171 |

||||||

|

Increase in cash surrender value of bank owned life insurance |

260 |

175 |

||||||

|

Fees and service charges on loans |

56 |

5 |

||||||

|

Unrealized gain (loss) on equity securities |

2 |

(3) |

||||||

|

Realized loss on sale of investments |

— |

(17) |

||||||

|

Realized gain on sale of loans |

24 |

— |

||||||

|

Other |

163 |

182 |

||||||

|

Total noninterest income |

801 |

513 |

||||||

|

Noninterest Expense |

||||||||

|

Salaries and employee benefits |

3,240 |

4,544 |

||||||

|

Occupancy |

632 |

237 |

||||||

|

Furniture and equipment |

293 |

161 |

||||||

|

Data Processing |

629 |

807 |

||||||

|

Advertising |

82 |

57 |

||||||

|

FDIC premiums |

120 |

83 |

||||||

|

Directors fees |

92 |

88 |

||||||

|

Professional fees |

489 |

854 |

||||||

|

Insurance |

159 |

116 |

||||||

|

Telephone, postage and supplies |

181 |

84 |

||||||

|

Other |

902 |

5,906 |

||||||

|

Total noninterest expense |

6,819 |

12,937 |

||||||

|

Income Before Income Tax Expense |

1,730 |

(12,441) |

||||||

|

Income Tax Expense |

363 |

(1,943) |

||||||

|

Net Income |

1,367 |

$ |

(10,498) |

|||||

|

Basic earnings per share |

$ |

0.16 |

$ |

(10.03) |

||||

|

Diluted earnings per share |

$ |

0.16 |

$ |

(10.03) |

||||

|

SR Bancorp, Inc. and Subsidiaries |

||||

|

Selected Ratios |

||||

|

(Dollars in thousands, except per share data) |

||||

|

Three Months Ended |

||||

|

September 30, 2024 |

September 30, 2023 |

|||

|

(Unaudited) |

||||

|

Performance Ratios: (1) |

||||

|

Return (loss) on average assets (2) |

0.53 % |

(5.74) % |

||

|

Return (loss) on average equity (3) |

2.77 % |

(32.39) % |

||

|

Net interest margin (4) |

3.21 % |

2.41 % |

||

|

Net interest rate spread (5) |

2.70 % |

2.12 % |

||

|

Efficiency ratio (6) |

81.23 % |

277.74 % |

||

|

Total gross loans to total deposits |

94.31 % |

79.53 % |

||

|

Asset Quality Ratios: |

||||

|

Allowance for credit losses on loans as a percentage of total gross loans |

0.66 % |

0.77 % |

||

|

Allowance for credit losses on loans as a percentage of non-performing loans |

56388.89 % |

3697.92 % |

||

|

Net (charge-offs) recoveries to average outstanding loans during the period |

0.00 % |

0.00 % |

||

|

Non-performing loans as a percentage of total gross loans |

0.00 % |

0.02 % |

||

|

Non-performing assets as a percentage of total assets |

0.00 % |

0.01 % |

||

|

Other Data: |

||||

|

Tangible book value per common share (7) |

$18.17 |

$17.35 |

||

|

Tangible common equity to tangible assets |

16.85 % |

15.29 % |

||

|

(1) Performance ratios for the three month periods ended September 30, 2024 and September 30, 2023 are annualized. |

|

(2) Represents net income divided by average total assets. |

|

(3) Represents net income divided by average equity. |

|

(4) Represents net interest income as a percentage of average interest-earning assets. (5) Represents net interest rate spread as a percentage of average interest-earning assets. |

|

(6) Represents non-interest expense divided by the sum of net interest income and non-interest income. |

|

(7) Tangible book value per share is calculated based on total stockholders’ equity, excluding intangible assets (goodwill and core deposit intangibles), divided by total shares outstanding as of the balance sheet date. Goodwill and core deposit intangibles were $27,755 and $28,141 at September 30, 2024 and September 30, 2023, respectively. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sr-bancorp-inc-announces-quarterly-financial-results-302292149.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sr-bancorp-inc-announces-quarterly-financial-results-302292149.html

SOURCE SR Bancorp, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

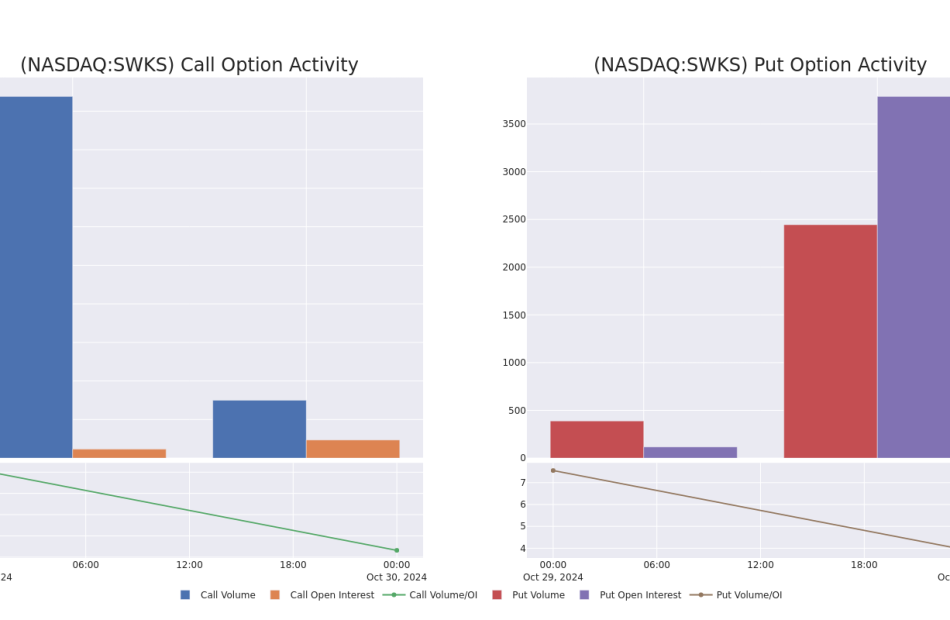

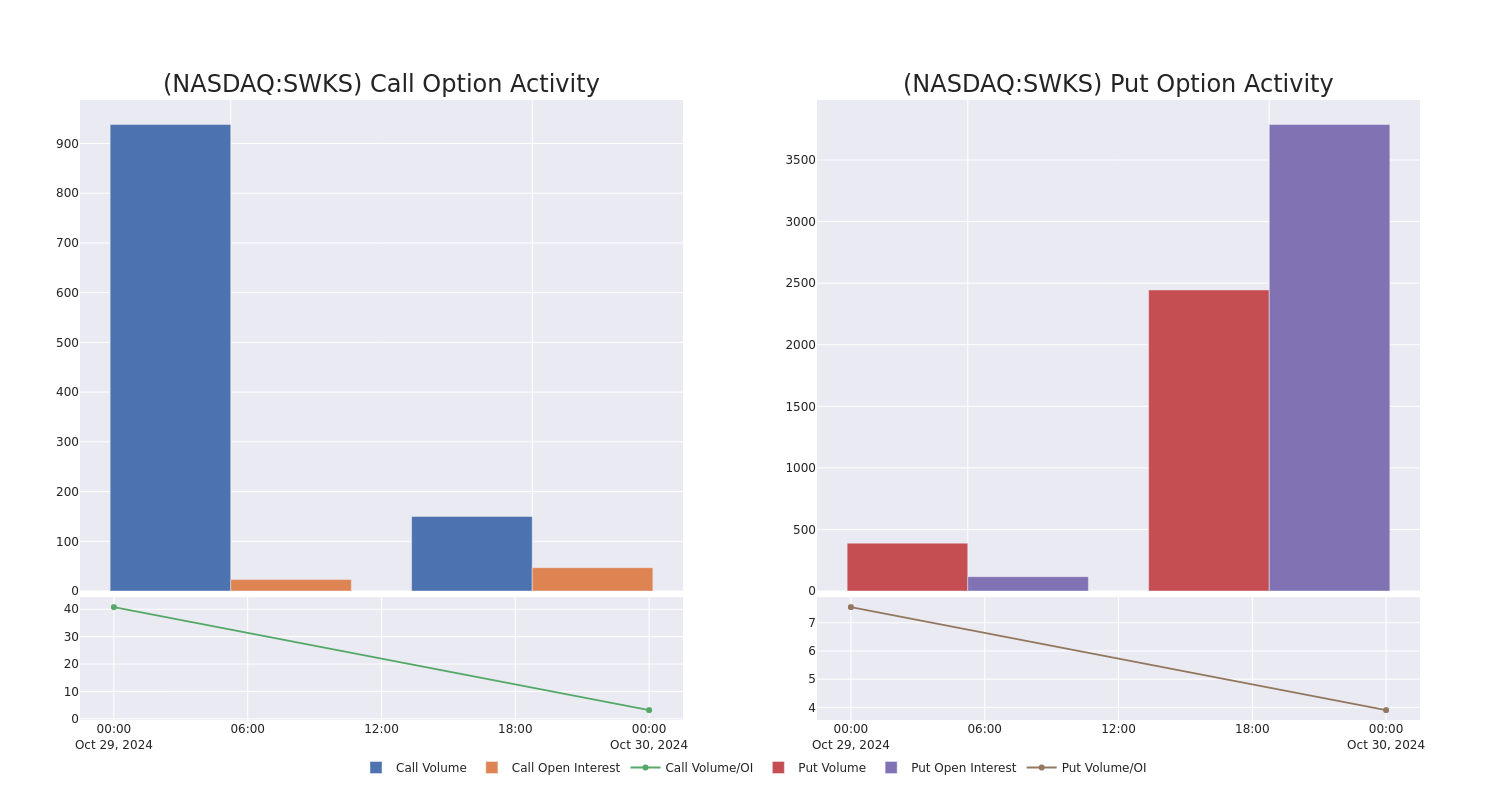

Skyworks Solutions's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Skyworks Solutions SWKS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SWKS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 10 extraordinary options activities for Skyworks Solutions. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 10% bearish. Among these notable options, 8 are puts, totaling $437,311, and 2 are calls, amounting to $53,000.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $97.5 for Skyworks Solutions during the past quarter.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Skyworks Solutions options trades today is 547.86 with a total volume of 2,545.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Skyworks Solutions’s big money trades within a strike price range of $85.0 to $97.5 over the last 30 days.

Skyworks Solutions Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SWKS | PUT | TRADE | BULLISH | 11/01/24 | $5.5 | $5.2 | $5.2 | $95.00 | $130.0K | 2.1K | 975 |

| SWKS | PUT | SWEEP | BULLISH | 11/01/24 | $5.5 | $5.2 | $5.33 | $95.00 | $57.2K | 2.1K | 233 |

| SWKS | PUT | SWEEP | BULLISH | 11/01/24 | $2.35 | $2.25 | $2.25 | $92.00 | $56.2K | 278 | 3 |

| SWKS | PUT | TRADE | NEUTRAL | 01/16/26 | $15.9 | $5.9 | $10.6 | $85.00 | $53.0K | 36 | 50 |

| SWKS | PUT | TRADE | NEUTRAL | 11/01/24 | $5.4 | $4.7 | $5.0 | $95.00 | $50.0K | 2.1K | 1.0K |

About Skyworks Solutions

Skyworks Solutions produces semiconductors for wireless handsets and other devices that are used to enable wireless connectivity. Its main products include power amplifiers, filters, switches, and integrated front-end modules that support wireless transmissions. Skyworks’ customers are mostly large smartphone manufacturers, but the firm also has a growing presence in nonhandset applications such as wireless routers, medical devices, and automobiles.

After a thorough review of the options trading surrounding Skyworks Solutions, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Skyworks Solutions Standing Right Now?

- Currently trading with a volume of 4,125,525, the SWKS’s price is down by -8.21%, now at $89.98.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 13 days.

What The Experts Say On Skyworks Solutions

In the last month, 4 experts released ratings on this stock with an average target price of $103.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B. Riley Securities has decided to maintain their Buy rating on Skyworks Solutions, which currently sits at a price target of $120.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Skyworks Solutions, targeting a price of $95.

* Reflecting concerns, an analyst from Barclays lowers its rating to Underweight with a new price target of $87.

* Maintaining their stance, an analyst from Susquehanna continues to hold a Neutral rating for Skyworks Solutions, targeting a price of $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Skyworks Solutions with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Silicon Motion Announces Results for the Period Ended September 30, 2024

Business Highlights

- Third quarter of 2024 sales increased 1% Q/Q and increased 23% Y/Y

- SSD controller sales: 3Q of 2024 were flat Q/Q and increased 20% to 25% Y/Y

- eMMC+UFS controller sales: 3Q of 2024 increased 0% to 5% Q/Q and increased 40% to 45% Y/Y

- SSD solutions sales: 3Q of 2024 increased 5% to 10% Q/Q and increased 5% to 10% Y/Y

Financial Highlights

| 3Q 2024 GAAP | 3Q 2024 Non-GAAP | |

| • Net sales | $212.4 million (+1% Q/Q, +23% Y/Y) | $212.4 million (+1% Q/Q, +23% Y/Y) |

| • Gross margin | 46.7% | 46.8% |

| • Operating margin | 11.5% | 16.1% |

| • Earnings per diluted ADS | $0.62 | $0.92 |

TAIPEI, Taiwan and MILPITAS, Calif., Oct. 31, 2024 (GLOBE NEWSWIRE) — Silicon Motion Technology Corporation SIMO (“Silicon Motion,” the “Company” or “we”) today announced its financial results for the quarter ended September 30, 2024. For the third quarter of 2024, net sales (GAAP) increased sequentially to $212.4 million from $210.7 million in the second quarter of 2024. Net income (GAAP) decreased to $20.8 million, or $0.62 per diluted American Depositary Share of the Company (“ADS”) (GAAP), from net income (GAAP) of $30.8 million, or $0.91 per diluted ADS (GAAP), in the second quarter of 2024.

For the third quarter of 2024, net income (non-GAAP) decreased to $31.0 million, or $0.92 per diluted ADS (non-GAAP), from net income (non-GAAP) of $32.5 million, or $0.96 per diluted ADS (non-GAAP), in the second quarter of 2024.

All financial numbers are in U.S. dollars unless otherwise noted.

Third Quarter of 2024 Review

“We continued to execute well in the third quarter of 2024, delivering revenue above the mid-point of our guided range and further expanding our gross margins,” said Wallace Kou, President and CEO of Silicon Motion. “Our eMMC and UFS controller revenue grew modestly, and our SSD controller revenue remained strong given continued growth in the OEM channel. We continue to outperform the market through new wins we secured this quarter with both NAND makers and module makers that we expect will ramp-up in 2025. We expect this trend to continue as we expand our product portfolio and deliver world-class controllers to the market.”

Key Financial Results

| (in millions, except percentages and per ADS amounts) | GAAP | Non-GAAP | ||||||||||||||||

| 3Q 2024 |

2Q 2024 |

3Q 2023 |

3Q 2024 |

2Q 2024 |

3Q 2023 |

|||||||||||||

| Revenue | $212.4 | $210.7 | $172.3 | $212.4 | $210.7 | $172.3 | ||||||||||||

| Gross profit | $99.3 | $96.8 | $73.1 | $99.3 | $96.8 | $73.3 | ||||||||||||

| Percent of revenue | 46.7% | 45.9% | 42.4% | 46.8% | 46.0% | 42.5% | ||||||||||||

| Operating expenses | $74.8 | $66.0 | $58.1 | $65.1 | $62.1 | $49.5 | ||||||||||||

| Operating income | $24.5 | $30.7 | $15.0 | $34.2 | $34.7 | $23.8 | ||||||||||||

| Percent of revenue | 11.5% | 14.6% | 8.7% | 16.1% | 16.5% | 13.8% | ||||||||||||

| Earnings per diluted ADS | $0.62 | $0.91 | $0.32 | $0.92 | $0.96 | $0.63 | ||||||||||||

Other Financial Information

| (in millions) | 3Q 2024 |

2Q 2024 |

3Q 2023 |

||||||

| Cash, cash equivalents, restricted cash and short-term investments—end of period | $368.6 | $343.6 | $350.3 | ||||||

| Routine capital expenditures | $7.4 | $6.3 | $6.3 | ||||||

| Dividend payments | $16.8 | $16.8 | — | ||||||

During the third quarter of 2024, we had $12.4 million of capital expenditures, including $7.4 million for the routine purchase of testing equipment, software, design tools and other items, and $5.0 million for building construction in Hsinchu.

Business Outlook

“Looking ahead, we expect to experience gains from greater outsourcing by our NAND flash maker partners, which should continue to deliver revenue and profitability growth for the company,” said Wallace Kou, President and CEO of Silicon Motion. “In the current quarter, we are introducing two key new controllers, including our first AI/enterprise server MonTitan controller and our first PCIe Gen 5.0 client SSD controller, placing Silicon Motion in an exceptionally strong position entering calendar 2025. While the seasonal holiday demand is expected to be more muted than in past years, we are confident that our highly differentiated controller solutions for PCs, smartphones and now enterprise-class storage controllers will further strengthen our market leadership position and will build on our foundation for strong, sustainable long-term growth.”

For the fourth quarter of 2024, management expects:

| ($ in millions) | GAAP | Non-GAAP Adjustment | Non-GAAP |

| Revenue | $191 to $202 -10% to -5% Q/Q -6% to 0% Y/Y |

— | $191 to $202 -10% to -5% Q/Q -6% to 0% Y/Y |

| Gross margin | 46.3% to 47.4% | Approximately $0.3* | 46.5 % to 47.5% |

| Operating margin | 8.0% to 9.9% | Approximately $13.4 to $14.4** | 15.6% to 16.6% |

* Projected gross margin (non-GAAP) excludes $0.3 million of stock-based compensation.

** Projected operating margin (non-GAAP) excludes $13.4 million to $14.4 million of stock-based compensation and dispute related expenses.

Conference Call & Webcast:

The Company’s management team will conduct a conference call at 8:00 am Eastern Time on October 31, 2024.

Conference Call Details

Participants must register in advance to join the conference call using the link provided below. Conference access information (including dial-in information and a unique access PIN) will be provided in the email received upon registration.

Participant Online Registration:

https://register.vevent.com/register/BI3e5d77077ee94ca9b9fd61325f52a0e9

A webcast of the call will be available on the Company’s website at www.siliconmotion.com.

Discussion of Non-GAAP Financial Measures

To supplement the Company’s unaudited selected financial results calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), the Company discloses certain non-GAAP financial measures that exclude stock-based compensation and other items, including gross profit (non-GAAP), gross margin (non-GAAP), operating expenses (non-GAAP), operating profit (non-GAAP), operating margin (non-GAAP), non-operating income (expense) (non-GAAP), net income (non-GAAP), and earnings per diluted ADS (non-GAAP). These non-GAAP measures are not in accordance with or an alternative to GAAP and may be different from similarly-titled non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all the amounts associated with the Company’s results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate the Company’s results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measure. We compensate for the limitations of our non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

Our non-GAAP financial measures are provided to enhance the user’s overall understanding of our current financial performance and our prospects for the future. Specifically, we believe the non-GAAP results provide useful information to both management and investors as these non-GAAP results exclude certain expenses, gains and losses that we believe are not indicative of our core operating results and because they are consistent with the financial models and estimates published by many analysts who follow the Company. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with our forecasts, and for benchmarking our performance externally against our competitors. Also, when evaluating potential acquisitions, we exclude the items described below from our consideration of the target’s performance and valuation. Since we find these measures to be useful, we believe that our investors benefit from seeing the results from management’s perspective in addition to seeing our GAAP results. We believe that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

- the ability to make more meaningful period-to-period comparisons of the Company’s on-going operating results;

- the ability to better identify trends in the Company’s underlying business and perform related trend analysis;

- a better understanding of how management plans and measures the Company’s underlying business; and

- an easier way to compare the Company’s operating results against analyst financial models and operating results of our competitors that supplement their GAAP results with non-GAAP financial measures.

The following are explanations of each of the adjustments that we incorporate into our non-GAAP measures, as well as the reasons for excluding each of these individual items in our reconciliation of these non-GAAP financial measures:

Stock-based compensation expense consists of non-cash charges related to the fair value of restricted stock units awarded to employees. The Company believes that the exclusion of these non-cash charges provides for more accurate comparisons of our operating results to our peer companies due to the varying available valuation methodologies, subjective assumptions and the variety of award types. In addition, the Company believes it is useful to investors to understand the specific impact of share-based compensation on its operating results.

Restructuring charges relate to the restructuring of our underperforming product lines, principally the write-down of NAND flash, embedded DRAM and SSD inventory valuation and severance payments.

M&A transaction expenses consist of legal, financial advisory and other fees related to the transaction.

Dispute related expenses consist of legal, consultant, other fees and resolution related to the dispute.

Foreign exchange loss (gain) consists of translation gains and/or losses of non-US$ denominated current assets and current liabilities, as well as certain other balance sheet items which result from the appreciation or depreciation of non-US$ currencies against the US$. We do not use financial instruments to manage the impact on our operations from changes in foreign exchange rates, and because our operations are subject to fluctuations in foreign exchange rates, we therefore exclude foreign exchange gains and losses when presenting non-GAAP financial measures.

Unrealized holding loss (gain) on investments relates to the net change in fair value of long-term investments.

| Silicon Motion Technology Corporation Consolidated Statements of Income (in thousands, except percentages and per ADS data, unaudited) |

|||||||||||||||

| For Three Months Ended | For the Nine Months Ended | ||||||||||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||||||||||

| 2023 | 2024 | 2024 | 2023 | 2024 | |||||||||||

| ($) | ($) | ($) | ($) | ($) | |||||||||||

| Net Sales | 172,333 | 210,670 | 212,412 | 436,763 | 612,392 | ||||||||||

| Cost of sales | 99,193 | 113,893 | 113,142 | 254,897 | 331,227 | ||||||||||

| Gross profit | 73,140 | 96,777 | 99,270 | 181,866 | 281,165 | ||||||||||

| Operating expenses | |||||||||||||||

| Research & development | 41,740 | 50,788 | 58,486 | 117,926 | 163,666 | ||||||||||

| Sales & marketing | 6,862 | 6,777 | 7,009 | 20,715 | 20,090 | ||||||||||

| General & administrative | 8,939 | 7,215 | 9,315 | 20,323 | 23,003 | ||||||||||

| Loss from settlement of litigation | 591 | 1,250 | – | 591 | 1,250 | ||||||||||

| Operating income | 15,008 | 30,747 | 24,460 | 22,311 | 73,156 | ||||||||||

| Non-operating income (expense) | |||||||||||||||

| Interest income, net | 3,480 | 4,175 | 3,518 | 8,026 | 10,760 | ||||||||||

| Foreign exchange gain (loss), net | 569 | 245 | (488 | ) | 2,030 | 345 | |||||||||

| Unrealized holding gain(loss) on investments | (2,828 | ) | 1,855 | (602 | ) | 8,053 | (355 | ) | |||||||

| Subtotal | 1,221 | 6,275 | 2,428 | 18,109 | 10,750 | ||||||||||

| Income before income tax | 16,229 | 37,022 | 26,888 | 40,420 | 83,906 | ||||||||||

| Income tax expense | 5,642 | 6,201 | 6,045 | 8,639 | 16,226 | ||||||||||

| Net income | 10,587 | 30,821 | 20,843 | 31,781 | 67,680 | ||||||||||

| Earnings per basic ADS | 0.32 | 0.92 | 0.62 | 0.95 | 2.01 | ||||||||||

| Earnings per diluted ADS | 0.32 | 0.91 | 0.62 | 0.95 | 2.01 | ||||||||||

| Margin Analysis: | |||||||||||||||

| Gross margin | 42.4 | % | 45.9 | % | 46.7 | % | 41.6 | % | 45.9 | % | |||||

| Operating margin | 8.7 | % | 14.6 | % | 11.5 | % | 5.1 | % | 11.9 | % | |||||

| Net margin | 6.1 | % | 14.6 | % | 9.8 | % | 7.3 | % | 11.1 | % | |||||

| Additional Data: | |||||||||||||||

| Weighted avg. ADS equivalents | 33,413 | 33,684 | 33,687 | 33,332 | 33,627 | ||||||||||

| Diluted ADS equivalents | 33,471 | 33,697 | 33,700 | 33,431 | 33,691 | ||||||||||

| Silicon Motion Technology Corporation Reconciliation of GAAP to Non-GAAP Operating Results (in thousands, except percentages and per ADS data, unaudited) |

|||||||||||||||

| For Three Months Ended | For the Nine Months Ended | ||||||||||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||||||||||

| 2023 | 2024 | 2024 | 2023 | 2024 | |||||||||||

| ($) | ($) | ($) | ($) | ($) | |||||||||||

| Gross profit (GAAP) | 73,140 | 96,777 | 99,270 | 181,866 | 281,165 | ||||||||||

| Gross margin (GAAP) | 42.4 | % | 45.9 | % | 46.7 | % | 41.6 | % | 45.9 | % | |||||

| Stock-based compensation (A) | 94 | 14 | 63 | 300 | 149 | ||||||||||

| Restructuring charges | 88 | 46 | – | 3,347 | 46 | ||||||||||

| Gross profit (non-GAAP) | 73,322 | 96,837 | 99,333 | 185,513 | 281,360 | ||||||||||

| Gross margin (non-GAAP) | 42.5 | % | 46.0 | % | 46.8 | % | 42.5 | % | 45.9 | % | |||||

| Operating expenses (GAAP) | 58,132 | 66,030 | 74,810 | 159,555 | 208,009 | ||||||||||

| Stock-based compensation (A) | (3,751 | ) | (371 | ) | (3,595 | ) | (11,460 | ) | (7,059 | ) | |||||

| M&A transaction expenses | (708 | ) | – | – | (2,893 | ) | – | ||||||||

| Dispute related expenses | (3,495 | ) | (3,527 | ) | (6,076 | ) | (3,495 | ) | (11,135 | ) | |||||

| Restructuring charges | (661 | ) | – | – | (4,581 | ) | – | ||||||||

| Operating expenses (non-GAAP) | 49,517 | 62,132 | 65,139 | 137,126 | 189,815 | ||||||||||

| Operating profit (GAAP) | 15,008 | 30,747 | 24,460 | 22,311 | 73,156 | ||||||||||

| Operating margin (GAAP) | 8.7 | % | 14.6 | % | 11.5 | % | 5.1 | % | 11.9 | % | |||||

| Total adjustments to operating profit | 8,797 | 3,958 | 9,734 | 26,076 | 18,389 | ||||||||||

| Operating profit (non-GAAP) | 23,805 | 34,705 | 34,194 | 48,387 | 91,545 | ||||||||||

| Operating margin (non-GAAP) | 13.8 | % | 16.5 | % | 16.1 | % | 11.1 | % | 14.9 | % | |||||

| Non-operating income (expense) (GAAP) | 1,221 | 6,275 | 2,428 | 18,109 | 10,750 | ||||||||||

| Foreign exchange loss (gain), net | (569 | ) | (245 | ) | 488 | (2,030 | ) | (345 | ) | ||||||

| Unrealized holding loss (gain) on investments | 2,828 | (1,855 | ) | 602 | (8,053 | ) | 355 | ||||||||

| Non-operating income (expense) (non-GAAP) | 3,480 | 4,175 | 3,518 | 8,026 | 10,760 | ||||||||||

| Net income (GAAP) | 10,587 | 30,821 | 20,843 | 31,781 | 67,680 | ||||||||||

| Total pre-tax impact of non-GAAP adjustments | 11,056 | 1,858 | 10,824 | 15,993 | 18,399 | ||||||||||

| Income tax impact of non-GAAP adjustments | (584 | ) | (218 | ) | (649 | ) | (2,968 | ) | (1,014 | ) | |||||

| Net income (non-GAAP) | 21,059 | 32,461 | 31,018 | 44,806 | 85,065 | ||||||||||

| Earnings per diluted ADS (GAAP) | $0.32 | $0.91 | $0.62 | $0.95 | $2.01 | ||||||||||

| Earnings per diluted ADS (non-GAAP) | $0.63 | $0.96 | $0.92 | $1.33 | $2.52 | ||||||||||

| Shares used in computing earnings per diluted ADS (GAAP) | 33,471 | 33,697 | 33,700 | 33,431 | 33,691 | ||||||||||

| Non-GAAP adjustments | 128 | 18 | 109 | 136 | 52 | ||||||||||

| Shares used in computing earnings per diluted ADS (non-GAAP) | 33,599 | 33,715 | 33,809 | 33,567 | 33,743 | ||||||||||

| (A) Excludes stock-based compensation as follows: | |||||||||||||||

| Cost of sales | 94 | 14 | 63 | 300 | 149 | ||||||||||

| Research & development | 2,422 | 94 | 2,377 | 7,605 | 4,614 | ||||||||||

| Sales & marketing | 521 | 173 | 455 | 1,496 | 975 | ||||||||||

| General & administrative | 808 | 104 | 763 | 2,359 | 1,470 | ||||||||||

| Silicon Motion Technology Corporation Consolidated Balance Sheet (In thousands, unaudited) |

|||||||||

| Sep. 30, |

Jun. 30, |

Sep. 30, |

|||||||

| 2023 |

2024 |

2024 |

|||||||

| ($) |

($) |

($) |

|||||||

| Cash and cash equivalents | 295,385 | 289,175 | 313,924 | ||||||

| Accounts receivable (net) | 193,389 | 191,692 | 202,726 | ||||||

| Inventories | 199,003 | 240,811 | 214,574 | ||||||

| Refundable deposits – current | 49,445 | 51,036 | 51,102 | ||||||

| Prepaid expenses and other current assets | 16,896 | 31,460 | 38,246 | ||||||

| Total current assets | 754,118 | 804,174 | 820,572 | ||||||

| Long-term investments | 17,023 | 17,301 | 16,878 | ||||||

| Property and equipment (net) | 162,107 | 179,550 | 181,983 | ||||||

| Other assets | 33,672 | 29,121 | 29,304 | ||||||

| Total assets | 966,920 | 1,030,146 | 1,048,737 | ||||||

| Accounts payable | 26,975 | 36,411 | 30,888 | ||||||

| Income tax payable | 26,279 | 14,103 | 14,444 | ||||||

| Accrued expenses and other current liabilities | 77,502 | 134,947 | 131,143 | ||||||

| Total current liabilities | 130,756 | 185,461 | 176,475 | ||||||

| Other liabilities | 62,112 | 60,182 | 62,673 | ||||||

| Total liabilities | 192,868 | 245,643 | 239,148 | ||||||

| Shareholders’ equity | 774,052 | 784,503 | 809,589 | ||||||

| Total liabilities & shareholders’ equity | 966,920 | 1,030,146 | 1,048,737 | ||||||

| Silicon Motion Technology Corporation Condensed Consolidated Statements of Cash Flows (in thousands, unaudited) |

|||||||||||||||

| For Three Months Ended | For the Nine Months Ended | ||||||||||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||||||||||

| 2023 | 2024 | 2024 | 2023 | 2024 | |||||||||||

| ($) | ($) | ($) | ($) | ($) | |||||||||||

| Net income | 10,587 | 30,821 | 20,843 | 31,781 | 67,680 | ||||||||||

| Depreciation & amortization | 8,043 | 5,802 | 6,664 | 19,032 | 18,075 | ||||||||||

| Stock-based compensation | 3,845 | 385 | 3,658 | 11,760 | 7,208 | ||||||||||

| Investment losses (gain) & disposals | 3,135 | (1,855 | ) | 602 | (7,556 | ) | 355 | ||||||||

| Changes in operating assets and liabilities | 39,302 | (13,660 | ) | 22,280 | 52,910 | (9,967 | ) | ||||||||

| Net cash provided by (used in) operating activities | 64,912 | 21,493 | 54,047 | 107,927 | 83,351 | ||||||||||

| Purchase of property & equipment | (17,052 | ) | (10,427 | ) | (12,436 | ) | (40,687 | ) | (33,612 | ) | |||||

| Net cash provided by (used in) investing activities | (17,052 | ) | (10,427 | ) | (12,436 | ) | (40,687 | ) | (33,612 | ) | |||||

| Dividend payments | – | (16,820 | ) | (16,812 | ) | (15 | ) | (50,441 | ) | ||||||

| Net cash used in financing activities | – | (16,820 | ) | (16,812 | ) | (15 | ) | (50,441 | ) | ||||||

| Net increase (decrease) in cash, cash equivalents & restricted cash | 47,860 | (5,754 | ) | 24,799 | 67,225 | (702 | ) | ||||||||

| Effect of foreign exchange changes | (2,528 | ) | 86 | 186 | (3,977 | ) | 308 | ||||||||

| Cash, cash equivalents & restricted cash—beginning of period | 304,971 | 349,279 | 343,611 | 287,055 | 368,990 | ||||||||||

| Cash, cash equivalents & restricted cash—end of period | 350,303 | 343,611 | 368,596 | 350,303 | 368,596 | ||||||||||

Shareholder Litigation

On August 31, 2023, a Silicon Motion ADS holder (the “Plaintiff”) filed a putative class action complaint in the United States District Court for the Southern District of California, captioned Water Island Event-Driven Fund v. MaxLinear, Inc., No. 23-cv-01607 (S.D. Cal.), asserting claims against MaxLinear and two of its officers (the “MaxLinear Defendants”) for alleged violations of (i) Section 10(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 10b-5 promulgated thereunder and (ii) Section 20(a) of the Exchange Act, in connection with alleged false and misleading statements made by the MaxLinear Defendants between June 6, 2023 and July 26, 2023 concerning MaxLinear’s intent to consummate the merger agreement it had entered into with Silicon Motion. On August 28, 2024, the Court dismissed the complaint against the MaxLinear Defendants without prejudice for lack of standing. On September 18, 2024, the Plaintiff filed an amended complaint against the MaxLinear Defendants, and also added Silicon Motion and two of its officers (the “Silicon Motion Defendants”), asserting substantially similar claims under the Exchange Act. The complaint seeks compensatory damages, including interest, costs and expenses, and such other equitable or injunctive relief that the court deems appropriate. Motions to dismiss the amended complaint are expected to be fully briefed by February 2025. The Silicon Motion Defendants believe that the claims asserted against them are without merit and intend to defend themselves vigorously.

About Silicon Motion:

We are the global leader in supplying NAND flash controllers for solid state storage devices. We supply more SSD controllers than any other company in the world for servers, PCs and other client devices and are the leading merchant supplier of eMMC and UFS embedded storage controllers used in smartphones, IoT devices and other applications. We also supply customized high-performance hyperscale data center and specialized industrial and automotive SSD solutions. Our customers include most of the NAND flash vendors, storage device module makers and leading OEMs. For further information on Silicon Motion, visit us at www.siliconmotion.com.

Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Although such statements are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on them. These statements involve risks and uncertainties, and actual market trends or our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons. Potential risks and uncertainties include, but are not limited to the unpredictable volume and timing of customer orders, which are not fixed by contract but vary on a purchase order basis; the loss of one or more key customers or the significant reduction, postponement, rescheduling or cancellation of orders from one or more customers; general economic conditions or conditions in the semiconductor or consumer electronics markets; the impact of inflation on our business and customer’s businesses and any effect this has on economic activity in the markets in which we operate; the functionalities and performance of our information technology (“IT”) systems, which are subject to cybersecurity threats and which support our critical operational activities, and any breaches of our IT systems or those of our customers, suppliers, partners and providers of third-party licensed technology; the effects on our business and our customer’s business taking into account the ongoing U.S.-China tariffs and trade disputes; the uncertainties associated with any future global or regional pandemic; the continuing tensions between Taiwan and China including enhanced military activities; decreases in the overall average selling prices of our products; changes in the relative sales mix of our products; changes in our cost of finished goods; supply chain disruptions that have affected us and our industry as well as other industries on a global basis; the payment, or non-payment, of cash dividends in the future at the discretion of our board of directors and any announced planned increases in such dividends; changes in our cost of finished goods; the availability, pricing, and timeliness of delivery of other components and raw materials used in the products we sell given the current raw material supply shortages being experienced in our industry; our customers’ sales outlook, purchasing patterns, and inventory adjustments based on consumer demands and general economic conditions; any potential impairment charges that may be incurred related to businesses previously acquired or divested in the future; our ability to successfully develop, introduce, and sell new or enhanced products in a timely manner; and the timing of new product announcements or introductions by us or by our competitors. For additional discussion of these risks and uncertainties and other factors, please see the documents we file from time to time with the U.S. Securities and Exchange Commission, including our Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on April 30, 2024. Other than as required under the securities laws, we do not intend, and do not undertake any obligation to, update or revise any forward-looking statements, which apply only as of the date of this press release.

![]()

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

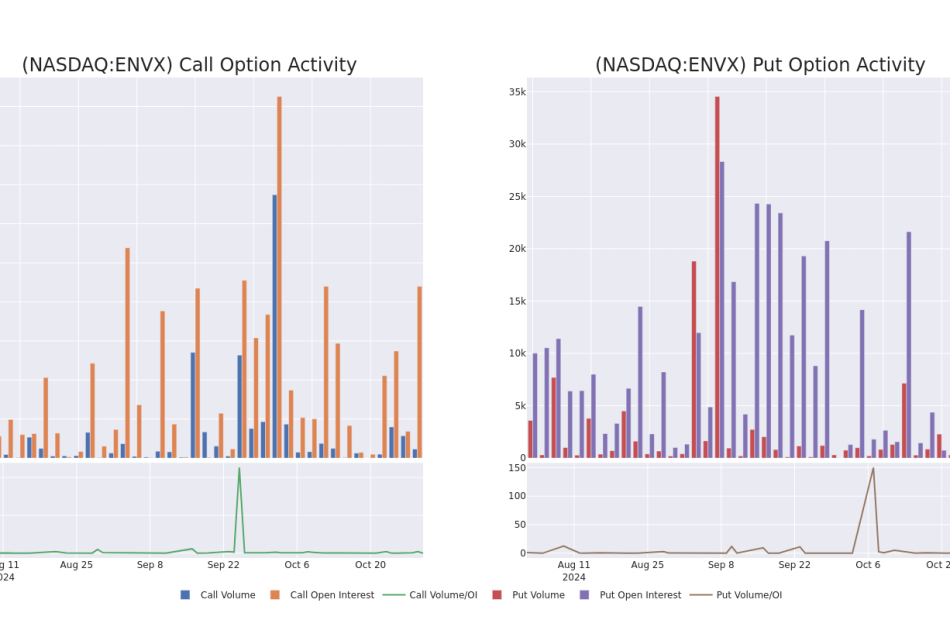

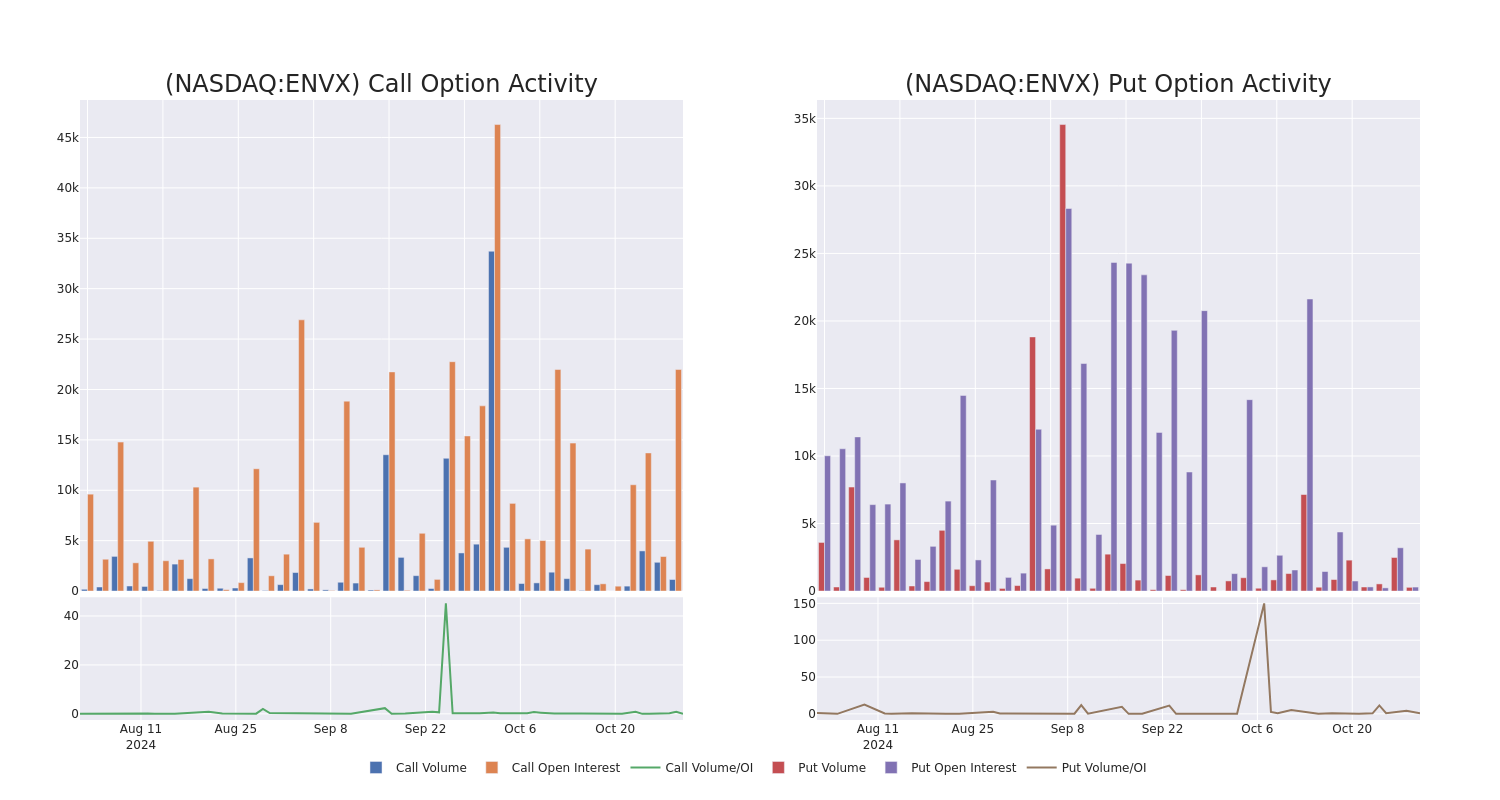

Enovix Unusual Options Activity For October 30

High-rolling investors have positioned themselves bullish on Enovix ENVX, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ENVX often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Enovix. This is not a typical pattern.

The sentiment among these major traders is split, with 75% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $105,105, and 7 calls, totaling $343,470.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $13.0 for Enovix over the last 3 months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Enovix options trades today is 2783.88 with a total volume of 1,419.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Enovix’s big money trades within a strike price range of $5.0 to $13.0 over the last 30 days.

Enovix 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | PUT | SWEEP | BULLISH | 04/17/25 | $3.95 | $3.85 | $3.85 | $13.00 | $105.1K | 294 | 274 |

| ENVX | CALL | SWEEP | BEARISH | 04/17/25 | $3.7 | $3.65 | $3.65 | $9.00 | $100.4K | 749 | 276 |

| ENVX | CALL | SWEEP | BEARISH | 04/17/25 | $3.5 | $3.45 | $3.45 | $10.00 | $97.3K | 1.3K | 283 |

| ENVX | CALL | TRADE | BULLISH | 11/01/24 | $2.13 | $2.13 | $2.13 | $9.00 | $31.9K | 1.1K | 150 |

| ENVX | CALL | TRADE | BULLISH | 01/17/25 | $6.15 | $5.25 | $5.88 | $5.00 | $29.4K | 3.7K | 50 |

About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

In light of the recent options history for Enovix, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Enovix

- With a volume of 13,865,343, the price of ENVX is down -6.68% at $9.92.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 111 days.

Professional Analyst Ratings for Enovix

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $23.333333333333332.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Enovix, targeting a price of $15.

* An analyst from Benchmark downgraded its action to Buy with a price target of $25.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $30.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enovix, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

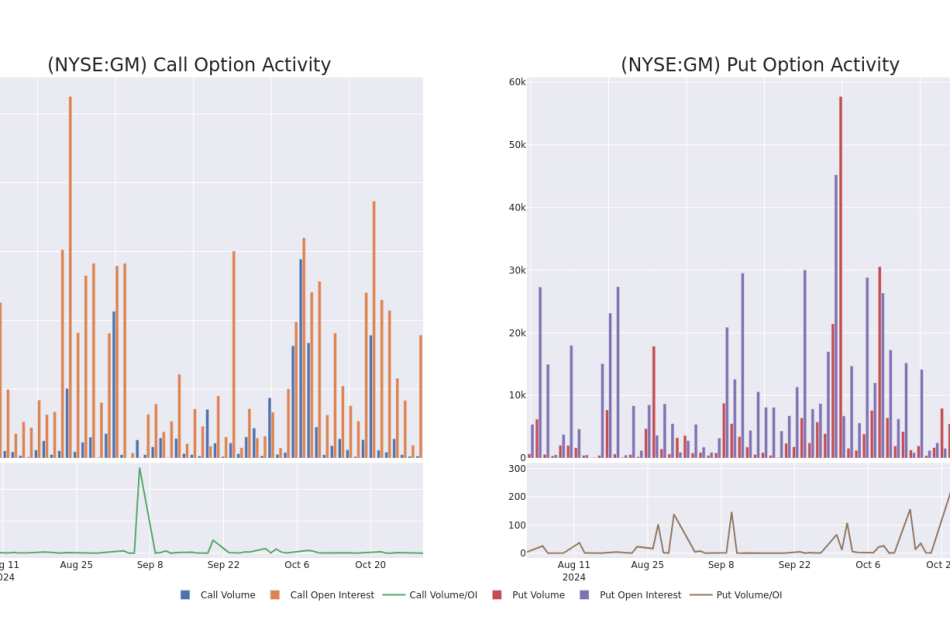

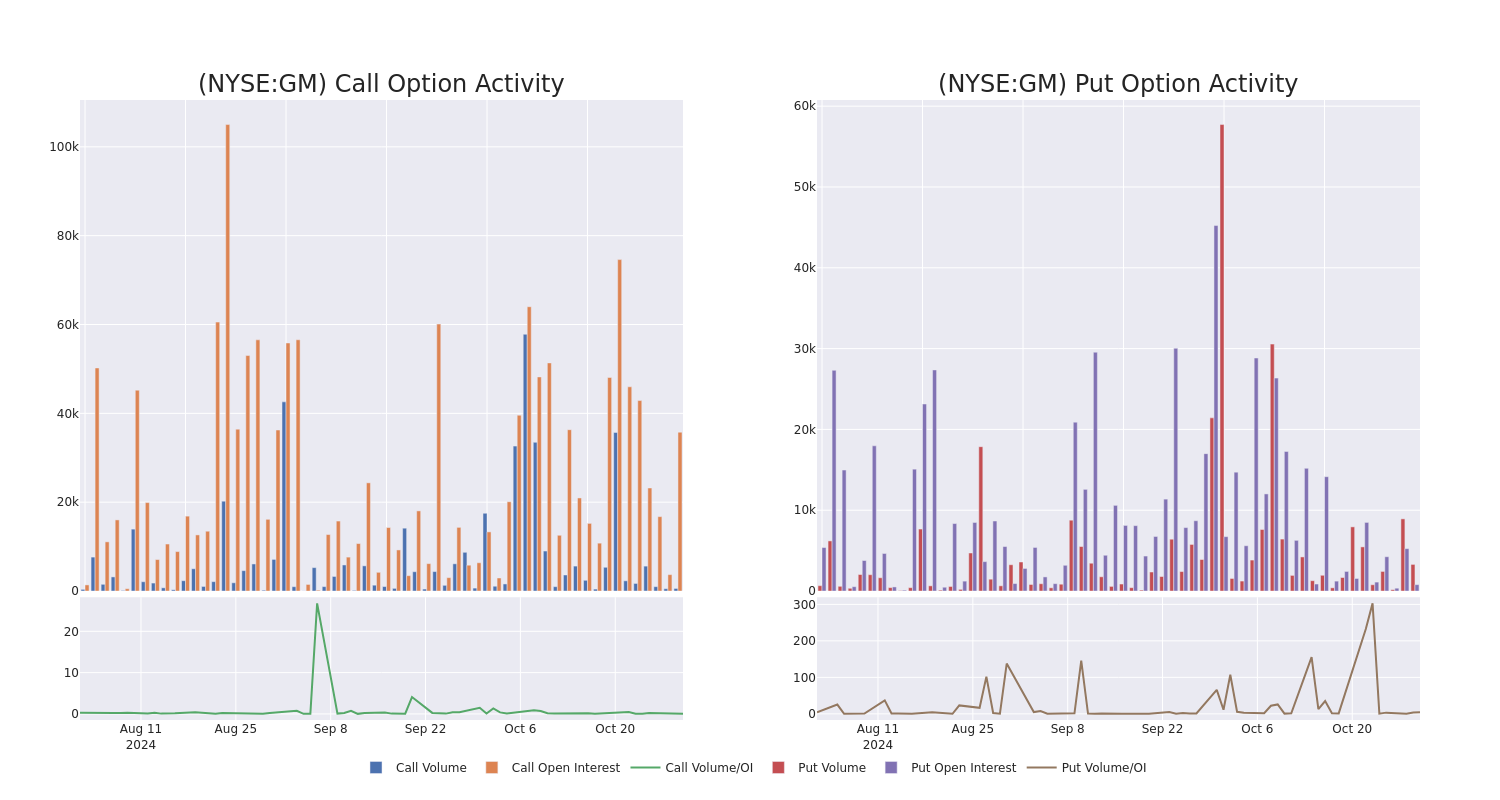

This Is What Whales Are Betting On General Motors

Financial giants have made a conspicuous bullish move on General Motors. Our analysis of options history for General Motors GM revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $103,759, and 6 were calls, valued at $442,030.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $52.5 for General Motors over the last 3 months.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for General Motors’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of General Motors’s whale activity within a strike price range from $40.0 to $52.5 in the last 30 days.

General Motors Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | BULLISH | 01/17/25 | $12.3 | $12.05 | $12.3 | $40.00 | $123.0K | 10.4K | 100 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $99.1K | 8.1K | 98 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $69.6K | 8.1K | 164 |

| GM | PUT | SWEEP | BEARISH | 11/08/24 | $0.56 | $0.56 | $0.56 | $51.00 | $66.4K | 792 | 1.3K |

| GM | CALL | SWEEP | BULLISH | 06/20/25 | $5.7 | $5.6 | $5.7 | $52.50 | $63.2K | 2.9K | 112 |

About General Motors

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023’s share was 16.5%. GM’s Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company’s captive finance arm in October 2010 via the purchase of AmeriCredit.

General Motors’s Current Market Status

- With a volume of 8,151,027, the price of GM is up 0.83% at $51.97.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 90 days.

Professional Analyst Ratings for General Motors

In the last month, 5 experts released ratings on this stock with an average target price of $58.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $54.

* Maintaining their stance, an analyst from Bernstein continues to hold a Market Perform rating for General Motors, targeting a price of $55.

* An analyst from UBS has decided to maintain their Buy rating on General Motors, which currently sits at a price target of $62.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for General Motors, targeting a price of $65.

* Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $55.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for General Motors, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NN, Inc. Reports Third Quarter 2024 Results

CHARLOTTE, N.C., Oct. 30, 2024 (GLOBE NEWSWIRE) — NN, Inc. NNBR, a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported its financial results for the third quarter ended September 30, 2024.

Highlights

- New business wins in the quarter were $15 million, bringing year-to-date and trailing-21-month totals to $49 million and $113 million, respectively; on pace with full-year guidance;

- Continuing to lower the cost structure of our North American Mobile Solutions footprint to achieve a minimum 10% adjusted EBITDA margin rate through footprint optimization and overhead cost reduction;

- China sales growth continues on track with top global tier-1 customers; up 19% versus prior year period;

- Implemented operational and cost reduction plans in Q3’24, including a ~$2 million annualized cost-out program, with additional cost-out initiatives in Q4’24 and first half of 2025;

- Leverage ratio declined to 2.97x, as cash proceeds from the sale of Lubbock plant were deployed towards debt reduction;

- Strategic refinancing process continues, evaluating future growth capital needs driven by successful new business wins program;

- End markets are opportunity-rich with current focus on increasing new business wins in Stamping and Medical markets.

“We achieved a faster pace in our enterprise transformation across cost-out and growth programs within our current capital structure,” said Harold Bevis, President and Chief Executive Officer of NN, Inc. “Our continued focus and execution across the pillars of our transformation initiatives delivered another quarter of results broadly across our business, evidenced by advances in operational efficiency, structural cost reductions, and commercial growth through our new business win program.”

“During the quarter, we remained focused on improving our profitability and launched a new round of successful cost reduction measures, which we believe will carry a meaningful impact to growing and sustaining the earnings power of our business, particularly as we begin to capture the embedded future top-line growth from the initial success of our new business program. Additionally, as was previously announced, we completed the sale of our non-core plastics products plant, which allows us to focus on our core competencies and further corrects our balance sheet.”

Mr. Bevis concluded, “NN is working to enhance its business model and adjust the revenue and margin mix, primarily in Mobile. We are underway installing new equipment to support global new wins for high-end next generation products, including steering and braking components. Additionally, as part of our focus on strategically realigning volumes in our group of underperforming plants, we announced the closure of our Dowagiac plant, reflecting our continued capacity shift towards lower cost geographies, particularly in China. We expect these optimization actions to support our adjusted EBITDA run rate and margin performance moving forward. As we look to the fourth quarter and fiscal 2025, we will judiciously invest our cash flows into electrical, medical, and other high return projects, and are excited about the opportunity set in front of us. We are encouraged with the pace and results of our transformation.”

Third Quarter GAAP Results

Net sales were $113.6 million, a decrease of 8.7% compared to the third quarter of 2023 net sales of $124.4 million, which was primarily due to the sale of our Lubbock operations, rationalized volume at plants undergoing turnarounds, a customer settlement received in 2023, and unfavorable foreign exchange effects of $1.1 million. Excluding these items, net sales decreased 0.5%.

Loss from operations was $3.8 million compared to a loss from operations of $2.7 million in the third quarter of 2023. The increased loss from operations was primarily due to lower sales volume.

Income from operations for Power Solutions was $2.5 million compared to income from operations of $3.9 million for the same period in 2023. Loss from operations for Mobile Solutions was $1.4 million compared to loss from operations of $1.3 million for the same period in 2023.

Net loss was $2.6 million compared to net loss of $5.1 million for the same period in 2023.

Third Quarter Adjusted Results

Adjusted income from operations for the third quarter of 2024 was $1.3 million compared to adjusted income from operations of $3.7 million for the same period in 2023. Adjusted EBITDA was $11.6 million, or 10.2% of sales, compared to $14.5 million, or 11.6% of sales, for the same period in 2023. The prior year adjusted EBITDA benefited by $2.5 million from a customer settlement, a favorable precious metals adjustment, and results of now divested Lubbock operations, partially offset by rationalized business of $0.9 million. Excluding these items, adjusted EBITDA declined $1.3 million.

Adjusted net loss was $2.5 million, or $0.05 per diluted share, compared to adjusted net income of $0.1 million, or $0.01 per diluted share, for the same period in 2023. Free cash flow was a generation of cash of $0.3 million compared to a generation of cash of $11.3 million for the same period in 2023.

Power Solutions

Net sales for the third quarter of 2024 were $42.9 million compared to $45.5 million in the same period in 2023. Prior year sales were $39.9 million, excluding the recently sold Lubbock operations, an increase of $3 million. The increase in sales when removing the impact from Lubbock was primarily due to higher precious metals pass-through pricing and pricing.

Adjusted income from operations was $5.2 million compared to adjusted income from operations of $7.1 million in the third quarter of 2023. The decrease in adjusted income from operations was primarily due to the lower revenue resulting from the sale of the Lubbock operations and unfavorable product mix.

Mobile Solutions

Net sales for the third quarter of 2024 were $70.7 million compared to $79.0 million in the third quarter of 2023, a decrease of 10.5%. The decrease in sales was primarily due to rationalized volume at plants undergoing turnarounds, contractual reduction in customer pass-through material pricing, a customer settlement received in 2023, and unfavorable foreign exchange effects of $1.0 million.

Adjusted income from operations was $0.9 million compared to adjusted income from operations of $1.6 million in the third quarter of 2023. The decrease in adjusted income from operations was primarily due to lower revenue, partially offset by lower depreciation expense.

2024 Outlook

- Revenue in the range of $465 million to $485 million;

- Adjusted EBITDA in the range of $47 million to $51 million;

- Free cash flow in the range of $8 million to $12 million; and

- New business wins in the range of $55 million to $70 million.

Chris Bohnert, Senior Vice President and Chief Financial Officer, commented, “We expect to perform within our guidance ranges, subject to market demand. Importantly, our operational transformation remains on track, and we are maintaining our outlook for new business wins to continue at a strong rate.”

Mr. Bohnert concluded, “The refinancing of our ABL and Term Loan is still in process and remains a top priority. We continue to refine based on the needs of our long-term growth capital requirements and cost reduction plans.”

Conference Call

NN will discuss its results during its quarterly investor conference call on October 31, 2024, at 9 a.m. ET. The call and supplemental presentation may be accessed via NN’s website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until October 31, 2025.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia. For more information about the company and its products, please visit www.nninc.com.