Enovix Unusual Options Activity For October 30

High-rolling investors have positioned themselves bullish on Enovix ENVX, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ENVX often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Enovix. This is not a typical pattern.

The sentiment among these major traders is split, with 75% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $105,105, and 7 calls, totaling $343,470.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $13.0 for Enovix over the last 3 months.

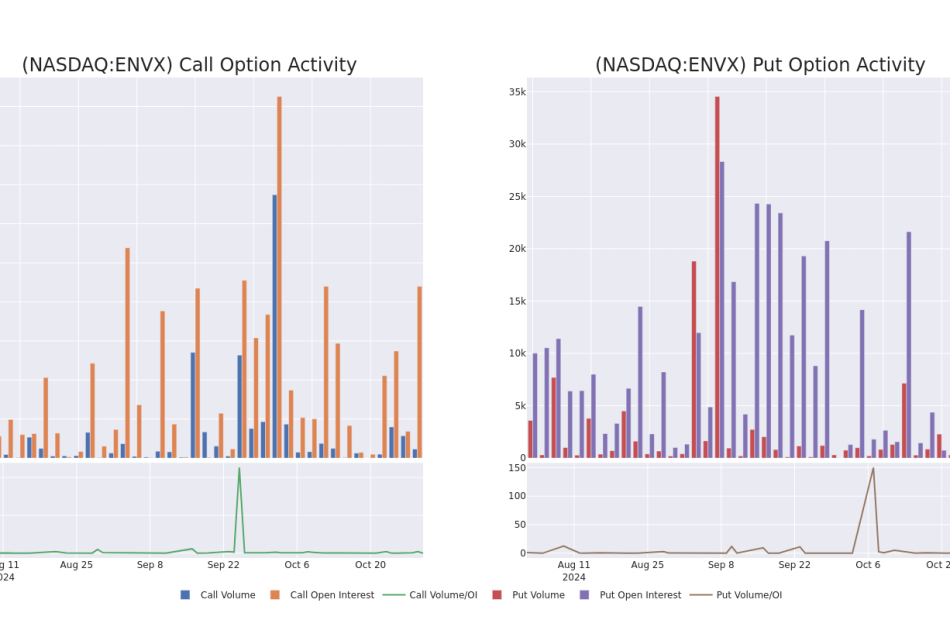

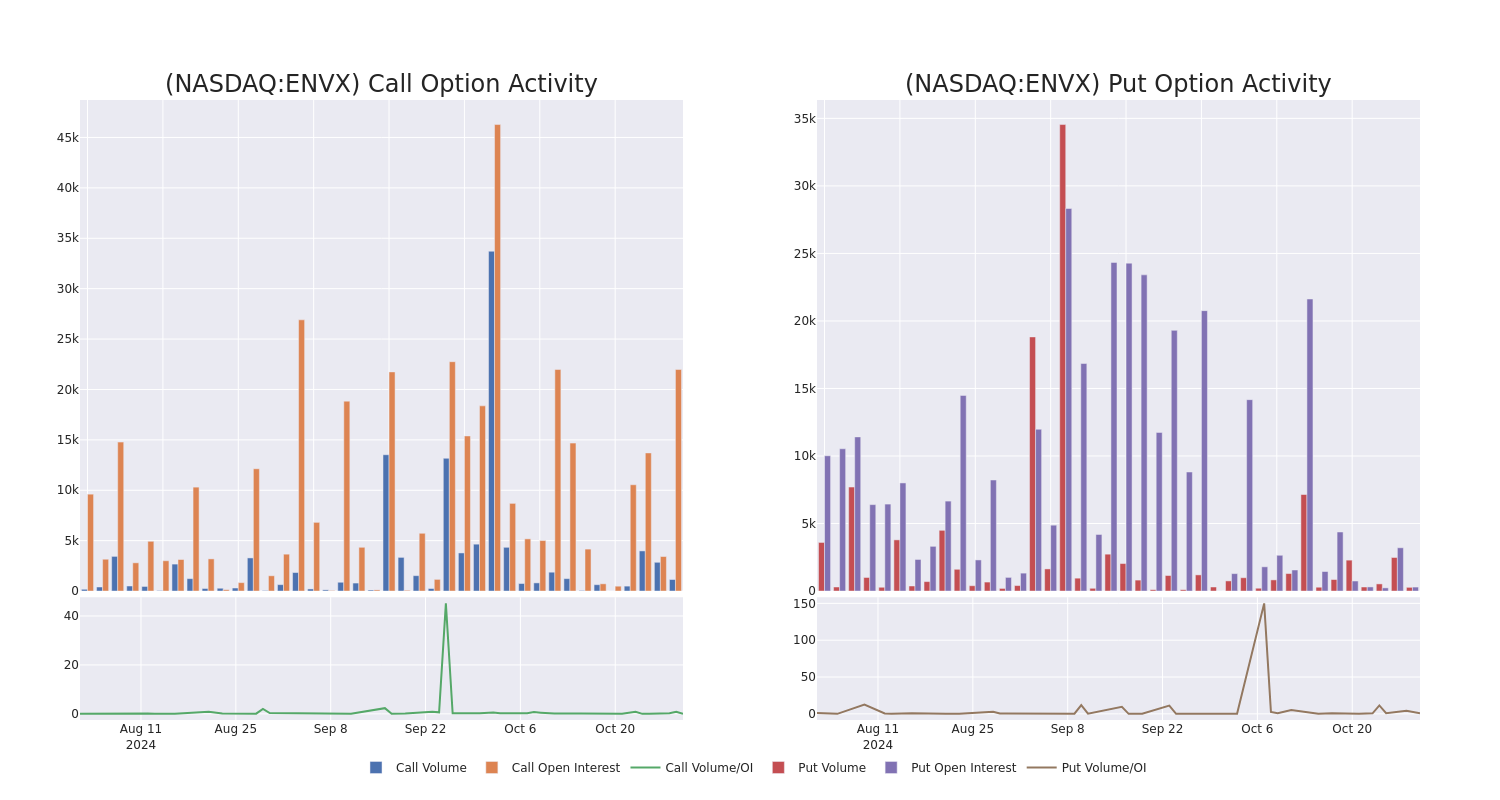

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Enovix options trades today is 2783.88 with a total volume of 1,419.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Enovix’s big money trades within a strike price range of $5.0 to $13.0 over the last 30 days.

Enovix 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | PUT | SWEEP | BULLISH | 04/17/25 | $3.95 | $3.85 | $3.85 | $13.00 | $105.1K | 294 | 274 |

| ENVX | CALL | SWEEP | BEARISH | 04/17/25 | $3.7 | $3.65 | $3.65 | $9.00 | $100.4K | 749 | 276 |

| ENVX | CALL | SWEEP | BEARISH | 04/17/25 | $3.5 | $3.45 | $3.45 | $10.00 | $97.3K | 1.3K | 283 |

| ENVX | CALL | TRADE | BULLISH | 11/01/24 | $2.13 | $2.13 | $2.13 | $9.00 | $31.9K | 1.1K | 150 |

| ENVX | CALL | TRADE | BULLISH | 01/17/25 | $6.15 | $5.25 | $5.88 | $5.00 | $29.4K | 3.7K | 50 |

About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

In light of the recent options history for Enovix, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Enovix

- With a volume of 13,865,343, the price of ENVX is down -6.68% at $9.92.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 111 days.

Professional Analyst Ratings for Enovix

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $23.333333333333332.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Enovix, targeting a price of $15.

* An analyst from Benchmark downgraded its action to Buy with a price target of $25.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $30.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enovix, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On General Motors

Financial giants have made a conspicuous bullish move on General Motors. Our analysis of options history for General Motors GM revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $103,759, and 6 were calls, valued at $442,030.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $52.5 for General Motors over the last 3 months.

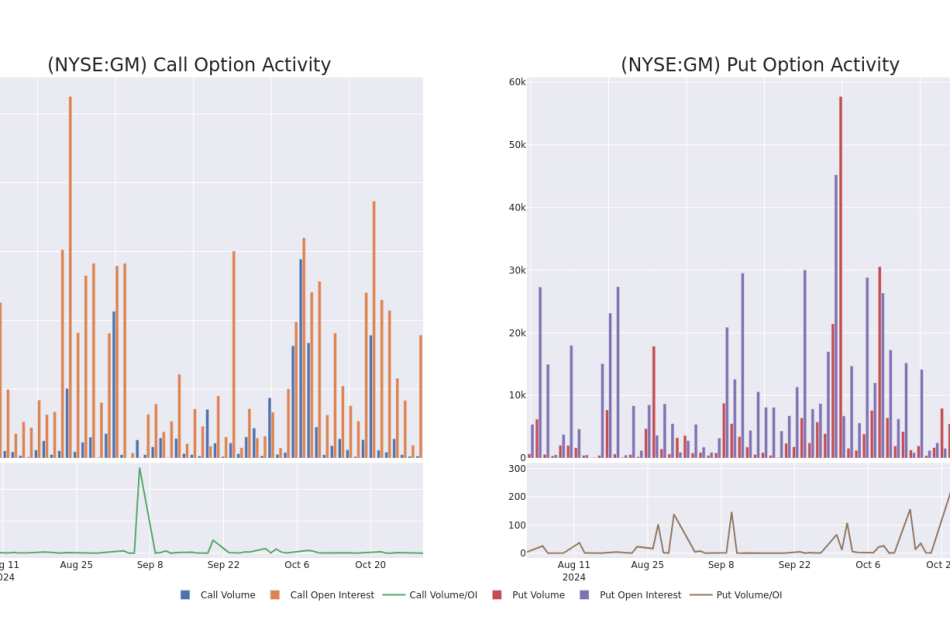

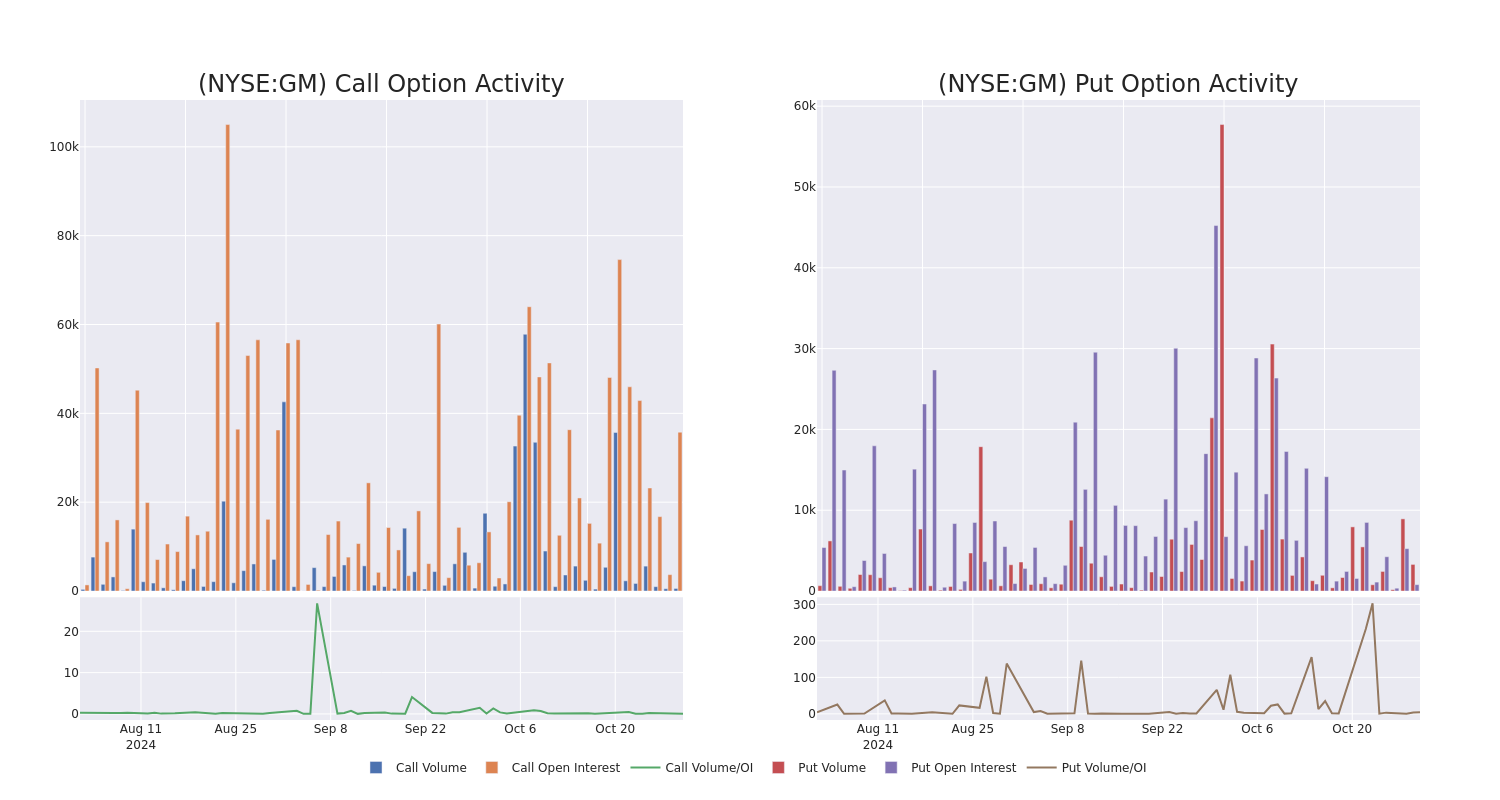

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for General Motors’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of General Motors’s whale activity within a strike price range from $40.0 to $52.5 in the last 30 days.

General Motors Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | BULLISH | 01/17/25 | $12.3 | $12.05 | $12.3 | $40.00 | $123.0K | 10.4K | 100 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $99.1K | 8.1K | 98 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $69.6K | 8.1K | 164 |

| GM | PUT | SWEEP | BEARISH | 11/08/24 | $0.56 | $0.56 | $0.56 | $51.00 | $66.4K | 792 | 1.3K |

| GM | CALL | SWEEP | BULLISH | 06/20/25 | $5.7 | $5.6 | $5.7 | $52.50 | $63.2K | 2.9K | 112 |

About General Motors

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023’s share was 16.5%. GM’s Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company’s captive finance arm in October 2010 via the purchase of AmeriCredit.

General Motors’s Current Market Status

- With a volume of 8,151,027, the price of GM is up 0.83% at $51.97.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 90 days.

Professional Analyst Ratings for General Motors

In the last month, 5 experts released ratings on this stock with an average target price of $58.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $54.

* Maintaining their stance, an analyst from Bernstein continues to hold a Market Perform rating for General Motors, targeting a price of $55.

* An analyst from UBS has decided to maintain their Buy rating on General Motors, which currently sits at a price target of $62.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for General Motors, targeting a price of $65.

* Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $55.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for General Motors, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NN, Inc. Reports Third Quarter 2024 Results

CHARLOTTE, N.C., Oct. 30, 2024 (GLOBE NEWSWIRE) — NN, Inc. NNBR, a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported its financial results for the third quarter ended September 30, 2024.

Highlights

- New business wins in the quarter were $15 million, bringing year-to-date and trailing-21-month totals to $49 million and $113 million, respectively; on pace with full-year guidance;

- Continuing to lower the cost structure of our North American Mobile Solutions footprint to achieve a minimum 10% adjusted EBITDA margin rate through footprint optimization and overhead cost reduction;

- China sales growth continues on track with top global tier-1 customers; up 19% versus prior year period;

- Implemented operational and cost reduction plans in Q3’24, including a ~$2 million annualized cost-out program, with additional cost-out initiatives in Q4’24 and first half of 2025;

- Leverage ratio declined to 2.97x, as cash proceeds from the sale of Lubbock plant were deployed towards debt reduction;

- Strategic refinancing process continues, evaluating future growth capital needs driven by successful new business wins program;

- End markets are opportunity-rich with current focus on increasing new business wins in Stamping and Medical markets.

“We achieved a faster pace in our enterprise transformation across cost-out and growth programs within our current capital structure,” said Harold Bevis, President and Chief Executive Officer of NN, Inc. “Our continued focus and execution across the pillars of our transformation initiatives delivered another quarter of results broadly across our business, evidenced by advances in operational efficiency, structural cost reductions, and commercial growth through our new business win program.”

“During the quarter, we remained focused on improving our profitability and launched a new round of successful cost reduction measures, which we believe will carry a meaningful impact to growing and sustaining the earnings power of our business, particularly as we begin to capture the embedded future top-line growth from the initial success of our new business program. Additionally, as was previously announced, we completed the sale of our non-core plastics products plant, which allows us to focus on our core competencies and further corrects our balance sheet.”

Mr. Bevis concluded, “NN is working to enhance its business model and adjust the revenue and margin mix, primarily in Mobile. We are underway installing new equipment to support global new wins for high-end next generation products, including steering and braking components. Additionally, as part of our focus on strategically realigning volumes in our group of underperforming plants, we announced the closure of our Dowagiac plant, reflecting our continued capacity shift towards lower cost geographies, particularly in China. We expect these optimization actions to support our adjusted EBITDA run rate and margin performance moving forward. As we look to the fourth quarter and fiscal 2025, we will judiciously invest our cash flows into electrical, medical, and other high return projects, and are excited about the opportunity set in front of us. We are encouraged with the pace and results of our transformation.”

Third Quarter GAAP Results

Net sales were $113.6 million, a decrease of 8.7% compared to the third quarter of 2023 net sales of $124.4 million, which was primarily due to the sale of our Lubbock operations, rationalized volume at plants undergoing turnarounds, a customer settlement received in 2023, and unfavorable foreign exchange effects of $1.1 million. Excluding these items, net sales decreased 0.5%.

Loss from operations was $3.8 million compared to a loss from operations of $2.7 million in the third quarter of 2023. The increased loss from operations was primarily due to lower sales volume.

Income from operations for Power Solutions was $2.5 million compared to income from operations of $3.9 million for the same period in 2023. Loss from operations for Mobile Solutions was $1.4 million compared to loss from operations of $1.3 million for the same period in 2023.

Net loss was $2.6 million compared to net loss of $5.1 million for the same period in 2023.

Third Quarter Adjusted Results

Adjusted income from operations for the third quarter of 2024 was $1.3 million compared to adjusted income from operations of $3.7 million for the same period in 2023. Adjusted EBITDA was $11.6 million, or 10.2% of sales, compared to $14.5 million, or 11.6% of sales, for the same period in 2023. The prior year adjusted EBITDA benefited by $2.5 million from a customer settlement, a favorable precious metals adjustment, and results of now divested Lubbock operations, partially offset by rationalized business of $0.9 million. Excluding these items, adjusted EBITDA declined $1.3 million.

Adjusted net loss was $2.5 million, or $0.05 per diluted share, compared to adjusted net income of $0.1 million, or $0.01 per diluted share, for the same period in 2023. Free cash flow was a generation of cash of $0.3 million compared to a generation of cash of $11.3 million for the same period in 2023.

Power Solutions

Net sales for the third quarter of 2024 were $42.9 million compared to $45.5 million in the same period in 2023. Prior year sales were $39.9 million, excluding the recently sold Lubbock operations, an increase of $3 million. The increase in sales when removing the impact from Lubbock was primarily due to higher precious metals pass-through pricing and pricing.

Adjusted income from operations was $5.2 million compared to adjusted income from operations of $7.1 million in the third quarter of 2023. The decrease in adjusted income from operations was primarily due to the lower revenue resulting from the sale of the Lubbock operations and unfavorable product mix.

Mobile Solutions

Net sales for the third quarter of 2024 were $70.7 million compared to $79.0 million in the third quarter of 2023, a decrease of 10.5%. The decrease in sales was primarily due to rationalized volume at plants undergoing turnarounds, contractual reduction in customer pass-through material pricing, a customer settlement received in 2023, and unfavorable foreign exchange effects of $1.0 million.

Adjusted income from operations was $0.9 million compared to adjusted income from operations of $1.6 million in the third quarter of 2023. The decrease in adjusted income from operations was primarily due to lower revenue, partially offset by lower depreciation expense.

2024 Outlook

- Revenue in the range of $465 million to $485 million;

- Adjusted EBITDA in the range of $47 million to $51 million;

- Free cash flow in the range of $8 million to $12 million; and

- New business wins in the range of $55 million to $70 million.

Chris Bohnert, Senior Vice President and Chief Financial Officer, commented, “We expect to perform within our guidance ranges, subject to market demand. Importantly, our operational transformation remains on track, and we are maintaining our outlook for new business wins to continue at a strong rate.”

Mr. Bohnert concluded, “The refinancing of our ABL and Term Loan is still in process and remains a top priority. We continue to refine based on the needs of our long-term growth capital requirements and cost reduction plans.”

Conference Call

NN will discuss its results during its quarterly investor conference call on October 31, 2024, at 9 a.m. ET. The call and supplemental presentation may be accessed via NN’s website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until October 31, 2025.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia. For more information about the company and its products, please visit www.nninc.com.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Investor & Media Contacts:

Joe Caminiti or Stephen Poe

NNBR@alpha-ir.com

312-445-2870

| Financial Tables Follow | |||||||||||||||

| NN, Inc. Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) (Unaudited) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in thousands, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net sales | $ | 113,587 | $ | 124,443 | $ | 357,777 | $ | 376,737 | |||||||

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 97,131 | 104,543 | 299,474 | 320,648 | |||||||||||

| Selling, general, and administrative expense | 10,257 | 11,693 | 37,116 | 35,833 | |||||||||||

| Depreciation and amortization | 10,844 | 11,577 | 35,152 | 34,643 | |||||||||||

| Other operating income, net | (895 | ) | (631 | ) | (3,285 | ) | (526 | ) | |||||||

| Loss from operations | (3,750 | ) | (2,739 | ) | (10,680 | ) | (13,861 | ) | |||||||

| Interest expense | 5,404 | 5,739 | 16,643 | 15,484 | |||||||||||

| Other expense (income), net | (5,315 | ) | (1,463 | ) | (4,623 | ) | 1,970 | ||||||||

| Loss before benefit (provision) for income taxes and share of net income from joint venture | (3,839 | ) | (7,015 | ) | (22,700 | ) | (31,315 | ) | |||||||

| Benefit (provision) for income taxes | (903 | ) | 245 | (1,194 | ) | (1,381 | ) | ||||||||

| Share of net income from joint venture | 2,185 | 1,713 | 6,597 | 3,087 | |||||||||||

| Net loss | $ | (2,557 | ) | $ | (5,057 | ) | $ | (17,297 | ) | $ | (29,609 | ) | |||

| Other comprehensive income (loss): | |||||||||||||||

| Foreign currency transaction gain (loss) | 3,970 | (3,072 | ) | (1,763 | ) | (3,606 | ) | ||||||||

| Interest rate swap: | |||||||||||||||

| Change in fair value, net of tax | — | — | — | (230 | ) | ||||||||||

| Reclassification adjustments included in net loss, net of tax | (109 | ) | (449 | ) | (1,007 | ) | (1,366 | ) | |||||||

| Other comprehensive income (loss) | $ | 3,861 | $ | (3,521 | ) | $ | (2,770 | ) | $ | (5,202 | ) | ||||

| Comprehensive income (loss) | $ | 1,304 | $ | (8,578 | ) | $ | (20,067 | ) | $ | (34,811 | ) | ||||

| Basic and diluted net loss per common share: | |||||||||||||||

| Basic and diluted net loss per share | $ | (0.13 | ) | $ | (0.18 | ) | $ | (0.59 | ) | $ | (0.84 | ) | |||

| Shares used to calculate basic and diluted net loss per share | 48,997 | 47,539 | 48,522 | 46,410 | |||||||||||

| NN, Inc. Condensed Consolidated Balance Sheets (Unaudited) |

|||||||

| (in thousands, except per share data) | September 30, 2024 |

December 31, 2023 |

|||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 12,449 | $ | 21,903 | |||

| Accounts receivable, net | 64,447 | 65,545 | |||||

| Inventories | 69,600 | 71,563 | |||||

| Income tax receivable | 12,956 | 11,885 | |||||

| Prepaid assets | 4,095 | 2,464 | |||||

| Other current assets | 10,357 | 9,194 | |||||

| Total current assets | 173,904 | 182,554 | |||||

| Property, plant and equipment, net | 172,947 | 185,812 | |||||

| Operating lease right-of-use assets | 40,821 | 43,357 | |||||

| Intangible assets, net | 47,816 | 58,724 | |||||

| Investment in joint venture | 39,843 | 32,701 | |||||

| Deferred tax assets | 1,177 | 734 | |||||

| Other non-current assets | 6,590 | 7,003 | |||||

| Total assets | $ | 483,098 | $ | 510,885 | |||

| Liabilities, Preferred Stock, and Stockholders’ Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 44,983 | $ | 45,480 | |||

| Accrued salaries, wages and benefits | 15,027 | 15,464 | |||||

| Income tax payable | 546 | 524 | |||||

| Short-term debt and current maturities of long-term debt | 8,085 | 3,910 | |||||

| Current portion of operating lease liabilities | 5,805 | 5,735 | |||||

| Other current liabilities | 14,126 | 10,506 | |||||

| Total current liabilities | 88,572 | 81,619 | |||||

| Deferred tax liabilities | 4,960 | 4,988 | |||||

| Long-term debt, net of current maturities | 135,548 | 149,369 | |||||

| Operating lease liabilities, net of current portion | 44,001 | 47,281 | |||||

| Other non-current liabilities | 14,154 | 24,827 | |||||

| Total liabilities | 287,235 | 308,084 | |||||

| Commitments and contingencies | |||||||

| Series D perpetual preferred stock | 89,289 | 77,799 | |||||

| Stockholders’ equity: | |||||||

| Common stock | 499 | 473 | |||||

| Additional paid-in capital | 459,245 | 457,632 | |||||

| Accumulated deficit | (312,645 | ) | (295,348 | ) | |||

| Accumulated other comprehensive loss | (40,525 | ) | (37,755 | ) | |||

| Total stockholders’ equity | 106,574 | 125,002 | |||||

| Total liabilities, preferred stock, and stockholders’ equity | $ | 483,098 | $ | 510,885 | |||

| NN, Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) |

|||||||

| Nine Months Ended September 30, |

|||||||

| (in thousands) | 2024 | 2023 | |||||

| Cash flows from operating activities | |||||||

| Net loss | $ | (17,297 | ) | $ | (29,609 | ) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

| Depreciation and amortization | 35,152 | 34,643 | |||||

| Amortization of debt issuance costs and discount | 1,718 | 1,409 | |||||

| Paid-in-kind interest | 2,064 | 1,491 | |||||

| Total derivative loss, net of cash settlements | 582 | 3,139 | |||||

| Share of net income from joint venture, net of cash dividends received | (6,597 | ) | 851 | ||||

| Gain on sale of business | (7,154 | ) | — | ||||

| Share-based compensation expense | 2,347 | 2,058 | |||||

| Deferred income taxes | (477 | ) | (1,531 | ) | |||

| Other | (658 | ) | (776 | ) | |||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable | (3,957 | ) | 335 | ||||

| Inventories | (1,916 | ) | 9,692 | ||||

| Other operating assets | (2,873 | ) | (8,223 | ) | |||

| Income taxes receivable and payable, net | (1,078 | ) | (576 | ) | |||

| Accounts payable | 1,794 | 5,240 | |||||

| Other operating liabilities | 2,739 | 5,747 | |||||

| Net cash provided by operating activities | 4,389 | 23,890 | |||||

| Cash flows from investing activities | |||||||

| Acquisition of property, plant and equipment | (15,352 | ) | (16,292 | ) | |||

| Proceeds from sale of property, plant, and equipment | 266 | 2,876 | |||||

| Proceeds received from sale of business | 17,000 | — | |||||

| Net cash provided by (used in) investing activities | 1,914 | (13,416 | ) | ||||

| Cash flows from financing activities | |||||||

| Proceeds from long-term debt | 38,000 | 52,000 | |||||

| Repayments of long-term debt | (75,320 | ) | (55,522 | ) | |||

| Cash paid for debt issuance costs | (746 | ) | (55 | ) | |||

| Proceeds from sale-leaseback of equipment | 8,324 | — | |||||

| Proceeds from sale-leaseback of land and buildings | 16,863 | — | |||||

| Repayments of financing obligations | (492 | ) | — | ||||

| Proceeds from short-term debt | — | 3,648 | |||||

| Other | (2,262 | ) | (1,276 | ) | |||

| Net cash used in financing activities | (15,633 | ) | (1,205 | ) | |||

| Effect of exchange rate changes on cash flows | (124 | ) | (287 | ) | |||

| Net change in cash and cash equivalents | (9,454 | ) | 8,982 | ||||

| Cash and cash equivalents at beginning of year | 21,903 | 12,808 | |||||

| Cash and cash equivalents at end of quarter | $ | 12,449 | $ | 21,790 | |||

Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations

| (in thousands) | Three Months Ended September 30, |

||||||

| NN, Inc. Consolidated | 2024 | 2023 | |||||

| GAAP loss from operations | $ | (3,750 | ) | $ | (2,739 | ) | |

| Professional fees | 22 | 32 | |||||

| Personnel costs (1) | 734 | 903 | |||||

| Facility costs (2) | 874 | 1,893 | |||||

| Amortization of intangibles | 3,405 | 3,563 | |||||

| Non-GAAP adjusted income from operations (a) | $ | 1,285 | $ | 3,652 | |||

| Non-GAAP adjusted operating margin (3) | 1.1 | % | 2.9 | % | |||

| GAAP net sales | $ | 113,587 | $ | 124,443 | |||

| (in thousands) | Three Months Ended September 30, |

||||||

| Power Solutions | 2024 | 2023 | |||||

| GAAP income from operations | $ | 2,505 | $ | 3,936 | |||

| Personnel costs (1) | 113 | 122 | |||||

| Facility costs (2) | 16 | 324 | |||||

| Amortization of intangibles | 2,567 | 2,725 | |||||

| Non-GAAP adjusted income from operations (a) | $ | 5,201 | $ | 7,107 | |||

| Non-GAAP adjusted operating margin (3) | 12.1 | % | 15.6 | % | |||

| GAAP net sales | $ | 42,935 | $ | 45,484 | |||

| (in thousands) | Three Months Ended September 30, |

||||||

| Mobile Solutions | 2024 | 2023 | |||||

| GAAP loss from operations | $ | (1,441 | ) | $ | (1,283 | ) | |

| Personnel costs (1) | 598 | 462 | |||||

| Facility costs (2) | 858 | 1,569 | |||||

| Amortization of intangibles | 838 | 838 | |||||

| Non-GAAP adjusted income from operations (a) | $ | 853 | $ | 1,586 | |||

| Share of net income from joint venture | 2,185 | 1,713 | |||||

| Non-GAAP adjusted income from operations with JV (a) | $ | 3,038 | $ | 3,299 | |||

| Non-GAAP adjusted operating margin (3) | 4.3 | % | 4.2 | % | |||

| GAAP net sales | $ | 70,678 | $ | 78,961 | |||

| (in thousands) | Three Months Ended September 30, |

||||||

| Elimination | 2023 | 2022 | |||||

| GAAP net sales | $ | (26 | ) | $ | (2 | ) | |

(1) Personnel costs include recruitment, retention, relocation, and severance costs

(2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3) Non-GAAP adjusted operating margin = Non-GAAP adjusted income (loss) from operations / GAAP net sales

| Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA | |||||||

| Three Months Ended September 30, |

|||||||

| (in thousands) | 2024 | 2023 | |||||

| GAAP net loss | $ | (2,557 | ) | $ | (5,057 | ) | |

| Benefit (provision) for income taxes | 903 | (245 | ) | ||||

| Interest expense | 5,404 | 5,739 | |||||

| Change in fair value of preferred stock derivatives and warrants | 1,858 | (2,104 | ) | ||||

| Gain on sale of business | (7,154 | ) | — | ||||

| Depreciation and amortization | 10,844 | 11,577 | |||||

| Professional fees | 22 | 32 | |||||

| Personnel costs (1) | 734 | 903 | |||||

| Facility costs (2) | 874 | 1,893 | |||||

| Non-cash stock compensation | 812 | 1,208 | |||||

| Non-cash foreign exchange (gain) loss on inter-company loans | (164 | ) | 520 | ||||

| Non-GAAP adjusted EBITDA (b) | $ | 11,576 | $ | 14,466 | |||

| Non-GAAP adjusted EBITDA margin (3) | 10.2 | % | 11.6 | % | |||

| GAAP net sales | $ | 113,587 | $ | 124,443 | |||

(1) Personnel costs include recruitment, retention, relocation, and severance costs

(2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3) Non-GAAP adjusted EBITDA margin = Non-GAAP adjusted EBITDA / GAAP net sales

| Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share | |||||||

| Three Months Ended September 30, |

|||||||

| (in thousands) | 2024 | 2023 | |||||

| GAAP net loss | $ | (2,557 | ) | $ | (5,057 | ) | |

| Pre-tax professional fees | 22 | 32 | |||||

| Pre-tax personnel costs | 734 | 903 | |||||

| Pre-tax facility costs | 874 | 1,893 | |||||

| Pre-tax foreign exchange (gain) loss on inter-company loans | (164 | ) | 520 | ||||

| Pre-tax change in fair value of preferred stock derivatives and warrants | 1,858 | (2,104 | ) | ||||

| Pre-tax change in gain on sale of business | (7,154 | ) | — | ||||

| Pre-tax amortization of intangibles and deferred financing costs | 4,018 | 4,092 | |||||

| Tax effect of adjustments reflected above (c) | (113 | ) | (162 | ) | |||

| Non-GAAP adjusted net income (loss) (d) | $ | (2,482 | ) | $ | 117 | ||

| Three Months Ended September 30, |

|||||||

| (per diluted common share) | 2024 | 2023 | |||||

| GAAP net loss per diluted common share | $ | (0.13 | ) | $ | (0.18 | ) | |

| Pre-tax personnel costs | 0.01 | 0.02 | |||||

| Pre-tax facility costs | 0.02 | 0.04 | |||||

| Pre-tax foreign exchange (gain) loss on inter-company loans | — | 0.01 | |||||

| Pre-tax change in fair value of preferred stock derivatives and warrants | 0.04 | (0.04 | ) | ||||

| Pre-tax change in gain on sale of business | (0.15 | ) | — | ||||

| Pre-tax amortization of intangibles and deferred financing costs | 0.08 | 0.09 | |||||

| Preferred stock cumulative dividends and deemed dividends | 0.08 | 0.07 | |||||

| Non-GAAP adjusted net income (loss) per diluted common share (d) | $ | (0.05 | ) | $ | 0.01 | ||

| Shares used to calculate net earnings (loss) per share | 48,997 | 47,539 | |||||

| Reconciliation of Operating Cash Flow to Free Cash Flow | |||||||

| Three Months Ended September 30, |

|||||||

| (in thousands) | 2024 | 2023 | |||||

| Net cash provided by operating activities | $ | 4,958 | $ | 15,247 | |||

| Acquisition of property, plant, and equipment | (6,300 | ) | (4,096 | ) | |||

| Proceeds from sale of property, plant, and equipment | 29 | 99 | |||||

| Transaction costs incurred from sale of business | 1,566 | — | |||||

| Free cash flow | $ | 253 | $ | 11,250 | |||

The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods.

The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company’s industry, as other companies may calculate such financial results differently. The Company’s non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results.

(a) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations.

(b) Non-GAAP adjusted EBITDA represents GAAP net income (loss), adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value that was recognized in earnings, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations.

(c) This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the respective table. NN, Inc. estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment.

(d) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Lemonade

Whales with a lot of money to spend have taken a noticeably bullish stance on Lemonade.

Looking at options history for Lemonade LMND we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $215,432 and 3, calls, for a total amount of $105,105.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $18.0 to $25.0 for Lemonade during the past quarter.

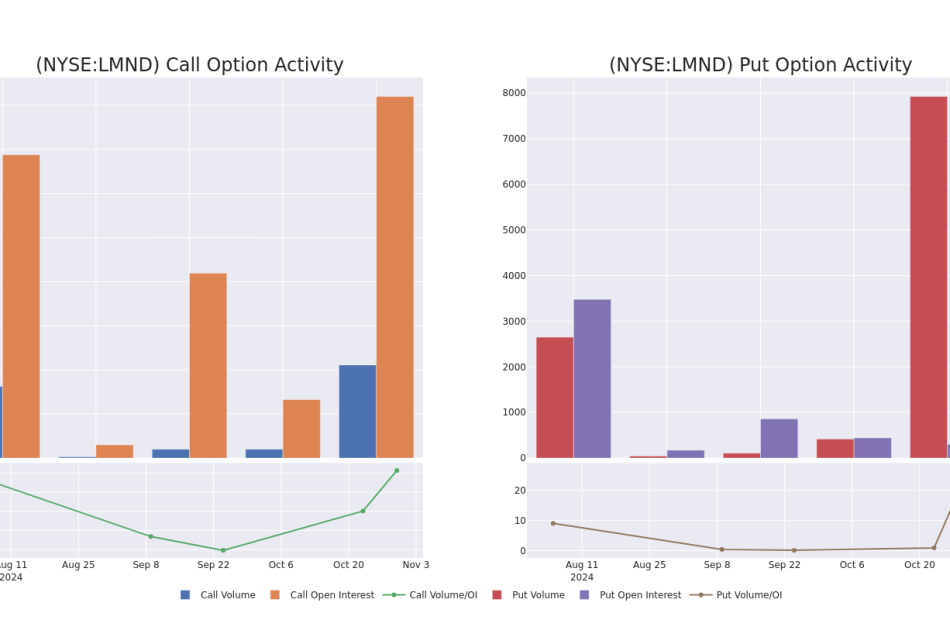

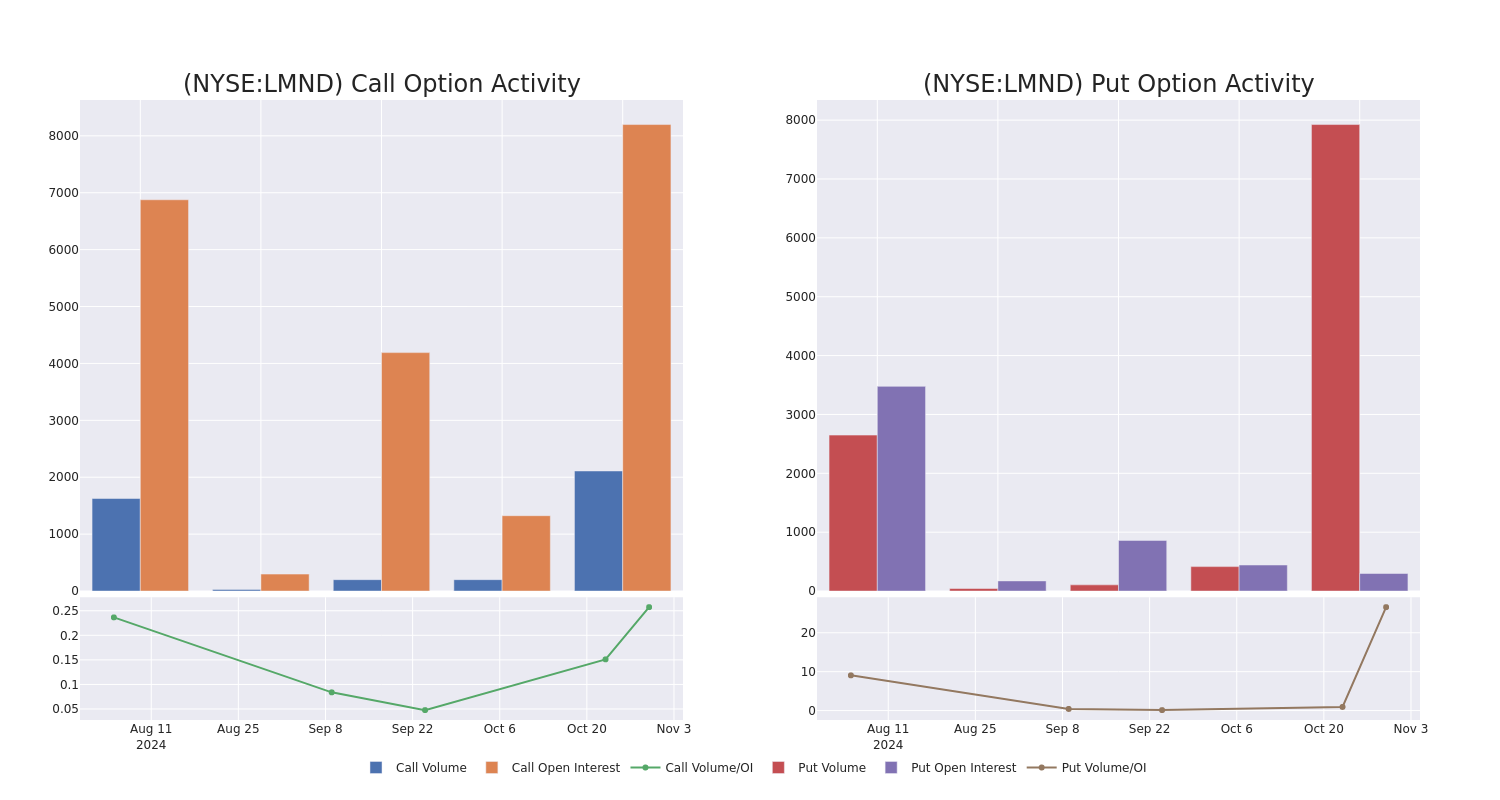

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Lemonade options trades today is 2832.0 with a total volume of 10,035.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lemonade’s big money trades within a strike price range of $18.0 to $25.0 over the last 30 days.

Lemonade 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.9 | $0.9 | $0.9 | $18.00 | $85.1K | 298 | 93 |

| LMND | CALL | SWEEP | BULLISH | 01/17/25 | $0.75 | $0.7 | $0.75 | $25.00 | $43.7K | 2.3K | 704 |

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.8 | $0.75 | $0.8 | $18.00 | $40.6K | 298 | 2.1K |

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.85 | $0.75 | $0.75 | $18.00 | $35.5K | 298 | 2.6K |

| LMND | CALL | TRADE | BULLISH | 01/17/25 | $0.8 | $0.65 | $0.75 | $25.00 | $31.2K | 2.3K | 1.1K |

About Lemonade

Lemonade Inc operates in the insurance industry. The company offers digital and artificial intelligence based platform for various insurances and for settling claims and paying premiums. The platform ensures transparency in issuing policies and settling disputes. The company is using technology, data, artificial intelligence, contemporary design, and social impact to deliver delightful and affordable insurances. Geographically, it operates in California, Texas, New York, New Jersey, Illinois, Georgia, Washington, Colorado, Pennsylvania, Oregon and others.

In light of the recent options history for Lemonade, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Lemonade

- Trading volume stands at 2,060,774, with LMND’s price up by 5.37%, positioned at $19.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

What Analysts Are Saying About Lemonade

2 market experts have recently issued ratings for this stock, with a consensus target price of $27.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $40.

* Consistent in their evaluation, an analyst from Jefferies keeps a Underperform rating on Lemonade with a target price of $14.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lemonade with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Teladoc Health Q3 Earnings: Revenue Beat, EPS Beat, Shares Jump 10%

Teladoc Health Inc TDOC shares are moving higher in extended trading Wednesday after the company reported financial results for the third quarter that topped analyst expectations.

- Q3 Revenue: $640.51 million, versus estimates of $631.16 million

- Q3 EPS: Loss of 19 cents, versus estimates for a loss of 27 cents

Total revenue was down 3% on a year-over-year basis. Integrated Care segment revenue was up 2% year-over-year, while BetterHelp segment revenue declined 10% year-over-year. U.S. revenue fell 6% year-over-year, while International revenue grew 15%.

Cash flow from operations totaled $110.2 million in the third quarter. The company said it generated $79 million in free cash flow during the quarter.

“As we close out 2024, we are moving with urgency and making changes to more effectively leverage our leadership position in the complex and dynamic markets we serve. There is more work ahead of us, and 2025 will be an important repositioning year. Our focus remains on delivering consistent performance and driving long-term shareholder value,” said Chuck Divita, CEO of Teladoc Health.

Guidance: Teladoc expects fourth-quarter Integrated Care segment revenue to be flat to up 2.5% in the fourth quarter. The company expects full-year Integrated Care segment revenue to grow in the low single digits to mid-single digits.

TDOC Price Action: Teladoc shares were up 9.26 % in after-hours, trading at $9.68 at the time of publication Wednesday, according to Benzinga Pro.

Read Next:

• Meta Platforms Q3 Earnings: Revenue Beat, EPS Beat, Daily Actives Up 5%, ‘Strong Momentum’ In AI

Photo: Courtesy of Teladoc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Move: ROBERT SANCHEZ Exercises Options, Realizing $1.55M At Texas Instruments

A large exercise of company stock options by ROBERT SANCHEZ, Board Member at Texas Instruments TXN was disclosed in a new SEC filing on October 29, as part of an insider exercise.

What Happened: The latest Form 4 filing on Tuesday with the U.S. Securities and Exchange Commission uncovered SANCHEZ, Board Member at Texas Instruments, exercising stock options for 9,990 shares of TXN. The total transaction was valued at $1,549,648.

As of Wednesday morning, Texas Instruments shares are down by 0.77%, with a current price of $209.72. This implies that SANCHEZ’s 9,990 shares have a value of $1,549,648.

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Texas Instruments’s Economic Impact: An Analysis

Revenue Growth: Over the 3 months period, Texas Instruments showcased positive performance, achieving a revenue growth rate of 8.61% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Navigating Financial Profits:

-

Gross Margin: The company maintains a high gross margin of 59.6%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Texas Instruments’s EPS is below the industry average. The company faced challenges with a current EPS of 1.491785. This suggests a potential decline in earnings.

Debt Management: Texas Instruments’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.8, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 39.28 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 12.35, Texas Instruments’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Texas Instruments’s EV/EBITDA ratio at 26.13 suggests potential undervaluation, falling below industry averages.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Texas Instruments’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Determining Who's 'Too High To Drive' Poses Challenge For Police Nationwide

In the wake of rising drug-related traffic fatalities, police departments across the U.S. find themselves grappling with outdated methods to determine cannabis impairment in drivers. As MLive reported, with cannabis legalization continuing to grow nationwide, law enforcement is left without a reliable tool akin to a breathalyzer for marijuana detection, leading to inconsistent enforcement and legal challenges.

Challenge Of Detecting Cannabis Impairment

In 2021, over half of drivers involved in fatal crashes tested positive for drugs, according to the National Highway Traffic Safety Administration. As states adopt different standards for cannabis impairment, six have introduced “per se” THC limits, similar to blood alcohol levels, despite research suggesting no correlation between THC levels in the bloodstream and impairment. Professor William McNichol of Rutgers Law School points out the limitations of this approach, comparing it to alcohol enforcement in its simplicity but noting that it “just doesn’t stand up” scientifically.

Research on THC levels has found that the substance disperses from the bloodstream rapidly after inhalation, complicating efforts to establish a universal standard. Studies also show that frequent cannabis users can maintain detectable THC levels long after impairment has passed, casting doubt on the reliability of blood tests alone.

Traditional Tactics: Drug Recognition Experts And Roadside Tests

In the absence of a scientifically validated test, law enforcement has leaned heavily on Drug Recognition Experts (DREs), officers trained to observe signs of impairment through a 12-step evaluation process, including eye movement, balance, and pulse rate. Although DREs are traditionally allowed to testify as experts in court, a growing number of states have begun stripping them of this status due to challenges over scientific validity.

“There’s a bit of a trial-and-error process,” explains DUI attorney Michael Boyle, underscoring the inconsistencies in these traditional methods. Boyle emphasizes that the limitations of available testing only add to the legal and logistical hurdles police face.

Push For Modern Solutions

In recent years, several states have attempted to modernize with new tools like the SoToxa roadside saliva test, which detects drugs including THC, cocaine and opioids within minutes. However, the tests have shown inaccuracies, with Michigan’s pilot program in 2019 revealing that nearly 24% of positive results were later contradicted by blood tests. Similarly, the OcuPro, a VR-based headset designed to measure pupil movement, has entered trials but is not yet admissible in court.

Some researchers are exploring brain-scan technology to detect impairment. Boston researchers recently demonstrated that portable brain scans could detect THC impairment with greater reliability than DREs, although the technology is still in its infancy.

Costly, Uncertain Path Forward

Despite limitations, many states, including Alabama, continue to invest in the DRE program, planning to expand it over the next few years. In Alabama’s case, a $1.15 million investment aims to “better detect” cannabis impairment, even as the efficacy of the approach remains under scrutiny.

The lack of a reliable, science-backed tool for determining cannabis impairment is a growing concern, particularly as drugged-driving fatalities increase in states where cannabis use is legal. As the demand for a solution grows, so does the debate over whether current efforts are the best use of resources or if alternative methods should be explored. For now, law enforcement is stuck with outdated methods that offer imperfect results, leaving drivers and police alike facing an uncertain road ahead.

Cover image made with AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

420 Property Unveils Version 5.0: Integrating BizTrader Connect API and Launching New Features

SACRAMENTO, Calif., Oct. 30, 2024 /PRNewswire/ — 420 Property proudly announces the launch of its comprehensive Version 5.0 update, significantly enhancing its online marketplace for cannabis and hemp real estate and businesses. This major update includes the successful integration of the BizTrader Connect API, new features like the Sold and Pending sections for comps, advanced search capabilities, updated pricing and packages for increased listing exposure, and streamlined payment management solutions.

The integration of the BizTrader Connect API is a cornerstone of the Version 5.0 release, enabling users to seamlessly add and manage their listings on BizTrader directly from the 420 Property platform. This strategic technology collaboration facilitates a more efficient listing process and broadens user reach, enhancing overall user experience and engagement.

Key Enhancements in 420 Property Version 5.0:

- BizTrader Connect API Integration: Users can now manage listings on both 420 Property and BizTrader with a single entry, enjoying real-time updates and expanded reach across both platforms.

- New Sections for Comparables: The introduction of Sold and Pending sections allows users to access valuable comps, aiding in more accurate pricing and market analysis.

- Enhanced Search Features: Advanced search functionalities have been improved to offer more precise filtering and faster results.

- Revised Pricing and Packages: New tailored packages are designed to maximize listing exposure and meet diverse marketing needs.

- Simplified Payment Solutions: Integration of new payment gateways and simplified payment management options enhance user convenience.

- Focus on Core Offerings: The removal of the equipment category allows 420 Property to concentrate on its primary market segments, ensuring better service and expertise.

“We are thrilled to introduce Version 5.0 of 420 Property, which reflects our commitment to innovation and user-centric design,” said Ryan George, CEO of 420 Property. “The integration with BizTrader Connect API and the introduction of new features are poised to transform how our users engage with our platform and enhance their experience significantly.”

This release is expected to attract more users to both 420 Property and BizTrader by reducing the complexities of managing listings across multiple platforms. It positions 420 Property as a technologically advanced player in the real estate market, further solidifying its reputation as a leader in the industry.

For more information about the BizTrader Connect API integration and to explore the new features of Version 5.0, please visit https://www.420property.com/.

About 420 Property: 420 Property is the premier real estate marketplace dedicated to providing listings and resources for cannabis and hemp properties and businesses. With a wide range of listings that include dispensaries, cultivation facilities, and manufacturing sites, 420 Property aims to streamline the buying, selling, and leasing process for specialized properties and businesses in the cannabis and hemp industries.

About BizTrader: BizTrader is an online marketplace that connects sellers, buyers, and brokers of various businesses. With its advanced platform, BizTrader facilitates the discovery and transaction of businesses across multiple industries, providing tools and resources to enhance the buying and selling experience.

Contact: 420 Property, Ryan George, 9254789805, Support@420property.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/420-property-unveils-version-5-0-integrating-biztrader-connect-api-and-launching-new-features-302290596.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/420-property-unveils-version-5-0-integrating-biztrader-connect-api-and-launching-new-features-302290596.html

SOURCE 420 Property

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.