Eye On Growth: Gabrielle Sulzberger Adds $229K Of Eli Lilly Stock To Portfolio

On November 20, Gabrielle Sulzberger, Director at Eli Lilly LLY executed a significant insider buy, as disclosed in the latest SEC filing.

What Happened: In a significant move reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Sulzberger purchased 315 shares of Eli Lilly, demonstrating confidence in the company’s growth potential. The total value of the transaction stands at $229,916.

Eli Lilly shares are trading down 1.56% at $741.66 at the time of this writing on Thursday morning.

Discovering Eli Lilly: A Closer Look

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly’s key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Eli Lilly: Delving into Financials

Revenue Growth: Eli Lilly’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 20.43%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Insights into Profitability:

-

Gross Margin: The company sets a benchmark with a high gross margin of 81.02%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Eli Lilly’s EPS is below the industry average. The company faced challenges with a current EPS of 1.08. This suggests a potential decline in earnings.

Debt Management: With a high debt-to-equity ratio of 2.19, Eli Lilly faces challenges in effectively managing its debt levels, indicating potential financial strain.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: Eli Lilly’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 81.19.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 16.67 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 59.36, the company’s market valuation exceeds industry averages.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Cracking Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Eli Lilly’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ross Stores Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Ross Stores, Inc. ROST will release earnings results for its third quarter, after the closing bell on Thursday, Nov. 21.

Analysts expect the Dublin, California-based bank to report quarterly earnings at $1.4 per share, up from $1.33 per share in the year-ago period. Ross Stores projects to report revenue of $5.15 billion for the recent quarter, compared to $4.92 billion a year earlier, according to data from Benzinga Pro.

On Oct. 28, Ross Stores named James Conroy, a seasoned retail CEO, as Chief Executive Officer, succeeding Barbara Rentler effective Feb. 2, 2025.

Ross Stores shares rose 0.1% to close at $139.32 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- TD Cowen analyst John Kernan maintained a Buy rating and cut the price target from $185 to $177 on Nov. 19. This analyst has an accuracy rate of 71%.

- Wells Fargo analyst Ike Boruchow maintained an Overweight rating and slashed the price target from $175 to $165 on Nov. 14. This analyst has an accuracy rate of 71%.

- Citigroup analyst Paul Lejuez downgraded the stock from Buy to Neutral and cut the price target from $179 to $152 on Nov. 12. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst Alex Straton maintained an Overweight rating and increased the price target from $163 to $178 on Aug. 23. This analyst has an accuracy rate of 64%.

- UBS analyst Jay Sole maintained a Neutral rating and boosted the price target from $147 to $167 on Aug. 23. This analyst has an accuracy rate of 73%.

Considering buying ROST stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Walt Disney's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards Walt Disney DIS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DIS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 15 extraordinary options activities for Walt Disney. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 20% bearish. Among these notable options, 6 are puts, totaling $240,736, and 9 are calls, amounting to $439,043.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $125.0 for Walt Disney during the past quarter.

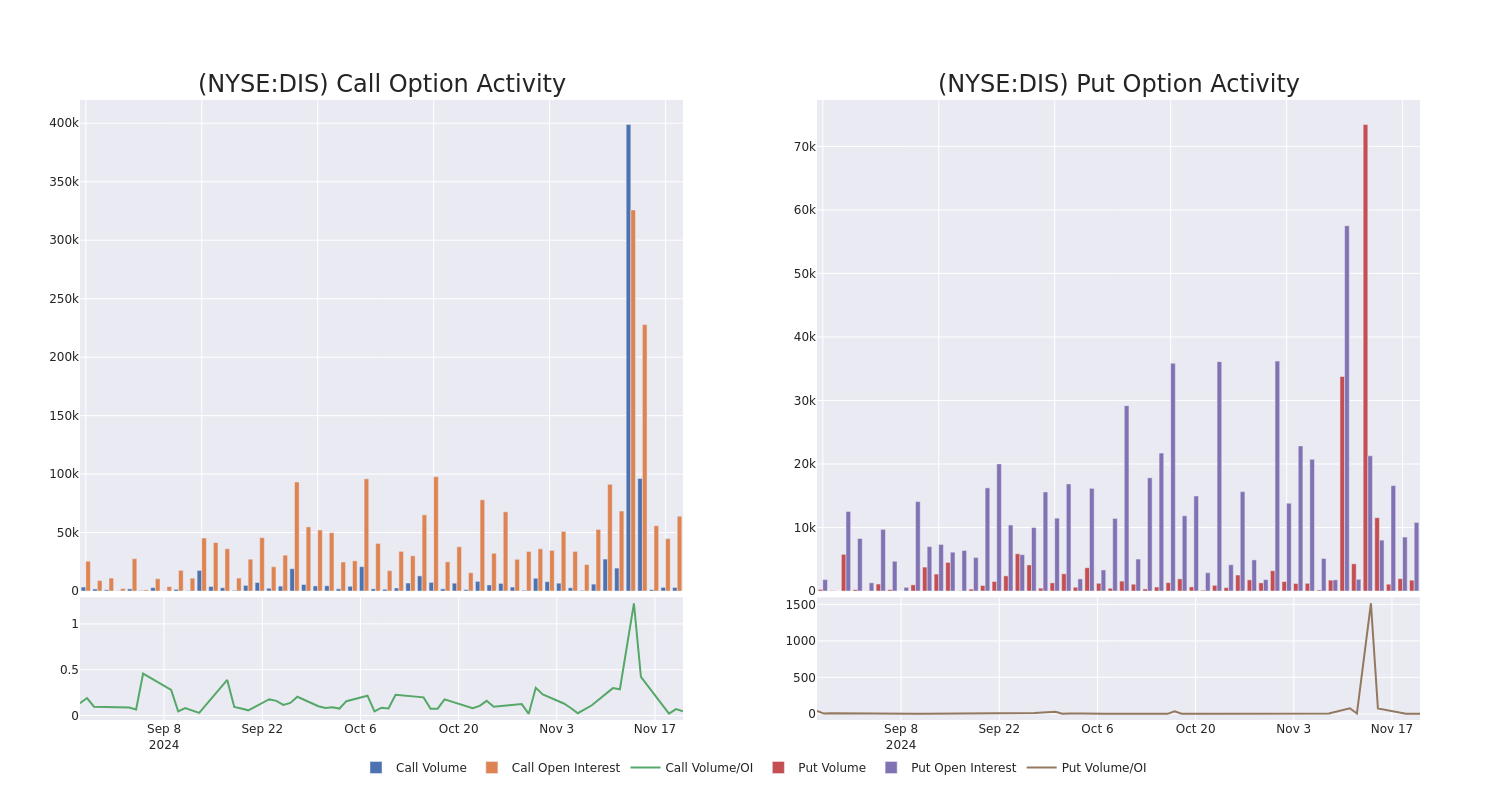

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walt Disney’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walt Disney’s substantial trades, within a strike price spectrum from $95.0 to $125.0 over the preceding 30 days.

Walt Disney Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $110.00 | $76.3K | 26.8K | 440 |

| DIS | CALL | TRADE | BULLISH | 12/06/24 | $1.6 | $1.6 | $1.6 | $115.00 | $64.0K | 2.8K | 426 |

| DIS | CALL | TRADE | NEUTRAL | 01/17/25 | $15.45 | $15.05 | $15.22 | $100.00 | $60.8K | 17.0K | 40 |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $7.55 | $7.4 | $7.52 | $115.00 | $59.4K | 3.2K | 442 |

| DIS | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $110.00 | $47.5K | 26.8K | 518 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm’s ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney’s own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney’s theme parks and vacation destinations, and also benefits from merchandise licensing.

Current Position of Walt Disney

- With a volume of 6,075,759, the price of DIS is up 0.99% at $115.39.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

What Analysts Are Saying About Walt Disney

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $129.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Deutsche Bank persists with their Buy rating on Walt Disney, maintaining a target price of $131.

* An analyst from B of A Securities has decided to maintain their Buy rating on Walt Disney, which currently sits at a price target of $140.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Walt Disney, which currently sits at a price target of $134.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $130.

* An analyst from Needham downgraded its action to Buy with a price target of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walt Disney, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabinoid Leader Innocan Pharma's Q3: 174% YoY Revenue Growth

Innocan Pharma Corporation INNPF, an Israel-based cannabinoids-focused pharmaceutical company, reported a 174% year-over-year revenue growth, reaching $24 million for the first nine months of 2024. Quarterly revenues rose 111% YoY to $8.6 million, driven by robust sales from its subsidiary, BI Sky Global Ltd.

Q3 2024 Financial Highlights

- Revenue was $8.6 million for the third quarter, up 111% year-over-year, and $24 million for the nine-month period, up 174% year-over-year.

- Net income was $0.3 million, an increase of $2.1 million compared to a net loss of $1.8 million in Q3 2023.

- Adjusted EBITDA was not stated in the press release.

- Gross profit was $7.8 million for the third quarter, up 112% year-over-year.

Gross profit surged 183% YoY for the nine-month period, totaling $21.8 million, while Q3 gross profit grew 112% to $7.8 million. Operating profit turned positive, reaching $0.4 million, reversing a $1.2 million loss in Q3 2023.

Net profit also improved significantly, increasing by $2.1 million to $0.3 million for the quarter.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Management Commentary

Iris Bincovich, Innocan’s CEO, attributed the strong performance to the company’s dual focus on pharmaceutical innovation and wellness. She highlighted the company’s progress in developing LPT-CBD, a proprietary non-opioid chronic pain management solution targeting both human and animal care. “Innocan is bringing strong value for shareholders,” Bincovich said, emphasizing the company’s commitment to addressing chronic pain.

Read Also: Can Trump’s Return Save The Cannabis Sector? Debt Mounts As Giants Face Post-Election Reckoning

Roni Kamhi, of BI Sky Global and COO of Innocan Pharma, highlighted the company’s consistent growth. “We are pleased to report nine consecutive quarters of continuous revenue growth,” he stated. He credited new product launches and enhanced brand awareness for the success.

Innocan’s financial gains underscore its strategic focus on innovation and market expansion, positioning the company as a rising player in the pharmaceutical sector. The company’s results signal ongoing growth potential amid increasing demand for non-opioid pain management solutions.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Lysander Announces Cash Distributions for the Lysander ActivETFs

TORONTO, Nov. 21, 2024 /CNW/ – Lysander Funds Limited (“Lysander”) announces the November 2024 cash distributions for each of Lysander-Slater Preferred Share ActivETF, Lysander-Canso Corporate Treasury ActivETF and Lysander-Canso Floating Rate ActivETF (TSX Symbols: PR; LYCT; LYFR, respectively) (each, an “ETF” and collectively, the “ETFs”). The unitholders of record of each ETF at the close of business on the Distribution Record Date will receive a cash distribution in the amount indicated below based on the number of units held, payable on or before the Payment Date.

|

ETF |

Distribution |

Distribution Record |

Payment Date |

|

Lysander-Slater Preferred Share ActivETF |

$0.0500 |

November 29, 2024 |

December 10, 2024 |

|

Lysander-Canso Corporate Treasury ActivETF |

$0.0058 |

November 29, 2024 |

December 10, 2024 |

|

Lysander-Canso Floating Rate ActivETF |

$0.0371 |

November 29, 2024 |

December 10, 2024 |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on the Toronto Stock Exchange (“TSX”). If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of an ETF and may receive less than the current net asset value when selling them.

SOURCE Lysander Funds Limited

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/21/c4028.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/21/c4028.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why C3.ai Stock Is Surging Today

C3.ai (NYSE: AI) stock is soaring in Thursday’s trading. The company’s share price was up 9.7% as of 2:30 p.m. ET. Meanwhile, the S&P 500 index was up roughly 0.5%.

C3.ai stock is seeing big gains on the heels of Nvidia‘s third-quarter report yesterday. Nvidia is the leading provider of the graphics processing units (GPUs) that are powering the artificial intelligence (AI) revolution, and its performance is often viewed as a bellwether for the broader AI industry.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

After the market closed yesterday, Nvidia published results for the third quarter of its 2025 fiscal year, which ended Oct. 29. The AI leader posted sales and earnings performance for the quarter that beat Wall Street’s expectations, and it also issued forward guidance that came in better than anticipated.

Nvidia posted non-GAAP (adjusted) earnings per share of $0.81 on sales of $35.08 billion, topping the average analyst estimate’s call for adjusted earnings of $0.75 on sales of $33.16 billion. The company’s revenue was up 94% year over year, and adjusted earnings per share were up 103%. Meanwhile, the average analyst estimate had called for the business to report adjusted earnings per share of $0.75 on revenue of $33.16 billion.

Nvidia expects revenue of roughly $37.5 billion for the current quarter. If the business were to hit that target, it would mean delivering annual sales growth of roughly 70%. While the company’s sales growth is decelerating, the overall demand outlook for the AI space is very strong. That bodes well for C3.ai and other players, and investors are responding by bidding up the company’s stock today.

With its last quarterly report, C3.ai’s revenue increased 21% year over year to $87.2 million. Meanwhile the business posted an adjusted loss per share of $0.05. Sales growth actually looks poised to accelerate in the near term.

For the current quarter, the company is guiding for sales to come in between $88.6 million and $93.6 million — good for growth of roughly 24.5% at the midpoint. Meanwhile, full-year sales are projected to come in between $370 million and $395 million. If the business were to hit the midpoint of that guidance range, it would mean delivering sales growth of approximately 23%.

Along with some encouraging forward sales guidance, C3.ai has also been scoring some promising partnerships recently. The company recently announced that it’s forged a new partnership with Microsoft to accelerate the adoption of enterprise AI applications, and it published a press release yesterday detailing a partnership with Capgemini targeting AI solutions for industries including life sciences, energy, utilities, government, banking, and manufacturing.

Super Micro Computer Stock Jumped Today. Here's What Investors Need to Know

A relief rally in Super Micro Computer (NASDAQ: SMCI) stock is back on track today after taking a breather on Wednesday. Shares of the artificial intelligence (AI) server stack provider exploded higher on Tuesday after the company announced plans to address corporate governance and accounting questions.

That rally stalled yesterday with some investors taking profits as uncertainty remained regarding Supermicro’s underlying business. But one clue that it remains on track came during the Nvidia earnings call yesterday. That helped reignite the rally today and send shares higher by 14.2% as of 2:25 p.m. ET.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Supermicro stock has now jumped by 65% in a week, but the company still has work to do.

Supermicro has delayed filing its last two financial reports with the Securities and Exchange Commission (SEC) as it works to resolve accounting concerns. Its last auditor resigned, causing even more concern. As a result, Supermicro was on the verge of being delisted from the Nasdaq Stock Exchange.

But the company delivered a plan to the exchange to remain listed and announced on Monday that it has hired a new auditor. The stock surged on that news, but questions remain.

Investors still need to wait for the filing of the financial reports and the sign-off from the auditor. Even in a best-case scenario, Supermicro has said its sales would be lower than anticipated for the most recent two quarterly periods. That’s understandable, though, as some customers may have wanted to avoid uncertainty related to orders. Data centers housing AI servers are under construction, and any equipment order delays would be costly.

Nvidia CEO Jensen Huang said yesterday that demand remains “incredible” for its AI chips and platforms. And during Nvidia’s earnings call for investors last night, Huang eased some fears related to Supermicro’s server business. Juang was discussing Nvidia’s partner companies, and he mentioned Supermicro among other server rack suppliers.

That Supermicro remains in partnership with Nvidia is a great sign that its underlying business continues as it works to resolve its problems. Investors cheered that fact today.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Why Litecoin Is Moving

Litecoin LTC/USD has surged 8.9% to $89.59 over the past week, benefiting from a wave of positive sentiment sweeping the cryptocurrency market.

This uptick comes as Bitcoin approaches the $100,000 milestone, which has significantly boosted investor confidence across the digital asset landscape.

What To Know: Polymarket bettors are closely watching Bitcoin’s trajectory this November, with a 79% probability of surpassing $100,000. This bullish outlook on Bitcoin has a cascading effect on altcoins like Litecoin, which often mirrors Bitcoin’s market movements.

The anticipation of Bitcoin reaching new heights has attracted substantial institutional interest, further enhancing market optimism.

Read Also: Why Bitcoin Cash Is Up 15% This Week

Additionally, the recent influx of $1.84 billion into U.S. Bitcoin spot ETFs over the past three days underscores growing institutional trust in cryptocurrencies. This surge in ETF inflows not only supports Bitcoin but also provides liquidity that benefits the broader crypto ecosystem, including Litecoin.

As investors seek diversification within the crypto space, Litecoin’s reputation as an alternative to Bitcoin may make it an attractive option.

Read Also: Bitcoin Close To $100,000 — Could It Happen Today?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.