Telematics Adoption Soars as 70% of Commercial Insurers Plan UBI Expansion Amid Rising Fleet Demand

Denver, CO, Oct. 30, 2024 (GLOBE NEWSWIRE) — Denver, CO – October 30, 2024 – SambaSafety has partnered with the Risk & Insurance Education Alliance and IoT Insurance Observatory to release its second annual 2024 Telematics Report: Connecting the Dots on Strategies & Adoption. This comprehensive report delivers an unparalleled view into the current state of telematics – tracking utilization, impact and investment trends across insurance teams and fleet segments.

“As the industry faces mounting claims costs, nuclear verdicts and increasing roadway risks, telematics offers an important tool for overcoming these challenges,” said Matt Scheuing, Chief Executive Officer of SambaSafety. “This report provides in-depth insights into how insurers, brokers and fleets are using telematics to create safer roads and establish more profitable insurance programs.”

Key Findings from the 2024 Telematics Report Include:

- 82% of commercial insurers now use telematics within their organizations, up from 65% in 2023.

- 60% of commercial insurers have formed dedicated, multi-disciplinary telematics teams, with Loss Control being the most represented area.

- 72% of fleets report a reduction in crashes and claims due to the combination of telematics and training, leading to lower insurance premiums for 1 in 4 respondents.

- 51% of fleets plan to expand their telematics devices or providers over the next 12 months, signaling ongoing telematics growth.

- Usage-Based Insurance (UBI) is accelerating, with 70% of commercial insurers planning UBI expansions within 1 to 2 years, up from 33% in 2023.

- 75% of insurers cite convincing fleets to share telematics data as the most significant barrier, while 74% of fleets indicate they don’t share data simply because they’ve never been asked.

- 62% of fleets report they don’t foresee challenges in sharing telematics data with insurers or brokers.

These findings underscore the value of telematics and the need for collaboration among insurers, brokers and fleets to reduce risk and accelerate progress toward their strategic goals.

“Telematics has evolved beyond data collection; it’s about converting that data into action for fleets and insurers,” said Rich Lacey, Chief Product Officer at SambaSafety. “By combining telematics with violations, roadside inspections and claims, a comprehensive risk profile allows fleets to benchmark performance and deliver targeted training to improve their risk.”

SambaSafety’s broad telematics integration footprint supports over 60% of connected commercial vehicles across North America and the UK. With fast, seamless access to standardized policyholder telematics data, our unmatched data quality and predictive variables enable diverse use cases in Commercial Lines Loss Control, Underwriting and Claims. Insurers gain an experienced partner and a trusted foundation for implementing and advancing their telematics programs efficiently, without device or industry limitations.

To download the 2024 Telematics Report or explore strategies for elevating risk control and underwriting, visit SambaSafety.com/telematics.

About SambaSafety:

SambaSafety is a recognized innovator and leading provider of cloud-based risk management solutions for over 15,000 organizations with automotive mobility exposure, including many on Fortune’s Global 500 list. Employers and insurers benefit from SambaSafety’s continuous monitoring, intuitive insights, risk reduction tools and configurable pricing solutions. Through the collection, correlation and analysis of federal, state, local and telematics data sources, our flexible, end-to-end capabilities enable businesses and insurers to better evaluate and mitigate driving risk, accelerate product development, reduce crashes and foster safer communities.

Ashley Newbill SambaSafety (720)254-4214 anewbill@sambasafety.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lennox Intl Recent Insider Activity

On October 29, a recent SEC filing unveiled that Michael Quenzer, EVP at Lennox Intl LII made an insider sell.

What Happened: Quenzer’s decision to sell 1,063 shares of Lennox Intl was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the sale is $659,081.

At Wednesday morning, Lennox Intl shares are down by 1.11%, trading at $604.0.

About Lennox Intl

Lennox International manufactures and distributes heating, ventilating, air conditioning, and refrigeration products to replacement (75% of sales) and new construction (25% of sales) markets. In fiscal 2023, residential HVAC was 68% of sales and commercial HVAC and Heatcraft refrigeration was 32% of sales. The company goes to market with multiple brands, but Lennox is the company’s flagship HVAC brand. The Texas-based company is focused on North America after the sale of its European HVAC and refrigeration businesses in late 2023.

Breaking Down Lennox Intl’s Financial Performance

Revenue Growth: Lennox Intl’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 9.65%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 32.6%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Lennox Intl’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 6.71.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.89, caution is advised due to increased financial risk.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 29.02 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.25, Lennox Intl’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Lennox Intl’s EV/EBITDA ratio stands at 21.41, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Lennox Intl’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Open Space Institute Study Reveals New York State Parks Are Integral to Healthy Communities

New York, NY, Oct. 30, 2024 (GLOBE NEWSWIRE) — The Open Space Institute (OSI) today issued “The Centennial Pulse of the Parks: State Park Visitor Insights and Recommendations for the Next Century.” The new report, produced from a major study conducted throughout the state, analyzes visitor demographics, experiences, and recreation trends, and demonstrates the tremendous value of state parks and the many ways that they positively impact people and communities. The report’s findings also reveal continued challenges, highlighting the critical need for continued investment in the state park system. Access the full report here.

Major themes revealed by the study include:

- State parks are integral to the fabric of communities throughout New York, enabling people to build meaningful connections with nature and with each other;

- Visitors appreciate recent and ongoing capital investments and improvements in state parks; and

- State parks are worthy of sustained investment—both for current visitors and for generations to come.

Based on the results of the study, the report makes the following recommendations:

- Continue and increase capital and operational investments for state parks;

- Broaden services and amenities to better engage and welcome diverse communities in state parks;

- Accelerate land acquisition, state park creation, and innovative state park development projects to accommodate a growing constituency of visitors and protect important open spaces; and

- Expand programs and amenities that improve access to nature for children and families.

“OSI is proud to share this comprehensive statewide study in celebration of the system’s Centennial anniversary,” said Kathy Moser, OSI’s Chief Conservation and Policy Officer. “This report is a key part of OSI’s ongoing commitment to expanding and improving state parks and making these spaces more welcoming and accessible for all. We believe that the information and recommendations in the report will help our partners at New York State Parks advance their excellent work by strategically investing in state park development, programming, and amenities to accommodate a growing and increasingly diverse audience of state park visitors.

State Parks Commissioner Pro Tempore Randy Simons said, “We are grateful to the Open Space Institute for this comprehensive statewide study. Not only has our Centennial been an exciting celebration, it’s been an opportunity to look back at our history and look forward to our future to better understand what the New York State park system means to our citizens. This detailed input from our visitors will better serve our regular parkgoers and to encourage new and diverse visitors to experience what our parks and historic sites have to offer. We are excited to be working with our partners to make the state park system even better in the next century.”

“The Natural Heritage Trust is proud to have partnered with OSI and OPRHP on the development of the Centennial Pulse of the Parks study which demonstrates the powerful impact of the state park system on the well-being and health of communities across New York. We look forward to our continued work together on behalf of the programs and projects that ensure the park system is welcoming and accessible to all,” said Sally Drake, Executive Director, Natural Heritage Trust (NHT).

In 2023, OSI commissioned a statewide survey of visitors, which assessed recreation and demographic trends from 2,600 visitors at 22 representative New York state parks. The parks were selected across five key regions: Western New York, Central New York, the Hudson Valley and Capital District, New York City and Long Island, and Thousand Islands. More than 116 participants also participated in semi-structured interviews with researchers, sharing deeper insights into individual and group experiences at state parks. Data was collected from mid-July through early September 2023, when park attendance is typically at its highest.

The report was produced in collaboration with the New York State Office of Parks, Recreation, and Historic Preservation (OPRHP) and the Natural Heritage Trust (NHT), and with the research expertise of the Public Space Research Group. Results from the report will help inform future priorities for state park programs, amenities, improvements, and marketing efforts.

Over the past 50 years, OSI has helped OPRHP add nearly 40,000 acres to its park system, increasing the acreage of the state park system by 10 percent. Over the past decade, OSI has invested millions of private dollars for new and upgraded trails and trailheads, visitor centers, restored carriage roads, and other amenities and enhancements at state parks, in partnership and coordination with New York State agencies.

The “Centennial Pulse of the Parks” report builds on OSI’s ongoing research and advocacy initiatives to support continued investment in New York’s state parks and public lands. From 2013 to 2015, OSI published the initial “Pulse of the Parks” series – a collection of seven reports analyzing visitor demographics, user experiences, and economic impacts at select New York state parks. These reports successfully communicated the value of six individual state parks and demonstrated the need for investments in the state park system to state leadership and policymakers.

The Centennial study and report were funded and developed by OSI in partnership with OPRHP and NHT. This project was made possible with the generous support of the Samuel Freeman Charitable Trust, Overhills Foundation, The New York Community Trust, and other private donors.

About the New York State Park and Historic Site Centennial Celebration

The New York state park and historic site system is one of the oldest in the nation. It encompasses more than 250 parks, historic sites, and recreational facilities across 360,000 acres, including more than 2,000 miles of trails. These facilities provide residents and visitors with access to some of New York’s most beautiful and iconic outdoor spaces, recreational areas, and historic sites. The Centennial celebration highlights the important role that state parks have played in preserving the state’s natural resources and cultural heritage, while providing physical and mental health benefits and countless opportunities for recreation, leisure, education, and affordable vacations to tens of millions of visitors each year.

About OSI

The Open Space Institute is a national leader in land conservation and efforts to make parks and other protected land more welcoming for all. Since 1974, OSI has partnered in the protection of more than 2.5 million at-risk and environmentally sensitive acres in the eastern U.S. and Canada. OSI’s land protection promotes clean air and water, improves access to recreation, provides wildlife habitat, strengthens communities, and combats climate change, while curbing its devastating effects.

About Natural Heritage Trust

The Natural Heritage Trust is a non-profit, public-benefit corporation with the mission to receive and administer gifts, grants and contributions to further public programs for parks, recreation, cultural, land and water conservation and historic preservation purposes of the State of New York. The NHT accomplishes its mission by accepting donations, raising funds, and through cooperative programs and projects with its agency partners: New York State Office of Parks, Recreation and Historic Preservation (OPRHP), Department of Environmental Conservation (DEC) and the Department of State (DOS). For more information visit www.naturalheritagetrust.org

#

Siobhan Gallagher Kent Open Space Institute (845) 576-8186 sgallagherkent@osiny.org

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Zero-Carbon Shipping Market Size/Share Worth USD 4,746.2 Million by 2033 at a 8.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

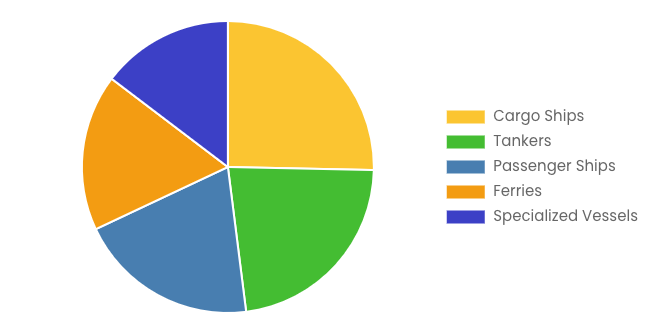

Austin, TX, USA, Oct. 30, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Zero-Carbon Shipping Market Size, Trends and Insights By Vessel Types (Cargo Ships, Tankers, Passenger Ships, Ferries, Specialized Vessels), By Technology Solutions (Hydrogen Fuel Cells, Ammonia Propulsion, Battery-Electric Propulsion, Wind-Assisted Propulsion, Biofuels, Solar Power, Nuclear Power, Others), By End-User Industries (Manufacturing, Oil & Gas, Agriculture, Retail, Passenger Transportation, Other Industries), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

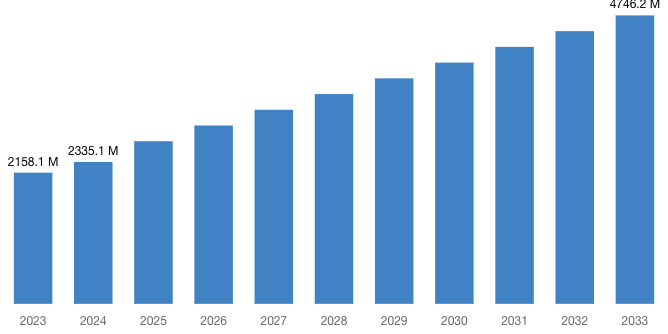

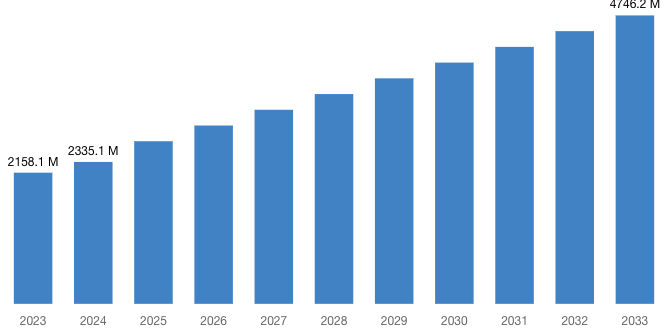

“According to the latest research study, the demand of global Zero-Carbon Shipping Market size & share was valued at approximately USD 2,158.1 Million in 2023 and is expected to reach USD 2,335.1 Million in 2024 and is expected to reach a value of around USD 4,746.2 Million by 2033, at a compound annual growth rate (CAGR) of about 8.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Zero-Carbon Shipping Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53040

Zero-Carbon Shipping Market: Growth Factors and Dynamics

- Regulatory Pressure and Environmental Concerns: Governments worldwide are imposing increasingly stringent regulations to curb greenhouse gas emissions from the shipping industry, aligning with global climate goals such as those outlined in the Paris Agreement. Heightened environmental consciousness among consumers and stakeholders is amplifying the urgency for sustainable shipping practices, propelling the demand for zero-carbon solutions.

- Industry Collaboration and Innovation: Collaborative initiatives among key industry players, research institutions, and governmental bodies are fostering a culture of innovation within the maritime sector. Joint research projects, knowledge-sharing platforms, and public-private partnerships are driving breakthroughs in zero-carbon propulsion technologies and sustainable shipping practices, facilitating the transition towards a greener maritime industry.

- Investment and Funding Support: Governments, international organizations, and private investors are injecting substantial capital into research, development, and deployment initiatives focused on zero-carbon shipping. Funding programs, grants, and incentives are accelerating innovation cycles and scaling up promising technologies, ensuring a robust pipeline of sustainable solutions to meet the industry’s evolving needs.

- Advancements in Technology: Ongoing advancements in zero-carbon propulsion technologies are pushing the boundaries of what is technologically feasible and economically viable within the maritime sector. Breakthroughs in hydrogen fuel cells, ammonia propulsion systems, battery-electric architectures, and wind-assisted propulsion technologies are enhancing the efficiency, reliability, and scalability of zero-carbon shipping solutions.

- Market Demand and Consumer Preferences: Heightened awareness among consumers, businesses, and governments regarding the environmental impact of shipping activities is driving market demand for sustainable transportation solutions. Consumers are increasingly favoring companies that prioritize environmental stewardship, compelling businesses to adopt zero-carbon shipping practices to remain competitive and align with evolving consumer preferences.

- Cost Competitiveness and Economic Viability: Continued innovation, economies of scale, and supportive policies are driving down the costs associated with zero-carbon shipping solutions, making them increasingly economically viable for shipowners and operators. As the cost competitiveness of zero-carbon technologies improves relative to conventional alternatives, market uptake is expected to accelerate, further driving down costs through increased adoption and technological refinement.

Request a Customized Copy of the Zero-Carbon Shipping Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53040

Zero-Carbon Shipping Market: Partnership and Acquisitions

- In 2023, AP Moller-Maersk (Maersk) finalizes its acquisition of Martin Bencher Group, a Danish Project Logistics specialist, enhancing its project logistics capabilities globally. The addition of Martin Bencher strengthens Maersk’s service portfolio, enabling the provision of comprehensive project logistics solutions to international clients across diverse industries.

- In 2023, Mazagon Dock Shipbuilders ventures into container manufacturing, securing an order from the Container Corporation of India Ltd (CONCOR) for 2,500 cargo-carrying steel boxes, marking its entry into this segment of the maritime industry.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 2,335.1 Million |

| Projected Market Size in 2033 | USD 4,746.2 Million |

| Market Size in 2023 | USD 2,158.1 Million |

| CAGR Growth Rate | 8.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Vessel Types, Technology Solutions, End-User Industries and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Zero-Carbon Shipping report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Zero-Carbon Shipping report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Zero-Carbon Shipping Market Report @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Zero-Carbon Shipping Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Zero-Carbon Shipping Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in Supply Chains and Manufacturing: The COVID-19 pandemic severely disrupted global supply chains and manufacturing operations, resulting in delays and disruptions in the production and deployment of zero-carbon shipping technologies and solutions. Shutdowns of factories, logistical challenges, and workforce shortages hampered the progress of ongoing projects, contributing to an overall slowdown in the market.

- Budget Constraints and Investment Uncertainty: Economic uncertainties triggered by the pandemic led to budget constraints and investment uncertainty across industries, including the maritime sector. Shipowners, operators, and investors became cautious about committing capital to long-term projects amidst volatile market conditions, slowing down funding and investment flows into zero-carbon shipping projects and initiatives.

- Resumption of Economic Activities: As economies gradually recover from the pandemic-induced slowdown, a resumption of economic activities is expected to drive increased demand for shipping services, including zero-carbon shipping solutions. Stimulated by economic recovery measures and growing trade volumes, the demand for sustainable transportation options is likely to rebound, providing impetus for the zero-carbon shipping market to recover.

- Government Stimulus Packages: Government stimulus packages aimed at economic recovery may include incentives and funding support for sustainable transportation initiatives, providing a much-needed boost to the zero-carbon shipping market. By allocating resources towards green infrastructure projects and incentivizing investments in clean technologies, governments can spur innovation and accelerate the adoption of zero-carbon shipping solutions.

- Renewed Focus on Environmental Sustainability: The COVID-19 pandemic underscored the interconnectedness of human health and environmental sustainability, prompting a renewed focus on green recovery strategies and sustainable development goals. Heightened awareness of environmental risks and vulnerabilities has amplified calls for ambitious climate action, creating an enabling environment for policies and initiatives that promote zero-carbon shipping and sustainable maritime practices.

- Technological Innovation and Research Investments: Continued investments in technological innovation and research efforts aimed at advancing zero-carbon propulsion technologies and sustainable shipping practices will be crucial for driving recovery in the zero-carbon shipping market. R&D initiatives focused on improving the efficiency, reliability, and scalability of zero-carbon solutions will play a pivotal role in overcoming technical challenges and accelerating market uptake.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Zero-Carbon Shipping Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Zero-Carbon Shipping Market Report @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Key questions answered in this report:

- What is the size of the Zero-Carbon Shipping market and what is its expected growth rate?

- What are the primary driving factors that push the Zero-Carbon Shipping market forward?

- What are the Zero-Carbon Shipping Industry’s top companies?

- What are the different categories that the Zero-Carbon Shipping Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Zero-Carbon Shipping market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Zero-Carbon Shipping Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Zero-Carbon Shipping Market – Regional Analysis

The Zero-Carbon Shipping Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: North America is at the forefront of adopting green initiatives in the Zero-Carbon Shipping Market, emphasizing the reduction of emissions through zero-carbon propulsion technologies. The region witnesses substantial investment in research and development projects aimed at advancing these technologies and supporting infrastructure. Moreover, strong regulatory support, including incentives and grants from governments, further accelerates the adoption of sustainable practices in the maritime sector, positioning North America as a key player in the global transition towards zero-carbon shipping.

- Europe: In Europe, stringent emission regulations drive the widespread adoption of zero-carbon shipping solutions to meet environmental standards. The region prioritizes the development of green ports and sustainable maritime infrastructure, facilitating the transition to zero-emission transportation. Through public-private partnerships, collaborative efforts between governments, industry players, and research institutions foster innovation and accelerate the deployment of zero-carbon technologies, positioning Europe as a leader in sustainable maritime practices.

- Asia-Pacific: The Asia-Pacific region experiences rapid growth in the shipping industry, leading to a heightened demand for zero-carbon shipping solutions to address environmental concerns. The emergence of clean energy technologies, such as hydrogen fuel cells and battery-electric propulsion systems, powers the transition to zero-carbon vessels. Additionally, investment in renewable energy infrastructure, particularly offshore wind farms, supports the electrification of maritime transportation, driving sustainable development and economic growth across Asia-Pacific.

- LAMEA (Latin America, Middle East, and Africa): In LAMEA regions, there is a strong focus on sustainable development, driving efforts to integrate zero-carbon shipping into broader sustainability agendas. Investment in green technologies and infrastructure plays a crucial role in reducing carbon emissions and enhancing environmental sustainability in maritime transportation. Collaborations with international partners for technology transfer and knowledge exchange further accelerate the adoption of zero-carbon shipping solutions, promoting economic growth and environmental stewardship in LAMEA.

Request a Customized Copy of the Zero-Carbon Shipping Market Report @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Zero-Carbon Shipping Market Size, Trends and Insights By Vessel Types (Cargo Ships, Tankers, Passenger Ships, Ferries, Specialized Vessels), By Technology Solutions (Hydrogen Fuel Cells, Ammonia Propulsion, Battery-Electric Propulsion, Wind-Assisted Propulsion, Biofuels, Solar Power, Nuclear Power, Others), By End-User Industries (Manufacturing, Oil & Gas, Agriculture, Retail, Passenger Transportation, Other Industries), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

List of the prominent players in the Zero-Carbon Shipping Market:

- Maersk

- CMA CGM Group

- Mediterranean Shipping Company (MSC)

- NYK Line (Nippon Yusen Kaisha)

- Hapag-Lloyd

- Evergreen Marine Corporation

- COSCO Shipping Lines

- Mitsui O.S.K. Lines (MOL)

- China Merchants Group

- Kawasaki Kisen Kaisha (K Line)

- Crowley Maritime Corporation

- Stena AB

- Wallenius Wilhelmsen

- Grimaldi Group

- Hyundai Merchant Marine (HMM)

- Others

Click Here to Access a Free Sample Report of the Global Zero-Carbon Shipping Market @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

US Cold Chain Logistics Market: US Cold Chain Logistics Market Size, Trends and Insights By Type (Refrigerated Storage, Refrigerated Transport, Cold Boxes, Monitoring Equipment), By Application (Food & Beverages, Pharmaceuticals, Chemicals, Agriculture, Others), By Temperature Range (Chilled, Frozen, Ambient), By End Use (Food Service, Retail, Medical Facilities, Industrial, Agriculture), By Sales Channel (Direct, Third-Party Logistics, Online Platforms), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

In Plant Logistics Market: In Plant Logistics Market Size, Trends and Insights By Product (Robots, Automated Storage and Retrieval Systems (ASRS), Conveyors & Sortation Systems, Cranes, Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Real-time Location Systems (RTLS), Others), By Technology (Automation and Robotics, IoT and Data Analytics, Blockchain, Others), By Location (Receiving & Delivery Docks, Assembly/Production Lines, Storage Facilities, Packaging Workstations, Others), By Industry Vertical (Automobiles, Retail & Consumer Goods, Food & Beverages, Metals & Heavy Machinery, Electronics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Cold Chain Market: Europe Cold Chain Market Size, Trends and Insights By Temperature Type (Chilled, Fruits & Vegetables, Dairy Products, Bakery & Confectionery, Processed Foods, Frozen, Seafood, Meat & Poultry, Ice Cream & Frozen Desserts, Pharmaceuticals), By Technology (Refrigerated Storage, Refrigerated Transport), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Chemicals & Materials, Others), By Service (Storage, Transportation, Value-Added Services, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Postal Services Market: Postal Services Market Size, Trends and Insights By Service Type (Mail Services, Parcel Services, Express Delivery Services, Logistics and Freight Services, Others), By Delivery Mode (Domestic Postal Services, International Postal Services), By Technology Adoption (Traditional Postal Services, E-postal Services, Mobile Postal Services), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Cold Chain Logistics Market: Cold Chain Logistics Market Size, Trends and Insights By Temperature Type (Chilled, Fruits & Vegetables, Dairy Products, Bakery & Confectionery, Processed Foods, Frozen, Seafood, Meat & Poultry, Ice Cream & Frozen Desserts, Pharmaceuticals), By Technology (Refrigerated Storage, Refrigerated Transport), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Chemicals & Materials, Others), By Service (Storage, Transportation, Value-Added Services, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Saudi Arabia Transportation Infrastructure Construction Market: Saudi Arabia Transportation Infrastructure Construction Market Size, Trends and Insights By Mode of Transportation (Roadways, Railways, Airways, Waterways, Others), By Type of Construction (New Construction, Renovation and Upgrades, Maintenance), By Project Type (Urban, Rural, Interstate and International, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Zero-Carbon Shipping Market: Zero-Carbon Shipping Market Size, Trends and Insights By Vessel Types (Cargo Ships, Tankers, Passenger Ships, Ferries, Specialized Vessels), By Technology Solutions (Hydrogen Fuel Cells, Ammonia Propulsion, Battery-Electric Propulsion, Wind-Assisted Propulsion, Biofuels, Solar Power, Nuclear Power, Others), By End-User Industries (Manufacturing, Oil & Gas, Agriculture, Retail, Passenger Transportation, Other Industries), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Truckload Logistics Market: Truckload Logistics Market Size, Trends and Insights By Service Type (Full Truckload (FTL), Partial Truckload (PTL)), By Distance Covered (Local Truckload, Regional Truckload, Long-Haul Truckload), By Truck Type (Dry Van, Refrigerated, Flatbed, Specialized, Others), By End-User Industry (Manufacturing, Retail and E-Commerce, Food and Beverage, Automotive, Healthcare and Pharmaceuticals, Construction, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Zero-Carbon Shipping Market is segmented as follows:

By Vessel Types

- Cargo Ships

- Tankers

- Passenger Ships

- Ferries

- Specialized Vessels

By Technology Solutions

- Hydrogen Fuel Cells

- Ammonia Propulsion

- Battery-Electric Propulsion

- Wind-Assisted Propulsion

- Biofuels

- Solar Power

- Nuclear Power

- Others

By End-User Industries

- Manufacturing

- Oil & Gas

- Agriculture

- Retail

- Passenger Transportation

- Other Industries

Click Here to Get a Free Sample Report of the Global Zero-Carbon Shipping Market @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Zero-Carbon Shipping Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Zero-Carbon Shipping Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Zero-Carbon Shipping Market? What Was the Capacity, Production Value, Cost and PROFIT of the Zero-Carbon Shipping Market?

- What Is the Current Market Status of the Zero-Carbon Shipping Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Zero-Carbon Shipping Market by Considering Applications and Types?

- What Are Projections of the Global Zero-Carbon Shipping Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Zero-Carbon Shipping Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Zero-Carbon Shipping Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Zero-Carbon Shipping Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Zero-Carbon Shipping Industry?

Click Here to Access a Free Sample Report of the Global Zero-Carbon Shipping Market @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

Reasons to Purchase Zero-Carbon Shipping Market Report

- Zero-Carbon Shipping Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Zero-Carbon Shipping Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Zero-Carbon Shipping Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Zero-Carbon Shipping Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Zero-Carbon Shipping market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Zero-Carbon Shipping Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Zero-Carbon Shipping market analysis.

- The competitive environment of current and potential participants in the Zero-Carbon Shipping market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Zero-Carbon Shipping market should find this report useful. The research will be useful to all market participants in the Zero-Carbon Shipping industry.

- Managers in the Zero-Carbon Shipping sector are interested in publishing up-to-date and projected data about the worldwide Zero-Carbon Shipping market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Zero-Carbon Shipping products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Zero-Carbon Shipping Market Report @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Zero-Carbon Shipping Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/zero-carbon-shipping-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shytoshi Kusama Touts Shiba Inu Lifetime Gains Of 33774726%: 'We Still Have Far To Go And Much Work To Be Done'

Shytoshi Kusama, the mysterious lead of the Shiba Inu SHIB/USD ecosystem, highlighted the coin’s impressive growth since its launch and the work ahead to gain further recognition.

What Happened: On Tuesday, Kusama took to X to talk about the SHIB’s lifetime growth, which stood at a staggering 33,774,726.7% from its all-time low, higher than those of Dogecoin DOGE/USD, Solana SOL/USD, and Binance Coin BNB/USD.

The pseudonymous personality added that this wasn’t enough and efforts were in place to further enhance the ecosystem.

“So, don’t ignore Shib. Or do, until you can no longer,” Kusama said, pointing toward critics.

See Also: MSTR Vs. RIOT Vs. COIN: Which Crypto Stock Stands Out Ahead Of Q3 Earnings?

Why It Matters: Kusama’s post comes in the wake of a broader cryptocurrency market rally that witnessed Bitcoin BTC/USD come within touching distance of a new all-time high.

SHIB, the second-largest meme coin by market capitalization, has gained 83% this year, exceeding SOL’s spike of 77% but trailed behind DOGE and BNB, which were up 95% and 92%, respectively.

The people at the helm of affairs have been making attempts at transforming Shiba Inu into a serious decentralized blockchain project.

Recently, Shiba Inu announced a partnership with Mass, a financial solutions company, to build the finance layer of its ambitious “Shiba State.”

Price Action: At the time of writing, Shiba Inu was exchanging hands at $0.00001901, up 2,60% in the last 24 hours, according to data from Benzinga Pro.

Read Next: Remember The ‘Passports For Bitcoin’ Initiative In El Salvador? It’s Not Going So Well

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Altrio Launches First Unified Deal Execution Platform For Commercial Real Estate Brokers

TORONTO, Oct. 30, 2024 /PRNewswire/ – Altrio, provider of Origin, the world’s leading real estate deal management software platform, is excited to announce the launch of a new version of Origin designed for investment sales and mortgage brokers.

Commercial real estate brokers have long relied on fragmented systems, manual workflows, and siloed information to manage complex transactions, with no way to support the many phases and facets of a real estate transaction in a single integrated system — until now.

A New Era for Commercial Real Estate Brokers

To outperform the competition, brokers rely on deep market knowledge, access to the right buyers, and the ability to provide exceptional client service. However, they are too often forced to rely on spreadsheets and cobbled together systems to manage critical data and stay on top of deal execution.

Origin changes the game by empowering brokers with a unified system that covers every stage of deal execution. By combining Pipeline Tracking, CRM, Market Data Management and Digital Deal Marketing, capabilities typically found in multiple point solutions, Origin gives brokers an unprecedented opportunity to simplify their workflows and centralize key data.

Designed in collaboration with leading institutional brokerage teams, Origin’s automation features allow brokers to track and execute every aspect of their deals in a single integrated platform, improving efficiency and ensuring nothing slips through the cracks.

The Future of Real Estate Capital Markets

“At Altrio, we see a future in which investors, lenders, brokers and sponsors execute deals online, not via email,” said Altrio CEO, Raj Singh. “We’re giving brokers a single platform to manage their business, end-to-end, allowing them to focus on building strong client relationships and getting deals done instead of getting bogged down by administrative tasks and data wrangling.”

About Altrio

Altrio is a leading global provider of software, data and services to real estate capital markets professionals. The company’s data-driven deal management platform, Origin, helps investors, lenders, brokers and sponsors harness proprietary and market data, automate business processes and close deals faster. Altrio was founded in 2020 and is headquartered in Toronto, Canada. For more information, visit altrio.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/altrio-launches-first-unified-deal-execution-platform-for-commercial-real-estate-brokers-302291447.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/altrio-launches-first-unified-deal-execution-platform-for-commercial-real-estate-brokers-302291447.html

SOURCE Altrio

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fosun Pharma Announces 2024Q3 Financial Results

Revenue Exceed RMB30.9 Billion with R&D Expenditure RMB3.9 Billion

Continuing to Consolidate its Dominant Position In The fields of Breast Cancer and Lung Cancer

SHANGHAI, Oct. 29, 2024 /PRNewswire/ — On October 29, Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (“Fosun Pharma” or “the Group”; Stock Code: 600196.SH; 02196.HK), announced its operating performance for the first three quarters of 2024. From January to September 2024, Fosun Pharma achieved revenue of RMB30.91 billion, an increase of about 5.74% YoY after excluding COVID-related products. The net profit attributable to owners of the parent of the Group after deducting extraordinary gain or loss amounted to RMB1.84 billion, up by 24.58% YoY.

In 2024, Fosun Pharma will further focus on innovative drugs and high-value devices, and continue to promote lean operations, cost reduction, efficiency improvement, and asset rationalization to optimize assets and financial structure, actively promote supply chain management and operational efficiency, and achieve healthy operating cash flow. In the first three quarters of 2024, the net cash flow from operating activities of Fosun Pharma was RMB2.99 billion, a year-on-year increase of 21.33%; the management expense ratio decreased by 0.15 percentage points YoY; excluding the impact of newly acquired companies, management expenses decreased by approximately RMB300 million on the same basis.

Focusing on advantageous therapeutic areas with innovative R&D pipelines continue to advance

In terms of innovative R&D, Fosun Pharma continues to focus on advantageous pipelines to achieve efficient results and continuous implementation of innovative products. In the first three quarters of 2024, Fosun Pharma’s R&D expenditure totaled RMB3.92 billion. In particular, R&D expenses were RMB2.65 billion. In addition to independent R&D, the Group fully implemented an open R&D model, and incubated and invested in R&D projects by initiating/managing industrial funds and other diversified ways, so as to ensure the sustainability of innovation and R&D.

Fosun Pharma’s innovative drug business mainly covers the core therapeutic areas of solid tumors, hematological tumors and immuno-inflammatory diseases, with emphasis on the enhancement of the core technology platforms of antibody/ADCs, cellular therapy and small molecules, to create an open and global innovative R&D system, continuously enhance pipeline value, and promote the development and commercialization of its products.

In the field of tumor immunotherapy, on September 13, 2024, Fosun Pharma announced it will acquire the 50% stake in Fosun Kite and will wholly own Fosun Kite (now renamed as “Fosun Kairos”). In the future, Fosun Kairos will serve as the core platform of Fosun Pharma’s cell therapy, continue to focus on the field of tumor immunotherapy, as well as to promote the development and commercialization of existing licensed products, Axi-Cel (i.e. Fosun Kite’s marketed product “Yi Kai Da”) and Brexu-Cel (i.e. Fosun Kite’s pipeline project FKC889), in Chinese mainland, Hong Kong SAR and Macau SAR with Kite Pharma.

In the third quarter of 2024, Fosun Pharma’s multiple independently developed innovative products and pipeline clinical trial results were announced in industry conferences and journals, further consolidating its dominant position in the fields of hematological tumors, breast cancer, lung cancer and other tumors. Particularly, the interim analysis results of the Phase III study of Foritinib Succinate (SAF-189s), an innovative drug independently developed to treat ALK-positiveb advanced non-small cell lung cancer (NSCLC), were released during the 2024 World Conference on Lung Cancer (“WCLC”). The above-mentioned studies have found that the overall efficacy of Foritinib Succinate is good. Compared with crizotinib treatment, it can significantly improve PFS and reduce the risk of CNS progression. Its safety is controllable, and no new safety signals appeared after treatment. Faritinib Succinate is expected to break through the current clinical difficulties faced in the treatment of ALK-positive NSCLC and bring new treatment options to NSCLC patients.

The multicenter real-world study of Fosun Pharma’s self-developed serplulimab-based immunochemotherapy for extensive-stage small cell lung cancer was released at the 2024 WCLC. The ASTRUM-005R study provides additional empirical evidence to support the therapeutic value of serplulimab plus chemotherapy and complements the pivotal data from the ASTRUM-005 clinical trial. Additionally, during the reporting period, the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency (EMA) issued a positive opinion recommending approval for Fosun Pharma’s self-developed serplulimab injection in combination with carboplatin and etoposide for the first-line treatment of adult patients with extensive-stage small cell lung cancer (ES-SCLC). The CHMP’s opinion will be submitted to the European Commission (EC) as a reference for marketing authorization approval.

Results of the phase 2 study of HLX22, an innovative anti-HER2 monoclonal antibody (mAb), in combination with Han Qu You (trastuzumab) and chemotherapy for the first-line treatment of HER2-positive advanced gastric/gastroesophageal junction (G/GEJ) cancer were presented on 2024 ESMO Gastrointestinal Cancers Congress (ESMO GI) and MED, a flagship clinical and translational research monthly journal by Cell Press. The results showed that add HLX22 to HLX02 (trastuzumab) and chemotherapy as first-line therapy improved efficacy in HER2-positive G/GEJ cancer patients with manageable safety.

In September 2024, Fosun Pharma announced the Biologics License Application (“BLA”) for the licensed product RT002 (DaxibotulinumtoxinA-lanm, Chinese trademark: 达希斐®) for the temporary improvement in the appearance of moderate to severe glabellar lines associated with corrugator and/or procerus muscle activity in adult patients, was approved by the National Medical Products Administration (“NMPA”), becoming the first DaxibotulinumtoxinA-lanm approved for marketing in Chinese mainland. Additionally, the results of a Phase III multicenter, double-blind, placebo-controlled study conducted in China for the treatment of moderate to severe glabellar lines were published in the Journal of Plastic, Reconstructive & Aesthetic Surgery (JPRAS). The study demonstrates that the product provides durable efficacy and high safety in Chinese patients with moderate to severe glabellar lines.

Actively implementing share repurchases and increasing holdings with continuous efforts on enhancing ESG

Fosun Pharma, a company listed on both the A-share and H-share markets, and its controlling shareholder Fosun High Tech have actively engaged in share repurchases and increased holdings this year, demonstrating confidence in the Company’s future development and further boosting market confidence. In the first three quarters of 2024, Fosun Pharma spent approximately RMB127 million and approximately HKD66.9 million to repurchase around 5.68 million A shares and 5.47 million H shares respectively. As of now, the H Share Repurchase Plan is still valid. In addition, the controlling shareholder Fosun High Tech, has spent a total of approximately RMB101 million to increase its holdings of around 4.30 million A shares of Fosun Pharma, under the latest Shareholding Increase Plan.

Founded in 1994 and with three decades of development, Fosun Pharma has grown into a global innovation-driven pharmaceutical and healthcare industry group. The Company always regards innovation as its primary social responsibility, consistently focusing on unmet clinical needs, prioritizing innovative R&D, advancing the launch of innovative products, promoting drug accessibility and affordability, and driving high-quality corporate growth. Fosun Pharma maintained an A grade rating in MSCI ESG Ratings for three consecutive years and an A- rating in HSI ESG, ranking among the top tier in the healthcare industry for pharmaceuticals and biotechnology. It was also selected as a constituent of the Hang Seng (China A) Corporate Sustainability Benchmark Index (“HSCASUSB”), Hang Seng (China A) Corporate Sustainability Index (“HSCASUS”), and Hang Seng (Mainland and HK) Corporate Sustainability Index (“HSMHSUS”).

With its sustained excellence in innovation and global operational capabilities, Fosun Pharma has been recognized by multiple authoritative institutions in innovative R&D, ESG and other areas. The Company ranked in the top four of China’s 2023 Top 100 Pharmaceutical Industry, was included in the “China Best Managed Companies” List (BMC) for the second consecutive year and was listed in Forbes 2024 China ESG 50. In addition, the Company has actively introduced its independently developed artemisinin-based innovative products to Africa, providing a Chinese solution to the global fight against malaria. This initiative highlights the inclusive, diverse, and open nature of ESG and earned Fosun Pharma recognition as an “Inspirational ESG Case”, serving as a model for corporate ESG practices.

***

About Fosun Pharma

Founded in 1994, Shanghai Fosun Pharmaceutical (Group) Co., Ltd.* (“Fosun Pharma”; stock code: 600196.SH, 02196.HK) is a global innovation-driven pharmaceutical and healthcare industry group. Fosun Pharma directly operates businesses including pharmaceuticals, medical devices, medical diagnosis, and healthcare services. As a shareholder of Sinopharm Co., Ltd., Fosun Pharma expands its areas in the pharmaceutical distribution and retail business.

Fosun Pharma is patient-centered and unmet clinical needs-oriented. Through diversified and multi-level cooperation models such as independent research and development, cooperative development, license-in, and industrial investment, the company continues to enrich its innovative product pipeline and focus on differentiated product R&D with high-tech barriers, to continuously enhance the value of its pipeline. Fosun Pharma’s innovative products focus on core therapeutic areas such as solid tumors, hematologic tumors and immunity inflammation. It also strengthens core technology platforms such as antibodies/ADC, cell therapy, and small molecules.

Guided by the 4IN strategy (Innovation, Internationalization, Intelligentization, and Integration), Fosun Pharma adheres to the business philosophy of “Innovation for Good Health”, continues to promote innovative transformation, actively deploys internationalization, strengthens business focus by product lines, promotes integrated operations and efficiency improvement, and is dedicated to being the global leading integrator of pharmaceutical and healthcare innovation.

For more information, please visit the official website: www.fosunpharma.com

![]() View original content:https://www.prnewswire.com/news-releases/fosun-pharma-announces-2024q3-financial-results-302290914.html

View original content:https://www.prnewswire.com/news-releases/fosun-pharma-announces-2024q3-financial-results-302290914.html

SOURCE Fosun Pharma

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Google Bought YouTube For $1.65B And Now It Prints $50B In Revenue Just In 1 Year — Sundar Pichai Says Alphabet 'Leaning Into The Living Room Experience'

YouTube, the video platform Google acquired for $1.65 billion in 2006, has generated $50 billion in combined advertising and subscription revenue over the past four quarters, marking a milestone in its evolution from a user-generated content site to a major streaming player.

What Happened: The achievement, announced during Alphabet Inc.‘s GOOGL GOOG third-quarter earnings call, reflects YouTube’s successful expansion into premium services and living room entertainment, competing directly with traditional television and streaming services.

“Together, YouTube TV, NFL Sunday Ticket and YouTube Music Premium are driving subscription growth for the platform,” said Sundar Pichai, CEO of Alphabet Inc., Google’s parent company. “We are leaning into the living room experience with multi-view and a new option for creators to organize content into episodes and seasons, similar to traditional TV.”

The platform has secured its position as the leading streaming service in the United States, according to Nielsen data. Philipp Schindler, Google’s chief business officer, reported that creators optimizing content for television viewing are seeing significant returns, with the number of creators earning the majority of their YouTube revenue from TV screens increasing by more than 30% year-over-year.

Sports content has emerged as a key growth driver. The platform’s Olympics coverage garnered over 12 billion views, with 850 million unique viewers watching more than 40 billion minutes of content.

Notably, 35% of Olympic content was viewed on television screens, highlighting YouTube’s successful transition to larger formats.

See Also: Cathie Wood’s Sky-High Vision: Dumps Shares Of Cybercab Touting Tesla For This eVTOL Play

Why It Matters: The platform’s advertising business has also shown strong momentum, with upfront advertising commitments increasing approximately 20% year-over-year, according to Schindler.

These results contributed to Alphabet’s strong quarterly performance, with the company reporting overall revenue of $88.27 billion, a 15% increase year-over-year, exceeding Wall Street expectations of $86.31 billion.

Looking ahead, YouTube plans to integrate Google DeepMind‘s video generation model into YouTube Shorts later this year, furthering its investment in artificial intelligence and creator tools.

Price Action: Alphabet Inc Class A shares closed at $169.68 on Tuesday, up 1.78% for the day. In after-hours trading, the stock rose by an additional 5.80%. Alphabet Inc Class C shares ended the day at $171.14, climbing 1.66%. After hours, the stock advanced a further 5.89%. Year to date, Alphabet Class C shares have risen by 22.63%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.