How Much House Is Too Much?

Homeownership is a cherished part of American society and a cornerstone of the American Dream. With the homeownership rate at 65% within the U.S. and home prices near record highs, the question is: how much house is too much?

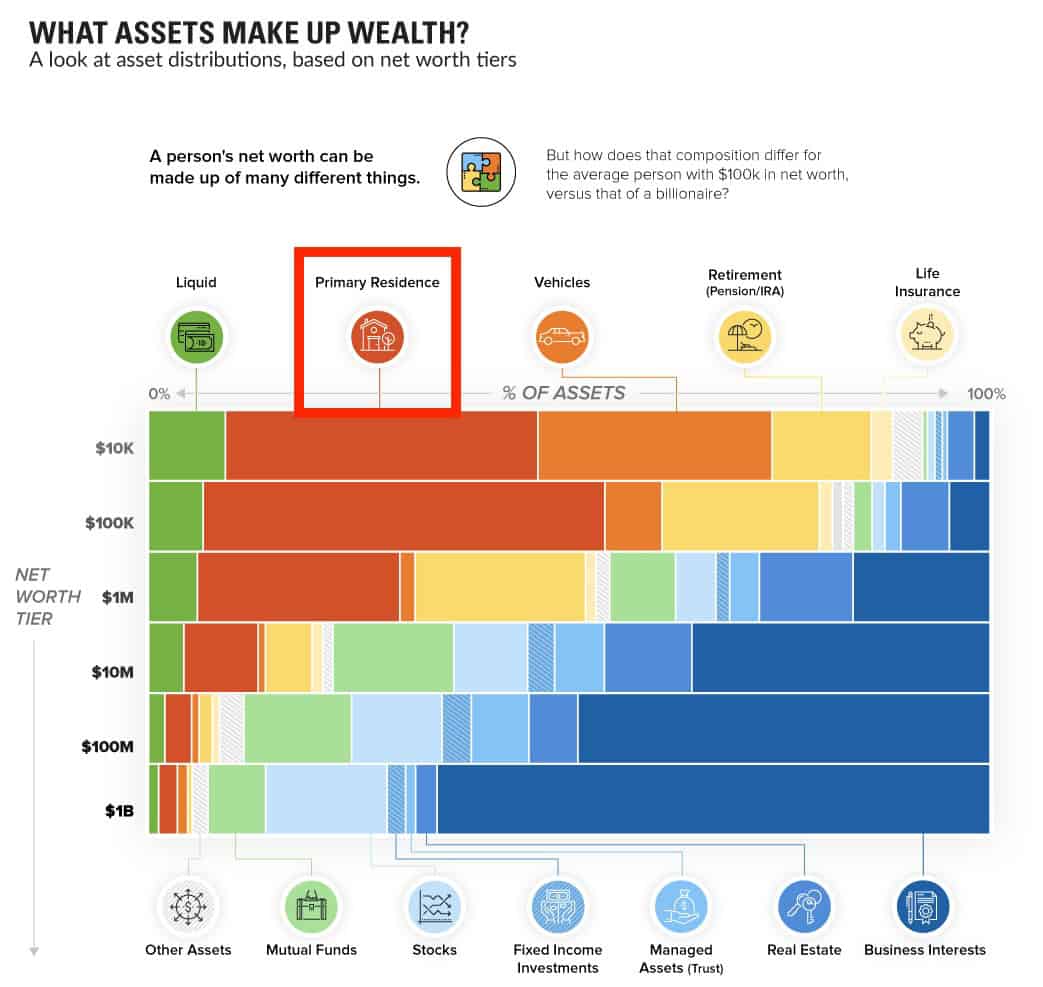

In other words, at what point is your house too big a portion of your overall assets? As a reminder, your total assets are everything that you own. This would include: your car, your house, your stocks, your bonds, your retirement accounts, and much more.

Given this, what percentage of your total assets should be in your primary residence? Is there a point where this percentage gets too high? And what are the risks associated with having too much of your money in a single property?

All of these questions, and more, will be answered in this blog post. We’ll explore the data behind homeownership in the U.S., some rules of thumb when it comes to how much house you can afford, and why this matters.

To start, let’s look at how much house the typical American owns.

How Much House Do Most Americans Own?

Though only 65% of Americans own their own home, among these homeowners, a significant percentage of their assets are in their primary residence. According to the 2022 Survey of Consumer Finances, the typical U.S. homeowner (i.e. median homeowner) has 60% of their total assets in their home.

To put this in perspective, the median total assets among U.S. homeowners is around $530,000. This means that roughly $318,000 of those assets (60%) would be in one asset—their house. The rest of their assets would be everything other than their house. But that’s just the median, what about the rest of the distribution? Here’s what that looks like:

- 10th Percentile = 18% of Total Assets in Primary Residence

- 25th Percentile = 36% of Total Assets in Primary Residence

- 50th Percentile = 60% of Total Assets in Primary Residence

- 75th Percentile = 81% of Total Assets in Primary Residence

- 90th Percentile = 91% of Total Assets in Primary Residence

In other words, 25% of U.S. homeowners have less than 36% of their assets in their primary residence and 1 in 10 U.S. homeowners have more than 91% of their assets in their primary residence! This illustrates the variation in how much house different American households own relative to their assets.

If we look at this breakdown by different net worth tiers, we can see that relatively poorer households have more of their wealth in their primary residence than wealthier households (h/t Visual Capitalist):

This demonstrates the importance of housing for the middle and upper middle class within the United States. Now that we’ve looked at how much house Americans tend to own, is there an ideal amount? Let’s take a look at that now.

What’s the Ideal Amount of House to Own?

When it comes to figuring out the ideal amount of house to own, there are two ways to approach this: based on your assets or based on your income. While neither approach is perfect, these two methodologies should help give you some peace of mind when it comes to buying a home.

- Asset-Based Approaches

- The One-Third Rule: Your primary residence should not be worth more than 33% of your total assets.

- The 40% of Net Worth Rule: Your primary residence should not be worth more than 40% of your total net worth. This rule is based on net worth (i.e. assets minus liabilities) rather than total assets which will be more conservative than the One-Third Rule.

- Age-based: Your allocation to your home should go down over time due to increasing age and decreasing risk tolerance:

- Under 35: Up to 40% of total assets

- 35-55: Up to 30% of total assets

- Over 55: Up to 20% of total assets

- Income-Based Approaches

- The 28/36 Rule: Your monthly mortgage payment shouldn’t exceed 28% of your monthly income and your total debt payments shouldn’t exceed 36% of your monthly income.

- The 35%/45% Rule: Your monthly mortgage payment shouldn’t exceed 35% of your monthly pre-tax income or 45% of your monthly post-tax income.

- The 2.5x Income Rule: Your home’s value should not exceed 2.5x your annual income. Therefore, if your income were $100,000, you shouldn’t buy a house worth more than $250,000.

Based on the asset-based approaches mentioned here, most American homeowners have far too much of their assets in their primary residence. This suggests that these households are either using a more reasonable income-based approach or they are overextending themselves to buy a home.

Whether you decide to use an asset-based or income-based approach when looking for a new home, these guidelines exist for a reason. They are meant to reduce the risk of owning a home so that you don’t get into future financial trouble. For those unfamiliar with such risks, we will cover them now.

The Risks Of Owning Too Much House

When it comes to the risks of having too much of your total assets in your home, a few ideas come to mind:

- Diversification: Concentrating too much of your wealth in a single asset class leaves you exposed to the volatility of that asset class. Anyone who owned a home in 2008 and saw their net worth decline by 20% (or more) knows what this feels like. Having a smaller percentage of your wealth in your primary residence is the best way to offset such a risk.

- Maintenance: Having too much of your assets in your home means that you are likely overextended and have to spend more on maintenance than you may be able to afford. Generally larger home are more expensive to maintain than smaller homes. Keep this in mind when buying a home that is already a little outside your budget.

- Illiquidity: While having a bigger, better home is great, much of that value is inaccessible as home equity. And, as the saying goes, “You can’t eat your home equity.” As a result, before buying a bigger home, think about how much more of your wealth you are locking up in a less liquid asset class.

- Property taxes: Similar to maintenance costs, if your property taxes go up over time, this will cost you even more on a more expensive home (all else equal). Owning a home is a lot more than just a mortgage, so make sure to take these other costs into account before pulling the trigger.

- Opportunity costs: Since your home is illiquid, every dollar you have locked up in it is a dollar that you can’t invest in income-producing assets. Remember what you give up when you decide to buy more house than what you truly need.

The risks of owning a home are about more than what initially meets the eye. While being less diversified is the most obvious risk, it’s not the only one. The phantom costs of owning a more expensive property and the illiquid nature of real estate amplify this problem even further.

The Bottom Line

When trying to figure out how much house is too much, the answer is in the eye of the beholder. Some approaches that work for one person may not work for another. And while there are many guidelines that you should consider on your home-buying journey, there are many other factors that can influence this decision. For example, the financial status of your parents, your financial goals, and where you live will all impact whether you can afford more or less house than the rules listed above.

Ultimately, what matters is finding a balance between getting the home that you want in the present without jeopardizing your financial future. If that means that you end up owning a home that is large share of your assets, but a small share of your income, that’s fine. You don’t have to follow an asset-based or an income-based approach when it comes to buying a house. However, I recommend that you at least consider these approaches during your house-hunting journey.

So, how much house is too much? The amount that could put your financial future in danger. After all, what’s the point of buying a bigger home if you can’t keep it?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SKF interim report Q3 2024: Solid margin and strong cash flow in weak markets

GOTHENBURG, Sweden, Oct. 30, 2024 /PRNewswire/ —

Q3 2024

Net sales: SEK 23,692 million (25,771)

Organic growth: −4.4% (−0.6%), driven by lower market demand across most regions and industries.

Adjusted operating profit: SEK 2,821 million (2,956). Continued strong price/mix contribution, driven by pricing actions and active portfolio management, as well as good cost control which largely offset the lower volumes and currency headwind.

Adjusted operating margin: 11.9% (11.5%)

Net cash flow from operations: SEK 3,576 million (3,435)

Rickard Gustafson, President and CEO:

“We are pleased to report a continued solid margin development, representing a year-over-year improvement, despite declining volumes in the prevailing weak market environment and significant currency headwinds. We continue our strategic execution creating an even stronger SKF, with the initiated separation of our Automotive business as a key component.”

Solid margin and strong cash flow

The weak market conditions prevailed globally during the third quarter, which also was reflected in multiple leading external macro indicators. Our organic sales declined by -4.4%, driven in particular by a weak demand in China and within Automotive, especially towards the end of the quarter. On the other hand, our sales in India and within Aerospace were solid.

Our adjusted operating margin, on the other hand, improved year-over-year and came in just shy of 12%, another proof point of our ability to better adapt to volatile market conditions. Our cost management and robust price/mix actions have effectively offset lower sales volumes, a significant negative currency impact and ongoing regionalization of our manufacturing footprint. We continue to work hard on cost out activities to mitigate potential short-term impact on our cost efficiency from the current lower volume environment.

Our ability to uphold solid earnings also contributed to a strong cash flow from operations of SEK 3.6 billion.

Unlocking value by separating the Automotive business

The announced initiated separation of our Automotive segment follows our strategy to create a separate Automotive business. There is a strong strategic rationale for the separation since Industrial and Automotive are two business segments with different business logics. By establishing two fit-for-purpose independent companies, we expect to unlock long-term value and to accelerate profitable growth in both businesses.

Since the announcement of the separation in mid-September, we have kick-started the separation planning and formed a dedicated project organization with the aim of listing the Automotive business in the first half of 2026. We intend to host a Capital Markets Day in Q4 2025 to share more information on the ambitions for both our Industrial and Automotive businesses.

Strategic portfolio management to build a stronger SKF

We continue to actively work with our portfolio to create a more focused and resilient SKF. I’m pleased that we have signed a contract to divest our ring and seal operation in Hanover, USA, which is a non-strategic asset for our Aerospace business, representing annual sales of approximately SEK 700 million, for a total value of approximately SEK 2.3 billion. Aerospace will remain one of our largest customer industries, representing total annual sales of approximately SEK 6 billion, corresponding to 9% of industrial net sales after the divestment. We will continue to invest and strengthen our position in core Aerospace segments related to the aeroengine and aerostructure bearing offers to optimize our business potential.

With our strategy and decentralized operating model being well implemented, we are now in a position to also gradually accelerate profitable growth through smaller bolt-on acquisitions. As an example, the announced acquisition of John Sample Group is margin accretive and further strengthens our lubrication offering and position in the expansive India and Southeast Asia region.

I would like to express my sincere gratitude to our employees for their contributions to achieving solid margin and strong cash flow, despite the weak demand environment, and a continued high pace in our strategic execution.

Outlook

We expect to see continued market and geopolitical volatility, and the business is prepared to tackle different scenarios. For the fourth quarter of 2024, we expect a mid-single-digit organic sales decline, year-over-year. For the full year, we expect a mid-single-digit organic sales decline, compared to 2023.”

|

Financial overview, MSEK unless otherwise stated |

Q3 2024 |

Q3 2023 |

Jan-Sep 2024 |

Jan-Sep 2023 |

|

Net sales |

23,692 |

25,771 |

73,997 |

79,443 |

|

Organic growth, % |

−4.4 |

−0.6 |

−6.1 |

5.7 |

|

Adjusted operating profit |

2,821 |

2,956 |

9,448 |

10,049 |

|

Adjusted operating margin, % |

11.9 |

11.5 |

12.8 |

12.6 |

|

Operating profit |

2,526 |

2,567 |

8,008 |

9,159 |

|

Operating margin, % |

10.7 |

10.0 |

10.8 |

11.5 |

|

Adjusted profit before taxes |

2,536 |

2,582 |

8,515 |

8,855 |

|

Profit before taxes |

2,241 |

2,193 |

7,075 |

7,965 |

|

Net cash flow from operating activities |

3,576 |

3,435 |

7,509 |

9,846 |

|

Basic earnings per share |

3.40 |

3.64 |

10.91 |

12.67 |

|

Adjusted earnings per share |

4.05 |

4.49 |

14.07 |

14.62 |

|

Net sales, change y-o-y, %, Q3 |

Organic1) |

Structure |

Currency |

Total |

|

SKF Group |

−4.4 |

0.0 |

−3.6 |

−8.0 |

|

Industrial |

−4.6 |

0.0 |

−3.7 |

−8.3 |

|

Automotive |

−4.0 |

0.0 |

−3.5 |

−7.5 |

|

1) Price, mix and volume |

||||

|

Net sales, change y-o-y, %, Jan-Sep 2024 |

Organic1) |

Structure |

Currency |

Total |

|

SKF Group |

−6.1 |

0.0 |

−0.8 |

−6.9 |

|

Industrial |

−6.5 |

0.1 |

−0.9 |

−7.3 |

|

Automotive |

−5.1 |

0.0 |

−0.8 |

−5.9 |

|

1) Price, mix and volume |

||||

|

Organic sales in local currencies, change y-o-y, %, Q3 |

Europe, Middle East & Africa |

The Americas |

China & Northeast Asia |

India & Southeast Asia |

|

SKF Group |

−5.2 |

−2.9 |

−8.7 |

2.9 |

|

Industrial |

– |

+/- |

— |

+ |

|

Automotive |

— |

– |

+/- |

+ |

|

Organic sales in local currencies, change y-o-y, %, Jan-Sep 2024 |

Europe, Middle East & Africa |

The Americas |

China & Northeast Asia |

India & Southeast Asia |

|

SKF Group |

−5.5 |

−6.1 |

−10.8 |

1.5 |

|

Industrial |

— |

— |

— |

+/- |

|

Automotive |

— |

— |

+/- |

++ |

Outlook and Guidance

Outlook

- Q4 2024: We expect a mid-single-digit organic sales decline, year-over-year.

- FY 2024: We expect a mid-single-digit organic sales decline, year-over-year.

Guidance Q4 2024

- Currency impact on the operating profit is expected to be around SEK 250 million negative compared with the fourth quarter 2023, based on exchange rates per 30 September 2024.

Guidance FY 2024

- Tax level excluding effects related to divested businesses: around 26%.

- Additions to property, plant and equipment: around SEK 5 billion.

A webcast will be held on 30 October 2024 at 08:00 (CET):

Sweden +46 (0)8 5051 0031

UK / International +44 (0)207 107 0613

https://investors.skf.com/en

Aktiebolaget SKF

(publ)

The financial information in this press release contains inside information that AB SKF is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication through the agency of the contact person set out below on 30 October 2024 at 07.00 CET.

For further information, please contact:

PRESS: Carl Bjernstam, Head of Media Relations

tel: 46 31-337 2517; mobile: 46 722-201 893; e-mail: carl.bjernstam@skf.com

INVESTOR RELATIONS: Sophie Arnius, Head of Investor Relations

tel: 46 31-337 8072; mobile: 46 705-908 072; e-mail: sophie.arnius@skf.com

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/skf-interim-report-q3-2024-solid-margin-and-strong-cash-flow-in-weak-markets-302291134.html

View original content:https://www.prnewswire.com/news-releases/skf-interim-report-q3-2024-solid-margin-and-strong-cash-flow-in-weak-markets-302291134.html

SOURCE SKF

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Akastor ASA: Third Quarter Results 2024

FORNEBU, Norway, Oct. 30, 2024 /PRNewswire/ —

Third Quarter Highlights

- Net capital employed increased by NOK 0.1 billion during the quarter to NOK 4.8 billion. Equity stood at NOK 5.6 billion at the end of the quarter, corresponding to NOK 20.4 per share, up from NOK 20.2 per share at the end of the last quarter.

- Akastor remained in a net cash position through the quarter, with no draw on corporate facilities.

- HMH delivered an adjusted EBITDA of USD 46 million for the quarter, up 32 percent year-on-year. The company completed the acquisition of Drillform, a leader in automated drilling tools, in July.

- Post-quarter end, Mr. Daniel “Dan” W. Rabun was appointed as Chairman of the Board of Directors of HMH.

- AKOFS Offshore achieved near-100 percent utilization on AKOFS Seafarer and Aker Wayfarer during the period. AKOFS Santos saw improved performance, recording a utilization of 85 percent, including 10 days of maintenance downtime.

- DDW Offshore operated all three vessels throughout the quarter, with a significant contract backlog secured post-quarter end, providing a solid foundation for 2025.

Akastor CEO Karl Erik Kjelstad comments:

“Akastor maintained its strong financial position through the third quarter, with net cash on account and no draw on corporate facilities, leaving us well positioned for potential future distributions. Our portfolio companies delivered another solid quarter, confirming their attractive positions within their respective niches. Despite slightly lower activity in HMH’s Service segment, the company achieved impressive year-on-year EBITDA growth. We were also pleased to see HMH complete the acquisition of Drillform, further advancing its growth strategy by expanding onshore capabilities. Both AKOFS Offshore and DDW Offshore delivered solid performances, with all vessels in operation throughout the quarter and high utilization. Additionally, DDW Offshore secured a significant contract backlog after the quarter ended, positioning the company well for the future.”

HMH

HMH reported revenues of USD 213 million in the quarter, with an adjusted EBITDA of USD 46 million, corresponding to an EBITDA margin of almost 22 percent.

Revenues from Aftermarket Services were USD 141 million in the quarter, down 4 percent year-on-year and down 6 percent quarter-on-quarter driven by lower service order intake in the quarter. Order intake within this segment was down 10 percent year-on-year and down 8 percent quarter-on-quarter driven by flat rig activity and restrained spending by customers.

Revenues from Projects, Products & Other were USD 73 million in the quarter, up 30 percent year-on-year and up 25 percent quarter-on-quarter driven by increased product shipments.

AKOFS Offshore

AKOFS Offshore reported revenues of USD 38 million and EBITDA of USD 11 million in the quarter.

The three vessels AKOFS Seafarer, AKOFS Santos and Aker Wayfarer all operated under their respective contracts through the full period. Aker Wayfarer delivered a revenue utilization of 99 percent, while AKOFS Seafarer delivered 98 percent. AKOFS Santos reported a revenue utilization of 85 percent in period, affected by a maintenance stop of 10 days.

DDW Offshore

DDW Offshore reported revenues of NOK 97 million and EBITDA of NOK 40 million in the quarter, up from NOK 53 million and NOK 18 million respectively in the same period last year. Revenue and EBITDA in period was affected by higher utilization than previous periods, as all three vessels were in operation through the full period. Skandi Emerald operated for Petrofac, while Skandi Atlantic was on contract with Chevron, both recording 100 percent utilization in the period. Skandi Peregrino operated in the spot market from Aberdeen through the third quarter after being reactivated and classed earlier this year, with a recorded utilization of 40 percent for the period.

Post quarter-end, the vessels Skandi Peregrino and Skandi Atlantic secured one-year contracts with an international oil company in Australia, set to commence in January and March 2025, respectively. These contracts provide solid visibility into 2025 and strengthen DDW Offshore’s presence in the Australian market.

Financial holdings

Net financials were negative NOK 59 million in the quarter, which included a non-cash net foreign exchange loss of NOK 27 million. Other financial investments contributed negatively with NOK 42 million.

Share of net profit from equity-accounted investees contributed positively with NOK 58 million. HMH contributed positively with NOK 100 million, whilst AKOFS Offshore contributed negatively with NOK 42 million.

Consolidated financial figures

Akastor’s consolidated revenue and EBTDA include earnings from subsidiaries which represent a minor part of Akastor’s total Net Capital Employed. The most relevant proxy for value development of Akastor is therefore the financial performance of each of the largest investments such as HMH, NES Fircroft and AKOFS Offshore. With this in mind, consolidated revenue and EBITDA of Akastor in the third quarter was NOK 99 million and NOK 25 million, respectively. Net profit in the third quarter was NOK 6 million.

Financial calendar

Fourth Quarter Results 2024: February 13, 2025

Media Contact

Øyvind Paaske

Chief Financial Officer

Tel: +47 917 59 705

E-mail: oyvind.paaske@akastor.com

Akastor is a Norway-based oil-services investment company with a portfolio of industrial holdings and other investments. The company has a flexible mandate for active ownership and long-term value creation.

This information is subject to the disclosure requirements pursuant to section 5 -12 of the Norwegian Securities Trading Act.

This information was brought to you by Cision http://news.cision.com.

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/akastor-asa-third-quarter-results-2024-302291137.html

View original content:https://www.prnewswire.com/news-releases/akastor-asa-third-quarter-results-2024-302291137.html

SOURCE Akastor ASA

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wolters Kluwer 2024 Nine-Month Trading Update

Wolters Kluwer 2024 Nine-Month Trading Update

Alphen aan den Rijn, October 30, 2024 – Wolters Kluwer, a global leader in professional information, software solutions and services, today releases its scheduled 2024 nine-month trading update.

Highlights

- Full-year 2024 guidance reiterated.

- Nine-month revenues up 6% in constant currencies and up 6% organically.

- Recurring revenues (83% of total revenues) up 7% organically; non-recurring revenues up 2%.

- Expert solutions revenues (59% of total revenues) grew 8% organically.

- Cloud software revenues (18% of total revenues) grew 16% organically.

- Nine-month adjusted operating profit up 8% in constant currencies.

- Nine-month adjusted operating profit margin increased.

- Nine-month adjusted free cash flow up 9% in constant currencies.

- Third quarter benefitted from favorable timing of vendor payments.

- Net-debt-to-EBITDA ratio 1.8x as of September 30, 2024.

- Share buyback 2024: on track to reach €1 billion by year-end.

- Share buyback 2025: mandate signed to repurchase up to €100 million in January and February 2025.

Nancy McKinstry, CEO and Chair of the Executive Board, commented: “I am pleased to report 6% organic growth through the first nine months, supported by continued growth in recurring revenues, led by our expert solutions including cloud-based software platforms. Investments in product innovation remained at record levels as we continue to pursue opportunities to support our customers in their drive for improved performance, outcomes, and efficiencies. We are on track to meet our full-year guidance.”

Nine Months to September 30, 2024

Total revenues were up 6% in the first nine months of 2024, despite a slightly weaker U.S. dollar in the third quarter. Excluding the effect of currency, acquisitions, and divestments, organic growth was 6% in the first nine months (9M 2023: 5%).

Recurring revenues (83% of total revenues) sustained 7% organic growth (9M 2023: 7%; HY 2024: 7%). Within recurring revenues, cloud software revenues grew 16% organically (9M 2023: 15%). Non-recurring revenues (17% of total revenues) increased 2% organically (9M 2023: 2% decline), benefitting from the improved trend in Legal Services transactional fees in the Financial & Corporate Compliance division compared to last year. Apart from transactional fees, non-recurring revenues include print books, on-premise software licenses, software implementation services, and other non-subscription products and services.

Revenues from North America (64% of total) grew 6% organically (9M 2023: 4%) while revenues from Europe (28% of total) grew 5% (9M 2023: 7%). Asia Pacific & ROW (8% of total) grew 7% organically (9M 2023: 8%).

Nine-month adjusted operating profit increased 8% in constant currencies. The nine-month adjusted operating profit margin improved, mainly driven by our Financial & Corporate Compliance and Legal & Regulatory divisions. Restructuring expenses, which are included in adjusted operating profit, increased. Product development spend (CAPEX + OPEX) was maintained at 11% of revenues (9M 2023: 11% of revenues).

Health: Nine-month revenues increased 6% in constant currencies and 6% organically (9M 2023: 6%). Clinical Solutions recorded 8% organic growth (9M 2023: 7%), led by clinical decision tool UpToDate and our clinical drug databases (Medi-Span and UpToDate Lexidrug). The UpToDate patient engagement solution delivered good growth. Surveillance, compliance, and terminology software saw improved organic growth, mainly reflecting the Invistics drug diversion business acquired in June 2023. Health Learning, Research & Practice recorded 3% organic growth (9M 2023: 4%), with good organic growth in medical research against a challenging comparable alongside improved growth in education and practice. In September 2024, we completed the previously announced divestment of Learner’s Digest International (LDI).

Tax & Accounting: Nine-month revenues increased 5% in constant currencies, reflecting the transfer of our Chinese legal research solution (BOLD) from Tax & Accounting to Legal & Regulatory at the start of the year. On an organic basis, revenues grew 7% (9M 2023: 8%). The North American business recorded 7% organic growth (9M 2023: 8%), driven by double-digit organic growth in our cloud-based software suite, CCH Axcess. While outsourced professional services continued to see strong growth, print books and other non-recurring revenues recorded slower growth. Tax & Accounting Europe sustained 7% organic growth (9M 2023: 7%) and began integrating the cloud software business acquired in September from the Isabel Group. Tax & Accounting Asia Pacific & ROW organic revenues were stable.

Financial & Corporate Compliance: Nine-month revenues increased 5% in constant currencies. On an organic basis, revenues rose 5% (9M 2023: 1%), with recurring revenues up 6% organically (9M 2023: 5%) and non-recurring transactional revenues up 3% (9M 2023: 7% decline). Legal Services grew 7% organically (9M 2023: 1%), supported by services subscriptions and 6% growth in Legal Services transactions. Subscriptions to our Beneficial Ownership Information (BOI) platform continued to build, in line with expectations. Financial Services recorded 3% organic growth (9M 2023: 0%), reflecting growth in recurring revenues and a stabilization in transactional revenues.

Legal & Regulatory: Nine-month revenues grew 8% in constant currencies, partly reflecting the transfer of BOLD into the division and bolt-on acquisitions. On an organic basis, revenues grew 5% (9M 2023: 4%). Legal & Regulatory Information Solutions grew 5% organically (9M 2023: 4%), supported by 7% growth in digital information solutions. Legal & Regulatory Software revenues grew 7% organically (9M 2023: 5%), led by double-digit organic growth at Legisway and continued growth in ELM transactional revenues.

Corporate Performance & ESG: Nine-month revenues increased 7% in constant currencies. On an organic basis, revenues increased by 7% (9M 2023: 8%), as recurring cloud software revenues sustained growth of 12%, but non-recurring on-premise license fees and software implementation services declined 2% (9M 2023: 0%). Our EHS & ESG1 unit (Enablon) delivered 14% organic growth (9M 2023: 15%), driven by 21% growth in cloud-based software revenues, partly offset by a decline in on-premise software license revenues. Within Corporate Performance Management, the CCH Tagetik CPM platform delivered 9% organic growth (9M 2023: 14%), driven by 17% organic growth in cloud software accompanied by a decline in on-premise software licenses and modest growth in services. Our Audit & Assurance (TeamMate) and Finance, Risk & Reporting (OneSumX) units posted modest organic growth for the nine-month period.

Corporate: Costs decreased in constant currencies as increased personnel costs were more than offset by lower miscellaneous expenses.

Cash Flow and Net Debt

Nine-month adjusted operating cash flow increased 7% in constant currencies, reflecting fewer large vendor payments in the third quarter. Nine-month adjusted free cash flow increased 9% in constant currencies.

Total dividends paid to shareholders amounted to €491 million in the first nine months, including the 2023 final dividend and the 2024 interim dividend (withholding tax to be paid in October). Total acquisition spending, net of cash acquired and including transaction costs, was €332 million in the first nine months, primarily related to the acquisition of Isabel Group assets completed in September 2024. Share repurchases amounted to €762 million in the first nine months.

As of September 30, 2024, net debt was €3,356 million (year-end 2023: €2,612 million), reflecting acquisition spending and cash returns to shareholders. Twelve months’ rolling net-debt-to-EBITDA was 1.8x (compared to 1.5x at year-end 2023).

Sustainability Update

Throughout 2024, we have continued to invest in programs designed to attract, engage, retain, and develop talent globally. Our workforce turnover rate remained stable throughout the first nine months at around 10%. Human resources programs currently emphasize career development and manager enablement while continuing initiatives to support an inclusive and engaging workplace culture. In the third quarter, we rolled out our Annual Compliance Training, which covers cybersecurity, data privacy, and business ethics. As of the end of October, over 99% of employees globally have completed the exercise.

Our global real estate team made better-than-expected progress in further rationalizing our office footprint, having been able to exit certain office leases earlier than planned. Through the first nine months of 2024, we have achieved an 8% organic reduction in office space (m2) compared to year-end 2023, thereby reducing our Scope 1 and 2 greenhouse gas emissions.

We continued work to align our sustainability reporting with the European Sustainability Reporting Standards (ESRS) set by the EU Corporate Sustainability Reporting Directive (CSRD).

Share Cancellation 2024

On September 13, 2024, we cancelled 10.0 million shares that were held in treasury, as approved by shareholders at the AGM in May 2024. Following this cancellation, the number of issued ordinary shares is now 238,516,153. As of September 30, 2024, 235.8 million shares were outstanding, and 2.7 million shares were held in treasury.

Share Buyback Program 2024 and 2025

In February 2024, we announced a 2024 share buyback program of up to €1 billion. In the year to date, through October 28, 2024, we have completed approximately 85% of this buyback, having repurchased €853 million in shares (5.8 million shares at an average price of €147.64). A third-party mandate is in place to complete the final tranche of €147 million in the period starting October 31, 2024, up to and including December 27, 2024.

For the upcoming year 2025, we have this week signed a third-party mandate to execute up to €100 million in share buybacks for the period starting January 2, 2025, up to and including February 24, 2025.

We continue to believe this level of share buybacks leaves us with ample headroom to support our dividend plans, to sustain organic investment, and to make selective acquisitions. The share repurchases may be suspended, discontinued, or modified at any time.

Third party mandates are governed by the limits of relevant laws and regulations (in particular Regulation (EU) 596/2014) and Wolters Kluwer’s Articles of Association. Repurchased shares are added to and held as treasury shares and are either cancelled or held to meet future obligations arising from share-based incentive plans. We remain committed to our anti-dilution policy which aims to offset the dilution caused by our annual incentive share issuance with share repurchases.

Full-Year 2024 Outlook

Our group-level guidance for 2024 is unchanged. See table below. We expect sustained good organic growth in 2024, in line with the prior year, and an increase in the adjusted operating profit margin.

| Full-Year 2024 Outlook | |||

| Performance indicators | 2024 Guidance | 2023 Actual | |

| Adjusted operating profit margin* | 26.4%-26.8% | 26.4% | |

| Adjusted free cash flow** | €1,150-€1,200 million | €1,164 million | |

| ROIC* | 17%-18% | 16.8% | |

| Diluted adjusted EPS growth** | Mid- to high single-digit | 12% | |

| *Guidance for adjusted operating profit margin and ROIC is in reporting currency and assumes an average EUR/USD rate in 2024 of €/$1.10. **Guidance for adjusted free cash flow and diluted adjusted EPS is in constant currencies (€/$ 1.08). Guidance reflects share repurchases of €1 billion in 2024. | |||

In 2023, Wolters Kluwer generated over 60% of its revenues and adjusted operating profit in North America. As a rule of thumb, based on our 2023 currency profile, each 1 U.S. cent move in the average €/$ exchange rate for the year causes an opposite change of approximately 3 euro cents in diluted adjusted EPS2.

We include restructuring costs in adjusted operating profit. We now expect 2024 restructuring expenses to increase to approximately €20-€25 million (FY 2023: €15 million). We expect adjusted net financing costs3 in constant currencies to be approximately €55 million. We expect the benchmark tax rate on adjusted pre-tax profits to be in the range of 23.0%-24.0% (FY 2023: 22.9%).

Capital expenditures are expected to be at the upper end of our guidance range of 5.0%-6.0% of total revenues (FY 2023: 5.8%). We continue to expect the full-year 2024 cash conversion ratio to be around 95% (FY 2023: 100%) due to lower net working capital inflows.

Our guidance assumes no additional significant change to the scope of operations. We may make further acquisitions or disposals which can be dilutive to margins, earnings, and ROIC in the near term.

2024 outlook by division

Our guidance for full-year 2024 organic revenue growth by divisions is summarized below. We expect the increase in full-year adjusted operating profit margin to be driven by our Finance & Corporate Compliance, Legal & Regulatory, and Corporate Performance & ESG divisions.

Health: we expect full-year 2024 organic growth to be in line with prior year (FY 2023: 6%). The division margin is expected to decline slightly due to one-time write-offs to streamline the portfolio.

Tax & Accounting: we expect full-year 2024 organic growth to be slightly below prior year (FY 2023: 8%) due to slower growth in non-recurring revenues and the absence of one-time favorable events in Europe. The division margin is expected to decline slightly due to increased product investment.

Financial & Corporate Compliance: we expect full-year 2024 organic growth to be higher than prior year (FY 2023: 2%) with Legal Services transactions recovering and Financial Services transactions stable.

Legal & Regulatory: we expect full-year 2024 organic growth to be in line with or slightly better than prior year (FY 2023: 4%).

Corporate Performance & ESG: we expect full-year 2024 organic growth to be in line with or slightly higher than in the prior year (FY 2023: 9%) as Finance, Risk & Reporting revenues stabilize.

About Wolters Kluwer

Wolters Kluwer WKL is a global leader in information, software solutions and services for professionals in healthcare; tax and accounting; financial and corporate compliance; legal and regulatory; corporate performance and ESG. We help our customers make critical decisions every day by providing expert solutions that combine deep domain knowledge with technology and services.

Wolters Kluwer reported 2023 annual revenues of €5.6 billion. The group serves customers in over 180 countries, maintains operations in over 40 countries, and employs approximately 21,400 people worldwide. The company is headquartered in Alphen aan den Rijn, the Netherlands.

Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and are included in the AEX, Euro Stoxx 50, and Euronext 100 indices. Wolters Kluwer has a sponsored Level 1 American Depositary Receipt (ADR) program. The ADRs are traded on the over-the-counter market in the U.S. (WTKWY).

For more information, visit www.wolterskluwer.com, follow us on LinkedIn, Facebook, YouTube, and Instagram.

Financial Calendar

February 26, 2025 Full-Year 2024 Results

March 12, 2025 Publication of 2024 Annual Report

May 6, 2025 First-Quarter 2025 Trading Update

May 15, 2025 Annual General Meeting of Shareholders

May 19, 2025 Ex-dividend date: 2024 final dividend ordinary shares

May 20, 2025 Record date: 2024 final dividend

June 11, 2025 Payment date: 2024 final dividend ordinary shares

June 18, 2025 Payment date: 2024 final dividend ADRs

July 30, 2025 Half-Year 2025 Results

August 26, 2025 Ex-dividend date: 2025 interim dividend ordinary shares

August 27, 2025 Record date: 2025 interim dividend

September 18, 2025 Payment date: 2025 interim dividend

September 25, 2025 Payment date: 2025 interim dividend ADRs

November 5, 2025 Nine-Month 2025 Trading Update

| Media | Investors/Analysts |

| Dave Guarino | Meg Geldens |

| VP, Head of Global Communications | Investor Relations |

| t +1-646 954 8215 | t +31 (0)172-641-407 |

| press@wolterskluwer.com | ir@wolterskluwer.com |

| Stefan Kloet | |

| Associate Director, Global Communications | |

| m +31 (0)612 22 36 57 | |

| press@wolterskluwer.com |

Forward-looking Statements and Other Important Legal Information

This report contains forward-looking statements. These statements may be identified by words such as “expect”, “should”, “could”, “shall” and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions; conditions in the markets in which Wolters Kluwer is engaged; conditions created by global pandemics, such as COVID-19; behavior of customers, suppliers, and competitors; technological developments; the implementation and execution of new ICT systems or outsourcing; and legal, tax, and regulatory rules affecting Wolters Kluwer’s businesses, as well as risks related to mergers, acquisitions, and divestments. In addition, financial risks such as currency movements, interest rate fluctuations, liquidity, and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Elements of this press release contain or may contain inside information about Wolters Kluwer within the meaning of Article 7(1) of the Market Abuse Regulation (596/2014/EU). Trademarks referenced are owned by Wolters Kluwer N.V. and its subsidiaries and may be registered in various countries.

1 EHS & ESG (formerly EHS/ORM) = environmental, health, and safety & environmental, social, and governance.

2 This rule of thumb excludes the impact of exchange rate movements on intercompany balances, which is accounted for in adjusted net financing costs in reported currencies and determined based on period-end spot rates and balances.

3 Adjusted net financing costs include lease interest charges. Guidance for adjusted net financing costs in constant currencies excludes the impact of exchange rate movements on currency hedging and intercompany balances.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Outokumpu interim report January-September 2024 – Solid third-quarter adjusted EBITDA driven by business areas Europe and Ferrochrome

HELSINKI, Oct. 30, 2024 /PRNewswire/ —

Highlights in Q3 2024

- Stainless steel deliveries were 459,000 tonnes (449,000 tonnes)*.

- Adjusted EBITDA amounted to EUR 86 million (EUR 51 million).

- EBITDA was EUR 81 million (EUR 18 million).

- ROCE amounted to -7.1% (5.3%).

- Free cash flow was EUR -113 million (EUR -24 million incl. discontinued operations).

- Earnings per share was EUR 0.05 (EUR -0.13).

- On July 9, 2024, Kati ter Horst was appointed as the President and CEO of Outokumpu and she started after the reporting period on October 1, 2024.

Highlights in Q1–Q3/2024

- Stainless steel deliveries were 1,371,000 tonnes (1,455,000 tonnes)*.

- Adjusted EBITDA amounted to EUR 180 million (EUR 445 million).

- EBITDA was EUR 174 million (EUR 401 million).

- ROCE amounted to -7.1% (5.3%).

- Free cash flow was EUR -105 million (EUR 134 million incl. discontinued operations).

- Earnings per share was EUR -0.02 (EUR 0.30)

- The impact of the political strike in Finland in the first half of 2024 was approximately EUR -60 million.

- The dividend of EUR 110 million from the year 2023 was paid in the second quarter.

- The most recent share buyback program was completed on February 29, 2024, and Outokumpu repurchased 8,357,545 shares during 2024.

*Figures in parentheses refer to the corresponding period for 2023, unless otherwise stated.

|

Key figures (EUR million, or as indicated) |

Q3/24 |

Q3/23 |

Q2/24 |

Q1-Q3/24 |

Q1-Q3/23 |

2023 |

|

Sales |

1,518 |

1,531 |

1,540 |

4,537 |

5,447 |

6,961 |

|

EBITDA |

81 |

18 |

56 |

174 |

401 |

416 |

|

Adjusted EBITDA 1) |

86 |

51 |

56 |

180 |

445 |

517 |

|

EBIT |

32 |

-45 |

1 |

14 |

214 |

-100 |

|

Adjusted EBIT 1) |

31 |

-12 |

1 |

15 |

261 |

274 |

|

Result before taxes |

22 |

-60 |

-7 |

-14 |

187 |

-133 |

|

Net result for the period |

20 |

-55 |

-5 |

-8 |

131 |

-111 |

|

Earnings per share |

0.05 |

-0.13 |

-0.01 |

-0.02 |

0.30 |

-0.26 |

|

Return on capital employed, rolling 12 months (ROCE), % 2) |

-7.1 |

5.3 |

-8.7 |

-7.1 |

5.3 |

-2.1 |

|

Capital expenditure |

37 |

31 |

37 |

133 |

84 |

170 |

|

Free cash flow3) |

-113 |

-24 |

35 |

-105 |

134 |

290 |

|

Stainless steel deliveries, 1000 tonnes |

459 |

449 |

468 |

1,371 |

1,455 |

1,906 |

|

Net result for the period from all operations incl discontinued operations |

20 |

-56 |

-5 |

-8 |

136 |

-106 |

|

1) Adjusted EBITDA or EBIT = EBITDA or EBIT – Items affecting comparability. |

||||||

|

2) The balance sheet component in 2022 includes the equity component of discontinued operations. |

||||||

|

3) The 2023 reference periods include discontinued operations. |

||||||

During 2022, Outokumpu announced that it had signed an agreement to divest the majority of the Long Products business operations to Marcegaglia Steel Group and Outokumpu reclassified its Long Products businesses to be divested assets held for sale and discontinued operations. The divestment was completed on January 3, 2023, and the gain on sale of EUR 5 million was reported in discontinued operations. In this report, all the comparative numbers are reported as continued operations without the impact of the gain on sale, if not otherwise stated.

President & CEO Kati ter Horst:

“I am honored to have started as Outokumpu’s President and CEO and be given the opportunity to lead the company into its next strategic phase. My immediate focus will be on ensuring a smooth transition and continuing to deliver on the EUR 350 million profitability improvement target by the end of 2025. I want to thank my predecessor Heikki Malinen for his leadership to strengthen Outokumpu’s balance sheet and making us the undisputed sustainability leader in stainless steel. This is a good foundation on which to build our future success.

My priorities are to reinforce our operational performance, strengthen our competitiveness, and maintain financial discipline. These are even more important now, as we are facing challenging market conditions both in Europe and the Americas. For us at Outokumpu, financial discipline means acting promptly in response to a changing market environment. In this situation, we adjust our business and steer it towards focusing on cash flow and shareholder returns.

During the third quarter, Outokumpu’s adjusted EBITDA increased to EUR 86 million, while stainless steel deliveries decreased by 2% compared to the previous quarter. Imports into both Europe and North America have continued to increase, and put pressure on stainless steel prices. However, we maintained our strong market positions, ranking number one in Europe and number two in North America.

In business area Europe, adjusted EBITDA improved to EUR 59 million, and stainless steel deliveries remained stable compared to the previous quarter. Within advanced materials, I am pleased to welcome Rolf Schencking to Outokumpu’s Leadership Team. He brings with him extensive technical and commercial experience in the specialty stainless steel business.

In business area Americas, adjusted EBITDA amounted to EUR 5 million, and stainless steel deliveries decreased by 8% compared to the previous quarter. Delivery volumes reflect the deterioration in the manufacturing sector, along with some postponements of deliveries to the fourth quarter due to flooding at our Mexico mill. However, our long-term view regarding the U.S. market remains highly positive.

Business area Ferrochrome had a solid result thanks to excellent operational performance and adjusted EBITDA reached EUR 29 million. The demand for our low emission ferrochrome remained resilient. Our Kemi mine is the only chrome mine in the EU area with the lowest carbon footprint globally and it will become the first carbon-neutral mine in the world by 2025.

Safety is our priority. Our safety performance remained at a world-class level despite a somewhat higher incident rate in the third quarter. We want to ensure that all our employees get home safe every day.

Decarbonization is one of the key focus areas in Outokumpu’s strategy. I am pleased to state that we are firmly committed to this path and are making good progress. We have maintained our recycled material content at 95%, which is the highest in the industry and a key contributor to us having the industry’s lowest carbon footprint.

I am very excited to embark on this journey at Outokumpu. My message is one of continuity and confidence – Outokumpu has a strong foundation, and there is great potential ahead. I look forward to working with our employees, customers, suppliers and other stakeholders to advance Outokumpu’s strategic journey.”

Outlook for Q4 2024

Group stainless steel deliveries in the fourth quarter are expected to decrease by 0–10% compared to the third quarter, driven by deteriorating markets for both business areas Europe and Americas.

The planned maintenance break in Tornio, Finland is expected to have approximately EUR -10 million impact on business area Europe’s adjusted EBITDA.

Energy costs for business area Europe are expected to increase by approximately EUR 5 million.

With the current raw material prices, some raw material-related inventory and metal derivative losses are forecasted to be realized in the fourth quarter.

Guidance for Q4 2024:

Adjusted EBITDA in the fourth quarter of 2024 is expected to be lower compared to the third quarter.

Results

Q3 2024 compared to Q3 2023

Outokumpu’s sales in the third quarter of 2024 decreased to EUR 1,518 million (EUR 1,531 million). Total stainless steel deliveries were 2% higher. Deliveries in business area Europe slightly decreased, while increased in business area Americas.

Adjusted EBITDA in the third quarter of 2024 increased to EUR 86 million (EUR 51 million). Profitability was supported by higher realized prices for stainless steel. Higher realized prices in Europe were partly offset by lower realized prices in Americas. The positive impact from realized prices was more than offset by the unfavorable raw material impacts resulting from tight scrap market. Costs increased due to salary inflation and maintenance work, partly offset by lower electricity and consumable prices. Profitability was supported by improved result for business area Ferrochrome. Raw material-related inventory and metal derivative gains amounted to EUR 10 million (losses of EUR 27 million), driven by a positive metal hedging result.

EBIT amounted to EUR 32 million in the third quarter of 2024 (EUR -45 million). EBIT in the comparison period includes a loss of EUR 26 million related to sale of the Long Products business in Sweden and other items affecting comparability. ROCE for rolling 12 months was -7.1% (5.3%), mainly due to weaker profitability and the significant impairment booking related to the renegotiated hot rolling contract in business area Americas at the end of 2023.

Net result increased to EUR 20 million in the third quarter of 2024 (EUR -55 million) and earnings per share amounted to EUR 0.05 (EUR -0.13). Net financial expenses in the third quarter of 2024 amounted to EUR 11 million (EUR 15 million) and interest expenses remained stable at EUR 15 million (EUR 15 million).

Q3 2024 compared to Q2 2024

Outokumpu’s sales decreased to EUR 1,518 million in the third quarter of 2024 (Q2/2024: EUR 1,540 million). Total stainless steel deliveries were 2% lower compared to the previous quarter. In business area Europe, stainless steel deliveries remained stable while decreased in business area Americas.

Outokumpu’s adjusted EBITDA increased to EUR 86 million in the third quarter (Q2/2024: EUR 56 million). In the second quarter, the impact of the political strike on adjusted EBITDA was approximately EUR -30 million.

Realized prices for stainless steel remained stable in both Europe and Americas, and product mix in business area Europe was slightly weaker. Profitability was supported by positive raw material impacts and improved result for business area Ferrochrome. Raw material-related inventory and metal derivative gains amounted to EUR 10 million in the third quarter (Q2/2024: losses of EUR 8 million), driven by a positive metal hedging result.

EBIT amounted to EUR 32 million in the third quarter of 2024 (Q2/2024: EUR 1 million). ROCE for the rolling 12 months was -7.1% (Q2/2024: -8.7%). ROCE development during the third quarter was impacted by slightly improved profitability. Both periods were affected by the significant impairment booking related to the renegotiated hot rolling contract in business area Americas at the end of 2023.

Net result in the third quarter amounted to EUR 20 million (Q2/2024: EUR -5 million) and earnings per share was EUR 0.05 (Q2/2024: EUR -0.01). Net financial expenses amounted to EUR 11 million (Q2/2024: EUR 9 million) and interest expenses to EUR 15 million (Q2/2024: EUR 16 million).

Q1–Q3/2024 compared to Q1–Q3/2023

During January–September 2024, Outokumpu’s sales decreased to EUR 4,537 million (EUR 5,447 million). Total stainless steel deliveries were 6% lower compared to the previous year, driven by weaker market and the political strike in Finland. Stainless steel deliveries decreased significantly in business area Europe, while significantly increasing in business area Americas.

Outokumpu’s adjusted EBITDA decreased to EUR 180 million in January–September 2024 (EUR 445 million). Profitability was negatively impacted by lower realized prices for stainless steel in both Europe and Americas and the unfavorable effects resulting from tight scrap market. Variable costs decreased, mainly due to lower energy and consumable prices and more efficient production, but the positive impact was partly offset by increased fixed costs, mainly in business area Americas due to higher tolling fee.

The impact of the political strike on adjusted EBITDA was approximately EUR -60 million in the first half of the year. Due to the political strike, the majority of Outokumpu’s stainless steel and ferrochrome operations in Finland as well as the Port of Tornio in Finland were shut down for four weeks. The strike also indirectly impacted the company’s operations in other countries through the disruption to internal material flows in both Europe and the Americas.

Raw material-related inventory and metal derivative losses amounted to EUR 2 million in January–September 2024 (losses of EUR 45 million).

EBIT amounted to EUR 14 million (EUR 214 million) in January–September 2024. EBIT in the comparison period includes a loss of EUR 26 million related to sale of the Long Products business in Sweden and other items affecting comparability. ROCE for the rolling 12 months was -7.1% (5.3%), mainly driven by weaker profitability and the significant impairment booking related to the renegotiated hot rolling contract in business area Americas at the end of 2023.

Net result declined to EUR -8 million (EUR 131 million) in January–September 2024 and earnings per share was EUR -0.02 (EUR 0.30). Net financial expenses amounted to EUR 30 million (EUR 31 million) and interest expenses to EUR 48 million (EUR 46 million).

|

Adjusted EBITDA by segment (EUR million) |

Q3/24 |

Q3/23 |

Q2/24 |

Q1-Q3/24 |

Q1-Q3/23 |

2023 |

|

Europe |

59 |

-29 |

28 |

91 |

144 |

148 |

|

Americas |

5 |

53 |

21 |

49 |

232 |

285 |

|

Ferrochrome |

29 |

21 |

22 |

73 |

73 |

96 |

|

Other operations and intra-group items |

–8 |

5 |

-15 |

-34 |

-4 |

-12 |

|

Total adjusted EBITDA |

86 |

51 |

56 |

180 |

445 |

517 |

|

Items affecting comparability in EBITDA (EUR million) |

Q3/24 |

Q3/23 |

Q2/24 |

Q1-Q3/24 |

Q1-Q3/23 |

2023 |

|

Europe |

-4 |

— |

0 |

-2 |

-7 |

-52 |

|

Americas |

— |

-5 |

— |

— |

-8 |

-16 |

|

Ferrochrome |

— |

— |

— |

— |

— |

-3 |

|

Other operations |

0 |

-28 |

0 |

-4 |

-29 |

-31 |

|

Total items affecting comparability in EBITDA |

-5 |

-33 |

0 |

-6 |

-44 |

-102 |

|

Total EBITDA |

81 |

18 |

56 |

174 |

401 |

416 |

A live webcast and conference call today, October 30, at 3.00pm EET

A live webcast and conference call to analysts, investors and representatives of media will be arranged today at 3.00 pm EET at https://outokumpu.videosync.fi/q3-2024/register hosted by President and CEO Kati ter Horst and CFO Marc-Simon Schaar.

To ask questions, please participate in the conference call by registering at https://palvelu.flik.fi/teleconference/?id=50049025. After registration you will receive phone number and a conference ID to access the conference call. If you wish to ask a question, please dial *5 on your telephone keypad to enter the queue.

All the interim report materials, a link to the webcast and later on its recording will be available at www.outokumpu.com/en/investors.

For more information:

Investors: Linda Häkkilä, Head of Investor Relations, tel. +358 400 719 669

Media: Päivi Allenius, SVP – Communications and Brand, tel. +358 40 753 7374,

or

Outokumpu media desk, tel. +358 40 351 9840, e-mail media(at) outokumpu.com

Outokumpu Corporation

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/outokumpu-interim-report-january-september-2024–solid-third-quarter-adjusted-ebitda-driven-by-business-areas-europe-and-ferrochrome-302291281.html

View original content:https://www.prnewswire.com/news-releases/outokumpu-interim-report-january-september-2024–solid-third-quarter-adjusted-ebitda-driven-by-business-areas-europe-and-ferrochrome-302291281.html

SOURCE Outokumpu Oyj

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft Earnings Are Imminent; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Microsoft Corporation MSFT will release earnings results for its first quarter, after the closing bell on Wednesday, Oct. 30.

Analysts expect the Redmond, Washington-based company to report quarterly earnings at $3.1 per share, up from $2.73 per share in the year-ago period. Microsoft projects to report revenue of $64.51 billion for the quarter, compared to $49.66 billion a year earlier, according to data from Benzinga Pro.

Microsoft recently accused Alphabet Inc. GOOGL GOOG subsidiary Google of orchestrating covert lobbying campaigns designed to undermine its cloud computing business while deflecting attention from its regulatory challenges.

Microsoft shares gained 1.3% to close at $431.95 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Truist Securities analyst Joel Fishbein maintained a Buy rating with a price target of $600 on Oct. 28. This analyst has an accuracy rate of 73%.

- Bernstein analyst Mark Moerdler maintained an Outperform rating and cut the price target from $501 to $500 on Oct. 25. This analyst has an accuracy rate of 71%.

- Citigroup analyst Tyler Radke maintained a Buy rating and cut the price target from $500 to $497 on Oct. 23. This analyst has an accuracy rate of 69%.

- Keybanc analyst Jackson Ader maintained an Overweight rating and raised the price target from $490 to $505 on Oct. 18. This analyst has an accuracy rate of 64%.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and cut the price target from $485 to $470 on Oct. 18. This analyst has an accuracy rate of 74%.

Considering buying MSFT stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

iPod Co-Creator Tony Fadell Dismisses ChatGPT Type LLMs Saying 'We're Trying To Make Science Fiction Happen' — Bashes Silicon Valley's Entitlement

Former Apple Inc. executive and co-creator of the iPod, Tony Fadell has expressed his disapproval of Silicon Valley’s entitlement culture and the use of large language models.

What Happened: On Tuesday, Fadell, who is also the founder and former CEO of Nest Labs, took the stage at TechCrunch Disrupt 2024.

During the conversation, he underscored the importance of “mission-driven a**holes” in the development of top-tier technology products.

Drawing a distinction between egocentric and mission-driven individuals, Fadell commended the latter for their attention to detail and critique of work, not people.

See Also: Team Biden’s Ban On China Tech Investments Could Impact Tesla’s AI Plans: Report

The tech mogul also took a swipe at Silicon Valley’s entitlement, humorously commenting on the culture of Googlers and their work habits. He voiced his disapproval of startups hiring Googlers due to their perceived entitlement.

“We said, we will never hire people from the East Coast,” referring to his time at General Magic in the 90s, adding, “because they had to have their driver, or they had to have their company car, and they had to have their corporate lunch and their special executive toilet.”

“And now I wake up today, and Silicon Valley has turned into that s***, and I’m like, get me the f*** out of here, yeah? Entitlement everywhere,” he stated.

Fadell further criticized LLMs, describing them as “know-it-alls.” He argued that while LLMs can be beneficial in certain areas like entertainment, their adoption should not be universal due to their propensity for errors.

“If you look at artificial-specific models, they work really well,” he said, adding, “They don’t hallucinate, but LLMs are trying to be this general thing because we’re trying to make science fiction happen.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Fadell’s critique of LLMs comes at a time when AI technology is increasingly being integrated into various sectors, including healthcare.

Last year, Google’s medical AI chatbot, Med-PaLM 2, began testing at the Mayo Clinic. The chatbot, a variant of the PaLM 2 language model, was specifically tailored for medical institutions.

Despite concerns about AI hallucinations, a 2023 study also suggested that chatbots like OpenAI’s ChatGPT could be more empathetic than actual doctors.

However, not all industry leaders share the same optimism about AI in healthcare.

Earlier this year in September, billionaire investor Chamath Palihapitiya expressed a more cautious view, acknowledging the potential of AI but also highlighting its limitations.

“It’s not all roses, but some areas if you imagine them, I’ll give you a couple if you want, are just bananas, I think,” he stated at the time.

Photo by @kmeron On Flickr

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Six modest-income families realize the dream of home ownership: Habitat for Humanity Québec and MONTONI Foundation wrap up construction of joint residential project in Lachine

LACHINE, QC, Oct. 29, 2024 /CNW/ – Habitat for Humanity Québec (HHQ) and the MONTONI Foundation today held an official key handover ceremony for six Greater Montréal families who are now the proud owners of their homes. The event, attended by Maja Vodanovic, Mayor of Lachine, marks a further step forward in the drive to provide access to home ownership, and a new chapter for HHQ. The project, the first on such a large scale since the pandemic, introduced an innovative construction model that enables HHQ to build more quickly and efficiently and optimize its impact across Québec, as it seeks to end the cycle of poverty by helping modest-income families.

More than $1,600,000 donated

The project in the borough of Lachine illustrates the commitment and generosity of a number of donors, who together contributed $1,641,954. The MONTONI Foundation played an essential role, with a $300,000 contribution. Montoni Group, for its part, raised just over $530,000 thanks to generous donations from partners and suppliers, and also built the project at cost, thus maximizing the impact of each dollar invested. Another $190,000 was raised through teambuilding activities organized by HHQ, in combination with $112,000 in donations from national partners. In-kind donations of materials, totalling some $90,000, along with $419,800 in support from Canada Mortgage and Housing Corporation (CMHC) rounded out the roster of contributions.

Access to home ownership: measurable results

For these families with a total of 12 children who will now have the chance to grow up in these residential units, the project means much more than simply a place to live: each dwelling unit is truly a place to call home, where everyone can thrive. Living in healthy, decent and safe home brings tangible benefits. Results observed among families supported by HHQ after moving into their new homes include the following:

- 86% report increased happiness;

- 70% say their health has improved;

- 65% see an increase in their children’s self-confidence;

- 58% note an improvement in their financial situation;

- 65% mention the positive impact on their children’s academic success.

“Our work together with the MONTONI Foundation, Montoni Group and the many other donors involved with this project has had a significant impact on the lives of six Québec families who are now first-time homeowners. The completion of construction of this project means new momentum for Habitat for Humanity Québec and enables us to strengthen our role as a lever for social mobility on behalf of families in Québec, all while offering a solution to the current housing crisis.”

– Shirlane Day, Executive Director, Habitat for Humanity Québec

Building for Tomorrow: an ambitious campaign

The Lachine project is a high point of HHQ’s 2023–26 major campaign, Building for Tomorrow, which aims to amplify the organization’s impact with modest-income families in the province.

In a recent report, CMHC estimates that nearly 620,000 additional housing units will be needed by 2030 to restore housing affordability in Québec. Against this backdrop, HHQ believes that it is essential for all players in the community to multiply their solutions in a concerted effort to enable as many families living in precarious conditions as possible to aspire to a better life.

In addition, since 2019, the Government of Canada, via the CMHC, has committed a total of $779,000 to Habitat for Humanity Quebec projects. This financial commitment from the National Housing Co-Investment Fund includes a $302,000 investment from the Black Families Co-Investment Fund.

“Organizations like Habitat for Humanity are invaluable partners as we work to tackle the housing crisis and ensure that every Canadian has a safe place to call their own. I am proud that we could support these new homes in Montréal, and I wish all the families the very best as they start their new chapters.”

– The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities.

In March 2023, the Government of Canada and Habitat for Humanity Canada announced an additional $25 million investment to build 500 new affordable homes across Canada over the next three years. This brings the total federal investment in Habitat for Humanity to $80.8 million through the Government of Canada’s Affordable Housing Fund.

About Habitat for Humanity Québec

Habitat for Humanity Québec responds to the urgent need to help families in Québec with modest incomes who live in precarious housing conditions, both in terms of their health and the security of their homes, helping them to become homeowners. For more information or to contribute to the cause, visit https://quebec.habitat.ca/en/.

About the MONTONI Foundation

Focused on prevention, the MONTONI Foundation works with and supports charitable organizations that help families in Québec and abroad, under the theme of empowerment. For more information: www.fondationmontoni.ca.

SOURCE MONTONI Foundation

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/29/c9118.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/29/c9118.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.