BellRing Brands Analysts Increase Their Forecasts After Upbeat Earnings

BellRing Brands BRBR reported better-than-expected earnings for its fourth quarter, after the closing bell on Monday.

The company posted quarterly earnings of 51 cents per share, which beat the analyst consensus estimate of 50 cents per share. The company reported quarterly sales of $555.80 million which beat the analyst consensus estimate of $536.13 million.

“We finished the year strong, with our results coming in at the high end of our expectations. Premier Protein consumption accelerated, lifted by better in stocks and meaningful distribution gains. Additionally, Premier Protein achieved all time highs this quarter for household penetration and total distribution points, and saw strong market share gains in both shakes and powders,” said Darcy H. Davenport, President and Chief Executive Officer of BellRing. “Our momentum remains high as we enter 2025. The convenient nutrition category continues to provide strong tailwinds, with ready-to-drink shakes and powders in the early stages of growth. We have leading mainstream brands that deeply resonate with consumers, giving us confidence in the long-term prospects for our company.”

BellRing Brands said it sees FY25 net sales of $2.24 billion to $2.32 billion and adjusted EBITDA of $460 million to $490 million.

BellRing Brands shares fell 0.2% to close at $73.26 on Tuesday.

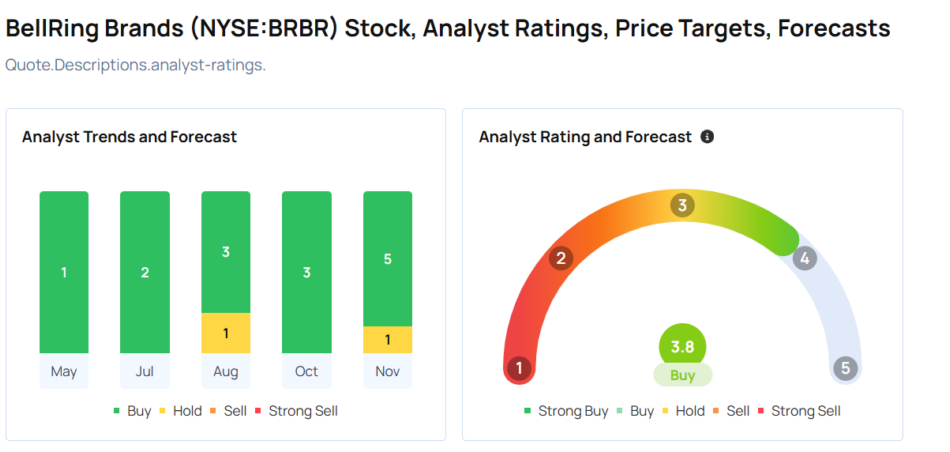

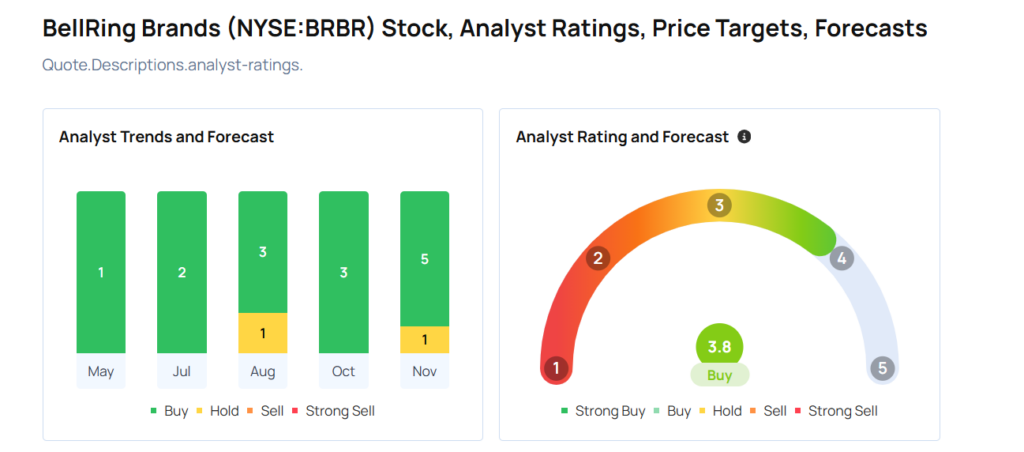

These analysts made changes to their price targets on BellRing Brands following earnings announcement.

- B of A Securities analyst Bryan Spillane maintained BellRing Brands with a Buy and raised the price target from $75 to $82.

- Deutsche Bank analyst Steve Powers maintained BellRing Brands with a Buy and raised the price target from $73 to $77.

- Stifel analyst Matthew Smith maintained the stock with a Buy and raised the price target from $67 to $81.

- Considering buying BRBR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gordon Johnson Slams Federal Reserve For Asset-Owner Centric Policies, Says Jerome Powell Needs To Focus On 'Real Economy': '…The Stock Market Will Be Fine'

After the U.S. headline and core consumer price inflation rose in October, and the Federal Reserve Chairman suggested that a December rate cut may not be necessary, treasury yields have risen, and inflation concerns have gripped the economy once again.

Gordon Johnson, chief executive officer and founder at GLJ Research in a conversation with Wealthion slammed the Federal Reserve for making policies that benefit the stock market and asset owners in general.

Also read: October Inflation Rate Rises To 2.6% As Expected: December Interest Rate Cut Remains Uncertain

What Happened: Johnson said that the Fed’s $3 trillion in monetary stimulus in late 2021 after the one which was already announced in 2020, was “reckless” and it wasn’t “data dependent.” According to him, this was the Fed’s first step into taking a measure that “was going to result in an excessive inflation.”

He added that recklessness seen from the U.S. government and Congress on the fiscal front “is the byproduct of Fed allowing this.”

“Fed is the only entity that can legally create U.S. dollars, so if the Fed stopped printing and buying the Treasuries, which they are still doing, despite telling the public that they are doing quantitative tightening. The Congress won’t be able to spend so recklessly.”

Why It Matters: Johnson believes that there is constant intervention by the United States Secretary of the Treasury, Janet Yellen along with Federal Reserve’s Chairman, Jerome Powell, whenever there is a spike in the yield.

“In early 2024, the Fed cut its pace of quantitative tightening by $30 billion a month, which is just the amount they were letting roll off. And recently, Janet Yellen announced that she is going to buy $4 billion in U.S. Treasury bonds per week. There is just constant intervention by these entities whenever the yields start to spike. It’s them trying to disallow any disfunction or rather I would argue functioning in the Treasury markets.”

Johnson is of the opinion that if Yellen and Powell do not constantly intervene in the Treasury markets and let the market function on their own, some of this excess spending by the government would not be allowed.

“Without putting any breaks in this out of control train, I am afraid that we are going to get a reacceleration in the rate on inflation if the Fed doesn’t cool quantitative easing,” he added.

What’s The Solution: Johnson suggested that the solution to this is to go back to a simpler framework and look at the real economy and not the stock markets while formulating the monetary policy.

According to him, the current approach by the Federal Reserve’s policies is good for asset holders as stocks go up every day, but they are bad for the people living on W2 income who don’t own assets, just regular income.

He highlighted that based on the Fed’s website, the top 10% of the wealthiest persons in the U.S. hold 87% of stocks. So, when the Fed’s goal is to push stock prices up every day, all they are doing is exacerbating the already reckless wealth inequality that exists.

“Fed needs to focus on actual economy and if the economy does well, the stock market will be fine. The real economy is going to suffer if they fail to do so,” Johnson said.

President-elect Trump’s victory, combined with stronger-than-expected economic data, helped drive the S&P 500 Index higher. Although the index dropped 2.3% last week to 5,870.62, it remains above its pre-election level of 5,712.69 as of the close on Tuesday, Nov. 3.

Meanwhile, in premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500 Index, rose 0.13% to $591.05 and the Invesco QQQ ETF QQQ, which tracks the Nasdaq 100 Index, gained 0.10% to $503.96, according to Benzinga Pro data.

Photo courtesy of the Federal Reserve

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia to report Q3 earnings today as AI fever continues to power Wall Street

Nvidia (NVDA) will report its third quarter earnings after the bell today, giving Wall Street its best and latest look into the strength of the artificial intelligence trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. Shares of Nvidia were up 196% year to date as of Wednesday, easily outpacing any of the company’s chipmaker rivals. AMD (AMD), the closest competitor, has seen its stock price sink over 5% year to date, while Intel (INTC), which is contending with a difficult turnaround, has seen its stock plunge nearly 52%.

Nvidia is expected to report Q3 earnings per share (EPS) of $0.74 on revenue of $33.2 billion, according to analysts’ estimates compiled by Bloomberg. That works out to an 83% year-over-year increase on both the top and bottom lines versus the same period last year, when Nvidia saw EPS of $0.40 on revenue of $22.1 billion.

Nvidia’s Data Center segment, its largest business, is set to bring in $29 billion for the quarter. That’s a 100% rise on the $14.5 billion reported in Q3 last year.

Gaming revenue is expected to top out at $3 billion, up 7% from last year, when the segment brought in $2.8 billion.

Analysts are anticipating gross margins to hit 75%.

Investors will be on the lookout for not only whether Nvidia beats on the top and bottom lines for Q3, but also whether it raises its outlook for Q4. Analysts are expecting Nvidia to give guidance of $37 billion in revenue in the quarter.

Even if the AI chip leader delivers a stellar report and outlook, its share price could still fall. Nvidia topped expectations on the top and bottom lines and beat out anticipated guidance in Q2, but its stock dropped 6% immediately after its results.

That could be a sign that some investors weren’t impressed with Nvidia’s performance compared to prior quarters, where it saw revenue growth of 200% and EPS growth of nearly 600%. Or it could simply come down to investors taking profits on their gains.

Investors will also be looking for any insights from CEO Jensen Huang about Nvidia’s next-generation Blackwell line of AI chips, which are used to both train and run AI applications. During the company’s last earnings call in August, Huang said Blackwell production would pick up in Q4, when he expects to see several billions of dollars of revenue from the chips.

At the time, Huang said demand for Blackwell was already outstripping supply, and he anticipated that would continue in the year ahead. What’s more, he said the company’s Hopper chip, the predecessor to the Blackwell line, was expected to continue selling well into Q4.

Prediction: Tilray Brands Won't Be a Cannabis Company in 5 Years

It was almost four years ago that Tilray Brands (NASDAQ: TLRY) announced that it would be merging with low-cost cannabis producer Aphria to create a larger, more dynamic, and global marijuana company. At the time, it was an exciting prospect for investors, creating what might end up becoming the best cannabis stock to own.

But since that announcement back in December 2020, the stock has declined by more than 85%. There was a lot of hype around the news, and the stock skyrocketed shortly afterwards, but the enthusiasm would fade — significantly.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Over the next five years, I expect Tilray to continue to evolve its business — but this time, away from cannabis. It might still be a small part of its business, but I predict that Tilray won’t be known as a marijuana company for much longer.

For years, while Tilray has been patiently optimistic that the U.S. might legalize marijuana, which would result in a huge new growth opportunity for the Canadian-based company, it has been expanding its operations in other ways. It has expanded into international cannabis markets and has acquired alcohol brands.

Last month, the company reported its first-quarter earnings of fiscal 2025. For the period ending Aug. 31, its sales grew by 13% year over year to $200 million. But of that total, less than one-third (31%) of sales actually came from its cannabis operations.

The company generates more money from distributing pharmaceuticals overseas (34%) than it does from what it’s most known for: cannabis. And even its alcohol business now accounts for 28% of revenue, with wellness being its smallest segment, contributing 7% of total sales.

In the future, the company could become even more of an alcohol business than it is now. Tilray completed its acquisition of Atwater Brewery in September, a brand that it acquired from Molson Coors. It has more than a dozen beverage brands in its portfolio, including SweetWater Brewing and Breckenridge Brewery, which investors may be most familiar with. And it wouldn’t be surprising for the company to continue to go deeper into alcohol because that may be its best growth opportunity in the years ahead.

The strategy of waiting for the U.S. to legalize marijuana isn’t paying off for Canadian cannabis companies. And the recent election results in the U.S. may only exacerbate the need for the company to become even less dependent on cannabis in the future.

G. WILLI-FOOD INTERNATIONAL REPORTS THE RESULTS OF THIRD QUARTER 2024

YAVNE, Israel, Nov. 20, 2024 /PRNewswire/ — G. Willi-Food International Ltd. WILC (the “Company” or “Willi-Food“), a global company that specializes in the development, marketing and international distribution of kosher foods, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter Fiscal Year 2024

- Sales increased by 23.3% to NIS 152.8 million (US$ 41.2 million) from NIS 123.9 million (US$ 33.4 million) in the third quarter of 2023.

- Gross profit increased by 78.3% year-over-year to NIS 42.0 million (US$ 11.3 million).

- Operating profit increased by 3,401.4% year-over-year to NIS 17.6 million (US$ 4.7 million).

- Net profit increased by 323.0% year-over-year to NIS 20.8 million (US$ 5.6 million).

- Basic earnings per share of NIS 1.5 (US$ 0.4).

- Cash and securities balance of NIS 225.7 million (US$ 60.8 million) as of September 30, 2024.

Management Comment

Zwi Williger & Joseph Williger, Chairman & CEO, respectively, of Willi-Food, commented: “We are pleased to present a strong third quarter 2024 financial results which show improvements in all operational parameters compared to the third quarter of 2023 despite the difficulties caused by the war like restrictions of sailing on the Red Sea and importing from Turkey. These financial results were due to the Company successful maintenance of sufficient inventory level for supporting increasing demands for its products and its improved commercial terms with its customers and suppliers. The Company is also continuing the construction of the new logistics center which is estimated to be completed in the second half of 2025. We believe that this new logistic center will help us in achieving our goals for the future by improving logistics and operational capabilities and supporting increasing product imports and sales.

Third Quarter Fiscal 2024 Summary

Sales for the third quarter of 2024 increased by 23.3% to NIS 152.8 million (US$ 41.2 million), compared to NIS 123.9 million (US$ 33.4 million) recorded in the third quarter of 2023. Sales were increased mainly due to increases in our inventory levels and its availability for the demand of our products.

Gross profit for the second quarter of 2024 increased by 78.3% to NIS 42.0 million (US$ 11.3 million), or 27.5% of revenues, compared to NIS 23.5 million (US$ 6.3 million), or 19.0% of revenues in the third quarter of 2023. The increases in gross profit and gross margins were due to the Company’s efforts to improve its commercial terms with its customers and suppliers and focusing on selling a more profitable products portfolio.

Selling expenses for the third quarter of 2024 were NIS 17.7 million (US$ 4.8 million), remaining at the same level compared to third quarter of 2023 despite the increase in sales. Distribution expenses increased due to the increase in sales, but this increase was offset by a decrease in advertising expenses compared to third quarter last year.

General and administrative expenses for the third quarter of 2024 increased by 14.2% to NIS 6.7 million (US$ 1.8 million), compared to NIS 5.9 million (US 1.6 million) in the third quarter of 2023. The increase was mainly due to the provision for compensation based on profit for senior management due to the increase in operating profit.

Operating profit for the third quarter of 2024 increased by 3,401.4% to NIS 17.6 million (US$ 4.7 million), compared to NIS 0.4 million (US$ 0.1 million) in the third quarter of 2023. The increase was primarily due to the increase in gross profit.

Financial income, net for the third quarter of 2024 totaled NIS 9.1 million (US$ 2.5 million), compared to NIS 5.7 million (US$ 1.5 million) in the third quarter of 2023. Financial income for the third quarter of 2024 was comprised mainly from revaluation of the Company’s portfolio of securities to in the amount of NIS 6.6 million (US$ 1.8 million) and from interest and dividend income from the Company’s portfolio of securities in an amount of NIS 2.4 million (US$ 0.6 million)

Willi-Food’s income before taxes for the third quarter of 2024 was NIS 26.7 million (US$ 7.2 million), compared to NIS 6.2 million (US$ 1.7 million) in the third quarter of 2023.

Willi-Food’s net profit in the third quarter of 2024 was NIS 20.8 million (US$ 5.6 million), or NIS 1.5 (US$ 0.4) per share, compared to NIS 4.9 million (US$ 1.3 million), or NIS 0.4 (US$ 0.1) per share, in the third quarter of 2023.

Willi-Food ended the third quarter of 2024 with NIS 225.7 million (US$ 60.8 million) in cash and securities. Net cash resulted from operating activities for the third quarter of 2024 was NIS 31.1 million (US$ 8.4 million).

First Nine Months Fiscal 2024 Highlights

- Sales increased by 7.7% to NIS 435.5 million (US$ 117.4 million), compared to NIS 404.5 million (US$ 109.0 million) in the first nine months of 2023.

- Gross profit increased by 36.7% year-over-year to NIS 122.5 million (US$ 33.0 million).

- Operating profit before other expenses (income) increased by 251.4% year-over-year to NIS 50.4 million (US$ 13.6 million).

- Operating profit after other expenses (income) increased by 167.9% year-over-year to NIS 38.8 million (US$ 10.5 million).

- Net profit increased by 123.8% year-over-year to NIS 46.2 million (US$ 12.5 million), or 10.6% of sales.

- Basic earnings per share of NIS 3.4 (US$ 0.9).

First Nine Months Fiscal 2024 Summary

Sales for the nine-month period ending September 30, 2024 increased by 7.7% to NIS 435.5 million (US$ 117.4 million), compared to NIS 404.5 million (US$ 109.0 million) recorded in the first nine months of 2023. The Company compensated for the decrease in sales in the first quarter of 2024 that resulted from delays in the arrival of goods as a result of the war, by increasing inventory balances and improving the availability of its products for sale to its customers in the second and third quarter.

Gross profit for the first nine months of 2024 increased by 36.7% to NIS 122.5 million (US$ 33.0 million), or 28.1% of revenues, compared to NIS 89.6 million (US$ 24.2 million), or 22.2% of revenues, in the first nine months of 2023. The increases in gross profit and gross margins were due to the increase in the Company’s sales and due to the Company’s efforts to improve its commercial terms with its customers and suppliers and focusing on selling a more profitable products portfolio.

Selling expenses for the first nine months of 2024 decreased by 5.8% to NIS 52.8 million (US$ 14.2 million), compared to NIS 56.0 million (US$ 15.1 million) in the first nine months of 2023. The decrease was mainly due to reduce in advertising.

General and administrative expenses for the first nine months of 2024 were NIS 19.4 million (US$ 5.2 million), remaining at the same level as in the third quarter of 2023.

Operating profit before other expenses (income) for the first nine months of 2024 increased by 251.4% to NIS 50.4 million (US$ 13.6 million), compared to NIS 14.3 million (US$ 3.9 million) in the first nine months of 2023. The increase was primarily due to the increase in gross profit.

Other expenses for the first nine months of 2024 were NIS 11.5 million (US$ 3.1 million), this was mainly due to the provision on the second quarter of 2024 made in the amount of approximately 11.6 million (US$ 3.1 million) in respect of the agreement reached by the Company with the Israel Competition Authority for the payment of an administrative fine as disclosed in the Company’s Report on Form 6-K submitted to the Securities and Exchange Commission on July 17, 2024.

Operating profit after other expenses (income) for the first nine months of 2024 increased by 167.9% to NIS 38.8 million (US$ 10.5 million), compared to NIS 14.5 million (US$ 3.9 million) in the first nine months of 2023. This increase was primarily due to the increase in gross profit and reduction in operating expenses compared to sales offset by the administrative fine of NIS 11.7 million (US$ 3.1 million).

Financial income, net for the first nine months of 2024 totaled NIS 23.2 million (US$ 6.3 million), compared to NIS 11.6 million (US$ 1.6 million) in the first nine months of 2023. Financial income, net for the first nine months of 2024 was comprised mainly from revaluation of the Company’s portfolio of securities to in the amount of NIS 13.4 million (US$ 3.6 million) and from interest and dividend income from the Company’s portfolio of securities in an amount of NIS 10.3 million (US$ 2.8 million).

Willi-Food’s income before taxes for the first nine months of 2024 was NIS 62.1 million (US$ 16.7 million), compared to NIS 26.1 million (US$ 7.0 million) in the first nine months of 2023.

Willi-Food’s net profit in the first nine months of 2024 was NIS 46.2 million (US$ 12.5 million), or NIS 3.3 (US$ 0.9) per share, compared to NIS 20.6 million (US$ 5.6 million), or NIS 1.5 (US$ 0.4) per share, recorded in the first nine months of 2023.

NOTE A: NIS to US$ exchange rate used for convenience only

Convenience translation of New Israeli Shekels (NIS) into U.S. dollars was made at the rate of exchange prevailing on September 30, 2024, with U.S. $1.00 equal to NIS 3.71. The translation is made solely for the convenience of the reader.

NOTE B: IFRS

The Company’s consolidated financial results for the three-month period ended September 30, 2024 are presented in accordance with International Financial Reporting Standards (“IFRS”).

ABOUT G. WILLI-FOOD INTERNATIONAL LTD.

G. Willi-Food International Ltd. (http://www.willi-food.com) is an Israeli-based company specializing in high-quality, great-tasting kosher food products. Willi-Food is engaged directly and through its subsidiaries in the design, import, marketing and distribution of over 650 food products worldwide. As one of Israel’s leading food importers, Willi-Food markets and sells its food products to over 1,500 customers and 3,000 selling points in Israel and around the world, including large retail and private supermarket chains, wholesalers and institutional consumers. The Company’s operating divisions include Willi-Food in Israel and Euro European Dairies, a wholly owned subsidiary that designs, develops and distributes branded kosher, dairy-food products.

FORWARD LOOKING STATEMENT

This press release contains forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995 relating to future events or our future performance, such as statements regarding trends, demand for our products, expected sales, operating results, and earnings. Forward-looking statements include statements regarding the commercial terms with customers and suppliers and timing of construction of the Company’s new logistics center and its expected benefits. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied in those forward-looking statements. These risks and other factors include but are not limited to: the inability to improve commercial terms with customers and suppliers: delays in the construction of the Company’s new logistics center and the risk that its expected benefits will not be materialized, monetary risks including changes in marketable securities or changes in currency exchange rates- especially the NIS/U.S. Dollar exchange rate, payment default by any of our major clients, the loss of one of more of our key personnel, changes in laws and regulations, including those relating to the food distribution industry, and inability to meet and maintain regulatory qualifications and approvals for our products, termination of arrangements with our suppliers, loss of one or more of our principal clients, increase or decrease in global purchase prices of food products, increasing levels of competition in Israel and other markets in which we do business, changes in political, economic and military conditions in Israel, particularly the recent war in Israel. Economic conditions in the Company’s core markets, delays and price increases due to the attacks on global shipping routes in the Red Sea, our inability to accurately predict consumption of our products and changes in consumer preferences, our inability to protect our intellectual property rights, our inability to successfully integrate our recent acquisitions, insurance coverage not sufficient enough to cover losses of product liability claims, risks associated with product liability claims and risks associated with the start of credit extension activity. We cannot guarantee future results, levels of activity, performance or achievements. The matters discussed in this press release also involve risks and uncertainties summarized under the heading “Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 21, 2024. These factors are updated from time to time through the filing of reports and registration statements with the Securities and Exchange Commission. We do not assume any obligation to update the forward-looking information contained in this press release.

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||

|

(unaudited) |

||||||

|

September 30, |

December 31 |

September 30, |

December 31 |

|||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

ASSETS |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

111,262 |

121,231 |

137,466 |

29,990 |

32,677 |

37,053 |

|

Financial assets carried at fair value through profit or loss |

114,437 |

99,895 |

102,163 |

30,846 |

26,926 |

27,537 |

|

Trade receivables |

178,047 |

155,857 |

160,379 |

47,990 |

42,010 |

43,229 |

|

Other receivables and prepaid expenses |

9,543 |

8,433 |

10,164 |

2,572 |

2,273 |

2,739 |

|

Inventories |

97,796 |

75,807 |

62,475 |

26,360 |

20,433 |

16,840 |

|

Current tax assets |

5,385 |

9,556 |

9,497 |

1,451 |

2,576 |

2,560 |

|

Total current assets |

516,470 |

470,779 |

482,144 |

139,209 |

126,895 |

129,958 |

|

Non-current assets |

||||||

|

Property, plant and equipment |

154,438 |

115,789 |

122,222 |

41,627 |

31,210 |

32,944 |

|

Less – Accumulated depreciation |

58,035 |

54,750 |

55,636 |

15,642 |

14,757 |

14,996 |

|

96,403 |

61,039 |

66,586 |

25,985 |

16,453 |

17,948 |

|

|

Right of use asset |

4,504 |

2,729 |

2,124 |

1,214 |

736 |

573 |

|

Financial assets carried at fair value through profit or loss |

45,851 |

44,505 |

46,143 |

12,359 |

11,996 |

12,437 |

|

Goodwill |

36 |

36 |

36 |

10 |

10 |

10 |

|

Total non-current assets |

146,794 |

108,309 |

114,889 |

39,568 |

29,195 |

30,968 |

|

663,264 |

579,088 |

597,033 |

178,777 |

156,090 |

160,926 |

|

|

EQUITY AND LIABILITIES |

||||||

|

Current liabilities |

||||||

|

Current maturities of lease liabilities |

2,112 |

1,847 |

1,512 |

569 |

498 |

408 |

|

Trade payables |

30,968 |

16,873 |

21,622 |

8,347 |

4,548 |

5,828 |

|

Employees Benefits |

4,264 |

4,132 |

4,193 |

1,149 |

1,114 |

1,130 |

|

Other payables and accrued expenses |

25,932 |

8,342 |

10,854 |

6,990 |

2,249 |

2,926 |

|

Total current liabilities |

63,276 |

31,194 |

38,181 |

17,055 |

8,409 |

10,292 |

|

Non-current liabilities |

||||||

|

Lease liabilities |

2,684 |

1,079 |

694 |

723 |

291 |

187 |

|

Deferred taxes |

7,455 |

4,742 |

4,868 |

2,009 |

1,278 |

1,312 |

|

Retirement benefit obligation |

1,055 |

1,030 |

1,055 |

284 |

278 |

284 |

|

Total non-current liabilities |

11,194 |

6,851 |

6,617 |

3,016 |

1,847 |

1,783 |

|

Shareholders’ equity |

||||||

|

Share capital |

1,490 |

1,490 |

1,490 |

402 |

402 |

402 |

|

Additional paid in capital |

172,981 |

172,477 |

172,589 |

46,626 |

46,490 |

46,520 |

|

Remeasurement of the net liability in respect of defined benefit |

(154) |

(195) |

(154) |

(42) |

(53) |

(42) |

|

Capital fund |

247 |

247 |

247 |

67 |

67 |

67 |

|

Retained earnings |

414,858 |

367,652 |

378,691 |

111,822 |

99,097 |

102,073 |

|

Treasury shares |

(628) |

(628) |

(628) |

(169) |

(169) |

(169) |

|

Equity attributable to owners of the Company |

588,794 |

541,043 |

552,235 |

158,706 |

145,834 |

148,851 |

|

663,264 |

579,088 |

597,033 |

178,777 |

156,090 |

160,926 |

|

|

(*) Convenience translation into U.S. dollars. |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||

|

(unaudited) |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

In thousands (except per share and share data) |

||||||

|

Sales |

435,493 |

404,521 |

152,799 |

123,921 |

117,384 |

109,035 |

|

Cost of sales |

312,956 |

314,895 |

110,837 |

100,387 |

84,355 |

84,877 |

|

Gross profit |

122,537 |

89,626 |

41,962 |

23,534 |

33,029 |

24,158 |

|

Operating costs and expenses: |

||||||

|

Selling expenses |

52,758 |

55,982 |

17,707 |

17,282 |

14,220 |

15,089 |

|

General and administrative expenses |

19,410 |

19,311 |

6,725 |

5,890 |

5,232 |

5,205 |

|

Operating profit before other expenses (income) |

50,369 |

14,333 |

17,530 |

362 |

13,577 |

3,864 |

|

Other expenses (income) |

11,522 |

(165) |

(47) |

(140) |

3,106 |

(44) |

|

Operating profit after other expenses (income) |

38,847 |

14,498 |

17,577 |

502 |

10,471 |

3,908 |

|

Financial income |

24,568 |

12,142 |

9,416 |

5,923 |

6,622 |

3,273 |

|

Financial expense |

1,345 |

550 |

314 |

181 |

363 |

148 |

|

Total financial income |

23,223 |

11,592 |

9,102 |

5,742 |

6,259 |

3,125 |

|

Income before taxes on income |

62,070 |

26,090 |

26,679 |

6,244 |

16,730 |

7,033 |

|

Taxes on income |

15,919 |

5,471 |

5,929 |

1,339 |

4,291 |

1,475 |

|

Profit for the period |

46,151 |

20,619 |

20,750 |

4,905 |

12,439 |

5,558 |

|

Earnings per share: |

||||||

|

Basic earnings per share |

3.33 |

1.49 |

1.50 |

0.35 |

0.90 |

0.40 |

|

Diluted earnings per share |

3.33 |

1.49 |

1.50 |

0.35 |

0.90 |

0.40 |

|

Shares used in computation of basic EPS |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

Shares used in computation of diluted EPS |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

Actual number of shares |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

(*) Convenience translation into U.S. dollars. |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

(unaudited) |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

CASH FLOWS – OPERATING ACTIVITIES |

||||||

|

Profit from continuing operations |

46,151 |

20,619 |

20,750 |

4,905 |

12,439 |

5,558 |

|

Adjustments to reconcile net profit to net cash used to continuing operating |

(30,029) |

(12,225) |

10,323 |

19,817 |

(8,095) |

(3,295) |

|

Net cash from continuing operating activities |

16,122 |

8,394 |

31,073 |

24,722 |

4,344 |

2,263 |

|

CASH FLOWS – INVESTING ACTIVITIES |

||||||

|

Acquisition of property plant and equipment |

(4,278) |

(4,230) (**) |

(804) |

(1,891)(**) |

(1,152) |

(1,140) |

|

Acquisition of property plant and equipment under construction |

(29,399) |

(12,318)(**) |

(11,137) |

(5,681)(**) |

(7,923) |

(3,320) |

|

Proceeds from sale of property plant and Equipment |

143 |

– |

27 |

– |

39 |

– |

|

Proceeds from sale of marketable securities, net |

1,074 |

19,772 |

(3,138) |

3,739 |

289 |

5,329 |

|

Net cash used in (from) continuing investing activities |

(32,460) |

3,224 |

(15,052) |

(3,833) |

(8,747) |

869 |

|

CASH FLOWS – FINANCING ACTIVITIES |

||||||

|

Lease liability payments |

(1,513) |

(1,681) |

(426) |

(727) |

(408) |

(453) |

|

Dividend |

(9,982) |

(39,946) |

– |

(9,997) |

(2,691) |

(10,767) |

|

Net cash used in continuing financing activities |

(11,495) |

(41,627) |

(426) |

(10,724) |

(3,099) |

(11,220) |

|

Increase (decrease) in cash and cash equivalents |

(27,833) |

(30,009) |

15,595 |

10,165 |

(7,502) |

(8,088) |

|

Cash and cash equivalents at the beginning of the financial period |

137,466 |

150,607 |

94,972 |

110,916 |

37,053 |

40,595 |

|

Exchange gains on cash and cash equivalents |

1,629 |

633 |

695 |

150 |

439 |

170 |

|

Cash and cash equivalents of the end of the financial year |

111,262 |

121,231 |

111,262 |

121,231 |

29,990 |

32,677 |

|

(*) Convenience Translation into U.S. Dollars. (**) Reclassified |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

APPENDIX A TO CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

(unaudited) |

||||||

|

CASH FLOWS – OPERATING ACTIVITIES: |

||||||

|

A. Adjustments to reconcile net profit to net cash from operating activities: |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

Decrease in deferred income taxes |

2,587 |

544 |

1,374 |

397 |

697 |

147 |

|

Unrealized losses (gains) on marketable securities |

(13,058) |

(3,297) |

(6,237) |

(2,744) |

(3,519) |

(889) |

|

Depreciation and amortization |

5,583 |

5,008 |

2,939 |

1,672 |

1,505 |

1,350 |

|

Stock based compensation reserve |

392 |

926 |

101 |

236 |

106 |

250 |

|

Capital gain on disposal of property plant and equipment |

(143) |

(25) |

(143) |

– |

(38) |

(7) |

|

Exchange gains on cash and cash equivalents |

(1,629) |

(633) |

(695) |

(150) |

(439) |

(170) |

|

Changes in assets and liabilities: |

||||||

|

Increase (decrease) in trade receivables and other receivables |

(1,764) |

10,882 |

(425) |

5,487 |

(477) |

2,933 |

|

Decrease (increase) in inventories |

(35,321) |

(3,878) |

24,112 |

22,495 |

(9,521) |

(1,045) |

|

Increase (decrease) in trade and other payables, and other current liabilities |

24,495 |

(10,935) |

(6,093) |

(5,176) |

6,602 |

(2,948) |

|

Cash generated from operations |

(18,858) |

(1,408) |

14,933 |

22,217 |

(5,084) |

(379) |

|

Income tax paid |

(11,171) |

(10,817) |

(4,610) |

(2,400) |

(3,011) |

(2,916) |

|

Net cash flows from (used in) operating activities |

(30,029) |

(12,225) |

10,323 |

19,817 |

(8,095) |

(3,295) |

|

(*) Convenience Translation into U.S. Dollars. (**) Reclassified |

||||||

This information is intended to be reviewed in conjunction with the Company’s filings with the Securities and Exchange Commission.

Company Contact:

G. Willi – Food International Ltd.

Yitschak Barabi, Chief Financial Officer

(+972) 8-932-1000

itsik.b@willi-food.co.il

Logo – https://stockburger.news/wp-content/uploads/2024/11/G_Willi_Food_International_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/g-willi-food-international-reports-the-results-of-third-quarter-2024-302311500.html

View original content:https://www.prnewswire.com/news-releases/g-willi-food-international-reports-the-results-of-third-quarter-2024-302311500.html

SOURCE G. Willi-Food International Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Investor David Einhorn Calls It 'Most Expensive Market Of All Time' As S&P 500 Gains 4% Since Trump's Win: 'Really, Really Pricey'

David Einhorn, founder of Greenlight Capital and billionaire investor, voiced his apprehensions about the elevated valuations in the stock market during CNBC’s Delivering Alpha conference last week.

What Happened: Einhorn pointed out that while long-term investors might not incur losses, the current high valuations indicate potentially lower returns in the future, Business Insider reported on Wednesday.

Einhorn characterized the market as “really, really, really pricey,” but clarified that this does not make him bearish. He highlighted that asset prices can remain mispriced for long durations. The Shiller cyclically adjusted price-to-earnings ratio is currently at 38 times earnings, marking one of the highest levels in a century, which Einhorn labeled as “the most expensive market of all time.”

According to Bank of America, these valuations suggest 1-2% annualized returns for the S&P 500 over the next decade, excluding dividends. Other experts, such as Goldman Sachs‘ David Kostin and Research Affiliates‘ Rob Arnott, have expressed similar concerns.

Why It Matters: The victory of President-elect Donald Trump accompanied by stronger-than-expected economic data drove the S&P 500 Index higher. The index, which fell by 2.3% last week at 5,870.62 is still higher than its pre-election levels of 5,712.69 points as of Tuesday, Nov. 3 close.

According to Rob Arnott, the founder and chairman of Research Affiliates, the current stock market environment is reminiscent of the dot-com bubble peak. Arnott predicts a significant pullback in the near future. “This looks and feels like the year 2000 to me,” Arnott said.

“Are we likely to see a bear market in the next two years for large-cap growth? Yeah.”

Meanwhile, in premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500 Index, rose 0.13% to $591.05 and the Invesco QQQ ETF QQQ, which tracks the Nasdaq 100 Index, gained 0.10% to $503.96, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

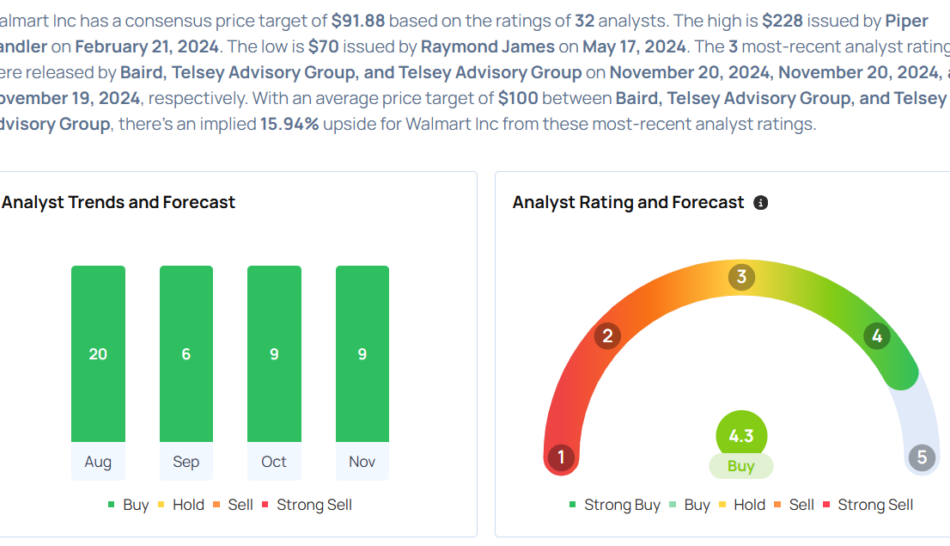

These Analysts Increase Their Forecasts On Walmart After Strong Earnings

Walmart Inc WMT announced upbeat third-quarter results and raised its fiscal-2025 guidance on Tuesday.

The retailer reported adjusted EPS of 58 cents, beating the consensus of 53 cents. Sales were $169.59 billion, up 5.5% year over year or 6.2% (at constant currency), beating the consensus of $167.72 billion.

Doug McMillon, President and CEO, said, “In the U.S., in-store volumes grew, pickup from store grew faster, and delivery from store grew even faster than that. Our teams are executing and delighting our customers and members with the value and convenience they expect from Walmart.”

For FY25, the big box retailer raised its adjusted EPS outlook to $2.42 – $2.47 (from $2.35 – $2.43), vs. the consensus of $2.45. Walmart boosted FY25 net sales (at constant currency) growth guidance to 4.8% – 5.1% from 3.75% – 4.75% earlier.

Walmart shares gained 3% to close at $86.60 on Tuesday.

These analysts made changes to their price targets on Walmart following earnings announcement.

Considering buying WMT stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LuxUrban Hotels Inc. Signs A Non-Binding Letter of Intent for Proposed Joint Venture with Lockwood Development Partners LLC and The Bright Hospitality Management to Elevate Hotel Operations and Guest Experience

-Strategic initiative would provide LuxUrban with a $7 million initial capital infusion, offering the opportunity to broaden its market impact representing a key milestone in building Lux 2.0

-Joint venture would leverage advanced technology integration to streamline operations, elevate service offerings, and deliver an enhanced guest experience

MIAMI, Nov. 20, 2024 (GLOBE NEWSWIRE) — LuxUrban Hotels Inc. LUXH, a hospitality company that leases entire hotels on a long-term basis, manages these hotels, and rents out rooms to guests in the properties it leases, today announced the signing of a Non-Binding Letter of Intent (LOI) with Lockwood Development Partners LLC and The Bright Hospitality Management, LLC proposing to establish a joint venture (“JV”) focused on hotel services and operations.

The joint venture would initially focus on two LuxUrban properties in New York City, with the parties to consider expansion of the relationship to include additional LuxUrban hotels based on the success of the initiative. The collaboration would leverage Lockwood’s established presence in hotel development and Bright’s innovative hospitality technology to create a unique guest experience and optimize operational efficiencies.

Key Highlights of the Joint Venture:

Initial Capital Investment: Lockwood would initially invest approximately $7 million to address obligations and enhance facilities in the initial two JV hotels, with potential additional investments reaching up to $35 million if all existing LuxUrban hotels are later added to the JV structure.

Property Enhancements: The JV will focus on rejuvenating the initial two JV properties, incorporating advanced technologies and amenities designed to improve operational performance and guest satisfaction.

Technology-Driven Guest Experience: The JV would leverage Bright’s platform, which features AI-driven management tools, to enhance guest satisfaction and streamline hotel operations.

Brand Integration: The JV would introduce Lockwood’s Vitality brand to the New York City market, enhancing customer engagement through a loyalty program and cohesive branding strategy.

Scalable Growth: The Non-Binding Letter of Intent contemplates that the definitive agreements will outline a pathway for expanding the JV to include additional LuxUrban properties, contingent upon achieving initial success and obtaining necessary consents and approvals, including the approval of the stockholders and noteholders of LuxUrban and the landlords for any additional properties.

Robert Arigo, CEO of LuxUrban Hotels, expressed, “We are excited about the opportunity to partner with Lockwood and Bright in this innovative joint venture. This collaboration would represent a significant step forward in enhancing our operational model and offering our guests a premier hospitality experience. By integrating our resources and leveraging new technologies, we would aim to set a new standard for quality service in the industry. Aligning with experienced partners, the JV would open up the potential to expand our footprint and bring value to additional properties, creating a strong foundation for future growth as we continue our Lux 2.0 efforts.”

The initial pilot JV will require approval of the landlords for the two hotels, approval of certain of LuxUrban’s debt holders (which has been obtained), and the negotiation and execution by the parties of definitive agreements governing the JV. While the companies will work closely together to secure all consents and approvals and finalize the definitive agreements, there can be no certainty that these will be obtained and executed. There are numerous risks and factors that could result in the terms of the JV being modified or not being consummated or commercially launched at all. The Company will disclose final terms of the definitive agreements if and when same are executed.

Charles Everhardt, President of Lockwood Development Partners, added, “Lockwood is dedicated to expanding its hotel portfolio in partnership with Rob Arigo and LuxUrban Hotels. Our mission centers on leveraging cutting-edge hospitality technology while operating at the highest levels of efficiency. We deeply respect our union hotel employees and are committed to treating them with the highest regard. With New York City’s hotel market on the upswing, we’re thrilled to play a part in delivering a top-notch experience that NYC truly deserves.”

LuxUrban Hotels Inc. continues to seek strategic opportunities that align with its mission of excellence in hospitality and innovative asset management, and looks forward to sharing further updates as the partnership progresses.

LuxUrban Hotels Inc.

LuxUrban Hotels Inc. secures long-term operating rights for entire hotels through Master Lease Agreements (MLA) and rents out, on a short-term basis, hotel rooms to business and vacation travelers. The Company is strategically building a portfolio of hotel properties in destination cities by capitalizing on the dislocation in commercial real estate markets and the large amount of debt maturity obligations on those assets coming due with a lack of available options for owners of those assets. LuxUrban’s MLA allows owners to hold onto their assets and retain their equity value while LuxUrban operates and owns the cash flows of the operating business for the life of the MLA.

Lockwood Development Partners

Lockwood Development Partners brings decades of expertise in real estate, development, and finance, with a history of successfully transforming distressed assets and pursuing large-scale developments. Its portfolio includes a range of hospitality properties and strategic ventures, including partnerships with major brands and cutting-edge technological innovations in the hotel industry.

The Bright Hospitality Management

Bright Hospitality Management delivers enterprise solutions to leading hotels worldwide, leveraging innovative technology and best-in-class services to optimize revenue, enhance profitability, and elevate the guest experience. With decades of industry expertise, Bright Hospitality offers customized solutions tailored to the unique challenges of each property and employs intelligent systems to streamline operations, reduce costs, and improve guest satisfaction.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). The statements contained in this release that are not purely historical are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Generally, the words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this release may include, for example, statements with respect to the Company’s ability to successfully finalize definitive documentation relating to the JV, ability to timely obtain all necessary consents to the JV, its ability to successfully launch the JV, the economic benefits to the Company with respect to the JV, both in its pilot form and any expanded form, its ability to improve its working capital and cash flow profiles, enhance its balance sheet and deliver organic revenue growth, scheduled property openings, expected closing of noted lease transactions, the Company’s ability to continue closing on additional leases for properties in the Company’s pipeline, as well the Company’s anticipated ability to commercialize efficiently and profitably the properties it leases and will lease in the future. The forward-looking statements contained in this release are based on current expectations and belief concerning future developments and their potential effect on the Company. There can be no assurance the JV will be consummated as currently planned or at all or that other future developments will be those that have been anticipated. These forward-looking statements are subject to a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results of performance to be materially different from those expressed or implied by these forward-looking statements, including those set forth under the caption “Risk Factors” in our public filings with the SEC, including in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 15, 2024, and any updates to those factors as set forth in subsequent Quarterly Reports on Form 10-Q or other public filings with the SEC, the base prospectus comprising part of the Registration Statement and when filed, the prospectus supplement filed with respect thereto. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

For more information, contact:

Investor Relations:

Jeff Ramson, PCG Advisory

Email: Jramson@pcgadvisory.com

Corporate:

Robert Arigo, CEO

Email: rob@luxurbanhotels.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.