Unpacking the Latest Options Trading Trends in Viking Therapeutics

Financial giants have made a conspicuous bearish move on Viking Therapeutics. Our analysis of options history for Viking Therapeutics VKTX revealed 34 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $146,300, and 29 were calls, valued at $2,404,204.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $105.0 for Viking Therapeutics over the last 3 months.

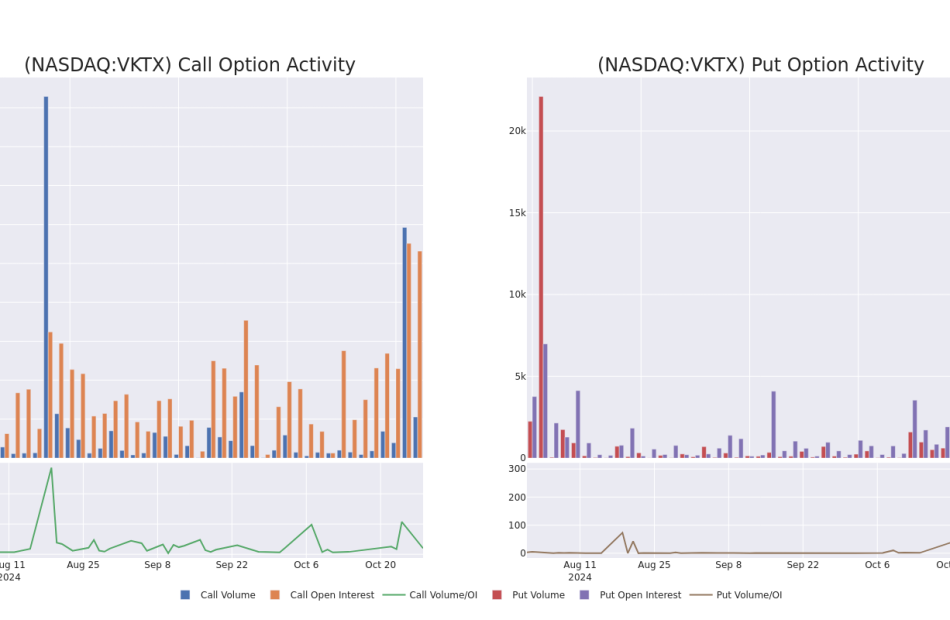

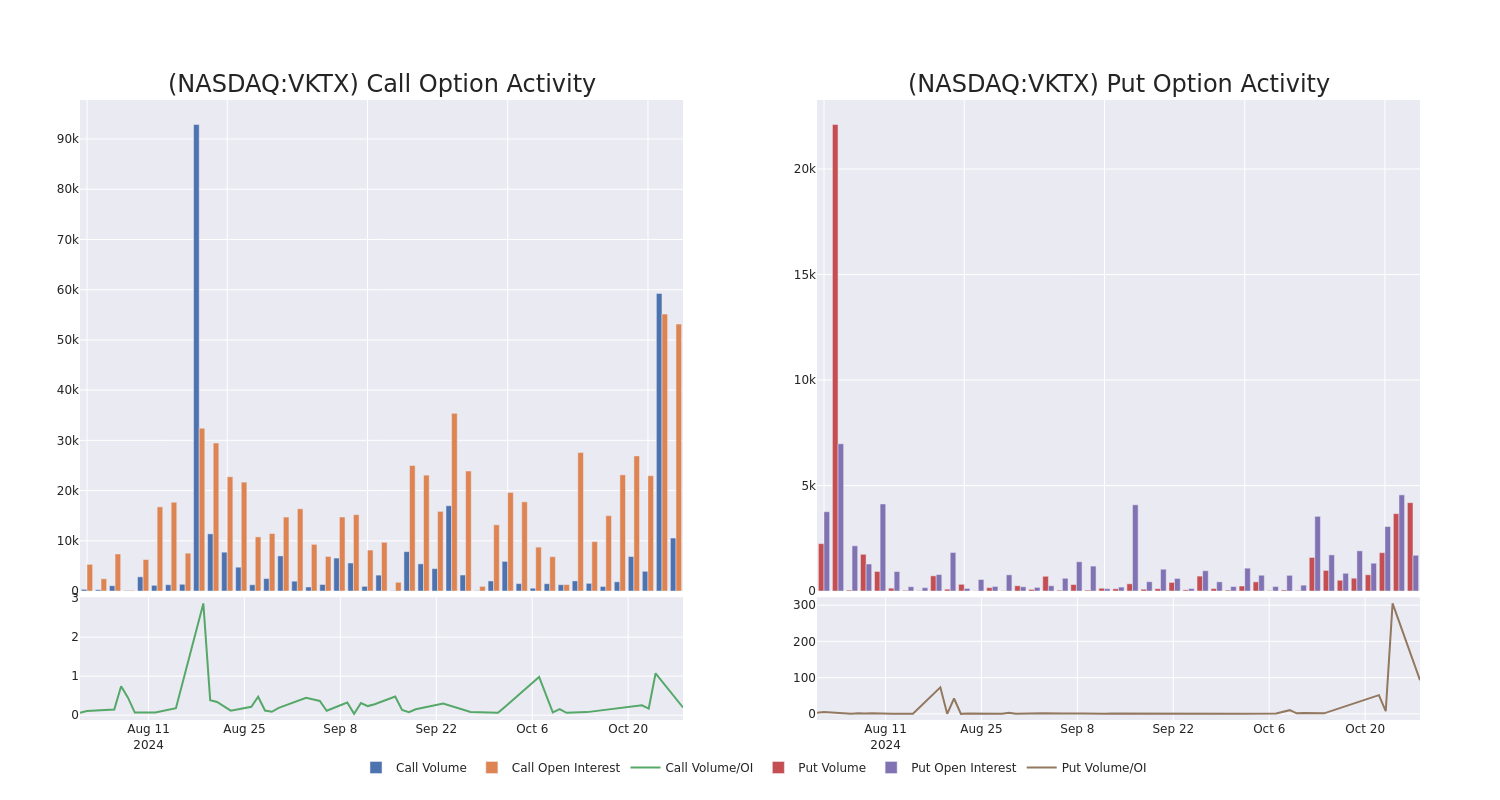

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Viking Therapeutics’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Viking Therapeutics’s whale trades within a strike price range from $15.0 to $105.0 in the last 30 days.

Viking Therapeutics 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BULLISH | 12/20/24 | $9.0 | $8.6 | $8.9 | $75.00 | $213.6K | 745 | 252 |

| VKTX | CALL | SWEEP | BULLISH | 01/16/26 | $62.9 | $59.0 | $61.34 | $15.00 | $191.7K | 154 | 31 |

| VKTX | CALL | TRADE | NEUTRAL | 12/20/24 | $8.1 | $7.5 | $7.8 | $77.50 | $187.2K | 14 | 493 |

| VKTX | CALL | SWEEP | BULLISH | 01/17/25 | $25.5 | $25.3 | $25.5 | $50.00 | $127.5K | 863 | 360 |

| VKTX | CALL | TRADE | BEARISH | 01/17/25 | $25.5 | $25.4 | $25.4 | $50.00 | $127.0K | 863 | 310 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company’s clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Following our analysis of the options activities associated with Viking Therapeutics, we pivot to a closer look at the company’s own performance.

Present Market Standing of Viking Therapeutics

- Currently trading with a volume of 2,977,355, the VKTX’s price is down by -1.41%, now at $73.47.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 99 days.

Professional Analyst Ratings for Viking Therapeutics

In the last month, 2 experts released ratings on this stock with an average target price of $90.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $90.

* Reflecting concerns, an analyst from HC Wainwright & Co. lowers its rating to Buy with a new price target of $90.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Viking Therapeutics with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How Much You Would Have Made Owning Tyler Technologies Stock In The Last 15 Years

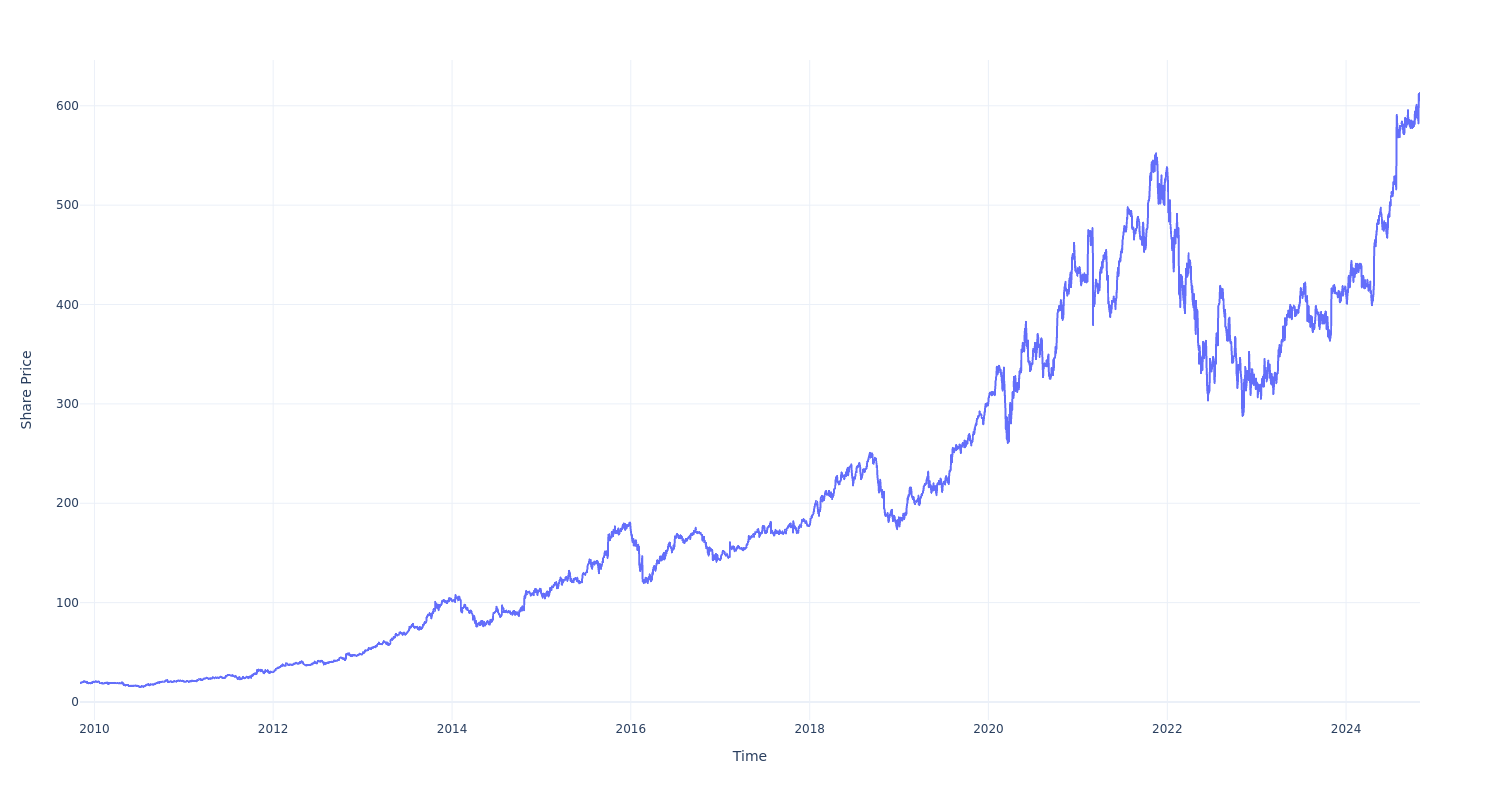

Tyler Technologies TYL has outperformed the market over the past 15 years by 14.0% on an annualized basis producing an average annual return of 26.09%. Currently, Tyler Technologies has a market capitalization of $25.70 billion.

Buying $100 In TYL: If an investor had bought $100 of TYL stock 15 years ago, it would be worth $3,225.53 today based on a price of $600.59 for TYL at the time of writing.

Tyler Technologies’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

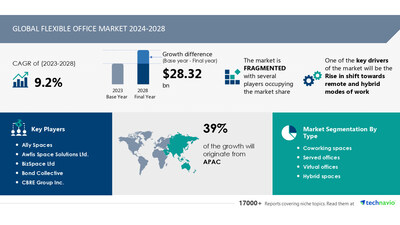

Flexible Office Market to grow by USD 28.32 Billion from 2024-2028, driven by the shift to remote and hybrid work and AI-powered market transformation – Technavio

NEW YORK, Oct. 28, 2024 /PRNewswire/ — Report with the AI impact on market trends – The global flexible office market size is estimated to grow by USD 28.32 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 9.2% during the forecast period. Rise in shift towards remote and hybrid modes of work is driving market growth, with a trend towards rise in demand from tier two cities. However, data security concerns in flexible office spaces poses a challenge.Key market players include Ally Spaces, Awfis Space Solutions Ltd., BizSpace Ltd, Bond Collective, CBRE Group Inc., Hub Australia Pty Ltd, Incuspaze Solutions Pvt Ltd., Industrious, International Workplace Group plc, Mindspace Ltd, Premier Office Centers, LLC, Serendipity Labs, Servcorp Ltd., Techspace Group Ltd., The Office Group, Tusker Workspace Pvt. Ltd, United Franchise Group, Vast Coworking Group, WeWork Inc, WOBA, and Workbar.

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View your snapshot now

|

Forecast period |

2024-2028 |

|

Base Year |

2023 |

|

Historic Data |

2018 – 2022 |

|

Segment Covered |

Type (Coworking spaces, Served offices, Virtual offices, and Hybrid spaces), End-user (IT, BFSI, Retail and consumer, and Others), and Geography (APAC, Europe, North America, Middle East and Africa, and South America) |

|

Region Covered |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Key companies profiled |

Ally Spaces, Awfis Space Solutions Ltd., BizSpace Ltd, Bond Collective, CBRE Group Inc., Hub Australia Pty Ltd, Incuspaze Solutions Pvt Ltd., Industrious, International Workplace Group plc, Mindspace Ltd, Premier Office Centers, LLC, Serendipity Labs, Servcorp Ltd., Techspace Group Ltd., The Office Group, Tusker Workspace Pvt. Ltd, United Franchise Group, Vast Coworking Group, WeWork Inc, WOBA, and Workbar |

Key Market Trends Fueling Growth

The demand for flexible workplaces is experiencing substantial growth in tier two cities of various countries, including India and Brazil. IT companies are spearheading this trend by setting up Global Customer Care Centers (GCCs) in these cities due to cost-effectiveness. Real estate firms are responding to this demand by offering flexible office spaces. In India, as of September 2023, Ahmedabad leads with the highest demand for such spaces, followed by Chandigarh, Jaipur, Coimbatore, Kochi, and Indore. Cities like Lucknow, Thiruvananthapuram, Visakhapatnam, and Bhubaneswar have lower demand and stock. These factors are expected to fuel the expansion of the global flexible office market.

The flexible office market is witnessing significant trends in IT and Information Technology sectors. Space providers are offering advanced data security solutions to cater to ITES, Media and Entertainment, and MSMEs. IT integrations and digital solutions are becoming essential for flexible workspaces, including co-working spaces, private offices, and virtual offices. Telecommunications and infrastructure are crucial for enabling dynamic work cultures and employee productivity. Flex space solutions are gaining popularity among SMEs, with hybrid work models and remote work arrangements becoming the new normal. Real estate management companies are focusing on flexible office configurations to meet the evolving needs of businesses. Flex office providers offer hotel-style coworking spaces, shared workspace solutions, and networking opportunities. WeWork, large enterprises, and other key players are investing in creating flexible office portfolios to cater to the talent pool in the commercial real estate sector. Labor laws and rental volume are critical factors influencing leasing decisions in the office sector. Flexible office solutions are helping businesses adapt to changing work environments while ensuring compliance with labor laws. With the increasing demand for flexible office spaces, the leasing market is expected to grow significantly in the coming years.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

Market Challenges

- Flexible offices, such as coworking spaces and shared work environments, offer businesses the use of shared networks and infrastructure. However, this sharing increases the risk of cyberattacks and data breaches, as unsecured internet networks can make sensitive company data vulnerable to unauthorized access. International Workplace Group plc, a vendor in the flexible office market, addresses this concern by isolating client connections and securing data privacy. Organizations are implementing data security practices for hybrid and remote work, including the use of virtual private networks (VPNs) for encrypted data transmission. While effective, these practices require significant investment and complexity, causing some businesses to prioritize traditional office spaces over flexible options to mitigate potential security risks. This focus on security may hinder the growth of the global flexible office market during the forecast period.

- The flexible office market is witnessing significant growth, with various sectors like IT, ITES, Media and Entertainment, and SMEs embracing flexible workspaces. Challenges in this sector include data security and IT infrastructure, which are crucial for businesses, especially in the IT and ITES verticals. Space providers must offer advanced digital integrations and telecommunications to ensure a productive work environment. Labor laws and rental volume are key concerns for leasing flexible office spaces. Real estate management companies are offering flexible office solutions, including co-working, private offices, and virtual offices, to cater to dynamic work cultures and remote work arrangements. Flex office providers must adapt to hybrid work models and offer networking opportunities to attract talent pools. Large enterprises are also exploring flexible office solutions, leading to an increase in demand for hotel-style coworking spaces. WeWork and other flex office providers are offering shared workspace solutions to cater to this growing need. Infrastructure and office configurations are essential considerations for businesses looking to optimize employee productivity. The flexible office sector is transforming commercial real estate and offering businesses the flexibility they need to thrive in today’s business landscape.

Insights into how AI is reshaping industries and driving growth- Download a Sample Report

Segment Overview

This flexible office market report extensively covers market segmentation by

- Type

- 1.1 Coworking spaces

- 1.2 Served offices

- 1.3 Virtual offices

- 1.4 Hybrid spaces

- 2.1 IT

- 2.2 BFSI

- 2.3 Retail and consumer

- 2.4 Others

- 3.1 APAC

- 3.2 Europe

- 3.3 North America

- 3.4 Middle East and Africa

- 3.5 South America

1.1 Coworking spaces- The flexible office market continues to grow, with businesses increasingly preferring flexible workspace solutions due to their cost-effective and flexible nature. These workspaces offer businesses the ability to rent office space on a short-term basis, providing them with the flexibility to scale up or down as needed. This trend is driven by the changing needs of businesses, particularly startups and small to medium-sized enterprises, who value the cost savings and flexibility that flexible workspaces offer. Additionally, the convenience of fully-furnished and serviced offices, as well as the opportunity to network with other businesses, makes flexible workspaces an attractive option for many organizations.

Download complimentary Sample Report to gain insights into AI’s impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 – 2022)

Research Analysis

The flexible office market is experiencing significant growth due to the increasing adoption of hybrid work models and remote work arrangements. Flexible office solutions, including coworking spaces and flexible workspaces, are becoming increasingly popular among businesses of all sizes, from SMEs to large enterprises. These spaces offer a range of options, from private offices and virtual offices to hotel-style coworking spaces. Flex space providers offer IT, telecommunications, and digital integrations to ensure seamless business operations. The media and entertainment, IT, and telecommunications industries are major consumers of flexible office solutions. Commercial real estate companies are also entering the market, expanding their office portfolios to include flex spaces. Networking opportunities and labor laws compliance are also important considerations for businesses choosing a flex space provider. Overall, the flexible office market is transforming the traditional office sector by offering agility, flexibility, and cost savings.

Market Research Overview

The flexible office market is experiencing significant growth as businesses adopt hybrid work models and remote work arrangements become the new norm. Flexible office solutions, including coworking spaces and flexible office spaces, offer businesses and individuals the flexibility to rent office spaces on a short-term basis. These spaces come in various configurations, from hotel-style coworking spaces to private offices and virtual offices. Flexible office providers offer IT and telecommunications infrastructure, ensuring seamless digital integrations for businesses. The talent pool in these spaces is diverse, providing opportunities for networking and collaboration. Commercial real estate companies are also entering the market, offering flexible office portfolios to cater to the demands of SMEs and MSMEs. Flexible office spaces offer dynamic work cultures, promoting employee productivity and innovation. Data security and IT support are essential offerings from space providers, ensuring businesses can operate securely and efficiently. Infrastructure and rental volume are key considerations for leasing flexible office spaces, with large enterprises and ITES companies leading the way. Labor laws and regulations are also shaping the flexible office market, with many governments encouraging the adoption of flexible work arrangements. The office sector is evolving, with vertical co-working spaces, private offices, and virtual offices becoming increasingly popular. The future of the flexible office market looks bright, with continued growth expected in the coming years.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Type

- Coworking Spaces

- Served Offices

- Virtual Offices

- Hybrid Spaces

- End-user

- IT

- BFSI

- Retail And Consumer

- Others

- Geography

- APAC

- Europe

- North America

- Middle East And Africa

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/flexible-office-market-to-grow-by-usd-28-32-billion-from-2024-2028–driven-by-the-shift-to-remote-and-hybrid-work-and-ai-powered-market-transformation—technavio-302287732.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/flexible-office-market-to-grow-by-usd-28-32-billion-from-2024-2028–driven-by-the-shift-to-remote-and-hybrid-work-and-ai-powered-market-transformation—technavio-302287732.html

SOURCE Technavio

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ryerson Reports Third Quarter 2024 Results

Quarterly business highlights include operating cash flow of $134.6 million, Central Steel & Wire’s University Park, IL distribution hub and service center open house, progress on expansion and modernization of the Shelbyville, KY non-ferrous processing center, closing of the Production Metals acquisition and entry into aerospace, defense, and semiconductor metals markets, and ongoing cost-reduction work across our North America service center network

CHICAGO, Oct. 29, 2024 /PRNewswire/ — Ryerson Holding Corporation RYI, a leading value-added processor and distributor of industrial metals, today reported results for the third quarter ended September 30, 2024.

Highlights:

- Generated $1.13 billion of revenue from 485,000 tons shipped and average selling price of $2,323 per ton

- Incurred Net Loss attributable to Ryerson Holding Corporation of $6.6 million, or Diluted Loss Per Share of $0.20 and Adjusted EBITDA1, excluding LIFO of $21.0 million as counter-cyclical and seasonal bottoming continues

- Generated Operating Cash Flow of $134.6 million and Free Cash Flow of $103.4 million

- Reduced inventory by $80.8 million on a FIFO cost basis2, compared to the second quarter of 2024

- Returned $42.0 million to shareholders during the quarter, comprised of $36.0 million in share repurchases and $6.0 million in dividends

- Ended the quarter with debt of $522 million and net debt3 of $487 million as of September 30, 2024, compared to $525 million and $497 million, respectively, on June 30, 2024

- Progressing well towards $60 million of annualized cost reduction expectations from operating expenses4

- Acquired Production Metals, a value-added processor of aluminum, stainless, and specialty steel

- Hosted open house at Central Steel & Wire’s University Park, IL distribution hub and service center for customers, suppliers, vendors, investors, and employees

- Declared a fourth-quarter 2024 dividend of $0.1875 per share

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

|

$ in millions, except tons (in thousands), average selling prices, and earnings per share |

||||||||||||||||

|

Financial Highlights: |

Q3 2024 |

Q2 2024 |

Q3 2023 |

QoQ |

YoY |

9MO 2024 |

9MO 2023 |

YoY |

||||||||

|

Revenue |

$1,126.6 |

$1,225.5 |

$1,246.7 |

(8.1) % |

(9.6) % |

$3,591.3 |

$3,996.3 |

(10.1) % |

||||||||

|

Tons shipped |

485 |

508 |

478 |

(4.5) % |

1.5 % |

1,490 |

1,493 |

(0.2) % |

||||||||

|

Average selling price/ton |

$2,323 |

$2,412 |

$2,608 |

(3.7) % |

(10.9) % |

$2,410 |

$2,677 |

(10.0) % |

||||||||

|

Gross margin |

17.9 % |

18.2 % |

20.0 % |

-30 bps |

-210 bps |

17.9 % |

19.4 % |

-150 bps |

||||||||

|

Gross margin, excl. LIFO |

16.3 % |

17.4 % |

17.3 % |

-110 bps |

-100 bps |

17.2 % |

18.4 % |

-120 bps |

||||||||

|

Warehousing, delivery, selling, general, and |

$196.9 |

$199.0 |

$193.0 |

(1.1) % |

2.0 % |

$612.7 |

$589.8 |

3.9 % |

||||||||

|

As a percentage of revenue |

17.5 % |

16.2 % |

15.5 % |

130 bps |

200 bps |

17.1 % |

14.8 % |

230 bps |

||||||||

|

Net income (loss) attributable to Ryerson Holding Corporation |

$(6.6) |

$9.9 |

$35.0 |

(166.7) % |

(118.9) % |

$(4.3) |

$119.9 |

(103.6) % |

||||||||

|

Diluted earnings (loss) per share |

$(0.20) |

$0.29 |

$1.00 |

$(0.49) |

$(1.20) |

$(0.13) |

$3.34 |

$(3.47) |

||||||||

|

Adjusted diluted earnings (loss) per share |

$(0.20) |

$0.33 |

$1.00 |

$(0.53) |

$(1.20) |

$(0.05) |

$3.34 |

$(3.39) |

||||||||

|

Adj. EBITDA, excl. LIFO |

$21.0 |

$42.6 |

$45.0 |

(50.7) % |

(53.3) % |

$103.8 |

$205.2 |

(49.4) % |

||||||||

|

Adj. EBITDA, excl. LIFO margin |

1.9 % |

3.5 % |

3.6 % |

-160 bps |

-170 bps |

2.9 % |

5.1 % |

-220 bps |

||||||||

|

Balance Sheet and Cash Flow Highlights: |

||||||||||||||||

|

Total debt |

$522.1 |

$525.4 |

$365.9 |

(0.6) % |

42.7 % |

$522.1 |

$365.9 |

42.7 % |

||||||||

|

Cash and cash equivalents |

$35.0 |

$28.0 |

$37.4 |

25.0 % |

(6.4) % |

$35.0 |

$37.4 |

(6.4) % |

||||||||

|

Net debt |

$487.1 |

$497.4 |

$328.5 |

(2.1) % |

48.3 % |

$487.1 |

$328.5 |

48.3 % |

||||||||

|

Net debt / LTM Adj. EBITDA, excl. LIFO |

3.8x |

3.2x |

1.4x |

0.6x |

2.4x |

3.8x |

1.4x |

2.4x |

||||||||

|

Cash conversion cycle (days) |

79.3 |

77.6 |

78.3 |

1.7 |

1.0 |

76.5 |

77.6 |

(1.1) |

||||||||

|

Net cash provided by operating activities |

$134.6 |

$25.9 |

$79.3 |

$108.7 |

$55.3 |

$112.7 |

$275.0 |

$(162.3) |

||||||||

Management Commentary

Eddie Lehner, Ryerson’s President, Chief Executive Officer, and Director, said, “I want to thank all my Ryerson teammates for working safely while striving to create an always improving Ryerson that delivers the industry’s best customer experience safely, enjoyably, and productively. Two things can be true at the same time: 1) the industry is experiencing a cyclical bottoming marked by twenty-four months of moving average demand and price contraction; and 2) Ryerson’s record investments in systems, capital expenditures, and acquisitions over this same period are positioning the company well for the next cyclical upturn. Over the third quarter we managed the business effectively through a contractionary industrial metals and manufacturing environment that produced compressed margins, most notably in carbon steels and across the commodity spectrum with lagging OEM customer contract price resets. Despite these challenges, we experienced improvements in key performance indicators including cash flow, expense and working capital management, and most importantly, we are seeing investment related growth pains and disruptions across our network beginning to subside as we move through the balance of 2024 with budding optimism for 2025. Ryerson has emerged more efficient and better through every previous counter-cycle and, looking forward, our optimization phase will bring together a greatly modernized service center network, enhanced value-added capabilities, across a digitally enabled enterprise to provide Ryerson’s best-ever customer experience while setting the table for realization of our next stage financial targets.”

Third Quarter Results

Ryerson generated net sales of $1.13 billion in the third quarter of 2024, a decrease of 8.1%, compared to the second quarter of 2024, and within our guidance expectations. Revenue performance during the quarter was impacted by seasonal and weather impacted volume declines of 4.5%, in addition to average selling prices decreasing 3.7%.

Gross margin contracted sequentially by 30 basis points to 17.9% in the third quarter of 2024, compared to 18.2% in the second quarter of 2024. Due to further declines in inventory costs, in the third quarter of 2024, LIFO income of $18 million was greater than our guidance expectations of LIFO income of $12 million. Excluding the impact of LIFO, gross margin contracted 110 basis points to 16.3% in the third quarter of 2024, compared to 17.4% in the second quarter. Gross margins continued to be under pressure in the quarter as demand conditions saw continuing contraction and selling price declines continued to outpace the decline in our average inventory costs.

Warehousing, delivery, selling, general and administrative expenses decreased 1.1%, or $2.1 million, to $196.9 million in the third quarter of 2024, compared to $199.0 million in the second quarter of 2024. Cost reductions were noted in personnel-related expenses, operating expenses, and general administrative expenses. Decreases in expenses were partially offset by increases in start-up, pre-operating, and reorganization expenses associated with Ryerson investments in capital expenditures and acquisitions.

Net Loss Attributable to Ryerson Holding Corporation for the third quarter of 2024 was $6.6 million, or $0.20 per diluted share, compared to net income of $9.9 million, or $0.29 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO, of $21.0 million in the third quarter of 2024, compared to the second quarter of 2024 Adjusted EBITDA, excluding LIFO of $42.6 million.

Liquidity & Debt Management

Ryerson generated $134.6 million of operating cash flow in the third quarter of 2024 due to a working capital release of $129 million. The Company ended the third quarter of 2024 with $522 million of debt and $487 million of net debt, sequential decreases of $3 million and $10 million, respectively, compared to the second quarter of 2024. Ryerson’s net leverage ratio as of the third quarter of 2024 was 3.8x above the Company’s target leverage range of 0.5x – 2.0x, but still well below Ryerson’s prior 10-year average. Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, decreased to $491 million as of September 30, 2024, compared to $585 million as of June 30, 2024.

Shareholder Return Activity

Dividends. On October 29, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share of common stock, payable on December 19, 2024, to stockholders of record as of December 5, 2024, unchanged from the prior quarter. During the third quarter of 2024, Ryerson’s quarterly dividend amounted to a cash return of approximately $6.0 million.

Share Repurchases and Authorization. Ryerson repurchased 1,849,017 shares for $36.0 million in the open market during the third quarter of 2024. Ryerson made these repurchases in accordance with its share repurchase authorization. As of September 30, 2024, $38.4 million remained under the existing authorization.

Outlook Commentary

For the fourth quarter of 2024, Ryerson expects customer shipments to seasonally and counter-cyclically decrease 8% to 10%, quarter-over-quarter. The Company anticipates fourth-quarter net sales to be in the range of $1.00 billion to $1.04 billion, with average selling prices between decreasing 1% to increasing 1%. LIFO income in the fourth quarter of 2024 is expected to be $10 million. We expect adjusted EBITDA, excluding LIFO in the range of $10 million to $12 million and loss per diluted share in the range of $0.53 to $0.47.

Sales by Product Metrics

As we continue to integrate our acquisitions of the past eight quarters into our systems and processes, we have refined our methodology for allocating their net sales and tons to our major product categories. As such, in addition to the third quarter and the first nine months of 2024 product metrics provided here under the refined methodology, we are providing updated sales by product information from the first quarter of 2023 to the second quarter of 2024 to provide comparable numbers. We note that consolidated net sales, tons shipped, and average selling price per ton as previously reported are unchanged and that the updates below are only at the product level.

|

Third Quarter 2024 Major Product Metrics |

||||||||||||

|

Net Sales (millions) |

||||||||||||

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

Quarter-over- quarter |

Year-over-year |

||||||||

|

Carbon Steel |

$ |

585 |

$ |

644 |

$ |

642 |

(9.2) % |

(8.9) % |

||||

|

Aluminum |

$ |

250 |

$ |

277 |

$ |

276 |

(9.7) % |

(9.4) % |

||||

|

Stainless Steel |

$ |

276 |

$ |

286 |

$ |

308 |

(3.5) % |

(10.4) % |

||||

|

Tons Shipped (thousands) |

||||||||||||

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

Quarter-over- quarter |

Year-over-year |

||||||||

|

Carbon Steel |

382 |

397 |

371 |

(3.8) % |

3.0 % |

|||||||

|

Aluminum |

44 |

49 |

48 |

(10.2) % |

(8.3) % |

|||||||

|

Stainless Steel |

58 |

59 |

57 |

(1.7) % |

1.8 % |

|||||||

|

Average Selling Prices (per ton) |

||||||||||||

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

Quarter-over- quarter |

Year-over-year |

||||||||

|

Carbon Steel |

$ |

1,531 |

$ |

1,622 |

$ |

1,730 |

(5.6) % |

(11.5) % |

||||

|

Aluminum |

$ |

5,682 |

$ |

5,653 |

$ |

5,750 |

0.5 % |

(1.2) % |

||||

|

Stainless Steel |

$ |

4,759 |

$ |

4,847 |

$ |

5,404 |

(1.8) % |

(11.9) % |

||||

|

First Nine Months 2024 Major Product Metrics |

||||||||||

|

Net Sales (millions) |

||||||||||

|

2024 |

2023 |

Year-over-year |

||||||||

|

Carbon Steel |

$ |

1,873 |

$ |

2,007 |

(6.7) % |

|||||

|

Aluminum |

$ |

806 |

$ |

889 |

(9.3) % |

|||||

|

Stainless Steel |

$ |

859 |

$ |

1,031 |

(16.7) % |

|||||

|

Tons Shipped (thousands) |

||||||||||

|

2024 |

2023 |

Year-over-year |

||||||||

|

Carbon Steel |

1,163 |

1,156 |

0.6 % |

|||||||

|

Aluminum |

143 |

151 |

(5.3) % |

|||||||

|

Stainless Steel |

178 |

179 |

(0.6) % |

|||||||

|

Average Selling Prices (per ton) |

||||||||||

|

2024 |

2023 |

Year-over-year |

||||||||

|

Carbon Steel |

$ |

1,610 |

$ |

1,736 |

(7.2) % |

|||||

|

Aluminum |

$ |

5,636 |

$ |

5,887 |

(4.3) % |

|||||

|

Stainless Steel |

$ |

4,826 |

$ |

5,760 |

(16.2) % |

|||||

|

Restated Major Product Metrics |

|||||||||||||||||||||

|

Net Sales (millions) |

|||||||||||||||||||||

|

Q1 2023 |

Q2 2023 |

1H 2023 |

Q3 2023 |

9MO 2023 |

Q4 2023 |

2023 |

Q1 2024 |

Q2 2024 |

1H 2024 |

||||||||||||

|

Carbon Steel |

$ |

687 |

$ |

678 |

$ |

1,365 |

$ |

642 |

$ |

2,007 |

$ |

574 |

$ |

2,581 |

$ |

644 |

$ |

644 |

$ |

1,288 |

|

|

Aluminum |

$ |

313 |

$ |

300 |

$ |

613 |

$ |

276 |

$ |

889 |

$ |

244 |

$ |

1,133 |

$ |

279 |

$ |

277 |

$ |

556 |

|

|

Stainless Steel |

$ |

381 |

$ |

342 |

$ |

723 |

$ |

308 |

$ |

1,031 |

$ |

275 |

$ |

1,306 |

$ |

297 |

$ |

286 |

$ |

583 |

|

|

Tons Shipped (thousands) |

|||||||||||||||||||||

|

Q1 2023 |

Q2 2023 |

1H 2023 |

Q3 2023 |

9MO 2023 |

Q4 2023 |

2023 |

Q1 2024 |

Q2 2024 |

1H 2024 |

||||||||||||

|

Carbon Steel |

401 |

384 |

785 |

371 |

1,156 |

352 |

1,508 |

384 |

397 |

781 |

|||||||||||

|

Aluminum |

52 |

51 |

103 |

48 |

151 |

43 |

194 |

50 |

49 |

99 |

|||||||||||

|

Stainless Steel |

64 |

58 |

122 |

57 |

179 |

52 |

231 |

61 |

59 |

120 |

|||||||||||

|

Average Selling Prices (per ton) |

|||||||||||||||||||||

|

Q1 2023 |

Q2 2023 |

1H 2023 |

Q3 2023 |

9MO 2023 |

Q4 2023 |

2023 |

Q1 2024 |

Q2 2024 |

1H 2024 |

||||||||||||

|

Carbon Steel |

$ |

1,713 |

$ |

1,766 |

$ |

1,739 |

$ |

1,730 |

$ |

1,736 |

$ |

1,631 |

$ |

1,712 |

$ |

1,677 |

$ |

1,622 |

$ |

1,649 |

|

|

Aluminum |

$ |

6,019 |

$ |

5,882 |

$ |

5,951 |

$ |

5,750 |

$ |

5,887 |

$ |

5,674 |

$ |

5,840 |

$ |

5,580 |

$ |

5,653 |

$ |

5,616 |

|

|

Stainless Steel |

$ |

5,953 |

$ |

5,897 |

$ |

5,926 |

$ |

5,404 |

$ |

5,760 |

$ |

5,288 |

$ |

5,654 |

$ |

4,869 |

$ |

4,847 |

$ |

4,858 |

|

Earnings Call Information

Ryerson will host a conference call to discuss third quarter 2024 financial results for the period ended September 30, 2024, on Wednesday, October 30, 2024, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,300 employees and over 110 locations. Visit Ryerson at www.ryerson.com.

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2FIFO cost basis is inventory cost excluding LIFO

3Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

4Operating expenses are Warehousing, delivery, selling, general, and administrative expenses

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management’s expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||||||||||||||||||

|

Selected Income and Cash Flow Data – Unaudited |

||||||||||||||||||||

|

(Dollars and Shares in Millions, except Per Share and Per Ton Data) |

||||||||||||||||||||

|

2024 |

2023 |

First Nine Months Ended |

||||||||||||||||||

|

Third |

Second |

Third |

September 30, |

|||||||||||||||||

|

Quarter |

Quarter |

Quarter |

2024 |

2023 |

||||||||||||||||

|

NET SALES |

$ |

1,126.6 |

$ |

1,225.5 |

$ |

1,246.7 |

$ |

3,591.3 |

$ |

3,996.3 |

||||||||||

|

Cost of materials sold |

924.6 |

1,002.0 |

997.4 |

2,948.2 |

3,221.9 |

|||||||||||||||

|

Gross profit |

202.0 |

223.5 |

249.3 |

643.1 |

774.4 |

|||||||||||||||

|

Warehousing, delivery, selling, general, and administrative |

196.9 |

199.0 |

193.0 |

612.7 |

589.8 |

|||||||||||||||

|

Gain on insurance settlement |

(1.3) |

— |

— |

(1.3) |

— |

|||||||||||||||

|

Restructuring and other charges |

1.1 |

1.7 |

— |

2.8 |

— |

|||||||||||||||

|

OPERATING PROFIT |

5.3 |

22.8 |

56.3 |

28.9 |

184.6 |

|||||||||||||||

|

Other income and (expense), net |

(0.2) |

1.8 |

1.2 |

1.4 |

0.8 |

|||||||||||||||

|

Interest and other expense on debt |

(11.5) |

(11.3) |

(9.3) |

(32.9) |

(25.2) |

|||||||||||||||

|

INCOME (LOSS) BEFORE INCOME TAXES |

(6.4) |

13.3 |

48.2 |

(2.6) |

160.2 |

|||||||||||||||

|

Provision (benefit) for income taxes |

(0.4) |

3.0 |

12.9 |

0.5 |

39.8 |

|||||||||||||||

|

NET INCOME (LOSS) |

(6.0) |

10.3 |

35.3 |

(3.1) |

120.4 |

|||||||||||||||

|

Less: Net income attributable to noncontrolling interest |

0.6 |

0.4 |

0.3 |

1.2 |

0.5 |

|||||||||||||||

|

NET INCOME (LOSS) ATTRIBUTABLE TO RYERSON HOLDING CORPORATION |

$ |

(6.6) |

$ |

9.9 |

$ |

35.0 |

$ |

(4.3) |

$ |

119.9 |

||||||||||

|

EARNINGS (LOSS) PER SHARE |

||||||||||||||||||||

|

Basic |

$ |

(0.20) |

$ |

0.29 |

$ |

1.02 |

$ |

(0.13) |

$ |

3.40 |

||||||||||

|

Diluted |

$ |

(0.20) |

$ |

0.29 |

$ |

1.00 |

$ |

(0.13) |

$ |

3.34 |

||||||||||

|

Shares outstanding – basic |

32.7 |

34.2 |

34.3 |

33.6 |

35.2 |

|||||||||||||||

|

Shares outstanding – diluted |

32.7 |

34.4 |

34.9 |

33.6 |

35.9 |

|||||||||||||||

|

Dividends declared per share |

$ |

0.1875 |

$ |

0.1875 |

$ |

0.1825 |

$ |

0.5625 |

$ |

0.5325 |

||||||||||

|

Supplemental Data : |

||||||||||||||||||||

|

Tons shipped (000) |

485 |

508 |

478 |

1,490 |

1,493 |

|||||||||||||||

|

Shipping days |

64 |

64 |

63 |

192 |

191 |

|||||||||||||||

|

Average selling price/ton |

$ |

2,323 |

$ |

2,412 |

$ |

2,608 |

$ |

2,410 |

$ |

2,677 |

||||||||||

|

Gross profit/ton |

416 |

440 |

522 |

432 |

519 |

|||||||||||||||

|

Operating profit/ton |

11 |

45 |

118 |

19 |

124 |

|||||||||||||||

|

LIFO income per ton |

(37) |

(20) |

(70) |

(18) |

(26) |

|||||||||||||||

|

LIFO income |

(18.1) |

(10.0) |

(33.4) |

(27.1) |

(38.4) |

|||||||||||||||

|

Depreciation and amortization expense |

19.5 |

18.0 |

13.6 |

54.9 |

42.4 |

|||||||||||||||

|

Cash flow provided by operating activities |

134.6 |

25.9 |

79.3 |

112.7 |

275.0 |

|||||||||||||||

|

Capital expenditures |

(31.6) |

(22.7) |

(22.4) |

(76.1) |

(96.5) |

|||||||||||||||

|

See Schedule 1 for Condensed Consolidated Balance Sheets |

||||||||||||||||||||

|

See Schedule 2 for EBITDA and Adjusted EBITDA reconciliation |

||||||||||||||||||||

|

See Schedule 3 for Adjusted EPS reconciliation |

||||||||||||||||||||

|

See Schedule 4 for Free Cash Flow reconciliation |

||||||||||||||||||||

|

See Schedule 5 for Fourth Quarter 2024 Guidance reconciliation |

||||||||||||||||||||

|

Schedule 1 |

||||

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||

|

Condensed Consolidated Balance Sheets |

||||

|

(In millions, except shares) |

||||

|

September 30, |

December 31, |

|||

|

2024 |

2023 |

|||

|

Assets |

(unaudited) |

|||

|

Current assets: |

||||

|

Cash and cash equivalents |

$35.0 |

$54.3 |

||

|

Restricted cash |

1.8 |

1.1 |

||

|

Receivables, less provisions of $3.0 at September 30, 2024 and $1.7 at December 31, 2023 |

499.7 |

467.7 |

||

|

Inventories |

681.4 |

782.5 |

||

|

Prepaid expenses and other current assets |

83.5 |

77.8 |

||

|

Total current assets |

1,301.4 |

1,383.4 |

||

|

Property, plant, and equipment, at cost |

1,134.8 |

1,071.5 |

||

|

Less: accumulated depreciation |

499.7 |

481.9 |

||

|

Property, plant, and equipment, net |

635.1 |

589.6 |

||

|

Operating lease assets |

348.4 |

349.4 |

||

|

Other intangible assets |

71.0 |

73.7 |

||

|

Goodwill |

160.2 |

157.8 |

||

|

Deferred charges and other assets |

17.2 |

15.7 |

||

|

Total assets |

$2,533.3 |

$2,569.6 |

||

|

Liabilities |

||||

|

Current liabilities: |

||||

|

Accounts payable |

$443.9 |

$463.4 |

||

|

Salaries, wages, and commissions |

35.7 |

51.9 |

||

|

Other accrued liabilities |

68.0 |

75.9 |

||

|

Short-term debt |

1.8 |

8.2 |

||

|

Current portion of operating lease liabilities |

31.7 |

30.5 |

||

|

Current portion of deferred employee benefits |

4.0 |

4.0 |

||

|

Total current liabilities |

585.1 |

633.9 |

||

|

Long-term debt |

520.3 |

428.3 |

||

|

Deferred employee benefits |

97.4 |

106.7 |

||

|

Noncurrent operating lease liabilities |

338.0 |

336.8 |

||

|

Deferred income taxes |

135.8 |

135.5 |

||

|

Other noncurrent liabilities |

14.7 |

13.9 |

||

|

Total liabilities |

1,691.3 |

1,655.1 |

||

|

Commitments and contingencies |

||||

|

Equity |

||||

|

Ryerson Holding Corporation stockholders’ equity: |

||||

|

Preferred stock, $0.01 par value; 7,000,000 shares authorized and no shares issued at September 30, 2024 and December 31, 2023 |

— |

— |

||

|

Common stock, $0.01 par value; 100,000,000 shares authorized; 39,896,148 and 39,450,659 shares issued at September 30, 2024 and December 31, 2023, respectively |

0.4 |

0.4 |

||

|

Capital in excess of par value |

422.7 |

411.6 |

||

|

Retained earnings |

789.9 |

813.2 |

||

|

Treasury stock, at cost – Common stock of 8,051,226 shares at September 30, 2024 and 5,413,434 shares at December 31, 2023 |

(234.4) |

(179.3) |

||

|

Accumulated other comprehensive loss |

(145.7) |

(140.0) |

||

|

Total Ryerson Holding Corporation Stockholders’ Equity |

832.9 |

905.9 |

||

|

Noncontrolling interest |

9.1 |

8.6 |

||

|

Total Equity |

842.0 |

914.5 |

||

|

Total Liabilities and Stockholders’ Equity |

$2,533.3 |

$2,569.6 |

||

|

Schedule 2 |

||||||||||||||||||||

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||||||||||||||||||

|

Reconciliations of Net Income (Loss) Attributable to Ryerson Holding Corporation to EBITDA and Gross profit to Gross profit excluding LIFO |

||||||||||||||||||||

|

(Dollars in millions) |

||||||||||||||||||||

|

2024 |

2023 |

First Nine Months Ended |

||||||||||||||||||

|

Third |

Second |

Third |

September 30, |

|||||||||||||||||

|

Quarter |

Quarter |

Quarter |

2024 |

2023 |

||||||||||||||||

|

Net income (loss) attributable to Ryerson Holding Corporation |

$ |

(6.6) |

$ |

9.9 |

$ |

35.0 |

$ |

(4.3) |

$ |

119.9 |

||||||||||

|

Interest and other expense on debt |

11.5 |

11.3 |

9.3 |

32.9 |

25.2 |

|||||||||||||||

|

Provision (benefit) for income taxes |

(0.4) |

3.0 |

12.9 |

0.5 |

39.8 |

|||||||||||||||

|

Depreciation and amortization expense |

19.5 |

18.0 |

13.6 |

54.9 |

42.4 |

|||||||||||||||

|

EBITDA |

$ |

24.0 |

$ |

42.2 |

$ |

70.8 |

$ |

84.0 |

$ |

227.3 |

||||||||||

|

Gain on insurance settlement |

(1.3) |

— |

— |

(1.3) |

— |

|||||||||||||||

|

Reorganization |

15.8 |

12.7 |

8.0 |

48.6 |

14.7 |

|||||||||||||||

|

Pension settlement loss |

— |

— |

— |

2.2 |

— |

|||||||||||||||

|

Benefit plan curtailment gain |

— |

— |

— |

(0.3) |

— |

|||||||||||||||

|

Foreign currency transaction (gains) losses |

0.6 |

(0.4) |

(0.8) |

(1.0) |

0.4 |

|||||||||||||||

|

Purchase consideration and other transaction costs (credits) |

(0.4) |

(1.1) |

0.3 |

(1.4) |

1.0 |

|||||||||||||||

|

Other adjustments |

0.4 |

(0.8) |

0.1 |

0.1 |

0.2 |

|||||||||||||||

|

Adjusted EBITDA |

$ |

39.1 |

$ |

52.6 |

$ |

78.4 |

$ |

130.9 |

$ |

243.6 |

||||||||||

|

Adjusted EBITDA |

$ |

39.1 |

$ |

52.6 |

$ |

78.4 |

$ |

130.9 |

$ |

243.6 |

||||||||||

|

LIFO income |

(18.1) |

(10.0) |

(33.4) |

(27.1) |

(38.4) |

|||||||||||||||

|

Adjusted EBITDA, excluding LIFO income |

$ |

21.0 |

$ |

42.6 |

$ |

45.0 |

$ |

103.8 |

$ |

205.2 |

||||||||||

|

Net sales |

$ |

1,126.6 |

$ |

1,225.5 |

$ |

1,246.7 |

$ |

3,591.3 |

$ |

3,996.3 |

||||||||||

|

Adjusted EBITDA, excluding LIFO income, as a percentage of net sales |

1.9 |

% |

3.5 |

% |

3.6 |

% |

2.9 |

% |

5.1 |

% |

||||||||||

|

Gross profit |

$ |

202.0 |

$ |

223.5 |

$ |

249.3 |

$ |

643.1 |

$ |

774.4 |

||||||||||

|

Gross margin |

17.9 |

% |

18.2 |

% |

20.0 |

% |

17.9 |

% |

19.4 |

% |

||||||||||

|

Gross profit |

$ |

202.0 |

$ |

223.5 |

$ |

249.3 |

$ |

643.1 |

$ |

774.4 |

||||||||||

|

LIFO income |

(18.1) |

(10.0) |

(33.4) |

(27.1) |

(38.4) |

|||||||||||||||

|

Gross profit, excluding LIFO income |

$ |

183.9 |

$ |

213.5 |

$ |

215.9 |

$ |

616.0 |

$ |

736.0 |

||||||||||

|

Gross margin, excluding LIFO income |

16.3 |

% |

17.4 |

% |

17.3 |

% |

17.2 |

% |

18.4 |

% |

||||||||||

|

Note: EBITDA represents net income (loss) before interest and other expense on debt, provision (benefit) for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain on insurance settlement, pension settlement loss, benefit plan curtailment gain, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. |

||||||||||||||||||||

|

Schedule 3 |

||||||||||||||||||||

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||||||||||||||||||

|

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Earnings (Loss) per Share |

||||||||||||||||||||

|

(Dollars and Shares in Millions, Except Per Share Data) |

||||||||||||||||||||

|

2024 |

2023 |

First Nine Months Ended |

||||||||||||||||||

|

Third |

Second |

Third |

September 30, |

|||||||||||||||||

|

Quarter |

Quarter |

Quarter |

2024 |

2023 |

||||||||||||||||

|

Net income (loss) attributable to Ryerson Holding Corporation |

$ |

(6.6) |

$ |

9.9 |

$ |

35.0 |

$ |

(4.3) |

$ |

119.9 |

||||||||||

|

Gain on insurance settlement |

(1.3) |

— |

— |

(1.3) |

— |

|||||||||||||||

|

Restructuring and other charges |

1.1 |

1.7 |

— |

2.8 |

— |

|||||||||||||||

|

Pension settlement loss |

— |

— |

— |

2.2 |

— |

|||||||||||||||

|

Benefit plan curtailment gain |

— |

— |

— |

(0.3) |

— |

|||||||||||||||

|

Provision (benefit) for income taxes |

0.1 |

(0.4) |

— |

(0.8) |

— |

|||||||||||||||

|

Adjusted net income (loss) attributable to Ryerson Holding Corporation |

$ |

(6.7) |

$ |

11.2 |

$ |

35.0 |

$ |

(1.7) |

$ |

119.9 |

||||||||||

|

Adjusted diluted earnings (loss) per share |

$ |

(0.20) |

$ |

0.33 |

$ |

1.00 |

$ |

(0.05) |

$ |

3.34 |

||||||||||

|

Shares outstanding – diluted |

32.7 |

34.4 |

34.9 |

33.6 |

35.9 |

|||||||||||||||

|

Note: Adjusted net income (loss) and Adjusted earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. |

||||||||||||||||||||

|

Schedule 4 |

||||||||||||||||||||

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||||||||||||||||||

|

Cash Flow from Operations to Free Cash Flow Yield |

||||||||||||||||||||

|

(Dollars in Millions) |

||||||||||||||||||||

|

2024 |

2023 |

First Nine Months Ended |

||||||||||||||||||

|

Third |

Second |

Third |

September 30, |

|||||||||||||||||

|

Quarter |

Quarter |

Quarter |

2024 |

2023 |

||||||||||||||||

|

Net cash provided by operating activities |

$ |

134.6 |

$ |

25.9 |

$ |

79.3 |

$ |

112.7 |

$ |

275.0 |

||||||||||

|

Capital expenditures |

(31.6) |

(22.7) |

(22.4) |

(76.1) |

(96.5) |

|||||||||||||||

|

Proceeds from sales of property, plant, and equipment |

0.4 |

0.1 |

— |

1.9 |

0.1 |

|||||||||||||||

|

Free cash flow |

$ |

103.4 |

$ |

3.3 |

$ |

56.9 |

$ |

38.5 |

$ |

178.6 |

||||||||||

|

Market capitalization |

$ |

634.0 |

$ |

657.0 |

$ |

996.5 |

$ |

634.0 |

$ |

996.5 |

||||||||||

|

Free cash flow yield |

16.3 |

% |

0.5 |

% |

5.7 |

% |

6.1 |

% |

17.9 |

% |

||||||||||

|

Note: Market capitalization is calculated using September 30, 2024, June 30, 2024, and September 30, 2023 stock prices and shares outstanding. |

||||||||||||||||||||

|

Schedule 5 |

||||

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

||||

|

Reconciliation of Fourth Quarter 2024 Net Income Attributable to Ryerson Holding Corporation to Adj. EBITDA, excl. LIFO Guidance |

||||

|

(Dollars in Millions, except Per Share Data) |

||||

|

Fourth Quarter 2024 |

||||

|

Low |

High |

|||

|

Net loss attributable to Ryerson Holding Corporation |

$(17) |

$(16) |

||

|

Diluted loss per share |

$(0.53) |

$(0.47) |

||

|

Interest and other expense on debt |

10 |

10 |

||

|

Benefit for income taxes |

(6) |

(5) |

||

|

Depreciation and amortization expense |

19 |

19 |

||

|

EBITDA |

$6 |

$8 |

||

|

Adjustments |

14 |

14 |

||

|

Adjusted EBITDA |

$20 |

$22 |

||

|

LIFO income |

(10) |

(10) |

||

|

Adjusted EBITDA, excluding LIFO |

$10 |

$12 |

||

|

Note: See the note within Schedule 2 for a description of EBITDA and Adjusted EBITDA. |

||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ryerson-reports-third-quarter-2024-results-302290713.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ryerson-reports-third-quarter-2024-results-302290713.html

SOURCE Ryerson Holding Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chevron's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on Chevron. Our analysis of options history for Chevron CVX revealed 12 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $839,579, and 4 were calls, valued at $462,055.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $152.5 for Chevron over the recent three months.

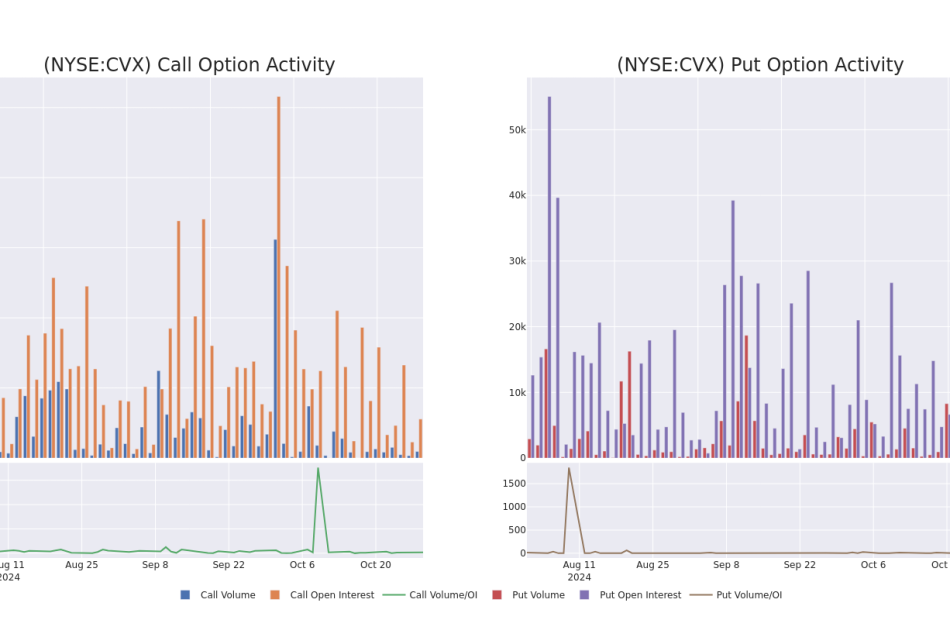

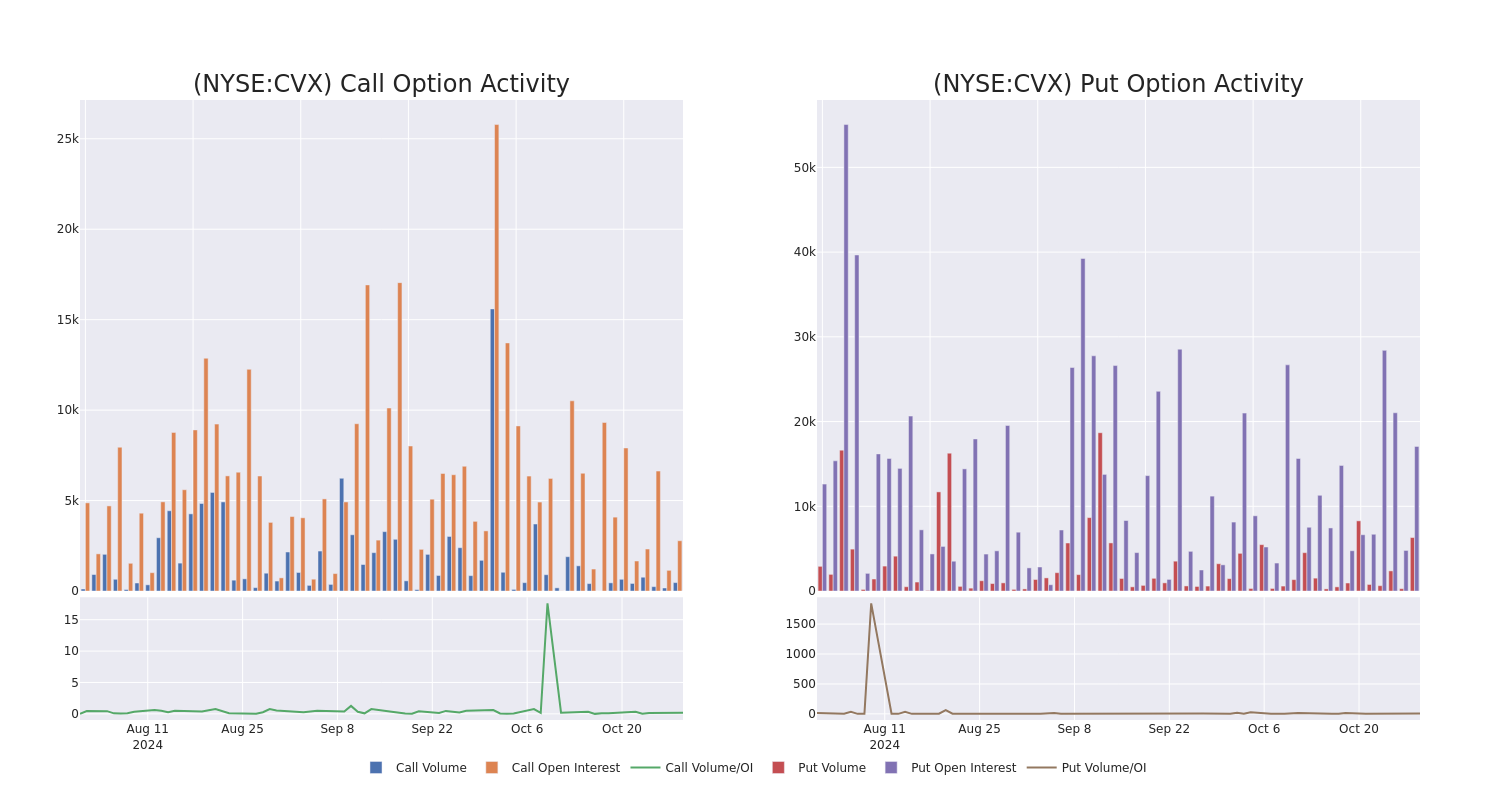

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Chevron’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Chevron’s significant trades, within a strike price range of $130.0 to $152.5, over the past month.

Chevron 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | SWEEP | BULLISH | 11/15/24 | $1.03 | $0.98 | $1.0 | $140.00 | $420.6K | 5.3K | 4.9K |

| CVX | CALL | TRADE | BEARISH | 11/08/24 | $9.25 | $9.05 | $9.12 | $140.00 | $319.1K | 3 | 350 |

| CVX | PUT | SWEEP | BEARISH | 11/22/24 | $3.75 | $3.75 | $3.75 | $148.00 | $95.2K | 51 | 2 |

| CVX | CALL | TRADE | NEUTRAL | 11/15/24 | $18.65 | $18.35 | $18.51 | $130.00 | $92.5K | 89 | 65 |

| CVX | PUT | SWEEP | BEARISH | 11/15/24 | $4.85 | $4.75 | $4.85 | $152.50 | $91.1K | 626 | 229 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Chevron Standing Right Now?

- Currently trading with a volume of 4,059,401, the CVX’s price is down by -1.37%, now at $148.48.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 3 days.

What The Experts Say On Chevron

5 market experts have recently issued ratings for this stock, with a consensus target price of $168.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Chevron with a target price of $192.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $170.

* An analyst from Scotiabank has decided to maintain their Sector Outperform rating on Chevron, which currently sits at a price target of $163.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Hold rating on Chevron with a target price of $150.

* An analyst from B of A Securities downgraded its action to Buy with a price target of $168.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chevron options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Solar Stock Sinks After Worse-Than-Expected Q3 Results, Cut FY24 Guidance

First Solar, Inc. FSLR reported its third-quarter results after Tuesday’s closing bell. Here’s a look at the key figures from the quarter.

The Details: First Solar reported quarterly earnings of $2.91 per share, which missed the analyst consensus estimate of $3.13. The company said its earnings were impacted by a $50 million product warranty reserve charge during the quarter.

Quarterly revenue came in at $887.67 million, which missed the analyst consensus estimate of $1.07 billion. First Solar reported year-to-date net bookings of 4.0 GW with 0.4 GW since the company’s second-quarter earnings call. The company said it has an expected sales backlog of 73.3 GW.

“As we approach the end of 2024, we remain pleased with the progress made across our business, navigating against a backdrop of industry volatility and political uncertainty, with a continued focus on balancing growth, profitability and liquidity,” said Mark Widmar, CEO of First Solar.

“We expect that our disciplined, long-term approach will allow us to work through the outcomes of the upcoming U.S. elections as well as the continued volatility across the solar manufacturing industry,” Widmar added.

Outlook: First Solar revised its fiscal 2024 net sales forecast from a range of $4.4 billion to $4.6 billion to a new range of $4.1 billion to $4.25 billion, versus the $4.44 billion estimate. The company also revised its full-year earnings forecast from between $13 and $14 per share to between $13 and $13.50 per share, versus the $13.49 estimate.

FSLR Price Action: According to Benzinga Pro, First Solar shares are down 4.84% after-hours at $190.38 at the time of publication Tuesday.

Read Also:

This image was generated using artificial intelligence via MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

United Airlines Holdings's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards United Airlines Holdings UAL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UAL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 28 extraordinary options activities for United Airlines Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 39% bearish. Among these notable options, 17 are puts, totaling $2,995,539, and 11 are calls, amounting to $1,077,053.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $90.0 for United Airlines Holdings over the last 3 months.

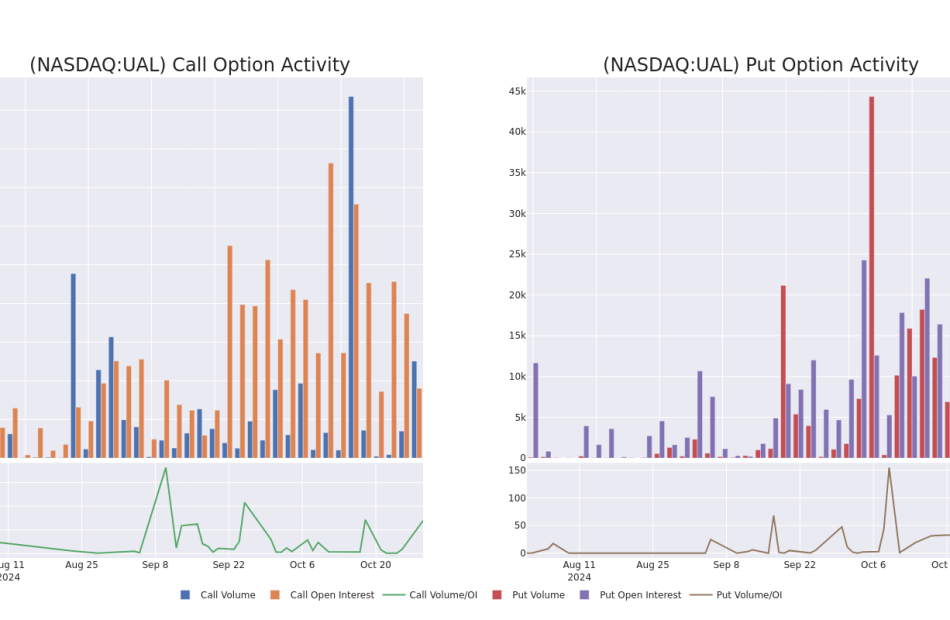

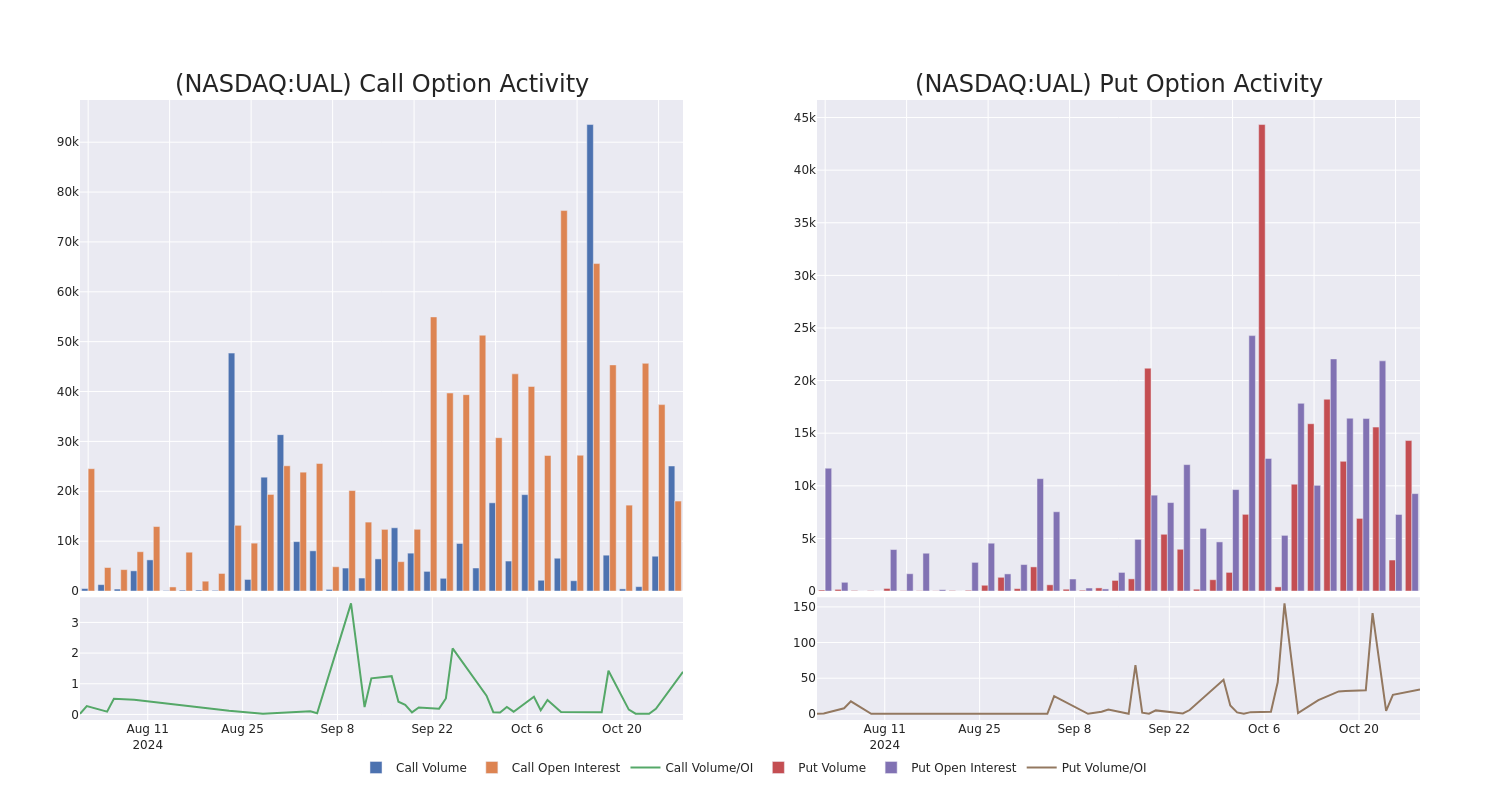

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for United Airlines Holdings options trades today is 1819.93 with a total volume of 39,377.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for United Airlines Holdings’s big money trades within a strike price range of $50.0 to $90.0 over the last 30 days.

United Airlines Holdings Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | SWEEP | BEARISH | 06/20/25 | $8.65 | $8.6 | $8.65 | $75.00 | $716.3K | 4.2K | 831 |

| UAL | CALL | TRADE | BULLISH | 01/17/25 | $2.91 | $2.84 | $2.89 | $85.00 | $476.8K | 3.3K | 1.6K |

| UAL | PUT | SWEEP | BEARISH | 06/20/25 | $8.65 | $8.6 | $8.65 | $75.00 | $426.4K | 4.2K | 2.2K |

| UAL | PUT | SWEEP | BEARISH | 06/20/25 | $8.65 | $8.6 | $8.65 | $75.00 | $390.1K | 4.2K | 1.5K |

| UAL | CALL | TRADE | BULLISH | 11/01/24 | $0.77 | $0.67 | $0.75 | $78.00 | $262.5K | 1.3K | 10.1K |

About United Airlines Holdings

United Airlines is a major US network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large US peers.

After a thorough review of the options trading surrounding United Airlines Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of United Airlines Holdings

- Trading volume stands at 4,058,299, with UAL’s price up by 1.45%, positioned at $77.19.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 84 days.

Professional Analyst Ratings for United Airlines Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $85.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Susquehanna has decided to maintain their Positive rating on United Airlines Holdings, which currently sits at a price target of $85.

* An analyst from B of A Securities has decided to maintain their Buy rating on United Airlines Holdings, which currently sits at a price target of $84.

* Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on United Airlines Holdings with a target price of $95.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for United Airlines Holdings, targeting a price of $88.

* An analyst from Jefferies persists with their Buy rating on United Airlines Holdings, maintaining a target price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United Airlines Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blue Ridge Bankshares, Inc. Announces 2024 Third Quarter Results

Performance reflects improvement across a range of metrics such as deposit growth, noninterest expense reduction, and nonperforming asset reduction

Bank to complete exit from fintech banking-as-a-service depository operations by the end of 2024

Regulatory remediation efforts on track

RICHMOND, Va., Oct. 29, 2024 /PRNewswire/ — Blue Ridge Bankshares, Inc. (the “Company”) BRBS, the holding company of Blue Ridge Bank, National Association (“Blue Ridge Bank” or the “Bank”) and BRB Financial Group, Inc. (“BRB Financial Group”), today announced financial results for the quarter and year-to-date period ended September 30, 2024.

For the quarter ended September 30, 2024, the Company reported net income of $0.9 million, or $0.01 per diluted common share, compared to a net loss of $11.4 million, or $0.47 per diluted common share, for the quarter ended June 30, 2024, and a net loss of $41.4 million, or $2.18 per diluted common share, for the third quarter of 2023. Net income for the third quarter of 2024 included a $6.6 million after-tax recovery of credit losses on a specialty finance loan for which the sale of the loan was completed in the quarter upon the receipt of all contractual amounts due. The second quarter 2024 loss included a $6.7 million non-cash, after-tax negative fair value adjustment recorded for an equity investment in a fintech company. The third quarter 2023 net loss included a non-cash, after-tax goodwill impairment charge of $26.8 million, which was the entirety of the goodwill balance, and a $4.7 million after-tax settlement reserve for the previously disclosed and now settled Employee Stock Ownership Plan (“ESOP”) litigation assumed in the 2019 acquisition of Virginia Community Bankshares, Inc (“VCB”).

For the year-to-date period ended September 30, 2024, the Company reported a net loss of $13.4 million, or $0.34 per diluted common share, compared to a net loss of $46.0 million, or $2.43 per diluted common share, for the same period of 2023.

A Message From Blue Ridge Bankshares, Inc. President and CEO, G. William “Billy” Beale:

“Our 2024 third quarter marks one year since we began – in earnest – our journey toward restoring Blue Ridge Bank to its core strengths as a community-focused banking institution.

“Today, we are focused on three vital areas of initiative: our remediation work in response to the directives of our primary regulator; our initiatives to improve operational efficiency across the organization; and third, positioning Blue Ridge Bank for future growth.

“During our third quarter, we advanced and generated additional momentum in all three areas. We are increasingly seeing the benefits of these initiatives in several key metrics that reflect a healthier Blue Ridge Bank:

- “With respect to our regulatory remediation work, we made additional progress in exiting our fintech banking-as-a-service (“BaaS”) deposit operations. I am pleased to say that we remain ahead of schedule on this initiative and expect to be fully exited from this business by the end of the year. Consequently, deposits from fintech BaaS sources were down to only 3% of total deposits at quarter end. This is reduced from 18% of total deposits on a year-over-year basis.

- “The second area of initiative is our focus on operational efficiency. Over the next several quarters, we will be accelerating our efforts to drive new levels of efficiency across our entire organization. We have already begun to take some important steps down this path. For the third quarter, our noninterest expense was sequentially down nearly 10% from the second quarter and approximately 30% lower than the third quarter of last year when excluding the goodwill impairment charge.