Market Whales and Their Recent Bets on Dollar Gen Options

High-rolling investors have positioned themselves bearish on Dollar Gen DG, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DG often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Dollar Gen. This is not a typical pattern.

The sentiment among these major traders is split, with 22% bullish and 66% bearish. Among all the options we identified, there was one put, amounting to $265,014, and 8 calls, totaling $905,522.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $120.0 for Dollar Gen over the last 3 months.

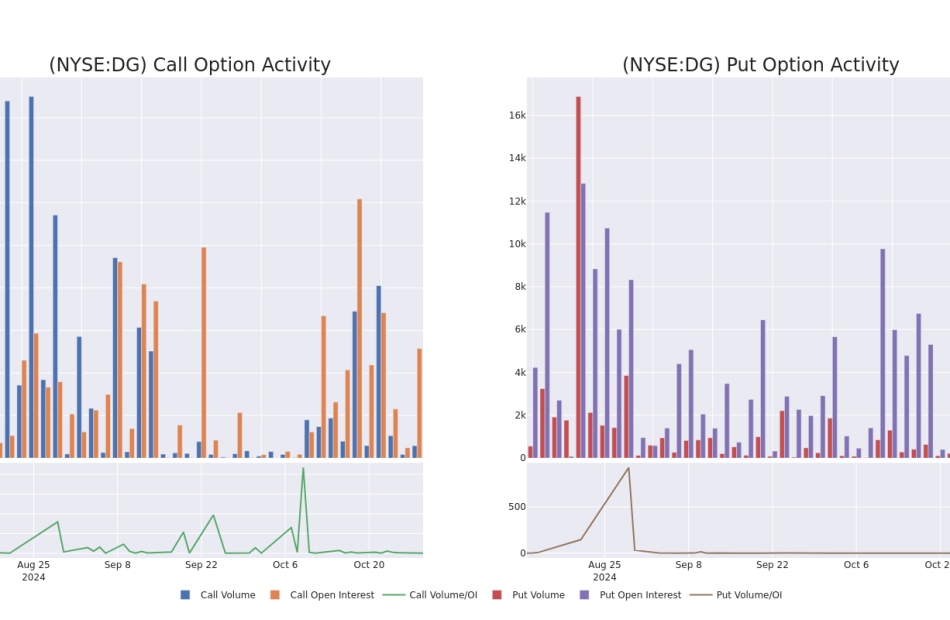

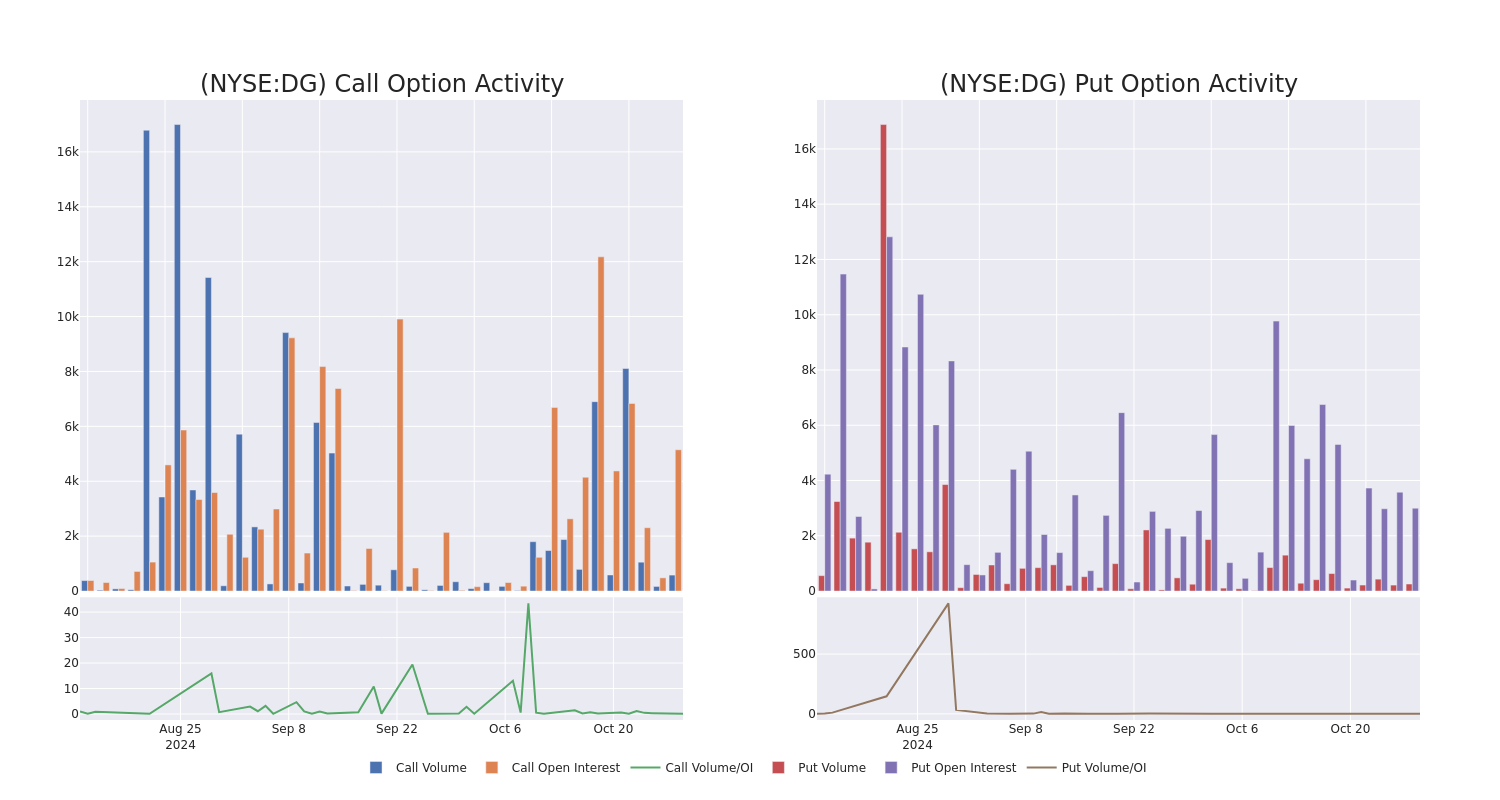

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Dollar Gen options trades today is 1017.88 with a total volume of 835.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dollar Gen’s big money trades within a strike price range of $60.0 to $120.0 over the last 30 days.

Dollar Gen 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DG | CALL | TRADE | BEARISH | 09/19/25 | $23.9 | $22.55 | $22.8 | $65.00 | $684.0K | 200 | 0 |

| DG | PUT | SWEEP | BEARISH | 03/21/25 | $10.95 | $10.9 | $10.95 | $85.00 | $265.0K | 2.9K | 254 |

| DG | CALL | TRADE | BEARISH | 12/20/24 | $22.8 | $22.0 | $22.0 | $60.00 | $44.0K | 1 | 0 |

| DG | CALL | SWEEP | BULLISH | 11/15/24 | $1.99 | $1.81 | $2.0 | $85.00 | $35.7K | 2.4K | 1 |

| DG | CALL | SWEEP | BULLISH | 11/15/24 | $1.78 | $1.69 | $1.77 | $85.00 | $35.6K | 2.4K | 381 |

About Dollar Gen

With more than 20,000 locations, Dollar General’s banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

Following our analysis of the options activities associated with Dollar Gen, we pivot to a closer look at the company’s own performance.

Dollar Gen’s Current Market Status

- Currently trading with a volume of 2,329,852, the DG’s price is down by -0.8%, now at $80.45.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 37 days.

Expert Opinions on Dollar Gen

In the last month, 2 experts released ratings on this stock with an average target price of $101.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein has revised its rating downward to Outperform, adjusting the price target to $98.

* An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Dollar Gen, which currently sits at a price target of $105.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dollar Gen with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Preview Of NCS Multistage Holdings's Earnings

NCS Multistage Holdings NCSM will release its quarterly earnings report on Wednesday, 2024-10-30. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate NCS Multistage Holdings to report an earnings per share (EPS) of $1.27.

Investors in NCS Multistage Holdings are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

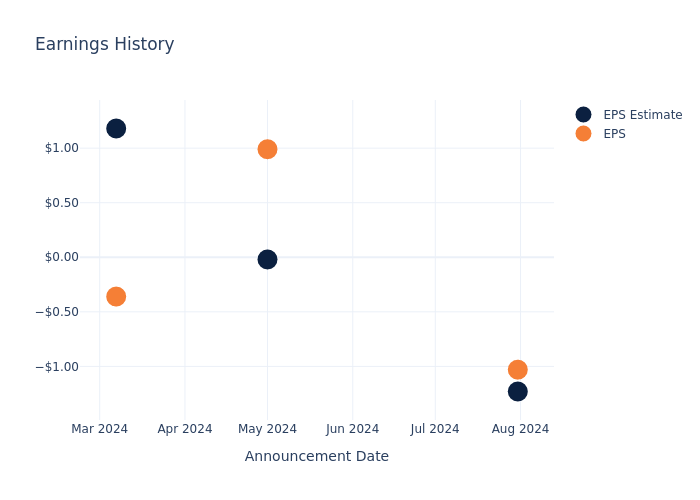

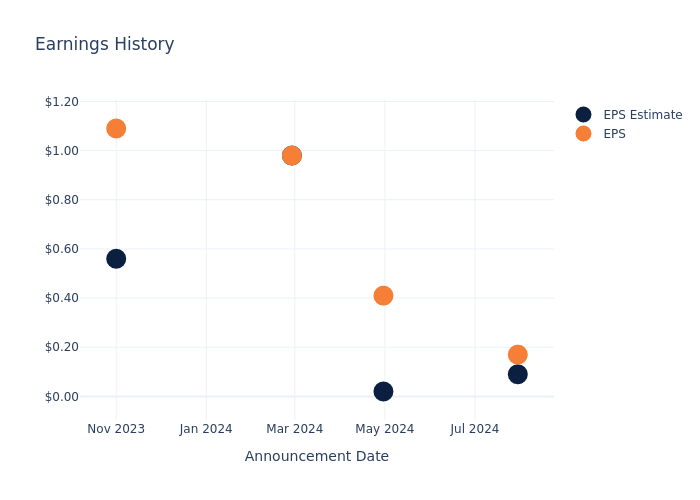

Earnings History Snapshot

Last quarter the company beat EPS by $0.20, which was followed by a 0.5% drop in the share price the next day.

Here’s a look at NCS Multistage Holdings’s past performance and the resulting price change:

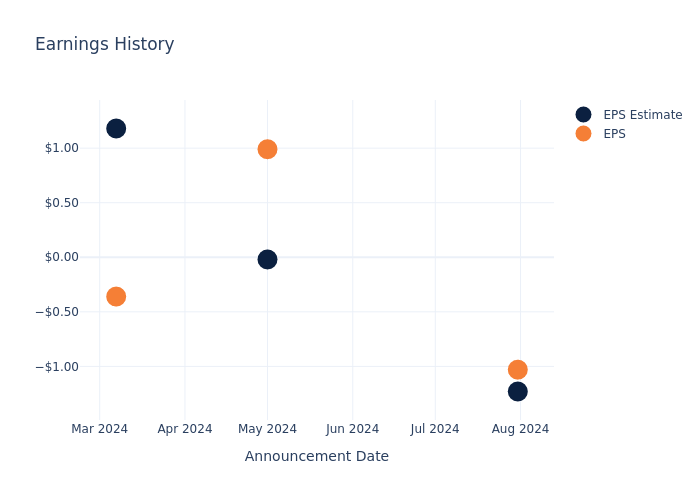

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -1.23 | -0.02 | 1.18 | 2.59 |

| EPS Actual | -1.03 | 0.99 | -0.36 | 1.91 |

| Price Change % | -1.0% | 8.0% | 3.0% | -5.0% |

NCS Multistage Holdings Share Price Analysis

Shares of NCS Multistage Holdings were trading at $17.855 as of October 28. Over the last 52-week period, shares are up 28.36%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Mobileye Global

Financial giants have made a conspicuous bearish move on Mobileye Global. Our analysis of options history for Mobileye Global MBLY revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $328,610, and 3 were calls, valued at $474,370.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $13.5 for Mobileye Global over the recent three months.

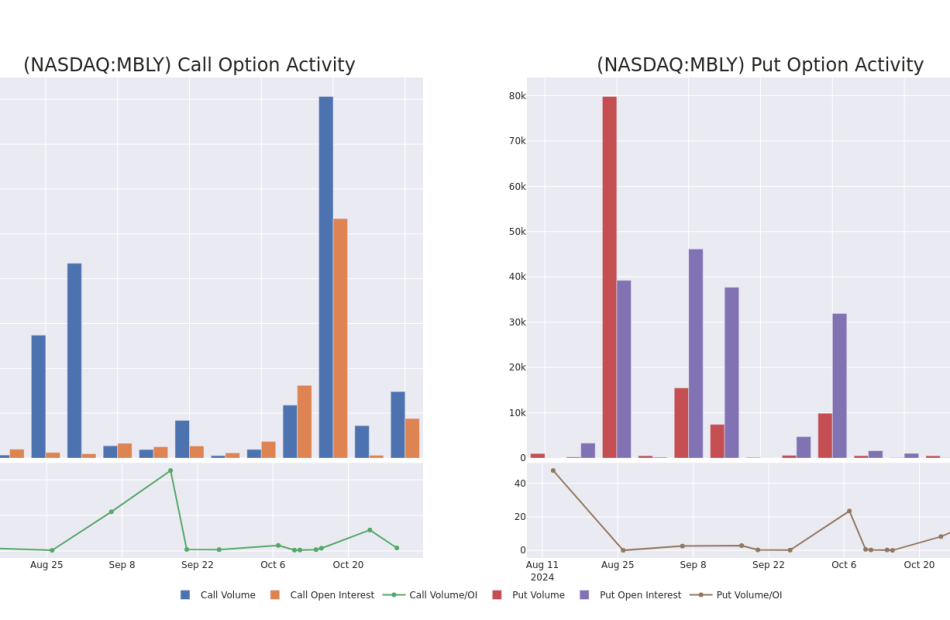

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Mobileye Global stands at 1030.67, with a total volume reaching 26,344.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Mobileye Global, situated within the strike price corridor from $12.0 to $13.5, throughout the last 30 days.

Mobileye Global Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | CALL | SWEEP | BULLISH | 01/17/25 | $2.8 | $2.6 | $2.77 | $12.00 | $329.8K | 909 | 2.3K |

| MBLY | CALL | SWEEP | BULLISH | 01/17/25 | $2.75 | $2.7 | $2.7 | $12.00 | $109.3K | 909 | 409 |

| MBLY | PUT | SWEEP | BEARISH | 05/16/25 | $3.0 | $2.95 | $3.0 | $13.00 | $90.3K | 1.3K | 341 |

| MBLY | PUT | SWEEP | BEARISH | 11/01/24 | $0.45 | $0.4 | $0.45 | $12.00 | $67.3K | 595 | 3.5K |

| MBLY | PUT | SWEEP | BEARISH | 11/01/24 | $0.6 | $0.5 | $0.6 | $12.50 | $64.0K | 2.2K | 7.5K |

About Mobileye Global

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company’s only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

After a thorough review of the options trading surrounding Mobileye Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Mobileye Global

- Currently trading with a volume of 3,891,167, the MBLY’s price is up by 1.54%, now at $13.22.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 2 days.

What The Experts Say On Mobileye Global

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Mobileye Global, targeting a price of $20.

* An analyst from Evercore ISI Group persists with their Outperform rating on Mobileye Global, maintaining a target price of $30.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $11.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Mobileye Global, targeting a price of $19.

* An analyst from UBS downgraded its action to Neutral with a price target of $14.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Mobileye Global, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview For Spok Holdings

Spok Holdings SPOK will release its quarterly earnings report on Wednesday, 2024-10-30. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Spok Holdings to report an earnings per share (EPS) of $0.18.

Investors in Spok Holdings are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

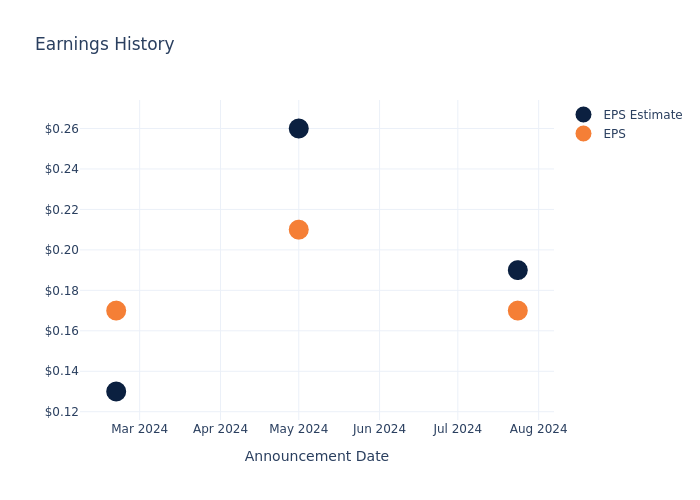

Overview of Past Earnings

The company’s EPS missed by $0.02 in the last quarter, leading to a 6.5% drop in the share price on the following day.

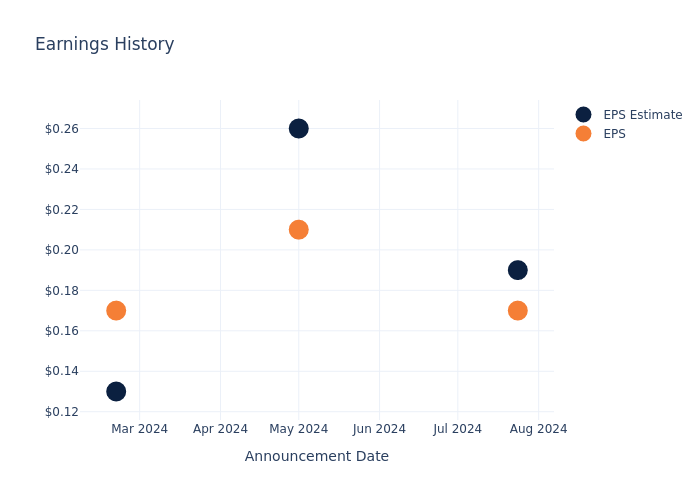

Here’s a look at Spok Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.19 | 0.26 | 0.13 | 0.18 |

| EPS Actual | 0.17 | 0.21 | 0.17 | 0.22 |

| Price Change % | -7.000000000000001% | -8.0% | 9.0% | 2.0% |

Stock Performance

Shares of Spok Holdings were trading at $15.14 as of October 28. Over the last 52-week period, shares are down 3.12%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Views on Spok Holdings

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Spok Holdings.

The consensus rating for Spok Holdings is Neutral, based on 1 analyst ratings. With an average one-year price target of $15.0, there’s a potential 0.92% downside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of and Spok Holdings, three major players in the industry, shedding light on their relative performance expectations and market positioning.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for and Spok Holdings, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Spok Holdings | Neutral | -6.80% | $26.82M | 2.15% |

Key Takeaway:

Spok Holdings ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it ranks in the middle for Return on Equity. The consensus rating for Spok Holdings is Neutral.

All You Need to Know About Spok Holdings

Spok Holdings Inc is a provider of healthcare communications. It reports three market segments namely Healthcare, Government, and Large enterprise. The company provides paging services and software solutions in the United States and abroad. It provides services such as Value-Added Services, Advisory Services, Assessment Services and Adoption Services.

Financial Milestones: Spok Holdings’s Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining Spok Holdings’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -6.8% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Spok Holdings’s net margin excels beyond industry benchmarks, reaching 10.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.15%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Spok Holdings’s ROA stands out, surpassing industry averages. With an impressive ROA of 1.59%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.06.

To track all earnings releases for Spok Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview For Spok Holdings

Spok Holdings SPOK will release its quarterly earnings report on Wednesday, 2024-10-30. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Spok Holdings to report an earnings per share (EPS) of $0.18.

Investors in Spok Holdings are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Overview of Past Earnings

The company’s EPS missed by $0.02 in the last quarter, leading to a 6.5% drop in the share price on the following day.

Here’s a look at Spok Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.19 | 0.26 | 0.13 | 0.18 |

| EPS Actual | 0.17 | 0.21 | 0.17 | 0.22 |

| Price Change % | -7.000000000000001% | -8.0% | 9.0% | 2.0% |

Stock Performance

Shares of Spok Holdings were trading at $15.14 as of October 28. Over the last 52-week period, shares are down 3.12%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Views on Spok Holdings

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Spok Holdings.

The consensus rating for Spok Holdings is Neutral, based on 1 analyst ratings. With an average one-year price target of $15.0, there’s a potential 0.92% downside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of and Spok Holdings, three major players in the industry, shedding light on their relative performance expectations and market positioning.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for and Spok Holdings, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Spok Holdings | Neutral | -6.80% | $26.82M | 2.15% |

Key Takeaway:

Spok Holdings ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it ranks in the middle for Return on Equity. The consensus rating for Spok Holdings is Neutral.

All You Need to Know About Spok Holdings

Spok Holdings Inc is a provider of healthcare communications. It reports three market segments namely Healthcare, Government, and Large enterprise. The company provides paging services and software solutions in the United States and abroad. It provides services such as Value-Added Services, Advisory Services, Assessment Services and Adoption Services.

Financial Milestones: Spok Holdings’s Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining Spok Holdings’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -6.8% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Spok Holdings’s net margin excels beyond industry benchmarks, reaching 10.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.15%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Spok Holdings’s ROA stands out, surpassing industry averages. With an impressive ROA of 1.59%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.06.

To track all earnings releases for Spok Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media & Technology's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Trump Media & Technology DJT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DJT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 223 extraordinary options activities for Trump Media & Technology. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 43% bearish. Among these notable options, 57 are puts, totaling $5,231,846, and 166 are calls, amounting to $10,801,068.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $115.0 for Trump Media & Technology over the recent three months.

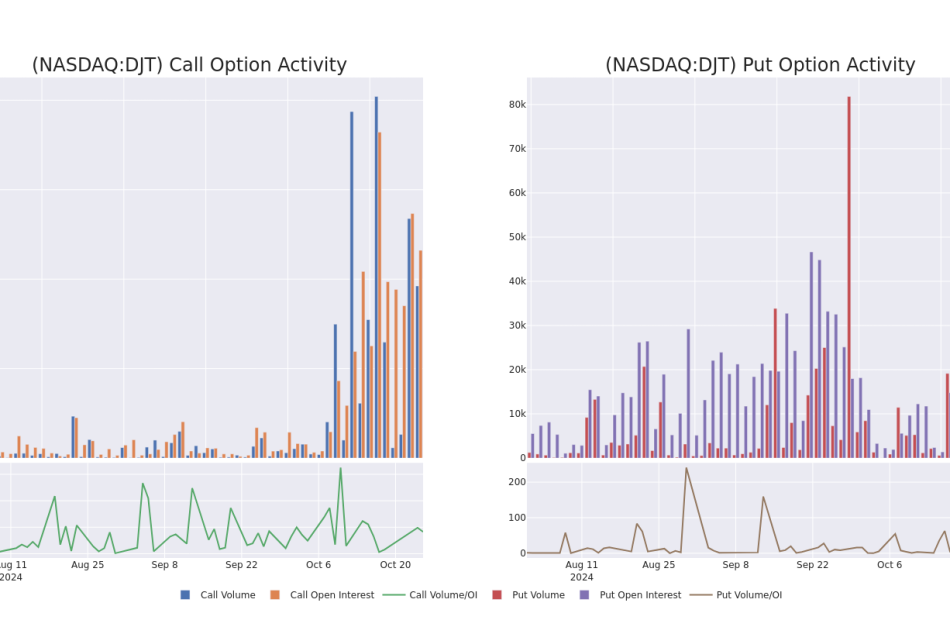

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Trump Media & Technology’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Trump Media & Technology’s significant trades, within a strike price range of $10.0 to $115.0, over the past month.

Trump Media & Technology 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DJT | CALL | SWEEP | BEARISH | 11/08/24 | $12.75 | $12.65 | $12.65 | $60.00 | $239.0K | 1.0K | 3.9K |

| DJT | PUT | SWEEP | BEARISH | 12/20/24 | $2.06 | $1.85 | $2.0 | $15.00 | $236.0K | 11.8K | 1.8K |

| DJT | PUT | SWEEP | BEARISH | 12/20/24 | $1.97 | $1.85 | $1.97 | $15.00 | $217.0K | 11.8K | 3.3K |

| DJT | PUT | SWEEP | BULLISH | 11/08/24 | $11.0 | $10.95 | $10.95 | $45.00 | $206.9K | 713 | 1.5K |

| DJT | PUT | SWEEP | BULLISH | 12/20/24 | $0.95 | $0.85 | $0.87 | $10.00 | $196.4K | 16.1K | 16.3K |

About Trump Media & Technology

Trump Media & Technology Group Corp is a media and technology company rooted in social media, digital streaming, information technology infrastructure, and more. Its initial product launch will focus on its social media platform, Truth Social, which encourages an open, free, and honest global conversation without discriminating against political ideology.

Current Position of Trump Media & Technology

- Currently trading with a volume of 157,258,588, the DJT’s price is up by 9.99%, now at $52.09.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 13 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Trump Media & Technology, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Rocky Brands

Rocky Brands RCKY is set to give its latest quarterly earnings report on Wednesday, 2024-10-30. Here’s what investors need to know before the announcement.

Analysts estimate that Rocky Brands will report an earnings per share (EPS) of $0.98.

The market awaits Rocky Brands’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

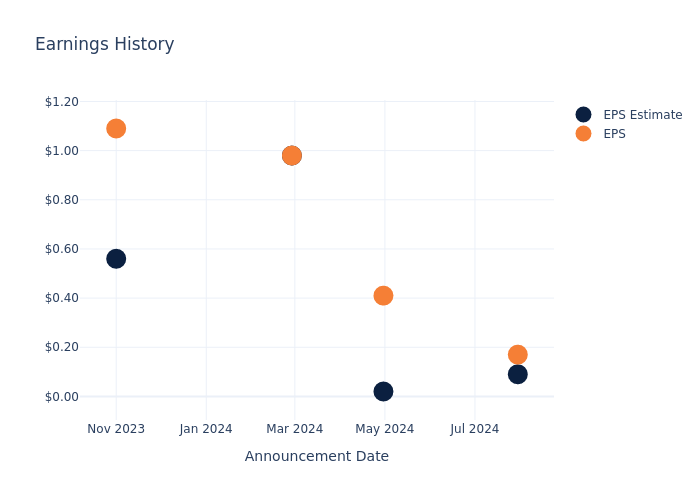

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.08, leading to a 2.45% drop in the share price on the subsequent day.

Here’s a look at Rocky Brands’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.09 | 0.02 | 0.98 | 0.56 |

| EPS Actual | 0.17 | 0.41 | 0.98 | 1.09 |

| Price Change % | -2.0% | 28.000000000000004% | -16.0% | 44.0% |

Rocky Brands Share Price Analysis

Shares of Rocky Brands were trading at $27.62 as of October 24. Over the last 52-week period, shares are up 118.89%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Rocky Brands visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

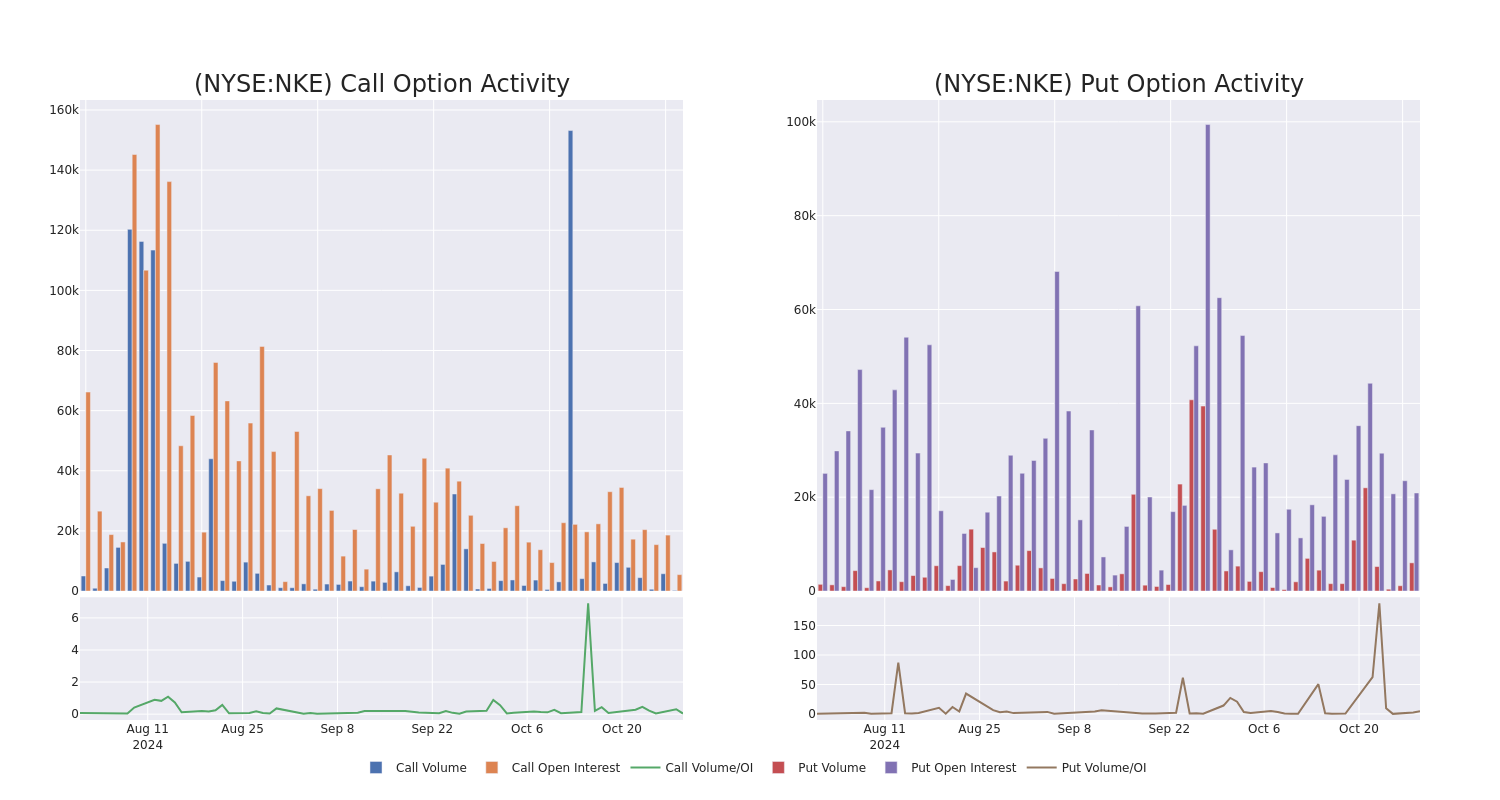

Nike Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Nike.

Looking at options history for Nike NKE we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 71% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $1,434,949 and 5, calls, for a total amount of $226,085.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $90.0 for Nike over the last 3 months.

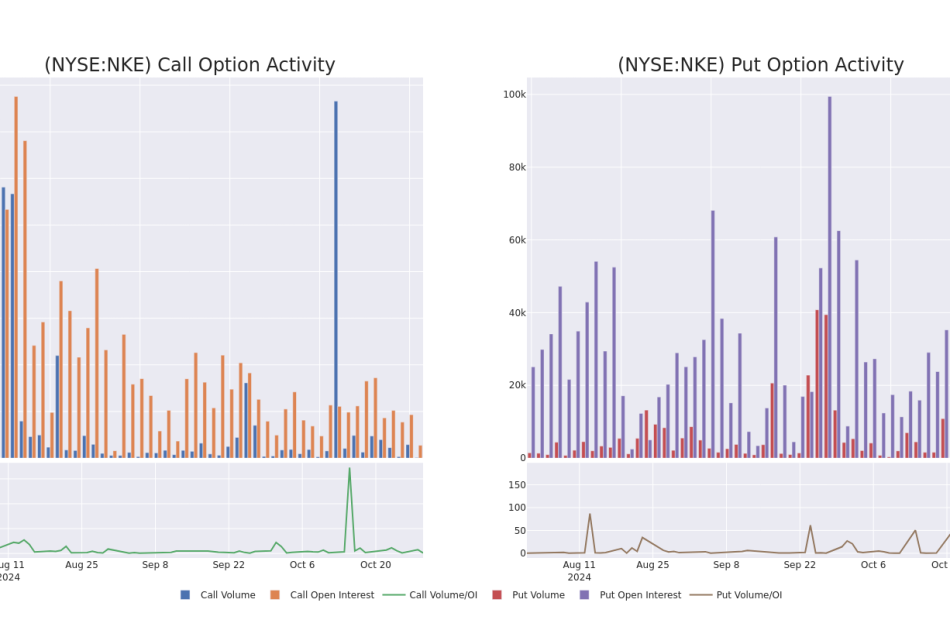

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Nike’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike’s whale activity within a strike price range from $65.0 to $90.0 in the last 30 days.

Nike 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | TRADE | BEARISH | 09/19/25 | $8.5 | $7.75 | $8.2 | $80.00 | $512.5K | 4.5K | 627 |

| NKE | PUT | SWEEP | BEARISH | 11/15/24 | $3.5 | $3.45 | $3.5 | $81.00 | $458.5K | 1.6K | 1.3K |

| NKE | PUT | SWEEP | BEARISH | 11/15/24 | $3.4 | $3.35 | $3.35 | $81.00 | $180.9K | 1.6K | 1.8K |

| NKE | PUT | TRADE | BEARISH | 09/19/25 | $2.73 | $2.56 | $2.73 | $65.00 | $102.3K | 844 | 635 |

| NKE | CALL | TRADE | BEARISH | 01/16/26 | $12.35 | $12.25 | $12.25 | $77.50 | $74.7K | 147 | 61 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

After a thorough review of the options trading surrounding Nike, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Nike

- With a volume of 5,032,224, the price of NKE is down -0.16% at $78.78.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 51 days.

What The Experts Say On Nike

5 market experts have recently issued ratings for this stock, with a consensus target price of $86.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Nike with a target price of $92.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Nike with a target price of $78.

* An analyst from Jefferies persists with their Hold rating on Nike, maintaining a target price of $85.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Nike with a target price of $81.

* An analyst from Truist Securities has elevated its stance to Buy, setting a new price target at $97.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nike options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.