Price Over Earnings Overview: NextEra Energy

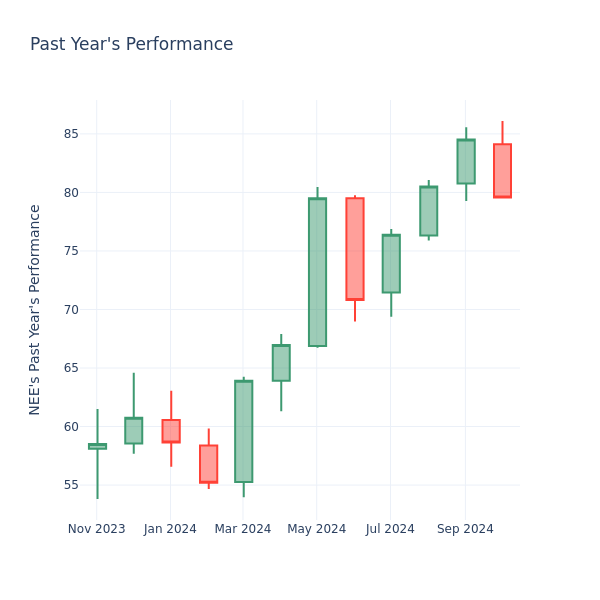

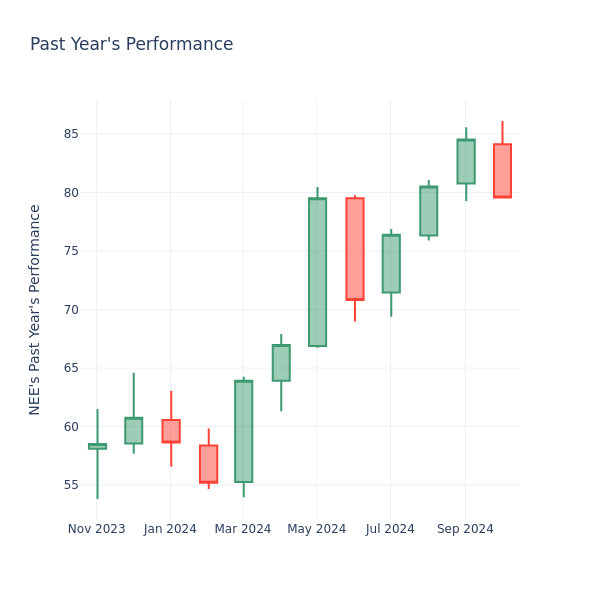

Looking into the current session, NextEra Energy Inc. NEE shares are trading at $79.50, after a 4.07% decrease. Over the past month, the stock decreased by 6.70%, but over the past year, it actually increased by 36.16%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

How Does NextEra Energy P/E Compare to Other Companies?

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

NextEra Energy has a better P/E ratio of 24.59 than the aggregate P/E ratio of 19.25 of the Electric Utilities industry. Ideally, one might believe that NextEra Energy Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Precision Drilling Announces 2024 Third Quarter Unaudited Financial Results

CALGARY, Alberta, Oct. 29, 2024 (GLOBE NEWSWIRE) — This news release contains “forward-looking information and statements” within the meaning of applicable securities laws. For a full disclosure of the forward-looking information and statements and the risks to which they are subject, see the “Cautionary Statement Regarding Forward-Looking Information and Statements” later in this news release. This news release contains references to certain Financial Measures and Ratios, including Adjusted EBITDA (earnings before income taxes, loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals and depreciation and amortization), Funds Provided by (Used in) Operations, Net Capital Spending, Working Capital and Total Long-term Financial Liabilities. These terms do not have standardized meanings prescribed under International Financial Reporting Standards (IFRS) Accounting Standards and may not be comparable to similar measures used by other companies. See “Financial Measures and Ratios” later in this news release.

Precision Drilling Corporation (“Precision” or the “Company”) PDPDS delivered strong third quarter financial results, demonstrating the resilience of the business and its robust cash flow potential. Year to date, Precision has already achieved the low end of its debt reduction target range and is well on track to allocate 25% to 35% of its free cash flow to share buybacks in 2024.

Financial Highlights

- Revenue was $477 million and exceeded the $447 million realized in the third quarter of 2023 as activity increased in Canada and internationally, which more than offset lower activity in the U.S.

- Adjusted EBITDA(1) was $142 million, including a share-based compensation recovery of $0.2 million. In 2023, third quarter Adjusted EBITDA was $115 million and included share-based compensation charges of $31 million.

- Net earnings was $39 million or $2.77 per share, nearly doubling the $20 million or $1.45 per share in 2023.

- Completion and Production Services revenue increased 27% over the same period last year to $73 million, while Adjusted EBITDA rose 40% to $20 million, reflecting the successful integration of the CWC Energy Services (CWC) acquisition in late 2023.

- Internationally, revenue increased 21% over the third quarter of last year as the Company realized US$35 million of contract drilling revenue versus US$29 million in 2023. Revenue for the third quarter of 2024 was negatively impacted by fewer rig moves and planned rig recertifications that accounted for 44 non-billable utilization days.

- Debt reduction during the quarter was $49 million and total $152 million year to date. Share repurchases during the quarter were $17 million and total $50 million year to date.

- Increased our 2024 planned capital expenditures from $195 million to $210 million to fund multiple contracted rig upgrades and the strategic purchase of drill pipe for use in 2025.

Operational Highlights

- Canada’s activity increased 25%, averaging 72 active drilling rigs versus 57 in the third quarter of 2023. Our Super Triple and Super Single rigs are in high demand and approaching full utilization.

- Canadian revenue per utilization day was $32,325 and comparable to the $32,224 in the same period last year.

- U.S. activity averaged 35 drilling rigs compared to 41 for the third quarter of 2023.

- U.S. revenue per utilization day was US$32,949 versus US$35,135 in the same quarter last year.

- International activity increased 33% compared to the third quarter of 2023, with eight drilling rigs fully contracted this year following rig reactivations in 2023. International revenue per utilization day was US$47,223 compared to US$51,570 in the third quarter of 2023 due to fewer rig moves and planned rig recertifications completed in 2024.

- Service rig operating hours increased 34% over the same quarter last year totaling 62,835 hours driven by the CWC acquisition.

- Formed a strategic Joint Partnership (Partnership) with Indigenous partners to provide well servicing operations in northeast British Columbia.

(1) See “FINANCIAL MEASURES AND RATIOS.”

MANAGEMENT COMMENTARY

“Precision’s international and Canadian businesses led our third quarter results, with revenue, Adjusted EBITDA, and net income all improving over the same period last year, demonstrating the resilience of our High Performance, High Value strategy and geographic exposure. Our cash flow conversion this quarter enabled us to repay debt, buy back shares, and continue to invest in our Super Series fleet. We have already achieved the low end of our debt repayment target range for this year and expect to be less than a year away from meeting our long-term target of a Net Debt to Adjusted EBITDA ratio(1) of less than one time.

“Canadian fundamentals for heavy oil, condensate, and LNG remain strong due to the additional takeaway capacity. The Trans Mountain oil pipeline expansion is driving higher and stable returns for producers, who are accelerating heavy oil and condensate targeted drilling plans, while Canada’s first LNG project is expected to stabilize natural gas pricing and further stimulate activity in the Montney in 2025. As the leading provider of high-quality and reliable services in Canada, demand for our Super Series fleet remains high. Today, we have 75 rigs operating, with our Super Triple and Super Single rigs nearly fully utilized. We expect strong customer demand and utilization to continue well beyond 2025.

“In the U.S., our rig count has been range-bound for the last several months, with 35 rigs operating today. Volatile commodity prices, customer consolidation, and budget exhaustion are all headwinds that we expect will continue to suppress activity for the remainder of the year. We are encouraged by recent momentum in our contract book with seven new contracts secured for oil and natural gas drilling projects that are expected to begin late this year for 2025 drilling programs. Looking ahead, we anticipate that the next wave of additional Gulf Coast LNG export facilities, coal plant retirements, and a build-out of AI data centers should drive further natural gas drilling and support sustained natural gas demand.

“Precision’s international operations provide a stable foundation for earnings and cash flow as our rigs are under long-term contracts that extend into 2028. Our well servicing business further complements our stability as we remain the premier well service provider in Canada where demand continues to outpace manned service rigs. In 2023, we repositioned these businesses with rig reactivations and our CWC acquisition and as a result, each business is on track to increase its 2024 Adjusted EBITDA by approximately 50% over the prior year.

“I am proud of the discipline Precision continues to show throughout the organization and we remain focused on our strategic priorities, which include generating free cash flow, improving capital returns to shareholders, and delivering operational excellence. With robust Canadian market fundamentals, an improving long-term outlook for the U.S., and a focused strategy, I am confident we will continue to drive higher total shareholder returns. I would like to thank our team for executing at the highest operating levels and generating strong financial performance and value for our customers,” stated Kevin Neveu, Precision’s President and CEO.

(1) See “FINANCIAL MEASURES AND RATIOS.”

SELECT FINANCIAL AND OPERATING INFORMATION

Financial Highlights

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||||||||||

| (Stated in thousands of Canadian dollars, except per share amounts) | 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||

| Revenue | 477,155 | 446,754 | 6.8 | 1,434,157 | 1,430,983 | 0.2 | |||||||||||||||||

| Adjusted EBITDA(1) | 142,425 | 114,575 | 24.3 | 400,695 | 459,887 | (12.9 | ) | ||||||||||||||||

| Net earnings | 39,183 | 19,792 | 98.0 | 96,400 | 142,522 | (32.4 | ) | ||||||||||||||||

| Cash provided by operations | 79,674 | 88,500 | (10.0 | ) | 319,292 | 330,316 | (3.3 | ) | |||||||||||||||

| Funds provided by operations(1) | 113,322 | 91,608 | 23.7 | 342,837 | 388,220 | (11.7 | ) | ||||||||||||||||

| Cash used in investing activities | 38,852 | 34,278 | 13.3 | 141,032 | 157,157 | (10.3 | ) | ||||||||||||||||

| Capital spending by spend category(1) | |||||||||||||||||||||||

| Expansion and upgrade | 7,709 | 13,479 | (42.8 | ) | 30,501 | 39,439 | (22.7 | ) | |||||||||||||||

| Maintenance and infrastructure | 56,139 | 38,914 | 44.3 | 127,297 | 108,463 | 17.4 | |||||||||||||||||

| Proceeds on sale | (5,647 | ) | (6,698 | ) | (15.7 | ) | (21,825 | ) | (20,724 | ) | 5.3 | ||||||||||||

| Net capital spending(1) | 58,201 | 45,695 | 27.4 | 135,973 | 127,178 | 6.9 | |||||||||||||||||

| Net earnings per share: | |||||||||||||||||||||||

| Basic | 2.77 | 1.45 | 91.0 | 6.74 | 10.45 | (35.5 | ) | ||||||||||||||||

| Diluted | 2.31 | 1.45 | 59.3 | 6.73 | 9.84 | (31.6 | ) | ||||||||||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||||

| Basic | 14,142 | 13,607 | 3.9 | 14,312 | 13,643 | 4.9 | |||||||||||||||||

| Diluted | 14,890 | 13,610 | 9.4 | 14,317 | 14,858 | (3.6 | ) | ||||||||||||||||

(1) See “FINANCIAL MEASURES AND RATIOS.”

Operating Highlights

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | ||||||||||||||||||

| Contract drilling rig fleet | 214 | 224 | (4.5 | ) | 214 | 224 | (4.5 | ) | |||||||||||||||

| Drilling rig utilization days: | |||||||||||||||||||||||

| U.S. | 3,196 | 3,815 | (16.2 | ) | 9,885 | 13,823 | (28.5 | ) | |||||||||||||||

| Canada | 6,586 | 5,284 | 24.6 | 17,667 | 15,247 | 15.9 | |||||||||||||||||

| International | 736 | 554 | 32.9 | 2,192 | 1,439 | 52.3 | |||||||||||||||||

| Revenue per utilization day: | |||||||||||||||||||||||

| U.S. (US$) | 32,949 | 35,135 | (6.2 | ) | 33,011 | 35,216 | (6.3 | ) | |||||||||||||||

| Canada (Cdn$) | 32,325 | 32,224 | 0.3 | 34,497 | 32,583 | 5.9 | |||||||||||||||||

| International (US$) | 47,223 | 51,570 | (8.4 | ) | 51,761 | 51,306 | 0.9 | ||||||||||||||||

| Operating costs per utilization day: | |||||||||||||||||||||||

| U.S. (US$) | 22,207 | 21,655 | 2.5 | 22,113 | 20,217 | 9.4 | |||||||||||||||||

| Canada (Cdn$) | 19,448 | 18,311 | 6.2 | 20,196 | 19,239 | 5.0 | |||||||||||||||||

| Service rig fleet | 165 | 121 | 36.4 | 165 | 121 | 36.4 | |||||||||||||||||

| Service rig operating hours | 62,835 | 46,894 | 34.0 | 194,390 | 144,944 | 34.1 | |||||||||||||||||

Drilling Activity

| Average for the quarter ended 2023 | Average for the quarter ended 2024 | ||||||||||||||||||||||||||

| Mar. 31 | June 30 | Sept. 30 | Dec. 31 | Mar. 31 | June 30 | Sept. 30 | |||||||||||||||||||||

| Average Precision active rig count(1): | |||||||||||||||||||||||||||

| U.S. | 60 | 51 | 41 | 45 | 38 | 36 | 35 | ||||||||||||||||||||

| Canada | 69 | 42 | 57 | 64 | 73 | 49 | 72 | ||||||||||||||||||||

| International | 5 | 5 | 6 | 8 | 8 | 8 | 8 | ||||||||||||||||||||

| Total | 134 | 98 | 104 | 117 | 119 | 93 | 115 | ||||||||||||||||||||

(1) Average number of drilling rigs working or moving.

Financial Position

| (Stated in thousands of Canadian dollars, except ratios) | September 30, 2024 | December 31, 2023(2) | |||||

| Working capital(1) | 166,473 | 136,872 | |||||

| Cash | 24,304 | 54,182 | |||||

| Long-term debt | 787,008 | 914,830 | |||||

| Total long-term financial liabilities(1) | 858,765 | 995,849 | |||||

| Total assets | 2,887,996 | 3,019,035 | |||||

| Long-term debt to long-term debt plus equity ratio (1) | 0.32 | 0.37 | |||||

(1) See “FINANCIAL MEASURES AND RATIOS.”

(2) Comparative period figures were restated due to a change in accounting policy. See “CHANGE IN ACCOUNTING POLICY.”

Summary for the three months ended September 30, 2024:

- Revenue increased to $477 million compared with $447 million in the third quarter of 2023 as a result of higher Canadian and international activity, partially offset by lower U.S. activity, day rates and lower idle but contract rig revenue.

- Adjusted EBITDA was $142 million as compared with $115 million in 2023, primarily due to increased Canadian and international results and lower share-based compensation. Please refer to “Other Items” later in this news release for additional information on share-based compensation.

- Adjusted EBITDA as a percentage of revenue was 30% as compared with 26% in 2023.

- Generated cash from operations of $80 million, reduced debt by $49 million, repurchased $17 million of shares, and ended the quarter with $24 million of cash and more than $500 million of available liquidity.

- Revenue per utilization day, excluding the impact of idle but contracted rigs was US$32,949 compared with US$33,543 in 2023, a decrease of 2%. Sequentially, revenue per utilization day, excluding idle but contracted rigs, was largely consistent with the second quarter of 2024. U.S. revenue per utilization day was US$32,949 compared with US$35,135 in 2023. The decrease was primarily the result of lower fleet average day rates and idle but contracted rig revenue, partially offset by higher recoverable costs. We did not recognize revenue from idle but contracted rigs in the quarter as compared with US$6 million in 2023.

- U.S. operating costs per utilization day increased to US$22,207 compared with US$21,655 in 2023. The increase is mainly due to higher recoverable costs and fixed costs being spread over fewer activity days, partially offset by lower repairs and maintenance. Sequentially, operating costs per utilization day were largely consistent with the second quarter of 2024.

- Canadian revenue per utilization day was $32,325, largely consistent with the $32,224 realized in 2023. Sequentially, revenue per utilization day decreased $3,750 due to our rig mix, partially offset by higher fleet-wide average day rates.

- Canadian operating costs per utilization day increased to $19,448, compared with $18,311 in 2023, resulting from higher repairs and maintenance and rig reactivation costs. Sequentially, daily operating costs decreased $2,204 due to lower labour expenses due to rig mix, recoverable expenses and repairs and maintenance.

- Internationally, third quarter revenue increased 21% over 2023 as we realized revenue of US$35 million versus US$29 million in the prior year. Our higher revenue was primarily the result of a 33% increase in activity, partially offset by lower average revenue per utilization day. International revenue per utilization day was US$47,223 compared with US$51,570 in 2023 due to fewer rig moves and planned rig recertifications that accounted for 44 non-billable utilization days.

- Completion and Production Services revenue was $73 million, an increase of $16 million from 2023, as our third quarter service rig operating hours increased 34%.

- General and administrative expenses were $23 million as compared with $44 million in 2023 primarily due to lower share-based compensation charges.

- Net finance charges were $17 million, a decrease of $3 million compared with 2023 as a result of lower interest expense on our outstanding debt balance.

- Capital expenditures were $64 million compared with $52 million in 2023 and by spend category included $8 million for expansion and upgrades and $56 million for the maintenance of existing assets, infrastructure, and intangible assets.

- Increased expected capital spending in 2024 to $210 million, an increase of $15 million, due to the strategic purchase of drill pipe before new import tariffs take effect and additional customer-backed upgrades.

- Income tax expense for the quarter was $14 million as compared with $8 million in 2023. During the third quarter, we continue to not recognize deferred tax assets on certain international operating losses.

- Reduced debt by $49 million from the redemption of US$33 million of 2026 unsecured senior notes and US$3 million repayment of our U.S. Real Estate Credit Facility.

- Renewed our Normal Course Issuer Bid (NCIB) and repurchased $17 million of common shares during the third quarter.

Summary for the nine months ended September 30, 2024:

- Revenue for the first nine months of 2024 was $1,434 million, consistent 2023.

- Adjusted EBITDA for the period was $401 million as compared with $460 million in 2023. Our lower Adjusted EBITDA was primarily attributed to decreased U.S. drilling results and higher share-based compensation, partially offset by the strengthening of Canadian and international results.

- Cash provided by operations was $319 million as compared with $330 million in 2023. Funds provided by operations were $343 million, a decrease of $45 million from the comparative period.

- General and administrative costs were $97 million, an increase of $14 million from 2023 primarily due to higher share-based compensation charges.

- Net finance charges were $53 million, $10 million lower than 2023 due to our lower interest expense on our outstanding debt balance.

- Capital expenditures were $158 million in 2024, an increase of $10 million from 2023. Capital spending by spend category included $31 million for expansion and upgrades and $127 million for the maintenance of existing assets, infrastructure, and intangible assets.

- Reduced debt by $152 million from the redemption of US$89 million of 2026 unsecured senior notes and $31 million repayment of our Canadian and U.S. Real Estate Credit Facilities.

- Repurchased $50 million of common shares under our NCIB.

STRATEGY

Precision’s vision is to be globally recognized as the High Performance, High Value provider of land drilling services. Our strategic priorities for 2024 are focused on increasing our capital returns to shareholders by delivering best-in-class service and generating free cash flow.

Precision’s 2024 strategic priorities and the progress made during the third quarter are as follows:

- Concentrate organizational efforts on leveraging our scale and generating free cash flow.

- Generated cash from operations of $80 million, bringing our year to date total to $319 million.

- Increased utilization of our Super Single and Double rigs in the third quarter, driving Canadian drilling activity up 25% year over year.

- Increased our third quarter Completion and Production Services operating hours and Adjusted EBITDA 34% and 40%, respectively, year over year. Achieved our $20 million annual synergies target from the CWC acquisition, which closed in November 2023.

- Internationally, we realized US$35 million of contract drilling revenue versus US$29 million in 2023. Revenue for the third quarter of 2024 was negatively impacted by fewer rig moves and planned rig recertifications that accounted for 44 non-billable utilization days.

- Reduce debt by between $150 million and $200 million and allocate 25% to 35% of free cash flow before debt repayments for share repurchases.

- Reduced debt by redeeming US$33 million of our 2026 unsecured senior notes and repaying US$3 million of our U.S. Real Estate Credit Facility. For the first nine months of the year, we have reduced debt by $152 million and already achieved the low end of our debt repayment target range.

- Returned $17 million of capital to shareholders through share repurchases. Year to date we allocated $50 million of our free cash flow to share buybacks, which represents over 25% of free cash flow for the first nine months of the year and within our annual target range of 25% to 35%.

- Remain firmly committed to our long-term debt reduction target of $600 million between 2022 and 2026 ($410 million achieved as of September 30, 2024), while moving direct shareholder capital returns towards 50% of free cash flow.

- Continue to deliver operational excellence in drilling and service rig operations to strengthen our competitive position and extend market penetration of our Alpha™ and EverGreen™ products.

- Increased our Canadian drilling rig utilization days and well servicing rig operating hours over the third quarter of 2023, maintaining our position as the leading provider of high-quality and reliable services in Canada.

- Nearly doubled our EverGreen™ revenue from the third quarter of 2023.

- Continued to expand our EverGreen™ product offering on our Super Single rigs with hydrogen injection systems. EverGreenHydrogen™ reduces diesel consumption resulting in lower operating costs and greenhouse gas emissions for our customers.

OUTLOOK

The long-term outlook for global energy demand remains positive with rising demand for all types of energy including oil and natural gas driven by economic growth, increasing demand from third-world regions, and emerging energy sources of power demand. Oil prices are constructive, and producers remain disciplined with their production plans while geopolitical issues continue to threaten supply. In Canada, the recent commissioning of the Trans Mountain pipeline expansion and the startup of LNG Canada projected in 2025 are expected to provide significant tidewater access for Canadian crude oil and natural gas, supporting additional Canadian drilling activity. In the U.S., the next wave of LNG projects is expected to add approximately 11 bcf/d of export capacity from 2025 to 2028, supporting additional U.S. natural gas drilling activity. Coal retirements and a build-out of AI data centers could provide further support for natural gas drilling.

In Canada, we currently have 75 rigs operating and expect this activity level to continue until spring breakup, except for the traditional slowdown over Christmas. Our Canadian drilling activity continues to outpace 2023 due to increased heavy oil drilling activity and strong Montney activity driven by robust condensate demand and pricing. Since the startup of the Trans Mountain pipeline expansion in May, customer activity in heavy oil targeted areas has exceeded expectations, resulting in near full utilization of our Super Single fleet. Customers are benefiting from improved commodity pricing and a weak Canadian dollar. Our Super Triple fleet, the preferred rig for Montney drilling, is also nearly fully utilized and with the expected startup of LNG Canada in mid-2025, demand could exceed supply.

In recent years, the Canadian market has witnessed stronger second quarter drilling activity due to the higher percentage of wells drilled on pads in both the Montney and in heavy oil developments. Once a pad-equipped drilling rig is mobilized to site, it can walk from well to well and avoid spring break up road restrictions. We expect this higher activity trend to continue in the second quarter of 2025.

In the U.S., we currently have 35 rigs operating as drilling activity remains constrained by volatile commodity prices, customer consolidation and budget exhaustion. We view these headwinds as short-term in nature, which will continue to suppress activity for the remainder of the year and into 2025. However, looking further ahead, we expect that a new budget cycle, the next wave of Gulf Coast LNG export facilities, and new sources of domestic power demand should begin to stimulate drilling.

Internationally, we expect to have eight rigs running for the remainder of 2024, representing an approximate 40% increase in activity compared to 2023. All eight rigs are contracted through 2025 as well. We continue to bid our remaining idle rigs within the region and remain optimistic about our ability to secure additional rig activations.

As the premier well service provider in Canada, the outlook for this business remains positive. We expect the Trans Mountain pipeline expansion and LNG Canada to drive more service-related activity, while increased regulatory spending requirements are expected to result in more abandonment work. Customer demand should remain strong, and with continued labor constraints, we expect firm pricing into the foreseeable future.

We believe cost inflation is largely behind us and will continue to look for opportunities to lower costs.

Contracts

The following chart outlines the average number of drilling rigs under term contract by quarter as at October 29, 2024. For those quarters ending after September 30, 2024, this chart represents the minimum number of term contracts from which we will earn revenue. We expect the actual number of contracted rigs to vary in future periods as we sign additional term contracts.

| As at October 29, 2024 | Average for the quarter ended 2023 | Average | Average for the quarter ended 2024 | Average | ||||||||||||||||||||||||||||||||||||

| Mar. 31 | June 30 | Sept. 30 | Dec. 31 | 2023 | Mar. 31 | June 30 | Sept. 30 | Dec. 31 | 2024 | |||||||||||||||||||||||||||||||

| Average rigs under term contract: | ||||||||||||||||||||||||||||||||||||||||

| U.S. | 40 | 37 | 32 | 28 | 34 | 20 | 17 | 17 | 16 | 18 | ||||||||||||||||||||||||||||||

| Canada | 19 | 23 | 23 | 23 | 22 | 24 | 22 | 23 | 24 | 23 | ||||||||||||||||||||||||||||||

| International | 4 | 5 | 7 | 7 | 6 | 8 | 8 | 8 | 8 | 8 | ||||||||||||||||||||||||||||||

| Total | 63 | 65 | 62 | 58 | 62 | 52 | 47 | 48 | 48 | 49 | ||||||||||||||||||||||||||||||

SEGMENTED FINANCIAL RESULTS

Precision’s operations are reported in two segments: Contract Drilling Services, which includes our drilling rig, oilfield supply and manufacturing divisions; and Completion and Production Services, which includes our service rig, rental and camp and catering divisions.

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Contract Drilling Services | 406,155 | 390,728 | 3.9 | 1,215,125 | 1,257,762 | (3.4 | ) | ||||||||||||||||

| Completion and Production Services | 73,074 | 57,573 | 26.9 | 225,987 | 178,257 | 26.8 | |||||||||||||||||

| Inter-segment eliminations | (2,074 | ) | (1,547 | ) | 34.1 | (6,955 | ) | (5,036 | ) | 38.1 | |||||||||||||

| 477,155 | 446,754 | 6.8 | 1,434,157 | 1,430,983 | 0.2 | ||||||||||||||||||

| Adjusted EBITDA:(1) | |||||||||||||||||||||||

| Contract Drilling Services | 133,235 | 131,701 | 1.2 | 406,662 | 468,302 | (13.2 | ) | ||||||||||||||||

| Completion and Production Services | 19,741 | 14,118 | 39.8 | 50,786 | 39,031 | 30.1 | |||||||||||||||||

| Corporate and Other | (10,551 | ) | (31,244 | ) | (66.2 | ) | (56,753 | ) | (47,446 | ) | 19.6 | ||||||||||||

| 142,425 | 114,575 | 24.3 | 400,695 | 459,887 | (12.9 | ) | |||||||||||||||||

(1) See “FINANCIAL MEASURES AND RATIOS.”

SEGMENT REVIEW OF CONTRACT DRILLING SERVICES

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||||||||||

| (Stated in thousands of Canadian dollars, except where noted) | 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||

| Revenue | 406,155 | 390,728 | 3.9 | 1,215,125 | 1,257,762 | (3.4 | ) | ||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Operating | 262,933 | 247,937 | 6.0 | 776,210 | 759,750 | 2.2 | |||||||||||||||||

| General and administrative | 9,987 | 11,090 | (9.9 | ) | 32,253 | 29,710 | 8.6 | ||||||||||||||||

| Adjusted EBITDA(1) | 133,235 | 131,701 | 1.2 | 406,662 | 468,302 | (13.2 | ) | ||||||||||||||||

| Adjusted EBITDA as a percentage of revenue(1) | 32.8 | % | 33.7 | % | 33.5 | % | 37.2 | % | |||||||||||||||

(1) See “FINANCIAL MEASURES AND RATIOS.”

| United States onshore drilling statistics:(1) | 2024 | 2023 | |||||||||||||

| Precision | Industry(2) | Precision | Industry(2) | ||||||||||||

| Average number of active land rigs for quarters ended: | |||||||||||||||

| March 31 | 38 | 602 | 60 | 744 | |||||||||||

| June 30 | 36 | 583 | 51 | 700 | |||||||||||

| September 30 | 35 | 565 | 41 | 631 | |||||||||||

| Year to date average | 36 | 583 | 51 | 692 | |||||||||||

(1) United States lower 48 operations only.

(2) Baker Hughes rig counts.

| Canadian onshore drilling statistics:(1) | 2024 | 2023 | |||||||||||||

| Precision | Industry(2) | Precision | Industry(2) | ||||||||||||

| Average number of active land rigs for quarters ended: | |||||||||||||||

| March 31 | 73 | 208 | 69 | 221 | |||||||||||

| June 30 | 49 | 134 | 42 | 117 | |||||||||||

| September 30 | 72 | 207 | 57 | 188 | |||||||||||

| Year to date average | 65 | 183 | 56 | 175 | |||||||||||

(1) Canadian operations only.

(2) Baker Hughes rig counts.

SEGMENT REVIEW OF COMPLETION AND PRODUCTION SERVICES

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||||||||||

| (Stated in thousands of Canadian dollars, except where noted) | 2024 | 2023 | % Change | 2024 | 2023 | ||||||||||||||||||

| Revenue | 73,074 | 57,573 | 26.9 | 225,987 | 178,257 | 26.8 | |||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Operating | 50,608 | 41,612 | 21.6 | 167,128 | 133,325 | 25.4 | |||||||||||||||||

| General and administrative | 2,725 | 1,843 | 47.9 | 8,073 | 5,901 | 36.8 | |||||||||||||||||

| Adjusted EBITDA(1) | 19,741 | 14,118 | 39.8 | 50,786 | 39,031 | 30.1 | |||||||||||||||||

| Adjusted EBITDA as a percentage of revenue(1) | 27.0 | % | 24.5 | % | 22.5 | % | 21.9 | % | |||||||||||||||

| Well servicing statistics: | |||||||||||||||||||||||

| Number of service rigs (end of period) | 165 | 121 | 36.4 | 165 | 121 | 36.4 | |||||||||||||||||

| Service rig operating hours | 62,835 | 46,894 | 34.0 | 194,390 | 144,944 | 34.1 | |||||||||||||||||

| Service rig operating hour utilization | 41 | % | 42 | % | 43 | % | 44 | % | |||||||||||||||

(1) See “FINANCIAL MEASURES AND RATIOS.”

OTHER ITEMS

Share-based Incentive Compensation Plans

We have several cash and equity-settled share-based incentive plans for non-management directors, officers, and other eligible employees. Our accounting policies for each share-based incentive plan can be found in our 2023 Annual Report.

A summary of expense amounts under these plans during the reporting periods are as follows:

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Cash settled share-based incentive plans | (1,626 | ) | 30,105 | 28,810 | 20,091 | ||||||||||

| Equity settled share-based incentive plans | 1,440 | 701 | 3,517 | 1,834 | |||||||||||

| Total share-based incentive compensation plan expense | (186 | ) | 30,806 | 32,327 | 21,925 | ||||||||||

| Allocated: | |||||||||||||||

| Operating | 221 | 7,692 | 8,159 | 6,732 | |||||||||||

| General and Administrative | (407 | ) | 23,114 | 24,168 | 15,193 | ||||||||||

| (186 | ) | 30,806 | 32,327 | 21,925 | |||||||||||

CRITICAL ACCOUNTING JUDGEMENTS AND ESTIMATES

Because of the nature of our business, we are required to make judgements and estimates in preparing our Condensed Consolidated Interim Financial Statements that could materially affect the amounts recognized. Our judgements and estimates are based on our past experiences and assumptions we believe are reasonable in the circumstances. The critical judgements and estimates used in preparing the Condensed Consolidated Interim Financial Statements are described in our 2023 Annual Report.

EVALUATION OF CONTROLS AND PROCEDURES

Based on their evaluation as at September 30, 2024, Precision’s Chief Executive Officer and Chief Financial Officer concluded that the Corporation’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the United States Securities Exchange Act of 1934, as amended (the Exchange Act)), are effective to ensure that information required to be disclosed by the Corporation in reports that are filed or submitted to Canadian and U.S. securities authorities is recorded, processed, summarized and reported within the time periods specified in Canadian and U.S. securities laws. In addition, as at September 30, 2024, there were no changes in the internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) that occurred during the three months ended September 30, 2024 that have materially affected, or are reasonably likely to materially affect, the Corporation’s internal control over financial reporting. Management will continue to periodically evaluate the Corporation’s disclosure controls and procedures and internal control over financial reporting and will make any modifications from time to time as deemed necessary.

Based on their inherent limitations, disclosure controls and procedures and internal control over financial reporting may not prevent or detect misstatements, and even those controls determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

FINANCIAL MEASURES AND RATIOS

| Non-GAAP Financial Measures | |

| We reference certain additional Non-Generally Accepted Accounting Principles (Non-GAAP) measures that are not defined terms under IFRS Accounting Standards to assess performance because we believe they provide useful supplemental information to investors. | |

| Adjusted EBITDA | We believe Adjusted EBITDA (earnings before income taxes, loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals and depreciation and amortization), as reported in our Condensed Interim Consolidated Statements of Net Earnings and our reportable operating segment disclosures, is a useful measure because it gives an indication of the results from our principal business activities prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges. The most directly comparable financial measure is net earnings. |

| For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Adjusted EBITDA by segment: | |||||||||||||||

| Contract Drilling Services | 133,235 | 131,701 | 406,662 | 468,302 | |||||||||||

| Completion and Production Services | 19,741 | 14,118 | 50,786 | 39,031 | |||||||||||

| Corporate and Other | (10,551 | ) | (31,244 | ) | (56,753 | ) | (47,446 | ) | |||||||

| Adjusted EBITDA | 142,425 | 114,575 | 400,695 | 459,887 | |||||||||||

| Depreciation and amortization | 75,073 | 73,192 | 227,104 | 218,823 | |||||||||||

| Gain on asset disposals | (3,323 | ) | (2,438 | ) | (14,235 | ) | (15,586 | ) | |||||||

| Foreign exchange | 849 | 363 | 772 | (894 | ) | ||||||||||

| Finance charges | 16,914 | 19,618 | 53,472 | 63,946 | |||||||||||

| Gain on repurchase of unsecured notes | — | (37 | ) | — | (137 | ) | |||||||||

| Loss (gain) on investments and other assets | (150 | ) | (3,813 | ) | (330 | ) | 6,075 | ||||||||

| Incomes taxes | 13,879 | 7,898 | 37,512 | 45,138 | |||||||||||

| Net earnings | 39,183 | 19,792 | 96,400 | 142,522 | |||||||||||

| Funds Provided by (Used in) Operations | We believe funds provided by (used in) operations, as reported in our Condensed Interim Consolidated Statements of Cash Flows, is a useful measure because it provides an indication of the funds our principal business activities generate prior to consideration of working capital changes, which is primarily made up of highly liquid balances. The most directly comparable financial measure is cash provided by (used in) operations. |

| Net Capital Spending | We believe net capital spending is a useful measure as it provides an indication of our primary investment activities. The most directly comparable financial measure is cash provided by (used in) investing activities. Net capital spending is calculated as follows: |

| For the three months ended September 30, | For the nine months ended September 30, | |||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Capital spending by spend category | ||||||||||||||||

| Expansion and upgrade | 7,709 | 13,479 | 30,501 | 39,439 | ||||||||||||

| Maintenance, infrastructure and intangibles | 56,139 | 38,914 | 127,297 | 108,463 | ||||||||||||

| 63,848 | 52,393 | 157,798 | 147,902 | |||||||||||||

| Proceeds on sale of property, plant and equipment | (5,647 | ) | (6,698 | ) | (21,825 | ) | (20,724 | ) | ||||||||

| Net capital spending | 58,201 | 45,695 | 135,973 | 127,178 | ||||||||||||

| Business acquisitions | — | — | — | 28,000 | ||||||||||||

| Proceeds from sale of investments and other assets | — | (10,013 | ) | (3,623 | ) | (10,013 | ) | |||||||||

| Purchase of investments and other assets | 7 | 3,211 | 7 | 5,282 | ||||||||||||

| Receipt of finance lease payments | (207 | ) | (64 | ) | (591 | ) | (64 | ) | ||||||||

| Changes in non-cash working capital balances | (19,149 | ) | (4,551 | ) | 9,266 | 6,774 | ||||||||||

| Cash used in investing activities | 38,852 | 34,278 | 141,032 | 157,157 | ||||||||||||

| Working Capital | We define working capital as current assets less current liabilities, as reported in our Condensed Interim Consolidated Statements of Financial Position. Working capital is calculated as follows: |

| September 30, | December 31, | ||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | |||||

| Current assets | 472,557 | 510,881 | |||||

| Current liabilities | 306,084 | 374,009 | |||||

| Working capital | 166,473 | 136,872 | |||||

| Total Long-term Financial Liabilities | We define total long-term financial liabilities as total non-current liabilities less deferred tax liabilities, as reported in our Condensed Interim Consolidated Statements of Financial Position. Total long-term financial liabilities is calculated as follows: |

| September 30, | December 31, | ||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | |||||

| Total non-current liabilities | 920,812 | 1,069,364 | |||||

| Deferred tax liabilities | 62,047 | 73,515 | |||||

| Total long-term financial liabilities | 858,765 | 995,849 | |||||

| Non-GAAP Ratios | |

| We reference certain additional Non-GAAP ratios that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors. | |

| Adjusted EBITDA % of Revenue | We believe Adjusted EBITDA as a percentage of consolidated revenue, as reported in our Condensed Interim Consolidated Statements of Net Earnings, provides an indication of our profitability from our principal business activities prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges. |

| Long-term debt to long-term debt plus equity | We believe that long-term debt (as reported in our Condensed Interim Consolidated Statements of Financial Position) to long-term debt plus equity (total shareholders’ equity as reported in our Condensed Interim Consolidated Statements of Financial Position) provides an indication of our debt leverage. |

| Net Debt to Adjusted EBITDA | We believe that the Net Debt (long-term debt less cash, as reported in our Condensed Interim Consolidated Statements of Financial Position) to Adjusted EBITDA ratio provides an indication of the number of years it would take for us to repay our debt obligations. |

| Supplementary Financial Measures | |

| We reference certain supplementary financial measures that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors. | |

| Capital Spending by Spend Category | We provide additional disclosure to better depict the nature of our capital spending. Our capital spending is categorized as expansion and upgrade, maintenance and infrastructure, or intangibles. |

CHANGE IN ACCOUNTING POLICY

Precision adopted Classification of Liabilities as Current or Non-current and Non-current Liabilities with Covenants – Amendments to IAS 1, as issued in 2020 and 2022. These amendments apply retrospectively for annual reporting periods beginning on or after January 1, 2024 and clarify requirements for determining whether a liability should be classified as current or non-current. Due to this change in accounting policy, there was a retrospective impact on the comparative Statement of Financial Position pertaining to the Corporation’s Deferred Share Unit (DSU) plan for non-management directors which are redeemable in cash or for an equal number of common shares upon the director’s retirement. In the case of a director retiring, the director’s respective DSU liability would become payable and the Corporation would not have the right to defer settlement of the liability for at least twelve months. As such, the liability is impacted by the revised policy. The following changes were made to the Statement of Financial Position:

- As at January 1, 2023, accounts payable and accrued liabilities increased by $12 million and non-current share-based compensation liability decreased by $12 million.

- As at December 31, 2023, accounts payable and accrued liabilities increased by $8 million and non-current share-based compensation liability decreased by $8 million.

The Corporation’s other liabilities were not impacted by the amendments. The change in accounting policy will also be reflected in the Corporation’s consolidated financial statements as at and for the year ending December 31, 2024.

JOINT PARTNERSHIP

On September 26, 2024, Precision formed a strategic Partnership with two Indigenous partners to provide well servicing operations in northeast British Columbia. Precision contributed $4 million in assets to the Partnership. Precision holds a controlling interest in the Partnership and the portions of the net earnings and equity not attributable to Precision’s controlling interest are shown separately as Non-Controlling Interests (NCI) in the consolidated statements of net earnings and consolidated statements of financial position.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements contained in this release, including statements that contain words such as “could”, “should”, “can”, “anticipate”, “estimate”, “intend”, “plan”, “expect”, “believe”, “will”, “may”, “continue”, “project”, “potential” and similar expressions and statements relating to matters that are not historical facts constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information and statements”).

In particular, forward-looking information and statements include, but are not limited to, the following:

- our strategic priorities for 2024;

- our capital expenditures, free cash flow allocation and debt reduction plans for 2024 through to 2026;

- anticipated activity levels, demand for our drilling rigs, day rates and daily operating margins in 2024;

- the average number of term contracts in place for 2024;

- customer adoption of Alpha™ technologies and EverGreen™ suite of environmental solutions;

- timing and amount of synergies realized from acquired drilling and well servicing assets;

- potential commercial opportunities and rig contract renewals; and

- our future debt reduction plans.

These forward-looking information and statements are based on certain assumptions and analysis made by Precision in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. These include, among other things:

- our ability to react to customer spending plans as a result of changes in oil and natural gas prices;

- the status of current negotiations with our customers and vendors;

- customer focus on safety performance;

- existing term contracts are neither renewed nor terminated prematurely;

- our ability to deliver rigs to customers on a timely basis;

- the impact of an increase/decrease in capital spending; and

- the general stability of the economic and political environments in the jurisdictions where we operate.

Undue reliance should not be placed on forward-looking information and statements. Whether actual results, performance or achievements will conform to our expectations and predictions is subject to a number of known and unknown risks and uncertainties which could cause actual results to differ materially from our expectations. Such risks and uncertainties include, but are not limited to:

- volatility in the price and demand for oil and natural gas;

- fluctuations in the level of oil and natural gas exploration and development activities;

- fluctuations in the demand for contract drilling, well servicing and ancillary oilfield services;

- our customers’ inability to obtain adequate credit or financing to support their drilling and production activity;

- changes in drilling and well servicing technology, which could reduce demand for certain rigs or put us at a competitive advantage;

- shortages, delays and interruptions in the delivery of equipment supplies and other key inputs;

- liquidity of the capital markets to fund customer drilling programs;

- availability of cash flow, debt and equity sources to fund our capital and operating requirements, as needed;

- the impact of weather and seasonal conditions on operations and facilities;

- competitive operating risks inherent in contract drilling, well servicing and ancillary oilfield services;

- ability to improve our rig technology to improve drilling efficiency;

- general economic, market or business conditions;

- the availability of qualified personnel and management;

- a decline in our safety performance which could result in lower demand for our services;

- changes in laws or regulations, including changes in environmental laws and regulations such as increased regulation of hydraulic fracturing or restrictions on the burning of fossil fuels and greenhouse gas emissions, which could have an adverse impact on the demand for oil and natural gas;

- terrorism, social, civil and political unrest in the foreign jurisdictions where we operate;

- fluctuations in foreign exchange, interest rates and tax rates; and

- other unforeseen conditions which could impact the use of services supplied by Precision and Precision’s ability to respond to such conditions.

Readers are cautioned that the forgoing list of risk factors is not exhaustive. Additional information on these and other factors that could affect our business, operations or financial results are included in reports on file with applicable securities regulatory authorities, including but not limited to Precision’s Annual Information Form for the year ended December 31, 2023, which may be accessed on Precision’s SEDAR+ profile at www.sedarplus.ca or under Precision’s EDGAR profile at www.sec.gov. The forward-looking information and statements contained in this release are made as of the date hereof and Precision undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as required by law.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

| (Stated in thousands of Canadian dollars) | September 30, 2024 |

December 31, 2023(1) |

January 1, 2023(1) |

|||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Cash | $ | 24,304 | $ | 54,182 | $ | 21,587 | ||||||

| Accounts receivable | 401,652 | 421,427 | 413,925 | |||||||||

| Inventory | 41,398 | 35,272 | 35,158 | |||||||||

| Assets held for sale | 5,203 | — | — | |||||||||

| Total current assets | 472,557 | 510,881 | 470,670 | |||||||||

| Non-current assets: | ||||||||||||

| Income tax recoverable | 696 | 682 | 1,602 | |||||||||

| Deferred tax assets | 27,767 | 73,662 | 455 | |||||||||

| Property, plant and equipment | 2,296,079 | 2,338,088 | 2,303,338 | |||||||||

| Intangibles | 15,566 | 17,310 | 19,575 | |||||||||

| Right-of-use assets | 63,708 | 63,438 | 60,032 | |||||||||

| Finance lease receivables | 4,938 | 5,003 | — | |||||||||

| Investments and other assets | 6,685 | 9,971 | 20,451 | |||||||||

| Total non-current assets | 2,415,439 | 2,508,154 | 2,405,453 | |||||||||

| Total assets | $ | 2,887,996 | $ | 3,019,035 | $ | 2,876,123 | ||||||

| LIABILITIES AND EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable and accrued liabilities | $ | 282,810 | $ | 350,749 | $ | 404,350 | ||||||

| Income taxes payable | 3,059 | 3,026 | 2,991 | |||||||||

| Current portion of lease obligations | 19,263 | 17,386 | 12,698 | |||||||||

| Current portion of long-term debt | 952 | 2,848 | 2,287 | |||||||||

| Total current liabilities | 306,084 | 374,009 | 422,326 | |||||||||

| Non-current liabilities: | ||||||||||||

| Share-based compensation | 10,339 | 16,755 | 47,836 | |||||||||

| Provisions and other | 7,408 | 7,140 | 7,538 | |||||||||

| Lease obligations | 54,010 | 57,124 | 52,978 | |||||||||

| Long-term debt | 787,008 | 914,830 | 1,085,970 | |||||||||

| Deferred tax liabilities | 62,047 | 73,515 | 28,946 | |||||||||

| Total non-current liabilities | 920,812 | 1,069,364 | 1,223,268 | |||||||||

| Equity: | ||||||||||||

| Shareholders’ capital | 2,337,079 | 2,365,129 | 2,299,533 | |||||||||

| Contributed surplus | 76,656 | 75,086 | 72,555 | |||||||||

| Deficit | (915,629 | ) | (1,012,029 | ) | (1,301,273 | ) | ||||||

| Accumulated other comprehensive income | 158,602 | 147,476 | 159,714 | |||||||||

| Total equity attributable to shareholders | 1,656,708 | 1,575,662 | 1,230,529 | |||||||||

| Non-controlling interest | 4,392 | — | — | |||||||||

| Total equity | 1,661,100 | 1,575,662 | 1,230,529 | |||||||||

| Total liabilities and equity | $ | 2,887,996 | $ | 3,019,035 | $ | 2,876,123 | ||||||

(1) Comparative period figures were restated due to a change in accounting policy. See “CHANGE IN ACCOUNTING POLICY.”

(2) See “JOINT PARTNERSHIP” for additional information.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF NET EARNINGS (LOSS) (UNAUDITED)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (Stated in thousands of Canadian dollars, except per share amounts) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 477,155 | $ | 446,754 | $ | 1,434,157 | $ | 1,430,983 | ||||||||

| Expenses: | ||||||||||||||||

| Operating | 311,467 | 288,002 | 936,383 | 888,039 | ||||||||||||

| General and administrative | 23,263 | 44,177 | 97,079 | 83,057 | ||||||||||||

| Earnings before income taxes, loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals, and depreciation and amortization | 142,425 | 114,575 | 400,695 | 459,887 | ||||||||||||

| Depreciation and amortization | 75,073 | 73,192 | 227,104 | 218,823 | ||||||||||||

| Gain on asset disposals | (3,323 | ) | (2,438 | ) | (14,235 | ) | (15,586 | ) | ||||||||

| Foreign exchange | 849 | 363 | 772 | (894 | ) | |||||||||||

| Finance charges | 16,914 | 19,618 | 53,472 | 63,946 | ||||||||||||

| Gain on repurchase of unsecured senior notes | — | (37 | ) | — | (137 | ) | ||||||||||

| Loss (gain) on investments and other assets | (150 | ) | (3,813 | ) | (330 | ) | 6,075 | |||||||||

| Earnings before income taxes | 53,062 | 27,690 | 133,912 | 187,660 | ||||||||||||

| Income taxes: | ||||||||||||||||

| Current | 2,297 | 2,047 | 4,659 | 4,008 | ||||||||||||

| Deferred | 11,582 | 5,851 | 32,853 | 41,130 | ||||||||||||

| 13,879 | 7,898 | 37,512 | 45,138 | |||||||||||||

| Net earnings | $ | 39,183 | $ | 19,792 | $ | 96,400 | $ | 142,522 | ||||||||

| Net earnings per share attributable to shareholders: | ||||||||||||||||

| Basic | $ | 2.77 | $ | 1.45 | $ | 6.74 | $ | 10.45 | ||||||||

| Diluted | $ | 2.31 | $ | 1.45 | $ | 6.73 | $ | 9.84 | ||||||||

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net earnings | $ | 39,183 | $ | 19,792 | $ | 96,400 | $ | 142,522 | ||||||||

| Unrealized gain (loss) on translation of assets and liabilities of operations denominated in foreign currency | (16,104 | ) | 39,180 | 30,409 | 3,322 | |||||||||||

| Foreign exchange gain (loss) on net investment hedge with U.S. denominated debt | 9,536 | (24,616 | ) | (19,283 | ) | (1,484 | ) | |||||||||

| Comprehensive income | $ | 32,615 | $ | 34,356 | $ | 107,526 | $ | 144,360 | ||||||||

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (Stated in thousands of Canadian dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Cash provided by (used in): | ||||||||||||||||

| Operations: | ||||||||||||||||

| Net earnings | $ | 39,183 | $ | 19,792 | $ | 96,400 | $ | 142,522 | ||||||||

| Adjustments for: | ||||||||||||||||

| Long-term compensation plans | 2,620 | 11,577 | 14,490 | 9,200 | ||||||||||||

| Depreciation and amortization | 75,073 | 73,192 | 227,104 | 218,823 | ||||||||||||

| Gain on asset disposals | (3,323 | ) | (2,438 | ) | (14,235 | ) | (15,586 | ) | ||||||||

| Foreign exchange | 815 | 1,275 | 965 | (13 | ) | |||||||||||

| Finance charges | 16,914 | 19,618 | 53,472 | 63,946 | ||||||||||||

| Income taxes | 13,879 | 7,898 | 37,512 | 45,138 | ||||||||||||

| Other | 27 | — | 120 | (220 | ) | |||||||||||

| Loss (gain) on investments and other assets | (150 | ) | (3,813 | ) | (330 | ) | 6,075 | |||||||||

| Gain on repurchase of unsecured senior notes | — | (37 | ) | — | (137 | ) | ||||||||||

| Income taxes paid | (508 | ) | (187 | ) | (4,842 | ) | (2,395 | ) | ||||||||

| Income taxes recovered | 58 | 4 | 58 | 7 | ||||||||||||

| Interest paid | (31,692 | ) | (35,500 | ) | (69,435 | ) | (79,702 | ) | ||||||||

| Interest received | 426 | 227 | 1,558 | 562 | ||||||||||||

| Funds provided by operations | 113,322 | 91,608 | 342,837 | 388,220 | ||||||||||||

| Changes in non-cash working capital balances | (33,648 | ) | (3,108 | ) | (23,545 | ) | (57,904 | ) | ||||||||

| Cash provided by operations | 79,674 | 88,500 | 319,292 | 330,316 | ||||||||||||

| Investments: | ||||||||||||||||

| Purchase of property, plant and equipment | (63,797 | ) | (51,546 | ) | (157,747 | ) | (146,378 | ) | ||||||||

| Purchase of intangibles | (51 | ) | (847 | ) | (51 | ) | (1,524 | ) | ||||||||

| Proceeds on sale of property, plant and equipment | 5,647 | 6,698 | 21,825 | 20,724 | ||||||||||||

| Proceeds from sale of investments and other assets | — | 10,013 | 3,623 | 10,013 | ||||||||||||

| Business acquisitions | — | — | — | (28,000 | ) | |||||||||||

| Purchase of investments and other assets | (7 | ) | (3,211 | ) | (7 | ) | (5,282 | ) | ||||||||

| Receipt of finance lease payments | 207 | 64 | 591 | 64 | ||||||||||||

| Changes in non-cash working capital balances | 19,149 | 4,551 | (9,266 | ) | (6,774 | ) | ||||||||||

| Cash used in investing activities | (38,852 | ) | (34,278 | ) | (141,032 | ) | (157,157 | ) | ||||||||

| Financing: | ||||||||||||||||

| Issuance of long-term debt | 10,900 | 23,600 | 10,900 | 162,649 | ||||||||||||

| Repayments of long-term debt | (59,658 | ) | (49,517 | ) | (162,506 | ) | (288,538 | ) | ||||||||

| Repurchase of share capital | (16,891 | ) | — | (50,465 | ) | (12,951 | ) | |||||||||

| Issuance of common shares from the exercise of options | 495 | — | 686 | — | ||||||||||||

| Debt amendment fees | — | — | (1,317 | ) | — | |||||||||||

| Lease payments | (3,586 | ) | (2,410 | ) | (10,005 | ) | (6,413 | ) | ||||||||

| Funding from non-controlling interest | 4,392 | — | 4,392 | — | ||||||||||||

| Cash used in financing activities | (64,348 | ) | (28,327 | ) | (208,315 | ) | (145,253 | ) | ||||||||

| Effect of exchange rate changes on cash | (403 | ) | 251 | 177 | (428 | ) | ||||||||||

| Increase (decrease) in cash | (23,929 | ) | 26,146 | (29,878 | ) | 27,478 | ||||||||||

| Cash, beginning of period | 48,233 | 22,919 | 54,182 | 21,587 | ||||||||||||

| Cash, end of period | $ | 24,304 | $ | 49,065 | $ | 24,304 | $ | 49,065 | ||||||||

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

| Attributable to shareholders of the Corporation | ||||||||||||||||||||||||||||

| (Stated in thousands of Canadian dollars) | Shareholders’ Capital |

Contributed Surplus |

Accumulated Other Comprehensive Income |

Deficit | Total | Non- controlling interest |

Total Equity |

|||||||||||||||||||||

| Balance at January 1, 2024 | $ | 2,365,129 | $ | 75,086 | $ | 147,476 | $ | (1,012,029 | ) | $ | 1,575,662 | $ | — | $ | 1,575,662 | |||||||||||||

| Net earnings for the period | — | — | — | 96,400 | 96,400 | — | 96,400 | |||||||||||||||||||||

| Other comprehensive income for the period | — | — | 11,126 | — | 11,126 | — | 11,126 | |||||||||||||||||||||

| Share options exercised | 978 | (292 | ) | — | — | 686 | — | 686 | ||||||||||||||||||||

| Settlement of Executive Performance and Restricted Share Units | 21,846 | (1,479 | ) | — | — | 20,367 | — | 20,367 | ||||||||||||||||||||

| Share repurchases | (51,050 | ) | — | — | — | (51,050 | ) | — | (51,050 | ) | ||||||||||||||||||

| Redemption of non-management directors share units | 176 | (176 | ) | — | — | — | — | – | ||||||||||||||||||||

| Share-based compensation expense | — | 3,517 | — | — | 3,517 | — | 3,517 | |||||||||||||||||||||

| Funding from non-controlling interest | — | — | — | — | — | 4,392 | 4,392 | |||||||||||||||||||||

| Balance at September 30, 2024 | $ | 2,337,079 | $ | 76,656 | $ | 158,602 | $ | (915,629 | ) | $ | 1,656,708 | $ | 4,392 | $ | 1,661,100 | |||||||||||||

| Attributable to shareholders of the Corporation | ||||||||||||||||||||||||||||

| (Stated in thousands of Canadian dollars) | Shareholders’ Capital |

Contributed Surplus |

Accumulated Other Comprehensive Income |

Deficit | Total | Non- controlling interest |

Total Equity |

|||||||||||||||||||||

| Balance at January 1, 2023 | $ | 2,299,533 | $ | 72,555 | $ | 159,714 | $ | (1,301,273 | ) | $ | 1,230,529 | $ | — | $ | 1,230,529 | |||||||||||||

| Net earnings for the period | — | — | — | 142,522 | 142,522 | — | 142,522 | |||||||||||||||||||||

| Other comprehensive income for the period | — | — | 1,838 | — | 1,838 | — | 1,838 | |||||||||||||||||||||

| Settlement of Executive Performance and Restricted Share Units | 19,206 | — | — | — | 19,206 | — | 19,206 | |||||||||||||||||||||

| Share repurchases | (12,951 | ) | — | — | — | (12,951 | ) | — | (12,951 | ) | ||||||||||||||||||

| Redemption of non-management directors share units | 757 | — | — | — | 757 | — | 757 | |||||||||||||||||||||

| Share-based compensation expense | — | 1,834 | — | — | 1,834 | — | 1,834 | |||||||||||||||||||||

| Balance at September 30, 2023 | $ | 2,306,545 | $ | 74,389 | $ | 161,552 | $ | (1,158,751 | ) | $ | 1,383,735 | $ | — | $ | 1,383,735 | |||||||||||||

2024 THIRD QUARTER RESULTS CONFERENCE CALL AND WEBCAST

Precision Drilling Corporation has scheduled a conference call and webcast to begin promptly at 11:00 a.m. MT (1:00 p.m. ET) on Wednesday, October 30, 2024.

To participate in the conference call please register at the URL link below. Once registered, you will receive a dial-in number and a unique PIN, which will allow you to ask questions.

https://register.vevent.com/register/BI4cb3a3db88084e66ad528ebb2bdb81e4

The call will also be webcast and can be accessed through the link below. A replay of the webcast call will be available on Precision’s website for 12 months.

https://edge.media-server.com/mmc/p/mov2xb4k

About Precision

Precision is a leading provider of safe and environmentally responsible High Performance, High Value services to the energy industry, offering customers access to an extensive fleet of Super Series drilling rigs. Precision has commercialized an industry-leading digital technology portfolio known as Alpha™ that utilizes advanced automation software and analytics to generate efficient, predictable, and repeatable results for energy customers. Our drilling services are enhanced by our EverGreen™ suite of environmental solutions, which bolsters our commitment to reducing the environmental impact of our operations. Additionally, Precision offers well service rigs, camps and rental equipment all backed by a comprehensive mix of technical support services and skilled, experienced personnel.

Precision is headquartered in Calgary, Alberta, Canada and is listed on the Toronto Stock Exchange under the trading symbol “PD” and on the New York Stock Exchange under the trading symbol “PDS”.

Additional Information

For further information, please contact:

Lavonne Zdunich, CPA, CA

Vice President, Investor Relations

403.716.4500

800, 525 – 8th Avenue S.W.

Calgary, Alberta, Canada T2P 1G1

Website: www.precisiondrilling.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Beyond Beer, Tilray's $1.67 Billion Market Play: Is This Cannabis Giant Still A Smart Buy?

Tilray Brands TLRY remains a cautious investment, according to Zuanic & Associates, despite its solid balance sheet and diverse global assets. With a “Neutral” rating, Zuanic views Tilray as a long-term player in the cannabis sector, though short-term uncertainties cloud its outlook.

Tilray’s international presence is expanding, notably in Germany, where sales have grown 50%. Yet, headwinds persist, including high operating expenses, rising share count and ongoing market share losses in Canada where Tilray has opted against aggressive discounting in certain product categories.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

U.S. Beverage Expansion Shows Potential

In the U.S., Tilray has bolstered its beverage portfolio with craft beer brands acquired from Molson Coors TAP, positioning itself to gain ground in the non-alcoholic hemp drink market – a segment showing explosive growth potential.

Still, Tilray’s revenue, at $200 million for the August quarter, trails its $950 million target for FY25, casting doubt on near-term growth momentum.

Rising Costs And Dilution

Tilray’s operating expenses remain a point of concern, with Selling, General & Administrative (SGA) costs reaching 34% of sales in the first quarter of FY25 – an increase from 31% in FY24. This rise in cash SGA expenses has contributed to a 300 basis point drop in Tilray’s adjusted EBITDA margin.

Additionally, Tilray’s share count has grown significantly, increasing from 657 million in FY23 to 903.3 million by October 2024. While this higher share count bolsters liquidity, it also affects per-share revenue metrics.

Despite the dilution, Tilray’s revenue per share has remained stable, reflecting accretive growth from recent acquisitions. However, the increased equity base will require the company to continue driving organic growth to justify valuation metrics and support long-term investor confidence.

Read Also: EXCLUSIVE: Tilray CEO Irwin Simon On Why US Cannabis Rescheduling Won’t Change A Billion-Dollar Play

Valuation Premium And Investor Outlook

Valued at an estimated $1.67 billion, Tilray trades at a 1.7x EV/sales multiple, with its cannabis segment trading at a premium of 4x, well above industry norms.

While Tilray’s liquidity and extensive market reach make it a formidable global contender, Zuanic advises investors to await clearer evidence of sustainable growth across international markets and gains in operational efficiency.

Path Ahead: Strategic Global Expansion

Tilray’s journey hinges on its ability to capitalize on international cannabis expansion, reinvigorate its U.S. brands, and improve financial performance. For now, Zuanic & Associates suggests that potential investors stay on the sidelines, with Tilray’s future resting on a steady, strategic push through emerging global markets.

Read Next: Canada’s Cannabis Market Goes Cold, Pot Prices Hit Bottom: Why Top Producers Are Losing Ground

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

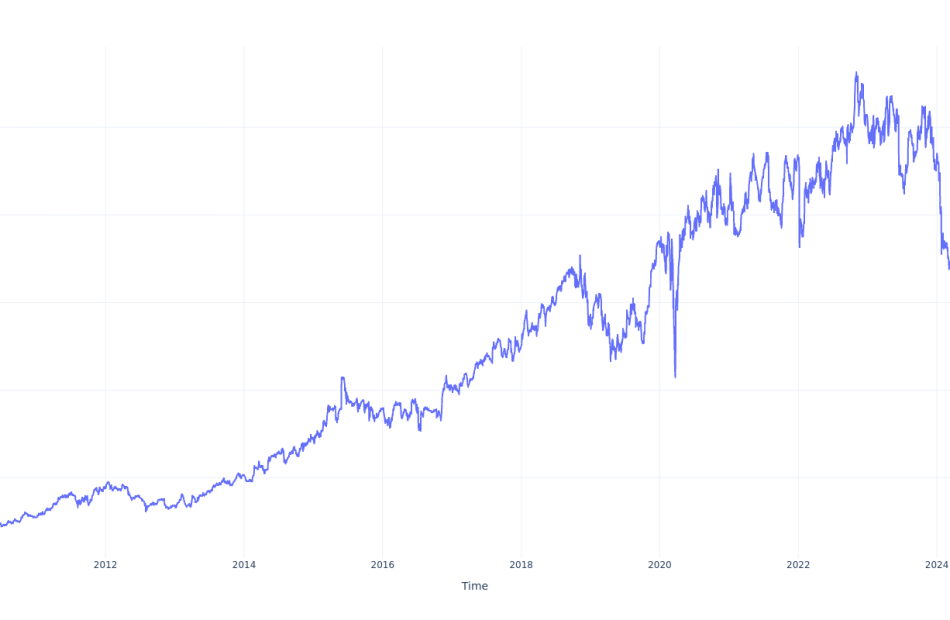

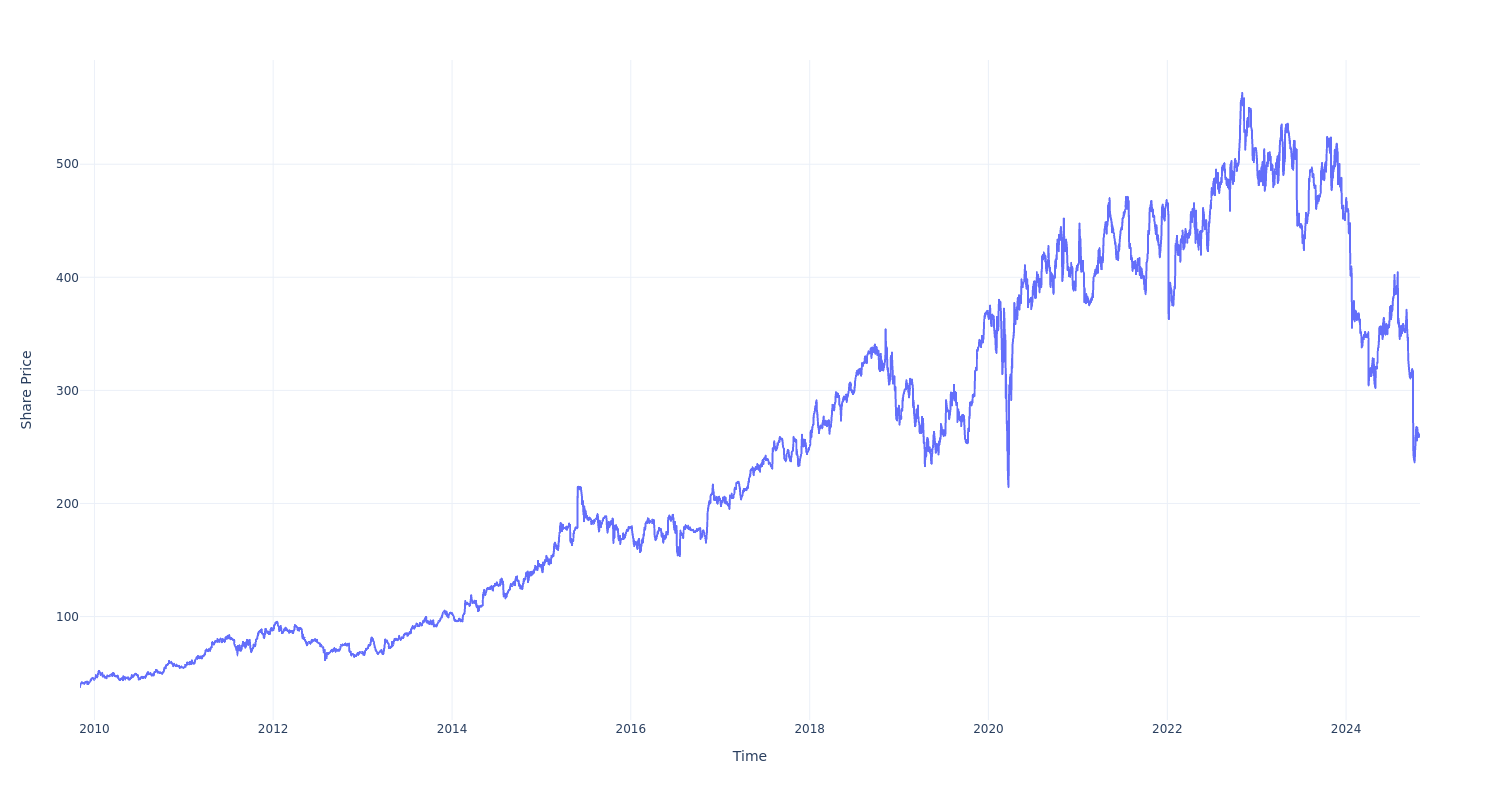

If You Invested $100 In This Stock 15 Years Ago, You Would Have $700 Today

Humana HUM has outperformed the market over the past 15 years by 1.4% on an annualized basis producing an average annual return of 13.49%. Currently, Humana has a market capitalization of $31.22 billion.

Buying $100 In HUM: If an investor had bought $100 of HUM stock 15 years ago, it would be worth $688.29 today based on a price of $259.28 for HUM at the time of writing.

Humana’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SitusAMC Earns 2024 Great Place To Work Certification in India

NEW YORK, Oct. 28, 2024 /PRNewswire/ — SitusAMC, the leading provider of innovative, trusted solutions supporting the entire lifecycle of real estate finance, is proud to be certified in India by Great Place To Work. The prestigious award is based entirely on current employees’ perspective on their experience working at SitusAMC. This year, the majority of employees in India said SitusAMC is a great place to work.

Great Place To Work is the global authority on workplace culture, employee experience, and leadership behaviors proven to deliver market-leading revenue, employee retention, and increased innovation.

“Great Place To Work Certification is a highly coveted achievement that requires consistent and intentional dedication to the overall employee experience,” says Sarah Lewis-Kulin, the Vice President of Global Recognition at Great Place To Work. Ms. Lewis-Kulin emphasized that Certification is the sole official recognition earned by the real-time feedback of employees regarding their company culture. “By successfully earning this recognition, it is evident that SitusAMC stands out as one of the top companies to work for, providing a great workplace environment for its employees.”

According to Great Place To Work research, job seekers are 4.5 times more likely to find a great boss at a certified great workplace. Additionally, employees at certified workplaces are 93% more likely to look forward to coming to work and are 2x as likely to be paid fairly, and have a fair chance at promotion.

“Great Place to Work’s recognition of our India team members is a testament to their unwavering commitment and efforts in fostering a culture that truly reflects our organization’s core values and character,” stated Sean Harding, Head of Human Resources at SitusAMC.

The Great Place To Work recognition builds on a strong foundation already established by SitusAMC as a leading employer. Earlier this year, the firm was recognized for our ongoing commitment to the highest environmental, social, and governance (ESG) standards with a Silver Sustainability Rating from EcoVadis. Our efforts landed us in the top 15th percentile amongst all award recipients. EcoVadis is the world’s largest and most trusted provider of business sustainability ratings. Amongst other things, the rating recognizes our commitment and ongoing efforts to:

- Build a diverse and inclusive work culture through our Employee Resource Group Program, Employee Engagement Communities, and hiring practices.

- Double the impact on causes important to our employees through our dedicated employee donation matching program.

- Reward and recognize employee accomplishments and achievements with our Global Rewards and Recognition Programs.

- Provide career and professional development opportunities through our Employee & Leadership Development and Mentorship programs.

“This is indeed a very proud moment for us at SitusAMC. The Great Place to Work certificateiontestifies to the respectful and positive culture we have built on trust, open communication, and an ever-enriching workplace, which our employees call their second home. This important milestone certainly motivates us to do more for our valued employees,” stated Priyankar Ghosh, Managing Director, Head of Shared Services.

WE’RE HIRING!

Looking to grow your career at a company that puts its people first? Visit our careers page at https://careers.situsamc.com/.

About SitusAMC

SitusAMC is the leading independent provider of innovative, trusted solutions that support the entire lifecycle of commercial and residential real estate finance, powering more efficient, effective, and agile businesses. For more information, visit www.situsamc.com.

About Great Place To Work®

As the global authority on workplace culture, Great Place To Work® brings 30 years of groundbreaking research and data to help every place become a great place to work for all. Their proprietary platform and For All™ Model helps companies evaluate the experience of every employee, with exemplary workplaces becoming Great Place To Work Certified™ or receiving recognition on a coveted Best Workplaces™ List.

Learn more at greatplacetowork.com and follow Great Place To Work on LinkedIn, Twitter, Facebook and Instagram.

Press Contact:

Andy Garrett

Head of Marketing, SitusAMC

andygarrett@situsamc.com

![]() View original content:https://www.prnewswire.com/news-releases/situsamc-earns-2024-great-place-to-work-certification-in-india-302289033.html

View original content:https://www.prnewswire.com/news-releases/situsamc-earns-2024-great-place-to-work-certification-in-india-302289033.html

SOURCE SitusAMC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Accenture Lands $1.6B US Air Force Deal To Elevate Cloud One: Details

Accenture plc ACN shares are trading marginally higher on Tuesday.

In a press release, the company announced that Accenture Federal Services has received a Task Order worth up to $1.6 billion to effectively scale and improve the U.S. Air Force’s multi-cloud Cloud One environment.

“Accenture Federal Services will help the U.S. Air Force optimize its current cloud environment and support Cloud One in realizing its full potential,” said Justin Shirk, a Mission Operations and Cloud Ecosystems managing director in Accenture Federal Services.

Accenture Federal Services will also deliver multi-cloud billing and account management services for the Air Force.

According to Benzinga Pro, ACN stock has gained over 24% in the past year. Investors can gain exposure to the stock via Trust for Professional Managers Jensen Quality Growth ETF JGRW and Siren Nasdaq NexGen Economy ETF BLCN.

Also Read: McDonald’s Q3 Earnings: Revenue And Profit Beat, Global Comp Sales Dip, No Mention Of E.coli Impact

The company expressed confidence that its deep understanding of the U.S. Air Force’s mission-critical needs, along with its expertise in cloud transformation and embedded FinOps, positions it to provide a managed cloud and software service that aligns effectively with the agency’s long-term goals.

The length of the Accenture Federal Services Cloud One Task Order support contract is up to five years and 3 months.

Last month, Accenture expanded its partnership with NVIDIA Corp. to launch the Accenture NVIDIA Business Group.

Accenture said the new Accenture Nvidia Business Group launched with 30,000 professionals receiving training globally to help clients scale enterprise AI adoption with AI agents using Accenture’s AI Refinery developed on the NVIDIA AI stack.

The Accenture AI Refinery will be available on all public and private cloud platforms and will integrate with other Accenture Business Groups to accelerate AI across the SaaS and Cloud AI ecosystem.

Price Action: ACN shares are trading higher by 0.63% to $363.60 at last check Tuesday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Center for California Real Estate Recaps Top Housing Issues, Insights of 2024

LOS ANGELES, Oct. 28, 2024 /PRNewswire/ — The Center for California Real Estate (CCRE) has just released its list of top issues and insights in housing this year, reflecting the past 10 months of conversations among the state’s leading government, academia, nonprofit and business leaders working together to tackle California’s multi-faceted housing challenges.

The list comes just ahead of the Center’s flagship event, the CCRE Housing Summit: Charting California’s Future, on Wednesday, Oct. 30 in Los Angeles. Arguably the most important statewide housing event of the year, the Summit features industry, academic, civic and private sector experts convening to analyze the current political environment for implementing housing policy changes, examine the state of homeownership for Californians, and explore broad strategies for enhancing housing supply.

“This is a critical time in housing with many different issues converging that impact our ability to deliver what Californians need,” said Melanie Barker, 2024 president of the CALIFORNIA ASSOCIATION OF REALTORS®. “The Center for California Real Estate was created for exactly this purpose ― to bring together the best minds from across the state and country to have frank conversations about what’s happening on the ground, what’s impeding progress and what needs to be done to help solve the biggest challenges in housing and real estate.”

The year that began with a spotlight on interest rates and housing affordability quickly shifted focus to homeowners insurance as the leading issue impacting housing and homeownership, which dominated news cycles.

The need for immediate consumer participation and action drove this year’s housing news to a new level of awareness across the state, as homeowners, buyers and sellers sought to replace canceled insurance plans and capitalize on market changes.

The below issues and insights are summarized from a series of conversations across the state this year hosted by the Center for California Real Estate.

- Insurance: relief in sight, but still far off