Hearing Protection Equipment Market Size on Track for USD 6,981.1 Million Milestone by 2031, Growing at a 6.5% CAGR| Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Oct. 29, 2024 (GLOBE NEWSWIRE) — The previous market valuation of the hearing protection equipment market (Markt für Gehörschutzgeräte) was measured in 2021, and it was valued at US$ 3,803.7 million. However, the said market shows a moderate advancement with a CAGR of 6.5%. This shall make the overall market valuation to US$ 6,981.1 million. Various market forces often govern this growth.

Governments of various countries play a crucial role in governing the industry’s growth. In the case of the subject market, multiple rules regarding the safety of people working in sectors requiring high-intensity noises have been imposed. As a result, it becomes imperative to meet these guidelines, thereby serving as a crucial market force.

Many end-user industries, including the automotive and construction industries, and so on, have been increasing staggeringly. Due to this, chances for product innovation increase, thereby enhancing the quality of hearing protection aids or instruments. Therefore, this plays the role of a significant market force.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=19841

Due to the worldwide increase in industrialization, manufacturing processes have started to increase rapidly. These processes often require a dedicated person to operate them, and the noise level at such places is high. Therefore, it drives the market substantially, contributing to the said industry’s growth.

Key Players

- Honeywell International Inc.

- 3M Company

- Pyramex Safety Products LLC

- MSA Safety, Inc.

- Delta Plus Group

- JSP Ltd.

- Uvex Safety Group

- Kimberly-Clark

- E I Du Pont De Nemours and Co.

- Bei Bei Safety Co. Ltd.

Key Findings from the Market Report

- In the case of the hearing protection equipment market segmentation, it is identified that various market segments contribute equally to the market’s growth. Earplug is the market segment that has great hygiene and maintenance properties. Due to this, earplugs’ handling is smooth. It depicts that a large consumer market segment is inclined toward the said segment.

- From the perspective of the application of devices, a manufacturing plant is one of the verticals of the market segment. Auditory control and safety are important in the said segment, and hence, hearing protection aids are widely used.

- From the auditory range segment perspective, ears are not supposed to be exposed to noises over 70 dB. Hence, this acoustic range is preferred, and devices damping the higher-frequency noise are used.

- In the case of the market segment concerning the distribution channel used, the direct sales segment is observed more often. This segment has been contributing to the market growth more.

Regional Profile

- The technological development and rise in medical proficiency make the North American continent a probable market leader. Countries, including Canada and the USA, have significantly contributed to the development of the market. Also, strict government regulations and policies at the workplace are responsible for the same.

- Apart from this, Europe contributes substantially to the global hearing protection equipment market. Due to the robust medical infrastructure available in the continent, it revolutionizes the said market.

- Also, Asia-Pacific and the Middle East are some regions to be noted during the discussion.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=19841

Key Developments in the Hearing Protection Equipment Market

- In October 2021, Honeywell International Inc. introduced a smart solution for analyzing real-time sounds. Due to this, the staff members of different companies could be safeguarded from hearing loss.

- In December 2021, for hearing loss caused during military operations, Maryland-based Zeteo Tech, Inc. introduced a canal hearing aid called The Canine Auditory Protection System (CAPS) technology.

- In April 2022, ISOtunes introduced its three products that are compatible with a fresher in the said matter and affordable.

Competitive Landscape

The competitive landscape of the global hearing protection equipment market is cluttered due to the presence of multiple players. Among these competitors, ISOtunes is the organization that produces an affordable product range like AIR DEFENDER, LINK 2.0, and FREE Aware.

- Maryland-based Zeteo Tech Inc. produces products designed especially for animals. Hearing protection aids called Ear Pro can be compatible with dogs and other animals.

- Honeywell International Inc. produces highly diversified products, often including sensory and protective devices for many sectors, like marine safety equipment, aerospace safety aids, etc.

Market Segmentation

Product Type

- Earplugs

- Moldable Earplugs

- Pre-molded Earplugs

- Semi Aural

- Earmuffs

- Passive Earmuffs

- Electronic Earmuffs

Application

- Manufacturing

- Construction

- Pharmaceuticals

- Oil and Gas

- Transportation

- Mining

- Utility

- Chemicals

- Defense & Maritime

- Others (Agriculture, Food, etc.)

Decibel Range

- 20 – 60 Decibel

- 61 – 120 Decibel

- Above 120 Decibel

Distribution Channel

- Direct Sales

- Indirect Sales

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=19841<ype=S

More Trending Reports by Transparency Market Research –

- Disposable Face Mask Market – The global disposable face mask market (Markt für Einweg-Gesichtsmasken) is estimated to advance at a CAGR of 13.4% from 2023 to 2031.

- Eye and Face Protection Market – The global eye and face protection market (Augen- und Gesichtsschutzmarkt) is expected to increase at a CAGR of 8.4% from 2023 to 2031.

- Lip Oil Market – The global market for lip oil products is anticipated to grow at a CAGR of 4.5% during the forecast period from 2022 to 2031.

- Epilator Market – The global epilator market (Epilierermarkt) is projected to grow at a CAGR of 5.1% from 2023 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nonprofit Money Management International Receives Grant from USAA to Expand Financial Crisis Counseling and Housing Stability Services to Military Families

STAFFORD, Texas, Oct. 29, 2024 (GLOBE NEWSWIRE) — Money Management International (MMI), a leading nonprofit financial counseling agency, has been awarded a grant from USAA to fund its Financial Readiness for Military Families program. The program aims to provide comprehensive financial crisis and housing counseling to hundreds of military-affiliated individuals, including active duty, veterans, reservists, and their families.

“We are deeply grateful for USAA’s continued commitment to our mission,” said Jim Triggs, President and CEO at MMI. “This generous grant will allow us to expand our efforts to address the unique financial challenges faced by military families, helping them to achieve financial stability and security.”

The Financial Readiness for Military Families program is designed to assist service members and their families in navigating financial crises while improving their long-term financial health. MMI’s certified financial counselors offer personalized counseling, coaching, and debt management, focusing on stabilizing at-risk households and ensuring housing stability. The program also aims to equip active military personnel with the tools and knowledge necessary to successfully transition to civilian life.

“Military families face a variety of financial stressors, from frequent relocations to disrupted spousal employment and the challenges of transitioning back to civilian life,” said Justin Schmitt, AVP of Corporate Responsibility at USAA. “We are honored to partner with MMI to provide these families with the financial guidance they need to overcome these challenges and build a secure future.”

In addition to personalized counseling, participants in the program will have access to MMI’s full range of educational resources, including the Military Reconnect program. This program offers free, tailored online learning tools and resources through MMI University, addressing the specific financial needs of military families.

MMI has a long history of supporting military-affiliated clients. One in six individuals who receive counseling from MMI are active-duty members or veterans. MMI’s counselors are trained to provide a holistic review of each client’s financial situation, offering advice and solutions on issues such as unmanageable debt, housing instability, and credit improvement.

MMI’s services are available nationwide and to military-affiliated individuals stationed overseas. The organization’s digital platform and 24/7 call center ensure that clients can access help when and where they need it.

The impact of MMI’s work is evident in the success of its clients. Joseph, a veteran from Virginia, paid off more than $93,000 in debt and increased his credit score by more than 100 points with MMI’s help. “I found myself in financial trouble twice for various reasons over the years. I reached out to MMI and their staff were terrific to work with,” he said. “It is an awesome opportunity. It gives you breathing room and a chance to rebuild what you once had.”

Through the Financial Readiness for Military Families program, MMI will continue to make a significant difference in the lives of military families, helping them overcome financial hardships and secure stable, affordable housing.

About MMI

Money Management International (MMI) has been at the forefront of financial health solutions for over 65 years. As a leading nonprofit organization, MMI is dedicated to changing how America overcomes financial challenges by delivering timely and expert guidance. Recognized by major financial organizations and media outlets, MMI’s programs help individuals reach their financial goals and foster a life of financial wellness. Learn more at MoneyManagement.org.

For information on the MMI Consumer Distress Dashboard or to schedule an interview with MMI experts and debt management clients, please contact:

Thomas Nitzsche, 404.490.2227, Thomas.Nitzsche@MoneyManagement.org

Lori Geary, 404.551.2151, lgeary@lexiconstrategies.com

Thomas Nitzsche Money Management International 404.490.2227 Thomas.Nitzsche@MoneyManagement.org Lori Geary Lexicon Strategies 404.551.2151 lgeary@lexiconstrategies.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DEADLINE ALERT for MGX, POWW, and FNA: The Law Offices of Frank R. Cruz Reminds Investors of Class Actions on Behalf of Shareholders

LOS ANGELES, Oct. 29, 2024 (GLOBE NEWSWIRE) — The Law Offices of Frank R. Cruz reminds investors that class action lawsuits have been filed on behalf of shareholders of the following publicly-traded companies. Investors have until the deadlines listed below to file a lead plaintiff motion.

Investors suffering losses on their investments are encouraged to contact The Law Offices of Frank R. Cruz to discuss their legal rights in these class actions at 310-914-5007 or by email to fcruz@frankcruzlaw.com.

Metagenomi, Inc. MGX

Class Period: February 6, 2024 – September 26, 2024

Lead Plaintiff Deadline: November 25, 2024

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors that: (1) Metagenomi’s collaboration with Moderna would not extend into the future but instead terminate in the immediate future; and (2) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

If you are a Metagenomi shareholder who suffered a loss, click here to participate.

AMMO, Inc. POWW

Class Period: August 19, 2020 – September 24, 2024

Lead Plaintiff Deadline: November 29, 2024

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that the company lacked adequate internal controls over financial reporting; (2) that there was a substantial likelihood the Company failed to accurately disclose all executive officers, members of management, and potential related party transactions in fiscal years 2020 through 2023; (3) that there was a substantial likelihood the Company failed to properly characterize certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses in fiscal years 2021 and 2022; (4) there was a substantial likelihood the Company failed to appropriately value unrestricted stock awards to officers, directors, employees and others in fiscal years 2020 through 2022; and (5) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

If you are an AMMO shareholder who suffered a loss, click here to participate.

Paragon 28, Inc. FNA

Class Period: May 5, 2023 – September 20, 2024

Lead Plaintiff Deadline: November 29, 2024

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors that: (1) Paragon 28’s financial statements were misstated; (2) Paragon 28 lacked adequate internal controls and at times understated the extent of the issues with its internal controls; and (3) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

If you are a Paragon shareholder who suffered a loss, click here to participate.

Follow us for updates on Twitter: twitter.com/FRC_LAW.

To be a member of these class actions, you need not take any action at this time; you may retain counsel of your choice or take no action and remain an absent member of the class action. If you wish to learn more about these class actions, or if you have any questions concerning this announcement or your rights or interests with respect to these matters, please contact Frank R. Cruz, of The Law Offices of Frank R. Cruz, 1999 Avenue of the Stars, Suite 1100, Los Angeles, California 90067 at 310-914-5007, by email to info@frankcruzlaw.com, or visit our website at www.frankcruzlaw.com. If you inquire by email please include your mailing address, telephone number, and number of shares purchased.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

The Law Offices of Frank R. Cruz, Los Angeles

Frank R. Cruz, 310-914-5007

fcruz@frankcruzlaw.com

www.frankcruzlaw.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BRIXMOR PROPERTY GROUP REPORTS THIRD QUARTER 2024 RESULTS

– Delivered Record Occupancy and ABR PSF –

NEW YORK, Oct. 28, 2024 /PRNewswire/ — Brixmor Property Group Inc. BRX (“Brixmor” or the “Company”) announced today its operating results for the three and nine months ended September 30, 2024. For the three months ended September 30, 2024 and 2023, net income was $0.32 per diluted share and $0.21 per diluted share, respectively, and for the nine months ended September 30, 2024 and 2023, net income was $0.84 per diluted share and $0.77 per diluted share, respectively.

Key highlights for the three months ended September 30, 2024 include:

- Executed 1.1 million square feet of new and renewal leases, with rent spreads on comparable space of 21.8%, including 0.6 million square feet of new leases, with rent spreads on comparable space of 31.8%

- Sequentially increased total leased occupancy to a record 95.6%, anchor leased occupancy to a record 97.7%, and small shop leased occupancy to a record 91.1%

- Commenced $17.7 million of annualized base rent

- Leased to billed occupancy spread totaled 370 basis points

- Total signed but not yet commenced new lease population represented 2.7 million square feet and $59.4 million of annualized base rent

- Reported an increase in same property NOI of 4.1%, including a contribution from base rent of 520 basis points

- Reported Nareit FFO of $159.2 million, or $0.52 per diluted share

- Stabilized $33.3 million of reinvestment projects at an average incremental NOI yield of 10%, with the in process reinvestment pipeline totaling $506.8 million at an expected average incremental NOI yield of 9%

- Completed $63.9 million of acquisitions and $73.8 million of dispositions

- Published the Company’s annual Corporate Responsibility Report on July 1, 2024 (view the 2023 report at https://www.brixmor.com/corporate-responsibility)

Subsequent events:

- Increased the quarterly dividend by 5.5% to $0.2875 per common share (equivalent to $1.15 per annum), which represents an annualized yield of approximately 4.2% as of October 25, 2024

- Updated previously provided Nareit FFO per diluted share expectations for 2024 to $2.13 – $2.15 from $2.11 – $2.14 and same property NOI growth expectations for 2024 to 4.75% – 5.25% from 4.25% – 5.00%

“Our strong operating results and revised 2024 expectations demonstrate the continued momentum of our transformative and value-added business plan,” commented James Taylor, Chief Executive Officer. “Importantly, our execution provides visibility for our continued outperformance in 2025 and beyond.”

FINANCIAL HIGHLIGHTS

Net Income

- For the three months ended September 30, 2024 and 2023, net income was $96.8 million, or $0.32 per diluted share, and $63.7 million, or $0.21 per diluted share, respectively.

- For the nine months ended September 30, 2024 and 2023, net income was $255.9 million, or $0.84 per diluted share, and $232.4 million, or $0.77 per diluted share, respectively.

- For the three and nine months ended September 30, 2024, general and administrative expense included approximately $2.4 million of one-time severance costs associated with the realignment of the Company’s regional operating structure. The realignment, which combines the Company’s North and Midwest regions and expands its South region, enables the Company to capitalize on efficiencies of scale resulting from its asset clustering strategy.

Nareit FFO

- For the three months ended September 30, 2024 and 2023, Nareit FFO was $159.2 million, or $0.52 per diluted share, and $152.2 million, or $0.50 per diluted share, respectively. Results for the three months ended September 30, 2024 and 2023 include items that impact FFO comparability, including transaction expenses, net and gain on extinguishment of debt, net, of $0.2 million, or $0.00 per diluted share, and $(0.1) million, or $(0.00) per diluted share, respectively.

- For the nine months ended September 30, 2024 and 2023, Nareit FFO was $486.4 million, or $1.60 per diluted share, and $460.9 million, or $1.52 per diluted share, respectively. Results for the nine months ended September 30, 2024 and 2023 include items that impact FFO comparability, including transaction expenses, net and gain on extinguishment of debt, net, of $0.4 million, or $0.00 per diluted share, and $4.2 million, or $0.01 per diluted share, respectively.

Same Property NOI Performance

- For the three months ended September 30, 2024, the Company reported an increase in same property NOI of 4.1% versus the comparable 2023 period.

- For the nine months ended September 30, 2024, the Company reported an increase in same property NOI of 5.2% versus the comparable 2023 period.

Dividend

- The Company’s Board of Directors declared a quarterly cash dividend of $0.2875 per common share (equivalent to $1.15 per annum) for the fourth quarter of 2024, which represents a 5.5% increase.

- The dividend is payable on January 15, 2025 to stockholders of record on January 3, 2025.

PORTFOLIO AND INVESTMENT ACTIVITY

Value Enhancing Reinvestment Opportunities

- During the three months ended September 30, 2024, the Company stabilized six value enhancing reinvestment projects with a total aggregate net cost of approximately $33.3 million at an average incremental NOI yield of 10% and added six new reinvestment projects to its in process pipeline. Projects added include three anchor space repositioning projects, one outparcel development project, and two redevelopment projects, with a total aggregate net estimated cost of approximately $35.8 million at an expected average incremental NOI yield of 9%.

- At September 30, 2024, the value enhancing reinvestment in process pipeline was comprised of 43 projects with an aggregate net estimated cost of approximately $506.8 million at an expected average incremental NOI yield of 9%. The in process pipeline includes 18 anchor space repositioning projects with an aggregate net estimated cost of approximately $88.6 million at an expected incremental NOI yield of 7% – 14%; seven outparcel development projects with an aggregate net estimated cost of approximately $14.8 million at an expected average incremental NOI yield of 12%; and 18 redevelopment projects with an aggregate net estimated cost of approximately $403.5 million at an expected average incremental NOI yield of 9%.

- An in-depth review of a redevelopment project which highlights the Company’s reinvestment capabilities, Middletown Plaza (New York–Newark–Jersey City, NY-NJ CBSA), can be found at this link: https://www.brixmor.com/blog/middletown-plaza-trader-joes.

- Follow Brixmor on LinkedIn for video updates on reinvestment projects at https://www.linkedin.com/company/brixmor.

Acquisitions

- During the three months ended September 30, 2024, the Company acquired two shopping centers and one land parcel at an existing property for a combined purchase price of $63.9 million, including:

- The Fresh Market Shoppes (previously announced), located in Hilton Head Island, South Carolina (Hilton Head Island-Bluffton-Port Royal, SC CBSA), for $23.6 million.

- Acton Plaza, a 137,572 square foot grocery-anchored community shopping center located in the affluent suburb of Acton, Massachusetts (Boston–Cambridge–Newton, MA-NH CBSA), for $38.0 million. Acton Plaza is anchored by a Roche Bros. grocer and T.J. Maxx/HomeGoods and has compelling near-term leasing opportunities and below-market in-place rents. The property complements the Company’s six other assets in the market and will benefit from leasing and operational synergies resulting from the Company’s clustered assets in the trade area.

- During the nine months ended September 30, 2024, the Company acquired three shopping centers and one land parcel at an existing property for a combined purchase price of $81.2 million.

Dispositions

- During the three months ended September 30, 2024, the Company generated approximately $73.8 million of gross proceeds on the disposition of two shopping centers, as well as four partial properties.

- During the nine months ended September 30, 2024, the Company generated approximately $143.1 million of gross proceeds on the disposition of five shopping centers, as well as six partial properties.

CAPITAL STRUCTURE

- During the three and nine months ended September 30, 2024, the Company raised approximately $20.0 million of gross proceeds, excluding commissions, from the sale of approximately 0.7 million shares of common stock at an average price per share of $27.92 through its at-the-market (“ATM”) equity offering program.

- At September 30, 2024, the Company had $1.7 billion in liquidity.

- At September 30, 2024, the Company’s net principal debt to adjusted EBITDA, current quarter annualized and net principal debt to adjusted EBITDA, trailing twelve months were 5.7x.

GUIDANCE

- The Company has updated its previously provided NAREIT FFO per diluted share expectations for 2024 to $2.13 – $2.15 from $2.11 – $2.14 and same property NOI growth expectations for 2024 to 4.75% – 5.25% from 4.25% – 5.00%.

- Expectations for 2024 Nareit FFO:

- Do not contemplate any additional tenants moving to or from a cash basis of accounting, either of which may result in significant volatility in straight-line rental income

- Do not include any additional items that impact FFO comparability, which include transaction expenses, net and gain or loss on extinguishment of debt, net, or any other one-time items

- The following table provides a reconciliation of the range of the Company’s 2024 estimated net income to Nareit FFO:

|

(Unaudited, dollars in millions, except per share amounts) |

2024E |

2024E Per |

||

|

Net income |

$324 – $330 |

$1.07 – $1.09 |

||

|

Depreciation and amortization related to real estate |

365 |

1.20 |

||

|

Gain on sale of real estate assets |

(54) |

(0.18) |

||

|

Impairment of real estate asset |

11 |

0.04 |

||

|

Nareit FFO |

$646 – $652 |

$2.13 – $2.15 |

CONNECT WITH BRIXMOR

CONFERENCE CALL AND SUPPLEMENTAL INFORMATION

The Company will host a teleconference on Tuesday, October 29, 2024 at 10:00 AM ET. To participate, please dial 877.704.4453 (domestic) or 201.389.0920 (international) within 15 minutes of the scheduled start of the call. The teleconference can also be accessed via a live webcast at https://www.brixmor.com in the Investors section. A replay of the teleconference will be available through November 12, 2024 by dialing 844.512.2921 (domestic) or 412.317.6671 (international) (Passcode: 13748655) or via the web through October 29, 2025 at https://www.brixmor.com in the Investors section.

The Company’s Supplemental Disclosure will be posted at https://www.brixmor.com in the Investors section. These materials are also available to all interested parties upon request to the Company at investorrelations@brixmor.com or 800.468.7526.

NON-GAAP PERFORMANCE MEASURES

The Company presents the non-GAAP performance measures set forth below. These measures should not be considered as alternatives to, or more meaningful than, net income (calculated in accordance with GAAP) or other GAAP financial measures, as an indicator of financial performance and are not alternatives to, or more meaningful than, cash flow from operating activities (calculated in accordance with GAAP) as a measure of liquidity. Non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results to those calculated in accordance with GAAP. The Company’s computation of these non-GAAP performance measures may differ in certain respects from the methodology utilized by other REITs and, therefore, may not be comparable to similarly titled measures presented by such other REITs. Investors are cautioned that items excluded from these non-GAAP performance measures are relevant to understanding and addressing financial performance. A reconciliation of net income to these non-GAAP performance measures is presented in the attached tables.

Nareit FFO

Nareit FFO is a supplemental, non-GAAP performance measure utilized to evaluate the operating and financial performance of real estate companies. Nareit defines FFO as net income (loss), calculated in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains and losses from the sale of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated joint ventures calculated to reflect FFO on the same basis. Considering the nature of its business as a real estate owner and operator, the Company believes that Nareit FFO is useful to investors in measuring its operating and financial performance because the definition excludes items included in net income that do not relate to or are not indicative of the Company’s operating and financial performance, such as depreciation and amortization related to real estate, and items which can make periodic and peer analyses of operating and financial performance more difficult, such as gains and losses from the sale of certain real estate assets and impairment write-downs of certain real estate assets.

Same Property NOI

Same property NOI is a supplemental, non-GAAP performance measure utilized to evaluate the operating performance of real estate companies. Same property NOI is calculated (using properties owned for the entirety of both periods and excluding properties under development and completed new development properties that have been stabilized for less than one year) as total property revenues (base rent, expense reimbursements, adjustments for revenues deemed uncollectible, ancillary and other rental income, percentage rents, and other revenues) less direct property operating expenses (operating costs and real estate taxes). Same property NOI excludes (i) lease termination fees, (ii) straight-line rental income, net, (iii) accretion of below-market leases, net of amortization of above-market leases and tenant inducements, (iv) straight-line ground rent expense, net, (v) income or expense associated with the Company’s captive insurance company, (vi) depreciation and amortization, (vii) impairment of real estate assets, (viii) general and administrative expense, and (ix) other income and expense (including interest expense and gain on sale of real estate assets). Considering the nature of its business as a real estate owner and operator, the Company believes that NOI is useful to investors in measuring the operating performance of its portfolio because the definition excludes various items included in net income that do not relate to, or are not indicative of, the operating performance of the Company’s properties, such as lease termination fees, straight-line rental income, net, income or expense associated with the Company’s captive insurance company, accretion of below-market leases, net of amortization of above-market leases and tenant inducements, straight-line ground rent expense, net, depreciation and amortization, impairment of real estate assets, general and administrative expense, and other income and expense (including interest expense and gain on sale of real estate assets). The Company believes that same property NOI is also useful to investors because it further eliminates disparities in NOI by only including NOI of properties owned for the entirety of both periods presented and excluding properties under development and completed new development properties that have been stabilized for less than one year and therefore provides a more consistent metric for comparing the operating performance of the Company’s real estate between periods.

Net Principal Debt to Adjusted EBITDA, current quarter annualized & Net Principal Debt to Adjusted EBITDA, trailing twelve months

Net principal debt to adjusted EBITDA, current quarter annualized and net principal debt to adjusted EBITDA, trailing twelve months are supplemental non-GAAP measures utilized to evaluate the performance of real estate companies in relation to outstanding debt. Net principal debt is calculated as Debt obligations, net, calculated in accordance with GAAP, excluding net unamortized premium or discount and deferred financing fees less cash, cash equivalents, and restricted cash. Adjusted EBITDA is calculated as the sum of net income (loss), calculated in accordance with GAAP, excluding (i) interest expense, (ii) federal and state taxes, (iii) depreciation and amortization, (iv) gains and losses from the sale of certain real estate assets, (v) gains and losses from change in control, (vi) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, (vii) gain (loss) on extinguishment of debt, net, and (viii) other items that the Company believes are not indicative of the Company’s operating performance. Net principal debt to adjusted EBITDA, current quarter annualized and net principal debt to adjusted EBITDA, trailing twelve months are calculated as net principal debt divided by quarterly annualized adjusted EBITDA or trailing twelve month adjusted EBITDA, respectively. Considering the nature of its business as a real estate owner and operator, the Company believes that net principal debt to adjusted EBITDA, current quarter annualized and net principal debt to adjusted EBITDA, trailing twelve months are useful to investors in measuring its operating performance because they exclude items included in net income that do not relate to or are not indicative of the operating performance of the Company’s real estate, are widely known and understood measures of performance, independent of a company’s capital structure and items which can make periodic and peer analyses of performance more difficult, and can provide investors with a more consistent basis by which to compare the Company with its peers.

ABOUT BRIXMOR PROPERTY GROUP

Brixmor BRX is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers. Its 360 retail centers comprise approximately 63 million square feet of prime retail space in established trade areas. The Company strives to own and operate shopping centers that reflect Brixmor’s vision “to be the center of the communities we serve” and are home to a diverse mix of thriving national, regional and local retailers. Brixmor is a proud real estate partner to over 5,000 retailers including The TJX Companies, The Kroger Co., Publix Super Markets and Ross Stores.

Brixmor announces material information to its investors in SEC filings and press releases and on public conference calls, webcasts and the “Investors” page of its website at https://www.brixmor.com. The Company also uses social media to communicate with its investors and the public, and the information Brixmor posts on social media may be deemed material information. Therefore, Brixmor encourages investors and others interested in the Company to review the information that it posts on its website and on its social media channels.

SAFE HARBOR LANGUAGE

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under the sections entitled “Forward-Looking Statements” and “Risk Factors” in our Form 10-K for the year ended December 31, 2023, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at https://www.sec.gov. These factors include (1) changes in national, regional, and local economies, due to global events such as international military conflicts, international trade disputes, a foreign debt crisis, foreign currency volatility, or due to domestic issues, such as government policies and regulations, tariffs, energy prices, market dynamics, general economic contractions, rising interest rates, inflation, unemployment, or limited growth in consumer income or spending; (2) local real estate market conditions, including an oversupply of space in, or a reduction in demand for, properties similar to those in our Portfolio (defined hereafter); (3) competition from other available properties and e-commerce; (4) disruption and/or consolidation in the retail sector, the financial stability of our tenants, and the overall financial condition of large retailing companies, including their ability to pay rent and/or expense reimbursements that are due to us; (5) in the case of percentage rents, the sales volumes of our tenants; (6) increases in property operating expenses, including common area expenses, utilities, insurance, and real estate taxes, which are relatively inflexible and generally do not decrease if revenue or occupancy decrease; (7) increases in the costs to repair, renovate, and re-lease space; (8) earthquakes, wildfires, tornadoes, hurricanes, damage from rising sea levels due to climate change, other natural disasters, epidemics and/or pandemics, civil unrest, terrorist acts, or acts of war, any of which may result in uninsured or underinsured losses; and (9) changes in laws and governmental regulations, including those governing usage, zoning, the environment, and taxes. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in our periodic filings. The forward-looking statements speak only as of the date of this press release, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except to the extent otherwise required by law.

|

CONSOLIDATED BALANCE SHEETS |

|||||||

|

Unaudited, dollars in thousands, except share information |

|||||||

|

As of |

As of |

||||||

|

9/30/2024 |

12/31/2023 |

||||||

|

Assets |

|||||||

|

Real estate |

|||||||

|

Land |

$ 1,791,843 |

$ 1,794,011 |

|||||

|

Buildings and tenant improvements |

8,740,670 |

8,570,874 |

|||||

|

Construction in progress |

131,564 |

126,007 |

|||||

|

Lease intangibles |

501,393 |

504,995 |

|||||

|

11,165,470 |

10,995,887 |

||||||

|

Accumulated depreciation and amortization |

(3,372,860) |

(3,198,980) |

|||||

|

Real estate, net |

7,792,610 |

7,796,907 |

|||||

|

Cash and cash equivalents |

451,326 |

866 |

|||||

|

Restricted cash |

1,121 |

18,038 |

|||||

|

Marketable securities |

21,205 |

19,914 |

|||||

|

Receivables, net, including straight-line rent receivables of $202,758 and $180,810, respectively |

260,571 |

278,775 |

|||||

|

Deferred charges and prepaid expenses, net |

172,947 |

164,061 |

|||||

|

Other assets |

50,037 |

54,155 |

|||||

|

Total assets |

$ 8,749,817 |

$ 8,332,716 |

|||||

|

Liabilities |

|||||||

|

Debt obligations, net |

$ 5,338,681 |

$ 4,933,525 |

|||||

|

Accounts payable, accrued expenses and other liabilities |

530,560 |

548,890 |

|||||

|

Total liabilities |

5,869,241 |

5,482,415 |

|||||

|

Equity |

|||||||

|

Common stock, $0.01 par value; authorized 3,000,000,000 shares; |

|||||||

|

311,190,362 and 309,723,386 shares issued and 302,063,370 and 300,596,394 |

|||||||

|

shares outstanding |

3,020 |

3,006 |

|||||

|

Additional paid-in capital |

3,331,941 |

3,310,590 |

|||||

|

Accumulated other comprehensive loss |

(759) |

(2,700) |

|||||

|

Distributions in excess of net income |

(453,626) |

(460,595) |

|||||

|

Total equity |

2,880,576 |

2,850,301 |

|||||

|

Total liabilities and equity |

$ 8,749,817 |

$ 8,332,716 |

|||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||

|

Unaudited, dollars in thousands, except per share amounts |

|||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||

|

9/30/2024 |

9/30/2023 |

9/30/2024 |

9/30/2023 |

||||||

|

Revenues |

|||||||||

|

Rental income |

$ 319,989 |

$ 307,118 |

$ 955,065 |

$ 927,440 |

|||||

|

Other revenues |

693 |

196 |

1,547 |

1,111 |

|||||

|

Total revenues |

320,682 |

307,314 |

956,612 |

928,551 |

|||||

|

Operating expenses |

|||||||||

|

Operating costs |

36,442 |

35,058 |

110,518 |

106,658 |

|||||

|

Real estate taxes |

42,902 |

42,156 |

120,659 |

130,556 |

|||||

|

Depreciation and amortization |

94,829 |

96,254 |

278,065 |

272,807 |

|||||

|

Impairment of real estate assets |

5,863 |

– |

11,143 |

17,836 |

|||||

|

General and administrative |

30,250 |

29,182 |

88,430 |

86,868 |

|||||

|

Total operating expenses |

210,286 |

202,650 |

608,815 |

614,725 |

|||||

|

Other income (expense) |

|||||||||

|

Dividends and interest |

5,289 |

273 |

15,798 |

345 |

|||||

|

Interest expense |

(55,410) |

(47,364) |

(160,553) |

(143,529) |

|||||

|

Gain on sale of real estate assets |

37,018 |

6,712 |

53,974 |

59,037 |

|||||

|

Gain on extinguishment of debt, net |

273 |

6 |

554 |

4,356 |

|||||

|

Other |

(726) |

(555) |

(1,700) |

(1,645) |

|||||

|

Total other expense |

(13,556) |

(40,928) |

(91,927) |

(81,436) |

|||||

|

Net income |

$ 96,840 |

$ 63,736 |

$ 255,870 |

$ 232,390 |

|||||

|

Net income per common share: |

|||||||||

|

Basic |

$ 0.32 |

$ 0.21 |

$ 0.84 |

$ 0.77 |

|||||

|

Diluted |

$ 0.32 |

$ 0.21 |

$ 0.84 |

$ 0.77 |

|||||

|

Weighted average shares: |

|||||||||

|

Basic |

302,676 |

301,007 |

302,518 |

300,955 |

|||||

|

Diluted |

303,608 |

302,511 |

303,377 |

302,447 |

|||||

|

EBITDA & RECONCILIATION OF DEBT OBLIGATIONS, NET TO NET PRINCIPAL DEBT |

|||||||||

|

Unaudited, dollars in thousands |

|||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||

|

9/30/2024 |

9/30/2023 |

9/30/2024 |

9/30/2023 |

||||||

|

Net income |

$ 96,840 |

$ 63,736 |

$ 255,870 |

$ 232,390 |

|||||

|

Interest expense |

55,410 |

47,364 |

160,553 |

143,529 |

|||||

|

Federal and state taxes |

616 |

597 |

1,982 |

1,945 |

|||||

|

Depreciation and amortization |

94,829 |

96,254 |

278,065 |

272,807 |

|||||

|

EBITDA |

247,695 |

207,951 |

696,470 |

650,671 |

|||||

|

Gain on sale of real estate assets |

(37,018) |

(6,712) |

(53,974) |

(59,037) |

|||||

|

Impairment of real estate assets |

5,863 |

– |

11,143 |

17,836 |

|||||

|

EBITDAre |

$ 216,540 |

$ 201,239 |

$ 653,639 |

$ 609,470 |

|||||

|

EBITDAre |

$ 216,540 |

$ 201,239 |

$ 653,639 |

$ 609,470 |

|||||

|

Transaction expenses, net |

73 |

103 |

131 |

198 |

|||||

|

Gain on extinguishment of debt, net |

(273) |

(6) |

(554) |

(4,356) |

|||||

|

Total adjustments |

(200) |

97 |

(423) |

(4,158) |

|||||

|

Adjusted EBITDA |

$ 216,340 |

$ 201,336 |

$ 653,216 |

$ 605,312 |

|||||

|

Adjusted EBITDA |

$ 216,340 |

$ 201,336 |

$ 653,216 |

$ 605,312 |

|||||

|

Straight-line rental income, net |

(8,133) |

(5,088) |

(23,669) |

(16,510) |

|||||

|

Accretion of below-market leases, net of amortization of above-market leases and tenant inducements |

(1,701) |

(2,178) |

(5,235) |

(6,414) |

|||||

|

Straight-line ground rent expense, net (1) |

(8) |

(8) |

(19) |

(25) |

|||||

|

Total adjustments |

(9,842) |

(7,274) |

(28,923) |

(22,949) |

|||||

|

Cash Adjusted EBITDA |

$ 206,498 |

$ 194,062 |

$ 624,293 |

$ 582,363 |

|||||

|

(1) Straight-line ground rent expense, net is included in Operating costs on the Consolidated Statements of Operations. |

|||||||||

|

Reconciliation of Debt Obligations, Net to Net Principal Debt |

|||||||||

|

As of |

|||||||||

|

9/30/2024 |

|||||||||

|

Debt obligations, net |

$ 5,338,681 |

||||||||

|

Less: Net unamortized premium |

(14,980) |

||||||||

|

Add: Deferred financing fees |

27,064 |

||||||||

|

Less: Cash, cash equivalents and restricted cash |

(452,447) |

||||||||

|

Net Principal Debt |

$ 4,898,318 |

||||||||

|

Adjusted EBITDA, current quarter annualized |

$ 865,360 |

||||||||

|

Net Principal Debt to Adjusted EBITDA, current quarter annualized |

5.7x |

||||||||

|

Adjusted EBITDA, trailing twelve months |

$ 856,911 |

||||||||

|

Net Principal Debt to Adjusted EBITDA, trailing twelve months |

5.7x |

||||||||

|

FUNDS FROM OPERATIONS (FFO) |

|||||||||

|

Unaudited, dollars in thousands, except per share amounts |

|||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||

|

9/30/2024 |

9/30/2023 |

9/30/2024 |

9/30/2023 |

||||||

|

Net income |

$ 96,840 |

$ 63,736 |

$ 255,870 |

$ 232,390 |

|||||

|

Depreciation and amortization related to real estate |

93,495 |

95,160 |

273,386 |

269,714 |

|||||

|

Gain on sale of real estate assets |

(37,018) |

(6,712) |

(53,974) |

(59,037) |

|||||

|

Impairment of real estate assets |

5,863 |

– |

11,143 |

17,836 |

|||||

|

Nareit FFO |

$ 159,180 |

$ 152,184 |

$ 486,425 |

$ 460,903 |

|||||

|

Nareit FFO per diluted share |

$ 0.52 |

$ 0.50 |

$ 1.60 |

$ 1.52 |

|||||

|

Weighted average diluted shares outstanding |

303,608 |

302,511 |

303,377 |

302,447 |

|||||

|

Items that impact FFO comparability |

|||||||||

|

Transaction expenses, net |

$ (73) |

$ (103) |

$ (131) |

$ (198) |

|||||

|

Gain on extinguishment of debt, net |

273 |

6 |

554 |

4,356 |

|||||

|

Total items that impact FFO comparability |

$ 200 |

$ (97) |

$ 423 |

$ 4,158 |

|||||

|

Items that impact FFO comparability, net per share |

$ 0.00 |

$ (0.00) |

$ 0.00 |

$ 0.01 |

|||||

|

Additional Disclosures |

|||||||||

|

Straight-line rental income, net |

$ 8,133 |

$ 5,088 |

$ 23,669 |

$ 16,510 |

|||||

|

Accretion of below-market leases, net of amortization of above-market leases and tenant inducements |

1,701 |

2,178 |

5,235 |

6,414 |

|||||

|

Straight-line ground rent expense, net (1) |

8 |

8 |

19 |

25 |

|||||

|

Dividends declared per share |

$ 0.2725 |

$ 0.2600 |

$ 0.8175 |

$ 0.7800 |

|||||

|

Dividends declared |

$ 82,312 |

$ 78,155 |

$ 246,533 |

$ 234,451 |

|||||

|

Dividend payout ratio (as % of Nareit FFO) |

51.7 % |

51.4 % |

50.7 % |

50.9 % |

|||||

|

(1) Straight-line ground rent expense, net is included in Operating costs on the Consolidated Statements of Operations. |

|||||||||

|

SAME PROPERTY NOI ANALYSIS |

||||||||||||||

|

Unaudited, dollars in thousands |

||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||

|

9/30/2024 |

9/30/2023 |

Change |

9/30/2024 |

9/30/2023 |

Change |

|||||||||

|

Same Property NOI Analysis |

||||||||||||||

|

Number of properties |

352 |

352 |

– % |

350 |

350 |

– % |

||||||||

|

Percent billed |

91.9 % |

90.2 % |

1.7 % |

91.9 % |

90.1 % |

1.8 % |

||||||||

|

Percent leased |

95.6 % |

94.1 % |

1.5 % |

95.6 % |

94.1 % |

1.5 % |

||||||||

|

Revenues |

||||||||||||||

|

Base rent |

$ 228,531 |

$ 217,396 |

$ 673,705 |

$ 646,068 |

||||||||||

|

Expense reimbursements |

72,230 |

67,084 |

209,598 |

204,007 |

||||||||||

|

Revenues deemed uncollectible |

(4,670) |

(613) |

(5,634) |

(3,669) |

||||||||||

|

Ancillary and other rental income / Other revenues |

6,080 |

5,728 |

17,858 |

17,111 |

||||||||||

|

Percentage rents |

1,248 |

1,495 |

7,790 |

7,133 |

||||||||||

|

303,419 |

291,090 |

4.2 % |

903,317 |

870,650 |

3.8 % |

|||||||||

|

Operating expenses |

||||||||||||||

|

Operating costs |

(35,580) |

(33,295) |

(107,362) |

(100,678) |

||||||||||

|

Real estate taxes |

(41,913) |

(40,683) |

(117,902) |

(125,358) |

||||||||||

|

(77,493) |

(73,978) |

4.8 % |

(225,264) |

(226,036) |

(0.3) % |

|||||||||

|

Same property NOI |

$ 225,926 |

$ 217,112 |

4.1 % |

$ 678,053 |

$ 644,614 |

5.2 % |

||||||||

|

NOI margin |

74.5 % |

74.6 % |

75.1 % |

74.0 % |

||||||||||

|

Expense recovery ratio |

93.2 % |

90.7 % |

93.0 % |

90.3 % |

||||||||||

|

Percent Contribution to Same Property NOI Performance: |

||||||||||||||

|

Change |

Percent Contribution |

Change |

Percent Contribution |

|||||||||||

|

Base Rent |

$ 11,135 |

5.2 % |

$ 27,637 |

4.3 % |

||||||||||

|

Revenues deemed uncollectible |

(4,057) |

(2.0) % |

(1,965) |

(0.3) % |

||||||||||

|

Net expense reimbursements |

1,631 |

0.8 % |

6,363 |

1.0 % |

||||||||||

|

Ancillary and other rental income / Other revenues |

352 |

0.2 % |

747 |

0.1 % |

||||||||||

|

Percentage rents |

(247) |

(0.1) % |

657 |

0.1 % |

||||||||||

|

4.1 % |

5.2 % |

|||||||||||||

|

Reconciliation of Net Income to Same Property NOI |

||||||||||||||

|

Net income |

$ 96,840 |

$ 63,736 |

$ 255,870 |

$ 232,390 |

||||||||||

|

Adjustments: |

||||||||||||||

|

Non-same property NOI |

(4,369) |

(4,780) |

(15,909) |

(19,895) |

||||||||||

|

Lease termination fees |

(1,201) |

(934) |

(2,550) |

(3,879) |

||||||||||

|

Straight-line rental income, net |

(8,133) |

(5,088) |

(23,669) |

(16,510) |

||||||||||

|

Accretion of below-market leases, net of amortization of above-market leases and tenant inducements |

(1,701) |

(2,178) |

(5,235) |

(6,414) |

||||||||||

|

Straight-line ground rent expense, net |

(8) |

(8) |

(19) |

(25) |

||||||||||

|

Depreciation and amortization |

94,829 |

96,254 |

278,065 |

272,807 |

||||||||||

|

Impairment of real estate assets |

5,863 |

– |

11,143 |

17,836 |

||||||||||

|

General and administrative |

30,250 |

29,182 |

88,430 |

86,868 |

||||||||||

|

Total other expense |

13,556 |

40,928 |

91,927 |

81,436 |

||||||||||

|

Same Property NOI |

$ 225,926 |

$ 217,112 |

$ 678,053 |

$ 644,614 |

||||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/brixmor-property-group-reports-third-quarter-2024-results-302288785.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/brixmor-property-group-reports-third-quarter-2024-results-302288785.html

SOURCE Brixmor Property Group Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Food Wrap Films Market Size Anticipated to Surpass USD 12.0 Billion by 2026 with 2.0% CAGR Growth | Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 29, 2024 (GLOBE NEWSWIRE) — The expected market valuation of the global food wrap films market (marché des films d’emballage alimentaire) is US$ 12.0 billion, which shall be achieved by the market by 2026. In the case of the current market valuation, the last measured value was in 2021, accounting for about US$ 10.8 billion. The advancement forecasted by the market is a sluggish progress at a CAGR of 2.0%.

As far as the fundamental market driver is concerned, it is evident from the rising demand for flexible wrapping and packaging solutions for the food industry that foils, wrappers, and films are frequently required. Therefore, it creates demand for the subject market. Additionally, this factor enables the transportation of the food with better handling and shelf-life. Due to this, demand from consumers is also increasing for the same.

Consumers demand more Cost-efficient and eco-friendly products so that food carrying becomes more convenient. These purposes are mainly served by aluminum foil. Apart from this, the weight of the foil is negligible, and hence, it proves to be another market driver for the subject market.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=10931

The food service industry has been emerging in the modern business world. As a result, there is a rising demand for better food packaging and delivery. This is better served with the help of different foil and wrapping film materials. Hence, this is another market driver.

Key Players

- Amcor Plc

- Berry Global Inc.

- Georgia-Pacific LLC

- Hindalco Industries Limited

- Huhtamaki Oyj

- Mitsubishi Chemical Holdings Limited

- Mondi Group

- Pactiv LLC

- Thong Guan Industries Berhad

- Tonesed Company RUSAL Plc

- Speciality Polyfilms

- Guangdong Xintianli Holdings Co. Ltd

- Nan Ya Wrap Film

- Dupont Teijin Films

- KM Packaging

- Cosmo Films Limited

- Borealis

- Indevco Plastics

- Korpak

- Sirane Group

Key Findings from the Market Report

- The global food wrap films market operates in limited market segments. From the perspective of the market segment of the material used, it is evident that aluminum is a widely used material. Aluminum foils find versatile applications; therefore, this market segment is vast.

- Apart from this, plastic material is a crucial vertical in the market segment that is vastly used. Polyethylene film carry bags are widely used in the food industry.

- From the industry’s perspective using food wrapping films, the retail sector uses several food-covering films to cover items from the store.

- Furthermore, meat shoppers, a food industry segment, use polyethylene films on a larger level.

Regional Profile

- Regarding the market share secured by different continents in the global food wrap films market, Europe is anticipated to have the largest share. This is due to the continent’s availability of labor and cheaper production costs. Also, the sales points within different European countries are higher, easing the wrapping films’ sales.

- Asia-Pacific is the following region, which shows significant growth in the subject market. It has been anticipated to progress with a CAGR of 2.3% from 2022 to 2026.

- The Middle East and North America also contribute to the subject market.

Key Trends for the Food Wrap Films Market

- In 2022, Georgia-Pacific LLC finalized an acquisition deal with Bakelite Synthetics. This shall diversify the market vertical for the business and help the organization collaborate with allied companies.

- In 2023, Amcor Plc acquired Phoenix Flexibles, Moda, and MDK from India, New Zealand, and China, respectively. Due to this strategic move made by the key player in the global food wrap films market, international expansion has become possible. Due to this, the consumer base of the said business has increased.

- In February 2024, Berry Global, Inc. introduced new circular stretch films due to innovation. Better load integrity can be achieved due to the said development.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=10931

Competitive Landscape

- Georgia-Pacific LLC is one of the key competitors working in different verticals. It does not only produce cellulose products but also offers packaging services and products related to the same.

- Berry Global, Inc. produces many plastic products, including plastic tubs, pots, bottles, bags, and more.

- Lastly, Amcor Plc operates in different markets, including food and beverage, pet care, healthcare, etc.

Market Segmentation

Material Type

- Polyethylene

- Polyamide

- Polypropylene

- PVC

- PVDC

- Others (EVOH, Bioplastic, etc.)

End User

- Bakery & Confectionery

- Meat & Seafood

- Dairy Product

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=10931<ype=S

More Trending Reports by Transparency Market Research –

- Plastic Crates Market – The Plastic Crates Market is expected to grow by US$ 6.6 Bn, progressing at a CAGR of almost 6.7% during the forecast period.

- Sustainable Packaging Market – The global sustainable packaging market was valued US$ 252.4 Bn in 2022 and is estimated to grow at a CAGR of 5.8% from 2023 to 2030.

- Hygiene Breathable Films Market – The global hygiene breathable films market (marché des films hygiéniques respirants) is estimated to grow at a CAGR of 4.9% from 2024 to 2032.

- Flexible Plastic Packaging Coating Market – The global Flexible Plastic Packaging Coating Market is estimated to grow at a CAGR of 4.0% from 2024 to 2032.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ProSearch and the Cowen Group Release New Research Paper: "Metaskills for the Future-Ready Team"

LOS ANGELES, Oct. 29, 2024 (GLOBE NEWSWIRE) — ProSearch, a leading provider of legal data intelligence and comprehensive discovery and compliance solutions to corporate legal departments and law firms, in partnership with the Cowen Group, a legal career development organization committed to elevating and accelerating professional growth through community-building and educational events, announces the launch of a new research paper: “Metaskills for the Future-Ready Team.”

The paper is comprised of three core sections:

- Part one discusses the impact of generative AI, identifies essential “metaskill” sets, and emphasizes assessing team capabilities to identify gaps and opportunities.

- Part two introduces a ranking exercise to evaluate metaskills and suggests the “Got, Want, Need” priority matrix to assess present capability, future opportunity, and risk.

- Part three outlines how to use these assessments to create a strategic plan, highlighting the need to buy, build, or partner for crucial skills.

Co-produced by ProSearch and the Cowen Group, “Metaskills for the Future-Ready Team” was developed by a working group of business-of-law professionals in eDiscovery legal operations, information governance, and beyond from leading Fortune 500 corporations. As with all working groups hosted by the Cowen Group, this group collaborated under the Chatham House Rules to encourage inclusive and open dialogue, resulting in a deeply thoughtful and thorough discussion and producing a comprehensive research paper on the topic.

“So much about our world and our work has evolved in recent years, not just with respect to new tools and technology, but also the skills and attributes of personnel required for legal teams to achieve success. We must be prepared to adapt or risk being left behind,” says ProSearch CEO Julia Hasenzahl. “We were thrilled to support this working group and the development of this paper, which we hope serves as a resource for law firms and legal departments aiming to prepare for the future.”

“Beyond the continued quest of legal teams to attract and retain the right people, developing that talent is further challenging because the skills needed for success today aren’t the same as they were in the past. This white paper addresses those issues and offers a useful tool for teams aiming to position themselves for the future,” says David Cowen, CEO of the Cowen Group. “We’re grateful to ProSearch for their input, leadership, and support in developing the paper, which is certain to be a valuable resource for many.”

Metaskills for the Future-Ready Team is a topic that will be addressed further in a series of upcoming in-person events, webinars, podcasts, and blog posts. The white paper is available for download via the ProSearch and Cowen Group websites.

About ProSearch

ProSearch is a leading provider of tech-enabled solutions to corporations and law firms. The ProSearch eDiscovery and AI-led review offerings allow clients to efficiently address their most challenging litigation, regulatory, privacy, and other legal matters. ProSearch’s team of consultants, data scientists, linguists, project managers, and eDiscovery specialists collaborates with clients to execute their matter strategies and ensure on-target, on-budget, on-time delivery. ProSearch works with some of the largest companies in the Fortune 500 as a trusted partner that brings efficiency to the legal process and spend. To learn more visit ProSearch.com.

About the Cowen Group

The Cowen Group is a dynamic force in legal career development, committed to elevating and accelerating professional growth through community-building and educational events, including the acclaimed Summit on Legal Innovation and Disruption (SOLID). A leader in fostering community, innovation, and growth for professionals in the business of law, the Cowen Group assembles experts to publish forward-thinking industry papers that explore evolving challenges in data intelligence, eDiscovery, and information governance and provide critical advancements in understanding and managing the complexities of modern data types within various legal contexts. For more information visit CowenGroup.com.

Media Contact

Vicki LaBrosse

Edge Marketing for ProSearch

vlabrosse@edgemarketinginc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ARC Awards $33.5 Million to Accelerate Economic Growth Across 13 Appalachian States; Project Funding Supports Disaster Recovery, Cybersecurity Job Training and Industry Expansion

Washington, DC, Oct. 29, 2024 (GLOBE NEWSWIRE) — Today, the Appalachian Regional Commission (ARC) awarded $33.5 million to 12 collaborative, multi-state projects that will drive large-scale economic transformation. Funded through ARC’s Appalachian Regional Initiative for Stronger Economies (ARISE), these projects bring together more than 145 partners across all 13 Appalachian states to strengthen workforce and educational opportunities, infrastructure and entrepreneurship.

Additionally, this ARISE funding package includes a $10 million grant to Appalachian Service Project that will build a multi-state network for home repair and disaster response and recovery. This project was developed in the wake of historic flooding in Eastern Kentucky in 2022, but will be critical for current and future recovery, including Hurricane Helene’s devastating impact in Southern Appalachia. Furthermore, this project exemplifies the long-term capacity building support ARC is able to provide for Appalachian communities recovering from natural disasters.

The 12 ARISE projects announced today include:

| Grantee | States Impacted | Grant Amount and Project Summary |

| American Association of Community Colleges | All 13 states | $10 million to create a network for cybersecurity workforce development |

| Appalachian Service Project | KY, TN, VA | $10 million to establish a natural disaster recovery and home rebuild network |

| Volunteer Energy Cooperative | GA, NC, TN | $10 million to develop battery supply chains and deploy utility-scale batteries for energy affordability and conservation |

| Appalachian Regional Healthcare, Inc. | KY, TN, VA, WV | $500,000 to develop a plan for a health task force and pilot programs for mobile healthcare |

| New River Conservancy | NC, VA, WV | $500,000 to develop a plan for an expansion of the New River Water Trail |

| Teach for America | KY, TN, VA, WV | $500,000 to expand a recruitment and retention model for educators |

| Tennessee Tech University | PA, TN, VA | $500,000 to plan for the implementation of the region’s first-ever quantum network |

| NEXT, LLC (NextGEN) | NC, SC | $472,237 to streamline and strengthen mentorship programs and resources for entrepreneurs |

| Grow Ohio Valley | OH, PA, WV | $418,000 to develop a plan to create a sustainable network of food and energy systems |

| University of Pittsburgh | PA, WV | $292,800 to develop a plan for biotech workforce development and engagement |

| DRIVE (Driving Real Innovation for a Vibrant Economy) | NC, NY, OH, PA, TN, WV | $189,720 to build an incubation network for small businesses and entrepreneurs |

| Northern State Community College | KY, NC, TN, VA | $120,806 to build a network for aviation industry education |

“ARC’s ARISE initiative builds upon the longstanding tradition of Appalachian collaboration and encourages organizations to work together across state lines to create long-term, regional economic success,” said ARC Federal Co-Chair Gayle Manchin. “I congratulate our newest ARISE grantees and am proud that these projects not only impact all 13 Appalachian states, but also provide critical funding for economic development at a time when many in the region are beginning recovery from Hurricane Helene.”

Federal Co-Chair Gayle Manchin announced the new ARISE awards in Beckley, West Virginia, alongside federal, state and local partners during a federal grant writing training. Hosted by ARC grantee WV Community Development Hub, the training also featured partners from Energy Communities IWG and USDA West Virginia Rural Development, who announced a new West Virginia Rapid Response Team (RRT). The West Virginia RRT will work to strengthen networks of assistance to catalyze projects that help energy communities across the state grow, diversify and transform their economies for long-term success.

Today’s announcement is the largest single award package ARC has invested through ARISE to date.

“The ARISE program’s investment in multi-state projects ranging from disaster recovery to workforce development exemplify the impact of ARC’s federal-state partnership,” said ARC 2024 States’ Co-Chair, Tennessee Governor Bill Lee. “We are proud Tennessee is engaged in eight of these projects and look forward to seeing how they positively impact communities in the Appalachian Region.”

With support from the Bipartisan Infrastructure Law, ARC has now invested $121.8 million in 46 ARISE projects to support the development of new economic opportunities across all 13 Appalachian states.

“Supported by Bipartisan Infrastructure Law funding, these ARISE awards show the Biden-Harris Administration’s commitment to help America’s hardest-hit communities make a comeback from historic weather disasters across Kentucky, Tennessee, and Virginia,” said Lael Brainard, White House National Economic Advisor.

To learn more about ARISE, visit www.arc.gov/ARISE. To learn more about the new ARISE grantees, visit https://www.arc.gov/grants-and-opportunities/arise/arise-project-summaries/.

###

About the Appalachian Regional Commission

The Appalachian Regional Commission is an economic development entity of the federal government and 13 state governments focusing on 423 counties across the Appalachian Region. ARC’s mission is to innovate, partner, and invest to build community capacity and strengthen economic growth in Appalachia to help the region achieve socioeconomic parity with the nation.

Janiene Bohannon Appalachian Regional Commission 202-754-0552 jbohannon@arc.gov

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Acute Respiratory Infection Market Size/Share Worth USD 20,796.6 Billion by 2033 at a 1.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

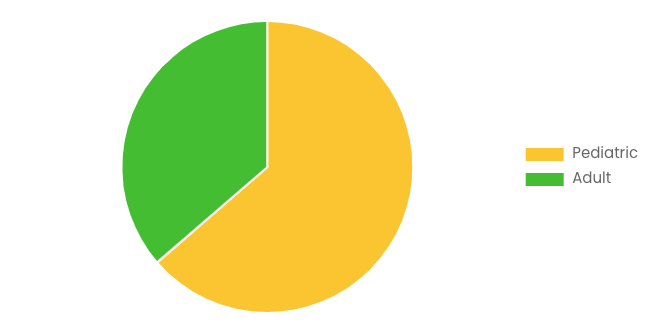

Austin, TX, USA, Oct. 29, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Acute Respiratory Infection Market Size, Trends and Insights By Drug Type (Antibiotics, Antivirals, Antipyretics/Analgesics, Bronchodilators, Mucolytics/Expectorants, Cough Suppressants, Steroids, Others), By Route of Administration (Oral, Inhalation, Intravenous (IV), Intramuscular (IM), Subcutaneous (SC), Topical/Nasal), By Age Group (Pediatric, Adult), By Type of Infection (Upper Respiratory Tract Infections (URTI), Lower Respiratory Tract Infections (LRTI), Pneumonia, Bronchitis, Influenza, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

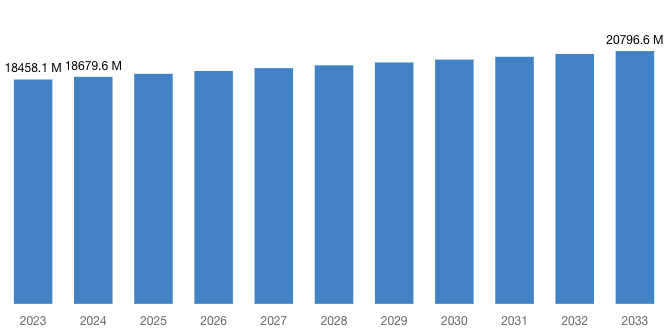

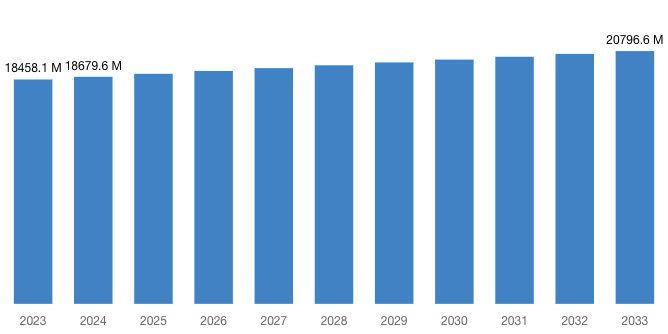

“According to the latest research study, the demand of global Acute Respiratory Infection Market size & share was valued at approximately USD 18,458.1 Billion in 2023 and is expected to reach USD 18,679.6 Billion in 2024 and is expected to reach a value of around USD 20,796.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 1.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Acute Respiratory Infection Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53337

Acute Respiratory Infection Market: Growth Factors and Dynamics

- Prevalence of Respiratory Diseases: The high prevalence of acute respiratory infections, including influenza, pneumonia, and bronchitis, drives market growth. Factors such as pollution, smoking, and the spread of infectious agents contribute to the increasing incidence of respiratory diseases worldwide.

- Rising Geriatric Population: With an aging population globally, there is a higher susceptibility to respiratory infections due to weakened immune systems and underlying health conditions. This demographic trend fuels the demand for treatments and medications to manage acute respiratory illnesses.

- Increased Healthcare Expenditure: Growing healthcare expenditure, coupled with improved access to medical facilities and treatments, drives market growth. Governments and healthcare organizations invest in preventive measures, diagnosis, and treatment options for respiratory infections, bolstering market expansion.

- Technological Advancements: Advances in medical technology and diagnostics, such as rapid antigen tests, point-of-care devices, and advanced imaging techniques, enhance the diagnosis and management of acute respiratory infections. These innovations improve patient outcomes, driving demand for advanced healthcare solutions.