INVESTIGATION ALERT (NASDAQ:TMDX): DiCello Levitt LLP Is Investigating Investor Claims Against TransMedics Group, Inc. and Encourages TMDX Investors with Losses to Contact the Firm

SAN DIEGO, Oct. 28, 2024 (GLOBE NEWSWIRE) — DiCello Levitt LLP announces that it is investigating whether TransMedics Group, Inc. (“TransMedics” or the “Company”) TMDX complied with federal securities laws. The Firm’s investigation focuses on whether the Company violated the federal securities laws, issued false and/or misleading statements, and/or failed to disclose information required to be disclosed to investors.

Investors who purchased TransMedics securities and those with information about the allegations are encouraged to obtain additional information and assist the Firm’s investigation by contacting DiCello Levitt attorneys Brian O’Mara or Hani Farah by calling (888) 287-9005 or emailing investors@dicellolevitt.com.

No Case Has Been Filed and No Class Has Been Certified. Until a case is filed and a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice.

Investigation Details:

TransMedics is a medical technology company that develops and provides organ care systems for lung, heart, and liver transplantation.

On October 28, 2024, TransMedics reported disappointing financial results for the third quarter of 2024, missing analyst expectations on both the top and bottom lines. Specifically, the Company reported earnings per share (“EPS”) of $0.12, missing EPS expectations of $0.29 by nearly 60%. TransMedics also reported revenue of $108.8 million, falling short of analysts’ $115 million estimate.

On this news, TransMedics stock fell 24% in after-hours trading.

About DiCello Levitt:

At DiCello Levitt, we are dedicated to achieving justice for our clients through class action, business-to-business, public client, whistleblower, personal injury, civil and human rights, and mass tort litigation. Our lawyers are highly respected for their ability to litigate and win cases – whether by trial, settlement, or otherwise – for people who have suffered harm, global corporations that have sustained significant economic losses, and public clients seeking to protect their citizens’ rights and interests. Every day, we put our reputations – and our capital – on the line for our clients.

DiCello Levitt has achieved top recognition as Plaintiffs Firm of the Year and Trial Innovation Firm of the Year by the National Law Journal, in addition to its top-tier Chambers and Benchmark ratings. The New York Law Journal also recently recognized DiCello Levitt as a Distinguished Leader in trial innovation. For more information about the Firm, including recent trial victories and case resolutions, please visit www.dicellolevitt.com.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Media Contact

Amy Coker

4747 Executive Drive, Suite 240

San Diego, CA 92121

619-963-2426

investors@dicellolevitt.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Agree Realty Announces Exercise of Underwriters' Option and Closing of Forward Offering of Common Stock

ROYAL OAK, Mich., Oct. 28, 2024 /PRNewswire/ — Agree Realty Corporation ADC (the “Company”) today announced that it has completed its public offering of 5,060,000 shares of its common stock, which includes the underwriters’ full exercise of their option to purchase additional shares, pursuant to the forward sale agreements described below.

Citigroup and Wells Fargo Securities acted as joint book-running managers for the offering.

The Company has entered into forward sale agreements with Citibank, N.A. and Wells Fargo Bank, National Association (the “forward purchasers”) with respect to 5,060,000 shares of its common stock. In connection with the forward sale agreements, the forward purchasers or their affiliates borrowed and sold to the underwriters an aggregate of 5,060,000 shares of the common stock delivered in this offering. Subject to its right to elect cash or net share settlement, which right is subject to certain conditions, the Company intends to deliver, upon physical settlement of such forward sale agreements on one or more dates specified by the Company occurring no later than December 31, 2025, an aggregate of 5,060,000 shares of its common stock to the forward purchasers in exchange for cash proceeds per share equal to the applicable forward sale price, which will be the public offering price of $74.00 per share, less underwriting discounts and commissions, and will be subject to certain adjustments as provided in the forward sale agreements.

The Company has not received any proceeds from the sale of shares of its common stock by the forward purchasers. The Company expects to use the net proceeds, if any, it receives upon the future settlement of the forward sale agreements for general corporate purposes, including to fund property acquisitions and development activity or the repayment of outstanding indebtedness under its revolving credit facility. Selling common stock through the forward sale agreements enables the Company to set the price of such shares upon pricing the offering (subject to certain adjustments) while delaying the issuance of such shares and the receipt of the net proceeds by the Company until the expected funding requirements described above have occurred.

Copies of the prospectus supplement relating to this offering may be obtained by contacting: Citigroup Global Markets Inc.: c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 (Tel: 800-831-9146) or Wells Fargo Securities, LLC, Attention: WFS Customer Service, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, at 800-645-3751 or email: wfscustomerservice@wellsfargo.com.

This offering was made pursuant to an effective shelf registration statement and related prospectus filed by the Company with the Securities and Exchange Commission (“SEC”). The offering of the securities was made only by means of a prospectus supplement and accompanying prospectus, which are on file with the SEC. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

About Agree Realty Corporation

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of September 30, 2024, the Company owned and operated a portfolio of 2,271 properties, located in 49 states and containing approximately 47.2 million square feet of gross leasable area. The Company’s common stock is listed on the New York Stock Exchange under the symbol “ADC”.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws, including statements about the intended use of proceeds from the offering, if any, and future settlement of its forward sales agreements, that represent the Company’s expectations and projections for the future. No assurance can be given that the forward sales discussed above will be completed on the terms described or at all, or that the net proceeds of the offering will be used as indicated. Although these forward-looking statements are based on good faith beliefs, reasonable assumptions and the Company’s best judgment reflecting current information, you should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and which could materially affect the Company’s results of operations, financial condition, cash flows, performance or future achievements or events. Currently, one of the most significant factors, however, is the adverse effect of macroeconomic conditions, including inflation and the potential impacts of pandemics, epidemics or other public health emergencies or fear of such events on the financial condition, results of operations, cash flows and performance of the Company and its tenants, the real estate market and the global economy and financial markets. The extent to which macroeconomic trends may impact us and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence. Moreover, investors are cautioned to interpret many of the risks identified in the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and other SEC filings, as well as the risks set forth below, as being heightened as a result of the ongoing and numerous adverse impacts of macroeconomic conditions. Additional important factors, among others, that may cause the Company’s actual results to vary include the general deterioration in national economic conditions, weakening of real estate markets, decreases in the availability of credit, increases in interest rates, adverse changes in the retail industry, the Company’s continuing ability to qualify as a REIT and other factors discussed in the Company’s reports filed with the SEC. The forward-looking statements included in this press release are made as of the date hereof. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, changes in the Company’s expectations or assumptions or otherwise.

For further information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s SEC filings, including, but not limited to, its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/agree-realty-announces-exercise-of-underwriters-option-and-closing-of-forward-offering-of-common-stock-302288917.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/agree-realty-announces-exercise-of-underwriters-option-and-closing-of-forward-offering-of-common-stock-302288917.html

SOURCE Agree Realty Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Moves Higher; Philips Shares Plunge After Q3 Earnings

U.S. stocks traded higher toward the end of trading, with the Dow Jones index gaining more than 300 points on Monday.

The Dow traded up 0.77% to 42,440.12 while the NASDAQ rose 0.46% to 18,603.67. The S&P 500 also rose, gaining, 0.43% to 5,832.99.

Check This Out: How To Earn $500 A Month From Ford Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Financials shares rose by 1.2% on Monday.

In trading on Monday, energy shares fell by 0.7%.

Top Headline

Koninklijke Philips NV PHG reported third-quarter adjusted EPS of 0.32 euros (or $0.35), missing the consensus of 0.35 euros. The Dutch conglomerate reported sales of 4.38 billion euros ($4.74 billion), down 2% year over year and missing the consensus of 4.54 billion euros.

Equities Trading UP

- Healthcare Triangle, Inc. HCTI shares shot up 106% to $1.19 after the company disclosed in a filing that it acquired the business, assets, and operations relating to cloud and technology domain of Securekloud Technologies.

- Shares of Autonomix Medical, Inc. AMIX got a boost, surging 70% to $13.08 after the company reported preliminary results from its clinical trial of RF Ablation technology where 100% of its responder group was able to eliminate opioid use and reduce pain scores.

- Evoke Pharma, Inc. EVOK shares were also up, gaining 52% to $7.78 after the company announced the presentation of GLP-1 data for users with diabetic gastoparesis using GIMOTI and showed statistically significant improvements.

Equities Trading DOWN

- Koninklijke Philips N.V. PHG shares dropped 16% to $26.52 after the company reported third-quarter EPS and sales below estimates and revised its 2024 outlook due to weak demand in China.

- Shares of Borr Drilling Limited BORR were down 7% to $4.38. The stock may be moving on continued weakness following Friday’s reported preliminary third-quarter financial results.

- CEMEX, S.A.B. de C.V. CX was down, falling 9% to $5.46 following weak quarterly results.

Commodities

In commodity news, oil traded down 6% to $67.49 while gold traded down 0.1% at $2,754.40.

Silver traded up 0.2% to $33.850 on Monday, while copper fell 0.1% to $4.3655.

Euro zone

European shares closed higher today. The eurozone’s STOXX 600 gained 0.41%, Germany’s DAX rose 0.35% and France’s CAC 40 rose 0.79%. Spain’s IBEX 35 Index rose 0.77%, while London’s FTSE 100 rose 0.45%.

Retail sales in Spain rose by 4.1% year-over-year in September, while retail sales volumes in the UK fell by 6% in October following a 4% increase in September.

Asia Pacific Markets

Asian markets closed higher on Monday, with Japan’s Nikkei 225 gaining 1.82%, Hong Kong’s Hang Seng Index gaining 0.05%, China’s Shanghai Composite Index gaining 0.68% and India’s BSE Sensex surging 0.76%.

Hong Kong’s trade deficit shrank to $53.2 billion in September from $64.6 billion in the year-ago month.

Economics

The Federal Reserve Bank of Dallas’ general business activity index for manufacturing in Texas rose to -3 in October compared to a reading of -9 in the earlier month.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Harmony Biosciences

Harmony Biosciences HRMY is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Harmony Biosciences will report an earnings per share (EPS) of $0.66.

Harmony Biosciences bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

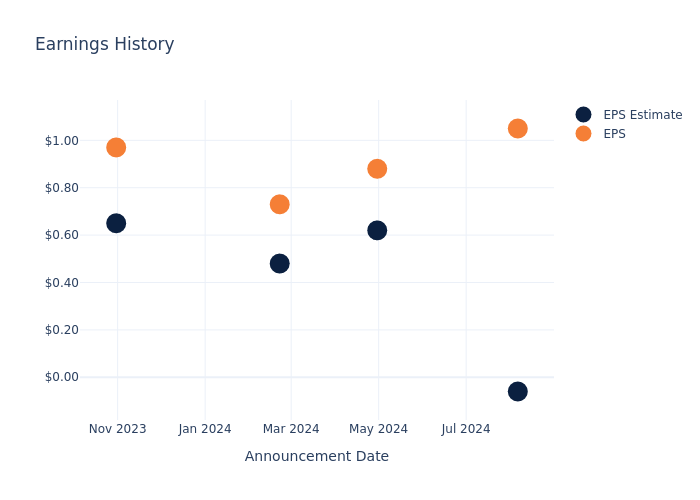

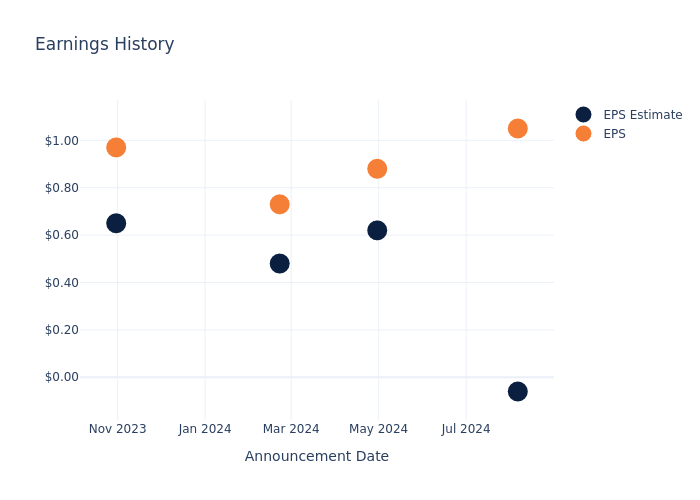

Earnings Track Record

The company’s EPS beat by $1.11 in the last quarter, leading to a 2.19% increase in the share price on the following day.

Here’s a look at Harmony Biosciences’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.06 | 0.62 | 0.48 | 0.65 |

| EPS Actual | 1.05 | 0.88 | 0.73 | 0.97 |

| Price Change % | 2.0% | -2.0% | 3.0% | 4.0% |

Performance of Harmony Biosciences Shares

Shares of Harmony Biosciences were trading at $34.5 as of October 25. Over the last 52-week period, shares are up 51.32%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Harmony Biosciences visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Modine Manufacturing's Earnings: A Preview

Modine Manufacturing MOD is preparing to release its quarterly earnings on Tuesday, 2024-10-29. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Modine Manufacturing to report an earnings per share (EPS) of $0.92.

The market awaits Modine Manufacturing’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

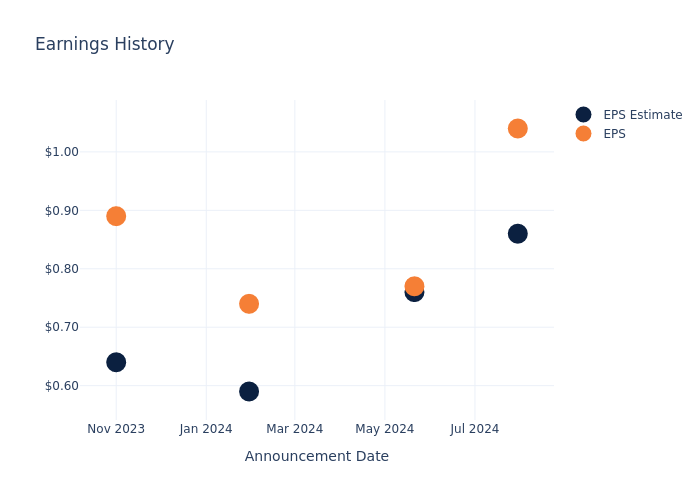

Performance in Previous Earnings

Last quarter the company beat EPS by $0.18, which was followed by a 18.94% increase in the share price the next day.

Here’s a look at Modine Manufacturing’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.86 | 0.76 | 0.59 | 0.64 |

| EPS Actual | 1.04 | 0.77 | 0.74 | 0.89 |

| Price Change % | 19.0% | -5.0% | 3.0% | -2.0% |

Performance of Modine Manufacturing Shares

Shares of Modine Manufacturing were trading at $127.25 as of October 25. Over the last 52-week period, shares are up 229.08%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Modine Manufacturing

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Modine Manufacturing.

The consensus rating for Modine Manufacturing is Buy, based on 6 analyst ratings. With an average one-year price target of $141.5, there’s a potential 11.2% upside.

Comparing Ratings with Competitors

The following analysis focuses on the analyst ratings and average 1-year price targets of Gentex, Autoliv and BorgWarner, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Gentex, with an average 1-year price target of $34.25, indicating a potential 73.08% downside.

- As per analysts’ assessments, Autoliv is favoring an Neutral trajectory, with an average 1-year price target of $111.83, suggesting a potential 12.12% downside.

- For BorgWarner, analysts project an Outperform trajectory, with an average 1-year price target of $43.0, indicating a potential 66.21% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Gentex, Autoliv and BorgWarner, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Modine Manufacturing | Buy | 6.28% | $162.60M | 6.16% |

| Gentex | Neutral | -1.81% | $188.56M | 3.55% |

| Autoliv | Neutral | -1.14% | $475M | 5.84% |

| BorgWarner | Outperform | -1.85% | $685M | 5.08% |

Key Takeaway:

Modine Manufacturing ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

All You Need to Know About Modine Manufacturing

Modine Manufacturing Co provides thermal management solutions to diversified markets and customers. The company provides engineered heat transfer systems and heat transfer components for use in on- and off-highway original equipment manufacturer (OEM) vehicular applications in the United States. It offers powertrain cooling products, such as engine cooling assemblies, radiators, condensers, and charge air coolers; auxiliary cooling products, including power steering and transmission oil coolers.

Financial Milestones: Modine Manufacturing’s Journey

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, Modine Manufacturing showcased positive performance, achieving a revenue growth rate of 6.28% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Modine Manufacturing’s net margin is impressive, surpassing industry averages. With a net margin of 7.15%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Modine Manufacturing’s ROE excels beyond industry benchmarks, reaching 6.16%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.54%, the company showcases effective utilization of assets.

Debt Management: Modine Manufacturing’s debt-to-equity ratio is below the industry average at 0.55, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Modine Manufacturing visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Preview: ExlService Holdings's Earnings

ExlService Holdings EXLS will release its quarterly earnings report on Tuesday, 2024-10-29. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate ExlService Holdings to report an earnings per share (EPS) of $0.41.

ExlService Holdings bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

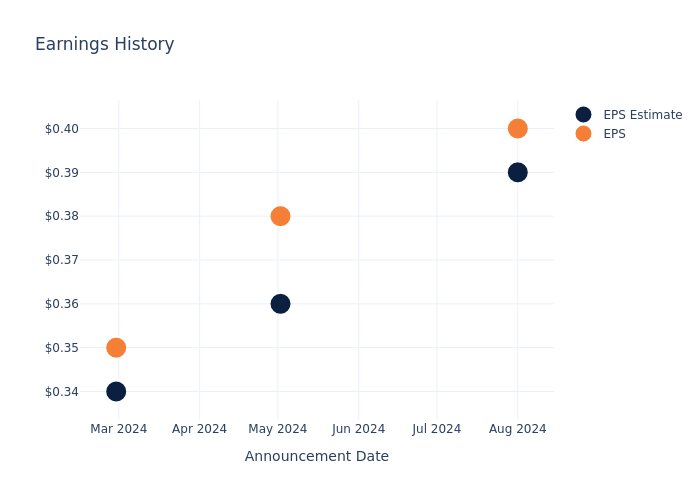

Past Earnings Performance

The company’s EPS beat by $0.01 in the last quarter, leading to a 4.13% increase in the share price on the following day.

Here’s a look at ExlService Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.39 | 0.36 | 0.34 | 0.34 |

| EPS Actual | 0.40 | 0.38 | 0.35 | 0.37 |

| Price Change % | 4.0% | -1.0% | 2.0% | -2.0% |

Market Performance of ExlService Holdings’s Stock

Shares of ExlService Holdings were trading at $38.6 as of October 25. Over the last 52-week period, shares are up 48.79%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on ExlService Holdings

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on ExlService Holdings.

ExlService Holdings has received a total of 5 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $41.8, the consensus suggests a potential 8.29% upside.

Comparing Ratings Among Industry Peers

The below comparison of the analyst ratings and average 1-year price targets of Genpact, Verra Mobility and Concentrix, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Genpact is maintaining an Neutral status according to analysts, with an average 1-year price target of $41.17, indicating a potential 6.66% upside.

- For Verra Mobility, analysts project an Neutral trajectory, with an average 1-year price target of $29.0, indicating a potential 24.87% downside.

- The prevailing sentiment among analysts is an Outperform trajectory for Concentrix, with an average 1-year price target of $80.43, implying a potential 108.37% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Genpact, Verra Mobility and Concentrix, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| ExlService Holdings | Buy | 10.71% | $166.26M | 5.53% |

| Genpact | Neutral | 6.39% | $416.38M | 5.26% |

| Verra Mobility | Neutral | 8.79% | $209.94M | 7.71% |

| Concentrix | Outperform | 46.21% | $864.19M | 0.39% |

Key Takeaway:

ExlService Holdings ranks first in revenue growth among its peers. It ranks lowest in gross profit and return on equity.

About ExlService Holdings

ExlService Holdings Inc. is a business process management company that provides digital operations and analytical services to clients driving enterprise-scale business transformation initiatives that leverage company’s deep expertise in analytics, AI, ML and cloud. The company offers business process outsourcing and automation services, and data-driven insights to customers across multiple industries. The company operates through four segments based on the products and services offered and markets served: Insurance, Healthcare, Emerging, Analytics. The vast majority of the company’s revenue is earned in the United States, and more than half of its revenue comes from Analytics segment.

ExlService Holdings: Delving into Financials

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: ExlService Holdings’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 10.71%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: ExlService Holdings’s net margin excels beyond industry benchmarks, reaching 10.22%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): ExlService Holdings’s ROE stands out, surpassing industry averages. With an impressive ROE of 5.53%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): ExlService Holdings’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 3.11% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.49.

To track all earnings releases for ExlService Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look Ahead: Mirion Technologies's Earnings Forecast

Mirion Technologies MIR is gearing up to announce its quarterly earnings on Tuesday, 2024-10-29. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Mirion Technologies will report an earnings per share (EPS) of $0.09.

The market awaits Mirion Technologies’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Performance in Previous Earnings

In the previous earnings release, the company beat EPS by $0.03, leading to a 2.04% drop in the share price the following trading session.

Here’s a look at Mirion Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.07 | 0.06 | 0.14 | |

| EPS Actual | 0.10 | 0.06 | 0.15 | 0.05 |

| Price Change % | -2.0% | -6.0% | 7.000000000000001% | 14.000000000000002% |

Market Performance of Mirion Technologies’s Stock

Shares of Mirion Technologies were trading at $14.36 as of October 25. Over the last 52-week period, shares are up 104.26%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Mirion Technologies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Mirion Technologies.

Mirion Technologies has received a total of 1 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $14.0, the consensus suggests a potential 2.51% downside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Crane NXT, Advanced Energy Indus and OSI Systems, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Crane NXT, with an average 1-year price target of $87.33, suggesting a potential 508.15% upside.

- For Advanced Energy Indus, analysts project an Neutral trajectory, with an average 1-year price target of $112.0, indicating a potential 679.94% upside.

- The prevailing sentiment among analysts is an Buy trajectory for OSI Systems, with an average 1-year price target of $175.75, implying a potential 1123.89% upside.

Insights: Peer Analysis

In the peer analysis summary, key metrics for Crane NXT, Advanced Energy Indus and OSI Systems are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Mirion Technologies | Buy | 5.02% | $97.40M | -0.79% |

| Crane NXT | Outperform | 5.16% | $160.90M | 4.26% |

| Advanced Energy Indus | Neutral | -12.17% | $127.74M | 1.30% |

| OSI Systems | Buy | -28.47% | $154.32M | 2.17% |

Key Takeaway:

Mirion Technologies ranks at the top for Revenue Growth among its peers. It is at the bottom for Gross Profit and Return on Equity.

All You Need to Know About Mirion Technologies

Mirion Technologies Inc provides products, services, and software that allows customers to safely leverage the power of ionizing radiation for the greater good of humanity through critical applications in the medical, nuclear, defense markets, as well as laboratories, scientific research, analysis and exploration. The Company manages its operations through two segments: Medical and Technologies. The Medical segment provides radiation oncology quality assurance, delivering patient safety solutions for diagnostic imaging and radiation therapy centers. The Technologies segment is based around the nuclear energy, defense, laboratories, and scientific research markets as well as other industrial markets. It derives maximum revenue from Technologies Segment.

Financial Milestones: Mirion Technologies’s Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Mirion Technologies’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.02% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Mirion Technologies’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -5.65%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Mirion Technologies’s ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -0.79%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.44%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Mirion Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.48, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Mirion Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FLUX INVESTOR NEWS: Flux Power Holdings, Inc. Investors that Suffered Losses are Encouraged to Contact RLF About Ongoing Investigation into the Company (NASDAQ: FLUX)

NEW YORK, Oct. 28, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Flux Power Holdings, Inc. FLUX resulting from allegations that Flux Power may have issued materially misleading business information to the investing public.

So What: If you purchased Flux Power securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=28783 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On September 5, 2024, after the market closed, Flux Power Holdings, Inc. filed a current report on Form 8-K with the SEC, in which it announced “[o]n August 30, 2024, the Board of Directors of Flux Power Holdings, Inc. (the “Company”) including its audit committee members, concluded that the previously issued audited consolidated financial statements as of and for the fiscal year ended June 30, 2023 and the unaudited consolidated financial statements as of and for the quarters ended September 30, 2023, December 31, 2023, and March 31, 2024 (collectively, the “Prior Financial Statements”), which were filed with the Securities and Exchange Commission (“SEC”) on September 21, 2023, November 9, 2023, February 8, 2024 and May 13, 2024, respectively, should no longer be relied upon because of errors in such financial statements relating to the improper accounting for inventory and a restatement should be undertaken.”

On this news, Flux Power’s common stock fell $0.17 per share, or 5.36%, to close at $3.00 per share on September 6, 2024. The next trading day, it fell a further $0.12 per share, or 4%, to close at $2.88 per share on September 9, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.