A Glimpse of Big 5 Sporting Goods's Earnings Potential

Big 5 Sporting Goods BGFV will release its quarterly earnings report on Tuesday, 2024-10-29. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Big 5 Sporting Goods to report an earnings per share (EPS) of $-0.25.

Anticipation surrounds Big 5 Sporting Goods’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

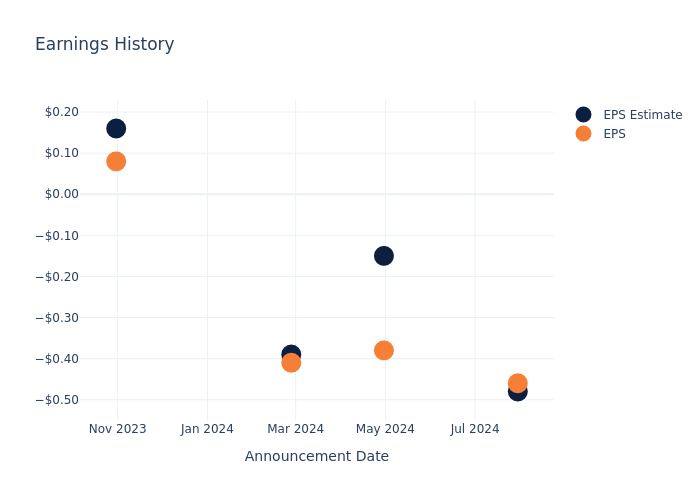

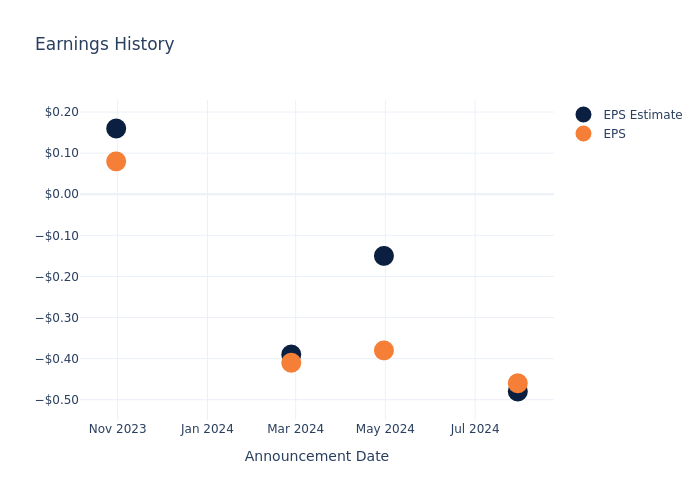

Overview of Past Earnings

Last quarter the company beat EPS by $0.02, which was followed by a 25.18% drop in the share price the next day.

Here’s a look at Big 5 Sporting Goods’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.48 | -0.15 | -0.39 | 0.16 |

| EPS Actual | -0.46 | -0.38 | -0.41 | 0.08 |

| Price Change % | -25.0% | -4.0% | -10.0% | -23.0% |

Big 5 Sporting Goods Share Price Analysis

Shares of Big 5 Sporting Goods were trading at $1.87 as of October 25. Over the last 52-week period, shares are down 72.24%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Big 5 Sporting Goods visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin Lifts 15% Amid Rising Odds Of Trump Victory In Betting Markets And Expectations Of Elon Musk Heading 'DOGE' Department

Dogecoin DOGE/USD exploded on price charts Monday, emerging as the best-performing billion-dollar capitalization cryptocurrency in the last 24 hours.

What happened: The ‘original meme coin’ was up over 15% as of this writing, with an 184% spike in 24-hour volumes. Dogecoin was the eighth-most traded cryptocurrency and the most traded meme token in the last 24 hours.

The jump was likely spurred by Tesla and Space X CEO Elon Musk’s grand introduction as the “co-founder of the Department of Government Efficiency,” or DOGE, during Donald Trump’s rally at Madison Square Garden.

With Trump’s presidential odds on betting markets increasing by the day, investors appeared to be pricing in the likelihood of a ‘DOGE’ department under Musk in the next administration.

DOGE was up over 28% over the month, and 72.82% since 2024 began.

Based on the data from TradingView, DOGE’s technical indicators flashed ‘Buy’ signals.

The exponential moving averages (EMA) all pointed to ‘Buy’ as of this writing, indicating that Dogecoin’s current price is greater than the average values for these respective periods.

The Moving Average Convergence Divergence (MACD) indicator, which compares two EMAs to assess the momentum of the asset, also indicated a ‘Buy’ signal.

Additionally, large transaction volume rose nearly 5% in the last 24 hours, according to IntoTheBlock, signaling increased interest from whales.

The net amount of DOGE entering cryptocurrency exchanges dropped 9% in the last 24 hours, reflecting a reduced desire to sell.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1662, up 15.65% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights Ahead: Enovix's Quarterly Earnings

Enovix ENVX is gearing up to announce its quarterly earnings on Tuesday, 2024-10-29. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Enovix will report an earnings per share (EPS) of $-0.20.

The announcement from Enovix is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

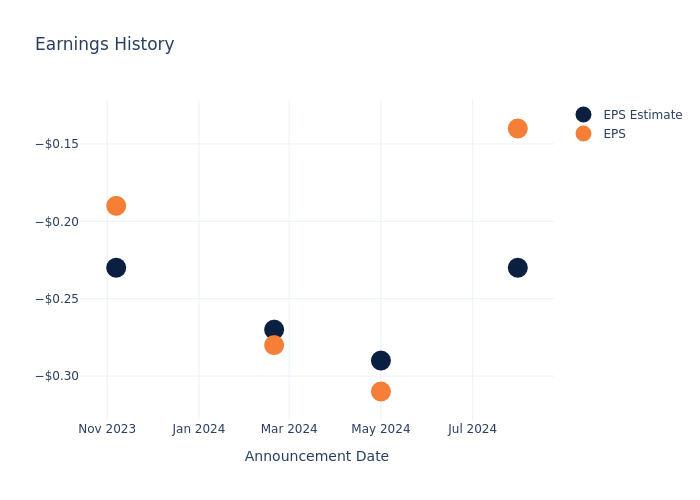

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.09, leading to a 19.15% drop in the share price on the subsequent day.

Here’s a look at Enovix’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.23 | -0.29 | -0.27 | -0.23 |

| EPS Actual | -0.14 | -0.31 | -0.28 | -0.19 |

| Price Change % | -19.0% | 45.0% | -9.0% | 15.0% |

Market Performance of Enovix’s Stock

Shares of Enovix were trading at $10.41 as of October 25. Over the last 52-week period, shares are up 28.73%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Enovix

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Enovix.

The consensus rating for Enovix is Outperform, based on 7 analyst ratings. With an average one-year price target of $22.0, there’s a potential 111.34% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Plug Power and Vicor, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Plug Power, with an average 1-year price target of $2.57, indicating a potential 75.31% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Vicor, with an average 1-year price target of $43.0, implying a potential 313.06% upside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Plug Power and Vicor are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Enovix | Outperform | 8871.43% | $-655K | -58.00% |

| Plug Power | Neutral | -44.90% | $-131.25M | -8.87% |

| Vicor | Neutral | 8.52% | $42.77M | 2.12% |

Key Takeaway:

Enovix ranks highest in Revenue Growth among its peers. However, it has the lowest Gross Profit margin. In terms of Return on Equity, Enovix is at the bottom compared to its peers.

All You Need to Know About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Enovix: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Enovix showcased positive performance, achieving a revenue growth rate of 8871.43% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Enovix’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -3075.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -58.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Enovix’s ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -23.22%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Enovix’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.14, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Enovix visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's Executive Says AI Will Soon Take Human Form: 'The Machine Is To The Body What AI Is To The Brain'

The future of artificial intelligence is set to be a game-changer, according to a top executive at NVIDIA Corp NVDA. The executive believes AI will soon take on a “human form.” This revelation was made at the Global Management Dialogue event in Tokyo.

What Happened: At the Global Management Dialogue, a forum organized by Nikkei and Swiss business school IMD, Masataka Osaki, the Vice President of Worldwide Field Operations at Nvidia, made a bold prediction. He stated that AI will soon take on a human-like form.

“The machine is to the body what AI is to the brain,” Osaki said. He also highlighted Japan’s potential to become a global leader in AI if businesses quickly connect AI and machines to create new services.

Osaki commended Japan for its efforts to build a domestic base for AI technologies and stressed the importance of developing domestic AI using domestically generated data.

See Also: Elon Musk’s ‘Doge-Flex’ Pose Sends Dogecoin, First Neiro On Ethereum Soaring

Why It Matters: Nvidia’s AI technology has been making waves globally. The company recently tapped into India’s growing AI market, recognizing the vast opportunities in AI-driven businesses across Asia. Osaki noted the immense data produced by Asian countries’ diverse languages and cultures, which can be transformed into AI tailored for each region.

This move came on the heels of Nvidia’s almost 200% stock surge, which positioned the company above the market value of Germany and Italy combined. The company’s market capitalization now stands at an impressive $3.5 trillion, reflecting a broader trend where foreign investors own approximately 18% of the U.S. stock market.

This surge in Nvidia’s stock, along with other tech giants, has led to a concentration in the S&P 500, with major U.S. investment funds being compelled to sell shares to avoid violating U.S. tax laws. This has put pressure on investment funds to comply with tax regulations and prevent breaching rules that mandate diversified portfolios.

Price Action: Nvidia stock closed at $140.52 on Monday down 0.72% for the day. In after-hours trading, the stock dipped 0.21%. Year to date, Nvidia’s stock has surged 191.72%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ohio Valley Banc Corp. Reports 3rd Quarter Earnings

GALLIPOLIS, Ohio, Oct. 28, 2024 /PRNewswire/ — Ohio Valley Banc Corp. OVBC (the “Company”) reported consolidated net income for the quarter ended September 30, 2024, of $2,719,000, an increase of $468,000, or 20.8%, from the same period the prior year. Earnings per share for the third quarter of 2024 were $.58 compared to $.47 for the prior year third quarter. For the nine months ended September 30, 2024, net income totaled $8,484,000, a decrease of $924,000 from the same period the prior year. Earnings per share were $1.79 for the first nine months of 2024 versus $1.97 for the first nine months of 2023. Return on average assets and return on average equity were .81% and 7.80%, respectively, for the first nine months of 2024, compared to 1.00% and 9.21%, respectively, for the same period in the prior year.

Ohio Valley Banc Corp. President and CEO, Larry Miller said, “All year, we have faced the challenging headwinds of an unfavorable interest rate environment and rising costs. Earlier in the year, I suggested that consistent, quality loan growth will be the key to meeting these challenges. And boy, did our bankers rise to the challenge by producing strong loan growth that exceeded expectations. This loan growth in conjunction with the successful roll out of the Sweet Home Ohio deposit account were key contributors to our 3rd quarter results. We look forward to a strong finish to 2024 as we maintain a laser focus on our Community First Mission.”

For the three months ended September 30, 2024, net interest income increased $1,205,000, and for the nine months ended September 30, 2024, net interest income increased $1,022,000 from the same respective periods last year. Contributing to the increase in quarterly net interest income was the $159 million increase in average earning assets, which was partially offset by a decrease in the net interest margin of 9 basis points. For the nine months ended September 30, 2024, the increase in net interest income was attributable to the $136 million increase in average earning assets, which was partially offset by the 32 basis point decrease in the net interest margin. In general, the growth in earning assets was primarily driven by loan growth followed by higher average balances being maintained at the Federal Reserve. The loan growth experienced during 2024 has exceeded expectations and has occurred within the commercial lending segment and in the residential real estate lending segment. A portion of the growth in the residential real estate segment was associated with the higher utilization of a warehouse line of credit extended to another mortgage lender. The decrease in the net interest margin for the respective periods was related to the cost of funding sources increasing more than the yield on earning assets. This increase in the cost of funding was partially linked to the Company’s decision to increase rates on deposit accounts to attract deposits amidst heightened market competition for such funds. In addition, the composition of funding sources trended toward certificates of deposit and wholesale funding sources, which generally cost more than other funding sources, such as checking, NOW, savings and money market deposit products. Although the net interest margin decreased from the prior year periods, the net interest margin has steadily improved throughout 2024 on a linked quarter basis. From the first quarter to the second quarter of 2024, the net interest margin increased 13 basis points and from the second quarter to the third quarter of 2024, the net interest margin increased 2 basis points. These increases were related to the heightened loan growth accompanied by a moderation in deposit pricing pressure.

For the three months ended September 30, 2024, the provision for credit loss expense totaled $920,000, an increase of $32,000 from the same period last year. The quarterly provision for credit loss expense was primarily related to quarter-to-date net charge-offs of $496,000 and to the establishment of a specific reserve of $427,000 on a collateral dependent impaired loan. For the nine months ended September 30, 2024, the provision for credit losses was $1,852,000, an increase of $451,000 from the same period last year. The year-to-date provision for credit loss expense was primarily associated with the $77 million in loan growth, net charge-offs of $827,000, and the specific reserve mentioned above. The allowance for credit losses was .95% of total loans at September 30, 2024, compared to .90% at December 31, 2023, and .85% at September 30, 2023. The ratio of nonperforming loans to total loans increased to .44% at September 30, 2024, compared to .26% at December 31, 2023, and .28% at September 30, 2023. The increase was partly related to the loans associated with the new specific reserve being placed on nonaccrual status.

For the three and nine months ended September 30, 2024, noninterest income increased $286,000 and $203,000, respectively, from the same periods last year. The increases were largely due to service charges on deposit accounts, trust fees and income from bank owned life insurance. The year-to-date increases were partially offset by a decrease in mortgage application referral income. Due to the closure of Race Day Mortgage at the end of 2023, there was no mortgage application referral income earned in 2024 compared to $247,000 in commissions earned during the first nine months of 2023.

For the three months ended September 30, 2024, noninterest expense increased $841,000 from the same period last year. For the nine months ended September 30, 2024, noninterest expense increased $1,758,000 from the same period last year. The Company’s largest noninterest expense, salaries and employee benefits, increased $687,000 as compared to the third quarter of 2023 and increased $1,315,000 as compared to the first nine months of 2023. The increase was primarily related to annual merit increases, higher health insurance premiums, and the severance expense associated with a voluntary early retirement program. During the third quarter of 2024, the Company established a voluntary early retirement program for select employees meeting certain criteria. Based on the number of employees that had accepted the severance package as of September 30, 2024, the Company incurred an expense of $295,000. Subsequent to quarter end, additional employees have accepted the offer, and the Company anticipates recording additional severance expense of $3,043,000 during the fourth quarter of 2024. The early retirement program is expected to reduce salary and employee benefit expense on a go forward basis. The growth in salaries and employee benefit expense was partially offset by the elimination of staffing for Race Day Mortgage by April 2023, which resulted in a savings of $200,000 for the first nine months of 2024, when compared to the same period last year. Further contributing to higher noninterest expense were data processing and professional fees. For the three months and nine months ended September 30, 2024, data processing increased $83,000 and $232,000, respectively, from the same periods last year. The increase was primarily related to debit card processing due to higher transaction volume and to higher costs associated with enhancements to the Company’s digital banking platform. Professional fees increased $80,000 during the third quarter of 2024 and increased $207,000 during the first nine months of 2024, as compared to the same periods in 2023. The increase was related to higher director fees and a general increase in legal fees.

The Company’s total assets at September 30, 2024 were $1.494 billion, an increase of $142 million from December 31, 2023. During the third quarter, the Company began participating in a program offered by the Ohio Treasurer called Ohio Homebuyer Plus. The program is designed to encourage Ohio residents to save for the purchase of a home. As a participant in the program, the Company developed the Sweet Home Ohio deposit account to offer participants an above-market interest rate along with a deposit bonus to assist customers in achieving their home savings goal. For each account that was opened, the Company received a deposit from the Treasurer at a subsidized interest rate. At September 30, 2024, the balance of Sweet Home Ohio accounts totaled $5.3 million and the amount deposited by the Treasurer totaled $100 million. These deposit balances were the key contributor to the growth in assets and the $134 million increase in total deposits. Since the Treasurer deposits are classified as public funds, which are required to be collateralized, the Company invested the funds in securities to be pledged as collateral to the Treasurer. The investment of these funds contributed to the $109 million increase in securities from December 31, 2023. As of September 30, 2024, total loans have increased $77 million. The increase was largely in the commercial and residential real estate segments. The growth in these segments was partially offset by a decrease in consumer loans, as this segment has been deemphasized by the Company as other loan portfolio segments are more profitable. In line with its decision to deemphasize consumer loans, the Company exited the indirect lending business for autos and recreational vehicles effective October 11, 2024. To assist with funding the growth in loans, the balance of funds maintained at the Federal Reserve decreased $50 million from yearend, which provided a higher rate of return. At September 30, 2024, shareholders’ equity increased $8.1 million from year end 2023. A portion of the increase was related to the increase in the fair value of securities classified as available-for-sale. Based on the decrease in market rates during the third quarter, the fair value of securities increased $4.2 million on an after-tax basis.

Ohio Valley Banc Corp. common stock is traded on the NASDAQ Global Market under the symbol OVBC. The holding company owns The Ohio Valley Bank Company with 17 offices in Ohio and West Virginia, and Loan Central, Inc. with six consumer finance offices in Ohio. Learn more about Ohio Valley Banc Corp. at www.ovbc.com.

Caution Regarding Forward-Looking Information

Certain statements contained in this earnings release that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believes,” “anticipates,” “expects,” “appears,” “intends,” “targeted” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying those statements. Forward-looking statements involve risks and uncertainties. Actual results may differ materially from those predicted by the forward-looking statements because of various factors and possible events, including: (i) changes in political, economic or other factors, such as inflation rates, recessionary or expansive trends, taxes, the effects of implementation of federal legislation with respect to taxes and government spending and the continuing economic uncertainty in various parts of the world; (ii) competitive pressures; (iii) fluctuations in interest rates; (iv) the level of defaults and prepayment on loans made by the Company; (v) unanticipated litigation, claims, or assessments; (vi) fluctuations in the cost of obtaining funds to make loans; (vii) regulatory changes; and (viii) other factors that may be described in the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission from time to time. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made to reflect unanticipated events.

|

OHIO VALLEY BANC CORP – Financial Highlights (Unaudited) |

||||||||||

|

Three months ended |

Nine months ended |

|||||||||

|

September 30, |

September 30, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||

|

PER SHARE DATA |

||||||||||

|

Earnings per share |

$ 0.58 |

$ 0.47 |

$ 1.79 |

$ 1.97 |

||||||

|

Dividends per share |

$ 0.22 |

$ 0.22 |

$ 0.66 |

$ 0.80 |

||||||

|

Book value per share |

$ 32.30 |

$ 28.66 |

$ 32.30 |

$ 28.66 |

||||||

|

Dividend payout ratio (a) |

38.12 % |

46.68 % |

37.03 % |

40.60 % |

||||||

|

Weighted average shares outstanding |

4,711,001 |

4,775,308 |

4,745,489 |

4,775,103 |

||||||

|

DIVIDEND REINVESTMENT (in 000’s) |

||||||||||

|

Dividends reinvested under |

||||||||||

|

employee stock ownership plan (b) |

$ – |

$ – |

$ 202 |

$ 193 |

||||||

|

Dividends reinvested under |

||||||||||

|

dividend reinvestment plan (c) |

$ 374 |

$ 397 |

$ 1,156 |

$ 1,544 |

||||||

|

PERFORMANCE RATIOS |

||||||||||

|

Return on average equity |

7.39 % |

6.46 % |

7.80 % |

9.21 % |

||||||

|

Return on average assets |

0.75 % |

0.70 % |

0.81 % |

1.00 % |

||||||

|

Net interest margin (d) |

3.76 % |

3.85 % |

3.71 % |

4.03 % |

||||||

|

Efficiency ratio (e) |

72.01 % |

73.62 % |

72.27 % |

70.28 % |

||||||

|

Average earning assets (in 000’s) |

$ 1,345,481 |

$ 1,186,548 |

$ 1,302,630 |

$ 1,166,889 |

||||||

|

(a) Total dividends paid as a percentage of net income. |

||||||||||

|

(b) Shares may be purchased from OVBC and on secondary market. |

||||||||||

|

(c) Shares may be purchased from OVBC and on secondary market. |

||||||||||

|

(d) Fully tax-equivalent net interest income as a percentage of average earning assets. |

||||||||||

|

(e) Noninterest expense as a percentage of fully tax-equivalent net interest income plus noninterest income. |

||||||||||

|

OHIO VALLEY BANC CORP – Consolidated Statements of Income (Unaudited) |

||||||||||

|

Three months ended |

Nine months ended |

|||||||||

|

(in $000’s) |

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||

|

Interest income: |

||||||||||

|

Interest and fees on loans |

$ 16,694 |

$ 14,299 |

$ 48,074 |

$ 39,868 |

||||||

|

Interest and dividends on securities |

1,921 |

1,032 |

4,014 |

3,177 |

||||||

|

Interest on interest-bearing deposits with banks |

790 |

601 |

3,653 |

1,698 |

||||||

|

Total interest income |

19,405 |

15,932 |

55,741 |

44,743 |

||||||

|

Interest expense: |

||||||||||

|

Deposits |

6,245 |

4,058 |

18,246 |

8,981 |

||||||

|

Borrowings |

579 |

498 |

1,761 |

1,050 |

||||||

|

Total interest expense |

6,824 |

4,556 |

20,007 |

10,031 |

||||||

|

Net interest income |

12,581 |

11,376 |

35,734 |

34,712 |

||||||

|

Provision for (recovery of) credit losses |

920 |

888 |

1,852 |

1,401 |

||||||

|

Noninterest income: |

||||||||||

|

Service charges on deposit accounts |

810 |

714 |

2,266 |

1,978 |

||||||

|

Trust fees |

99 |

79 |

304 |

247 |

||||||

|

Income from bank owned life insurance and |

||||||||||

|

annuity assets |

237 |

219 |

688 |

637 |

||||||

|

Mortgage banking income |

39 |

42 |

118 |

133 |

||||||

|

Electronic refund check/deposit fees |

0 |

0 |

675 |

675 |

||||||

|

Debit / credit card interchange income |

1,326 |

1,285 |

3,694 |

3,673 |

||||||

|

Tax preparation fees |

7 |

3 |

640 |

667 |

||||||

|

Other |

336 |

226 |

866 |

1,038 |

||||||

|

Total noninterest income |

2,854 |

2,568 |

9,251 |

9,048 |

||||||

|

Noninterest expense: |

||||||||||

|

Salaries and employee benefits |

6,596 |

5,909 |

18,949 |

17,634 |

||||||

|

Occupancy |

485 |

493 |

1,491 |

1,440 |

||||||

|

Furniture and equipment |

327 |

351 |

987 |

979 |

||||||

|

Professional fees |

510 |

430 |

1,503 |

1,296 |

||||||

|

Marketing expense |

228 |

241 |

674 |

723 |

||||||

|

FDIC insurance |

160 |

141 |

469 |

421 |

||||||

|

Data processing |

820 |

737 |

2,415 |

2,183 |

||||||

|

Software |

542 |

621 |

1,704 |

1,771 |

||||||

|

Foreclosed assets |

(2) |

6 |

(2) |

15 |

||||||

|

Amortization of intangibles |

1 |

5 |

8 |

18 |

||||||

|

Other |

1,553 |

1,445 |

4,626 |

4,586 |

||||||

|

Total noninterest expense |

11,220 |

10,379 |

32,824 |

31,066 |

||||||

|

Income before income taxes |

3,295 |

2,677 |

10,309 |

11,293 |

||||||

|

Income taxes |

576 |

426 |

1,825 |

1,885 |

||||||

|

NET INCOME |

$ 2,719 |

$ 2,251 |

$ 8,484 |

$ 9,408 |

||||||

|

OHIO VALLEY BANC CORP – Consolidated Balance Sheets (Unaudited) |

||||||||||

|

(in $000’s, except share data) |

September 30, |

December 31, |

||||||||

|

2024 |

2023 |

|||||||||

|

ASSETS |

||||||||||

|

Cash and noninterest-bearing deposits with banks |

$ 18,741 |

$ 14,252 |

||||||||

|

Interest-bearing deposits with banks |

63,463 |

113,874 |

||||||||

|

Total cash and cash equivalents |

82,204 |

128,126 |

||||||||

|

Securities available for sale |

271,187 |

162,258 |

||||||||

|

Securities held to maturity, net of allowance for credit losses of $2 in 2024 and 2023 |

7,912 |

7,986 |

||||||||

|

Restricted investments in bank stocks |

5,007 |

5,037 |

||||||||

|

Total loans |

1,048,912 |

971,900 |

||||||||

|

Less: Allowance for credit losses |

(9,919) |

(8,767) |

||||||||

|

Net loans |

1,038,993 |

963,133 |

||||||||

|

Premises and equipment, net |

21,443 |

21,450 |

||||||||

|

Premises and equipment held for sale, net |

512 |

573 |

||||||||

|

Accrued interest receivable |

4,841 |

3,606 |

||||||||

|

Goodwill |

7,319 |

7,319 |

||||||||

|

Other intangible assets, net |

0 |

8 |

||||||||

|

Bank owned life insurance and annuity assets |

41,864 |

40,593 |

||||||||

|

Operating lease right-of-use asset, net |

1,068 |

1,205 |

||||||||

|

Deferred tax assets |

5,108 |

6,306 |

||||||||

|

Other assets |

6,565 |

4,535 |

||||||||

|

Total assets |

$ 1,494,023 |

$ 1,352,135 |

||||||||

|

LIABILITIES |

||||||||||

|

Noninterest-bearing deposits |

$ 315,961 |

$ 322,222 |

||||||||

|

Interest-bearing deposits |

945,459 |

804,914 |

||||||||

|

Total deposits |

1,261,420 |

1,127,136 |

||||||||

|

Other borrowed funds |

40,888 |

44,593 |

||||||||

|

Subordinated debentures |

8,500 |

8,500 |

||||||||

|

Operating lease liability |

1,068 |

1,205 |

||||||||

|

Allowance for credit losses on off-balance sheet commitments |

566 |

692 |

||||||||

|

Other liabilities |

29,428 |

26,002 |

||||||||

|

Total liabilities |

1,341,870 |

1,208,128 |

||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||||

|

Common stock ($1.00 stated value per share, 10,000,000 shares authorized; |

||||||||||

|

2024 – 5,490,995 shares issued; 2023 – 5,470,453 shares issued) |

5,491 |

5,470 |

||||||||

|

Additional paid-in capital |

52,321 |

51,842 |

||||||||

|

Retained earnings |

120,214 |

114,871 |

||||||||

|

Accumulated other comprehensive income (loss) |

(7,194) |

(11,428) |

||||||||

|

Treasury stock, at cost (2024 – 779,994 shares; 2023 – 697,321 shares) |

(18,679) |

(16,748) |

||||||||

|

Total shareholders’ equity |

152,153 |

144,007 |

||||||||

|

Total liabilities and shareholders’ equity |

$ 1,494,023 |

$ 1,352,135 |

||||||||

Contact: Scott Shockey, CFO (740) 446-2631

![]() View original content:https://www.prnewswire.com/news-releases/ohio-valley-banc-corp-reports-3rd-quarter-earnings-302289043.html

View original content:https://www.prnewswire.com/news-releases/ohio-valley-banc-corp-reports-3rd-quarter-earnings-302289043.html

SOURCE Ohio Valley Banc Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asset Manager VanEck Predicts Bitcoin To Hit $3M By 2050 And This Is Why It May Not Be An 'Extreme' Estimate

In a massively bullish estimate, investment management company VanEck projected Bitcoin BTC/USD to hit $3 million in value in 2050.

What happened: During a CNBC interview on Monday, Matthew Sigel, the firm’s digital assets head, said that the projection may appear “extreme,” but when broken down to a 16% compound annual growth rate over the next two decades, it was reasonable.

Seigel said that the estimate stemmed from the company’s belief that Bitcoin would become a global reserve asset, used in global trade and held by central banks at a “modest” 2% weight.

Seigel was asked about Ark Invest CEO Cathie Wood’s prediction of the apex cryptocurrency going to $500,000 by 2026, to which he said, “I don’t think about them very much.”

VanEck had earlier predicted that Bitcoin would reach an all-time high in Q4, driven by political changes and regulatory optimism.

These predictions aligned with Standard Chartered, which anticipates that Bitcoin could reach $73,000 by Election Day on Nov. 5 and potentially surge to $80,000 shortly if Trump secures a victory.

Why It Matters: Seigel’s comments came even as VanEck noted a “very bullish setup” for Bitcoin going into the upcoming presidential elections.

He said that Trump’s rising popularity and surge in odds of his victory were helping drive demand.

Siegel also highlighted the growing interest in Bitcoin in BRICS member countries such as Russia, the UAE, and Ethiopia.

Price Action: Bitcoin broke above $71,000 at midnight, a level not seen since the first week of June, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The American Dream Is Alive … In El Salvador, And It's Safer Than Disneyland, Says Bitcoin Bull Max Keiser

Prominent Bitcoin BTC/USD bull Max Keiser said that El Salvador under President Nayib Bukele was achieving the ‘American Dream’ with the help of the apex cryptocurrency.

What happened: During an interview with Fox Business Monday, Keiser, who serves as the senior Bitcoin adviser to the El Salvador president’s office, highlighted several achievements of the Bukele administration.

“More people are going to El Salvador than the other way around. We have economic freedom here, freedom of speech. The economy is growing, we’re paying down our debt, and inflation is under 1%,” Keiser stated.

Keiser added that El Salvador was now the safest country in the Western Hemisphere. “You have a greater risk of getting mugged in Disneyland than getting attacked here in El Salvador.”

Singing praises for Bukele, Keiser called the president “decisive, courageous, and charismatic” and lauded his efforts in bringing peace to the country by cracking down on gangs.

On his views on Donald Trump’s pro-Bitcoin campaign, Keiser said, “America is doing a good job imitating El Salvador.”

He said that El Salvador is the “Bitcoin country,” having made the leading cryptocurrency legal tender in 2021 and now building capital markets on top of it.

Why It Matters: Keiser’s remarks come in the wake of surging approval ratings for President Bukele, surpassing those of leaders like India’s Narendra Modi and Russia’s Vladimir Putin.

According to data from the World Bank, El Salvador’s economy has seen some growth and improvement under President Bukele but also faced challenges.

While GDP grew 3.5% in 2023, recovering from the COVID-19 pandemic, about around 10% of the population was estimated to be living in extreme poverty. The public debt exceeded 84% of GDP in 2023.

The country’s record on freedom of speech remained debatable. El Salvador was ranked 133rd out of 180 countries in the World Press Freedom Index 2024, down 18 places from the previous year’s rankings.

Image Credits – Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Welltower Issues Business Update

TOLEDO, Ohio, Oct. 28, 2024 /PRNewswire/ — Welltower® Inc. WELL has issued the following business update which can be found at:

https://welltower.com/business-update-October2024

About Welltower

Welltower® Inc. WELL, an S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. The Company invests with leading seniors housing operators, post-acute providers, and health systems to fund the real estate infrastructure needed to scale innovative care delivery models and improve people’s wellness and overall health care experience. Welltower, a real estate investment trust (“REIT”), owns interests in properties concentrated in major, high-growth markets in the United States, Canada, and the United Kingdom, consisting of seniors housing, post-acute communities and outpatient medical properties. More information is available at www.welltower.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/welltower-issues-business-update-302289058.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/welltower-issues-business-update-302289058.html

SOURCE Welltower Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.