Allarity Therapeutics, Inc. Investors: Please contact the Portnoy Law Firm to recover your losses. November 12, 2024 Deadline to file Lead Plaintiff Motion.

LOS ANGELES, Oct. 28, 2024 (GLOBE NEWSWIRE) — The Portnoy Law Firm advises Allarity Therapeutics, Inc. (“Allarity” or the “Company”) ALLR investors of a class action representing investors that bought securities between May 17, 2022, and July 19, 2024, inclusive (the “Class Period”). Allarity investors have until November 12, 2024 to file a lead plaintiff motion.

Investors are encouraged to contact attorney Lesley F. Portnoy, by phone 310-692-8883 or email: lesley@portnoylaw.com, to discuss their legal rights, or click here to join the case. The Portnoy Law Firm can provide a complimentary case evaluation and discuss investors’ options for pursuing claims to recover their losses.

The Complaint asserts that, throughout the Class Period, the Defendants issued materially false and misleading statements concerning the Company’s business practices, operations, and adherence to compliance policies. Specifically, it contends that the Defendants inflated the ongoing regulatory prospects of the Dovitinib NDA and engaged in illegal, illicit, or otherwise improper conduct related to the Dovitinib NDA and/or the Dovitinib-DRP PMA, involving Allarity and three of its former officers. This misconduct exposed the Company to heightened risks of regulatory and governmental scrutiny, enforcement actions, and significant legal, financial, and reputational damages. Following the disclosure that Allarity was under investigation for wrongdoing related to the Dovitinib NDA and/or Dovitinib-DRP PMA, the Company downplayed the likelihood of an enforcement action resulting from the investigation. As a result, the Company’s public statements were materially false and misleading throughout the relevant period.

Please visit our website to review more information and submit your transaction information.

The Portnoy Law Firm represents investors in pursuing claims against caused by corporate wrongdoing. The Firm’s founding partner has recovered over $5.5 billion for aggrieved investors. Attorney advertising. Prior results do not guarantee similar outcomes.

Lesley F. Portnoy, Esq.

Admitted CA and NY Bar

lesley@portnoylaw.com

310-692-8883

www.portnoylaw.com

Attorney Advertising

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Safehold Reports Third Quarter 2024 Results

NEW YORK, Oct. 28, 2024 /PRNewswire/ — Safehold Inc. SAFE reported results for the third quarter 2024.

SAFE published a presentation detailing these results which can be found on its website, www.safeholdinc.com in the “Investors” section.

Highlights from the earnings announcement include:

- Q3’24 revenue was $90.7 million

- Q3’24 net income attributable to common shareholders was $19.3 million, or $26.1 million excluding the portion of the quarter’s non-cash general provision for credit losses on prior period balances1

- Q3’24 earnings per share was $0.27, or $0.37 excluding the portion of the quarter’s non-cash general provision for credit losses on prior period balances1

- Closed $104 million of new originations in Q3’24, including three new ground leases for $72 million2 and one leasehold loan for $32 million3

- Purchased joint venture partner’s ownership interest in all ground leases acquired by the venture to date for a total commitment of $69 million4

“This was a productive quarter for Safehold, supplementing new originations with an opportunistic joint venture buyout that is expected to grow earnings and further diversify the portfolio,” said Jay Sugarman, Chairman and Chief Executive Officer. “While rate volatility remains disruptive to real estate and transaction activity, we’re seeing positive trends in certain markets and are well-positioned to capitalize on opportunities and best serve our customers.”

The Company will host an earnings conference call reviewing this presentation beginning at 9:00 a.m. ET on Tuesday, October 29, 2024. This conference call will be broadcast live and can be accessed by all interested parties through Safehold’s website and by using the dial-in information listed below:

|

Dial-In: |

877.545.0523 |

|

International: |

973.528.0016 |

|

Access Code: |

161168 |

A replay of the call will be archived on the Company’s website. Alternatively, the replay can be accessed via dial-in from 2:00 p.m. ET on October 29, 2024 through 12:00 a.m. ET on November 12, 2024 by calling:

|

Replay: |

877.481.4010 |

|

International: |

919.882.2331 |

|

Access Code: |

51479 |

Non-GAAP Financial Measures:

Net income attributable to Safehold Inc. common shareholders excluding general provision for credit losses on prior period balances, and EPS excluding general provision for credit losses on prior period balances, are non-GAAP measures used as supplemental performance measures to give management and investors a view of net income and EPS more directly derived from operating activities in the period in which they occur. It should be examined in conjunction with net income attributable to common shareholders as shown in our consolidated statements of operations. EPS excluding general provision for credit losses on prior period balances is calculated as net income attributable to Safehold Inc. common shareholders excluding general provision for credit losses on prior period balances, divided by the weighted average number of common shares. These metrics should not be considered as alternatives to net income attributable to common shareholders or EPS, respectively (in each case determined in accordance with generally accepted accounting principles in the United States of America (“GAAP”)). These measures may differ from similarly-titled measures used by other companies. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures are presented below.

|

Earnings Reconciliation (all figures in thousands except per share figures) |

|||

|

Net income attributable to Safehold Inc. common shareholders |

$19,331 |

||

|

Add: General provision for credit losses on prior period balances1 |

6,804 |

||

|

Net income attributable to Safehold Inc. common shareholders excluding general |

$26,135 |

||

|

Weighted average number of common shares – basic |

71,436 |

||

|

Weighted average number of common shares – diluted |

71,540 |

||

|

EPS excluding general provision for credit losses on prior period balances (basic & |

$0.37 |

||

|

1 Includes general provision for credit losses on prior period balances of $6.6m on consolidated assets and $0.2m on |

|||

About Safehold:

Safehold Inc. SAFE is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Having created the modern ground lease industry in 2017, Safehold continues to help owners of high quality multifamily, office, industrial, hospitality, student housing, life science and mixed-use properties generate higher returns with less risk. The Company, which is taxed as a real estate investment trust (REIT), seeks to deliver safe, growing income and long-term capital appreciation to its shareholders. Additional information on Safehold is available on its website at www.safeholdinc.com.

Company Contact:

Pearse Hoffmann

Senior Vice President

Capital Markets & Investor Relations

T 212.930.9400

E investors@safeholdinc.com

1 The Company electively enhanced its general provision for credit losses methodology during the quarter, and applied the updated methodology to prior period balances in accordance with GAAP. Of the quarter’s $7.5 million total non-cash general provision for credit losses expense, $6.8 million represents the expense related to prior period balances. See the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 for additional information.

2 Gross of joint venture partner’s 45% participation in one new investment in the third quarter in the amount of $10.7m. $72m total commitments includes $19m of forward commitments that have not yet been funded as of 9/30/24. Such funding commitments are subject to certain conditions. There can be no assurance that Safehold will fully fund these transactions.

3 Gross of leasehold loan partner’s 47% participation interest. The leasehold loan did not fund during the third quarter and there can be no assurance that Safehold will fully fund its commitment.

4 Gross purchase price of $80 million for 9 ownership interests within the joint venture, including forward commitments and purchase premium. The $69 million net purchase price excludes one investment that was originated early in the third quarter and is included within the new originations metrics.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/safehold-reports-third-quarter-2024-results-302288937.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/safehold-reports-third-quarter-2024-results-302288937.html

SOURCE Safehold

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

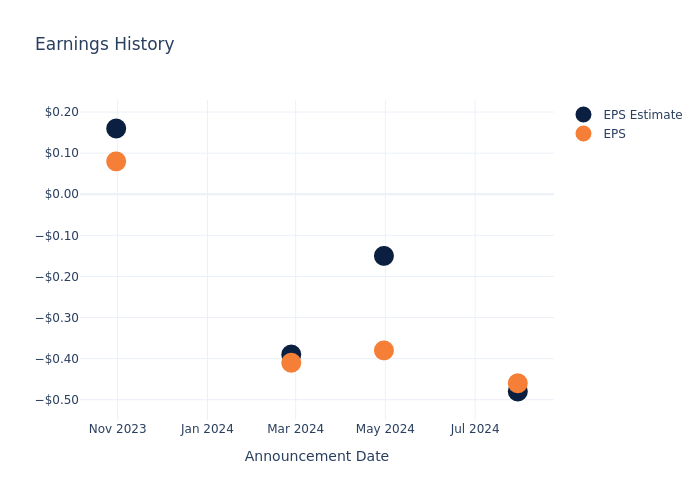

A Preview Of PJT Partners's Earnings

PJT Partners PJT will release its quarterly earnings report on Tuesday, 2024-10-29. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate PJT Partners to report an earnings per share (EPS) of $0.93.

Anticipation surrounds PJT Partners’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.50, leading to a 2.13% increase in the share price on the subsequent day.

Here’s a look at PJT Partners’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.69 | 0.45 | 0.88 | 0.49 |

| EPS Actual | 1.19 | 0.98 | 0.96 | 0.78 |

| Price Change % | 2.0% | 1.0% | -3.0% | 3.0% |

Market Performance of PJT Partners’s Stock

Shares of PJT Partners were trading at $139.64 as of October 25. Over the last 52-week period, shares are up 81.04%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for PJT Partners visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Flurry Of Trades: Offloads $31.5M in Tesla, Buys Amazon, AMD And Meta — Dumps Palantir, Trims Robinhood And Square Amid Bitcoin Rally

On Monday, Cathie Wood’s Ark Invest made significant trades in Amazon.com Inc AMZN, Robinhood Markets Inc HOOD, Block Inc SQ, Advanced Micro Devices, Inc. AMD, Meta Platforms Inc. META, Tesla Inc TSLA and Palantir Technologies Inc PLTR. These trades were part of a series of transactions carried out by Ark Invest’s various ETFs.

The Amazon Trade

Ark Invest’s ARK Innovation ETF (NYSE; ARKK) and ARK Next Generation Internet ETF ARKW purchased a substantial 141,504 shares of Amazon.com Inc. This transaction was valued at $26.65 million based on Amazon’s closing price of $188.39 on Monday. This move comes after a Goldman Sachs analyst’s prediction of a solid mix of revenue growth and operating margin expansion for the e-commerce giant in its third-quarter financial results.

The Robinhood Trade

On the same day, Ark Invest’s Ark Fintech Innovation ETF ARKF fund sold 7,555 shares of Robinhood Markets Inc. The transaction was valued at $210.633. On Monday Robinhood stock closed 3% higher at $27.88.This decision followed a Bernstein report that highlighted Robinhood’s potential to become the leading cryptocurrency investment platform in the future, thanks to its diverse offering of 15 crypto tokens. Notably, the world’s apex cryptocurrency Bitcoin BTC/USD surged past the $70,000 mark on Monday.

The Square Trade

Ark Invest’s ARKK and ARKW funds sold a combined total of 418,556 shares of Block Inc. The transaction was valued at $31.2 million based on the stock’s closing price of $74.48 on Monday. This trade occurred despite analyst praise for the company’s second-quarter results, which showcased growth in its Cash App and strategic innovations.

The AMD Trade

Ark Invest’s ARK Space Exploration & Innovation ETF ARKX fund purchased 10,199 shares of Advanced Micro Devices Inc worth $1.63 million. This move comes as AMD is set to report its third-quarter earnings, with Wall Street expecting 92 cents in EPS and $6.71 billion in revenues. According to Benzinga, the stock has seen a 65.19% increase over the past year and a 14.65% increase year-to-date.

The Meta Platforms Trade

Ark Invest’s ARKK and ARKW funds bought 22,175 and 16,580 shares of Meta Platforms Inc. respectively. The trades amounted to $22.4 million. Meta stock closed nearly 0.9% higher at $578.16 for the day. This decision follows reports of Meta’s development of an AI-powered search engine to reduce reliance on other big tech players, such as Alphabet Inc and Microsoft Corp.

The Palantir Trade

Ark Invest’s ARKW fund sold 128,908 shares of Palantir Technologies Inc, worth $5.8 million. Palantir closed 0.25% higher at $44.97 on Monday. Palantir’s stock recently hit a new 52-week high, with significant growth in 2024 and a market cap of $100.69 billion. The company also announced a strategic partnership with L3Harris Technologies Inc to expand capabilities in AI-driven defense technology.

The Tesla Trade

Ark Invest sold a total of 120,141 Tesla shares from ARKK and ARKW, the transaction was valued at $31.5 million based on Tesla’s closing price of $262.51 per share on the same day. This move by Ark Invest comes on the heels of Tesla’s strong third-quarter earnings, which exceeded estimates and demonstrated improving margins. The electric vehicle behemoth also provided a robust vehicle delivery outlook for 2025, a highlight for analysts. Notably, Wood $22 million worth of Tesla shares on Thursday.

Other Key Trades:

- ARK Invest’s ARKG fund bought shares of Absci Corp and sold shares of Veracyte Inc. The ARKK fund also bought shares of Cerus Corp. ARKW bought shares of Shopify Inc.

- ARKX sold 854 shares of Lockheed Martin Corp LMT.

Image via Ark Invest

Read Next: Ford: How To Earn $500 A Month From Q3 Earnings

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

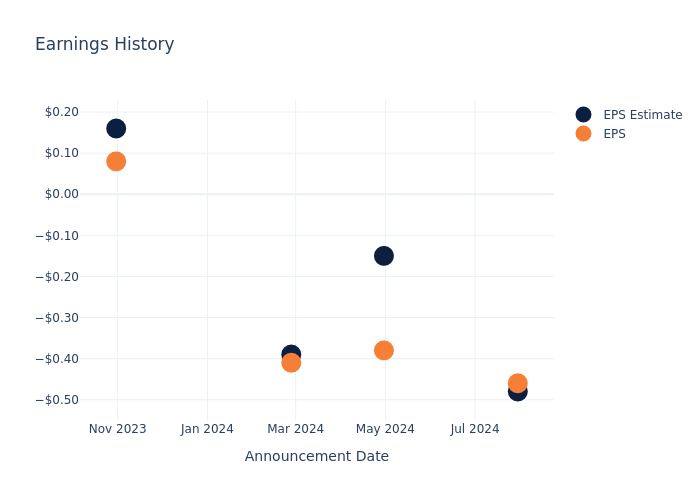

A Glimpse of Big 5 Sporting Goods's Earnings Potential

Big 5 Sporting Goods BGFV will release its quarterly earnings report on Tuesday, 2024-10-29. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Big 5 Sporting Goods to report an earnings per share (EPS) of $-0.25.

Anticipation surrounds Big 5 Sporting Goods’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Overview of Past Earnings

Last quarter the company beat EPS by $0.02, which was followed by a 25.18% drop in the share price the next day.

Here’s a look at Big 5 Sporting Goods’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.48 | -0.15 | -0.39 | 0.16 |

| EPS Actual | -0.46 | -0.38 | -0.41 | 0.08 |

| Price Change % | -25.0% | -4.0% | -10.0% | -23.0% |

Big 5 Sporting Goods Share Price Analysis

Shares of Big 5 Sporting Goods were trading at $1.87 as of October 25. Over the last 52-week period, shares are down 72.24%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Big 5 Sporting Goods visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin Lifts 15% Amid Rising Odds Of Trump Victory In Betting Markets And Expectations Of Elon Musk Heading 'DOGE' Department

Dogecoin DOGE/USD exploded on price charts Monday, emerging as the best-performing billion-dollar capitalization cryptocurrency in the last 24 hours.

What happened: The ‘original meme coin’ was up over 15% as of this writing, with an 184% spike in 24-hour volumes. Dogecoin was the eighth-most traded cryptocurrency and the most traded meme token in the last 24 hours.

The jump was likely spurred by Tesla and Space X CEO Elon Musk’s grand introduction as the “co-founder of the Department of Government Efficiency,” or DOGE, during Donald Trump’s rally at Madison Square Garden.

With Trump’s presidential odds on betting markets increasing by the day, investors appeared to be pricing in the likelihood of a ‘DOGE’ department under Musk in the next administration.

DOGE was up over 28% over the month, and 72.82% since 2024 began.

Based on the data from TradingView, DOGE’s technical indicators flashed ‘Buy’ signals.

The exponential moving averages (EMA) all pointed to ‘Buy’ as of this writing, indicating that Dogecoin’s current price is greater than the average values for these respective periods.

The Moving Average Convergence Divergence (MACD) indicator, which compares two EMAs to assess the momentum of the asset, also indicated a ‘Buy’ signal.

Additionally, large transaction volume rose nearly 5% in the last 24 hours, according to IntoTheBlock, signaling increased interest from whales.

The net amount of DOGE entering cryptocurrency exchanges dropped 9% in the last 24 hours, reflecting a reduced desire to sell.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1662, up 15.65% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

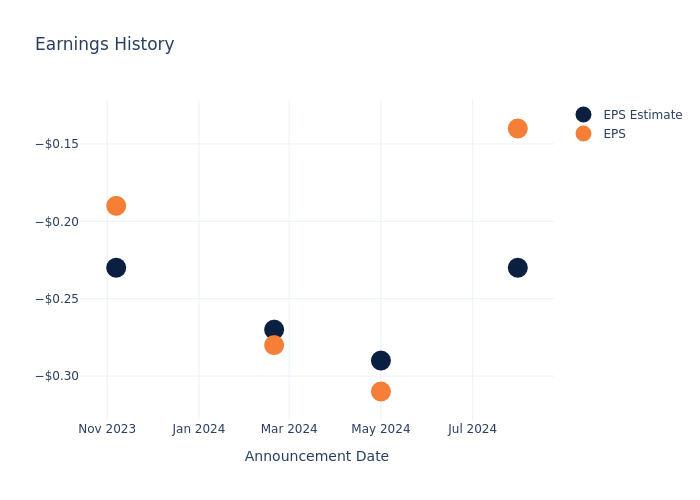

Insights Ahead: Enovix's Quarterly Earnings

Enovix ENVX is gearing up to announce its quarterly earnings on Tuesday, 2024-10-29. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Enovix will report an earnings per share (EPS) of $-0.20.

The announcement from Enovix is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.09, leading to a 19.15% drop in the share price on the subsequent day.

Here’s a look at Enovix’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.23 | -0.29 | -0.27 | -0.23 |

| EPS Actual | -0.14 | -0.31 | -0.28 | -0.19 |

| Price Change % | -19.0% | 45.0% | -9.0% | 15.0% |

Market Performance of Enovix’s Stock

Shares of Enovix were trading at $10.41 as of October 25. Over the last 52-week period, shares are up 28.73%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Enovix

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Enovix.

The consensus rating for Enovix is Outperform, based on 7 analyst ratings. With an average one-year price target of $22.0, there’s a potential 111.34% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Plug Power and Vicor, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Plug Power, with an average 1-year price target of $2.57, indicating a potential 75.31% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Vicor, with an average 1-year price target of $43.0, implying a potential 313.06% upside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Plug Power and Vicor are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Enovix | Outperform | 8871.43% | $-655K | -58.00% |

| Plug Power | Neutral | -44.90% | $-131.25M | -8.87% |

| Vicor | Neutral | 8.52% | $42.77M | 2.12% |

Key Takeaway:

Enovix ranks highest in Revenue Growth among its peers. However, it has the lowest Gross Profit margin. In terms of Return on Equity, Enovix is at the bottom compared to its peers.

All You Need to Know About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Enovix: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Enovix showcased positive performance, achieving a revenue growth rate of 8871.43% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Enovix’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -3075.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -58.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Enovix’s ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -23.22%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Enovix’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.14, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Enovix visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's Executive Says AI Will Soon Take Human Form: 'The Machine Is To The Body What AI Is To The Brain'

The future of artificial intelligence is set to be a game-changer, according to a top executive at NVIDIA Corp NVDA. The executive believes AI will soon take on a “human form.” This revelation was made at the Global Management Dialogue event in Tokyo.

What Happened: At the Global Management Dialogue, a forum organized by Nikkei and Swiss business school IMD, Masataka Osaki, the Vice President of Worldwide Field Operations at Nvidia, made a bold prediction. He stated that AI will soon take on a human-like form.

“The machine is to the body what AI is to the brain,” Osaki said. He also highlighted Japan’s potential to become a global leader in AI if businesses quickly connect AI and machines to create new services.

Osaki commended Japan for its efforts to build a domestic base for AI technologies and stressed the importance of developing domestic AI using domestically generated data.

See Also: Elon Musk’s ‘Doge-Flex’ Pose Sends Dogecoin, First Neiro On Ethereum Soaring

Why It Matters: Nvidia’s AI technology has been making waves globally. The company recently tapped into India’s growing AI market, recognizing the vast opportunities in AI-driven businesses across Asia. Osaki noted the immense data produced by Asian countries’ diverse languages and cultures, which can be transformed into AI tailored for each region.

This move came on the heels of Nvidia’s almost 200% stock surge, which positioned the company above the market value of Germany and Italy combined. The company’s market capitalization now stands at an impressive $3.5 trillion, reflecting a broader trend where foreign investors own approximately 18% of the U.S. stock market.

This surge in Nvidia’s stock, along with other tech giants, has led to a concentration in the S&P 500, with major U.S. investment funds being compelled to sell shares to avoid violating U.S. tax laws. This has put pressure on investment funds to comply with tax regulations and prevent breaching rules that mandate diversified portfolios.

Price Action: Nvidia stock closed at $140.52 on Monday down 0.72% for the day. In after-hours trading, the stock dipped 0.21%. Year to date, Nvidia’s stock has surged 191.72%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.