Earnings Preview: Syra Health

Syra Health SYRA is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Syra Health will report an earnings per share (EPS) of $-0.21.

The market awaits Syra Health’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

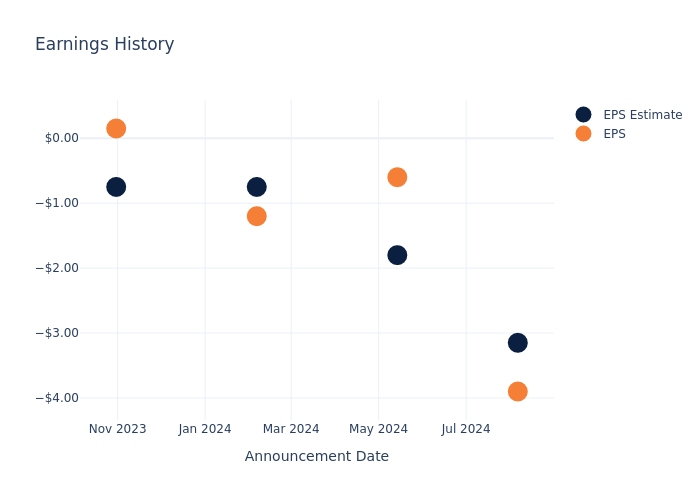

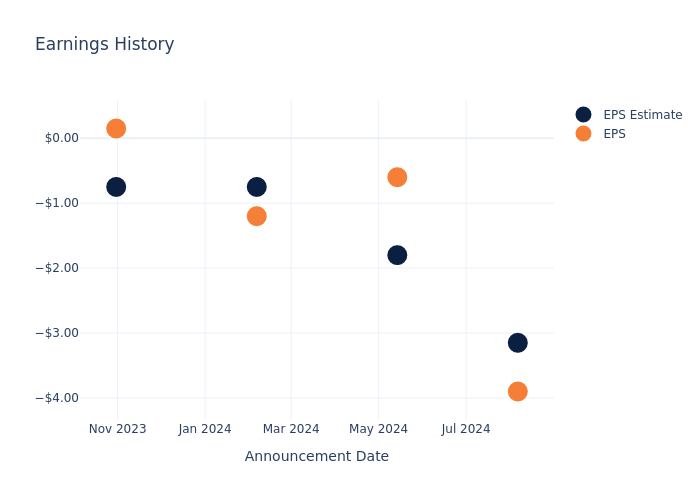

Overview of Past Earnings

During the last quarter, the company reported an EPS missed by $0.02, leading to a 0.61% increase in the share price on the subsequent day.

Here’s a look at Syra Health’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.19 | -0.19 | -0.09 | |

| EPS Actual | -0.21 | -0.22 | -0.16 | -0.08 |

| Price Change % | 1.0% | -5.0% | -15.0% | 14.000000000000002% |

Stock Performance

Shares of Syra Health were trading at $0.404 as of October 25. Over the last 52-week period, shares are down 67.62%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

To track all earnings releases for Syra Health visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

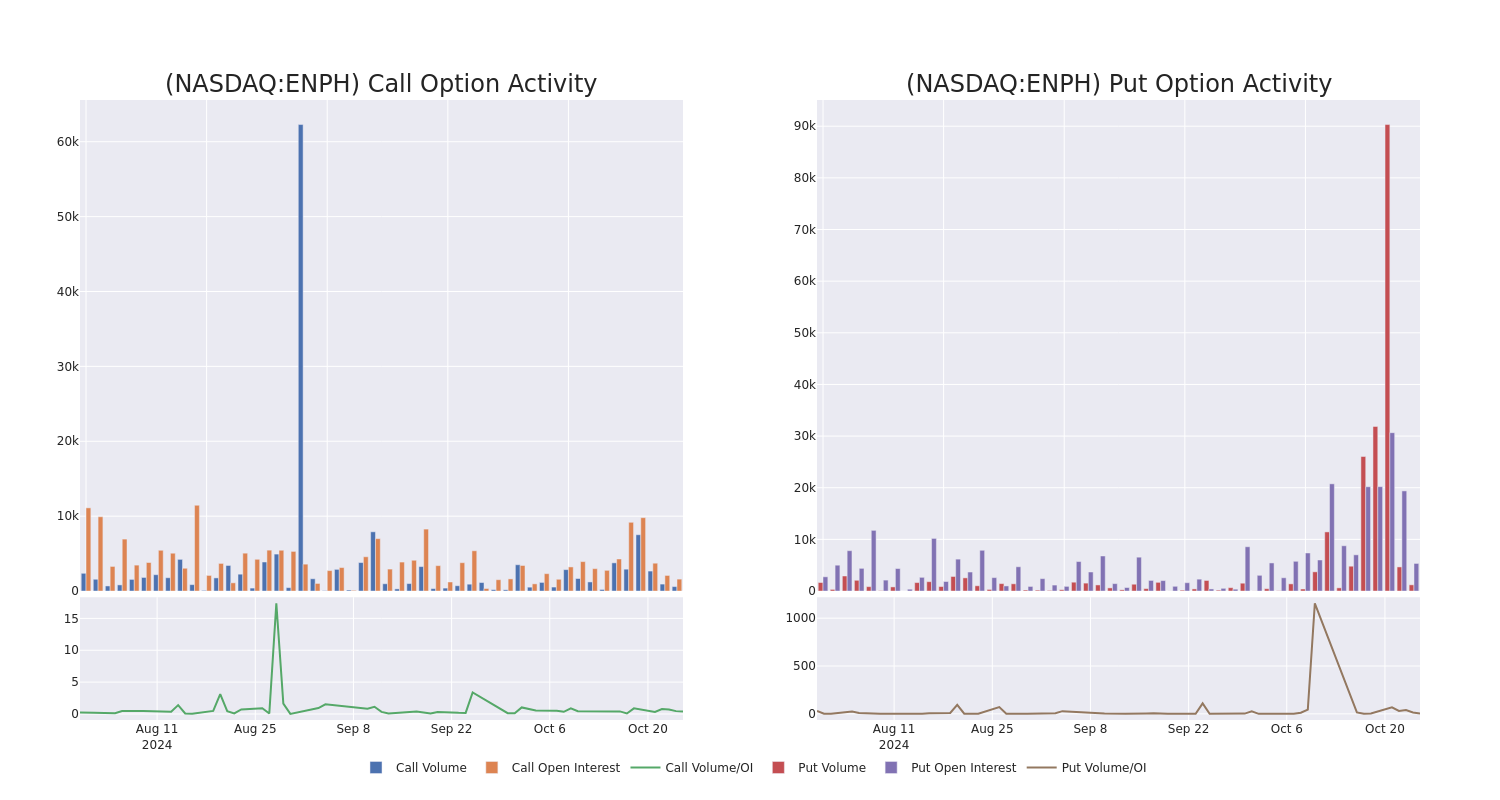

Enphase Energy Unusual Options Activity For October 28

Financial giants have made a conspicuous bearish move on Enphase Energy. Our analysis of options history for Enphase Energy ENPH revealed 22 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 59% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $292,401, and 14 were calls, valued at $634,099.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $170.0 for Enphase Energy over the last 3 months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Enphase Energy’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Enphase Energy’s substantial trades, within a strike price spectrum from $70.0 to $170.0 over the preceding 30 days.

Enphase Energy Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | CALL | SWEEP | BEARISH | 02/21/25 | $17.7 | $17.55 | $17.55 | $75.00 | $114.0K | 150 | 66 |

| ENPH | CALL | SWEEP | BEARISH | 05/16/25 | $24.3 | $24.0 | $24.0 | $70.00 | $76.8K | 33 | 37 |

| ENPH | PUT | TRADE | BEARISH | 11/15/24 | $16.3 | $16.15 | $16.3 | $100.00 | $74.9K | 1.6K | 54 |

| ENPH | CALL | TRADE | BEARISH | 12/20/24 | $7.95 | $7.9 | $7.9 | $85.00 | $69.5K | 1.0K | 482 |

| ENPH | CALL | SWEEP | BULLISH | 11/15/24 | $2.87 | $2.87 | $2.87 | $92.00 | $57.4K | 122 | 223 |

About Enphase Energy

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company’s microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

In light of the recent options history for Enphase Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Enphase Energy

- Trading volume stands at 4,287,092, with ENPH’s price up by 1.01%, positioned at $84.68.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 99 days.

What Analysts Are Saying About Enphase Energy

5 market experts have recently issued ratings for this stock, with a consensus target price of $98.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Enphase Energy with a target price of $105.

* An analyst from Barclays persists with their Overweight rating on Enphase Energy, maintaining a target price of $114.

* In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $100.

* Reflecting concerns, an analyst from Janney Montgomery Scott lowers its rating to Neutral with a new price target of $83.

* An analyst from Citigroup has decided to maintain their Neutral rating on Enphase Energy, which currently sits at a price target of $88.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enphase Energy, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

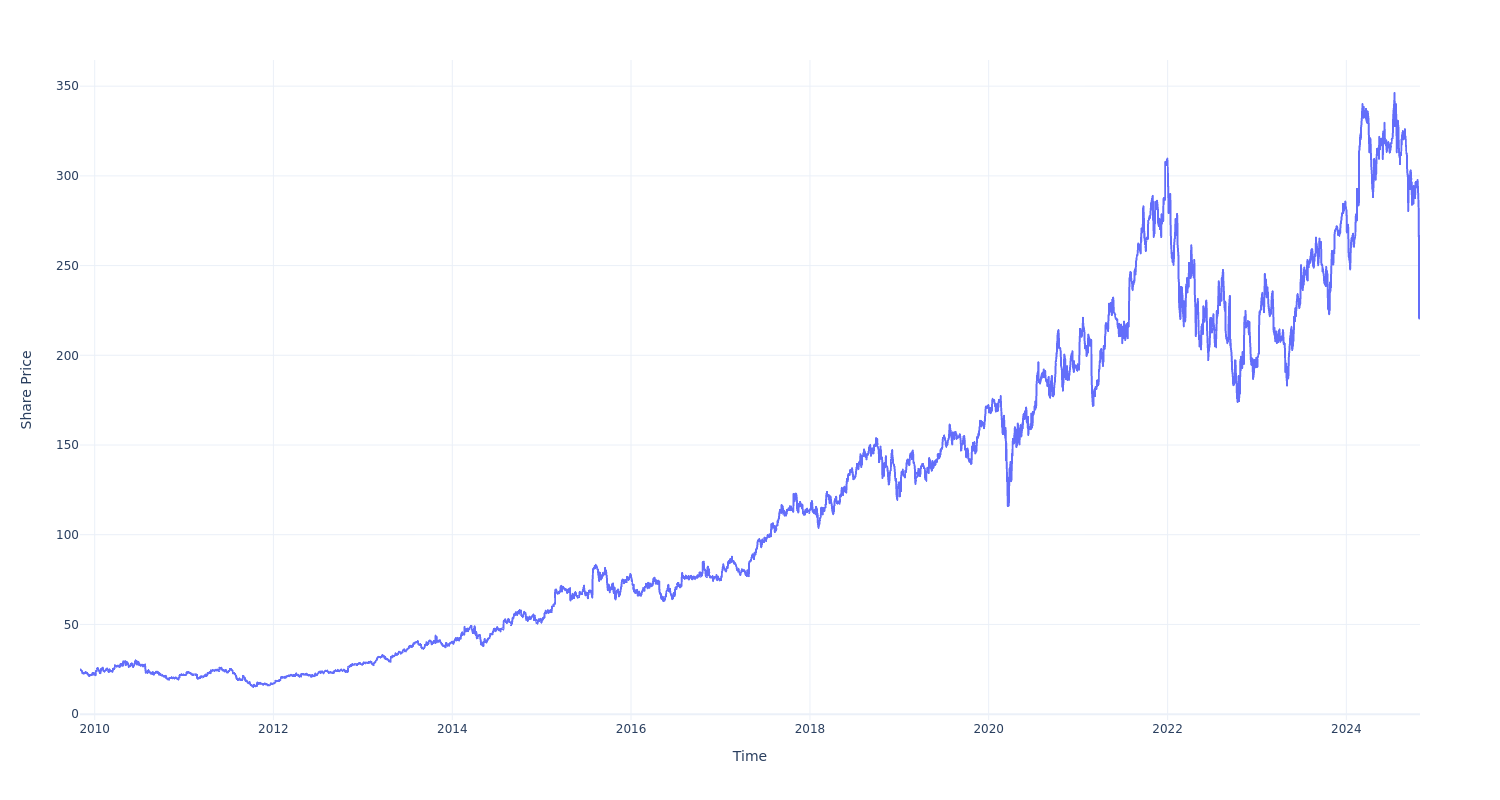

$1000 Invested In This Stock 15 Years Ago Would Be Worth $9,100 Today

Icon ICLR has outperformed the market over the past 15 years by 3.83% on an annualized basis producing an average annual return of 15.94%. Currently, Icon has a market capitalization of $18.20 billion.

Buying $1000 In ICLR: If an investor had bought $1000 of ICLR stock 15 years ago, it would be worth $9,139.97 today based on a price of $220.47 for ICLR at the time of writing.

Icon’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

COREWEAVE SIGNS 280,000 SF LEASE AT ONYX AND MACHINE'S NORTHEAST SCIENCE & TECHNOLOGY CENTER IN KENILWORTH

Conversion to Datacenter will be a Collaborative Effort Between Developer, CoreWeave and PSE&G

KENILWORTH, N.J., Oct. 28, 2024 /PRNewswire/ — Roseland-based CoreWeave has signed a long term lease with an Onyx Equities and Machine Investment Group partnership for the entirety of building 11 NEST at The Northeast Science & Technology (NEST) Center in Kenilworth with plans to convert the 280,000-square-foot former lab and manufacturing building into a state-of-the-art data center.

CoreWeave plans to invest $1.2 billion, and the Onyx Equities-led venture expects to spend over $50 million on the project, which will become CoreWeave’s first data center in New Jersey.

PSE&G, New Jersey’s oldest and largest utility, will be readying the area’s electrical infrastructure to support the energy needs of the datacenter facility in Kenilworth. PSE&G currently serves over 30 large data centers.

“CoreWeave’s commitment to invest over a billion dollars at the NEST campus demonstrates New Jersey’s leading role in artificial intelligence, and our innovation strategies are working,” said New Jersey Governor Phil Murphy. “Through collaboration with utilities, government, investors, and real estate developers, we’re committed to attracting businesses that will build an innovation economy for the future. Thanks to PSE&G, Mayor Linda Karlovitch, the development team at Onyx Equities, Machine Investment Group and CoreWeave, this new data center will further fuel our state’s leadership in innovation.”

“PSE&G is committed to providing safe, affordable and reliable energy to all of our customers, no matter their location or their energy requirements,” said Ralph LaRossa, Chair, President and CEO of PSEG, PSE&G’s parent company. “This project is a good example of the work that Governor Murphy and the New Jersey Economic Development Authority are doing to foster a new wave of economic development for our state. We are excited to welcome and partner with Onyx and CoreWeave on this project.”

“We are incredibly excited to open a next-generation data center in CoreWeave’s home state of New Jersey,” said CoreWeave CEO and Co-founder Michael Intrator. “Governor Phil Murphy’s efforts have helped spur the creation of an AI ecosystem in the State, and CoreWeave’s announcement today underscores that New Jersey is open for AI business.” In 2023, CoreWeave more than quadrupled its data center footprint and is on track to end the year with 28 data centers globally.

“This partnership positions the NEST campus as a major hub for data processing, AI, and biopharma innovation,” said John Saraceno, Co-Founder and Managing Principal for Onyx Equities. “CoreWeave will be a key cornerstone of NEST, as life science and biotechnology tenants at the campus will benefit from CoreWeave’s advanced cloud infrastructure to support their AI-driven projects and boost research and development capabilities.”

11 NEST is part of the 100+ acre, 2M SF campus that is purpose-built and zoned for life science innovation and data centers, answering a need for immediately available, turn-key, and customizable office, laboratory, and bio-manufacturing space in the tri-state area. Formerly the global headquarters of Merck, the Onyx Equities, Machine Investment Group, and Pivot Real Estate Partners group acquired the campus February 2023 and have since begun work to develop it into a hub of research and innovation in the Northeast region of the United States. For more information about NEST, visit www.NestCenter.com.

For more information on PSE&G’s electric service, please visit pseg.com/service.

About Onyx Equities, LLC

Headquartered in Gateway One in Newark, Onyx Equities, LLC is a leading, full-service real estate firm specializing in investment, asset repositioning and ground-up development. Since its founding in 2004, Onyx has acquired more than $4 billion worth of diverse real estate assets throughout New Jersey, New York, and Pennsylvania, and has executed over $1 billion in capital improvement projects under its signature repositioning program. Driving Onyx’s success is its deep understanding of the development process and core geographic markets, a seasoned team of expertise in all facets of real estate, and its adaptability to market conditions and the experience gained from managing over 65 MSF since inception. Throughout its esteemed portfolio of properties, Onyx takes aim at increasing operational efficiency, tenant satisfaction and long-term value to create dynamic commercial, residential and mixed-use environments of the highest quality. For more information about Onyx Equities, visit https://www.onyxequities.com/.

About Machine Investment Group

Machine Investment Group is a real estate investment platform focused on investing in opportunistic, distressed, and special situations across all major asset classes in diverse geographies throughout the United States. Co-Founded by Eric Rosenthal, Machine principals are directly responsible for deploying $2.0 BN in capital to date. With a strong reputation, solutions-oriented approach, and extensive lender relationships, Machine aims to deliver consistent, opportunistic returns while minimizing losses. For more information, please visit https://machineinv.com/.

About PSE&G

Public Service Electric & Gas Co. is New Jersey’s oldest and largest gas and electric delivery public utility, as well as one of the nation’s largest utilities. PSE&G has won the ReliabilityOne® Award for superior electric system reliability in the Mid-Atlantic region for 22 consecutive years. For the third consecutive year, PSE&G is the recipient of the ENERGY STAR Partner of the Year award in the Energy Efficiency Program Delivery category. In 2023 J.D. Power named PSE&G number one in customer satisfaction with residential and business electric service in the east among large utilities. PSE&G is a subsidiary of Public Service Enterprise Group Inc., (PSEG), a predominantly regulated infrastructure company focused on a clean energy future and has been named to the Dow Jones Sustainability Index for North America for 16 consecutive years (www.pseg.com).

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/coreweave-signs-280-000-sf-lease-at-onyx-and-machines-northeast-science–technology-center-in-kenilworth-302289222.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/coreweave-signs-280-000-sf-lease-at-onyx-and-machines-northeast-science–technology-center-in-kenilworth-302289222.html

SOURCE Onyx Equities

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Preview Of Zedge's Earnings

Zedge ZDGE is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Zedge will report an earnings per share (EPS) of $0.04.

Anticipation surrounds Zedge’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Here’s a look at Zedge’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0 | |||

| EPS Actual | 0.03 | 0.04 | 0 | 0.01 |

| Price Change % | 13.0% | -19.0% | 3.0% | -8.0% |

Tracking Zedge’s Stock Performance

Shares of Zedge were trading at $3.08 as of October 25. Over the last 52-week period, shares are up 59.38%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Zedge visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

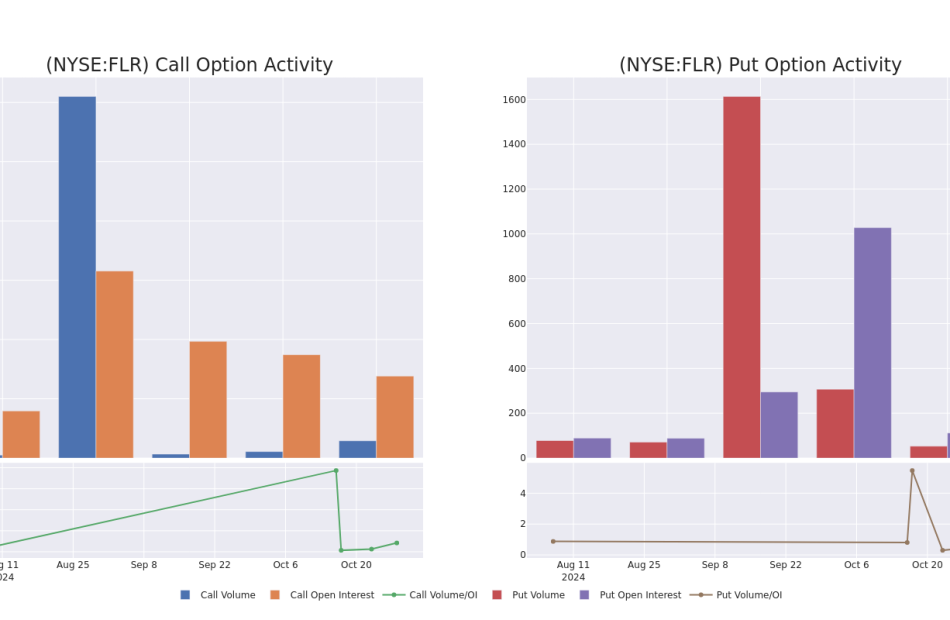

Smart Money Is Betting Big In FLR Options

High-rolling investors have positioned themselves bullish on Fluor FLR, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FLR often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Fluor. This is not a typical pattern.

The sentiment among these major traders is split, with 62% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $46,640, and 7 calls, totaling $398,329.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $60.0 for Fluor over the recent three months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Fluor’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Fluor’s substantial trades, within a strike price spectrum from $50.0 to $60.0 over the preceding 30 days.

Fluor Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FLR | CALL | SWEEP | BULLISH | 03/21/25 | $4.5 | $4.3 | $4.48 | $55.00 | $102.3K | 5.6K | 250 |

| FLR | CALL | TRADE | BEARISH | 01/16/26 | $13.3 | $11.0 | $11.3 | $50.00 | $90.4K | 421 | 80 |

| FLR | CALL | SWEEP | BULLISH | 03/21/25 | $4.5 | $4.3 | $4.5 | $55.00 | $58.0K | 5.6K | 380 |

| FLR | CALL | SWEEP | BEARISH | 03/21/25 | $2.85 | $2.8 | $2.8 | $60.00 | $49.8K | 7.7K | 254 |

| FLR | PUT | SWEEP | BULLISH | 01/16/26 | $9.0 | $8.8 | $8.8 | $55.00 | $46.6K | 112 | 53 |

About Fluor

Fluor is one of the largest global providers of engineering, procurement, construction, fabrication, operations, and maintenance services. The firm serves a wide range of end markets including oil and gas, chemicals, mining, metals, and transportation. The company’s business is organized into three core segments: urban solutions, mission solutions, and energy solutions. Fluor generated $15.5 billion in revenue in 2023.

Fluor’s Current Market Status

- Trading volume stands at 1,714,947, with FLR’s price up by 2.58%, positioned at $53.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 11 days.

Expert Opinions on Fluor

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $64.66666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has elevated its stance to Buy, setting a new price target at $65.

* An analyst from Truist Securities persists with their Buy rating on Fluor, maintaining a target price of $66.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Fluor with a target price of $63.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Fluor, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview For Container Store Group

Container Store Group TCS is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Container Store Group will report an earnings per share (EPS) of $-0.05.

Investors in Container Store Group are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Performance in Previous Earnings

The company’s EPS missed by $0.75 in the last quarter, leading to a 25.14% drop in the share price on the following day.

Here’s a look at Container Store Group’s past performance and the resulting price change:

| Quarter | Q1 2024 | Q4 2023 | Q3 2023 | Q2 2023 |

|---|---|---|---|---|

| EPS Estimate | -3.15 | -1.8 | -0.75 | -0.75 |

| EPS Actual | -3.90 | -0.6 | -1.20 | 0.15 |

| Price Change % | -25.0% | -3.0% | -39.0% | -5.0% |

Tracking Container Store Group’s Stock Performance

Shares of Container Store Group were trading at $9.57 as of October 25. Over the last 52-week period, shares are down 65.48%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Container Store Group visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bullish Monday For Marijuana Stocks – Greenlane Hldgs, Global Compliance Among Top Gainers

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.