Looking At Las Vegas Sands's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Las Vegas Sands. Our analysis of options history for Las Vegas Sands LVS revealed 12 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $576,561, and 7 were calls, valued at $840,707.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $45.0 and $65.0 for Las Vegas Sands, spanning the last three months.

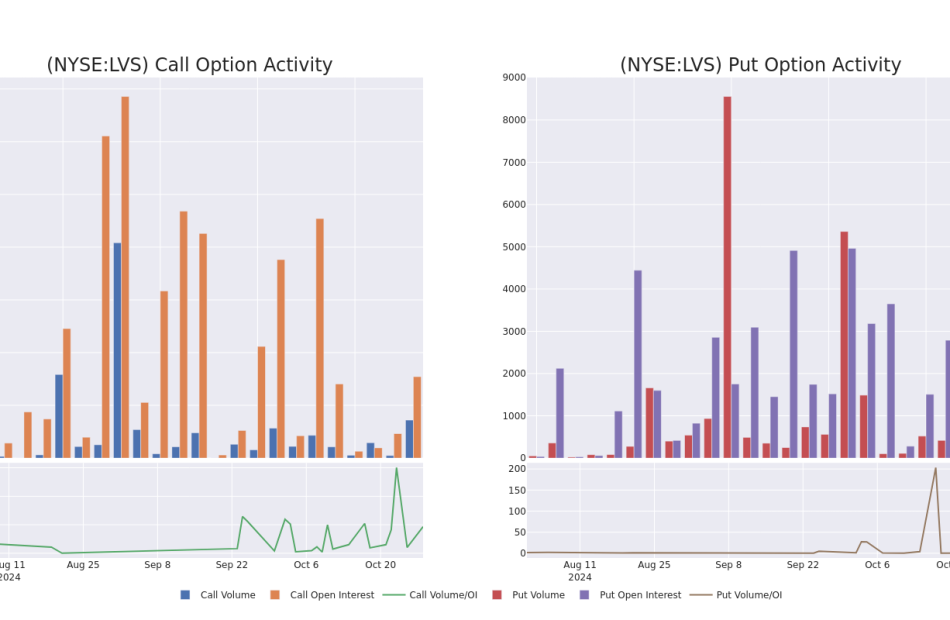

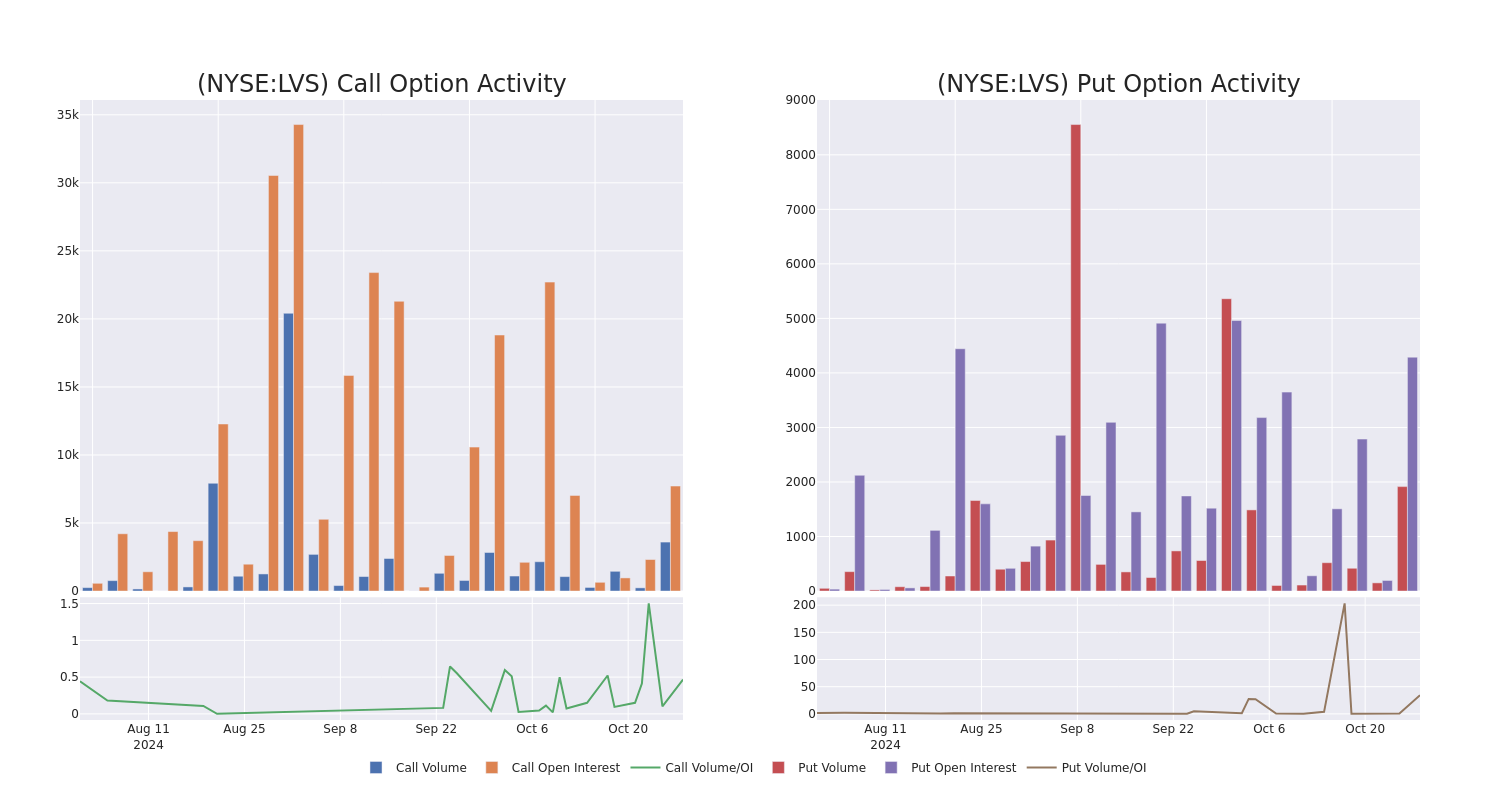

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Las Vegas Sands stands at 1333.78, with a total volume reaching 5,514.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Las Vegas Sands, situated within the strike price corridor from $45.0 to $65.0, throughout the last 30 days.

Las Vegas Sands Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LVS | CALL | SWEEP | BULLISH | 03/21/25 | $4.1 | $4.1 | $4.1 | $55.00 | $241.4K | 4.2K | 1.0K |

| LVS | PUT | SWEEP | BULLISH | 06/20/25 | $12.7 | $12.3 | $12.35 | $65.00 | $202.5K | 6 | 165 |

| LVS | CALL | TRADE | BULLISH | 03/21/25 | $4.15 | $4.0 | $4.1 | $55.00 | $182.4K | 4.2K | 1.4K |

| LVS | CALL | SWEEP | BULLISH | 03/21/25 | $4.1 | $4.05 | $4.05 | $55.00 | $181.8K | 4.2K | 452 |

| LVS | PUT | TRADE | BULLISH | 11/15/24 | $1.18 | $1.15 | $1.16 | $52.50 | $173.9K | 4.0K | 1.5K |

About Las Vegas Sands

Las Vegas Sands is the world’s largest operator of fully integrated resorts, featuring casino, hotel, entertainment, food and beverage, retail, and convention center operations. The company owns the Venetian Macao, Sands Macao, Londoner Macao, Four Seasons Hotel Macao, and Parisian Macao, as well as the Marina Bay Sands resort in Singapore. We expect Sands to open a fourth tower in Singapore toward the end of 2028. Its Venetian and Palazzo Las Vegas assets in the US were sold to Apollo and VICI in 2022. With the sale of its Vegas assets, the company generates all its EBITDA from Asia, with its casino operations generating the majority of sales.

After a thorough review of the options trading surrounding Las Vegas Sands, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Las Vegas Sands

- With a trading volume of 4,212,144, the price of LVS is up by 1.63%, reaching $53.62.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 86 days from now.

Professional Analyst Ratings for Las Vegas Sands

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $59.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Las Vegas Sands, targeting a price of $60.

* An analyst from Wells Fargo persists with their Overweight rating on Las Vegas Sands, maintaining a target price of $60.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Las Vegas Sands with a target price of $55.

* Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Las Vegas Sands, targeting a price of $59.

* Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Las Vegas Sands, targeting a price of $64.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Las Vegas Sands options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Invested $1000 In This Stock 15 Years Ago, You Would Have $7,400 Today

Valero Energy VLO has outperformed the market over the past 15 years by 2.05% on an annualized basis producing an average annual return of 14.17%. Currently, Valero Energy has a market capitalization of $41.56 billion.

Buying $1000 In VLO: If an investor had bought $1000 of VLO stock 15 years ago, it would be worth $7,386.20 today based on a price of $129.71 for VLO at the time of writing.

Valero Energy’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CVR Energy Reports Third Quarter 2024 Results

- Third quarter net loss attributable to CVR Energy stockholders of $124 million; EBITDA loss of $35 million; adjusted EBITDA of $63 million

- Third quarter loss per diluted share of $1.24 and adjusted loss per diluted share of 50 cents

- CVR Energy will not pay a cash dividend for the third quarter of 2024

- CVR Partners announced a cash distribution of $1.19 per common unit

SUGAR LAND, Texas, Oct. 28, 2024 (GLOBE NEWSWIRE) — CVR Energy, Inc. CVI “CVR Energy” or the “Company”))) today announced a net loss attributable to CVR Energy stockholders of $124 million, or $1.24 per diluted share, and an EBITDA loss of $35 million for the third quarter of 2024, compared to net income attributable to CVR Energy stockholders of $353 million, or $3.51 per diluted share, and EBITDA of $530 million for the third quarter of 2023. Excluding the adjustments shown in the corresponding earnings release tables, adjusted loss per diluted share for the third quarter of 2024 was 50 cents and adjusted EBITDA was $63 million, compared to adjusted earnings per diluted share of $1.89 and adjusted EBITDA of $313 million in the third quarter of 2023.

“CVR Energy’s 2024 third quarter earnings results for its refining business were impacted by reduced refining throughputs attributable to unplanned downtime at both facilities partially caused by external power supply outages during the quarter,” said Dave Lamp, CVR Energy’s Chief Executive Officer. “The Board’s decision to suspend the quarterly dividend reflects its concerns on just how long the current margin environment will persist in light of the Company’s large, planned turnaround at its Coffeyville refinery in the first quarter of 2025.

“CVR Partners achieved solid operating results for the third quarter of 2024 driven by safe, reliable operations and a combined ammonia production rate of 97 percent,” Lamp said. “CVR Partners was pleased to declare a third quarter 2024 cash distribution of $1.19 per common unit.”

Petroleum

The Petroleum Segment reported a third quarter 2024 net loss of $110 million and an EBITDA loss of $75 million, compared to net income of $460 million and EBITDA of $484 million for the third quarter of 2023. Adjusted EBITDA for the Petroleum Segment was $24 million for the third quarter of 2024, compared to $281 million for the third quarter of 2023.

Combined total throughput for the third quarter of 2024 was approximately 189,000 barrels per day (bpd) compared to approximately 212,000 bpd of combined total throughput for the third quarter of 2023.

Refining margin for the third quarter of 2024 was $44 million, or $2.53 per total throughput barrel, compared to $607 million, or $31.05 per total throughput barrel, during the same period in 2023. Included in our third quarter 2024 refining margin were unfavorable mark-to-market impacts on our outstanding RFS obligation of $59 million, unfavorable derivative impacts of $9 million from open crack spread swap positions and unfavorable inventory valuation impacts of $31 million. Excluding these items, adjusted refining margin for the third quarter of 2024 was $8.23 per barrel, compared to an adjusted refining margin per barrel of $20.73 for the third quarter of 2023. The decrease in adjusted refining margin per barrel was primarily due to a decrease in the Group 3 2-1-1 crack spread.

Nitrogen Fertilizer

The Nitrogen Fertilizer Segment reported net income of $4 million and EBITDA of $36 million on net sales of $125 million for the third quarter of 2024, compared to net income of $1 million and EBITDA of $32 million on net sales of $131 million for the third quarter of 2023.

Production at CVR Partners, LP’s (“CVR Partners”) fertilizer facilities decreased slightly compared to the third quarter of 2023, producing a combined 212,000 tons of ammonia during the third quarter of 2024, of which 61,000 net tons were available for sale while the rest was upgraded to other fertilizer products, including 321,000 tons of urea ammonia nitrate (“UAN”). During the third quarter of 2023, the fertilizer facilities produced a combined 217,000 tons of ammonia, of which 68,000 net tons were available for sale while the remainder was upgraded to other fertilizer products, including 358,000 tons of UAN.

For the third quarter 2024, average realized gate prices for UAN showed an improvement compared to the prior year, up 3 percent to $229 per ton, and ammonia was up 9 percent over the prior year to $399 per ton. Average realized gate prices for UAN and ammonia were $223 and $365 per ton, respectively, for the third quarter of 2023.

Corporate and Other

The Company reported an income tax benefit of $6 million, or 4.6 percent of loss before income taxes, for the three months ended September 30, 2024, compared to an income tax expense of $84 million, or 19.3 percent of income before income taxes, for the three months ended September 30, 2023. The decrease in income tax expense was primarily due to a decrease in overall pretax earnings while the change in the effective tax rate was primarily due to changes in pretax earnings attributable to noncontrolling interest and the impact of federal and state tax credits and incentives in relation to overall pretax earnings.

The renewable diesel unit at the Wynnewood refinery had total vegetable oil throughputs for the third quarter of 2024 of approximately 19.6 million gallons, down from 23.8 million gallons in the third quarter of 2023. The decrease was primarily due to running the unit at lower utilization rates in the current period in an effort to optimize catalyst life.

Cash, Debt and Dividend

Consolidated cash and cash equivalents were $534 million at September 30, 2024, a decrease of $47 million from December 31, 2023. Consolidated total debt and finance lease obligations were $1.6 billion at September 30, 2024, including $548 million held by the Nitrogen Fertilizer Segment.

CVR Energy will not pay a cash dividend for the third quarter of 2024.

Today, CVR Partners announced that the Board of Directors of its general partner declared a third quarter 2024 cash distribution of $1.19 per common unit, which will be paid on November 18, 2024, to common unitholders of record as of November 8, 2024.

Third Quarter 2024 Earnings Conference Call

CVR Energy previously announced that it will host its third quarter 2024 Earnings Conference Call on Tuesday, October 29, at 1 p.m. Eastern. The Earnings Conference Call may also include discussion of Company developments, forward-looking information and other material information about business and financial matters.

The third quarter 2024 Earnings Conference Call will be webcast live and can be accessed on the Investor Relations section of CVR Energy’s website at www.CVREnergy.com. For investors or analysts who want to participate during the call, the dial-in number is (877) 407-8291. The webcast will be archived and available for 14 days at https://edge.media-server.com/mmc/p/fm39ca3r. A repeat of the call also can be accessed for 14 days by dialing (877) 660-6853, conference ID 13749245.

Forward-Looking Statements

This news release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, statements regarding future: continued safe and reliable operations; drivers of our results; income, losses, and earnings per diluted share; EBITDA and Adjusted EBITDA; renewable identification numbers (“RINs”) expense; asset utilization, capture, production volume, product yield and crude oil gathering rates; cash flow generation; production; operating income and net sales; throughput, including the impact of turnarounds or fires thereon; refining margin, including contributors thereto; margin environment; impact of costs to comply with the RFS and revaluation of our RFS liability; outcome of litigation and disputes, including impact on our financial position and cash flows; crude oil and refined product pricing impacts on inventory valuation; dividend yield; derivative gains and losses and the drivers thereof; crack spreads, including the drivers thereof; demand trends; RIN generation levels; ethanol and biodiesel blending activities; inventory levels; benefits of our corporate transformation to segregate our renewables business; access to capital and new partnerships; RIN pricing, including its impact on our results and our ability to offset the impact thereof; disruptions to operations (planned and unplanned), including impacts on results; carbon capture and decarbonization initiatives; ammonia and UAN pricing; global fertilizer industry conditions; grain prices; crop inventory levels; crop and planting levels; demand for refined products; economic downturns and demand destruction; production rates; production levels and utilization at our nitrogen fertilizer facilities; nitrogen fertilizer sales volumes, including factors driving same; ability to and levels to which we upgrade ammonia to other fertilizer products, including UAN; income tax expense, including the drivers thereof; changes to pretax earnings and our effective tax rate; the availability of tax credits and incentives; production rates and operations capabilities of our renewable diesel unit, including the ability to return to hydrocarbon service; renewable feedstock throughput; purchases under share or unit repurchase programs (if any), or the termination thereof; ability to access capital markets, secure financing or sell assets; cash and cash equivalent levels; debt levels; borrowings under our credit facilities (if any); dividends and distributions, including the timing, payment and amount (if any) thereof; any suspension of our dividend, including the duration thereof; direct operating expenses, capital expenditures, depreciation and amortization; efforts to reduce or defer expenses and the amount and impact thereof; cash reserves; turnaround timing and expense, including the impacts thereof on our liquidity; impacts of any pandemic; labor supply shortages, difficulties, disputes or strikes, including the impact thereof; the April 2024 fire at the Wynnewood Refinery including the impact and cost thereof on and to our operations, financial position or otherwise; and other matters. You can generally identify forward-looking statements by our use of forward-looking terminology such as “outlook,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “explore,” “evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. Investors are cautioned that various factors may affect these forward-looking statements, including (among others) the health and economic effects of any pandemic, demand for fossil fuels and price volatility of crude oil, other feedstocks and refined products; the ability of Company to pay cash dividends and of CVR Partners to make cash distributions; potential operating hazards, including the impacts of fires at our facilities; costs of compliance with existing or new laws and regulations and potential liabilities arising therefrom; impacts of the planting season on CVR Partners; our controlling shareholder’s intention regarding ownership of our common stock and potential strategic transactions involving us or CVR Partners; general economic and business conditions; political disturbances, geopolitical instability and tensions; impacts of plant outages and weather conditions and events; and other risks. For additional discussion of risk factors which may affect our results, please see the risk factors and other disclosures included in our most recent Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q and our other Securities and Exchange Commission (“SEC”) filings. These and other risks may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this news release are made only as of the date hereof. CVR Energy disclaims any intention or obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by law.

About CVR Energy, Inc.

Headquartered in Sugar Land, Texas, CVR Energy is a diversified holding company primarily engaged in the renewables, petroleum refining and marketing business as well as in the nitrogen fertilizer manufacturing business through its interest in CVR Partners. CVR Energy subsidiaries serve as the general partner and own 37 percent of the common units of CVR Partners.

Investors and others should note that CVR Energy may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of its website. CVR Energy may use these channels to distribute material information about the Company and to communicate important information about the Company, corporate initiatives and other matters. Information that CVR Energy posts on its website could be deemed material; therefore, CVR Energy encourages investors, the media, its customers, business partners and others interested in the Company to review the information posted on its website.

Contact Information:

Investor Relations

Richard Roberts

(281) 207-3205

InvestorRelations@CVREnergy.com

Media Relations

Brandee Stephens

(281) 207-3516

MediaRelations@CVREnergy.com

Non-GAAP Measures

Our management uses certain non-GAAP performance measures, and reconciliations to those measures, to evaluate current and past performance and prospects for the future to supplement our financial information presented in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are important factors in assessing our operating results and profitability and include the performance and liquidity measures defined below.

As a result of continuing volatile market conditions and the impacts certain non-cash items may have on the evaluation of our operations and results, the Company began disclosing the Adjusted Refining Margin non-GAAP measure, as defined below, in the second quarter of 2024. We believe the presentation of this non-GAAP measure is meaningful to compare our operating results between periods and better aligns with our peer companies. All prior periods presented have been conformed to the definition below.

The following are non-GAAP measures we present for the periods ended September 30, 2024 and 2023:

EBITDA – Consolidated net income (loss) before (i) interest expense, net, (ii) income tax expense (benefit) and (iii) depreciation and amortization expense.

Petroleum EBITDA and Nitrogen Fertilizer EBITDA – Segment net income (loss) before segment (i) interest expense, net, (ii) income tax expense (benefit), and (iii) depreciation and amortization.

Refining Margin – The difference between our Petroleum Segment net sales and cost of materials and other.

Adjusted Refining Margin – Refining Margin adjusted for certain significant noncash items and items that management believes are not attributable to or indicative of our underlying operational results of the period or that may obscure results and trends we deem useful.

Refining Margin and Adjusted Refining Margin, per Throughput Barrel – Refining Margin and Adjusted Refining Margin divided by the total throughput barrels during the period, which is calculated as total throughput barrels per day times the number of days in the period.

Direct Operating Expenses per Throughput Barrel – Direct operating expenses for our Petroleum Segment divided by total throughput barrels for the period, which is calculated as total throughput barrels per day times the number of days in the period.

Adjusted EBITDA, Petroleum Adjusted EBITDA and Nitrogen Fertilizer Adjusted EBITDA – EBITDA, Petroleum EBITDA and Nitrogen Fertilizer EBITDA adjusted for certain significant noncash items and items that management believes are not attributable to or indicative of our underlying operational results of the period or that may obscure results and trends we deem useful.

Adjusted Earnings (Loss) per Share – Earnings (loss) per share adjusted for certain significant non-cash items and items that management believes are not attributable to or indicative of our underlying operational results of the period or that may obscure results and trends we deem useful.

Free Cash Flow – Net cash provided by (used in) operating activities less capital expenditures and capitalized turnaround expenditures.

We present these measures because we believe they may help investors, analysts, lenders and ratings agencies analyze our results of operations and liquidity in conjunction with our U.S. GAAP results, including but not limited to our operating performance as compared to other publicly traded companies in the refining and fertilizer industries, without regard to historical cost basis or financing methods and our ability to incur and service debt and fund capital expenditures. Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect net earnings and operating income. These measures should not be considered substitutes for their most directly comparable U.S. GAAP financial measures. See “Non-GAAP Reconciliations” included herein for reconciliation of these amounts. Due to rounding, numbers presented within this section may not add or equal to numbers or totals presented elsewhere within this document.

Factors Affecting Comparability of Our Financial Results

Petroleum Segment

Our results of operations for the periods presented may not be comparable with prior periods or to our results of operations in the future due to capitalized expenditures as part of planned turnarounds. Total capitalized expenditures were $3 million and $2 million during the three months ended September 30, 2024 and 2023, respectively, and $45 million and $53 million during the nine months ended September 30, 2024 and 2023, respectively. The next planned turnaround is currently scheduled to take place in the first quarter of 2025 at the Coffeyville refinery.

| CVR Energy, Inc. (all information in this release is unaudited) |

|||||||||||||||

| Consolidated Statement of Operations Data | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net sales | $ | 1,833 | $ | 2,522 | $ | 5,663 | $ | 7,045 | |||||||

| Operating costs and expenses: | |||||||||||||||

| Cost of materials and other | 1,666 | 1,787 | 4,796 | 5,211 | |||||||||||

| Direct operating expenses (exclusive of depreciation and amortization) | 165 | 170 | 502 | 503 | |||||||||||

| Depreciation and amortization | 73 | 80 | 218 | 217 | |||||||||||

| Cost of sales | 1,904 | 2,037 | 5,516 | 5,931 | |||||||||||

| Selling, general and administrative expenses (exclusive of depreciation and amortization) | 40 | 38 | 103 | 109 | |||||||||||

| Depreciation and amortization | 2 | 1 | 6 | 4 | |||||||||||

| Loss on asset disposal | — | 1 | 1 | 1 | |||||||||||

| Operating (loss) income | (113 | ) | 445 | 37 | 1,000 | ||||||||||

| Other (expense) income: | |||||||||||||||

| Interest expense, net | (18 | ) | (11 | ) | (56 | ) | (44 | ) | |||||||

| Other income, net | 3 | 4 | 10 | 10 | |||||||||||

| (Loss) income before income tax benefit | (128 | ) | 438 | (9 | ) | 966 | |||||||||

| Income tax (benefit) expense | (6 | ) | 84 | (14 | ) | 185 | |||||||||

| Net (loss) income | (122 | ) | 354 | 5 | 781 | ||||||||||

| Less: Net income attributable to noncontrolling interest | 2 | 1 | 27 | 103 | |||||||||||

| Net (loss) income attributable to CVR Energy stockholders | $ | (124 | ) | $ | 353 | $ | (22 | ) | $ | 678 | |||||

| Basic and diluted (loss) earnings per share | $ | (1.24 | ) | $ | 3.51 | $ | (0.22 | ) | $ | 6.74 | |||||

| Dividends declared per share | $ | 0.50 | $ | 1.50 | $ | 1.50 | $ | 2.50 | |||||||

| Adjusted (loss) earnings per share | $ | (0.50 | ) | $ | 1.89 | $ | (0.38 | ) | $ | 4.98 | |||||

| EBITDA* | $ | (35 | ) | $ | 530 | $ | 271 | $ | 1,231 | ||||||

| Adjusted EBITDA * | $ | 63 | $ | 313 | $ | 249 | $ | 994 | |||||||

| Weighted-average common shares outstanding – basic and diluted | 100.5 | 100.5 | 100.5 | 100.5 | |||||||||||

_________________

* See “Non-GAAP Reconciliations” section below.

Selected Consolidated Balance Sheet Data

| (in millions) | September 30, 2024 | December 31, 2023 | |||

| Cash and cash equivalents | $ | 534 | $ | 581 | |

| Working capital | 353 | 497 | |||

| Total assets | 3,878 | 4,707 | |||

| Total debt and finance lease obligations, including current portion | 1,582 | 2,185 | |||

| Total liabilities | 3,022 | 3,669 | |||

| Total CVR stockholders’ equity | 675 | 847 | |||

Selected Consolidated Cash Flow Data

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net cash (used in) provided by: | |||||||||||||||

| Operating activities | $ | 48 | $ | 370 | $ | 306 | $ | 984 | |||||||

| Investing activities | (35 | ) | (51 | ) | (164 | ) | (181 | ) | |||||||

| Financing activities | (65 | ) | (181 | ) | (794 | ) | (424 | ) | |||||||

| Net (decrease) increase in cash, cash equivalents, and restricted cash | $ | (52 | ) | $ | 138 | $ | (652 | ) | $ | 379 | |||||

| Free cash flow* | $ | 13 | $ | 318 | $ | 141 | $ | 802 | |||||||

_________________

* See “Non-GAAP Reconciliations” section below.

Selected Segment Data

| Three Months Ended September 30, | |||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||

| (in millions) | Petroleum | Nitrogen Fertilizer | Consolidated | Petroleum | Nitrogen Fertilizer | Consolidated | |||||||||||||

| Net sales | $ | 1,648 | $ | 125 | $ | 1,833 | $ | 2,298 | $ | 131 | $ | 2,522 | |||||||

| Operating (loss) income | (119 | ) | 11 | (113 | ) | 431 | 8 | 445 | |||||||||||

| Net (loss) income | (110 | ) | 4 | (122 | ) | 460 | 1 | 354 | |||||||||||

| EBITDA* | (75 | ) | 36 | (35 | ) | 484 | 32 | 530 | |||||||||||

| Capital expenditures(1) | |||||||||||||||||||

| Maintenance capital expenditures | $ | 22 | $ | 7 | $ | 31 | $ | 20 | $ | 8 | $ | 30 | |||||||

| Growth capital expenditures | 6 | 3 | 8 | 6 | — | 21 | |||||||||||||

| Total capital expenditures | $ | 28 | $ | 10 | $ | 39 | $ | 26 | $ | 8 | $ | 51 | |||||||

| Nine Months Ended September 30, | |||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

| (in millions) | Petroleum | Nitrogen Fertilizer | Consolidated | Petroleum | Nitrogen Fertilizer | Consolidated | |||||||||||

| Net sales | $ | 5,165 | $ | 386 | $ | 5,663 | $ | 6,290 | $ | 540 | $ | 7,045 | |||||

| Operating income | 9 | 65 | 37 | 838 | 184 | 1,000 | |||||||||||

| Net income | 35 | 43 | 5 | 913 | 162 | 781 | |||||||||||

| EBITDA* | 152 | 129 | 271 | 989 | 243 | 1,231 | |||||||||||

| Capital expenditures(1) | |||||||||||||||||

| Maintenance capital expenditures | $ | 66 | $ | 15 | $ | 87 | $ | 70 | $ | 17 | $ | 92 | |||||

| Growth capital expenditures | 31 | 4 | 43 | 9 | 1 | 56 | |||||||||||

| Total capital expenditures | $ | 97 | $ | 19 | $ | 130 | $ | 79 | $ | 18 | $ | 148 | |||||

_________________

* See “Non-GAAP Reconciliations” section below.

(1) Capital expenditures are shown exclusive of capitalized turnaround expenditures.

Selected Balance Sheet Data

| September 30, 2024 | December 31, 2023 | ||||||||||||||||

| (in millions) | Petroleum | Nitrogen Fertilizer | Consolidated | Petroleum | Nitrogen Fertilizer | Consolidated | |||||||||||

| Cash and cash equivalents | $ | 275 | $ | 111 | $ | 534 | $ | 375 | $ | 45 | $ | 581 | |||||

| Total assets | 2,804 | 987 | 3,878 | 2,978 | 975 | 4,707 | |||||||||||

| Total debt and finance lease obligations, including current portion(1) | 39 | 548 | 1,582 | 44 | 547 | 2,185 | |||||||||||

_________________

(1) Corporate total debt and finance lease obligations, including current portion consisted of $995 million and $1,594 million at September 30, 2024 and December 31, 2023, respectively.

Petroleum Segment

Key Operating Metrics per Total Throughput Barrel

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||

| Refining margin * | $ | 2.53 | $ | 31.05 | $ | 9.96 | $ | 24.33 | |||

| Adjusted refining margin * | 8.23 | 20.73 | 9.51 | 20.02 | |||||||

| Direct operating expenses * | 5.72 | 5.39 | 6.14 | 5.58 | |||||||

_________________

* See “Non-GAAP Reconciliations” section below.

Refining Throughput and Production Data by Refinery

| Throughput Data | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||

| (in bpd) | 2024 | 2023 | 2024 | 2023 | |||

| Coffeyville | |||||||

| Gathered crude | 66,781 | 68,176 | 71,993 | 62,442 | |||

| Other domestic | 35,111 | 49,303 | 36,549 | 47,491 | |||

| Canadian | 6,243 | 2,731 | 8,423 | 2,307 | |||

| Condensate | — | 7,401 | 4,244 | 7,718 | |||

| Other crude oil | 3,876 | — | 1,484 | — | |||

| Other feedstocks and blendstocks | 11,691 | 12,260 | 11,678 | 12,538 | |||

| Wynnewood | |||||||

| Gathered crude | 51,821 | 53,554 | 43,055 | 51,519 | |||

| Other domestic | 1,504 | 543 | 1,309 | 1,822 | |||

| Condensate | 9,663 | 15,780 | 8,634 | 14,567 | |||

| Other feedstocks and blendstocks | 2,604 | 2,672 | 3,058 | 2,984 | |||

| Total throughput | 189,294 | 212,420 | 190,427 | 203,388 | |||

| Production Data | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||

| (in bpd) | 2024 | 2023 | 2024 | 2023 | |||||||

| Coffeyville | |||||||||||

| Gasoline | 62,031 | 69,833 | 68,732 | 67,463 | |||||||

| Distillate | 52,030 | 60,661 | 55,237 | 56,311 | |||||||

| Other liquid products | 5,169 | 4,463 | 5,578 | 4,461 | |||||||

| Solids | 4,734 | 4,416 | 4,901 | 3,896 | |||||||

| Wynnewood | |||||||||||

| Gasoline | 34,539 | 36,997 | 30,746 | 37,656 | |||||||

| Distillate | 23,902 | 25,615 | 19,722 | 24,825 | |||||||

| Other liquid products | 5,874 | 9,038 | 4,600 | 7,355 | |||||||

| Solids | 11 | 9 | 8 | 10 | |||||||

| Total production | 188,290 | 211,032 | 189,524 | 201,977 | |||||||

| Light product yield (as % of crude throughput)(1) | 98.6 | % | 97.8 | % | 99.3 | % | 99.1 | % | |||

| Liquid volume yield (as % of total throughput)(2) | 97.0 | % | 97.3 | % | 96.9 | % | 97.4 | % | |||

| Distillate yield (as % of crude throughput)(3) | 43.4 | % | 43.7 | % | 42.7 | % | 43.2 | % | |||

_________________

(1) Total Gasoline and Distillate divided by total Gathered crude, Other domestic, Canadian, and Condensate throughput (collectively, “Total Crude Throughput”).

(2) Total Gasoline, Distillate, and Other liquid products divided by total throughput.

(3) Total Distillate divided by Total Crude Throughput.

Key Market Indicators

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| West Texas Intermediate (WTI) NYMEX | $ | 75.27 | $ | 82.22 | $ | 77.62 | $ | 77.25 | |||||||

| Crude Oil Differentials to WTI: | |||||||||||||||

| Brent | 3.43 | 3.71 | 4.20 | 4.70 | |||||||||||

| WCS (heavy sour) | (13.84 | ) | (15.91 | ) | (14.43 | ) | (16.33 | ) | |||||||

| Condensate | (0.32 | ) | (0.22 | ) | (0.60 | ) | (0.18 | ) | |||||||

| Midland Cushing | 0.78 | 1.53 | 1.14 | 1.32 | |||||||||||

| NYMEX Crack Spreads: | |||||||||||||||

| Gasoline | 19.86 | 32.40 | 23.31 | 32.61 | |||||||||||

| Heating Oil | 22.21 | 45.20 | 27.78 | 40.35 | |||||||||||

| NYMEX 2-1-1 Crack Spread | 21.03 | 38.80 | 25.54 | 36.48 | |||||||||||

| PADD II Group 3 Product Basis: | |||||||||||||||

| Gasoline | (1.77 | ) | 0.84 | (7.43 | ) | (2.39 | ) | ||||||||

| Ultra-Low Sulfur Diesel | (1.51 | ) | (0.25 | ) | (5.15 | ) | (0.38 | ) | |||||||

| PADD II Group 3 Product Crack Spread: | |||||||||||||||

| Gasoline | 18.09 | 33.24 | 15.88 | 30.22 | |||||||||||

| Ultra-Low Sulfur Diesel | 20.70 | 44.96 | 22.62 | 39.97 | |||||||||||

| PADD II Group 3 2-1-1 | 19.40 | 39.10 | 19.25 | 35.10 | |||||||||||

Nitrogen Fertilizer Segment

Ammonia Utilization Rates (1)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| (percent of capacity utilization) | 2024 | 2023 | 2024 | 2023 | |||||||

| Consolidated | 97 | % | 99 | % | 96 | % | 101 | % | |||

_________________

(1) Reflects our ammonia utilization rates on a consolidated basis. Utilization is an important measure used by management to assess operational output at each of CVR Partners’ facilities. Utilization is calculated as actual tons produced divided by capacity. We present our utilization for the three and nine months ended September 30, 2024 and 2023 and take into account the impact of our current turnaround cycles on any specific period. Additionally, we present utilization solely on ammonia production rather than each nitrogen product as it provides a comparative baseline against industry peers and eliminates the disparity of plant configurations for upgrade of ammonia into other nitrogen products. With our efforts being primarily focused on ammonia upgrade capabilities, this measure provides a meaningful view of how well we operate.

Sales and Production Data

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| Consolidated sales volumes (thousand tons): | |||||||||||

| Ammonia | 62 | 62 | 175 | 183 | |||||||

| UAN | 336 | 387 | 950 | 1,075 | |||||||

| Consolidated product pricing at gate (dollars per ton):(1) | |||||||||||

| Ammonia | $ | 399 | $ | 365 | $ | 481 | $ | 633 | |||

| UAN | 229 | 223 | 254 | 330 | |||||||

| Consolidated production volume (thousand tons): | |||||||||||

| Ammonia(gross produced)(2) | 212 | 217 | 626 | 660 | |||||||

| Ammonia(net available for sale)(2) | 61 | 68 | 191 | 200 | |||||||

| UAN | 321 | 358 | 964 | 1,063 | |||||||

| Feedstock: | |||||||||||

| Petroleum coke used in production(thousands of tons) | 133 | 131 | 395 | 386 | |||||||

| Petroleum coke used in production(dollars per ton) | $ | 44.69 | $ | 84.09 | $ | 60.93 | $ | 78.49 | |||

| Natural gas used in production(thousands of MMBtus)(3) | 2,082 | 2,133 | 6,443 | 6,429 | |||||||

| Natural gas used in production(dollars per MMBtu)(3) | $ | 2.19 | $ | 2.67 | $ | 2.40 | $ | 3.57 | |||

| Natural gas in cost of materials and other(thousands of MMBtus)(3) | 1,783 | 2,636 | 5,403 | 6,354 | |||||||

| Natural gas in cost of materials and other(dollars per MMBtu)(3) | $ | 2.18 | $ | 2.51 | $ | 2.50 | $ | 4.21 | |||

_________________

(1) Product pricing at gate represents sales less freight revenue divided by product sales volume in tons and is shown in order to provide a pricing measure that is comparable across the fertilizer industry.

(2) Gross tons produced for ammonia represent total ammonia produced, including ammonia produced that was upgraded into other fertilizer products. Net tons available for sale represent ammonia available for sale that was not upgraded into other fertilizer products.

(3) The feedstock natural gas shown above does not include natural gas used for fuel. The cost of fuel natural gas is included in direct operating expense.

Key Market Indicators

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| Ammonia — Southern plains(dollars per ton) | $ | 481 | $ | 429 | $ | 507 | $ | 533 | |||

| Ammonia — Corn belt(dollars per ton) | 529 | 501 | 550 | 621 | |||||||

| UAN — Corn belt(dollars per ton) | 240 | 272 | 264 | 314 | |||||||

| Natural gas NYMEX(dollars per MMBtu) | $ | 2.23 | $ | 2.66 | $ | 2.22 | $ | 2.58 | |||

Q4 2024 Outlook

The table below summarizes our outlook for certain operational statistics and financial information for the fourth quarter of 2024. See “Forward-Looking Statements” above.

| Q4 2024 | |||||||

| Low | High | ||||||

| Petroleum | |||||||

| Total throughput(bpd) | 200,000 | 215,000 | |||||

| Direct operating expenses(in millions)(1) | $ | 100 | $ | 110 | |||

| Turnaround(2) | 8 | 12 | |||||

| Renewables(3) | |||||||

| Total throughput(in millions of gallons) | 17 | 22 | |||||

| Direct operating expenses(in millions)(1) | $ | 9 | $ | 11 | |||

| Nitrogen Fertilizer | |||||||

| Ammonia utilization rates | |||||||

| Consolidated | 92 | % | 97 | % | |||

| Coffeyville Fertilizer Facility | 90 | % | 95 | % | |||

| East Dubuque Fertilizer Facility | 95 | % | 100 | % | |||

| Direct operating expenses(in millions)(1) | $ | 60 | $ | 70 | |||

| Capital Expenditures (in millions)(2) | |||||||

| Petroleum | $ | 38 | $ | 42 | |||

| Renewables(3) | 1 | 2 | |||||

| Nitrogen Fertilizer | 19 | 23 | |||||

| Other | 1 | 3 | |||||

| Total capital expenditures | $ | 59 | $ | 70 | |||

_________________

(1) Direct operating expenses are shown exclusive of depreciation and amortization, turnaround expenses, and inventory valuation impacts.

(2) Turnaround and capital expenditures are disclosed on an accrual basis.

(3) As of September 30, 2024, Renewables does not meet the definition of a reportable segment as defined under Accounting Standards Codification 280.

Non-GAAP Reconciliations

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net (loss) income | $ | (122 | ) | $ | 354 | $ | 5 | $ | 781 | ||||||

| Interest expense, net | 18 | 11 | 56 | 44 | |||||||||||

| Income tax (benefit) expense | (6 | ) | 84 | (14 | ) | 185 | |||||||||

| Depreciation and amortization | 75 | 81 | 224 | 221 | |||||||||||

| EBITDA | (35 | ) | 530 | 271 | 1,231 | ||||||||||

| Adjustments: | |||||||||||||||

| Revaluation of RFS liability, unfavorable (favorable) | 59 | (174 | ) | (32 | ) | (228 | ) | ||||||||

| Unrealized loss on derivatives, net | 9 | 48 | 16 | 35 | |||||||||||

| Inventory valuation impacts, unfavorable (favorable) | 30 | (91 | ) | (6 | ) | (44 | ) | ||||||||

| Adjusted EBITDA | $ | 63 | $ | 313 | $ | 249 | $ | 994 | |||||||

Reconciliation of Basic and Diluted (Loss) Earnings per Share to Adjusted (Loss) Earnings per Share

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Basic and diluted (loss) earnings per share | $ | (1.24 | ) | $ | 3.51 | $ | (0.22 | ) | $ | 6.74 | |||||

| Adjustments:(1) | |||||||||||||||

| Revaluation of RFS liability, unfavorable (favorable) | 0.44 | (1.30 | ) | (0.24 | ) | (1.69 | ) | ||||||||

| Unrealized loss on derivatives, net | 0.07 | 0.36 | 0.12 | 0.26 | |||||||||||

| Inventory valuation impacts, unfavorable (favorable) | 0.23 | (0.68 | ) | (0.04 | ) | (0.33 | ) | ||||||||

| Adjusted (loss) earnings per share | $ | (0.50 | ) | $ | 1.89 | $ | (0.38 | ) | $ | 4.98 | |||||

_________________

(1) Amounts are shown after-tax, using the Company’s marginal tax rate, and are presented on a per share basis using the weighted average shares outstanding for each period.

Reconciliation of Net Cash Provided By Operating Activities to Free Cash Flow

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net cash provided by operating activities | $ | 48 | $ | 370 | $ | 306 | $ | 984 | |||||||

| Less: | |||||||||||||||

| Capital expenditures | (34 | ) | (50 | ) | (124 | ) | (150 | ) | |||||||

| Capitalized turnaround expenditures | (2 | ) | (3 | ) | (46 | ) | (53 | ) | |||||||

| Return of equity method investment | 1 | 1 | 5 | 21 | |||||||||||

| Free cash flow | $ | 13 | $ | 318 | $ | 141 | $ | 802 | |||||||

Reconciliation of Petroleum Segment Net (Loss) Income to EBITDA and Adjusted EBITDA

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Petroleum net (loss) income | $ | (110 | ) | $ | 460 | $ | 35 | $ | 913 | ||||||

| Interest income, net | (5 | ) | (26 | ) | (16 | ) | (65 | ) | |||||||

| Depreciation and amortization | 40 | 50 | 133 | 141 | |||||||||||

| Petroleum EBITDA | (75 | ) | 484 | 152 | 989 | ||||||||||

| Adjustments: | |||||||||||||||

| Revaluation of RFS liability, unfavorable (favorable) | 59 | (174 | ) | (32 | ) | (228 | ) | ||||||||

| Unrealized loss on derivatives, net | 9 | 53 | 16 | 37 | |||||||||||

| Inventory valuation impacts, unfavorable (favorable)(1) | 31 | (82 | ) | (8 | ) | (48 | ) | ||||||||

| Petroleum Adjusted EBITDA | $ | 24 | $ | 281 | $ | 128 | $ | 750 | |||||||

Reconciliation of Petroleum Segment Gross (Loss) Profit to Refining Margin and Adjusted Refining Margin

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net sales | $ | 1,648 | $ | 2,298 | $ | 5,165 | $ | 6,290 | |||||||

| Less: | |||||||||||||||

| Cost of materials and other | (1,604 | ) | (1,691 | ) | (4,645 | ) | (4,939 | ) | |||||||

| Direct operating expenses (exclusive of depreciation and amortization) | (100 | ) | (105 | ) | (320 | ) | (310 | ) | |||||||

| Depreciation and amortization | (40 | ) | (50 | ) | (133 | ) | (141 | ) | |||||||

| Gross (loss) profit | (96 | ) | 452 | 67 | 900 | ||||||||||

| Add: | |||||||||||||||

| Direct operating expenses (exclusive of depreciation and amortization) | 100 | 105 | 320 | 310 | |||||||||||

| Depreciation and amortization | 40 | 50 | 133 | 141 | |||||||||||

| Refining margin | 44 | 607 | 520 | 1,351 | |||||||||||

| Adjustments: | |||||||||||||||

| Revaluation of RFS liability, unfavorable (favorable) | 59 | (174 | ) | (32 | ) | (228 | ) | ||||||||

| Unrealized loss on derivatives, net | 9 | 53 | 16 | 37 | |||||||||||

| Inventory valuation impacts, unfavorable (favorable)(1) | 31 | (82 | ) | (8 | ) | (48 | ) | ||||||||

| Adjusted refining margin | $ | 143 | $ | 404 | $ | 496 | $ | 1,112 | |||||||

_________________

(1) The Petroleum Segment’s basis for determining inventory value under GAAP is First-In, First-Out (“FIFO”). Changes in crude oil prices can cause fluctuations in the inventory valuation of crude oil, work in process and finished goods, thereby resulting in a favorable inventory valuation impact when crude oil prices increase and an unfavorable inventory valuation impact when crude oil prices decrease. The inventory valuation impact is calculated based upon inventory values at the beginning of the accounting period and at the end of the accounting period. In order to derive the inventory valuation impact per total throughput barrel, we utilize the total dollar figures for the inventory valuation impact and divide by the number of total throughput barrels for the period.

Reconciliation of Petroleum Segment Total Throughput Barrels and Metrics per Total Throughput Barrel

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| Total throughput barrels per day | 189,294 | 212,420 | 190,427 | 203,388 | |||||||

| Days in the period | 92 | 92 | 274 | 273 | |||||||

| Total throughput barrels | 17,415,033 | 19,542,631 | 52,176,994 | 55,524,925 | |||||||

| (in millions, except per total throughput barrel) | |||||||||||

| Refining margin | $ | 44 | $ | 607 | $ | 520 | $ | 1,351 | |||

| Refining margin per total throughput barrel | $ | 2.53 | $ | 31.05 | $ | 9.96 | $ | 24.33 | |||

| Adjusted refining margin | $ | 143 | $ | 404 | $ | 496 | $ | 1,112 | |||

| Adjusted refining margin per total throughput barrel | $ | 8.23 | $ | 20.73 | $ | 9.51 | $ | 20.02 | |||

| Direct operating expenses (exclusive of depreciation and amortization) | $ | 100 | $ | 105 | $ | 320 | $ | 310 | |||

| Direct operating expenses per total throughput barrel | $ | 5.72 | $ | 5.39 | $ | 6.14 | $ | 5.58 | |||

Reconciliation of Nitrogen Fertilizer Segment Net Income to EBITDA and Adjusted EBITDA

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||

| Nitrogen Fertilizer net income | $ | 4 | $ | 1 | $ | 43 | $ | 162 | |||

| Interest expense, net | 7 | 8 | 22 | 22 | |||||||

| Depreciation and amortization | 25 | 23 | 64 | 59 | |||||||

| Nitrogen Fertilizer EBITDA and Adjusted EBITDA | $ | 36 | $ | 32 | $ | 129 | $ | 243 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Marvell Tech

Whales with a lot of money to spend have taken a noticeably bullish stance on Marvell Tech.

Looking at options history for Marvell Tech MRVL we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $69,375 and 13, calls, for a total amount of $829,349.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $120.0 for Marvell Tech over the recent three months.

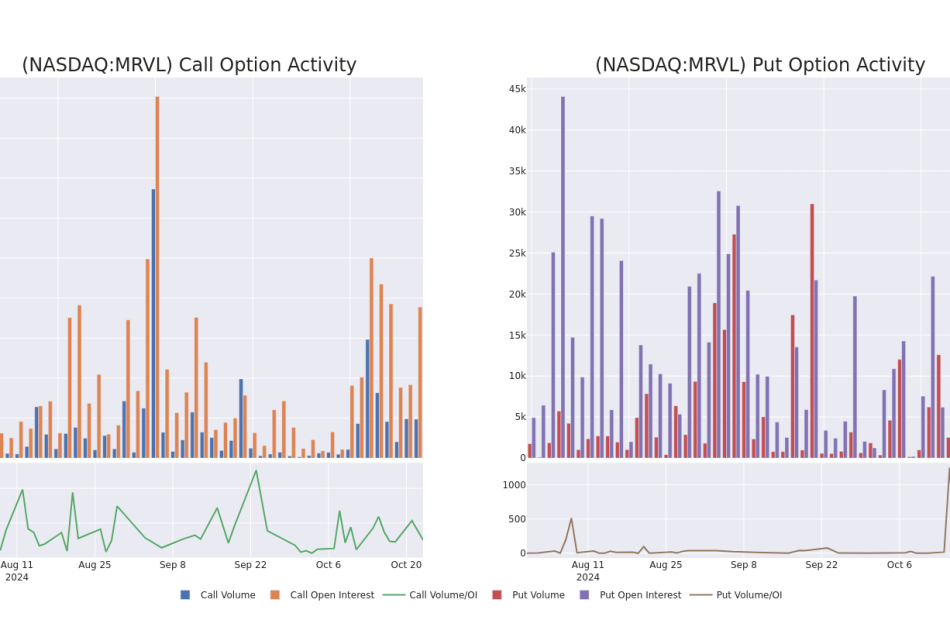

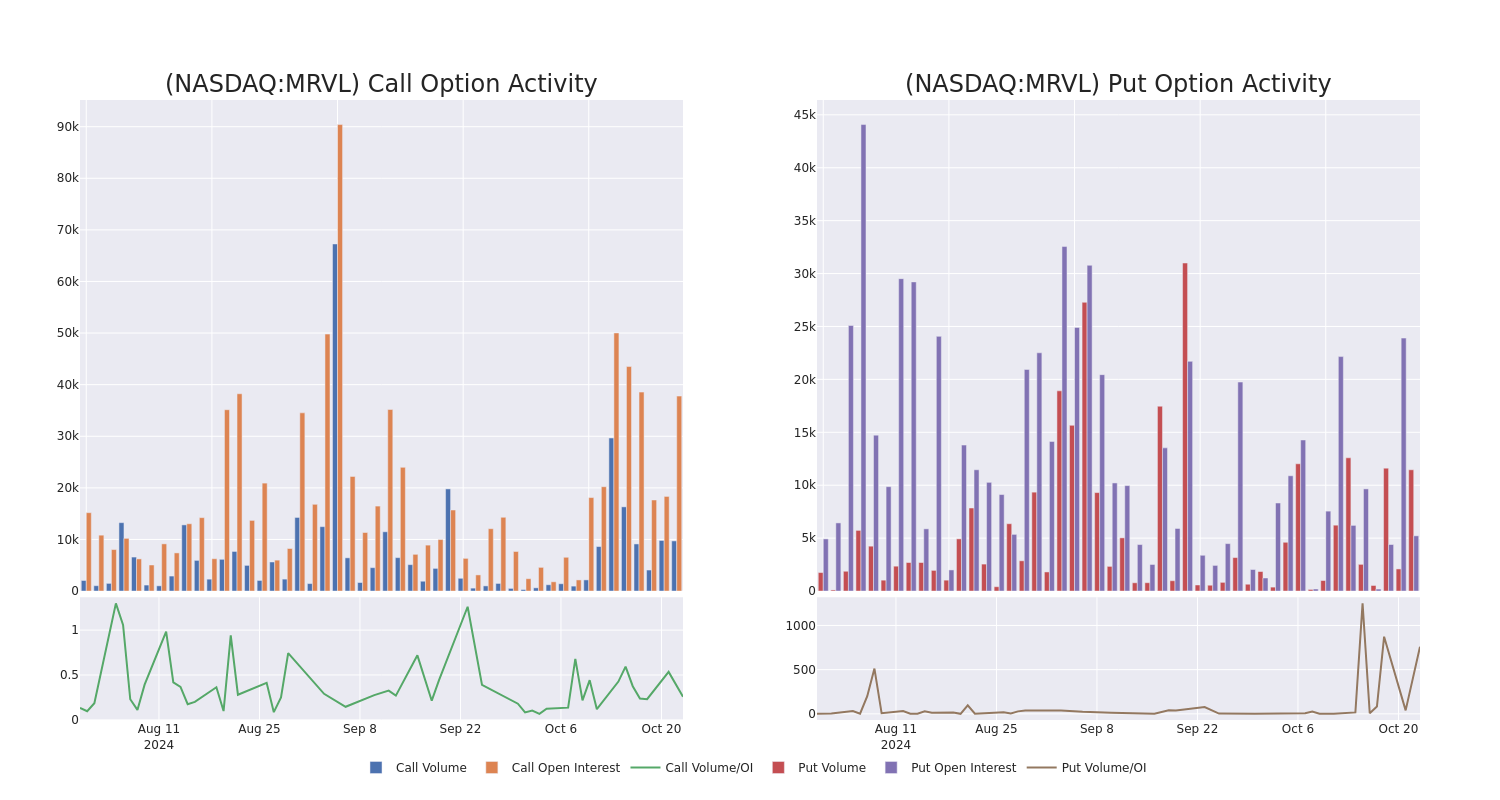

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Marvell Tech stands at 2811.9, with a total volume reaching 4,424.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Marvell Tech, situated within the strike price corridor from $30.0 to $120.0, throughout the last 30 days.

Marvell Tech Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | TRADE | BEARISH | 12/18/26 | $14.15 | $13.65 | $13.75 | $120.00 | $343.7K | 0 | 250 |

| MRVL | CALL | SWEEP | BULLISH | 12/20/24 | $8.7 | $8.6 | $8.65 | $80.00 | $64.8K | 8.9K | 99 |

| MRVL | CALL | TRADE | BEARISH | 01/16/26 | $57.7 | $52.7 | $54.15 | $30.00 | $54.1K | 45 | 10 |

| MRVL | CALL | TRADE | BULLISH | 11/15/24 | $2.82 | $2.78 | $2.82 | $85.00 | $49.0K | 5.3K | 789 |

| MRVL | CALL | SWEEP | BEARISH | 12/20/24 | $6.1 | $6.05 | $6.1 | $85.00 | $45.7K | 7.7K | 347 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Where Is Marvell Tech Standing Right Now?

- With a trading volume of 6,638,777, the price of MRVL is up by 2.24%, reaching $83.44.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 32 days from now.

Expert Opinions on Marvell Tech

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $91.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Marvell Tech, targeting a price of $91.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marvell Tech with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TransMedics Group Stock Sinks On Q3 Earnings: The Details

TransMedics Group Inc TMDX shares are trading lower in Monday’s after-hours session after the company reported worse-than-expected financial results for the third quarter.

- Q3 Revenue: $108.76 million, versus estimates of $115 million

- Q3 EPS: 12 cents, versus estimates of 30 cents

Total revenue was up 64% on a year-over-year basis, primarily driven by an increase in utilization of the Organ Care System across all three organs, as well as additional revenue generated by the company’s logistics services.

TransMedics said it ended the quarter with $330.1 million in cash, down from $362.8 million at the end of the second quarter.

“We are proud of our performance year to date and look forward to ending 2024 on a strong note,” said Waleed Hassanein, president and CEO of TransMedics.

“We continued to make meaningful progress across each of our growth initiatives through the third quarter and maintain our conviction in our growth runway for 2025 and beyond.”

See Also: Ford Q3 Earnings: Revenue Beat, EPS Beat, EV Sales Down 33%, Updated Outlook, Shares Slide

Outlook: TransMedics said it continued to expect full-year revenue to be in the range of $425 million to $445 million versus estimates of $444.36 million.

“Overall, we remain well on track to reach our stated target of achieving 10,000 OCS transplant cases per year in the U.S. by 2028,” Hassanein added.

TMDX Price Action: TransMedics shares were down 23.95% after hours at $95.75 at the time of publication Monday, according to Benzinga Pro.

Photo: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Walmart

Financial giants have made a conspicuous bullish move on Walmart. Our analysis of options history for Walmart WMT revealed 24 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $605,248, and 17 were calls, valued at $1,590,292.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $53.33 and $110.0 for Walmart, spanning the last three months.

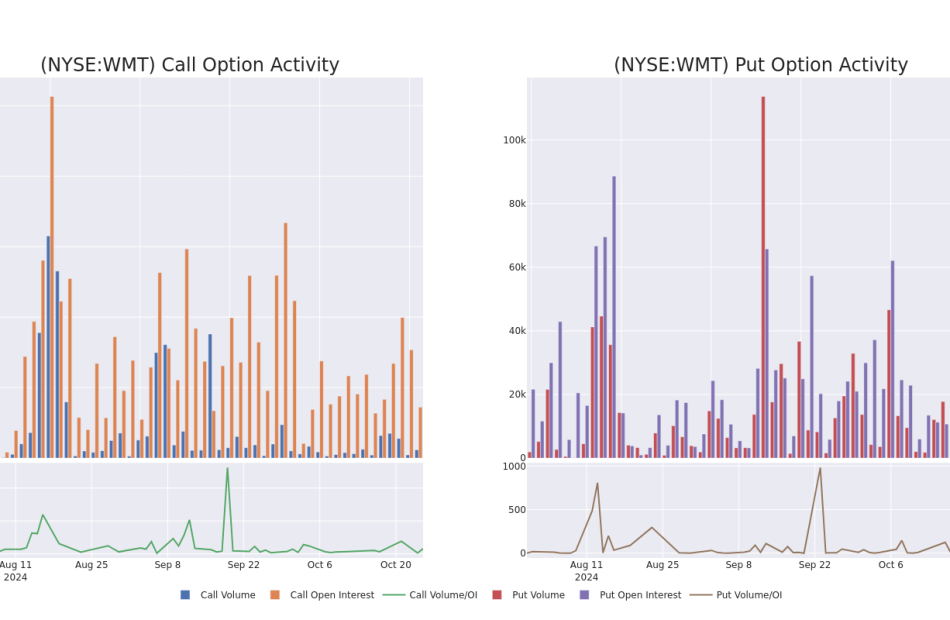

Analyzing Volume & Open Interest

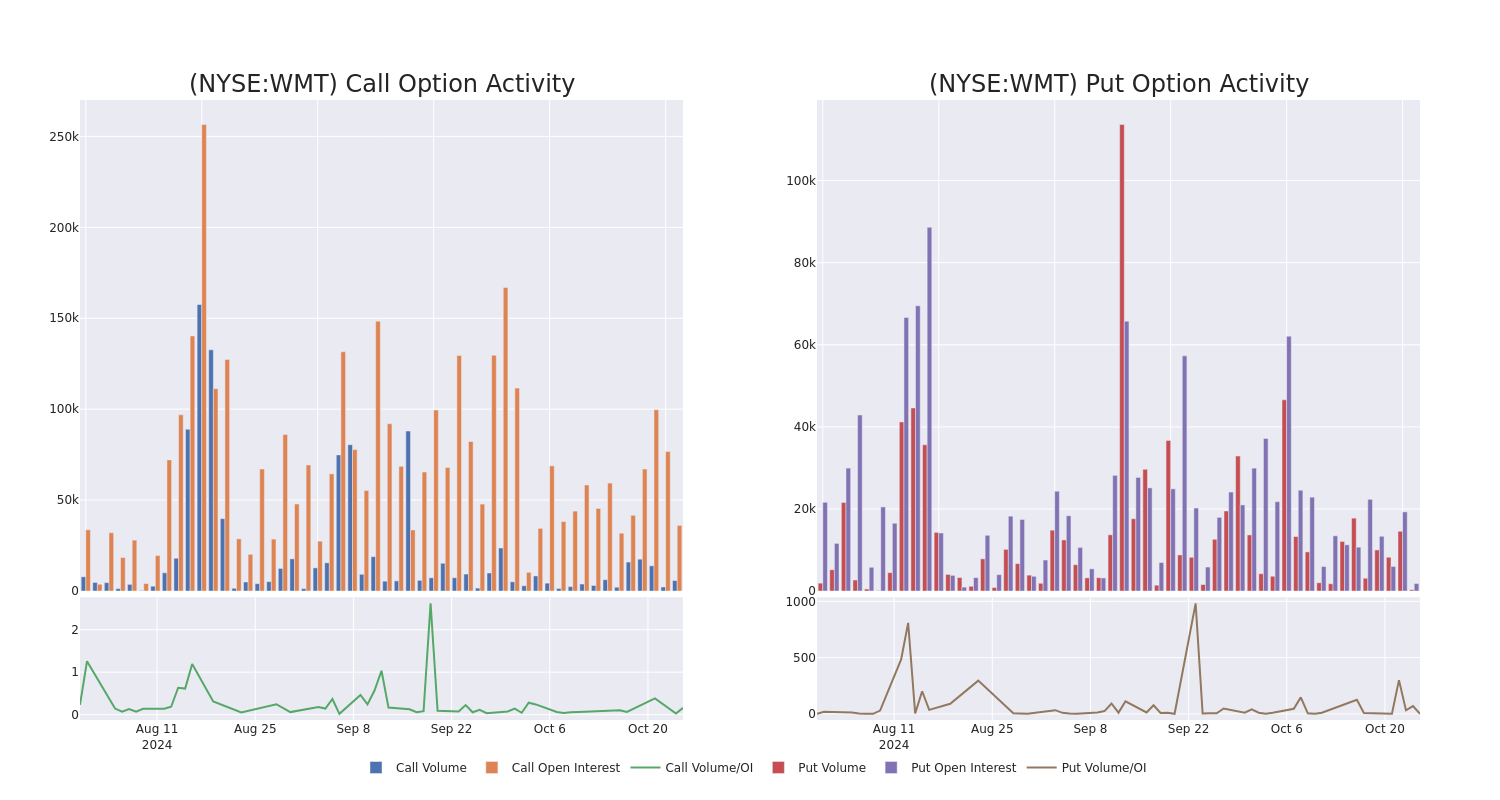

In terms of liquidity and interest, the mean open interest for Walmart options trades today is 4105.26 with a total volume of 10,356.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Walmart’s big money trades within a strike price range of $53.33 to $110.0 over the last 30 days.

Walmart 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BULLISH | 08/15/25 | $12.75 | $12.65 | $12.75 | $75.00 | $374.8K | 632 | 295 |

| WMT | CALL | TRADE | BEARISH | 01/16/26 | $1.92 | $1.83 | $1.85 | $110.00 | $370.0K | 368 | 3.9K |

| WMT | CALL | TRADE | BEARISH | 01/16/26 | $1.92 | $1.83 | $1.85 | $110.00 | $351.5K | 368 | 1.9K |

| WMT | PUT | SWEEP | BULLISH | 06/20/25 | $7.5 | $7.45 | $7.45 | $86.67 | $164.6K | 45 | 232 |

| WMT | PUT | SWEEP | BULLISH | 04/17/25 | $4.5 | $4.4 | $4.4 | $82.50 | $145.6K | 240 | 376 |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart’s Current Market Status

- With a volume of 7,967,824, the price of WMT is up 0.41% at $82.85.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 22 days.

Expert Opinions on Walmart

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $90.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein downgraded its action to Outperform with a price target of $95.

* An analyst from Baird has decided to maintain their Outperform rating on Walmart, which currently sits at a price target of $90.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Walmart, targeting a price of $90.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Walmart, targeting a price of $86.

* An analyst from UBS persists with their Buy rating on Walmart, maintaining a target price of $92.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walmart, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vera Therapeutics' Atacicept Shows Sustained, Substantial Improvement In Kidney Function For Patients At Almost Two Years

On Saturday, Vera Therapeutics Inc. VERA released data from its ORIGIN Phase 2b trial of atacicept in immunoglobulin A nephropathy (IgAN), which showed stabilized kidney function through 96 weeks of long-term follow-up.

These data were presented in a late-breaking oral presentation at the American Society of Nephrology Kidney Week 2024 and published in a manuscript in the Journal of the American Society of Nephrology.

Over 96 weeks, participants treated with atacicept demonstrated a -66% reduction in galactose-deficient IgA1 (Gd-IgA1), resolution of hematuria in 75% of participants, a -52% reduction in proteinuria, and a mean annualized estimated glomerular filtration rate (eGFR) slope of -0.6 mL/min/1.73m2/year.

The cumulative generally favorable safety profile of atacicept remained consistent with that observed during the randomized period, with a 90% completion rate of atacicept treatment.

The company says these data support the potential for atacicept to offer long-term, comprehensive IgAN disease modification and provide further confidence in the ongoing pivotal Phase 3 ORIGIN 3 trial of atacicept in IgAN.

The company plans to initiate an ORIGIN Extend study in the fourth quarter of 2024, which will provide ORIGIN participants with extended access to atacicept before its commercial availability.

The ORIGIN 3 trial is on track to announce topline results in the second quarter of 2025, with planned FDA marketing application submission later in the year.

Earlier this year, Vera Therapeutics revealed 72-week data from the open-label extension (OLE) period of its Phase 2b ORIGIN clinical trial of atacicept in participants with IgA nephropathy (IgAN).

Data from the OLE showed the consistent and sustained reductions of serum galactose-deficient IgA1 (Gd-lgA1), hematuria, and urine protein to creatinine ratio (UPCR), as well as the stability of eGFR over 72 weeks in participants with IgAN.

Price Action: VERA stock is up 12.2% at $46.12 at last check Monday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBDC Transaction Volume to Reach 7.8 Billion by 2031, Juniper Research Finds

HAMPSHIRE, United Kingdom, Oct. 28, 2024 (GLOBE NEWSWIRE) — A new study by Juniper Research, the foremost experts in fintech and payments markets, has forecast that, by 2031, the number of global payments made using CBDCs (Central Bank Digital Currencies) will reach 7.8 billion, up from 307.1 million in 2024.

This remarkable 2,430% growth will be driven by central banks seeking to safeguard monetary sovereignty in the face of card-network dominance and growing stablecoin popularity. Collaborative projects such as mBridge and Project Icebreaker, which seek to connect national CBDCs, will leave nations less reliant on established payment rails.

CBDCs are central bank issued digital versions of existing fiat currencies.

An extract from the new report, Global CBDCs and Stablecoins Market 2024-2031, is now available as a free download.

Demand for Simplified Cross-Border Payments Builds CBDC Momentum

The research forecast that, through the use of CBDCs and stablecoins, cross-border payments will save $45 billion by 2031. Remittance senders and global businesses are currently burdened by high fees and limited visibility. CBDCs and stablecoins streamline transfers by bypassing costly intermediaries, enabling direct transactions on decentralised or central bank-controlled networks.

Research author Lorien Carter commented: “Emerging payment technologies, like CBDCs and stablecoins, will streamline international payments. These innovative technologies will help grow the digital economy and increase global financial inclusion by reducing the reliance on the US dollar for international settlements.”

Prioritise Interoperability While Building CBDCs

To fully unlock cross-border growth, the study emphasises that interoperability between different CBDCs is essential. CBDC vendors must participate in projects pioneered by global organisations such as BIS, allowing them to test their infrastructure and contribute to the design of multilateral interoperability standards. Without this collaboration, the CBDC ecosystem risks fragmentation, resulting in ‘digital islands’ which fail to realise the efficiency of cross-border payments.

The Research Suite

The new market research suite offers the most comprehensive assessment of the CBDC and stablecoins market to date, providing analysis and forecasts of over 45,600 datapoints across 60 countries over eight years. It includes a ‘Competitor Leaderboard’ and examination of current and future market opportunities.

Juniper Research has, for two decades, provided market intelligence and advisory services to the global financial sector, and is retained by many of the world’s leading banks, intermediaries and providers.

Contact Sam Smith, Press Relations

T: +44(0)1256 830002

E: sam.smith@juniperresearch.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.