This Is What Whales Are Betting On Marvell Tech

Whales with a lot of money to spend have taken a noticeably bullish stance on Marvell Tech.

Looking at options history for Marvell Tech MRVL we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $69,375 and 13, calls, for a total amount of $829,349.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $120.0 for Marvell Tech over the recent three months.

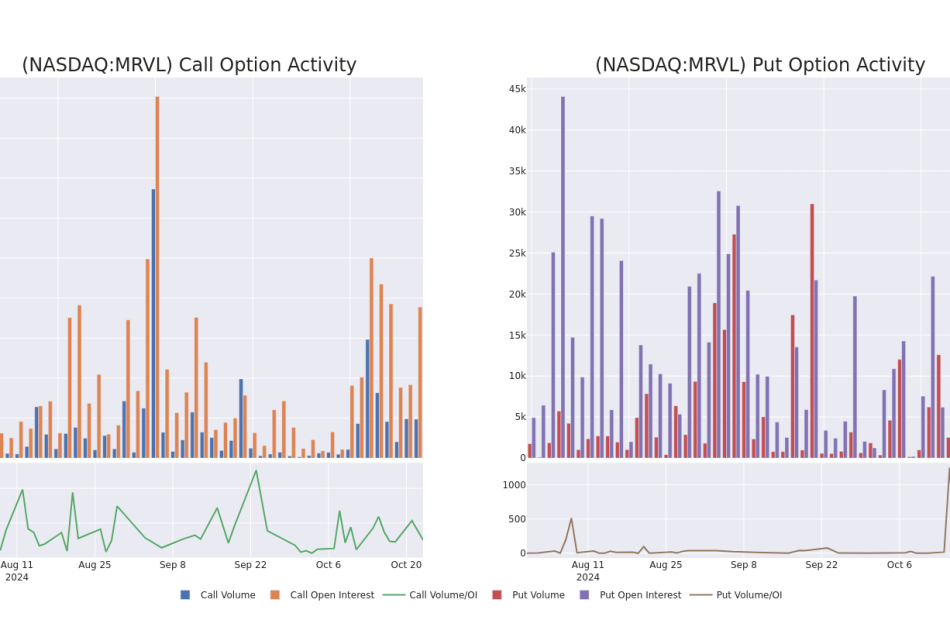

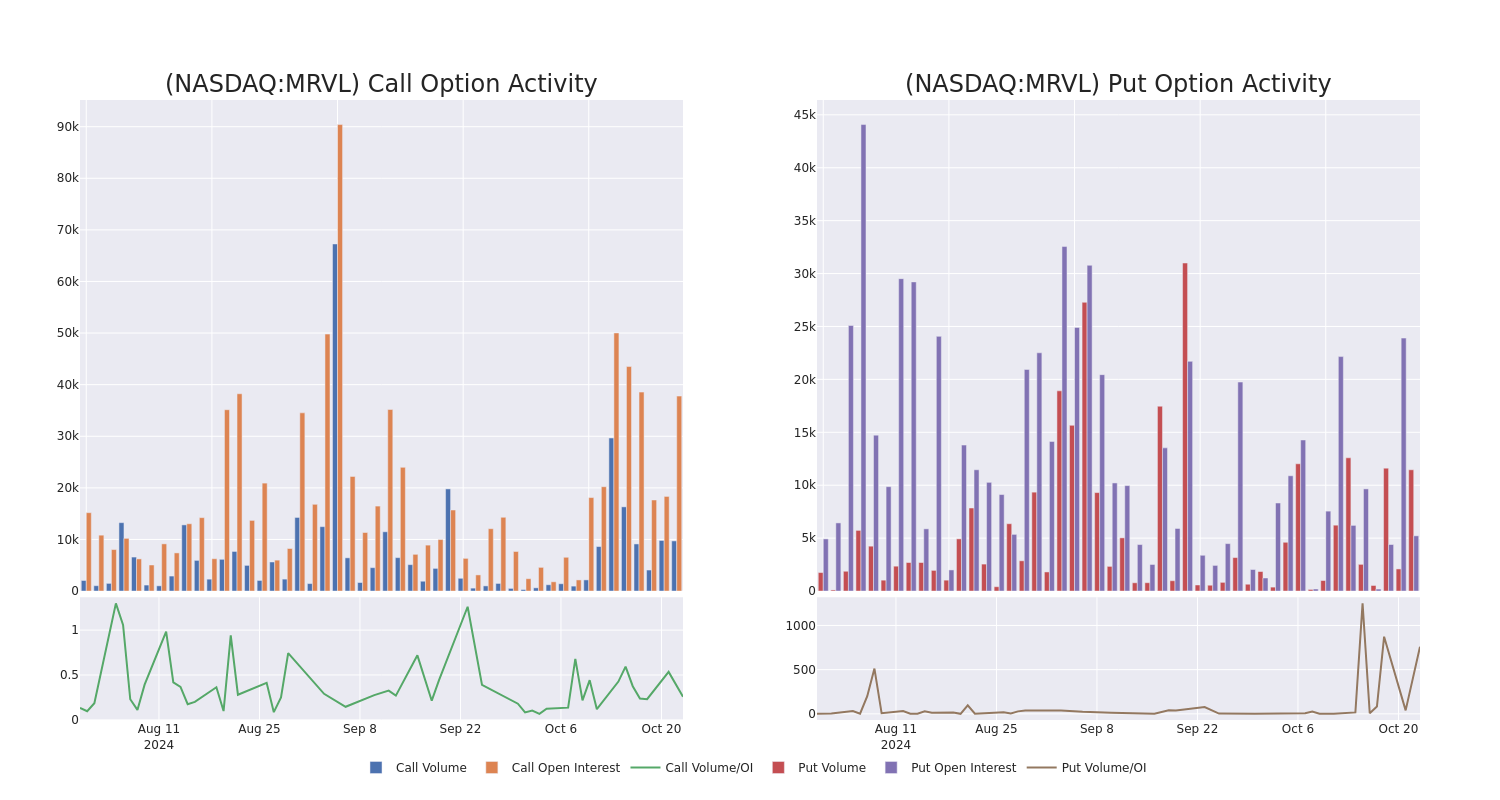

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Marvell Tech stands at 2811.9, with a total volume reaching 4,424.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Marvell Tech, situated within the strike price corridor from $30.0 to $120.0, throughout the last 30 days.

Marvell Tech Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | TRADE | BEARISH | 12/18/26 | $14.15 | $13.65 | $13.75 | $120.00 | $343.7K | 0 | 250 |

| MRVL | CALL | SWEEP | BULLISH | 12/20/24 | $8.7 | $8.6 | $8.65 | $80.00 | $64.8K | 8.9K | 99 |

| MRVL | CALL | TRADE | BEARISH | 01/16/26 | $57.7 | $52.7 | $54.15 | $30.00 | $54.1K | 45 | 10 |

| MRVL | CALL | TRADE | BULLISH | 11/15/24 | $2.82 | $2.78 | $2.82 | $85.00 | $49.0K | 5.3K | 789 |

| MRVL | CALL | SWEEP | BEARISH | 12/20/24 | $6.1 | $6.05 | $6.1 | $85.00 | $45.7K | 7.7K | 347 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Where Is Marvell Tech Standing Right Now?

- With a trading volume of 6,638,777, the price of MRVL is up by 2.24%, reaching $83.44.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 32 days from now.

Expert Opinions on Marvell Tech

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $91.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Marvell Tech, targeting a price of $91.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marvell Tech with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TransMedics Group Stock Sinks On Q3 Earnings: The Details

TransMedics Group Inc TMDX shares are trading lower in Monday’s after-hours session after the company reported worse-than-expected financial results for the third quarter.

- Q3 Revenue: $108.76 million, versus estimates of $115 million

- Q3 EPS: 12 cents, versus estimates of 30 cents

Total revenue was up 64% on a year-over-year basis, primarily driven by an increase in utilization of the Organ Care System across all three organs, as well as additional revenue generated by the company’s logistics services.

TransMedics said it ended the quarter with $330.1 million in cash, down from $362.8 million at the end of the second quarter.

“We are proud of our performance year to date and look forward to ending 2024 on a strong note,” said Waleed Hassanein, president and CEO of TransMedics.

“We continued to make meaningful progress across each of our growth initiatives through the third quarter and maintain our conviction in our growth runway for 2025 and beyond.”

See Also: Ford Q3 Earnings: Revenue Beat, EPS Beat, EV Sales Down 33%, Updated Outlook, Shares Slide

Outlook: TransMedics said it continued to expect full-year revenue to be in the range of $425 million to $445 million versus estimates of $444.36 million.

“Overall, we remain well on track to reach our stated target of achieving 10,000 OCS transplant cases per year in the U.S. by 2028,” Hassanein added.

TMDX Price Action: TransMedics shares were down 23.95% after hours at $95.75 at the time of publication Monday, according to Benzinga Pro.

Photo: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Walmart

Financial giants have made a conspicuous bullish move on Walmart. Our analysis of options history for Walmart WMT revealed 24 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $605,248, and 17 were calls, valued at $1,590,292.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $53.33 and $110.0 for Walmart, spanning the last three months.

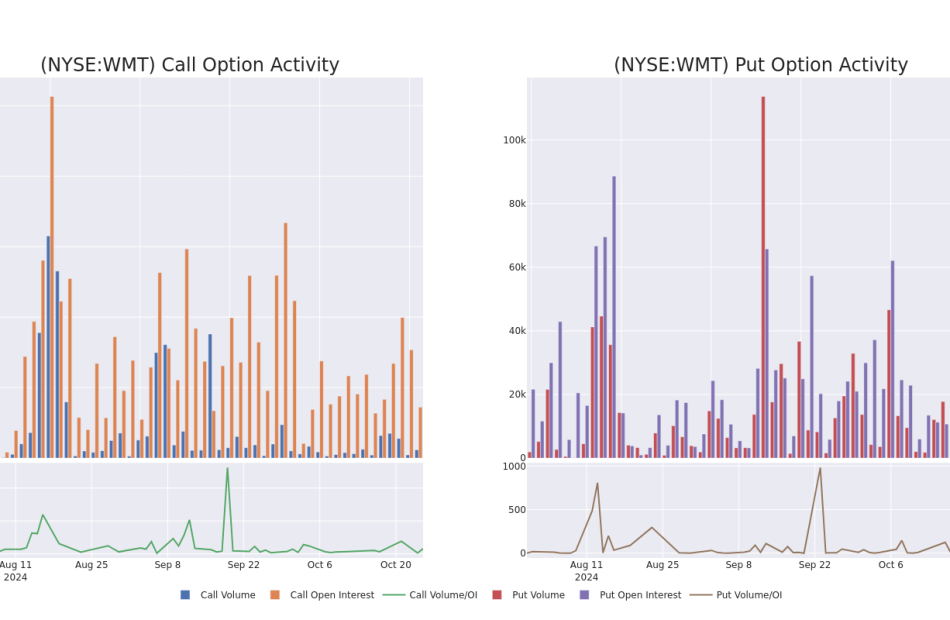

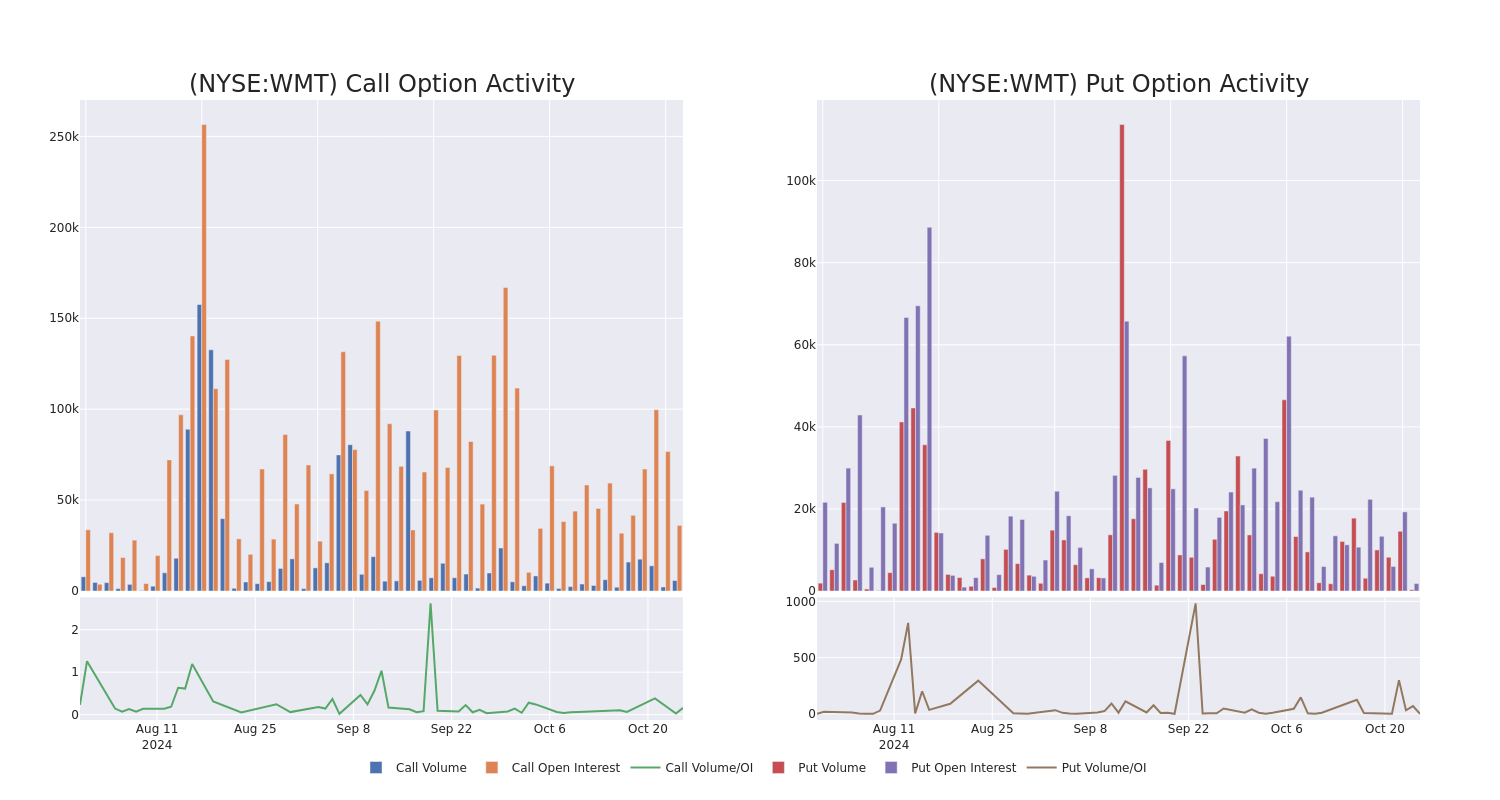

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Walmart options trades today is 4105.26 with a total volume of 10,356.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Walmart’s big money trades within a strike price range of $53.33 to $110.0 over the last 30 days.

Walmart 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BULLISH | 08/15/25 | $12.75 | $12.65 | $12.75 | $75.00 | $374.8K | 632 | 295 |

| WMT | CALL | TRADE | BEARISH | 01/16/26 | $1.92 | $1.83 | $1.85 | $110.00 | $370.0K | 368 | 3.9K |

| WMT | CALL | TRADE | BEARISH | 01/16/26 | $1.92 | $1.83 | $1.85 | $110.00 | $351.5K | 368 | 1.9K |

| WMT | PUT | SWEEP | BULLISH | 06/20/25 | $7.5 | $7.45 | $7.45 | $86.67 | $164.6K | 45 | 232 |

| WMT | PUT | SWEEP | BULLISH | 04/17/25 | $4.5 | $4.4 | $4.4 | $82.50 | $145.6K | 240 | 376 |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart’s Current Market Status

- With a volume of 7,967,824, the price of WMT is up 0.41% at $82.85.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 22 days.

Expert Opinions on Walmart

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $90.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein downgraded its action to Outperform with a price target of $95.

* An analyst from Baird has decided to maintain their Outperform rating on Walmart, which currently sits at a price target of $90.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Walmart, targeting a price of $90.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Walmart, targeting a price of $86.

* An analyst from UBS persists with their Buy rating on Walmart, maintaining a target price of $92.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walmart, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vera Therapeutics' Atacicept Shows Sustained, Substantial Improvement In Kidney Function For Patients At Almost Two Years

On Saturday, Vera Therapeutics Inc. VERA released data from its ORIGIN Phase 2b trial of atacicept in immunoglobulin A nephropathy (IgAN), which showed stabilized kidney function through 96 weeks of long-term follow-up.

These data were presented in a late-breaking oral presentation at the American Society of Nephrology Kidney Week 2024 and published in a manuscript in the Journal of the American Society of Nephrology.

Over 96 weeks, participants treated with atacicept demonstrated a -66% reduction in galactose-deficient IgA1 (Gd-IgA1), resolution of hematuria in 75% of participants, a -52% reduction in proteinuria, and a mean annualized estimated glomerular filtration rate (eGFR) slope of -0.6 mL/min/1.73m2/year.

The cumulative generally favorable safety profile of atacicept remained consistent with that observed during the randomized period, with a 90% completion rate of atacicept treatment.

The company says these data support the potential for atacicept to offer long-term, comprehensive IgAN disease modification and provide further confidence in the ongoing pivotal Phase 3 ORIGIN 3 trial of atacicept in IgAN.

The company plans to initiate an ORIGIN Extend study in the fourth quarter of 2024, which will provide ORIGIN participants with extended access to atacicept before its commercial availability.

The ORIGIN 3 trial is on track to announce topline results in the second quarter of 2025, with planned FDA marketing application submission later in the year.

Earlier this year, Vera Therapeutics revealed 72-week data from the open-label extension (OLE) period of its Phase 2b ORIGIN clinical trial of atacicept in participants with IgA nephropathy (IgAN).

Data from the OLE showed the consistent and sustained reductions of serum galactose-deficient IgA1 (Gd-lgA1), hematuria, and urine protein to creatinine ratio (UPCR), as well as the stability of eGFR over 72 weeks in participants with IgAN.

Price Action: VERA stock is up 12.2% at $46.12 at last check Monday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBDC Transaction Volume to Reach 7.8 Billion by 2031, Juniper Research Finds

HAMPSHIRE, United Kingdom, Oct. 28, 2024 (GLOBE NEWSWIRE) — A new study by Juniper Research, the foremost experts in fintech and payments markets, has forecast that, by 2031, the number of global payments made using CBDCs (Central Bank Digital Currencies) will reach 7.8 billion, up from 307.1 million in 2024.

This remarkable 2,430% growth will be driven by central banks seeking to safeguard monetary sovereignty in the face of card-network dominance and growing stablecoin popularity. Collaborative projects such as mBridge and Project Icebreaker, which seek to connect national CBDCs, will leave nations less reliant on established payment rails.

CBDCs are central bank issued digital versions of existing fiat currencies.

An extract from the new report, Global CBDCs and Stablecoins Market 2024-2031, is now available as a free download.

Demand for Simplified Cross-Border Payments Builds CBDC Momentum

The research forecast that, through the use of CBDCs and stablecoins, cross-border payments will save $45 billion by 2031. Remittance senders and global businesses are currently burdened by high fees and limited visibility. CBDCs and stablecoins streamline transfers by bypassing costly intermediaries, enabling direct transactions on decentralised or central bank-controlled networks.

Research author Lorien Carter commented: “Emerging payment technologies, like CBDCs and stablecoins, will streamline international payments. These innovative technologies will help grow the digital economy and increase global financial inclusion by reducing the reliance on the US dollar for international settlements.”

Prioritise Interoperability While Building CBDCs

To fully unlock cross-border growth, the study emphasises that interoperability between different CBDCs is essential. CBDC vendors must participate in projects pioneered by global organisations such as BIS, allowing them to test their infrastructure and contribute to the design of multilateral interoperability standards. Without this collaboration, the CBDC ecosystem risks fragmentation, resulting in ‘digital islands’ which fail to realise the efficiency of cross-border payments.

The Research Suite

The new market research suite offers the most comprehensive assessment of the CBDC and stablecoins market to date, providing analysis and forecasts of over 45,600 datapoints across 60 countries over eight years. It includes a ‘Competitor Leaderboard’ and examination of current and future market opportunities.

Juniper Research has, for two decades, provided market intelligence and advisory services to the global financial sector, and is retained by many of the world’s leading banks, intermediaries and providers.

Contact Sam Smith, Press Relations

T: +44(0)1256 830002

E: sam.smith@juniperresearch.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blow Moulding Machine Market to Reach US$ 3,604.0 Million by 2034, Growing at a 3.7% CAGR | Fact.MR Analysis

Rockville, MD , Oct. 28, 2024 (GLOBE NEWSWIRE) — The Global Blow Moulding Machine Market was valued at US$ 2,443.4 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 3.7% to end up at US$ 3,604.0 Million by 2034.

Automotive industry has been one of the major market for blow moulded solutions. Components such as fuel tanks, air ducts, fluid reservoirs, seating components, and HVAC components among others are all made using blow moulding machines. Blow moulds in car manufacturing allows for the creation of fuel tanks that are not only lighter but also more durable than those made with traditional methods. Use of blow moulds also ensure that the systems are more efficient to promote better fuel consumption and enhance the overall vehicle performance.

Additionally, blow moulding has become increasingly important in the medical industry, offering numerous advantages for producing a wide range of medical devices and packaging. With continuous growth in medical moulding solution market players are implementing these machines to enhance their manufacturing and expand their production capabilities. For instance, on May 2024, The MGS Mfg Group, a U.S. provider of customized manufacturing solutions to the plastics sector, is constructing an ISO Class 100,000 cleanroom at its moulding facility in Germantown, Wisconsin. The company’s manufacturing and services for the healthcare market will improve with the addition.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=1750

Key Takeaways from Market Study:

- The global blow moulding machine market is projected to grow at 7% CAGR and reach US$ 3,604.0 million by 2034

- The market created an absolute $ opportunity of US$ 1,097.9 million growing at a CAGR of 7% between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 8% in 2034

- Pharmaceutical & cosmetics under Industry are estimated to grow at a CAGR of 3% creating an absolute $ opportunity of US$ 104.8 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 532.2 million collectively

“Adoption of sustainable solutions such as recycle plastics for manufacturing will drive the market” says a Fact.MR analyst.

Leading Players Driving Innovation in the Blow Moulding Machine Market:

Akei Holdings Company Limited; Bekum; Chia Ming Machinery Co., Ltd.; China JWELL Intelligent Machinery Co.,Ltd; Jomar Corp.; Kautex Maschinenbau System GmbH; Krones AG; Meccanoplastica; PARKER PLASTIC MACHINERY CO., LTD; Simoparma Packaging Italia Srl (TECHNE); The Japan Steel Works, Ltd.; Wilmington Machinery; Other Prominent Players

Market Development:

Global blow moulding machine market key players are focusing on expansion activities, technological advancement, product innovations, strategic partnerships and collaborations, and regulatory compliances to acquire significant share in the industry.

For example, on August 2022, The U.S.-based company Trexel, which specializes in lightweighting solutions, has expanded the use of its royalty-free Trexel MuCell foaming solution and license to blow-molded components. Trexel has long been involved in blow moulding applications for automobiles in an effort to lower weight, enhance insulation, and lengthen battery life. In line with what it regards as “breakthrough innovations,” Trexel has expanded its offering to include a variety of packaging options.

Blow Moulding Machine Industry News:

- On January 2024, China-based Jwell Machinery acquired German-based blow moulding machine manufacturer Kautex Machinenbau. According to reports, Kautex will maintain to operate as an independent company under Jwell.

- On January 2024, Container Services, Inc. (“CSI”), a custom blow moulder recognized for its trademark honey bear bottle acquired Apex Plastics (“Apex”), a custom blow moulder primarily serving the beverage and domestic industries. With this acquisition, CSI also announced the formation of FirmaPak, a platform of like-minded customer-focused blow moulders.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=1750

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global blow moulding machine market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of the Machine Type (Extrusion Blow Moulding Machine, Injection Blow Moulding Machine, Injection-Stretch Blow Moulding Machine, Stretch Blow Moulding Machine (Linear and Rotary)), Raw Material (Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polypropylene (PP), Polybutylene Terephthalate (PBT), Polyvinyl Chloride (PVC), Polystyrene (PS), Nylon (PA), and Others), End Use Vertical (Automotive, Food & Beverages, Packaging & Containers, Electronics & Electrical, Pharmaceuticals & Cosmetics, Medical Devices, Consumer Goods, Sporting Goods, Chemicals & Lubricants, and Others), Distribution Channel (Direct Sales and Distributors), across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa).

Segmentation of Blow Moulding Machine Industry Research:

- By Machine Type :

- Extrusion Blow Moulding Machine

- Injection Blow Moulding Machine

- Injection-Stretch Blow Moulding Machine

- Stretch Blow Moulding Machine

- By Raw Material :

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Nylon (PA)

- Others

- By End Use Vertical :

- Automotive

- Food & Beverages

- Packaging & Containers

- Electronics & Electrical

- Pharmaceuticals & Cosmetics

- Medical Devices

- Consumer Goods

- Sporting Goods

- Chemicals & Lubricants

- Others

- By Distribution Channel :

Checkout More Related Studies Published by Fact.MR Research:

The global naval radar market size has reached US$ 12.5 billion in 2023 and is forecasted to end up at US$ 20 billion by 2033. Over the next ten years, Fact.MR’s research projects global demand for naval radars to rise at 4.8% CAGR.

The global industrial air preheater market is expected to reach a valuation of US$ 9,069.8 million in 2024 and is projected to climb to US$ 16,396.5 million by 2034, expanding at a CAGR of 6.1% during the forecast period of 2024 to 2034.

The global drone spraying services market is estimated to be around US$ 266.5 million in 2024. Drone spraying services sales are projected to increase at a CAGR of 24.7%, reaching over US$ 2,422.5 million by 2034.

The modular robot market is estimated to reach valuation of US$ 984.0 Million in 2023 and will top US$ 2,744.1 Million by 2033, growing with a CAGR of around 10.8% from 2023-2033.

The global mobile pallet trucks market is set to surpass a valuation of US$ 25 Billion in 2023 and further expand at a CAGR of 7.3% to reach US$ 50.7 Billion by the end of 2033.

The global portable inverter generator market was valued at US$ 3,404.1 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 9.4% to end up at US$ 8,959.8 Million by 2034. The portable inverter generator market accounts for around 19% in overall generator market.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decorative Film and Foil Market is Expected to Expand at a CAGR of 5.3%, Reaching US$ 32 Billion by 2034 | Fact.MR Report

Rockville, MD , Oct. 28, 2024 (GLOBE NEWSWIRE) — Not only in homes, film and foil is being increasingly used for vehicle aesthetics enhancements too. According to Fact.MR, a market research and competitive intelligence provider, the global Decorative Films and Foils Market is set to be worth US$ 19.1 billion in 2024 and has been forecasted to expand at a CAGR of 5.3% during the study period of (2024 to 2034).

In modern architecture, a commercial building’s floor is divided by partition walls. These walls are made up of glass as they are less expensive to install than standard walls. This trend of floor sharing is creating the demand for decorative films.

- The global window films market is expected to reach a size of US$ 24 billion by the end of 2034.

Companies are experimenting with various materials for decorative films and foils, including metallic options. A rising trend is car wrap films, which elevate a vehicle’s elegance and appearance by enveloping it in decorative film.

- For instance, Avery Dennison provides car wrap films with simplified and expedited installation, along with an extensive range of colors and finishes.

Utilization of decorative films on vehicles can reduce CO2 emissions by approximately 68% compared to conventional paint coatings. Given the aim for carbon neutrality, there is increasing focus on decorative films as an environmentally friendly coating technology.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9959

Key Takeaways from Market Study:

- The global decorative film and foil market is projected to expand at 5.3% CAGR and reach US$ 32 billion by 2034-end.

- The market created an absolute $ opportunity of US$ 4.4 billion from 2019 to 2023.

- North America is projected to hold a market share of 29.1% in 2034.

- Prominent market players include Eastman Chemical Company, 3M, LG Hausys Ltd., and Omnova Solutions Inc.

- The residential segment is forecasted to expand at a CAGR of 5.7% through 2034, creating an absolute $ opportunity of US$ 5.2 billion from 2024 to 2034.

- North America and East Asia are collectively projected to create an absolute $ opportunity of US$ 9.1 billion.

“Increasing focus on aesthetics in several domains is a key factor driving demand for decorative films and foils. Rising inclination toward energy-efficient construction practices is driving market growth,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Decorative Film and Foil Market:

Eastman Chemical Company | The 3M Company | LG Hausys, Ltd. | OMNOVA Solutions, Inc. | Ergis S.A. | Avery Dennison Corporation | Jindal Poly Films Ltd. | Klöckner Pentaplast Group | Folienwerk Wolfen GmbH | Mondoplastico S.p.A. | Other Prominent Players

Market Development:

Companies operating in the decorative film and foil market are adopting several strategies to navigate the competitive landscape. Companies are discovering ideas that can transform creative designs into eye-catching effective decorative film manufacturing.

Expanding distribution channels enables these companies to reach new markets and capitalize on emerging trends effectively. Companies are expanding their businesses by acquiring companies or investing more in manufacturing plants.

- For instance, Renolit expanded its business in North America by opening up a new product line. The decision was made to strengthen the company’s market position.

Decorative Film and Foil Industry News:

- Renolit opened their new production plant in North America on August 30, 2023. The choice was made to hold onto the company’s position in the market while growing its market share.

- In March 2023, Eastman Chemical Company launched a high-energy visible light filtering film for the transportation sector. In China, the product line was introduced.

- Surteco Group SE purchased Omnova’s laminates, performance films, and coated fabrics sector in February 2023. Omnova is a manufacturer of foils, laminates, and vinyl-coated fabrics. Through the planning of the company’s internationalisation, this action is expected to boost the company’s position in the market.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9959

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global decorative film and foil market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on material (polyvinyl chloride, polyester, polypropylene, vinyl), application (furniture, doors & windows, flooring, automotive interiors & exteriors), and end use (residential, commercial, institutional), across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa).

Segmentation of Decorative Film and Foil Market Research:

- By Material :

- Polyvinyl Chloride

- Polyester

- Polypropylene

- Vinyl

- By Application :

- Furniture

- Doors & Windows

- Flooring

- Automotive Interiors & Exteriors

- By End Use :

- Residential

- Commercial

- Institutional

Checkout More Related Studies Published by Fact.MR Research:

Film Formers Market: The global film formers market has reached US$ 1.6 billion in 2022 and is expected to progress at a steady CAGR of 4.9% to end up with a market valuation of US$ 2.5 billion by 2032.

EVOH Film for Packaging Market: Increasing focus of food manufacturers on keeping their products nutrition-rich and increasing their shelf life is all set to increase the demand for EVOH films for packaging. The global EVOH film for packaging market is calculated at US$ 5.52 billion in 2024 and has been forecasted to rise at a CAGR of 5.1% to reach US$ 9.03 billion by the end of 2034.

Window Films Market: The global market for window films reached a valuation of around US$ 11.5 Bn in 2021 and is slated to accelerate at a CAGR of 6% to top US$ 22 Bn by 2032. Demand for the sun-type segment is high and is set to increase at a CAGR of 5.5% across the assessment period of 2022 to 2032.

Agricultural Film Market: The global agricultural film market size is estimated to account for a value of US$ 11.78 billion in 2024 and is forecasted to reach US$ 21 billion by the end of 2034. Worldwide sales of agricultural films are predicted to increase at 5.9% CAGR over the next ten years.

Automotive Wrap Films Market: Expanding at a significant CAGR of 22.5%, the global automotive wrap films market is predicted to increase from US$ 7.11 billion in 2023 to US$ 54.1 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Front End Module Market Size is Projected to Reach US$ 205.1 Billion by 2032 at a CAGR of 5.07% | Fact.MR Report

Rockville, MD, Oct. 28, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, has published a new report, which reveals that during the forecast period of 2022-2032, the automotive front-end module market is scheduled to embark on a positive trajectory, recording a CAGR of 5.07% to secure US$ 205.1 Billion.

The electric vehicle demand is rising owing to the need for addressing future energy demands. The need to achieve a sustainable transportation method plays a vital role in increasing EV demand. The EV market is emerging as an important part of the automotive sector and acts as a significant catalyst toward achieving energy efficiency, along with lessened emissions of pollutants and other greenhouse gasses.

Growing environmental concerns, along with favorable government initiatives are some of the significant factors benefitting the market during the forecast period. Increasing energy costs and growing competition among energy-efficient technologies are likely to propel the market growth in the forthcoming time. Increasing demand for lightweight vehicles is expected to offer a conducive environment of growth during the forecast period.

Since lightweight auto parts lessen the overall weight of the vehicles and reduce CO2 emission and cost, the market will expand significantly in the forecast period.

In July 2020, an advanced integrated bolster produced with a ‘hybrid’ plastic-metal composite technology for the Ford Kuga SUV, is manufactured with steel panels and Durethan BKV30H2.)EF, fiberglass-reinforced nylon 6 from Lanxess, Pittsburgh, Penn. The fully assembled front-end module was developed and is offered by Germany’s Montaplast GmbH, a global system supplied by the automotive industry. However, increasing safety and technological constraints involved in lightweight fems, increasing vehicle parts modernization, and emerging competitors are projected to be the most significant factors that can hamper the market during the forecast period.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=29

Key Takeaways from the Market Study:

Key Takeaways from the Market Study:

- The global automotive front-end module market is expected to have held a value worth US$ 119 Billion in 2021.

- By the end of the forecast period, the front-end module market in Europe is expected to claim about 40% of the global revenue.

- The passenger segment of the automotive front-end module market is expected to display a CAGR of 6% during the forecast period.

- The automotive front-end module market in North America is expected to display a CAGR of 4.8% during the forecast period.

“Increasing demand for lightweight vehicles and growing demand for EVs are expected to benefit the global automotive front-end market during the forecast period,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Automotive Front End Module Market:

Key players in the global automotive front-end module market include Hyundai Mobis Co. Ltd., Faurecia S.A, MAHLE GmbH, Denso Corporation, HBPO GmbH, Murata Manufacturing Co. Ltd., Samvardhana Motherson Automotive Systems Group B.V, Montaplast GmbH, Compagnie Plastic Omnium S.A, Magna International Inc., Valeo S.A, and SL Corporation.

Automotive Front End Module Industry News:

- Hyundai Mobis declared in December 2020 that the board of directors had given its approval for the purchase of Hyundai Autron’s semiconductor division. Hyundai Mobis intends to use this endeavour to differentiate its integrated control technology in the future automotive industry by providing the capacity to design, develop, and verify semiconductors for automobiles.

- Through its subsidiary Samvardhana Motherson Reflectec, Motherson Group completed the purchase of a majority interest in Turkey’s Plast Met Group in May 2021. The deal was completed successfully, giving Motherson Group access to the sizeable Turkish auto industry.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=29

More Insights Available:

Fact.MR, in its new offering, presents an unbiased analysis of the global automotive front-end module market, presenting historical analysis from 2017 to 2021 and forecast statistics for the period of 2022-2032.

The study reveals essential insights on the basis of Vehicle Type (Passenger Cars, Light Commercial Vehicle, and Heavy Commercial vehicles), Raw Material (Metal, Composite, and Others), and Region (North America, Europe, and Rest of the World).

Check out More Related Studies Published by Fact.MR:

Automotive Battery Market: Expanding at a CAGR of 6.1%, the global automotive battery market is projected to increase from a valuation of US$ 52.71 billion in 2024 to US$ 95.29 billion by 2034.

Automotive Automatic Transmission Market: Worldwide revenue from the automotive automatic transmission market is estimated at US$ 76.11 billion in 2024 and has been forecasted to increase at 3.6% CAGR to climb to US$ 122.81 billion by the end of 2034.

Automotive Tire Market: The global automotive tire market is projected to increase from a value of US$ 403.53 billion in 2024 to US$ 626.67 billion by the end of 2034. Worldwide sales of automobile tires have been projected to rise at 3.6% CAGR from 2024 to 2034.

Automotive Fuel Filter Market: A recently revised research study released by Fact.MR places the global automotive fuel filter market size at a value of US$ 2.77 billion in 2024. Worldwide sales of automotive fuel filters are projected to increase to US$ 5.09 billion by the end of 2034, rising at 6.3% CAGR between 2024 and 2034.

Automotive Actuator Market: Revenue from the global automotive actuator market is estimated to reach US$ 22.45 billion in 2024. The market has been analyzed to climb to a value of US$ 42.53 billion by the end of 2034, expanding at a CAGR of 6.6% over the next ten years.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.