CHITA LIVING Celebrates Modern Luxury Nashville with Chic and Tasteful Furniture at Announcement Event on November 4, 2024

HOUSTON, Oct. 28, 2024 (GLOBE NEWSWIRE) — CHITA LIVING (“CHITA”), a furniture company offering stylish and comfortable pieces at an affordable price, is proud to participate as a sponsor of Modern Luxury Nashville’s Announcement Party on November 4, 2024, at Diamond Creek Farms.

Given Nashville’s renowned country music heritage, CHITA’s booth theme, “Take Me Home,” pays homage to this legacy and resonates with the beloved song, Take Me Home, Country Roads. This theme promises a celebration of elegance and comfort, embodying CHITA’s design philosophy. Attendees will have an exclusive opportunity to experience CHITA’s latest furniture pieces, all crafted to elevate any living space.

“We are thrilled to be part of Modern Luxury Nashville’s Announcement Party and to showcase our latest collections,” said Stefano Sette, CHITA LIVING’s Brand Ambassador. “Each piece, from the spacious Kenna Modular Sofa to the stylish Jolie Swivel Accent Chair, reflects our dedication to modern design that marries luxury with everyday livability. We believe that every home deserves beautiful, comfortable furniture that tells a story, and we can’t wait for guests to experience the warmth and elegance of CHITA LIVING.”

Furniture on display will include:

- Grace 2-Seat Modular Sofa: A newly released centerpiece that boasts a sleek silhouette and soft, inviting curves, perfect for both cozy gatherings and stylish entertaining.

- Kenna 4-Piece Modular Sofa: This spacious piece offers the ultimate comfort, featuring plush cushioning and a contemporary design that makes it a must-have for any modern home.

- Delaney 3-Piece Modular Sofa: A classic choice that combines timeless elegance with modern touches, the Delaney Sofa is designed for those who appreciate both style and durability.

- Ambre Swivel Accent Chair: A stylish addition to any living area, the Ambre chair offers a contemporary aesthetic with a comfortable seat, perfect for adding personality to your space.

- Jolie Swivel Accent Chair: With its playful swivel feature and chic design, this chair adds a touch of flair while providing the comfort needed for relaxed lounging.

- Sienna Braid Chair: This unique accent chair showcases a braided texture that brings an artisanal quality to any room, making it a statement piece for discerning homeowners.

- Josie Performance Boucle 4-Piece Modular Sofa: This versatile modular set combines stylish design with practicality, allowing for customizable configurations to suit any space.

- Teddi Modern Accent Chair: A striking accent chair that blends contemporary design with rich color, offering both comfort and style to elevate your living area.

For more information about CHITA LIVING, visit CHITALIVING.com.

About CHITA LIVING

Bringing two decades of design and manufacturing expertise, CHITA LIVING is a leading provider of stylish and affordable furniture, with pieces suitable for any budget. Offering a wide range of furniture including sofas, recliners, and dining chairs, CHITA LIVING uses premium materials to ensure durability and comfort. Their in-house designs ensure originality and unique appeal, resonating with modern homeowners, apartment renters and design enthusiasts. CHITA LIVING is a key player in the home decor market, dedicated to enhancing living spaces with functional and aesthetically pleasing furniture.

Contact Info

Email: press@chitaliving.com

Phone number: 1 (877) 389-4648

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Likely To Open In Green As Investors Eye 'Magnificent 7' Earnings This Week: Oil Prices Tumble, Expert Highlights Best 'Sell In May' Period Since 2009

U.S. stocks could get off to a positive start on Monday after the averages registered a mixed week. While the S&P 500 and Dow Jones snapped their six-week winning streak, the Nasdaq Composite chalked its seventh straight week of gains.

Earning news flow will continue to pick up momentum in the coming days, potentially cushioning any downside, with five of the “Magnificent 7” companies all set to post their earnings this week. This includes Apple Inc. AAPL, Microsoft Corp. MSFT, Alphabet Inc. GOOG GOOGL, Meta Platforms Inc. META, and Amazon.com Inc. AMZN.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.78% |

| S&P 500 | 0.62% |

| Dow Jones | 0.52% |

| R2K | 0.68% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY gained 0.64% to $582.72 and the Invesco QQQ ETF QQQ rose 0.77% to $499.11, according to Benzinga Pro data.

Cues From Last Week: Amid simmering tensions in the Middle East and Israel’s missile strikes in Iran, oil prices tumbled over the weekend.

Treasury yields rose during the week, signaling concerns that regardless of who wins the elections, the next administration might struggle with fiscal discipline. This sentiment was further exacerbated by the International Monetary Fund’s warnings on the long-term trajectory of the U.S. national debt.

On the economic data front, the University of Michigan consumer sentiment for the U.S. rose to 70.5 in October compared to a preliminary reading of 68.9.

Both the Dow Jones and S&P 500 ended a six-week winning streak, falling around 1% and 2.7%, respectively. The Nasdaq recorded gains for the seventh straight week, gaining nearly 0.2% last week.

| Index | Week’s Performance (+/-) | Value |

| Nasdaq Composite | 0.2% | 18,518.61 |

| S&P 500 | -1% | 5,808.12 |

| Dow Jones | -2.7% | 42,114.40 |

| Russell 2000 | 1.87% | 2,207.99 |

Insights From Analysts: Ryan Detrick, Chief Market Strategist at Carson Group, highlighted that this was the best “Sell in May” period since 2009.

“This is the best ‘sell in May’ period since 2009. Remember when they told us to sell because of valuations, yield curves, wars, inflation, Fed, elections, quad poor, GDI, LEIs, weak breadth, recessions, etc? I do,” he wrote.

“What happens next? Strength in these usually weak months is a clue the bull is alive and well.”

He added that the best six months of the year for equity markets are “right around the corner.”

However, despite mega-cap earnings scheduled for this week, rising treasury yields could potentially play spoilsport, according to Nathan Peterson, Director of Derivatives Analysis at the Schwab Center for Financial Research.

“If yields continue to move higher next week this could generate selling pressure, regardless of mega-cap tech earnings,” Peterson said.

He underscored that pre-election selling next week is a “possibility” and that there could be higher volatility in the markets.

See Also: How To Trade Futures

Upcoming Economic Data: Monday’s economic calendar is light, with only the Dallas Fed’s Manufacturing Business Index for October set to be released.

- On Monday, the Dallas Fed Manufacturing Business Index will be released at 10:30 a.m. ET.

- On Tuesday, retail (ex-auto) and wholesale inventory data will be released at 8:30 a.m. ET.

- House Price Index will be released at 9 a.m. ET.

- On Wednesday, Mortgage Market and Refinance indices will be released at 7 a.m. ET.

- The Bureau of Economic Analysis will release Q3 GDP numbers at 8:30 a.m. ET.

- The U.S. Department of Commerce will release the Q3 Real Consumer Spending data at 8:30 a.m. ET.

- Pending home sales data will be released at 10 a.m. ET.

- Crude oil inventories data will be released at 10:30 a.m. ET.

- On Thursday, pending jobless claims and the Core PCE price index will be announced at 8:30 a.m. ET.

- On Friday, payroll data will be released at 8:30 a.m. ET.

Stocks In Focus:

- Exxon Mobil Corp. XOM, and Occidental Petroleum Corp. OXY fell by over 2% in premarket trading due to falling crude oil prices.

- Delta Air Lines Inc. DAL rose over 2% after the company sued CrowdStrike Holdings Inc. CRWD for the July IT outage, saying it cost the company over $500 million.

- Taiwan Semiconductor Manufacturing Co. Ltd. TSM shares fell 1.7% after cofounder Morris Chang warned that the company faces challenges due to a growing threat to the free trade of chips amid geopolitical tensions.

- Investors are awaiting earnings results from ON Semiconductor Corporation ON, Waste Management, Inc. WM, and Ford Motor Company F today.

Commodities, Bonds And Global Equity Markets: Crude oil futures tumbled in the early New York session, falling by over nearly 6% due to Israel’s strikes on Iran.

The 10-year Treasury note yield surged to 4.254%.

Major Asian markets ended mixed on Monday, while European stocks showed tentativeness and were mostly lower in early trading.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nano Compounds Market is Projected to Reach USD 36 billion, Growing at a 10.1% CAGR by 2031: Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 28, 2024 (GLOBE NEWSWIRE) — The global nano compounds market (나노 화합물 시장) was projected to attain US$ 15.2 billion in 2022. It is anticipated to garner a 10.1% CAGR from 2023 to 2031 and by 2031, the market is likely to attain US$ 36 billion by 2031.

Nano compounds provide higher mechanical qualities, such as increased tensile strength as well as impact resistance, which contribute to vehicle safety and endurance. Nanoparticles and nanocomposites are used in the manufacture of displays, semiconductors, batteries, sensors, and other electronic components. The unique electrical, thermal, and optical characteristics of nano compounds make them essential for high performance and downsizing in electronic devices.

Nanomaterials enable the development of flexible and wearable electronics, expanding the possibilities for healthcare monitoring systems, consumer electronics, and smart fabrics. The growing need for innovative electronics is projected to provide attractive nano compounds market prospects in the coming years.

Nanomaterials are changing medical diagnostics, medication delivery, as well as tissue engineering, providing remarkable efficacy and precision in various healthcare applications.

Download Sample Copy of the Report:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85971

Global Nano Compounds Market: Key Players

Players in the nano compounds market are strategically partnering and heavily spending in thorough research and development initiatives in order to boost innovation and grow their business lines in both domestic and foreign markets. The following companies are well-known participants in the global nano compounds market:

- Makevale Acrylics Pvt. Ltd

- Ad-Nano Technologies

- Cabot Corporation

- Phosphorex

- Nanomakers

- TECNAN

- Nanocyl SA

- Nanophase Technologies Corporation

- Emfutur Technologies

- Nanoshel LLC

- Others

Key developments by the players in this market are:

- In February 2021, Nanomakers boosted their yearly nanoparticle production by five times, hitting 40 tons per manufacturing line. This growth satisfies the growing need for mass market quantities, especially in the semiconductor and electric car battery sectors.

- Birla Carbon acquired Nanocyl SA on October 11, 2023. Birla Carbon’s presence in the energy systems industry was expanded by the purchase, especially in materials that are essential to improving the performance of lithium-ion batteries and other conductive application areas.

- Birla Carbon now provides a wide range of solutions for different conductive applications with the addition of Nanocyl’s advanced multiwall carbon nanotubes (MWCNTs) to its portfolio, in addition to the Conductex family of conductive carbon black additives and active anode materials.

Key Findings of the Market Report

- The capacity of nanocomposites to improve the mechanical, electrical, thermal, and barrier qualities of host materials is one of the primary drivers behind their dominance in this global market.

- Nanocomposites can significantly enhance strength, stiffness, and toughness by spreading nanoparticles or nanofibers inside a polymer, metal, or ceramic matrix.

- This makes them ideal for applications that require lightweight yet durable materials, including as automobile components, aeronautical structures, and sporting products.

- Nanocomposites have high thermal stability, electrical conductivity, and resistance to corrosion and wear, making them excellent for application in electronics, energy storage devices, and protective coatings.

Market Trends for Nano Compounds

- Chemical vapor deposition (CVD) is the dominating manufacturing technology, providing exceptional accuracy, scalability, and variety in the synthesis of nanomaterials.

- CVD is the deposition of thin films or coatings onto surfaces via chemical processes in the vapor phase, resulting in nanostructures with controlled composition, shape, and characteristics.

- This technology is widely used in industries like electronics, energy, aerospace, and healthcare, resulting in its popularity in the global nano compounds market.

- The CVD process is scalable and cost-effective, making it ideal for large-scale synthesis of nanomaterials to fulfill commercial demands. CVD may be easily scaled up to generate nanomaterials in continuous or batch processes, depending on the unique application needs.

Request PDF Brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85971

Global Market for Nano Compounds: Regional Outlook

- The Asia-Pacific region is dominant. Rapid development, technological improvement, and increased demand from major sectors are all driving market dynamics in the region.

- Asia Pacific is positioned to dominate in the production, use, and acceptance of nano compounds across multiple industries, thanks to its huge and diversified manufacturing base and a rising emphasis on innovation and sustainability.

- A strong manufacturing sector, which includes automotive, electronics, aerospace, healthcare, and construction, is a major market driver.

- The region’s countries are home to prominent electronics manufacturers who produce a wide range of consumer goods, smartphones, tablets, and wearables.

- Nano compounds have an important role in allowing the downsizing, performance increase, and energy efficiency of electronic equipment, which drives their broad use across these regions.

Global Nano Compounds Market Segmentation

By Types

- Nanoparticles

- Nanocomposites

- Nanocrystals

By Production Methods

- Chemical Vapor Deposition

- Physical Vapor Deposition

- Sol-Gel Synthesis

- Mechanical Mining

- Others

By Application

- Electronics and Semiconductor Industry

- Healthcare and Pharmaceuticals

- Automotive and Aerospace

- Construction and Infrastructure

- Packaging

- Power Generation

- Paints & Coatings

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85971<ype=S

Explore More Trending Report by Transparency Market Research:

Addiction Treatment Market (依存症治療市場) Size is Expected to Boom at a CAGR of 6% by 2030 | Transparency Market Research

Melasma Drug Treatment Market (سوق علاج الكلف بالأدوية) Expected to Reach US$ 5.2 Billion by 2031, Driven by Strong 8.3% CAGR: TMR Study

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

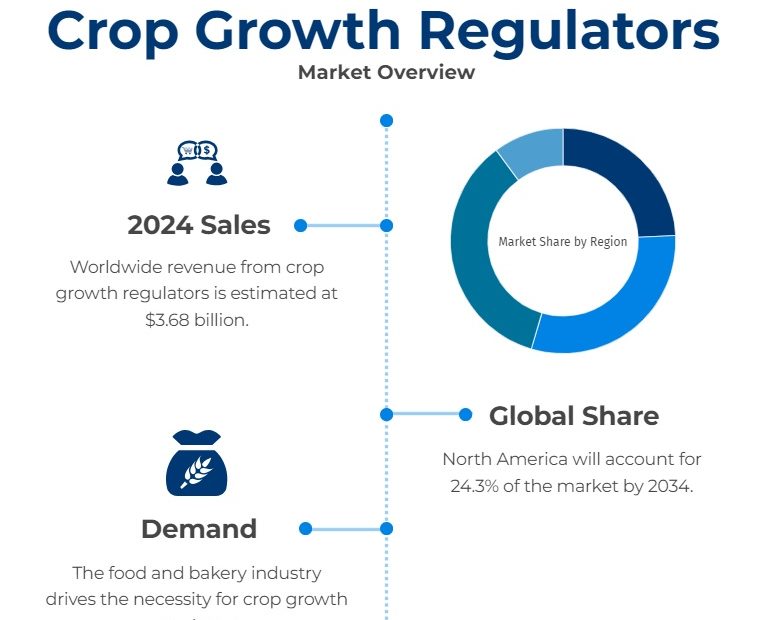

Crop growth regulators sales are estimated to rise at a 6.7% CAGR to reach US$ 7.07 billion by 2034 : Fact.MR Report

Rockville Pike, Oct. 28, 2024 (GLOBE NEWSWIRE) — As stated in the recently published report by Fact.MR, a market research and competitive intelligence provider, the global crop growth regulator market is projected to reach US$ 3.68 billion in 2024. The market is further forecasted to advance at a CAGR of 6.7% between 2024 and 2034.

Crop growth regulators (CGRs) are seeing a sharp increase in demand due to their wide range of uses and several advantages in contemporary agriculture. These man-made substances imitate or disrupt the plant hormones, giving growers unparalleled control over a range of plant growth and development processes. CGRs are becoming essential for farmers globally, helping with anything from controlling plant height and fruit ripening to increasing agricultural yields and stress tolerance. In an era of climate change and food security concerns, their capacity to maximize resource allocation within plants, boost overall crop quality, and prolong produce shelf life has made them particularly appealing.

Click to Request a Sample of this Report for Additional Market Insights

https://www.factmr.com/connectus/sample?flag=S&rep_id=10423

Due to their adaptability, CGRs are important components in agricultural methods as agriculture encounters more difficulties, such as erratic weather patterns and the requirement for sustainable intensification. The CGR market is rising to new heights because of the growing acknowledgment of their potential, which is driving higher use across various crop kinds and geographical areas.

Key Takeaways from the Crop growth regulators’ Market Study:

The global crop growth regulator market is forecasted to attain a valuation of US$ 7.07 billion by the end of 2034. The market in South Korea is analyzed to expand at a CAGR of 7.5% from 2024 to 2034.

The East Asia market is projected to reach US$ 1.63 billion by 2034-end. Mexico is analyzed to account for a market share of 19.9% in the North American region by 2034.

Based on the product type, cytokinin sales are projected to rise at a CAGR of 6.8% from 2024 to 2034. The North American market is forecasted to expand at a CAGR of 6.9% through 2034.

“Synchronized crop maturity and extended life of produce is stimulating the sales of crop growth regulators around the world,” says a Fact.MR analyst.

Some of the leading providers of crop growth regulator market are Dhanuka Agritech Ltd.; BASF SE; PBI-Gordon Companies, Inc.; Corteva Agriscience; Syngenta Group; Biotechnology Co., Ltd; Sikko India; FMC Corporation; Hangzhou Tianlong; Nufarm; De Sangosse; Sichuan Guoguang Agrochemical Co., Ltd; Bayer AG; Tata Chemicals Ltd.; Zagro; UPL; Sumitomo Chemical Co., Ltd.; Barclay Chemicals; Nippon Soda Co., Ltd.; Barclay Chemicals; Sipcam Oxon Spa; Aristo Biotech.

Crop Growth Regulator Industry News & Trends:

In August 2023, AMVAC, a global provider of agricultural technology solutions, expanded its line of products with the introduction of Mandolin, a growth regulator for plants specifically designed for citrus fruits.

A new plant growth regulator called Promalin® was unveiled in Shimla, Himachal Pradesh, in March 2023 by Sumitomo Chemical India Ltd., a subsidiary of Sumitomo Chemicals. The product comes in 500 ml and one-liter pack sizes and is available in the North Indian states of Jammu & Kashmir and Himachal Pradesh.

June 2022: The agricultural company Valent Canada Inc. extended its partnership with Nufarm Agriculture Inc. of Australia to expand its distribution network across Canada.

Get a Custom Analysis for Targeted Research Solutions

https://www.factmr.com/connectus/sample?flag=RC&rep_id=10423

Development in Nanotechnology Helping Escalating Demand for Crop Growth Regulators

Thanks to developments in nanotechnology, CGR efficiency has increased and the environmental effect has decreased with the creation of nano-formulations. Because of their enhanced absorption and tailored administration, these formulations enable lower application rates without sacrificing effectiveness.

As bio-based CGRs produced from natural sources are introduced, biotechnology is playing an increasingly important role. These environment-friendly substitutes allay worries about synthetic chemical use and appeal to the expanding organic farming industry.

Smart CGR application methods combined with precision agricultural technology allow for site-specific treatments that maximize crop response and resource efficiency. Farm operations are also becoming more efficient with the introduction of multifunctional CGRs that combine growth regulation with pest management or nutrient absorption augmentation.

By solving environmental and regulatory issues and enhancing crop yields and quality, these developments are establishing CGRs as essential instruments in contemporary, sustainable agriculture.

More Valuable Insights on Offer

Fact.MR presents an unbiased analysis of the crop growth regulator market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (cytokinins, auxin, gibberellins, ethylene, others), formulation type (wettable powders, solutions), crop type (fruits & vegetables, cereals & grains, oilseeds & pulses, turf & ornamental), and function (promoters, inhibitors), cross seaven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Discover Additional Market Insights from Fact.MR Research:

Insect Growth Regulators Market Analysis by Anti-juvenile, Chitin Synthesis, Juvenile Hormone Analogs, and Mimics in Liquid, Aerosol, and Bait Forms from 2023 to 2033

Pre-Packaged Food Market Study by Ready Meals, Milk-based, and Canned Tuna in Liquid State, Frozen State, Solid State, and Fresh State from 2022 to 2032

The valuation of the global food retail market is estimated at US$ 12,588.8 billion in 2024 and has been evaluated to rise at a CAGR of 5.5% to reach US$ 21,503.5 billion by the end of 2034.

The competitive landscape of the indoor farming market is strong and diverse, with established firms and creative start-ups contending for prominence in this developing sector.

Foodservice packaging market growth in China can be attributed to several key factors. As urbanization continues to shape lifestyles, there is a noticeable increase in the need for convenient and portable packaging solutions, catering to on-the-go preferences.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Follow Us: LinkedIn | Twitter | Blog

US Sales Office: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cool Roof Coatings Market Projected to Reach USD 780.9 million with a CAGR of 6.8%: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 28, 2024 (GLOBE NEWSWIRE) — The forecasted advancement of the global cool roof coating market (시원한 지붕 코팅 시장) with a moderate CAGR of 6.8% shall take the market to a US $ 780.9 million valuation. The last recorded market valuation for the subject market was about US $ 402.8 million in 2021. This market growth is influenced by various governing forces that help the market to grow.

To develop green buildings, governments of different countries have implemented various laws. These laws aim to reduce energy costs by 40%. Such efforts fuel the growth of the subject market. The main reason behind this is the scope for cool roofing in the modern world. Governments have been encouraging cool roofs, which propels the market advancement.

Global warming has been increasing worldwide. Due to this, energy-saving buildings have come into demand. It is one of the lucrative market segments that creates substantial opportunities for the subject market to grow by reducing energy consumption. This makes another market driver for the market under consideration.

The construction industry has been growing significantly in the last few years. This growth agitates other sectors that are related to the construction industry. This collaborative growth of industries proves to be a fueling factor for the market under consideration.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=47445

Key Findings from the Market Report

- The global cool roof coating market can be segmented into various market segments, out of which low-sloped roofs are one of the key segments. The lower installation cost of these roofs shall help the market segment to get propelled.

- From the perspective of the coating on roofs, the elastomeric coating has gained substantial demand. The main reason is the longevity of coatings. Also, they can withstand adverse environmental conditions.

- The reflective roof market segment is gaining popularity, as it reflects infrared radiations to reduce roof heating.

- Based on the application of roofs, the commercial segment is one of the key market segments that help the market grow, as more cool roofs are used in the said segment.

Regional Profile

- The total number of retrofitting projects in North America has been increasing recently. Due to this, the continent has become the market leader by securing about 66.4% of the full market share of the global cool roof coatings market.

- Europe is another reason that has been contributing to the subject market. This region holds about 21.3% of the global market share. Due to the advancement of technological infrastructure in the area, it contributes significantly to the growth of the market.

- Asia Pacific is also one of the important regions, securing 10.8% of the global market share. It helps the market to grow within the global landscape.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=47445

Key Developments in the Cool Roof Coatings Market

- In September 2021, BASF SE purchased Vattenfall’s offshore wind farm, Hollandse Kust Zuid. This helped the organization to initiate construction projects in the Northern Sea.

- In January 2022, Berkeley Lab introduced roofs that can auto-adjust based on the weather and the outside temperature. This innovation shall help the subject market to expand into new horizons.

- In April 2022, Akzo Nobel N.V. acquired Grupo Orbis. This strategic move allowed the organization to create its presence in Latin America. Also, it has helped the business to diversify its existing product portfolio.

Competitive Landscape

In the case of competition within the industry, the global cool roof coatings market provides a highly cluttered competitive landscape. Various key players have been contributing to the industry via their differentiated products.

- Akzo Nobel N.V. is a competitor known for its different abrasion resistance coatings, epoxy primers, composite coatings, etc.

- PPG Industries Inc. operates in various markets. It produces multiple protective coatings. Apart from this, it has added SEM products to its product portfolio.

- BASF SE operates in diversified markets, including automotive, agriculture, energy, construction, etc. It also offers different resins and textiles.

Key Players

- BASF SE

- DowDuPont

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Huntsman International LLC

- Sika AG

- GAF Materials Corporation

- NIPPON PAINT (M) SDN. BHD

- The Valspar Corporation

- Nutech Paint

Market Segmentation

Type

Roof Slope

Application

- Residential

- Commercial

- Industrial

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=47445<ype=S

Have a Look at More Valuable Insights of Chemicals and Materials

Metal Powder Market (金属粉末市場): Metal powder market worth US$ 7.8 billion in 2021. A CAGR of 4.4% is expected between 2022 and 2031. In 2031, the global market for metal powder is expected to reach US$ 12.1 billion. The metal powder market is expected to benefit from rapid advances in additive manufacturing technologies, such as 3D printing.

Xanthan Gum Market (سوق صمغ الزانثان): The global xanthan gum market was estimated at a value of US$ 1 billion in 2021. It is anticipated to register a 5.9% CAGR from 2022 to 2031 and by 2031, the market is likely to attain US$ 1.9 billion by 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Australia and New Zealand Dental Aligners Market Projected to Expand at a CAGR of 13.7%, Elevating to a Valuation of USD 581.0 Million by 2031 | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 28, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, Australia and New Zealand dental aligners market size was worth US$ 190.8 Mn in 2022 and is expected to reach US$ 581.0 Mn by the year 2031 at a CAGR of 13.7 % between 2023 and 2031.

Dental aligners refer to orthodontic devices designed to straighten and correct the alignment of teeth in a less invasive and more aesthetic manner as compared to traditional metal braces. Dental aligners, particularly clear aligners, are transparent, removable trays made from medical-grade plastic that gradually shift teeth into the desired position. These aligners have gained popularity due to their discreet appearance, comfort, and convenience, making them a preferred choice for both – teenagers and adults seeking orthodontic treatment.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/australia-and-new-zealand-dental-aligners-market.html

Prominent Players Operating in Australia and New Zealand Dental Aligners Market

Ormco (part of Envista Holdings Corporation), 3M, Dentsply Sirona, Align Technology, Angelalign Technology, Inc., Institut Straumann AG, SmilePath Australia Pty Ltd., SmartSmileCo and EZ SMILE Pty Ltd. are some of the leading players operating in the industry.

Australia and New Zealand Dental Aligners Market Overview

The dental aligners market is growing rapidly, driven by multiple key factors. One of the primary drivers is the increasing demand for aesthetic dentistry. Today’s consumers are more conscious of their appearance, and the demand for orthodontic solutions that offer a discreet way to straighten teeth is rising. Clear aligners, in particular, provide a nearly invisible alternative to traditional braces, making them appealing to adults and teens alike. Social media and influencer marketing have also played a significant role in increasing awareness about dental aesthetics, further boosting demand for clear aligners.

Another significant growth factor is advancements in technology. The development of digital scanning and 3D printing technologies has revolutionized the dental aligners market. These innovations allow for highly personalized treatment plans and precise aligners that deliver better outcomes in shorter time frames.

Additionally, the incorporation of artificial intelligence (AI) and machine learning into treatment planning has streamlined the process, reducing both – the cost and duration of orthodontic care. These technological advancements have made aligners more accessible and attractive to a broader range of consumers.

The growing awareness of dental health and wellness is also a key factor boosting the market. As more people recognize the importance of oral health, there is an increasing interest in correcting dental issues such as misalignment, crowding, and gaps. Clear aligners offer a comfortable, non-invasive way to achieve dental corrections, which has led to rising adoption rates. Furthermore, the ease of maintaining dental hygiene with removable aligners as compared to traditional braces has made them a preferred choice for many.

Direct-to-consumer (DTC) models have also contributed to the market’s expansion. Companies offering aligners through online platforms, such as SmileDirectClub and Byte, have made orthodontic care more affordable and convenient. These platforms allow patients to receive clear aligners without regular visits to an orthodontist, reducing costs and time commitments. This model has been particularly popular with cost-conscious consumers and those seeking a more flexible solution.

Lastly, the increase in disposable income and healthcare expenditure across various regions has enabled more people to invest in advanced dental treatments. As consumers have greater financial capacity to spend on aesthetic and health-related services, dental aligners are becoming more mainstream. This trend is especially noticeable in emerging markets, where economic growth is fueling the expansion of the dental aligners market.

In summary, the dental aligners market is experiencing strong growth due to rising consumers’ demand for aesthetic solutions, technological advancements, heightened awareness of oral health, the convenience of direct-to-consumer models, and increasing disposable income. These factors are expected to drive continued expansion in the coming years.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85744

Australia and New Zealand Dental Aligners Market Regional Insights

• North America dominated the market share in 2022

The dental aligners market in Australia and New Zealand is witnessing significant growth, driven by various factors that reflect changing consumer preferences and advancements in dental technology. One of the primary drivers is the rising demand for aesthetic and non-invasive dental treatments. Consumers in both the countries are increasingly seeking orthodontic solutions that are less visible and more comfortable than traditional braces. Clear aligners provide a discreet and convenient way to straighten teeth, appealing to both – teenagers and adults who prioritize appearance and ease of use. This shift toward aesthetic dentistry is further supported by a growing focus on personal appearance, fueled by social media and influencer-driven trends.

Technological advancements in digital dentistry and 3D printing have also played a crucial role in boosting the dental aligners market in the region. The introduction of digital scanners and 3D imaging technology allows dental practitioners to create highly accurate and customized aligners that fit individual patient needs. This has significantly improved the effectiveness of aligner treatments, resulting in better patient outcomes and shorter treatment times.

Moreover, AI-powered treatment planning has enhanced the precision and efficiency of aligner therapy, making it more accessible to a wider range of patients in both Australia and New Zealand.

Australia and New Zealand Dental Aligners Market Segmentation

- Product

- Age Group

- Material

- Metal

- Polyurethane Plastic

- Polyethylene Terephthalate Glycol

- Acrylic Resin

- Others (PVC)

- End-user

- General Dentists

- Orthodontists

- Homecare

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85744<ype=S

More Trending Report by Transparency Market Research:

- Pediatric Medical Devices Market on Track to Reach USD 47.4 Billion by 2031: Driven by Advancements in Medical Devices and Digital Solutions at 6.3% CAGR: Analysis by TMR

- Kidney Transplant Market to Grow at a 3.3% CAGR from 2024 to 2034, Fueled by Healthcare Spending and Renal Calculi Retrieval Devices Landscape | TMR

- mHealth Services Market – The global mHealth Services Market is projected to expand at a CAGR of 15.7% during the forecast period from 2023 to 2031.

- Wearable Heart Monitoring Devices Market Size to Hit US$ 5.8 Billion, Globally, by 2031, Expanding at a CAGR of 12.5% Says, Transparency Market Research

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Taiwan Semiconductor Manufacturing Stock Stumbled Monday Morning

Shares of Taiwan Semiconductor Manufacturing Company (NYSE: TSM), commonly called TSMC, tumbled Monday morning, falling as much as 4%. As of 11:02 a.m. ET, the stock was still down 3.9%.

Events that transpired this weekend and comments made by the semiconductor specialist’s founder put some investors on edge.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

At a company event this weekend, founder Morris Chang addressed the ongoing crackdown by U.S. regulators limiting the sale of the most advanced chips used for artificial intelligence (AI) to companies in China. He said that the company would face its “most severe” challenges yet in achieving growth, according to a report by Bloomberg.

“Free trade of semiconductors, particularly the most advanced semiconductors, has died,” Chang said. “In such an environment, our challenge lies in how to continue to drive growth.” He went on to say, “TSMC is now truly a turf all major powers want to secure.”

U.S. officials and allies fear that the most advanced AI technology could end up being used by China’s military, something the administration is seeking to prevent. TSMC reportedly suspended shipments to Chinese chip company Sophgo after some of its advanced processors were found in products made by Chinese telecommunications company Huawei, according to a report by Reuters.

While comments of that magnitude might give investors pause, they should be taken in the context of other remarks made by TSMC officials. CEO C.C. Wei was more upbeat, noting that the company’s semiconductor facility being built in Arizona is “progressing well.” He remains confident in TSMC’s ability to increase its technological advantages and global leadership in the industry.

Despite curbs that have been in place since last year, TSMC has continued to generate impressive growth. During the third quarter, revenue of $23.5 billion jumped 36% year over year, while earnings per share increased 54%.

Management expects the company’s growth spurt to continue. TSMC is guiding for revenue of $26.5 billion, which would represent year-over-year growth of 35%.

Despite any potential challenges down the road, TSMC produces an estimated 90% of the world’s most advanced processors. This puts the company in the pole position for AI-fueled growth. At just 27 times next year’s growth, TSMC is attractively priced.

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

Experts Push Back On Goldman Sachs' Forecast For Low Returns

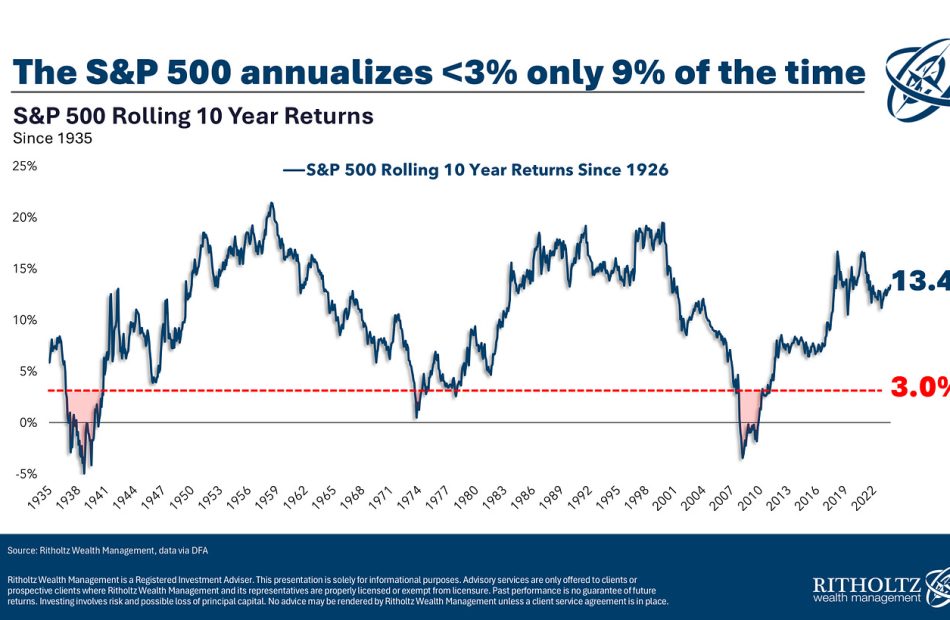

Goldman Sachs’ prediction that the S&P 500 will deliver 3% annualized nominal total returns over the next 10 years has gotten a lot of attention. (Read TKer’s view here and here.)

I think Ben Carlson of Ritholtz Wealth Management said it best: “It’s rare to see such low returns over a 10 year stretch but it can happen. Roughly 9% of all rolling 10 year annual returns have been 3% or less… So it’s improbable but possible.”

Sub 3% returns are unusual but not unprecedented. (Source: Ben Carlson)

Investors would probably love to hear a more decisive view. But predicting long-term returns is hard, and these kinds of imprecise assessments are the best we can do as we manage our expectations.

That said, last week came with a lot of Wall Streeters pushing back on Goldman’s forecast.

JPMorgan Asset Management (JPMAM) expects large-cap U.S. stocks to “return an annualized 6.7% over the next 10-15 years,” Bloomberg reports.

“I feel more confident in our numbers than theirs over the next decade,” JPMAM’s David Kelly said. “But overall, we think that American corporations are extreme — they’ve got sharp elbows and they are very good at growing margins.“

Expectations for improving productivity, strong profit margins, and healthy earnings growth have been hot topics lately. They’re trends that Ed Yardeni of Yardeni Research also expects to drive stock prices higher for years to come.

“In our opinion, even Goldman’s optimistic scenario might not be optimistic enough,” Yardeni wrote. “If the productivity growth boom continues through the end of the decade and into the 2030s, as we expect, the S&P 500’s average annual return should at least match the 6%-7% achieved since the early 1990s. It should be more like 11% including reinvested dividends.”

Profit margins are high, and they’re expected to stay high. (Source: Yardeni Research)

“In our view, a looming lost decade for U.S. stocks is unlikely if earnings and dividends continue to grow at solid paces boosted by higher profit margins thanks to better technology-led productivity growth,” Yardeni said.

Datatrek Research co-founder Nicholas Colas is encouraged by where the stock market stands today and where it could be headed.

“The S&P 500 starts its next decade stacked with world class, profitable companies and there are more in the pipeline,” Colas wrote on Monday. “Valuations reflect that, but they cannot know what the future will bring.“

He believes “the next decade will see S&P returns at least as strong as the long run average of 10.6%, and possibly better.“

Could Something ‘Very, Very Bad’ Occur?

Colas noted that historical cases of <3% returns “always have very specific catalysts which explain those subpar returns.“ The Great Depression, the oil shock of the 1970s and its after effects, and the Global Financial Crisis were all associated with these low 10-year returns.

“History shows that 3% returns or worse only come when something very, very bad has occurred,” Colas said. “While we are relying on press accounts of Goldman’s research, we have read nothing that outlines what crisis their researchers are envisioning. Without one, it is very difficult to square their conclusion with almost a century of historical data.“

Because of the way Wall Street research is distributed and controlled, not everyone is able to access every report, including experts who may be asked to respond to them.*

Goldman shared the report with TKer. Regarding the issue Colas flagged, Goldman does discuss those catalysts but actually highlights them as periods when their forecasting model failed.

That said, very bad things have happened in the past, and they could happen again in the future. And those events could cause stock market returns to be poor.

“Forecasting one form of economic disaster or another over the next 10 years is not much of a reach; you will be hard-pressed to think of any decade where some economic calamity or another didn’t befall the global economy,” Barry Ritholtz of Ritholtz Wealth Management wrote. “But that’s a very different discussion than 3% annually for 10 years.”

This leads me to my conclusion: It is very difficult to predict with any accuracy what will happen in the next 10 years. Goldman makes a point of this in their report. There are good cases to be made for weak returns as well as strong returns as argued by Yardeni and Colas.

Who will be right? We’ll only know in hindsight.

Generally speaking, I’m of the mind that the stock market usually goes up because we have a capitalist system that’s great at generating earnings growth, and earnings are the most important long-term driver of stock prices. And history shows there’s never been a challenge the economy and stock market couldn’t overcome. After all, the long game is undefeated.

“I have no idea what the next decade will bring in terms of S&P 500 returns, but neither does anyone else,” Ritholtz said. “I do believe that the economic gains we are going to see in technology justify higher market prices. I just don’t know how much higher; my sneaking suspicion is one percent real returns over the next 10 years is way too conservative.”

A version of this post was originally published on Tker.co.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.