These Analysts Boost Their Forecasts On Keysight Technologies Following Better-Than-Expected Earnings

Keysight Technologies, Inc. KEYS reported better-than-expected fourth-quarter financial results.

Keysight Techs reported quarterly earnings of $1.65 per share which beat the analyst consensus estimate of $1.57. The company reported quarterly sales of $1.287 billion which beat the analyst consensus estimate of $1.258 billion.

“Keysight executed well and delivered fourth-quarter revenue and earnings per share above the high end of guidance under market conditions which remained consistent with our expectations,” said Satish Dhanasekaran, president and CEO of Keysight. “As we look ahead, the strength of our differentiated portfolio, deep engagement with customers and the accelerating pace of technology innovation give us confidence in our ability to outperform as markets recover.”

Keysight expects first-quarter revenue to be in the range of $1.265 billion to $1.285 billion. The company expects first-quarter adjusted earnings to be between $1.65 and $1.71 per share

Keysight shares gained 0.5% to close at $152.13 on Tuesday.

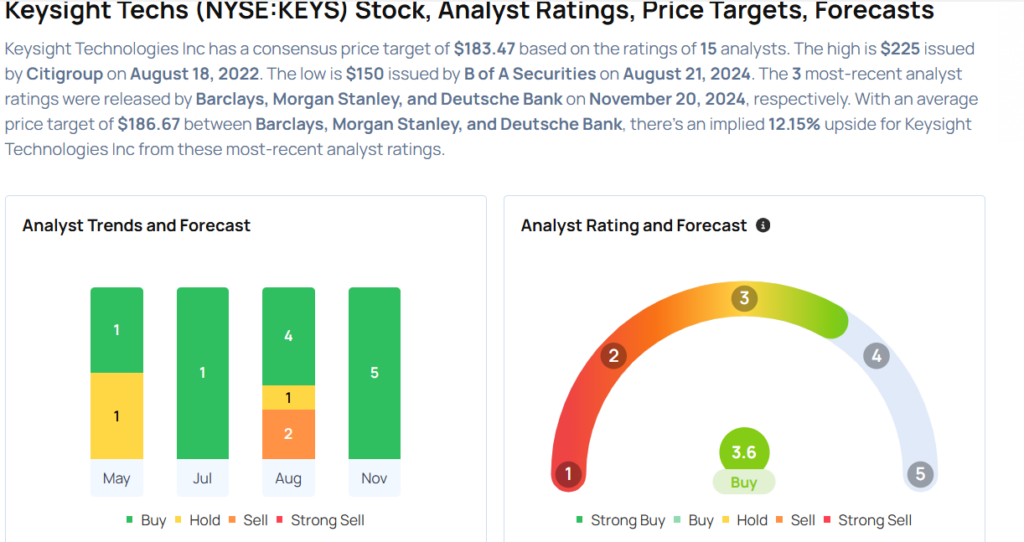

These analysts made changes to their price targets on Keysight following earnings announcement.

- Baird analyst Richard Eastman maintained Keysight with an Outperform and raised the price target from $163 to $180.

- Deutsche Bank analyst Matthew Niknam maintained the stock with a Buy and raised the price target from $175 to $180.

- Morgan Stanley analyst Meta Marshall maintained Keysight with an Overweight and raised the price target from $165 to $180.

- Barclays analyst Tim Long maintained Keysight with an Overweight and raised the price target from $180 to $200.

Considering buying KEYS stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir's Stock Just Did Something It Hasn't Done Since 2021

Palantir (NYSE: PLTR) has been one of the hottest artificial intelligence (AI) stocks to own this year. It’s up around 280% as of the time of this writing and has far exceeded many investors’ expectations.

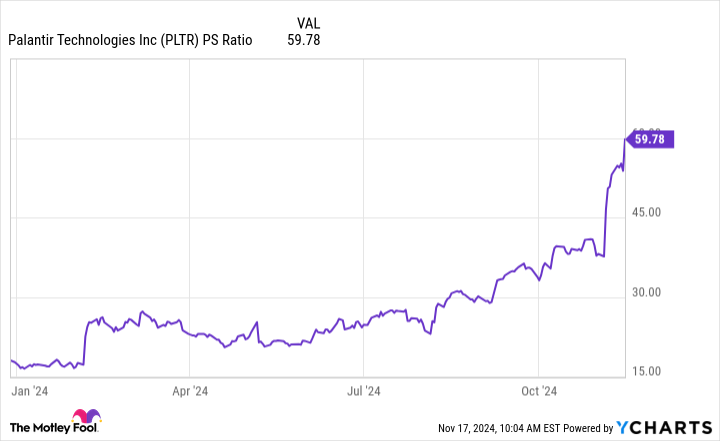

However, this run-up hasn’t entirely come from its business booming, as the price investors are willing to pay for its performance has surged alongside its stock price. This has caused the stock to do something it hasn’t done since 2021, and investors need to pay attention to it.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Palantir’s AI software has become a massive hit, as the company has years of expertise in this space that its competition doesn’t have. Palantir’s platform started off tailored for government use, allowing the software to take in massive amounts of information, process it quickly, and then give insights as to which actions to take next.

This general concept is also useful for commercial businesses, so Palantir eventually expanded to this side. As of the third quarter, the government business is still larger than the commercial side, but it’s starting to become a fairly even split, with government revenue making up 56% of the total.

The latest surge in AI demand has massively benefited Palantir, as more clients are looking for ways to integrate AI into their daily operations. This has a twofold effect for its customers. First, Palantir can automate some of the repetitive tasks that an employee may manually do. Second, the employees making decisions based on this information can be better informed because it gets to them in real-time.

All of this has caused Palantir’s product revenue to soar, rising 30% year over year to $726 million. The U.S., in particular, is seeing more demand than the international side. U.S. commercial revenue rose 54% year over year to $179 million, and U.S. government revenue rose 40% year over year to $320 million.

International sales are a big deal for Palantir, as they make up about a third of sales. While this part of the business isn’t necessarily “weak,” it just hasn’t seen the AI race that the U.S. has. Once the international client base starts to get the same AI fever as the U.S., Palantir’s growth could accelerate even more.

You may be tempted to place a significant bet on Palantir’s stock with just that information. However, what Palantir has recently done for the first time since 2021 isn’t good, and it could end in disaster for Palantir investors.

BellRing Brands Analysts Increase Their Forecasts After Upbeat Earnings

BellRing Brands BRBR reported better-than-expected earnings for its fourth quarter, after the closing bell on Monday.

The company posted quarterly earnings of 51 cents per share, which beat the analyst consensus estimate of 50 cents per share. The company reported quarterly sales of $555.80 million which beat the analyst consensus estimate of $536.13 million.

“We finished the year strong, with our results coming in at the high end of our expectations. Premier Protein consumption accelerated, lifted by better in stocks and meaningful distribution gains. Additionally, Premier Protein achieved all time highs this quarter for household penetration and total distribution points, and saw strong market share gains in both shakes and powders,” said Darcy H. Davenport, President and Chief Executive Officer of BellRing. “Our momentum remains high as we enter 2025. The convenient nutrition category continues to provide strong tailwinds, with ready-to-drink shakes and powders in the early stages of growth. We have leading mainstream brands that deeply resonate with consumers, giving us confidence in the long-term prospects for our company.”

BellRing Brands said it sees FY25 net sales of $2.24 billion to $2.32 billion and adjusted EBITDA of $460 million to $490 million.

BellRing Brands shares fell 0.2% to close at $73.26 on Tuesday.

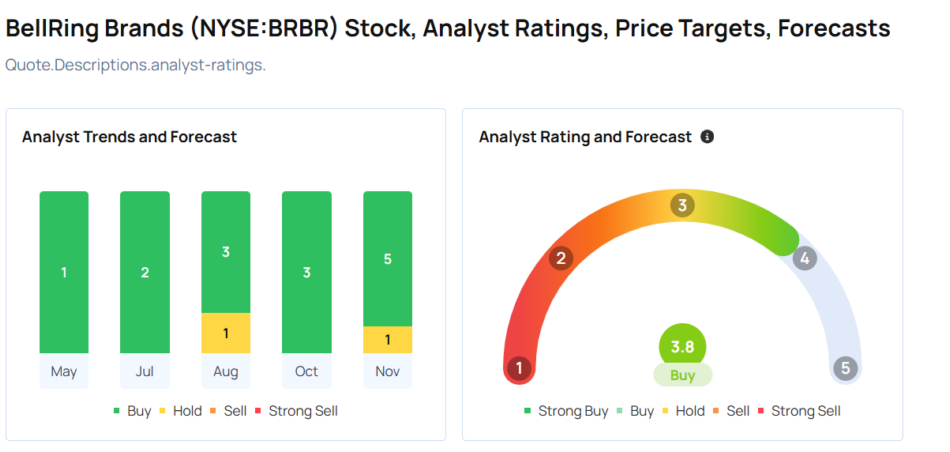

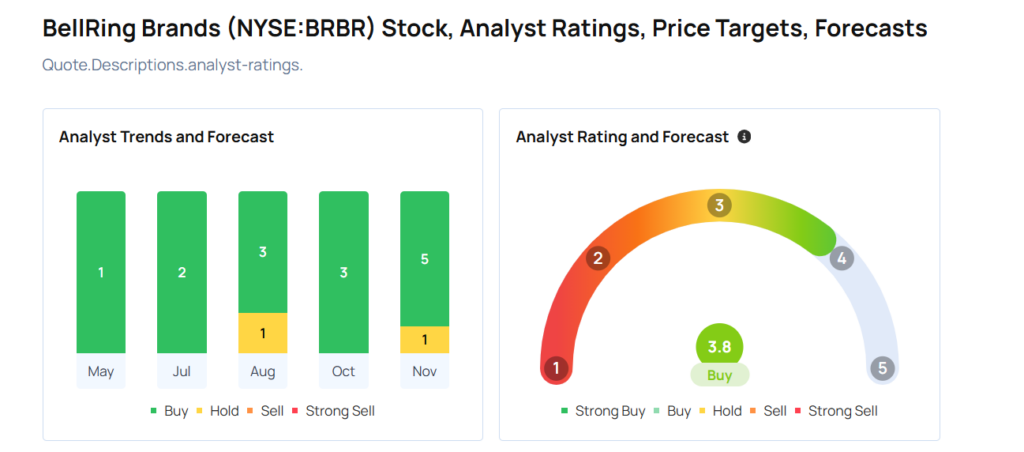

These analysts made changes to their price targets on BellRing Brands following earnings announcement.

- B of A Securities analyst Bryan Spillane maintained BellRing Brands with a Buy and raised the price target from $75 to $82.

- Deutsche Bank analyst Steve Powers maintained BellRing Brands with a Buy and raised the price target from $73 to $77.

- Stifel analyst Matthew Smith maintained the stock with a Buy and raised the price target from $67 to $81.

- Considering buying BRBR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gordon Johnson Slams Federal Reserve For Asset-Owner Centric Policies, Says Jerome Powell Needs To Focus On 'Real Economy': '…The Stock Market Will Be Fine'

After the U.S. headline and core consumer price inflation rose in October, and the Federal Reserve Chairman suggested that a December rate cut may not be necessary, treasury yields have risen, and inflation concerns have gripped the economy once again.

Gordon Johnson, chief executive officer and founder at GLJ Research in a conversation with Wealthion slammed the Federal Reserve for making policies that benefit the stock market and asset owners in general.

Also read: October Inflation Rate Rises To 2.6% As Expected: December Interest Rate Cut Remains Uncertain

What Happened: Johnson said that the Fed’s $3 trillion in monetary stimulus in late 2021 after the one which was already announced in 2020, was “reckless” and it wasn’t “data dependent.” According to him, this was the Fed’s first step into taking a measure that “was going to result in an excessive inflation.”

He added that recklessness seen from the U.S. government and Congress on the fiscal front “is the byproduct of Fed allowing this.”

“Fed is the only entity that can legally create U.S. dollars, so if the Fed stopped printing and buying the Treasuries, which they are still doing, despite telling the public that they are doing quantitative tightening. The Congress won’t be able to spend so recklessly.”

Why It Matters: Johnson believes that there is constant intervention by the United States Secretary of the Treasury, Janet Yellen along with Federal Reserve’s Chairman, Jerome Powell, whenever there is a spike in the yield.

“In early 2024, the Fed cut its pace of quantitative tightening by $30 billion a month, which is just the amount they were letting roll off. And recently, Janet Yellen announced that she is going to buy $4 billion in U.S. Treasury bonds per week. There is just constant intervention by these entities whenever the yields start to spike. It’s them trying to disallow any disfunction or rather I would argue functioning in the Treasury markets.”

Johnson is of the opinion that if Yellen and Powell do not constantly intervene in the Treasury markets and let the market function on their own, some of this excess spending by the government would not be allowed.

“Without putting any breaks in this out of control train, I am afraid that we are going to get a reacceleration in the rate on inflation if the Fed doesn’t cool quantitative easing,” he added.

What’s The Solution: Johnson suggested that the solution to this is to go back to a simpler framework and look at the real economy and not the stock markets while formulating the monetary policy.

According to him, the current approach by the Federal Reserve’s policies is good for asset holders as stocks go up every day, but they are bad for the people living on W2 income who don’t own assets, just regular income.

He highlighted that based on the Fed’s website, the top 10% of the wealthiest persons in the U.S. hold 87% of stocks. So, when the Fed’s goal is to push stock prices up every day, all they are doing is exacerbating the already reckless wealth inequality that exists.

“Fed needs to focus on actual economy and if the economy does well, the stock market will be fine. The real economy is going to suffer if they fail to do so,” Johnson said.

President-elect Trump’s victory, combined with stronger-than-expected economic data, helped drive the S&P 500 Index higher. Although the index dropped 2.3% last week to 5,870.62, it remains above its pre-election level of 5,712.69 as of the close on Tuesday, Nov. 3.

Meanwhile, in premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500 Index, rose 0.13% to $591.05 and the Invesco QQQ ETF QQQ, which tracks the Nasdaq 100 Index, gained 0.10% to $503.96, according to Benzinga Pro data.

Photo courtesy of the Federal Reserve

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia to report Q3 earnings today as AI fever continues to power Wall Street

Nvidia (NVDA) will report its third quarter earnings after the bell today, giving Wall Street its best and latest look into the strength of the artificial intelligence trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. Shares of Nvidia were up 196% year to date as of Wednesday, easily outpacing any of the company’s chipmaker rivals. AMD (AMD), the closest competitor, has seen its stock price sink over 5% year to date, while Intel (INTC), which is contending with a difficult turnaround, has seen its stock plunge nearly 52%.

Nvidia is expected to report Q3 earnings per share (EPS) of $0.74 on revenue of $33.2 billion, according to analysts’ estimates compiled by Bloomberg. That works out to an 83% year-over-year increase on both the top and bottom lines versus the same period last year, when Nvidia saw EPS of $0.40 on revenue of $22.1 billion.

Nvidia’s Data Center segment, its largest business, is set to bring in $29 billion for the quarter. That’s a 100% rise on the $14.5 billion reported in Q3 last year.

Gaming revenue is expected to top out at $3 billion, up 7% from last year, when the segment brought in $2.8 billion.

Analysts are anticipating gross margins to hit 75%.

Investors will be on the lookout for not only whether Nvidia beats on the top and bottom lines for Q3, but also whether it raises its outlook for Q4. Analysts are expecting Nvidia to give guidance of $37 billion in revenue in the quarter.

Even if the AI chip leader delivers a stellar report and outlook, its share price could still fall. Nvidia topped expectations on the top and bottom lines and beat out anticipated guidance in Q2, but its stock dropped 6% immediately after its results.

That could be a sign that some investors weren’t impressed with Nvidia’s performance compared to prior quarters, where it saw revenue growth of 200% and EPS growth of nearly 600%. Or it could simply come down to investors taking profits on their gains.

Investors will also be looking for any insights from CEO Jensen Huang about Nvidia’s next-generation Blackwell line of AI chips, which are used to both train and run AI applications. During the company’s last earnings call in August, Huang said Blackwell production would pick up in Q4, when he expects to see several billions of dollars of revenue from the chips.

At the time, Huang said demand for Blackwell was already outstripping supply, and he anticipated that would continue in the year ahead. What’s more, he said the company’s Hopper chip, the predecessor to the Blackwell line, was expected to continue selling well into Q4.

Prediction: Tilray Brands Won't Be a Cannabis Company in 5 Years

It was almost four years ago that Tilray Brands (NASDAQ: TLRY) announced that it would be merging with low-cost cannabis producer Aphria to create a larger, more dynamic, and global marijuana company. At the time, it was an exciting prospect for investors, creating what might end up becoming the best cannabis stock to own.

But since that announcement back in December 2020, the stock has declined by more than 85%. There was a lot of hype around the news, and the stock skyrocketed shortly afterwards, but the enthusiasm would fade — significantly.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Over the next five years, I expect Tilray to continue to evolve its business — but this time, away from cannabis. It might still be a small part of its business, but I predict that Tilray won’t be known as a marijuana company for much longer.

For years, while Tilray has been patiently optimistic that the U.S. might legalize marijuana, which would result in a huge new growth opportunity for the Canadian-based company, it has been expanding its operations in other ways. It has expanded into international cannabis markets and has acquired alcohol brands.

Last month, the company reported its first-quarter earnings of fiscal 2025. For the period ending Aug. 31, its sales grew by 13% year over year to $200 million. But of that total, less than one-third (31%) of sales actually came from its cannabis operations.

The company generates more money from distributing pharmaceuticals overseas (34%) than it does from what it’s most known for: cannabis. And even its alcohol business now accounts for 28% of revenue, with wellness being its smallest segment, contributing 7% of total sales.

In the future, the company could become even more of an alcohol business than it is now. Tilray completed its acquisition of Atwater Brewery in September, a brand that it acquired from Molson Coors. It has more than a dozen beverage brands in its portfolio, including SweetWater Brewing and Breckenridge Brewery, which investors may be most familiar with. And it wouldn’t be surprising for the company to continue to go deeper into alcohol because that may be its best growth opportunity in the years ahead.

The strategy of waiting for the U.S. to legalize marijuana isn’t paying off for Canadian cannabis companies. And the recent election results in the U.S. may only exacerbate the need for the company to become even less dependent on cannabis in the future.

G. WILLI-FOOD INTERNATIONAL REPORTS THE RESULTS OF THIRD QUARTER 2024

YAVNE, Israel, Nov. 20, 2024 /PRNewswire/ — G. Willi-Food International Ltd. WILC (the “Company” or “Willi-Food“), a global company that specializes in the development, marketing and international distribution of kosher foods, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter Fiscal Year 2024

- Sales increased by 23.3% to NIS 152.8 million (US$ 41.2 million) from NIS 123.9 million (US$ 33.4 million) in the third quarter of 2023.

- Gross profit increased by 78.3% year-over-year to NIS 42.0 million (US$ 11.3 million).

- Operating profit increased by 3,401.4% year-over-year to NIS 17.6 million (US$ 4.7 million).

- Net profit increased by 323.0% year-over-year to NIS 20.8 million (US$ 5.6 million).

- Basic earnings per share of NIS 1.5 (US$ 0.4).

- Cash and securities balance of NIS 225.7 million (US$ 60.8 million) as of September 30, 2024.

Management Comment

Zwi Williger & Joseph Williger, Chairman & CEO, respectively, of Willi-Food, commented: “We are pleased to present a strong third quarter 2024 financial results which show improvements in all operational parameters compared to the third quarter of 2023 despite the difficulties caused by the war like restrictions of sailing on the Red Sea and importing from Turkey. These financial results were due to the Company successful maintenance of sufficient inventory level for supporting increasing demands for its products and its improved commercial terms with its customers and suppliers. The Company is also continuing the construction of the new logistics center which is estimated to be completed in the second half of 2025. We believe that this new logistic center will help us in achieving our goals for the future by improving logistics and operational capabilities and supporting increasing product imports and sales.

Third Quarter Fiscal 2024 Summary

Sales for the third quarter of 2024 increased by 23.3% to NIS 152.8 million (US$ 41.2 million), compared to NIS 123.9 million (US$ 33.4 million) recorded in the third quarter of 2023. Sales were increased mainly due to increases in our inventory levels and its availability for the demand of our products.

Gross profit for the second quarter of 2024 increased by 78.3% to NIS 42.0 million (US$ 11.3 million), or 27.5% of revenues, compared to NIS 23.5 million (US$ 6.3 million), or 19.0% of revenues in the third quarter of 2023. The increases in gross profit and gross margins were due to the Company’s efforts to improve its commercial terms with its customers and suppliers and focusing on selling a more profitable products portfolio.

Selling expenses for the third quarter of 2024 were NIS 17.7 million (US$ 4.8 million), remaining at the same level compared to third quarter of 2023 despite the increase in sales. Distribution expenses increased due to the increase in sales, but this increase was offset by a decrease in advertising expenses compared to third quarter last year.

General and administrative expenses for the third quarter of 2024 increased by 14.2% to NIS 6.7 million (US$ 1.8 million), compared to NIS 5.9 million (US 1.6 million) in the third quarter of 2023. The increase was mainly due to the provision for compensation based on profit for senior management due to the increase in operating profit.

Operating profit for the third quarter of 2024 increased by 3,401.4% to NIS 17.6 million (US$ 4.7 million), compared to NIS 0.4 million (US$ 0.1 million) in the third quarter of 2023. The increase was primarily due to the increase in gross profit.

Financial income, net for the third quarter of 2024 totaled NIS 9.1 million (US$ 2.5 million), compared to NIS 5.7 million (US$ 1.5 million) in the third quarter of 2023. Financial income for the third quarter of 2024 was comprised mainly from revaluation of the Company’s portfolio of securities to in the amount of NIS 6.6 million (US$ 1.8 million) and from interest and dividend income from the Company’s portfolio of securities in an amount of NIS 2.4 million (US$ 0.6 million)

Willi-Food’s income before taxes for the third quarter of 2024 was NIS 26.7 million (US$ 7.2 million), compared to NIS 6.2 million (US$ 1.7 million) in the third quarter of 2023.

Willi-Food’s net profit in the third quarter of 2024 was NIS 20.8 million (US$ 5.6 million), or NIS 1.5 (US$ 0.4) per share, compared to NIS 4.9 million (US$ 1.3 million), or NIS 0.4 (US$ 0.1) per share, in the third quarter of 2023.

Willi-Food ended the third quarter of 2024 with NIS 225.7 million (US$ 60.8 million) in cash and securities. Net cash resulted from operating activities for the third quarter of 2024 was NIS 31.1 million (US$ 8.4 million).

First Nine Months Fiscal 2024 Highlights

- Sales increased by 7.7% to NIS 435.5 million (US$ 117.4 million), compared to NIS 404.5 million (US$ 109.0 million) in the first nine months of 2023.

- Gross profit increased by 36.7% year-over-year to NIS 122.5 million (US$ 33.0 million).

- Operating profit before other expenses (income) increased by 251.4% year-over-year to NIS 50.4 million (US$ 13.6 million).

- Operating profit after other expenses (income) increased by 167.9% year-over-year to NIS 38.8 million (US$ 10.5 million).

- Net profit increased by 123.8% year-over-year to NIS 46.2 million (US$ 12.5 million), or 10.6% of sales.

- Basic earnings per share of NIS 3.4 (US$ 0.9).

First Nine Months Fiscal 2024 Summary

Sales for the nine-month period ending September 30, 2024 increased by 7.7% to NIS 435.5 million (US$ 117.4 million), compared to NIS 404.5 million (US$ 109.0 million) recorded in the first nine months of 2023. The Company compensated for the decrease in sales in the first quarter of 2024 that resulted from delays in the arrival of goods as a result of the war, by increasing inventory balances and improving the availability of its products for sale to its customers in the second and third quarter.

Gross profit for the first nine months of 2024 increased by 36.7% to NIS 122.5 million (US$ 33.0 million), or 28.1% of revenues, compared to NIS 89.6 million (US$ 24.2 million), or 22.2% of revenues, in the first nine months of 2023. The increases in gross profit and gross margins were due to the increase in the Company’s sales and due to the Company’s efforts to improve its commercial terms with its customers and suppliers and focusing on selling a more profitable products portfolio.

Selling expenses for the first nine months of 2024 decreased by 5.8% to NIS 52.8 million (US$ 14.2 million), compared to NIS 56.0 million (US$ 15.1 million) in the first nine months of 2023. The decrease was mainly due to reduce in advertising.

General and administrative expenses for the first nine months of 2024 were NIS 19.4 million (US$ 5.2 million), remaining at the same level as in the third quarter of 2023.

Operating profit before other expenses (income) for the first nine months of 2024 increased by 251.4% to NIS 50.4 million (US$ 13.6 million), compared to NIS 14.3 million (US$ 3.9 million) in the first nine months of 2023. The increase was primarily due to the increase in gross profit.

Other expenses for the first nine months of 2024 were NIS 11.5 million (US$ 3.1 million), this was mainly due to the provision on the second quarter of 2024 made in the amount of approximately 11.6 million (US$ 3.1 million) in respect of the agreement reached by the Company with the Israel Competition Authority for the payment of an administrative fine as disclosed in the Company’s Report on Form 6-K submitted to the Securities and Exchange Commission on July 17, 2024.

Operating profit after other expenses (income) for the first nine months of 2024 increased by 167.9% to NIS 38.8 million (US$ 10.5 million), compared to NIS 14.5 million (US$ 3.9 million) in the first nine months of 2023. This increase was primarily due to the increase in gross profit and reduction in operating expenses compared to sales offset by the administrative fine of NIS 11.7 million (US$ 3.1 million).

Financial income, net for the first nine months of 2024 totaled NIS 23.2 million (US$ 6.3 million), compared to NIS 11.6 million (US$ 1.6 million) in the first nine months of 2023. Financial income, net for the first nine months of 2024 was comprised mainly from revaluation of the Company’s portfolio of securities to in the amount of NIS 13.4 million (US$ 3.6 million) and from interest and dividend income from the Company’s portfolio of securities in an amount of NIS 10.3 million (US$ 2.8 million).

Willi-Food’s income before taxes for the first nine months of 2024 was NIS 62.1 million (US$ 16.7 million), compared to NIS 26.1 million (US$ 7.0 million) in the first nine months of 2023.

Willi-Food’s net profit in the first nine months of 2024 was NIS 46.2 million (US$ 12.5 million), or NIS 3.3 (US$ 0.9) per share, compared to NIS 20.6 million (US$ 5.6 million), or NIS 1.5 (US$ 0.4) per share, recorded in the first nine months of 2023.

NOTE A: NIS to US$ exchange rate used for convenience only

Convenience translation of New Israeli Shekels (NIS) into U.S. dollars was made at the rate of exchange prevailing on September 30, 2024, with U.S. $1.00 equal to NIS 3.71. The translation is made solely for the convenience of the reader.

NOTE B: IFRS

The Company’s consolidated financial results for the three-month period ended September 30, 2024 are presented in accordance with International Financial Reporting Standards (“IFRS”).

ABOUT G. WILLI-FOOD INTERNATIONAL LTD.

G. Willi-Food International Ltd. (http://www.willi-food.com) is an Israeli-based company specializing in high-quality, great-tasting kosher food products. Willi-Food is engaged directly and through its subsidiaries in the design, import, marketing and distribution of over 650 food products worldwide. As one of Israel’s leading food importers, Willi-Food markets and sells its food products to over 1,500 customers and 3,000 selling points in Israel and around the world, including large retail and private supermarket chains, wholesalers and institutional consumers. The Company’s operating divisions include Willi-Food in Israel and Euro European Dairies, a wholly owned subsidiary that designs, develops and distributes branded kosher, dairy-food products.

FORWARD LOOKING STATEMENT

This press release contains forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995 relating to future events or our future performance, such as statements regarding trends, demand for our products, expected sales, operating results, and earnings. Forward-looking statements include statements regarding the commercial terms with customers and suppliers and timing of construction of the Company’s new logistics center and its expected benefits. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied in those forward-looking statements. These risks and other factors include but are not limited to: the inability to improve commercial terms with customers and suppliers: delays in the construction of the Company’s new logistics center and the risk that its expected benefits will not be materialized, monetary risks including changes in marketable securities or changes in currency exchange rates- especially the NIS/U.S. Dollar exchange rate, payment default by any of our major clients, the loss of one of more of our key personnel, changes in laws and regulations, including those relating to the food distribution industry, and inability to meet and maintain regulatory qualifications and approvals for our products, termination of arrangements with our suppliers, loss of one or more of our principal clients, increase or decrease in global purchase prices of food products, increasing levels of competition in Israel and other markets in which we do business, changes in political, economic and military conditions in Israel, particularly the recent war in Israel. Economic conditions in the Company’s core markets, delays and price increases due to the attacks on global shipping routes in the Red Sea, our inability to accurately predict consumption of our products and changes in consumer preferences, our inability to protect our intellectual property rights, our inability to successfully integrate our recent acquisitions, insurance coverage not sufficient enough to cover losses of product liability claims, risks associated with product liability claims and risks associated with the start of credit extension activity. We cannot guarantee future results, levels of activity, performance or achievements. The matters discussed in this press release also involve risks and uncertainties summarized under the heading “Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 21, 2024. These factors are updated from time to time through the filing of reports and registration statements with the Securities and Exchange Commission. We do not assume any obligation to update the forward-looking information contained in this press release.

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||

|

(unaudited) |

||||||

|

September 30, |

December 31 |

September 30, |

December 31 |

|||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

ASSETS |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

111,262 |

121,231 |

137,466 |

29,990 |

32,677 |

37,053 |

|

Financial assets carried at fair value through profit or loss |

114,437 |

99,895 |

102,163 |

30,846 |

26,926 |

27,537 |

|

Trade receivables |

178,047 |

155,857 |

160,379 |

47,990 |

42,010 |

43,229 |

|

Other receivables and prepaid expenses |

9,543 |

8,433 |

10,164 |

2,572 |

2,273 |

2,739 |

|

Inventories |

97,796 |

75,807 |

62,475 |

26,360 |

20,433 |

16,840 |

|

Current tax assets |

5,385 |

9,556 |

9,497 |

1,451 |

2,576 |

2,560 |

|

Total current assets |

516,470 |

470,779 |

482,144 |

139,209 |

126,895 |

129,958 |

|

Non-current assets |

||||||

|

Property, plant and equipment |

154,438 |

115,789 |

122,222 |

41,627 |

31,210 |

32,944 |

|

Less – Accumulated depreciation |

58,035 |

54,750 |

55,636 |

15,642 |

14,757 |

14,996 |

|

96,403 |

61,039 |

66,586 |

25,985 |

16,453 |

17,948 |

|

|

Right of use asset |

4,504 |

2,729 |

2,124 |

1,214 |

736 |

573 |

|

Financial assets carried at fair value through profit or loss |

45,851 |

44,505 |

46,143 |

12,359 |

11,996 |

12,437 |

|

Goodwill |

36 |

36 |

36 |

10 |

10 |

10 |

|

Total non-current assets |

146,794 |

108,309 |

114,889 |

39,568 |

29,195 |

30,968 |

|

663,264 |

579,088 |

597,033 |

178,777 |

156,090 |

160,926 |

|

|

EQUITY AND LIABILITIES |

||||||

|

Current liabilities |

||||||

|

Current maturities of lease liabilities |

2,112 |

1,847 |

1,512 |

569 |

498 |

408 |

|

Trade payables |

30,968 |

16,873 |

21,622 |

8,347 |

4,548 |

5,828 |

|

Employees Benefits |

4,264 |

4,132 |

4,193 |

1,149 |

1,114 |

1,130 |

|

Other payables and accrued expenses |

25,932 |

8,342 |

10,854 |

6,990 |

2,249 |

2,926 |

|

Total current liabilities |

63,276 |

31,194 |

38,181 |

17,055 |

8,409 |

10,292 |

|

Non-current liabilities |

||||||

|

Lease liabilities |

2,684 |

1,079 |

694 |

723 |

291 |

187 |

|

Deferred taxes |

7,455 |

4,742 |

4,868 |

2,009 |

1,278 |

1,312 |

|

Retirement benefit obligation |

1,055 |

1,030 |

1,055 |

284 |

278 |

284 |

|

Total non-current liabilities |

11,194 |

6,851 |

6,617 |

3,016 |

1,847 |

1,783 |

|

Shareholders’ equity |

||||||

|

Share capital |

1,490 |

1,490 |

1,490 |

402 |

402 |

402 |

|

Additional paid in capital |

172,981 |

172,477 |

172,589 |

46,626 |

46,490 |

46,520 |

|

Remeasurement of the net liability in respect of defined benefit |

(154) |

(195) |

(154) |

(42) |

(53) |

(42) |

|

Capital fund |

247 |

247 |

247 |

67 |

67 |

67 |

|

Retained earnings |

414,858 |

367,652 |

378,691 |

111,822 |

99,097 |

102,073 |

|

Treasury shares |

(628) |

(628) |

(628) |

(169) |

(169) |

(169) |

|

Equity attributable to owners of the Company |

588,794 |

541,043 |

552,235 |

158,706 |

145,834 |

148,851 |

|

663,264 |

579,088 |

597,033 |

178,777 |

156,090 |

160,926 |

|

|

(*) Convenience translation into U.S. dollars. |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||

|

(unaudited) |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

In thousands (except per share and share data) |

||||||

|

Sales |

435,493 |

404,521 |

152,799 |

123,921 |

117,384 |

109,035 |

|

Cost of sales |

312,956 |

314,895 |

110,837 |

100,387 |

84,355 |

84,877 |

|

Gross profit |

122,537 |

89,626 |

41,962 |

23,534 |

33,029 |

24,158 |

|

Operating costs and expenses: |

||||||

|

Selling expenses |

52,758 |

55,982 |

17,707 |

17,282 |

14,220 |

15,089 |

|

General and administrative expenses |

19,410 |

19,311 |

6,725 |

5,890 |

5,232 |

5,205 |

|

Operating profit before other expenses (income) |

50,369 |

14,333 |

17,530 |

362 |

13,577 |

3,864 |

|

Other expenses (income) |

11,522 |

(165) |

(47) |

(140) |

3,106 |

(44) |

|

Operating profit after other expenses (income) |

38,847 |

14,498 |

17,577 |

502 |

10,471 |

3,908 |

|

Financial income |

24,568 |

12,142 |

9,416 |

5,923 |

6,622 |

3,273 |

|

Financial expense |

1,345 |

550 |

314 |

181 |

363 |

148 |

|

Total financial income |

23,223 |

11,592 |

9,102 |

5,742 |

6,259 |

3,125 |

|

Income before taxes on income |

62,070 |

26,090 |

26,679 |

6,244 |

16,730 |

7,033 |

|

Taxes on income |

15,919 |

5,471 |

5,929 |

1,339 |

4,291 |

1,475 |

|

Profit for the period |

46,151 |

20,619 |

20,750 |

4,905 |

12,439 |

5,558 |

|

Earnings per share: |

||||||

|

Basic earnings per share |

3.33 |

1.49 |

1.50 |

0.35 |

0.90 |

0.40 |

|

Diluted earnings per share |

3.33 |

1.49 |

1.50 |

0.35 |

0.90 |

0.40 |

|

Shares used in computation of basic EPS |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

Shares used in computation of diluted EPS |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

Actual number of shares |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

13,867,017 |

|

(*) Convenience translation into U.S. dollars. |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

(unaudited) |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

CASH FLOWS – OPERATING ACTIVITIES |

||||||

|

Profit from continuing operations |

46,151 |

20,619 |

20,750 |

4,905 |

12,439 |

5,558 |

|

Adjustments to reconcile net profit to net cash used to continuing operating |

(30,029) |

(12,225) |

10,323 |

19,817 |

(8,095) |

(3,295) |

|

Net cash from continuing operating activities |

16,122 |

8,394 |

31,073 |

24,722 |

4,344 |

2,263 |

|

CASH FLOWS – INVESTING ACTIVITIES |

||||||

|

Acquisition of property plant and equipment |

(4,278) |

(4,230) (**) |

(804) |

(1,891)(**) |

(1,152) |

(1,140) |

|

Acquisition of property plant and equipment under construction |

(29,399) |

(12,318)(**) |

(11,137) |

(5,681)(**) |

(7,923) |

(3,320) |

|

Proceeds from sale of property plant and Equipment |

143 |

– |

27 |

– |

39 |

– |

|

Proceeds from sale of marketable securities, net |

1,074 |

19,772 |

(3,138) |

3,739 |

289 |

5,329 |

|

Net cash used in (from) continuing investing activities |

(32,460) |

3,224 |

(15,052) |

(3,833) |

(8,747) |

869 |

|

CASH FLOWS – FINANCING ACTIVITIES |

||||||

|

Lease liability payments |

(1,513) |

(1,681) |

(426) |

(727) |

(408) |

(453) |

|

Dividend |

(9,982) |

(39,946) |

– |

(9,997) |

(2,691) |

(10,767) |

|

Net cash used in continuing financing activities |

(11,495) |

(41,627) |

(426) |

(10,724) |

(3,099) |

(11,220) |

|

Increase (decrease) in cash and cash equivalents |

(27,833) |

(30,009) |

15,595 |

10,165 |

(7,502) |

(8,088) |

|

Cash and cash equivalents at the beginning of the financial period |

137,466 |

150,607 |

94,972 |

110,916 |

37,053 |

40,595 |

|

Exchange gains on cash and cash equivalents |

1,629 |

633 |

695 |

150 |

439 |

170 |

|

Cash and cash equivalents of the end of the financial year |

111,262 |

121,231 |

111,262 |

121,231 |

29,990 |

32,677 |

|

(*) Convenience Translation into U.S. Dollars. (**) Reclassified |

||||||

|

G. WILLI-FOOD INTERNATIONAL LTD. |

||||||

|

APPENDIX A TO CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

(unaudited) |

||||||

|

CASH FLOWS – OPERATING ACTIVITIES: |

||||||

|

A. Adjustments to reconcile net profit to net cash from operating activities: |

||||||

|

Nine months |

Three months |

Nine months |

||||

|

ended |

ended |

ended |

||||

|

September 30, |

September 30, |

September 30, |

||||

|

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

2 0 2 4 |

2 0 2 3 |

|

|

NIS |

US dollars (*) |

|||||

|

(in thousands) |

||||||

|

Decrease in deferred income taxes |

2,587 |

544 |

1,374 |

397 |

697 |

147 |

|

Unrealized losses (gains) on marketable securities |

(13,058) |

(3,297) |

(6,237) |

(2,744) |

(3,519) |

(889) |

|

Depreciation and amortization |

5,583 |

5,008 |

2,939 |

1,672 |

1,505 |

1,350 |

|

Stock based compensation reserve |

392 |

926 |

101 |

236 |

106 |

250 |

|

Capital gain on disposal of property plant and equipment |

(143) |

(25) |

(143) |

– |

(38) |

(7) |

|

Exchange gains on cash and cash equivalents |

(1,629) |

(633) |

(695) |

(150) |

(439) |

(170) |

|

Changes in assets and liabilities: |

||||||

|

Increase (decrease) in trade receivables and other receivables |

(1,764) |

10,882 |

(425) |

5,487 |

(477) |

2,933 |

|

Decrease (increase) in inventories |

(35,321) |

(3,878) |

24,112 |

22,495 |

(9,521) |

(1,045) |

|

Increase (decrease) in trade and other payables, and other current liabilities |

24,495 |

(10,935) |

(6,093) |

(5,176) |

6,602 |

(2,948) |

|

Cash generated from operations |

(18,858) |

(1,408) |

14,933 |

22,217 |

(5,084) |

(379) |

|

Income tax paid |

(11,171) |

(10,817) |

(4,610) |

(2,400) |

(3,011) |

(2,916) |

|

Net cash flows from (used in) operating activities |

(30,029) |

(12,225) |

10,323 |

19,817 |

(8,095) |

(3,295) |

|

(*) Convenience Translation into U.S. Dollars. (**) Reclassified |

||||||

This information is intended to be reviewed in conjunction with the Company’s filings with the Securities and Exchange Commission.

Company Contact:

G. Willi – Food International Ltd.

Yitschak Barabi, Chief Financial Officer

(+972) 8-932-1000

itsik.b@willi-food.co.il

Logo – https://stockburger.news/wp-content/uploads/2024/11/G_Willi_Food_International_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/g-willi-food-international-reports-the-results-of-third-quarter-2024-302311500.html

View original content:https://www.prnewswire.com/news-releases/g-willi-food-international-reports-the-results-of-third-quarter-2024-302311500.html

SOURCE G. Willi-Food International Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Investor David Einhorn Calls It 'Most Expensive Market Of All Time' As S&P 500 Gains 4% Since Trump's Win: 'Really, Really Pricey'

David Einhorn, founder of Greenlight Capital and billionaire investor, voiced his apprehensions about the elevated valuations in the stock market during CNBC’s Delivering Alpha conference last week.

What Happened: Einhorn pointed out that while long-term investors might not incur losses, the current high valuations indicate potentially lower returns in the future, Business Insider reported on Wednesday.

Einhorn characterized the market as “really, really, really pricey,” but clarified that this does not make him bearish. He highlighted that asset prices can remain mispriced for long durations. The Shiller cyclically adjusted price-to-earnings ratio is currently at 38 times earnings, marking one of the highest levels in a century, which Einhorn labeled as “the most expensive market of all time.”

According to Bank of America, these valuations suggest 1-2% annualized returns for the S&P 500 over the next decade, excluding dividends. Other experts, such as Goldman Sachs‘ David Kostin and Research Affiliates‘ Rob Arnott, have expressed similar concerns.

Why It Matters: The victory of President-elect Donald Trump accompanied by stronger-than-expected economic data drove the S&P 500 Index higher. The index, which fell by 2.3% last week at 5,870.62 is still higher than its pre-election levels of 5,712.69 points as of Tuesday, Nov. 3 close.

According to Rob Arnott, the founder and chairman of Research Affiliates, the current stock market environment is reminiscent of the dot-com bubble peak. Arnott predicts a significant pullback in the near future. “This looks and feels like the year 2000 to me,” Arnott said.

“Are we likely to see a bear market in the next two years for large-cap growth? Yeah.”

Meanwhile, in premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500 Index, rose 0.13% to $591.05 and the Invesco QQQ ETF QQQ, which tracks the Nasdaq 100 Index, gained 0.10% to $503.96, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.